|

市場調查報告書

商品編碼

1840917

全球手術影像處理市場(按產品、應用、最終用戶和地區分類)- 預測至 2030 年Surgical Imaging Market by Product (Surgical Navigation Software, System), Brand (Azurion, StealthStation, Ingenia, Nexaris), Application (MIS, Endoscopy, CVD, OB/GYN, Ortho, Neuro), End User-Global Forecast to 2030 |

||||||

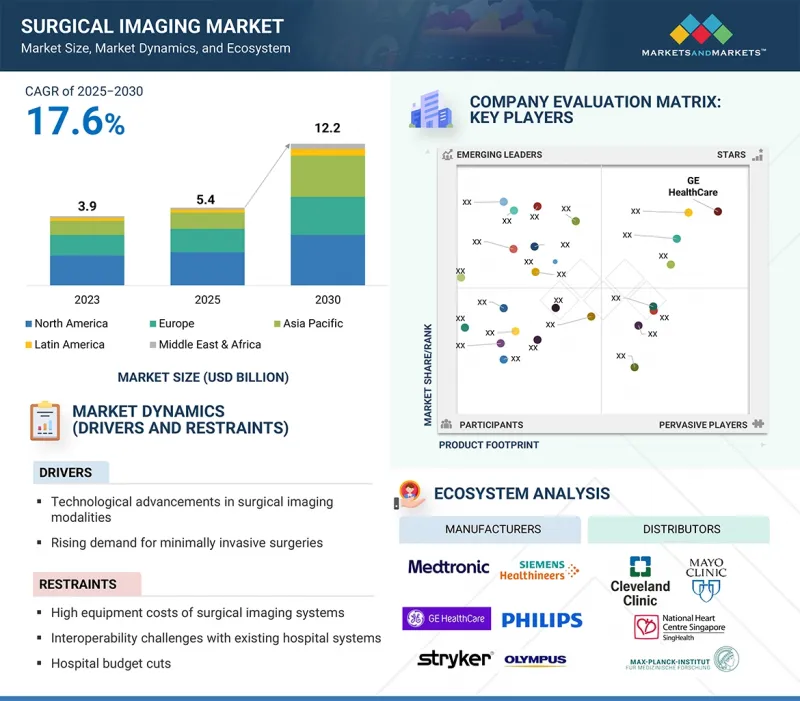

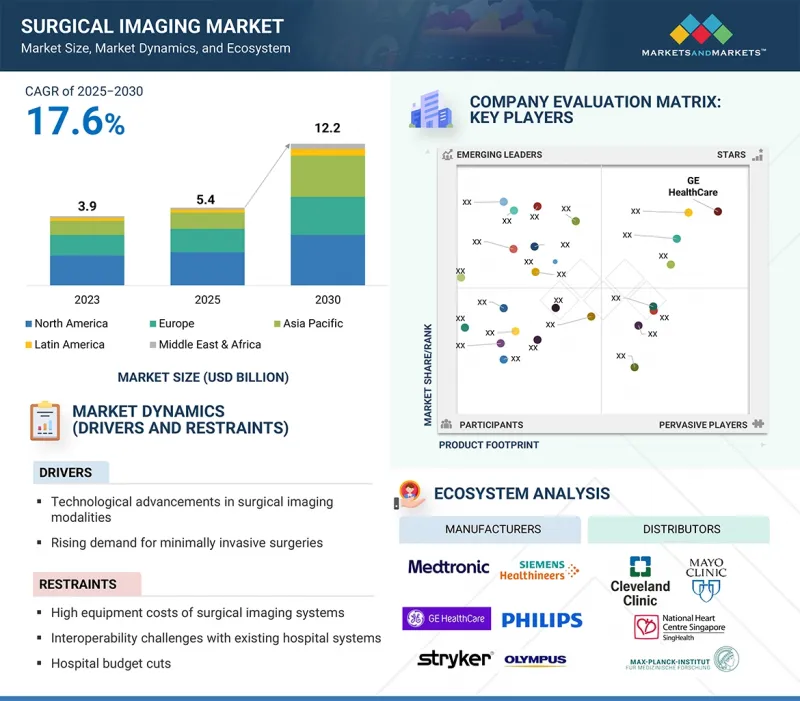

預計 2025 年手術影像處理市場價值將達到 540 萬美元,到 2030 年將達到 1,220 萬美元,預測期內複合年成長率為 17.6%。

這是由於先進的術中影像處理技術的使用日益增多、人工智慧主導的影像分析和擴增實境在手術導引的整合,以及醫院和門診手術中心擴大採用混合手術室。

| 調查範圍 | |

|---|---|

| 調查年份 | 2024-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 對價單位 | 金額(十億美元) |

| 部分 | 按產品、應用程式、最終用戶和地區 |

| 目標區域 | 北美、亞太地區、歐洲、拉丁美洲、中東和非洲 |

需求的促進因素包括對提高手術精度、縮短手術時間和改善患者治療效果的需求不斷成長,以及支持性報銷政策和影像處理軟體和連接解決方案的持續技術創新。

從應用角度來看,預計骨科和脊椎外科領域將在2024年佔據外科影像處理市場的最大佔有率,這得益於各種整形外科和肌肉骨骼手術(例如膝關節和髖關節置換術、脊椎側彎矯正和複雜手術)對精確即時影像處理的需求很高。 整形外科使外科醫生能夠精確定位植入、檢查骨骼排列並即時評估手術效果,從而降低併發症和再次手術的風險。由於運動傷害、交通事故和與老齡化相關的退化性疾病,整形外科手術數量不斷增加,進一步推動了該領域對外科影像解決方案的採用。

2024年,北美在外科影像市場佔有領先地位。這一領先地位得益於該地區先進的醫療基礎設施、新一代術中影像技術的廣泛應用以及人工智慧視覺化和資料管理系統的強大整合。美國和加拿大醫院複雜外科手術的增多,加上配備即時影像的混合手術室的快速成長,進一步鞏固了這一市場地位。優惠的醫療保險政策、頂尖醫療技術公司的集中以及對外科創新的持續投入,也鞏固了北美市場的領先地位。

本報告研究了全球手術影像處理市場,提供了按產品、應用、最終用戶和地區分類的趨勢資訊,以及參與市場的公司概況。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章重要考察

第5章 市場概況

- 介紹

- 市場動態

- 影響客戶業務的趨勢/中斷

- 產業趨勢

- 定價分析

- 價值鏈分析

- 供應鏈分析

- 生態系分析

- 投資金籌措場景

- 技術分析

- 專利分析

- 貿易分析

- 2025-2026年主要會議和活動

- 案例研究分析

- 關稅和監管狀況

- 還款情境分析

- 波特五力分析

- 主要相關人員和採購標準

- 未滿足需求分析

- 經營模式

- 人工智慧/生成式人工智慧對外科影像處理市場的影響

- 2025年美國關稅的影響—概述

第6章 手術影像處理市場(按產品)

- 介紹

- C臂

- CT掃描儀

- 超音波系統

- 整合MR-OR系統

- 手術導引軟體

- 配件

第7章 手術影像處理市場(按應用)

- 介紹

- 手術類型

- 微創手術

- 腹腔鏡檢查

- 內視鏡檢查

- 其他

- 手術類型

- 一般外科

- 心血管外科

- 婦科手術

- 整形外科和肌肉骨骼外科

- 神經外科

- 泌尿系統

- 其他

8. 手術影像處理市場(依最終使用者)

- 介紹

- 醫院和外科中心

- 專科診所

- 門診手術中心

- 其他

第9章 手術影像處理市場(按地區)

- 介紹

- 北美洲

- 北美宏觀經濟展望

- 美國

- 加拿大

- 歐洲

- 歐洲宏觀經濟展望

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他

- 亞太地區

- 亞太宏觀經濟展望

- 日本

- 中國

- 印度

- 韓國

- 澳洲

- 其他

- 拉丁美洲

- 拉丁美洲宏觀經濟展望

- 巴西

- 墨西哥

- 其他

- 中東和非洲

- 中東和非洲宏觀經濟展望

- 海灣合作理事會國家

- 其他

第10章 競爭格局

- 概述

- 主要參與企業的策略/優勢

- 2020-2024年收益分析

- 2024年市佔率分析

- 公司估值矩陣:2024 年關鍵參與企業

- 公司估值矩陣:Start-Ups/中小企業,2024 年

- 估值和財務指標

- 品牌/產品比較

- 競爭場景

第11章 公司簡介

- 主要參與企業

- GE HEALTHCARE

- SIEMENS HEALTHINEERS AG

- KONINKLIJKE PHILIPS NV

- SHIMADZU CORPORATION

- FUJIFILM HOLDINGS CORPORATION

- ZIEHM IMAGING GMBH

- HOLOGIC, INC.

- SMITH+NEPHEW

- MEDTRONIC

- STRYKER

- CANON MEDICAL SYSTEMS CORPORATION

- OLYMPUS CORPORATION

- NOVANTA INC.

- GLOBUS MEDICAL

- SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.

- SONY ELECTRONICS INC.

- UNITED IMAGING HEALTHCARE CO., LTD.

- BARCO

- AUXEIN

- BRAINLAB SE

- 其他公司

- TRIVITRON HEALTHCARE

- RGS HEALTHCARE

- GEMSS HEALTHCARE CO., LTD.

- SKANRAY TECHNOLOGIES LIMITED

- NANJING PERLOVE MEDICAL EQUIPMENT CO., LTD.

- ARTHREX, INC.

第12章 附錄

The surgical imaging market was valued at USD 5.4 million in 2025 and is estimated to reach USD 12.2 million by 2030, registering a CAGR of 17.6% during the forecast period. This is due to the increased use of advanced intraoperative imaging technologies, integration of AI-driven image analysis and augmented reality for surgical navigation, and the expanding installation of hybrid operating rooms in hospitals and outpatient surgical centers.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Brand, Application, End User, Region |

| Regions covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

The demand is further boosted by the need for greater surgical precision, shorter procedure times, and better patient outcomes, along with supportive reimbursement policies and ongoing innovations in imaging software and connectivity solutions.

"The orthopedic & musculoskeletal surgery segment is estimated to hold the largest share of the surgical imaging market in 2024."

By application, the orthopedic & musculoskeletal surgery segment is expected to hold the largest share of the surgical imaging market in 2024 due to the high demand for precise, real-time imaging across various orthopedic and musculoskeletal procedures, including knee and hip replacements, scoliosis correction, and complex surgeries. Advanced technologies such as C-arm systems, 3D imaging, and intraoperative CT allow surgeons to accurately position implants, verify bone alignment, and evaluate surgical outcomes immediately, thereby reducing the risk of complications or needing revisions. The increasing number of orthopedic surgeries, driven by sports injuries, traffic accidents, and age-related degenerative conditions, has further boosted the adoption of surgical imaging solutions in this field segment.

"North America accounts for the largest market share in the surgical imaging market in 2024."

The North American market led the surgical imaging market in 2024. This leadership is driven by factors such as the region's advanced healthcare infrastructure, high adoption of next-generation intraoperative imaging technologies, and strong integration of AI-powered visualization and data management systems. The growing number of complex surgical procedures in US and Canadian hospitals, along with the rapid growth of hybrid operating rooms equipped with real-time imaging, has further solidified this position. Favorable reimbursement policies, a high concentration of top medical technology companies, and ongoing investments in surgical innovation also support North America's market leadership.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the surgical imaging marketplace.

The breakdown of primary participants is as mentioned below:

- By Company Type - Tier 1 (48%), Tier 2 (36%), and Tier 3 (16%)

- By Designation - Directors (15%), Managers (10%), and Others (75%)

- By Region - North America (39%), Europe (31%), the Asia Pacific (21%), and Latin America (6%), and the Middle East & Africa (3%)

Key Players in the Surgical Imaging Market

Prominent players in the surgical imaging market include GE HealthCare (US), Siemens Healthineers AG(Germany), Koninklijke Philips N.V. (Netherlands), Shimadzu Corporation (Japan), Fujifilm Holdings Corporation (Japan), Ziehm Imaging GmbH (Germany), Hologic, Inc. (US), Smith & Nephew (UK), Medtronic (Ireland), United Imaging Healthcare Co. Ltd. (China), Canon Inc. (Japan), Stryker (US), Olympus Corporation (Japan), Novanta Inc. (US), Global Medical (US), Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China), Sony Electronics Inc. (Japan), Barco (Belgium), Brainlab SE (UK), Auxein (US), Trivitron Healthcare (India), RGS Healthcare (US), GEMSS HEALTHCARE Co., Ltd. (South Korea), Skanray Technologies Limited (India), Nanjing Perlove Medical Equipment Co., Ltd. (China), Arthrex, Inc. (Florida).

Players adopted both organic and inorganic growth strategies, such as product launches and improvements, investments, partnerships, collaborations, joint ventures, funding, acquisitions, expansions, agreements, contracts, and alliances, to increase their offerings, address unmet customer needs, boost profitability, and expand their presence in the global market.

The study features a detailed competitive analysis of major players in the surgical imaging market, including their company profiles, recent updates, and primary market strategies.

Research Coverage

- The report studies the surgical imaging market based on product, brand, application, end user, and region.

- The report analyzes factors (such as drivers, restraints, opportunities, and challenges) affecting the market growth.

- The report evaluates the opportunities and challenges in the market for stakeholders and provides details of the competitive landscape for market leaders.

- The report studies micro-markets with respect to their growth trends, prospects, and contributions to the total surgical imaging market.

- The report forecasts the revenue of market segments with respect to five major regions.

Reasons to Buy the Report

The report can help established firms as well as new entrants/smaller firms gauge the pulse of the market, which, in turn, would help them garner a greater share. Firms purchasing the report could use one or a combination of the five strategies mentioned below.

This report provides insights into the following pointers:

- Analysis of key drivers (technological advancements in surgical imaging modalities, rising demand for minimally invasive surgeries, technological transition to flat-panel detectors and hybrid ORs, expanding applications across surgical specialties), restraints (high equipment costs of surgical imaging systems, interoperability challenges with existing hospital systems, hospital cost cut), opportunities (increasing number of surgical procedures conducted in ambulatory surgical centers, development of hybrid operating rooms, growing demand for data-integrated imaging systems), and challenges (shortage of skilled workforce, imaging obese patients, hospital budget cuts) influencing the industry macrodynamics of surgical imaging market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and product launches in the surgical imaging market.

- Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the markets for various types of surgical imaging across regions.

- Market Diversification: Exhaustive information about products, untapped regions, recent developments, and investments in the surgical imaging market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, distribution networks, and manufacturing capabilities of the leading players in the surgical imaging market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS AND REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.5.1 METHODOLOGY-RELATED LIMITATIONS

- 1.5.2 SCOPE-RELATED LIMITATIONS

- 1.6 MARKET STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of secondary sources

- 2.1.2 PRIMARY DATA SOURCES

- 2.1.2.1 List of key primary stakeholders interviewed

- 2.1.2.2 Insights from primary experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET ESTIMATION METHODOLOGY

- 2.2.1 APPROACH 1: COMPANY REVENUE ESTIMATION APPROACH

- 2.2.2 APPROACH 2: CUSTOMER-BASED MARKET ESTIMATION

- 2.2.3 PRIMARY RESEARCH VALIDATION

- 2.3 GROWTH RATE ASSUMPTIONS

- 2.4 DATA TRIANGULATION AND MARKET BREAKDOWN

- 2.5 RESEARCH ASSUMPTIONS

- 2.5.1 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SURGICAL IMAGING MARKET

- 4.2 ASIA PACIFIC: SURGICAL IMAGING MARKET, BY PRODUCT

- 4.3 SURGICAL IMAGING MARKET, BY KEY COUNTRY/REGION

- 4.4 REGIONAL MIX: SURGICAL IMAGING MARKET

- 4.5 SURGICAL IMAGING MARKET: DEVELOPED VS. EMERGING ECONOMIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Technological advancements in surgical imaging modalities

- 5.2.1.2 Rising demand for minimally invasive surgeries

- 5.2.1.3 Technological transition to flat-panel detectors and hybrid operating rooms

- 5.2.1.4 Expanding applications across surgical specialties

- 5.2.2 RESTRAINTS

- 5.2.2.1 High equipment costs of surgical imaging systems

- 5.2.2.2 Interoperability challenges with existing hospital systems

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing number of surgical procedures conducted in ASCs (ambulatory surgical centers)

- 5.2.3.2 Development of hybrid operating rooms (ORs)

- 5.2.3.3 Growing demand for data-integrated imaging systems

- 5.2.4 CHALLENGES

- 5.2.4.1 Shortage of skilled workforce

- 5.2.4.2 Imaging obese patients

- 5.2.4.3 Hospital budget cuts

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 INDUSTRY TRENDS

- 5.4.1 INTEGRATION OF ARTIFICIAL INTELLIGENCE AND ADVANCED ANALYTICS

- 5.4.2 AUGMENTED REALITY (AR) AND VIRTUAL REALITY (VR) IN SURGERY

- 5.4.3 GROWTH OF HYBRID OPERATING ROOMS AND MULTIMODAL IMAGING

- 5.4.4 COMPACT, MOBILE, AND LOW-DOSE IMAGING TECHNOLOGIES

- 5.4.5 INTEGRATION WITH SURGICAL ROBOTICS AND ADVANCED 3D/4D IMAGING

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE OF SURGICAL IMAGING PRODUCTS, BY TYPE

- 5.5.2 AVERAGE SELLING PRICE OF SURGICAL IMAGING PRODUCTS, BY KEY PLAYER

- 5.5.3 PRICING MODELS

- 5.6 VALUE CHAIN ANALYSIS

- 5.6.1 RESEARCH & DEVELOPMENT

- 5.6.2 MANUFACTURING & ASSEMBLY

- 5.6.3 DISTRIBUTION, MARKETING & SALES, AND POST-SALES SERVICES

- 5.7 SUPPLY CHAIN ANALYSIS

- 5.7.1 PROMINENT COMPANIES

- 5.7.2 SMALL & MEDIUM-SIZED ENTERPRISES

- 5.7.3 END USERS

- 5.8 ECOSYSTEM ANALYSIS

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Intraoperative imaging systems

- 5.10.1.2 Image-guided surgery and navigation systems

- 5.10.2 COMPLEMENTARY TECHNOLOGIES

- 5.10.2.1 Radiopharmaceutical development and theranostics

- 5.10.2.2 Advanced computing and big data analytics

- 5.10.3 ADJACENT TECHNOLOGIES

- 5.10.3.1 Endoscopic & laparoscopic imaging systems

- 5.10.3.2 AI/Image analytics solutions

- 5.10.1 KEY TECHNOLOGIES

- 5.11 PATENT ANALYSIS

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT DATA FOR SURGICAL IMAGING PRODUCTS (HS CODE 9022)

- 5.12.2 EXPORT DATA FOR SURGICAL IMAGING PRODUCTS (HS CODE 9022)

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 CASE STUDY ANALYSIS

- 5.14.1 ADVANCING ENDOSCOPIC SINUS AND SKULL BASE SURGERY WITH SURGICAL NAVIGATION AT GMCH-32

- 5.14.2 PRECISION MAXILLOFACIAL SURGERY THROUGH BRAINLAB'S INTRAOPERATIVE NAVIGATION AND CT INTEGRATION

- 5.14.3 AI-POWERED REAL-TIME TUMOR MARGIN DETECTION IN SKULL BASE SURGERY WITH STIMULATED RAMAN HISTOLOGY

- 5.15 TARIFF AND REGULATORY LANDSCAPE

- 5.15.1 TARIFF DATA FOR HS CODE 9022

- 5.15.2 REGULATORY LANDSCAPE

- 5.15.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.4 REGULATORY TRENDS

- 5.15.4.1 North America

- 5.15.4.1.1 US

- 5.15.4.1.2 Canada

- 5.15.4.1 North America

- 5.15.5 EUROPE

- 5.15.6 ASIA PACIFIC

- 5.15.6.1 Japan

- 5.15.6.2 China

- 5.15.6.3 India

- 5.15.6.4 Middle East (GCC Region)

- 5.15.6.4.1 UAE

- 5.15.6.4.2 Saudi Arabia

- 5.15.6.5 Africa

- 5.16 REIMBURSEMENT SCENARIO ANALYSIS

- 5.17 PORTER'S FIVE FORCES ANALYSIS

- 5.17.1 BARGAINING POWER OF SUPPLIERS

- 5.17.2 BARGAINING POWER OF BUYERS

- 5.17.3 THREAT OF NEW ENTRANTS

- 5.17.4 THREAT OF SUBSTITUTES

- 5.17.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.18 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.18.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.18.2 BUYING CRITERIA

- 5.19 UNMET NEEDS ANALYSIS

- 5.19.1 CURRENT UNMET NEEDS

- 5.19.2 END-USER EXPECTATIONS

- 5.20 BUSINESS MODEL

- 5.20.1 CAPITAL EQUIPMENT SALES MODEL

- 5.20.2 SUBSCRIPTION AND SAAS MODEL

- 5.20.3 PAY-PER-USE/TRANSACTION-BASED MODEL

- 5.20.4 MANAGED SERVICES MODEL

- 5.20.5 VALUE-BASED/OUTCOME-DRIVEN MODEL

- 5.20.6 HYBRID MODEL (BUNDLED HARDWARE + DIGITAL SERVICES)

- 5.21 IMPACT OF AI/GEN AI ON SURGICAL IMAGING MARKET

- 5.21.1 INTRODUCTION

- 5.21.2 MARKET POTENTIAL OF AI/GEN AI IN SURGICAL IMAGING MARKET

- 5.21.3 CASE STUDIES RELATED TO AI/GEN AI IMPLEMENTATION

- 5.21.3.1 AI-assisted intraoperative imaging for enhanced detection of peritoneal metastases

- 5.21.4 IMPACT OF AI/GEN AI ON INTERCONNECTED AND ADJACENT ECOSYSTEMS

- 5.21.4.1 Surgical navigation & visualization software

- 5.21.4.2 Operating room integration platforms

- 5.21.4.3 Intraoperative imaging systems (CT, MRI, fluoroscopy, ultrasound)

- 5.21.5 USER READINESS AND IMPACT ASSESSMENT

- 5.21.5.1 User readiness

- 5.21.5.1.1 User A: Hospitals

- 5.21.5.1.2 User B: Ambulatory surgical clinics (ASCs)

- 5.21.5.2 Impact assessment

- 5.21.5.2.1 User A: Hospitals

- 5.21.5.2.1.1 Implementation

- 5.21.5.2.1.2 Impact

- 5.21.5.2.2 User B: Ambulatory surgical clinics (ASCs)

- 5.21.5.2.2.1 Implementation

- 5.21.5.2.2.2 Impact

- 5.21.5.2.1 User A: Hospitals

- 5.21.5.1 User readiness

- 5.22 IMPACT OF 2025 US TARIFF - OVERVIEW

- 5.22.1 INTRODUCTION

- 5.22.2 KEY TARIFF RATES

- 5.22.3 PRICE IMPACT ANALYSIS

- 5.22.4 IMPACT ON COUNTRY/REGION

- 5.22.4.1 US

- 5.22.4.2 EUROPE

- 5.22.4.3 ASIA PACIFIC

- 5.22.5 IMPACT ON END-USE INDUSTRIES

- 5.22.6 CONCLUSION

6 SURGICAL IMAGING MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 C-ARMS

- 6.2.1 C-ARMS ENHANCING SURGICAL OUTCOMES THROUGH REAL-TIME FLUOROSCOPIC IMAGING TO DRIVE MARKET

- 6.3 CT SCANNERS

- 6.3.1 ENHANCED OPERATIVE CARE WITH HIGH-ACCURACY INTRAOPERATIVE IMAGING TO DRIVE ADOPTION OF CT SCANNERS

- 6.4 ULTRASOUND SYSTEMS

- 6.4.1 ULTRASOUND ADVANCING SURGICAL PRECISION THROUGH REAL-TIME INTRAOPERATIVE IMAGING TO DRIVE SEGMENTAL GROWTH

- 6.5 INTEGRATED MR-OR SYSTEMS

- 6.5.1 INTEGRATED MR OR SYSTEMS DRIVING SURGICAL ACCURACY THROUGH REAL-TIME SOFT TISSUE IMAGING

- 6.6 SURGICAL NAVIGATION SOFTWARE

- 6.6.1 GROWING USE OF SURGICAL NAVIGATION SOFTWARE DRIVING OPERATIVE PRECISION WITH REAL-TIME GUIDANCE

- 6.7 ACCESSORIES

- 6.7.1 INCREASING ADOPTION OF SURGICAL IMAGING ACCESSORIES TO DRIVE ENHANCED VISUALIZATION AND WORKFLOW EFFICIENCY

7 SURGICAL IMAGING MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 PROCEDURE TYPE

- 7.2.1 MINIMALLY INVASIVE SURGERY

- 7.2.1.1 Rising adoption of minimally invasive techniques driving precision and faster recovery in surgical imaging

- 7.2.2 LAPAROSCOPY

- 7.2.2.1 Enhanced precision and faster recovery driving increased adoption of laparoscopic imaging

- 7.2.3 ENDOSCOPY

- 7.2.3.1 Real-time internal visualization driving growth in endoscopic imaging

- 7.2.4 OTHER PROCEDURES

- 7.2.1 MINIMALLY INVASIVE SURGERY

- 7.3 SURGERY TYPE

- 7.3.1 GENERAL SURGERY

- 7.3.1.1 Enhanced visualization transforming general surgical procedures to fuel growth

- 7.3.2 CARDIOVASCULAR SURGERY

- 7.3.2.1 Advanced imaging techniques enhancing cardiovascular interventions to fuel growth

- 7.3.3 OB/GYN SURGERY

- 7.3.3.1 Growing use of imaging-guided precision driving improved surgical outcomes in OB/GYN procedures

- 7.3.4 ORTHOPEDIC & MUSCULOSKELETAL SURGERY

- 7.3.4.1 Adoption of imaging solutions driving optimized implant placement and bone alignment

- 7.3.5 NEUROSURGERY

- 7.3.5.1 High-precision imaging navigating complex neural procedures to drive market

- 7.3.6 UROLOGY SURGERY

- 7.3.6.1 Imaging-guided precision improving outcomes in urological surgeries to drive demand

- 7.3.7 OTHER SURGERIES

- 7.3.1 GENERAL SURGERY

8 SURGICAL IMAGING MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 HOSPITALS & SURGICAL CENTERS

- 8.2.1 RISING SURGICAL VOLUMES IN HOSPITALS AND SURGICAL CENTERS TO DRIVE MARKET

- 8.3 SPECIALTY CLINICS

- 8.3.1 SPECIALTY CLINICS DRIVING SURGICAL IMAGING ADOPTION THROUGH PRECISION AND EFFICIENCY

- 8.4 AMBULATORY SURGICAL CENTERS

- 8.4.1 AMBULATORY SURGICAL CENTERS DRIVING SURGICAL IMAGING ADOPTION FOR EFFICIENT OUTPATIENT CARE

- 8.5 OTHER END USERS

9 SURGICAL IMAGING MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 Advancements in AI and augmented reality integration in surgery to drive market

- 9.2.3 CANADA

- 9.2.3.1 Collaborations between national AI institutes and health systems to drive market

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Precision-driven imaging and expanding hospital capacity to drive regional growth

- 9.3.3 UK

- 9.3.3.1 NHS-led integration of surgical imaging and skilled workforce strength to drive regional growth

- 9.3.4 FRANCE

- 9.3.4.1 Steady growth in radiology workforce supporting imaging expansion

- 9.3.5 ITALY

- 9.3.5.1 Balancing imaging modernization with workforce shortages

- 9.3.6 SPAIN

- 9.3.6.1 Expanding surgical imaging access with focus on regional equity

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 JAPAN

- 9.4.2.1 Enhancing surgical outcomes with innovative imaging technologies

- 9.4.3 CHINA

- 9.4.3.1 Strong network of grade-A tertiary hospitals driving advanced imaging adoption

- 9.4.4 INDIA

- 9.4.4.1 Government initiatives and private hospital collaborations to fuel growth

- 9.4.5 SOUTH KOREA

- 9.4.5.1 Rising aging population driving demand for precision surgical imaging

- 9.4.6 AUSTRALIA

- 9.4.6.1 Strengthening surgical imaging capabilities for minimally invasive procedures

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 9.5.2 BRAZIL

- 9.5.2.1 Government and private investment in surgical infrastructure to drive market

- 9.5.3 MEXICO

- 9.5.3.1 Accelerating minimally invasive and AI-enabled surgical imaging to drive market

- 9.5.4 REST OF LATIN AMERICA

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 9.6.2 GCC COUNTRIES

- 9.6.2.1 Rising healthcare demand and innovation driving surgical imaging advancements

- 9.6.3 REST OF MIDDLE EAST & AFRICA

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN SURGICAL IMAGING MARKET

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Region footprint

- 10.5.5.3 Product footprint

- 10.5.5.4 Application (procedure type) footprint

- 10.5.5.5 Application (surgery type) footprint

- 10.5.5.6 End-user footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/SMEs

- 10.6.5.2 Competitive benchmarking of emerging players/startups

- 10.7 COMPANY VALUATION & FINANCIAL METRICS

- 10.7.1 FINANCIAL METRICS

- 10.7.2 COMPANY VALUATION

- 10.8 BRAND/PRODUCT COMPARISON

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 GE HEALTHCARE

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches & approvals

- 11.1.1.3.2 Deals

- 11.1.1.3.3 Expansions

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses & competitive threats

- 11.1.2 SIEMENS HEALTHINEERS AG

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches & approvals

- 11.1.2.3.2 Deals

- 11.1.2.3.3 Other developments

- 11.1.2.3.4 Expansions

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses & competitive threats

- 11.1.3 KONINKLIJKE PHILIPS N.V.

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches & approvals

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses & competitive threats

- 11.1.4 SHIMADZU CORPORATION

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches & approvals

- 11.1.4.3.2 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses & competitive threats

- 11.1.5 FUJIFILM HOLDINGS CORPORATION

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches & approvals

- 11.1.5.3.2 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses & competitive threats

- 11.1.6 ZIEHM IMAGING GMBH

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches & approvals

- 11.1.6.3.2 Deals

- 11.1.7 HOLOGIC, INC.

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Deals

- 11.1.8 SMITH+NEPHEW

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Product launches & approvals

- 11.1.8.3.2 Deals

- 11.1.9 MEDTRONIC

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product launches & approvals

- 11.1.9.3.2 Deals

- 11.1.10 STRYKER

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product launches & approvals

- 11.1.10.3.2 Deals

- 11.1.11 CANON MEDICAL SYSTEMS CORPORATION

- 11.1.11.1 Business overview

- 11.1.11.2 Products offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Product launches & approvals

- 11.1.11.3.2 Deals

- 11.1.12 OLYMPUS CORPORATION

- 11.1.12.1 Business overview

- 11.1.12.2 Products offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 PRODUCT LAUNCHES AND APPROVALS

- 11.1.12.3.2 Deals

- 11.1.12.3.3 Expansions

- 11.1.13 NOVANTA INC.

- 11.1.13.1 Business overview

- 11.1.13.2 Products offered

- 11.1.13.3 Recent developments

- 11.1.13.3.1 Deals

- 11.1.14 GLOBUS MEDICAL

- 11.1.14.1 Business overview

- 11.1.14.2 Products offered

- 11.1.14.3 Recent developments

- 11.1.14.3.1 Product launches & approvals

- 11.1.14.3.2 Deals

- 11.1.15 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.

- 11.1.15.1 Business overview

- 11.1.15.2 Products offered

- 11.1.15.3 Recent developments

- 11.1.15.3.1 Product launches & approvals

- 11.1.16 SONY ELECTRONICS INC.

- 11.1.16.1 Business overview

- 11.1.16.2 Products offered

- 11.1.16.3 Recent developments

- 11.1.16.3.1 Product launches & approvals

- 11.1.16.3.2 Deals

- 11.1.17 UNITED IMAGING HEALTHCARE CO., LTD.

- 11.1.17.1 Business overview

- 11.1.17.2 Products offered

- 11.1.17.3 Recent developments

- 11.1.17.3.1 Product launches & approvals

- 11.1.18 BARCO

- 11.1.18.1 Business overview

- 11.1.18.2 Products offered

- 11.1.18.3 Recent developments

- 11.1.18.3.1 Product launches & approvals

- 11.1.18.3.2 Deals

- 11.1.19 AUXEIN

- 11.1.19.1 Business overview

- 11.1.19.2 Products offered

- 11.1.19.3 Recent developments

- 11.1.19.3.1 Product launches & approvals

- 11.1.20 BRAINLAB SE

- 11.1.20.1 Business overview

- 11.1.20.2 Products offered

- 11.1.20.3 Recent developments

- 11.1.20.3.1 Deals

- 11.1.1 GE HEALTHCARE

- 11.2 OTHER PLAYERS

- 11.2.1 TRIVITRON HEALTHCARE

- 11.2.2 RGS HEALTHCARE

- 11.2.3 GEMSS HEALTHCARE CO., LTD.

- 11.2.4 SKANRAY TECHNOLOGIES LIMITED

- 11.2.5 NANJING PERLOVE MEDICAL EQUIPMENT CO., LTD.

- 11.2.6 ARTHREX, INC.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

List of Tables

- TABLE 1 SURGICAL IMAGING MARKET: IMPACT ANALYSIS OF MARKET DYNAMICS

- TABLE 2 AVERAGE SELLING PRICE OF TOP PRODUCTS, BY KEY PLAYER, 2024

- TABLE 3 AVERAGE SELLING PRICE TREND OF SURGICAL IMAGING PRODUCTS, BY REGION, 2022-2024

- TABLE 4 SURGICAL IMAGING MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 5 JURISDICTION ANALYSIS OF TOP APPLICANT COUNTRIES FOR SURGICAL IMAGING MARKET (2025)

- TABLE 6 IMPORT DATA FOR SURGICAL IMAGING PRODUCTS (HS CODE 9022), BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 7 EXPORT DATA FOR SURGICAL IMAGING PRODUCTS (HS CODE 9022), BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 8 SURGICAL IMAGING MARKET: DETAILED LIST OF MAJOR CONFERENCES AND EVENTS, 2025-2026

- TABLE 9 TARIFF DATA FOR HS CODE 9022

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 US FDA: MEDICAL DEVICE CLASSIFICATION

- TABLE 16 US: APPROVED IMAGING DEVICES BY FDA

- TABLE 17 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 18 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 19 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PMDA

- TABLE 20 CHINA: CLASSIFICATION OF MEDICAL DEVICES

- TABLE 21 MEDICAL REIMBURSEMENT CPT CODES FOR SURGICAL PROCEDURES IN US, 2025

- TABLE 22 SURGICAL IMAGING MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER (%)

- TABLE 24 KEY BUYING CRITERIA FOR END USERS

- TABLE 25 UNMET NEEDS IN SURGICAL IMAGING MARKET

- TABLE 26 END-USER EXPECTATIONS IN SURGICAL IMAGING MARKET

- TABLE 27 US ADJUSTED RECIPROCAL TARIFF RATES (AS OF AUGUST 2025)

- TABLE 28 SURGICAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 29 C-ARMS SURGICAL IMAGING MARKET, BY OFFERINGS OF MAJOR PLAYERS

- TABLE 30 C-ARMS: SURGICAL IMAGING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 31 C-ARMS: SURGICAL IMAGING MARKET, BY APPLICATION (PROCEDURE TYPE), 2023-2030 (USD MILLION)

- TABLE 32 C-ARMS: SURGICAL IMAGING MARKET, BY APPLICATION (SURGERY TYPE), 2023-2030 (USD MILLION)

- TABLE 33 C-ARMS: SURGICAL IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 34 CT SCANNERS: SURGICAL IMAGING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 35 CT SCANNERS: SURGICAL IMAGING MARKET, BY APPLICATION (PROCEDURE TYPE), 2023-2030 (USD MILLION)

- TABLE 36 CT SCANNERS: SURGICAL IMAGING MARKET, BY APPLICATION (SURGERY TYPE), 2023-2030 (USD MILLION)

- TABLE 37 CT SCANNERS: SURGICAL IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 38 ULTRASOUND SYSTEMS: SURGICAL IMAGING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 39 ULTRASOUND SYSTEMS: SURGICAL IMAGING MARKET, BY APPLICATION (PROCEDURE TYPE), 2023-2030 (USD MILLION)

- TABLE 40 ULTRASOUND SYSTEMS: SURGICAL IMAGING MARKET, BY APPLICATION (SURGERY TYPE), 2023-2030 (USD MILLION)

- TABLE 41 ULTRASOUND SYSTEMS: SURGICAL IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 42 INTEGRATED MR-OR SYSTEMS: SURGICAL IMAGING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 43 INTEGRATED MR-OR SYSTEMS: SURGICAL IMAGING MARKET, BY APPLICATION (PROCEDURE TYPE), 2023-2030 (USD MILLION)

- TABLE 44 INTEGRATED MR-OR SYSTEMS: SURGICAL IMAGING MARKET, BY APPLICATION (SURGERY TYPE, 2023-2030 (USD MILLION)

- TABLE 45 INTEGRATED MR-OR SYSTEMS: SURGICAL IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 46 SURGICAL NAVIGATION SOFTWARE: SURGICAL IMAGING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 47 SURGICAL NAVIGATION SOFTWARE: SURGICAL IMAGING MARKET, BY APPLICATION (PROCEDURE TYPE), 2023-2030 (USD MILLION)

- TABLE 48 SURGICAL NAVIGATION SOFTWARE: SURGICAL IMAGING MARKET, BY APPLICATION (SURGERY TYPE), 2023-2030 (USD MILLION)

- TABLE 49 SURGICAL NAVIGATION SOFTWARE: SURGICAL IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 50 ACCESSORIES: SURGICAL IMAGING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 51 ACCESSORIES: SURGICAL IMAGING MARKET, BY APPLICATION (PROCEDURE TYPE), 2023-2030 (USD MILLION)

- TABLE 52 ACCESSORIES: SURGICAL IMAGING MARKET, BY APPLICATION (SURGERY TYPE), 2023-2030 (USD MILLION)

- TABLE 53 ACCESSORIES: SURGICAL IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 54 SURGICAL IMAGING MARKET, BY PROCEDURE TYPE, 2023-2030 (USD MILLION)

- TABLE 55 PROCEDURE TYPE: SURGICAL IMAGING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 56 MINIMALLY INVASIVE SURGERY: SURGICAL IMAGING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 57 LAPAROSCOPY: SURGICAL IMAGING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 58 ENDOSCOPY: SURGICAL IMAGING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 59 OTHER PROCEDURES: SURGICAL IMAGING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 60 SURGICAL IMAGING MARKET, BY SURGERY TYPE, 2023-2030 (USD MILLION)

- TABLE 61 SURGERY TYPE: SURGICAL IMAGING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 62 GENERAL SURGERY: SURGICAL IMAGING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 63 CARDIOVASCULAR SURGERY: SURGICAL IMAGING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 64 OB/GYN SURGERY: SURGICAL IMAGING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 65 ORTHOPEDIC & MUSCULOSKELETAL SURGERY: SURGICAL IMAGING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 66 NEUROSURGERY: SURGICAL IMAGING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 67 UROLOGY SURGERY: SURGICAL IMAGING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 68 OTHER SURGERIES: SURGICAL IMAGING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 69 SURGICAL IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 70 SURGICAL IMAGING MARKET FOR HOSPITALS & SURGICAL CENTERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 71 SURGICAL IMAGING MARKET FOR SPECIALTY CLINICS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 72 SURGICAL IMAGING MARKET FOR AMBULATORY SURGICAL CENTERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 73 SURGICAL IMAGING MARKET FOR OTHER END USERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 74 SURGICAL IMAGING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 75 NORTH AMERICA: MACROECONOMIC OUTLOOK

- TABLE 76 NORTH AMERICA: SURGICAL IMAGING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 77 NORTH AMERICA: SURGICAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 78 NORTH AMERICA: SURGICAL IMAGING MARKET, BY APPLICATION (PROCEDURE TYPE), 2023-2030 (USD MILLION)

- TABLE 79 NORTH AMERICA: SURGICAL IMAGING MARKET, BY APPLICATION (SURGERY TYPE), 2023-2030 (USD MILLION)

- TABLE 80 NORTH AMERICA: SURGICAL IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 81 US: SURGICAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 82 CANADA: SURGICAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 83 EUROPE: MACROECONOMIC OUTLOOK

- TABLE 84 EUROPE: SURGICAL IMAGING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 85 EUROPE: SURGICAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 86 EUROPE: SURGICAL IMAGING MARKET, BY APPLICATION (PROCEDURE TYPE), 2023-2030 (USD MILLION)

- TABLE 87 EUROPE: SURGICAL IMAGING MARKET, BY APPLICATION (SURGERY TYPE), 2023-2030 (USD MILLION)

- TABLE 88 EUROPE: SURGICAL IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 89 GERMANY: SURGICAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 90 UK: SURGICAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 91 FRANCE: SURGICAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 92 ITALY: SURGICAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 93 SPAIN: SURGICAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 94 REST OF EUROPE: SURGICAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 95 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- TABLE 96 ASIA PACIFIC: SURGICAL IMAGING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 97 ASIA PACIFIC: SURGICAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 98 ASIA PACIFIC: SURGICAL IMAGING MARKET, BY APPLICATION (PROCEDURE TYPE), 2023-2030 (USD MILLION)

- TABLE 99 ASIA PACIFIC: SURGICAL IMAGING MARKET, BY APPLICATION (SURGERY TYPE), 2023-2030 (USD MILLION)

- TABLE 100 ASIA PACIFIC: SURGICAL IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 101 JAPAN: SURGICAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 102 CHINA: SURGICAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 103 INDIA: SURGICAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 104 SOUTH KOREA: SURGICAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 105 AUSTRALIA: SURGICAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 106 REST OF ASIA PACIFIC: SURGICAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 107 LATIN AMERICA: MACROECONOMIC OUTLOOK

- TABLE 108 LATIN AMERICA: SURGICAL IMAGING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 109 LATIN AMERICA: SURGICAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 110 LATIN AMERICA: SURGICAL IMAGING MARKET, BY APPLICATION (PROCEDURE TYPE), 2023-2030 (USD MILLION)

- TABLE 111 LATIN AMERICA: SURGICAL IMAGING MARKET, BY APPLICATION (SURGERY TYPE), 2023-2030 (USD MILLION)

- TABLE 112 LATIN AMERICA: SURGICAL IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 113 BRAZIL: SURGICAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 114 MEXICO: SURGICAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 115 REST OF LATIN AMERICA: SURGICAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 116 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- TABLE 117 MIDDLE EAST & AFRICA: SURGICAL IMAGING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 118 MIDDLE EAST & AFRICA: SURGICAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 119 MIDDLE EAST & AFRICA: SURGICAL IMAGING MARKET, BY APPLICATION (PROCEDURE TYPE), 2023-2030 (USD MILLION)

- TABLE 120 MIDDLE EAST & AFRICA: SURGICAL IMAGING MARKET, BY APPLICATION (SURGERY TYPE), 2023-2030 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: SURGICAL IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 122 GCC COUNTRIES: SURGICAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 123 REST OF MIDDLE EAST & AFRICA: SURGICAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 124 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN SURGICAL IMAGING MARKET, JANUARY 2022-AUGUST 2025

- TABLE 125 SURGICAL IMAGING MARKET: DEGREE OF COMPETITION

- TABLE 126 SURGICAL IMAGING MARKET: REGION FOOTPRINT

- TABLE 127 SURGICAL IMAGING MARKET: PRODUCT FOOTPRINT

- TABLE 128 SURGICAL IMAGING MARKET: APPLICATION (PROCEDURE TYPE) FOOTPRINT

- TABLE 129 SURGICAL IMAGING MARKET: APPLICATION (SURGERY TYPE) FOOTPRINT

- TABLE 130 SURGICAL IMAGING MARKET: END-USER FOOTPRINT

- TABLE 131 SURGICAL IMAGING MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 132 SURGICAL IMAGING MARKET: COMPETITIVE BENCHMARKING OF KEY EMERGING PLAYERS/STARTUPS

- TABLE 133 SURGICAL IMAGING MARKET: PRODUCT LAUNCHES, JANUARY 2022-AUGUST 2025

- TABLE 134 SURGICAL IMAGING MARKET: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 135 SURGICAL IMAGING MARKET: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 136 GE HEALTHCARE: COMPANY OVERVIEW

- TABLE 137 GE HEALTHCARE: PRODUCTS OFFERED

- TABLE 138 GE HEALTHCARE: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 139 GE HEALTHCARE: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 140 GE HEALTHCARE: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 141 SIEMENS HEALTHINEERS AG: COMPANY OVERVIEW

- TABLE 142 SIEMENS HEALTHINEERS AG: PRODUCTS OFFERED

- TABLE 143 SIEMENS HEALTHINEERS AG: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 144 SIEMENS HEALTHINEERS AG: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 145 SIEMENS HEALTHINEERS AG: OTHER DEVELOPMENTS, JANUARY 2022-AUGUST 2025

- TABLE 146 SIEMENS HEALTHINEERS AG: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 147 KONINKLIJKE PHILIPS N.V.: COMPANY OVERVIEW

- TABLE 148 KONINKLIJKE PHILIPS N.V.: PRODUCTS OFFERED

- TABLE 149 KONINKLIJKE PHILIPS N.V.: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 150 KONINKLIJKE PHILIPS N.V.: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 151 SHIMADZU CORPORATION: COMPANY OVERVIEW

- TABLE 152 SHIMADZU CORPORATION: PRODUCTS OFFERED

- TABLE 153 SHIMADZU CORPORATION: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 154 SHIMADZU CORPORATION: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 155 FUJIFILM HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 156 FUJIFILM HOLDINGS CORPORATION: PRODUCTS OFFERED

- TABLE 157 FUJIFILM HOLDINGS CORPORATION: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 158 FUJIFILM HOLDINGS CORPORATION: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 159 ZIEHM IMAGING GMBH: COMPANY OVERVIEW

- TABLE 160 ZIEHM IMAGING GMBH: PRODUCTS OFFERED

- TABLE 161 ZIEHM IMAGING GMBH: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 162 ZIEHM IMAGING GMBH: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 163 HOLOGIC, INC.: COMPANY OVERVIEW

- TABLE 164 HOLOGIC, INC.: PRODUCTS OFFERED

- TABLE 165 HOLOGIC, INC.: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 166 SMITH+NEPHEW: COMPANY OVERVIEW

- TABLE 167 SMITH+NEPHEW: PRODUCTS OFFERED

- TABLE 168 SMITH+NEPHEW: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 169 SMITH+NEPHEW: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 170 MEDTRONIC: COMPANY OVERVIEW

- TABLE 171 MEDTRONIC: PRODUCTS OFFERED

- TABLE 172 MEDTRONIC: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 173 MEDTRONIC: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 174 STRYKER: COMPANY OVERVIEW

- TABLE 175 STRYKER: PRODUCTS OFFERED

- TABLE 176 STRYKER: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 177 STRYKER: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 178 CANON INC.: COMPANY OVERVIEW

- TABLE 179 CANON MEDICAL SYSTEMS CORPORATION: PRODUCTS OFFERED

- TABLE 180 CANON MEDICAL SYSTEMS CORPORATION: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 181 CANON MEDICAL SYSTEMS CORPORATION: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 182 OLYMPUS CORPORATION: COMPANY OVERVIEW

- TABLE 183 OLYMPUS CORPORATION: PRODUCTS OFFERED

- TABLE 184 OLYMPUS CORPORATION: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 185 OLYMPUS CORPORATION: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 186 OLYMPUS CORPORATION: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 187 NOVANTA INC.: COMPANY OVERVIEW

- TABLE 188 NOVANTA INC.: PRODUCTS OFFERED

- TABLE 189 NOVANTA INC.: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 190 GLOBUS MEDICAL: COMPANY OVERVIEW

- TABLE 191 GLOBUS MEDICAL: PRODUCTS OFFERED

- TABLE 192 GLOBUS MEDICAL: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 193 GLOBUS MEDICAL: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 194 SHENZHEN MINDRAY: COMPANY OVERVIEW

- TABLE 195 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.: PRODUCTS OFFERED

- TABLE 196 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 197 SONY ELECTRONICS INC.: COMPANY OVERVIEW

- TABLE 198 SONY ELECTRONICS INC.: PRODUCTS OFFERED

- TABLE 199 SONY ELECTRONICS INC.: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-MAY 2025

- TABLE 200 SONY ELECTRONICS INC: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 201 UNITED IMAGING HEALTHCARE CO., LTD.: COMPANY OVERVIEW

- TABLE 202 UNITED IMAGING HEALTHCARE CO., LTD.: PRODUCTS OFFERED

- TABLE 203 UNITED IMAGING HEALTHCARE CO., LTD.: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 204 BARCO: COMPANY OVERVIEW

- TABLE 205 BARCO: PRODUCTS OFFERED

- TABLE 206 BARCO: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 207 BARCO: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 208 AUXEIN: COMPANY OVERVIEW

- TABLE 209 AUXEIN: PRODUCTS OFFERED

- TABLE 210 AUXEIN: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-AUGUST 2025

- TABLE 211 BRAINLAB SE: COMPANY OVERVIEW

- TABLE 212 BRAINLAB SE: PRODUCTS OFFERED

- TABLE 213 BRAINLAB SE: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 214 TRIVITRON HEALTHCARE: COMPANY OVERVIEW

- TABLE 215 RGS HEALTHCARE: COMPANY OVERVIEW

- TABLE 216 GEMSS HEALTHCARE CO., LTD.: COMPANY OVERVIEW

- TABLE 217 SKANRAY TECHNOLOGIES LIMITED: COMPANY OVERVIEW

- TABLE 218 NANJING PERLOVE MEDICAL EQUIPMENT CO., LTD.: COMPANY OVERVIEW

- TABLE 219 ARTHREX, INC.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 MARKET AND REGIONAL SEGMENTATION

- FIGURE 2 SURGICAL IMAGING MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 5 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 6 SURGICAL IMAGING MARKET: BOTTOM-UP APPROACH

- FIGURE 7 CAGR PROJECTIONS

- FIGURE 8 DATA TRIANGULATION METHODOLOGY

- FIGURE 9 SURGICAL IMAGING MARKET, BY PRODUCT, 2025 VS. 2030

- FIGURE 10 SURGICAL IMAGING MARKET, BY APPLICATION (PROCEDURE TYPE), 2025 VS. 2030

- FIGURE 11 SURGICAL IMAGING MARKET, BY APPLICATION (SURGERY TYPE), 2025 VS. 2030

- FIGURE 12 SURGICAL IMAGING MARKET, BY END USER, 2025 VS. 2030

- FIGURE 13 SURGICAL IMAGING MARKET: REGIONAL SNAPSHOT

- FIGURE 14 GROWING DEMAND FOR MINIMALLY INVASIVE SURGERIES AND ADVANCEMENTS IN INTRAOPERATIVE IMAGING TO DRIVE MARKET

- FIGURE 15 C-ARMS SEGMENT AND JAPAN TO COMMAND LARGEST SHARES OF ASIA PACIFIC MARKET IN 2024

- FIGURE 16 MARKET IN CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 ASIA PACIFIC TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 18 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH RATES DURING FORECAST PERIOD

- FIGURE 19 SURGICAL IMAGING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 REVENUE SHIFT AND NEW REVENUE POCKETS IN SURGICAL IMAGING MARKET

- FIGURE 21 AVERAGE SELLING PRICE TREND OF SURGICAL IMAGING PRODUCTS, BY TYPE, 2024

- FIGURE 22 AVERAGE SELLING PRICE TREND OF SURGICAL IMAGING PRODUCTS, BY KEY PLAYER, 2024

- FIGURE 23 AVERAGE SELLING PRICE TREND OF SURGICAL IMAGING PRODUCTS, BY REGION, 2024

- FIGURE 24 SURGICAL IMAGING MARKET: VALUE CHAIN ANALYSIS

- FIGURE 25 SURGICAL IMAGING MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 26 SURGICAL IMAGING MARKET: ECOSYSTEM ANALYSIS

- FIGURE 27 INVESTMENT AND FUNDING SCENARIO

- FIGURE 28 JURISDICTION ANALYSIS OF TOP APPLICANT COUNTRIES FOR SURGICAL IMAGING MARKET (2025)

- FIGURE 29 SURGICAL IMAGING MARKET: TOP PATENT OWNERS/PATENTING TRENDS, 2015-2025

- FIGURE 30 SURGICAL IMAGING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

- FIGURE 32 KEY BUYING CRITERIA FOR END USERS

- FIGURE 33 MARKET POTENTIAL OF AI/GEN AI ON SURGICAL IMAGING ACROSS INDUSTRIES

- FIGURE 34 IMPACT OF AI/GEN AI ON INTERCONNECTED AND ADJACENT ECOSYSTEMS

- FIGURE 35 NORTH AMERICA: SURGICAL IMAGING MARKET SNAPSHOT, 2024

- FIGURE 36 ASIA PACIFIC: SURGICAL IMAGING MARKET SNAPSHOT, 2024

- FIGURE 37 REVENUE ANALYSIS OF KEY PLAYERS IN SURGICAL IMAGING MARKET, 2020-2024

- FIGURE 38 MARKET SHARE ANALYSIS OF KEY PLAYERS IN SURGICAL IMAGING MARKET, 2024

- FIGURE 39 SURGICAL IMAGING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 40 SURGICAL IMAGING MARKET: COMPANY FOOTPRINT

- FIGURE 41 SURGICAL IMAGING MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 42 EV/EBITDA OF KEY VENDORS

- FIGURE 43 YEAR-TO-DATE (YTD) PRICE, TOTAL RETURN, AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 44 SURGICAL IMAGING MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 45 GE HEALTHCARE: COMPANY SNAPSHOT (2024)

- FIGURE 46 SIEMENS HEALTHINEERS AG: COMPANY SNAPSHOT (2024)

- FIGURE 47 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2024)

- FIGURE 48 SHIMADZU CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 49 FUJIFILM HOLDINGS CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 50 HOLOGIC, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 51 SMITH+NEPHEW: COMPANY SNAPSHOT (2024)

- FIGURE 52 MEDTRONIC: COMPANY SNAPSHOT (2024)

- FIGURE 53 STRYKER: COMPANY SNAPSHOT (2024)

- FIGURE 54 CANON INC.: COMPANY SNAPSHOT (2024)

- FIGURE 55 OLYMPUS CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 56 NOVANTA INC.: COMPANY SNAPSHOT (2024)

- FIGURE 57 GLOBUS MEDICAL: COMPANY SNAPSHOT (2024)

- FIGURE 58 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.: COMPANY SNAPSHOT (2024)

- FIGURE 59 UNITED IMAGING HEALTHCARE CO., LTD.: COMPANY SNAPSHOT (2024)

- FIGURE 60 BARCO: COMPANY SNAPSHOT (2024)