|

市場調查報告書

商品編碼

1826565

兆赫技術市場:2030 年全球預測(按類型、應用、發生器和檢測器以及地區)Terahertz Technology Market by Type, Application, Sources and Detectors & Region - Global Forecast to 2030 |

||||||

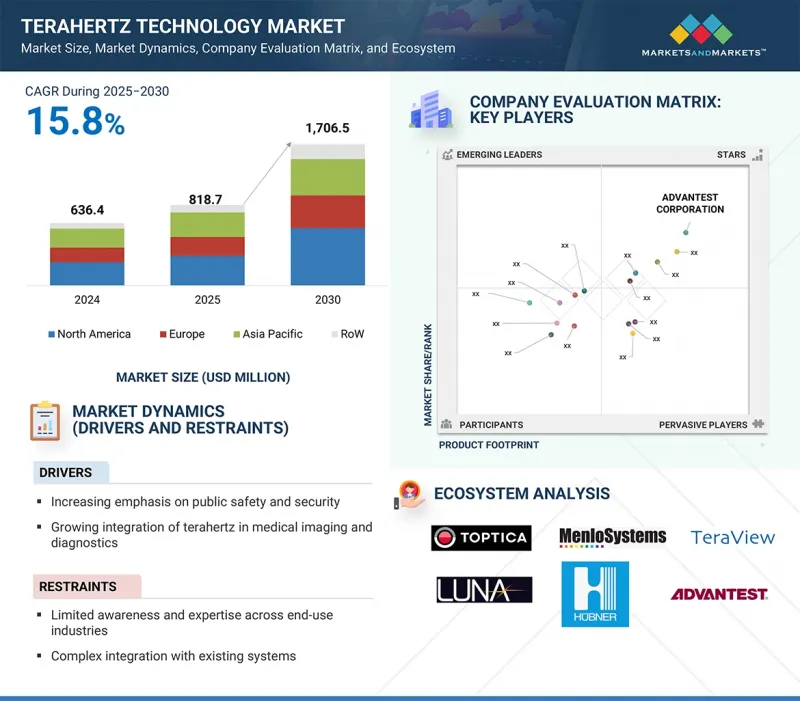

全球兆赫技術市場預計將從 2025 年的 8.187 億美元成長到 2030 年的 17.065 億美元,複合年成長率為 15.8%。

成長的主要動力是兆赫成像和兆赫在醫療領域的應用日益廣泛,這使得非電離高解析度診斷、塗層完整性檢查和藥品品管成為可能。

| 調查範圍 | |

|---|---|

| 調查年份 | 2021-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 單元 | 100萬美元 |

| 部分 | 類型、用途、發生器/檢測器、區域 |

| 目標區域 | 北美、歐洲、亞太地區和其他地區 |

同時,軍事和國防安全保障領域投資的不斷增加,推動了用於非侵入式篩檢以檢測爆炸物和隱藏威脅的兆赫系統的需求,因為兆赫頻率支援通訊、通訊和室內/室外通訊的超高速、安全的無線資料傳輸。此外,兆赫解決方案也被用於實驗室研究,用於分子分析和工業無損檢測 (NDT),以在不損壞結構的情況下評估結構完整性。這些多樣化的應用使兆赫技術成為醫療、國防、通訊和工業領域的關鍵推動因素,並支持其全球市場的強勁擴張。

2024年,醫療應用佔據第二大市場。

預計到 2024 年,醫療應用將佔據兆赫技術市場的第二大佔有率,這得益於其在非侵入性診斷和藥品品管中日益擴大的作用。兆赫系統正在擴大其在早期疾病檢測、組織表徵和牙科成像等應用中的使用,因為它們能夠實現比傳統方法更安全的高解析度非電離成像。此外,製藥公司正在採用兆赫光譜法分析塗層厚度、結晶度和雜質水平,以確保產品品質和法規遵循。醫院、研究機構和生命科學公司也正在整合這些系統,以推動精準醫療並改善治療效果。對更安全的診斷技術日益成長的需求以及對藥物開發中可靠品質保證的需求,使醫療保健成為最有前景的終端使用領域之一。隨著技術創新的加速,特別是在影像和照護現場應用領域,這一領域繼續擴大其對全球兆赫技術市場的貢獻。

預計兆赫成像領域在預測期內的複合年成長率將位居第二。

預計在預測期內,兆赫成像領域將成為兆赫技術市場中複合年成長率第二高的領域,這得益於其在醫療、安全和工業應用中的日益成長。在醫療領域,兆赫成像正在推動非侵入性診斷,無需使用有害輻射即可對組織進行詳細可視化。同樣,在軍事和國防安全保障,它擴大被用於檢測隱藏的武器和爆炸物,為傳統掃描方法提供了安全有效的替代方案。該技術也被用於工業無損檢測 (NDT),它可以在不損壞材料和組件的情況下進行精確檢查。人們對高解析度、即時成像的日益關注以及緊湊型可攜式系統的進步,正在推動其在商業和研究領域的應用。隨著各行各業繼續優先考慮安全、品質保證和先進的診斷解決方案,預計兆赫成像將在未來幾年的市場成長中發揮關鍵作用。

在預計預測期內,加拿大將在北美兆赫技術市場中實現最高的複合年成長率。

受醫學研究、國防現代化和先進通訊技術投資增加的推動,預計預測期內加拿大將在北美兆赫技術市場中實現最高的複合年成長率。加拿大的大學和研究機構正在積極探索兆赫在生物醫學成像和藥物測試中的應用,對光譜和成像系統的需求強勁。同時,政府為加強國防安全保障和防禦能力所做的努力正在推動採用基於兆赫的篩檢和偵測系統進行威脅識別。此外,加拿大擴大參與包括 6G 研究在內的下一代無線通訊基礎設施開發,這加速了人們對用於超高速資料傳輸的兆赫頻率的興趣。強大的研究活動、不斷成長的醫療創新以及政府支持計劃使加拿大成為北美兆赫技術的主要成長市場。

本報告研究了全球兆赫技術市場,提供了關鍵促進因素和限制因素、競爭格局和未來趨勢的資訊。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章 主要發現

- 兆赫技術市場中誘人的成長機會

- 兆赫技術市場類型

- 兆赫技術市場(按應用)

- 兆赫技術市場(按地區)

- 兆赫技術市場(按國家)

第5章 市場概況

- 介紹

- 市場動態

- 驅動程式

- 抑制因素

- 機會

- 任務

- 影響客戶業務的趨勢/中斷

- 定價分析

- 各地區平均銷售價格趨勢

- 主要企業各類型平均銷售價格趨勢

- 供應鏈分析

- 生態系分析

- 技術分析

- 主要技術

- 互補技術

- 鄰近技術

- 專利分析

- 貿易分析

- 出口場景

- 導入場景

- 大型會議及活動

- 案例研究分析

- 監管格局

- 監管機構、政府機構和其他組織

- 主要法規

- 波特五力分析

- 主要相關利益者和採購標準

- 人工智慧對兆赫技術市場的影響

- 2025年美國關稅的影響 -兆赫技術市場

- 介紹

- 主要關稅稅率

- 價格影響分析

- 國家/地區影響力

- 對使用的影響

第6章兆赫技術市場(按類型)

- 介紹

- 兆赫成像

- 兆赫光譜

- 兆赫通訊系統

第7章兆赫技術市場(依應用)

- 介紹

- 實驗室研究

- 醫療保健

- 軍事/國防安全保障

- 工業無損檢測(NDT)

- 衛星通訊

- 戰術/軍事通訊

- 室外/室內無線通訊

第 8 章兆赫技術(產生器與檢測器)

- 介紹

- 兆赫發生器

- 量子級聯雷射(QCL)

- 倍頻器

- 格羅佛

- 光電導天線(PCA)

- STAR(Stimulated Terahertz Amplified Radiation)

- 檢測器

- 肖特基二極體

- 高電子移動性電晶體(HEMT)

- 奈米線

- 熱電檢測器

- 戈萊塞爾

- 輻射熱計,SHAB(超導熱點空氣橋輻射熱計)

第9章兆赫技術市場(按地區)

- 介紹

- 北美洲

- 北美宏觀經濟展望

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 歐洲宏觀經濟展望

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 亞太宏觀經濟展望

- 日本

- 中國

- 印度

- 韓國

- 其他亞太地區

- 其他地區

- 其他地區的宏觀經濟前景

- 中東和非洲

- 南美洲

第10章 競爭格局

- 介紹

- 主要參與企業的策略/優勢

- 收益分析(2021-2024)

- 市佔率分析(2024年)

- 企業評估矩陣:主要企業(2024年)

- 公司評估矩陣:Start-Ups/中小企業(2024 年)

- 競爭場景

第11章:公司簡介

- 主要企業

- ADVANTEST CORPORATION

- LUNA INNOVATIONS

- TERAVIEW LIMITED

- TOPTICA PHOTONICS AG

- HUBNER GMBH & CO. KG

- MENLO SYSTEMS

- TERASENSE GROUP INC.

- GENTEC ELECTRO-OPTICS

- QMC INSTRUMENTS LTD.

- TERAVIL LTD

- 其他公司

- VIRGINIA DIODES, INC.

- MICROTECH INSTRUMENTS

- SWISSTO12

- DEL MAR PHOTONICS, INC.

- INSIGHT PRODUCT COMPANY

- BATOP GMBH

- LYTID SAS

- TYDEX

- QUANTUM DESIGN INC.

- RAYSECUR, INC.

- LONGWAVE PHOTONICS LLC

- BRIDGE12 TECHNOLOGIES, INC.

- ACAL BFI

- THORLABS, INC.

- SCIENCETECH INC.

第12章 附錄

The Terahertz Technology market is expected to grow from USD 818.7 million in 2025 to USD 1,706.5 million by 2030, at a CAGR of 15.8%. Growth is primarily fueled by the expanding adoption of terahertz imaging and spectroscopy in the medical and healthcare sector, where it enables non-ionizing, high-resolution diagnostics, coating integrity checks, and pharmaceutical quality control.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Segments | By Type, Application, Sources and Detectors, Region |

| Regions covered | North America, Europe, APAC, RoW |

At the same time, increasing investments in military and homeland security are driving demand for terahertz systems used in non-invasive screening to detect explosives and concealed threats. Another major growth catalyst is the advancement of next-generation communication technologies, as terahertz frequencies support ultra-fast, secure wireless data transfer for satellite, tactical, and indoor/outdoor communications. In addition, terahertz solutions are being adopted in laboratory research for molecular analysis and in industrial non-destructive testing (NDT) to evaluate structural integrity without causing damage. Together, these diverse application areas position terahertz technology as a critical enabler across healthcare, defense, communications, and industrial domains, sustaining strong market expansion worldwide.

The medical & healthcare applications accounted for the second-largest market share in 2024.

The medical & healthcare application represents the second largest share of the terahertz technology market in 2024, supported by its growing role in non-invasive diagnostics and pharmaceutical quality control. Terahertz systems are increasingly utilized for applications such as early disease detection, tissue characterization, and dental imaging, owing to their ability to deliver high-resolution, non-ionizing imaging that is safer than conventional methods. In addition, pharmaceutical companies are adopting terahertz spectroscopy to analyze coating thickness, crystallinity, and impurity levels, ensuring product quality and regulatory compliance. Hospitals, research institutions, and life sciences companies are also integrating these systems to advance precision medicine and improve treatment outcomes. The rising demand for safer diagnostic technologies, coupled with the need for reliable quality assurance in drug development, has positioned medical and healthcare as one of the most promising end-use sectors. As innovation accelerates, particularly in imaging and point-of-care applications, this segment continues to expand its contribution to the global terahertz technology market.

The terahertz imaging segment is projected to register the second-highest CAGR during the forecast period.

The terahertz imaging segment is projected to register the second-highest CAGR in the terahertz technology market during the forecast period, driven by its expanding use across healthcare, security, and industrial applications. In the medical and healthcare sector, terahertz imaging is gaining traction for non-invasive diagnostics, enabling detailed visualization of tissues without harmful radiation. Similarly, in military and homeland security, it is increasingly deployed to detect concealed weapons and explosives, offering a safer and more effective alternative to conventional scanning methods. The technology is also being adopted in industrial non-destructive testing (NDT), where it ensures precise inspection of materials and components without causing damage. The growing emphasis on high-resolution, real-time imaging, combined with advancements in compact and portable systems, is fueling wider adoption across both commercial and research domains. As industries continue to prioritize safety, quality assurance, and advanced diagnostic solutions, terahertz imaging is set to play a pivotal role in shaping market growth over the coming years.

Canada is estimated to register the highest CAGR in the North American terahertz technology market during the forecast period.

Canada is anticipated to record the highest CAGR in the North American terahertz technology market over the forecast period, driven by increasing investments in medical research, defense modernization, and advanced communication technologies. Canadian universities and research institutes are actively exploring terahertz applications in biomedical imaging and pharmaceutical testing, creating strong demand for spectroscopy and imaging systems. At the same time, government initiatives to enhance homeland security and defense capabilities are fostering the adoption of terahertz-based screening and detection systems for threat identification. Furthermore, the growing participation of Canada in developing next-generation wireless communication infrastructure, including 6G research, is accelerating interest in terahertz frequencies for ultra-fast data transfer. The strong research activity, rising healthcare innovation, and supportive government programs position Canada as a leading growth market for terahertz technology in North America.

Breakdown of Primaries

A variety of executives from key organizations operating in the terahertz technology market were interviewed in-depth, including CEOs, marketing directors, and innovation and technology directors.

- By Company Type: Tier 1-35%, Tier 2- 40%, and Tier 3-25%

- By Designation: C-level Executives-30%, Directors-40%, and Others-30%

- By Region: North America-40%, Europe -32%, Asia Pacific -23%, and Rest of the World-5%

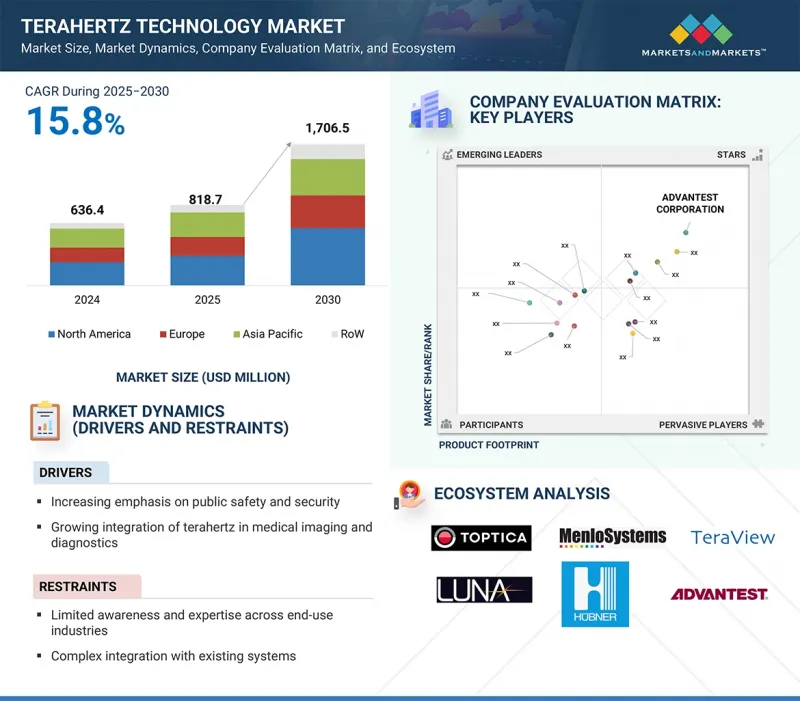

The terahertz technology market is dominated by globally established players such as ADVANTEST CORPORATION (Japan), HUBNER GmbH & Co. KG (Germany), TOPTICA Photonics AG (Germany), Gentec Electro-Optics (Canada), Luna Innovations (US), Menlo Systems (Germany), TeraView Limited (UK), Terasense Group Inc. (US), QMC Instruments Ltd. (UK), and Quantum Design Inc. (US). The study includes an in-depth competitive analysis of these key players in the terahertz technology market, as well as their company profiles, recent developments, and key market strategies.

Study Coverage

The report segments the terahertz technology market and forecasts its size by type, application, and region. It also discusses the market's drivers, restraints, opportunities, and challenges. It gives a detailed view of the market across four main regions: North America, Europe, Asia Pacific, and Rest of the World. The report includes a supply chain analysis, along with the key players and their competitive analysis of the terahertz technology ecosystem.

Key Benefits of Buying the Report

- Analysis of key drivers (increasing emphasis on public safety and security, growing integration of terahertz in medical imaging and diagnostics), restraints (limited awareness and expertise across end-use industries, and complex integration with existing systems), opportunities (increasing focus on 6G and ultra-high-speed communications, booming automotive sector for advanced driver assistance systems, and growing investment in quantum and ultrafast optics research), and challenges (technical barriers to generating and detecting stable terahertz signals) influencing the growth of the terahertz technology market

- Products/Solution/Service Development/Innovation: Detailed insights into upcoming technologies, research and development activities, and new product/solution/service launches in the terahertz technology market

- Market Development: Comprehensive information about lucrative markets-the report analyses the terahertz technology market across varied regions.

- Market Diversification: Exhaustive information about new products/solutions/services, untapped geographies, recent developments, and investments in the terahertz technology market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as ADVANTEST CORPORATION (Japan), HUBNER GmbH & Co. KG (Germany), TOPTICA Photonics AG (Germany), Luna Innovations (US), and Thorlabs, Inc. (US), among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION AND SCOPE

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.2.2 MARKETS COVERED

- 1.2.3 YEARS CONSIDERED

- 1.3 CURRENCY

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.1.2 List of key secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of primary interview participants

- 2.1.2.3 Breakdown of primaries

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET SHARE ESTIMATION

- 2.4 DATA TRIANGULATION

- 2.5 RISK ANALYSIS

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN TERAHERTZ TECHNOLOGY MARKET

- 4.2 TERAHERTZ TECHNOLOGY MARKET, BY TYPE

- 4.3 TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION

- 4.4 TERAHERTZ TECHNOLOGY MARKET, BY REGION

- 4.5 TERAHERTZ TECHNOLOGY MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing use in security screening and surveillance applications

- 5.2.1.2 Rise in applications in medical imaging and diagnostics

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited awareness and expertise across end-user industries

- 5.2.2.2 Complex integration with existing systems

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Role in 6G and ultra-high-speed communications

- 5.2.3.2 Expansion into automotive sector with Advanced Driver Assistance Systems (ADAS)

- 5.2.3.3 Growing investment in quantum and ultrafast optics research

- 5.2.4 CHALLENGES

- 5.2.4.1 Technical barriers to generating and detecting stable terahertz signals

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND, BY REGION

- 5.4.2 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Terahertz detectors

- 5.7.1.2 Terahertz imaging systems

- 5.7.1.3 Terahertz spectroscopy

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Photonic integration

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Infrared and optical imaging

- 5.7.3.2 Nanotechnology

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- 5.9 TRADE ANALYSIS

- 5.9.1 EXPORT SCENARIO

- 5.9.2 IMPORT SCENARIO

- 5.10 KEY CONFERENCES AND EVENTS

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 NVIDIA LEVERAGED TERAVIEW TERAHERTZ TECHNOLOGY TO OVERCOME CHIP-LEVEL FAULT ANALYSIS CHALLENGES

- 5.11.2 LUNA INNOVATIONS AND BRIDGESTONE ENHANCED TIRE RELIABILITY WITH TERAHERTZ-BASED MEASUREMENT SOLUTIONS

- 5.11.3 ENHANCED CHIP-LEVEL FAULT ANALYSIS WITH TERAHERTZ TIME-DOMAIN REFLECTOMETRY DRIVING PRECISION AND RELIABILITY

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 KEY REGULATIONS

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF NEW ENTRANTS

- 5.13.2 THREAT OF SUBSTITUTES

- 5.13.3 BARGAINING POWER OF SUPPLIERS

- 5.13.4 BARGAINING POWER OF BUYERS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 IMPACT OF ARTIFICIAL INTELLIGENCE ON TERAHERTZ TECHNOLOGY MARKET

- 5.15.1 INTRODUCTION

- 5.16 IMPACT OF 2025 US TARIFF - TERAHERTZ TECHNOLOGY MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 KEY TARIFF RATES

- 5.16.3 PRICE IMPACT ANALYSIS

- 5.16.4 IMPACT OF COUNTRY/REGION

- 5.16.4.1 US

- 5.16.4.2 Europe

- 5.16.4.3 Asia Pacific

- 5.16.5 IMPACT ON APPLICATION

6 TERAHERTZ TECHNOLOGY MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 TERAHERTZ IMAGING

- 6.2.1 TRANSFORMING NON-INVASIVE DIAGNOSTICS AND HIGH-PRECISION SECURITY SCREENING USING NEXT-GENERATION TERAHERTZ IMAGING

- 6.2.1.1 Active terahertz imaging systems

- 6.2.1.2 Passive terahertz imaging systems

- 6.2.1 TRANSFORMING NON-INVASIVE DIAGNOSTICS AND HIGH-PRECISION SECURITY SCREENING USING NEXT-GENERATION TERAHERTZ IMAGING

- 6.3 TERAHERTZ SPECTROSCOPY

- 6.3.1 HARNESSING TERAHERTZ SPECTROSCOPY AS STRATEGIC ENABLER FOR NEXT-WAVE BIOMEDICAL AND PHARMA GROWTH

- 6.3.1.1 Terahertz time-domain spectroscopy

- 6.3.1.2 Terahertz frequency-domain spectroscopy

- 6.3.1 HARNESSING TERAHERTZ SPECTROSCOPY AS STRATEGIC ENABLER FOR NEXT-WAVE BIOMEDICAL AND PHARMA GROWTH

- 6.4 TERAHERTZ COMMUNICATION SYSTEMS

- 6.4.1 HARNESSING TERAHERTZ FREQUENCY BANDS TO ENABLE SCALABLE HIGH SPEED WIRELESS COMMUNICATION

- 6.4.1.1 Antennas

- 6.4.1.2 Emitters

- 6.4.1.3 Modulators

- 6.4.1 HARNESSING TERAHERTZ FREQUENCY BANDS TO ENABLE SCALABLE HIGH SPEED WIRELESS COMMUNICATION

7 TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 LABORATORY RESEARCH

- 7.2.1 ADVANCING SCIENTIFIC FRONTIERS THROUGH TERAHERTZ-ENABLED HIGH-PRECISION LABORATORY RESEARCH SOLUTIONS

- 7.2.1.1 Material characterization

- 7.2.1.2 Biochemistry

- 7.2.1.3 Plasma diagnostics

- 7.2.1 ADVANCING SCIENTIFIC FRONTIERS THROUGH TERAHERTZ-ENABLED HIGH-PRECISION LABORATORY RESEARCH SOLUTIONS

- 7.3 MEDICAL & HEALTHCARE

- 7.3.1 LEVERAGING TERAHERTZ IMAGING FOR NON-IONIZING, HIGH-PRECISION DIAGNOSTICS IN NEXT-GEN HEALTHCARE

- 7.3.1.1 Oncology

- 7.3.1.2 Dentistry

- 7.3.1.3 Dermatology

- 7.3.1.4 Tomography

- 7.3.1 LEVERAGING TERAHERTZ IMAGING FOR NON-IONIZING, HIGH-PRECISION DIAGNOSTICS IN NEXT-GEN HEALTHCARE

- 7.4 MILITARY & HOMELAND SECURITY

- 7.4.1 ADVANCING DEFENSE AND SECURITY CAPABILITIES THROUGH TERAHERTZ-DRIVEN THREAT DETECTION AND HIGH-SPEED COMMUNICATIONS

- 7.4.1.1 Passenger screening

- 7.4.1.2 Landmine and improvised explosive device detection

- 7.4.1 ADVANCING DEFENSE AND SECURITY CAPABILITIES THROUGH TERAHERTZ-DRIVEN THREAT DETECTION AND HIGH-SPEED COMMUNICATIONS

- 7.5 INDUSTRIAL NON-DESTRUCTIVE TESTING (NDT)

- 7.5.1 UNLOCKING STRATEGIC VALUE THROUGH TERAHERTZ-DRIVEN, HIGH-PRECISION NON-DESTRUCTIVE TESTING SOLUTIONS

- 7.5.1.1 Aerospace

- 7.5.1.2 Semiconductor and electronics

- 7.5.1.3 Pharmaceuticals

- 7.5.1 UNLOCKING STRATEGIC VALUE THROUGH TERAHERTZ-DRIVEN, HIGH-PRECISION NON-DESTRUCTIVE TESTING SOLUTIONS

- 7.6 SATELLITE COMMUNICATIONS

- 7.6.1 LEVERAGING INTER-SATELLITE COMMUNICATIONS TO ENHANCE BANDWIDTH, SECURITY, AND ORBITAL ASSET MONITORING

- 7.7 TACTICAL/MILITARY COMMUNICATIONS

- 7.7.1 TRANSFORMING TACTICAL CONNECTIVITY THROUGH TERAHERTZ-ENABLED ULTRA-SECURE, HIGH-BANDWIDTH BATTLEFIELD COMMUNICATIONS

- 7.8 OUTDOOR/INDOOR WIRELESS COMMUNICATIONS

- 7.8.1 UNLOCKING ULTRA-HIGH DATA THROUGHPUT VIA SHORT-RANGE, LOW-TERAHERTZ WIRELESS NETWORK INNOVATION

8 TERAHERTZ TECHNOLOGY: SOURCES AND DETECTORS

- 8.1 INTRODUCTION

- 8.2 THZ SOURCES

- 8.2.1 QUANTUM-CASCADE LASER (QCL)

- 8.2.2 FREQUENCY MULTIPLIER

- 8.2.3 GLOBAR

- 8.2.4 PHOTOCONDUCTIVE ANTENNA (PCA)

- 8.2.5 STIMULATED TERAHERTZ AMPLIFIED RADIATION (STAR)

- 8.3 DETECTORS

- 8.3.1 SCHOTTKY DIODE

- 8.3.2 HIGH ELECTRON MOBILITY TRANSISTOR (HEMT)

- 8.3.3 NANOWIRE

- 8.3.4 PYROELECTRIC DETECTOR

- 8.3.5 GOLAY CELL

- 8.3.6 BOLOMETER AND SUPERCONDUCTIVE HOT-SPOT AIR-BRIDGE BOLOMETER (SHAB)

9 TERAHERTZ TECHNOLOGY MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 Academic leadership and stratospheric mission validations to accelerate commercialization of terahertz systems

- 9.2.3 CANADA

- 9.2.3.1 Healthcare innovation and cancer diagnostics drive adoption of non-ionizing terahertz imaging solutions

- 9.2.4 MEXICO

- 9.2.4.1 Telecom reforms and national research infrastructure to strengthen Mexico's terahertz technology capabilities

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 UK

- 9.3.2.1 Research excellence and breakthroughs to drive commercialization of terahertz applications in UK

- 9.3.3 GERMANY

- 9.3.3.1 Germany to fuel market leadership through breakthroughs in terahertz imaging and 6G-enabled systems

- 9.3.4 FRANCE

- 9.3.4.1 France to strengthen terahertz ecosystem through strategic investments in security, telecom, and industrial modernization

- 9.3.5 ITALY

- 9.3.5.1 Italy to strengthen global terahertz positioning through quantum devices and industrial integration

- 9.3.6 SPAIN

- 9.3.6.1 Spain to position terahertz as strategic enabler for industrial and healthcare innovation

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 JAPAN

- 9.4.2.1 Innovations in terahertz devices and 6G demonstrations to drive Japan's market growth across telecom and connectivity sectors

- 9.4.3 CHINA

- 9.4.3.1 Economic expansion and semiconductor autonomy to support China's terahertz technology market growth

- 9.4.4 INDIA

- 9.4.4.1 India to accelerate terahertz adoption through health, wellness, and defense-focused technological innovations

- 9.4.5 SOUTH KOREA

- 9.4.5.1 South Korea to expand terahertz commercialization through 6G innovation and cross-industry adoption

- 9.4.6 REST OF ASIA PACIFIC

- 9.5 REST OF THE WORLD (ROW)

- 9.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 9.5.2 MIDDLE EAST & AFRICA

- 9.5.2.1 Unlocking strategic value of terahertz in next-gen connectivity and cultural asset preservation to support market growth

- 9.5.3 SOUTH AMERICA

- 9.5.3.1 Advancing terahertz innovation to drive South America's science and industry landscape

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.3 REVENUE ANALYSIS, 2021-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Regional footprint

- 10.5.5.3 Application footprint

- 10.5.5.4 Type footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/SMEs

- 10.6.5.2 Competitive benchmarking of key startups/SMEs

- 10.7 COMPETITIVE SCENARIO

- 10.7.1 PRODUCT LAUNCHES

- 10.7.2 DEALS

- 10.7.3 EXPANSIONS

- 10.7.4 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 ADVANTEST CORPORATION

- 11.1.1.1 Business overview

- 11.1.1.2 Products/solutions/services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.3.2 Deals

- 11.1.1.3.3 Other developments

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths/right to win

- 11.1.1.4.2 Strategic choices made

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 LUNA INNOVATIONS

- 11.1.2.1 Business overview

- 11.1.2.2 Products/solutions/services offered

- 11.1.2.2.1 Expansions

- 11.1.2.2.2 Other developments

- 11.1.2.3 MnM view

- 11.1.2.3.1 Key strengths/right to win

- 11.1.2.3.2 Strategic choices made

- 11.1.2.3.3 Weaknesses and competitive threats

- 11.1.3 TERAVIEW LIMITED

- 11.1.3.1 Business overview

- 11.1.3.2 Products/solutions/services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths/right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 TOPTICA PHOTONICS AG

- 11.1.4.1 Business overview

- 11.1.4.2 Products/solutions/services offered

- 11.1.4.3 MnM view

- 11.1.4.3.1 Key strengths/right to win

- 11.1.4.3.2 Strategic choices made

- 11.1.4.3.3 Weaknesses and competitive threats

- 11.1.5 HUBNER GMBH & CO. KG

- 11.1.5.1 Business overview

- 11.1.5.2 Products/solutions/services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches

- 11.1.5.3.2 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths/right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 MENLO SYSTEMS

- 11.1.6.1 Business overview

- 11.1.6.2 Products/solutions/services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches

- 11.1.6.3.2 Expansions

- 11.1.7 TERASENSE GROUP INC.

- 11.1.7.1 Business overview

- 11.1.7.2 Products/solutions/services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product launches

- 11.1.8 GENTEC ELECTRO-OPTICS

- 11.1.8.1 Business overview

- 11.1.8.2 Products/solutions/services offered

- 11.1.9 QMC INSTRUMENTS LTD.

- 11.1.9.1 Business overview

- 11.1.9.2 Products/solutions/services offered

- 11.1.10 TERAVIL LTD

- 11.1.10.1 Business overview

- 11.1.10.2 Products/solutions/services offered

- 11.1.1 ADVANTEST CORPORATION

- 11.2 OTHER PLAYERS

- 11.2.1 VIRGINIA DIODES, INC.

- 11.2.2 MICROTECH INSTRUMENTS

- 11.2.3 SWISSTO12

- 11.2.4 DEL MAR PHOTONICS, INC.

- 11.2.5 INSIGHT PRODUCT COMPANY

- 11.2.6 BATOP GMBH

- 11.2.7 LYTID SAS

- 11.2.8 TYDEX

- 11.2.9 QUANTUM DESIGN INC.

- 11.2.10 RAYSECUR, INC.

- 11.2.11 LONGWAVE PHOTONICS LLC

- 11.2.12 BRIDGE12 TECHNOLOGIES, INC.

- 11.2.13 ACAL BFI

- 11.2.14 THORLABS, INC.

- 11.2.15 SCIENCETECH INC.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

List of Tables

- TABLE 1 TERAHERTZ TECHNOLOGY MARKET: RISK ANALYSIS

- TABLE 2 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024 (USD)

- TABLE 3 AVERAGE SELLING PRICE TREND BY KEY PLAYERS, BY TYPE, 2020-2024 (USD)

- TABLE 4 KEY COMPANIES AND THEIR ROLE IN ECOSYSTEM

- TABLE 5 LIST OF PATENTS IN TERAHERTZ TECHNOLOGY, 2023-2025

- TABLE 6 EXPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 9027 FOR KEY COUNTRIES, 2020-2024 (USD MILLION)

- TABLE 7 IMPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 9027 FOR KEY COUNTRIES, 2020-2024 (USD MILLION)

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 TERAHERTZ TECHNOLOGY MARKET: REGULATORY LANDSCAPE

- TABLE 12 TERAHERTZ TECHNOLOGY MARKET: PORTER'S FIVE FORCES ANALYSIS, 2024

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 14 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 15 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 16 TERAHERTZ TECHNOLOGY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 17 TERAHERTZ TECHNOLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 18 TERAHERTZ TECHNOLOGY MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 19 TERAHERTZ TECHNOLOGY MARKET, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 20 TERAHERTZ IMAGING TECHNOLOGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 21 TERAHERTZ IMAGING TECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 22 TERAHERTZ SPECTROSCOPY TECHNOLOGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 23 TERAHERTZ SPECTROSCOPY TECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 24 TERAHERTZ COMMUNICATION SYSTEMS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 25 TERAHERTZ COMMUNICATION SYSTEMS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 26 TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 27 TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 28 TERAHERTZ TECHNOLOGY MARKET FOR LABORATORY RESEARCH, BY REGION, 2021-2024 (USD MILLION)

- TABLE 29 TERAHERTZ TECHNOLOGY MARKET FOR LABORATORY RESEARCH, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 NORTH AMERICA: TERAHERTZ TECHNOLOGY MARKET FOR LABORATORY RESEARCH, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 31 NORTH AMERICA: TERAHERTZ TECHNOLOGY MARKET FOR LABORATORY RESEARCH, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 32 EUROPE: TERAHERTZ TECHNOLOGY MARKET FOR LABORATORY RESEARCH, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 33 EUROPE: TERAHERTZ TECHNOLOGY MARKET FOR LABORATORY RESEARCH, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 34 ASIA PACIFIC: TERAHERTZ TECHNOLOGY MARKET FOR LABORATORY RESEARCH, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 35 ASIA PACIFIC: TERAHERTZ TECHNOLOGY MARKET FOR LABORATORY RESEARCH, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 36 ROW: TERAHERTZ TECHNOLOGY MARKET FOR LABORATORY RESEARCH, BY REGION, 2021-2024 (USD MILLION)

- TABLE 37 ROW: TERAHERTZ TECHNOLOGY MARKET FOR LABORATORY RESEARCH, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 TERAHERTZ TECHNOLOGY MARKET FOR MEDICAL & HEALTHCARE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 39 TERAHERTZ TECHNOLOGY MARKET FOR MEDICAL & HEALTHCARE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 NORTH AMERICA: TERAHERTZ TECHNOLOGY MARKET FOR MEDICAL & HEALTHCARE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 41 NORTH AMERICA: TERAHERTZ TECHNOLOGY MARKET FOR MEDICAL & HEALTHCARE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 42 EUROPE: TERAHERTZ TECHNOLOGY MARKET FOR MEDICAL & HEALTHCARE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 43 EUROPE: TERAHERTZ TECHNOLOGY MARKET FOR MEDICAL & HEALTHCARE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 44 ASIA PACIFIC: TERAHERTZ TECHNOLOGY MARKET FOR MEDICAL & HEALTHCARE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 45 ASIA PACIFIC: TERAHERTZ TECHNOLOGY MARKET FOR MEDICAL & HEALTHCARE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 46 ROW: TERAHERTZ TECHNOLOGY MARKET FOR MEDICAL & HEALTHCARE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 47 ROW: TERAHERTZ TECHNOLOGY MARKET FOR MEDICAL & HEALTHCARE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 TERAHERTZ TECHNOLOGY MARKET FOR MILITARY & HOMELAND SECURITY, BY REGION, 2021-2024 (USD MILLION)

- TABLE 49 TERAHERTZ TECHNOLOGY MARKET FOR MILITARY & HOMELAND SECURITY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 NORTH AMERICA: TERAHERTZ TECHNOLOGY MARKET FOR MILITARY & HOMELAND SECURITY, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 51 NORTH AMERICA: TERAHERTZ TECHNOLOGY MARKET FOR MILITARY & HOMELAND SECURITY, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 52 EUROPE: TERAHERTZ TECHNOLOGY MARKET FOR MILITARY & HOMELAND SECURITY, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 53 EUROPE: TERAHERTZ TECHNOLOGY MARKET FOR MILITARY & HOMELAND SECURITY, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 54 ASIA PACIFIC: TERAHERTZ TECHNOLOGY MARKET FOR MILITARY & HOMELAND SECURITY, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 55 ASIA PACIFIC: TERAHERTZ TECHNOLOGY MARKET FOR MILITARY & HOMELAND SECURITY, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 56 ROW: TERAHERTZ TECHNOLOGY MARKET FOR MILITARY & HOMELAND SECURITY, BY REGION, 2021-2024 (USD MILLION)

- TABLE 57 ROW: TERAHERTZ TECHNOLOGY MARKET FOR MILITARY & HOMELAND SECURITY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 TERAHERTZ TECHNOLOGY MARKET FOR INDUSTRIAL NDT, BY REGION, 2021-2024 (USD MILLION)

- TABLE 59 TERAHERTZ TECHNOLOGY MARKET FOR INDUSTRIAL NDT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 NORTH AMERICA: TERAHERTZ TECHNOLOGY MARKET FOR INDUSTRIAL NDT, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 61 NORTH AMERICA: TERAHERTZ TECHNOLOGY MARKET FOR INDUSTRIAL NDT, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 62 EUROPE: TERAHERTZ TECHNOLOGY MARKET FOR INDUSTRIAL NDT, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 63 EUROPE: TERAHERTZ TECHNOLOGY MARKET FOR INDUSTRIAL NDT, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 64 ASIA PACIFIC: TERAHERTZ TECHNOLOGY MARKET FOR INDUSTRIAL NDT, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 65 ASIA PACIFIC: TERAHERTZ TECHNOLOGY MARKET FOR INDUSTRIAL NDT, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 66 ROW: TERAHERTZ TECHNOLOGY MARKET FOR INDUSTRIAL NDT, BY REGION, 2021-2024 (USD MILLION)

- TABLE 67 ROW: TERAHERTZ TECHNOLOGY MARKET FOR INDUSTRIAL NDT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 TERAHERTZ TECHNOLOGY MARKET FOR SATELLITE COMMUNICATION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 69 TERAHERTZ TECHNOLOGY MARKET FOR SATELLITE COMMUNICATION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 NORTH AMERICA: TERAHERTZ TECHNOLOGY MARKET FOR SATELLITE COMMUNICATION, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 71 NORTH AMERICA: TERAHERTZ TECHNOLOGY MARKET FOR SATELLITE COMMUNICATION, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 72 EUROPE: TERAHERTZ TECHNOLOGY MARKET FOR SATELLITE COMMUNICATION, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 73 EUROPE: TERAHERTZ TECHNOLOGY MARKET FOR SATELLITE COMMUNICATION, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 74 ASIA PACIFIC: TERAHERTZ TECHNOLOGY MARKET FOR SATELLITE COMMUNICATION, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 75 ASIA PACIFIC: TERAHERTZ TECHNOLOGY MARKET FOR SATELLITE COMMUNICATION, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 76 ROW: TERAHERTZ TECHNOLOGY MARKET FOR SATELLITE COMMUNICATION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 77 ROW: TERAHERTZ TECHNOLOGY MARKET FOR SATELLITE COMMUNICATION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 TERAHERTZ TECHNOLOGY MARKET FOR TACTICAL/MILITARY COMMUNICATIONS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 79 TERAHERTZ TECHNOLOGY MARKET FOR TACTICAL/MILITARY COMMUNICATIONS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 80 NORTH AMERICA: TERAHERTZ TECHNOLOGY MARKET FOR TACTICAL/MILITARY COMMUNICATIONS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 81 NORTH AMERICA: TERAHERTZ TECHNOLOGY MARKET FOR TACTICAL/MILITARY COMMUNICATIONS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 82 EUROPE: TERAHERTZ TECHNOLOGY MARKET FOR TACTICAL/MILITARY COMMUNICATIONS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 83 EUROPE: TERAHERTZ TECHNOLOGY MARKET FOR TACTICAL/MILITARY COMMUNICATIONS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 84 ASIA PACIFIC: TERAHERTZ TECHNOLOGY MARKET FOR TACTICAL/MILITARY COMMUNICATIONS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 85 ASIA PACIFIC: TERAHERTZ TECHNOLOGY MARKET FOR TACTICAL/MILITARY COMMUNICATIONS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 86 ROW: TERAHERTZ TECHNOLOGY MARKET FOR TACTICAL/MILITARY COMMUNICATIONS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 87 ROW: TERAHERTZ TECHNOLOGY MARKET FOR TACTICAL/MILITARY COMMUNICATIONS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 88 TERAHERTZ TECHNOLOGY MARKET FOR OUTDOOR/INDOOR WIRELESS COMMUNICATIONS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 89 TERAHERTZ TECHNOLOGY MARKET FOR OUTDOOR/INDOOR WIRELESS COMMUNICATIONS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 90 NORTH AMERICA: TERAHERTZ TECHNOLOGY MARKET FOR OUTDOOR/INDOOR WIRELESS COMMUNICATIONS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 91 NORTH AMERICA: TERAHERTZ TECHNOLOGY MARKET FOR OUTDOOR/INDOOR WIRELESS COMMUNICATIONS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 92 EUROPE: TERAHERTZ TECHNOLOGY MARKET FOR OUTDOOR/INDOOR WIRELESS COMMUNICATIONS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 93 EUROPE: TERAHERTZ TECHNOLOGY MARKET FOR OUTDOOR/INDOOR WIRELESS COMMUNICATIONS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 94 ASIA PACIFIC: TERAHERTZ TECHNOLOGY MARKET FOR OUTDOOR/INDOOR WIRELESS COMMUNICATIONS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 95 ASIA PACIFIC: TERAHERTZ TECHNOLOGY MARKET FOR OUTDOOR/INDOOR WIRELESS COMMUNICATIONS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 96 ROW: TERAHERTZ TECHNOLOGY MARKET FOR OUTDOOR/INDOOR WIRELESS COMMUNICATIONS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 97 ROW: TERAHERTZ TECHNOLOGY MARKET FOR OUTDOOR/INDOOR WIRELESS COMMUNICATIONS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 98 TERAHERTZ TECHNOLOGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 99 TERAHERTZ TECHNOLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 100 NORTH AMERICA: TERAHERTZ TECHNOLOGY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 101 NORTH AMERICA: TERAHERTZ TECHNOLOGY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 102 NORTH AMERICA: TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 103 NORTH AMERICA: TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 104 US: TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 105 US: TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 106 CANADA: TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 107 CANADA: TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 108 MEXICO: TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 109 MEXICO: TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 110 EUROPE: TERAHERTZ TECHNOLOGY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 111 EUROPE: TERAHERTZ TECHNOLOGY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 112 EUROPE: TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 113 EUROPE: TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 114 UK: TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 115 UK: TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 116 GERMANY: TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 117 GERMANY: TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 118 FRANCE: TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 119 FRANCE: TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 120 ITALY: TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 121 ITALY: TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 122 SPAIN: TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 123 SPAIN: TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 124 REST OF EUROPE: TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 125 REST OF EUROPE: TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 126 ASIA PACIFIC: TERAHERTZ TECHNOLOGY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 127 ASIA PACIFIC: TERAHERTZ TECHNOLOGY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 128 ASIA PACIFIC: TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 129 ASIA PACIFIC: TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 130 JAPAN: TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 131 JAPAN: TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 132 CHINA: TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 133 CHINA: TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 134 INDIA: TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 135 INDIA: TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 136 SOUTH KOREA: TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 137 SOUTH KOREA: TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 138 REST OF ASIA PACIFIC: TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 139 REST OF ASIA PACIFIC: TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 140 ROW: TERAHERTZ TECHNOLOGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 141 ROW: TERAHERTZ TECHNOLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 142 ROW: TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 143 ROW: TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 146 SOUTH AMERICA: TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 147 SOUTH AMERICA: TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 148 TERAHERTZ TECHNOLOGY MARKET: KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 149 TERAHERTZ TECHNOLOGY MARKET: DEGREE OF COMPETITION

- TABLE 150 TERAHERTZ TECHNOLOGY MARKET: COMPANY REGIONAL FOOTPRINT, 2024

- TABLE 151 TERAHERTZ TECHNOLOGY MARKET: APPLICATION FOOTPRINT, 2024

- TABLE 152 TERAHERTZ TECHNOLOGY MARKET: TYPE FOOTPRINT, 2024

- TABLE 153 TERAHERTZ TECHNOLOGY MARKET: DETAILED LIST OF KEY STARTUPS/SMES, 2024

- TABLE 154 TERAHERTZ TECHNOLOGY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (REGIONAL FOOTPRINT), 2024

- TABLE 155 TERAHERTZ TECHNOLOGY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (APPLICATION FOOTPRINT), 2024

- TABLE 156 TERAHERTZ TECHNOLOGY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (TECHNOLOGY FOOTPRINT), 2024

- TABLE 157 TERAHERTZ TECHNOLOGY MARKET: PRODUCT LAUNCHES, JANUARY 2021-AUGUST 2025

- TABLE 158 TERAHERTZ TECHNOLOGY MARKET: DEALS, JANUARY 2021-AUGUST 2025

- TABLE 159 TERAHERTZ TECHNOLOGY MARKET: EXPANSIONS, JANUARY 2021-AUGUST 2025

- TABLE 160 TERAHERTZ TECHNOLOGY MARKET: OTHER DEVELOPMENTS, JANUARY 2021-AUGUST 2025

- TABLE 161 ADVANTEST CORPORATION: BUSINESS OVERVIEW

- TABLE 162 ADVANTEST CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 163 ADVANTEST CORPORATION: PRODUCT LAUNCHES

- TABLE 164 ADVANTEST CORPORATION: DEALS

- TABLE 165 ADVANTEST CORPORATION: OTHER DEVELOPMENTS

- TABLE 166 LUNA INNOVATIONS: BUSINESS OVERVIEW

- TABLE 167 LUNA INNOVATIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 168 LUNA INNOVATIONS: EXPANSIONS

- TABLE 169 LUNA INNOVATIONS: OTHER DEVELOPMENTS

- TABLE 170 TERAVIEW LIMITED: BUSINESS OVERVIEW

- TABLE 171 TERAVIEW LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 172 TERAVIEW LIMITED: PRODUCT LAUNCHES

- TABLE 173 TERAVIEW LIMITED: DEALS

- TABLE 174 TOPTICA PHOTONICS AG: BUSINESS OVERVIEW

- TABLE 175 TOPTICA PHOTONICS AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 176 HUBNER GMBH & CO. KG: BUSINESS OVERVIEW

- TABLE 177 HUBNER GMBH & CO. KG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 178 HUBNER GMBH & CO. KG: PRODUCT LAUNCHES

- TABLE 179 HUBNER GMBH & CO. KG: DEALS

- TABLE 180 MENLO SYSTEMS: BUSINESS OVERVIEW

- TABLE 181 MENLO SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 182 MENLO SYSTEMS: PRODUCT LAUNCHES

- TABLE 183 MENLO SYSTEMS: EXPANSIONS

- TABLE 184 TERASENSE GROUP INC.: BUSINESS OVERVIEW

- TABLE 185 TERASENSE GROUP INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 TERASENSE GROUP INC.: PRODUCT LAUNCHES

- TABLE 187 GENTEC-EO: BUSINESS OVERVIEW

- TABLE 188 GENTEC-EO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 QMC INSTRUMENTS LTD.: BUSINESS OVERVIEW

- TABLE 190 QMC INSTRUMENTS LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 TERAVIL LTD: BUSINESS OVERVIEW

- TABLE 192 TERAVIL LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 TERAHERTZ TECHNOLOGY MARKET SEGMENTATION

- FIGURE 2 STUDY YEARS CONSIDERED

- FIGURE 3 TERAHERTZ TRANSMISSION MARKET: RESEARCH DESIGN

- FIGURE 4 KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 KEY DATA FROM PRIMARY SOURCES

- FIGURE 6 BREAKDOWN OF PRIMARIES, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 7 KEY INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 8 SECONDARY AND PRIMARY RESEARCH APPROACHES

- FIGURE 9 METHODOLOGY-APPROACH 1 (SUPPLY SIDE)

- FIGURE 10 METHODOLOGY-APPROACH 2 (SUPPLY SIDE)

- FIGURE 11 METHODOLOGY-APPROACH 3 (DEMAND SIDE)

- FIGURE 12 TERAHERTZ TECHNOLOGY MARKET: BOTTOM-UP APPROACH

- FIGURE 13 TERAHERTZ TECHNOLOGY MARKET: TOP-DOWN APPROACH

- FIGURE 14 TERAHERTZ TECHNOLOGY MARKET: DATA TRIANGULATION

- FIGURE 15 TERAHERTZ TECHNOLOGY MARKET: RESEARCH ASSUMPTIONS

- FIGURE 16 TERAHERTZ TECHNOLOGY MARKET: RESEARCH LIMITATIONS

- FIGURE 17 TERAHERTZ TECHNOLOGY MARKET GROWTH TREND, 2021-2030 (USD MILLION)

- FIGURE 18 TERAHERTZ IMAGING SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2030

- FIGURE 19 LABORATORY RESEARCH APPLICATION TO WITNESS HIGHEST MARKET SHARE OF TERAHERTZ TECHNOLOGY MARKET IN 2030

- FIGURE 20 NORTH AMERICA ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 21 GROWING ADOPTION OF TERAHERTZ SYSTEMS IN SEMICONDUCTOR INDUSTRY TO FUEL GROWTH OF TERAHERTZ TECHNOLOGY MARKET DURING FORECAST PERIOD

- FIGURE 22 TERAHERTZ COMMUNICATION SYSTEMS TO BE FASTEST-GROWING TYPE SEGMENT DURING FORECAST PERIOD

- FIGURE 23 SATELLITE COMMUNICATIONS TO WITNESS HIGHEST CAGR IN FORECASTING PERIOD

- FIGURE 24 ASIA PACIFIC TO BE LARGEST REGIONAL TERAHERTZ TECHNOLOGY MARKET IN 2030

- FIGURE 25 INDIA TO RECORD HIGHEST CAGR IN OVERALL TERAHERTZ TECHNOLOGY MARKET DURING FORECAST PERIOD

- FIGURE 26 TERAHERTZ TECHNOLOGY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 27 TERAHERTZ TECHNOLOGY MARKET DRIVERS AND THEIR IMPACT

- FIGURE 28 TERAHERTZ TECHNOLOGY MARKET RESTRAINTS AND THEIR IMPACT

- FIGURE 29 TERAHERTZ TECHNOLOGY MARKET OPPORTUNITIES AND THEIR IMPACT

- FIGURE 30 TERAHERTZ TECHNOLOGY MARKET CHALLENGES AND THEIR IMPACT

- FIGURE 31 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

- FIGURE 32 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024 (USD)

- FIGURE 33 AVERAGE SELLING PRICE TREND BY KEY PLAYERS, BY TYPE, 2024 (USD)

- FIGURE 34 SUPPLY CHAIN OF TERAHERTZ TECHNOLOGY MARKET

- FIGURE 35 KEY PLAYERS IN TERAHERTZ TECHNOLOGY MARKET

- FIGURE 36 NUMBER OF PATENTS GRANTED IN TERAHERTZ TECHNOLOGY MARKET, 2015-2024

- FIGURE 37 EXPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 9027 FOR KEY COUNTRIES, 2020-2024 (USD MILLION)

- FIGURE 38 IMPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 9027 FOR KEY COUNTRIES, 2020-2024 (USD MILLION)

- FIGURE 39 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 40 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 41 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 42 IMPACT OF ARTIFICIAL INTELLIGENCE ON TERAHERTZ TECHNOLOGY MARKET

- FIGURE 43 TERAHERTZ COMMUNICATION SYSTEMS TO RECORD HIGHEST CAGR IN TERAHERTZ TECHNOLOGY MARKET DURING FORECAST PERIOD

- FIGURE 44 TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- FIGURE 45 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 46 NORTH AMERICA: TERAHERTZ TECHNOLOGY MARKET SNAPSHOT

- FIGURE 47 EUROPE: TERAHERTZ TECHNOLOGY MARKET SNAPSHOT

- FIGURE 48 ASIA PACIFIC: TERAHERTZ TECHNOLOGY MARKET SNAPSHOT

- FIGURE 49 LABORATORY RESEARCH TO LEAD TERAHERTZ TECHNOLOGY MARKET IN ASIA PACIFIC DURING FORECAST PERIOD

- FIGURE 50 SOUTH AMERICA TO LEAD TERAHERTZ TECHNOLOGY MARKET IN ROW DURING FORECAST PERIOD

- FIGURE 51 TERAHERTZ TECHNOLOGY MARKET: REVENUE ANALYSIS OF FOUR KEY PLAYERS, 2021-2024 (USD MILLION)

- FIGURE 52 MARKET SHARE ANALYSIS OF COMPANIES OFFERING TERAHERTZ TECHNOLOGY, 2024

- FIGURE 53 TERAHERTZ TECHNOLOGY MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 54 TERAHERTZ TECHNOLOGY MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 55 TERAHERTZ TECHNOLOGY MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 56 ADVANTEST CORPORATION: COMPANY SNAPSHOT