|

市場調查報告書

商品編碼

1826558

全球低溫冷凍機市場(至 2030 年)按低溫冷凍機類型、產品類別、熱交換器、運轉週期、溫度範圍和應用分類Cryocooler Market By Cryocooler Type, Offering, Heat Exchanger, Operating Cycle, Tempreature Range, and Application - Global Forecast to 2030 |

||||||

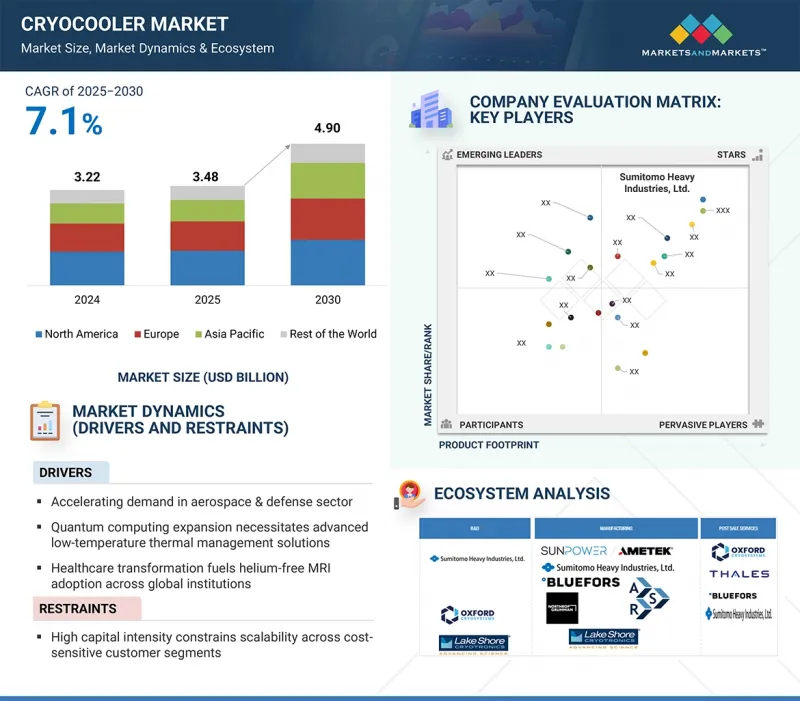

預計低溫冷凍機市場規模將從 2025 年的 34.8 億美元成長到 2030 年的 49 億美元,預測期內的複合年成長率為 7.1%。

| 調查範圍 | |

|---|---|

| 調查年份 | 2021-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 單元 | 金額(美元) |

| 部分 | 低溫冷凍機類型、供應類別、熱交換器、運作週期、溫度範圍和應用 |

| 目標區域 | 北美、歐洲、亞太地區和其他地區 |

低溫冷凍機的成長得益於衛星發射、太空探勘和國防領域應用的不斷增加,這得益於政府投資、冷卻效率的技術進步以及量子計算和醫療圖像系統對超低溫日益成長的需求。

根據硬體類型,預計電源調節單元部分在預測期內將以最高的複合年成長率成長。

這是因為它們在確保敏感低溫系統穩定且有效率的電源供應方面發揮關鍵作用。這些裝置有助於調節電壓波動、最大限度地降低電氣噪聲,並保護精密元件免受電源干擾,這對於航太儀器、紅外線感測器和量子計算設備等振動敏感應用至關重要。隨著低溫冷凍機擴展到國防、航太和醫療圖像應用領域,對可靠、不間斷電源的需求是其廣泛採用的關鍵驅動力。此外,與先進控制電子設備和緊湊系統設計的整合也推動了對可靠電源調節解決方案的需求,以確保低溫冷凍機系統的長期運作穩定性和更高的性能。

按低溫冷凍機類型分類,脈衝管製冷機將在 2024 年佔據較大佔有率。

這是因為它們具有高可靠性、長壽命和低振動的特點,非常適合衛星和太空應用。這些系統擴大用於冷卻紅外線感測器、超導性設備和太空望遠鏡,為對振動敏感的設備提供穩定的性能。國防和航太任務對緊湊、免維護低溫低溫冷凍機的需求日益成長,這加速了它們的應用。這些解決方案可確保持續冷卻且無機械磨損。此外,與先進電子設備、溫度控管系統和小型有效載荷的整合正在推動它們在下一代衛星和監視項目中的應用。這些特性確保了穩定、高效和持久的低溫性能,從而增加了脈衝管技術在關鍵航太和國防應用中的採用。

“按營運週期計算,預計閉合迴路週期在預測期內將實現更高的複合年成長率。”

這一成長的驅動力源於醫療成像系統日益普及、超導性磁體高效冷卻需求的不斷成長以及對節能低溫系統的日益關注。閉合迴路低溫冷凍機無需頻繁補料即可提供持續穩定的冷卻性能,從而提高運行效率並減少停機時間。此外,其適應可變冷卻負荷的能力使其適用於核磁共振造影系統、低溫研究和新興量子技術的應用。與自動化控制和先進溫度控管解決方案的整合進一步增強了可靠性和擴充性,顯著促進了市場成長。

本報告調查了全球低溫冷凍機市場,並提供了市場概況、影響市場成長的各種因素分析、技術和專利趨勢、法律制度、案例研究、市場規模趨勢和預測、各個細分市場、地區/主要國家的詳細分析、競爭格局和主要企業的概況。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章重要考察

第5章 市場概況

- 市場動態

- 驅動程式

- 抑制因素

- 機會

- 任務

- 影響客戶業務的趨勢/中斷

- 定價分析

- 價值鏈分析

- 生態系分析

- 技術分析

- 專利分析

- 貿易分析

- 2025-2026年重要會議和活動

- 案例研究分析

- 投資金籌措場景

- 監管狀況

- 波特五力分析

- 主要相關利益者和採購標準

- 生成式人工智慧/人工智慧對冷凍市場的影響

- 2025年美國關稅對低溫冷凍機市場的影響

第6章低溫冷凍機市場(依服務細分)

- 硬體

- 壓縮機

- 冷頭

- 散熱管

- 電源調節單元

- 其他

- 服務

- 技術支援

- 產品維修及維修

- 預防性保養

- 客戶培訓

第7章低溫冷凍機市場(依熱交換器類型)

- 回收熱交換器

- 蓄熱式熱交換器

第 8 章低溫冷凍機市場(依運轉週期)

- 開放回路循環

- 閉合迴路循環

第9章低溫冷凍機市場(按低溫冷凍機類型)

- 吉福德-麥克馬洪低溫冷凍機

- 脈衝低溫冷凍機

- 史特林型低溫冷凍機

- 焦耳-湯姆遜低溫冷凍機

- 布雷頓型低溫冷凍機

第 10 章低溫冷凍機市場(按溫度範圍)

- 1~50K

- 50-150 K

- 超過15萬

第 11 章低溫冷凍機市場(依應用)

- 軍隊

- 用於飛彈導引的紅外線感測器

- 用於衛星監視的紅外線感測器

- 醫療保健

- MRI系統

- 氧氣液化儲存

- 冷凍手術和質子治療

- 商業的

- 半導體製造

- 用於行動電話基地台的高溫超導性

- 用於無損檢測和製程監控的紅外線感測器

- 環境

- 用於大氣研究臭氧空洞和溫室效應的紅外線感測器。

- 用於污染監測的紅外線感測器

- 能源

- 用於測量熱損失的紅外線感測器

- 超導體電磁儲能系統抑低尖峰負載

- 運輸

- 超導性磁體磁浮列車

- 車隊車輛的液化天然氣

- 研究與開發

- 核磁共振

- 電子順磁性磁共振

- 空間

- 太空天文學

- 行星科學

- 農業和生物學

- 生物細胞和標本儲存

- 採礦和金屬

- 金屬硬化

- 收縮配合

- 其他用途

第12章低溫冷凍機市場(按地區)

- 北美洲

- 宏觀經濟展望

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 宏觀經濟展望

- 德國

- 英國

- 法國

- 義大利

- 荷蘭

- 波蘭

- 北歐的

- 其他

- 亞太地區

- 宏觀經濟展望

- 日本

- 中國

- 韓國

- 印度

- 澳洲

- 印尼

- 馬來西亞

- 泰國

- 越南

- 其他

- 其他地區

- 宏觀經濟展望

- 中東

- 非洲

- 南美洲

第13章競爭格局

- 概述

- 主要參與企業的策略/優勢

- 市佔率分析

- 收益分析

- 估值和財務指標

- 品牌比較

- 公司評估矩陣:主要企業

- 公司估值矩陣:Start-Ups/中小型企業

- 競爭場景

第14章:公司簡介

- 主要企業

- SUMITOMO HEAVY INDUSTRIES, LTD.

- THALES

- EDWARDS VACUUM(ATLAS COPCO GROUP)

- AMETEK.INC.

- CHART INDUSTRIES, INC.

- BLUEFORS

- NORTHROP GRUMMAN

- ADVANCED RESEARCH SYSTEMS

- RICOR

- AIR LIQUIDE ADVANCED TECHNOLOGIES

- 其他公司

- LAKE SHORE CRYOTRONICS

- CREARE

- LIHAN CRYOGENICS CO., LTD.

- TRISTAN TECHNOLOGIES, INC.

- VACREE TECHNOLOGIES CO., LTD.

- HONEYWELL INTERNATIONAL INC.

- BRIGHT INSTRUMENT CO. LTD.

- ABSOLUT SYSTEM

- FABRUM

- CRYOSPECTRA GMBH

- ULVAC CRYOGENICS INC.

- OXFORD CRYOSYSTEMS LTD.

- HYCON LTD.

- RIX INDUSTRIES

- AIM INFRAROT-MODULE GMBH

第15章 附錄

The cryocooler market was valued at USD 3.48 billion in 2025 and is projected to reach USD 4.90 billion by 2030, registering a CAGR of 7.1% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Cryocooler Type, Offering, Heat Exchanger, Operating Cycle, Tempreature Range, and Application |

| Regions covered | North America, Europe, APAC, RoW |

The growth of cryocoolers is driven by rising adoption in satellite launches, space exploration, and defense applications, supported by government investments, technological advancements in cooling efficiency, and the growing need for cryogenic temperatures in quantum computing and medical imaging systems.

"Power conditioning unit in hardware type to grow at highest CAGR during forecast period"

By hardware type, the power conditioning unit segment is expected to witness the highest CAGR in the cryocooler market during the forecast period due to its critical role in ensuring stable and efficient power delivery for sensitive cryogenic systems. These units help regulate voltage fluctuations, minimize electrical noise, and protect delicate components from power disturbances, which is essential for vibration-sensitive applications such as space instruments, infrared sensors, and quantum computing devices. As cryocoolers find broader use in defense, aerospace, and medical imaging, the demand for a reliable and continuous power supply is becoming a key driver of adoption. Furthermore, integration with advanced control electronics and compact system designs is driving the requirement for reliable power conditioning solutions, ensuring long-term operational stability and enhanced performance of cryocooler systems.

"Pulse-tube cryocoolers segment accounted for significant share of cryocooler market in 2024"

By cryocooler type, the pulse-tube cryocoolers segment is estimated to account for a significant share of the overall cryocooler market in 2024 due to their ability to deliver high reliability, long operational life, and low vibration, making them suitable for satellite and space applications. These systems are increasingly being adopted for cooling infrared sensors, superconducting devices, and space telescopes, where vibration-sensitive instruments require stable performance. The growing demand for compact and maintenance-free cryocoolers in defense and aerospace missions is accelerating adoption, as these solutions ensure consistent cooling without mechanical wear. Furthermore, integration with advanced electronics, thermal management systems, and miniaturized payloads is driving their use in next-generation satellites and surveillance programs. These features ensure stable, efficient, and durable cryogenic performance, contributing to the increasing preference for pulse-tube technology in critical aerospace and defense applications.

"Closed-loop cycle to register higher CAGR in cryocooler market between 2025 and 2030"

The closed-loop cycle segment is projected to register the highest CAGR in the cryocooler market during the forecast period. This growth is attributed to rising adoption in medical imaging equipment, growing demand for efficient cooling in superconducting magnets, and the increasing focus on energy-efficient cryogenic systems. Closed-loop cryocoolers enable continuous and stable cooling performance without the need for frequent refilling, improving operational efficiency and reducing downtime. Furthermore, their ability to handle variable cooling loads makes them suitable for applications in MRI machines, cryogenic research, and emerging quantum technologies. The integration of closed-loop systems with automated controls and advanced thermal management solutions further enhances reliability and scalability, significantly contributing to market growth.

Extensive primary interviews were conducted with key industry experts in the cryocooler market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is shown below.

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type - Tier 1 - 20%, Tier 2 - 35%, Tier 3 - 45%

- By Designation- C-level Executives - 35%, Directors - 25%, Others - 40%

- By Reion - North America - 45%, Europe -25%, Asia Pacific - 20%, RoW - 10%

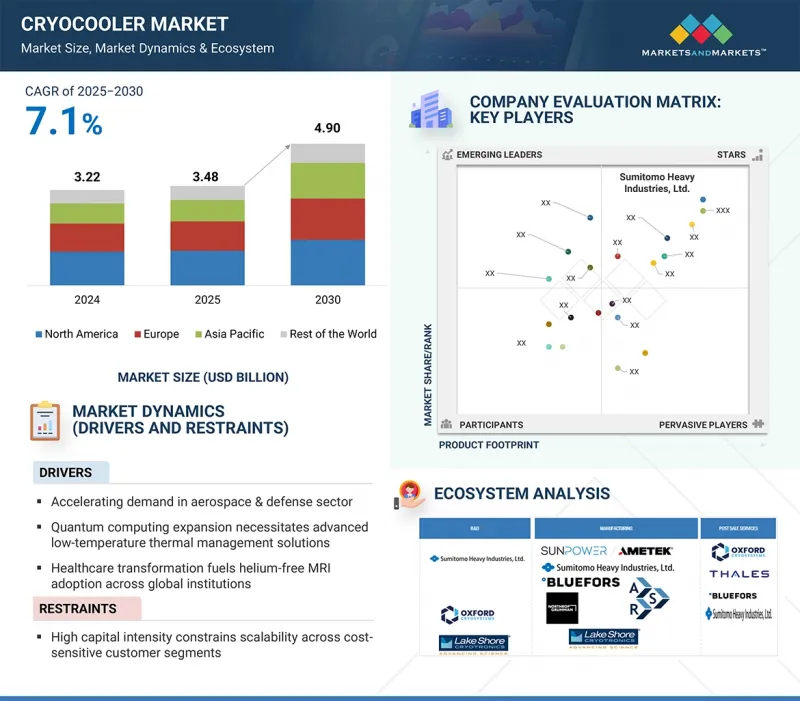

The cryocooler market is dominated by a few globally established players, such as Sumitomo Heavy Industries, Ltd. (Japan), Thales (France), AMETEK.Inc. (US), Edwards Vacuum (UK), and Chart Industries, Inc. (US).

The study includes an in-depth competitive analysis of these key players in the cryocooler market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the cryocooler market and forecasts its size by application (military, medical, commercial, environmental, energy, transport, research & development, space, agriculture & biology, mining & metal, other applications), offering (hardware, services), heat exchanger type (recuperative heat exchanger, regenerative heat exchanger), temperature range (1k-50k, 50k-150k, above 150k), operating range (open-loop cycle, closed-loop cycle), type (Gifford-McMahon Cryocoolers, Pulse-tube Cryocoolers, Stirling Cryocoolers, Joule Thomson Cryocoolers, Brayton Cryocoolers). It also discusses the market's drivers, restraints, opportunities, and challenges. It gives a detailed view of the market across the regions (North America, Europe, Asia Pacific, RoW). The report includes a supply chain analysis of the key players and their competitive analysis in the cryocooler ecosystem.

Key Benefits of Buying the Report:

- Analysis of key drivers (Accelerating demand in aerospace and defense catalyzes sustained cryocooler adoption, Quantum computing expansion necessitates advanced low-temperature thermal management solutions, Healthcare transformation fuels helium-free MRI adoption across global institutions), restraint (High capital intensity constrains scalability across cost-sensitive customer segments, Complex maintenance cycles elevate operational expenditure and adoption hesitancy), opportunities (Quantum computing scale-up driving sub-4K pre-cooler demand surges, Rapid commercialization of small satellites generates demand for miniaturized cryocoolers), challenges (Geopolitical risks destabilize specialized component sourcing across critical region, Balancing performance and cost metrics complicates commercial-scale market entry)

- Product Development/Innovation: Detailed insights into upcoming technologies, research and development activities, and new product launches in the cryocooler market

- Market Development: Comprehensive information about lucrative markets - the report analyses the cryocooler market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the cryocooler market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as Sumitomo Heavy Industries, Ltd. (Japan), Thales (France), AMETEK.Inc. (US), Edwards Vacuum (UK), and Chart Industries, Inc. (US), among others, in the cryocooler market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 INTRODUCTION

- 2.2 RESEARCH APPROACH

- 2.2.1 SECONDARY DATA

- 2.2.1.1 List of major secondary sources

- 2.2.1.2 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Breakdown of primaries

- 2.2.2.2 Key participants in interviews

- 2.2.2.3 Key data from primary sources

- 2.2.2.4 Key industry insights

- 2.2.1 SECONDARY DATA

- 2.3 FACTOR ANALYSIS

- 2.3.1 SUPPLY-SIDE ANALYSIS

- 2.3.2 DEMAND-SIDE ANALYSIS

- 2.4 MARKET SIZE ESTIMATION METHODOLOGY

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.4.2 TOP-DOWN APPROACH

- 2.4.2.1 Approach to arrive at market size using top-down approach (supply side)

- 2.4.1 BOTTOM-UP APPROACH

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN CRYOCOOLER MARKET

- 4.2 CRYOCOOLER MARKET, BY OPERATING CYCLE

- 4.3 CRYOCOOLER MARKET, BY TEMPERATURE RANGE

- 4.4 CRYOCOOLER MARKET, BY HARDWARE TYPE

- 4.5 CRYOCOOLER MARKET IN ASIA PACIFIC, BY COUNTRY

- 4.6 CRYOCOOLER MARKET, BY REGION

- 4.7 CRYOCOOLER MARKET, BY GEOGRAPHY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Accelerating cryocooler demand from aerospace & defense sector

- 5.2.1.2 Surging adoption of quantum computing technology

- 5.2.1.3 Escalating demand for helium-free MRI systems by healthcare providers

- 5.2.2 RESTRAINTS

- 5.2.2.1 Low adoption in cost-sensitive markets due to high upfront costs and extended payback

- 5.2.2.2 Maintenance-driven expenditure and workforce skill gaps

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emergence of sub-4K pre-coolers tailored for quantum data centers

- 5.2.3.2 Commercialization of small satellites

- 5.2.4 CHALLENGES

- 5.2.4.1 Geopolitical risks impacting specialized component sourcing

- 5.2.4.2 Commercial-scale expansion barriers due to performance-cost trade-offs

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 PRICING RANGE OF CRYOCOOLERS, BY KEY PLAYER, 2024

- 5.4.2 AVERAGE SELLING PRICE TREND OF CRYOCOOLERS, BY REGION, 2021-2024

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Pulse tube cryocoolers

- 5.7.1.2 Stirling cryocoolers

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Thermal management & insulation

- 5.7.2.2 Cryogenic sensors & instrumentation

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Thermoelectric coolers (Peltier devices)

- 5.7.3.2 Quantum technologies

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO (HS CODE 8418)

- 5.9.2 EXPORT SCENARIO (HS CODE 8418)

- 5.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 SHI'S HIGH-CAPACITY 4 KGM-JT RJT-100 CRYOCOOLER SYSTEM FOR INDUSTRIAL SRF ACCELERATORS

- 5.11.2 CRYOR'S FLEXIBLE AND ADAPTABLE CRYOCOOLER SOLUTION FOR RESEARCH LABORATORIES

- 5.11.3 CREARE'S MECHANICAL CRYOCOOLER FOR NICMOS INFRARED VISION RECOVERY ON HUBBLE SPACE TELESCOPE

- 5.11.4 BLUEFOR' PT450 PULSE TUBE CRYOCOOLER MEETING PERFORMANCE AND ENERGY EFFICIENCY GOALS

- 5.12 INVESTMENT AND FUNDING SCENARIO

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 KEY REGULATIONS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF BUYERS

- 5.14.4 BARGAINING POWER OF SUPPLIERS

- 5.14.5 THREAT OF NEW ENTRANTS

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF GEN AI/AI ON CRYOCOOLER MARKET

- 5.17 2025 US TARIFF IMPACT ON CRYOCOOLER MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON APPLICATIONS

6 CRYOCOOLER MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.2 HARDWARE

- 6.2.1 COMPRESSOR

- 6.2.1.1 Ability to minimize vibration and acoustic interference in sensitive systems to accelerate demand

- 6.2.2 COLD HEAD

- 6.2.2.1 Extended maintenance-free operation to boost demand

- 6.2.3 HEAT DISSIPATION PIPE

- 6.2.3.1 Rising use of additive manufacturing to fabricate complex heat pipe geometries to fuel segmental growth

- 6.2.4 POWER CONDITIONING UNIT

- 6.2.4.1 Ability to withstand radiation and voltage fluctuations to propel market

- 6.2.5 OTHER HARDWARE TYPES

- 6.2.1 COMPRESSOR

- 6.3 SERVICES

- 6.3.1 TECHNICAL SUPPORT

- 6.3.1.1 Need for on-demand expertise to ensure operational continuity to push segmental growth

- 6.3.2 PRODUCT REPAIR & REFURBISHMENT

- 6.3.2.1 Rising focus on extending product lifecycle and maximizing ROI to boost demand

- 6.3.3 PREVENTIVE MAINTENANCE

- 6.3.3.1 Significant focus on reducing downtime and avoiding costly system failures to surge demand

- 6.3.4 CUSTOMER TRAINING

- 6.3.4.1 Requirement to keep customers updated with latest operational practices to spike demand

- 6.3.1 TECHNICAL SUPPORT

7 CRYOCOOLER MARKET, BY HEAT EXCHANGER TYPE

- 7.1 INTRODUCTION

- 7.2 RECUPERATIVE HEAT EXCHANGER

- 7.2.1 INCREASING CRYOGENIC ADOPTION IN SPACE PROGRAMS TO SUPPORT SEGMENTAL GROWTH

- 7.3 REGENERATIVE HEAT EXCHANGER

- 7.3.1 SUPERIOR THERMAL STABILITY AND BETTER UNIFORMITY TO BOOST DEMAND

8 CRYOCOOLER MARKET, BY OPERATING CYCLE

- 8.1 INTRODUCTION

- 8.2 OPEN-LOOP CYCLE

- 8.2.1 EXCELLENCE IN HANDLING HIGH THROUGHPUT AND ADAPTING TO VARYING PROCESS REQUIREMENTS TO SPIKE DEMAND

- 8.3 CLOSED-LOOP CYCLE

- 8.3.1 REDUCED VIBRATION, LOWER MAINTENANCE, AND HIGHER RELIABILITY THAN OPEN-LOOP SYSTEMS TO ACCELERATE ADOPTION

9 CRYOCOOLER MARKET, BY CRYOCOOLER TYPE

- 9.1 INTRODUCTION

- 9.2 GIFFORD-MCMAHON CRYOCOOLERS

- 9.2.1 SUITABILITY FOR APPLICATIONS REQUIRING CONTINUOUS AND STABLE COOLING TO BOOST DEMAND

- 9.3 PULSE TUBE CRYOCOOLERS

- 9.3.1 ABILITY TO DELIVER VIBRATION-FREE, MAINTENANCE-FREE, AND SPACE-COMPATIBLE COOLING SOLUTIONS TO INCREASE DEMAND

- 9.4 STIRLING CRYOCOOLERS

- 9.4.1 RISING USE IN SPACE APPLICATIONS TO DRIVE MARKET

- 9.5 JOULE-THOMSON CRYOCOOLERS

- 9.5.1 WIDESPREAD USE IN GAS LIQUEFACTION, CRYOGENIC RESEARCH, AND MEDICAL IMAGING TO PROPEL MARKET

- 9.6 BRAYTON CRYOCOOLERS

- 9.6.1 INCREASING DEMAND IN AEROSPACE, DEFENSE, AND HIGH-POWER INDUSTRIAL APPLICATIONS TO FOSTER MARKET GROWTH

10 CRYOCOOLER MARKET, BY TEMPERATURE RANGE

- 10.1 INTRODUCTION

- 10.2 1-50 K

- 10.2.1 RISING USE IN ULTRA-LOW-NOISE DETECTION AND QUANTUM COMPUTING APPLICATIONS TO FACILITATE SEGMENTAL GROWTH

- 10.3 >50-150 K

- 10.3.1 ELEVATING DEMAND FOR FIELD-DEPLOYABLE DEFENSE SYSTEMS TO ACCELERATE SEGMENTAL GROWTH

- 10.4 ABOVE 150 K

- 10.4.1 ESCALATING USE IN INDUSTRIAL LIQUEFACTION AND HIGH-TEMPERATURE SUPERCONDUCTING APPLICATIONS TO BOOST SEGMENTAL GROWTH

11 CRYOCOOLER MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- 11.2 MILITARY

- 11.2.1 ESCALATING USE OF UAVS AND DRONES IN BATTLEFIELD SURVEILLANCE TO DRIVE MARKET

- 11.2.2 IR SENSORS FOR MISSILE GUIDANCE

- 11.2.3 IR SENSORS FOR SATELLITE-BASED SURVEILLANCE

- 11.3 MEDICAL

- 11.3.1 PRESSING NEED TO REDUCE DOWNTIME IN CRITICAL HEALTHCARE INFRASTRUCTURE TO CONTRIBUTE TO MARKET GROWTH

- 11.3.2 MRI SYSTEMS

- 11.3.3 LIQUEFACTION OF OXYGEN FOR STORAGE

- 11.3.4 CRYOSURGERY AND PROTON THERAPY

- 11.4 COMMERCIAL

- 11.4.1 EXPANSION OF INDUSTRIAL-SCALE GAS LIQUEFACTION PLANTS TO FACILITATE DEMAND

- 11.4.2 SEMICONDUCTOR FABRICATION

- 11.4.3 HIGH-TEMPERATURE SUPERCONDUCTORS FOR CELL PHONE BASE STATIONS

- 11.4.4 IR SENSORS FOR NDE AND PROCESS MONITORING

- 11.5 ENVIRONMENTAL

- 11.5.1 RISING FOCUS ON TRACKING POLLUTION SOURCES AND IMPROVING URBAN AIR QUALITY TO SUPPORT MARKET GROWTH

- 11.5.2 IR SENSORS FOR ATMOSPHERIC STUDIES ON OZONE HOLE AND GREENHOUSE EFFECT

- 11.5.3 IR SENSORS FOR POLLUTION MONITORING

- 11.6 ENERGY

- 11.6.1 GREATER EMPHASIS ON REDUCING ENERGY LOSSES DURING TRANSMISSION TO FOSTER MARKET GROWTH

- 11.6.2 IR SENSORS FOR THERMAL LOSS MEASUREMENTS

- 11.6.3 SUPERCONDUCTING MAGNETIC ENERGY STORAGE FOR PEAK SHAVING

- 11.7 TRANSPORT

- 11.7.1 ELEVATING DEMAND FOR HYDROGEN-POWERED SHIPS AND SUBMARINES TO CREATE GROWTH OPPORTUNITIES

- 11.7.2 SUPERCONDUCTING MAGNETS IN MAGLEV TRAINS

- 11.7.3 LNG FOR FLEET VEHICLES

- 11.8 RESEARCH & DEVELOPMENT

- 11.8.1 RAPID INNOVATIONS IN SENSORS, NANOTECHNOLOGY, AND SUPERCONDUCTING ELECTRONICS TO PROMOTE MARKET GROWTH

- 11.8.2 NUCLEAR MAGNETIC RESONANCE

- 11.8.3 ELECTRON PARAMAGNETIC RESONANCE

- 11.9 SPACE

- 11.9.1 EARTH OBSERVATION, ASTROPHYSICS, AND DEEP-SPACE EXPLORATION MISSIONS TO SPUR DEMAND

- 11.9.2 SPACE ASTRONOMY

- 11.9.3 PLANETARY SCIENCE

- 11.10 AGRICULTURE & BIOLOGY

- 11.10.1 REQUIREMENT TO PRESERVE SEEDS, GENETIC MATERIALS, AND BIOLOGICAL SAMPLES TO ENCOURAGE ADOPTION

- 11.10.2 STORAGE OF BIOLOGICAL CELLS AND SPECIMENS

- 11.11 MINING & METAL

- 11.11.1 LEVERAGING CRYOCOOLERS TO ENHANCE CORROSION RESISTANCE AND WEAR PERFORMANCE

- 11.11.2 METAL TEMPERING

- 11.11.3 SHRINK FITTING

- 11.12 OTHER APPLICATIONS

12 CRYOCOOLER MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 12.2.2 US

- 12.2.2.1 Well-established military industry and high expenditure on healthcare equipment to drive market

- 12.2.3 CANADA

- 12.2.3.1 Growing medical and healthcare expenditure to spur demand

- 12.2.4 MEXICO

- 12.2.4.1 Emerging industrial applications to drive demand

- 12.3 EUROPE

- 12.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 12.3.2 GERMANY

- 12.3.2.1 Thriving healthcare sector and government support for cryogenic research to foster market growth

- 12.3.3 UK

- 12.3.3.1 Government efforts toward defense system enhancement to fuel market growth

- 12.3.4 FRANCE

- 12.3.4.1 Emphasis on innovation and technological advancement to facilitate market growth

- 12.3.5 ITALY

- 12.3.5.1 Rising use of cryogenic technology in MRI and cancer treatment applications to support market growth

- 12.3.6 NETHERLANDS

- 12.3.6.1 Partnerships between cryogenic technology providers and research institutions to expedite market growth

- 12.3.7 POLAND

- 12.3.7.1 Surging deployment of cooling systems in electronic devices and automotive systems to accelerate market growth

- 12.3.8 NORDICS

- 12.3.8.1 Significant focus on sustainability and cryogenic research synergies to propel market

- 12.3.9 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 12.4.2 JAPAN

- 12.4.2.1 Surging demand from universities, national laboratories, and research centers to develop innovative products to drive market

- 12.4.3 CHINA

- 12.4.3.1 Adoption of clean energy objectives to promote demand for cooling systems

- 12.4.4 SOUTH KOREA

- 12.4.4.1 Escalating demand for cryopumps from semiconductor manufacturers to fuel market growth

- 12.4.5 INDIA

- 12.4.5.1 Booming healthcare industry to intensify demand

- 12.4.6 AUSTRALIA

- 12.4.6.1 Healthcare, space, and defense verticals to contribute most to market growth

- 12.4.7 INDONESIA

- 12.4.7.1 Introduction of I-NCAP plan to ensure sustainable cooling practices to stimulate demand

- 12.4.8 MALAYSIA

- 12.4.8.1 Rising focus on adopting energy-efficient cooling and modernizing air conditioning standards to spike demand

- 12.4.9 THAILAND

- 12.4.9.1 Heightened demand for high-performance cryogenic systems across industrial and healthcare sectors to propel market

- 12.4.10 VIETNAM

- 12.4.10.1 Expansion of digital infrastructure due to rapid industrialization to create growth opportunities

- 12.4.11 REST OF ASIA PACIFIC

- 12.5 ROW

- 12.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 12.5.2 MIDDLE EAST

- 12.5.2.1 Bahrain

- 12.5.2.1.1 Expanding industrial parks, energy facilities, and manufacturing hubs to support market growth

- 12.5.2.2 Kuwait

- 12.5.2.2.1 Government-supported research programs in energy and materials science to boost adoption

- 12.5.2.3 Oman

- 12.5.2.3.1 Strategic government programs aimed at infrastructure modernization to rise deployment

- 12.5.2.4 Qatar

- 12.5.2.4.1 Capitalize on defense and scientific infrastructure expansion

- 12.5.2.5 Saudi Arabia

- 12.5.2.5.1 Vision 2030 initiative to create opportunities

- 12.5.2.6 UAE

- 12.5.2.6.1 Investment to improve data center capabilities to contribute to market growth

- 12.5.2.7 Rest of Middle East

- 12.5.2.1 Bahrain

- 12.5.3 AFRICA

- 12.5.3.1 South Africa

- 12.5.3.1.1 Healthcare infrastructure modernization efforts to support market growth

- 12.5.3.2 Other African countries

- 12.5.3.1 South Africa

- 12.5.4 SOUTH AMERICA

- 12.5.4.1 Brazil

- 12.5.4.1.1 Push toward renewable energy and industrial automation to spur demand

- 12.5.4.2 Argentina

- 12.5.4.2.1 Growing investments in healthcare, space research, and energy efficiency programs to drive market

- 12.5.4.3 Rest of South America

- 12.5.4.1 Brazil

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 13.3 MARKET SHARE ANALYSIS, 2024

- 13.4 REVENUE ANALYSIS, 2021-2024

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.6 BRAND COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 Cryocooler type footprint

- 13.7.5.4 Temperature range footprint

- 13.7.5.5 Application footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.8.5.2 Competitive benchmarking of key startups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 SUMITOMO HEAVY INDUSTRIES, LTD.

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths/Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses/Competitive threats

- 14.1.2 THALES

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 MnM view

- 14.1.2.3.1 Key strengths/Right to win

- 14.1.2.3.2 Strategic choices

- 14.1.2.3.3 Weaknesses/Competitive threats

- 14.1.3 EDWARDS VACUUM (ATLAS COPCO GROUP)

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 MnM view

- 14.1.3.3.1 Key strengths/Right to win

- 14.1.3.3.2 Strategic choices

- 14.1.3.3.3 Weaknesses/Competitive threats

- 14.1.4 AMETEK.INC.

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 MnM view

- 14.1.4.3.1 Key strengths/Right to win

- 14.1.4.3.2 Strategic choices

- 14.1.4.3.3 Weaknesses/Competitive threats

- 14.1.5 CHART INDUSTRIES, INC.

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 MnM view

- 14.1.5.3.1 Key strengths/Right to win

- 14.1.5.3.2 Strategic choices

- 14.1.5.3.3 Weaknesses/Competitive threats

- 14.1.6 BLUEFORS

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches

- 14.1.6.3.2 Deals

- 14.1.6.3.3 Expansions

- 14.1.7 NORTHROP GRUMMAN

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Deals

- 14.1.8 ADVANCED RESEARCH SYSTEMS

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Services/Solutions offered

- 14.1.9 RICOR

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.10 AIR LIQUIDE ADVANCED TECHNOLOGIES

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.1 SUMITOMO HEAVY INDUSTRIES, LTD.

- 14.2 OTHER PLAYERS

- 14.2.1 LAKE SHORE CRYOTRONICS

- 14.2.2 CREARE

- 14.2.3 LIHAN CRYOGENICS CO., LTD.

- 14.2.4 TRISTAN TECHNOLOGIES, INC.

- 14.2.5 VACREE TECHNOLOGIES CO., LTD.

- 14.2.6 HONEYWELL INTERNATIONAL INC.

- 14.2.7 BRIGHT INSTRUMENT CO. LTD.

- 14.2.8 ABSOLUT SYSTEM

- 14.2.9 FABRUM

- 14.2.10 CRYOSPECTRA GMBH

- 14.2.11 ULVAC CRYOGENICS INC.

- 14.2.12 OXFORD CRYOSYSTEMS LTD.

- 14.2.13 HYCON LTD.

- 14.2.14 RIX INDUSTRIES

- 14.2.15 AIM INFRAROT-MODULE GMBH

15 APPENDIX

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS

List of Tables

- TABLE 1 CRYOCOOLER MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 LIST OF SECONDARY SOURCES

- TABLE 3 INTENDED PARTICIPANTS AND MAJOR OPINION LEADERS

- TABLE 4 CRYOCOOLER MARKET: RISK ANALYSIS

- TABLE 5 PRICING RANGE OF CRYOCOOLERS PROVIDED BY KEY PLAYERS, 2024 (USD)

- TABLE 6 AVERAGE SELLING PRICE TREND OF CRYOCOOLERS, BY REGION, 2021-2024 (USD)

- TABLE 7 ROLE OF KEY PLAYERS IN ECOSYSTEM

- TABLE 8 LIST OF MAJOR PATENTS, 2022-2024

- TABLE 9 IMPORT DATA FOR HS CODE 8418-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 10 EXPORT DATA FOR HS CODE 8418-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 11 MAJOR CONFERENCES AND EVENTS RELATED TO CRYOCOOLERS IN DIFFERENT REGIONS, 2025-2026

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 CRYOCOOLER MARKET: REGULATORY LANDSCAPE

- TABLE 17 CRYOCOOLER MARKET: IMPACT OF PORTER'S FIVE FORCES

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR OFFERINGS

- TABLE 19 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 20 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 21 CRYOCOOLER MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 22 CRYOCOOLER MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 23 CRYOCOOLER MARKET, 2021-2024 (THOUSAND UNITS)

- TABLE 24 CRYOCOOLER MARKET, 2025-2030 (THOUSAND UNITS)

- TABLE 25 CRYOCOOLER MARKET, BY HARDWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 26 CRYOCOOLER MARKET, BY HARDWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 27 CRYOCOOLER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 28 CRYOCOOLER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 29 CRYOCOOLER MARKET, BY HEAT EXCHANGER TYPE, 2021-2024 (USD MILLION)

- TABLE 30 CRYOCOOLER MARKET, BY HEAT EXCHANGER TYPE, 2025-2030 (USD MILLION)

- TABLE 31 CRYOCOOLER MARKET, BY OPERATING CYCLE, 2021-2024 (USD MILLION)

- TABLE 32 CRYOCOOLER MARKET, BY OPERATING CYCLE, 2025-2030 (USD MILLION)

- TABLE 33 CRYOCOOLER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 34 CRYOCOOLER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 35 GIFFORD-MCMAHON CRYOCOOLERS: CRYOCOOLER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 36 GIFFORD-MCMAHON CRYOCOOLERS: CRYOCOOLER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 GIFFORD-MCMAHON CRYOCOOLERS: CRYOCOOLER MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 38 GIFFORD-MCMAHON CRYOCOOLERS: CRYOCOOLER MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 39 GIFFORD-MCMAHON CRYOCOOLERS: CRYOCOOLER MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 40 GIFFORD-MCMAHON CRYOCOOLERS: CRYOCOOLER MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 41 GIFFORD-MCMAHON CRYOCOOLERS: CRYOCOOLER MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 42 GIFFORD-MCMAHON CRYOCOOLERS: CRYOCOOLER MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 43 GIFFORD-MCMAHON CRYOCOOLERS: CRYOCOOLER MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 44 GIFFORD-MCMAHON CRYOCOOLERS: CRYOCOOLER MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 PULSE TUBE CRYOCOOLERS: CRYOCOOLER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 46 PULSE TUBE CRYOCOOLERS: CRYOCOOLER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 PULSE TUBE CRYOCOOLERS: CRYOCOOLER MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 48 PULSE TUBE CRYOCOOLERS: CRYOCOOLER MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 49 PULSE TUBE CRYOCOOLERS: CRYOCOOLER MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 50 PULSE TUBE CRYOCOOLERS: CRYOCOOLER MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 51 PULSE TUBE CRYOCOOLERS: CRYOCOOLER MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 52 PULSE TUBE CRYOCOOLERS: CRYOCOOLER MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 53 PULSE TUBE CRYOCOOLERS: CRYOCOOLER MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 54 PULSE TUBE CRYOCOOLERS: CRYOCOOLER MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 STIRLING CRYOCOOLERS: CRYOCOOLER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 STIRLING CRYOCOOLERS: CRYOCOOLER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 STIRLING CRYOCOOLERS: CRYOCOOLER MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 58 STIRLING CRYOCOOLERS: CRYOCOOLER MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 59 STIRLING CRYOCOOLERS: CRYOCOOLER MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 60 STIRLING CRYOCOOLERS: CRYOCOOLER MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 61 STIRLING CRYOCOOLERS: CRYOCOOLER MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 62 STIRLING CRYOCOOLERS: CRYOCOOLER MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 63 STIRLING CRYOCOOLERS: CRYOCOOLER MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 64 STIRLING CRYOCOOLERS: CRYOCOOLER MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 JOULE-THOMSON CRYOCOOLERS: CRYOCOOLER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 66 JOULE-THOMSON CRYOCOOLERS: CRYOCOOLER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 JOULE-THOMSON CRYOCOOLERS: CRYOCOOLER MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 68 JOULE-THOMSON CRYOCOOLERS: CRYOCOOLER MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 69 JOULE-THOMSON CRYOCOOLERS: CRYOCOOLER MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 70 JOULE-THOMSON CRYOCOOLERS: CRYOCOOLER MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 71 JOULE-THOMSON CRYOCOOLERS: CRYOCOOLER MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 72 JOULE-THOMSON CRYOCOOLERS: CRYOCOOLER MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 73 JOULE-THOMSON CRYOCOOLERS: CRYOCOOLER MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 JOULE-THOMSON CRYOCOOLERS: CRYOCOOLER MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 BRAYTON CRYOCOOLERS: CRYOCOOLER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 76 BRAYTON CRYOCOOLERS: CRYOCOOLER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 BRAYTON CRYOCOOLERS: CRYOCOOLER MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 78 BRAYTON CRYOCOOLERS: CRYOCOOLER MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 79 BRAYTON CRYOCOOLERS: CRYOCOOLER MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 80 BRAYTON CRYOCOOLERS: CRYOCOOLER MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 81 BRAYTON CRYOCOOLERS: CRYOCOOLER MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 82 BRAYTON CRYOCOOLERS: CRYOCOOLER MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 83 BRAYTON CRYOCOOLERS: CRYOCOOLER MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 84 BRAYTON CRYOCOOLERS: CRYOCOOLER MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85 CRYOCOOLER MARKET, BY TEMPERATURE RANGE, 2021-2024 (USD MILLION)

- TABLE 86 CRYOCOOLER MARKET, BY TEMPERATURE RANGE, 2025-2030 (USD MILLION)

- TABLE 87 CRYOCOOLER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 88 CRYOCOOLER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 89 MILITARY: CRYOCOOLER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 90 MILITARY: CRYOCOOLER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91 MEDICAL: CRYOCOOLER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 92 MEDICAL: CRYOCOOLER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 93 COMMERCIAL: CRYOCOOLER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 94 COMMERCIAL: CRYOCOOLER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 95 ENVIRONMENTAL: CRYOCOOLER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 96 ENVIRONMENTAL: CRYOCOOLER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 97 ENERGY: CRYOCOOLER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 98 ENERGY: CRYOCOOLER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 99 TRANSPORT: CRYOCOOLER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 100 TRANSPORT: CRYOCOOLER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 101 RESEARCH & DEVELOPMENT: CRYOCOOLER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 102 RESEARCH & DEVELOPMENT: CRYOCOOLER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 103 SPACE: CRYOCOOLER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 104 SPACE: CRYOCOOLER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 105 AGRICULTURE & BIOLOGY: CRYOCOOLER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 106 AGRICULTURE & BIOLOGY: CRYOCOOLER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 107 MINING & METAL: CRYOCOOLER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 108 MINING & METAL: CRYOCOOLER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 109 OTHER APPLICATIONS: CRYOCOOLER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 110 OTHER APPLICATIONS: CRYOCOOLER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 111 CRYOCOOLER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 112 CRYOCOOLER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 113 NORTH AMERICA: CRYOCOOLER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 114 NORTH AMERICA: CRYOCOOLER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 115 NORTH AMERICA: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2021-2024 (USD MILLION)

- TABLE 116 NORTH AMERICA: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2025-2030 (USD MILLION)

- TABLE 117 NORTH AMERICA: CRYOCOOLER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 118 NORTH AMERICA: CRYOCOOLER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 119 US: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2021-2024 (USD MILLION)

- TABLE 120 US: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2025-2030 (USD MILLION)

- TABLE 121 CANADA: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2021-2024 (USD MILLION)

- TABLE 122 CANADA: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2025-2030 (USD MILLION)

- TABLE 123 MEXICO: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2021-2024 (USD MILLION)

- TABLE 124 MEXICO: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2025-2030 (USD MILLION)

- TABLE 125 EUROPE: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2021-2024 (USD MILLION)

- TABLE 126 EUROPE: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2025-2030 (USD MILLION)

- TABLE 127 EUROPE: CRYOCOOLER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 128 EUROPE: CRYOCOOLER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 129 EUROPE: CRYOCOOLER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 130 EUROPE: CRYOCOOLER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 131 GERMANY: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2021-2024 (USD MILLION)

- TABLE 132 GERMANY: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2025-2030 (USD MILLION)

- TABLE 133 UK: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2021-2024 (USD MILLION)

- TABLE 134 UK: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2025-2030 (USD MILLION)

- TABLE 135 FRANCE: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2021-2024 (USD MILLION)

- TABLE 136 FRANCE: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2025-2030 (USD MILLION)

- TABLE 137 ITALY: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2021-2024 (USD MILLION)

- TABLE 138 ITALY: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2025-2030 (USD MILLION)

- TABLE 139 NETHERLANDS: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2021-2024 (USD MILLION)

- TABLE 140 NETHERLANDS: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2025-2030 (USD MILLION)

- TABLE 141 POLAND: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2021-2024 (USD MILLION)

- TABLE 142 POLAND: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2025-2030 (USD MILLION)

- TABLE 143 NORDICS: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2021-2024 (USD MILLION)

- TABLE 144 NORDICS: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2025-2030 (USD MILLION)

- TABLE 145 REST OF EUROPE: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2021-2024 (USD MILLION)

- TABLE 146 REST OF EUROPE: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2025-2030 (USD MILLION)

- TABLE 147 ASIA PACIFIC: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2021-2024 (USD MILLION)

- TABLE 148 ASIA PACIFIC: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2025-2030 (USD MILLION)

- TABLE 149 ASIA PACIFIC: CRYOCOOLER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 150 ASIA PACIFIC: CRYOCOOLER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 151 ASIA PACIFIC: CRYOCOOLER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 152 ASIA PACIFIC: CRYOCOOLER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 153 JAPAN: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2021-2024 (USD MILLION)

- TABLE 154 JAPAN: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2025-2030 (USD MILLION)

- TABLE 155 CHINA: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2021-2024 (USD MILLION)

- TABLE 156 CHINA: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2025-2030 (USD MILLION)

- TABLE 157 SOUTH KOREA: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2021-2024 (USD MILLION)

- TABLE 158 SOUTH KOREA: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2025-2030 (USD MILLION)

- TABLE 159 INDIA: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2021-2024 (USD MILLION)

- TABLE 160 INDIA: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2025-2030 (USD MILLION)

- TABLE 161 AUSTRALIA: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2021-2024 (USD MILLION)

- TABLE 162 AUSTRALIA: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2025-2030 (USD MILLION)

- TABLE 163 INDONESIA: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2021-2024 (USD MILLION)

- TABLE 164 INDONESIA: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2025-2030 (USD MILLION)

- TABLE 165 MALAYSIA: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2021-2024 (USD MILLION)

- TABLE 166 MALAYSIA: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2025-2030 (USD MILLION)

- TABLE 167 THAILAND: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2021-2024 (USD MILLION)

- TABLE 168 THAILAND: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2025-2030 (USD MILLION)

- TABLE 169 VIETNAM: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2021-2024 (USD MILLION)

- TABLE 170 VIETNAM: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2025-2030 (USD MILLION)

- TABLE 171 REST OF ASIA PACIFIC: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2021-2024 (USD MILLION)

- TABLE 172 REST OF ASIA PACIFIC: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2025-2030 (USD MILLION)

- TABLE 173 ROW: CRYOCOOLER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 174 ROW: CRYOCOOLER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 175 ROW: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2021-2024 (USD MILLION)

- TABLE 176 ROW: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2025-2030 (USD MILLION)

- TABLE 177 ROW: CRYOCOOLER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 178 ROW: CRYOCOOLER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 179 MIDDLE EAST: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2021-2024 (USD MILLION)

- TABLE 180 MIDDLE EAST: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2025-2030 (USD MILLION)

- TABLE 181 MIDDLE EAST: CRYOCOOLER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 182 MIDDLE EAST: CRYOCOOLER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 183 AFRICA: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2021-2024 (USD MILLION)

- TABLE 184 AFRICA: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2025-2030 (USD MILLION)

- TABLE 185 AFRICA: CRYOCOOLER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 186 AFRICA: CRYOCOOLER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 187 SOUTH AMERICA: CRYOCOOLER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 188 SOUTH AMERICA: CRYOCOOLER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 189 SOUTH AMERICA: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2021-2024 (USD MILLION)

- TABLE 190 SOUTH AMERICA: CRYOCOOLER MARKET, BY CRYOCOOLER TYPE, 2025-2030 (USD MILLION)

- TABLE 191 CRYOCOOLER MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2025

- TABLE 192 CRYOCOOLER MARKET: DEGREE OF COMPETITION, 2024

- TABLE 193 CRYOCOOLER MARKET: REGION FOOTPRINT

- TABLE 194 CRYOCOOLER MARKET: CRYOCOOLER TYPE FOOTPRINT

- TABLE 195 CRYOCOOLER MARKET: TEMPERATURE RANGE FOOTPRINT

- TABLE 196 CRYOCOOLER MARKET: APPLICATION FOOTPRINT

- TABLE 197 CRYOCOOLER MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 198 CRYOCOOLER MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 199 CRYOCOOLER MARKET: PRODUCT LAUNCHES, JUNE 2021-JULY 2025

- TABLE 200 CRYOCOOLER MARKET: DEALS, JUNE 2021-JULY 2025

- TABLE 201 SUMITOMO HEAVY INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 202 SUMITOMO HEAVY INDUSTRIES, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 SUMITOMO HEAVY INDUSTRIES, LTD.: PRODUCT LAUNCHES

- TABLE 204 THALES: COMPANY OVERVIEW

- TABLE 205 THALES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 EDWARDS VACUUM: COMPANY OVERVIEW

- TABLE 207 EDWARDS VACUUM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 AMETEK.INC.: COMPANY OVERVIEW

- TABLE 209 AMETEK.INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 CHART INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 211 CHART INDUSTRIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 BLUEFORS: COMPANY OVERVIEW

- TABLE 213 BLUEFORS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 BLUEFORS: PRODUCT LAUNCHES

- TABLE 215 BLUEFORS: DEALS

- TABLE 216 BLUEFORS: EXPANSIONS

- TABLE 217 NORTHROP GRUMMAN: COMPANY OVERVIEW

- TABLE 218 NORTHROP GRUMMAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 NORTHROP GRUMMAN: DEALS

- TABLE 220 ADVANCED RESEARCH SYSTEMS: COMPANY OVERVIEW

- TABLE 221 ADVANCED RESEARCH SYSTEMS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 222 RICOR: COMPANY OVERVIEW

- TABLE 223 RICOR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 AIR LIQUIDE ADVANCED TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 225 AIR LIQUIDE ADVANCED TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 CRYOCOOLER MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 DURATION CONSIDERED

- FIGURE 3 CRYOCOOLER MARKET: RESEARCH DESIGN

- FIGURE 4 CRYOCOOLER MARKET: RESEARCH APPROACH

- FIGURE 5 KEY DATA SOURCED FROM SECONDARY LITERATURE

- FIGURE 6 PRIMARY BREAKDOWN, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 7 DATA DERIVED FROM PRIMARY SOURCES

- FIGURE 8 KEY INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 9 REVENUE OF KEY PLAYERS VS. REVENUE OF OTHER PLAYERS

- FIGURE 10 REGIONAL MARKET SIZE ESTIMATION, BY OFFERING

- FIGURE 11 CRYOCOOLER MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 12 CRYOCOOLER MARKET: BOTTOM-UP APPROACH

- FIGURE 13 CRYOCOOLER MARKET: TOP-DOWN APPROACH

- FIGURE 14 CRYOCOOLER MARKET: DATA TRIANGULATION

- FIGURE 15 CRYOCOOLER MARKET, 2021-2030 (USD BILLION)

- FIGURE 16 PULSE TUBE CRYOCOOLERS TO WITNESS HIGHEST CAGR IN CRYOCOOLER MARKET FROM 2025 TO 2030

- FIGURE 17 REGENERATIVE HEAT EXCHANGER SEGMENT TO RECORD HIGHER CAGR IN CRYOCOOLER MARKET FROM 2025 TO 2030

- FIGURE 18 SERVICES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 19 SPACE APPLICATIONS TO RECORD HIGHEST CAGR IN CRYOCOOLER MARKET DURING FORECAST PERIOD

- FIGURE 20 CLOSED-LOOP CYCLE SEGMENT TO RECORD HIGHER CAGR IN CRYOCOOLER MARKET DURING FORECAST PERIOD

- FIGURE 21 1-50 K SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 22 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR CRYOCOOLERS FROM 2025 TO 2030

- FIGURE 23 QUANTUM COMPUTING EXPANSION NECESSITATING ADVANCED LOW-TEMPERATURE THERMAL MANAGEMENT SOLUTIONS TO DRIVE MARKET

- FIGURE 24 CLOSED-LOOP CYCLE TO COMMAND CRYOCOOLER MARKET IN 2025

- FIGURE 25 1-50 K SEGMENT TO REGISTER HIGHEST CAGR IN CRYOCOOLER MARKET DURING FORECAST PERIOD

- FIGURE 26 POWER CONDITIONING UNIT SEGMENT TO RECORD HIGHEST CAGR IN CRYOCOOLER MARKET FOR HARDWARE OFFERINGS FROM 2025 TO 2030

- FIGURE 27 CRYOCOOLER MARKET IN INDIA TO EXPAND AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 28 ASIA PACIFIC TO SECURE LARGEST SHARE OF CRYOCOOLER MARKET, IN TERMS OF VALUE, IN 2030

- FIGURE 29 INDIA TO RECORD HIGHEST CAGR IN GLOBAL CRYOCOOLER MARKET DURING FORECAST PERIOD

- FIGURE 30 CRYOCOOLER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 31 DRIVERS: CRYOCOOLER MARKET

- FIGURE 32 RESTRAINTS: CRYOCOOLER MARKET

- FIGURE 33 OPPORTUNITIES: CRYOCOOLER MARKET

- FIGURE 34 CHALLENGES: CRYOCOOLER MARKET

- FIGURE 35 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 36 AVERAGE SELLING PRICE TREND OF CRYOCOOLERS, BY REGION, 2021-2024

- FIGURE 37 CRYOCOOLER VALUE CHAIN ANALYSIS

- FIGURE 38 KEY PLAYERS IN CRYOCOOLER ECOSYSTEM

- FIGURE 39 NUMBER OF PATENTS GRANTED FOR CRYOCOOLERS, 2015-2024

- FIGURE 40 JURISDICTION-BASED ANALYSIS OF CRYOCOOLER-RELATED PATENTS, 2015-2024

- FIGURE 41 IMPORT SCENARIO FOR HS CODE 8418-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020-2024

- FIGURE 42 EXPORT SCENARIO FOR HS CODE 8418-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020-2024

- FIGURE 43 INVESTMENT AND FUNDING SCENARIO, 2021-2024

- FIGURE 44 CRYOCOOLER MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 45 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR OFFERINGS

- FIGURE 46 KEY BUYING CRITERIA FOR OFFERINGS

- FIGURE 47 IMPACT OF GEN AI/AI ON CRYOCOOLER MARKET

- FIGURE 48 SERVICES SEGMENT TO EXHIBIT HIGHER CAGR THAN HARDWARE SEGMENT DURING FORECAST PERIOD

- FIGURE 49 REGENERATIVE HEAT EXCHANGERS TO DOMINATE CRYOCOOLER MARKET FROM 2025 TO 2030

- FIGURE 50 CLOSED-LOOP CYCLE SEGMENT TO LEAD CRYOCOOLER MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 51 PULSE TUBE CRYOCOOLERS TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 52 >50-150 K SEGMENT TO LEAD CRYOCOOLER MARKET IN 2030

- FIGURE 53 MILITARY APPLICATIONS TO HOLD LARGEST SHARE OF CRYOCOOLER MARKET IN 2030

- FIGURE 54 ASIA PACIFIC TO LEAD CRYOCOOLER MARKET IN 2030

- FIGURE 55 SNAPSHOT OF CRYOCOOLER MARKET IN NORTH AMERICA

- FIGURE 56 PULSE TUBE CRYOCOOLERS TO CAPTURE LARGEST MARKET SHARE OF NORTH AMERICAN MARKET IN 2030

- FIGURE 57 SNAPSHOT OF CRYOCOOLER MARKET IN EUROPE

- FIGURE 58 STIRLING CRYOCOOLERS TO EXHIBIT HIGHEST CAGR IN EUROPEAN MARKET DURING FORECAST PERIOD

- FIGURE 59 SNAPSHOT OF CRYOCOOLER MARKET IN ASIA PACIFIC

- FIGURE 60 PULSE TUBE CRYOCOOLERS TO SECURE LARGEST MARKET SHARE OF ASIA PACIFIC IN 2030

- FIGURE 61 SNAPSHOT OF CRYOCOOLER MARKET IN ROW

- FIGURE 62 PULSE TUBE CRYOCOOLERS TO SECURE LARGEST MARKET SHARE OF ROW REGION IN 2030

- FIGURE 63 CRYOCOOLER MARKET SHARE ANALYSIS, 2024

- FIGURE 64 REVENUE ANALYSIS OF FIVE KEY PLAYERS IN CRYOCOOLER MARKET, 2020-2024

- FIGURE 65 COMPANY VALUATION

- FIGURE 66 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 67 BRAND COMPARISON

- FIGURE 68 CRYOCOOLER MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 69 CRYOCOOLER MARKET: COMPANY FOOTPRINT

- FIGURE 70 CRYOCOOLER MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 71 SUMITOMO HEAVY INDUSTRIES, LTD.: COMPANY SNAPSHOT

- FIGURE 72 THALES: COMPANY SNAPSHOT

- FIGURE 73 AMETEK.INC.: COMPANY SNAPSHOT

- FIGURE 74 CHART INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 75 NORTHROP GRUMMAN: COMPANY SNAPSHOT