|

市場調查報告書

商品編碼

1826557

全球微生物檢測市場(至 2030 年)按微生物學、最終用戶產業、技術、組件和地區分類Bacteriological Testing Market by Bacterium, End-Use Industry, Technology, Component, and Region - Global Forecast to 2030 |

||||||

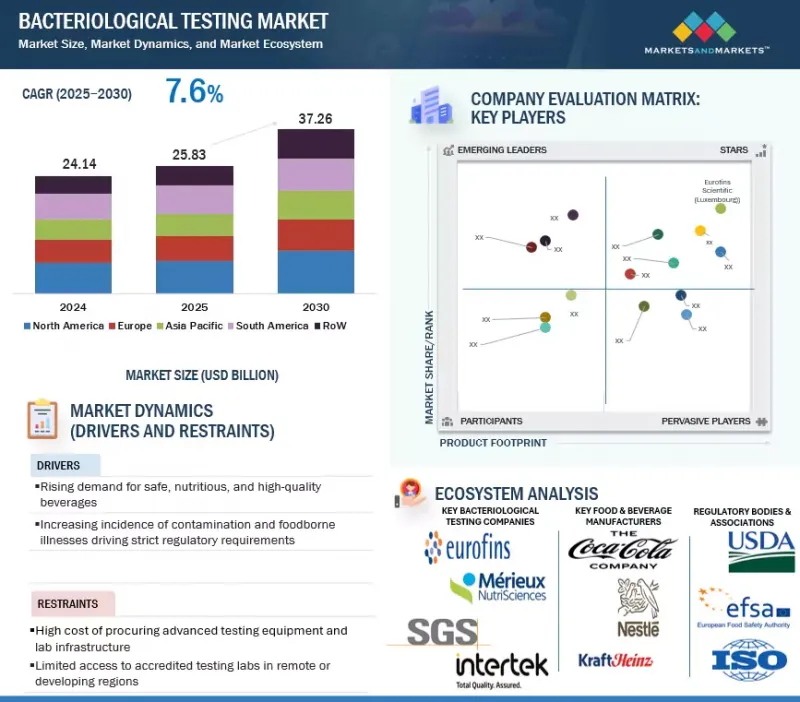

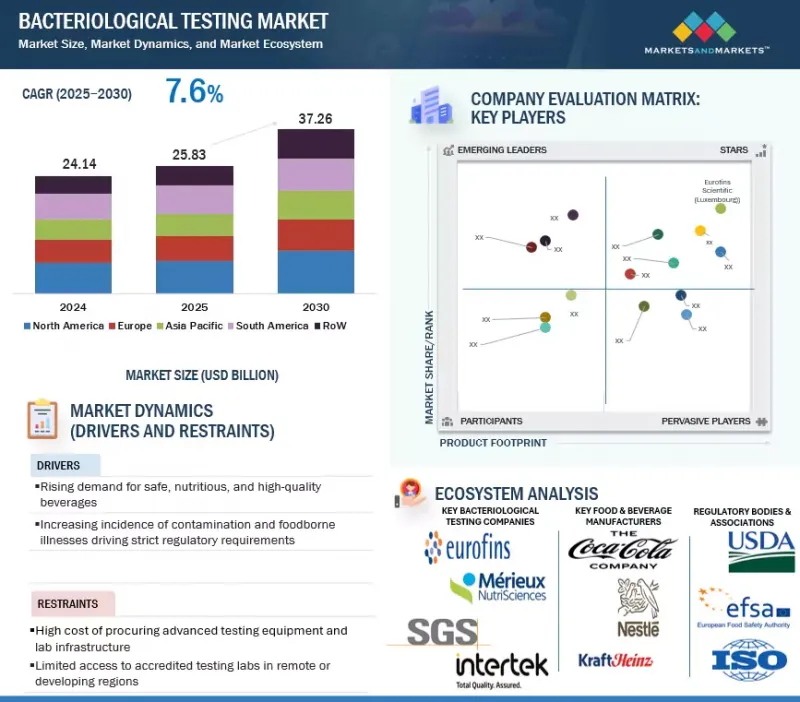

細菌檢測市場預計將從 2025 年的 258.3 億美元成長到 2030 年的 372.6 億美元,複合年成長率為 7.6%。

此外,細菌檢測設備的市場規模預計將從 2025 年的 159.5 億美元成長到 2030 年的 224.8 億美元,複合年成長率為 7.1%。

| 調查範圍 | |

|---|---|

| 調查年份 | 2021-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 單元 | 金額(美元)及數量(檢查次數) |

| 部分 | 按細菌、最終用戶行業、技術、組件和地區 |

| 目標區域 | 北美、歐洲、亞太、南美和其他地區 |

微生物檢測市場對於保障公眾健康和維護食品飲料、水、藥品、化妝品及個人護理等關鍵產業的產品品質至關重要。人們對食源性疾病、自來水污染以及醫療保健和消費品中微生物安全的日益擔憂,正推動全球範圍內採用先進的檢測解決方案。該市場正在快速發展,已從傳統的基於培養的方法轉向更快、更精確的技術,例如PCR、免疫檢測和次世代定序。在嚴格的監管標準、不斷提升的消費者意識以及持續的技術進步的支持下,微生物檢測現已成為全球品管、合規性和風險緩解實踐的重要組成部分。

從終端用戶產業來看,食品飲料產業預計將在2025年引領市場。全球食源性疾病發生率的上升以及消費者食品安全意識的不斷增強,推動了對新鮮食材、加工食品、乳製品、飲料和已調理食品進行嚴格檢測的需求。各國政府和監管機構正在強制要求在HACCP和ISO標準等框架下定期進行細菌學檢測,敦促食品製造商、加工商和零售商大規模使用微生物檢測解決方案。這項持續的要求,加上產品召回帶來的聲譽和財務風險,將使食品飲料行業的表現優於水、製藥、化妝品和個人護理等其他終端用戶行業。

從細菌種類來看,大腸桿菌群預計將在 2025 年引領市場。大腸桿菌群被廣泛用作指示生物,用於評估水、食品和飲料的衛生質量,是常規微生物檢測的重要參數。區域監管機構要求定期進行大腸桿菌群檢測,以監測飲用水、加工食品和乳製品的污染水平,這使得全球的檢測量保持在較高水平。其他細菌也是市場關注的重點領域。沙門氏菌檢測在食品和飲料行業尤其重要,因為它與嚴重的食源性疾病爆發和高度公共衛生風險有關。李斯特菌檢測正成為乳製品、肉類和已調理食品的優先檢測項目,因為這種病原體可以在冷藏條件下存活。曲狀桿菌檢測在禽類產品中的重要性日益凸顯,因為它是全球最常見的胃腸道感染疾病原因之一。同時,退伍軍人菌檢測主要在水基系統(如冷卻塔、公共供水網路和醫療機構)中進行,如果不加以控制,會帶來嚴重風險。

從地理位置來看,預計到2025年,歐洲將成為全球最大的市場。嚴格的食品和水安全法規、強大的製藥業以及消費品中日益成長的微生物品質保證需求,共同支撐著歐洲的市場地位。該地區擁有完善的檢測基礎設施、高度的公眾意識以及積極主動的監管機構,例如歐洲食品安全局 (EFSA) 和歐洲藥品管理局 (EMA)。食品出口的嚴格合規要求,尤其是在歐盟單一市場內,進一步推動了檢測數量的成長。先進的實驗室、強大的法規環境以及對高品質標準的重視,使歐洲成為細菌學檢測市場的全球領導者。

本報告調查了全球細菌檢測市場,並提供了市場概況、影響市場成長的各種因素分析、技術和專利趨勢、法律制度、案例研究、市場規模趨勢和預測、各個細分市場、地區/主要國家的詳細分析、競爭格局和主要企業的概況。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章重要考察

第5章 市場概況

- 宏觀經濟展望

- 市場動態

- 驅動程式

- 抑制因素

- 機會

- 任務

- 生成式人工智慧對細菌檢測市場的影響

第6章 產業趨勢

- 監管狀況

- 美國關稅

- 專利分析

- 貿易分析

- 定價分析

- 影響客戶業務的趨勢/中斷

- 價值鏈分析

- 生態系分析

- 案例研究分析

- 波特五力分析

- 技術分析

- 2025-2026年重要會議和活動

- 投資金籌措場景

第7章 細菌學檢測市場(按細菌)

- 大腸桿菌

- 普通大腸菌群/大腸桿菌

- 致病性大腸桿菌(O157:H7,STEC)

- 沙門氏菌

- 曲狀桿菌

- 空腸彎曲曲狀桿菌

- 其他曲狀桿菌屬

- 李斯特菌

- 退伍軍人菌

- 其他

第8章微生物檢測市場(依技術)

- 傳統的

- 快速檢測

- 基於便利性的測試

- PC

- 免疫檢測

- 層析法和光譜學

- 其他

第9章微生物檢測設備市場(按組件)

- 裝置

- 測試套件

- 試劑和耗材

第 10 章。按最終用戶行業分類的微生物學檢測市場

- 食品/飲料

- 魚貝類

- 乳製品

- 加工食品

- 水果和蔬菜

- 糧食

- 其他食物

- 飲料

- 水

- 飲用水

- 工業污水

- 製藥

- 化妝品和個人護理

- 其他

第11章細菌學檢測設備市場(依用途)

- 可攜式/現場設備

- 基於實驗室的系統

第 12 章微生物學檢測市場(按地區)

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 波蘭

- 其他

- 亞太地區

- 中國

- 日本

- 澳洲和紐西蘭

- 印度

- 東南亞

- 其他

- 南美洲

- 巴西

- 阿根廷

- 其他

- 世界其他地區

- 非洲

- 中東

第13章競爭格局

- 概述

- 主要參與企業的策略/優勢

- 收益分析

- 細菌檢測市場主要企業市佔率分析

- 細菌學檢測設備市場排名分析

- 公司估值矩陣:主要企業(細菌學檢測市場)

- 公司估值矩陣:主要企業(細菌檢測設備市場)

- 估值和財務指標

- 品牌/產品比較

- 競爭場景

第14章:公司簡介

- 細菌學檢測市場主要企業

- SGS SOCIETE GENERALE DE SURVEILLANCE SA

- INTERTEK GROUP PLC

- EUROFINS SCIENTIFIC

- ALS

- MERIEUX NUTRISCIENCES

- CERTIFIED GROUP

- SYMBIO LABS

- TUV SUD

- FOODCHAIN ID

- TENTAMUS

- ALFA CHEMISTRY

- AGQ LABS

- CENTRE TESTING INTERNATIONAL

- MICROBAC

- VIMTA LABS LTD.

- 細菌檢測設備市場主要企業

- NEOGEN CORPORATION

- BIO-RAD LABORATORIES, INC.

- BIOMERIEUX

- THERMO FISHER SCIENTIFIC INC.

- MERCK & CO., INC.

- BD

- 3M

- HARDY DIAGNOSTICS

- HIMEDIA LABORATORIES

- AGILENT TECHNOLOGIES, INC.

第15章:鄰近市場與相關市場

第16章 附錄

The bacteriological testing market is estimated to be valued at USD 25.83 billion in 2025. It is projected to reach USD 37.26 billion by 2030 at a CAGR of 7.6%. The bacteriological testing equipment market is estimated to be valued at USD 15.95 billion in 2025. It is projected to reach USD 22.48 billion by 2030 at a CAGR of 7.1%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD), Volume (No. of tests) |

| Segments | By Bacterium, End-Use Industry, technology, Component, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and RoW |

The bacteriological testing market has become a cornerstone in safeguarding public health and maintaining product quality across critical industries, including food & beverage, water, pharmaceuticals, and cosmetics & personal care. Growing concerns over foodborne diseases, contaminated water supplies, and microbial safety in healthcare and consumer goods are driving the adoption of advanced testing solutions worldwide. The market is evolving rapidly, moving beyond conventional culture-based methods toward faster and more precise technologies, such as PCR, immunoassays, and next-generation sequencing. Backed by stringent regulatory standards, heightened consumer awareness, and continuous technological progress, bacteriological testing is now integral to global quality control, compliance, and risk mitigation practices.

By industry, the food & beverage segment is estimated to lead the bacteriological testing market in 2025. Rising global cases of foodborne infections and heightened consumer awareness around food safety have amplified the need for robust testing across raw materials, processed foods, dairy, beverages, and ready-to-eat products. Governments and regulatory authorities have mandated routine bacteriological testing under frameworks, such as HACCP and ISO standards, pushing food manufacturers, processors, and retailers to use microbial testing solutions heavily. This consistent requirement, combined with the reputational and financial risks of product recalls, ensures the food & beverage sector outpaces other end-use industries, such as water, pharmaceuticals, and cosmetics & personal care.

By bacterium, the coliform segment is estimated to lead the bacteriological testing market in 2025. Coliforms are widely used as indicator organisms to assess the hygienic quality of water, food, and beverages, which makes them an essential parameter in routine microbial testing. Regulatory bodies across regions require regular coliform testing to monitor contamination levels in drinking water, processed food, and dairy products, which sustains their high testing volume globally. Other bacteria also represent critical focus areas within the market. Salmonella testing is in strong demand, particularly in the food & beverage industry, given its association with severe foodborne outbreaks and high public health risks. Listeria testing is increasingly prioritized in dairy, meat, and ready-to-eat products due to the pathogen's resilience in cold storage conditions. Campylobacter testing has gained importance in poultry products, as it is among the most common causes of gastrointestinal infections worldwide. Meanwhile, Legionella testing is primarily conducted in water systems-including cooling towers, public water supply networks, and healthcare facilities-where the pathogen poses serious risks if uncontrolled.

Europe is estimated to be the largest regional market for bacteriological testing in 2025. The position of this market is driven by stringent food and water safety regulations, a strong pharmaceutical industry, and growing demand for microbiological quality assurance across consumer goods. The region benefits from well-established testing infrastructure, high levels of public awareness, and the proactive stance of regulatory authorities, such as the European Food Safety Authority (EFSA) and the European Medicines Agency (EMA). Strict compliance requirements for food exports, particularly within the EU's harmonized market, further increase testing volumes. With its advanced laboratories, robust regulatory environment, and focus on maintaining high-quality standards, Europe has cemented its position as the global leader in the bacteriological testing market.

In-depth interviews were conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the bacteriological testing market.

- By Company Type: Tier 1 - 25%, Tier 2 - 45%, and Tier 3 - 30%

- By Designation: Directors - 20%, Managers - 50%, Others - 30%

- By Region: North America - 25%, Europe - 30%, Asia Pacific - 20%, South America - 15%, and Rest of the World - 10%

Key players providing bacteriological testing services include SGS (Switzerland), Eurofins (Luxembourg), Intertek (UK), TUV SUD (Germany), and ALS Limited (Australia). Additionally, key bacteriological safety testing equipment providers include 3M (US), Thermo Fisher Scientific (US), Merck KGaA (Germany), Bio-Rad Laboratories (United States), and Romer Labs (Austria).

Research Coverage:

This research report categorizes the bacteriological safety testing market by bacterium (Coliform, Salmonella, Campylobacter, Listeria, Legionella, Other Bacteria), end-use industry (Food & Beverage, Water, Pharmaceutical, Cosmetics & Personal Care, Other End-Use Industries), technology (Traditional, Rapid), component (Instruments, Test Kits, Reagents & Consumables), and Region (North America, Europe, Asia Pacific, South America, RoW).

The scope of the report covers detailed information regarding the major factors (drivers, restraints, challenges, and opportunities) influencing the growth of the bacteriological testing market. A detailed analysis of the key industry players has been done to provide insights into their business overview; services; and key strategies like contracts, partnerships, agreements, service launches, and mergers and acquisitions associated with the bacteriological testing market. Also, this report covers a competitive analysis of upcoming startups in the bacteriological testing market ecosystem. Furthermore, industry-specific trends, such as technology analysis, ecosystem and market mapping, and patent and regulatory landscape, are also covered in the study.

Reasons to buy this report:

The report will help market leaders/new entrants in this market with information on the closest approximations of revenue numbers for the overall bacteriological testing market and its subsegments. Additionally, this report will help stakeholders understand the competitive landscape and gain more insights to position their businesses and plan suitable go-to-market strategies. The report will also help stakeholders understand the pulse of the market and will provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (Rising prevalence of foodborne and waterborne illnesses; rising demand from cosmetics & personal care industry), restraints (High cost of advanced rapid testing; complexity in testing techniques), opportunities (Advances in rapid, portable, and automated testing; popularity of digital & automated testing platforms), and challenges (Lack of harmonized global regulations; high cost of advanced technologies) influencing the growth of the bacteriological testing market

- Service Launch/Innovation: Detailed insights into research & development activities and service launches in the bacteriological testing market

- Market Development: Comprehensive information about lucrative markets across varied regions

- Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the bacteriological testing market

- Competitive Assessment: In-depth assessment of market share, growth strategies, product offerings, product/service comparison, and product/service footprints of leading bacteriological testing service providers, namely SGS (Switzerland), Eurofins (Luxembourg), Intertek (UK), TUV SUD (Germany), and ALS Limited (Australia); major equipment providers, namely 3M (US), Thermo Fisher Scientific (US), Merck KGaA (Germany), Agilent Technologies (US), Bio-Rad Laboratories (US), and Romer Labs (Austria); and other players.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 BACTERIOLOGICAL TESTING MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 VOLUME UNIT CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary profiles

- 2.1.2.3 Key insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 SUPPLY-SIDE ANALYSIS

- 2.2.3 BOTTOM-UP APPROACH (DEMAND SIDE)

- 2.3 DATA TRIANGULATION AND MARKET BREAKUP

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 LIMITATIONS & RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN BACTERIOLOGICAL TESTING MARKET

- 4.2 BACTERIOLOGICAL TESTING MARKET, BY COUNTRY

- 4.3 EUROPE: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM AND COUNTRY

- 4.4 BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM

- 4.5 BACTERIOLOGICAL TESTING MARKET, BY TECHNOLOGY

- 4.6 BACTERIOLOGICAL TESTING MARKET, BY END-USE INDUSTRY

- 4.7 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN BACTERIOLOGICAL TESTING EQUIPMENT MARKET

- 4.8 BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY COUNTRY

- 4.9 EUROPE: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY COMPONENT AND COUNTRY

- 4.10 BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY COMPONENT

- 4.11 BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY MODE OF USE

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC OUTLOOK

- 5.2.1 INCREASING GLOBAL OUTBREAKS OF FOODBORNE ILLNESSES

- 5.2.2 INCREASED GLOBAL FOOD TRADE

- 5.3 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Cross-contamination of food products due to complex processes

- 5.3.1.2 Technological advancements in bacteriological testing

- 5.3.1.3 Increasing demand for convenience and packaged food products

- 5.3.1.4 Rising food recalls due to non-compliant food products

- 5.3.1.5 Rising consumer awareness regarding food safety

- 5.3.1.6 Rising demand from cosmetics & personal care industry

- 5.3.2 RESTRAINTS

- 5.3.2.1 Improper enforcement of regulatory laws and supporting infrastructure

- 5.3.2.2 Complexity in testing techniques

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Technological advancements in testing industry

- 5.3.3.2 Popularity of digital and automated testing platforms

- 5.3.3.3 Rising demand for portable and field-based testing

- 5.3.4 CHALLENGES

- 5.3.4.1 Increasing cost of procuring bacteriological testing equipment

- 5.3.1 DRIVERS

- 5.4 IMPACT OF GEN AI ON BACTERIOLOGICAL TESTING MARKET

- 5.4.1 USE OF GEN AI IN BACTERIOLOGICAL TESTING

- 5.4.2 USE CASE

- 5.4.2.1 Adoption of Gen AI by CarbConnect to achieve accuracy and consistency in diagnostics

- 5.4.3 EVOLVING ADJACENT ECOSYSTEM THROUGH ADOPTION OF GEN AI

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 REGULATORY LANDSCAPE

- 6.2.1 REGULATORY FRAMEWORK FOR FOOD & BEVERAGE INDUSTRY

- 6.2.1.1 North America

- 6.2.1.1.1 US

- 6.2.1.1.2 Canada

- 6.2.1.1.3 Mexico

- 6.2.1.2 Europe

- 6.2.1.2.1 European Union

- 6.2.1.2.2 Germany

- 6.2.1.2.3 UK

- 6.2.1.2.4 France

- 6.2.1.2.5 Italy

- 6.2.1.2.6 Poland

- 6.2.1.3 Asia Pacific

- 6.2.1.3.1 China

- 6.2.1.3.2 Japan

- 6.2.1.3.3 India

- 6.2.1.3.4 Australia & New Zealand

- 6.2.1.4 South America

- 6.2.1.4.1 Brazil

- 6.2.1.4.2 Argentina

- 6.2.1.5 Rest of the World

- 6.2.1.5.1 South Africa

- 6.2.1.1 North America

- 6.2.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.2.1 REGULATORY FRAMEWORK FOR FOOD & BEVERAGE INDUSTRY

- 6.3 US 2025 TARIFF

- 6.3.1 INTRODUCTION

- 6.3.2 KEY TARIFF RATES

- 6.3.3 DISRUPTION IN BACTERIOLOGICAL TESTING INDUSTRY

- 6.3.4 PRICE IMPACT ANALYSIS

- 6.3.5 IMPACT ON COUNTRY/REGION

- 6.3.5.1 US

- 6.3.5.2 Europe

- 6.3.5.3 Asia Pacific

- 6.3.6 IMPACT ON END-USE INDUSTRIES

- 6.4 PATENT ANALYSIS

- 6.5 TRADE ANALYSIS

- 6.5.1 IMPORT SCENARIO

- 6.5.2 EXPORT SCENARIO

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE OF BACTERIOLOGICAL TESTING TECHNOLOGIES, BY KEY PLAYER

- 6.6.2 AVERAGE SELLING PRICE OF BACTERIOLOGICAL TESTING SERVICES, BY END-USE INDUSTRY

- 6.6.3 AVERAGE SELLING PRICE OF BACTERIOLOGICAL TESTING SERVICES, BY REGION

- 6.6.4 AVERAGE SELLING PRICE OF BACTERIOLOGICAL TESTING EQUIPMENT, BY KEY PLAYER

- 6.6.5 AVERAGE SELLING PRICE OF BACTERIOLOGICAL TESTING INSTRUMENTS, BY REGION

- 6.6.6 AVERAGE SELLING PRICE OF BACTERIOLOGICAL TESTING KITS, BY REGION

- 6.6.7 AVERAGE SELLING PRICE OF BACTERIOLOGICAL TESTING REAGENTS & CONSUMABLES, BY REGION

- 6.6.8 KEY STAKEHOLDERS & BUYING CRITERIA

- 6.6.8.1 Key stakeholders in buying process

- 6.6.8.2 Key buying criteria

- 6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.8 VALUE CHAIN ANALYSIS

- 6.8.1 SAMPLE COLLECTION

- 6.8.2 TRANSPORTATION AND HANDLING

- 6.8.3 LABORATORY TESTING

- 6.8.4 DATA ANALYSIS AND INTERPRETATION

- 6.8.5 REGULATORY COMPLIANCE

- 6.8.6 CONSULTATION AND ADVISORY SERVICES

- 6.8.7 COLLABORATION AND NETWORKING

- 6.9 ECOSYSTEM ANALYSIS

- 6.10 CASE STUDY ANALYSIS

- 6.11 PORTER'S FIVE FORCES ANALYSIS

- 6.11.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.11.2 BARGAINING POWER OF SUPPLIERS

- 6.11.3 BARGAINING POWER OF BUYERS

- 6.11.4 THREAT FROM SUBSTITUTES

- 6.11.5 THREAT FROM NEW ENTRANTS

- 6.12 TECHNOLOGY ANALYSIS

- 6.12.1 KEY TECHNOLOGIES

- 6.12.1.1 Molecular diagnostics

- 6.12.1.2 Immunological methods

- 6.12.1.3 Biosensors

- 6.12.2 ADJACENT TECHNOLOGIES

- 6.12.2.1 Automation & robotics

- 6.12.2.2 Data analysis & bioinformatics

- 6.12.2.3 Advanced imaging

- 6.12.2.4 Sterility & contamination control

- 6.12.3 COMPLEMENTARY TECHNOLOGIES

- 6.12.3.1 IoT & connected devices

- 6.12.3.2 Food & water safety monitoring tools

- 6.12.3.3 Antimicrobial resistance testing

- 6.12.3.4 Predictive analytics & AI

- 6.12.1 KEY TECHNOLOGIES

- 6.13 KEY CONFERENCES & EVENTS, 2025-2026

- 6.14 INVESTMENT & FUNDING SCENARIO

7 BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM

- 7.1 INTRODUCTION

- 7.2 COLIFORM

- 7.2.1 NEED TO ENSURE COMPLIANCE WITH SAFETY STANDARDS ACROSS DAIRY, MEAT, BEVERAGES, AND PROCESSED FOOD INDUSTRIES TO DRIVE MARKET

- 7.2.2 GENERIC COLIFORMS/E. COLI

- 7.2.3 PATHOGENIC E. COLI (O157:H7, STEC)

- 7.3 SALMONELLA

- 7.3.1 DEMAND FOR CONSISTENT TESTING SOLUTIONS FOR HIGH-RISK FOOD CATEGORIES TO DRIVE DEMAND

- 7.4 CAMPYLOBACTER

- 7.4.1 RISING CASES OF GASTROINTESTINAL INFECTIONS TO DRIVE MARKET

- 7.4.2 CAMPYLOBACTER JEJUNI

- 7.4.3 OTHER CAMPYLOBACTER SPP.

- 7.5 LISTERIA

- 7.5.1 RISING CONTAMINATION IN WELL-MAINTAINED PRODUCTION ENVIRONMENTS TO DRIVE GROWTH

- 7.6 LEGIONELLA

- 7.6.1 NEED TO ENSURE COMPLIANCE IN WATER AND ENVIRONMENTAL TESTING TO BOOST GROWTH

- 7.7 OTHER BACTERIA

8 BACTERIOLOGICAL TESTING MARKET, BY TECHNOLOGY

- 8.1 INTRODUCTION

- 8.2 TRADITIONAL

- 8.2.1 POPULARITY OF CULTURE-BASED TESTING TECHNIQUES TO DRIVE MARKET

- 8.3 RAPID

- 8.3.1 NEED FOR ACCELERATING BACTERIOLOGICAL TESTING TO BOOST MARKET

- 8.3.2 CONVENIENCE-BASED TESTING

- 8.3.3 PCR-BASED TESTING

- 8.3.4 IMMUNOASSAY-BASED TESTING

- 8.3.5 CHROMATOGRAPHY & SPECTROMETRY

- 8.3.6 OTHER RAPID TECHNOLOGIES

9 BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY COMPONENT

- 9.1 INTRODUCTION

- 9.2 INSTRUMENTS

- 9.2.1 GROWING ADOPTION OF REAL-TIME AND DIGITAL PCR TO DRIVE MARKET

- 9.3 TEST KITS

- 9.3.1 HIGH LEVEL OF PRACTICALITY AND TIME EFFICIENCY TO BOOST DEMAND

- 9.4 REAGENTS & CONSUMABLES

- 9.4.1 FOCUS ON OPTIMIZING PERFORMANCE OF ANALYTICAL INSTRUMENTS TO SPUR DEMAND

10 BACTERIOLOGICAL TESTING MARKET, BY END-USE INDUSTRY

- 10.1 INTRODUCTION

- 10.2 FOOD & BEVERAGE

- 10.2.1 NEED TO DETECT PATHOGENIC AND SPOILAGE ORGANISMS TO DRIVE MARKET

- 10.2.2 MEAT & POULTRY

- 10.2.3 FISH & SEAFOOD

- 10.2.4 DAIRY

- 10.2.5 PROCESSED FOODS

- 10.2.6 FRUITS & VEGETABLES

- 10.2.7 CEREALS & GRAINS

- 10.2.8 OTHER FOOD PRODUCTS

- 10.2.9 BEVERAGES

- 10.3 WATER

- 10.3.1 RISING CONTAMINATION OF WATER TO DRIVE DEMAND FOR TESTING SERVICES

- 10.3.2 DRINKING WATER

- 10.3.3 INDUSTRIAL WASTEWATER

- 10.4 PHARMACEUTICAL

- 10.4.1 RISING GLOBAL CONSUMPTION OF PHARMACEUTICAL PRODUCTS TO BOOST GROWTH

- 10.5 COSMETICS & PERSONAL CARE

- 10.5.1 NEED TO PREVENT MICROBIAL GROWTH IN COSMETICS AND PERSONAL CARE PRODUCTS TO DRIVE MARKET

- 10.6 OTHER END-USE INDUSTRIES

11 BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY MODE OF USE

- 11.1 INTRODUCTION

- 11.1.1 PORTABLE/FIELD-USE DEVICES

- 11.1.1.1 Demand for testing services in remote or resource-limited settings to drive market

- 11.1.2 LABORATORY-BASED SYSTEMS

- 11.1.2.1 Demand for advanced testing services in research and healthcare facilities to drive popularity

- 11.1.1 PORTABLE/FIELD-USE DEVICES

12 BACTERIOLOGICAL TESTING MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 US

- 12.2.1.1 Demand for advanced surveillance networks to spur growth

- 12.2.2 CANADA

- 12.2.2.1 Focus on effective water quality monitoring to boost demand

- 12.2.3 MEXICO

- 12.2.3.1 Expanding bacteriological testing capacity through trade and food safety enforcement to drive market

- 12.2.1 US

- 12.3 EUROPE

- 12.3.1 GERMANY

- 12.3.1.1 Presence of testing agencies with robust surveillance systems to drive market

- 12.3.2 UK

- 12.3.2.1 Need for foodborne outbreak tracking to bolster demand for testing equipment

- 12.3.3 FRANCE

- 12.3.3.1 Demand for food safety alerts to fuel market

- 12.3.4 ITALY

- 12.3.4.1 Need for safety compliance to propel demand for bacteriological testing

- 12.3.5 SPAIN

- 12.3.5.1 Seafood exports and foodborne outbreak surveillance to drive demand

- 12.3.6 POLAND

- 12.3.6.1 Rising food safety standards to propel market

- 12.3.7 REST OF EUROPE

- 12.3.1 GERMANY

- 12.4 ASIA PACIFIC

- 12.4.1 CHINA

- 12.4.1.1 High-profile contamination events and export standards to propel market

- 12.4.2 JAPAN

- 12.4.2.1 Stringent safety laws and foodborne outbreaks to accelerate market

- 12.4.3 AUSTRALIA & NEW ZEALAND

- 12.4.3.1 Need to strengthen testing capacity to uphold supplement quality to boost market

- 12.4.4 INDIA

- 12.4.4.1 Rising bacterial disease burden and regulatory oversight to drive market expansion

- 12.4.5 SOUTHEAST ASIA

- 12.4.5.1 Rising bacterial disease burden to drive market

- 12.4.6 REST OF ASIA PACIFIC

- 12.4.1 CHINA

- 12.5 SOUTH AMERICA

- 12.5.1 BRAZIL

- 12.5.1.1 Need for manufacturers to comply with ANVISA's rules to drive demand

- 12.5.2 ARGENTINA

- 12.5.2.1 Need to improve pharma quality to drive demand for testing services

- 12.5.3 REST OF SOUTH AMERICA

- 12.5.1 BRAZIL

- 12.6 REST OF THE WORLD

- 12.6.1 AFRICA

- 12.6.1.1 Regulatory attention on safety of drinking water and food hygiene to drive market

- 12.6.2 MIDDLE EAST

- 12.6.2.1 Increased investment in bacteriological testing, driven by food import/export controls, to boost market

- 12.6.1 AFRICA

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.3 REVENUE ANALYSIS, 2021-2024

- 13.4 MARKET SHARE ANALYSIS OF KEY PLAYERS IN BACTERIOLOGICAL TESTING MARKET, 2024

- 13.5 MARKET RANKING ANALYSIS OF BACTERIOLOGICAL TESTING EQUIPMENT MARKET, 2024

- 13.6 COMPANY EVALUATION MATRIX: KEY PLAYERS (BACTERIOLOGICAL TESTING MARKET), 2024

- 13.6.1 STARS

- 13.6.2 EMERGING LEADERS

- 13.6.3 PERVASIVE PLAYERS

- 13.6.4 PARTICIPANTS

- 13.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.6.5.1 Company footprint

- 13.6.5.2 Region footprint

- 13.6.5.3 Bacterium footprint

- 13.6.5.4 End-use industry footprint

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS (BACTERIOLOGICAL TESTING EQUIPMENT MARKET), 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 Component footprint

- 13.7.5.4 Mode of use footprint

- 13.8 COMPANY VALUATION AND FINANCIAL METRICS

- 13.9 BRAND/PRODUCT COMPARISON

- 13.10 COMPETITIVE SCENARIO

- 13.10.1 PRODUCT/SERVICE LAUNCHES

- 13.10.2 DEALS

- 13.10.3 EXPANSIONS

- 13.10.4 OTHER DEVELOPMENTS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS: BACTERIOLOGICAL TESTING MARKET

- 14.1.1 SGS SOCIETE GENERALE DE SURVEILLANCE SA

- 14.1.1.1 Business overview

- 14.1.1.2 Services offered

- 14.1.1.3 Recent developments

- 14.1.1.4 MnM view

- 14.1.1.4.1 Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 INTERTEK GROUP PLC

- 14.1.2.1 Business overview

- 14.1.2.2 Services offered

- 14.1.2.3 Recent developments

- 14.1.2.4 MnM view

- 14.1.2.4.1 Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 EUROFINS SCIENTIFIC

- 14.1.3.1 Business overview

- 14.1.3.2 Services offered

- 14.1.3.3 Recent developments

- 14.1.3.4 MnM view

- 14.1.3.4.1 Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 ALS

- 14.1.4.1 Business overview

- 14.1.4.2 Services offered

- 14.1.4.3 Recent developments

- 14.1.4.4 MnM view

- 14.1.4.4.1 Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 MERIEUX NUTRISCIENCES

- 14.1.5.1 Business overview

- 14.1.5.2 Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Expansions

- 14.1.5.4 MnM view

- 14.1.5.4.1 Right to win

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 CERTIFIED GROUP

- 14.1.6.1 Business overview

- 14.1.6.2 Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Expansions

- 14.1.6.4 MnM view

- 14.1.7 SYMBIO LABS

- 14.1.7.1 Business overview

- 14.1.7.2 Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Other developments

- 14.1.7.4 MnM view

- 14.1.8 TUV SUD

- 14.1.8.1 Business overview

- 14.1.8.2 Services offered

- 14.1.8.3 MnM view

- 14.1.9 FOODCHAIN ID

- 14.1.9.1 Business overview

- 14.1.9.2 Services offered

- 14.1.9.3 MnM view

- 14.1.10 TENTAMUS

- 14.1.10.1 Business overview

- 14.1.10.2 Services offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Service launches

- 14.1.10.4 MnM view

- 14.1.11 ALFA CHEMISTRY

- 14.1.11.1 Business overview

- 14.1.11.2 Services offered

- 14.1.11.3 MnM view

- 14.1.12 AGQ LABS

- 14.1.12.1 Business overview

- 14.1.12.2 Services offered

- 14.1.12.3 Recent developments

- 14.1.12.3.1 Expansions

- 14.1.12.3.2 Deals

- 14.1.12.4 MnM view

- 14.1.13 CENTRE TESTING INTERNATIONAL

- 14.1.13.1 Business overview

- 14.1.13.2 Services offered

- 14.1.13.3 MnM view

- 14.1.14 MICROBAC

- 14.1.14.1 Business overview

- 14.1.14.2 Services offered

- 14.1.14.3 MnM view

- 14.1.15 VIMTA LABS LTD.

- 14.1.15.1 Business overview

- 14.1.15.2 Services offered

- 14.1.15.3 Recent developments

- 14.1.15.3.1 Other developments

- 14.1.15.4 MnM view

- 14.1.1 SGS SOCIETE GENERALE DE SURVEILLANCE SA

- 14.2 KEY PLAYERS: BACTERIOLOGICAL TESTING EQUIPMENT MARKET

- 14.2.1 NEOGEN CORPORATION

- 14.2.1.1 Business overview

- 14.2.1.2 Products offered

- 14.2.1.3 Recent developments

- 14.2.1.3.1 Product launches

- 14.2.1.3.2 Deals

- 14.2.1.4 MnM view

- 14.2.2 BIO-RAD LABORATORIES, INC.

- 14.2.2.1 Business overview

- 14.2.2.2 Products offered

- 14.2.2.3 Recent developments

- 14.2.2.4 MnM view

- 14.2.3 BIOMERIEUX

- 14.2.3.1 Business overview

- 14.2.3.2 Products offered

- 14.2.3.3 MnM view

- 14.2.4 THERMO FISHER SCIENTIFIC INC.

- 14.2.4.1 Business overview

- 14.2.4.2 Products offered

- 14.2.4.3 MnM view

- 14.2.5 MERCK & CO., INC.

- 14.2.5.1 Business overview

- 14.2.5.2 Products offered

- 14.2.5.3 MnM view

- 14.2.6 BD

- 14.2.6.1 Business overview

- 14.2.6.2 Products offered

- 14.2.6.3 MnM view

- 14.2.7 3M

- 14.2.7.1 Business overview

- 14.2.7.2 Products offered

- 14.2.7.3 MnM view

- 14.2.8 HARDY DIAGNOSTICS

- 14.2.8.1 Business overview

- 14.2.8.2 Products offered

- 14.2.8.3 MnM view

- 14.2.9 HIMEDIA LABORATORIES

- 14.2.9.1 Business overview

- 14.2.9.2 Products offered

- 14.2.9.3 MnM view

- 14.2.10 AGILENT TECHNOLOGIES, INC.

- 14.2.10.1 Business overview

- 14.2.10.2 Products offered

- 14.2.10.3 Recent developments

- 14.2.10.3.1 Expansions

- 14.2.10.3.2 Deals

- 14.2.10.4 MnM view

- 14.2.1 NEOGEN CORPORATION

15 ADJACENT & RELATED MARKETS

- 15.1 INTRODUCTION

- 15.2 LIMITATIONS

- 15.3 FOOD SAFETY TESTING MARKET

- 15.3.1 MARKET DEFINITION

- 15.3.2 MARKET OVERVIEW

- 15.4 FOOD PATHOGEN TESTING MARKET

- 15.4.1 MARKET DEFINITION

- 15.4.2 MARKET OVERVIEW

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

List of Tables

- TABLE 1 USD EXCHANGE RATES, BY COUNTRY/REGION, 2021-2024

- TABLE 2 BACTERIOLOGICAL TESTING MARKET SHARE SNAPSHOT, 2025 VS. 2030 (USD MILLION)

- TABLE 3 BACTERIOLOGICAL TESTING EQUIPMENT MARKET SHARE SNAPSHOT, 2025 VS. 2030 (USD MILLION)

- TABLE 4 FOOD RECALLS IN US AND REASONS, 2023

- TABLE 5 FOOD RECALLS IN US, BY SPECIES, 2023

- TABLE 6 TOP INNOVATIONS IN FOOD TESTING TECHNOLOGY

- TABLE 7 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 RECIPROCAL TARIFF RATES ADJUSTED BY US

- TABLE 12 IMPACT OF TARIFFS ON TARGET TESTING MATERIALS

- TABLE 13 IMPACT OF TARIFFS ON END-USE INDUSTRIES

- TABLE 14 LIST OF MAJOR PATENTS PERTAINING TO BACTERIOLOGICAL TESTING MARKET, 2019-2025

- TABLE 15 IMPORT DATA FOR HS CODE 3822-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (TONS)

- TABLE 16 EXPORT DATA FOR HS CODE 3822-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (TONS)

- TABLE 17 AVERAGE SELLING PRICE OF BACTERIOLOGICAL TESTING TECHNOLOGIES, BY KEY PLAYER, 2024 (USD/TEST)

- TABLE 18 AVERAGE SELLING PRICE OF BACTERIOLOGICAL TESTING INSTRUMENTS, BY KEY PLAYER, 2024 (USD/TEST)

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY TECHNOLOGY TYPES

- TABLE 20 KEY BUYING CRITERIA FOR KEY FOOD TYPES

- TABLE 21 BACTERIOLOGICAL TESTING MARKET: ROLE OF PLAYERS IN MARKET ECOSYSTEM

- TABLE 22 CASE STUDY 1: EUROFINS MICROBIOLOGY LABORATORY NETWORK REDUCED TIME NEEDED FOR LISTERIA TESTING WITH RHEONIX LISTERIA PATTERNALERT ASSAY

- TABLE 23 CASE STUDY 2: SGS EXPANDED ITS LABORATORY TO IMPROVE HARMONIZED WORKFLOWS AND QUALITY SYSTEMS

- TABLE 24 CASE STUDY 3: EUROFINS SCIENTIFIC DEVELOPED AND IMPLEMENTED STATE-OF-THE-ART ANALYTICAL METHODOLOGIES FOR DETECTION OF PATULIN IN FRUIT PRODUCTS

- TABLE 25 BACTERIOLOGICAL TESTING MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 26 BACTERIOLOGICAL TESTING MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2025-2026

- TABLE 27 BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2021-2024 (USD MILLION)

- TABLE 28 BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2025-2030 (USD MILLION)

- TABLE 29 COLIFORM: BACTERIOLOGICAL TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 30 COLIFORM: BACTERIOLOGICAL TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 COLIFORM: BACTERIOLOGICAL TESTING MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 32 COLIFORM: BACTERIOLOGICAL TESTING MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 33 SALMONELLA: BACTERIOLOGICAL TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 34 SALMONELLA: BACTERIOLOGICAL TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 CAMPYLOBACTER: BACTERIOLOGICAL TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 36 CAMPYLOBACTER: BACTERIOLOGICAL TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 CAMPYLOBACTER: BACTERIOLOGICAL TESTING MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 38 CAMPYLOBACTER: BACTERIOLOGICAL TESTING MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 39 LISTERIA: BACTERIOLOGICAL TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 40 LISTERIA: BACTERIOLOGICAL TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 LEGIONELLA: BACTERIOLOGICAL TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 LEGIONELLA: BACTERIOLOGICAL TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 OTHER BACTERIA: BACTERIOLOGICAL TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 44 OTHER BACTERIA: BACTERIOLOGICAL TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 BACTERIOLOGICAL TESTING MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 46 BACTERIOLOGICAL TESTING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 47 TRADITIONAL: BACTERIOLOGICAL TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 48 TRADITIONAL: BACTERIOLOGICAL TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 RAPID: BACTERIOLOGICAL TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 50 RAPID: BACTERIOLOGICAL TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 RAPID: BACTERIOLOGICAL TESTING MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 52 RAPID: BACTERIOLOGICAL TESTING MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 53 CONVENIENCE-BASED TESTING: RAPID BACTERIOLOGICAL TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 54 CONVENIENCE-BASED TESTING: RAPID BACTERIOLOGICAL TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 PCR-BASED TESTING: RAPID BACTERIOLOGICAL TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 PCR-BASED TESTING: RAPID BACTERIOLOGICAL TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 IMMUNOASSAY-BASED TESTING: RAPID BACTERIOLOGICAL TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 58 IMMUNOASSAY-BASED TESTING: RAPID BACTERIOLOGICAL TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 CHROMATOGRAPHY & SPECTROMETRY: RAPID BACTERIOLOGICAL TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 60 CHROMATOGRAPHY & SPECTROMETRY: RAPID BACTERIOLOGICAL TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 OTHER RAPID TECHNOLOGIES: RAPID BACTERIOLOGICAL TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 62 OTHER RAPID TECHNOLOGIES: RAPID BACTERIOLOGICAL TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 64 BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 65 INSTRUMENTS: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 66 INSTRUMENTS: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY REGION, 2025-2030 (UNITS)

- TABLE 67 INSTRUMENTS: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 68 INSTRUMENTS: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 TEST KITS: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 70 TEST KITS: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 71 TEST KITS: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 72 TEST KITS: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 REAGENTS & CONSUMABLES: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY REGION, 2021-2024 (TONS)

- TABLE 74 REAGENTS & CONSUMABLES: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY REGION, 2025-2030 (TONS)

- TABLE 75 REAGENTS & CONSUMABLES: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 76 REAGENTS & CONSUMABLES: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 BACTERIOLOGICAL TESTING MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 78 BACTERIOLOGICAL TESTING MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 79 FOOD & BEVERAGE: BACTERIOLOGICAL TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 80 FOOD & BEVERAGE: BACTERIOLOGICAL TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 FOOD & BEVERAGE: BACTERIOLOGICAL TESTING MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 82 FOOD & BEVERAGE: BACTERIOLOGICAL TESTING MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 83 WATER: BACTERIOLOGICAL TESTING MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 84 WATER: BACTERIOLOGICAL TESTING MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 85 WATER: BACTERIOLOGICAL TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 86 WATER: BACTERIOLOGICAL TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 87 PHARMACEUTICAL: BACTERIOLOGICAL TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 88 PHARMACEUTICAL: BACTERIOLOGICAL TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 COSMETICS & PERSONAL CARE: BACTERIOLOGICAL TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 90 COSMETICS & PERSONAL CARE: BACTERIOLOGICAL TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91 OTHER END-USE INDUSTRIES: BACTERIOLOGICAL TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 92 OTHER END-USE INDUSTRIES: BACTERIOLOGICAL TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 93 BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY MODE OF USE, 2021-2024 (USD MILLION)

- TABLE 94 BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY MODE OF USE, 2025-2030 (USD MILLION)

- TABLE 95 PORTABLE/FIELD-USE DEVICES: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 96 PORTABLE/FIELD-USE DEVICES: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 97 LABORATORY-BASED SYSTEMS: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 98 LABORATORY-BASED SYSTEMS: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 99 BACTERIOLOGICAL TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 100 BACTERIOLOGICAL TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 101 BACTERIOLOGICAL TESTING MARKET, BY REGION, 2021-2024 (MILLION TESTS)

- TABLE 102 BACTERIOLOGICAL TESTING MARKET, BY REGION, 2025-2030 (MILLION TESTS)

- TABLE 103 BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 104 BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 105 NORTH AMERICA: BACTERIOLOGICAL TESTING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 106 NORTH AMERICA: BACTERIOLOGICAL TESTING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 107 NORTH AMERICA: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 108 NORTH AMERICA: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 109 NORTH AMERICA: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2021-2024 (USD MILLION)

- TABLE 110 NORTH AMERICA: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2025-2030 (USD MILLION)

- TABLE 111 NORTH AMERICA: BACTERIOLOGICAL TESTING MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 112 NORTH AMERICA: BACTERIOLOGICAL TESTING MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 113 NORTH AMERICA: BACTERIOLOGICAL TESTING MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 114 NORTH AMERICA: BACTERIOLOGICAL TESTING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 115 BACTERIOLOGICAL TESTING MARKET, BY RAPID TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 116 BACTERIOLOGICAL TESTING MARKET, BY RAPID TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 117 NORTH AMERICA: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 118 NORTH AMERICA: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 119 NORTH AMERICA: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY MODE OF USE, 2021-2024 (USD MILLION)

- TABLE 120 NORTH AMERICA: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY MODE OF USE, 2025-2030 (USD MILLION)

- TABLE 121 US: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2021-2024 (USD MILLION)

- TABLE 122 US: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2025-2030 (USD MILLION)

- TABLE 123 CANADA: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2021-2024 (USD MILLION)

- TABLE 124 CANADA: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2025-2030 (USD MILLION)

- TABLE 125 MEXICO: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2021-2024 (USD MILLION)

- TABLE 126 MEXICO: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2025-2030 (USD MILLION)

- TABLE 127 EUROPE: BACTERIOLOGICAL TESTING MARKET, BY COUNTRY/REGION, 2021-2024 (USD MILLION)

- TABLE 128 EUROPE: BACTERIOLOGICAL TESTING MARKET, BY COUNTRY/REGION, 2025-2030 (USD MILLION)

- TABLE 129 EUROPE: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY COUNTRY/REGION, 2021-2024 (USD MILLION)

- TABLE 130 EUROPE: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY COUNTRY/REGION, 2025-2030 (USD MILLION)

- TABLE 131 EUROPE: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2021-2024 (USD MILLION)

- TABLE 132 EUROPE: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2025-2030 (USD MILLION)

- TABLE 133 EUROPE: BACTERIOLOGICAL TESTING MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 134 EUROPE: BACTERIOLOGICAL TESTING MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 135 EUROPE: BACTERIOLOGICAL TESTING MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 136 EUROPE: BACTERIOLOGICAL TESTING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 137 EUROPE: BACTERIOLOGICAL TESTING MARKET, BY RAPID TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 138 EUROPE: BACTERIOLOGICAL TESTING MARKET, BY RAPID TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 139 EUROPE: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 140 EUROPE: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 141 EUROPE: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY MODE OF USE, 2021-2024 (USD MILLION)

- TABLE 142 EUROPE: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY MODE OF USE, 2025-2030 (USD MILLION)

- TABLE 143 GERMANY: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2021-2024 (USD MILLION)

- TABLE 144 GERMANY: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2025-2030 (USD MILLION)

- TABLE 145 UK: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2021-2024 (USD MILLION)

- TABLE 146 UK: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2025-2030 (USD MILLION)

- TABLE 147 FRANCE: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2021-2024 (USD MILLION)

- TABLE 148 FRANCE: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2025-2030 (USD MILLION)

- TABLE 149 ITALY: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2021-2024 (USD MILLION)

- TABLE 150 ITALY: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2025-2030 (USD MILLION)

- TABLE 151 SPAIN: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2021-2024 (USD MILLION)

- TABLE 152 SPAIN: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2025-2030 (USD MILLION)

- TABLE 153 POLAND: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2021-2024 (USD MILLION)

- TABLE 154 POLAND: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2025-2030 (USD MILLION)

- TABLE 155 REST OF EUROPE: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2021-2024 (USD MILLION)

- TABLE 156 REST OF EUROPE: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2025-2030 (USD MILLION)

- TABLE 157 ASIA PACIFIC: BACTERIOLOGICAL TESTING MARKET, BY COUNTRY/REGION, 2021-2024 (USD MILLION)

- TABLE 158 ASIA PACIFIC: BACTERIOLOGICAL TESTING MARKET, BY COUNTRY/REGION, 2025-2030 (USD MILLION)

- TABLE 159 ASIA PACIFIC: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY COUNTRY/REGION, 2021-2024 (USD MILLION)

- TABLE 160 ASIA PACIFIC: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY COUNTRY/REGION, 2025-2030 (USD MILLION)

- TABLE 161 ASIA PACIFIC: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2021-2024 (USD MILLION)

- TABLE 162 ASIA PACIFIC: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2025-2030 (USD MILLION)

- TABLE 163 ASIA PACIFIC: BACTERIOLOGICAL TESTING MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 164 ASIA PACIFIC: BACTERIOLOGICAL TESTING MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 165 ASIA PACIFIC: BACTERIOLOGICAL TESTING MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 166 ASIA PACIFIC: BACTERIOLOGICAL TESTING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 167 ASIA PACIFIC: BACTERIOLOGICAL TESTING MARKET, BY RAPID TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 168 ASIA PACIFIC: BACTERIOLOGICAL TESTING MARKET, BY RAPID TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 169 ASIA PACIFIC: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 170 ASIA PACIFIC: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 171 ASIA PACIFIC: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY MODE OF USE, 2021-2024 (USD MILLION)

- TABLE 172 ASIA PACIFIC: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY MODE OF USE, 2025-2030 (USD MILLION)

- TABLE 173 CHINA: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2021-2024 (USD MILLION)

- TABLE 174 CHINA: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2025-2030 (USD MILLION)

- TABLE 175 JAPAN: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2021-2024 (USD MILLION)

- TABLE 176 JAPAN: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2025-2030 (USD MILLION)

- TABLE 177 AUSTRALIA & NEW ZEALAND: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2021-2024 (USD MILLION)

- TABLE 178 AUSTRALIA & NEW ZEALAND: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2025-2030 (USD MILLION)

- TABLE 179 INDIA: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2021-2024 (USD MILLION)

- TABLE 180 INDIA: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2025-2030 (USD MILLION)

- TABLE 181 SOUTHEAST ASIA: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2021-2024 (USD MILLION)

- TABLE 182 SOUTHEAST ASIA: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2025-2030 (USD MILLION)

- TABLE 183 REST OF ASIA PACIFIC: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2021-2024 (USD MILLION)

- TABLE 184 REST OF ASIA PACIFIC: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2025-2030 (USD MILLION)

- TABLE 185 SOUTH AMERICA: BACTERIOLOGICAL TESTING MARKET, BY COUNTRY/REGION, 2021-2024 (USD MILLION)

- TABLE 186 SOUTH AMERICA: BACTERIOLOGICAL TESTING MARKET, BY COUNTRY/REGION, 2025-2030 (USD MILLION)

- TABLE 187 SOUTH AMERICA: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2021-2024 (USD MILLION)

- TABLE 188 SOUTH AMERICA: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2025-2030 (USD MILLION)

- TABLE 189 SOUTH AMERICA: BACTERIOLOGICAL TESTING MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 190 SOUTH AMERICA: BACTERIOLOGICAL TESTING MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 191 SOUTH AMERICA: BACTERIOLOGICAL TESTING MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 192 SOUTH AMERICA: BACTERIOLOGICAL TESTING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 193 SOUTH AMERICA: BACTERIOLOGICAL TESTING MARKET, BY RAPID TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 194 SOUTH AMERICA: BACTERIOLOGICAL TESTING MARKET, BY RAPID TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 195 SOUTH AMERICA: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 196 SOUTH AMERICA: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 197 SOUTH AMERICA: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY MODE OF USE, 2021-2024 (USD MILLION)

- TABLE 198 SOUTH AMERICA: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY MODE OF USE, 2025-2030 (USD MILLION)

- TABLE 199 BRAZIL: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2021-2024 (USD MILLION)

- TABLE 200 BRAZIL: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2025-2030 (USD MILLION)

- TABLE 201 ARGENTINA: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2021-2024 (USD MILLION)

- TABLE 202 ARGENTINA: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2025-2030 (USD MILLION)

- TABLE 203 REST OF SOUTH AMERICA: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2021-2024 (USD MILLION)

- TABLE 204 REST OF SOUTH AMERICA: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2025-2030 (USD MILLION)

- TABLE 205 REST OF THE WORLD: BACTERIOLOGICAL TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 206 REST OF THE WORLD: BACTERIOLOGICAL TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 207 REST OF THE WORLD: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2021-2024 (USD MILLION)

- TABLE 208 REST OF THE WORLD: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2025-2030 (USD MILLION)

- TABLE 209 REST OF THE WORLD: BACTERIOLOGICAL TESTING MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 210 REST OF THE WORLD: BACTERIOLOGICAL TESTING MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 211 REST OF THE WORLD: BACTERIOLOGICAL TESTING MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 212 REST OF THE WORLD: BACTERIOLOGICAL TESTING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 213 REST OF THE WORLD: BACTERIOLOGICAL TESTING MARKET, BY RAPID TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 214 REST OF THE WORLD: BACTERIOLOGICAL TESTING MARKET, BY RAPID TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 215 REST OF THE WORLD: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 216 REST OF THE WORLD: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 217 REST OF THE WORLD: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY MODE OF USE, 2021-2024 (USD MILLION)

- TABLE 218 REST OF THE WORLD: BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY MODE OF USE, 2025-2030 (USD MILLION)

- TABLE 219 AFRICA: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2021-2024 (USD MILLION)

- TABLE 220 AFRICA: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2025-2030 (USD MILLION)

- TABLE 221 MIDDLE EAST: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2021-2024 (USD MILLION)

- TABLE 222 MIDDLE EAST: BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2025-2030 (USD MILLION)

- TABLE 223 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN BACTERIOLOGICAL TESTING MARKET

- TABLE 224 BACTERIOLOGICAL TESTING MARKET: DEGREE OF COMPETITION

- TABLE 225 BACTERIOLOGICAL TESTING MARKET: REGION FOOTPRINT

- TABLE 226 BACTERIOLOGICAL TESTING MARKET: BACTERIA FOOTPRINT

- TABLE 227 BACTERIOLOGICAL TESTING MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 228 BACTERIOLOGICAL TESTING EQUIPMENT MARKET: REGION FOOTPRINT

- TABLE 229 BACTERIOLOGICAL TESTING EQUIPMENT MARKET: COMPONENT FOOTPRINT

- TABLE 230 BACTERIOLOGICAL TESTING EQUIPMENT MARKET: MODE OF USE FOOTPRINT

- TABLE 231 BACTERIOLOGICAL TESTING MARKET: SERVICE LAUNCHES, JANUARY 2021-AUGUST 2025

- TABLE 232 BACTERIOLOGICAL TESTING EQUIPMENT MARKET: PRODUCT LAUNCHES, JANUARY 2021-AUGUST 2025

- TABLE 233 BACTERIOLOGICAL TESTING MARKET: DEALS, JANUARY 2021-AUGUST 2025

- TABLE 234 BACTERIOLOGICAL TESTING EQUIPMENT MARKET: DEALS, JANUARY 2021-AUGUST 2025

- TABLE 235 BACTERIOLOGICAL TESTING MARKET: EXPANSIONS, JANUARY 2021-AUGUST 2025

- TABLE 236 BACTERIOLOGICAL TESTING MARKET: OTHER DEVELOPMENTS, JANUARY 2021-AUGUST 2025

- TABLE 237 SGS SOCIETE GENERALE DE SURVEILLANCE SA: COMPANY OVERVIEW

- TABLE 238 SGS SOCIETE GENERALE DE SURVEILLANCE SA: SERVICES OFFERED

- TABLE 239 SGS SOCIETE GENERALE DE SURVEILLANCE SA: DEALS

- TABLE 240 SGS SOCIETE GENERALE DE SURVEILLANCE SA: EXPANSIONS

- TABLE 241 INTERTEK GROUP PLC: COMPANY OVERVIEW

- TABLE 242 INTERTEK GROUP PLC: SERVICES OFFERED

- TABLE 243 INTERTEK GROUP PLC: EXPANSIONS

- TABLE 244 EUROFINS SCIENTIFIC: COMPANY OVERVIEW

- TABLE 245 EUROFINS SCIENTIFIC: SERVICES OFFERED

- TABLE 246 EUROFINS SCIENTIFIC: SERVICE LAUNCHES

- TABLE 247 EUROFINS SCIENTIFIC: DEALS

- TABLE 248 ALS: COMPANY OVERVIEW

- TABLE 249 ALS: SERVICES OFFERED

- TABLE 250 ALS: DEALS

- TABLE 251 MERIEUX NUTRISCIENCES: COMPANY OVERVIEW

- TABLE 252 MERIEUX NUTRISCIENCES: SERVICES OFFERED

- TABLE 253 MERIEUX NUTRISCIENCES: DEALS

- TABLE 254 MERIEUX NUTRISCIENCES: EXPANSIONS

- TABLE 255 CERTIFIED GROUP: COMPANY OVERVIEW

- TABLE 256 CERTIFIED GROUP: SERVICES OFFERED

- TABLE 257 CERTIFIED GROUP: EXPANSIONS

- TABLE 258 SYMBIO LABS: COMPANY OVERVIEW

- TABLE 259 SYMBIO LABS: SERVICES OFFERED

- TABLE 260 SYMBIO LABS: OTHER DEVELOPMENTS

- TABLE 261 TUV SUD: COMPANY OVERVIEW

- TABLE 262 TUV SUD: SERVICES OFFERED

- TABLE 263 FOODCHAIN ID: COMPANY OVERVIEW

- TABLE 264 FOODCHAIN ID: SERVICES OFFERED

- TABLE 265 TENTAMUS: COMPANY OVERVIEW

- TABLE 266 TENTAMUS: SERVICES OFFERED

- TABLE 267 TENTAMUS: SERVICE LAUNCHES

- TABLE 268 ALFA CHEMISTRY: COMPANY OVERVIEW

- TABLE 269 ALFA CHEMISTRY: SERVICES OFFERED

- TABLE 270 AGQ LABS: COMPANY OVERVIEW

- TABLE 271 AGQ LABS: SERVICES OFFERED

- TABLE 272 AGQ LABS: EXPANSIONS

- TABLE 273 AGQ LABS: DEALS

- TABLE 274 CENTRE TESTING INTERNATIONAL: COMPANY OVERVIEW

- TABLE 275 CENTRE TESTING INTERNATIONAL: SERVICES OFFERED

- TABLE 276 MICROBAC: COMPANY OVERVIEW

- TABLE 277 MICROBAC: SERVICES OFFERED

- TABLE 278 VIMTA LABS LTD.: COMPANY OVERVIEW

- TABLE 279 VIMTA LABS LTD.: SERVICES OFFERED

- TABLE 280 VIMTA LABS LTD.: OTHER DEVELOPMENTS

- TABLE 281 NEOGEN CORPORATION: COMPANY OVERVIEW

- TABLE 282 NEOGEN CORPORATION: PRODUCTS OFFERED

- TABLE 283 NEOGEN CORPORATION: PRODUCT LAUNCHES

- TABLE 284 NEOGEN CORPORATION: DEALS

- TABLE 285 BIO-RAD LABORATORIES, INC.: COMPANY OVERVIEW

- TABLE 286 BIO-RAD LABORATORIES, INC.: PRODUCTS OFFERED

- TABLE 287 BIO-RAD LABORATORIES, INC.: PRODUCT LAUNCHES

- TABLE 288 BIOMERIEUX: COMPANY OVERVIEW

- TABLE 289 BIOMERIEUX: PRODUCTS OFFERED

- TABLE 290 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- TABLE 291 THERMO FISHER SCIENTIFIC INC.: PRODUCTS OFFERED

- TABLE 292 MERCK & CO., INC.: COMPANY OVERVIEW

- TABLE 293 MERCK & CO., INC.: PRODUCTS OFFERED

- TABLE 294 BD: COMPANY OVERVIEW

- TABLE 295 BD: PRODUCTS OFFERED

- TABLE 296 3M: COMPANY OVERVIEW

- TABLE 297 3M: PRODUCTS OFFERED

- TABLE 298 HARDY DIAGNOSTICS: COMPANY OVERVIEW

- TABLE 299 HARDY DIAGNOSTICS: PRODUCTS OFFERED

- TABLE 300 HIMEDIA LABORATORIES: COMPANY OVERVIEW

- TABLE 301 HIMEDIA LABORATORIES: PRODUCTS OFFERED

- TABLE 302 AGILENT TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 303 AGILENT TECHNOLOGIES, INC.: PRODUCTS OFFERED

- TABLE 304 AGILENT TECHNOLOGIES, INC.: EXPANSIONS

- TABLE 305 AGILENT TECHNOLOGIES, INC.: DEALS

- TABLE 306 ADJACENT MARKETS

- TABLE 307 FOOD SAFETY TESTING MARKET, BY TECHNOLOGY, 2017-2021 (USD MILLION)

- TABLE 308 FOOD SAFETY TESTING MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 309 FOOD PATHOGEN TESTING MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 310 FOOD PATHOGEN TESTING MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

List of Figures

- FIGURE 1 BACTERIOLOGICAL TESTING MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 4 SUPPLY-SIDE ANALYSIS: SOURCES OF INFORMATION AT EVERY STEP

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 SALMONELLA SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 8 RAPID SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 9 FOOD & BEVERAGE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 10 EUROPE ACCOUNTED FOR LARGEST SHARE OF BACTERIOLOGICAL TESTING MARKET IN 2024

- FIGURE 11 REAGENTS & CONSUMABLES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 LABORATORY-BASED SYSTEMS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 13 EUROPE TO ACCOUNT FOR LARGEST SHARE OF BACTERIOLOGICAL TESTING EQUIPMENT MARKET DURING FORECAST PERIOD

- FIGURE 14 GROWING EMPHASIS ON FOOD QUALITY AND PROTECTING BRAND REPUTATION TO CREATE MARKET OPPORTUNITIES

- FIGURE 15 US TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 16 SALMONELLA SEGMENT AND GERMANY ACCOUNTED FOR SIGNIFICANT SHARE IN 2024

- FIGURE 17 SALMONELLA SEGMENT TO LEAD MARKET ACROSS REGIONS DURING FORECAST PERIOD

- FIGURE 18 RAPID SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 19 FOOD & BEVERAGE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 20 GROWING EMPHASIS ON RIGOROUS REGULATORY STANDARDS AND ONGOING SAFETY CONCERNS TO CREATE MARKET OPPORTUNITIES

- FIGURE 21 US TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 22 REAGENTS & CONSUMABLES SEGMENT AND GERMANY ACCOUNTED FOR SIGNIFICANT SHARE IN 2024

- FIGURE 23 REAGENTS & CONSUMABLES SEGMENT TO LEAD MARKET ACROSS REGIONS DURING FORECAST PERIOD

- FIGURE 24 LABORATORY-BASED SYSTEMS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 25 PATHOGENS CAUSING FOODBORNE ILLNESSES IN US

- FIGURE 26 CASES OF FOODBORNE ILLNESSES, BY REGION, 2020

- FIGURE 27 GLOBAL FOOD EXPORTS, BY REGION, 2022 (USD BILLION)

- FIGURE 28 BACTERIOLOGICAL TESTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 29 PRODUCTS RECALLED GLOBALLY, 2012-2022

- FIGURE 30 ADOPTION OF GEN AI FOR BACTERIOLOGICAL TESTING

- FIGURE 31 LEGISLATION PROCESS IN EU

- FIGURE 32 NUMBER OF PATENTS GRANTED FOR BACTERIOLOGICAL TESTING, 2015-2026

- FIGURE 33 REGIONAL ANALYSIS OF PATENTS GRANTED FOR BACTERIOLOGICAL TESTING SERVICES

- FIGURE 34 IMPORT DATA FOR HS CODE 3822-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2021-2024 (TONS)

- FIGURE 35 EXPORT DATA FOR HS CODE 3822-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2021-2024 (TONS)

- FIGURE 36 AVERAGE SELLING PRICE OF BACTERIOLOGICAL TESTING TECHNOLOGIES, BY KEY PLAYER, 2024 (USD/TEST)

- FIGURE 37 AVERAGE SELLING PRICE OF BACTERIOLOGICAL TESTING SERVICES, BY END-USE INDUSTRY, 2021-2024 (USD/TEST)

- FIGURE 38 AVERAGE SELLING PRICE OF BACTERIOLOGICAL TESTING SERVICES, BY REGION, 2021-2024 (USD/TEST)

- FIGURE 39 AVERAGE SELLING PRICE OF BACTERIOLOGICAL TESTING INSTRUMENTS, BY KEY PLAYER, 2024 (USD/UNIT)

- FIGURE 40 AVERAGE SELLING PRICE OF BACTERIOLOGICAL TESTING INSTRUMENTS, BY REGION, 2021-2024 (USD/TEST)

- FIGURE 41 AVERAGE SELLING PRICE OF BACTERIOLOGICAL TESTING KITS, BY REGION, 2021-2024 (USD/UNITS)

- FIGURE 42 AVERAGE SELLING PRICE OF BACTERIOLOGICAL TESTING REAGENTS & CONSUMABLES, 2021-2024 (USD/KG)

- FIGURE 43 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY TECHNOLOGY TYPES

- FIGURE 44 KEY BUYING CRITERIA FOR KEY FOOD TYPES

- FIGURE 45 TRENDS & DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 46 VALUE CHAIN ANALYSIS

- FIGURE 47 BACTERIOLOGICAL TESTING MARKET: ECOSYSTEM ANALYSIS

- FIGURE 48 BACTERIOLOGICAL TESTING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 49 INVESTMENT & FUNDING SCENARIO

- FIGURE 50 BACTERIOLOGICAL TESTING MARKET, BY BACTERIUM, 2025 VS. 2030 (USD MILLION)

- FIGURE 51 BACTERIOLOGICAL TESTING MARKET, BY TECHNOLOGY, 2025 VS. 2030 (USD MILLION)

- FIGURE 52 BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY COMPONENT, 2025 VS. 2030 (USD MILLION)

- FIGURE 53 BACTERIOLOGICAL TESTING MARKET, BY END-USE INDUSTRY, 2025 VS. 2030 (USD MILLION)

- FIGURE 54 BACTERIOLOGICAL TESTING EQUIPMENT MARKET, BY MODE OF USE, 2025 VS. 2030 (USD MILLION)

- FIGURE 55 US TO RECORD HIGHEST GROWTH IN BACTERIOLOGICAL TESTING MARKET DURING FORECAST PERIOD

- FIGURE 56 US TO RECORD HIGHEST GROWTH IN BACTERIOLOGICAL TESTING EQUIPMENT MARKET DURING FORECAST PERIOD

- FIGURE 57 NORTH AMERICA: BACTERIOLOGICAL TESTING MARKET SNAPSHOT

- FIGURE 58 NORTH AMERICA: BACTERIOLOGICAL TESTING EQUIPMENT MARKET SNAPSHOT

- FIGURE 59 EUROPE: BACTERIOLOGICAL TESTING MARKET SNAPSHOT

- FIGURE 60 EUROPE: BACTERIOLOGICAL TESTING EQUIPMENT MARKET SNAPSHOT

- FIGURE 61 REVENUE ANALYSIS FOR KEY PLAYERS IN BACTERIOLOGICAL TESTING MARKET, 2021-2024 (USD BILLION)

- FIGURE 62 BACTERIOLOGICAL TESTING MARKET SHARE ANALYSIS, 2024

- FIGURE 63 RANKING OF TOP FIVE PLAYERS IN BACTERIOLOGICAL TESTING EQUIPMENT MARKET, 2024

- FIGURE 64 BACTERIOLOGICAL TESTING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 65 BACTERIOLOGICAL TESTING MARKET: COMPANY FOOTPRINT

- FIGURE 66 BACTERIOLOGICAL TESTING EQUIPMENT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 67 BACTERIOLOGICAL TESTING EQUIPMENT MARKET: COMPANY FOOTPRINT

- FIGURE 68 COMPANY VALUATION OF KEY VENDORS

- FIGURE 69 FINANCIAL METRICS OF KEY VENDORS

- FIGURE 70 YEAR-TO-DATE PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 71 BACTERIOLOGICAL TESTING EQUIPMENT MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 72 SGS SOCIETE GENERALE DE SURVEILLANCE SA: COMPANY SNAPSHOT

- FIGURE 73 INTERTEK GROUP PLC: COMPANY SNAPSHOT

- FIGURE 74 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT

- FIGURE 75 ALS: COMPANY SNAPSHOT

- FIGURE 76 TUV SUD: COMPANY SNAPSHOT

- FIGURE 77 CENTRE TESTING INTERNATIONAL: COMPANY SNAPSHOT

- FIGURE 78 VIMTA LABS LTD.: COMPANY OVERVIEW

- FIGURE 79 NEOGEN CORPORATION: COMPANY SNAPSHOT

- FIGURE 80 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT

- FIGURE 81 BIOMERIEUX: COMPANY SNAPSHOT

- FIGURE 82 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT

- FIGURE 83 MERCK & CO., INC.: COMPANY SNAPSHOT

- FIGURE 84 BD: COMPANY SNAPSHOT

- FIGURE 85 3M: COMPANY SNAPSHOT

- FIGURE 86 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT