|

市場調查報告書

商品編碼

1822298

全球殺線蟲劑市場(按類型、線蟲種類、施用方法、劑型、作物類型和地區分類)- 預測至2030年Nematicide Market by Type (Chemical, Biological), Nematode Type (Root-knot, Cyst, Lesion), Mode of Application (Drenching, Soil Dressing, Seed Treatment, Fumigation), Formulation, Crop Type and Region - Global Forecast to 2030 |

||||||

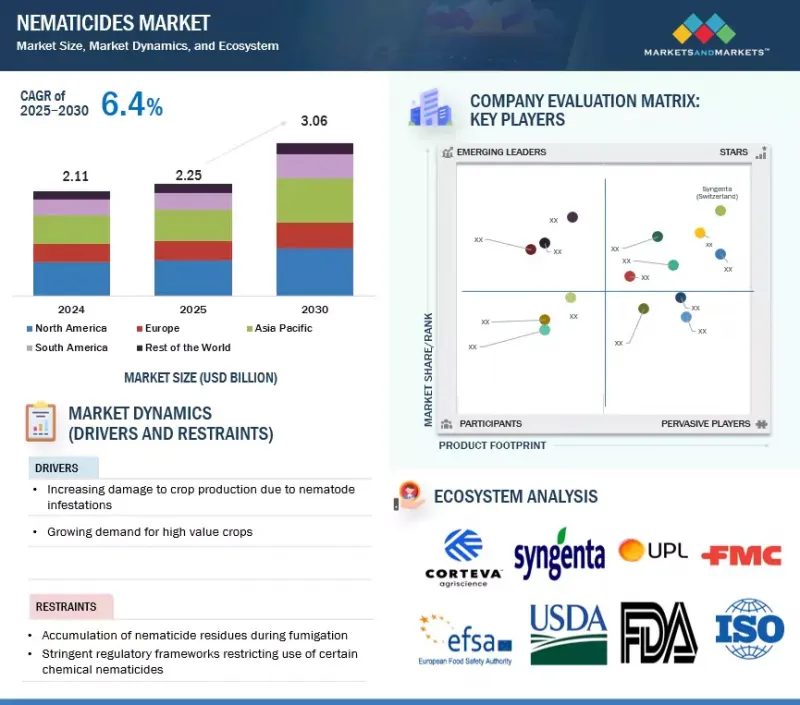

預計 2025 年全球殺線蟲劑市場規模為 22.5 億美元,到 2030 年將達到 30.6 億美元,預測期內複合年成長率為 6.4%。

市場驅動力是植物寄生線蟲導致作物損失不斷增加,這大大降低了大豆、玉米、棉花和蔬菜等主要作物的產量。

| 調查範圍 | |

|---|---|

| 調查年份 | 2025-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 單元 | 美元、千噸 |

| 部分 | 類型、劑型、線蟲類型、施用方法、作物類型、地區 |

| 目標區域 | 北美、歐洲、亞太地區、南美洲、其他亞太地區 |

隨著全球糧食需求的增加和可耕地面積的減少,農民面臨著最大化每公頃產量的壓力,有效的線蟲管理至關重要。水果、蔬菜和種植作物等高價值作物尤其容易受到線蟲侵害,這進一步推動了對殺線蟲劑的需求。此外,大規模商業性農業和設施化種植體系的擴張也推動了對可靠的線蟲防治解決方案的需求。

種子施用殺線蟲劑、精密農業和綜合蟲害管理 (IPM) 等先進技術的快速應用也是關鍵促進因素,因為這些技術提高了施用效率並降低了投入成本。在政府措施和永續性目標的支持下,對傳統燻蒸劑的監管限制也加速了向更安全的生物基殺線蟲劑的過渡。此外,全球農化公司的持續產品創新、策略夥伴關係和投資正在擴大化學和生物殺線蟲劑解決方案的可用性,從而促進市場成長。

“按應用方法來看,種子處理領域預計在預測期內將快速成長。”

種子處理作為一種施用方法,由於其效率高、成本效益高以及能夠為作物提供早期保護,在殺線蟲劑市場中發展迅速。與傳統的土壤或葉面噴布施用不同,種子處理可以將殺線蟲劑直接精確地施用在種子上,從而實現均勻施用並減少所需的化學品總量。這種有針對性的方法可以最大限度地減少環境影響,提高發芽率,促進植物生長,從而提高作物產量。對永續農業實踐的需求不斷成長以及減少過度使用化學品的監管壓力進一步加速了種子施用技術的應用。此外,製劑技術的進步以及生物殺線蟲劑與種子處理的整合正在增加其吸引力,尤其是對於尋求綜合蟲害管理解決方案的農民而言。隨著全球公司對創新種子處理解決方案的投資,這種施用方法預計將在殺線蟲劑市場繼續保持強勁的成長勢頭。

“根據線蟲類型,預計根結線蟲部分將在預測期內引領市場。”

根據線蟲類型,根結線蟲由於分佈廣泛且對農業生產力造成嚴重影響,估計佔據線蟲市場的最大佔有率。這些線蟲會感染多種作物,包括水果、蔬菜、穀類和豆類,在根部形成蟲癭,阻礙生長,並造成嚴重的產量損失。它們能夠在不同的農業氣候條件下茁壯成長,這使它們成為全球最具破壞性的植物寄生線蟲群之一。高價值作物高價值作物的種植面積不斷擴大,這進一步刺激了對有效控制解決方案的需求。隨著種子處理和綜合蟲害管理方法的進步,農民越來越依賴化學和生物殺線蟲劑來控制這些害蟲。持續的產品創新和生物基替代品的引入正在解決對抗性和環境安全的擔憂,加強根結線蟲在線蟲類型領域的主導地位。

“預計北美將佔據最大的市場佔有率,而歐洲預計將成為預測期內成長最快的市場。”

北美預計將引領全球殺線蟲劑市場,這得益於其高度商業化的農業部門以及蔬菜、水果、玉米和大豆等高價值作物的種植。該地區的農民因植物寄生線蟲(尤其是根結線蟲和囊胞線蟲)而面臨嚴重的產量損失,這推動了對有效控制解決方案的強勁需求。種子施用殺線蟲劑和綜合蟲害管理系統等先進農業技術的採用,正在進一步促進市場成長。

本報告分析了全球殺線蟲劑市場,提供了關鍵促進因素和限制因素、競爭格局和未來趨勢的資訊。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章 主要發現

- 殺線蟲劑市場充滿機遇

- 北美殺線蟲劑市場(按類型和國家)

- 殺線蟲劑市場主要國家

- 殺線蟲劑市場按類型和地區分類

- 殺線蟲劑市場:依線蟲類型和地區分類

- 殺線蟲劑市場:依劑型及地區分類

- 殺線蟲劑市場:依應用方法、按地區

- 殺線蟲劑市場(按作物和地區)

第5章 市場概況

- 介紹

- 總體經濟指標

- 使用殺蟲劑防止害蟲侵襲

- 外國直接投資

- 線蟲造成的全球作物損失

- 市場動態

- 驅動程式

- 抑制因素

- 機會

- 任務

- 殺線蟲劑/人工合成殺線蟲劑對殺線蟲劑市場的影響

- 介紹

- 生成式人工智慧在殺線蟲劑市場的應用

- 案例研究分析

第6章 產業趨勢

- 介紹

- 2025年美國關稅對殺線蟲劑市場的影響

- 介紹

- 主要關稅稅率

- 價格影響分析

- 對國家的影響

- 對終端產業的影響

- 價值鏈分析

- 研究與開發

- 製造業

- 分配

- 行銷和銷售

- 售後服務

- 貿易分析

- HS 編碼 3808 的出口場景

- HS 編碼 3808 的進口場景

- 技術分析

- 主要技術

- 互補技術

- 鄰近技術

- 定價分析

- 主要企業價格分佈(2024年)

- 價格趨勢:殺線蟲劑(依類型)(2020-2024)

- 各地區殺線蟲劑價格趨勢(2020-2024)

- 生態系分析

- 需求端

- 供應端

- 影響客戶業務的趨勢/中斷

- 專利分析

- 大型會議和活動(2025-2026)

- 監管格局

- 監管機構、政府機構和其他組織

- 北美洲

- 歐洲

- 亞太地區

- 南美洲

- 其他地區

- 波特五力分析

- 主要相關利益者和採購標準

- 投資金籌措場景

- 案例研究分析

第7章殺線蟲劑市場(按類型)

- 介紹

- 化學

- 生物

第8章 殺線蟲劑市場(依線蟲類型)

- 介紹

- 根結線蟲

- 囊胞線蟲

- 根部病害線蟲

- 其他線蟲類型

第9章殺線蟲劑市場(按劑型)

- 介紹

- 顆粒狀

- 液體

第10章 殺線蟲劑市場:依應用方法

- 介紹

- 燻蒸

- 灌溉

- 客土

- 種子處理

- 其他應用方法

第11章 殺線蟲劑市場(依作物)

- 介紹

- 穀類

- 油籽/豆類

- 水果和蔬菜

- 其他作物

第12章殺線蟲劑市場(按地區)

- 介紹

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲和紐西蘭

- 其他亞太地區

- 南美洲

- 阿根廷

- 巴西

- 南美洲其他地區

- 其他地區

- 中東

- 非洲

第13章競爭格局

- 概述

- 主要參與企業的策略/優勢

- 收益分析(2020-2024)

- 市佔率分析(2024年)

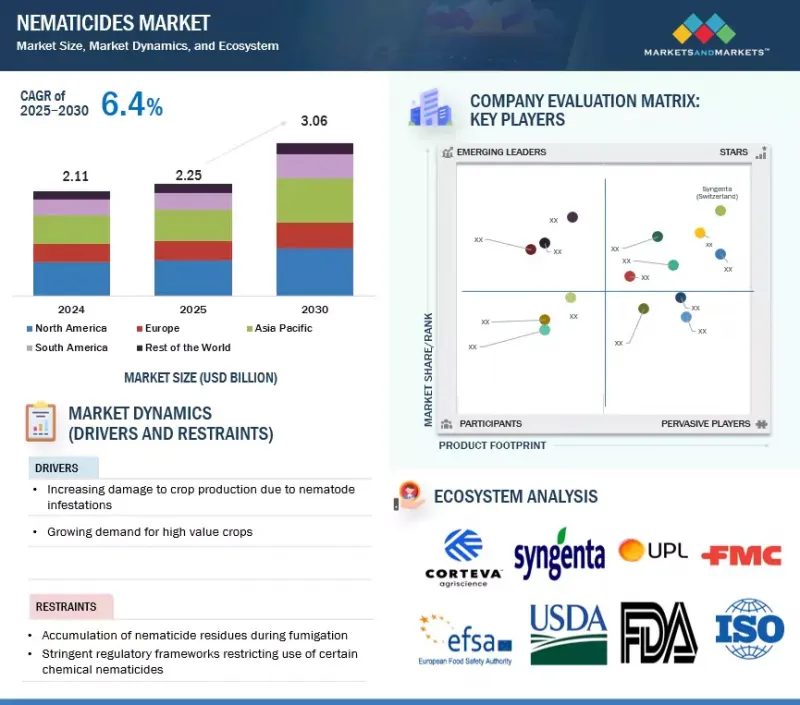

- 企業評估矩陣:主要企業(2024年)

- 公司評估矩陣:Start-Ups/中小企業(2024 年)

- 公司估值及財務指標

- 品牌/產品比較

- 競爭情境和趨勢

第14章:公司簡介

- 主要企業

- BASF SE

- SYNGENTA

- CORTEVA

- UPL

- BAYER AG

- FMC CORPORATION

- SUMITOMO CHEMICAL CO., LTD.

- NUFARM

- AMERICAN VANGUARD CORPORATION

- NOVONESIS GROUP

- BIOCERES CROP SOLUTIONS

- GOWAN COMPANY

- CERTIS USA LLC

- LALLEMAND INC

- AECI PLANT HEALTH

- 其他公司

- ANDERMATT GROUP AG

- IPL BIOLOGICALS

- PHERONYM, INC.

- AGRILIFE

- CROP IQ TECHNOLOGY

- ROVENSA NEXT

- BIONEMA

- BIOCONSORTIA

- VIVE CROP PROTECTION INC.

- VEGALAB SA

第15章:鄰近市場與相關市場

- 介紹

- 限制

- 作物保護化學品市場

- 市場定義

- 市場概況

- 生物合理農藥市場

- 市場定義

- 市場概況

第16章 附錄

The market for nematicides is estimated to be USD 2.25 billion in 2025 and is projected to reach USD 3.06 billion by 2030, at a CAGR of 6.4% during the forecast period. The market is driven by rising crop losses caused by plant-parasitic nematodes, significantly reducing yields in major crops such as soybeans, corn, cotton, and vegetables.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2025-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) and Volume (KT) |

| Segments | By Type, Formulation, Nematode Type, Mode of Application, Crop Type, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and Rest of the World |

With growing global food demand and shrinking arable land, farmers are under increasing pressure to maximize productivity per hectare, making effective nematode management essential. High-value crops like fruits, vegetables, and plantation crops are particularly vulnerable, further boosting the demand for nematicides. In addition, the expansion of large-scale commercial farming and protected cultivation systems has heightened the need for reliable nematode control solutions.

Another key driver is the rapid adoption of advanced technologies such as seed-applied nematicides, precision agriculture, and integrated pest management (IPM), which improve application efficiency and reduce input costs. Regulatory restrictions on traditional fumigants have also accelerated the shift toward safer, bio-based nematicides, supported by government initiatives and sustainability goals. Furthermore, continuous product innovations, strategic partnerships, and investments by global agrochemical companies are expanding the availability of both chemical and biological nematicide solutions, thereby reinforcing market growth.

"By mode of application, the seed treatment segment is projected to grow at a significant rate during the forecast period"

Seed treatment as a mode of application is growing at a significant rate in the nematicides market, driven by its efficiency, cost-effectiveness, and ability to provide early-stage protection to crops. Unlike traditional soil or foliar applications, seed treatment enables precise application of nematicides directly onto seeds, ensuring uniform coverage and reducing the overall quantity of chemicals required. This targeted approach minimizes environmental impact, enhances germination rates, and strengthens plant establishment, thereby improving crop yield potential. Rising demand for sustainable agricultural practices and regulatory pressures to reduce excessive chemical usage have further accelerated the adoption of seed-applied technologies. Additionally, advancements in formulation technology and the integration of biological nematicides into seed treatments have broadened their appeal, particularly among farmers seeking integrated pest management solutions. With global players investing in innovative seed treatment solutions, this mode of application is expected to continue its strong growth trajectory in the nematicides market.

"By nematode type, the root-knot nematodes segment is estimated to lead the market during the forecast period"

By nematode type, the root-knot nematodes segment is estimated to account for the largest share of the nematicides market due to the wide distribution and severe impact of root-knot nematodes on agricultural productivity. These nematodes infect a broad range of crops, including fruits, vegetables, cereals, and pulses, causing gall formation on roots, stunted growth, and significant yield losses. Their ability to thrive in diverse agro-climatic conditions makes them one of the most destructive groups of plant-parasitic nematodes globally. The rising cultivation of high-value crops that are highly susceptible to root-knot nematode infestations has further accelerated the demand for effective control solutions. Farmers are increasingly relying on both chemical and biological nematicides to manage these pests, supported by advancements in seed treatments and integrated pest management practices. Continuous product innovations and the introduction of bio-based alternatives are also addressing concerns over resistance and environmental safety, reinforcing root-knot nematodes' dominance in the nematode type segment.

"North America is estimated to hold the largest market share, while Europe is expected to be the fastest-growing market during the forecast period"

North America is estimated to lead the global nematicides market, driven by its highly commercialized agriculture sector and extensive cultivation of high-value crops such as vegetables, fruits, corn, and soybeans. Farmers in the region face significant yield losses from plant-parasitic nematodes, particularly root-knot and cyst nematodes, which have fueled strong demand for effective control solutions. The adoption of advanced farming technologies, including seed-applied nematicides and integrated pest management systems, has further strengthened the market's growth. Additionally, the presence of leading agrochemical companies with strong product portfolios and continuous innovations supports regional dominance. Stringent regulations on chemical pesticide use have also accelerated the shift toward biological nematicides, aligning with consumer demand for residue-free produce. These factors position North America as the leading market for nematicides, reflecting both the scale of production and advanced crop protection practices.

The European market is projected to grow at the highest rate, supported by strong regulatory backing for sustainable agriculture and rising adoption of biological crop protection solutions. The European Union's strict restrictions on conventional chemical pesticides have increased reliance on bio-based and environmentally friendly nematicides, driving innovation and market expansion. Countries such as Spain, Italy, and France, with large-scale fruit and vegetable cultivation, face significant nematode infestations, creating high demand for effective and safer alternatives. The region is also witnessing rapid integration of precision agriculture practices, enabling targeted nematicide application and minimizing environmental impact. Furthermore, increasing consumer preference for organic and residue-free food products is encouraging growers to invest in biological nematicide solutions. With active support from government policies and continuous R&D investments, Europe is positioned to emerge as the fastest-growing region in the global nematicides market.

Break-up of Primaries

In-depth interviews were conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the nematicides market:

- By Company Type: Tier 1 - 25%, Tier 2 - 45%, and Tier 3 - 30%

- By Designation: Directors- 20%, Managers - 50%, Executives - 30%

- By Region: North America - 25%, Europe - 30%, Asia Pacific - 20%, South America - 15%, and Rest of the World - 10%

Prominent companies in the market include BASF SE (Germany), Bayer AG (Germany), UPL (India), T. STANES AND COMPANY LIMITED (India), Corteva (US), Koppert (Netherlands), FMC Corporation (US), Nufarm (Australia), Syngenta (Switzerland), American Vanguard Corporation (US), Sumitomo Chemicals (Japan), Lallemand Inc. (Canada), Novonesis Group (Denmark), Biobest Group NV (Belgium), and PI Industries (India).

Other players include IPL Biologicals (India), Bioceres Crop Solutions (Argentina), Rovensa Next (Spain), Bionema (UK), BioConsortia (US), Certis USA L.L.C. (US), Futureco Bioscience (Spain), Gowan Company (US), AgriLife (India), and Andermatt Group AG (Switzerland).

Research Coverage

This research report categorizes the nematicides market by type (chemical and biological), nematode type (root-knot nematodes, cyst nematodes, lesion nematodes, and other nematodes), formulation (granular and liquid), mode of application (fumigation, soil dressing, drenching, seed treatment, and other modes of application), crop type (cereals & grains, oilseeds, fruits & vegetables, and other crop types), and region (North America, Europe, Asia Pacific, South America, and Rest of the World). The scope of the report covers detailed information regarding drivers, restraints, challenges, and opportunities influencing the growth of the nematicides market.

A detailed analysis of the key industry players was done to provide insights into their business overview, services, key strategies, contracts, partnerships, agreements, new service launches, mergers and acquisitions, and recent developments associated with the nematicides market. This report covers competitive analysis of upcoming startups in the nematicides market ecosystem. Furthermore, the study also covers industry-specific trends such as technology analysis, ecosystem and market mapping, and patent and regulatory landscape, among others.

Reasons to buy this report

The report will help market leaders/new entrants in this market by providing information on the closest approximations of the revenue numbers for the overall nematicides and the subsegments. It will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

It provides insights into the following pointers:

- Analysis of key drivers (high demand for high-value crops), restraints (varying government regulations), opportunities (use of plant-based nematicides in organic agriculture), and challenges (resistance development) influencing the growth of the nematicides market

- New Product Launch/Innovation: Detailed insights on research & development activities and new product launches in the nematicides market

- Market Development: Comprehensive information about lucrative markets - analysis of the nematicides market across varied regions

- Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the nematicides market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, brand/product comparisons, and product footprints of leading players such as BASF (Germany), Syngenta (Switzerland), Bayer AG (Germany), UPL (India), Corteva (US), FMC Corporation (US), and others in the nematicides market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.5.1 CURRENCY/VALUE UNIT

- 1.5.2 VOLUME CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN NEMATICIDES MARKET

- 4.2 NORTH AMERICA: NEMATICIDES MARKET, BY TYPE & COUNTRY

- 4.3 NEMATICIDE MARKETS, BY KEY COUNTRY

- 4.4 NEMATICIDES MARKET, BY TYPE AND REGION

- 4.5 NEMATICIDES MARKET, BY NEMATODE TYPE AND REGION

- 4.6 NEMATICIDES MARKET, BY FORMULATION AND REGION

- 4.7 NEMATICIDES MARKET, BY MODE OF APPLICATION AND REGION

- 4.8 NEMATICIDES MARKET, BY CROP TYPE AND REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 ADOPTION OF PESTICIDES FOR DEFENSE AGAINST PEST ATTACKS

- 5.2.2 FOREIGN DIRECT INVESTMENTS

- 5.3 GLOBAL CROP LOSSES DUE TO NEMATODES

- 5.4 MARKET DYNAMICS

- 5.4.1 DRIVERS

- 5.4.1.1 Strong demand for high-value crops

- 5.4.1.2 Rising demand for low-cost crop protection solutions

- 5.4.1.3 Increasing damage to crop production due to nematode infestations

- 5.4.1.4 Integration of nematicides with modern farming practices

- 5.4.1.5 Advancements in biological nematicides

- 5.4.2 RESTRAINTS

- 5.4.2.1 Technological limitations in using biological products

- 5.4.2.2 Stringent government regulations

- 5.4.3 OPPORTUNITIES

- 5.4.3.1 Use of plant-based nematicides in organic agriculture and horticulture

- 5.4.3.2 Resistance to crop protection chemicals

- 5.4.3.3 Rising demand for biological solutions

- 5.4.4 CHALLENGES

- 5.4.4.1 Expanding adoption of GM crops to reduce dependence on conventional crop protection chemicals

- 5.4.4.2 Lack of awareness and low utilization of biologicals

- 5.4.4.3 Inconsistent field performance

- 5.4.1 DRIVERS

- 5.5 IMPACT OF AI/GEN AI ON NEMATICIDES MARKET

- 5.5.1 INTRODUCTION

- 5.5.2 USE OF GEN AI IN NEMATICIDES MARKET

- 5.5.3 CASE STUDY ANALYSIS

- 5.5.3.1 Revolutionizing nematode management: Syngenta's satellite-powered precision tool

- 5.5.3.2 Agmatix and BASF partnered to develop AI-powered detection of soybean cyst nematode

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 IMPACT OF 2025 US TARIFF - NEMATICIDES MARKET

- 6.2.1 INTRODUCTION

- 6.2.2 KEY TARIFF RATES

- 6.2.3 PRICE IMPACT ANALYSIS

- 6.2.4 IMPACT ON COUNTRY/REGION

- 6.2.4.1 US

- 6.2.4.2 Europe

- 6.2.4.3 Asia Pacific

- 6.2.5 IMPACT ON END-USE INDUSTRIES

- 6.3 VALUE CHAIN ANALYSIS

- 6.3.1 RESEARCH & DEVELOPMENT

- 6.3.2 MANUFACTURING

- 6.3.3 DISTRIBUTION

- 6.3.4 MARKETING & SALES

- 6.3.5 POST-SALE SERVICES

- 6.4 TRADE ANALYSIS

- 6.4.1 EXPORT SCENARIO OF HS CODE 3808

- 6.4.2 IMPORT SCENARIO OF HS CODE 3808

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 RNAi-based nematicides

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Precision agriculture tools

- 6.5.3 ADJACENT TECHNOLOGIES

- 6.5.3.1 Seed treatment technologies

- 6.5.1 KEY TECHNOLOGIES

- 6.6 PRICING ANALYSIS

- 6.6.1 PRICING RANGE OF NEMATICIDE TYPES, BY KEY PLAYER, 2024

- 6.6.2 PRICING TREND, BY NEMATICIDE TYPE, 2020-2024

- 6.6.3 PRICING TREND OF NEMATICIDE PRODUCTS, BY REGION, 2020-2024

- 6.7 ECOSYSTEM ANALYSIS

- 6.7.1 DEMAND SIDE

- 6.7.2 SUPPLY SIDE

- 6.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.9 PATENT ANALYSIS

- 6.10 KEY CONFERENCES & EVENTS, 2025-2026

- 6.11 REGULATORY LANDSCAPE

- 6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11.2 NORTH AMERICA

- 6.11.2.1 US

- 6.11.2.2 Canada

- 6.11.3 EUROPE

- 6.11.3.1 UK

- 6.11.3.2 France

- 6.11.3.3 Russia

- 6.11.4 ASIA PACIFIC

- 6.11.4.1 India

- 6.11.4.2 China

- 6.11.4.3 Australia

- 6.11.5 SOUTH AMERICA

- 6.11.5.1 Brazil

- 6.11.6 REST OF WORLD

- 6.11.6.1 South Africa

- 6.11.6.2 UAE

- 6.12 PORTER'S FIVE FORCES ANALYSIS

- 6.12.1 THREAT OF NEW ENTRANTS

- 6.12.2 THREAT OF SUBSTITUTES

- 6.12.3 BARGAINING POWER OF BUYERS

- 6.12.4 BARGAINING POWER OF SUPPLIERS

- 6.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.13.2 BUYING CRITERIA

- 6.14 INVESTMENT AND FUNDING SCENARIO

- 6.15 CASE STUDY ANALYSIS

- 6.15.1 NUFARM LAUNCHED EVOLVANCE BIOLOGICAL BIONEMATICIDE TO ENHANCE CROP RESILIENCE

- 6.15.2 SYNGENTA LAUNCHED TYMIRIUM TECHNOLOGY FOR SUSTAINABLE NEMATODE AND FUNGAL DISEASE CONTROL

7 NEMATICIDES MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 CHEMICAL

- 7.2.1 LONGER RESIDUAL ACTIVITY AND QUICK MODE OF ACTION AGAINST NEMATODES TO DRIVE SEGMENT

- 7.2.2 FUMIGANTS

- 7.2.2.1 Broad-spectrum functionality of fumigants against nematodes to drive market

- 7.2.2.2 Methyl bromide

- 7.2.2.2.1 Ability to penetrate quickly into sorptive materials at normal atmospheric pressure to drive segment

- 7.2.2.3 Metam sodium

- 7.2.2.3.1 Increasing adoption in agriculture sector to boost market

- 7.2.2.4 1-3-Dichloropropene

- 7.2.2.4.1 Minimum soil contamination and air dispersion to drive segment

- 7.2.2.5 Other fumigant types

- 7.2.3 NON-FUMIGANTS

- 7.2.3.1 Carbamates

- 7.2.3.1.1 Low toxicity to non-target organisms and selective action against nematodes

- 7.2.3.2 Organophosphates

- 7.2.3.2.1 Fast absorption rate and immediate protection against nematode feeding damage

- 7.2.3.3 Abamectin (Next-gen)

- 7.2.3.3.1 Targeted activity against nematodes, disrupting their nerve and muscle functions

- 7.2.3.4 SDHI (Next-gen)

- 7.2.3.4.1 Disrupting energy production in nematodes, leading to their effective control

- 7.2.3.4.2 Fluopyram

- 7.2.3.4.3 Cyclobutrifluram

- 7.2.3.1 Carbamates

- 7.2.4 OTHER CHEMICALS

- 7.2.4.1 Fluoroalkenyl compounds

- 7.2.4.2 Fluensulfone

- 7.2.4.3 Tioxazafen

- 7.2.4.4 Fluazaindolizine

- 7.3 BIOLOGICAL

- 7.3.1 STRINGENT REGULATORY POLICIES ON CONVENTIONAL AGROCHEMICALS TO DRIVE MARKET

- 7.3.2 MICROBIALS

- 7.3.2.1 High adoption of sustainable agricultural techniques to fuel growth

- 7.3.3 BIOCHEMICALS

- 7.3.3.1 Residue-free nematode management by biochemicals to propel growth

8 NEMATICIDES MARKET, BY NEMATODE TYPE

- 8.1 INTRODUCTION

- 8.2 ROOT-KNOT NEMATODES

- 8.2.1 RISING NEED TO REDUCE ECONOMIC LOSSES AND ENHANCE CROP QUALITY TO DRIVE DEMAND FOR NEMATICIDES

- 8.3 CYST NEMATODES

- 8.3.1 LARGE-SCALE ECONOMIC LOSSES AND LOWER YIELD QUALITY DUE TO CYST NEMATODE INFESTATION TO INCREASE DEMAND

- 8.4 LESION NEMATODES

- 8.4.1 WIDE HOST RANGE AND PRESENCE IN TEMPERATE AND TROPICAL ENVIRONMENTS TO DRIVE MARKET

- 8.5 OTHER NEMATODE TYPES

9 NEMATICIDES MARKET, BY FORMULATION

- 9.1 INTRODUCTION

- 9.2 GRANULAR

- 9.2.1 GOOD STORAGE VIABILITY TO DRIVE SEGMENT GROWTH

- 9.3 LIQUID

- 9.3.1 GREATER DEGREE OF DISPERSION PROPERTY OFFERED BY LIQUID NEMATICIDES TO DRIVE DEMAND

10 NEMATICIDES MARKET, BY MODE OF APPLICATION

- 10.1 INTRODUCTION

- 10.2 FUMIGATION

- 10.2.1 LOWER COSTS INVOLVED IN FUMIGATION FOR NEMATODE CONTROL TO PROPEL GROWTH

- 10.3 DRENCHING

- 10.3.1 PRECISE APPLICATION AND DEEP PENETRATION OF NEMATICIDES ON TARGET NEMATODES TO DRIVE DEMAND

- 10.4 SOIL DRESSING

- 10.4.1 EFFECTIVE MANAGEMENT OF EARLY SEASON NEMATODE TO DRIVE DEMAND

- 10.5 SEED TREATMENT

- 10.5.1 SAFER APPLICATION AND EARLY SEASON PROTECTION AGAINST NEMATODE TO AUGMENT DEMAND

- 10.6 OTHER MODES OF APPLICATION

11 NEMATICIDES MARKET, BY CROP TYPE

- 11.1 INTRODUCTION

- 11.2 CEREALS & GRAINS

- 11.2.1 RISE IN CONSUMPTION AND EXTENSIVE CULTIVATION AREA TO DRIVE MARKET

- 11.2.2 CORN

- 11.2.3 WHEAT

- 11.2.4 RICE

- 11.2.5 OTHER CEREALS & GRAINS

- 11.3 OILSEEDS & PULSES

- 11.3.1 INCREASE IN CONSUMPTION OF PROTEIN- AND HEALTHY FAT-RICH MEALS TO DRIVE SEGMENTAL GROWTH

- 11.3.2 SOYBEAN

- 11.3.3 SUNFLOWER

- 11.3.4 OTHER OILSEEDS & PULSES

- 11.4 FRUITS & VEGETABLES

- 11.4.1 RISE IN EXPORTS OF FRESH, FROZEN, AND PROCESSED FRUITS & VEGETABLES FROM SOUTH ASIA TO DRIVE DEMAND

- 11.4.2 POME FRUITS

- 11.4.3 CITRUS FRUITS

- 11.4.4 LEAFY VEGETABLES

- 11.4.5 BERRIES

- 11.4.6 ROOTS & TUBERS VEGETABLES

- 11.4.7 OTHER FRUITS & VEGETABLES

- 11.5 OTHER CROP TYPES

12 NEMATICIDES MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 US

- 12.2.1.1 Research undertaken to introduce nematode-resistant vegetables and field crops to drive market

- 12.2.2 CANADA

- 12.2.2.1 Losses in high-value cash crops to drive adoption of nematicides

- 12.2.3 MEXICO

- 12.2.3.1 Increase in root-knot and root-lesion nematode infestation in wheat to fuel market

- 12.2.1 US

- 12.3 EUROPE

- 12.3.1 GERMANY

- 12.3.1.1 Environment-friendly and organic farming practices to cater to nematode attacks in field crops

- 12.3.2 UK

- 12.3.2.1 High demand for nematicides since farmers still use traditional farming methods

- 12.3.3 FRANCE

- 12.3.3.1 Extensive government funds in R&D to devise sustainable methods for nematode control

- 12.3.4 SPAIN

- 12.3.4.1 Surge in government initiatives to encourage use of biological nematicides

- 12.3.5 ITALY

- 12.3.5.1 Adoption of sustainable farming procedures to drive market

- 12.3.6 REST OF EUROPE

- 12.3.1 GERMANY

- 12.4 ASIA PACIFIC

- 12.4.1 CHINA

- 12.4.1.1 Rise in infestation by root-knot nematodes in crops to propel market

- 12.4.2 JAPAN

- 12.4.2.1 Rising demand for novel nematicides catering to long-term viability of crops to drive growth

- 12.4.3 INDIA

- 12.4.3.1 Protected environment in polyhouses to create favorable environment for root-knot nematodes

- 12.4.4 AUSTRALIA & NEW ZEALAND

- 12.4.4.1 Increase in canola losses due to nematode attacks to support adoption of nematicides

- 12.4.5 REST OF ASIA PACIFIC

- 12.4.1 CHINA

- 12.5 SOUTH AMERICA

- 12.5.1 ARGENTINA

- 12.5.1.1 Increasing focus on soybean and corn cultivation to boost demand for nematicides

- 12.5.2 BRAZIL

- 12.5.2.1 High adoption of genetically modified crops to increase usage of nematicides

- 12.5.3 REST OF SOUTH AMERICA

- 12.5.1 ARGENTINA

- 12.6 REST OF THE WORLD (ROW)

- 12.6.1 MIDDLE EAST

- 12.6.1.1 Rise in population, high dependency on imports, and yield loss due to nematodes to boost market

- 12.6.2 AFRICA

- 12.6.2.1 Growth in demand for vegetable crops to drive growth

- 12.6.1 MIDDLE EAST

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- 13.3 REVENUE ANALYSIS, 2020-2024

- 13.4 MARKET SHARE ANALYSIS, 2024

- 13.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- 13.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.5.5.1 Company footprint

- 13.5.5.2 Region footprint

- 13.5.5.3 Type footprint

- 13.5.5.4 Formulation footprint

- 13.5.5.5 Crop type footprint

- 13.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- 13.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.6.5.1 Detailed list of key startups/SMEs

- 13.6.5.2 Competitive benchmarking of key startups/SMEs

- 13.7 COMPANY VALUATION AND FINANCIAL METRICS

- 13.8 BRAND/PRODUCT COMPARISON

- 13.9 COMPETITIVE SCENARIO AND TRENDS

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 BASF SE

- 14.1.1.1 Business overview

- 14.1.1.2 Products offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.4 MnM view

- 14.1.1.4.1 Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 SYNGENTA

- 14.1.2.1 Business overview

- 14.1.2.2 Products offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 CORTEVA

- 14.1.3.1 Business overview

- 14.1.3.2 Products offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches

- 14.1.3.3.2 Expansions

- 14.1.3.4 MnM view

- 14.1.3.4.1 Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 UPL

- 14.1.4.1 Business overview

- 14.1.4.2 Products offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches

- 14.1.4.3.2 Deals

- 14.1.4.4 MnM view

- 14.1.4.4.1 Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 BAYER AG

- 14.1.5.1 Business overview

- 14.1.5.2 Products offered

- 14.1.5.3 MnM view

- 14.1.5.3.1 Right to win

- 14.1.5.3.2 Strategic choices

- 14.1.5.3.3 Weaknesses and competitive threats

- 14.1.6 FMC CORPORATION

- 14.1.6.1 Business overview

- 14.1.6.2 Products offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Deals

- 14.1.6.3.2 Expansions

- 14.1.7 SUMITOMO CHEMICAL CO., LTD.

- 14.1.7.1 Business overview

- 14.1.7.2 Products offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Deals

- 14.1.7.3.2 Expansions

- 14.1.8 NUFARM

- 14.1.8.1 Business overview

- 14.1.8.2 Products offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Other developments

- 14.1.9 AMERICAN VANGUARD CORPORATION

- 14.1.9.1 Business overview

- 14.1.9.2 Products offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Deals

- 14.1.10 NOVONESIS GROUP

- 14.1.10.1 Business overview

- 14.1.10.2 Products offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Deals

- 14.1.11 BIOCERES CROP SOLUTIONS

- 14.1.11.1 Business overview

- 14.1.11.2 Products offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Product launches

- 14.1.11.3.2 Deals

- 14.1.12 GOWAN COMPANY

- 14.1.12.1 Business overview

- 14.1.12.2 Products offered

- 14.1.13 CERTIS USA L.L.C.

- 14.1.13.1 Business overview

- 14.1.13.2 Products offered

- 14.1.13.3 Recent developments

- 14.1.13.3.1 Deals

- 14.1.13.3.2 Other developments

- 14.1.14 LALLEMAND INC

- 14.1.14.1 Business overview

- 14.1.14.2 Products offered

- 14.1.14.3 Recent developments

- 14.1.14.3.1 Product launches

- 14.1.15 AECI PLANT HEALTH

- 14.1.15.1 Business overview

- 14.1.15.2 Products offered

- 14.1.1 BASF SE

- 14.2 OTHER PLAYERS

- 14.2.1 ANDERMATT GROUP AG

- 14.2.1.1 Business overview

- 14.2.1.2 Products offered

- 14.2.2 IPL BIOLOGICALS

- 14.2.2.1 Business overview

- 14.2.2.2 Products offered

- 14.2.2.3 Recent developments

- 14.2.2.3.1 Expansions

- 14.2.3 PHERONYM, INC.

- 14.2.3.1 Business overview

- 14.2.3.2 Products offered

- 14.2.4 AGRILIFE

- 14.2.4.1 Business overview

- 14.2.4.2 Products offered

- 14.2.5 CROP IQ TECHNOLOGY

- 14.2.5.1 Business overview

- 14.2.5.2 Products offered

- 14.2.5.3 Recent developments

- 14.2.5.3.1 Expansions

- 14.2.6 ROVENSA NEXT

- 14.2.7 BIONEMA

- 14.2.8 BIOCONSORTIA

- 14.2.9 VIVE CROP PROTECTION INC.

- 14.2.10 VEGALAB SA

- 14.2.1 ANDERMATT GROUP AG

15 ADJACENT AND RELATED MARKETS

- 15.1 INTRODUCTION

- 15.2 LIMITATIONS

- 15.3 CROP PROTECTION CHEMICALS MARKET

- 15.3.1 MARKET DEFINITION

- 15.3.2 MARKET OVERVIEW

- 15.4 BIORATIONAL PESTICIDES MARKET

- 15.4.1 MARKET DEFINITION

- 15.4.2 MARKET OVERVIEW

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 AVAILABLE CUSTOMIZATION

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

List of Tables

- TABLE 1 NEMATICIDES MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES CONSIDERED, 2020-2024

- TABLE 3 KEY DATA FROM PRIMARY SOURCES

- TABLE 4 NEMATICIDES MARKET SNAPSHOT, 2025 VS. 2030

- TABLE 5 AVERAGE ANNUAL MONETARY LOSS CAUSED BY PLANT PARASITIC NEMATODES TO ECONOMICALLY IMPORTANT CROPS

- TABLE 6 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 7 EXPORT VALUE OF HS CODE 3808, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 8 IMPORT VALUE OF HS CODE 3808, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 9 PRICING RANGE OF NEMATICIDE TYPES, BY KEY PLAYER, 2024 (USD/KG)

- TABLE 10 PRICING TREND, BY NEMATICIDE TYPE, 2020-2024 (USD/KG)

- TABLE 11 PRICING TREND OF NEMATICIDE PRODUCTS, BY REGION, 2020-2024 (USD/KG)

- TABLE 12 NEMATICIDES MARKET: ECOSYSTEM

- TABLE 13 KEY PATENTS PERTAINING TO NEMATICIDES, 2015-2025

- TABLE 14 NEMATICIDES MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 REST OF WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 IMPACT OF PORTER'S FIVE FORCES ON NEMATICIDES MARKET

- TABLE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY MODE OF APPLICATION

- TABLE 22 KEY BUYING CRITERIA, BY MODE OF APPLICATION

- TABLE 23 NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 24 NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 25 NEMATICIDES MARKET, BY TYPE, 2020-2024 (TONS)

- TABLE 26 NEMATICIDES MARKET, BY TYPE, 2025-2030 (TONS)

- TABLE 27 CHEMICAL: NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 28 CHEMICAL: NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 29 CHEMICAL: NEMATICIDES MARKET, BY TYPE, 2020-2024 (TONS)

- TABLE 30 CHEMICAL: NEMATICIDES MARKET, BY TYPE, 2025-2030 (TONS)

- TABLE 31 CHEMICAL: NEMATICIDES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 32 CHEMICAL: NEMATICIDES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 CHEMICAL: NEMATICIDES MARKET, BY REGION, 2020-2024 (TONS)

- TABLE 34 CHEMICAL: NEMATICIDES MARKET, BY REGION, 2025-2030 (TONS)

- TABLE 35 FUMIGANTS APPLIED TO AGRONOMIC CROPS

- TABLE 36 FUMIGANTS: CHEMICAL NEMATICIDES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 37 FUMIGANTS: CHEMICAL NEMATICIDES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 FUMIGANTS: CHEMICAL NEMATICIDES MARKET, BY REGION, 2020-2024 (TONS)

- TABLE 39 FUMIGANTS: CHEMICAL NEMATICIDES MARKET, BY REGION, 2025-2030 (TONS)

- TABLE 40 FUMIGANTS: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 41 FUMIGANTS: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 42 NON-FUMIGANTS: CHEMICAL NEMATICIDES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 43 NON-FUMIGANTS: CHEMICAL NEMATICIDES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 NON-FUMIGANTS: CHEMICAL NEMATICIDES MARKET, BY REGION, 2020-2024 (TONS)

- TABLE 45 NON-FUMIGANTS: CHEMICAL NEMATICIDES MARKET, BY REGION, 2025-2030 (TONS)

- TABLE 46 NON-FUMIGANTS: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 47 NON-FUMIGANTS: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 48 NON-FUMIGANTS: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (TONS)

- TABLE 49 NON-FUMIGANTS: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (TONS)

- TABLE 50 CROPS RECEIVING CARBAMATE APPLICATIONS

- TABLE 51 CARBAMATES: NON-FUMIGANT NEMATICIDES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 52 CARBAMATES: NON-FUMIGANT NEMATICIDES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 CARBAMATES: NON-FUMIGANT NEMATICIDES MARKET, BY REGION, 2020-2024 (TONS)

- TABLE 54 CARBAMATES: NON-FUMIGANT NEMATICIDES MARKET, BY REGION, 2025-2030 (TONS)

- TABLE 55 ORGANOPHOSPHATES: NON-FUMIGANT NEMATICIDES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 56 ORGANOPHOSPHATES: NON-FUMIGANT NEMATICIDES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 ORGANOPHOSPHATES: NON-FUMIGANT NEMATICIDES MARKET, BY REGION, 2020-2024 (TONS)

- TABLE 58 ORGANOPHOSPHATES: NON-FUMIGANT NEMATICIDES MARKET, BY REGION, 2025-2030 (TONS)

- TABLE 59 ABAMECTIN: NON-FUMIGANT NEMATICIDES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 60 ABAMECTIN: NON-FUMIGANT NEMATICIDES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 ABAMECTIN: NON-FUMIGANT NEMATICIDES MARKET, BY REGION, 2020-2024 (TONS)

- TABLE 62 ABAMECTIN: NON-FUMIGANT NEMATICIDES MARKET, BY REGION, 2025-2030 (TONS)

- TABLE 63 SUCCINATE DEHYDROGENASE INHIBITORS: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 64 SUCCINATE DEHYDROGENASE INHIBITORS: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 65 SUCCINATE DEHYDROGENASE INHIBITORS: NON-FUMIGANT NEMATICIDES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 66 SUCCINATE DEHYDROGENASE INHIBITORS: NON-FUMIGANT NEMATICIDES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 SUCCINATE DEHYDROGENASE INHIBITORS: NON-FUMIGANT NEMATICIDES MARKET, BY REGION, 2020-2024 (TONS)

- TABLE 68 SUCCINATE DEHYDROGENASE INHIBITORS: NON-FUMIGANT NEMATICIDES MARKET, BY REGION, 2025-2030 (TONS)

- TABLE 69 OTHERS: NON-FUMIGANT NEMATICIDES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 70 OTHERS: NON-FUMIGANT NEMATICIDES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 OTHERS: NON-FUMIGANT NEMATICIDES MARKET, BY REGION, 2020-2024 (TONS)

- TABLE 72 OTHERS: NON-FUMIGANT NEMATICIDES MARKET, BY REGION, 2025-2030 (TONS)

- TABLE 73 BIOLOGICAL: NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 74 BIOLOGICAL: NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 75 BIOLOGICAL: NEMATICIDES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 76 BIOLOGICAL: NEMATICIDES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 BIOLOGICAL: NEMATICIDES MARKET, BY REGION, 2020-2024 (TONS)

- TABLE 78 BIOLOGICAL: NEMATICIDES MARKET, BY REGION, 2025-2030 (TONS)

- TABLE 79 MICROBIALS: BIOLOGICAL NEMATICIDES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 80 MICROBIALS: BIOLOGICAL NEMATICIDES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 BIOCHEMICALS: BIOLOGICAL NEMATICIDES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 82 BIOCHEMICALS: BIOLOGICAL NEMATICIDES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 83 MOST COMMON NEMATODE SPECIES

- TABLE 84 NEMATICIDES MARKET, BY NEMATODE TYPE, 2020-2024 (USD MILLION)

- TABLE 85 NEMATICIDES MARKET, BY NEMATODE TYPE, 2025-2030 (USD MILLION)

- TABLE 86 ROOT-KNOT NEMATODES: NEMATICIDES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 87 ROOT-KNOT NEMATODES: NEMATICIDES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 88 ROOT-KNOT NEMATODES: NEMATICIDES MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 89 ROOT-KNOT NEMATODES: NEMATICIDES MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 90 ECONOMIC LOSSES IN VEGETABLE CROPS DUE TO ROOT-KNOT NEMATODES

- TABLE 91 CYST NEMATODES: NEMATICIDES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 92 CYST NEMATODES: NEMATICIDES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 93 CYST NEMATODES: NEMATICIDES MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 94 CYST NEMATODES: NEMATICIDES MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 95 LESION NEMATODES: NEMATICIDES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 96 LESION NEMATODES: NEMATICIDES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 97 LESION NEMATODES: NEMATICIDES MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 98 LESION NEMATODES: NEMATICIDES MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 99 OTHER NEMATODE TYPES: NEMATICIDES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 100 OTHER NEMATODE TYPES: NEMATICIDES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 101 OTHER NEMATODE TYPES: NEMATICIDES MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 102 OTHER NEMATODE TYPES: NEMATICIDES MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 103 NEMATICIDES MARKET, BY FORMULATION, 2020-2024 (USD MILLION)

- TABLE 104 NEMATICIDES MARKET, BY FORMULATION, 2025-2030 (USD MILLION)

- TABLE 105 GRANULAR NEMATICIDES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 106 GRANULAR NEMATICIDES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 107 LIQUID NEMATICIDES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 108 LIQUID NEMATICIDES MARKET, BY REGION, 2025-2030(USD MILLION)

- TABLE 109 NEMATICIDES MARKET, BY MODE OF APPLICATION, 2020-2024 (USD MILLION)

- TABLE 110 NEMATICIDES MARKET, BY MODE OF APPLICATION, 2025-2030 (USD MILLION)

- TABLE 111 NEMATICIDES MARKET, BY MODE OF APPLICATION, 2020-2024 (TONS)

- TABLE 112 NEMATICIDES MARKET, BY MODE OF APPLICATION, 2025-2030 (TONS)

- TABLE 113 FUMIGATION: NEMATICIDES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 114 FUMIGATION: NEMATICIDES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 115 FUMIGATION: NEMATICIDES MARKET, BY REGION, 2020-2024 (TONS)

- TABLE 116 FUMIGATION: NEMATICIDES MARKET, BY REGION, 2025-2030 (TONS)

- TABLE 117 DRENCHING: NEMATICIDES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 118 DRENCHING: NEMATICIDES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 119 DRENCHING: NEMATICIDES MARKET, BY REGION, 2020-2024 (TONS)

- TABLE 120 DRENCHING: NEMATICIDES MARKET, BY REGION, 2025-2030 (TONS)

- TABLE 121 SOIL DRESSING: NEMATICIDES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 122 SOIL DRESSING: NEMATICIDES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 123 SOIL DRESSING: NEMATICIDES MARKET, BY REGION, 2020-2024 (TONS)

- TABLE 124 SOIL DRESSING: NEMATICIDES MARKET, BY REGION, 2025-2030 (TONS)

- TABLE 125 SEED TREATMENT: NEMATICIDES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 126 SEED TREATMENT: NEMATICIDES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 127 SEED TREATMENT: NEMATICIDES MARKET, BY REGION, 2020-2024 (TONS)

- TABLE 128 SEED TREATMENT: NEMATICIDES MARKET, BY REGION, 2025-2030 (TONS)

- TABLE 129 OTHER MODES OF APPLICATION: NEMATICIDES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 130 OTHER MODES OF APPLICATION: NEMATICIDES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 131 OTHER MODES OF APPLICATION: NEMATICIDES MARKET, BY REGION, 2020-2024 (TONS)

- TABLE 132 OTHER MODES OF APPLICATION: NEMATICIDES MARKET, BY REGION, 2025-2030 (TONS)

- TABLE 133 NEMATICIDES MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 134 NEMATICIDES MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 135 CEREALS & GRAINS: NEMATICIDES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 136 CEREALS & GRAINS: NEMATICIDES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 137 CEREALS & GRAINS: NEMATICIDES MARKET, BY CROP SUB-TYPE, 2020-2024 (USD MILLION)

- TABLE 138 CEREALS & GRAINS: NEMATICIDES MARKET, BY CROP SUB-TYPE, 2025-2030 (USD MILLION)

- TABLE 139 NEMATODE TYPES AFFECTING CORN

- TABLE 140 OILSEEDS & PULSES: NEMATICIDES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 141 OILSEEDS & PULSES: NEMATICIDES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 142 OILSEEDS & PULSES: NEMATICIDES MARKET, BY CROP SUB-TYPE, 2020-2024 (USD MILLION)

- TABLE 143 OILSEEDS & PULSES: NEMATICIDES MARKET, BY CROP SUB-TYPE, 2025-2030 (USD MILLION)

- TABLE 144 FRUITS & VEGETABLES: NEMATICIDES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 145 FRUITS & VEGETABLES: NEMATICIDES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 146 FRUITS & VEGETABLES: NEMATICIDES MARKET, BY CROP SUB-TYPE, 2020-2024 (USD MILLION)

- TABLE 147 FRUITS & VEGETABLES: NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 148 OTHER CROP TYPES: NEMATICIDES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 149 OTHER CROP TYPES: NEMATICIDES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 150 NEMATICIDES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 151 NEMATICIDES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 152 NEMATICIDES MARKET, BY REGION, 2020-2024 (TON)

- TABLE 153 NEMATICIDES MARKET, BY REGION, 2025-2030 (TON)

- TABLE 154 NORTH AMERICA: NEMATICIDES MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 155 NORTH AMERICA: NEMATICIDES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 156 NORTH AMERICA: NEMATICIDES MARKET, BY COUNTRY, 2020-2024 (TON)

- TABLE 157 NORTH AMERICA: NEMATICIDES MARKET, BY COUNTRY, 2025-2030 (TON)

- TABLE 158 NORTH AMERICA: NEMATICIDES MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 159 NORTH AMERICA: NEMATICIDES MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 160 NORTH AMERICA: NEMATICIDES MARKET, BY NEMATODE TYPE, 2020-2024 (USD MILLION)

- TABLE 161 NORTH AMERICA: NEMATICIDES MARKET, BY NEMATODE TYPE, 2025-2030 (USD MILLION)

- TABLE 162 NORTH AMERICA: NEMATICIDES MARKET, BY FORMULATION, 2020-2024 (USD MILLION)

- TABLE 163 NORTH AMERICA: NEMATICIDES MARKET, BY FORMULATION, 2025-2030 (USD MILLION)

- TABLE 164 NORTH AMERICA: NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 165 NORTH AMERICA: NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 166 NORTH AMERICA: NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 167 NORTH AMERICA: NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 168 NORTH AMERICA: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 169 NORTH AMERICA: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 170 NORTH AMERICA: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 171 NORTH AMERICA: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 172 NORTH AMERICA: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 173 NORTH AMERICA: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 174 NORTH AMERICA: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 175 NORTH AMERICA: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 176 NORTH AMERICA: BIOLOGICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 177 NORTH AMERICA: BIOLOGICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 178 NORTH AMERICA: NEMATICIDES MARKET, BY MODE OF APPLICATION, 2020-2024 (USD MILLION)

- TABLE 179 NORTH AMERICA: NEMATICIDES MARKET, BY MODE OF APPLICATION, 2025-2030 (USD MILLION)

- TABLE 180 NORTH AMERICA: NEMATICIDES MARKET, BY MODE OF APPLICATION, 2020-2024 (TON)

- TABLE 181 NORTH AMERICA: NEMATICIDES MARKET, BY MODE OF APPLICATION, 2025-2030 (TON)

- TABLE 182 US: NEMATODE SPECIES AND THEIR PREVALENCE

- TABLE 183 US: NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 184 US: NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 185 US: NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 186 US: NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 187 US: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 188 US: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 189 US: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 190 US: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 191 US: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 192 US: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 193 US: NEMATICIDES MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 194 US: NEMATICIDES MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 195 CANADA: CROPS INFESTED BY NEMATODES

- TABLE 196 CANADA: NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 197 CANADA: NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 198 CANADA: NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 199 CANADA: NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 200 CANADA: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 201 CANADA: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 202 CANADA: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 203 CANADA: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 204 CANADA: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 205 CANADA: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 206 CANADA: NEMATICIDES MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 207 CANADA: NEMATICIDES MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 208 MEXICO: NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 209 MEXICO: NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 210 MEXICO: NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 211 MEXICO: NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 212 MEXICO: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 213 MEXICO: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 214 MEXICO: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 215 MEXICO: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 216 MEXICO: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 217 MEXICO: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 218 MEXICO: NEMATICIDES MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 219 MEXICO: NEMATICIDES MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 220 EUROPE: NEMATICIDES MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 221 EUROPE: NEMATICIDES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 222 EUROPE: NEMATICIDES MARKET, BY COUNTRY, 2020-2024 (TON)

- TABLE 223 EUROPE: NEMATICIDES MARKET, BY COUNTRY, 2025-2030 (TON)

- TABLE 224 EUROPE: NEMATICIDES MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 225 EUROPE: NEMATICIDES MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 226 EUROPE: NEMATICIDES MARKET, BY NEMATODE TYPE, 2020-2024 (USD MILLION)

- TABLE 227 EUROPE: NEMATICIDES MARKET, BY NEMATODE TYPE, 2025-2030 (USD MILLION)

- TABLE 228 EUROPE: NEMATICIDES MARKET, BY FORMULATION, 2020-2024 (USD MILLION)

- TABLE 229 EUROPE: NEMATICIDES MARKET, BY FORMULATION, 2025-2030 (USD MILLION)

- TABLE 230 EUROPE: NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 231 EUROPE: NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 232 EUROPE: NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 233 EUROPE: NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 234 EUROPE: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 235 EUROPE: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 236 EUROPE: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 237 EUROPE: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 238 EUROPE: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 239 EUROPE: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 240 EUROPE: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 241 EUROPE: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 242 EUROPE: BIOLOGICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 243 EUROPE: BIOLOGICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 244 EUROPE: NEMATICIDES MARKET, BY MODE OF APPLICATION, 2020-2024 (USD MILLION)

- TABLE 245 EUROPE: NEMATICIDES MARKET, BY MODE OF APPLICATION, 2025-2030 (USD MILLION)

- TABLE 246 EUROPE: NEMATICIDES MARKET, BY MODE OF APPLICATION, 2020-2024 (TON)

- TABLE 247 EUROPE: NEMATICIDES MARKET, BY MODE OF APPLICATION, 2025-2030 (TON)

- TABLE 248 GERMANY: NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 249 GERMANY: NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 250 GERMANY: NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 251 GERMANY: NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 252 GERMANY: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 253 GERMANY: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 254 GERMANY: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 255 GERMANY: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 256 GERMANY: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 257 GERMANY: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 258 GERMANY: NEMATICIDES MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 259 GERMANY: NEMATICIDES MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 260 UK: NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 261 UK: NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 262 UK: NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 263 UK: NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 264 UK: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 265 UK: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 266 UK: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 267 UK: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 268 UK: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 269 UK: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 270 UK: NEMATICIDES MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 271 UK: NEMATICIDES MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 272 FRANCE: NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 273 FRANCE: NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 274 FRANCE: NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 275 FRANCE: NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 276 FRANCE: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 277 FRANCE: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 278 FRANCE: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 279 FRANCE: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 280 FRANCE: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 281 FRANCE: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 282 FRANCE: NEMATICIDES MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 283 FRANCE: NEMATICIDES MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 284 SPAIN: NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 285 SPAIN: NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 286 SPAIN: NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 287 SPAIN: NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 288 SPAIN: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 289 SPAIN: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 290 SPAIN: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 291 SPAIN: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 292 SPAIN: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 293 SPAIN: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 294 SPAIN: NEMATICIDES MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 295 SPAIN: NEMATICIDES MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 296 ITALY: NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 297 ITALY: NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 298 ITALY: NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 299 ITALY: NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 300 ITALY: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 301 ITALY: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 302 ITALY: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 303 ITALY: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 304 ITALY: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 305 ITALY: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 306 ITALY: NEMATICIDES MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 307 ITALY: NEMATICIDES MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 308 REST OF EUROPE: NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 309 REST OF EUROPE: NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 310 REST OF EUROPE: NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 311 REST OF EUROPE: NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 312 REST OF EUROPE: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 313 REST OF EUROPE: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 314 REST OF EUROPE: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 315 REST OF EUROPE: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 316 REST OF EUROPE: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 317 REST OF EUROPE: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 318 REST OF EUROPE: NEMATICIDES MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 319 REST OF EUROPE: NEMATICIDES MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 320 ASIA PACIFIC: NEMATICIDES MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 321 ASIA PACIFIC: NEMATICIDES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 322 ASIA PACIFIC: NEMATICIDES MARKET, BY COUNTRY, 2020-2024 (TON)

- TABLE 323 ASIA PACIFIC: NEMATICIDES MARKET, BY COUNTRY, 2025-2030 (TON)

- TABLE 324 ASIA PACIFIC: NEMATICIDES MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 325 ASIA PACIFIC: NEMATICIDES MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 326 ASIA PACIFIC: NEMATICIDES MARKET, BY NEMATODE TYPE, 2020-2024 (USD MILLION)

- TABLE 327 ASIA PACIFIC: NEMATICIDES MARKET, BY NEMATODE TYPE, 2025-2030 (USD MILLION)

- TABLE 328 ASIA PACIFIC: NEMATICIDES MARKET, BY FORMULATION, 2020-2024 (USD MILLION)

- TABLE 329 ASIA PACIFIC: NEMATICIDES MARKET, BY FORMULATION, 2025-2030 (USD MILLION)

- TABLE 330 ASIA PACIFIC: NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 331 ASIA PACIFIC: NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 332 ASIA PACIFIC: NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 333 ASIA PACIFIC: NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 334 ASIA PACIFIC: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 335 ASIA PACIFIC: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 336 ASIA PACIFIC: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 337 ASIA PACIFIC: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 338 ASIA PACIFIC: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 339 ASIA PACIFIC: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 340 ASIA PACIFIC: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 341 ASIA PACIFIC: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 342 ASIA PACIFIC: BIOLOGICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 343 ASIA PACIFIC: BIOLOGICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 344 ASIA PACIFIC: NEMATICIDES MARKET, BY MODE OF APPLICATION, 2020-2024 (USD MILLION)

- TABLE 345 ASIA PACIFIC: NEMATICIDES MARKET, BY MODE OF APPLICATION, 2025-2030 (USD MILLION)

- TABLE 346 ASIA PACIFIC: NEMATICIDES MARKET, BY MODE OF APPLICATION, 2020-2024 (TON)

- TABLE 347 ASIA PACIFIC: NEMATICIDES MARKET, BY MODE OF APPLICATION, 2025-2030 (TON)

- TABLE 348 CHINA: NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 349 CHINA: NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 350 CHINA: NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 351 CHINA: NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 352 CHINA: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 353 CHINA: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 354 CHINA: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 355 CHINA: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 356 CHINA: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 357 CHINA: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 358 CHINA: NEMATICIDES MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 359 CHINA: NEMATICIDES MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 360 JAPAN: MAJOR CROPS INFESTED BY NEMATODES

- TABLE 361 JAPAN: NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 362 JAPAN: NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 363 JAPAN: NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 364 JAPAN: NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 365 JAPAN: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 366 JAPAN: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 367 JAPAN: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 368 JAPAN: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 369 JAPAN: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 370 JAPAN: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 371 JAPAN: NEMATICIDES MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 372 JAPAN: NEMATICIDES MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 373 INDIA: NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 374 INDIA: NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 375 INDIA: NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 376 INDIA: NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 377 INDIA: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 378 INDIA: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 379 INDIA: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 380 INDIA: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 381 INDIA: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 382 INDIA: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 383 INDIA: NEMATICIDES MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 384 INDIA: NEMATICIDES MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 385 AUSTRALIA & NEW ZEALAND: NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 386 AUSTRALIA & NEW ZEALAND: NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 387 AUSTRALIA & NEW ZEALAND: NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 388 AUSTRALIA & NEW ZEALAND: NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 389 AUSTRALIA & NEW ZEALAND: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 390 AUSTRALIA & NEW ZEALAND: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 391 AUSTRALIA & NEW ZEALAND: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 392 AUSTRALIA & NEW ZEALAND: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 393 AUSTRALIA & NEW ZEALAND: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 394 AUSTRALIA & NEW ZEALAND: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 395 AUSTRALIA & NEW ZEALAND: NEMATICIDES MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 396 AUSTRALIA & NEW ZEALAND: NEMATICIDES MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 397 REST OF ASIA PACIFIC: NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 398 REST OF ASIA PACIFIC: NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 399 REST OF ASIA PACIFIC: NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 400 REST OF ASIA PACIFIC: NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 401 REST OF ASIA PACIFIC: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 402 REST OF ASIA PACIFIC: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 403 REST OF ASIA PACIFIC: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 404 REST OF ASIA PACIFIC: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 405 REST OF ASIA PACIFIC: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 406 REST OF ASIA PACIFIC: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 407 REST OF ASIA PACIFIC: NEMATICIDES MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 408 REST OF ASIA PACIFIC: NEMATICIDES MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 409 SOUTH AMERICA: NEMATICIDES MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 410 SOUTH AMERICA: NEMATICIDES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 411 SOUTH AMERICA: NEMATICIDES MARKET, BY COUNTRY, 2020-2024 (TON)

- TABLE 412 SOUTH AMERICA: NEMATICIDES MARKET, BY COUNTRY, 2025-2030 (TON)

- TABLE 413 SOUTH AMERICA: NEMATICIDES MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 414 SOUTH AMERICA: NEMATICIDES MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 415 SOUTH AMERICA: NEMATICIDES MARKET, BY NEMATODE TYPE, 2020-2024 (USD MILLION)

- TABLE 416 SOUTH AMERICA: NEMATICIDES MARKET, BY NEMATODE TYPE, 2025-2030 (USD MILLION)

- TABLE 417 SOUTH AMERICA: NEMATICIDES MARKET, BY FORMULATION, 2020-2024 (USD MILLION)

- TABLE 418 SOUTH AMERICA: NEMATICIDES MARKET, BY FORMULATION, 2025-2030 (USD MILLION)

- TABLE 419 SOUTH AMERICA: NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 420 SOUTH AMERICA: NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 421 SOUTH AMERICA: NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 422 SOUTH AMERICA: NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 423 SOUTH AMERICA: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 424 SOUTH AMERICA: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 425 SOUTH AMERICA: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 426 SOUTH AMERICA: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 427 SOUTH AMERICA: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 428 SOUTH AMERICA: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 429 SOUTH AMERICA: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 430 SOUTH AMERICA: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 431 SOUTH AMERICA: BIOLOGICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 432 SOUTH AMERICA: BIOLOGICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 433 SOUTH AMERICA: NEMATICIDES MARKET, BY MODE OF APPLICATION, 2020-2024 (USD MILLION)

- TABLE 434 SOUTH AMERICA: NEMATICIDES MARKET, BY MODE OF APPLICATION, 2025-2030 (USD MILLION)

- TABLE 435 SOUTH AMERICA: NEMATICIDES MARKET, BY MODE OF APPLICATION, 2020-2024 (TON)

- TABLE 436 SOUTH AMERICA: NEMATICIDES MARKET, BY MODE OF APPLICATION, 2025-2030 (TON)

- TABLE 437 ARGENTINA: NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 438 ARGENTINA: NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 439 ARGENTINA: NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 440 ARGENTINA: NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 441 ARGENTINA: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 442 ARGENTINA: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 443 ARGENTINA: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 444 ARGENTINA: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 445 ARGENTINA: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 446 ARGENTINA: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 447 ARGENTINA: NEMATICIDES MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 448 ARGENTINA: NEMATICIDES MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 449 BRAZIL: MOST PREVALENT NEMATODE SPECIES

- TABLE 450 BRAZIL: NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 451 BRAZIL: NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 452 BRAZIL: NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 453 BRAZIL: NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 454 BRAZIL: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 455 BRAZIL: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 456 BRAZIL: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 457 BRAZIL: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 458 BRAZIL: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 459 BRAZIL: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 460 BRAZIL: NEMATICIDES MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 461 BRAZIL: NEMATICIDES MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 462 REST OF SOUTH AMERICA: NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 463 REST OF SOUTH AMERICA: NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 464 REST OF SOUTH AMERICA: NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 465 REST OF SOUTH AMERICA: NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 466 REST OF SOUTH AMERICA: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 467 REST OF SOUTH AMERICA: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 468 REST OF SOUTH AMERICA: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 469 REST OF SOUTH AMERICA: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 470 REST OF SOUTH AMERICA: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 471 REST OF SOUTH AMERICA: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 472 REST OF SOUTH AMERICA: NEMATICIDES MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 473 REST OF SOUTH AMERICA: NEMATICIDES MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 474 ROW: NEMATICIDES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 475 ROW: NEMATICIDES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 476 ROW: NEMATICIDES MARKET, BY REGION, 2020-2024 (TON)

- TABLE 477 ROW: NEMATICIDES MARKET, BY REGION, 2025-2030 (TON)

- TABLE 478 ROW: NEMATICIDES MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 479 ROW: NEMATICIDES MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 480 ROW: NEMATICIDES MARKET, BY NEMATODE TYPE, 2020-2024 (USD MILLION)

- TABLE 481 ROW: NEMATICIDES MARKET, BY NEMATODE TYPE, 2025-2030 (USD MILLION)

- TABLE 482 ROW: NEMATICIDES MARKET, BY FORMULATION, 2020-2024 (USD MILLION)

- TABLE 483 ROW: NEMATICIDES MARKET, BY FORMULATION, 2025-2030 (USD MILLION)

- TABLE 484 ROW: NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 485 ROW: NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 486 ROW: NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 487 ROW: NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 488 ROW: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 489 ROW: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 490 ROW: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 491 ROW: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 492 ROW: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 493 ROW: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 494 ROW: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 495 ROW: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 496 ROW: BIOLOGICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 497 ROW: BIOLOGICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 498 ROW: NEMATICIDES MARKET, BY MODE OF APPLICATION, 2020-2024 (USD MILLION)

- TABLE 499 ROW: NEMATICIDES MARKET, BY MODE OF APPLICATION, 2025-2030 (USD MILLION)

- TABLE 500 ROW: NEMATICIDES MARKET, BY MODE OF APPLICATION, 2020-2024 (TON)

- TABLE 501 ROW: NEMATICIDES MARKET, BY MODE OF APPLICATION, 2025-2030 (TON)

- TABLE 502 MIDDLE EAST: NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 503 MIDDLE EAST: NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 504 MIDDLE EAST: NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 505 MIDDLE EAST: NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 506 MIDDLE EAST: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 507 MIDDLE EAST: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 508 MIDDLE EAST: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 509 MIDDLE EAST: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 510 MIDDLE EAST: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 511 MIDDLE EAST: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 512 MIDDLE EAST: NEMATICIDES MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 513 MIDDLE EAST: NEMATICIDES MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 514 SOUTH AFRICA: POPULAR WEED SPECIES AS HOSTS OF ROOT-KNOT NEMATODES

- TABLE 515 AFRICA: NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 516 AFRICA: NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 517 AFRICA: NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 518 AFRICA: NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 519 AFRICA: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 520 AFRICA: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 521 AFRICA: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2020-2024 (TON)

- TABLE 522 AFRICA: CHEMICAL NEMATICIDES MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 523 AFRICA: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 524 AFRICA: NON-FUMIGANT NEMATICIDES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 525 AFRICA: NEMATICIDES MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 526 AFRICA: NEMATICIDES MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 527 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN NEMATICIDES MARKET, 2020-2025

- TABLE 528 NEMATICIDES MARKET: DEGREE OF COMPETITION

- TABLE 529 NEMATICIDES MARKET: REGION FOOTPRINT

- TABLE 530 NEMATICIDES MARKET: TYPE FOOTPRINT

- TABLE 531 NEMATICIDES MARKET: FORMULATION FOOTPRINT

- TABLE 532 NEMATICIDES MARKET: CROP TYPE FOOTPRINT

- TABLE 533 NEMATICIDES MARKET: KEY STARTUPS/SMES

- TABLE 534 NEMATICIDES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024

- TABLE 535 NEMATICIDES MARKET: PRODUCT/SERVICE LAUNCHES, JANUARY 2020- JULY 2025

- TABLE 536 NEMATICIDES MARKET: DEALS, JANUARY 2020-JULY 2025

- TABLE 537 NEMATICIDES MARKET: EXPANSIONS, JANUARY 2020-JULY 2025

- TABLE 538 BASF SE: COMPANY OVERVIEW

- TABLE 539 BASF SE: PRODUCTS OFFERED

- TABLE 540 BASF SE: PRODUCT LAUNCHES

- TABLE 541 SYNGENTA: COMPANY OVERVIEW

- TABLE 542 SYNGENTA: PRODUCTS OFFERED

- TABLE 543 SYNGENTA: PRODUCT LAUNCHES

- TABLE 544 CORTEVA: COMPANY OVERVIEW

- TABLE 545 CORTEVA: PRODUCTS OFFERED

- TABLE 546 CORTEVA: PRODUCT LAUNCHES

- TABLE 547 CORTEVA: EXPANSIONS

- TABLE 548 UPL: COMPANY OVERVIEW