|

市場調查報告書

商品編碼

1822293

全球感測器貼片市場(按技術、穿戴式裝置類型、產品類型、應用、最終用途產業和地區分類)- 預測至 2030 年Sensor Patch Market by Wearable Type (Bodywear, Neckwear, Footwear, Wristwear), Product Type (Temperature, Blood Glucose, Blood Pressure, Heart Rate, ECG, Blood Oxygen, and Others), Application, End-use Industry and Region - Global Forecast to 2030 |

||||||

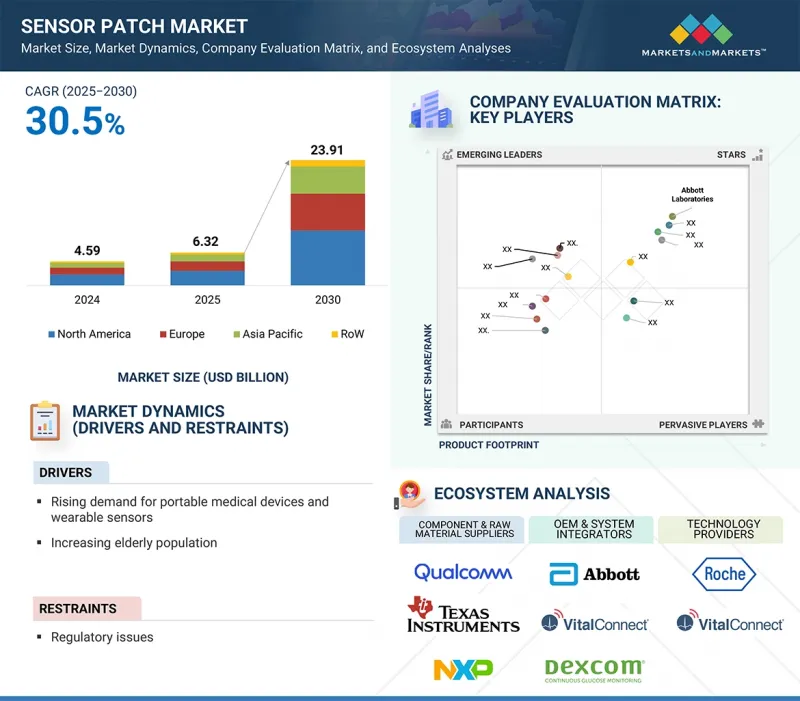

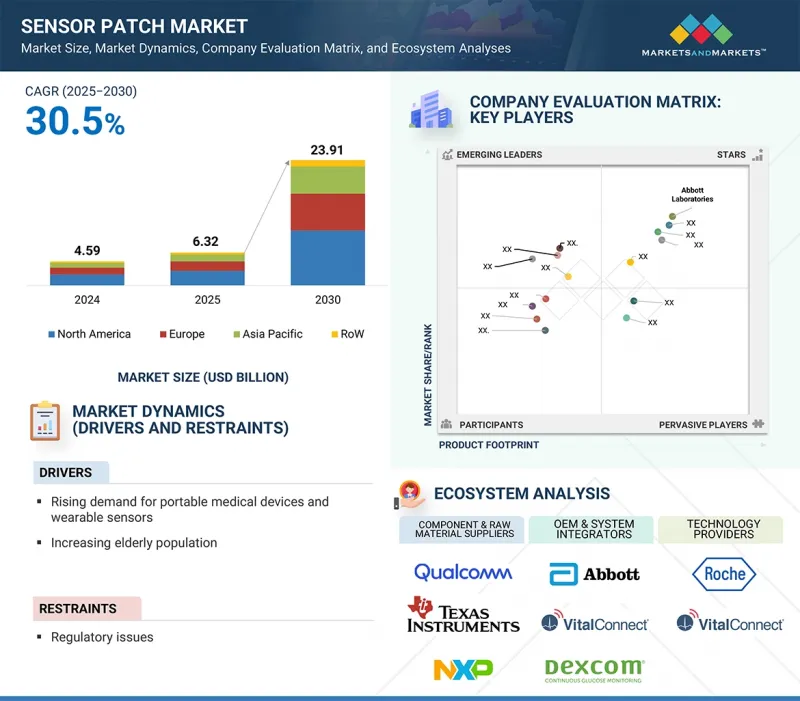

全球感測器貼片市場預計將從 2025 年的 63.2 億美元成長到 2030 年的 239.1 億美元,複合年成長率為 30.5%。

| 調查範圍 | |

|---|---|

| 調查年份 | 2021-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 對價單位 | 金額(十億美元) |

| 按細分市場 | 按技術、按穿戴設備類型、按產品類型、按應用、按最終用途行業、按地區 |

| 目標區域 | 北美、歐洲、亞太地區和其他地區 |

市場成長歸因於糖尿病患者擴大使用感測器貼片監測血糖濃度、老年人口的成長以及無線行動醫療醫療系統的普及。此外,遠端醫療的興起也推動了市場的成長。穿戴式感測器貼片擴大被用於持續監測患者、早產兒、兒童、運動員、健身愛好者以及遠離醫療衛生服務的偏遠地區的個人的生命徵象。

血糖感測器貼片可測量血液或汗水中的血糖值。這些貼片專為糖尿病患者、跑步者、騎乘者、運動員和競技者設計,用於追蹤血糖值。使用胰島素的糖尿病患者會監測血糖水平,以確定是否需要下次注射胰島素。血糖感測器貼片可用於血糖值和膽固醇檢測,以及藥物濫用、感染疾病和懷孕篩檢。主要的血糖監測儀和感測器製造商包括美敦力公司(美國)、雅培實驗室(美國)和 DexCom, Inc.(美國)。

貼身衣物包括臂飾、胸貼和配備感應器的隱形眼鏡。臂飾用於各種醫療保健應用,例如測量和監測血壓、體溫和心率。這些裝置可以透過藍牙連接到 iOS 或 Android 手機。胸帶佩戴在胸部,可在跑步時監測心率。運動員和健身愛好者使用這些設備。其他設備則配備感測器,可以測量汗液中的鈉含量並直接透過皮膚測量汗液的產生量。糖尿病患者可以使用由無線晶片組成的智慧隱形眼鏡。這些鏡片用於監測淚液中的血糖濃度。谷歌公司(美國)和諾華公司(瑞士)正在合作開發可以監測血糖值和矯正視力的智慧隱形眼鏡。

中國龐大的人口基數以及政府致力於發展現代醫療體系和相應報銷機制的舉措,是推動中國感測器貼片市場成長的關鍵因素。其他推動中國感測器貼片市場成長的因素包括快速的經濟成長、人口老化以及政府致力於改善醫療服務的努力。許多在中國的跨國公司(MNCs)、出口商和製造商正在採取收購和合作等策略,以建立可靠的國內分銷和服務基礎設施。隨著人口老化,包括心臟病在內的各種疾病的發生率預計將大幅上升。

本報告研究了全球感測器貼片市場,並按技術、穿戴式類型、產品類型、應用、最終用途行業、區域趨勢和公司概況對市場進行了細分。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章重要考察

第5章 市場概況

- 介紹

- 市場動態

- 價值鏈分析

- 生態系分析

- 影響客戶業務的趨勢/中斷

- 定價分析

- 技術分析

- 案例研究分析

- 投資金籌措場景

- 生成式人工智慧/人工智慧對感測器貼片市場的影響

- 專利分析

- 貿易分析

- 主要相關人員和採購標準

- 波特五力分析

- 2025-2026年主要會議和活動

- 監管現狀和標準

- 2025年美國關稅對感測器貼片市場的影響

6. 感測器貼片市場(按技術)

- 介紹

- 電流測量

- 電導率測量

- 電位器

7. 感測器貼片市場(依穿戴式裝置類型)

- 介紹

- 腕飾

- 鞋類

- 領帶

- 貼身衣物

第8章感測器貼片市場(依產品類型)

- 介紹

- 體溫感光元件貼片

- 血糖感測器貼片

- 血壓/血流感測器貼片

- 心率感測器貼片

- ECG 感測器貼片

- 氧氣感測器貼片

- 其他

第9章感測器貼片市場(按應用)

- 介紹

- 監控

- 診斷

- 治療

第 10 章。感測器貼片市場(按最終用途行業)

- 介紹

- 衛生保健

- 健身與運動

第 11 章感測器貼片市場(按地區)

- 介紹

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 其他

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 其他

- 其他地區

- 南美洲

- 中東

- 非洲

第12章 競爭格局

- 概述

- 主要參與企業所採用的策略(2021 年 1 月 - 2025 年 8 月)

- 2024年市佔率分析

- 2022-2024年收益分析

- 估值和財務指標

- 品牌比較

- 公司估值矩陣:2024 年關鍵參與企業

- 公司估值矩陣:Start-Ups/中小企業,2024 年

- 競爭情境和趨勢

第13章:公司簡介

- 主要參與企業

- ABBOTT LABORATORIES

- MEDTRONIC

- DEXCOM, INC.

- IRHYTHM INC.

- TEXAS INSTRUMENTS INCORPORATED

- MASIMO

- GENTAG, INC.

- KONINKLIJKE PHILIPS NV

- SENSEONICS, INC.

- BOSTON SCIENTIFIC CORPORATION

- 其他公司

- LIFESIGNALS

- VITALCONNECT

- BIOLINQ INCORPORATED

- NANOSONIC, INC.

- G TECH MEDICAL

- SMARTCARDIA INC.

- VIVALNK, INC.

- EPICORE BIOSYSTEMS, INC.

- VPATCH CARDIO PTY LTD

- WEAROPTIMO

- MAKANISCIENCE.NET

- LIEF THERAPEUTICS

- COVESTRO AG

- BIOINTELLISENSE, INC.

- THERANICA BIO-ELECTRONICS LTD.

第14章 附錄

The global sensor patch market is projected to grow from 6.32 billion in 2025 to USD 23.91 billion by 2030, at a CAGR of 30.5%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Technology, Product Type, Wearable Type, Application, End-use Industry, and Region |

| Regions covered | North America, Europe, APAC, RoW |

The growth in the market is attributed to the increasing use of sensor patches to monitor glucose levels in individuals with diabetes, the increasing elderly population, and the rising adoption of wireless mobile healthcare systems. Additionally, the growing trend of telehealth is boosting market growth. Wearable sensor patches find increasing opportunities for continuously monitoring patients' vital signs, premature infants, children, athletes, or fitness buffs, and individuals in remote areas far from medical and health services.

"Blood glucose sensor patch segment to account for significant market share in 2030"

Blood glucose sensor patches measure glucose concentration in blood or sweat. These patches are designed for diabetic patients, runners, cyclists, athletes, and players to keep track of their blood glucose levels. Diabetic patients who use insulin monitor their glucose levels in their blood to determine the requirement for the next insulin dose. Blood glucose sensor patches find applications in blood glucose and cholesterol testing, as well as for testing drug abuse, infectious diseases, and pregnancy. Some major manufacturers of blood glucose monitors and blood glucose sensors include Medtronic (US) and Abbott Laboratories. (US), and DexCom, Inc. (US).

"Bodywear segment to capture largest share of sensor patch market throughout forecast period"

Bodywear includes armwear, chest patches, and sensor-based contact lenses. Armwear patches are used for various healthcare applications, such as measuring and monitoring blood pressure, body temperature, and heart rate. These devices can be connected to iOS or Android phones via Bluetooth. Chest straps are worn on the chest to monitor the heart rate while running. Athletes and fitness-conscious people use these devices. Also, some sensors can measure the sodium level in sweat and determine the sweat rate directly from the skin. Smart contact lenses consist of a wireless chip, which diabetes patients use. These lenses are used to monitor the glucose level in tears. Google Inc. (US) and Novartis AG (Switzerland) are working to manufacture smart contact lenses that monitor blood sugar levels and correct vision.

"China to hold largest share of Asia Pacific sensor patch market in 2030"

The presence of a vast population base in China and the implementation of government initiatives focusing on developing a modern healthcare system and corresponding reimbursement facilities are the major factors promoting the growth of the sensor patch market in the country. Other factors driving the sensor patch market in China include fast economic growth, a growing aging population, and government efforts to create better healthcare services. Many multinational corporations (MNCs) exporters and producers in China have adopted strategies such as acquisitions or partnerships that help in reliable domestic distribution and service infrastructure. With the aging population, there would be a considerable increase in the incidence rates of various disorders, including heart diseases.

Extensive primary interviews were conducted with key industry experts in the sensor patch market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakup of primary participants for the report is shown below: The study contains insights from various industry experts, from component suppliers to tier 1

companies and OEMs. The breakup of the primaries is as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation: C-level Executives - 45%, Directors - 35%, and Others - 20%

- By Region: North America - 30%, Europe - 22%, Asia Pacific - 40%, and RoW - 8%

Note: Three tiers of companies are defined based on their total revenue as of 2024; tier 1: revenue more than or equal to USD 500 million, tier 2: revenue between USD 100 million and USD 500 million, and tier 3: revenue less than or equal to USD 100 million. Other designations include sales and marketing executives, researchers, and members of various sensor patch organizations.

Abbott Laboratories (US), Medtronic PLC (Ireland), DexCom, Inc. (US), iRhythm Technologies, Inc. (US), Texas Instruments Incorporated (US), Masimo (US), GENTAG, Inc. (US), Koninklijke Philips N.V. (Netherlands), Senseonics, Inc. (US), and Boston Scientific Corporation (US) are some key players in the sensor patch market.

The study includes an in-depth competitive analysis of these key players in the sensor patch market, with their company profiles, recent developments, and key market strategies.

Study Coverage:

This research report categorizes the sensor patch market based on wearable type (bodywear, neckwear, footwear, wristwear), product type (temperature, blood glucose, blood pressure, heart rate, ECG, blood oxygen, and other product types (stress monitoring patches, sweat monitoring sensor patches, and position and motion sensor patches), technology (amperometric, potentiometric, conductometric) application (monitoring, diagnostics, medical therapeutics), end-use industry (healthcare, fitness & sports), and region (North America, Europe, Asia Pacific, and RoW). The report describes the major drivers, restraints, challenges, and opportunities pertaining to the sensor patch market and forecasts the same till 2030. The report also consists of leadership mapping and analysis of all companies in the sensor patch ecosystem.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants in this market by providing information on the closest approximations of the revenue numbers for the overall sensor patch market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of market dynamics: The report includes drivers (rising demand for portable medical devices and wearable sensors, increasing elderly population, and surging use of sensor patches to monitor glucose levels in individuals with diabetes) restraints (regulatory issues), opportunities (growing adoption of telehealth and high-growth opportunities in the wearable device market), and challenges (issues related to data security due to connected medical devices and design complexities and thermal considerations) influencing the growth of the sensor patch market.

- Product Development/Innovation: The report detailed insights into upcoming technologies, research and development activities, and the latest product and service launches in the sensor patch market.

- Market Development: The report provides comprehensive information about lucrative markets and analyzes the sensor patch market across varied regions.

- Market Diversification: It includes exhaustive information about new products and services, untapped geographies, recent developments, and investments in the sensor patch market.

- Competitive Assessment: Details regarding In-depth assessment of market shares, growth strategies of players, and service offerings of leading players, such as Abbott Laboratories (US), Medtronic PLC (Ireland), DexCom, Inc. (US), iRhythm Technologies, Inc. (US), Texas Instruments Incorporated (US), Masimo (US), GENTAG, Inc. (US), Koninklijke Philips N.V. (Netherlands), Senseonics, Inc. (US), Boston Scientific Corporation (US) are included in the sensor patch market report.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primaries

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to derive market size using top-down approach (supply side)

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN SENSOR PATCH MARKET

- 4.2 SENSOR PATCH MARKET FOR HEALTHCARE APPLICATIONS

- 4.3 SENSOR PATCH MARKET IN NORTH AMERICA, BY COUNTRY AND BY PRODUCT

- 4.4 SENSOR PATCH MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for portable medical devices and wearable sensors

- 5.2.1.2 Increasing elderly population

- 5.2.1.3 Increasing use of sensor patches to monitor glucose levels in individuals with diabetes

- 5.2.2 RESTRAINTS

- 5.2.2.1 Regulatory issues

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing adoption of telehealth

- 5.2.3.2 High-growth opportunities in wearable device market

- 5.2.4 CHALLENGES

- 5.2.4.1 Issues related to data security due to connected medical devices

- 5.2.4.2 Design complexities and thermal considerations

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE TREND OF SENSOR PATCHES, BY APPLICATION (USD)

- 5.6.2 AVERAGE SELLING PRICE OF MONITORING & DIAGNOSTICS SENSOR PATCH OFFERED BY THREE KEY PLAYERS (USD)

- 5.6.3 INDICATIVE SELLING PRICE TREND OF SENSOR PATCHES, BY REGION, 2021-2024

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Multiplexed sensor patches

- 5.7.1.2 AI-integrated sensor patch platforms

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Cloud-based data analytics platforms

- 5.7.2.2 Nanotechnology in sensing

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Drug delivery systems

- 5.7.1 KEY TECHNOLOGIES

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 COVESTRO COLLABORATES WITH MEDTECH COMPANIES TO DEVELOP SENSOR-BASED WEARABLE PATCHES TO MONITOR VITAL SIGNS

- 5.8.2 MEDHERANT COLLABORATES WITH BAYER TO LEVERAGE TEPI PATCH TECHNOLOGY FOR IMPROVED DRUG DELIVERY

- 5.8.3 DEXCOM PARTNERS WITH QUALCOMM TO ENABLE SEAMLESS DATA TRANSMISSION FROM PATIENTS' HOMES

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 IMPACT OF GEN AI/AI ON SENSOR PATCH MARKET

- 5.11 PATENT ANALYSIS

- 5.12 TRADE ANALYSIS

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF BUYERS

- 5.14.4 BARGAINING POWER OF SUPPLIERS

- 5.14.5 THREAT OF NEW ENTRANTS

- 5.15 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.16 REGULATORY LANDSCAPE AND STANDARDS

- 5.16.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.16.2 STANDARDS

- 5.17 2025 US TARIFF IMPACT ON SENSOR PATCH MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRY/REGION

- 5.17.4.1 US

- 5.17.5 EUROPE

- 5.17.6 ASIA PACIFIC

- 5.17.7 IMPACT ON APPLICATION

- 5.17.7.1 Healthcare

- 5.17.7.2 Fitness & sports

6 SENSOR PATCH MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- 6.2 AMPEROMETRIC

- 6.2.1 AMPEROMETRIC TECHNIQUE-BASED SENSOR PATCH SOLUTIONS: COST-EFFECTIVE AND EASY TO MASS-PRODUCE

- 6.3 CONDUCTOMETRIC

- 6.3.1 CONDUCTOMETRIC TECHNIQUE-BASED SOLUTIONS: SUITABLE FOR BLOOD GLUCOSE MONITORING DEVICES

- 6.4 POTENTIOMETRIC

- 6.4.1 POTENTIOMETRIC-BASED SENSOR PATCHES: MAINLY USED TO MONITOR TOTAL ION CONTENT IN PERSPIRATION

7 SENSOR PATCH MARKET, BY WEARABLE TYPE

- 7.1 INTRODUCTION

- 7.2 WRISTWEAR

- 7.2.1 HIGH DEMAND FOR MEDICAL AND FITNESS PURPOSES - KEY DRIVERS

- 7.3 FOOTWEAR

- 7.3.1 USE IN TRACKING POSITION FOR FITNESS AND MEDICAL PURPOSES TO BOOST MARKET

- 7.4 NECKWEAR

- 7.4.1 USE IN DIAGNOSIS AND TREATMENT OF APHASIA TO BOOST MARKET

- 7.5 BODYWEAR

- 7.5.1 CAN BE USED FOR VARIOUS HEALTHCARE AND FITNESS APPLICATIONS TO BOOST MARKET

8 SENSOR PATCH MARKET, BY PRODUCT TYPE

- 8.1 INTRODUCTION

- 8.2 TEMPERATURE SENSOR PATCHES

- 8.2.1 ADOPTION FOR PATIENT MONITORING AND DIAGNOSTICS PROPELS MARKET GROWTH

- 8.3 BLOOD GLUCOSE SENSOR PATCHES

- 8.3.1 NEED FOR SELF-MONITORING OF GLUCOSE LEVELS TO FUEL DEMAND

- 8.4 BLOOD PRESSURE/FLOW SENSOR PATCHES

- 8.4.1 INCREASING NEED FOR BLOOD PRESSURE MONITORING IN HOSPITALS TO BOOST MARKET

- 8.5 HEART RATE SENSOR PATCHES

- 8.5.1 GROWING INCIDENCES OF HEART-RELATED DISEASES PROPEL DEMAND

- 8.6 ECG SENSOR PATCHES

- 8.6.1 INCREASING DEMAND FOR ECG SENSOR PATCHES FOR QUICK DIAGNOSIS TO BOOST MARKET GROWTH

- 8.7 BLOOD OXYGEN SENSOR PATCHES

- 8.7.1 BLOOD OXYGEN SENSORS FOR ANESTHESIA MONITORING APPLICATION TO WITNESS STEADY GROWTH

- 8.8 OTHERS

- 8.8.1 NEED TO MONITOR STRESS AND ANXIETY SYMPTOMS OF PATIENTS TO BOOST MARKET

9 SENSOR PATCH MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 MONITORING

- 9.2.1 RISING ADOPTION OF PORTABLE PATIENT MONITORING DEVICES TO PROPEL MARKET GROWTH

- 9.3 DIAGNOSTICS

- 9.3.1 INCREASING DEMAND FOR IMPROVED DIAGNOSIS TO LEAD TO GROWTH OF MARKET

- 9.4 MEDICAL THERAPEUTICS

- 9.4.1 USE FOR INSULIN DELIVERY TO BOOST MARKET

10 SENSOR PATCH MARKET, BY END-USE INDUSTRY

- 10.1 INTRODUCTION

- 10.2 HEALTHCARE

- 10.2.1 HOSPITALS & CLINICS

- 10.2.1.1 Large patient volume and high demand from hospitals to propel adoption

- 10.2.2 HOME CARE

- 10.2.2.1 Growing geriatric population and increasing number of diabetic patients to drive adoption in home care settings

- 10.2.3 DIAGNOSTIC LABORATORIES

- 10.2.3.1 Growing volume of clinic data and rising need to modernize imaging workflows to drive segment

- 10.2.1 HOSPITALS & CLINICS

- 10.3 FITNESS & SPORTS

- 10.3.1 GROWING AWARENESS OF HEALTH AND FITNESS BOOSTS DEMAND FOR SENSOR PATCHES

11 SENSOR PATCH MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Presence of key players that offer sensor patch-based PoC applications to boost market growth

- 11.2.2 CANADA

- 11.2.2.1 Increasing government support likely to escalate growth of market

- 11.2.3 MEXICO

- 11.2.3.1 Use to detect cardiovascular disorders propels market growth

- 11.2.1 US

- 11.3 EUROPE

- 11.3.1 GERMANY

- 11.3.1.1 Monitoring of chronic diseases to accelerate sensor patch market growth

- 11.3.2 FRANCE

- 11.3.2.1 Technological advancements in healthcare systems to drive growth

- 11.3.3 UK

- 11.3.3.1 Rising cardiac diseases and aging population to drive market growth

- 11.3.4 ITALY

- 11.3.4.1 Growing private sector to result in increasing demand for sensor patch

- 11.3.5 REST OF EUROPE

- 11.3.1 GERMANY

- 11.4 ASIA PACIFIC

- 11.4.1 CHINA

- 11.4.1.1 Government initiatives for better healthcare products and services likely to propel market growth

- 11.4.2 JAPAN

- 11.4.2.1 Improved standard of living, rise in health awareness, and surge in aging population - key market drivers

- 11.4.3 SOUTH KOREA

- 11.4.3.1 Improving health infrastructure drives market

- 11.4.4 INDIA

- 11.4.4.1 Growing population accelerates demand for sensor patches for healthcare services

- 11.4.5 REST OF ASIA PACIFIC

- 11.4.1 CHINA

- 11.5 ROW

- 11.5.1 SOUTH AMERICA

- 11.5.1.1 Emerging economies present significant opportunities for market growth

- 11.5.2 MIDDLE EAST

- 11.5.2.1 Significant government and financial support for adoption of POC testing kits to drive market

- 11.5.2.2 GCC

- 11.5.2.2.1 Saudi Arabia

- 11.5.2.2.2 UAE

- 11.5.2.2.3 Rest of GCC

- 11.5.2.3 Rest of Middle East

- 11.5.3 AFRICA

- 11.5.3.1 Increasing penetration in medical devices to boost market

- 11.5.1 SOUTH AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2021-AUGUST 2025

- 12.3 MARKET SHARE ANALYSIS, 2024

- 12.4 REVENUE ANALYSIS, 2022-2024

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Product footprint

- 12.7.5.4 Type footprint

- 12.7.5.5 End-use industry footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING

- 12.8.5.1 Sensor patch market: Detailed list of startups/SMEs

- 12.8.5.2 Sensor patch market: Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO AND TRENDS

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 ABBOTT LABORATORIES

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses & competitive threats

- 13.1.2 MEDTRONIC

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Services/Solutions offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses & competitive threats

- 13.1.3 DEXCOM, INC.

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses & competitive threats

- 13.1.4 IRHYTHM INC.

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses & competitive threats

- 13.1.5 TEXAS INSTRUMENTS INCORPORATED

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 MnM view

- 13.1.5.3.1 Right to win

- 13.1.5.3.2 Strategic choices

- 13.1.5.3.3 Weaknesses & competitive threats

- 13.1.6 MASIMO

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.7 GENTAG, INC.

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.8 KONINKLIJKE PHILIPS N.V.

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.9 SENSEONICS, INC.

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.10 BOSTON SCIENTIFIC CORPORATION

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Deals

- 13.1.1 ABBOTT LABORATORIES

- 13.2 OTHER PLAYERS

- 13.2.1 LIFESIGNALS

- 13.2.2 VITALCONNECT

- 13.2.3 BIOLINQ INCORPORATED

- 13.2.4 NANOSONIC, INC.

- 13.2.5 G TECH MEDICAL

- 13.2.6 SMARTCARDIA INC.

- 13.2.7 VIVALNK, INC.

- 13.2.8 EPICORE BIOSYSTEMS, INC.

- 13.2.9 VPATCH CARDIO PTY LTD

- 13.2.10 WEAROPTIMO

- 13.2.11 MAKANISCIENCE.NET

- 13.2.12 LIEF THERAPEUTICS

- 13.2.13 COVESTRO AG

- 13.2.14 BIOINTELLISENSE, INC.

- 13.2.15 THERANICA BIO-ELECTRONICS LTD.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

List of Tables

- TABLE 1 SENSOR PATCH MARKET: RESEARCH ASSUMPTIONS

- TABLE 2 COMPANIES AND THEIR ROLE IN SENSOR PATCH ECOSYSTEM

- TABLE 3 AVERAGE SELLING PRICE TREND OF SENSOR PATCHES, BY APPLICATION (USD)

- TABLE 4 INDICATIVE SELLING PRICE TREND OF GLUCOSE MONITORING SYSTEMS, BY REGION, 2021-2024 (USD)

- TABLE 5 SENSOR PATCH MARKET: MAJOR PATENTS

- TABLE 6 IMPORT DATA FOR HS CODE 901890-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 7 EXPORT DATA FOR HS CODE 901890-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 8 SENSOR PATCH MARKET: INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR APPLICATION (%)

- TABLE 9 SENSOR PATCH MARKET: KEY BUYING CRITERIA FOR APPLICATIONS

- TABLE 10 SENSOR PATCH MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 11 SENSOR PATCH MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 NORTH AMERICA: SAFETY STANDARDS FOR SENSOR PATCHES

- TABLE 17 EUROPE: SAFETY STANDARDS FOR SENSOR PATCHES

- TABLE 18 ASIA PACIFIC: SAFETY STANDARDS FOR SENSOR PATCHES

- TABLE 19 ROW: SAFETY STANDARDS FOR SENSOR PATCHES

- TABLE 20 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 21 SENSOR PATCH MARKET, BY WEARABLE TYPE, 2021-2024 (USD MILLION)

- TABLE 22 SENSOR PATCH MARKET, BY WEARABLE TYPE, 2025-2030 (USD MILLION)

- TABLE 23 SENSOR PATCH MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 24 SENSOR PATCH MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 25 SENSOR PATCH MARKET, BY PRODUCT TYPE, 2021-2024 (MILLION UNITS)

- TABLE 26 SENSOR PATCH MARKET, BY PRODUCT TYPE, 2025-2030 (MILLION UNITS)

- TABLE 27 TEMPERATURE SENSOR PATCH MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 28 TEMPERATURE SENSOR PATCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 NORTH AMERICA: TEMPERATURE SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 30 NORTH AMERICA: TEMPERATURE SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 31 EUROPE: TEMPERATURE SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 32 EUROPE: TEMPERATURE SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 33 ASIA PACIFIC: TEMPERATURE SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 34 ASIA PACIFIC: TEMPERATURE SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 35 BLOOD GLUCOSE SENSOR PATCH MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 36 BLOOD GLUCOSE SENSOR PATCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 NORTH AMERICA: BLOOD GLUCOSE SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 38 NORTH AMERICA: BLOOD GLUCOSE SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 39 EUROPE: BLOOD GLUCOSE SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 40 EUROPE: BLOOD GLUCOSE SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 41 ASIA PACIFIC: BLOOD GLUCOSE SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 42 ASIA PACIFIC: BLOOD GLUCOSE SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 43 BLOOD PRESSURE/FLOW SENSOR PATCH MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 44 BLOOD PRESSURE/FLOW SENSOR PATCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 NORTH AMERICA: BLOOD PRESSURE/FLOW SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 46 NORTH AMERICA: BLOOD PRESSURE/FLOW SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 47 EUROPE: BLOOD PRESSURE/FLOW SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 48 EUROPE: BLOOD PRESSURE/FLOW SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 49 ASIA PACIFIC: BLOOD PRESSURE/FLOW SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 50 ASIA PACIFIC: BLOOD PRESSURE/FLOW SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 51 HEART RATE SENSOR PATCH MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 52 HEART RATE SENSOR PATCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 NORTH AMERICA: HEART RATE SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 54 NORTH AMERICA: HEART RATE SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 55 EUROPE: HEART RATE SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 56 EUROPE: HEART RATE SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 57 ASIA PACIFIC: HEART RATE SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 58 ASIA PACIFIC: HEART RATE SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 59 ECG SENSOR PATCH MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 60 ECG SENSOR PATCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 NORTH AMERICA: ECG SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 62 NORTH AMERICA: ECG SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 63 EUROPE: ECG SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 64 EUROPE: ECG SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 65 ASIA PACIFIC: ECG SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 66 ASIA PACIFIC: ECG SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 67 BLOOD OXYGEN SENSOR PATCH MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 68 BLOOD OXYGEN SENSOR PATCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 NORTH AMERICA: BLOOD OXYGEN SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 70 NORTH AMERICA: BLOOD OXYGEN SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 71 EUROPE: BLOOD OXYGEN SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 72 EUROPE: BLOOD OXYGEN SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 73 ASIA PACIFIC: BLOOD OXYGEN SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 74 ASIA PACIFIC: BLOOD OXYGEN SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 75 OTHER SENSOR PATCH MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 76 OTHER SENSOR PATCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 NORTH AMERICA: OTHER SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 78 NORTH AMERICA: OTHER SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 79 EUROPE: OTHER SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 80 EUROPE: OTHER SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 81 ASIA PACIFIC: OTHER SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 82 ASIA PACIFIC: OTHER SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 83 SENSOR PATCH MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 84 SENSOR PATCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 85 MONITORING: SENSOR PATCH MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 86 MONITORING: SENSOR PATCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 87 DIAGNOSTICS: SENSOR PATCH MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 88 DIAGNOSTICS: SENSOR PATCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 MEDICAL THERAPEUTICS: SENSOR PATCH MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 90 MEDICAL THERAPEUTICS: SENSOR PATCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91 SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 92 SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 93 HEALTHCARE: SENSOR PATCH MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 94 HEALTHCARE: SENSOR PATCH MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 95 HEALTHCARE: SENSOR PATCH MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 96 HEALTHCARE: SENSOR PATCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 97 NORTH AMERICA: HEALTHCARE SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 98 NORTH AMERICA: HEALTHCARE SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 99 FITNESS & SPORTS: SENSOR PATCH MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 100 FITNESS & SPORTS: SENSOR PATCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 101 NORTH AMERICA: NORTH AMERICA: FITNESS & SPORTS SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 102 NORTH AMERICA: FITNESS & SPORTS SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 103 SENSOR PATCH MARKET BY REGION, 2021-2024 (USD MILLION)

- TABLE 104 SENSOR PATCH MARKET BY REGION, 2025-2030 (USD MILLION)

- TABLE 105 NORTH AMERICA: SENSOR PATCH MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 106 NORTH AMERICA: SENSOR PATCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 107 NORTH AMERICA: SENSOR PATCH MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 108 NORTH AMERICA: SENSOR PATCH MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 109 NORTH AMERICA: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 110 NORTH AMERICA: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 111 NORTH AMERICA: SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 112 NORTH AMERICA: SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 113 US: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 114 US: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 115 CANADA: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 116 CANADA: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 117 MEXICO: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 118 MEXICO: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 119 EUROPE: SENSOR PATCH MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 120 EUROPE: SENSOR PATCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 121 EUROPE: SENSOR PATCH MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 122 EUROPE: SENSOR PATCH MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 123 EUROPE: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 124 EUROPE: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 125 EUROPE: SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 126 EUROPE: SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 127 GERMANY: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 128 GERMANY: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 129 FRANCE: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 130 FRANCE: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 131 UK: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 132 UK: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 133 ITALY: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 134 ITALY: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 135 REST OF EUROPE: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 136 REST OF EUROPE: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 137 ASIA PACIFIC: SENSOR PATCH MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 138 ASIA PACIFIC: SENSOR PATCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 139 ASIA PACIFIC: SENSOR PATCH MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 140 ASIA PACIFIC: SENSOR PATCH MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 141 ASIA PACIFIC: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 142 ASIA PACIFIC: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 143 ASIA PACIFIC: SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 144 ASIA PACIFIC: SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 145 CHINA: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 146 CHINA: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 147 JAPAN: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 148 JAPAN: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 149 SOUTH KOREA: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 150 SOUTH KOREA: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 151 INDIA: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 152 INDIA: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 153 REST OF ASIA PACIFIC: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 154 REST OF ASIA PACIFIC: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 155 ROW: SENSOR PATCH MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 156 ROW: SENSOR PATCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 157 ROW: SENSOR PATCH MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 158 ROW: SENSOR PATCH MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 159 ROW: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 160 ROW: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 161 ROW: SENSOR PATCH MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 162 ROW: SENSOR PATCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 163 SOUTH AMERICA: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 164 SOUTH AMERICA: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 165 MIDDLE EAST: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 166 MIDDLE EAST: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 167 MIDDLE EAST: SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 168 MIDDLE EAST: SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 169 GCC: SENSOR PATCH MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 170 GCC: SENSOR PATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 171 AFRICA: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 172 AFRICA: SENSOR PATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 173 SENSOR PATCH MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2021-2025

- TABLE 174 SENSOR PATCH MARKET SHARE ANALYSIS, 2024

- TABLE 175 SENSOR PATCH MARKET: REGION FOOTPRINT

- TABLE 176 SENSOR PATCH MARKET: PRODUCT FOOTPRINT

- TABLE 177 SENSOR PATCH MARKET: WEARABLE TYPE FOOTPRINT

- TABLE 178 SENSOR PATCH MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 179 SENSOR PATCH MARKET: KEY STARTUPS/SMES

- TABLE 180 SENSOR PATCH MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 181 SENSOR PATCH MARKET: PRODUCT LAUNCHES, JANUARY 2021-AUGUST 2025

- TABLE 182 SENSOR PATCH MARKET: DEALS, JANUARY 2021-AUGUST 2025

- TABLE 183 ABBOTT LABORATORIES: COMPANY OVERVIEW

- TABLE 184 ABBOTT LABORATORIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 185 ABBOTT LABORATORIES: DEALS

- TABLE 186 MEDTRONIC: COMPANY OVERVIEW

- TABLE 187 MEDTRONIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 MEDTRONIC: DEALS

- TABLE 189 DEXCOM, INC.: COMPANY OVERVIEW

- TABLE 190 DEXCOM, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 DEXCOM, INC.: PRODUCT LAUNCHES

- TABLE 192 IRHYTHM INC.: COMPANY OVERVIEW

- TABLE 193 IRHYTHM INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 IRHYTHM INC.: PRODUCT LAUNCHES

- TABLE 195 IRHYTHM TECHNOLOGIES, INC.: DEALS

- TABLE 196 TEXAS INSTRUMENTS INCORPORATED: COMPANY OVERVIEW

- TABLE 197 TEXAS INSTRUMENTS INCORPORATED: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 198 MASIMO: COMPANY OVERVIEW

- TABLE 199 MASIMO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 MASIMO: DEALS

- TABLE 201 GENTAG, INC.: COMPANY OVERVIEW

- TABLE 202 GENTAG, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 KONINKLIJKE PHILIPS N.V.: COMPANY OVERVIEW

- TABLE 204 KONINKLIJKE PHILIPS N.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 KONINKLIJKE PHILIPS N.V.: DEALS

- TABLE 206 SENSEONICS, INC.: COMPANY OVERVIEW

- TABLE 207 SENSEONICS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 SENSEONICS, INC.: DEALS

- TABLE 209 BOSTON SCIENTIFIC CORPORATION: COMPANY OVERVIEW

- TABLE 210 BOSTON SCIENTIFIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 BOSTON SCIENTIFIC CORPORATION: DEALS

List of Figures

- FIGURE 1 SENSOR PATCH MARKET SEGMENTATION

- FIGURE 2 SENSOR PATCH MARKET: RESEARCH DESIGN

- FIGURE 3 SENSOR PATCH MARKET: BOTTOM-UP APPROACH

- FIGURE 4 SENSOR PATCH MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 5 SENSOR PATCH MARKET: TOP-DOWN APPROACH

- FIGURE 6 SENSOR PATCH MARKET: DATA TRIANGULATION

- FIGURE 7 BLOOD GLUCOSE SENSOR PATCHES LEADS MARKET IN 2025

- FIGURE 8 HEALTHCARE TO BE DOMINANT END-USE INDUSTRY OF SENSOR PATCHES IN 2025

- FIGURE 9 SENSOR PATCH MARKET FOR BODYWEAR TO HOLD LARGEST SHARE IN 2030

- FIGURE 10 SENSOR PATCH MARKET FOR DIAGNOSTICS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 SENSOR PATCH MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 12 RISING DEMAND FOR PORTABLE MEDICAL DEVICES AND WEARABLE SENSORS TO BOOST SENSOR PATCH MARKET DURING FORECAST PERIOD

- FIGURE 13 HOMECARE TO HOLD LARGEST SHARE OF SENSOR PATCH MARKET DURING FORECAST PERIOD

- FIGURE 14 US AND NON-WEARABLE DEVICES EXPECTED TO ACCOUNT FOR MAJOR SHARE OF NORTH AMERICAN MARKET IN 2025

- FIGURE 15 SENSOR PATCH MARKET IN INDIA TO GROW AT HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 16 SENSOR PATCH MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 SENSOR PATCH MARKET: DRIVERS AND THEIR IMPACT

- FIGURE 18 SENSOR PATCH MARKET: RESTRAINTS AND THEIR IMPACT

- FIGURE 19 SENSOR PATCH MARKET: OPPORTUNITIES AND THEIR IMPACT

- FIGURE 20 SENSOR PATCH MARKET: CHALLENGES AND THEIR IMPACT

- FIGURE 21 SENSOR PATCH MARKET: VALUE CHAIN ANALYSIS

- FIGURE 22 SENSOR PATCH MARKET: ECOSYSTEM ANALYSIS

- FIGURE 23 SENSOR PATCH MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 24 AVERAGE SELLING PRICE OF MONITORING & DIAGNOSTICS SENSOR PATCH OFFERED BY THREE KEY PLAYERS (USD)

- FIGURE 25 INDICATIVE SELLING PRICE TREND OF SENSOR PATCHES, BY REGION, 2021-2024

- FIGURE 26 INVESTMENT AND FUNDING SCENARIO, 2023 TO 2025

- FIGURE 27 SENSOR PATCH MARKET: PATENTS APPLIED AND GRANTED, 2014-2024

- FIGURE 28 IMPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 901890, BY COUNTRY, 2020-2025 (USD THOUSAND)

- FIGURE 29 EXPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 901890, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 30 SENSOR PATCH MARKET: INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR APPLICATIONS

- FIGURE 31 SENSOR PATCH MARKET: KEY BUYING CRITERIA FOR APPLICATIONS

- FIGURE 32 SENSOR PATCH MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 33 NECKWEAR MARKET TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 34 MARKET FOR HEART RATE SENSOR PATCHES EXPECTED TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 35 MONITORING APPLICATIONS LEAD SENSOR PATCH MARKET IN 2025

- FIGURE 36 SENSOR PATCH MARKET FOR HEALTHCARE TO LEAD IN 2025 AND 2030

- FIGURE 37 NORTH AMERICA TO LEAD SENSOR PATCH MARKET IN 2025

- FIGURE 38 SNAPSHOT: SENSOR PATCH MARKET IN NORTH AMERICA

- FIGURE 39 SNAPSHOT: SENSOR PATCH MARKET IN EUROPE

- FIGURE 40 SNAPSHOT: SENSOR PATCH MARKET IN ASIA PACIFIC

- FIGURE 41 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2024

- FIGURE 42 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2022-2024

- FIGURE 43 COMPANY VALUATION

- FIGURE 44 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 45 BRAND COMPARISON

- FIGURE 46 SENSOR PATCH MARKET: COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- FIGURE 47 SENSOR PATCH MARKET: COMPANY FOOTPRINT

- FIGURE 48 SENSOR PATCH MARKET: COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- FIGURE 49 ABBOTT LABORATORIES: COMPANY SNAPSHOT

- FIGURE 50 MEDTRONIC: COMPANY SNAPSHOT

- FIGURE 51 DEXCOM, INC.: COMPANY SNAPSHOT

- FIGURE 52 IRHYTHM INC.: COMPANY SNAPSHOT

- FIGURE 53 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

- FIGURE 54 MASIMO: COMPANY SNAPSHOT

- FIGURE 55 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT

- FIGURE 56 SENSEONICS, INC.: COMPANY SNAPSHOT

- FIGURE 57 BOSTON SCIENTIFIC CORPORATION: COMPANY SNAPSHOT