|

市場調查報告書

商品編碼

1819105

全球醋酸甲酯市場按等級、純度、銷售管道、最終用途產業和地區分類-預測至2030年Methyl Acetate Market by Grade (Industrial grade, Pharmaceutical grade, and Food grade), Purity (= 99% Purity, 90-99% Purity, and < 90% purity), Sales Channel (Direct and Indirect), End-use Industry, and Region - Global Forecast to 2030 |

||||||

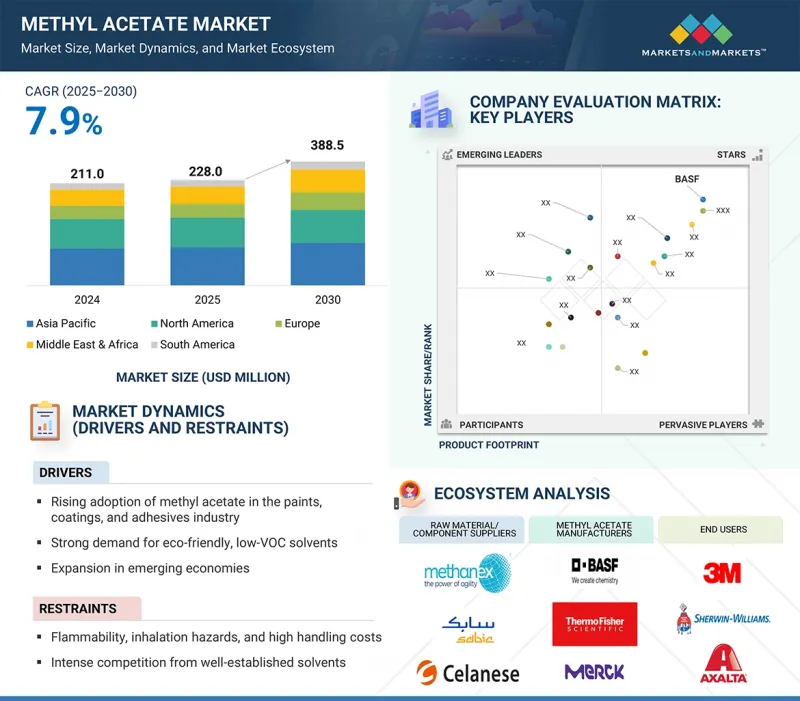

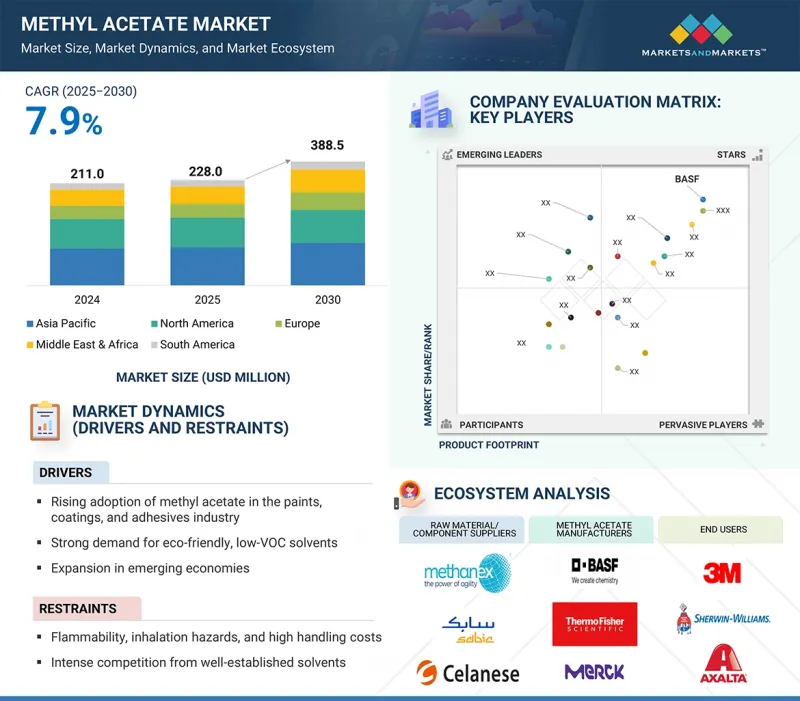

預計醋酸甲酯市場規模將從 2025 年的 2.28 億美元成長到 2030 年的 3.885 億美元,預測期內複合年成長率為 7.9%。

| 調查範圍 | |

|---|---|

| 調查年份 | 2024-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 對價單位 | 金額(百萬美元)及數量(噸) |

| 部分 | 按等級、純度、銷售管道、最終用途行業和地區 |

| 目標區域 | 北美、亞太地區、歐洲、中東和非洲、南美 |

預計醋酸甲酯的需求將持續穩定成長,這得益於各行各業對快速蒸發、低毒性且用途廣泛的溶劑的需求。醋酸甲酯不僅性能卓越,還能滿足油漆、被覆劑、黏合劑、密封劑、藥品、電子產品和個人護理等應用領域嚴格的環境和性能規範。美國環保署 (EPA)、加州南加州空氣品質管理區 (SCAQMD) 和歐洲化學品管理局 (ECHA) 等機構正在對揮發性有機化合物 (VOC)排放、化學品安全和環境足跡實施更嚴格的監管。為了應對這項挑戰,製造商正在提供高純度、低VOC、永續等級的產品,以滿足永續的配方策略。

近期創新包括溶劑配方最佳化、濕敏配方開發以及新的加工技術,從而提升了效率、乾燥時間和性能。醋酸甲酯憑藉其合規性、技術靈活性和永續性,仍然是許多工業領域的可行產品。醋酸甲酯有助於確保高性能、高效且環保的製造流程。

工業醋酸甲酯以其高溶解度、快速揮發和低毒性而聞名,廣泛應用於尋求高性能、環保溶劑的工業製造業。工業醋酸甲酯的監管現狀也使其成為對揮發性有機化合物(VOC)有嚴格限制的應用,以及在性能與永續/可再生解決方案之間尋求平衡至關重要的工業領域的理想選擇。電子、建築、汽車和包裝等行業的需求也在不斷成長,醋酸甲酯在這些行業中提供了一種安全有效的替代有毒溶劑的方法。此外,醋酸甲酯與成型行業中使用的大多數樹脂和聚合物的兼容性增強了其多功能性,使其能夠被添加到產品配方中。這種能持續取代危險溶劑的能力,加上人們對環保生產日益成長的需求,對工業醋酸甲酯市場有利,該市場在2024年將引領全球市場。

2024年,醋酸甲酯市場將以油漆和塗料領域為主,這得益於其優異的表面光潔度、高溶解性、快速蒸發速率和低毒性。醋酸甲酯廣泛應用於汽車、建築和工業領域,可實現無縫施工、快速乾燥並提高塗料的耐久性。醋酸甲酯與多種樹脂和顏料的兼容性使其配方更加靈活,並且嚴格遵守揮發性有機化合物 (VOC) 法規,使其比傳統溶劑更環保。基礎設施建設和工業成長對裝飾和防護塗料的需求不斷成長,進一步推動了該領域的主導地位。

2024 年,亞太地區鞏固了其在醋酸甲酯市場的主導地位,這得益於先進的工業發展、不斷成長的製造程序以及從油漆和塗料到粘合劑和藥品等廣泛關鍵終端用途的強勁需求。中國、印度、日本和韓國是主要醋酸甲酯製造和消費中心之一。這一角色得益於大量原料的易得性、成本效益高的製造方法以及旨在支持工業成長的友好政府政策。高都市化加上廣泛的基礎設施建設也在推動對黏合劑和被覆劑的需求。同時,電子、汽車和包裝產業持續顯著推動溶劑需求。對高性能和更環保的化學品的投資不斷增加也支持了市場擴張。頂級化學品製造商的存在,加上生產機械的持續進步,使亞太地區在 2024 年鞏固了其在全球醋酸甲酯市場的主導地位。

目標公司

其中包括:BASF(德國)、賽默飛世爾科技公司(美國)、默克公司(德國)、塞拉尼斯公司(美國)、伊士曼化學公司(美國)、工業(日本)、瓦克化學股份有限公司(德國)、Synthomer plc(英國)、安徽皖維集團(中國)和股份長春集團(中國)。

本研究報告按等級、純度、銷售管道、終端用途行業和地區對醋酸甲酯市場進行了細分。報告提供了影響醋酸甲酯市場成長的促進因素、阻礙因素、挑戰和機會的詳細資訊。該報告對主要行業參與企業進行了詳細分析,深入了解了他們的業務概況、產品供應以及與醋酸甲酯市場相關的關鍵策略,例如合作夥伴關係、合作、合併、收購和業務擴張。該報告還涵蓋了醋酸甲酯市場生態系統中新興企業的競爭分析。

本報告為市場領導者/新進業者提供醋酸甲酯市場整體及其細分市場最接近的收益數據資訊。它有助於相關人員了解競爭格局,獲得洞察力以更好地定位其業務,並規劃適當的打入市場策略。本報告幫助相關人員了解市場脈搏,並提供關鍵市場促進因素、阻礙因素、挑戰和機會的資訊。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章重要考察

第5章 市場概況

- 介紹

- 市場動態

- 影響我們客戶業務的趨勢和中斷

- 生態系分析

- 價值鏈分析

- 關稅和監管狀況

- 貿易分析

- 技術分析

- 專利分析

- 大型會議及活動

- 案例研究分析

- 投資金籌措場景

- 生成式人工智慧/人工智慧對乙酸甲酯市場的影響

- 波特五力分析

- 主要相關人員和採購標準

- 宏觀經濟分析

- 2025年美國關稅的影響:醋酸甲酯市場

第6章醋酸甲酯市場(依等級)

- 介紹

- 工業級

- 醫藥級

- 食品級

7. 乙酸甲酯市場(依純度)

- 介紹

- 純度:99%以上

- 純度90-99%

- 純度低於90%

第 8 章:醋酸甲酯市場(依銷售管道)

- 介紹

- 直接地

- 間接

9. 醋酸甲酯市場(依最終用途產業)

- 介紹

- 油漆和塗料

- 黏合劑和密封劑

- 製藥

- 墨水

- 個人護理和化妝品

- 其他

第10章醋酸甲酯市場(按地區)

- 介紹

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他

- 歐洲

- 德國

- 法國

- 英國

- 西班牙

- 其他

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 中東和非洲

- 海灣合作理事會國家

- 南非

- 其他

- 南美洲

- 巴西

- 阿根廷

- 其他

第11章 競爭格局

- 概述

- 主要參與企業的策略

- 市佔率分析

- 收益分析

- 估值和財務指標

- 產品/品牌比較

- 公司估值矩陣:2024 年關鍵參與企業

- 公司估值矩陣:Start-Ups/中小企業,2024 年

- 競爭場景

第12章:公司簡介

- 主要參與企業

- BASF

- THERMO FISHER SCIENTIFIC INC.

- MERCK KGAA

- CELANESE CORPORATION

- EASTMAN CHEMICAL COMPANY

- SEKISUI CHEMICAL CO., LTD.

- WACKER CHEMIE AG

- SYNTHOMER PLC

- ANHUI WANWEI GROUP CO., LTD.

- CHANG CHUN GROUP

- 其他公司

- DAICEL CORPORATION

- SHANXI SANWEI GROUP CO, LTD.

- KISHIDA CHEMICAL CO., LTD.

- ATOM SCIENTIFIC LTD

- HAIHANG INDUSTRY

- CENTRAL DRUG HOUSE

- LOBACHEMIE PVT. LTD.

- DUBICHEM

- NACALAI TESQUE, INC.

- ARDIN CHEMICAL COMPANY

- MOLEKULA GROUP

- RECOCHEM CORPORATION

- SCHARLAB SL

- SIMSON PHARMA LIMITED

- CHEMICAL IRAN

第14章 附錄

The methyl acetate market is estimated to reach USD 388.5 million by 2030 from USD 228.0 million in 2025, at a CAGR of 7.9% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (tons) |

| Segments | Grade, Purity, Sales Channel, End-use Industry, and Region |

| Regions covered | North America, Asia Pacific, Europe, the Middle East & Africa, and South America |

The demand for methyl acetate is anticipated to continue to grow steadily due to a variety of industries requiring fast-evaporating, low-toxicity, and versatile solvents. Methyl acetate delivers high performance while conforming to rigid environmental and performance specifications for use in paints, coatings, adhesives, sealants, pharmaceuticals, electronics, and personal care. Organizations such as the US Environmental Protection Agency (EPA), California's SCAQMD, and the European Chemicals Agency (ECHA) are imposing more stringent regulations on VOC emissions, chemical safety, and environmental footprint. Manufacturers are stepping up to the challenge by providing high-purity, low-VOC, and sustainability grades that enable sustainable formulation strategies to satisfaction.

Recent innovations involve optimizing solvent blends, developing moisture-sensitive formulations, and new processing technologies that provide improved efficiency, drying times, and performance. Methyl acetate remains a viable product to many industrial sectors because of its combination of regulatory compliance, technical flexibility, and sustainability. Methyl acetate helps ensure high-performance, efficient, and environmentally friendly manufacturing processes.

"Industrial-grade accounted for the largest share in the methyl acetate market in 2024."

In 2024, the methyl acetate market's industrial grade segment led the market due to its significant usage in paints and coatings, adhesives, inks, and cleaning products. Industrial-grade methyl acetate is known to have high solubility, fast evaporation time, and low toxicity, and is widely used in industrial manufacturing, looking for high-performing and eco-friendly solvents. The industrial methyl acetate segment was also gaining consideration for its regulatory status, which has made it a suitable candidate for applications where specified VOC (volatile organic compound) restrictions are important, and for the industrial sector, where finding a balance between performance and sustainable/renewable solutions is paramount. Demand has also been increasing in industries such as electronics, construction, automotive, and packaging applications, where methyl acetate is a safe and effective substitution for toxic solvents. Additionally, the compatibility of methyl acetate with the product formulations adds to the versatility of the product because methyl acetate is compatible with most resins and polymers used in the molding industry. This ability to continuously replace hazardous solvents, coupled with a growing desire for environmentally safe production, was advantageous to the industrial-grade methyl acetate segment and its lead in the global market in 2024.

"The paints & coatings segment accounted for the largest share of the methyl acetate market in 2024."

The market for methyl acetate in 2024 was dominated by the paints & coatings sector because of its superior surface finishes, high solvency, rapid evaporation rate, and low toxicity. Methyl acetate, extensively utilized in automotive, construction, and industrial sectors, facilitates seamless application, rapid drying, and enhanced durability of coatings. It can work with a large variety of resins and pigments, adding flexibility to formulations and rigorous adherence to VOC regulations, making it more environmentally friendly than conventional solvents. The growing demand for decorative and protective coatings, as a result of infrastructure development and industrial growth, has reinforced this segment's dominance. Continuous innovation in coating formulations will continue to allow for the use of methyl acetate in several global end-use segments.

"Asia Pacific dominated the regional market for methyl acetate in 2024."

During the year 2024, the Asia Pacific region solidified its dominance in the market for methyl acetate, a role spurred by high levels of industrial development, the rise in manufacturing processes, and a strong demand from major end-use applications whose range spans from paints and coatings to adhesives and pharmaceuticals. China, India, Japan, and South Korea are among the major countries that have risen to a frontline position as major manufacturing and consumption centers for methyl acetate. This role has been supported intensely by the ready availability of huge quantities of raw materials, the availability of cost-effective manufacturing processes, and the formulation of friendly government policies aimed at helping the growth of industry. The high levels of urbanization rates, coupled with wide infrastructure development, have also boosted the demand for adhesives and coatings. At the same time, the electronics, automotive, and packaging industries continue to drive their demand for solvents significantly. The market expansion has also been supported by increasing investments in high-performance, more environmentally friendly chemicals. Asia Pacific solidified their dominance of the global methyl acetate market in 2024 with the presence of top chemical producers, along with continued mechanical advances in production.

By Company Type: Tier 1: 25%, Tier 2: 42%, and Tier 3: 33%

By Designation: C-level Executives: 20%, Directors: 30%, and Other Designations: 50%

By Region: North America: 20%, Europe: 10%, Asia Pacific: 40%, South America: 10%, and Middle East & Africa: 20%

Notes: Other designations include sales, marketing, and product managers.

Tier 1: > USD 1 Billion; Tier 2: USD 500 million to USD 1 Billion; and Tier 3: < USD 500 million

Companies Covered: BASF (Germany), Thermo Fisher Scientific Inc. (US), Merck KGaA (Germany), Celanese Corporation (US), Eastman Chemical Company (US), Sekisui Chemical Co., Ltd. (Japan), Wacker Chemie AG (Germany), Synthomer plc (UK), Anhui Wanwei Group Co., Ltd. (China), and Chang Chun Group (Taiwan) are covered in the report.

The study includes an in-depth competitive analysis of these key players in the methyl acetate market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the methyl acetate market based on grade (Industrial Grade, Pharmaceutical Grade, and Food Grade), purity (>= 99% purity, 90-99% purity, < 90% purity), sales channel (Direct and Indirect), end-use industry (Paints and Coatings, Adhesives and Sealants, Pharmaceuticals, Inks, Personal Care and Cosmetics, and Other endues industries) and Region (Asia Pacific, North America, Europe, South America, and Middle East & Africa). The report's scope covers detailed information regarding the drivers, restraints, challenges, and opportunities influencing the growth of the methyl acetate market. A detailed analysis of the key industry players has been done to provide insights into their business overview, products offered, and key strategies, such as partnerships, collaborations, mergers, acquisitions, and expansions, associated with the methyl acetate market. This report covers a competitive analysis of upcoming startups in the methyl acetate market ecosystem.

Reasons to Buy the Report

The report will offer the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall methyl acetate market and the subsegments. This report will help stakeholders understand the competitive landscape, gain more insights into positioning their businesses better, and plan suitable go-to-market strategies. The report will help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (rising adoption of methyl acetate in the paints, coatings, and adhesives industry, strong demand for eco-friendly, low-VOC solvents, and expansion in emerging economies), restraints (flammability, inhalation hazards & high handling costs, and Intense competition from well-established solvents), opportunities (expanding applications across high-growth industries and growth through bio-based and circular economy integration), and challenges (stringent regulatory compliance across regions and escalating production costs driven by feedstock volatility and energy intensity).

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the methyl acetate market.

- Market Development: Comprehensive information about profitable markets-the report analyzes the methyl acetate market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the methyl acetate market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as BASF (Germany), Thermo Fisher Scientific Inc. (US), Merck KGaA (Germany), Celanese Corporation (US), Eastman Chemical Company (US), Sekisui Chemical Co., Ltd. (Japan), Wacker Chemie AG (Germany), Synthomer plc (UK), Anhui Wanwei Group Co., Ltd. (China), and Chang Chun Group (Taiwan), among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 BASE NUMBER CALCULATION

- 2.3.1 DEMAND-SIDE APPROACH

- 2.3.2 SUPPLY-SIDE APPROACH

- 2.4 MARKET FORECAST APPROACH

- 2.4.1 SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- 2.5 DATA TRIANGULATION

- 2.6 FACTOR ANALYSIS

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN METHYL ACETATE MARKET

- 4.2 ASIA PACIFIC: METHYL ACETATE MARKET, BY GRADE AND COUNTRY

- 4.3 METHYL ACETATE MARKET, BY GRADE

- 4.4 METHYL ACETATE MARKET, BY END-USE INDUSTRY

- 4.5 METHYL ACETATE MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rise in adoption of methyl acetate in paints, coatings, and adhesives

- 5.2.1.2 Strong demand for eco-friendly, low-VOC solvents

- 5.2.1.3 Expansion in emerging economies

- 5.2.2 RESTRAINTS

- 5.2.2.1 Flammability, inhalation hazards, and high handling costs

- 5.2.2.2 Intense competition from well-established solvents

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expanding applications across high-growth industries

- 5.2.3.2 Growth through bio-based and circular economy integration

- 5.2.4 CHALLENGES

- 5.2.4.1 Stringent regulatory compliance across regions

- 5.2.4.2 Escalating production costs driven by feedstock volatility and energy intensity

- 5.2.1 DRIVERS

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.3.1 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 TARIFF AND REGULATORY LANDSCAPE

- 5.6.1 TARIFF ANALYSIS (HS CODE: 291539)

- 5.6.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.6.3 KEY REGULATIONS

- 5.6.3.1 REACH Regulation (EC 1907/2006)

- 5.6.3.2 OSHA - Hazard Communication Standard (29 CFR 1910.1200)

- 5.6.3.3 GHS - Globally Harmonized System of Classification and Labelling of Chemicals

- 5.6.3.4 Clean Air Act (CAA) - US EPA (40 CFR Part 60 & 63

- 5.6.4 PRICING ANALYSIS

- 5.6.4.1 Pricing analysis based on grade

- 5.6.4.2 Pricing analysis based on region

- 5.7 TRADE ANALYSIS

- 5.7.1 EXPORT SCENARIO (HS CODE 291539)

- 5.7.2 IMPORT SCENARIO (HS CODE 291539)

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Reactive distillation (RD)

- 5.8.1.2 Carbonylation of dimethyl ether (DME)

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Microwave-assisted esterification

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Enzyme-based formulations

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- 5.9.1 INTRODUCTION

- 5.9.2 METHODOLOGY

- 5.10 KEY CONFERENCES AND EVENTS

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 SCCNFP SAFETY EVALUATION OF METHYL ACETATE IN NAIL POLISH REMOVERS

- 5.11.2 USING DYNAMIC FLOWSHEET DIVA(R) SIMULATOR FOR MODELING METHYL ACETATE REACTIVE DISTILLATION PROCESS

- 5.11.3 ACUTE METHYL ACETATE POISONING IN FABRIC PROCESSING WORKSHOP (CHINA)

- 5.12 INVESTMENT AND FUNDING SCENARIO

- 5.13 IMPACT OF GEN AI/AI ON METHYL ACETATE MARKET

- 5.13.1 INTRODUCTION

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 MACROECONOMIC ANALYSIS

- 5.16.1 INTRODUCTION

- 5.16.2 GDP TRENDS AND FORECASTS

- 5.17 IMPACT OF 2025 US TARIFF: METHYL ACETATE MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRY/REGION

- 5.17.4.1 US

- 5.17.4.2 China

- 5.17.4.3 India

- 5.17.5 END-USE INDUSTRY IMPACT

6 METHYL ACETATE MARKET, BY GRADE

- 6.1 INTRODUCTION

- 6.2 INDUSTRIAL GRADE

- 6.2.1 VERSATILE SOLVENT FOR COATINGS, ADHESIVES, AND CHEMICAL SYNTHESIS

- 6.3 PHARMACEUTICAL GRADE

- 6.3.1 HIGH-PURITY SOLVENT FOR DRUG FORMULATION AND SYNTHESIS

- 6.4 FOOD GRADE

- 6.4.1 SAFE, REGULATED SOLVENT FOR FLAVORING AND FOOD PROCESSING

7 METHYL ACETATE MARKET, BY PURITY

- 7.1 INTRODUCTION

- 7.2 >= 99% PURITY

- 7.2.1 HIGH-PURITY METHYL ACETATE MEETS STRINGENT STANDARDS FOR SPECIALTY AND HIGH-VALUE APPLICATIONS

- 7.3 90-99% PURITY

- 7.3.1 INDUSTRIAL-GRADE METHYL ACETATE SUPPORTS MASS-MARKET PRODUCTION NEEDS

- 7.4 < 90% PURITY

- 7.4.1 TECHNICAL-GRADE METHYL ACETATE OFFERS COST-EFFICIENT SOLUTION FOR BLENDED APPLICATIONS

8 METHYL ACETATE MARKET, BY SALES CHANNEL

- 8.1 INTRODUCTION

- 8.2 DIRECT

- 8.2.1 LARGE-SCALE INDUSTRIAL CONSUMPTION TO DRIVE DEMAND FOR DIRECT SUPPLY AGREEMENTS

- 8.3 INDIRECT

- 8.3.1 DISTRIBUTION NETWORKS EXPAND MARKET REACH AND FLEXIBILITY FOR SMALLER BUYERS

9 METHYL ACETATE MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- 9.2 PAINTS & COATINGS

- 9.2.1 RISE IN ENVIRONMENTAL REGULATIONS AND DEMAND FOR LOW-VOC SOLVENTS TO PROPEL METHYL ACETATE USE

- 9.3 ADHESIVES & SEALANTS

- 9.3.1 STRINGENT VOC REGULATIONS AND DEMAND FOR FAST-CURING ADHESIVES TO DRIVE METHYL ACETATE ADOPTION

- 9.4 PHARMACEUTICALS

- 9.4.1 REGULATORY COMPLIANCE AND SAFETY TO DRIVE METHYL ACETATE USE IN PHARMACEUTICAL MANUFACTURING

- 9.5 INKS

- 9.5.1 ABILITY TO ADVANCE SUSTAINABLE AND SAFE INK PRODUCTION WITH METHYL ACETATE SOLVENT TO FUEL SEGMENT GROWTH

- 9.6 PERSONAL CARE & COSMETICS

- 9.6.1 RISE IN CONSUMER DEMAND FOR SAFE AND SUSTAINABLE COSMETICS TO DRIVE METHYL ACETATE ADOPTION

- 9.7 OTHER END-USE INDUSTRIES

10 METHYL ACETATE MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

- 10.2.1 CHINA

- 10.2.1.1 Industrial renaissance and pharmaceutical expansion to drive methyl acetate demand

- 10.2.2 INDIA

- 10.2.2.1 Expanding pharmaceutical, cosmetics, and automotive industries to propel methyl acetate demand

- 10.2.3 JAPAN

- 10.2.3.1 Industrial innovation and environmental standards to boost demand

- 10.2.4 SOUTH KOREA

- 10.2.4.1 Emerging electronics and automotive growth to underpin methyl acetate market expansion

- 10.2.5 REST OF ASIA PACIFIC

- 10.2.1 CHINA

- 10.3 EUROPE

- 10.3.1 GERMANY

- 10.3.1.1 Industrial innovation and automotive strength to fuel sustainable solvent demand

- 10.3.2 FRANCE

- 10.3.2.1 Sustainability and innovation in France's pharmaceuticals and cosmetics sector to boost methyl acetate demand

- 10.3.3 UK

- 10.3.3.1 Sustainable manufacturing and innovation to elevate methyl acetate adoption

- 10.3.4 SPAIN

- 10.3.4.1 Rise in pharmaceutical innovation and strong cosmetics market to fuel demand for sustainable solvents

- 10.3.5 REST OF EUROPE

- 10.3.1 GERMANY

- 10.4 NORTH AMERICA

- 10.4.1 US

- 10.4.1.1 Regulatory exemption and expanding industrial demand to drive market

- 10.4.2 CANADA

- 10.4.2.1 Eco-friendly manufacturing and regulatory alignment to fuel demand

- 10.4.3 MEXICO

- 10.4.3.1 Growth anchored in construction, manufacturing, and sustainable industrial practices to drive adoption of methyl acetate

- 10.4.1 US

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.5.1.1 Saudi Arabia

- 10.5.1.1.1 Industrial diversification to support methyl acetate applications

- 10.5.1.2 UAE

- 10.5.1.2.1 Expanding industrial base and pharmaceutical sector to drive demand

- 10.5.1.3 Rest of GCC Countries

- 10.5.1.1 Saudi Arabia

- 10.5.2 SOUTH AFRICA

- 10.5.2.1 Industrial growth and regulatory shifts to fuel safer, high-performance solvent adoption

- 10.5.3 REST OF MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.6 SOUTH AMERICA

- 10.6.1 BRAZIL

- 10.6.1.1 Industrial diversification and manufacturing growth to propel methyl acetate demand

- 10.6.2 ARGENTINA

- 10.6.2.1 Industrial resilience and automotive activity to sustain methyl acetate demand

- 10.6.3 REST OF SOUTH AMERICA

- 10.6.1 BRAZIL

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES

- 11.3 MARKET SHARE ANALYSIS

- 11.4 REVENUE ANALYSIS

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.5.1 COMPANY VALUATION

- 11.5.2 FINANCIAL METRICS

- 11.6 PRODUCT/BRAND COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Regional footprint

- 11.7.5.3 Grade footprint

- 11.7.5.4 Purity footprint

- 11.7.5.5 Sales channel footprint

- 11.7.5.6 End-use industry footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 DEALS

- 11.9.2 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 BASF

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.3.2 Expansions

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses & competitive threats

- 12.1.2 THERMO FISHER SCIENTIFIC INC.

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.3.2 Expansions

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses & competitive threats

- 12.1.3 MERCK KGAA

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.3.2 Expansions

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 CELANESE CORPORATION

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.3.2 Expansions

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses & competitive threats

- 12.1.5 EASTMAN CHEMICAL COMPANY

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Expansions

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses & competitive threats

- 12.1.6 SEKISUI CHEMICAL CO., LTD.

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Expansions

- 12.1.6.4 MnM view

- 12.1.7 WACKER CHEMIE AG

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Expansions

- 12.1.7.4 MnM view

- 12.1.8 SYNTHOMER PLC

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.8.4 MnM view

- 12.1.9 ANHUI WANWEI GROUP CO., LTD.

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.9.3 MnM view

- 12.1.10 CHANG CHUN GROUP

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.10.3 MnM view

- 12.1.1 BASF

- 12.2 OTHER PLAYERS

- 12.2.1 DAICEL CORPORATION

- 12.2.2 SHANXI SANWEI GROUP CO, LTD.

- 12.2.3 KISHIDA CHEMICAL CO., LTD.

- 12.2.4 ATOM SCIENTIFIC LTD

- 12.2.5 HAIHANG INDUSTRY

- 12.2.6 CENTRAL DRUG HOUSE

- 12.2.7 LOBACHEMIE PVT. LTD.

- 12.2.8 DUBICHEM

- 12.2.9 NACALAI TESQUE, INC.

- 12.2.10 ARDIN CHEMICAL COMPANY

- 12.2.11 MOLEKULA GROUP

- 12.2.12 RECOCHEM CORPORATION

- 12.2.13 SCHARLAB S.L.

- 12.2.14 SIMSON PHARMA LIMITED

- 12.2.15 CHEMICAL IRAN

13 ADJACENT & RELATED MARKET

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.2.1 PAINTS & COATINGS MARKET

- 13.2.1.1 Market definition

- 13.2.1.2 Paints & coatings market, by technology

- 13.2.1.3 Paints & coatings market, by resin type

- 13.2.1.4 Paints & coatings market, by end-use industry

- 13.2.1.5 Paints & coatings market, by region

- 13.2.1 PAINTS & COATINGS MARKET

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

List of Tables

- TABLE 1 RESEARCH LIMITATIONS AND RISK ASSUMPTIONS

- TABLE 2 ROLES OF COMPANIES IN METHYL ACETATE ECOSYSTEM

- TABLE 3 TARIFF SCENARIO FOR HS CODE 291539-COMPLIANT PRODUCTS, BY COUNTRY, 2024

- TABLE 4 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, INDUSTRY ASSOCIATIONS, AND OTHER ORGANIZATIONS

- TABLE 5 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, INDUSTRY ASSOCIATIONS, AND OTHER ORGANIZATIONS

- TABLE 6 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, INDUSTRY ASSOCIATIONS, AND OTHER ORGANIZATIONS

- TABLE 7 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, INDUSTRY ASSOCIATIONS, AND OTHER ORGANIZATIONS

- TABLE 8 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, INDUSTRY ASSOCIATIONS, AND OTHER ORGANIZATIONS

- TABLE 9 AVERAGE SELLING PRICE OF METHYL ACETATE AMONG KEY PLAYERS, BY GRADE, 2024 (USD/KG)

- TABLE 10 AVERAGE SELLING PRICE OF METHYL ACETATE AMONG KEY PLAYERS, BY REGION, 2021-2024 (USD/KG)

- TABLE 11 EXPORT DATA RELATED TO HS CODE 291539-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 12 IMPORT DATA RELATED TO HS CODE 291539-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 13 METHYL ACETATE MARKET: LIST OF KEY PATENTS, 2022-2024

- TABLE 14 METHYL ACETATE MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 15 PORTER'S FIVE FORCES ANALYSIS

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY END-USE INDUSTRIES

- TABLE 17 KEY BUYING CRITERIA FOR KEY APPLICATIONS

- TABLE 18 GLOBAL GDP GROWTH PROJECTION, BY REGION, 2021-2028 (USD TRILLION)

- TABLE 19 METHYL ACETATE MARKET, BY GRADE, 2024-2030 (USD MILLION)

- TABLE 20 METHYL ACETATE MARKET, BY GRADE, 2024-2030 (KT)

- TABLE 21 METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 22 METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (KT)

- TABLE 23 METHYL ACETATE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 24 METHYL ACETATE MARKET, BY REGION, 2024-2030 (KT)

- TABLE 25 ASIA PACIFIC: METHYL ACETATE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 26 ASIA PACIFIC: METHYL ACETATE MARKET, BY COUNTRY, 2024-2030 (KT)

- TABLE 27 ASIA PACIFIC: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (USD MILLION)

- TABLE 28 ASIA PACIFIC: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (KT)

- TABLE 29 ASIA PACIFIC: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 30 ASIA PACIFIC: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (KT)

- TABLE 31 CHINA: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (USD MILLION)

- TABLE 32 CHINA: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (KT)

- TABLE 33 CHINA: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 34 CHINA: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (KT)

- TABLE 35 INDIA: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (USD MILLION)

- TABLE 36 INDIA: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (KT)

- TABLE 37 INDIA: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 38 INDIA: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (KT)

- TABLE 39 JAPAN: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (USD MILLION)

- TABLE 40 JAPAN: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (KT)

- TABLE 41 JAPAN: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 42 JAPAN: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (KT)

- TABLE 43 SOUTH KOREA: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (USD MILLION)

- TABLE 44 SOUTH KOREA: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (KT)

- TABLE 45 SOUTH KOREA: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 46 SOUTH KOREA: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (KT)

- TABLE 47 REST OF ASIA PACIFIC: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (USD MILLION)

- TABLE 48 REST OF ASIA PACIFIC: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (KT)

- TABLE 49 REST OF ASIA PACIFIC: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 50 REST OF ASIA PACIFIC: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (KT)

- TABLE 51 EUROPE: METHYL ACETATE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 52 EUROPE: METHYL ACETATE MARKET, BY COUNTRY, 2024-2030 (KT)

- TABLE 53 EUROPE: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (USD MILLION)

- TABLE 54 EUROPE: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (KT)

- TABLE 55 EUROPE: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 56 EUROPE: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (KT)

- TABLE 57 GERMANY: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (USD MILLION)

- TABLE 58 GERMANY: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (KT)

- TABLE 59 GERMANY: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 60 GERMANY: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (KT)

- TABLE 61 FRANCE: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (USD MILLION)

- TABLE 62 FRANCE: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (KT)

- TABLE 63 FRANCE: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 64 FRANCE: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (KT)

- TABLE 65 UK: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (USD MILLION)

- TABLE 66 UK: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (KT)

- TABLE 67 UK: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 68 UK: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (KT)

- TABLE 69 SPAIN: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (USD MILLION)

- TABLE 70 SPAIN: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (KT)

- TABLE 71 SPAIN: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 72 SPAIN: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (KT)

- TABLE 73 REST OF EUROPE: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (USD MILLION)

- TABLE 74 REST OF EUROPE: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (KT)

- TABLE 75 REST OF EUROPE: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 76 REST OF EUROPE: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (KT)

- TABLE 77 NORTH AMERICA: METHYL ACETATE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 78 NORTH AMERICA: METHYL ACETATE MARKET, BY COUNTRY, 2024-2030 (KT)

- TABLE 79 NORTH AMERICA: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (USD MILLION)

- TABLE 80 NORTH AMERICA: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (KT)

- TABLE 81 NORTH AMERICA: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 82 NORTH AMERICA: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (KT)

- TABLE 83 US: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (USD MILLION)

- TABLE 84 US: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (KT)

- TABLE 85 US: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 86 US: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (KT)

- TABLE 87 CANADA: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (USD MILLION)

- TABLE 88 CANADA: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (KT)

- TABLE 89 CANADA: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 90 CANADA: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (KT)

- TABLE 91 MEXICO: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (USD MILLION)

- TABLE 92 MEXICO: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (KT)

- TABLE 93 MEXICO: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 94 MEXICO: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (KT)

- TABLE 95 MIDDLE EAST & AFRICA: METHYL ACETATE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 96 MIDDLE EAST & AFRICA: METHYL ACETATE MARKET, BY COUNTRY, 2024-2030 (KT)

- TABLE 97 MIDDLE EAST & AFRICA: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (USD MILLION)

- TABLE 98 MIDDLE EAST & AFRICA: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (KT)

- TABLE 99 MIDDLE EAST & AFRICA: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 100 MIDDLE EAST & AFRICA: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (KT)

- TABLE 101 GCC COUNTRIES: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (USD MILLION)

- TABLE 102 GCC COUNTRIES: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (KT)

- TABLE 103 GCC COUNTRIES: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 104 GCC COUNTRIES: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (KT)

- TABLE 105 SAUDI ARABIA: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (USD MILLION)

- TABLE 106 SAUDI ARABIA: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (KT)

- TABLE 107 SAUDI ARABIA: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 108 SAUDI ARABIA: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (KT)

- TABLE 109 UAE: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (USD MILLION)

- TABLE 110 UAE: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (KT)

- TABLE 111 UAE: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 112 UAE: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (KT)

- TABLE 113 REST OF GCC COUNTRIES: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (USD MILLION)

- TABLE 114 REST OF GCC COUNTRIES: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (KT)

- TABLE 115 REST OF GCC COUNTRIES: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 116 REST OF GCC COUNTRIES: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (KT)

- TABLE 117 SOUTH AFRICA: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (USD MILLION)

- TABLE 118 SOUTH AFRICA: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (KT)

- TABLE 119 SOUTH AFRICA: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 120 SOUTH AFRICA: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (KT)

- TABLE 121 REST OF MIDDLE EAST & AFRICA: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (USD MILLION)

- TABLE 122 REST OF MIDDLE EAST & AFRICA: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (KT)

- TABLE 123 REST OF MIDDLE EAST & AFRICA: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 124 REST OF MIDDLE EAST & AFRICA: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (KT)

- TABLE 125 SOUTH AMERICA: METHYL ACETATE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 126 SOUTH AMERICA: METHYL ACETATE MARKET, BY COUNTRY, 2024-2030 (KT)

- TABLE 127 SOUTH AMERICA: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (USD MILLION)

- TABLE 128 SOUTH AMERICA: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (KT)

- TABLE 129 SOUTH AMERICA: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 130 SOUTH AMERICA: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (KT)

- TABLE 131 BRAZIL: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (USD MILLION)

- TABLE 132 BRAZIL: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (KT)

- TABLE 133 BRAZIL: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 134 BRAZIL: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (KT)

- TABLE 135 ARGENTINA: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (USD MILLION)

- TABLE 136 ARGENTINA: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (KT)

- TABLE 137 ARGENTINA: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 138 ARGENTINA: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (KT)

- TABLE 139 REST OF SOUTH AMERICA: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (USD MILLION)

- TABLE 140 REST OF SOUTH AMERICA: METHYL ACETATE MARKET, BY GRADE, 2024-2030 (KT)

- TABLE 141 REST OF SOUTH AMERICA: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 142 REST OF SOUTH AMERICA: METHYL ACETATE MARKET, BY END-USE INDUSTRY, 2024-2030 (KT)

- TABLE 143 METHYL ACETATE MARKET: OVERVIEW OF MAJOR STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2020-AUGUST 2025

- TABLE 144 METHYL ACETATE MARKET: DEGREE OF COMPETITION, 2024

- TABLE 145 METHYL ACETATE MARKET: REGIONAL FOOTPRINT, 2024

- TABLE 146 METHYL ACETATE MARKET: GRADE FOOTPRINT, 2024

- TABLE 147 METHYL ACETATE MARKET: PURITY FOOTPRINT, 2024

- TABLE 148 METHYL ACETATE MARKET: SALES CHANNEL FOOTPRINT, 2024

- TABLE 149 METHYL ACETATE MARKET: END-USE INDUSTRY FOOTPRINT, 2024

- TABLE 150 METHYL ACETATE MARKET: DETAILED LIST OF KEY STARTUPS/SMES, 2024

- TABLE 151 METHYL ACETATE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024

- TABLE 152 METHYL ACETATE MARKET: DEALS, JANUARY 2020-AUGUST 2025

- TABLE 153 METHYL ACETATE MARKET: EXPANSIONS, JANUARY 2020-AUGUST 2025

- TABLE 154 BASF: COMPANY OVERVIEW

- TABLE 155 BASF: PRODUCTS OFFERED

- TABLE 156 BASF: DEALS

- TABLE 157 BASF: EXPANSIONS

- TABLE 158 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- TABLE 159 THERMO FISHER SCIENTIFIC INC.: PRODUCTS OFFERED

- TABLE 160 THERMO FISHER SCIENTIFIC INC.: DEALS

- TABLE 161 THERMO FISHER SCIENTIFIC INC.: EXPANSIONS

- TABLE 162 MERCK KGAA: COMPANY OVERVIEW

- TABLE 163 MERCK KGAA: PRODUCTS OFFERED

- TABLE 164 MERCK KGAA: DEALS

- TABLE 165 MERCK KGAA: EXPANSIONS

- TABLE 166 CELANESE CORPORATION: COMPANY OVERVIEW

- TABLE 167 CELANESE CORPORATION: PRODUCTS OFFERED

- TABLE 168 CELANESE CORPORATION: DEALS

- TABLE 169 CELANESE CORPORATION: EXPANSIONS

- TABLE 170 EASTMAN CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 171 EASTMAN CHEMICAL COMPANY: PRODUCTS OFFERED

- TABLE 172 EASTMAN CHEMICAL COMPANY: EXPANSIONS

- TABLE 173 SEKISUI CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 174 SEKISUI CHEMICAL CO., LTD.: PRODUCTS OFFERED

- TABLE 175 SEKISUI CHEMICAL CO., LTD.: EXPANSIONS

- TABLE 176 WACKER CHEMIE AG: COMPANY OVERVIEW

- TABLE 177 WACKER CHEMIE AG: PRODUCTS OFFERED

- TABLE 178 WACKER CHEMIE AG: EXPANSIONS

- TABLE 179 SYNTHOMER PLC: COMPANY OVERVIEW

- TABLE 180 SYNTHOMER PLC: PRODUCTS OFFERED

- TABLE 181 SYNTHOMER PLC: DEALS

- TABLE 182 ANHUI WANWEI GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 183 ANHUI WANWEI GROUP CO., LTD.: PRODUCTS OFFERED

- TABLE 184 CHANG CHUN GROUP: COMPANY OVERVIEW

- TABLE 185 CHANG CHUN GROUP: PRODUCTS OFFERED

- TABLE 186 DAICEL CORPORATION: COMPANY OVERVIEW

- TABLE 187 SHANXI SANWEI GROUP CO, LTD.: COMPANY OVERVIEW

- TABLE 188 KISHIDA CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 189 ATOM SCIENTIFIC LTD: COMPANY OVERVIEW

- TABLE 190 HAIHANG INDUSTRY: COMPANY OVERVIEW

- TABLE 191 CENTRAL DRUG HOUSE: COMPANY OVERVIEW

- TABLE 192 LOBACHEMIE PVT. LTD.: COMPANY OVERVIEW

- TABLE 193 DUBICHEM: COMPANY OVERVIEW

- TABLE 194 NACALAI TESQUE, INC.: COMPANY OVERVIEW

- TABLE 195 ARDIN CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 196 MOLEKULA GROUP: COMPANY OVERVIEW

- TABLE 197 RECOCHEM CORPORATION: COMPANY OVERVIEW

- TABLE 198 SCHARLAB S.L.: COMPANY OVERVIEW

- TABLE 199 SIMSON PHARMA LIMITED: COMPANY OVERVIEW

- TABLE 200 CHEMICAL IRAN: COMPANY OVERVIEW

- TABLE 201 INDUSTRIAL: PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2018-2023 (USD MILLION)

- TABLE 202 INDUSTRIAL: PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 203 INDUSTRIAL: PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2018-2023 (KILOTON)

- TABLE 204 INDUSTRIAL: PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2024-2029 (KILOTON)

- TABLE 205 ARCHITECTURAL: PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2018-2023 (USD MILLION)

- TABLE 206 ARCHITECTURAL: PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 207 ARCHITECTURAL: PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2018-2023 (KILOTON)

- TABLE 208 ARCHITECTURAL: PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2024-2029 (KILOTON)

- TABLE 209 PAINTS & COATINGS MARKET, BY RESIN TYPE, 2018-2023 (USD MILLION)

- TABLE 210 PAINTS & COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 211 PAINTS & COATINGS MARKET, BY RESIN TYPE, 2018-2023 (KILOTON)

- TABLE 212 PAINTS & COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 213 ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2018-2023 (USD MILLION)

- TABLE 214 ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 215 ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2018-2023 (KILOTON)

- TABLE 216 ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 217 INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2018-2023 (USD MILLION)

- TABLE 218 INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 219 INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2018-2023 (KILOTON)

- TABLE 220 INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 221 PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2023 (USD MILLION)

- TABLE 222 PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 223 PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2018-2023 (KILOTON)

- TABLE 224 PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 225 PAINTS & COATINGS MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 226 PAINTS & COATINGS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 227 PAINTS & COATINGS MARKET, BY REGION, 2018-2023 (KILOTON)

- TABLE 228 PAINTS & COATINGS MARKET, BY REGION, 2024-2029 (KILOTON)

List of Figures

- FIGURE 1 METHYL ACETATE MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 STUDY YEARS CONSIDERED

- FIGURE 3 METHYL ACETATE MARKET: RESEARCH DESIGN

- FIGURE 4 KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 KEY DATA FROM PRIMARY SOURCES

- FIGURE 6 KEY INDUSTRY INSIGHTS

- FIGURE 7 BREAKDOWN OF INTERVIEWS WITH EXPERTS

- FIGURE 8 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 9 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 10 METHYL ACETATE MARKET: APPROACH 1

- FIGURE 11 METHYL ACETATE MARKET: APPROACH 2

- FIGURE 12 METHYL ACETATE MARKET: DATA TRIANGULATION

- FIGURE 13 FACTOR ANALYSIS

- FIGURE 14 RESEARCH ASSUMPTIONS

- FIGURE 15 INDUSTRIAL GRADE TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 16 PHARMACEUTICALS TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 17 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 18 EMERGING ECONOMIES OFFER ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN METHYL ACETATE MARKET

- FIGURE 19 INDUSTRIAL GRADE SEGMENT AND CHINA LED METHYL ACETATE MARKET IN 2024

- FIGURE 20 INDUSTRIAL GRADE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 21 PAINTS & COATINGS TO BE LARGEST SEGMENT OF METHYL ACETATE MARKET

- FIGURE 22 MARKET IN CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 23 METHYL ACETATE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 24 SALES OF NEW VEHICLES - ALL TYPES, 2019-2024 (UNITS)

- FIGURE 25 HENRY HUB NATURAL GAS SPOT PRICE, 2024-2025 (DOLLARS PER MILLION BTU)

- FIGURE 26 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 27 METHYL ACETATE MARKET: ECOSYSTEM ANALYSIS

- FIGURE 28 METHYL ACETATE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 29 AVERAGE SELLING PRICE TREND OF METHYL ACETATE AMONG KEY PLAYERS, BY GRADE, 2024 (USD/KG)

- FIGURE 30 AVERAGE SELLING PRICE OF METHYL ACETATE AMONG KEY PLAYERS, BY REGION, 2021-2024 (USD/KG)

- FIGURE 31 EXPORT DATA FOR HS CODE 291539-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 32 IMPORT DATA FOR HS CODE 291539-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 33 LIST OF MAJOR PATENTS FOR METHYL ACETATE, 2015-2024

- FIGURE 34 MAJOR PATENTS APPLIED AND GRANTED RELATED TO METHYL ACETATE, BY COUNTRY/REGION, 2015-2024

- FIGURE 35 INVESTMENT AND FUNDING SCENARIO, 2018-2024 (USD MILLION)

- FIGURE 36 IMPACT OF GEN AI/AI ON METHYL ACETATE MARKET

- FIGURE 37 METHYL ACETATE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 38 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 39 KEY BUYING CRITERIA FOR KEY APPLICATIONS

- FIGURE 40 INDUSTRIAL-GRADE METHYL ACETATE TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 41 PAINTS & COATINGS TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 42 CHINA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 43 ASIA PACIFIC TO DOMINATE METHYL ACETATE MARKET DURING FORECAST PERIOD

- FIGURE 44 ASIA PACIFIC: METHYL ACETATE MARKET SNAPSHOT

- FIGURE 45 EUROPE: METHYL ACETATE MARKET SNAPSHOT

- FIGURE 46 METHYL ACETATE MARKET SHARE ANALYSIS, 2024

- FIGURE 47 METHYL ACETATE MARKET: REVENUE ANALYSIS OF KEY COMPANIES IN LAST FIVE YEARS, 2020-2024 (USD BILLION)

- FIGURE 48 METHYL ACETATE MARKET: COMPANY VALUATION, 2024 (USD BILLION)

- FIGURE 49 METHYL ACETATE MARKET: FINANCIAL METRICS: EV/EBITDA RATIO, 2024

- FIGURE 50 METHYL ACETATE MARKET: YEAR-TO-DATE PRICE AND FIVE-YEAR STOCK BETA, 2024

- FIGURE 51 METHYL ACETATE MARKET: PRODUCT/BRAND COMPARISON

- FIGURE 52 METHYL ACETATE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 53 METHYL ACETATE MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 54 METHYL ACETATE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 55 BASF: COMPANY SNAPSHOT, 2024

- FIGURE 56 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT, 2024

- FIGURE 57 MERCK KGAA: COMPANY SNAPSHOT, 2024

- FIGURE 58 CELANESE CORPORATION: COMPANY SNAPSHOT, 2024

- FIGURE 59 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT, 2024

- FIGURE 60 SEKISUI CHEMICAL CO., LTD.: COMPANY SNAPSHOT, 2024

- FIGURE 61 WACKER CHEMIE AG: COMPANY SNAPSHOT, 2024

- FIGURE 62 SYNTHOMER PLC: COMPANY SNAPSHOT, 2024