|

市場調查報告書

商品編碼

1819098

全球氟化鋁(AlF3)市場按產品類型、體積密度、形式、等級、應用和最終用途產業分類-預測至2030年Aluminum Fluoride Market by Product Type, Bulk Density, Form, Grade, Application, End-use Industry - Global Forecast to 2030 |

||||||

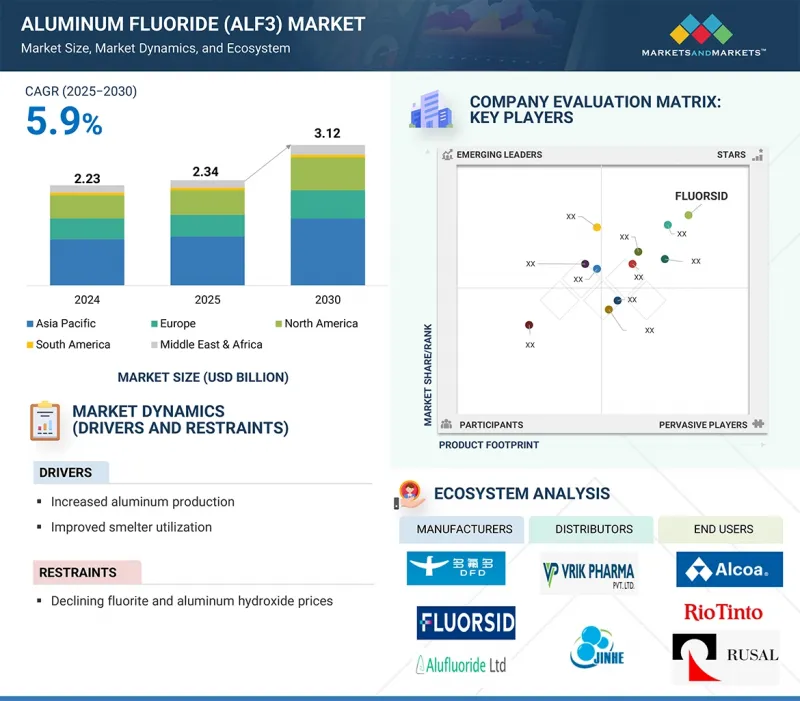

全球氟化鋁 (AlF3) 市場規模預計將從 2025 年的 23.4 億美元增至 2030 年的 31.2 億美元,預測期內的複合年成長率為 5.9%。

| 調查範圍 | |

|---|---|

| 調查年份 | 2021-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 單元 | 百萬美元/十億美元,千噸 |

| 部分 | 產品類型、體積密度、形狀、等級、用途、最終用途產業、地區 |

| 目標區域 | 亞太地區、北美、歐洲、中東和非洲、南美 |

由於氟化鋁在維持電解過程穩定方面發揮著至關重要的作用,隨著全球鋁產量的持續成長,其需求量也隨之增加。冶煉廠正在擴大產能,以滿足汽車、建築和大規模製造業日益成長的鋁需求。

每套新的電解槽和生產設施都需要可靠的氟化鋁供應才能有效運作,其消耗量與鋁產量直接相關。此外,老舊冶煉廠的現代化升級也促使高性能氟化鋁的使用量不斷增加,以提高製程可靠性並減少運作中斷。鋁生產的地理分佈不斷擴大,尤其是在新興經濟體,這進一步推動了需求成長,因為新建設施高度依賴大量穩定的氟化鋁供應。

“預測期內,無水氟化鋁(AlF3)市場將成為以金額為準成長最快的產品類型。”

無水氟化鋁已成為成長最快的產品類型,滿足了現代冶煉過程不斷變化的需求,這些工藝強調更清潔的投入和減少對環境的影響。與水合物不同,無水氟化鋁避免了水分釋放相關的問題,水分釋放會降低電解槽的穩定性並增加能耗。其乾態濃度更高、重量更輕,可實現更精準的配料、更方便的操作並降低運輸成本。此外,先進的冶煉廠擴大使用自動進料系統,青睞能夠提供穩定流量和均勻分佈的無水材料。這些營運優勢,加上大型冶煉廠對進料控制的趨勢,使無水氟化鋁成為首選,並在全球迅速普及。

“預測期內,高容重(HBD)將成為氟化鋁(AlF3)市場以金額為準成長最快的部分。”

高堆積密度三氟化鋁 (AlF3) 的成長速度最快,因為它順應了鋁業向更大規模、更高能耗冶煉製程轉型的趨勢。隨著電解槽不斷增大,且效率標準愈發嚴格,冶煉廠越來越青睞能夠確保穩定電源並最大程度降低性能波動的材料。高堆積密度三氟化鋁 (AlF3) 具有優異的流動性能,使自動進料系統能夠更精確地運行,並降低堵塞和計量不一致的風險。這提高了電流效率並延長了電解槽壽命,而這對製造商來說是一個關鍵的成本因素。此外,減少運輸量和提高貨櫃運轉率等物流優勢,增強了其在全球供應鏈中的競爭力。這些技術和經濟協同效應正在推動其快速普及。

“在預測期內,粉末將成為氟化鋁(AlF3)市場以金額為準成長最快的幾何部分。”

粉狀氟化鋁因其用途廣泛且易於融入現代鋁冶煉製程而成為成長最快的容重材料。其細小的顆粒尺寸使其能夠在電解槽內快速溶解並均勻分佈,有助於穩定冶煉廠運作並提高電流效率。與顆粒狀氟化鋁相比,粉末狀氟化鋁所需的處理設備也相對簡單,因此在中小型冶煉廠較常見的地區越來越受歡迎。此外,人們對靈活包裝和運輸解決方案的日益重視也推動了其應用,因為粉末可以有效地裝入袋裝和散裝容器中,從而降低處理成本。粉末狀氟化鋁在各種冶煉環境中的多功能性以及與傳統和新興技術的兼容性,使其成為近年來成長最快的材料。

本報告分析了全球氟化鋁 (AlF3) 市場,提供了關鍵促進因素和限制因素、競爭格局和未來趨勢的資訊。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章 主要發現

- 氟化鋁(AlF3)市場充滿機遇

- 氟化鋁(AlF3)市場(依產品類型)

- 氟化鋁(AlF3)市場(以體積密度)

- 氟化鋁(AlF3)市場(依形態)

- 氟化鋁(AlF3)市場(依等級)

- 氟化鋁(AlF3)市場應用

- 氟化鋁(AlF3)市場(依最終用途產業分類)

- 氟化鋁(AlF3)市場(依國家)

第5章 市場概況

- 介紹

- 市場動態

- 驅動程式

- 抑制因素

- 機會

- 任務

- 人工智慧世代

- 介紹

- 對氟化鋁(AlF3)市場的影響

第6章 產業趨勢

- 介紹

- 影響客戶業務的趨勢/中斷

- 供應鏈分析

- 投資狀況及資金籌措情景

- 定價分析

- 2021-2024年各地區氟化鋁(AlF3)平均售價

- 氟化鋁(AlF3)各等級平均售價(2021-2024年)

- 氟化鋁(AlF3)各等級平均售價(2024年)

- 生態系分析

- 技術分析

- 主要技術

- 互補技術

- 鄰近技術

- 專利分析

- 調查方法

- 全球專利授權情形(2015-2024)

- 考慮

- 專利的法律地位

- 司法管轄權分析

- 主申請人

- 關鍵專利清單

- 貿易分析

- 進口情形(HS 編碼 282612)

- 出口情形(HS 編碼 282612)

- 大型會議和活動(2025-2026)

- 關稅和監管格局

- 海關分析

- 標準和監管環境

- 波特五力分析

- 主要相關利益者和採購標準

- 宏觀經濟展望

- 案例研究分析

- 2025年美國關稅的影響 - 氟化鋁(AlF3)市場

- 介紹

- 主要關稅稅率

- 價格影響分析

- 對該地區的影響

- 對產品類型的影響

7. 氟化鋁(AlF3)市場(依等級)

- 介紹

- 冶煉級

- 催化劑級

- 技術等級

- 實驗室級

- 高純度

8. 氟化鋁(AlF3)市場(依產品類型)

- 介紹

- 無水

- 烘乾

- 濕的

9. 氟化鋁(AlF3)市場(依形態)

- 介紹

- 粉末

- 顆粒狀

- 顆粒

10. 氟化鋁(AlF3)市場(以體積密度)

- 介紹

- 低容重

- 堆積密度高

第 11 章氟化鋁(AlF3)市場應用

- 介紹

- 電解添加劑

- 通量

- 催化劑/觸媒撐體

- 功能添加物

- 光學鍍膜材料

- 氟中間體

- 其他用途

- 腐蝕抑制劑

- 蝕刻/表面處理

12. 氟化鋁(AlF3)市場(依最終用途產業)

- 介紹

- 鋁

- 陶瓷和玻璃

- 化工/石化

- 電子/光學

- 車

- 航太

- 建造

- 其他終端用途產業

- 金屬加工與焊接

- 醫療/製藥

13. 氟化鋁(AlF3)市場(按地區)

- 介紹

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 義大利

- 法國

- 英國

- 西班牙

- 俄羅斯

- 其他歐洲國家

- 中東和非洲

- 海灣合作理事會國家

- 南非

- 其他中東和非洲地區

- 南美洲

- 阿根廷

- 巴西

- 南美洲其他地區

第14章競爭格局

- 介紹

- 主要參與企業的策略/優勢

- 市佔率分析

- 收益分析

- 企業評估矩陣:主要企業(2024年)

- 公司評估矩陣:Start-Ups/中小企業(2024 年)

- 品牌/產品比較

- 公司估值及財務指標

- 競爭場景

第15章 公司簡介

- 主要企業

- FLUORSID

- INDUSTRIES CHIMIQUES DU FLUOR

- ALUFLUOR

- GULF FLUOR

- ALUFLUORIDE LIMITED

- ORBIA FLUOR & ENERGY MATERIALS

- PHOSAGRO GROUP

- DO-FLUORIDE NEW MATERIALS CO., LTD.

- HUNAN NONFERROUS FLUORIDE CHEMICAL GROUP CO., LTD.

- AB LIFOSA

- 其他公司

- SHANDONG HAIRUN NEW MATERIAL TECHNOLOGY CO., LTD.

- HENAN JINHE INDUSTRY CO., LTD.

- ELIXIRGROUP

- HENAN WEILAI ALUMINUM (GROUP) CO., LTD

- NAVIN FLUORINE INTERNATIONAL LIMITED

- DERIVADOS DEL FLUOR

- TANFAC INDUSTRIES LTD.

- YINGKE NEW MATERIALS CO., LTD.

- LICHE OPTO GROUP CO., LTD

- JIAOZUO JINHONGLI ALUMINUM CO., LTD.

- VRIK PHARMA

- FOSHAN NANHAI SHUANGFU CHEMICAL CO., LTD

- HENAN YELLOW RIVER NEW MATERIAL TECHNOLOGY CO., LTD.

- PARTH INDUSTRIES

- SB CHEMICALS

第16章 附錄

The aluminum fluoride (AlF3) market is projected to grow from USD 2.34 billion in 2025 to USD 3.12 billion by 2030, registering a CAGR of 5.9% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) and Volume (Kiloton) |

| Segments | Product Type, Bulk Density, Form, Grade, Application, End-Use Industry, and Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

The demand for AlF3 is rising as global aluminum production continues to increase, driven by its essential role in maintaining stable electrolytic processes. Smelters are expanding their capacity to meet the growing needs for aluminum in automotive, construction, and high-volume manufacturing sectors.

Each new potline and production facility requires a reliable supply of AlF3 to operate efficiently, making its consumption directly linked to aluminum output. Modernizing older smelters has also led to increased use of high-performance AlF3 grades to improve process reliability and reduce operational disruptions. The expanding geographic distribution of aluminum production, especially in emerging economies, further boosts demand, as new facilities depend heavily on large volumes of secure AlF3 supplies.

"Anhydrous to be fastest-growing product type segment of aluminum fluoride (AlF3) market in terms of value during forecast period"

Anhydrous AlF3 has emerged as the fastest-growing product type because it meets the changing needs of modern smelting operations that focus on cleaner inputs and lower environmental impact. Unlike hydrated forms, anhydrous AlF3 avoids issues related to moisture release, which can weaken cell stability and increase energy consumption. Its dry form allows for more accurate dosing, better handling, and lower transportation costs due to higher concentration and lighter weight. Additionally, the increased use of automated feeding systems in advanced smelters favors anhydrous material, as it provides consistent flow and even distribution. These operational benefits, along with the trend of large-capacity smelters seeking greater control over input materials, make anhydrous AlF3 the preferred choice and boost its rapid adoption worldwide.

"High-bulk density (HBD) to be fastest-growing segment of aluminum fluoride (AlF3) market in terms of value during forecast period"

High bulk density AlF3 is experiencing the fastest growth because it aligns with the shift of the aluminum industry toward larger and more energy-intensive smelting operations. As electrolytic cells become bigger and operate under stricter efficiency standards, smelters increasingly favor materials that ensure stable feeding and minimize variability in performance. High bulk density AlF3 provides superior flow properties, allowing automated feeding systems to work with greater precision, reducing the risk of blockages or inconsistent dosing. This improves current efficiency and extends cell life, which is a critical cost factor for producers. Moreover, its logistical advantages, such as reduced transport volume and better container utilization, make it more competitive in global supply chains. These technological and economic synergies are fueling its rapid adoption.

"Powder to be fastest-growing form segment of aluminum fluoride (AlF3) market in terms of value during forecast period"

The powder form of AlF3 has become the fastest-growing segment in bulk density due to its versatility and easy integration into modern aluminum smelting processes. Its fine particles ensure quicker dissolution and more uniform distribution within electrolytic cells, helping smelters maintain stable operation and improved current efficiency. Powder AlF3 is also increasingly preferred in regions where smaller or mid-scale smelting units are common, as it needs less advanced handling equipment than granular forms. Additionally, the growing emphasis on flexible packaging and transportation solutions supports its use since powder can be efficiently packed in bags or bulk containers at lower handling costs. The versatility of powder AlF3 across various smelting setups and its compatibility with both traditional and new technologies have made it the fastest-growing segment in recent years.

"Smelter to be fastest-growing grade segment of aluminum fluoride (AlF3) market in terms of value during forecast period"

Smelter-grade AlF3 is the fastest-growing segment because its adoption is linked to the shift in global aluminum production to regions with abundant energy resources and integrated industrial clusters. Emerging markets are focusing on large-scale smelters designed to use standardized inputs, where smelter-grade AlF3 is the most compatible choice. Unlike specialty grades that serve niche applications, smelter-grade AlF3 addresses the core demand for primary aluminum, which continues to grow due to urbanization, renewable energy projects, and electric mobility. The ability to secure stable supply contracts with aluminum producers and lower production complexity compared to advanced grades has driven its rapid growth. This structural alignment with the expansion of base metal industries makes smelter-grade AlF3 the fastest-growing segment in the market.

"Electrolyte additive to be fastest-growing application segment of aluminum fluoride (AlF3) market in terms of value during forecast period"

Electrolyte additive has emerged as the fastest-growing application in the AlF3 market due to their role in enabling process flexibility in the evolving smelter technologies. Maintaining an optimal bath ratio has become more challenging as the industry shifts toward larger reduction cells and higher current intensities. When added as an electrolyte, AlF3 provides precise control over these parameters, making it essential for next-generation cell designs. Additionally, as producers increasingly incorporate renewable energy into smelting operations, fluctuations in power supply demand tighter bath management to prevent efficiency losses. The ability of electrolyte additives to adapt bath chemistry under variable operating conditions has opened new opportunities for adoption. This adaptability and support for modern, high-capacity smelting facilities make electrolyte additives the fastest-growing segment in the AlF3 market.

"Aluminum to be fastest-growing end-use industry segment of aluminum fluoride (AlF3) market in terms of value during forecast period"

The aluminum industry is the fastest-growing end-use sector for AlF3 due to rising global demand for aluminum products in high-tech and industrial applications. Rapid urbanization and infrastructure development, especially in emerging economies, are increasing aluminum use in construction, transportation, and machinery. As smelters expand production to meet this demand, the need for AlF3 also grows, as it is vital for achieving higher purity aluminum and consistent output. Additionally, industry players are investing in specialized alloys and advanced processing techniques that depend on precise AlF3 formulations. Regulatory requirements for process efficiency and product quality in aluminum manufacturing further strengthen the reliance on AlF3. These factors position the aluminum sector as the leading and fastest-growing driver of AlF3 consumption worldwide.

"Asia Pacific to be fastest-growing market for aluminum fluoride (AlF3) during forecast period"

The Asia Pacific region is the fastest-growing market for AlF3 because of the rapid growth of its aluminum industry, fueled by rising demand from automotive, aerospace, electronics, and construction sectors. China and India, as the largest aluminum producers in the area, are investing heavily in smelting capacity and upgrading existing facilities, which need high-quality AlF3 to improve electrolytic efficiency and boost production. Additionally, industrial growth in Southeast Asia, including Malaysia, Vietnam, and Thailand, is further increasing the use of aluminum and related chemicals. Technological advances, such as better production methods and digital monitoring in smelters, are encouraging the use of premium AlF3 grades. With raw material availability and competitive regional manufacturing, Asia Pacific is the fastest-growing AlF3 market worldwide.

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations in the aluminum fluoride (AlF3) market. Additionally, secondary research was used to gather information to identify and confirm the market size of different segments.

- By Company Type: Tier 1 - 50%, Tier 2 - 30%, and Tier 3 - 20%

- By Designation: Managers - 15%, Directors - 20%, and Others - 65%

- By Region: North America - 30%, Europe - 25%, Asia Pacific - 35%, Middle East & Africa - 5%, and South America - 5%

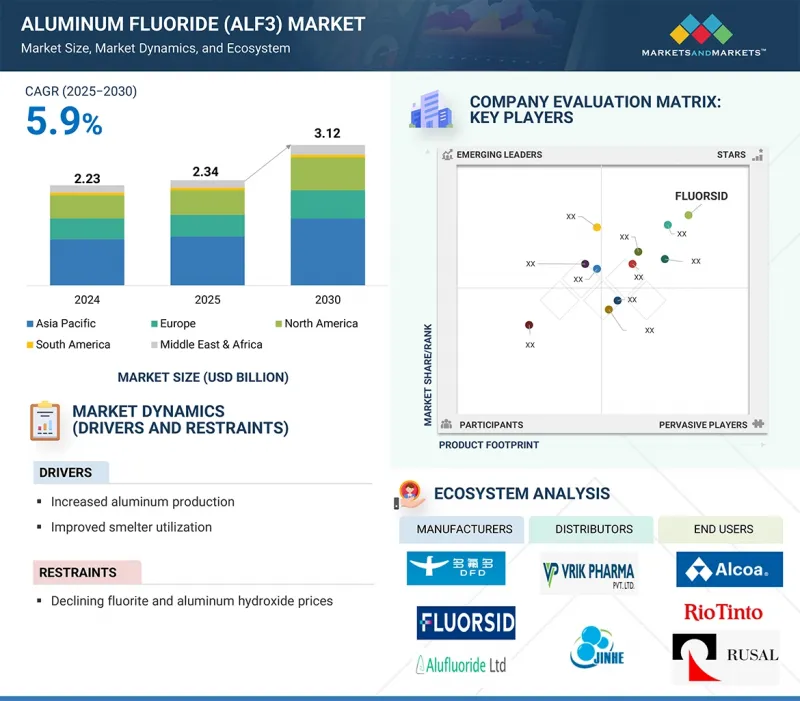

The aluminum fluoride (AlF3) market comprises Fluorsid (Italy), Industries Chimiques du Fluor (Tunisia), Do-Fluoride New Materials Co., Ltd. (China), Alufluor (Sweden), Alufluoride Limited (India), Orbia Fluor & Energy Materials (US), Gulf Fluor (UAE), Hunan Nonferrous Fluoride Chemical Group Co., Ltd. (China), AB LIFOSA (Lithuania), and PhosAgro Group (Russia). The study includes an in-depth competitive analysis of these key players in the aluminum fluoride (AlF3) market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This report examines the market for aluminum fluoride (AlF3) based on product type, bulk density, form, grade, application, end-use industry, and region, and provides estimates of the overall market value across various regions. It includes a comprehensive review of key industry players, offering insights into their business overviews, products and services, key strategies, and market expansion activities.

Key benefits of buying this report

This research report focuses on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape; emerging and high-growth segments of the aluminum fluoride (AlF3) market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights into the following pointers:

- Analysis of drivers: (Increased aluminum production), restraints (Declining fluorite and aluminum hydroxide prices), opportunities (Shift toward fluorosilicic acid (FSA)-based AlF3 production), and challenges (Regulatory pressure on hydrofluoric acid (HF) use) influencing the growth of the aluminum fluoride (AlF3) market.

- Market Penetration: Comprehensive information on the AlF3 market offered by top global aluminum fluoride (AlF3) market players.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, expansions, and partnerships in the aluminum fluoride (AlF3) market.

- Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the markets for aluminum fluoride (AlF3) across regions.

- Market Capacity: Recycling capacity of the companies is provided wherever available, with upcoming capacities for the aluminum fluoride (AlF3) market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the aluminum fluoride (AlF3) market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS OF STUDY

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary sources

- 2.1.2.3 Key participants from primary interviews

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.2.5 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 SUPPLY-SIDE ANALYSIS

- 2.2.2 DEMAND-SIDE ANALYSIS

- 2.3 GROWTH FORECAST

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 GROWTH FORECAST

- 2.8 RISK ASSESSMENT

- 2.9 FACTOR ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ALUMINUM FLUORIDE MARKET

- 4.2 ALUMINUM FLUORIDE MARKET, BY PRODUCT TYPE

- 4.3 ALUMINUM FLUORIDE MARKET, BY BULK DENSITY

- 4.4 ALUMINUM FLUORIDE MARKET, BY FORM

- 4.5 ALUMINUM FLUORIDE MARKET, BY GRADE

- 4.6 ALUMINUM FLUORIDE MARKET, BY APPLICATION

- 4.7 ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY

- 4.8 ALUMINUM FLUORIDE MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Surging aluminum production to elevate aluminum fluoride requirements in electrolytic processes

- 5.2.1.2 Improved smelter utilization ensures steady demand

- 5.2.2 RESTRAINTS

- 5.2.2.1 Declining fluorite and aluminum hydroxide prices exert margin pressure on producers

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Shift toward fluorosilicic acid (FSA)-based aluminum fluoride production

- 5.2.3.2 Growing adoption of vertical integration by aluminum producers to supply aluminum fluoride and stabilize costs

- 5.2.4 CHALLENGES

- 5.2.4.1 Just-in-time procurement by aluminum smelters limits demand recovery

- 5.2.4.2 Regulatory pressure on hydrofluoric acid use

- 5.2.1 DRIVERS

- 5.3 GENERATIVE AI

- 5.3.1 INTRODUCTION

- 5.3.2 IMPACT ON ALUMINUM FLUORIDE MARKET

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.3 SUPPLY CHAIN ANALYSIS

- 6.4 INVESTMENT LANDSCAPE AND FUNDING SCENARIO

- 6.5 PRICING ANALYSIS

- 6.5.1 AVERAGE SELLING PRICE OF ALUMINUM FLUORIDE, BY REGION, 2021-2024

- 6.5.2 AVERAGE SELLING PRICE OF ALUMINUM FLUORIDE, BY GRADE, 2021-2024

- 6.5.3 AVERAGE SELLING PRICE OF ALUMINUM FLUORIDE, BY GRADE, 2024

- 6.6 ECOSYSTEM ANALYSIS

- 6.7 TECHNOLOGY ANALYSIS

- 6.7.1 KEY TECHNOLOGIES

- 6.7.2 COMPLEMENTARY TECHNOLOGIES

- 6.7.3 ADJACENT TECHNOLOGIES

- 6.8 PATENT ANALYSIS

- 6.8.1 METHODOLOGY

- 6.8.2 PATENTS GRANTED WORLDWIDE, 2015-2024

- 6.8.2.1 Patent publication trends

- 6.8.3 INSIGHTS

- 6.8.4 LEGAL STATUS OF PATENTS

- 6.8.5 JURISDICTION ANALYSIS

- 6.8.6 TOP APPLICANTS

- 6.8.7 LIST OF MAJOR PATENTS

- 6.9 TRADE ANALYSIS

- 6.9.1 IMPORT SCENARIO (HS CODE 282612)

- 6.9.2 EXPORT SCENARIO (HS CODE 282612)

- 6.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.11 TARIFF AND REGULATORY LANDSCAPE

- 6.11.1 TARIFF ANALYSIS

- 6.11.2 STANDARDS AND REGULATORY LANDSCAPE

- 6.11.2.1 Regulatory bodies, government agencies, and other organizations

- 6.11.2.2 Standards

- 6.12 PORTER'S FIVE FORCES ANALYSIS

- 6.12.1 THREAT OF NEW ENTRANTS

- 6.12.2 THREAT OF SUBSTITUTES

- 6.12.3 BARGAINING POWER OF SUPPLIERS

- 6.12.4 BARGAINING POWER OF BUYERS

- 6.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.13.2 BUYING CRITERIA

- 6.14 MACROECONOMIC OUTLOOK

- 6.14.1 GDP TRENDS AND FORECASTS OF MAJOR ECONOMIES

- 6.15 CASE STUDY ANALYSIS

- 6.15.1 IMPROVEMENT IN SODIUM REDUCTION PROCESS DURING TAC THROUGH ALF3

- 6.15.2 VARIATION IN ALUMINUM SMELTING CELL THERMAL STATE WITH CONTROL IMPLICATIONS

- 6.15.3 OPTIMIZING ALUMINUM SMELTING EFFICIENCY WITH SYSTEMATIC FLUORIDE CONTROL

- 6.16 IMPACT OF 2025 US TARIFF - ALUMINUM FLUORIDE MARKET

- 6.16.1 INTRODUCTION

- 6.16.2 KEY TARIFF RATES

- 6.16.3 PRICE IMPACT ANALYSIS

- 6.16.4 IMPACT ON REGION

- 6.16.4.1 North America

- 6.16.4.2 Europe

- 6.16.4.3 Asia Pacific

- 6.16.5 IMPACT ON PRODUCT TYPE

7 ALUMINUM FLUORIDE MARKET, BY GRADE

- 7.1 INTRODUCTION

- 7.2 SMELTER GRADE

- 7.2.1 EFFECTIVE FLUXING AGENT IN ELECTROLYTIC REDUCTION OF ALUMINA TO ALUMINUM METAL-KEY FACTOR DRIVING MARKET

- 7.3 CATALYST GRADE

- 7.3.1 WIDELY USED IN PROCESSES WHERE PRECISE CONTROL OVER REACTION KINETICS AND SELECTIVITY IS CRITICAL

- 7.4 TECHNICAL GRADE

- 7.4.1 BROAD UTILITY, COST-EFFICIENCY, AND ADAPTABLE CHARACTERISTICS TO DRIVE ADOPTION

- 7.5 LABORATORY GRADE

- 7.5.1 EXCEPTIONAL CHEMICAL PURITY, MINIMAL IMPURITIES, AND CONSISTENT PHYSICAL PROPERTIES TO DRIVE GROWTH

- 7.6 HIGH-PURITY GRADE

- 7.6.1 DEMAND FOR ULTRA-PURE ALUMINUM FLUORIDE IN PRECISION MANUFACTURING TO DRIVE MARKET

8 ALUMINUM FLUORIDE MARKET, BY PRODUCT TYPE

- 8.1 INTRODUCTION

- 8.2 ANHYDROUS

- 8.2.1 PREFERRED CHOICE FOR APPLICATIONS REQUIRING MAXIMUM RELIABILITY AND EFFICIENCY

- 8.3 DRY

- 8.3.1 IMPROVES SMELTING PERFORMANCE AND PRODUCT QUALITY THROUGH EFFICIENT MOISTURE-CONTROLLED FLUXING SOLUTIONS

- 8.4 WET

- 8.4.1 DRIVES EFFICIENT SMELTING AND RECYCLING INNOVATION THROUGH MOISTURE-RICH ALUMINUM FLUORIDE SOLUTIONS

9 ALUMINUM FLUORIDE MARKET, BY FORM

- 9.1 INTRODUCTION

- 9.2 POWDER

- 9.2.1 PREFERRED CHOICE DUE TO SUPERIOR CHEMICAL PERFORMANCE AND FLEXIBILITY IN DOSING

- 9.3 GRANULE

- 9.3.1 COMPATIBILITY WITH VARIETY OF DOSING SYSTEMS TO SUPPORT ADOPTION

- 9.4 PELLET

- 9.4.1 LARGER PARTICLE SIZE AND DENSE COMPOSITION TO DRIVE ADOPTION

10 ALUMINUM FLUORIDE MARKET, BY BULK DENSITY

- 10.1 INTRODUCTION

- 10.2 LOW-BULK DENSITY

- 10.2.1 ADVANTAGEOUS IN CERTAIN SMELTING TECHNOLOGIES WHERE RAPID INCORPORATION INTO BATH IS REQUIRED

- 10.3 HIGH-BULK DENSITY

- 10.3.1 SUPERIOR HANDLING, PACKING EFFICIENCY, AND PURITY TO DRIVE MARKET GROWTH

11 ALUMINUM FLUORIDE MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- 11.2 ELECTROLYTE ADDITIVE

- 11.2.1 ROLE OF ALUMINUM FLUORIDE IN OPTIMIZING ELECTROLYTIC BATH EFFICIENCY AND ENERGY SAVINGS TO DRIVE MARKET

- 11.3 FLUX AGENT

- 11.3.1 ENERGY SAVINGS AND IMPROVED REFINING IN METAL PRODUCTION WITH ADVANCED FLUX AGENTS TO PROPEL MARKET

- 11.4 CATALYST/CATALYST SUPPORT

- 11.4.1 IMPROVED CATALYTIC PERFORMANCE AND DURABILITY IN DIVERSE CHEMICAL MANUFACTURING PROCESSES TO DRIVE MARKET

- 11.5 FUNCTIONAL ADDITIVE

- 11.5.1 ADVANCING INDUSTRIAL MATERIALS WITH MULTIFUNCTIONAL ADDITIVES FOR ENHANCED DURABILITY AND PERFORMANCE TO DRIVE MARKET

- 11.6 OPTICAL COATING MATERIAL

- 11.6.1 OPTICAL CLARITY AND DURABILITY FUELED BY ADVANCED COATING MATERIALS TO DRIVE DEMAND

- 11.7 FLUORO INTERMEDIATE

- 11.7.1 HIGH-QUALITY PRODUCTION OF FLUORINE-CONTAINING COMPOUNDS TO PROPEL MARKET

- 11.8 OTHER APPLICATIONS

- 11.8.1 CORROSION INHIBITORS

- 11.8.2 ETCHING/SURFACE TREATMENT

12 ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY

- 12.1 INTRODUCTION

- 12.2 ALUMINUM

- 12.2.1 OPTIMIZING ELECTROLYTE BATH PERFORMANCE FOR EFFICIENT AND SUSTAINABLE ALUMINUM SMELTING PROCESSES TO DRIVE MARKET

- 12.3 CERAMICS & GLASS

- 12.3.1 INCREASING CERAMIC TILE PRODUCTION AND GLASS INNOVATION TO PROPEL CONSUMPTION OF ALUMINUM FLUORIDE

- 12.4 CHEMICAL & PETROCHEMICAL

- 12.4.1 CATALYTIC EFFICIENCY AND FLUORINATION NEEDS TO PROPEL DEMAND FOR ALUMINUM FLUORIDE

- 12.5 ELECTRONICS & OPTICS

- 12.5.1 DEMAND FOR ULTRA-PURE MATERIALS TO DRIVE MARKET

- 12.6 AUTOMOTIVE

- 12.6.1 ADVANCEMENTS IN VEHICLE DESIGN DRIVE DEMAND FOR LIGHTWEIGHT MATERIALS

- 12.7 AEROSPACE

- 12.7.1 ADVANCEMENTS IN LIGHTWEIGHT AEROSPACE MATERIALS AND RIGOROUS QUALITY STANDARDS TO DRIVE DEMAND

- 12.8 CONSTRUCTION

- 12.8.1 ENHANCED ALUMINUM ALLOY REQUIREMENTS IN CONSTRUCTION TO DRIVE DEMAND

- 12.9 OTHER END-USE INDUSTRIES

- 12.9.1 METALWORKING & WELDING

- 12.9.2 MEDICAL & PHARMACEUTICAL

13 ALUMINUM FLUORIDE MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 ASIA PACIFIC

- 13.2.1 CHINA

- 13.2.1.1 Dominance in global aluminum production to drive market

- 13.2.2 JAPAN

- 13.2.2.1 Growth in electronics sector to increase demand

- 13.2.3 INDIA

- 13.2.3.1 Rising demand from automotive and aerospace sectors to drive market

- 13.2.4 SOUTH KOREA

- 13.2.4.1 Growth of export-oriented ceramics and glass manufacturing industries to drive market

- 13.2.5 REST OF ASIA PACIFIC

- 13.2.1 CHINA

- 13.3 NORTH AMERICA

- 13.3.1 US

- 13.3.1.1 Growing aerospace and automotive industries to increase demand

- 13.3.2 CANADA

- 13.3.2.1 Presence of established aluminum industry to propel market

- 13.3.3 MEXICO

- 13.3.3.1 Rise as key manufacturing hub for aluminum to support market growth

- 13.3.1 US

- 13.4 EUROPE

- 13.4.1 GERMANY

- 13.4.1.1 Growth in commercial vehicle and specialty automotive sectors to drive market

- 13.4.2 ITALY

- 13.4.2.1 Growth in construction industry to drive demand

- 13.4.3 FRANCE

- 13.4.3.1 Research into aluminum alloys to boost usage

- 13.4.4 UK

- 13.4.4.1 Growth in industrial and manufacturing sectors to drive market

- 13.4.5 SPAIN

- 13.4.5.1 Rising adoption of low-carbon footprint tires to drive market

- 13.4.6 RUSSIA

- 13.4.6.1 Expansion of domestic aluminum smelting capacity to propel market

- 13.4.7 REST OF EUROPE

- 13.4.1 GERMANY

- 13.5 MIDDLE EAST & AFRICA

- 13.5.1 GCC COUNTRIES

- 13.5.1.1 Saudi Arabia

- 13.5.1.1.1 Saudi Arabia's vision 2030 spurs investment in aluminum sector

- 13.5.1.2 UAE

- 13.5.1.2.1 Major aluminum smelting hub in Dubai to boost demand

- 13.5.1.3 Rest of GCC countries

- 13.5.1.1 Saudi Arabia

- 13.5.2 SOUTH AFRICA

- 13.5.2.1 Growing construction activities to increase consumption of aluminum fluoride

- 13.5.3 REST OF MIDDLE EAST & AFRICA

- 13.5.1 GCC COUNTRIES

- 13.6 SOUTH AMERICA

- 13.6.1 ARGENTINA

- 13.6.1.1 Expansion of automotive sector to drive demand

- 13.6.2 BRAZIL

- 13.6.2.1 Rise in aluminum production to propel demand

- 13.6.3 REST OF SOUTH AMERICA

- 13.6.1 ARGENTINA

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 14.3 MARKET SHARE ANALYSIS

- 14.4 REVENUE ANALYSIS

- 14.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.5.1 STARS

- 14.5.2 EMERGING LEADERS

- 14.5.3 PERVASIVE PLAYERS

- 14.5.4 PARTICIPANTS

- 14.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.5.5.1 Company footprint

- 14.5.5.2 Region footprint

- 14.5.5.3 Form footprint

- 14.5.5.4 Grade footprint

- 14.5.5.5 End-use industry footprint

- 14.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.6.1 PROGRESSIVE COMPANIES

- 14.6.2 RESPONSIVE COMPANIES

- 14.6.3 DYNAMIC COMPANIES

- 14.6.4 STARTING BLOCKS

- 14.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 14.6.5.1 Detailed list of key startups/SMEs

- 14.6.5.2 Competitive benchmarking of key startups/SMEs

- 14.7 BRAND/PRODUCT COMPARISON

- 14.8 COMPANY VALUATION AND FINANCIAL METRICS

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 DEALS

- 14.9.2 EXPANSIONS

- 14.9.3 OTHER DEVELOPMENTS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 FLUORSID

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions/Services offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Deals

- 15.1.1.4 MnM view

- 15.1.1.4.1 Key strengths

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses & competitive threats

- 15.1.2 INDUSTRIES CHIMIQUES DU FLUOR

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions/Services offered

- 15.1.2.3 MnM view

- 15.1.2.3.1 Key strengths

- 15.1.2.3.2 Strategic choices

- 15.1.2.3.3 Weaknesses & competitive threats

- 15.1.3 ALUFLUOR

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions/Services offered

- 15.1.3.3 MnM view

- 15.1.3.3.1 Key strengths

- 15.1.3.3.2 Strategic choices

- 15.1.3.3.3 Weaknesses & competitive threats

- 15.1.4 GULF FLUOR

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions/Services offered

- 15.1.4.3 MnM view

- 15.1.4.3.1 Key strengths

- 15.1.4.3.2 Strategic choices

- 15.1.4.3.3 Weaknesses & competitive threats

- 15.1.5 ALUFLUORIDE LIMITED

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions/Services offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Expansions

- 15.1.5.4 MnM view

- 15.1.5.4.1 Key strengths

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses & competitive threats

- 15.1.6 ORBIA FLUOR & ENERGY MATERIALS

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Other developments

- 15.1.6.4 MnM view

- 15.1.6.4.1 Key strengths

- 15.1.6.4.2 Strategic choices

- 15.1.6.4.3 Weaknesses & competitive threats

- 15.1.7 PHOSAGRO GROUP

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Deals

- 15.1.7.3.2 Expansions

- 15.1.7.4 MnM view

- 15.1.7.4.1 Key strengths

- 15.1.7.4.2 Strategic choices

- 15.1.7.4.3 Weaknesses & competitive threats

- 15.1.8 DO-FLUORIDE NEW MATERIALS CO., LTD.

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.8.3 MnM view

- 15.1.8.3.1 Key strengths

- 15.1.8.3.2 Strategic choices

- 15.1.8.3.3 Weaknesses & competitive threats

- 15.1.9 HUNAN NONFERROUS FLUORIDE CHEMICAL GROUP CO., LTD.

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.9.3 MnM view

- 15.1.9.3.1 Key strengths

- 15.1.9.3.2 Strategic choices

- 15.1.9.3.3 Weaknesses & competitive threats

- 15.1.10 AB LIFOSA

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Other developments

- 15.1.10.4 MnM view

- 15.1.10.4.1 Key strengths

- 15.1.10.4.2 Strategic choices

- 15.1.10.4.3 Weaknesses & competitive threats

- 15.1.1 FLUORSID

- 15.2 OTHER PLAYERS

- 15.2.1 SHANDONG HAIRUN NEW MATERIAL TECHNOLOGY CO., LTD.

- 15.2.2 HENAN JINHE INDUSTRY CO., LTD.

- 15.2.3 ELIXIRGROUP

- 15.2.4 HENAN WEILAI ALUMINUM (GROUP) CO., LTD

- 15.2.5 NAVIN FLUORINE INTERNATIONAL LIMITED

- 15.2.6 DERIVADOS DEL FLUOR

- 15.2.7 TANFAC INDUSTRIES LTD.

- 15.2.8 YINGKE NEW MATERIALS CO., LTD.

- 15.2.9 LICHE OPTO GROUP CO., LTD

- 15.2.10 JIAOZUO JINHONGLI ALUMINUM CO., LTD.

- 15.2.11 VRIK PHARMA

- 15.2.12 FOSHAN NANHAI SHUANGFU CHEMICAL CO., LTD

- 15.2.13 HENAN YELLOW RIVER NEW MATERIAL TECHNOLOGY CO., LTD.

- 15.2.14 PARTH INDUSTRIES

- 15.2.15 S B CHEMICALS

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

List of Tables

- TABLE 1 AVERAGE SELLING PRICE OF ALUMINUM FLUORIDE, BY REGION, 2021-2024 (USD/KG)

- TABLE 2 AVERAGE SELLING PRICE OF ALUMINUM FLUORIDE, BY GRADE, 2021-2024 (USD/KG)

- TABLE 3 AVERAGE SELLING PRICE OF KEY PLAYERS FOR ALUMINUM FLUORIDE, BY GRADE (USD/KG), 2024

- TABLE 4 ALUMINUM FLUORIDE MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 5 ALUMINUM FLUORIDE MARKET: KEY TECHNOLOGIES

- TABLE 6 ALUMINUM FLUORIDE MARKET: COMPLEMENTARY TECHNOLOGIES

- TABLE 7 ALUMINUM FLUORIDE MARKET: ADJACENT TECHNOLOGIES

- TABLE 8 ALUMINUM FLUORIDE MARKET: TOTAL NUMBER OF PATENTS

- TABLE 9 ALUMINUM FLUORIDE MARKET: LIST OF MAJOR PATENT OWNERS

- TABLE 10 ALUMINUM FLUORIDE MARKET: LIST OF MAJOR PATENTS, 2015-2024

- TABLE 11 ALUMINUM FLUORIDE MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 12 TARIFF RELATED TO ALUMINUM FLUORIDE MARKET

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 STANDARDS AND REGULATIONS FOR PLAYERS IN ALUMINUM FLUORIDE MARKET

- TABLE 19 ALUMINUM FLUORIDE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY (%)

- TABLE 21 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- TABLE 22 GDP TRENDS AND FORECASTS, BY KEY COUNTRY, 2023-2025 (USD MILLION)

- TABLE 23 ALUMINUM FLUORIDE MARKET, BY GRADE, 2021-2024 (USD MILLION)

- TABLE 24 ALUMINUM FLUORIDE MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 25 ALUMINUM FLUORIDE MARKET, BY GRADE, 2021-2024 (KILOTON)

- TABLE 26 ALUMINUM FLUORIDE MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 27 ALUMINUM FLUORIDE MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 28 ALUMINUM FLUORIDE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 29 ALUMINUM FLUORIDE MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 30 ALUMINUM FLUORIDE MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 31 ALUMINUM FLUORIDE MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 32 ALUMINUM FLUORIDE MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 33 ALUMINUM FLUORIDE MARKET, BY FORM, 2021-2024 (KILOTON)

- TABLE 34 ALUMINUM FLUORIDE MARKET, BY FORM, 2025-2030 (KILOTON)

- TABLE 35 ALUMINUM FLUORIDE MARKET, BY BULK DENSITY, 2021-2024 (USD MILLION)

- TABLE 36 ALUMINUM FLUORIDE MARKET, BY BULK DENSITY, 2025-2030 (USD MILLION)

- TABLE 37 ALUMINUM FLUORIDE MARKET, BY BULK DENSITY, 2021-2024 (KILOTON)

- TABLE 38 ALUMINUM FLUORIDE MARKET, BY BULK DENSITY, 2025-2030 (KILOTON)

- TABLE 39 ALUMINUM FLUORIDE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 40 ALUMINUM FLUORIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 41 ALUMINUM FLUORIDE MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 42 ALUMINUM FLUORIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 43 ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 44 ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 45 ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 46 ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 47 ALUMINUM FLUORIDE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 48 ALUMINUM FLUORIDE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 ALUMINUM FLUORIDE MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 50 ALUMINUM FLUORIDE MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 51 ASIA PACIFIC: ALUMINUM FLUORIDE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 52 ASIA PACIFIC: ALUMINUM FLUORIDE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 53 ASIA PACIFIC: ALUMINUM FLUORIDE MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 54 ASIA PACIFIC: ALUMINUM FLUORIDE MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 55 ASIA PACIFIC: ALUMINUM FLUORIDE MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 56 ASIA PACIFIC: ALUMINUM FLUORIDE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 57 ASIA PACIFIC: ALUMINUM FLUORIDE MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 58 ASIA PACIFIC: ALUMINUM FLUORIDE MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 59 ASIA PACIFIC: ALUMINUM FLUORIDE MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 60 ASIA PACIFIC: ALUMINUM FLUORIDE MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 61 ASIA PACIFIC: ALUMINUM FLUORIDE MARKET, BY FORM, 2021-2024 (KILOTON)

- TABLE 62 ASIA PACIFIC: ALUMINUM FLUORIDE MARKET, BY FORM, 2025-2030 (KILOTON)

- TABLE 63 ASIA PACIFIC: ALUMINUM FLUORIDE MARKET, BY BULK DENSITY, 2021-2024 (USD MILLION)

- TABLE 64 ASIA PACIFIC: ALUMINUM FLUORIDE MARKET, BY BULK DENSITY, 2025-2030 (USD MILLION)

- TABLE 65 ASIA PACIFIC: ALUMINUM FLUORIDE MARKET, BY BULK DENSITY, 2021-2024 (KILOTON)

- TABLE 66 ASIA PACIFIC: ALUMINUM FLUORIDE MARKET, BY BULK DENSITY, 2025-2030 (KILOTON)

- TABLE 67 ASIA PACIFIC: ALUMINUM FLUORIDE MARKET, BY GRADE, 2021-2024 (USD MILLION)

- TABLE 68 ASIA PACIFIC: ALUMINUM FLUORIDE MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 69 ASIA PACIFIC: ALUMINUM FLUORIDE MARKET, BY GRADE, 2021-2024 (KILOTON)

- TABLE 70 ASIA PACIFIC: ALUMINUM FLUORIDE MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 71 ASIA PACIFIC: ALUMINUM FLUORIDE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 72 ASIA PACIFIC: ALUMINUM FLUORIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 73 ASIA PACIFIC: ALUMINUM FLUORIDE MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 74 ASIA PACIFIC: ALUMINUM FLUORIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 75 ASIA PACIFIC: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 76 ASIA PACIFIC: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 77 ASIA PACIFIC: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 78 ASIA PACIFIC: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 79 CHINA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 80 CHINA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 81 CHINA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 82 CHINA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 83 JAPAN: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 84 JAPAN: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 85 JAPAN: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 86 JAPAN: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 87 INDIA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 88 INDIA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 89 INDIA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 90 INDIA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 91 SOUTH KOREA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 92 SOUTH KOREA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 93 SOUTH KOREA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 94 SOUTH KOREA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 95 REST OF ASIA PACIFIC: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 96 REST OF ASIA PACIFIC: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 97 REST OF ASIA PACIFIC: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 98 REST OF ASIA PACIFIC: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 99 NORTH AMERICA: ALUMINUM FLUORIDE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 100 NORTH AMERICA: ALUMINUM FLUORIDE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 101 NORTH AMERICA: ALUMINUM FLUORIDE MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 102 NORTH AMERICA: ALUMINUM FLUORIDE MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 103 NORTH AMERICA: ALUMINUM FLUORIDE MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 104 NORTH AMERICA: ALUMINUM FLUORIDE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 105 NORTH AMERICA: ALUMINUM FLUORIDE MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 106 NORTH AMERICA: ALUMINUM FLUORIDE MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 107 NORTH AMERICA: ALUMINUM FLUORIDE MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 108 NORTH AMERICA: ALUMINUM FLUORIDE MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 109 NORTH AMERICA: ALUMINUM FLUORIDE MARKET, BY FORM, 2021-2024 (KILOTON)

- TABLE 110 NORTH AMERICA: ALUMINUM FLUORIDE MARKET, BY FORM, 2025-2030 (KILOTON)

- TABLE 111 NORTH AMERICA: ALUMINUM FLUORIDE MARKET, BY BULK DENSITY, 2021-2024 (USD MILLION)

- TABLE 112 NORTH AMERICA: ALUMINUM FLUORIDE MARKET, BY BULK DENSITY, 2025-2030 (USD MILLION)

- TABLE 113 NORTH AMERICA: ALUMINUM FLUORIDE MARKET, BY BULK DENSITY, 2021-2024 (KILOTON)

- TABLE 114 NORTH AMERICA: ALUMINUM FLUORIDE MARKET, BY BULK DENSITY, 2025-2030 (KILOTON)

- TABLE 115 NORTH AMERICA: ALUMINUM FLUORIDE MARKET, BY GRADE, 2021-2024 (USD MILLION)

- TABLE 116 NORTH AMERICA: ALUMINUM FLUORIDE MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 117 NORTH AMERICA: ALUMINUM FLUORIDE MARKET, BY GRADE, 2021-2024 (KILOTON)

- TABLE 118 NORTH AMERICA: ALUMINUM FLUORIDE MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 119 NORTH AMERICA: ALUMINUM FLUORIDE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 120 NORTH AMERICA: ALUMINUM FLUORIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 121 NORTH AMERICA: ALUMINUM FLUORIDE MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 122 NORTH AMERICA: ALUMINUM FLUORIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 123 NORTH AMERICA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 124 NORTH AMERICA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 125 NORTH AMERICA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 126 NORTH AMERICA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 127 US: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 128 US: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 129 US: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 130 US: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 131 CANADA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 132 CANADA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 133 CANADA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 134 CANADA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 135 MEXICO: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 136 MEXICO: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 137 MEXICO: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 138 MEXICO: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 139 EUROPE: ALUMINUM FLUORIDE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 140 EUROPE: ALUMINUM FLUORIDE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 141 EUROPE: ALUMINUM FLUORIDE MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 142 EUROPE: ALUMINUM FLUORIDE MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 143 EUROPE: ALUMINUM FLUORIDE MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 144 EUROPE: ALUMINUM FLUORIDE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 145 EUROPE: ALUMINUM FLUORIDE MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 146 EUROPE: ALUMINUM FLUORIDE MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 147 EUROPE: ALUMINUM FLUORIDE MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 148 EUROPE: ALUMINUM FLUORIDE MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 149 EUROPE: ALUMINUM FLUORIDE MARKET, BY FORM, 2021-2024 (KILOTON)

- TABLE 150 EUROPE: ALUMINUM FLUORIDE MARKET, BY FORM, 2025-2030 (KILOTON)

- TABLE 151 EUROPE: ALUMINUM FLUORIDE MARKET, BY BULK DENSITY, 2021-2024 (USD MILLION)

- TABLE 152 EUROPE: ALUMINUM FLUORIDE MARKET, BY BULK DENSITY, 2025-2030 (USD MILLION)

- TABLE 153 EUROPE: ALUMINUM FLUORIDE MARKET, BY BULK DENSITY, 2021-2024 (KILOTON)

- TABLE 154 EUROPE: ALUMINUM FLUORIDE MARKET, BY BULK DENSITY, 2025-2030 (KILOTON)

- TABLE 155 EUROPE: ALUMINUM FLUORIDE MARKET, BY GRADE, 2021-2024 (USD MILLION)

- TABLE 156 EUROPE: ALUMINUM FLUORIDE MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 157 EUROPE: ALUMINUM FLUORIDE MARKET, BY GRADE, 2021-2024 (KILOTON)

- TABLE 158 EUROPE: ALUMINUM FLUORIDE MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 159 EUROPE: ALUMINUM FLUORIDE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 160 EUROPE: ALUMINUM FLUORIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 161 EUROPE: ALUMINUM FLUORIDE MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 162 EUROPE: ALUMINUM FLUORIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 163 EUROPE: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 164 EUROPE: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 165 EUROPE: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 166 EUROPE: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 167 GERMANY: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 168 GERMANY: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 169 GERMANY: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 170 GERMANY: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 171 ITALY: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 172 ITALY: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 173 ITALY: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 174 ITALY: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 175 FRANCE: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 176 FRANCE: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 177 FRANCE: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 178 FRANCE: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 179 UK: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 180 UK: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 181 UK: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 182 UK: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 183 SPAIN: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 184 SPAIN: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 185 SPAIN: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 186 SPAIN: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 187 RUSSIA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 188 RUSSIA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 189 RUSSIA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 190 RUSSIA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 191 REST OF EUROPE: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 192 REST OF EUROPE: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 193 REST OF EUROPE: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 194 REST OF EUROPE: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 195 MIDDLE EAST & AFRICA: ALUMINUM FLUORIDE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 196 MIDDLE EAST & AFRICA: ALUMINUM FLUORIDE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 197 MIDDLE EAST & AFRICA: ALUMINUM FLUORIDE MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 198 MIDDLE EAST & AFRICA: ALUMINUM FLUORIDE MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 199 MIDDLE EAST & AFRICA: ALUMINUM FLUORIDE MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 200 MIDDLE EAST & AFRICA: ALUMINUM FLUORIDE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 201 MIDDLE EAST & AFRICA: ALUMINUM FLUORIDE MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 202 MIDDLE EAST & AFRICA: ALUMINUM FLUORIDE MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 203 MIDDLE EAST & AFRICA: ALUMINUM FLUORIDE MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 204 MIDDLE EAST & AFRICA: ALUMINUM FLUORIDE MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 205 MIDDLE EAST & AFRICA: ALUMINUM FLUORIDE MARKET, BY FORM, 2021-2024 (KILOTON)

- TABLE 206 MIDDLE EAST & AFRICA: ALUMINUM FLUORIDE MARKET, BY FORM, 2025-2030 (KILOTON)

- TABLE 207 MIDDLE EAST & AFRICA: ALUMINUM FLUORIDE MARKET, BY BULK DENSITY, 2021-2024 (USD MILLION)

- TABLE 208 MIDDLE EAST & AFRICA: ALUMINUM FLUORIDE MARKET, BY BULK DENSITY, 2025-2030 (USD MILLION)

- TABLE 209 MIDDLE EAST & AFRICA: ALUMINUM FLUORIDE MARKET, BY BULK DENSITY, 2021-2024 (KILOTON)

- TABLE 210 MIDDLE EAST & AFRICA: ALUMINUM FLUORIDE MARKET, BY BULK DENSITY, 2025-2030 (KILOTON)

- TABLE 211 MIDDLE EAST & AFRICA: ALUMINUM FLUORIDE MARKET, BY GRADE, 2021-2024 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: ALUMINUM FLUORIDE MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 213 MIDDLE EAST & AFRICA: ALUMINUM FLUORIDE MARKET, BY GRADE, 2021-2024 (KILOTON)

- TABLE 214 MIDDLE EAST & AFRICA: ALUMINUM FLUORIDE MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 215 MIDDLE EAST & AFRICA: ALUMINUM FLUORIDE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: ALUMINUM FLUORIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: ALUMINUM FLUORIDE MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 218 MIDDLE EAST & AFRICA: ALUMINUM FLUORIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 219 MIDDLE EAST & AFRICA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 222 MIDDLE EAST & AFRICA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 223 SAUDI ARABIA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 224 SAUDI ARABIA ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 225 SAUDI ARABIA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 226 SAUDI ARABIA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 227 UAE: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 228 UAE: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 229 UAE: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 230 UAE: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 231 REST OF GCC COUNTRIES: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 232 REST OF GCC COUNTRIES: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 233 REST OF GCC COUNTRIES: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 234 REST OF GCC COUNTRIES: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 235 SOUTH AFRICA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 236 SOUTH AFRICA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 237 SOUTH AFRICA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 238 SOUTH AFRICA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 239 REST OF MIDDLE EAST & AFRICA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 240 REST OF MIDDLE EAST & AFRICA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 241 REST OF MIDDLE EAST & AFRICA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 242 REST OF MIDDLE EAST & AFRICA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 243 SOUTH AMERICA: ALUMINUM FLUORIDE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 244 SOUTH AMERICA: ALUMINUM FLUORIDE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 245 SOUTH AMERICA: ALUMINUM FLUORIDE MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 246 SOUTH AMERICA: ALUMINUM FLUORIDE MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 247 SOUTH AMERICA: ALUMINUM FLUORIDE MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 248 SOUTH AMERICA: ALUMINUM FLUORIDE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 249 SOUTH AMERICA: ALUMINUM FLUORIDE MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 250 SOUTH AMERICA: ALUMINUM FLUORIDE MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 251 SOUTH AMERICA: ALUMINUM FLUORIDE MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 252 SOUTH AMERICA: ALUMINUM FLUORIDE MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 253 SOUTH AMERICA: ALUMINUM FLUORIDE MARKET, BY FORM, 2021-2024 (KILOTON)

- TABLE 254 SOUTH AMERICA: ALUMINUM FLUORIDE MARKET, BY FORM, 2025-2030 (KILOTON)

- TABLE 255 SOUTH AMERICA: ALUMINUM FLUORIDE MARKET, BY BULK DENSITY, 2021-2024 (USD MILLION)

- TABLE 256 SOUTH AMERICA: ALUMINUM FLUORIDE MARKET, BY BULK DENSITY, 2025-2030 (USD MILLION)

- TABLE 257 SOUTH AMERICA: ALUMINUM FLUORIDE MARKET, BY BULK DENSITY, 2021-2024 (KILOTON)

- TABLE 258 SOUTH AMERICA: ALUMINUM FLUORIDE MARKET, BY BULK DENSITY, 2025-2030 (KILOTON)

- TABLE 259 SOUTH AMERICA: ALUMINUM FLUORIDE MARKET, BY GRADE, 2021-2024 (USD MILLION)

- TABLE 260 SOUTH AMERICA: ALUMINUM FLUORIDE MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 261 SOUTH AMERICA: ALUMINUM FLUORIDE MARKET, BY GRADE, 2021-2024 (KILOTON)

- TABLE 262 SOUTH AMERICA: ALUMINUM FLUORIDE MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 263 SOUTH AMERICA: ALUMINUM FLUORIDE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 264 SOUTH AMERICA: ALUMINUM FLUORIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 265 SOUTH AMERICA: ALUMINUM FLUORIDE MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 266 SOUTH AMERICA: ALUMINUM FLUORIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 267 SOUTH AMERICA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 268 SOUTH AMERICA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 269 SOUTH AMERICA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 270 SOUTH AMERICA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 271 ARGENTINA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 272 ARGENTINA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 273 ARGENTINA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 274 ARGENTINA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 275 BRAZIL: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 276 BRAZIL: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 277 BRAZIL: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 278 BRAZIL: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 279 REST OF SOUTH AMERICA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 280 REST OF SOUTH AMERICA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 281 REST OF SOUTH AMERICA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 282 REST OF SOUTH AMERICA: ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 283 ALUMINUM FLUORIDE MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 284 ALUMINUM FLUORIDE MARKET: DEGREE OF COMPETITION, 2024

- TABLE 285 ALUMINUM FLUORIDE MARKET: REGION FOOTPRINT

- TABLE 286 ALUMINUM FLUORIDE MARKET: FORM FOOTPRINT

- TABLE 287 ALUMINUM FLUORIDE MARKET: GRADE FOOTPRINT

- TABLE 288 ALUMINUM FLUORIDE MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 289 ALUMINUM FLUORIDE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 290 ALUMINUM FLUORIDE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (1/2)

- TABLE 291 ALUMINUM FLUORIDE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (2/2)

- TABLE 292 ALUMINUM FLUORIDE MARKET: DEALS, JANUARY 2021-JULY 2025

- TABLE 293 ALUMINUM FLUORIDE MARKET: EXPANSIONS, JANUARY 2021- JULY 2025

- TABLE 294 ALUMINUM FLUORIDE MARKET: OTHER DEVELOPMENTS, JANUARY 2021- JULY 2025

- TABLE 295 FLUORSID: COMPANY OVERVIEW

- TABLE 296 FLUORSID: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 297 FLUORSID: DEALS

- TABLE 298 INDUSTRIES CHIMIQUES DU FLUOR: COMPANY OVERVIEW

- TABLE 299 INDUSTRIES CHIMIQUES DU FLUOR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 300 ALUFLUOR: COMPANY OVERVIEW

- TABLE 301 ALUFLUOR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 302 GULF FLUOR: COMPANY OVERVIEW

- TABLE 303 GULF FLUOR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 304 ALUFLUORIDE LIMITED: COMPANY OVERVIEW

- TABLE 305 ALUFLUORIDE LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 306 ALUFLUORIDE LIMITED: EXPANSIONS

- TABLE 307 ORBIA FLUOR & ENERGY MATERIALS: COMPANY OVERVIEW

- TABLE 308 ORBIA FLUOR & ENERGY MATERIALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 309 ORBIA FLUOR & ENERGY MATERIALS: OTHER DEVELOPMENTS

- TABLE 310 PHOSAGRO GROUP: COMPANY OVERVIEW

- TABLE 311 PHOSAGRO GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 312 PHOSAGRO GROUP: DEALS

- TABLE 313 PHOSAGRO GROUP: EXPANSIONS

- TABLE 314 DO-FLUORIDE NEW MATERIALS CO., LTD.: COMPANY OVERVIEW

- TABLE 315 DO-FLUORIDE NEW MATERIALS CO., LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 316 HUNAN NONFERROUS FLUORIDE CHEMICAL GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 317 HUNAN NONFERROUS FLUORIDE CHEMICAL GROUP CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 318 AB LIFOSA: COMPANY OVERVIEW

- TABLE 319 AB LIFOSA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 320 AB LIFOSA: OTHER DEVELOPMENTS

- TABLE 321 SHANDONG HAIRUN NEW MATERIAL TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 322 HENAN JINHE INDUSTRY CO., LTD.: COMPANY OVERVIEW

- TABLE 323 ELIXIRGROUP: COMPANY OVERVIEW

- TABLE 324 HENAN WEILAI ALUMINUM (GROUP) CO., LTD: COMPANY OVERVIEW

- TABLE 325 NAVIN FLUORINE INTERNATIONAL LIMITED: COMPANY OVERVIEW

- TABLE 326 DERIVADOS DEL FLUOR: COMPANY OVERVIEW

- TABLE 327 TANFAC INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 328 YINGKE NEW MATERIALS CO., LTD.: COMPANY OVERVIEW

- TABLE 329 LICHE OPTO GROUP CO., LTD: COMPANY OVERVIEW

- TABLE 330 JIAOZUO JINHONGLI ALUMINUM CO., LTD.: COMPANY OVERVIEW

- TABLE 331 VRIK PHARMA: COMPANY OVERVIEW

- TABLE 332 FOSHAN NANHAI SHUANGFU CHEMICAL CO., LTD: COMPANY OVERVIEW

- TABLE 333 HENAN YELLOW RIVER NEW MATERIAL TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 334 PARTH INDUSTRIES: COMPANY OVERVIEW

- TABLE 335 S B CHEMICALS: COMPANY OVERVIEW

List of Figures

IGURE 1 ALUMINUM FLUORIDE MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 ALUMINUM FLUORIDE MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: REVENUE OF MARKET PLAYERS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 ALUMINUM FLUORIDE MARKET: DATA TRIANGULATION

- FIGURE 9 ANHYDROUS PRODUCT TYPE SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 10 HIGH-BULK DENSITY SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 11 POWDER FORM SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 12 SMELTER GRADE SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 13 ELECTROLYTE ADDITIVE APPLICATION SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 14 ALUMINUM INDUSTRY SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 15 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 RISING DEMAND FOR LIGHTWEIGHT MATERIALS IN AUTOMOTIVE, CONSTRUCTION, AND AEROSPACE INDUSTRIES TO DRIVE MARKET

- FIGURE 17 ANHYDROUS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 HIGH-BULK DENSITY SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 19 POWDER SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 20 SMELTER GRADE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 21 ELECTROLYTE ADDITIVE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 22 ALUMINUM INDUSTRY SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 23 CHINA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 24 ALUMINUM FLUORIDE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 25 USE OF GENERATIVE AI IN ALUMINUM FLUORIDE MARKET

- FIGURE 26 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 27 ALUMINUM FLUORIDE MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 28 ALUMINUM FLUORIDE MARKET: INVESTMENT AND FUNDING SCENARIO, 2023 VS. 2024 (USD MILLION)

- FIGURE 29 AVERAGE SELLING PRICE OF ALUMINUM FLUORIDE, BY REGION, 2021-2024 (USD/KG)

- FIGURE 30 AVERAGE SELLING PRICE OF KEY PLAYERS FOR ALUMINUM FLUORIDE, BY GRADE, 2024 (USD/KG)

- FIGURE 31 ALUMINUM FLUORIDE MARKET: ECOSYSTEM

- FIGURE 32 PATENTS GRANTED, 2015-2024

- FIGURE 33 ALUMINUM FLUORIDE MARKET: LEGAL STATUS OF PATENTS, 2015-2024

- FIGURE 34 PATENTS ANALYSIS FOR ALUMINUM FLUORIDE, BY JURISDICTION, 2015-2024

- FIGURE 35 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENTS IN LAST 10 YEARS

- FIGURE 36 IMPORT DATA FOR HS CODE 282612-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 37 EXPORT DATA FOR HS CODE 282612-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 38 ALUMINUM FLUORIDE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 39 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY

- FIGURE 40 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- FIGURE 41 SMELTER GRADE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 42 ANHYDROUS SEGMENT WILL DOMINATE MARKET IN 2030

- FIGURE 43 POWDER SEGMENT TO REGISTER FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 44 HIGH-BULK DENSITY SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 45 ELECTROLYTE ADDITIVE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 46 ALUMINUM END-USE INDUSTRY SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 47 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 48 ASIA PACIFIC: ALUMINUM FLUORIDE MARKET SNAPSHOT

- FIGURE 49 NORTH AMERICA: ALUMINUM FLUORIDE MARKET SNAPSHOT

- FIGURE 50 EUROPE: ALUMINUM FLUORIDE MARKET SNAPSHOT

- FIGURE 51 ALUMINUM FLUORIDE MARKET SHARE ANALYSIS, 2024

- FIGURE 52 ALUMINUM FLUORIDE MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2021-2024 (USD BILLION)

- FIGURE 53 ALUMINUM FLUORIDE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 54 ALUMINUM FLUORIDE MARKET: COMPANY FOOTPRINT

- FIGURE 55 ALUMINUM FLUORIDE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 56 ALUMINUM FLUORIDE MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 57 ALUMINUM FLUORIDE MARKET: EV/EBITDA OF KEY COMPANIES, 2025

- FIGURE 58 ALUMINUM FLUORIDE MARKET: YEAR-TO-DATE (YTD) PRICE TOTAL RETURN, 2025

- FIGURE 59 INDUSTRIES CHIMIQUES DU FLUOR: COMPANY SNAPSHOT

- FIGURE 60 ALUFLUORIDE LIMITED: COMPANY SNAPSHOT

- FIGURE 61 PHOSAGRO GROUP: COMPANY SNAPSHOT

- FIGURE 62 DO-FLUORIDE NEW MATERIALS CO., LTD.: COMPANY SNAPSHOT