|

市場調查報告書

商品編碼

1812626

焊接耗材市場:按技術、類型、最終用途行業和地區分類的全球市場 - 預測至 2030 年Welding Materials Market by Type (Electrodes & Filler Materials, Fluxes & Wires, Gases), Technology (Arc, Resistance, Oxy-Fuel Welding), End-use Industry (Transportation, Building & Construction, Heavy Industries), and Region - Global Forecast to 2030 |

||||||

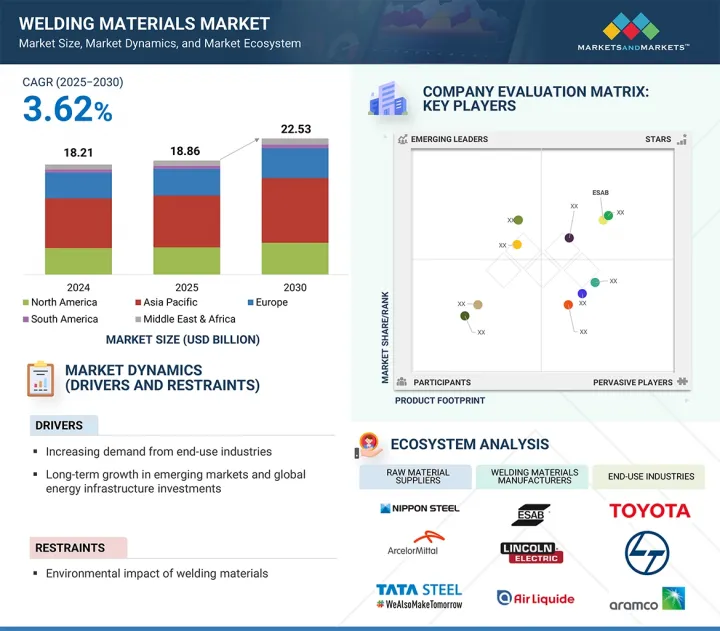

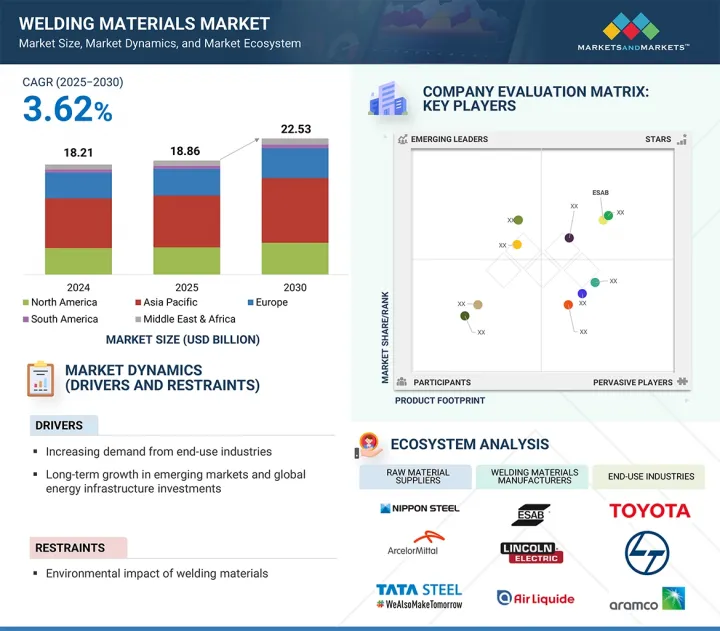

預計焊接耗材市場將從 2025 年的 188.6 億美元成長到 2030 年的 225.3 億美元,預測期內的複合年成長率為 3.62%。

預計建築業支出的增加、製造業的進步以及維修和保養活動的增加將推動對焊接耗材的需求。

| 調查範圍 | |

|---|---|

| 調查年份 | 2021-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 對價單位 | 金額(百萬美元/十億美元) |

| 部分 | 按技術、類型、最終用途行業和地區 |

| 目標區域 | 亞太地區、北美、歐洲、中東和非洲、南美 |

住宅建設和現有基礎設施的維修/重建的增加可能會促進焊接耗材市場的發展。然而,該市場也面臨環境影響的挑戰。焊接耗材的環境影響包括其生產、使用和處置,這些都會影響空氣品質、資源消耗和廢棄物管理。

預計在預測期內,電弧焊接將成為焊接耗材市場中最大的細分市場。這種焊接方法的優點在於焊接過程中產生的高集中熱量,即在電極和母材之間形成電弧,從而熔化金屬。穩定的金屬熔敷層、優異的耐腐蝕性和高衝擊韌性也使其成為領先的焊接技術。電弧焊接因其價格實惠且適用於各種金屬表面而成為焊接行業的首選。這些優勢使得電弧焊接在需要可靠、堅固和高效金屬接頭的行業中仍然是一種受歡迎的焊接耗材選擇。

焊條和填充材料主要用於焊接,因為它們對於形成堅固、耐用、高品質的焊接至關重要。焊條可用於各種焊接方法和應用。焊條充當電流從焊鉗到被連接金屬表面的導管。它們還提供焊接過程中所需的熔填材料。熔填材料是一種用於填充焊接過程中出現的間隙的消耗品。這些間隙通常出現在連接兩塊金屬時,填充這些間隙可以提高焊接組裝的強度和功能。

重工業預計將成為焊接耗材市場的第二大細分市場。重工業廣泛使用焊接,因為它對於大型設備和結構的製造、組裝和維護至關重要,這些設備和結構需要堅固、耐用且高度完整的接頭。造船、石油和天然氣、採礦、鐵路和重型機械製造等行業需要處理厚厚的高強度鋼板和複雜的組裝,因此需要各種焊接耗材,包括焊條、焊劑和填充焊絲。

由於工業的快速發展、基礎設施計劃和製造業的成長,亞太地區焊接耗材市場正在不斷擴大。中國和印度等國家正大力投資交通系統、城市住房、發電廠、港口和工業園區。大型建築和計劃計劃需要大量焊接鋼骨、管道和零件,從而推動了對焊條、焊絲和焊劑的需求。亞太地區是中國、日本、印度、韓國和泰國等主要汽車製造地的所在地,也是家電和機械的主要樞紐。這些行業依賴自動和手動焊接,消耗大量材料。此外,各國正在擴大其重型機械和鐵路製造的生產能力。

其中包括:液化空氣集團(法國)、空氣產品公司(美國)、伊薩(美國)、伊利諾工具廠公司(美國)、林德公司(德國)、林肯電氣控股公司(美國)、阿多爾焊接公司(印度)、天津大橋焊接材料集團(中國)、神戶製鋼所(日本)和奧鋼聯公司(奧地利)。

該研究包括對焊接材料市場這些主要企業的詳細競爭分析,包括公司簡介、最新發展和主要市場策略。

調查對象

本研究報告按類型(電極和填充材料、氣體、焊劑和焊絲)、技術(電弧焊接、電阻焊接、氧燃料焊接和其他技術)、最終用途行業(運輸、重工業、建築和其他最終用途行業)和地區(亞太地區、北美、歐洲、南美和中東和非洲)對南美耗材市場進行細分。報告的範圍包括影響焊接耗材市場成長的促進因素、限制因素、挑戰和機會的詳細資訊。該報告對主要企業概況進行了深入分析,深入了解了它們的業務概況、產品供應以及焊接耗材市場中的合作夥伴關係、協議、產品發布、業務擴展和收購等關鍵策略。它還對焊接耗材生態系統中的新興企業進行了競爭分析。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章重要考察

第5章 市場概況

- 介紹

- 市場動態

- 產業趨勢

- 影響客戶業務的趨勢/中斷

- 定價分析

- 價值鏈分析

- 生態系分析

- 技術分析

- 產生人工智慧對焊接材料市場的影響

- 專利分析

- 貿易分析

- 2025-2026年主要會議和活動

- 監管格局和框架

- 波特五力分析

- 主要相關人員和採購標準

- 案例研究分析

- 宏觀經濟分析

- 投資金籌措場景

- 2025年美國關稅對焊接耗材市場的影響

第6章焊接材料市場(依技術)

- 介紹

- 電弧焊接

- 電阻焊接

- 氧燃料焊接

- 其他

第7章焊接耗材市場(按類型)

- 介紹

- 電極和填充材

- 焊劑和焊絲

- 氣體

第8章焊接耗材市場(依最終用途產業)

- 介紹

- 運輸

- 重工業

- 建築/施工

- 其他

第9章焊接耗材市場(按地區)

- 介紹

- 亞太地區

- 中國

- 日本

- 印度

- 印尼

- 其他

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 荷蘭

- 義大利

- 其他

- 中東和非洲

- 海灣合作理事會國家

- 南非

- 其他

- 南美洲

- 巴西

- 阿根廷

- 其他

第10章 競爭格局

- 概述

- 主要參與企業的策略/優勢

- 市佔率分析

- 收益分析

- 估值和財務指標

- 產品/品牌比較

- 公司估值矩陣:2024 年關鍵參與企業

- 公司估值矩陣:Start-Ups/中小企業,2024 年

- 競爭場景

第11章 公司簡介

- 主要參與企業

- AIR LIQUIDE

- AIR PRODUCTS AND CHEMICALS, INC.

- ESAB

- LINDE PLC

- ILLINOIS TOOL WORKS INC.

- THE LINCOLN ELECTRIC COMPANY

- ADOR WELDING

- TIANJIN BRIDGE WELDING MATERIALS GROUP CO.,LTD.

- KOBE STEEL, LTD.

- VOESTALPINE AG

- 其他公司

- PRECISION CASTPARTS CORP.

- ROLLED ALLOYS

- LAIWU JINCAI WELDING MATERIALS CO., LTD.

- ADVANCED TECHNOLOGY & MATERIALS CO., LTD.

- HYUNDAI WELDING CO.

- ZULFI WELDING ELECTRODES FACTORY CO. LTD.

- ATLANTIC CHINA WELDING CONSUMABLES

- FORTIUS METALS

- B&H GROUP

- ROCKMOUNT

- WELDFAST ELECTRODES PVT. LTD.

- D&H SECHERON

- GEDIK WELDING

- SUPERON SCHWEISSTECHNIK INDIA

- NEXA WELD

第12章:鄰近市場

第13章 附錄

The welding materials market is projected to grow from USD 18.86 billion in 2025 to USD 22.53 billion by 2030, at a CAGR of 3.62% during the forecast period. The increase in spending in the building and construction sector, advancements in manufacturing industries, and the growth of repair and maintenance activities are expected to drive the demand for welding materials.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/USD Billion) |

| Segments | Type, Technology, End-use industry, and Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

The rise in residential construction and the renovation or rebuilding of existing infrastructure will likely push the welding materials market. However, the market faces challenges related to its environmental impact. The environmental effects of welding materials include their production, use, and disposal, affecting air quality, resource consumption, and waste management.

"Arc welding technology segment to lead market during forecast period"

Arc welding is expected to be the largest segment in the welding materials market during the forecast period. This method benefits from a high concentration of heat during the welding process, where an electric arc forms between the electrode and base materials, melting the metals. The consistent metal deposition, excellent corrosion resistance, and high impact toughness also contribute to its status as a leading welding technology. Arc welding is also preferred in the welding industry due to its affordability and versatility across various metal surfaces. These advantages explain why arc welding remains a popular choice in welding materials for industries that require reliable, strong, and efficient metal joining.

"Electrodes and filler materials to be largest segment during forecast period"

Electrodes and filler materials are primarily used in welding because they are essential for creating strong, durable, and high-quality welded joints. They can be employed across a wide range of welding methods and applications. Welding electrodes serve as the conduit that conducts electricity from the electrode holder to the metal surface being joined. They also supply the necessary filler material during welding. Filler materials are consumables used to fill gaps that may form during welding. These gaps typically occur when two metal pieces are joined, and filling them enhances the strength and functionality of the welded assembly.

"Heavy industries segment to hold second-largest share during forecast period"

Heavy industries are expected to be the second-largest segment of the welding materials market. Heavy industries use welding extensively because welding is critical for fabricating, assembling, and maintaining heavy-duty equipment and structures requiring strong, durable, and high-integrity joints. Sectors like shipbuilding, oil & gas, mining, railways, and heavy machinery manufacture work with thick, high-strength steel plates and complex assemblies requiring substantial welding consumables such as electrodes, fluxes, and filler wires.

"Asia Pacific welding materials market to record highest CAGR during forecast period"

The welding materials market in Asia Pacific is expanding due to rapid industrial development, infrastructure projects, and manufacturing growth. Countries like China and India are investing heavily in transportation systems, urban housing, power plants, ports, and industrial zones. Large construction and infrastructure projects require extensive welding for steel structures, pipelines, and components, boosting the demand for electrodes, wires, and fluxes. Asia Pacific also hosts major automotive manufacturing hubs in China, Japan, India, South Korea, and Thailand, along with key centers for appliances and machinery. These industries depend on automated and manual welding methods, which consume considerable materials. Furthermore, countries are ramping up their production abilities in heavy machinery and rail manufacturing.

By Company Type: Tier 1: 25%, Tier 2: 42%, and Tier 3: 33%

By Designation: C-level Executives: 20%, Directors: 30%, and Other Designations: 50%

By Region: North America: 20%, Europe: 10%, Asia Pacific: 40%, South America: 10%, and Middle East & Africa 20%

Notes: Other designations include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million-1 Billion; and Tier 3: <USD 500 million

Companies Covered: Air Liquide (France), Air Products Inc. (US), ESAB (US), Illinois Tool Works Inc. (US), Linde plc (Germany), Lincoln Electric Holdings, Inc. (US), Ador Welding (India), Tianjin Bridge Welding Materials Group Co., Ltd. (China), Kobe Steel, Ltd. (Japan), and voestalpine AG (Austria) among others.

The study includes an in-depth competitive analysis of these key players in the welding materials market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the welding materials market by type (electrode & filler materials, gases, fluxes & wires), technology (arc welding, resistant welding, oxy fuel welding, other technologies), end-use industry (transportation, heavy industries, building & construction, and other end-use industries), and region (Asia Pacific, North America, Europe, South America, and Middle East & Africa). The report's scope includes detailed information on the drivers, restraints, challenges, and opportunities affecting the growth of the welding materials market. A thorough analysis of key industry players provides insights into their business profiles, products offered, and key strategies such as partnerships, agreements, product launches, expansions, and acquisitions in the welding materials market. This report also features a competitive analysis of emerging startups within the welding materials ecosystem.

Reasons to Buy Report

The report provides market leaders and new entrants with approximate revenue figures for the overall welding materials market and its subsegments. It helps stakeholders understand the competitive landscape, gain insights into positioning their businesses better, and develop appropriate go-to-market strategies. Additionally, the report offers information on key market drivers, restraints, challenges, and opportunities to help stakeholders grasp the market's pulse.

The report provides insights into the following points:

- Analysis of key drivers (increasing demand from end-use industries, and long-term growth in emerging markets and investments in energy infrastructure), restraints (environmental impact of welding materials), opportunities (growth prospects in developing economies, and new and advanced applications), and challenges (shortage and high labor costs).

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the welding materials market.

- Market Development: Comprehensive information about profitable markets - the report analyzes the welding materials market across varied regions.

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the welding materials market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and offerings of leading players such as Air Liquide (France), Air Products Inc. (US), ESAB (US), Illinois Tool Works Inc. (US), Linde plc (Germany), Lincoln Electric Holdings, Inc. (US), Ador Welding (India), Tianjin Bridge Welding Materials Group Co., Ltd. (China), Kobe Steel, Ltd. (Japan), and voestalpine AG (Austria).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS & EXCLUSIONS

- 1.3.4 CURRENCY CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key market insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- 2.6 GROWTH RATE ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN WELDING MATERIALS MARKET

- 4.2 WELDING MATERIALS MARKET, BY REGION AND TYPE, 2024

- 4.3 WELDING MATERIALS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing construction and automotive industries

- 5.2.1.2 Rising demand for energy and growing investments in renewable energy in emerging markets

- 5.2.2 RESTRAINTS

- 5.2.2.1 Environmental impact of welding materials

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth prospects in emerging economies

- 5.2.3.2 New and advanced applications

- 5.2.4 CHALLENGES

- 5.2.4.1 Shortage of skilled labor and high labor cost

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.5 PRICING ANALYSIS

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Advanced filler materials

- 5.8.1.2 Shielding gas innovations

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Welding automation & robotics

- 5.8.2.2 Weld imperfection detections

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Additive manufacturing

- 5.8.3.2 Surface coating technologies

- 5.8.1 KEY TECHNOLOGIES

- 5.9 IMPACT OF GEN AI ON WELDING MATERIALS MARKET

- 5.9.1 INTRODUCTION

- 5.10 PATENT ANALYSIS

- 5.10.1 INTRODUCTION

- 5.10.2 METHODOLOGY

- 5.11 TRADE ANALYSIS

- 5.11.1 EXPORT SCENARIO (HS CODE 3811)

- 5.11.2 IMPORT SCENARIO (HS CODE 3811)

- 5.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.13 REGULATORY LANDSCAPE AND FRAMEWORK

- 5.13.1 REGULATORY LANDSCAPE

- 5.13.1.1 Regulatory bodies, government agencies, and other organizations

- 5.13.2 REGULATORY FRAMEWORK

- 5.13.2.1 AWS A5 series

- 5.13.2.2 ISO 2560:2020

- 5.13.2.3 ISO 14341:2020

- 5.13.1 REGULATORY LANDSCAPE

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 CASE STUDY ANALYSIS

- 5.17 MACROECONOMIC ANALYSIS

- 5.17.1 INTRODUCTION

- 5.17.2 GDP TRENDS AND FORECASTS

- 5.18 INVESTMENT AND FUNDING SCENARIO

- 5.19 IMPACT OF 2025 US TARIFF ON WELDING MATERIALS MARKET

- 5.19.1 INTRODUCTION

- 5.19.2 KEY TARIFF RATES

- 5.19.3 PRICE IMPACT ANALYSIS

- 5.19.4 IMPACT ON COUNTRY/REGION

6 WELDING MATERIALS MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- 6.2 ARC WELDING

- 6.2.1 UNIFORMITY IN METAL DEPOSITION, GOOD CORROSION AND HIGH IMPACT RESISTANCE TO DRIVE MARKET

- 6.3 RESISTANCE WELDING

- 6.3.1 DEMAND FOR LONG PRODUCTION RUNS AND CONSISTENT CONDITIONS TO BOOST GROWTH

- 6.4 OXY-FUEL WELDING

- 6.4.1 PORTABILITY AND WELDING NON-FERROUS AND FERROUS METALS TO PROPEL MARKET

- 6.5 OTHER TECHNOLOGIES

7 WELDING MATERIALS MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 ELECTRODES & FILLER MATERIALS

- 7.2.1 ECONOMICAL AND WIDE APPLICABILITY TO FUEL MARKET GROWTH

- 7.3 FLUXES & WIRES

- 7.3.1 HIGH DEPOSITION RATE, FLEXIBILITY, AND USE IN EXTERNAL ENVIRONMENTS TO SUPPORT GROWTH

- 7.4 GASES

- 7.4.1 USE WITH OR WITHOUT PRESSURE AND PROTECTION OF MOLTEN METALS FROM CONTAMINATION AND OXIDATION TO DRIVE MARKET

8 WELDING MATERIALS MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- 8.2 TRANSPORTATION

- 8.2.1 INCREASING SALES OF ELECTRIC VEHICLES TO BOOST MARKET

- 8.3 HEAVY INDUSTRIES

- 8.3.1 DEMAND FOR REPAIRING SHIPS, PIPELINES, AND OFFSHORE OIL PLATFORMS TO DRIVE GROWTH

- 8.4 BUILDING & CONSTRUCTION

- 8.4.1 RISING CONSTRUCTION ACTIVITIES IN EMERGING ECONOMIES TO BOOST MARKET

- 8.5 OTHER END-USE INDUSTRIES

9 WELDING MATERIALS MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 ASIA PACIFIC

- 9.2.1 CHINA

- 9.2.1.1 High demand from infrastructure, aerospace & defense, automobile, and marine industries to fuel market

- 9.2.2 JAPAN

- 9.2.2.1 Innovations in transportation industry to boost market

- 9.2.3 INDIA

- 9.2.3.1 Rising demand from automobile and construction sectors to drive market

- 9.2.4 INDONESIA

- 9.2.4.1 Growing population to boost demand in construction sector

- 9.2.5 REST OF ASIA PACIFIC

- 9.2.1 CHINA

- 9.3 NORTH AMERICA

- 9.3.1 US

- 9.3.1.1 Significant oil & gas production to propel market

- 9.3.2 CANADA

- 9.3.2.1 Large automobile industry to offer opportunities for growth

- 9.3.3 MEXICO

- 9.3.3.1 Increasing demand from OEMs and automotive industry to boost growth

- 9.3.1 US

- 9.4 EUROPE

- 9.4.1 GERMANY

- 9.4.1.1 Rising installation of wind turbines and investments in automobile production facilities to propel growth

- 9.4.2 UK

- 9.4.2.1 Growth of automotive industry to offer lucrative opportunities

- 9.4.3 FRANCE

- 9.4.3.1 Increasing foreign investments in various end-use industries to drive market

- 9.4.4 RUSSIA

- 9.4.4.1 Rise in public and private construction projects to support growth

- 9.4.5 NETHERLANDS

- 9.4.5.1 Growth of manufacturing sector to contribute to demand

- 9.4.6 ITALY

- 9.4.6.1 Vast construction industry to favor growth

- 9.4.7 REST OF EUROPE

- 9.4.1 GERMANY

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 GCC COUNTRIES

- 9.5.1.1 Saudi Arabia

- 9.5.1.1.1 Increasing government investments in public infrastructure-related projects to support market growth

- 9.5.1.2 UAE

- 9.5.1.2.1 Operation 300bn to boost market growth

- 9.5.1.3 Rest of GCC countries

- 9.5.1.1 Saudi Arabia

- 9.5.2 SOUTH AFRICA

- 9.5.2.1 Growing automotive sector to boost market

- 9.5.3 REST OF MIDDLE EAST & AFRICA

- 9.5.1 GCC COUNTRIES

- 9.6 SOUTH AMERICA

- 9.6.1 BRAZIL

- 9.6.1.1 Economic development, industrialization, and urbanization to drive market

- 9.6.2 ARGENTINA

- 9.6.2.1 Government focus on automotive industry to propel market

- 9.6.3 REST OF SOUTH AMERICA

- 9.6.1 BRAZIL

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.3 MARKET SHARE ANALYSIS

- 10.4 REVENUE ANALYSIS

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 PRODUCT/BRAND COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 End-use industry footprint

- 10.7.5.4 Type footprint

- 10.7.5.5 Technology footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs, 2024

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 AIR LIQUIDE

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Expansions

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 AIR PRODUCTS AND CHEMICALS, INC.

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 ESAB

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 LINDE PLC

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 ILLINOIS TOOL WORKS INC.

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 MnM view

- 11.1.5.3.1 Right to win

- 11.1.5.3.2 Strategic choices

- 11.1.5.3.3 Weaknesses and competitive threats

- 11.1.6 THE LINCOLN ELECTRIC COMPANY

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches

- 11.1.6.3.2 Deals

- 11.1.6.4 MnM view

- 11.1.7 ADOR WELDING

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Deals

- 11.1.7.4 MnM view

- 11.1.8 TIANJIN BRIDGE WELDING MATERIALS GROUP CO.,LTD.

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 MnM view

- 11.1.9 KOBE STEEL, LTD.

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 MnM view

- 11.1.10 VOESTALPINE AG

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product launches

- 11.1.10.3.2 Deals

- 11.1.10.4 MnM view

- 11.1.1 AIR LIQUIDE

- 11.2 OTHER PLAYERS

- 11.2.1 PRECISION CASTPARTS CORP.

- 11.2.2 ROLLED ALLOYS

- 11.2.3 LAIWU JINCAI WELDING MATERIALS CO., LTD.

- 11.2.4 ADVANCED TECHNOLOGY & MATERIALS CO., LTD.

- 11.2.5 HYUNDAI WELDING CO.

- 11.2.6 ZULFI WELDING ELECTRODES FACTORY CO. LTD.

- 11.2.7 ATLANTIC CHINA WELDING CONSUMABLES

- 11.2.8 FORTIUS METALS

- 11.2.9 B&H GROUP

- 11.2.10 ROCKMOUNT

- 11.2.11 WELDFAST ELECTRODES PVT. LTD.

- 11.2.12 D&H SECHERON

- 11.2.13 GEDIK WELDING

- 11.2.14 SUPERON SCHWEISSTECHNIK INDIA

- 11.2.15 NEXA WELD

12 ADJACENT MARKET

- 12.1 INTRODUCTION

- 12.2 WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET

13 APPENDIX

- 13.1 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.2 CUSTOMIZATION OPTIONS

- 13.3 RELATED REPORTS

- 13.4 AUTHOR DETAILS

List of Tables

- TABLE 1 AVERAGE SELLING PRICE OF ELECTRODES & FILLER MATERIALS, 2024 (KG/USD)

- TABLE 2 AVERAGE SELLING PRICE OF FLUXES, 2024 (KG/USD)

- TABLE 3 AVERAGE SELLING PRICE OF WIRES, 2024 (KG/USD)

- TABLE 4 AVERAGE SELLING PRICE OF GAS, 2024 (CUBIC METER/USD)

- TABLE 5 WELDING MATERIALS MARKET: ECOSYSTEM

- TABLE 6 LIST OF KEY PATENTS, 2022-2024

- TABLE 7 EXPORT DATA RELATED TO HS CODE 3811-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 8 IMPORT DATA RELATED TO HS CODE 3811-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 9 LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 WELDING MATERIALS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR WELDING MATERIALS

- TABLE 17 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 18 ENSURING WELDING CONSISTENCY & FEEDABILITY FOR HIGH-VOLUME RACK PRODUCTION

- TABLE 19 HARDFACING REPAIR OF VRM GRINDING COMPONENTS AT HANSON CEMENT DURING COVID-19

- TABLE 20 HANDS-ON TECHNICAL SUPPORT FOR STAINLESS-STEEL WELDING WIRE SETUP

- TABLE 21 WORLD GDP ANNUAL PERCENTAGE CHANGE OF ADVANCED ECONOMIES, 2024-2026

- TABLE 22 WORLD GDP ANNUAL PERCENTAGE CHANGE OF EMERGING MARKETS AND DEVELOPING ECONOMIES, 2024-2026

- TABLE 23 WELDING MATERIALS MARKET, BY TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 24 WELDING MATERIALS MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 25 WELDING MATERIALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 26 WELDING MATERIALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 27 WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 28 WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 29 WELDING MATERIALS MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 30 WELDING MATERIALS MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 31 ASIA PACIFIC: WELDING MATERIALS MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 32 ASIA PACIFIC: WELDING MATERIALS MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 33 ASIA PACIFIC: WELDING MATERIALS MARKET, BY TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 34 ASIA PACIFIC: WELDING MATERIALS MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 35 ASIA PACIFIC: WELDING MATERIALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 36 ASIA PACIFIC: WELDING MATERIALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 37 ASIA PACIFIC: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 38 ASIA PACIFIC: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 39 CHINA: WELDING MATERIALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 40 CHINA: WELDING MATERIALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 41 CHINA: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 42 CHINA: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 43 JAPAN: WELDING MATERIALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 44 JAPAN: WELDING MATERIALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 45 JAPAN: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 46 JAPAN: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 47 INDIA: WELDING MATERIALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 48 INDIA: WELDING MATERIALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 49 INDIA: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 50 INDIA: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 51 INDONESIA: WELDING MATERIALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 52 INDONESIA: WELDING MATERIALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 53 INDONESIA: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 54 INDONESIA: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 55 REST OF ASIA PACIFIC: WELDING MATERIALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 56 REST OF ASIA PACIFIC: WELDING MATERIALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 57 REST OF ASIA PACIFIC: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 58 REST OF ASIA PACIFIC: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 59 NORTH AMERICA: WELDING MATERIALS MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 60 NORTH AMERICA: WELDING MATERIALS MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 61 NORTH AMERICA: WELDING MATERIALS MARKET, BY TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 62 NORTH AMERICA: WELDING MATERIALS MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 63 NORTH AMERICA: WELDING MATERIALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 64 NORTH AMERICA: WELDING MATERIALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 65 NORTH AMERICA: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 66 NORTH AMERICA: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 67 US: WELDING MATERIALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 68 US: WELDING MATERIALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 69 US: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 70 US: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 71 CANADA: WELDING MATERIALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 72 CANADA: WELDING MATERIALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 73 CANADA: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 74 CANADA: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 75 MEXICO: WELDING MATERIALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 76 MEXICO: WELDING MATERIALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 77 MEXICO: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 78 MEXICO: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 79 EUROPE: WELDING MATERIALS MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 80 EUROPE: WELDING MATERIALS MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 81 EUROPE: WELDING MATERIALS MARKET, BY TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 82 EUROPE: WELDING MATERIALS MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 83 EUROPE: WELDING MATERIALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 84 EUROPE: WELDING MATERIALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 85 EUROPE: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 86 EUROPE: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 87 GERMANY: WELDING MATERIALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 88 GERMANY: WELDING MATERIALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 89 GERMANY: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 90 GERMANY: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 91 UK: WELDING MATERIALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 92 UK: WELDING MATERIALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 93 UK: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 94 UK: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 95 FRANCE: WELDING MATERIALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 96 FRANCE: WELDING MATERIALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 97 FRANCE: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 98 FRANCE: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 99 RUSSIA: WELDING MATERIALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 100 RUSSIA: WELDING MATERIALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 101 RUSSIA: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 102 RUSSIA: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 103 NETHERLANDS: WELDING MATERIALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 104 NETHERLANDS: WELDING MATERIALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 105 NETHERLANDS: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 106 NETHERLANDS: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 107 ITALY: WELDING MATERIALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 108 ITALY: WELDING MATERIALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 109 ITALY: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 110 ITALY: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 111 REST OF EUROPE: WELDING MATERIALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 112 REST OF EUROPE: WELDING MATERIALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 113 REST OF EUROPE: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 114 REST OF EUROPE: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 115 MIDDLE EAST & AFRICA: WELDING MATERIALS MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 116 MIDDLE EAST & AFRICA: WELDING MATERIALS MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 117 MIDDLE EAST & AFRICA: WELDING MATERIALS MARKET, BY TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 118 MIDDLE EAST & AFRICA: WELDING MATERIALS MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 119 MIDDLE EAST & AFRICA: WELDING MATERIALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 120 MIDDLE EAST & AFRICA: WELDING MATERIALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 122 MIDDLE EAST & AFRICA: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 123 GCC COUNTRIES: WELDING MATERIALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 124 GCC COUNTRIES: WELDING MATERIALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 125 GCC COUNTRIES: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 126 GCC COUNTRIES: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 127 SAUDI ARABIA: WELDING MATERIALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 128 SAUDI ARABIA: WELDING MATERIALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 129 SAUDI ARABIA: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 130 SAUDI ARABIA: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 131 UAE: WELDING MATERIALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 132 UAE: WELDING MATERIALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 133 UAE: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 134 UAE: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 135 REST OF GCC COUNTRIES: WELDING MATERIALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 136 REST OF GCC COUNTRIES: WELDING MATERIALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 137 REST OF GCC COUNTRIES: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 138 REST OF GCC COUNTRIES: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 139 SOUTH AFRICA: WELDING MATERIALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 140 SOUTH AFRICA: WELDING MATERIALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 141 SOUTH AFRICA: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 142 SOUTH AFRICA: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 143 REST OF MIDDLE EAST & AFRICA: WELDING MATERIALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 144 REST OF MIDDLE EAST & AFRICA: WELDING MATERIALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 145 REST OF MIDDLE EAST & AFRICA: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 146 REST OF MIDDLE EAST & AFRICA: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 147 SOUTH AMERICA: WELDING MATERIALS MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 148 SOUTH AMERICA: WELDING MATERIALS MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 149 SOUTH AMERICA: WELDING MATERIALS MARKET, BY TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 150 SOUTH AMERICA: WELDING MATERIALS MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 151 SOUTH AMERICA: WELDING MATERIALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 152 SOUTH AMERICA: WELDING MATERIALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 153 SOUTH AMERICA: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 154 SOUTH AMERICA: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 155 BRAZIL: WELDING MATERIALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 156 BRAZIL: WELDING MATERIALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 157 BRAZIL: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 158 BRAZIL: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 159 ARGENTINA: WELDING MATERIALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 160 ARGENTINA: WELDING MATERIALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 161 ARGENTINA: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 162 ARGENTINA: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 163 REST OF SOUTH AMERICA: WELDING MATERIALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 164 REST OF SOUTH AMERICA: WELDING MATERIALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 165 REST OF SOUTH AMERICA: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 166 REST OF SOUTH AMERICA: WELDING MATERIALS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 167 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 168 DEGREE OF COMPETITION

- TABLE 169 WELDING MATERIALS MARKET: REGION FOOTPRINT

- TABLE 170 WELDING MATERIALS MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 171 WELDING MATERIALS MARKET: TYPE FOOTPRINT

- TABLE 172 WELDING MATERIALS MARKET: TECHNOLOGY FOOTPRINT

- TABLE 173 WELDING MATERIALS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 174 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY REGION AND END-USE INDUSTRY

- TABLE 175 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY TYPE AND TECHNOLOGY

- TABLE 176 WELDING MATERIALS MARKET: PRODUCT LAUNCHES, JANUARY 2021-JULY 2025

- TABLE 177 WELDING MATERIALS MARKET: DEALS, JANUARY 2021-JULY 2025

- TABLE 178 WELDING MATERIALS MARKET: EXPANSIONS, JANUARY 2021-JULY 2025

- TABLE 179 AIR LIQUIDE: COMPANY OVERVIEW

- TABLE 180 AIR LIQUIDE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 181 AIR LIQUIDE: EXPANSIONS, JANUARY 2021-JULY 2025

- TABLE 182 AIR PRODUCTS AND CHEMICALS, INC.: COMPANY OVERVIEW

- TABLE 183 AIR PRODUCTS AND CHEMICALS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 AIR PRODUCTS AND CHEMICALS, INC.: DEALS, JANUARY 2021-JULY 2025

- TABLE 185 ESAB: COMPANY OVERVIEW

- TABLE 186 ESAB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 187 ESAB: PRODUCT LAUNCHES, JANUARY 2021-JULY 2025

- TABLE 188 ESAB: DEALS, JANUARY 2021-JULY 2025

- TABLE 189 LINDE PLC: COMPANY OVERVIEW

- TABLE 190 LINDE PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 LINDE PLC: DEALS, JANUARY 2021-JULY 2025

- TABLE 192 ILLINOIS TOOL WORKS INC.: COMPANY OVERVIEW

- TABLE 193 ILLINOIS TOOL WORKS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 THE LINCOLN ELECTRIC COMPANY: COMPANY OVERVIEW

- TABLE 195 THE LINCOLN ELECTRIC COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 THE LINCOLN ELECTRIC COMPANY: PRODUCT LAUNCHES, JANUARY 2021-JULY 2025

- TABLE 197 THE LINCOLN ELECTRIC COMPANY: DEALS, JANUARY 2021-JULY 2025

- TABLE 198 ADOR WELDING: COMPANY OVERVIEW

- TABLE 199 ADOR WELDING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 ADOR WELDING: DEALS, JANUARY 2021 - MAY 2025

- TABLE 201 TIANJIN BRIDGE WELDING MATERIALS GROUP CO.,LTD.: COMPANY OVERVIEW

- TABLE 202 TIANJIN BRIDGE WELDING MATERIALS GROUP CO.,LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 KOBE STEEL, LTD.: COMPANY OVERVIEW

- TABLE 204 KOBE STEEL, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 VOESTALPINE AG: COMPANY OVERVIEW

- TABLE 206 VOESTALPINE AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 VOESTALPINE AG: PRODUCT LAUNCHES, JANUARY 2021-JULY 2025

- TABLE 208 VOESTALPINE AG: DEALS, JANUARY 2021-JULY 2025

- TABLE 209 PRECISION CASTPARTS CORP.: COMPANY OVERVIEW

- TABLE 210 ROLLED ALLOYS

- TABLE 211 LAIWU JINCAI WELDING MATERIALS CO., LTD.

- TABLE 212 ADVANCED TECHNOLOGY & MATERIALS CO., LTD.

- TABLE 213 HYUNDAI WELDING CO.

- TABLE 214 ZULFI WELDING ELECTRODES FACTORY CO. LTD.

- TABLE 215 ATLANTIC CHINA WELDING CONSUMABLES

- TABLE 216 FORTIUS METALS

- TABLE 217 B&H GROUP

- TABLE 218 ROCKMOUNT

- TABLE 219 WELDFAST ELECTRODES PVT. LTD.

- TABLE 220 D&H SECHERON

- TABLE 221 GEDIK WELDING

- TABLE 222 SUPERON SCHWEISSTECHNIK INDIA

- TABLE 223 NEXA WELD

- TABLE 224 WELDING EQUIPMENT, ACCESSORIES, AND CONSUMABLES MARKET, BY REGION, 2019-2026 (USD MILLION)

List of Figures

- FIGURE 1 WELDING MATERIALS MARKET: MARKETS COVERED AND REGIONAL SCOPE

- FIGURE 2 WELDING MATERIALS MARKET: RESEARCH DESIGN

- FIGURE 3 STAKEHOLDERS INVOLVED AND BREAKDOWN OF INTERVIEWS WITH EXPERTS

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION: SUPPLY SIDE

- FIGURE 7 WELDING MATERIALS MARKET: DATA TRIANGULATION

- FIGURE 8 ELECTRODES & FILLER MATERIALS TO BE LARGEST TYPE DURING FORECAST PERIOD

- FIGURE 9 ARC WELDING TO BE FASTEST-GROWING TECHNOLOGY DURING FORECAST PERIOD

- FIGURE 10 TRANSPORTATION END-USE INDUSTRY TO LEAD WELDING MATERIALS MARKET DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC MARKET TO GROW AT HIGHEST CAGR BETWEEN 2025 AND 2030

- FIGURE 12 INCREASING DEMAND FROM TRANSPORTATION INDUSTRY TO DRIVE MARKET DURING FORECAST PERIOD

- FIGURE 13 CHINA AND ELECTRODES & FILLER MATERIALS SEGMENT ACCOUNTED FOR LARGEST SHARES

- FIGURE 14 INDIA TO REGISTER HIGHEST CAGR

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN WELDING MATERIALS MARKET

- FIGURE 16 GLOBAL AUTOMOBILE SALES DATA, 2019-2024

- FIGURE 17 GLOBAL ENERGY CONSUMPTION, 2019-2023

- FIGURE 18 CARBON DIOXIDE EMISSIONS FROM ENERGY COMBUSTION AND INDUSTRIAL PROCESSES, 2020-2024

- FIGURE 19 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 20 WELDING MATERIALS: VALUE CHAIN ANALYSIS

- FIGURE 21 ECOSYSTEM MAP

- FIGURE 22 LIST OF MAJOR PATENTS, 2014-2024

- FIGURE 23 MAJOR PATENTS, BY COUNTRY, 2014-2024

- FIGURE 24 EXPORT DATA RELATED TO HS CODE 3811-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 25 IMPORT DATA RELATED TO HS CODE 3811-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 26 WELDING MATERIALS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY

- FIGURE 28 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- FIGURE 29 INVESTOR DEALS AND FUNDING SCENARIO

- FIGURE 30 ARC WELDING TECHNOLOGY SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 31 FLUXES & WIRES TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 32 TRANSPORTATION END-USE INDUSTRY TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 33 ASIA PACIFIC: WELDING MATERIALS MARKET SNAPSHOT

- FIGURE 34 NORTH AMERICA: WELDING MATERIALS MARKET SNAPSHOT

- FIGURE 35 MARKET SHARE ANALYSIS, 2024

- FIGURE 36 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024 (USD BILLION)

- FIGURE 37 COMPANY VALUATION (USD BILLION)

- FIGURE 38 FINANCIAL MATRIX: EV/EBITDA RATIO

- FIGURE 39 YEAR-TO-DATE PRICE AND FIVE-YEAR STOCK BETA

- FIGURE 40 WELDING MATERIALS MARKET: PRODUCT/BRAND COMPARISON

- FIGURE 41 WELDING MATERIALS MARKET: COMPANY EVALUATION MATRIX, KEY PLAYERS, 2024

- FIGURE 42 WELDING MATERIALS MARKET: COMPANY FOOTPRINT

- FIGURE 43 WELDING MATERIALS MARKET: COMPANY EVALUATION MATRIX, STARTUPS/SMES, 2024

- FIGURE 44 AIR LIQUIDE: COMPANY SNAPSHOT

- FIGURE 45 AIR PRODUCTS AND CHEMICALS, INC.: COMPANY SNAPSHOT

- FIGURE 46 ESAB: COMPANY SNAPSHOT

- FIGURE 47 LINDE PLC: COMPANY SNAPSHOT

- FIGURE 48 ILLINOIS TOOL WORKS INC.: COMPANY SNAPSHOT

- FIGURE 49 THE LINCOLN ELECTRIC COMPANY: COMPANY SNAPSHOT

- FIGURE 50 ADOR WELDING: COMPANY SNAPSHOT

- FIGURE 51 KOBE STEEL, LTD.: COMPANY SNAPSHOT

- FIGURE 52 VOESTALPINE AG: COMPANY SNAPSHOT