|

市場調查報告書

商品編碼

1811732

全球過濾袋市場按過濾類型、過濾類型、過濾介質介質、過濾織物、最終用途產業和地區分類-預測至2030年Filter Bag Market by Filter Type (Pulse Jet, Reverse Air Bag, Shaker), Filtration Fabric (Polyester, Polypropylene, Fiberglass, Polyimide, Acrylic Fibers, Ceramic, Teflon, Aramid), Media, Filtration Type, and End-use Industry - Global Forecast to 2030 |

||||||

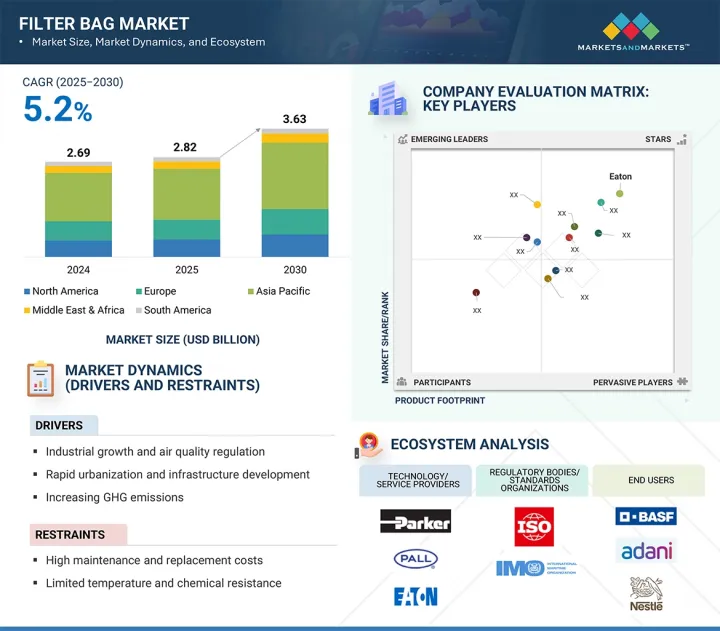

預計到 2025 年過濾袋市場規模將達到 28.2 億美元,到 2030 年將達到 36.3 億美元,預測期內複合年成長率為 5.2%。

| 調查範圍 | |

|---|---|

| 調查年份 | 2021-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 對價單位 | 金額(百萬美元/十億美元) |

| 部分 | 按過濾類型、過濾類型、過濾介質、過濾織物、最終用途行業和地區 |

| 目標區域 | 北美、歐洲、亞太地區、南美、中東和非洲 |

水泥、發電、採礦、化工和鋼鐵等各行各業日益加強的空氣污染控制法規,推動了濾袋的普及。隨著工業產量的不斷成長,以及美國環保署 (EPA)、歐盟委員會和中國生態環境部等機構推出的顆粒物排放標準日益嚴格,濾袋正成為除塵系統的重要組成部分。此外,對永續性、工人安全和營運效率的日益重視,也推動著業界採用先進的濾袋材料,例如芳香聚醯胺、聚四氟乙烯和玻璃纖維,這些材料能夠承受高溫和惡劣的化學環境。

在快速都市化、基礎設施計劃以及政府支持的清潔空氣項目的推動下,亞太地區的新興經濟體在應用方面處於領先地位。然而,挑戰依然存在。濾袋的高昂維護和更換成本,以及靜電除塵設備和筒式過濾器等替代過濾技術的日益普及,可能會限制某些行業的應用。儘管存在這些障礙,但長期需求前景仍然樂觀。

預計脈衝噴氣市場將在 2025 年至 2030 年期間呈現濾袋市場中最高的複合年成長率。脈衝噴氣濾袋因其高效、緊湊的設計以及處理大量含塵氣體的能力而被廣泛用於水泥、發電、鋼鐵和化學品等行業。與反向空氣和振動器系統不同,脈衝噴氣噴射濾袋利用壓縮空氣脈衝連續清洗濾袋,從而實現連續運轉並減少停機時間。該技術可確保提高過濾性能、降低營業成本並符合嚴格的排放標準,使其成為高要求工業環境中的首選。在對能源效率的關注和日益嚴格的空氣品質法規的推動下,脈衝噴氣過濾器類型預計將佔全球安裝量的大多數,特別是在亞太地區和歐洲,工業擴張和日益嚴格的法規是強勁的成長動力。

氣體過濾對於捕獲水泥窯、發電廠、焚燒爐、鋼鐵生產和化學加工設備產生的細懸浮微粒、有害氣體和危險排放至關重要。隨著世界各國政府實施更嚴格的空氣污染控制標準,例如美國環保署 (EPA) 的《清潔空氣法案》和歐洲《工業排放指令》,對先進氣體過濾解決方案的需求正在飆升。專為氣體過濾設計的濾袋具有耐高溫、化學穩定性和卓越的除塵效率,使工業企業能夠在確保安全職場環境的同時保持合規性。此外,人們對減少溫室氣體排放和工業脫碳的興趣日益濃厚,進一步加速了氣體過濾系統的普及。預計這種主導地位將持續下去,尤其是在亞太地區,該地區工業化進程迅速推進,環境監測也日益加強。

預計在2025年至2030年期間,歐洲將佔據過濾袋市場的第二大佔有率,這得益於嚴格的環境法規、工業現代化以及對永續性的關注。歐盟(EU)根據《工業排放指令》(IED)和《環境空氣品質指令》等指令實施了嚴格的排放標準,鼓勵水泥、發電、化學品和廢棄物焚燒等行業採用先進的過濾系統。循環經濟計劃、脫碳目標以及對環保製造實踐的關注,進一步推動了過濾袋作為顆粒物和氣體過濾的有效解決方案的成長。

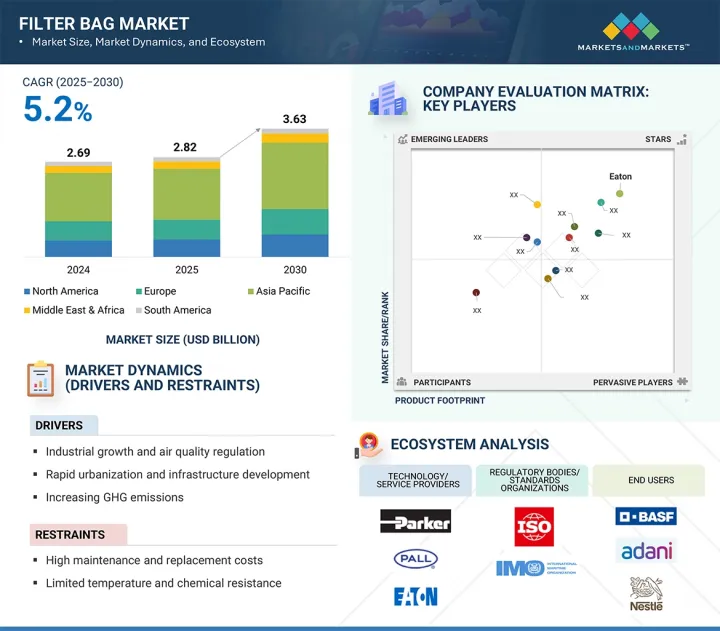

過濾袋市場由大型、成熟的全球性企業主導。過濾袋市場的主要企業包括伊頓公司(愛爾蘭)、唐納森公司(美國)、3M公司(美國)、派克漢尼汾公司(美國)和巴布科克威爾科克斯企業公司(美國)。

本報告根據過濾類型、過濾類型、過濾介質介質、過濾織物、最終用途行業和地區對過濾袋市場進行定義、說明和預測。

該報告全面回顧了關鍵的市場促進因素、限制因素、機會和挑戰,並涵蓋了市場的各個重要方面,包括競爭格局分析、市場動態、以金額為準的市場估計和趨勢以及過濾袋市場的未來趨勢。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章重要考察

第5章 市場概況

- 介紹

- 市場動態

- 影響客戶業務的趨勢/中斷

- 價值鏈分析

- 生態系分析

- 技術分析

- 專利分析

- 貿易分析

- 2025-2026年主要會議和活動

- 關稅和監管狀況

- 定價分析

- 波特五力分析

- 主要相關人員和採購標準

- 投資金籌措場景

- 案例研究分析

- 生成式人工智慧/人工智慧對過濾袋市場的影響

- 世界宏觀經濟展望

- 2025年美國關稅對過濾袋市場的影響

第6章過濾袋市場(按過濾類型)

- 介紹

- 氣體過濾

- 液體過濾

第7章過濾袋市場(按過濾器類型)

- 介紹

- 脈衝噴氣

- 倒車氣囊

- 搖酒器

第8章 過濾袋市場(過濾介質介質)

- 介紹

- 機織織物

- 不織布

第9章 過濾袋市場(按過濾織物)

- 介紹

- 聚酯纖維

- 聚丙烯

- 玻璃纖維

- 聚醯亞胺

- 腈綸纖維

- 陶瓷製品

- 鐵氟龍

- 芳香聚醯胺

第10章過濾袋市場(依最終用途產業)

- 介紹

- 水泥

- 金屬和採礦

- 發電

- 石油和天然氣

- 食品/飲料

- 化學品

- 油漆和塗料

- 製藥

- 車

- 其他

第 11 章 過濾袋市場(按地區)

- 介紹

- 亞太地區

- 中國

- 澳洲

- 日本

- 印度

- 其他

- 歐洲

- 德國

- 俄羅斯

- 義大利

- 英國

- 法國

- 其他

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 中東和非洲

- GCC

- 南非

- 奈及利亞

- 其他

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他

第12章 競爭格局

- 概述

- 主要參與企業的策略/優勢,2021-2025

- 2024年市場佔有率分析

- 2020-2024年收益分析

- 估值和財務指標

- 產品比較

- 公司估值矩陣:2024 年關鍵參與企業

- 公司估值矩陣:Start-Ups/中小企業,2024 年

- 競爭場景

第13章:公司簡介

- 主要參與企業

- EATON

- DONALDSON COMPANY, INC.

- PARKER HANNIFIN CORP

- PALL CORPORATION

- 3M

- THERMAX LIMITED

- PENTAIR

- BABCOCK & WILCOX ENTERPRISES, INC.

- CAMFIL

- WL GORE & ASSOCIATES, INC.

- GENERAL FILTRATION

- BWF OFFERMANN, WALDENFELS & CO. KG

- LENNTECH BV

- ROSEDALE PRODUCTS INC.

- AMERICAN FABRIC FILTER

- 其他公司

- FILTRATION SYSTEMS PRODUCTS INC.

- AJR FILTRATION

- FAB-TEX FILTRATION

- CUSTOM ADVANCED

- INDUSTRIAL FILTER MANUFACTURING LTD.

- K2TEC

- TEFLO

- PRECISION WIRE PRODUCTS, INC.

- GRIFFIN FILTERS

- SHELCO FILTERS

第14章 附錄

The filter bag market is projected to be valued at USD 2.82 billion in 2025 and USD 3.63 billion by 2030, registering a CAGR of 5.2% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Segments | Filtration Type, Filter Type, Filtration Fabric, Media, and End-use Industry |

| Regions covered | North America, Europe, Asia Pacific, South America, and the Middle East & Africa |

The increasing enforcement of air pollution control regulations across several industries, such as cement, power generation, mining, chemicals, and steel, boosts the adoption of filter bags. With growing industrial output and stricter particulate matter emission norms by agencies such as the EPA, the EU Commission, and China's Ministry of Ecology and Environment, filter bags are becoming indispensable in dust collection systems. Additionally, the rising emphasis on sustainability, worker safety, and operational efficiency pushes industries to adopt advanced filter bag materials, such as aramid, PTFE, and fiberglass, which can withstand high temperatures and aggressive chemical environments.

Emerging economies in Asia Pacific are leading the adoption, driven by rapid urbanization, infrastructure projects, and government-backed clean air programs. However, challenges remain. High maintenance and replacement costs of filter bags, coupled with the growing availability of alternative filtration technologies, such as electrostatic precipitators and cartridge filters, may restrain the pace of adoption in certain industries. Despite these hurdles, the long-term demand outlook remains positive as industries balance cost-efficiency with the need to comply with ever-tightening global environmental norms.

"By filter type, the pulse jet segment is expected to record the highest CAGR from 2025 to 2030."

The pulse jet segment is likely to exhibit the highest CAGR in the filter bag market between 2025 and 2030. Pulse jet filter bags are widely adopted due to their high efficiency, compact design, and ability to handle large volumes of dust-laden gases in industries such as cement, power generation, steel, and chemicals. Unlike reverse air or shaker systems, pulse jet filter bags use compressed air bursts to continuously clean the bags, which enables uninterrupted operation and reduces downtime. This technology ensures better filtration performance, lower operational costs, and compliance with stringent emission norms, making it the preferred choice in high-demand industrial environments. With increasing emphasis on energy efficiency and stricter air quality regulations, the pulse jet filter type is expected to dominate installations globally, particularly across Asia Pacific and Europe, where industrial expansion and regulatory enforcement are strong growth drivers.

"Based on filtration type, the gas filtration segment is anticipated to hold the largest market share in 2030."

Gas filtration is critical in capturing fine particulate matter, hazardous gases, and toxic emissions generated in cement kilns, power plants, incinerators, steel production, and chemical processing units. With governments worldwide imposing stricter air pollution control standards, such as the US EPA's Clean Air Act and Europe's Industrial Emissions Directive, the demand for advanced gas filtration solutions is surging. Filter bags designed for gas filtration provide high-temperature resistance, chemical stability, and superior dust collection efficiency, enabling industries to maintain compliance while ensuring safe workplace environments. Additionally, rising concerns over greenhouse gas reduction and industrial decarbonization further accelerate the adoption of gas filtration systems. This dominance is expected to continue, especially in Asia Pacific, where rapid industrialization is paired with stronger environmental monitoring.

"Europe is likely to be the second-largest-growing region in the filter bag market."

Europe is projected to account for the second-largest share of the filter bag market between 2025 and 2030, driven by its stringent environmental regulations, industrial modernization, and strong emphasis on sustainability. The European Union has enforced rigorous emission standards under directives, such as the Industrial Emissions Directive (IED) and the Ambient Air Quality Directive, compelling industries to adopt advanced filtration systems, including cement, power generation, chemicals, and waste incineration. The focus on circular economy initiatives, decarbonization targets, and green manufacturing practices further supports the growth of filter bags as efficient solutions for particulate and gas filtration.

Breakdown of Primaries:

By Company Type: Tier 1 - 30%, Tier 2 - 55%, and Tier 3 - 15%

By Designation: C-Level Executives - 30%, Directors - 20%, and Others - 50%

By Region: Asia Pacific - 55%, North America - 20%, Europe - 8%, Middle East & Africa - 13%, and South America - 4%

Note: "Others" include sales managers, engineers, and regional managers

The tiers of the companies are defined based on their total revenue as of 2021: Tier 1: >USD 1 billion, Tier 2: USD 500 million-1 billion, and Tier 3: <USD 500 million.

Major globally established players dominate the filter bag market. The leading players in the filter bag market are Eaton (Ireland), Donaldson Company, Inc. (US), 3M (US), Parker Hannifin Corp (US), and Babcock & Wilcox Enterprises, Inc (US).

Study Coverage:

The report defines, describes, and forecasts the filter bag market, by filtration type (gas filtration, liquid filtration), filtration fabric (polyester, polypropylene, fiberglass, polyimide, acrylic fibers, ceramic, Teflon, aramid), media (woven, non-woven), filter type (pulse jet, reverse air bag, shaker), end-use industry (cement, metals & mining, power generation, oil & gas, food & beverages, chemicals, paint & coatings, pharmaceuticals, automotive, other end-use industries), and region.

The report provides a comprehensive review of the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market, which include the analysis of the competitive landscape, market dynamics, market estimates in terms of value, and future trends in the filter bag market.

Key Benefits of Buying the Report

- Key drivers (Rapid industrial growth and implementation of air quality regulations), restraints (High maintenance and replacement costs), opportunities (Technological advancements in filter media), and challenges (Environmental and disposal challenges) influence the growth of the filter bag market.

- Market Development: In April 2024, Eaton's Filtration Division introduced two new liquid filtration solutions, SENTINEL and DURAGAF filter bag ranges. These advanced, fully welded polypropylene needle-felt bags integrate particle retention and oil absorption into a single step.

- Product Innovation/Development: There was significant product innovation in the filter bag market, but notable is the innovation of IoT-enabled diagnostics and predictive maintenance capabilities of the most advanced systems. These trends are geared toward improving reliability, minimizing gas release, and increasing efficiency standards among end users.

- Market Diversification: In July 2025, Siemens acquired the industrial drive technology business of ebm-papst, which is now marketed under the name Mechatronic Systems. The portfolio encompasses built-in smart drive systems such as autonomous transport and extra-low voltage protection.

- Competitive Assessment: The report includes an in-depth assessment of market shares, growth strategies, and service offerings of leading market players, such as Eaton (Ireland), Donaldson Company, Inc. (US), 3M (US), Parker Hannifin Corp (US), and Babcock & Wilcox Enterprises, Inc (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Key industry insights

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Regional analysis

- 2.2.1.2 Country-level analysis

- 2.2.1.3 Demand-side assumptions

- 2.2.1.4 Demand-side calculations

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Supply-side assumptions

- 2.2.2.2 Supply-side calculations

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN FILTER BAG MARKET

- 4.2 FILTER BAG MARKET, BY REGION

- 4.3 FILTER BAG MARKET IN ASIA PACIFIC, BY FILTRATION TYPE AND COUNTRY

- 4.4 FILTER BAG MARKET, BY FILTRATION TYPE

- 4.5 FILTER BAG MARKET, BY MEDIA

- 4.6 FILTER BAG MARKET, BY FILTER TYPE

- 4.7 FILTER BAG MARKET, BY FILTRATION FABRIC

- 4.8 FILTER BAG MARKET, BY END-USE INDUSTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rapid industrial growth and implementation of air quality regulations

- 5.2.1.2 Increasing infrastructure development and urbanization

- 5.2.1.3 Growing emphasis on reducing GHG emissions in industrial sectors

- 5.2.2 RESTRAINTS

- 5.2.2.1 High maintenance and replacement costs

- 5.2.2.2 Limited temperature and chemical resistance

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Technological advances in filter media

- 5.2.4 CHALLENGES

- 5.2.4.1 Environmental and disposal challenges

- 5.2.4.2 Availability of alternate filtration technologies

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 Pleated filter bag design

- 5.6.1.2 Advanced filter fabrics

- 5.6.2 ADJACENT TECHNOLOGIES

- 5.6.2.1 Cartridge filters

- 5.6.2.2 Electrostatic precipitators

- 5.6.3 COMPLEMENTARY TECHNOLOGIES

- 5.6.3.1 Bag leak detection systems

- 5.6.3.2 Pulse-jet cleaning systems

- 5.6.1 KEY TECHNOLOGIES

- 5.7 PATENT ANALYSIS

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT SCENARIO (HS CODE 842199)

- 5.8.2 EXPORT SCENARIO (HS CODE 842199)

- 5.9 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.10 TARIFF AND REGULATORY LANDSCAPE

- 5.10.1 TARIFF ANALYSIS

- 5.10.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11 PRICING ANALYSIS

- 5.11.1 AVERAGE SELLING PRICE TREND OF FILTER BAGS, BY MEDIA, 2021-2024

- 5.11.2 AVERAGE SELLING PRICE TREND OF FILTER BAGS, BY REGION, 2021-2024

- 5.12 PORTER'S FIVE FORCES ANALYSIS

- 5.12.1 THREAT OF SUBSTITUTES

- 5.12.2 BARGAINING POWER OF SUPPLIERS

- 5.12.3 BARGAINING POWER OF BUYERS

- 5.12.4 THREAT OF NEW ENTRANTS

- 5.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 INVESTMENT AND FUNDING SCENARIO

- 5.15 CASE STUDY ANALYSIS

- 5.15.1 INDUSTRIAL FACILITY INSTALLS GORE LOW DRAG FILTER BAGS TO ENHANCE DUST COLLECTION EFFICIENCY IN CATALYST CALCINER FEEDBINS

- 5.15.2 US CEMENT PRODUCER USES BHA THERMOPLEAT FILTER ELEMENTS TO RESOLVE ABRASION-DRIVEN FAILURES IN BAGHOUSE

- 5.15.3 STANDARD FILTER PROVIDES CUSTOMIZED FILTER BAG TO BOOST OPERATIONAL PERFORMANCE IN CEMENT FACILITY

- 5.16 IMPACT OF GEN AI/AI ON FILTER BAG MARKET

- 5.16.1 ADOPTION OF GEN AI/AI IN FILTER BAG MARKET

- 5.16.2 IMPACT OF GEN AI/AI ON KEY END-USE INDUSTRIES, BY REGION

- 5.17 GLOBAL MACROECONOMIC OUTLOOK

- 5.17.1 INTRODUCTION

- 5.17.2 GDP TRENDS AND FORECAST

- 5.17.3 INFLATION

- 5.17.4 MANUFACTURING VALUE ADDED (MVA)

- 5.17.5 VALUE ADDED BY INDUSTRY (INCLUDING CONSTRUCTION) (% OF GDP)

- 5.18 IMPACT OF 2025 US TARIFF ON FILTER BAG MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON COUNTRIES/REGIONS

- 5.18.4.1 US

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON END-USE INDUSTRIES

6 FILTER BAG MARKET, BY FILTRATION TYPE

- 6.1 INTRODUCTION

- 6.2 GAS FILTRATION

- 6.2.1 INCREASING ENFORCEMENT OF STRINGENT AIR POLLUTION CONTROL NORMS TO ACCELERATE SEGMENTAL GROWTH

- 6.3 LIQUID FILTRATION

- 6.3.1 RISING FOCUS ON SUSTAINABLE WATER MANAGEMENT AND INDUSTRIAL WASTEWATER TREATMENT TO BOOST SEGMENTAL GROWTH

7 FILTER BAG MARKET, BY FILTER TYPE

- 7.1 INTRODUCTION

- 7.2 PULSE JET

- 7.2.1 PLEATED

- 7.2.1.1 Rising demand for high-efficiency filtration and compact design to accelerate segmental growth

- 7.2.2 OTHER PULSE JET FILTER BAGS

- 7.2.1 PLEATED

- 7.3 REVERSE AIR BAG

- 7.3.1 GROWING EMPHASIS ON RETROFIT AND MODERNIZATION PROJECTS TO EXPEDITE SEGMENTAL GROWTH

- 7.4 SHAKER

- 7.4.1 RISING FOCUS ON MODERNIZATION TRENDS TO OPTIMIZE CLEANING CYCLES AND REDUCE DOWNTIME TO DRIVE MARKET

8 FILTER BAG MARKET, BY MEDIA

- 8.1 INTRODUCTION

- 8.2 WOVEN

- 8.2.1 INCREASING REQUIREMENT FOR LOW-MAINTENANCE AND DURABLE FILTRATION MEDIA TO FUEL SEGMENTAL GROWTH

- 8.3 NON-WOVEN

- 8.3.1 RISING FOCUS ON HIGH-EFFICIENCY STANDARDS AND ECO-FRIENDLY INDUSTRIAL SOLUTIONS TO AUGMENT SEGMENTAL GROWTH

9 FILTER BAG MARKET, BY FILTRATION FABRIC

- 9.1 INTRODUCTION

- 9.2 POLYESTER

- 9.2.1 STRICT EMISSION DIRECTIVES AND HYGIENE STANDARDS TO BOOST ADOPTION

- 9.3 POLYPROPYLENE

- 9.3.1 CLEAN WATER INITIATIVES, INDUSTRIAL WASTEWATER RECYCLING, AND SAFE CHEMICAL PROCESSING TO AUGMENT SEGMENTAL GROWTH

- 9.4 FIBERGLASS

- 9.4.1 DIMENSIONAL STABILITY, RESISTANCE TO CHEMICAL ATTACK, AND EXCELLENT FILTRATION EFFICIENCY TO FUEL SEGMENTAL GROWTH

- 9.5 POLYIMIDE

- 9.5.1 FOCUS ON SUPERIOR FILTRATION EFFICIENCY AND LOWER EMISSIONS TO ACCELERATE SEGMENTAL GROWTH

- 9.6 ACRYLIC FIBERS

- 9.6.1 ABILITY TO LOWER PRESSURE DROP AND ENERGY CONSUMPTION TO BOOST SEGMENTAL GROWTH

- 9.7 CERAMIC

- 9.7.1 THERMAL STABILITY, HIGH MECHANICAL STRENGTH, AND RESISTANCE TO CONTRIBUTE TO SEGMENTAL GROWTH

- 9.8 TEFLON

- 9.8.1 ABILITY TO PREVENT DUST PARTICLES FROM ADHERING TIGHTLY TO FILTER SURFACE TO BOOST SEGMENTAL GROWTH

- 9.9 ARAMID

- 9.9.1 HIGH THERMAL STABILITY, MECHANICAL STRENGTH, AND RESISTANCE TO ABRASION TO FOSTER SEGMENTAL GROWTH

10 FILTER BAG MARKET, BY END-USE INDUSTRY

- 10.1 INTRODUCTION

- 10.2 CEMENT

- 10.2.1 REQUIREMENT FOR STRINGENT ENVIRONMENTAL COMPLIANCE TO CONTRIBUTE TO SEGMENTAL GROWTH

- 10.3 METALS & MINING

- 10.3.1 DUST-INTENSIVE OPERATIONS AND EMISSION REGULATIONS TO AUGMENT SEGMENTAL GROWTH

- 10.4 POWER GENERATION

- 10.4.1 RISING NEED TO CONTROL PARTICULATE EMISSIONS TO BOLSTER SEGMENTAL GROWTH

- 10.5 OIL & GAS

- 10.5.1 GROWING EMPHASIS ON IMPROVING WORKPLACE AIR QUALITY AND ENSURING STACK COMPLIANCE TO DRIVE MARKET

- 10.6 FOOD & BEVERAGES

- 10.6.1 INCREASING NEED TO MITIGATE IGNITION RISKS FROM COMBUSTIBLE DUSTS TO BOOST SEGMENTAL GROWTH

- 10.7 CHEMICALS

- 10.7.1 RISING FOCUS ON FILTERING AIRBORNE PARTICULATES AND ULTRA-FINE PARTICULATES TO ACCELERATE SEGMENTAL GROWTH

- 10.8 PAINT & COATINGS

- 10.8.1 INCREASING NEED FOR COMPLIANCE WITH PARTICULATE EMISSION NORMS TO CONTRIBUTE TO SEGMENTAL GROWTH

- 10.9 PHARMACEUTICALS

- 10.9.1 STRINGENT REQUIREMENTS FOR AIR PURITY, PRODUCT INTEGRITY, AND REGULATORY COMPLIANCE TO DRIVE MARKET

- 10.10 AUTOMOTIVE

- 10.10.1 IMPLEMENTATION OF SUSTAINABILITY AND WORKER-SAFETY INITIATIVES TO BOLSTER SEGMENTAL GROWTH

- 10.11 OTHER END-USE INDUSTRIES

11 FILTER BAG MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 ASIA PACIFIC

- 11.2.1 CHINA

- 11.2.1.1 Implementation of government-led initiatives to tackle air pollution to drive market

- 11.2.2 AUSTRALIA

- 11.2.2.1 Growing focus on sustainable industrial to support market growth

- 11.2.3 JAPAN

- 11.2.3.1 Increasing enforcement of stringent air quality standards to bolster market growth

- 11.2.4 INDIA

- 11.2.4.1 Rapid industrialization, urbanization, and regulatory pressure to curb air pollution to drive market

- 11.2.5 REST OF ASIA PACIFIC

- 11.2.1 CHINA

- 11.3 EUROPE

- 11.3.1 GERMANY

- 11.3.1.1 Rising need to comply with strict particulate emission standards to bolster market growth

- 11.3.2 RUSSIA

- 11.3.2.1 Increasing focus on modernizing emission control activities at industrial sites to accelerate market growth

- 11.3.3 ITALY

- 11.3.3.1 Ongoing industrial modernization and rising demand for reliable aftermarket services to drive market

- 11.3.4 UK

- 11.3.4.1 Industrial modernization and demand for sustainable filtration solutions to augment market growth

- 11.3.5 FRANCE

- 11.3.5.1 Robust environmental mandates and industry-driven modernization to expedite market growth

- 11.3.6 REST OF EUROPE

- 11.3.1 GERMANY

- 11.4 NORTH AMERICA

- 11.4.1 US

- 11.4.1.1 Growing emphasis on industrial modernization and decarbonization initiatives to boost market growth

- 11.4.2 CANADA

- 11.4.2.1 Strong focus on clean energy transition and industrial sustainability to fuel market growth

- 11.4.3 MEXICO

- 11.4.3.1 Rapid industrial expansion and implementation of environmental regulations to accelerate market growth

- 11.4.1 US

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 GCC

- 11.5.1.1 Saudi Arabia

- 11.5.1.1.1 Strong government support for environmental sustainability and emission reduction to augment market growth

- 11.5.1.2 UAE

- 11.5.1.2.1 Booming construction industry and ambitious sustainability initiatives to fuel market growth

- 11.5.1.3 Rest of GCC

- 11.5.1.1 Saudi Arabia

- 11.5.2 SOUTH AFRICA

- 11.5.2.1 Large-scale mining and power generation activities to contribute to market growth

- 11.5.3 NIGERIA

- 11.5.3.1 Growing health concerns due to pollution to drive market

- 11.5.4 REST OF MIDDLE EAST & AFRICA

- 11.5.1 GCC

- 11.6 SOUTH AMERICA

- 11.6.1 BRAZIL

- 11.6.1.1 Rapid industrial growth and environmental pressures to boost market growth

- 11.6.2 ARGENTINA

- 11.6.2.1 Evolving regulatory frameworks to curb emissions to fuel market growth

- 11.6.3 CHILE

- 11.6.3.1 Growing emphasis on mitigating severe particulate pollution to boost market growth

- 11.6.4 REST OF SOUTH AMERICA

- 11.6.1 BRAZIL

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 12.3 MARKET SHARE ANALYSIS, 2024

- 12.4 REVENUE ANALYSIS, 2020-2024

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 End-use industry footprint

- 12.7.5.4 Filtration fabric footprint

- 12.7.5.5 Filtration type footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

- 12.9.4 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 EATON

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses/Competitive threats

- 13.1.2 DONALDSON COMPANY, INC.

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.3.2 Expansions

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths/Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses/Competitive threats

- 13.1.3 PARKER HANNIFIN CORP

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths/Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses/Competitive threats

- 13.1.4 PALL CORPORATION

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Expansions

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths/Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses/Competitive threats

- 13.1.5 3M

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Developments

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths/Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses/Competitive threats

- 13.1.6 THERMAX LIMITED

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.7 PENTAIR

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.8 BABCOCK & WILCOX ENTERPRISES, INC.

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.9 CAMFIL

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Expansions

- 13.1.10 W. L. GORE & ASSOCIATES, INC.

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.11 GENERAL FILTRATION

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Deals

- 13.1.12 BWF OFFERMANN, WALDENFELS & CO. KG

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Deals

- 13.1.12.3.2 Expansions

- 13.1.13 LENNTECH B.V.

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Solutions/Services offered

- 13.1.14 ROSEDALE PRODUCTS INC.

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Solutions/Services offered

- 13.1.15 AMERICAN FABRIC FILTER

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Solutions/Services offered

- 13.1.1 EATON

- 13.2 OTHER PLAYERS

- 13.2.1 FILTRATION SYSTEMS PRODUCTS INC.

- 13.2.2 AJR FILTRATION

- 13.2.3 FAB-TEX FILTRATION

- 13.2.4 CUSTOM ADVANCED

- 13.2.5 INDUSTRIAL FILTER MANUFACTURING LTD.

- 13.2.6 K2TEC

- 13.2.7 TEFLO

- 13.2.8 PRECISION WIRE PRODUCTS, INC.

- 13.2.9 GRIFFIN FILTERS

- 13.2.10 SHELCO FILTERS

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS

List of Tables

- TABLE 1 FILTER BAG MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 MAJOR SECONDARY SOURCES

- TABLE 3 PRIMARY INTERVIEW PARTICIPANTS, BY COMPANY

- TABLE 4 DATA CAPTURED FROM PRIMARY SOURCES

- TABLE 5 FILTER BAG MARKET SIZE ESTIMATION METHODOLOGY (DEMAND SIDE)

- TABLE 6 FILTER BAG MARKET: RISK ANALYSIS

- TABLE 7 FILTER BAG MARKET SNAPSHOT

- TABLE 8 INTERNATIONAL FINANCIAL SUPPORT FOR INFRASTRUCTURE, 2022

- TABLE 9 ROLE OF COMPANIES IN FILTER BAG ECOSYSTEM

- TABLE 10 LIST OF MAJOR PATENTS, 2021-2025

- TABLE 11 IMPORT DATA FOR HS CODE 842199-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 12 EXPORT DATA FOR HS CODE 842199-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 13 LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 14 TARIFF DATA FOR HS CODE 842199-COMPLIANT PRODUCTS, BY COUNTRY, 2024

- TABLE 15 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 AVERAGE SELLING PRICE TREND OF FILTER BAGS, BY MEDIA, 2021-2024 (USD/UNIT)

- TABLE 21 AVERAGE SELLING PRICE TREND OF FILTER BAGS, BY REGION, 2021-2024 (USD/UNIT)

- TABLE 22 IMPACT OF PORTER'S FIVE FORCES, 2025

- TABLE 23 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES (%)

- TABLE 24 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 25 WORLD GDP GROWTH PROJECTION, 2021-2028 (USD TRILLION)

- TABLE 26 INFLATION RATE, AVERAGE CONSUMER PRICES, AND ANNUAL CHANGE (2024, %)

- TABLE 27 MANUFACTURING VALUE ADDED (% OF GDP), 2023

- TABLE 28 VALUE ADDED BY INDUSTRY (INCLUDING CONSTRUCTION) (% OF GDP)

- TABLE 29 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 30 ANTICIPATED CHANGE IN PRICES AND POTENTIAL IMPACT ON KEY END-USE INDUSTRIES DUE TO TARIFF ENFORCEMENT

- TABLE 31 FILTER BAG MARKET, BY FILTRATION TYPE, 2021-2024 (USD MILLION)

- TABLE 32 FILTER BAG MARKET, BY FILTRATION TYPE, 2025-2030 (USD MILLION)

- TABLE 33 GAS FILTRATION: FILTER BAG MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 34 GAS FILTRATION: FILTER BAG MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 LIQUID FILTRATION: FILTER BAG MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 36 LIQUID FILTRATION: FILTER BAG MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 FILTER BAG MARKET, BY FILTER TYPE, 2021-2024 (USD MILLION)

- TABLE 38 FILTER BAG MARKET, BY FILTER TYPE, 2025-2030 (USD MILLION)

- TABLE 39 PULSE JET: FILTER BAG MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 40 PULSE JET: FILTER BAG MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 PULSE JET: FILTER BAG MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 42 PULSE JET: FILTER BAG MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 43 REVERSE AIR BAG: FILTER BAG MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 44 REVERSE AIR BAG: FILTER BAG MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 SHAKER: FILTER BAG MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 46 SHAKER: FILTER BAG MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 FILTER BAG MARKET, BY MEDIA, 2021-2024 (USD MILLION)

- TABLE 48 FILTER BAG MARKET, BY MEDIA, 2025-2030 (USD MILLION)

- TABLE 49 WOVEN: FILTER BAG MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 50 WOVEN: FILTER BAG MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 NON-WOVEN: FILTER BAG MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 52 NON-WOVEN: FILTER BAG MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 FILTER BAG MARKET, BY FILTRATION FABRIC, 2021-2024 (USD MILLION)

- TABLE 54 FILTER BAG MARKET, BY FILTRATION FABRIC, 2025-2030 (USD MILLION)

- TABLE 55 POLYESTER: FILTER BAG MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 POLYESTER: FILTER BAG MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 POLYPROPYLENE: FILTER BAG MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 58 POLYPROPYLENE: FILTER BAG MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 FIBERGLASS: FILTER BAG MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 60 FIBERGLASS: FILTER BAG MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 POLYIMIDE: FILTER BAG MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 62 POLYIMIDE: FILTER BAG MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 ACRYLIC FIBERS: FILTER BAG MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 64 ACRYLIC FIBERS: FILTER BAG MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 CERAMIC: FILTER BAG MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 66 CERAMIC: FILTER BAG MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 TEFLON: FILTER BAG MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 68 TEFLON: FILTER BAG MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 ARAMID: FILTER BAG MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 70 ARAMID: FILTER BAG MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 FILTER BAG MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 72 FILTER BAG MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 73 CEMENT: FILTER BAG MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 CEMENT: FILTER BAG MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 METALS & MINING: FILTER BAG MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 76 METALS & MINING: FILTER BAG MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 POWER GENERATION: FILTER BAG MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 78 POWER GENERATION: FILTER BAG MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79 OIL & GAS: FILTER BAG MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 80 OIL & GAS: FILTER BAG MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 FOOD & BEVERAGES: FILTER BAG MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 82 FOOD & BEVERAGES: FILTER BAG MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 83 CHEMICALS: FILTER BAG MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 84 CHEMICALS: FILTER BAG MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85 PAINT & COATINGS: FILTER BAG MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 86 PAINT & COATINGS: FILTER BAG MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 87 PHARMACEUTICALS: FILTER BAG MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 88 PHARMACEUTICALS: FILTER BAG MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 AUTOMOTIVE: FILTER BAG MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 90 AUTOMOTIVE: FILTER BAG MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91 OTHER END-USE INDUSTRIES: FILTER BAG MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 92 OTHER END-USE INDUSTRIES: FILTER BAG MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 93 FILTER BAG MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 94 FILTER BAG MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 95 FILTER BAG MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 96 FILTER BAG MARKET, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 97 ASIA PACIFIC: FILTER BAG MARKET, BY FILTRATION TYPE, 2021-2024 (USD MILLION)

- TABLE 98 ASIA PACIFIC: FILTER BAG MARKET, BY FILTRATION TYPE, 2025-2030 (USD MILLION)

- TABLE 99 ASIA PACIFIC: FILTER BAG MARKET, BY FILTRATION FABRIC, 2021-2024 (USD MILLION)

- TABLE 100 ASIA PACIFIC: FILTER BAG MARKET, BY FILTRATION FABRIC, 2025-2030 (USD MILLION)

- TABLE 101 ASIA PACIFIC: FILTER BAG MARKET, BY MEDIA, 2021-2024 (USD MILLION)

- TABLE 102 ASIA PACIFIC: FILTER BAG MARKET, BY MEDIA, 2025-2030 (USD MILLION)

- TABLE 103 ASIA PACIFIC: FILTER BAG MARKET, BY FILTER TYPE, 2021-2024 (USD MILLION)

- TABLE 104 ASIA PACIFIC: FILTER BAG MARKET, BY FILTER TYPE, 2025-2030 (USD MILLION)

- TABLE 105 ASIA PACIFIC: FILTER BAG MARKET FOR PULSE JET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 106 ASIA PACIFIC: FILTER BAG MARKET FOR PULSE JET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 107 ASIA PACIFIC: FILTER BAG MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 108 ASIA PACIFIC: FILTER BAG MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 109 ASIA PACIFIC: FILTER BAG MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 110 ASIA PACIFIC: FILTER BAG MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 111 CHINA: FILTER BAG MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 112 CHINA: FILTER BAG MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 113 AUSTRALIA: FILTER BAG MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 114 AUSTRALIA: FILTER BAG MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 115 JAPAN: FILTER BAG MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 116 JAPAN: FILTER BAG MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 117 INDIA: FILTER BAG MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 118 INDIA: FILTER BAG MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 119 REST OF APAC: FILTER BAG MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 120 REST OF APAC: FILTER BAG MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 121 EUROPE: FILTER BAG MARKET, BY FILTRATION TYPE, 2021-2024 (USD MILLION)

- TABLE 122 EUROPE: FILTER BAG MARKET, BY FILTRATION TYPE, 2025-2030 (USD MILLION)

- TABLE 123 EUROPE: FILTER BAG MARKET, BY FILTRATION FABRIC, 2021-2024 (USD MILLION)

- TABLE 124 EUROPE: FILTER BAG MARKET, BY FILTRATION FABRIC, 2025-2030 (USD MILLION)

- TABLE 125 EUROPE: FILTER BAG MARKET, BY MEDIA, 2021-2024 (USD MILLION)

- TABLE 126 EUROPE: FILTER BAG MARKET, BY MEDIA, 2025-2030 (USD MILLION)

- TABLE 127 EUROPE: FILTER BAG MARKET, BY FILTER TYPE, 2021-2024 (USD MILLION)

- TABLE 128 EUROPE: FILTER BAG MARKET, BY FILTER TYPE, 2025-2030 (USD MILLION)

- TABLE 129 EUROPE: FILTER BAG MARKET FOR PULSE JET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 130 EUROPE: FILTER BAG MARKET FOR PULSE JET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 131 EUROPE: FILTER BAG MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 132 EUROPE: FILTER BAG MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 133 EUROPE: FILTER BAG MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 134 EUROPE: FILTER BAG MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 135 GERMANY: FILTER BAG MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 136 GERMANY: FILTER BAG MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 137 RUSSIA: FILTER BAG MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 138 RUSSIA: FILTER BAG MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 139 ITALY: FILTER BAG MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 140 ITALY: FILTER BAG MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 141 UK: FILTER BAG MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 142 UK: FILTER BAG MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 143 FRANCE: FILTER BAG MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 144 FRANCE: FILTER BAG MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 145 REST OF EUROPE: FILTER BAG MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 146 REST OF EUROPE: FILTER BAG MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 147 NORTH AMERICA: FILTER BAG MARKET, BY FILTRATION TYPE, 2021-2024 (USD MILLION)

- TABLE 148 NORTH AMERICA: FILTER BAG MARKET, BY FILTRATION TYPE, 2025-2030 (USD MILLION)

- TABLE 149 NORTH AMERICA: FILTER BAG MARKET, BY FILTRATION FABRIC, 2021-2024 (USD MILLION)

- TABLE 150 NORTH AMERICA: FILTER BAG MARKET, BY FILTRATION FABRIC, 2025-2030 (USD MILLION)

- TABLE 151 NORTH AMERICA: FILTER BAG MARKET, BY MEDIA, 2021-2024 (USD MILLION)

- TABLE 152 NORTH AMERICA: FILTER BAG MARKET, BY MEDIA, 2025-2030 (USD MILLION)

- TABLE 153 NORTH AMERICA: FILTER BAG MARKET, BY FILTER TYPE, 2021-2024 (USD MILLION)

- TABLE 154 NORTH AMERICA: FILTER BAG MARKET, BY FILTER TYPE, 2025-2030 (USD MILLION)

- TABLE 155 NORTH AMERICA: FILTER BAG MARKET FOR PULSE JET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 156 NORTH AMERICA: FILTER BAG MARKET FOR PULSE JET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 157 NORTH AMERICA: FILTER BAG MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 158 NORTH AMERICA: FILTER BAG MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 159 NORTH AMERICA: FILTER BAG MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 160 NORTH AMERICA: FILTER BAG MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 161 US: FILTER BAG MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 162 US: FILTER BAG MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 163 CANADA: FILTER BAG MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 164 CANADA: FILTER BAG MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 165 MEXICO: FILTER BAG MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 166 MEXICO: FILTER BAG MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: FILTER BAG MARKET, BY FILTRATION TYPE, 2021-2024 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: FILTER BAG MARKET, BY FILTRATION TYPE, 2025-2030 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: FILTER BAG MARKET, BY FILTRATION FABRIC, 2021-2024 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: FILTER BAG MARKET, BY FILTRATION FABRIC, 2025-2030 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: FILTER BAG MARKET, BY MEDIA, 2021-2024 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: FILTER BAG MARKET, BY MEDIA, 2025-2030 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: FILTER BAG MARKET, BY FILTER TYPE, 2021-2024 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: FILTER BAG MARKET, BY FILTER TYPE, 2025-2030 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: FILTER BAG MARKET FOR PULSE JET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: FILTER BAG MARKET FOR PULSE JET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: FILTER BAG MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: FILTER BAG MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: FILTER BAG MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: FILTER BAG MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 181 GCC: FILTER BAG MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 182 GCC: FILTER BAG MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 183 GCC: FILTER BAG MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 184 GCC: FILTER BAG MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 185 SAUDI ARABIA: FILTER BAG MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 186 SAUDI ARABIA: FILTER BAG MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 187 UAE: FILTER BAG MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 188 UAE: FILTER BAG MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 189 REST OF GCC: FILTER BAG MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 190 REST OF GCC: FILTER BAG MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 191 SOUTH AFRICA: FILTER BAG MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 192 SOUTH AFRICA: FILTER BAG MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 193 NIGERIA: FILTER BAG MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 194 NIGERIA: FILTER BAG MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 195 REST OF MIDDLE EAST & AFRICA: FILTER BAG MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 196 REST OF MIDDLE EAST & AFRICA: FILTER BAG MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 197 SOUTH AMERICA: FILTER BAG MARKET, BY FILTRATION TYPE, 2021-2024 (USD MILLION)

- TABLE 198 SOUTH AMERICA: FILTER BAG MARKET, BY FILTRATION TYPE, 2025-2030 (USD MILLION)

- TABLE 199 SOUTH AMERICA: FILTER BAG MARKET, BY FILTRATION FABRIC, 2021-2024 (USD MILLION)

- TABLE 200 SOUTH AMERICA: FILTER BAG MARKET, BY FILTRATION FABRIC, 2025-2030 (USD MILLION)

- TABLE 201 SOUTH AMERICA: FILTER BAG MARKET, BY MEDIA, 2021-2024 (USD MILLION)

- TABLE 202 SOUTH AMERICA: FILTER BAG MARKET, BY MEDIA, 2025-2030 (USD MILLION)

- TABLE 203 SOUTH AMERICA: FILTER BAG MARKET, BY FILTER TYPE, 2021-2024 (USD MILLION)

- TABLE 204 SOUTH AMERICA: FILTER BAG MARKET, BY FILTER TYPE, 2025-2030 (USD MILLION)

- TABLE 205 SOUTH AMERICA: FILTER BAG MARKET FOR PULSE JET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 206 SOUTH AMERICA: FILTER BAG MARKET FOR PULSE JET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 207 SOUTH AMERICA: FILTER BAG MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 208 SOUTH AMERICA: FILTER BAG MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 209 SOUTH AMERICA: FILTER BAG MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 210 SOUTH AMERICA: FILTER BAG MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 211 BRAZIL: FILTER BAG MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 212 BRAZIL: FILTER BAG MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 213 ARGENTINA: FILTER BAG MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 214 ARGENTINA: FILTER BAG MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 215 CHILE: FILTER BAG MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 216 CHILE: FILTER BAG MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 217 REST OF SOUTH AMERICA: FILTER BAG MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 218 REST OF SOUTH AMERICA: FILTER BAG MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 219 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS, JANUARY 2021-JULY 2025

- TABLE 220 FILTER BAG MARKET: DEGREE OF COMPETITION, 2024

- TABLE 221 FILTER BAG MARKET: REGION FOOTPRINT

- TABLE 222 FILTER BAG MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 223 FILTER BAG MARKET: FILTRATION FABRIC FOOTPRINT

- TABLE 224 FILTER BAG MARKET: FILTRATION TYPE FOOTPRINT

- TABLE 225 FILTER BAG MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 226 FILTER BAG MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 227 FILTER BAG MARKET: PRODUCT LAUNCHES, JANUARY 2021-JULY 2025

- TABLE 228 FILTER BAG MARKET: DEALS, JANUARY 2021-JULY 2025

- TABLE 229 FILTER BAG MARKET: EXPANSIONS, JANUARY 2021-JULY 2025

- TABLE 230 FILTER BAG MARKET: OTHER DEVELOPMENTS, JANUARY 2021-JULY 2025

- TABLE 231 EATON: COMPANY OVERVIEW

- TABLE 232 EATON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 EATON: PRODUCT LAUNCHES

- TABLE 234 DONALDSON COMPANY, INC.: COMPANY OVERVIEW

- TABLE 235 DONALDSON COMPANY, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 236 DONALDSON COMPANY, INC.: DEALS

- TABLE 237 DONALDSON COMPANY, INC.: EXPANSIONS

- TABLE 238 PARKER HANNIFIN CORP: COMPANY OVERVIEW

- TABLE 239 PARKER HANNIFIN CORP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 PARKER HANNIFIN CORP: PRODUCT LAUNCHES

- TABLE 241 PALL CORPORATION: COMPANY OVERVIEW

- TABLE 242 PALL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 243 PALL CORPORATION: EXPANSIONS

- TABLE 244 3M: COMPANY OVERVIEW

- TABLE 245 3M: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 246 3M: DEVELOPMENTS

- TABLE 247 THERMAX LIMITED: COMPANY OVERVIEW

- TABLE 248 THERMAX LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 249 THERMAX LIMITED: DEALS

- TABLE 250 PENTAIR: COMPANY OVERVIEW

- TABLE 251 PENTAIR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 BABCOCK & WILCOX ENTERPRISES, INC.: COMPANY OVERVIEW

- TABLE 253 BABCOCK & WILCOX ENTERPRISES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 254 BABCOCK & WILCOX ENTERPRISES, INC.: DEALS

- TABLE 255 CAMFIL: COMPANY OVERVIEW

- TABLE 256 CAMFIL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 257 CAMFIL: EXPANSIONS

- TABLE 258 W. L. GORE & ASSOCIATES, INC.: COMPANY OVERVIEW

- TABLE 259 W. L. GORE & ASSOCIATES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 260 GENERAL FILTRATION: COMPANY OVERVIEW

- TABLE 261 GENERAL FILTRATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 262 GENERAL FILTRATION: DEALS

- TABLE 263 BWF OFFERMANN, WALDENFELS & CO. KG: COMPANY OVERVIEW

- TABLE 264 BWF OFFERMANN, WALDENFELS & CO. KG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 265 BWF OFFERMANN, WALDENFELS & CO. KG: DEALS

- TABLE 266 BWF OFFERMANN, WALDENFELS & CO. KG: EXPANSIONS

- TABLE 267 LENNTECH B.V.: COMPANY OVERVIEW

- TABLE 268 LENNTECH B.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 269 ROSEDALE PRODUCTS INC.: COMPANY OVERVIEW

- TABLE 270 ROSEDALE PRODUCTS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 271 AMERICAN FABRIC FILTER: COMPANY OVERVIEW

- TABLE 272 AMERICAN FABRIC FILTER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 FILTER BAG MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 DURATION CONSIDERED

- FIGURE 3 FILTER BAG MARKET: RESEARCH DESIGN

- FIGURE 4 DATA CAPTURED FROM SECONDARY SOURCES

- FIGURE 5 CORE FINDINGS FROM INDUSTRY EXPERTS

- FIGURE 6 BREAKDOWN OF PRIMARIES, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 7 KEY METRICS CONSIDERED TO ANALYZE DEMAND FOR FILTER BAGS

- FIGURE 8 FILTER BAG MARKET: BOTTOM-UP APPROACH

- FIGURE 9 FILTER BAG MARKET: TOP-DOWN APPROACH

- FIGURE 10 KEY STEPS CONSIDERED TO ASSESS SUPPLY OF FILTER BAGS

- FIGURE 11 FILTER BAG MARKET ESTIMATION METHODOLOGY (SUPPLY SIDE)

- FIGURE 12 FILTER BAG MARKET: DATA TRIANGULATION

- FIGURE 13 FILTER BAG MARKET: RESEARCH ASSUMPTIONS

- FIGURE 14 ASIA PACIFIC HELD LARGEST SHARE OF FILTER BAG MARKET IN 2024

- FIGURE 15 CEMENT SEGMENT TO DOMINATE FILTER BAG MARKET FROM 2025 TO 2030

- FIGURE 16 POLYESTER SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 17 PULSE JET SEGMENT TO CAPTURE LARGEST SHARE OF FILTER BAG MARKET IN 2030

- FIGURE 18 NON-WOVEN SEGMENT TO EXHIBIT HIGHER CAGR FROM 2025 TO 2030

- FIGURE 19 GAS FILTRATION SEGMENT TO HOLD LARGER MARKET SHARE IN 2025

- FIGURE 20 GROWING CONCERN ABOUT HEALTH AND SAFETY TO DRIVE FILTER BAG MARKET BETWEEN 2025 AND 2030

- FIGURE 21 ASIA PACIFIC TO RECORD HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 22 GAS FILTRATION SEGMENT AND CHINA HELD LARGEST SHARES OF ASIA PACIFIC FILTER BAG MARKET IN 2024

- FIGURE 23 GAS FILTRATION SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 24 NON-WOVEN SEGMENT TO CAPTURE LARGER MARKET SHARE IN 2030

- FIGURE 25 PULSE JET SEGMENT TO HOLD LARGEST SHARE OF FILTER BAG MARKET IN 2030

- FIGURE 26 POLYESTER SEGMENT TO CAPTURE LARGEST SHARE OF FILTER BAG MARKET IN 2030

- FIGURE 27 CEMENT INDUSTRY TO ACCOUNT FOR LARGEST SHARE OF FILTER BAG MARKET IN 2030

- FIGURE 28 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 29 ECONOMIC OUTPUT FOR INDUSTRIES (INCLUDING CONSTRUCTION), 2014-2024

- FIGURE 30 NUMBER OF PEOPLE IN URBAN AND RURAL AREAS WORLDWIDE, 2013-2023

- FIGURE 31 GREENHOUSE GAS EMISSIONS WORLDWIDE, BY GAS, 2019-2023

- FIGURE 32 GREENHOUSE GAS EMISSIONS, 2013-2023

- FIGURE 33 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 34 FILTER BAG VALUE CHAIN

- FIGURE 35 FILTER BAG ECOSYSTEM

- FIGURE 36 PATENTS GRANTED AND APPLIED, 2014-2024

- FIGURE 37 IMPORT DATA FOR HS CODE 842199-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 38 EXPORT DATA FOR HS CODE 842199-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 39 AVERAGE SELLING PRICE TREND OF FILTER BAGS, BY MEDIA, 2021-2024

- FIGURE 40 AVERAGE SELLING PRICE TREND OF FILTER BAGS, BY REGION, 2021-2024

- FIGURE 41 PORTER'S FIVE FORCES ANALYSIS, 2025

- FIGURE 42 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 43 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- FIGURE 44 INVESTMENT AND FUNDING SCENARIO

- FIGURE 45 IMPACT OF GEN AI/AI ON KEY END-USE INDUSTRIES, BY REGION

- FIGURE 46 FILTER BAG MARKET SHARE, BY FILTRATION TYPE, 2024

- FIGURE 47 FILTER BAG MARKET SHARE, BY FILTER TYPE, 2024

- FIGURE 48 FILTER BAG MARKET SHARE, BY MEDIA, 2024

- FIGURE 49 FILTER BAG MARKET SHARE, BY FILTRATION FABRIC, 2024

- FIGURE 50 FILTER BAG MARKET SHARE, BY END-USE INDUSTRY, 2024

- FIGURE 51 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN FILTER BAG MARKET FROM 2025 TO 2030

- FIGURE 52 FILTER BAG MARKET SHARE, BY REGION, 2024

- FIGURE 53 ASIA PACIFIC: FILTER BAG MARKET SNAPSHOT

- FIGURE 54 EUROPE: FILTER BAG MARKET SNAPSHOT

- FIGURE 55 MARKET SHARE ANALYSIS OF COMPANIES OFFERING FILTER BAGS, 2024

- FIGURE 56 FILTER BAG MARKET: REVENUE ANALYSIS OF TOP FOUR PLAYERS, 2020-2024

- FIGURE 57 COMPANY VALUATION

- FIGURE 58 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 59 PRODUCT COMPARISON

- FIGURE 60 FILTER BAG MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 61 FILTER BAG MARKET: COMPANY FOOTPRINT

- FIGURE 62 FILTER BAG MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 63 EATON: COMPANY SNAPSHOT

- FIGURE 64 DONALDSON COMPANY, INC.: COMPANY SNAPSHOT

- FIGURE 65 PARKER HANNIFIN CORP: COMPANY SNAPSHOT

- FIGURE 66 3M: COMPANY SNAPSHOT

- FIGURE 67 THERMAX LIMITED: COMPANY SNAPSHOT

- FIGURE 68 PENTAIR: COMPANY SNAPSHOT

- FIGURE 69 BABCOCK & WILCOX ENTERPRISES, INC.: COMPANY SNAPSHOT