|

市場調查報告書

商品編碼

1811729

全球氧氣濃縮機市場(按類型、技術、流量、應用、最終用戶和地區分類)- 預測至 2030 年Oxygen Concentrators Market by Type, Technology, Flowrate, Application, End User - Global Forecast to 2030 |

||||||

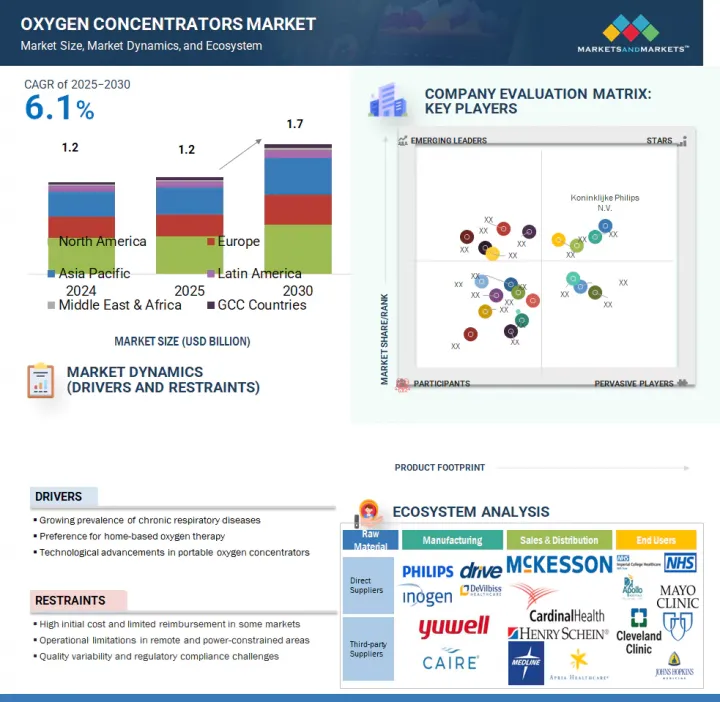

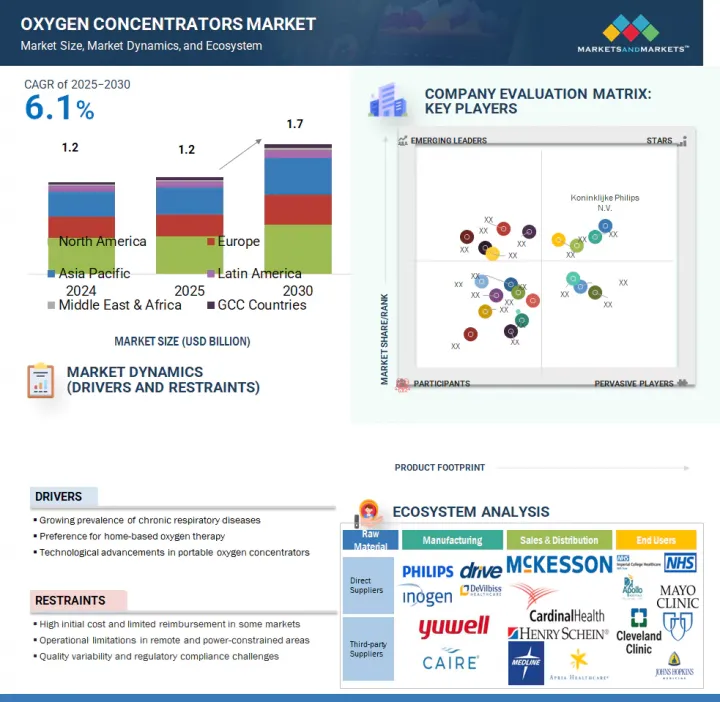

預計氧氣濃縮機市場將從 2025 年的 12.7 億美元成長到 2030 年的 17.1 億美元,預測期內的複合年成長率為 6.1%。

| 調查範圍 | |

|---|---|

| 調查年份 | 2024-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 對價單位 | 金額(十億美元) |

| 部分 | 按類型、技術、流量、應用、最終用戶和地區 |

| 目標區域 | 北美、歐洲、亞太地區、拉丁美洲、中東和非洲、海灣合作理事會國家 |

技術進步對於推動氧氣濃縮機市場的成長至關重要。最新的氧氣濃縮機更加緊湊、輕巧、節能且方便用戶使用。脈衝定量技術等創新技術,尤其是在可攜式型號中,僅在吸氣時輸送氧氣,以節省氧氣並延長電池壽命。較新的設備運作安靜,配備數位顯示器、警報器、遠端監控連接,並支援脈衝流和連續流模式。

配備長效電池的攜帶式製氧機深受活躍用戶和旅客的歡迎,有些甚至核准了美國聯邦航空管理局 (FAA) 的航空許可。物聯網整合可與醫療保健提供者即時共用數據,從而提高患者的依從性。人工智慧演算法可根據呼吸模式最佳化供氧。這些技術創新提高了便利性、病患生活品質並拓寬了適用範圍,隨著採用率的提高,市場也隨之成長。

按類型,市場分為攜帶式氧氣濃縮機和固定式氧氣濃縮機。到2024年,攜帶式氧氣濃縮機器將佔全球氧氣濃縮機市場的最大佔有率。全球老年人口的成長是推動攜帶式氧氣濃縮機(POC)需求的主要因素。老年人易患慢性呼吸系統疾病,如慢性阻塞性肺病、肺纖維化和與心臟衰竭相關的缺氧。隨著年齡的成長,行動變得越來越困難,POC 提供了一種實用的解決方案,使老年患者能夠接受氧氣療法不受固定設備的限制。無論是在家、戶外或旅行時,攜帶氧氣設備的能力都大大提高了患者的獨立性和生活品質。隨著老齡化人口的不斷成長,特別是在北美、歐洲和亞洲部分地區等已開發地區,對 POC 等緊湊、可靠且易於使用的氧氣設備的需求正在穩步成長,從而增強了它們的市場主導地位。

按最終用戶分類,制氧機市場分為居家照護機構、醫院和診所、門診手術中心和醫生辦公室。預計到 2024 年,居家醫療機構將佔據制氧機市場的最大佔有率。全球老年人口的成長是氧氣濃縮機市場居家照護領域需求的主要驅動力。老年人易患慢性呼吸系統疾病,如慢性阻塞性肺病(COPD)、肺氣腫及與老齡化相關的肺功能下降。這些疾病通常需要長期氧氣療法,而家庭氧氣療法因其便利性和低成本而日益流行。此外,老年患者通常行動不便,也難以頻繁到醫院就診。家用氧氣濃縮機提供了一種安全且易於使用的解決方案,使他們能夠保持獨立,同時保持持續的呼吸支持。在人口老化快速發展的國家,如日本、德國、義大利和美國,居家醫療機構對氧氣濃縮機的採用尤其強烈。

預計北美將在預測期內佔據 OC 市場的最大佔有率。北美,特別是美國和加拿大,擁有高度發展的醫療保健系統和最新的診斷和治療技術。該地區的醫院、診所和門診中心可以廣泛使用氧氣輸送設備,包括濃縮器。此外,結構化的醫療保健政策、綜合保險網路和簡化的採購管道確保了這些設備的順利供應和分銷。患者可受益於更快的診斷和及時開始氧氣療法。家庭護理支持系統也在進步,透過持續的氧氣支持實現從醫院到家庭的安全過渡。這些有利條件改善了氧氣濃縮機的取得和使用,特別是對於慢性病患者,鞏固了北美在全球氧氣濃縮機市場的主導地位。

本報告研究了全球氧氣濃縮機市場,並根據類型、技術、流量、應用、最終用戶、區域趨勢和公司概況對市場進行了全面的分析。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章重要考察

第5章 市場概況

- 介紹

- 市場動態

- 影響客戶業務的趨勢/中斷

- 定價分析

- 價值鏈分析

- 供應鏈分析

- 生態系分析

- 投資金籌措場景

- 技術分析

- 產業趨勢

- 專利分析

- 貿易分析

- 2025-2026年主要會議和活動

- 案例研究分析

- 監管分析

- 監管機構、政府機構和其他組織

- 波特五力分析

- 主要相關人員和採購標準

- 未滿足的需求/最終用戶期望

- 2025年美國關稅對氧氣濃縮機市場的影響

- 人工智慧對氧氣濃縮機市場的影響

- 鄰近市場分析

第6章氧氣濃縮機市場(按類型)

- 介紹

- 攜帶式氧氣濃縮機

- 固定式氧氣濃縮機

第7章氧氣濃縮機市場(依技術)

- 介紹

- 連續型

- 脈衝流型

第8章氧氣濃縮機市場(按流量)

- 介紹

- 0-5公升/分鐘

- 5-10公升/分鐘

- 10公升/分鐘以上

第9章氧氣濃縮機市場(依應用)

- 介紹

- COPD

- 氣喘

- 呼吸困難

- 其他

第 10 章。氧氣濃縮機市場(按最終用戶)

- 介紹

- 居家照護

- 醫院和診所

- 門診手術中心及診所

第 11 章氧氣濃縮機市場(按地區)

- 介紹

- 北美洲

- 北美宏觀經濟展望

- 美國

- 加拿大

- 歐洲

- 歐洲宏觀經濟展望

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 其他

- 亞太地區

- 亞太宏觀經濟展望

- 日本

- 中國

- 印度

- 韓國

- 澳洲

- 其他

- 拉丁美洲

- 拉丁美洲宏觀經濟展望

- 巴西

- 墨西哥

- 其他

- 中東和非洲

- 中東和非洲宏觀經濟展望

- 海灣合作理事會國家

- 海灣合作理事會國家宏觀經濟展望

第12章 競爭格局

- 概述

- 主要參與企業的策略/優勢

- 收益分析

- 市場佔有率分析

- 公司估值矩陣:2024 年關鍵參與企業

- 公司估值矩陣:Start-Ups/中小企業,2024 年

- 估值和財務指標

- 品牌/產品比較

- 競爭場景

第13章:公司簡介

- 主要參與企業

- KONINKLIJKE PHILIPS NV

- INOGEN, INC.

- JIANGSU YUYUE MEDICAL EQUIPMENT & SUPPLY CO., LTD.

- CAIRE INC.

- DRIVE DEVILBISS HEALTHCARE

- TEIJIN LIMITED

- DAIKIN INDUSTRIES, LTD.

- ESAB CORPORATION(GCE GROUP)

- REACT HEALTH

- PRECISION MEDICAL, INC.

- NIDEK MEDICAL PRODUCTS, INC.

- O2 CONCEPTS, LLC

- BPL MEDICAL TECHNOLOGIES

- BESCO

- OXUS

- 其他公司

- FOSHAN KEYHUB ELECTRONIC INDUSTRIES CO., LTD

- LONGFIAN SCITECH CO., LTD.

- SHENYANG CANTA MEDICAL TECH. CO., LTD.

- BELLUSCURA

- HOYO SCITECH CO., LTD.

- HACENOR SOLUTIONS

- XNUO INTERNATIONAL GROUP(USA)HOLDINGS

- OXYMED

- KALSTEIN

- ESS PEE ENTERPRISES

第14章 附錄

The oxygen concentrators market is projected to reach USD 1.71 billion by 2030 from USD 1.27 billion in 2025, at a CAGR of 6.1% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Type, Technology, Flowrate, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa, and GCC Countries |

Technological advancements are crucial in driving growth in the oxygen concentrators market. Modern units are more compact, lightweight, energy-efficient, and user-friendly. Innovations like pulse dose technology deliver oxygen only during inhalation to conserve it and extend battery life, especially in portable models. New devices feature silent operation, digital displays, alarms, connectivity for remote monitoring, and support both pulse and continuous flow modes.

Portable concentrators with long-lasting batteries are popular among active users and travelers, some FAA-approved for flights. IoT integration enables real-time data sharing with healthcare providers, enhancing patient compliance. AI algorithms optimize oxygen delivery based on respiratory patterns. These innovations improve convenience, patient quality of life, and broaden application scope, fueling market growth as adoption increases.

Based on type, the market is divided into portable and stationary oxygen concentrators. In 2024, the portable oxygen concentrator segment holds the largest share of the global oxygen concentrator market. The increasing global geriatric population is a key factor driving demand for portable oxygen concentrators (POCs). Older adults are more vulnerable to chronic respiratory conditions such as COPD, pulmonary fibrosis, and hypoxia related to heart failure. Mobility challenges in old age make POCs a practical solution, allowing elderly patients to receive oxygen therapy without being restricted to a stationary device. Being able to carry oxygen support while moving around at home, outdoors, or during travel greatly improves their independence and quality of life. As the aging population continues to grow-especially in developed areas like North America, Europe, and parts of Asia-the demand for compact, dependable, and easy-to-use oxygen devices like POCs steadily increases, strengthening their market dominance.

Based on end users, the OC market has been categorized into home care settings, hospitals and clinics, and ambulatory surgical centers & physician offices. In 2024, home care settings held the largest share in the OC market. The increasing global elderly population is a key factor driving demand in the home care segment of the oxygen concentrators market. Older adults are more vulnerable to chronic respiratory conditions such as chronic obstructive pulmonary disease (COPD), emphysema, and age-related decline in lung function. These conditions often require long-term oxygen therapy, which is increasingly managed at home due to its convenience and lower cost. Additionally, elderly patients often face mobility issues, making frequent hospital visits difficult. Home-based oxygen concentrators provide a safe and accessible solution, allowing independence while maintaining continuous respiratory support. Countries like Japan, Germany, Italy, and the US-with rapidly aging populations-are seeing a particularly high adoption of oxygen concentrators in home care settings.

North America is expected to hold the largest share of the OC market during the forecast period. North America, especially the US and Canada, has highly developed healthcare systems equipped with modern diagnostic and therapeutic technologies. The region's hospitals, clinics, and outpatient centers have widespread access to oxygen delivery equipment, including concentrators. Additionally, structured healthcare policies, integrated insurance networks, and streamlined procurement channels ensure the smooth availability and distribution of these devices. Patients benefit from faster diagnoses and prompt initiation of oxygen therapy. Home care support systems are also advanced, allowing a safe transition from hospital to home with continuous oxygen support. These favorable conditions improve the accessibility and use of oxygen concentrators, especially for chronic patients, and reinforce North America's leadership position in the global oxygen concentrators market.

A breakdown of the primary participants (supply-side) for the oxygen concentrators market referred to in this report is provided below:

- By Company Type: Tier 1:34%, Tier 2: 38%, and Tier 3: 28%

- By Designation: C-level: 26%, Director Level: 35%, and Others: 39%

- By Region: North America: 17%, Europe: 39%, Asia Pacific: 28%, Latin America: 8%, Middle East & Africa: 3%, GCC Countries: 5%

Major players in the oxygen concentrators market include Koninklijke Philips N.V. (Netherlands), Inogen, Inc. (US), Jiangsu Yuyue Medical Equipment & Supply Co., Ltd. (China), Caire, Inc. (US), and Drive DeVilbiss Healthcare (US).

Research Coverage

The report assesses the oxygen concentrators market and estimates its size and future growth potential across various segments, including type, technology, flow rate, application, end user, and region. It also provides a competitive analysis of the leading companies in the market, along with their profiles, product offerings, recent developments, and key strategies.

Reasons to Buy the Report

The report will help market leaders and new entrants by providing data on the closest estimates of revenue for the overall oxygen concentrators market and its subsegments. It will aid stakeholders in understanding the competitive landscape and gaining insights to better position their businesses and develop effective go-to-market strategies. Additionally, the report helps stakeholders grasp market trends and offers data on key drivers, obstacles, challenges, and opportunities within the market.

This report provides insights into the following points:

- Analysis of key drivers (rising prevalence of respiratory diseases, growing geriatric population, increasing demand for home healthcare, government initiatives and reimbursement support, technological advancements), restraints (high cost of advanced oxygen concentrators, product recalls or malfunctions), opportunities (integration of digital health features, development of solar-powered or battery-efficient models) and challenges (lack of awareness and diagnosis, competition from low-cost alternatives)

- Product Enhancement/Innovation: Comprehensive details about product launches and anticipated trends in the global OC market

- Market Development: Thorough knowledge and analysis of the profitable rising markets by type, technology, flowrate, application, end user, and region

- Market Diversification: Comprehensive information about newly launched products and services, expanding markets, current advancements, and investments in the global OC market

- Competitive Assessment: Thorough evaluation of the market shares, growth plans, offerings, and capacities of the major competitors in the global OC market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 SEGMENTS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY USED

- 1.6 STAKEHOLDERS

- 1.7 LIMITATIONS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 DATA TRIANGULATION

- 2.4 MARKET SHARE ESTIMATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 METHODOLOGY-RELATED LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 OXYGEN CONCENTRATORS MARKET OVERVIEW

- 4.2 ASIA PACIFIC: OXYGEN CONCENTRATORS MARKET, BY TECHNOLOGY AND COUNTRY

- 4.3 OXYGEN CONCENTRATORS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.4 OXYGEN CONCENTRATORS MARKET, REGIONAL MIX

- 4.5 OXYGEN CONCENTRATORS MARKET: EMERGING VS. DEVELOPED MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing prevalence of chronic respiratory diseases

- 5.2.1.2 Preference for home-based oxygen therapy

- 5.2.1.3 Technological advancements in portable oxygen concentrators

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial cost and limited reimbursement in some markets

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion in emerging markets

- 5.2.3.2 Integration with remote monitoring and telehealth

- 5.2.3.3 Institutional demand and tender-based opportunities

- 5.2.4 CHALLENGES

- 5.2.4.1 Operational limitations in remote and power-constrained areas

- 5.2.4.2 Quality variability and regulatory compliance challenges

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY TYPE

- 5.4.2 AVERAGE SELLING PRICE TREND OF PORTABLE OXYGEN CONCENTRATORS, BY REGION

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 INVESTMENT & FUNDING SCENARIO

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Pressure swing adsorption (PSA) technology

- 5.9.1.2 Pulse-dose vs. continuous flow delivery

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Remote patient monitoring (RPM) integration

- 5.9.2.2 Battery and power management systems

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 PSA oxygen plants

- 5.9.3.2 Oxygen cylinders as backup systems

- 5.9.1 KEY TECHNOLOGIES

- 5.10 INDUSTRY TRENDS

- 5.10.1 RISING DEMAND FOR HOME-BASED OXYGEN THERAPY

- 5.10.2 INTEGRATION WITH TELEHEALTH AND REMOTE MONITORING

- 5.10.3 SHIFT TOWARD PORTABLE AND WEARABLE TECHNOLOGIES

- 5.10.4 CONSOLIDATION AND COMPETITIVE LANDSCAPE EVOLUTION

- 5.11 PATENT ANALYSIS

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT DATA (HS CODE 901920)

- 5.12.2 EXPORT DATA (HS CODE 901920)

- 5.13 KEY CONFERENCES & EVENTS, 2025-2026

- 5.14 CASE STUDY ANALYSIS

- 5.14.1 DEPLOYMENT OF PORTABLE OXYGEN CONCENTRATORS IN RURAL INDIA

- 5.14.2 INOGEN'S DIRECT-TO-CONSUMER EXPANSION IN US

- 5.14.3 BELLUSCURA'S STRATEGIC PARTNERSHIP WITH CHINESE OEM

- 5.15 REGULATORY ANALYSIS

- 5.16 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.16.1 REGULATORY LANDSCAPE

- 5.16.1.1 North America

- 5.16.1.1.1 US

- 5.16.1.1.2 Canada

- 5.16.1.2 Europe

- 5.16.1.2.1 Germany

- 5.16.1.2.2 France

- 5.16.1.2.3 UK

- 5.16.1.3 Asia Pacific

- 5.16.1.3.1 China

- 5.16.1.3.2 Japan

- 5.16.1.3.3 India

- 5.16.1.4 Latin America

- 5.16.1.4.1 Brazil

- 5.16.1.4.2 Mexico

- 5.16.1.5 Middle East & Africa

- 5.16.1.5.1 South Africa

- 5.16.1.5.2 GCC Countries

- 5.16.1.1 North America

- 5.16.1 REGULATORY LANDSCAPE

- 5.17 PORTER'S FIVE FORCES ANALYSIS

- 5.17.1 THREAT OF NEW ENTRANTS

- 5.17.2 THREAT OF SUBSTITUTES

- 5.17.3 BARGAINING POWER OF SUPPLIERS

- 5.17.4 BARGAINING POWER OF BUYERS

- 5.17.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.18 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.18.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.18.2 BUYING CRITERIA

- 5.19 UNMET NEEDS/END-USER EXPECTATIONS

- 5.20 IMPACT OF 2025 US TARIFF ON OXYGEN CONCENTRATORS MARKET

- 5.20.1 KEY TARIFF RATES

- 5.20.2 PRICE IMPACT ANALYSIS

- 5.20.3 KEY IMPACT ON COUNTRY/REGION

- 5.20.3.1 US

- 5.20.3.2 Europe

- 5.20.3.3 Asia Pacific

- 5.20.4 IMPACT ON END-USER INDUSTRIES

- 5.21 IMPACT OF ARTIFICIAL INTELLIGENCE ON OXYGEN CONCENTRATORS MARKET

- 5.22 ADJACENT MARKET ANALYSIS

6 OXYGEN CONCENTRATORS MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 PORTABLE OXYGEN CONCENTRATORS

- 6.3 STATIONARY OXYGEN CONCENTRATORS

7 OXYGEN CONCENTRATORS MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- 7.2 CONTINUOUS FLOW

- 7.3 PULSE FLOW

8 OXYGEN CONCENTRATORS MARKET, BY FLOWRATE

- 8.1 INTRODUCTION

- 8.2 0-5 L/MIN FLOWRATE

- 8.3 5-10 L/MIN FLOWRATE

- 8.4 ABOVE 10 L/MIN FLOWRATE

9 OXYGEN CONCENTRATORS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 COPD

- 9.3 ASTHMA

- 9.4 RESPIRATORY DISTRESS

- 9.5 OTHER APPLICATIONS

10 OXYGEN CONCENTRATORS MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 HOME CARE SETTINGS

- 10.3 HOSPITALS & CLINICS

- 10.4 AMBULATORY SURGICAL CENTERS & PHYSICIANS' OFFICES

11 OXYGEN CONCENTRATORS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Medicare coverage, COPD prevalence, and connected POCs to catalyze sustained market expansion through 2030

- 11.2.3 CANADA

- 11.2.3.1 Provincial funding, COPD burden, and connected POCs to accelerate home oxygen concentrator adoption trajectory

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Strong payer coverage and clinical guidelines to drive predictable replacement cycles in Germany's market

- 11.3.3 FRANCE

- 11.3.3.1 Hospital-to-home shift and connected devices sustain resilient replacement cycles in France's oxygen concentrators market

- 11.3.4 UK

- 11.3.4.1 Aging population and funded home oxygen programs to underpin steady expansion

- 11.3.5 ITALY

- 11.3.5.1 Regional tenders, SSN homecare funding, and COPD burden to support steady growth in Italy's market

- 11.3.6 SPAIN

- 11.3.6.1 Driving home-based healthcare with portable oxygen concentrator growth

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 JAPAN

- 11.4.2.1 Stable funding and service-led home care models to support steady growth

- 11.4.3 CHINA

- 11.4.3.1 Policy momentum and robust manufacturing ecosystem to drive resilient replacement cycles

- 11.4.4 INDIA

- 11.4.4.1 Building resilient healthcare infrastructure with rising oxygen concentrator demand

- 11.4.5 SOUTH KOREA

- 11.4.5.1 Hospital-to-home shift and connected POCs to propel South Korea's portable and stationary oxygen concentrator demand growth

- 11.4.6 AUSTRALIA

- 11.4.6.1 Policy support, service networks, and digital monitoring to drive steady expansion of Australia's market through 2030

- 11.4.7 REST OF ASIA PACIFIC

- 11.5 LATIN AMERICA

- 11.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 11.5.2 BRAZIL

- 11.5.2.1 Public procurement, ANVISA registration, and service networks to drive predictable replacement cycles in Brazil's oxygen therapy landscape

- 11.5.3 MEXICO

- 11.5.3.1 Strengthening respiratory care access through expanding oxygen concentrator adoption

- 11.5.4 REST OF LATIN AMERICA

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 11.7 GCC COUNTRIES

- 11.7.1 MACROECONOMIC OUTLOOK FOR GCC COUNTRIES

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGY/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.5.5.1 Company footprint

- 12.5.5.2 Regional footprint

- 12.5.5.3 Type footprint

- 12.5.5.4 Application footprint

- 12.5.5.5 End User footprint

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.6.5.1 Detailed list of key startups/SMEs

- 12.6.5.2 Competitive benchmarking of startups/SMEs

- 12.7 COMPANY VALUATION AND FINANCIAL METRICS

- 12.7.1 FINANCIAL METRICS

- 12.7.2 COMPANY VALUATION

- 12.8 BRAND/PRODUCT COMPARISON

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 KONINKLIJKE PHILIPS N.V.

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 MnM view

- 13.1.1.3.1 Right to win

- 13.1.1.3.2 Strategic choices

- 13.1.1.3.3 Weaknesses and competitive threats

- 13.1.2 INOGEN, INC.

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches & approvals

- 13.1.2.3.2 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 JIANGSU YUYUE MEDICAL EQUIPMENT & SUPPLY CO., LTD.

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 CAIRE INC.

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches & approvals

- 13.1.4.3.2 Deals

- 13.1.4.3.3 Expansions

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 DRIVE DEVILBISS HEALTHCARE

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches & approvals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 TEIJIN LIMITED

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.7 DAIKIN INDUSTRIES, LTD.

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.8 ESAB CORPORATION (GCE GROUP)

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.9 REACT HEALTH

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.10 PRECISION MEDICAL, INC.

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.11 NIDEK MEDICAL PRODUCTS, INC.

- 13.1.11.1 Business overview

- 13.1.11.2 Products offered

- 13.1.12 O2 CONCEPTS, LLC

- 13.1.12.1 Business overview

- 13.1.12.2 Products offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Product launches & approvals

- 13.1.12.3.2 Deals

- 13.1.13 BPL MEDICAL TECHNOLOGIES

- 13.1.13.1 Business overview

- 13.1.13.2 Products offered

- 13.1.14 BESCO

- 13.1.14.1 Business overview

- 13.1.14.2 Products offered

- 13.1.15 OXUS

- 13.1.15.1 Business overview

- 13.1.15.2 Products offered

- 13.1.1 KONINKLIJKE PHILIPS N.V.

- 13.2 OTHER COMPANIES

- 13.2.1 FOSHAN KEYHUB ELECTRONIC INDUSTRIES CO., LTD

- 13.2.2 LONGFIAN SCITECH CO., LTD.

- 13.2.3 SHENYANG CANTA MEDICAL TECH. CO., LTD.

- 13.2.4 BELLUSCURA

- 13.2.5 HOYO SCITECH CO., LTD.

- 13.2.6 HACENOR SOLUTIONS

- 13.2.7 XNUO INTERNATIONAL GROUP (USA) HOLDINGS

- 13.2.8 OXYMED

- 13.2.9 KALSTEIN

- 13.2.10 ESS PEE ENTERPRISES

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

List of Tables

- TABLE 1 USD STANDARD CURRENCY CONVERSION RATES, 2020-2024

- TABLE 2 RISK ASSESSMENT: OXYGEN CONCENTRATORS

- TABLE 3 OXYGEN CONCENTRATORS MARKET: IMPACT OF ANALYSIS OF MARKET DYNAMICS

- TABLE 4 AVERAGE SELLING PRICE OF KEY PLAYERS, BY TYPE, 2024 (USD)

- TABLE 5 AVERAGE SELLING PRICE TREND OF PORTABLE OXYGEN CONCENTRATORS, BY REGION, 2022-2024 (USD)

- TABLE 6 OXYGEN CONCENTRATORS MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 7 IMPORT DATA FOR HS CODE 901920-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 8 EXPORT DATA FOR HS CODE 901920-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 9 OXYGEN CONCENTRATORS MARKET: KEY CONFERENCES & EVENTS, 2025-2026

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 OXYGEN CONCENTRATORS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP TWO PRODUCTS

- TABLE 17 KEY BUYING CRITERIA FOR TOP TWO PRODUCTS

- TABLE 18 US-ADJUSTED RECIPROCAL TARIFF RATES, 2024

- TABLE 19 KEY PRODUCT-RELATED TARIFFS EFFECTIVE FOR OXYGEN CONCENTRATORS

- TABLE 20 OXYGEN CONCENTRATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 21 EXAMPLES OF PORTABLE OXYGEN CONCENTRATORS (POC)

- TABLE 22 PORTABLE OXYGEN CONCENTRATORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 23 PORTABLE OXYGEN CONCENTRATORS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 24 EXAMPLES OF STATIONARY OXYGEN CONCENTRATORS (POC)

- TABLE 25 STATIONARY OXYGEN CONCENTRATORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 26 STATIONARY OXYGEN CONCENTRATORS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 27 OXYGEN CONCENTRATORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 28 CONTINUOUS-FLOW OXYGEN CONCENTRATORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 29 PULSE-FLOW OXYGEN CONCENTRATORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 30 OXYGEN CONCENTRATORS MARKET, BY FLOWRATE, 2023-2030 (USD MILLION)

- TABLE 31 0-5 L/MIN FLOWRATE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 32 5-10 L/MIN FLOWRATE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 33 ABOVE 10 L/MIN FLOWRATE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 34 OXYGEN CONCENTRATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 35 OXYGEN CONCENTRATORS MARKET FOR COPD, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 36 OXYGEN CONCENTRATORS MARKET FOR ASTHMA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 37 OXYGEN CONCENTRATORS MARKET FOR RESPIRATORY DISTRESS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 38 OXYGEN CONCENTRATORS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 39 OXYGEN CONCENTRATORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 40 OXYGEN CONCENTRATORS MARKET FOR HOME CARE SETTINGS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 41 OXYGEN CONCENTRATORS MARKET FOR HOSPITALS & CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 42 OXYGEN CONCENTRATORS MARKET FOR AMBULATORY SURGICAL CENTERS & PHYSICIANS' OFFICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 43 OXYGEN CONCENTRATORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 44 NORTH AMERICA: OXYGEN CONCENTRATORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 45 NORTH AMERICA: OXYGEN CONCENTRATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 46 NORTH AMERICA: OXYGEN CONCENTRATORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 47 NORTH AMERICA: OXYGEN CONCENTRATORS MARKET, BY FLOWRATE, 2023-2030 (USD MILLION)

- TABLE 48 NORTH AMERICA: OXYGEN CONCENTRATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 49 NORTH AMERICA: OXYGEN CONCENTRATORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 50 US: MACROECONOMIC INDICATORS

- TABLE 51 US: OXYGEN CONCENTRATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 52 US: OXYGEN CONCENTRATORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 53 US: OXYGEN CONCENTRATORS MARKET, BY FLOWRATE, 2023-2030 (USD MILLION)

- TABLE 54 US: OXYGEN CONCENTRATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 55 US: OXYGEN CONCENTRATORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 56 CANADA: MACROECONOMIC INDICATORS

- TABLE 57 CANADA: OXYGEN CONCENTRATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 58 CANADA: OXYGEN CONCENTRATORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 59 CANADA: OXYGEN CONCENTRATORS MARKET, BY FLOWRATE, 2023-2030 (USD MILLION)

- TABLE 60 CANADA: OXYGEN CONCENTRATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 61 CANADA: OXYGEN CONCENTRATORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 62 EUROPE: OXYGEN CONCENTRATORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 63 EUROPE: OXYGEN CONCENTRATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 64 EUROPE: OXYGEN CONCENTRATORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 65 EUROPE: OXYGEN CONCENTRATORS MARKET, BY FLOWRATE, 2023-2030 (USD MILLION)

- TABLE 66 EUROPE: OXYGEN CONCENTRATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 67 EUROPE: OXYGEN CONCENTRATORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 68 GERMANY: MACROECONOMIC INDICATORS

- TABLE 69 GERMANY: OXYGEN CONCENTRATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 70 GERMANY: OXYGEN CONCENTRATORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 71 GERMANY: OXYGEN CONCENTRATORS MARKET, BY FLOWRATE, 2023-2030 (USD MILLION)

- TABLE 72 GERMANY: OXYGEN CONCENTRATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 73 GERMANY: OXYGEN CONCENTRATORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 74 FRANCE: MACROECONOMIC INDICATORS

- TABLE 75 FRANCE: OXYGEN CONCENTRATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 76 FRANCE: OXYGEN CONCENTRATORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 77 FRANCE: OXYGEN CONCENTRATORS MARKET, BY FLOWRATE, 2023-2030 (USD MILLION)

- TABLE 78 FRANCE: OXYGEN CONCENTRATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 79 FRANCE: OXYGEN CONCENTRATORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 80 UK: MACROECONOMIC INDICATORS

- TABLE 81 UK: OXYGEN CONCENTRATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 82 UK: OXYGEN CONCENTRATORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 83 UK: OXYGEN CONCENTRATORS MARKET, BY FLOWRATE, 2023-2030 (USD MILLION)

- TABLE 84 UK: OXYGEN CONCENTRATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 85 UK: OXYGEN CONCENTRATORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 86 ITALY: MACROECONOMIC INDICATORS

- TABLE 87 ITALY: OXYGEN CONCENTRATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 88 ITALY: OXYGEN CONCENTRATORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 89 ITALY: OXYGEN CONCENTRATORS MARKET, BY FLOWRATE, 2023-2030 (USD MILLION)

- TABLE 90 ITALY: OXYGEN CONCENTRATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 91 ITALY: OXYGEN CONCENTRATORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 92 SPAIN: MACROECONOMIC INDICATORS

- TABLE 93 SPAIN: OXYGEN CONCENTRATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 94 SPAIN: OXYGEN CONCENTRATORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 95 SPAIN: OXYGEN CONCENTRATORS MARKET, BY FLOWRATE, 2023-2030 (USD MILLION)

- TABLE 96 SPAIN: OXYGEN CONCENTRATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 97 SPAIN: OXYGEN CONCENTRATORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 98 REST OF EUROPE: OXYGEN CONCENTRATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 99 REST OF EUROPE: OXYGEN CONCENTRATORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 100 REST OF EUROPE: OXYGEN CONCENTRATORS MARKET, BY FLOWRATE, 2023-2030 (USD MILLION)

- TABLE 101 REST OF EUROPE: OXYGEN CONCENTRATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 102 REST OF EUROPE: OXYGEN CONCENTRATORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 103 ASIA PACIFIC: OXYGEN CONCENTRATORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 104 ASIA PACIFIC: OXYGEN CONCENTRATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 105 ASIA PACIFIC: OXYGEN CONCENTRATORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 106 ASIA PACIFIC: OXYGEN CONCENTRATORS MARKET, BY FLOWRATE, 2023-2030 (USD MILLION)

- TABLE 107 ASIA PACIFIC: OXYGEN CONCENTRATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 108 ASIA PACIFIC: OXYGEN CONCENTRATORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 109 JAPAN: MACROECONOMIC INDICATORS

- TABLE 110 JAPAN: OXYGEN CONCENTRATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 111 JAPAN: OXYGEN CONCENTRATORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 112 JAPAN: OXYGEN CONCENTRATORS MARKET, BY FLOWRATE, 2023-2030 (USD MILLION)

- TABLE 113 JAPAN: OXYGEN CONCENTRATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 114 JAPAN: OXYGEN CONCENTRATORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 115 CHINA: MACROECONOMIC INDICATORS

- TABLE 116 CHINA: OXYGEN CONCENTRATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 117 CHINA: OXYGEN CONCENTRATORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 118 CHINA: OXYGEN CONCENTRATORS MARKET, BY FLOWRATE, 2023-2030 (USD MILLION)

- TABLE 119 CHINA: OXYGEN CONCENTRATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 120 CHINA: OXYGEN CONCENTRATORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 121 INDIA: MACROECONOMIC INDICATORS

- TABLE 122 INDIA: OXYGEN CONCENTRATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 123 INDIA: OXYGEN CONCENTRATORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 124 INDIA: OXYGEN CONCENTRATORS MARKET, BY FLOWRATE, 2023-2030 (USD MILLION)

- TABLE 125 INDIA: OXYGEN CONCENTRATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 126 INDIA: OXYGEN CONCENTRATORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 127 SOUTH KOREA: MACROECONOMIC INDICATORS

- TABLE 128 SOUTH KOREA: OXYGEN CONCENTRATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 129 SOUTH KOREA: OXYGEN CONCENTRATORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 130 SOUTH KOREA: OXYGEN CONCENTRATORS MARKET, BY FLOWRATE, 2023-2030 (USD MILLION)

- TABLE 131 SOUTH KOREA: OXYGEN CONCENTRATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 132 SOUTH KOREA: OXYGEN CONCENTRATORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 133 AUSTRALIA: MACROECONOMIC INDICATORS

- TABLE 134 AUSTRALIA: OXYGEN CONCENTRATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 135 AUSTRALIA: OXYGEN CONCENTRATORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 136 AUSTRALIA: OXYGEN CONCENTRATORS MARKET, BY FLOWRATE, 2023-2030 (USD MILLION)

- TABLE 137 AUSTRALIA: OXYGEN CONCENTRATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 138 AUSTRALIA: OXYGEN CONCENTRATORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 139 REST OF ASIA PACIFIC: OXYGEN CONCENTRATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 140 REST OF ASIA PACIFIC: OXYGEN CONCENTRATORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 141 REST OF ASIA PACIFIC: OXYGEN CONCENTRATORS MARKET, BY FLOWRATE, 2023-2030 (USD MILLION)

- TABLE 142 REST OF ASIA PACIFIC: OXYGEN CONCENTRATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 143 REST OF ASIA PACIFIC: OXYGEN CONCENTRATORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 144 LATIN AMERICA: OXYGEN CONCENTRATORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 145 LATIN AMERICA: OXYGEN CONCENTRATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 146 LATIN AMERICA: OXYGEN CONCENTRATORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 147 LATIN AMERICA: OXYGEN CONCENTRATORS MARKET, BY FLOWRATE, 2023-2030 (USD MILLION)

- TABLE 148 LATIN AMERICA: OXYGEN CONCENTRATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 149 LATIN AMERICA: OXYGEN CONCENTRATORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 150 BRAZIL: MACROECONOMIC INDICATORS

- TABLE 151 BRAZIL: OXYGEN CONCENTRATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 152 BRAZIL: OXYGEN CONCENTRATORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 153 BRAZIL: OXYGEN CONCENTRATORS MARKET, BY FLOWRATE, 2023-2030 (USD MILLION)

- TABLE 154 BRAZIL: OXYGEN CONCENTRATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 155 BRAZIL: OXYGEN CONCENTRATORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 156 MEXICO: MACROECONOMIC INDICATORS

- TABLE 157 MEXICO: OXYGEN CONCENTRATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 158 MEXICO: OXYGEN CONCENTRATORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 159 MEXICO: OXYGEN CONCENTRATORS MARKET, BY FLOWRATE, 2023-2030 (USD MILLION)

- TABLE 160 MEXICO: OXYGEN CONCENTRATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 161 MEXICO: OXYGEN CONCENTRATORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 162 REST OF LATIN AMERICA: OXYGEN CONCENTRATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 163 REST OF LATIN AMERICA: OXYGEN CONCENTRATORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 164 REST OF LATIN AMERICA: OXYGEN CONCENTRATORS MARKET, BY FLOWRATE, 2023-2030 (USD MILLION)

- TABLE 165 REST OF LATIN AMERICA: OXYGEN CONCENTRATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 166 REST OF LATIN AMERICA: OXYGEN CONCENTRATORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: OXYGEN CONCENTRATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: OXYGEN CONCENTRATORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: OXYGEN CONCENTRATORS MARKET, BY FLOWRATE, 2023-2030 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: OXYGEN CONCENTRATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: OXYGEN CONCENTRATORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 172 GCC COUNTRIES: OXYGEN CONCENTRATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 173 GCC COUNTRIES: OXYGEN CONCENTRATORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 174 GCC COUNTRIES: OXYGEN CONCENTRATORS MARKET, BY FLOWRATE, 2023-2030 (USD MILLION)

- TABLE 175 GCC COUNTRIES: OXYGEN CONCENTRATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 176 GCC COUNTRIES: OXYGEN CONCENTRATORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 177 KEY DEVELOPMENTS IN OXYGEN CONCENTRATORS MARKET, JANUARY 2021-JULY 2025

- TABLE 178 OXYGEN CONCENTRATORS MARKET: DEGREE OF COMPETITION

- TABLE 179 OXYGEN CONCENTRATORS MARKET: REGIONAL FOOTPRINT, 2024

- TABLE 180 OXYGEN CONCENTRATORS MARKET: TYPE FOOTPRINT, 2024

- TABLE 181 OXYGEN CONCENTRATORS MARKET: APPLICATION FOOTPRINT, 2024

- TABLE 182 OXYGEN CONCENTRATORS MARKET: END USER FOOTPRINT, 2024

- TABLE 183 OXYGEN CONCENTRATORS MARKET: DETAILED LIST OF KEY STARTUPS/SMES, 2024

- TABLE 184 OXYGEN CONCENTRATORS MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES, 2024

- TABLE 185 OXYGEN CONCENTRATORS MARKET: PRODUCT LAUNCHES, JANUARY 2021-JULY 2025

- TABLE 186 OXYGEN CONCENTRATORS MARKET: DEALS, JANUARY 2021-JULY 2025

- TABLE 187 OXYGEN CONCENTRATORS MARKET: EXPANSIONS, JANUARY 2021-JULY 2025

- TABLE 188 KONINKLIJKE PHILIPS N.V.: COMPANY OVERVIEW

- TABLE 189 KONINKLIJKE PHILIPS N.V.: PRODUCTS OFFERED

- TABLE 190 INOGEN, INC.: COMPANY OVERVIEW

- TABLE 191 INOGEN, INC.: PRODUCTS OFFERED

- TABLE 192 INOGEN, INC.: PRODUCT LAUNCHES & APPROVALS, JANUARY 2021-JULY 2025

- TABLE 193 INOGEN INC.: DEALS

- TABLE 194 JIANGSU YUYUE MEDICAL EQUIPMENT & SUPPLY CO., LTD.: COMPANY OVERVIEW

- TABLE 195 JIANGSU YUYUE MEDICAL EQUIPMENT & SUPPLY CO., LTD.: PRODUCTS OFFERED

- TABLE 196 JIANGSU YUYUE MEDICAL EQUIPMENT & SUPPLY CO., LTD..: DEALS

- TABLE 197 CAIRE INC.: COMPANY OVERVIEW

- TABLE 198 CAIRE INC.: PRODUCTS OFFERED

- TABLE 199 CAIRE INC.: PRODUCT LAUNCHES & APPROVALS

- TABLE 200 CAIRE INC.: DEALS

- TABLE 201 CAIRE INC.: EXPANSIONS

- TABLE 202 DRIVE DEVILBISS HEALTHCARE: COMPANY OVERVIEW

- TABLE 203 DRIVE DEVILBISS HEALTHCARE: PRODUCTS OFFERED

- TABLE 204 DRIVE DEVILBISS HEALTHCARE: PRODUCT LAUNCHES & APPROVALS

- TABLE 205 TEIJIN LIMITED: COMPANY OVERVIEW

- TABLE 206 TEIJIN LIMITED: PRODUCTS OFFERED

- TABLE 207 DAIKIN INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 208 DAIKIN INDUSTRIES, LTD.: PRODUCTS OFFERED

- TABLE 209 ESAB CORPORATION (GCE GROUP): COMPANY OVERVIEW

- TABLE 210 ESAB CORPORATION (GCE GROUP): PRODUCTS OFFERED

- TABLE 211 REACT HEALTH: COMPANY OVERVIEW

- TABLE 212 REACT HEALTH: PRODUCTS OFFERED

- TABLE 213 REACT HEALTH.: DEALS, JANUARY 2021-JULY 2025

- TABLE 214 PRECISION MEDICAL, INC.: COMPANY OVERVIEW

- TABLE 215 PRECISION MEDICAL, INC.: PRODUCTS OFFERED

- TABLE 216 NIDEK MEDICAL PRODUCTS, INC.: COMPANY OVERVIEW

- TABLE 217 NIDEK MEDICAL PRODUCTS, INC.: PRODUCTS OFFERED

- TABLE 218 O2 CONCEPTS, LLC: COMPANY OVERVIEW

- TABLE 219 O2 CONCEPTS, LLC: PRODUCTS OFFERED

- TABLE 220 O2 CONCEPTS, LLC: PRODUCT LAUNCHES & APPROVALS

- TABLE 221 O2 CONCEPTS, LLC: DEALS

- TABLE 222 BPL MEDICAL TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 223 BPL MEDICAL TECHNOLOGIES: PRODUCTS OFFERED

- TABLE 224 BESCO: COMPANY OVERVIEW

- TABLE 225 BESCO: PRODUCTS OFFERED

- TABLE 226 OXUS: COMPANY OVERVIEW

- TABLE 227 OXUS: PRODUCTS OFFERED

- TABLE 228 FOSHAN KEYHUB ELECTRONIC INDUSTRIES CO., LTD: COMPANY OVERVIEW

- TABLE 229 LONGFIAN SCITECH CO., LTD.: COMPANY OVERVIEW

- TABLE 230 SHENYANG CANTA MEDICAL TECH. CO., LTD.: COMPANY OVERVIEW

- TABLE 231 BELLUSCURA: COMPANY OVERVIEW

- TABLE 232 HOYO SCITECH CO., LTD.: COMPANY OVERVIEW

- TABLE 233 HACENOR SOLUTIONS: COMPANY OVERVIEW

- TABLE 234 XNUO INTERNATIONAL GROUP (USA) HOLDINGS: COMPANY OVERVIEW

- TABLE 235 OXYMED: COMPANY OVERVIEW

- TABLE 236 KALSTEIN: COMPANY OVERVIEW

- TABLE 237 ESS PEE ENTERPRISES: COMPANY OVERVIEW

List of Figures

- FIGURE 1 OXYGEN CONCENTRATORS MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 KEY DATA FROM SECONDARY RESEARCH

- FIGURE 4 PRIMARY SOURCES

- FIGURE 5 KEY DATA FROM PRIMARY SOURCES

- FIGURE 6 KEY INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 7 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 8 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE), BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 9 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE), BY END USER, DESIGNATION, AND REGION

- FIGURE 10 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 11 REVENUE SHARE ANALYSIS ILLUSTRATION: KONINKLIJKE PHILIPS N.V.

- FIGURE 12 SUPPLY-SIDE MARKET SIZE ESTIMATION: OXYGEN CONCENTRATORS, 2024

- FIGURE 13 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES, 2025-2030

- FIGURE 14 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 15 TOP-DOWN APPROACH

- FIGURE 16 DATA TRIANGULATION METHODOLOGY

- FIGURE 17 OXYGEN CONCENTRATORS MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 18 OXYGEN CONCENTRATORS MARKET, BY TECHNOLOGY, 2025 VS. 2030 (USD MILLION)

- FIGURE 19 OXYGEN CONCENTRATORS MARKET, BY FLOWRATE, 2025 VS. 2030 (USD MILLION)

- FIGURE 20 OXYGEN CONCENTRATORS MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 21 OXYGEN CONCENTRATORS MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 22 GEOGRAPHICAL SNAPSHOT OF OXYGEN CONCENTRATORS MARKET

- FIGURE 23 RISING INVESTMENTS IN HEALTHCARE, DEMAND FOR INTEGRATED MULTIFUNCTIONAL DEVICES, AND EXPANDING ACCESS TO ADVANCED ICUS IN UNDERSERVED REGIONS TO DRIVE MARKET GROWTH

- FIGURE 24 JAPAN AND PORTABLE OXYGEN CONCENTRATORS ACCOUNTED FOR LARGEST RESPECTIVE SHARES IN ASIA PACIFIC IN 2024

- FIGURE 25 INDIA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 26 NORTH AMERICA TO DOMINATE OXYGEN CONCENTRATORS MARKET

- FIGURE 27 EMERGING MARKETS TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 28 OXYGEN CONCENTRATORS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 29 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 30 AVERAGE SELLING PRICE TREND OF PORTABLE OXYGEN CONCENTRATORS, BY REGION, 2022-2024 (USD)

- FIGURE 31 VALUE CHAIN ANALYSIS: MAJOR VALUE-ADDED DURING MANUFACTURING AND DISTRIBUTION PHASES

- FIGURE 32 OXYGEN CONCENTRATORS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 33 OXYGEN CONCENTRATORS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 34 OXYGEN CONCENTRATORS MARKET: INVESTMENT & FUNDING SCENARIO, 2019-2023

- FIGURE 35 OXYGEN CONCENTRATORS MARKET: VALUE OF INVESTOR DEALS, BY KEY PLAYER, 2019-2023

- FIGURE 36 OXYGEN CONCENTRATORS MARKET: NUMBER OF INVESTOR DEALS, BY KEY PLAYER, 2019-2023 (USD MILLION)

- FIGURE 37 OXYGEN CONCENTRATORS MARKET: PATENT ANALYSIS, JANUARY 2015-JULY 2025

- FIGURE 38 OXYGEN CONCENTRATORS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 39 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP TWO PRODUCTS

- FIGURE 40 KEY BUYING CRITERIA FOR TOP TWO PRODUCTS

- FIGURE 41 OXYGEN CONCENTRATORS MARKET: IMPACT OF AI/GEN AI

- FIGURE 42 OXYGEN CONCENTRATORS MARKET: ADJACENT MARKETS

- FIGURE 43 NORTH AMERICA: OXYGEN CONCENTRATORS MARKET SNAPSHOT

- FIGURE 44 ASIA PACIFIC: OXYGEN CONCENTRATORS MARKET SNAPSHOT

- FIGURE 45 REVENUE ANALYSIS OF TOP PLAYERS IN OXYGEN CONCENTRATORS MARKET, 2020-2024 (USD MILLION)

- FIGURE 46 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 47 OXYGEN CONCENTRATORS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 48 OXYGEN CONCENTRATORS MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 49 OXYGEN CONCENTRATORS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 50 EV/EBITDA OF KEY VENDORS, 2025

- FIGURE 51 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS, 2025

- FIGURE 52 OXYGEN CONCENTRATORS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 53 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT

- FIGURE 54 INOGEN, INC.: COMPANY SNAPSHOT

- FIGURE 55 TEIJIN LIMITED: COMPANY SNAPSHOT

- FIGURE 56 DAIKIN INDUSTRIES, LTD.: COMPANY SNAPSHOT

- FIGURE 57 ESAB CORPORATION (GCE GROUP): COMPANY SNAPSHOT