|

市場調查報告書

商品編碼

1810322

全球超低功耗微控制器市場(按周邊設備、封裝類型、最終用途和地區)預測至 2030 年Ultra-low-power Microcontroller Market by Peripheral Device, Packaging Type, End-use Application, Region - Global Forecast to 2030 |

||||||

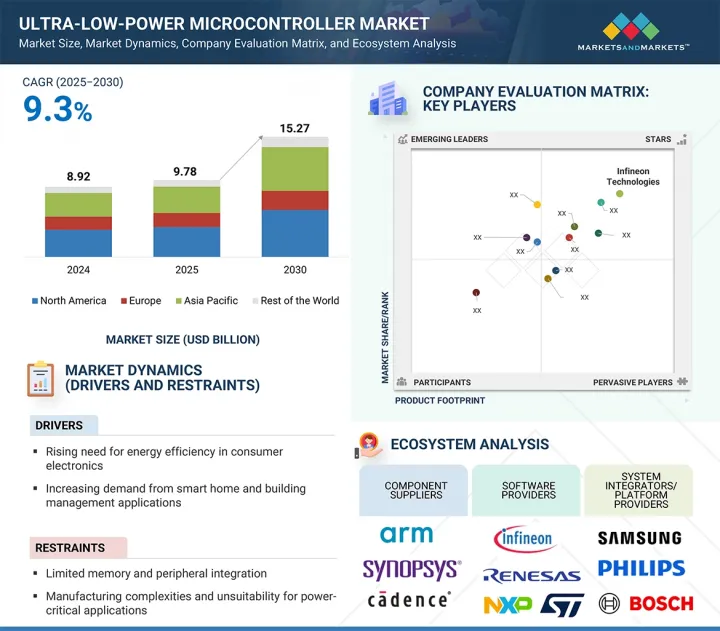

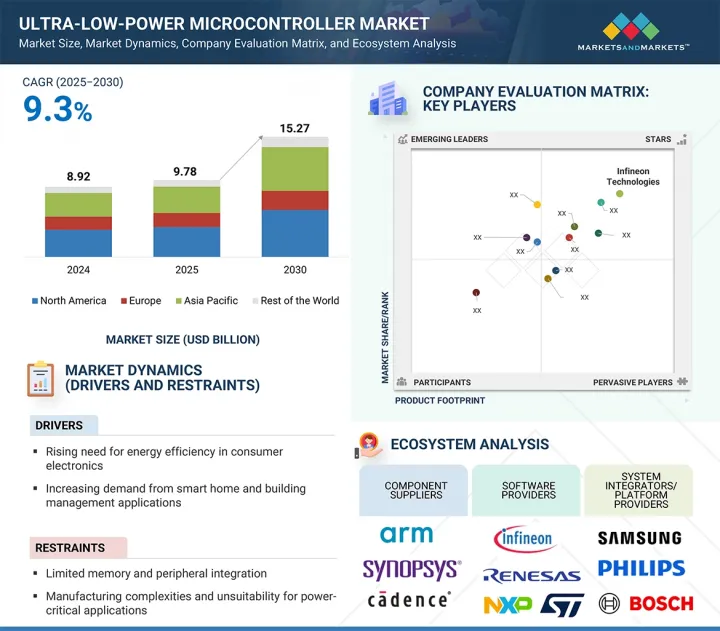

超低功耗微控制器市場預計將以 9.3% 的複合年成長率成長,從 2025 年的 97.8 億美元成長到 2030 年的 152.7 億美元。

| 調查範圍 | |

|---|---|

| 調查年份 | 2021-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 對價單位 | 金額(十億美元) |

| 按細分市場 | 按周邊設備、包裝類型、最終用途和地區 |

| 目標區域 | 北美、歐洲、亞太地區和其他地區 |

超低功耗微控制器市場的成長得益於電池供電工業感測器的日益普及,以及智慧家庭和建築管理應用需求的不斷成長。這些 MCU 具有最佳化的能源效率和更長的使用壽命,使其成為功耗敏感環境中自動化、監控和控制系統的理想選擇。新興經濟體的綠色工業化進程,加上政府的支持性政策以及對物聯網和半導體產業的投資,進一步提升了市場潛力。

隨著可攜式醫療設備、遠端患者監護系統和穿戴式健康追蹤器的日益普及,醫療保健領域超低功耗微控制器市場預計將迎來強勁成長。 ULP MCU 可在血糖監測儀、心電圖貼片和脈搏血氧飽和度分析儀等設備中實現持續運作、可靠的數據處理和安全的無線連接,同時節省電池電量。隨著醫療保健向預防性護理、遠端醫療和居家診斷方向發展,對小型、低功耗 MCU 的需求正在飆升。監管部門對互聯醫療技術的大力支持,進一步加速了該領域的成長潛力。

數位設備領域佔據了超低功耗微控制器市場的很大佔有率,因為它們適用於能源受限的應用,能夠完成處理、邏輯控制和通訊功能。這些 MCU 對於需要高效數位訊號處理、安全資料處理以及與無線通訊協定整合的設備至關重要。它們廣泛應用於家用電子電器、智慧電錶、行動裝置、工業控制系統以及其他以小尺寸和低功耗為關鍵因素的應用領域。隨著物聯網生態系統的擴展以及對高效能、低功耗運算需求的不斷成長,配備數位周邊裝置的 ULP MCU 預計將保持穩定的市場成長。

歐洲超低功耗微控制器 (ULP MCU) 市場預計將迎來強勁成長,這得益於該地區對能源效率、工業自動化和永續電子產品的重視。嚴格的歐盟環境法規和《歐洲綠色交易》等舉措正在加速低功耗解決方案在汽車、醫療保健和智慧基礎設施領域的應用。在德國、法國和義大利領先汽車製造商的支持下,電動車需求的不斷成長正推動 ULP MCU 整合到電池管理系統和感測器系統中。此外,物聯網工業和醫療設備的進步正在推動創新,意法半導體和恩智浦等主要企業正在推動區域市場的發展。

本報告研究了全球超低功耗微控制器市場,提供了周邊設備、封裝類型、最終用途和區域趨勢的資訊,以及參與該市場的公司概況。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章重要考察

第5章 市場概況

- 介紹

- 市場動態

- 影響客戶業務的趨勢/中斷

- 價值鏈分析

- 生態系分析

- 波特五力分析

- 專利分析

- 監管分析

- 貿易分析

- 定價分析

- 技術分析

- 案例研究分析

- 2025-2026年主要會議和活動

- 主要相關人員和採購標準

- 人工智慧對超低功耗微控制器市場的影響

- 2025年美國關稅對超低功耗微控制器市場的影響

第6章 超低功耗微控制器市場(按周邊設備)

- 介紹

- 模擬

- 數位的

第7章 超低功耗微控制器市場(依封裝類型)

- 介紹

- 8位

- 16位

- 32位

第 8 章:超低功耗微控制器市場(依最終用途)

- 介紹

- 家電

- 製造業

- 車

- 衛生保健

- 電訊

- 航太/國防

- 媒體與娛樂

- 伺服器和資料中心

- 其他

第9章超低功耗微控制器市場(按地區)

- 介紹

- 北美洲

- 北美宏觀經濟展望

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 歐洲宏觀經濟展望

- 英國

- 德國

- 法國

- 義大利

- 其他

- 亞太地區

- 亞太宏觀經濟展望

- 日本

- 中國

- 韓國

- 印度

- 澳洲

- 其他

- 其他地區

- 世界其他地區宏觀經濟展望

- 南美洲

- 中東

- 非洲

第10章 競爭格局

- 概述

- 主要參與企業的策略/優勢,2021-2025

- 2021-2024年收益分析

- 2024年市場佔有率分析

- 估值和財務指標

- 品牌/產品比較

- 公司估值矩陣:2024 年關鍵參與企業

- 公司估值矩陣:Start-Ups/中小企業,2024 年

- 競爭場景

第 11 章:公司簡介

- 主要參與企業

- INFINEON TECHNOLOGIES AG

- NXP SEMICONDUCTORS

- RENESAS ELECTRONICS CORPORATION

- STMICROELECTRONICS

- MICROCHIP TECHNOLOGY INC.

- TEXAS INSTRUMENTS INCORPORATED

- ANALOG DEVICES, INC.

- SILICON LABORATORIES

- ROHM CO., LTD.

- NUVOTON TECHNOLOGY CORPORATION

- 其他公司

- CHINA MICRO SEMICON CO.,LIMITED

- CEC HUADA ELECTRONIC DESIGN CO., LTD.

- NORDIC SEMICONDUCTOR

- AMBIQ MICRO, INC.

- GIGADEVICE

- EM MICROELECTRONIC

- ABOV SEMICONDUCTOR CO. LTD.

- SHANGHAI LINGDONG MICROELECTRONICS CO., LTD.

- TELINK

- MEGAWIN TECHNOLOGY CO., LTD.

- DIEDEVICES

- ALIF SEMICONDUCTOR

- ASPINITY

- INNOPHASE IOT, INC.

- ATMOSIC, INC.

- MORSE MICRO

- SYNTIANT

第12章 附錄

The ultra-low-power microcontroller market is projected to expand from USD 9.78 billion in 2025 to USD 15.27 billion by 2030, at a CAGR of 9.3%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Peripheral Device, Packaging Type, End-use Application and Region |

| Regions covered | North America, Europe, APAC, RoW |

The growth of the ultra-low-power microcontroller market is propelled by the increasing demand from smart home and building management applications alongside the rising deployment of battery-powered industrial sensors. These MCUs offer optimized energy efficiency and extended operational lifespans, making them ideal for automation, monitoring, and control systems in power-sensitive environments. Green industrialization initiatives in developing economies, coupled with supportive government policies and investments in IoT and semiconductor sectors, are further enhancing market potential.

"Healthcare is projected to record the highest CAGR during the forecast period."

The ultra-low-power microcontroller market for healthcare is expected to grow at a high rate, fueled by the increasing adoption of portable medical devices, remote patient monitoring systems, and wearable health trackers. ULP MCUs enable continuous operation, reliable data processing, and secure wireless connectivity in devices such as glucose monitors, ECG patches, and pulse oximeters, all while conserving battery power. As healthcare shifts toward preventive care, telemedicine, and home-based diagnostics, demand for compact, power-efficient MCUs is rising sharply. Regulatory support for connected medical technologies further accelerates this segment's growth potential.

"The digital devices segment is expected to hold a significant market share in 2025."

The digital devices segment accounts for a significant share of the ultra-low-power microcontroller market, owing to their suitability for processing, logic control, and communication functions in energy-constrained applications. These MCUs are integral to devices requiring efficient digital signal processing, secure data handling, and integration with wireless communication protocols. They are widely deployed in consumer electronics, smart meters, portable gadgets, and industrial control systems where compact size and low power consumption are critical. As IoT ecosystems expand and demand for high-performance, low-power computing increases, digital peripheral-equipped ULP MCUs are expected to maintain steady market growth.

"Europe is expected to hold a significant market share in 2025."

The ultra-low-power microcontroller (ULP MCU) market in Europe is set for strong growth, driven by the region's emphasis on energy efficiency, industrial automation, and sustainable electronics. The EU's stringent environmental regulations and initiatives like the European Green Deal are accelerating the adoption of low-power solutions in automotive, healthcare, and smart infrastructure. Growing demand for electric vehicles, supported by leading automakers in Germany, France, and Italy, is boosting ULP MCU integration in battery management and sensor systems. Additionally, advancements in IoT-enabled industrial equipment and medical devices are fostering innovation, with companies like STMicroelectronics and NXP leading the regional market push.

Extensive primary interviews were conducted with key industry experts in the ultra-low-power microcontroller market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is shown below.

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 (40%), Tier 2 (30%), and Tier 3 (30%)

- By Designation: C-level Executives (20%), Directors (30%), and Others (50%)

- By Region: Asia Pacific (40%), Europe (20%), North America (30%), and RoW (10%)

The ultra-low-power microcontroller market is dominated by a few globally established players, such as Infineon Technologies AG (Germany), NXP Semiconductors (Netherlands), Renesas Electronics Corporation (Japan), STMicroelectronics (Switzerland), Microchip Technology Inc. (US), Texas Instruments Incorporated (US), Analog Devices, Inc. (US), Silicon Laboratories (US), ROHM Co., Ltd. (Japan), Nuvoton Technology Corporation (Taiwan), CHINA MICRO SEMICON CO., LIMITED (China), CEC Huada Electronic Design Co., Ltd. (China), Nordic Semiconductor (Norway), Ambiq Micro, Inc. (US), GigaDevice (China), EM Microelectronic (Switzerland), ABOV Semiconductor Co. Ltd. (South Korea), Shanghai Lingdong Microelectronics Co., Ltd. (China), Telink (China), megawin Technology Co., Ltd. (Taiwan), DieDevices (UK), Alif Semiconductor (US), Aspinity (US), InnoPhase IoT, Inc. (US), Atmosic, Inc. (US), Morse Micro (Australia), and Syntiant (US).

The study includes an in-depth competitive analysis of these key players in the ultra-low-power microcontroller market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the ultra-low-power microcontroller market based on peripheral device (analog devices, digital devices), packaging type (8-bit packaging, 16-bit packaging, 32-bit packaging), and end-use application (consumer electronics, manufacturing, automotive, healthcare, telecommunications, aerospace and defense, media and entertainment, servers and data centers, others). It also discusses the market's drivers, restraints, opportunities, and challenges. It gives a detailed view of the market across four main regions (North America, Europe, Asia Pacific, and RoW). The report includes an ecosystem analysis of key players.

Key Benefits of Buying the Report:

- Analysis of key drivers (rising need for energy efficiency in consumer electronics, increasing demand from smart home and building management applications, growing number of connected devices in IoT network, and rising deployment in battery-powered industrial sensors), restraints (limited memory and peripheral integration and manufacturing complexities and unsuitability for power-critical applications), opportunities (growing adoption of power electronics in EV industry, government policies and investments for IoT and semiconductors, and green industrialization in developing economies), challenges (lower penetration of ultra-low-power MCUs than high- and low-power MCUs and integration with diverse connectivity protocols)

- Service Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the ultra-low-power microcontroller market

- Market Development: Comprehensive information about lucrative markets through the analysis of the ultra-low-power microcontroller market across varied regions

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the ultra-low-power microcontroller market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players, such as Infineon Technologies AG (Germany), NXP Semiconductors (Netherlands), Renesas Electronics Corporation (Japan), STMicroelectronics (Switzerland), Microchip Technology Inc. (US), Texas Instruments Incorporated (US), Analog Devices, Inc. (US), Silicon Laboratories (US), ROHM Co., Ltd. (Japan), Nuvoton Technology Corporation (Taiwan), CHINA MICRO SEMICON CO., LIMITED (China), CEC Huada Electronic Design Co., Ltd. (China), Nordic Semiconductor (Norway), Ambiq Micro, Inc. (US), and GigaDevice (China), among others

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY & PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- 2.6 LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 OPPORTUNITIES FOR PLAYERS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET

- 4.2 ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL DEVICE AND PACKAGING TYPE

- 4.3 ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION

- 4.4 ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising need for energy efficiency in consumer electronics

- 5.2.1.2 Increasing demand for smart home and building management applications

- 5.2.1.3 Growing number of connected devices in IoT networks

- 5.2.1.4 Rising deployment of battery-powered industrial sensors

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited memory and peripheral integration

- 5.2.2.2 Manufacturing complexities and unsuitability for power-critical applications

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing adoption of power electronics in EV industry

- 5.2.3.2 Government policies and investments for IoT and semiconductors

- 5.2.3.3 Green industrialization in developing economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Lower penetration of ultra-low-power microcontrollers than high- and low-power microcontrollers

- 5.2.4.2 Integration with diverse connectivity protocols

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- 5.7 PATENT ANALYSIS

- 5.8 REGULATORY ANALYSIS

- 5.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8.2 STANDARDS

- 5.8.3 REGULATIONS

- 5.8.3.1 North America

- 5.8.3.1.1 US

- 5.8.3.1.2 Canada

- 5.8.3.2 Europe

- 5.8.3.2.1 Germany

- 5.8.3.2.2 UK

- 5.8.3.2.3 France

- 5.8.3.3 Asia Pacific

- 5.8.3.3.1 South Korea

- 5.8.3.3.2 Japan

- 5.8.3.4 Rest of the World

- 5.8.3.4.1 Nigeria

- 5.8.3.4.2 Brazil

- 5.8.3.1 North America

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT DATA (HS CODE 854231)

- 5.9.2 EXPORT SCENARIO (HS CODE 854231)

- 5.10 PRICING ANALYSIS

- 5.10.1 AVERAGE SELLING PRICE TREND OF ULTRA-LOW-POWER MICROCONTROLLERS OFFERED BY KEY PLAYERS, BY END-USE APPLICATION, 2021-2024

- 5.10.2 AVERAGE SELLING PRICE TREND OF ULTRA-LOW-POWER MICROCONTROLLERS, BY REGION, 2021-2024 (USD)

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 KEY TECHNOLOGIES

- 5.11.1.1 Advanced semiconductor process nodes

- 5.11.1.2 Multi-power domain & power gating architectures

- 5.11.1.3 Dynamic voltage and frequency scaling (DVFS)

- 5.11.2 COMPLEMENTARY TECHNOLOGIES

- 5.11.2.1 Low-power wireless protocols

- 5.11.2.2 Energy harvesting solutions

- 5.11.3 ADJACENT TECHNOLOGIES

- 5.11.3.1 System-on-Chip (SoC) integration

- 5.11.3.2 FPGA with low-power modes

- 5.11.1 KEY TECHNOLOGIES

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 KWIKSET: POWERING THE NEXT GENERATION OF SMART LOCKS WITH ULTRA-LOW-POWER MULTIPROTOCOL CONNECTIVITY

- 5.12.2 ASPINITY: DELIVERING ULTRA-LOW-POWER VEHICLE SURVEILLANCE FOR PARKED CARS WITH ALWAYS-ON, BATTERY-FRIENDLY SYSTEM

- 5.12.3 HONDA MOTOR CO., LTD.: ACCELERATING KNOWLEDGE TRANSFER WITH GENERATIVE AI, SLASHING DOCUMENTATION TIME BY 67%

- 5.12.4 ECARX: REVOLUTIONIZING IN-VEHICLE EXPERIENCE WITH AMD-POWERED IMMERSIVE DIGITAL COCKPIT PLATFORM

- 5.12.5 SUBARU CORPORATION: ELEVATING EYESIGHT ADAS WITH AMD VERSAL AI EDGE GEN 2 FOR SMARTER, SAFER DRIVING

- 5.13 KEY CONFERENCES & EVENTS, 2025-2026

- 5.14 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 IMPACT OF AI ON ULTRA-LOW-POWER MICROCONTROLLER MARKET

- 5.16 IMPACT OF 2025 US TARIFFS ON ULTRA-LOW-POWER MICROCONTROLLER MARKET

- 5.16.1 KEY TARIFF RATES

- 5.16.2 PRICE IMPACT ANALYSIS

- 5.16.3 KEY IMPACT ON VARIOUS REGIONS

- 5.16.3.1 US

- 5.16.3.2 Europe

- 5.16.3.3 Asia Pacific

- 5.16.4 IMPACT ON END-USE APPLICATIONS

6 ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL DEVICE

- 6.1 INTRODUCTION

- 6.2 ANALOG

- 6.2.1 GROWING DEMAND FOR ANALOG-ENABLED SENSING AND SIGNAL CONDITIONING TO ACCELERATE ADOPTION

- 6.3 DIGITAL

- 6.3.1 GROWING INTEGRATION OF ADVANCED DIGITAL PERIPHERALS TO BOOST ULP MCU ADOPTION

7 ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE

- 7.1 INTRODUCTION

- 7.2 8-BIT

- 7.2.1 AFFORDABILITY, SIMPLICITY, AND BATTERY LONGEVITY ASSOCIATED WITH 8-BIT ULP MCUS TO DRIVE ADOPTION

- 7.3 16-BIT

- 7.3.1 EXPANSION OF 16-BIT ARCHITECTURES TO DRIVE ADOPTION IN IOT, AUTOMOTIVE, AND HEALTHCARE

- 7.4 32-BIT

- 7.4.1 RISING DEMAND FOR AI-ENABLED SENSING AND REAL-TIME ANALYTICS TO FUEL ADOPTION OF 32-BIT ULP MCUS

8 ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION

- 8.1 INTRODUCTION

- 8.2 CONSUMER ELECTRONICS

- 8.2.1 ABILITY OF ULP MCUS TO DELIVER REAL-TIME INTELLIGENCE WITH ULTRA-LOW ENERGY FOOTPRINTS TO DRIVE MARKET GROWTH

- 8.3 MANUFACTURING

- 8.3.1 SHIFT TOWARD CONNECTED, INTELLIGENT PRODUCTION TO ACCELERATE DEMAND FOR ULP MCUS

- 8.4 AUTOMOTIVE

- 8.4.1 GROWING ELECTRIFICATION AND ADAS INTEGRATION TO POSITION ULP MCUS AS FOUNDATIONAL TO AUTOMOTIVE SECTOR

- 8.5 HEALTHCARE

- 8.5.1 ABILITY OF ULP MCUS TO POWER SMART, IOT-ENABLED HEALTHCARE DEVICES TO SUPPORT MARKET GROWTH

- 8.6 TELECOMMUNICATIONS

- 8.6.1 SECURE DATA FLOWS AND EXTENDED DEVICE LIFECYCLES ASSOCIATED WITH ULP MCUS TO BOOST MARKET

- 8.7 AEROSPACE & DEFENSE

- 8.7.1 SECURE EDGE INTELLIGENCE AND EXTENDED ENDURANCE ACROSS AEROSPACE AND DEFENSE PLATFORMS TO PROPEL MARKET

- 8.8 MEDIA & ENTERTAINMENT

- 8.8.1 EMERGENCE OF NEW TECHNOLOGIES IN MEDIA & ENTERTAINMENT TO PROPEL MARKET GROWTH DURING FORECAST PERIOD

- 8.9 SERVERS & DATA CENTERS

- 8.9.1 NEED TO BALANCE PERFORMANCE WITH ENERGY EFFICIENCY IN HIGHLY SCALED COMPUTING ENVIRONMENTS TO BOOST MARKET

- 8.10 OTHERS

9 ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 Rising AI workloads and electrification trends to accelerate demand for scalable ultra-low-power MCU platforms

- 9.2.3 CANADA

- 9.2.3.1 Precision farming, hyperscale data centers, and smart cities to unlock new growth frontiers for Canada's ULP MCUs

- 9.2.4 MEXICO

- 9.2.4.1 Convergence of manufacturing strength and free trade agreements to create robust market growth trajectory

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 UK

- 9.3.2.1 Rising IoT and EV adoption to propel ultra-low-power MCU deployment across UK

- 9.3.3 GERMANY

- 9.3.3.1 Germany's leadership in EVs and smart factories to drive robust growth for ultra-low-power microcontroller technologies

- 9.3.4 FRANCE

- 9.3.4.1 France's strategic chip investments and energy-efficient policies to drive scalable adoption of ULP microcontrollers

- 9.3.5 ITALY

- 9.3.5.1 Smart infrastructure and healthcare innovation to propel Italy's adoption of ultra-low-power microcontrollers

- 9.3.6 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 JAPAN

- 9.4.2.1 Energy-efficient industrial automation and healthcare IoT platforms to position Japan as high-growth market

- 9.4.3 CHINA

- 9.4.3.1 IoT-enabled factories and intelligent consumer devices to drive strategic adoption of ultra-low-power MCUs in China

- 9.4.4 SOUTH KOREA

- 9.4.4.1 Semiconductor innovation and connected industrial ecosystems to expand ultra-low-power microcontroller market in South Korea

- 9.4.5 INDIA

- 9.4.5.1 Government-led semiconductor policies and IoT-driven consumer electronics to fuel India's market expansion

- 9.4.6 AUSTRALIA

- 9.4.6.1 Energy-efficient medical devices, industrial IoT, and smart infrastructure initiatives to support market growth

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 REST OF THE WORLD

- 9.5.1 MACROECONOMIC OUTLOOK FOR REST OF THE WORLD

- 9.5.2 SOUTH AMERICA

- 9.5.2.1 Growing ULP MCU adoption to accelerate precision farming and renewable energy optimization in South America

- 9.5.3 MIDDLE EAST

- 9.5.3.1 Energy-efficient buildings and telemedicine growth to drive market

- 9.5.4 AFRICA

- 9.5.4.1 Increasing focus on renewable energy solutions to address power access challenges to boost growth

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 10.3 REVENUE ANALYSIS, 2021-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY VALUATION & FINANCIAL METRICS

- 10.6 BRAND/PRODUCT COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Regional footprint

- 10.7.5.3 Peripheral device footprint

- 10.7.5.4 Packaging type footprint

- 10.7.5.5 End-use application footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs, by peripheral device and end-use application

- 10.8.5.3 Competitive benchmarking of key startups/SMEs, by packaging type and region

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 INFINEON TECHNOLOGIES AG

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Services/Solutions offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.3.2 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses & competitive threats

- 11.1.2 NXP SEMICONDUCTORS

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Services/Solutions offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches

- 11.1.2.3.2 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses & competitive threats

- 11.1.3 RENESAS ELECTRONICS CORPORATION

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Services/Solutions offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses & competitive threats

- 11.1.4 STMICROELECTRONICS

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Services/Solutions offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches

- 11.1.4.3.2 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses & competitive threats

- 11.1.5 MICROCHIP TECHNOLOGY INC.

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Services/Solutions offered

- 11.1.5.3 Recent Developments

- 11.1.5.3.1 Product launches

- 11.1.5.3.2 Deals

- 11.1.5.3.3 Expansions

- 11.1.5.4 MnM view

- 11.1.5.4.1 Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses & competitive threats

- 11.1.6 TEXAS INSTRUMENTS INCORPORATED

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Services/Solutions offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches

- 11.1.6.3.2 Deals

- 11.1.6.3.3 Expansions

- 11.1.7 ANALOG DEVICES, INC.

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Services/Solutions offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Deals

- 11.1.7.3.2 Expansions

- 11.1.8 SILICON LABORATORIES

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Services/Solutions offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Product launches

- 11.1.9 ROHM CO., LTD.

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Services/Solutions offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product launches

- 11.1.9.3.2 Deals

- 11.1.10 NUVOTON TECHNOLOGY CORPORATION

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Services/Solutions offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product launches

- 11.1.1 INFINEON TECHNOLOGIES AG

- 11.2 OTHER PLAYERS

- 11.2.1 CHINA MICRO SEMICON CO.,LIMITED

- 11.2.2 CEC HUADA ELECTRONIC DESIGN CO., LTD.

- 11.2.3 NORDIC SEMICONDUCTOR

- 11.2.4 AMBIQ MICRO, INC.

- 11.2.5 GIGADEVICE

- 11.2.6 EM MICROELECTRONIC

- 11.2.7 ABOV SEMICONDUCTOR CO. LTD.

- 11.2.8 SHANGHAI LINGDONG MICROELECTRONICS CO., LTD.

- 11.2.9 TELINK

- 11.2.10 MEGAWIN TECHNOLOGY CO., LTD.

- 11.2.11 DIEDEVICES

- 11.2.12 ALIF SEMICONDUCTOR

- 11.2.13 ASPINITY

- 11.2.14 INNOPHASE IOT, INC.

- 11.2.15 ATMOSIC, INC.

- 11.2.16 MORSE MICRO

- 11.2.17 SYNTIANT

12 APPENDIX

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS

List of Tables

- TABLE 1 ULTRA-LOW-POWER MICROCONTROLLER MARKET: RISK ANALYSIS

- TABLE 2 ULTRA-LOW-POWER MICROCONTROLLER MARKET: ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 3 ULTRA-LOW-POWER MICROCONTROLLER MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 LIST OF APPLIED/GRANTED PATENTS RELATED TO ULTRA-LOW-POWER MICROCONTROLLER, JUNE 2021-NOVEMBER 2024

- TABLE 5 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 STANDARDS

- TABLE 10 IMPORT DATA FOR HS CODE 854231-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 11 EXPORT DATA FOR HS CODE 854231-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 12 PRICING TREND OF ULTRA-LOW-POWER MICROCONTROLLERS OFFERED BY KEY PLAYERS, BY END-USE APPLICATION, 2024 (USD)

- TABLE 13 PRICING TREND OF ULTRA-LOW-POWER MICROCONTOLLERS, BY END-USE APPLICATION, 2021-2024 (USD)

- TABLE 14 AVERAGE SELLING PRICE TREND OF ULTRA-LOW-POWER MICROCONTROLLERS FOR CONSUMER ELECTRONICS, BY REGION, 2021-2024 (USD)

- TABLE 15 AVERAGE SELLING PRICE TREND OF ULTRA-LOW-POWER MICROCONTROLLERS FOR HEALTHCARE, BY REGION, 2021-2024 (USD)

- TABLE 16 AVERAGE SELLING PRICE TREND OF ULTRA-LOW-POWER MICROCONTROLLERS FOR AUTOMOTIVE, BY REGION, 2021-2024 (USD)

- TABLE 17 AVERAGE SELLING PRICE TREND OF ULTRA-LOW-POWER MICROCONTROLLERS FOR MANUFACTURING, BY REGION, 2021-2024 (USD)

- TABLE 18 KEY CONFERENCES & EVENTS, 2025-2026

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USE APPLICATIONS (%)

- TABLE 20 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 21 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 22 ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL DEVICE, 2021-2024 (USD MILLION)

- TABLE 23 ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL DEVICE, 2025-2030 (USD MILLION)

- TABLE 24 ANALOG: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 25 ANALOG: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 26 ANALOG: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 27 ANALOG: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 28 ANALOG: 8-BIT ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 29 ANALOG: 8-BIT ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 30 ANALOG: 16-BIT ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 31 ANALOG: 16-BIT ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 32 ANALOG: 32-BIT ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 33 ANALOG: 32-BIT ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 34 DIGITAL: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 35 DIGITAL: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 36 DIGITAL: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 37 DIGITAL: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 38 DIGITAL: 8-BIT ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 39 DIGITAL: 8-BIT ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 40 DIGITAL: 16-BIT ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 41 DIGITAL: 16-BIT ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 42 DIGITAL: 32-BIT ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 43 DIGITAL: 32-BIT ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 44 ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 45 ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 46 8-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL DEVICE, 2021-2024 (USD MILLION)

- TABLE 47 8-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL DEVICE, 2025-2030 (USD MILLION)

- TABLE 48 8-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 49 8-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 50 8-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR CONSUMER ELECTRONICS, BY PERIPHERAL DEVICE, 2021-2024 (USD MILLION)

- TABLE 51 8-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR CONSUMER ELECTRONICS, BY PERIPHERAL DEVICE, 2025-2030 (USD MILLION)

- TABLE 52 8-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR MANUFACTURING, BY PERIPHERAL DEVICE, 2021-2024 (USD MILLION)

- TABLE 53 8-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR MANUFACTURING, BY PERIPHERAL DEVICE, 2025-2030 (USD MILLION)

- TABLE 54 8-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR AUTOMOTIVE, BY PERIPHERAL DEVICE, 2021-2024 (USD MILLION)

- TABLE 55 8-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR AUTOMOTIVE, BY PERIPHERAL DEVICE, 2025-2030 (USD MILLION)

- TABLE 56 8-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR HEALTHCARE, BY PERIPHERAL DEVICE, 2021-2024 (USD MILLION)

- TABLE 57 8-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR HEALTHCARE, BY PERIPHERAL DEVICE, 2025-2030 (USD MILLION)

- TABLE 58 8-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR TELECOMMUNICATIONS, BY PERIPHERAL DEVICE, 2021-2024 (USD MILLION)

- TABLE 59 8-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR TELECOMMUNICATIONS, BY PERIPHERAL DEVICE, 2025-2030 (USD MILLION)

- TABLE 60 8-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR AEROSPACE & DEFENSE, BY PERIPHERAL DEVICE, 2021-2024 (USD MILLION)

- TABLE 61 8-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR AEROSPACE & DEFENSE, BY PERIPHERAL DEVICE, 2025-2030 (USD MILLION)

- TABLE 62 8-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR MEDIA & ENTERTAINMENT, BY PERIPHERAL DEVICE, 2021-2024 (USD MILLION)

- TABLE 63 8-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR MEDIA & ENTERTAINMENT, BY PERIPHERAL DEVICE, 2025-2030 (USD MILLION)

- TABLE 64 8-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR SERVERS & DATA CENTERS, BY PERIPHERAL DEVICE, 2021-2024 (USD MILLION)

- TABLE 65 8-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR SERVERS & DATA CENTERS, BY PERIPHERAL DEVICE, 2025-2030 (USD MILLION)

- TABLE 66 8-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR OTHERS, BY PERIPHERAL DEVICE, 2021-2024 (USD MILLION)

- TABLE 67 8-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR OTHERS, BY PERIPHERAL DEVICE, 2025-2030 (USD MILLION)

- TABLE 68 16-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL DEVICE, 2021-2024 (USD MILLION)

- TABLE 69 16-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL DEVICE, 2025-2030 (USD MILLION)

- TABLE 70 16-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 71 16-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 72 16-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR CONSUMER ELECTRONICS, BY PERIPHERAL DEVICE, 2021-2024 (USD MILLION)

- TABLE 73 16-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR CONSUMER ELECTRONICS, BY PERIPHERAL DEVICE, 2025-2030 (USD MILLION)

- TABLE 74 16-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR MANUFACTURING, BY PERIPHERAL DEVICE, 2021-2024 (USD MILLION)

- TABLE 75 16-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR MANUFACTURING, BY PERIPHERAL DEVICE, 2025-2030 (USD MILLION)

- TABLE 76 16-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR AUTOMOTIVE, BY PERIPHERAL DEVICE, 2021-2024 (USD MILLION)

- TABLE 77 16-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR AUTOMOTIVE, BY PERIPHERAL DEVICE, 2025-2030 (USD MILLION)

- TABLE 78 16-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR HEALTHCARE, BY PERIPHERAL DEVICE, 2021-2024 (USD MILLION)

- TABLE 79 16-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR HEALTHCARE, BY PERIPHERAL DEVICE, 2025-2030 (USD MILLION)

- TABLE 80 16-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR TELECOMMUNICATIONS, BY PERIPHERAL DEVICE, 2021-2024 (USD MILLION)

- TABLE 81 16-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR TELECOMMUNICATIONS, BY PERIPHERAL DEVICE, 2025-2030 (USD MILLION)

- TABLE 82 16-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR AEROSPACE & DEFENSE, BY PERIPHERAL DEVICE, 2021-2024 (USD MILLION)

- TABLE 83 16-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR AEROSPACE & DEFENSE, BY PERIPHERAL DEVICE, 2025-2030 (USD MILLION)

- TABLE 84 16-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR MEDIA & ENTERTAINMENT, BY PERIPHERAL DEVICE, 2021-2024 (USD MILLION)

- TABLE 85 16-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR MEDIA & ENTERTAINMENT, BY PERIPHERAL DEVICE, 2025-2030 (USD MILLION)

- TABLE 86 16-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR SERVERS & DATA CENTERS, BY PERIPHERAL DEVICE, 2021-2024 (USD MILLION)

- TABLE 87 16-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR SERVERS & DATA CENTERS, BY PERIPHERAL DEVICE, 2025-2030 (USD MILLION)

- TABLE 88 16-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR OTHERS, BY PERIPHERAL DEVICE, 2021-2024 (USD MILLION)

- TABLE 89 16-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR OTHERS, BY PERIPHERAL DEVICE, 2025-2030 (USD MILLION)

- TABLE 90 32-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL DEVICE, 2021-2024 (USD MILLION)

- TABLE 91 32-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL DEVICE, 2025-2030 (USD MILLION)

- TABLE 92 32-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 93 32-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 94 32-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR CONSUMER ELECTRONICS, BY PERIPHERAL DEVICE, 2021-2024 (USD MILLION)

- TABLE 95 32-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR CONSUMER ELECTRONICS, BY PERIPHERAL DEVICE, 2025-2030 (USD MILLION)

- TABLE 96 32-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR MANUFACTURING, BY PERIPHERAL DEVICE, 2021-2024 (USD MILLION)

- TABLE 97 32-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR MANUFACTURING, BY PERIPHERAL DEVICE, 2025-2030 (USD MILLION)

- TABLE 98 32-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR AUTOMOTIVE, BY PERIPHERAL DEVICE, 2021-2024 (USD MILLION)

- TABLE 99 32-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR AUTOMOTIVE, BY PERIPHERAL DEVICE, 2025-2030 (USD MILLION)

- TABLE 100 32-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR HEALTHCARE, BY PERIPHERAL DEVICE, 2021-2024 (USD MILLION)

- TABLE 101 32-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR HEALTHCARE, BY PERIPHERAL DEVICE, 2025-2030 (USD MILLION)

- TABLE 102 32-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR TELECOMMUNICATIONS, BY PERIPHERAL DEVICE, 2021-2024 (USD MILLION)

- TABLE 103 32-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR TELECOMMUNICATIONS, BY PERIPHERAL DEVICE, 2025-2030 (USD MILLION)

- TABLE 104 32-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR AEROSPACE & DEFENSE, BY PERIPHERAL DEVICE, 2021-2024 (USD MILLION)

- TABLE 105 32-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR AEROSPACE & DEFENSE, BY PERIPHERAL DEVICE, 2025-2030 (USD MILLION)

- TABLE 106 32-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR MEDIA & ENTERTAINMENT, BY PERIPHERAL DEVICE, 2021-2024 (USD MILLION)

- TABLE 107 32-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR MEDIA & ENTERTAINMENT, BY PERIPHERAL DEVICE, 2025-2030 (USD MILLION)

- TABLE 108 32-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR SERVERS & DATA CENTERS, BY PERIPHERAL DEVICE, 2021-2024 (USD MILLION)

- TABLE 109 32-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR SERVERS & DATA CENTERS, BY PERIPHERAL DEVICE, 2025-2030 (USD MILLION)

- TABLE 110 32-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR OTHERS, BY PERIPHERAL DEVICE, 2021-2024 (USD MILLION)

- TABLE 111 32-BIT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR OTHERS, BY PERIPHERAL DEVICE, 2025-2030 (USD MILLION)

- TABLE 112 ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 113 ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 114 ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 115 ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2025-2030 (MILLION UNITS)

- TABLE 116 CONSUMER ELECTRONICS: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL DEVICE, 2021-2024 (USD MILLION)

- TABLE 117 CONSUMER ELECTRONICS: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL DEVICE, 2025-2030 (USD MILLION)

- TABLE 118 CONSUMER ELECTRONICS: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 119 CONSUMER ELECTRONICS: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 120 CONSUMER ELECTRONICS: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR ANALOG DEVICES, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 121 CONSUMER ELECTRONICS: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR ANALOG DEVICES, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 122 CONSUMER ELECTRONICS: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR DIGITAL DEVICES, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 123 CONSUMER ELECTRONICS: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR DIGITAL DEVICES, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 124 CONSUMER ELECTRONICS: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 125 CONSUMER ELECTRONICS: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 126 CONSUMER ELECTRONICS: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 127 CONSUMER ELECTRONICS: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 128 CONSUMER ELECTRONICS: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 129 CONSUMER ELECTRONICS: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 130 CONSUMER ELECTRONICS: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 131 CONSUMER ELECTRONICS: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 132 CONSUMER ELECTRONICS: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 133 CONSUMER ELECTRONICS: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 134 MANUFACTURING: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL DEVICE, 2021-2024 (USD MILLION)

- TABLE 135 MANUFACTURING: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL DEVICE, 2025-2030 (USD MILLION)

- TABLE 136 MANUFACTURING: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 137 MANUFACTURING: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 138 MANUFACTURING: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR ANALOG DEVICES, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 139 MANUFACTURING: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR ANALOG DEVICES, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 140 MANUFACTURING: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR DIGITAL DEVICES, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 141 MANUFACTURING: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR DIGITAL DEVICES, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 142 MANUFACTURING: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 143 MANUFACTURING: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 144 MANUFACTURING: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 145 MANUFACTURING: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 146 MANUFACTURING: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 147 MANUFACTURING: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 148 MANUFACTURING: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 149 MANUFACTURING: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 150 MANUFACTURING: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 151 MANUFACTURING: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 152 AUTOMOTIVE: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL DEVICE, 2021-2024 (USD MILLION)

- TABLE 153 AUTOMOTIVE: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL DEVICE, 2025-2030 (USD MILLION)

- TABLE 154 AUTOMOTIVE: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 155 AUTOMOTIVE: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 156 AUTOMOTIVE: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR ANALOG DEVICES, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 157 AUTOMOTIVE: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR ANALOG DEVICES, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 158 AUTOMOTIVE: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR DIGITAL DEVICES, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 159 AUTOMOTIVE: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR DIGITAL DEVICES, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 160 AUTOMOTIVE: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 161 AUTOMOTIVE: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 162 AUTOMOTIVE: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 163 AUTOMOTIVE: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 164 AUTOMOTIVE: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 165 AUTOMOTIVE: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 166 AUTOMOTIVE: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 167 AUTOMOTIVE: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 168 AUTOMOTIVE: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 169 AUTOMOTIVE: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 170 HEALTHCARE: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL DEVICE, 2021-2024 (USD MILLION)

- TABLE 171 HEALTHCARE: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL DEVICE, 2025-2030 (USD MILLION)

- TABLE 172 HEALTHCARE: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 173 HEALTHCARE: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 174 HEALTHCARE: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR ANALOG DEVICES, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 175 HEALTHCARE: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR ANALOG DEVICES, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 176 HEALTHCARE: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR DIGITAL DEVICES, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 177 HEALTHCARE: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR DIGITAL DEVICES, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 178 HEALTHCARE: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 179 HEALTHCARE: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 180 HEALTHCARE: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 181 HEALTHCARE: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 182 HEALTHCARE: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 183 HEALTHCARE: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 184 HEALTHCARE: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 185 HEALTHCARE: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 186 HEALTHCARE: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 187 HEALTHCARE: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 188 TELECOMMUNICATIONS: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL DEVICE, 2021-2024 (USD MILLION)

- TABLE 189 TELECOMMUNICATIONS: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL DEVICE, 2025-2030 (USD MILLION)

- TABLE 190 TELECOMMUNICATIONS: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 191 TELECOMMUNICATIONS: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 192 TELECOMMUNICATIONS: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR ANALOG DEVICES, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 193 TELECOMMUNICATIONS: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR ANALOG DEVICES, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 194 TELECOMMUNICATIONS: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR DIGITAL DEVICES, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 195 TELECOMMUNICATIONS: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR DIGITAL DEVICES, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 196 TELECOMMUNICATIONS: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 197 TELECOMMUNICATIONS: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 198 TELECOMMUNICATIONS: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 199 TELECOMMUNICATIONS: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 200 TELECOMMUNICATIONS: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 201 TELECOMMUNICATIONS: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 202 TELECOMMUNICATIONS: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 203 TELECOMMUNICATIONS: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 204 TELECOMMUNICATIONS: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 205 TELECOMMUNICATIONS: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 206 AEROSPACE & DEFENSE: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL DEVICE, 2021-2024 (USD MILLION)

- TABLE 207 AEROSPACE & DEFENSE: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL DEVICE, 2025-2030 (USD MILLION)

- TABLE 208 AEROSPACE & DEFENSE: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 209 AEROSPACE & DEFENSE: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 210 AEROSPACE & DEFENSE: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR ANALOG DEVICES, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 211 AEROSPACE & DEFENSE: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR ANALOG DEVICES, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 212 AEROSPACE & DEFENSE: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR DIGITAL DEVICES, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 213 AEROSPACE & DEFENSE: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR DIGITAL DEVICES, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 214 AEROSPACE & DEFENSE: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 215 AEROSPACE & DEFENSE: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 216 AEROSPACE & DEFENSE: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 217 AEROSPACE & DEFENSE: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 218 AEROSPACE & DEFENSE: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 219 AEROSPACE & DEFENSE: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 220 AEROSPACE & DEFENSE: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 221 AEROSPACE & DEFENSE: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 222 AEROSPACE & DEFENSE: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 223 AEROSPACE & DEFENSE: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 224 MEDIA & ENTERTAINMENT: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL DEVICE, 2021-2024 (USD MILLION)

- TABLE 225 MEDIA & ENTERTAINMENT: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL DEVICE, 2025-2030 (USD MILLION)

- TABLE 226 MEDIA & ENTERTAINMENT: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 227 MEDIA & ENTERTAINMENT: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 228 MEDIA & ENTERTAINMENT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR ANALOG DEVICES, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 229 MEDIA & ENTERTAINMENT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR ANALOG DEVICES, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 230 MEDIA & ENTERTAINMENT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR DIGITAL DEVICES, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 231 MEDIA & ENTERTAINMENT: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR DIGITAL DEVICES, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 232 MEDIA & ENTERTAINMENT: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 233 MEDIA & ENTERTAINMENT: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 234 MEDIA & ENTERTAINMENT: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 235 MEDIA & ENTERTAINMENT: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 236 MEDIA & ENTERTAINMENT: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 237 MEDIA & ENTERTAINMENT: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 238 MEDIA & ENTERTAINMENT: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 239 MEDIA & ENTERTAINMENT: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 240 MEDIA & ENTERTAINMENT: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 241 MEDIA & ENTERTAINMENT: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 242 SERVERS & DATA CENTERS: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL DEVICE, 2021-2024 (USD MILLION)

- TABLE 243 SERVERS & DATA CENTERS: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL DEVICE, 2025-2030 (USD MILLION)

- TABLE 244 SERVERS & DATA CENTERS: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 245 SERVERS & DATA CENTERS: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 246 SERVERS & DATA CENTERS: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR ANALOG DEVICES, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 247 SERVERS & DATA CENTERS: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR ANALOG DEVICES, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 248 SERVERS & DATA CENTERS: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR DIGITAL DEVICES, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 249 SERVERS & DATA CENTERS: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR DIGITAL DEVICES, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 250 SERVERS & DATA CENTERS: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 251 SERVERS & DATA CENTERS: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 252 SERVERS & DATA CENTERS: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 253 SERVERS & DATA CENTERS: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 254 SERVERS & DATA CENTERS: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 255 SERVERS & DATA CENTERS: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 256 SERVERS & DATA CENTERS: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 257 SERVERS & DATA CENTERS: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 258 SERVERS & DATA CENTERS: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 259 SERVERS & DATA CENTERS: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 260 OTHERS: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL DEVICE, 2021-2024 (USD MILLION)

- TABLE 261 OTHERS: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL DEVICE, 2025-2030 (USD MILLION)

- TABLE 262 OTHERS: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 263 OTHERS: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 264 OTHERS: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR ANALOG DEVICES, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 265 OTHERS: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR ANALOG DEVICES, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 266 OTHERS: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR DIGITAL DEVICES, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 267 OTHERS: ULTRA-LOW-POWER MICROCONTROLLER MARKET FOR DIGITAL DEVICES, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 268 OTHERS: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 269 OTHERS: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 270 OTHERS: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 271 OTHERS: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 272 OTHERS: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 273 OTHERS: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 274 OTHERS: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 275 OTHERS: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 276 OTHERS: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 277 OTHERS: ULTRA-LOW-POWER MICROCONTROLLER MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 278 ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 279 ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 280 NORTH AMERICA: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 281 NORTH AMERICA: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 282 NORTH AMERICA: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 283 NORTH AMERICA: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 284 US: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 285 US: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 286 CANADA: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 287 CANADA: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 288 MEXICO: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 289 MEXICO: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 290 EUROPE: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 291 EUROPE: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 292 EUROPE: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 293 EUROPE: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 294 UK: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 295 UK: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 296 GERMANY: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 297 GERMANY: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 298 FRANCE: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 299 FRANCE: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 300 ITALY: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 301 ITALY: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 302 REST OF EUROPE: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 303 REST OF EUROPE: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 304 ASIA PACIFIC: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 305 ASIA PACIFIC: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 306 ASIA PACIFIC: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 307 ASIA PACIFIC: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 308 JAPAN: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 309 JAPAN: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 310 CHINA: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 311 CHINA: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 312 SOUTH KOREA: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 313 SOUTH KOREA: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 314 INDIA: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 315 INDIA: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 316 AUSTRALIA: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 317 AUSTRALIA: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 318 REST OF ASIA PACIFIC: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 319 REST OF ASIA PACIFIC: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 320 REST OF THE WORLD: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 321 REST OF THE WORLD: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 322 REST OF THE WORLD: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 323 REST OF THE WORLD: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 324 SOUTH AMERICA: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 325 SOUTH AMERICA: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 326 MIDDLE EAST: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 327 MIDDLE EAST: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 328 AFRICA: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 329 AFRICA: ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 330 OVERVIEW OF STRATEGIES ADOPTED BY ULTRA-LOW-POWER MICROCONTROLLER MANUFACTURERS AND PROVIDERS

- TABLE 331 ULTRA-LOW-POWER MICROCONTROLLER MARKET SHARE ANALYSIS, 2024

- TABLE 332 ULTRA-LOW-POWER MICROCONTROLLER MARKET: REGIONAL FOOTPRINT, 2024

- TABLE 333 ULTRA-LOW-POWER MICROCONTROLLER MARKET: PERIPHERAL DEVICE FOOTPRINT, 2024

- TABLE 334 ULTRA-LOW-POWER MICROCONTROLLER MARKET: PACKAGING TYPE FOOTPRINT, 2024

- TABLE 335 ULTRA-LOW-POWER MICROCONTROLLER MARKET: END-USE APPLICATION FOOTPRINT, 2024

- TABLE 336 ULTRA-LOW-POWER MICROCONTROLLER MARKET: LIST OF KEY STARTUPS/SMES, 2024

- TABLE 337 ULTRA-LOW-POWER MICROCONTROLLER MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024 (1/2)

- TABLE 338 ULTRA-LOW-POWER MICROCONTROLLER MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024 (2/2)

- TABLE 339 ULTRA-LOW-POWER MICROCONTROLLER MARKET: PRODUCT LAUNCHES, JANUARY 2021-AUGUST 2025

- TABLE 340 ULTRA-LOW-POWER MICROCONTROLLER MARKET: DEALS, JANUARY 2021-AUGUST 2025

- TABLE 341 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW

- TABLE 342 INFINEON TECHNOLOGIES AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 343 INFINEON TECHNOLOGIES AG: PRODUCT LAUNCHES, JANUARY 2021-AUGUST 2025

- TABLE 344 INFINEON TECHNOLOGIES AG: DEALS, JANUARY 2021-AUGUST 2025

- TABLE 345 NXP SEMICONDUCTORS: COMPANY OVERVIEW

- TABLE 346 NXP SEMICONDUCTORS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 347 NXP SEMICONDUCTORS: PRODUCT LAUNCHES, JANUARY 2021-AUGUST 2025

- TABLE 348 NXP SEMICONDUCTORS: DEALS, JANUARY 2021-AUGUST 2025

- TABLE 349 RENESAS ELECTRONICS CORPORATION: COMPANY OVERVIEW

- TABLE 350 RENESAS ELECTRONICS CORPORATION: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- TABLE 351 RENESAS ELECTRONICS CORPORATION: PRODUCT LAUNCHES, JANUARY 2021-AUGUST 2025

- TABLE 352 RENESAS ELECTRONICS CORPORATION: DEALS, JANUARY 2021-AUGUST 2025

- TABLE 353 STMICROELECTRONICS: COMPANY OVERVIEW

- TABLE 354 STMICROELECTRONICS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 355 STMICROELECTRONICS: PRODUCT LAUNCHES, JANUARY 2021-AUGUST 2025

- TABLE 356 STMICROELECTRONICS: DEALS, JANUARY 2021-AUGUST 2025

- TABLE 357 MICROCHIP TECHNOLOGY INC.: COMPANY OVERVIEW

- TABLE 358 MICROCHIP TECHNOLOGY INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 359 MICROCHIP TECHNOLOGY INC.: PRODUCT LAUNCHES, JANUARY 2021-AUGUST 2025

- TABLE 360 MICROCHIP TECHNOLOGY INC.: DEALS, JANUARY 2021-AUGUST 2025

- TABLE 361 MICROCHIP TECHNOLOGY INC.: EXPANSIONS, JANUARY 2021-AUGUST 2025

- TABLE 362 TEXAS INSTRUMENTS INCORPORATED: COMPANY OVERVIEW

- TABLE 363 TEXAS INSTRUMENTS INCORPORATED: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- TABLE 364 TEXAS INSTRUMENTS INCORPORATED: PRODUCT LAUNCHES, JANUARY 2021-AUGUST 2025

- TABLE 365 TEXAS INSTRUMENTS INCORPORATED: DEALS, JANUARY 2021-AUGUST 2025

- TABLE 366 TEXAS INSTRUMENTS INCORPORATED: EXPANSIONS, JANUARY 2021-AUGUST 2025

- TABLE 367 ANALOG DEVICES, INC.: COMPANY OVERVIEW

- TABLE 368 ANALOG DEVICES, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 369 ANALOG DEVICES, INC.: DEALS, JANUARY 2021-AUGUST 2025

- TABLE 370 ANALOG DEVICES, INC.: EXPANSIONS, JANUARY 2021-AUGUST 2025

- TABLE 371 SILICON LABORATORIES: COMPANY OVERVIEW

- TABLE 372 SILICON LABORATORIES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 373 SILICON LABORATORIES: PRODUCT LAUNCHES, JANUARY 2021-AUGUST 2025

- TABLE 374 ROHM CO., LTD.: COMPANY OVERVIEW

- TABLE 375 ROHM CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 376 ROHM CO., LTD.: PRODUCT LAUNCHES, JANUARY 2021-AUGUST 2025

- TABLE 377 ROHM CO., LTD.: DEALS, JANUARY 2021-AUGUST 2025

- TABLE 378 NUVOTON TECHNOLOGY CORPORATION: COMPANY OVERVIEW

- TABLE 379 NUVOTON TECHNOLOGY CORPORATION: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- TABLE 380 NUVOTON TECHNOLOGY CORPORATION: PRODUCT LAUNCHES, JANUARY 2021-AUGUST 2025

List of Figures

- FIGURE 1 ULTRA-LOW-POWER MICROCONTROLLER MARKET SEGMENTATION & REGIONAL SCOPE

- FIGURE 2 ULTRA-LOW-POWER MICROCONTROLLER MARKET: RESEARCH DESIGN

- FIGURE 3 ULTRA-LOW-POWER MICROCONTROLLER MARKET: RESEARCH FLOW OF MARKET SIZE ESTIMATION

- FIGURE 4 ULTRA-LOW-POWER MICROCONTROLLER MARKET: SUPPLY-SIDE ANLYSIS

- FIGURE 5 ULTRA-LOW-POWER MICROCONTROLLER MARKET: BOTTOM-UP APPROACH

- FIGURE 6 ULTRA-LOW-POWER MICROCONTROLLER MARKET: TOP-DOWN APPROACH

- FIGURE 7 ULTRA-LOW-POWER MICROCONTROLLER MARKET: DATA TRIANGULATION

- FIGURE 8 ANALOG DEVICES TO DOMINATE ULTRA-LOW-POWER MICROCONTROLLER MARKET DURING FORECAST PERIOD

- FIGURE 9 32-BIT ULTRA-LOW-POWER MICROCONTROLLER MARKET TO GROW AT HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 10 HEALTHCARE END-USE APPLICATION TO WITNESS HIGHEST GROWTH IN ULTRA-LOW-POWER MICROCONTROLLER MARKET DURING FORECAST PERIOD

- FIGURE 11 NORTH AMERICA TO LEAD ULTRA-LOW-POWER MICROCONTROLLER MARKET DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 GROWING NEED FOR ENERGY EFFICIENCY IN CONSUMER ELECTRONICS TO DRIVE GROWTH IN ULTRA-LOW-POWER MICROCONTROLLER MARKET

- FIGURE 14 ANALOG DEVICES AND 32-BIT PACKAGING SEGMENTS TO HOLD LARGE MARKET SHARES IN 2025

- FIGURE 15 CONSUMER ELECTRONICS TO DOMINATE MARKET BY 2030

- FIGURE 16 CHINA TO WITNESS HIGHEST CAGR IN GLOBAL ULTRA-LOW-POWER MICROCONTROLLER MARKET DURING FORECAST PERIOD

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET

- FIGURE 18 IMPACT ANALYSIS: DRIVERS

- FIGURE 19 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 20 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 21 IMPACT ANALYSIS: CHALLENGES

- FIGURE 22 TRENDS/DISRUPTIONS INFLUENCING CUSTOMERS' BUSINESSES

- FIGURE 23 ULTRA-LOW-POWER MICROCONTROLLER MARKET: VALUE CHAIN ANALYSIS

- FIGURE 24 ULTRA-LOW POWER MICROCONTROLLER MARKET: ECOSYSTEM ANALYSIS

- FIGURE 25 ULTRA-LOW-POWER MICROCONTROLLER MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 26 ULTRA-LOW-POWER MICROCONTROLLER MARKET: PATENT ANALYSIS, 2014-2024

- FIGURE 27 IMPORT SCENARIO FOR HS CODE 854231-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020-2024

- FIGURE 28 EXPORT SCENARIO FOR HS CODE 854231-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020-2024

- FIGURE 29 AVERAGE SELLING PRICE TREND OF ULTRA-LOW-POWER MICROCONTROLLERS PROVIDED BY KEY PLAYERS, BY END-USE APPLICATION, 2024

- FIGURE 30 AVERAGE SELLING PRICE TREND OF ULTRA-LOW-POWER MICROCONTROLLERS FOR CONSUMER ELECTRONICS, BY REGION, 2021-2024 (USD)

- FIGURE 31 AVERAGE SELLING PRICE TREND OF ULTRA-LOW-POWER MICROCONTROLLERS FOR HEALTHCARE, BY REGION, 2021-2024 (USD)

- FIGURE 32 AVERAGE SELLING PRICE TREND OF ULTRA-LOW-POWER MICROCONTROLLERS FOR AUTOMOTIVE, BY REGION, 2021-2024 (USD)

- FIGURE 33 AVERAGE SELLING PRICE TREND OF ULTRA-LOW-POWER MICROCONTROLLERS FOR MANUFACTURING, BY REGION, 2021-2024 (USD)

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USE APPLICATIONS

- FIGURE 35 KEY BUYING CRITERIA FOR TOP 3 END-USE APPLICATIONS

- FIGURE 36 ANALOG DEVICES TO DOMINATE ULTRA-LOW-POWER MICROCONTROLLER MARKET DURING FORECAST PERIOD

- FIGURE 37 32-BIT ULTRA-LOW-POWER MICROCONTROLLER MARKET TO GROW AT HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 38 HEALTHCARE END-USE APPLICATION TO WITNESS HIGHEST CAGR IN ULTRA-LOW-POWER MICROCONTROLLER MARKET DURING FORECAST PERIOD

- FIGURE 39 NORTH AMERICA TO LEAD ULTRA-LOW-POWER MICROCONTROLLER MARKET DURING FORECAST PERIOD

- FIGURE 40 NORTH AMERICA: ULTRA-LOW-POWER MICROCONTROLLER MARKET SNAPSHOT

- FIGURE 41 US TO ACCOUNT FOR LARGEST SHARE OF ULTRA-LOW-POWER MICROCONTROLLER MARKET DURING FORECAST PERIOD

- FIGURE 42 EUROPE: ULTRA-LOW-POWER MICROCONTROLLER MARKET SNAPSHOT

- FIGURE 43 GERMANY TO LEAD ULTRA-LOW-POWER MICROCONTROLLER MARKET IN EUROPE IN 2030

- FIGURE 44 ASIA PACIFIC: ULTRA-LOW-POWER MICROCONTROLLER MARKET SNAPSHOT

- FIGURE 45 CHINA TO GROW AT HIGH CAGR IN ULTRA-LOW-POWER MICROCONTROLLER MARKET IN ASIA PACIFIC DURING FORECAST PERIOD

- FIGURE 46 SOUTH AMERICA TO DOMINATE ULTRA-LOW-POWER MICROCONTROLLER MARKET IN ROW

- FIGURE 47 REVENUE ANALYSIS OF FIVE KEY PLAYERS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, 2021-2024 (USD MILLION)

- FIGURE 48 ULTRA-LOW-POWER MICROCONTROLLER MARKET SHARE OF KEY PLAYERS, 2024

- FIGURE 49 COMPANY VALUATION, 2025 (USD BILLION)

- FIGURE 50 FINANCIAL METRICS (EV/EBITDA), 2025

- FIGURE 51 ULTRA-LOW-POWER MICROCONTROLLER MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 52 ULTRA-LOW-POWER MICROCONTROLLER MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 53 ULTRA-LOW-POWER MICROCONTROLLER MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 54 ULTRA-LOW-POWER MICROCONTROLLER MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 55 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT (2024)

- FIGURE 56 NXP SEMICONDUCTORS: COMPANY SNAPSHOT (2024)

- FIGURE 57 RENESAS ELECTRONICS CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 58 STMICROELECTRONICS: COMPANY SNAPSHOT (2024)

- FIGURE 59 MICROCHIP TECHNOLOGY INC.: COMPANY SNAPSHOT (2024)

- FIGURE 60 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT (2024)

- FIGURE 61 ANALOG DEVICES, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 62 SILICON LABORATORIES: COMPANY SNAPSHOT (2024)

- FIGURE 63 ROHM CO., LTD.: COMPANY SNAPSHOT (2025)

- FIGURE 64 NUVOTON TECHNOLOGY CORPORATION: COMPANY SNAPSHOT (2024)