|

市場調查報告書

商品編碼

1810319

全球導管市場(按類型、適應症、最終用戶和地區分類)- 預測至 2030 年Catheters Market by Type (Cardiovascular, Intravenous, Urological, Neurovascular), Indication - Global Forecast to 2030 |

||||||

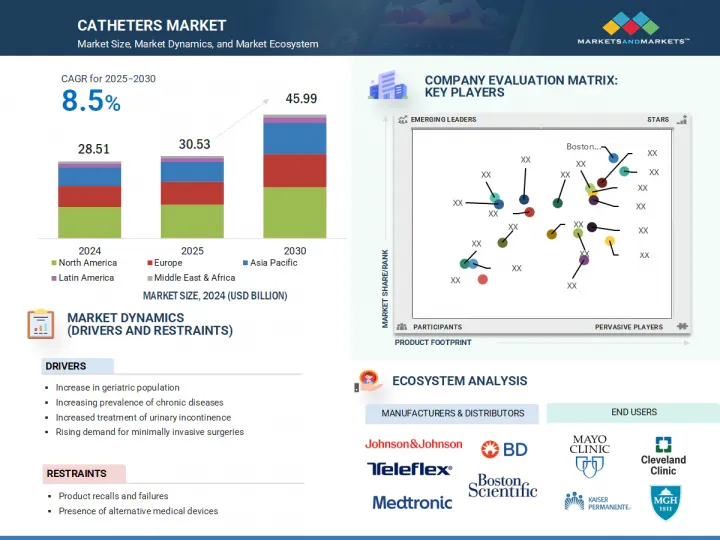

由於心血管、泌尿系統和神經系統應用中擴大採用影像導引和微創導管手術,導管市場規模預計將出現強勁成長。

可操縱和壓力敏感導管、藥物塗層技術和抗菌塗層等創新改善了手術結果並降低了併發症率。

| 調查範圍 | |

|---|---|

| 調查年份 | 2024-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 對價單位 | 金額(十億美元) |

| 部分 | 按類型、適應症、最終用戶和地區 |

| 目標區域 | 北美、歐洲、亞太地區、拉丁美洲、中東和非洲 |

此外,介入性心臟病學和神經病學擴大採用人工智慧輔助導航和即時影像技術,以提高手術準確性,尤其是在複雜病例中。此外,三級醫療機構中混合手術室和導管室的發展,使得先進的干涉措施成為可能,並刺激了需求。這些專業領域的進步正在推動市場持續成長,尤其是在手術量大、文明病日益增加的地區。

預計心臟導管部分將在 2024 年佔據最大的市場佔有率,這一趨勢預計將在整個預測期內持續下去。此部分的成長是由冠狀動脈疾病、心臟衰竭和心律不整等心臟病發病率的上升所驅動,尤其是在老年人中,這些疾病通常需要進行血管成形術和消融術等微創導管手術。藥物釋放型導管和影像相容導管等導管技術的進步提高了手術安全性和療效。此外,公眾對早期心臟介入的認知不斷提高以及優惠的報銷政策鼓勵了主要企業持續進行研發投資,進一步推動了該領域的成長。

預計到 2024 年,醫院領域將佔據全球導管插入市場的最大佔有率。這一領域的優勢在於其所進行的手術量大,且擁有先進的醫療基礎設施。醫院進行各種導管手術,包括心血管、泌尿系統和神經外科手術,這些手術需要熟練的專業人員和專門的設備。因心臟病和腎臟病等慢性疾病住院的患者數量不斷增加也加劇了這項需求。醫院設備精良,能夠實施先進的導管插入技術並實施適當的感染控制。此外,許多國家對醫院內手術的大力報銷支持進一步推動了利用率。所有這些因素共同使醫院成為導管的最大終端使用者。

北美在全球導管市場佔有最大的市場佔有率,這主要歸功於其先進的醫療基礎設施、高昂的醫療支出以及對創新醫療技術的早期採用。此外,該地區心血管疾病、腎衰竭和尿失禁等慢性疾病的發生率很高,這大大推動了對各種導管的需求。此外,領先的導管製造商、強大的分銷網路和完善的報銷政策支持其在醫院、診所和門診手術中心的廣泛使用。有利的監管核准、對微創手術日益成長的偏好以及老年人口的成長進一步推動了市場的發展。這些綜合因素使得北美在全球導管市場佔據主導地位。

本報告研究了全球導管市場,按類型、適應症、最終用戶和地區進行細分,並提供了參與市場的公司概況。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章重要考察

第5章 市場概況

- 介紹

- 市場動態

- 技術分析

- 監管狀況

- 專利分析

- 貿易分析

- 贖回情景

- 2025-2026年主要會議和活動

- 主要相關人員和採購標準

- 定價分析

- 價值鏈分析

- 生態系分析

- 人工智慧/生成式人工智慧對導管市場的影響

- 影響客戶業務的趨勢/中斷

- 投資金籌措場景

- 導管市場:2025年美國關稅的影響

第6章導管市場(按類型)

- 介紹

- 心血管導管

- 靜脈導管

- 泌尿系統

- 特殊導管

- 神經血管導管

第7章導管市場(按適應症)

- 介紹

- 心臟病

- 神經血管疾病

- 泌尿道疾病

- 血管疾病

- 靜脈給藥和液體管理

- 腎臟疾病

- 輸血

- 其他

第 8 章導管市場(按最終用戶)

- 介紹

- 醫院

- 門診手術中心

- 長期照護機構

- 診斷影像中心

- 門診

- 其他

第9章導管市場(按地區)

- 介紹

- 北美洲

- 北美宏觀經濟展望

- 北美:2023-2030 年靜脈導管容量分析(按類型分類)(千支)

- 美國

- 加拿大

- 歐洲

- 歐洲宏觀經濟展望

- 歐洲:2023-2030 年靜脈導管容量分析(按類型分類)(千支)

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 其他

- 亞太地區

- 亞太宏觀經濟展望

- 2023-2030年亞太地區靜脈導管類型數量分析(千支)

- 日本

- 中國

- 印度

- 澳洲

- 韓國

- 其他

- 拉丁美洲

- 拉丁美洲宏觀經濟展望

- 拉丁美洲:2023-2030 年靜脈導管容量分析(按類型分類)(千支)

- 巴西

- 墨西哥

- 其他

- 中東和非洲

- 中東和非洲宏觀經濟展望

- 中東和非洲:2023-2030 年靜脈導管容量分析(按類型分類)(千支)

- 海灣合作理事會國家

- 其他

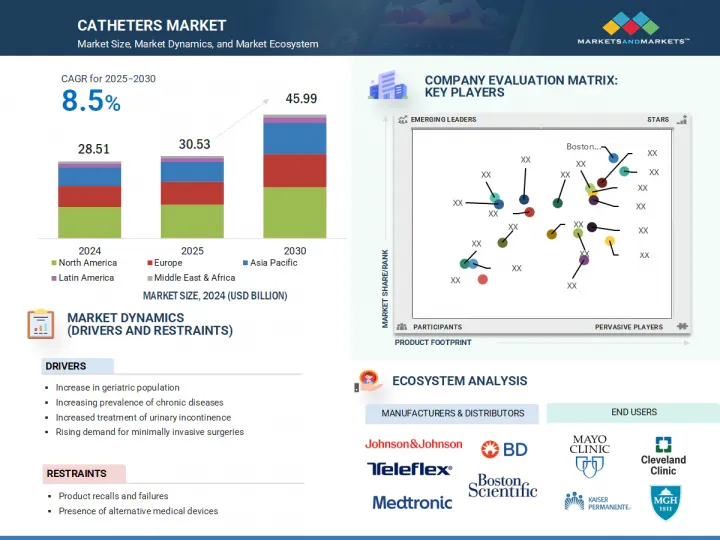

第10章 競爭格局

- 概述

- 主要參與企業的策略/優勢

- 導管市場主要企業收益分析(2022-2024)

- 市場佔有率分析

- 公司估值矩陣:2024 年關鍵參與企業

- 公司估值矩陣:Start-Ups/中小企業,2024 年

- 品牌/產品比較

- 主要企業研發支出

- 估值和財務指標

- 競爭場景

第11章:公司簡介

- 主要參與企業

- BOSTON SCIENTIFIC CORPORATION

- MEDTRONIC PLC

- B. BRAUN SE

- BECTON, DICKINSON AND COMPANY

- STRYKER CORPORATION

- ABBOTT LABORATORIES

- TERUMO CORPORATION

- COLOPLAST A/S

- CONVATEC GROUP PLC

- MERIT MEDICAL SYSTEMS, INC.

- JOHNSON & JOHNSON

- COOK

- EDWARDS LIFESCIENCES CORPORATION

- NIPRO CORPORATION

- TELEFLEX INCORPORATED

- CARDINAL HEALTH, INC.

- HOLLISTER INCORPORATED

- INTEGRA LIFESCIENCES HOLDINGS CORPORATION

- KONINKLIJKE PHILIPS NV

- MICROPORT SCIENTIFIC CORPORATION

- 其他公司

- AMECATH

- SIS MEDICAL AG

- ANGIPLAST PRIVATE LIMITED

- RELISYS MEDICAL DEVICES LIMITED

- CAGENT VASCULAR

- BIOTRONIK

- ADVIN HEALTH CARE

- ALVIMEDICA

- INGENION MEDICAL LIMITED

- SUMMA THERAPEUTICS, LLC

第12章 附錄

The catheters market is projected to grow steadily, driven by the increasing adoption of image-guided and minimally invasive catheter-based procedures across cardiovascular, urological, and neurological applications. Innovations such as steerable and pressure-sensitive catheters, drug-coated technologies, and antimicrobial coatings improve procedural outcomes and reduce complication rates.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Type, Indication, End User, Region |

| Regions covered | North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa |

Additionally, the rising deployment of AI-powered navigation and real-time imaging in interventional cardiology and neurology enhances procedural precision, particularly in complex cases. Demand is further fueled by the development of hybrid operating rooms and catheter labs in tertiary care settings, enabling advanced interventions. These specialized advancements propel the market's consistent growth trajectory, especially in regions facing high procedural volumes and increasing lifestyle-related diseases.

"By type, the cardiovascular catheters segment accounted for the largest market in 2024."

The cardiovascular catheters segment accounted for the largest market in 2024, and this trend is projected to continue during the forecast period. The growth of this segment is fueled by the increasing incidence of heart conditions, such as coronary artery disease, heart failure, and arrhythmias, particularly among older adults, often requiring minimally invasive procedures like angioplasty and ablation, which involve the use of catheters. Advancements in catheter technologies, including drug-eluting and imaging-compatible catheters, have improved procedure safety and outcomes. Additionally, the rising awareness of people regarding early cardiac care and favorable reimbursement policies is driving continuous R&D investments by key players, further boosting the segment's growth.

"By end user, the hospitals segment accounted for the largest share in the catheters market in 2024."

The hospitals segment accounted for the largest share of the global catheters market in 2024. The segment's position can be attributed to the high volume of procedures performed in these settings and the availability of advanced medical infrastructure. Hospitals handle various catheter-based treatments, including cardiovascular, urinary, and neurological procedures requiring skilled professionals and specialized equipment. The rising number of inpatient admissions for chronic conditions, such as heart disease and kidney disorders, is also contributing to this demand. Hospitals are better equipped to adopt advanced catheter technologies and ensure proper infection control practices. Additionally, many countries' strong reimbursement support for hospital-based procedures further boosts utilization. All these factors collectively make hospitals the largest end users of catheters.

"North America accounted for the largest share of the global catheters market in 2024."

North America accounted for the largest market in the global catheters market, mainly due to its advanced healthcare infrastructure, high healthcare spending, and early adoption of innovative medical technologies. Additionally, the region sees a high prevalence of chronic diseases like cardiovascular disorders, kidney failure, and urinary incontinence, which significantly drives the demand for various catheter types. Moreover, leading catheter manufacturers, strong distribution networks, and well-established reimbursement policies support widespread usage across hospitals, clinics, and ambulatory surgical centers. Favorable regulatory approvals, growing preference for minimally invasive procedures, and rising geriatric population further boost the market. These combined factors make North America the dominant global catheter market in the region.

Breakdown of Supply-side Primary Interviews:

- By Company Type: Tier 1 - 45%, Tier 2 - 20%, and Tier 3 - 35%

- By Designation: C-level Executives - 35%, Directors - 25%, and Other Designations - 40%

- By Region: North America - 40%, Europe - 25%, Asia Pacific - 20%, Latin America - 10%, Middle East & Africa - 5%

Research Coverage

This report studies the catheters market in terms of type, indication, end user, and region. It also studies market growth factors (drivers, restraints, opportunities, and challenges). The report further analyzes the market's opportunities and challenges and details the competitive landscape for market leaders. It analyzes micro markets concerning their growth trends and forecasts the revenue of the market segments concerning five main regions and respective countries.

Reasons to Buy the Report

The report can help established and new entrants/smaller firms gauge the market's pulse, which, in turn, would help them garner a greater share. The report provides insights into the following pointers:

- Analysis of key drivers, restraints, opportunities, and challenges influencing the growth of the catheters market

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and product launches in the catheters market

- Market Development: Comprehensive information about lucrative emerging markets across regions

- Market Diversification: Exhaustive information about products, untapped regions, recent developments, and investments in the catheters market

- Competitive Assessment: In-depth assessment of market share, strategies, products, distribution networks, and manufacturing capabilities of the leading players in the catheters market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 MARKETS COVERED

- 1.2.2 INCLUSIONS & EXCLUSIONS

- 1.2.3 YEARS CONSIDERED

- 1.3 CURRENCY

- 1.4 UNIT CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 MARKET SHARE ESTIMATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 RISK ASSESSMENT

- 2.7 RESEARCH LIMITATIONS

- 2.7.1 METHODOLOGY-RELATED LIMITATIONS

- 2.7.2 SCOPE-RELATED LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 CATHETERS MARKET OVERVIEW

- 4.2 NORTH AMERICA: CATHETERS MARKET OVERVIEW

- 4.3 CATHETERS MARKET: REGIONAL MIX

- 4.4 CATHETERS MARKET: GEOGRAPHICAL GROWTH OPPORTUNITIES

- 4.5 CATHETERS MARKET: DEVELOPING VS. DEVELOPED MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising geriatric population

- 5.2.1.2 Increasing prevalence of chronic diseases

- 5.2.1.3 Increased awareness and treatment of urinary incontinence

- 5.2.1.4 Rising demand for minimally invasive surgeries

- 5.2.2 RESTRAINTS

- 5.2.2.1 Product recalls and failures

- 5.2.2.2 Presence of substitute medical devices

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing demand in emerging markets

- 5.2.3.2 Technological advancements and product innovation

- 5.2.4 CHALLENGES

- 5.2.4.1 Integration complexity with existing production lines

- 5.2.1 DRIVERS

- 5.3 TECHNOLOGY ANALYSIS

- 5.3.1 KEY TECHNOLOGIES

- 5.3.1.1 Antimicrobial-coated catheters

- 5.3.1.2 Drug-eluting catheters

- 5.3.2 COMPLEMENTARY TECHNOLOGIES

- 5.3.2.1 Hydrophilic coatings for catheters

- 5.3.2.2 Ultrasound-guided insertion systems

- 5.3.3 ADJACENT TECHNOLOGIES

- 5.3.3.1 Minimally invasive surgical devices

- 5.3.1 KEY TECHNOLOGIES

- 5.4 PORTER'S FIVE FORCES ANALYSIS

- 5.4.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.4.2 BARGAINING POWER OF BUYERS

- 5.4.3 BARGAINING POWER OF SUPPLIERS

- 5.4.4 THREAT OF SUBSTITUTES

- 5.4.5 THREAT OF NEW ENTRANTS

- 5.5 REGULATORY LANDSCAPE

- 5.5.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.5.2 REGULATORY FRAMEWORK

- 5.5.2.1 North America

- 5.5.2.1.1 US

- 5.5.2.1.2 Canada

- 5.5.2.2 Europe

- 5.5.2.3 Asia Pacific

- 5.5.2.3.1 China

- 5.5.2.3.2 Japan

- 5.5.2.3.3 India

- 5.5.2.4 Latin America

- 5.5.2.4.1 Brazil

- 5.5.2.4.2 Mexico

- 5.5.2.5 Middle East

- 5.5.2.6 Africa

- 5.5.2.1 North America

- 5.6 PATENT ANALYSIS

- 5.6.1 INSIGHTS ON PATENT PUBLICATION TRENDS, TOP APPLICANTS AND JURISDICTION FOR CATHETERS MARKET, JANUARY 2015-DECEMBER 2025

- 5.6.2 LIST OF MAJOR PATENTS, 2023-2024

- 5.7 TRADE ANALYSIS

- 5.7.1 IMPORT DATA FOR HS CODE 901839, 2020-2024

- 5.7.2 EXPORT DATA FOR HS CODE 901839, 2020-2024

- 5.8 REIMBURSEMENT SCENARIO

- 5.9 KEY CONFERENCES & EVENTS, 2025-2026

- 5.10 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 KEY BUYING CRITERIA

- 5.11 PRICING ANALYSIS

- 5.11.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE, 2022-2024

- 5.11.2 AVERAGE SELLING PRICE TREND OF CATHETERS, BY REGION, 2022-2024

- 5.12 VALUE CHAIN ANALYSIS

- 5.13 ECOSYSTEM ANALYSIS

- 5.14 IMPACT OF AI/GEN AI ON CATHETERS MARKET

- 5.15 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- 5.16 INVESTMENT & FUNDING SCENARIO

- 5.17 CATHETERS MARKET: IMPACT OF 2025 US TARIFF

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRY/REGION

- 5.17.4.1 North America

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON END USERS

- 5.17.5.1 Hospitals

- 5.17.5.2 Ambulatory surgical centers

- 5.17.5.3 Long-term care facilities

- 5.17.5.4 Diagnostic imaging centers

- 5.17.5.5 Outpatient clinics

- 5.17.5.6 Other end users

6 CATHETERS MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 CARDIOVASCULAR CATHETERS

- 6.2.1 HIGH PREVALENCE OF CARDIOVASCULAR DISEASES AND GROWING INTERVENTIONAL PROCEDURES TO FUEL DEMAND

- 6.2.2 ELECTROPHYSIOLOGY CATHETERS

- 6.2.2.1 Increasing prevalence of atrial fibrillation and expansion of electrophysiology labs to drive segment

- 6.2.3 ANGIOGRAPHY CATHETERS

- 6.2.3.1 Growing use of minimally invasive diagnostics and better imaging outcomes to propel growth

- 6.2.4 CORONARY BALLOON CATHETERS

- 6.2.4.1 Rapid growth in percutaneous coronary interventions and technological innovation to support growth

- 6.2.5 IVUS/OCT CATHETERS

- 6.2.5.1 Integration of intravascular imaging into PCI and clinical guidelines to drive uptake

- 6.2.6 GUIDING CATHETERS

- 6.2.6.1 Versatility in access and support during complex interventions to boost demand

- 6.2.7 OTHER CARDIOVASCULAR CATHETERS

- 6.3 INTRAVENOUS CATHETERS

- 6.3.1 INCREASING USE IN LONG-TERM THERAPIES AND HOSPITAL-ACQUIRED INFECTION PREVENTION EFFORTS TO DRIVE GROWTH

- 6.3.2 GLOBAL VOLUME ANALYSIS OF INTRAVENOUS CATHETER TYPES, 2023-2030 (THOUSAND UNITS)

- 6.3.3 CENTRAL VENOUS CATHETERS

- 6.3.3.1 Rising use in intensive and emergency care, along with multi-lumen design advancements, to drive demand

- 6.3.3.2 Peripherally inserted central catheters

- 6.3.3.2.1 Preference for long-term, outpatient IV therapy and reduced complication rates to drive use

- 6.3.3.3 Non-tunneled central venous catheters

- 6.3.3.3.1 Immediate access in emergency and ICU settings supports continued use

- 6.3.3.4 Skin-tunneled central venous catheters

- 6.3.3.4.1 Low infection risk and suitability for long-term therapies drive adoption

- 6.3.3.5 Implantable ports

- 6.3.3.5.1 Rise in cancer prevalence and demand for discreet, low-maintenance access devices drive use

- 6.3.4 PERIPHERAL INTRAVENOUS CATHETERS

- 6.3.4.1 High frequency of use and cost-effectiveness drive widespread adoption

- 6.3.5 MIDLINE PERIPHERAL CATHETERS

- 6.3.5.1 Rising preference in infection-prone patients and long-duration therapies to fuel market growth

- 6.4 UROLOGICAL CATHETERS

- 6.4.1 AGING POPULATION AND RISE IN RENAL AND UROLOGICAL DISORDERS TO DRIVE DEMAND

- 6.4.2 URINARY CATHETERS

- 6.4.2.1 Rising geriatric population and increased incidence of urinary incontinence - key drivers of growth

- 6.4.2.2 Indwelling catheters

- 6.4.2.2.1 Hospital-acquired urinary retention cases and long-term catheterization needs to drive demand

- 6.4.2.3 Intermittent catheters

- 6.4.2.3.1 Rising preference for self-catheterization and reduced infection risk accelerates adoption

- 6.4.2.4 External catheters

- 6.4.2.4.1 Growing use of non-invasive options in female and bedridden patients to fuel demand

- 6.4.3 DIALYSIS CATHETERS

- 6.4.3.1 Rising prevalence of end-stage renal disease and need for immediate vascular access to drive use

- 6.4.3.2 Peritoneal dialysis catheters

- 6.4.3.2.1 Preference for home-based renal therapy to support segment growth

- 6.4.3.3 Hemodialysis catheters

- 6.4.3.3.1 Increasing prevalence of end-stage renal disease and urgency for rapid vascular access to drive demand

- 6.5 SPECIALTY CATHETERS

- 6.5.1 DIVERSE CLINICAL UTILITY AND ADVANCEMENTS IN MINIMALLY INVASIVE MONITORING TO SUPPORT GROWTH

- 6.5.2 PRESSURE & HEMODYNAMIC CATHETERS

- 6.5.2.1 Precision in critical care and expanding cardiac monitoring - key drivers

- 6.5.3 TEMPERATURE MONITORING CATHETERS

- 6.5.3.1 Segment to gain traction due to need for precise core temperature control in critical illness

- 6.5.4 INTRAUTERINE INSEMINATION CATHETERS

- 6.5.4.1 Rising use of assisted reproduction and favorable clinical outcomes support growth of segment

- 6.5.5 OTHER SPECIALTY CATHETERS

- 6.6 NEUROVASCULAR CATHETERS

- 6.6.1 INCREASING STROKE BURDEN AND SHIFT TOWARD ENDOVASCULAR THERAPY TO ACCELERATE DEMAND

7 CATHETERS MARKET, BY INDICATION

- 7.1 INTRODUCTION

- 7.2 CARDIAC DISEASES

- 7.2.1 GROWING CARDIOVASCULAR DISEASE BURDEN TO DRIVE DOMINANCE OF SEGMENT

- 7.3 NEUROVASCULAR CONDITIONS

- 7.3.1 INCREASING STROKE INCIDENCE AND ADVANCED NEURO-INTERVENTION TECHNIQUES TO FUEL SEGMENT

- 7.4 URINARY CONDITIONS

- 7.4.1 RISING CASES OF URINARY INCONTINENCE AND UROLOGICAL DISORDERS TO DRIVE DEMAND

- 7.5 VASCULAR DISEASES

- 7.5.1 PREVALENCE OF PERIPHERAL ARTERY DISEASE AND DEEP VEIN THROMBOSIS AIDS GROWTH OF SEGMENT

- 7.6 IV MEDICATION DELIVERY & FLUID MANAGEMENT

- 7.6.1 GROWING USE OF LONG-TERM IV THERAPY IN CHRONIC CONDITIONS TO SUPPORT EXPANSION OF SEGMENT

- 7.7 KIDNEY DISEASES

- 7.7.1 HIGH GLOBAL BURDEN OF END-STAGE RENAL DISEASE TO ACCELERATE GROWTH

- 7.8 BLOOD TRANSFUSION

- 7.8.1 INCREASE IN SURGICAL VOLUME AND CRITICAL CARE NEEDS TO DRIVE DEMAND

- 7.9 OTHER INDICATIONS

8 CATHETERS MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 HOSPITALS

- 8.2.1 RAPID EXPANSION OF HOSPITAL CAPACITY AND INFRASTRUCTURE TO DRIVE MARKET

- 8.3 AMBULATORY SURGICAL CENTERS

- 8.3.1 SURGE IN OUTPATIENT PROCEDURES AND REGULATORY SUPPORT TO SPUR GROWTH

- 8.4 LONG-TERM CARE FACILITIES

- 8.4.1 AGING POPULATION AND ASSISTED LIVING DEMAND INCREASED CATHETER USE

- 8.5 DIAGNOSTIC IMAGING CENTERS

- 8.5.1 HIGH VOLUME OF IMAGING PROCEDURES BOOSTS CATHETER DEMAND

- 8.6 OUTPATIENT CLINICS

- 8.6.1 RISING OUTPATIENT VISIT VOLUMES AND PROCEDURAL SHIFT INCREASE CATHETER USE

- 8.7 OTHER END USERS

9 CATHETERS MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 NORTH AMERICA: VOLUME ANALYSIS OF INTRAVENOUS CATHETER TYPES, 2023--2030 (THOUSAND UNITS)

- 9.2.3 US

- 9.2.3.1 Rising chronic disease burden spurs innovation demand in catheter use

- 9.2.4 CANADA

- 9.2.4.1 Aging population and rising hypertension & urinary conditions lift catheter demand

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 EUROPE: VOLUME ANALYSIS OF INTRAVENOUS CATHETER TYPES, 2023-2030 (THOUSAND UNITS)

- 9.3.3 GERMANY

- 9.3.3.1 Aging population and high PCI volume to drive catheter usage

- 9.3.4 UK

- 9.3.4.1 High prevalence of long-term urinary catheter use maintained by community nursing demand

- 9.3.5 FRANCE

- 9.3.5.1 Widespread use of intermittent urinary catheters to support second-largest share

- 9.3.6 SPAIN

- 9.3.6.1 Rising UTI burden in nursing homes boosts urinary catheter demand

- 9.3.7 ITALY

- 9.3.7.1 Recent heightened CAUTI risk in ICUs underpins demand for safer urinary catheters

- 9.3.8 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 ASIA PACIFIC VOLUME ANALYSIS OF INTRAVENOUS CATHETER TYPES, 2023-2030 (THOUSAND UNITS)

- 9.4.3 JAPAN

- 9.4.3.1 Aging population and rising cardiovascular care needs to boost demand for catheters

- 9.4.4 CHINA

- 9.4.4.1 High cardiovascular disease burden and expanding care access to drive demand

- 9.4.5 INDIA

- 9.4.5.1 Set to be fastest-growing market with escalating CVD incidence

- 9.4.6 AUSTRALIA

- 9.4.6.1 High cardiovascular disease burden and strong government support to drive growth

- 9.4.7 SOUTH KOREA

- 9.4.7.1 Rising arrhythmia treatments and expanding interventional cardiology infrastructure bolster catheter demand

- 9.4.8 REST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 9.5.2 LATIN AMERICA: VOLUME ANALYSIS OF INTRAVENOUS CATHETER TYPES, 2023-2030 (THOUSAND UNITS)

- 9.5.3 BRAZIL

- 9.5.3.1 Robust public healthcare infrastructure and high cardiovascular procedure volume drive dominance

- 9.5.4 MEXICO

- 9.5.4.1 High diabetes and cardiovascular disease prevalence spurs catheter demand

- 9.5.5 REST OF LATIN AMERICA

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 9.6.2 MIDDLE EAST & AFRICA: VOLUME ANALYSIS OF INTRAVENOUS CATHETER TYPES, 2023-2030 (THOUSAND UNITS)

- 9.6.3 GCC COUNTRIES

- 9.6.3.1 Market uplift through strategic healthcare investments and rising procedure volumes

- 9.6.3.2 Kingdom of Saudi Arabia (KSA)

- 9.6.3.2.1 Market gains strength from healthcare transformation and NCD burden

- 9.6.3.3 United Arab Emirates (UAE)

- 9.6.3.3.1 Market growth anchored in advanced hospital infrastructure and medical tourism

- 9.6.3.4 Other GCC Countries

- 9.6.4 REST OF MIDDLE EAST & AFRICA

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGY/RIGHT TO WIN

- 10.3 REVENUE ANALYSIS OF KEY PLAYERS IN CATHETERS MARKET (2022-2024)

- 10.4 MARKET SHARE ANALYSIS

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Region footprint

- 10.5.5.3 Type footprint

- 10.5.5.4 Indication footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 DYNAMIC COMPANIES

- 10.6.3 STARTING BLOCKS

- 10.6.4 RESPONSIVE COMPANIES

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/SMEs

- 10.6.5.2 Competitive benchmarking of key emerging players/startups

- 10.7 BRAND/PRODUCT COMPARISON

- 10.8 R&D EXPENDITURE OF KEY PLAYERS

- 10.9 COMPANY VALUATION & FINANCIAL METRICS

- 10.9.1 COMPANY VALUATION

- 10.9.2 FINANCIAL METRICS

- 10.10 COMPETITIVE SCENARIO

- 10.10.1 PRODUCT APPROVALS/LAUNCHES

- 10.10.2 DEALS

- 10.10.3 EXPANSIONS

- 10.10.4 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 BOSTON SCIENTIFIC CORPORATION

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches & approvals

- 11.1.1.3.2 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 MEDTRONIC PLC

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches & approvals

- 11.1.2.3.2 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 B. BRAUN SE

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Deals

- 11.1.3.3.2 Expansions

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 BECTON, DICKINSON AND COMPANY

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches & approvals

- 11.1.4.3.2 Deals

- 11.1.4.3.3 Expansions

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 STRYKER CORPORATION

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches & approvals

- 11.1.5.3.2 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 ABBOTT LABORATORIES

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches & approvals

- 11.1.6.3.2 Deals

- 11.1.6.3.3 Other developments

- 11.1.7 TERUMO CORPORATION

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product launches & approvals

- 11.1.7.3.2 Deals

- 11.1.7.3.3 Expansions

- 11.1.8 COLOPLAST A/S

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Product launches & approvals

- 11.1.8.3.2 Expansions

- 11.1.9 CONVATEC GROUP PLC

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product launches & approvals

- 11.1.10 MERIT MEDICAL SYSTEMS, INC.

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product launches & approvals

- 11.1.10.3.2 Deals

- 11.1.11 JOHNSON & JOHNSON

- 11.1.11.1 Business overview

- 11.1.11.2 Products offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Product launches & approvals

- 11.1.11.3.2 Deals

- 11.1.12 COOK

- 11.1.12.1 Business overview

- 11.1.12.2 Products offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 Product launches & approvals

- 11.1.12.3.2 Deals

- 11.1.13 EDWARDS LIFESCIENCES CORPORATION

- 11.1.13.1 Business overview

- 11.1.13.2 Products offered

- 11.1.14 NIPRO CORPORATION

- 11.1.14.1 Business overview

- 11.1.14.2 Products offered

- 11.1.14.3 Recent developments

- 11.1.14.3.1 Expansions

- 11.1.15 TELEFLEX INCORPORATED

- 11.1.15.1 Business overview

- 11.1.15.2 Products offered

- 11.1.15.3 Recent developments

- 11.1.15.3.1 Product launches & approvals

- 11.1.15.3.2 Deals

- 11.1.16 CARDINAL HEALTH, INC.

- 11.1.16.1 Business overview

- 11.1.16.2 Products offered

- 11.1.16.3 Recent developments

- 11.1.16.3.1 Expansions

- 11.1.17 HOLLISTER INCORPORATED

- 11.1.17.1 Business overview

- 11.1.17.2 Products offered

- 11.1.17.3 Recent developments

- 11.1.17.3.1 Expansions

- 11.1.18 INTEGRA LIFESCIENCES HOLDINGS CORPORATION

- 11.1.18.1 Business overview

- 11.1.18.2 Products offered

- 11.1.19 KONINKLIJKE PHILIPS N.V.

- 11.1.19.1 Business overview

- 11.1.19.2 Products offered

- 11.1.19.3 Recent developments

- 11.1.19.3.1 Expansions

- 11.1.20 MICROPORT SCIENTIFIC CORPORATION

- 11.1.20.1 Business overview

- 11.1.20.2 Products offered

- 11.1.20.3 Recent developments

- 11.1.20.3.1 Product launches & approvals

- 11.1.1 BOSTON SCIENTIFIC CORPORATION

- 11.2 OTHER PLAYERS

- 11.2.1 AMECATH

- 11.2.2 SIS MEDICAL AG

- 11.2.3 ANGIPLAST PRIVATE LIMITED

- 11.2.4 RELISYS MEDICAL DEVICES LIMITED

- 11.2.5 CAGENT VASCULAR

- 11.2.6 BIOTRONIK

- 11.2.7 ADVIN HEALTH CARE

- 11.2.8 ALVIMEDICA

- 11.2.9 INGENION MEDICAL LIMITED

- 11.2.10 SUMMA THERAPEUTICS, LLC

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.3.1 PRODUCT ANALYSIS

- 12.3.2 GEOGRAPHIC ANALYSIS

- 12.3.3 COMPANY INFORMATION

- 12.3.4 REGIONAL/COUNTRY-LEVEL MARKET SHARE ANALYSIS

- 12.3.5 COUNTRY-LEVEL VOLUME ANALYSIS

- 12.3.6 PRODUCT TYPE MARKET SHARE ANALYSIS (TOP 5 PLAYERS)

- 12.3.7 ANY CONSULTS/CUSTOM STUDIES AS PER CLIENT REQUIREMENTS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

List of Tables

- TABLE 1 STANDARD CURRENCY CONVERSION RATES (USD)

- TABLE 2 CATHETERS MARKET: STUDY ASSUMPTION ANALYSIS

- TABLE 3 CATHETERS MARKET: RISK ASSESSMENT ANALYSIS

- TABLE 4 CATHETERS MARKET: PORTER'S FIVE FORCES

- TABLE 5 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 US FDA: MEDICAL DEVICE CLASSIFICATION

- TABLE 11 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 12 CATHETERS MARKET: KEY PATENTS, JANUARY 2023-DECEMBER 2024

- TABLE 13 IMPORT DATA FOR HS CODE 901839, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 14 EXPORT DATA FOR HS CODE 901839, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 15 CATHETERS MARKET: KEY CONFERENCES & EVENTS, JULY 2025-JUNE 2026

- TABLE 16 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS, BY TYPE

- TABLE 17 KEY BUYING CRITERIA FOR CATHETERS

- TABLE 18 AVERAGE SELLING PRICE TRENDS OF KEY PLAYERS, BY CATHETER TYPE, 2022-2024 (USD)

- TABLE 19 AVERAGE SELLING PRICE OF CATHETERS, BY REGION, 2022-2024 (USD)

- TABLE 20 CATHETERS MARKET: IMPACT OF AI/GEN AI

- TABLE 21 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 22 CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 23 CARDIOVASCULAR CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 24 CARDIOVASCULAR CATHETERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 25 ELECTROPHYSIOLOGY CATHETERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 26 ANGIOGRAPHY CATHETERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 27 CORONARY BALLOON CATHETERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 28 IVUS/OCT CATHETERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 29 GUIDING CATHETERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 30 OTHER CARDIOVASCULAR CATHETERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 31 INTRAVENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (THOUSAND UNITS)

- TABLE 32 INTRAVENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 33 INTRAVENOUS CATHETERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 34 CENTRAL VENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 35 CENTRAL VENOUS CATHETERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 36 PERIPHERALLY INSERTED CENTRAL CATHETERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 37 NON-TUNNELED CENTRAL VENOUS CATHETERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 38 SKIN-TUNNELED CENTRAL VENOUS CATHETERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 39 IMPLANTABLE PORTS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 40 PERIPHERAL INTRAVENOUS CATHETERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 41 MIDLINE PERIPHERAL CATHETERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 42 UROLOGICAL CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 43 UROLOGICAL CATHETERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 44 URINARY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 45 URINARY CATHETERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 46 INDWELLING CATHETERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 47 INTERMITTENT CATHETERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 48 EXTERNAL CATHETERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 49 DIALYSIS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 50 DIALYSIS CATHETERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 51 PERITONEAL DIALYSIS CATHETERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 52 HEMODIALYSIS CATHETERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 53 SPECIALTY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 54 SPECIALTY CATHETERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 55 PRESSURE & HEMODYNAMIC CATHETERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 56 TEMPERATURE MONITORING CATHETERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 57 INTRAUTERINE INSEMINATION CATHETERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 58 OTHER SPECIALTY CATHETERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 59 NEUROVASCULAR CATHETERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 60 CATHETERS MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 61 CARDIAC DISEASES: CATHETERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 62 NEUROVASCULAR CONDITIONS: CATHETERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 63 URINARY CONDITIONS: CATHETERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 64 VASCULAR DISEASES: CATHETERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 65 IV MEDICATION DELIVERY & FLUID MANAGEMENT: CATHETERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 66 KIDNEY DISEASES: CATHETERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 67 BLOOD TRANSFUSION: CATHETERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 68 OTHER INDICATIONS: CATHETERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 69 CATHETERS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 70 HOSPITALS: CATHETERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 71 AMBULATORY SURGICAL CENTERS: CATHETERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 72 LONG-TERM CARE FACILITIES: CATHETERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 73 DIAGNOSTIC IMAGING CENTERS: CATHETERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 74 OUTPATIENT CLINICS: CATHETERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 75 OTHER END USERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 76 CATHETERS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 77 NORTH AMERICA: CATHETERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 78 NORTH AMERICA: CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 79 NORTH AMERICA: CARDIOVASCULAR CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 80 NORTH AMERICA: INTRAVENOUS CATHETERS MARKET, BY TYPE, (2023-2030) (THOUSAND UNITS)

- TABLE 81 NORTH AMERICA: INTRAVENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 82 NORTH AMERICA: CENTRAL VENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 83 NORTH AMERICA: UROLOGICAL CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 84 NORTH AMERICA: URINARY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 85 NORTH AMERICA: DIALYSIS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 86 NORTH AMERICA: SPECIALTY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 87 NORTH AMERICA: CATHETERS MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 88 NORTH AMERICA: CATHETERS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 89 US: KEY MACROINDICATORS

- TABLE 90 US: CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 91 US: CARDIOVASCULAR CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 92 US: INTRAVENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 93 US: CENTRAL VENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 94 US: UROLOGICAL CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 95 US: URINARY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 96 US: DIALYSIS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 97 US: SPECIALTY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 98 US: CATHETERS MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 99 US: CATHETERS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 100 CANADA: KEY MACROINDICATORS

- TABLE 101 CANADA: CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 102 CANADA: CARDIOVASCULAR CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 103 CANADA: INTRAVENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 104 CANADA: CENTRAL VENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 105 CANADA: UROLOGICAL CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 106 CANADA: URINARY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 107 CANADA: DIALYSIS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 108 CANADA: SPECIALTY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 109 CANADA: CATHETERS MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 110 CANADA: CATHETERS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 111 EUROPE: CATHETERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 112 EUROPE: CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 113 EUROPE: CARDIOVASCULAR CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 114 EUROPE: INTRAVENOUS CATHETERS MARKET, BY TYPE, (2023-2030) (THOUSAND UNITS)

- TABLE 115 EUROPE: INTRAVENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 116 EUROPE: CENTRAL VENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 117 EUROPE: UROLOGICAL CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 118 EUROPE: URINARY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 119 EUROPE: DIALYSIS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 120 EUROPE: SPECIALTY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 121 EUROPE: CATHETERS MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 122 EUROPE: CATHETERS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 123 GERMANY: KEY MACROINDICATORS

- TABLE 124 GERMANY: CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 125 GERMANY: CARDIOVASCULAR CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 126 GERMANY: INTRAVENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 127 GERMANY: CENTRAL VENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 128 GERMANY: UROLOGICAL CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 129 GERMANY: URINARY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 130 GERMANY: DIALYSIS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 131 GERMANY: SPECIALTY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 132 GERMANY: CATHETERS MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 133 GERMANY: CATHETERS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 134 UK: KEY MACROINDICATORS

- TABLE 135 UK: CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 136 UK: CARDIOVASCULAR CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 137 UK: INTRAVENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 138 UK: CENTRAL VENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 139 UK: UROLOGICAL CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 140 UK: URINARY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 141 UK: DIALYSIS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 142 UK: SPECIALTY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 143 UK: CATHETERS MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 144 UK: CATHETERS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 145 FRANCE: KEY MACROINDICATORS

- TABLE 146 FRANCE: CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 147 FRANCE: CARDIOVASCULAR CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 148 FRANCE: INTRAVENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 149 FRANCE: CENTRAL VENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 150 FRANCE: UROLOGICAL CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 151 FRANCE: URINARY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 152 FRANCE: DIALYSIS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 153 FRANCE: SPECIALTY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 154 FRANCE: CATHETERS MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 155 FRANCE: CATHETERS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 156 SPAIN: KEY MACROINDICATORS

- TABLE 157 SPAIN: CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 158 SPAIN: CARDIOVASCULAR CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 159 SPAIN: INTRAVENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 160 SPAIN: CENTRAL VENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 161 SPAIN: UROLOGICAL CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 162 SPAIN: URINARY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 163 SPAIN: DIALYSIS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 164 SPAIN: SPECIALTY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 165 SPAIN: CATHETERS MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 166 SPAIN: CATHETERS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 167 ITALY: KEY MACROINDICATORS

- TABLE 168 ITALY: CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 169 ITALY: CARDIOVASCULAR CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 170 ITALY: INTRAVENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 171 ITALY: CENTRAL VENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 172 ITALY: UROLOGICAL CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 173 ITALY: URINARY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 174 ITALY: DIALYSIS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 175 ITALY: SPECIALTY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 176 ITALY: CATHETERS MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 177 ITALY: CATHETERS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 178 REST OF EUROPE: CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 179 REST OF EUROPE: CARDIOVASCULAR CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 180 REST OF EUROPE: INTRAVENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 181 REST OF EUROPE: CENTRAL VENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 182 REST OF EUROPE: UROLOGICAL CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 183 REST OF EUROPE: URINARY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 184 REST OF EUROPE: DIALYSIS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 185 REST OF EUROPE: SPECIALTY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 186 REST OF EUROPE: CATHETERS MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 187 REST OF EUROPE: CATHETERS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 188 ASIA PACIFIC: CATHETERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 189 ASIA PACIFIC: CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 190 ASIA PACIFIC: CARDIOVASCULAR CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 191 ASIA PACIFIC: INTRAVENOUS CATHETERS MARKET, BY TYPE, (2023-2030) (THOUSAND UNITS)

- TABLE 192 ASIA PACIFIC: INTRAVENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 193 ASIA PACIFIC: CENTRAL VENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 194 ASIA PACIFIC: UROLOGICAL CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 195 ASIA PACIFIC: URINARY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 196 ASIA PACIFIC: DIALYSIS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 197 ASIA PACIFIC: SPECIALTY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 198 ASIA PACIFIC: CATHETERS MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 199 ASIA PACIFIC: CATHETERS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 200 JAPAN: KEY MACROINDICATORS

- TABLE 201 JAPAN: CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 202 JAPAN: CARDIOVASCULAR CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 203 JAPAN: INTRAVENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 204 JAPAN: CENTRAL VENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 205 JAPAN: UROLOGICAL CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 206 JAPAN: URINARY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 207 JAPAN: DIALYSIS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 208 JAPAN: SPECIALTY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 209 JAPAN: CATHETERS MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 210 JAPAN: CATHETERS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 211 CHINA: KEY MACROINDICATORS

- TABLE 212 CHINA: CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 213 CHINA: CARDIOVASCULAR CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 214 CHINA: INTRAVENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 215 CHINA: CENTRAL VENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 216 CHINA: UROLOGICAL CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 217 CHINA: URINARY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 218 CHINA: DIALYSIS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 219 CHINA: SPECIALTY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 220 CHINA: CATHETERS MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 221 CHINA: CATHETERS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 222 INDIA: KEY MACROINDICATORS

- TABLE 223 INDIA: CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 224 INDIA: CARDIOVASCULAR CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 225 INDIA: INTRAVENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 226 INDIA: CENTRAL VENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 227 INDIA: UROLOGICAL CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 228 INDIA: URINARY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 229 INDIA: DIALYSIS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 230 INDIA: SPECIALTY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 231 INDIA: CATHETERS MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 232 INDIA: CATHETERS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 233 AUSTRALIA: KEY MACROINDICATORS

- TABLE 234 AUSTRALIA: CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 235 AUSTRALIA: CARDIOVASCULAR CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 236 AUSTRALIA: INTRAVENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 237 AUSTRALIA: CENTRAL VENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 238 AUSTRALIA: UROLOGICAL CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 239 AUSTRALIA: URINARY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 240 AUSTRALIA: DIALYSIS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 241 AUSTRALIA: SPECIALTY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 242 AUSTRALIA: CATHETERS MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 243 AUSTRALIA: CATHETERS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 244 SOUTH KOREA: KEY MACROINDICATORS

- TABLE 245 SOUTH KOREA: CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 246 SOUTH KOREA: CARDIOVASCULAR CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 247 SOUTH KOREA: INTRAVENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 248 SOUTH KOREA: CENTRAL VENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 249 SOUTH KOREA: UROLOGICAL CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 250 SOUTH KOREA: URINARY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 251 SOUTH KOREA: DIALYSIS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 252 SOUTH KOREA: SPECIALTY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 253 SOUTH KOREA: CATHETERS MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 254 SOUTH KOREA: CATHETERS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 255 REST OF ASIA PACIFIC: CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 256 REST OF ASIA PACIFIC: CARDIOVASCULAR CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 257 REST OF ASIA PACIFIC: INTRAVENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 258 REST OF ASIA PACIFIC: CENTRAL VENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 259 REST OF ASIA PACIFIC: UROLOGICAL CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 260 REST OF ASIA PACIFIC: URINARY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 261 REST OF ASIA PACIFIC: DIALYSIS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 262 REST OF ASIA PACIFIC: SPECIALTY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 263 REST OF ASIA PACIFIC: CATHETERS MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 264 REST OF ASIA PACIFIC: CATHETERS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 265 LATIN AMERICA: CATHETERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 266 LATIN AMERICA: CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 267 LATIN AMERICA: CARDIOVASCULAR CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 268 LATIN AMERICA: INTRAVENOUS CATHETERS MARKET, BY TYPE, (2023-2030) (THOUSAND UNITS)

- TABLE 269 LATIN AMERICA: INTRAVENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 270 LATIN AMERICA: CENTRAL VENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 271 LATIN AMERICA: UROLOGICAL CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 272 LATIN AMERICA: URINARY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 273 LATIN AMERICA: DIALYSIS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 274 LATIN AMERICA: SPECIALTY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 275 LATIN AMERICA: CATHETERS MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 276 LATIN AMERICA: CATHETERS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 277 BRAZIL: KEY MACROINDICATORS

- TABLE 278 BRAZIL: CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 279 BRAZIL: CARDIOVASCULAR CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 280 BRAZIL: INTRAVENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 281 BRAZIL: CENTRAL VENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 282 BRAZIL: UROLOGICAL CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 283 BRAZIL: URINARY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 284 BRAZIL: DIALYSIS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 285 BRAZIL: SPECIALTY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 286 BRAZIL: CATHETERS MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 287 BRAZIL: CATHETERS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 288 MEXICO: KEY MACROINDICATORS

- TABLE 289 MEXICO: CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 290 MEXICO: CARDIOVASCULAR CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 291 MEXICO: INTRAVENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 292 MEXICO: CENTRAL VENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 293 MEXICO: UROLOGICAL CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 294 MEXICO: URINARY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 295 MEXICO: DIALYSIS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 296 MEXICO: SPECIALTY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 297 MEXICO: CATHETERS MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 298 MEXICO: CATHETERS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 299 REST OF LATIN AMERICA: CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 300 REST OF LATIN AMERICA: CARDIOVASCULAR CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 301 REST OF LATIN AMERICA: INTRAVENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 302 REST OF LATIN AMERICA: CENTRAL VENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 303 REST OF LATIN AMERICA: UROLOGICAL CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 304 REST OF LATIN AMERICA: URINARY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 305 REST OF LATIN AMERICA: DIALYSIS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 306 REST OF LATIN AMERICA: SPECIALTY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 307 REST OF LATIN AMERICA: CATHETERS MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 308 REST OF LATIN AMERICA: CATHETERS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 309 MIDDLE EAST & AFRICA: CATHETERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 310 MIDDLE EAST & AFRICA: CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 311 MIDDLE EAST & AFRICA: CARDIOVASCULAR CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 312 MIDDLE EAST & AFRICA: INTRAVENOUS CATHETERS MARKET, BY TYPE, (2023-2030) (THOUSAND UNITS)

- TABLE 313 MIDDLE EAST & AFRICA: INTRAVENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 314 MIDDLE EAST & AFRICA: CENTRAL VENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 315 MIDDLE EAST & AFRICA: UROLOGICAL CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 316 MIDDLE EAST & AFRICA: URINARY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 317 MIDDLE EAST & AFRICA: DIALYSIS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 318 MIDDLE EAST & AFRICA: SPECIALTY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 319 MIDDLE EAST & AFRICA: CATHETERS MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 320 MIDDLE EAST & AFRICA: CATHETERS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 321 GCC COUNTRIES: CATHETERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 322 GCC COUNTRIES: CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 323 GCC COUNTRIES: CARDIOVASCULAR CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 324 GCC COUNTRIES: INTRAVENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 325 GCC COUNTRIES: CENTRAL VENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 326 GCC COUNTRIES: UROLOGICAL CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 327 GCC COUNTRIES: URINARY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 328 GCC COUNTRIES: DIALYSIS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 329 GCC COUNTRIES: SPECIALTY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 330 GCC COUNTRIES: CATHETERS MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 331 GCC COUNTRIES: CATHETERS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 332 KINGDOM OF SAUDI ARABIA (KSA): CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 333 KINGDOM OF SAUDI ARABIA (KSA): CARDIOVASCULAR CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 334 KINGDOM OF SAUDI ARABIA (KSA): INTRAVENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 335 KINGDOM OF SAUDI ARABIA (KSA): CENTRAL VENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 336 KINGDOM OF SAUDI ARABIA (KSA): UROLOGICAL CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 337 KINGDOM OF SAUDI ARABIA (KSA): URINARY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 338 KINGDOM OF SAUDI ARABIA (KSA): DIALYSIS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 339 KINGDOM OF SAUDI ARABIA (KSA): SPECIALTY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 340 KINGDOM OF SAUDI ARABIA (KSA): CATHETERS MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 341 KINGDOM OF SAUDI ARABIA (KSA): CATHETERS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 342 UNITED ARAB EMIRATES (UAE): CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 343 UNITED ARAB EMIRATES (UAE): CARDIOVASCULAR CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 344 UNITED ARAB EMIRATES (UAE): INTRAVENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 345 UNITED ARAB EMIRATES (UAE): CENTRAL VENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 346 UNITED ARAB EMIRATES (UAE): UROLOGICAL CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 347 UNITED ARAB EMIRATES (UAE): URINARY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 348 UNITED ARAB EMIRATES (UAE): DIALYSIS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 349 UNITED ARAB EMIRATES (UAE): SPECIALTY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 350 UNITED ARAB EMIRATES (UAE): CATHETERS MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 351 UNITED ARAB EMIRATES (UAE): CATHETERS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 352 OTHER GCC COUNTRIES: CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 353 OTHER GCC COUNTRIES: CARDIOVASCULAR CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 354 OTHER GCC COUNTRIES: INTRAVENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 355 OTHER GCC COUNTRIES: CENTRAL VENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 356 OTHER GCC COUNTRIES: UROLOGICAL CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 357 OTHER GCC COUNTRIES: URINARY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 358 OTHER GCC COUNTRIES: DIALYSIS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 359 OTHER GCC COUNTRIES: SPECIALTY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 360 OTHER GCC COUNTRIES: CATHETERS MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 361 OTHER GCC COUNTRIES: CATHETERS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 362 REST OF MIDDLE EAST & AFRICA: CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 363 REST OF MIDDLE EAST & AFRICA: CARDIOVASCULAR CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 364 REST OF MIDDLE EAST & AFRICA: INTRAVENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 365 REST OF MIDDLE EAST & AFRICA: CENTRAL VENOUS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 366 REST OF MIDDLE EAST & AFRICA: UROLOGICAL CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 367 REST OF MIDDLE EAST & AFRICA: URINARY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 368 REST OF MIDDLE EAST & AFRICA: DIALYSIS CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 369 REST OF MIDDLE EAST & AFRICA: SPECIALTY CATHETERS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 370 REST OF MIDDLE EAST & AFRICA: CATHETERS MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 371 REST OF MIDDLE EAST & AFRICA: CATHETERS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 372 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN CATHETERS MARKET

- TABLE 373 CATHETERS MARKET: DEGREE OF COMPETITION

- TABLE 374 CATHETERS MARKET: REGION FOOTPRINT

- TABLE 375 CATHETERS MARKET: TYPE FOOTPRINT

- TABLE 376 CATHETERS MARKET: INDICATION FOOTPRINT

- TABLE 377 LIST OF KEY STARTUPS/SMES

- TABLE 378 COMPETITIVE BENCHMARKING OF KEY EMERGING PLAYERS/STARTUPS

- TABLE 379 CATHETERS MARKET: PRODUCT APPROVALS/LAUNCHES, JANUARY 2022-JULY 2025

- TABLE 380 CATHETERS MARKET: DEALS, JANUARY 2022-JULY 2025

- TABLE 381 CATHETERS MARKET: EXPANSIONS, JANUARY 2022-JULY 2025

- TABLE 382 CATHETERS MARKET: OTHER DEVELOPMENTS, JANUARY 2022-JULY 2025

- TABLE 383 BOSTON SCIENTIFIC CORPORATION: BUSINESS OVERVIEW

- TABLE 384 BOSTON SCIENTIFIC CORPORATION: PRODUCTS OFFERED

- TABLE 385 BOSTON SCIENTIFIC CORPORATION: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-JULY 2025

- TABLE 386 BOSTON SCIENTIFIC CORPORATION: DEALS, JANUARY 2022-JULY 2025

- TABLE 387 MEDTRONIC PLC: BUSINESS OVERVIEW

- TABLE 388 MEDTRONIC PLC: PRODUCTS OFFERED

- TABLE 389 MEDTRONIC PLC: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-JULY 2025

- TABLE 390 MEDTRONIC PLC: DEALS, JANUARY 2022-JULY 2025

- TABLE 391 B. BRAUN SE: BUSINESS OVERVIEW

- TABLE 392 B. BRAUN SE: PRODUCTS OFFERED

- TABLE 393 B. BRAUN SE: DEALS, JANUARY 2022-JULY 2025

- TABLE 394 B. BRAUN SE: EXPANSIONS, JANUARY 2022-JULY 2025

- TABLE 395 BECTON, DICKINSON AND COMPANY: BUSINESS OVERVIEW

- TABLE 396 BECTON, DICKINSON AND COMPANY: PRODUCTS OFFERED

- TABLE 397 BECTON, DICKINSON AND COMPANY: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-JULY 2025

- TABLE 398 BECTON, DICKINSON AND COMPANY: DEALS, JANUARY 2022-JULY 2025

- TABLE 399 BECTON, DICKINSON AND COMPANY: EXPANSIONS, JANUARY 2022-JULY 2025

- TABLE 400 STRYKER CORPORATION: BUSINESS OVERVIEW

- TABLE 401 STRYKER CORPORATION: PRODUCTS OFFERED

- TABLE 402 STRYKER CORPORATION: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-JULY 2025

- TABLE 403 STRYKER CORPORATION: DEALS, JANUARY 2022-JULY 2025

- TABLE 404 ABBOTT LABORATORIES: BUSINESS OVERVIEW

- TABLE 405 ABBOTT LABORATORIES: PRODUCTS OFFERED

- TABLE 406 ABBOTT LABORATORIES: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-JULY 2025

- TABLE 407 ABBOTT LABORATORIES: DEALS, JANUARY 2022-JULY 2025

- TABLE 408 ABBOTT LABORATORIES: OTHER DEVELOPMENTS, JANUARY 2022-JULY 2025

- TABLE 409 TERUMO CORPORATION: BUSINESS OVERVIEW

- TABLE 410 TERUMO CORPORATION: PRODUCTS OFFERED

- TABLE 411 TERUMO CORPORATION: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-JULY 2025

- TABLE 412 TERUMO CORPORATION: DEALS, JANUARY 2022-JULY 2025

- TABLE 413 TERUMO CORPORATION: EXPANSIONS, JANUARY 2022-JULY 2025

- TABLE 414 COLOPLAST A/S: BUSINESS OVERVIEW

- TABLE 415 COLOPLAST A/S: PRODUCTS OFFERED

- TABLE 416 COLOPLAST A/S: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-JULY 2025

- TABLE 417 COLOPLAST A/S: EXPANSIONS, JANUARY 2022-JULY 2025

- TABLE 418 CONVATEC GROUP PLC: BUSINESS OVERVIEW

- TABLE 419 CONVATEC GROUP PLC: PRODUCTS OFFERED

- TABLE 420 CONVATEC GROUP PLC: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-JULY 2025

- TABLE 421 MERIT MEDICAL SYSTEMS, INC.: BUSINESS OVERVIEW

- TABLE 422 MERIT MEDICAL SYSTEMS, INC.: PRODUCTS OFFERED

- TABLE 423 MERIT MEDICAL SYSTEMS, INC.: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-JULY 2025

- TABLE 424 MERIT MEDICAL SYSTEMS, INC.: DEALS, JANUARY 2022-JULY 2025

- TABLE 425 JOHNSON & JOHNSON: BUSINESS OVERVIEW

- TABLE 426 JOHNSON & JOHNSON: PRODUCTS OFFERED

- TABLE 427 JOHNSON & JOHNSON: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-JULY 2025

- TABLE 428 JOHNSON & JOHNSON: DEALS, JANUARY 2022-JULY 2025

- TABLE 429 COOK: BUSINESS OVERVIEW

- TABLE 430 COOK: PRODUCTS OFFERED

- TABLE 431 COOK: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-JULY 2025

- TABLE 432 COOK: DEALS, JANUARY 2022-JULY 2025

- TABLE 433 EDWARDS LIFESCIENCES CORPORATION: BUSINESS OVERVIEW

- TABLE 434 EDWARDS LIFESCIENCES CORPORATION: PRODUCTS OFFERED

- TABLE 435 NIPRO CORPORATION: BUSINESS OVERVIEW

- TABLE 436 NIPRO CORPORATION: PRODUCTS OFFERED

- TABLE 437 NIPRO CORPORATION: EXPANSIONS, JANUARY 2022-JULY 2025

- TABLE 438 TELEFLEX INCORPORATED: BUSINESS OVERVIEW

- TABLE 439 TELEFLEX INCORPORATED: PRODUCTS OFFERED

- TABLE 440 TELEFLEX INCORPORATED: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-JULY 2025

- TABLE 441 TELEFLEX INCORPORATED: DEALS, JANUARY 2022-JULY 2025

- TABLE 442 CARDINAL HEALTH, INC.: BUSINESS OVERVIEW

- TABLE 443 CARDINAL HEALTH, INC.: PRODUCTS OFFERED

- TABLE 444 CARDINAL HEALTH, INC.: EXPANSIONS, JANUARY 2022-JULY 2025

- TABLE 445 HOLLISTER INCORPORATED: BUSINESS OVERVIEW

- TABLE 446 HOLLISTER INCORPORATED: PRODUCTS OFFERED

- TABLE 447 HOLLISTER INCORPORATED: EXPANSIONS, JANUARY 2022-JULY 2025

- TABLE 448 INTEGRA LIFESCIENCES HOLDINGS CORPORATION: BUSINESS OVERVIEW

- TABLE 449 INTEGRA LIFESCIENCES HOLDINGS CORPORATION: PRODUCTS OFFERED

- TABLE 450 KONINKLIJKE PHILIPS N.V.: BUSINESS OVERVIEW

- TABLE 451 KONINKLIJKE PHILIPS N.V.: PRODUCTS OFFERED

- TABLE 452 KONINKLIJKE PHILIPS N.V.: EXPANSIONS, JANUARY 2022-JULY 2025

- TABLE 453 MICROPORT SCIENTIFIC CORPORATION: BUSINESS OVERVIEW

- TABLE 454 MICROPORT SCIENTIFIC CORPORATION: PRODUCTS OFFERED

- TABLE 455 MICROPORT SCIENTIFIC CORPORATION: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-JULY 2025

List of Figures

- FIGURE 1 CATHETERS MARKET: MARKETS & REGIONS COVERED

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 PRIMARY SOURCES

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY END USER, DESIGNATION, AND REGION

- FIGURE 7 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 8 REVENUE SHARE ANALYSIS ILLUSTRATION: MEDTRONIC PLC

- FIGURE 9 SUPPLY-SIDE ANALYSIS: CATHETERS MARKET (2024)

- FIGURE 10 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2023-2030)

- FIGURE 11 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 12 DATA TRIANGULATION METHODOLOGY

- FIGURE 13 CATHETERS MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 CARDIOVASCULAR CATHETERS MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 15 INTRAVENOUS CATHETERS MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 16 CENTRAL VENOUS CATHETERS MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 17 UROLOGICAL CATHETERS MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 18 URINARY CATHETERS MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 19 DIALYSIS CATHETERS MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 20 SPECIALTY CATHETERS MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 21 CATHETERS MARKET, BY INDICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 22 CATHETERS MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 23 GEOGRAPHIC SNAPSHOT: CATHETERS MARKET

- FIGURE 24 INCREASING PREVALENCE OF CHRONIC DISEASES DRIVES GROWTH OF CATHETERS MARKET

- FIGURE 25 CARDIOVASCULAR CATHETERS ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICAN MARKET IN 2024

- FIGURE 26 ASIA PACIFIC TO GROW FASTEST IN MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 27 INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 28 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 29 CATHETERS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 30 CATHETERS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 31 PATENT PUBLICATION TRENDS, JURISDICTION, AND TOP APPLICANT ANALYSIS (JANUARY 2015-DECEMBER 2024)

- FIGURE 32 TOP APPLICANT COUNTRIES/REGIONS FOR CATHETER PATENTS (JANUARY 2015-DECEMBER 2024)

- FIGURE 33 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS, BY TYPE

- FIGURE 34 KEY BUYING CRITERIA FOR CATHETERS

- FIGURE 35 CATHETERS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 36 CATHETERS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 37 CATHETERS MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- FIGURE 38 CATHETERS MARKET: FUNDING AND NUMBER OF DEALS, 2020-2024

- FIGURE 39 CATHETERS MARKET: REGIONAL GROWTH OPPORTUNITIES

- FIGURE 40 NORTH AMERICA: CATHETERS MARKET SNAPSHOT

- FIGURE 41 REVENUE ANALYSIS OF KEY PLAYERS IN CATHETERS MARKET (2022-2024)

- FIGURE 42 CATHETERS MARKET SHARE ANALYSIS OF KEY PLAYERS (2024)

- FIGURE 43 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- FIGURE 44 CATHETERS MARKET: COMPANY FOOTPRINT

- FIGURE 45 COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 46 BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 47 R&D EXPENDITURE OF KEY PLAYERS IN CATHETERS MARKET, 2022-2024

- FIGURE 48 EV/EBITDA OF KEY VENDORS

- FIGURE 49 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 50 BOSTON SCIENTIFIC CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 51 MEDTRONIC PLC: COMPANY SNAPSHOT (2024)

- FIGURE 52 B. BRAUN SE: COMPANY SNAPSHOT (2024)

- FIGURE 53 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2024)

- FIGURE 54 STRYKER CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 55 ABBOTT LABORATORIES: COMPANY SNAPSHOT (2024)

- FIGURE 56 TERUMO CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 57 COLOPLAST A/S: COMPANY SNAPSHOT (2024)

- FIGURE 58 CONVATEC GROUP PLC: COMPANY SNAPSHOT (2024)

- FIGURE 59 MERIT MEDICAL SYSTEMS, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 60 JOHNSON & JOHNSON: COMPANY SNAPSHOT (2024)

- FIGURE 61 EDWARDS LIFESCIENCES CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 62 NIPRO CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 63 TELEFLEX INCORPORATED: COMPANY SNAPSHOT (2024)

- FIGURE 64 CARDINAL HEALTH, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 65 INTEGRA LIFESCIENCES HOLDINGS CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 66 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2024)

- FIGURE 67 MICROPORT SCIENTIFIC CORPORATION: COMPANY SNAPSHOT (2024)