|

市場調查報告書

商品編碼

1808967

全球石油狀況監測市場(按產品、最終用途、垂直產業和地區分類)- 預測至 2030 年Oil Condition Monitoring Market by Offering (Oil Analyzers, Oil Sensors, Spectrometers, Viscometers), Oil Sampling Type (On-Site, Off-Site), End Use (Turbines, Compressors, Engines, Hydraulic Systems, Gearboxes, Transformers) - Global Forecast to 2030 |

||||||

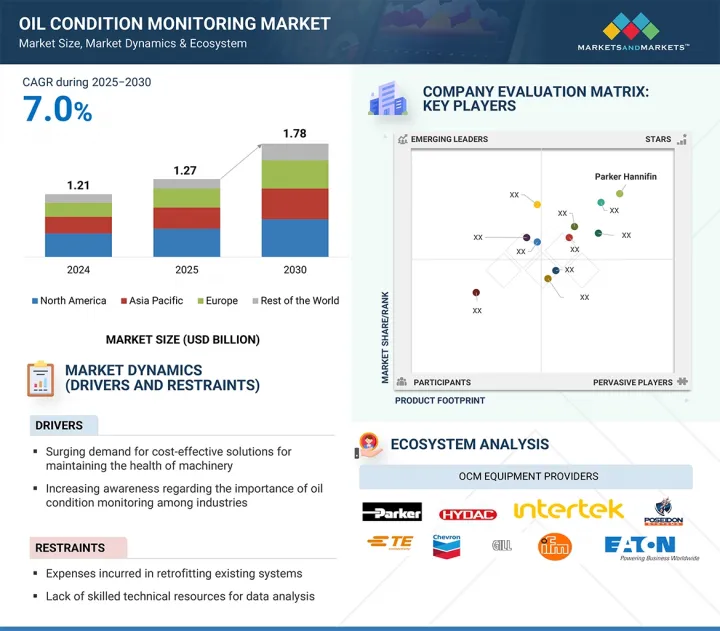

全球石油狀況監測市場預計將從 2025 年的 12.7 億美元成長到 2030 年的 17.8 億美元,複合年成長率為 7.0%。

汽車和運輸行業仍然是關鍵驅動力,引擎、渦輪機、壓縮機和液壓系統中擴大採用 OCM 解決方案,以實現及時維護、減少停機時間並最佳化設備性能。除交通運輸外,石油天然氣、工業製造和發電行業的應用也在不斷成長,在這些行業中,持續監測油品質量對於提高營運效率、節省成本和延長設備壽命至關重要。

| 調查範圍 | |

|---|---|

| 調查年份 | 2021-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 對價單位 | 金額(十億美元) |

| 按細分市場 | 按產品、最終用途、行業和地區 |

| 目標區域 | 北美、歐洲、亞太地區及其他地區 |

油液狀態監測解決方案(包括硬體、軟體和服務)正被廣泛部署,用於即時診斷、遠端監控和數據驅動的維護決策。感測器技術、分析工具和預測軟體的進步正在提高測量精度,並與數位維護系統無縫整合,為維護團隊提供切實可行的洞察。隨著各行各業越來越重視自動化、可靠性和成本效益,預計各應用領域和產業對強大的油液狀態監測解決方案的需求將穩定成長。

在預測期內,油液狀態監測市場的軟體部分預計將以最高的複合年成長率成長,這得益於各行各業日益採用數據驅動的維護和預測分析技術。這些解決方案能夠即時監控、診斷和報告關鍵油液參數,從而及時採取維護措施,減少停機時間並延長設備使用壽命。與物聯網感測器、雲端平台和基於人工智慧的分析技術的整合,可提高測量精度、支援遠端監控並最佳化維護計劃。預測軟體的持續進步、對基於狀態的維護的日益重視以及數位化程度的不斷提高,正在推動其應用。隨著各行各業優先考慮可靠性、效率和成本最佳化,軟體部分已成為油液狀態監測市場生態系統的關鍵成長動力。

預計能源和電力產業在預測期內將實現顯著的複合年成長率,這得益於對營運可靠性和效率的日益關注。該領域的油液狀態監測解決方案使營運商能夠預測設備問題、最佳化維護計劃、提升整體系統性能並確保不間斷發電。與數位監控平台和物聯網感測器的整合可提供即時洞察,支援主動決策,並減少計劃外停機時間。電力基礎設施現代化、智慧電網部署和可再生能源整合的投資不斷成長,進一步加速了油液狀態監測的普及。隨著各行各業持續重視彈性、效率和成本控制,能源和電力產業已成為更廣泛的油液狀態監測市場中的關鍵成長動力。

由於北美地區擁有先進的工業基礎設施、預測性維護技術的高度採用以及主要市場參與企業的強大影響力,預計北美將在預測期內主導油液狀態監測 (OCM) 市場。石油和天然氣、汽車、航太和製造業等行業擴大利用 OCM 解決方案來最佳化資產性能、減少停機時間並提高營運安全性。該地區致力於將物聯網、人工智慧和雲端基礎的分析等先進技術融入維護營運,這進一步推動了市場成長。此外,有關設備安全和環境合規的嚴格法規正在推動工業界採用主動監測系統。持續的研發投入,加上工業流程的快速數位轉型,使北美成為 OCM 解決方案的關鍵市場。

本報告研究了全球石油狀況監測市場,按產品、最終用途、行業垂直和地區對其進行細分,並介紹了參與市場的公司。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章重要考察

第5章市場概述

- 介紹

- 市場動態

- 價值鏈分析

- 定價分析

- 波特五力分析

- 影響客戶業務的趨勢和中斷

- 生態系分析

- 案例研究分析

- 技術分析

- 貿易分析

- 專利分析

- 監管狀況

- 人工智慧對石油狀況監測市場的影響

- 美國2025年關稅

第6章 油液狀態測量參數

- 介紹

- 溫度

- 壓力

- 密度

- 黏度

- 電介質

- TAN/TBN

- 燃料稀釋

- 水稀釋

- 煤煙

- 磨損顆粒

第 7 章 油液狀態監測中使用的主要感測器

- 介紹

- 油品品質感測器

- 磨損碎片感測器/金屬顆粒感測器

- 黏度/密度感測器

- 油中含水感測器

第 8 章:油液狀態監測的關鍵技術

- 介紹

- 鐵譜學

- 油液狀態監測中的線上聲學黏度測量

- 感應耦合電漿發射光譜學(ICP-OES)

- 傅立葉轉換紅外線光譜(FTIR)

- 絕緣強度測試

- 電位滴定法

第 9 章 油液狀態監測中所使用的採樣類型

- 介紹

- 現場

- 異地

10. 油品狀況監測市場(依產品分類)

- 介紹

- 硬體

- 軟體

- 服務

11. 油液狀態監測市場(依最終用途)

- 介紹

- 渦輪

- 壓縮機

- 引擎

- 液壓系統

- 其他

第 12 章 油液狀態監測市場(依垂直產業分類)

- 介紹

- 汽車和運輸

- 石油和天然氣

- 能源與電力

- 金屬和採礦

- 食品/飲料

- 製藥

- 化學品

- 其他

第13章 油液狀態監測市場(按地區)

- 介紹

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他

- 其他地區

- 南美洲

- 中東

- 非洲

第14章競爭格局

- 概述

- 主要參與企業的策略/優勢

- 2024年市場佔有率分析

- 2020-2024年主要企業收益分析

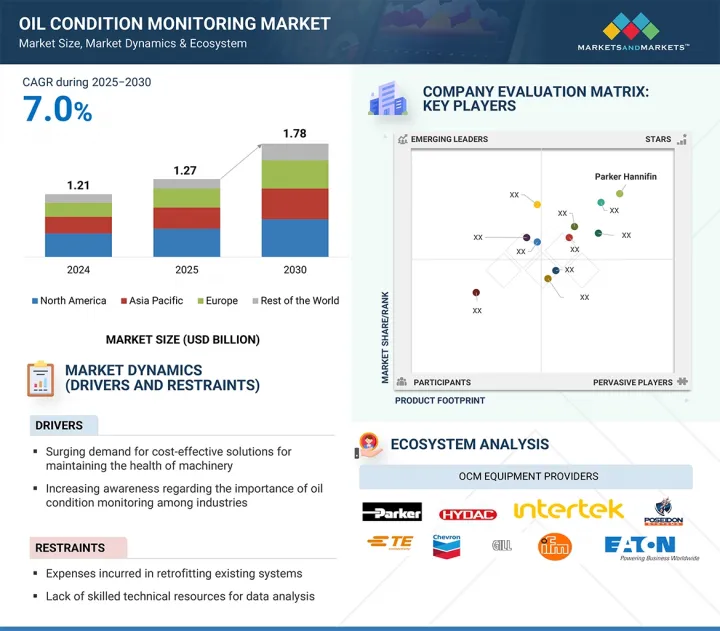

- 公司估值矩陣:2024 年關鍵參與企業

- 公司估值矩陣:Start-Ups/中小企業,2024 年

- 競爭場景

第15章 公司簡介

- 主要參與企業

- PARKER HANNIFIN CORP

- SCHAEFFLER AG

- IFM ELECTRONIC GMBH

- TE CONNECTIVITY

- EATON

- SHELL

- GE VERNOVA

- CHEVRON CORPORATION

- INTERTEK GROUP PLC

- BUREAU VERITAS

- TOTALENERGIES

- 其他公司

- EVERLLENCE

- UNIMARINE

- HYDAC INTERNATIONAL GMBH

- TAN DELTA SYSTEMS PLC

- VERITAS PETROLEUM SERVICES

- SPECTRO ANALYTICAL INSTRUMENTS GMBH

- AVENISENSE

- MICROMEN TECHNOLOGIES INC.

- GILL SENSORS & CONTROLS LIMITED

- POSEIDON SYSTEMS, LLC

- CM TECHNOLOGIES GMBH

- ERALYTICS

- DES-CASE

- BUHLER TECHNOLOGIES GMBH

- MINIMAC SYSTEMS PVT LTD

第16章 附錄

With a CAGR of 7.0%, the global oil condition monitoring market is projected to grow from USD 1.27 billion in 2025 to USD 1.78 billion by 2030. The automotive and transportation sector remains a key growth driver, with OCM solutions increasingly adopted in engines, turbines, compressors, and hydraulic systems to enable timely maintenance, reduce downtime, and optimize equipment performance. Beyond mobility, adoption is rising across the oil and gas, industrial manufacturing, and power generation sectors, where continuous monitoring of oil quality is critical for operational efficiency, cost reduction, and equipment longevity.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Offering, End Use, Industry, and Region |

| Regions covered | North America, Europe, APAC, RoW |

Oil condition monitoring solutions, including hardware, software, and services, are being deployed for real-time diagnostics, remote monitoring, and data-driven maintenance decisions. Advances in sensor technology, analytical tools, and predictive software are enhancing measurement accuracy, integrating seamlessly with digital maintenance systems, and providing actionable insights for maintenance teams. As industries increasingly prioritize automation, reliability, and cost-efficient operations, the demand for robust oil condition monitoring solutions is expected to grow steadily across diverse applications and industries.

" Rise of Predictive Analytics to Drive Growth of Software in the Oil Condition Monitoring Market."

The software segment in the oil condition monitoring market is set to grow at the highest CAGR during the forecast period, driven by the rising adoption of data-driven maintenance and predictive analytics across industries. These solutions enable real-time monitoring, diagnostics, and reporting of key oil parameters, allowing timely maintenance actions that reduce downtime and extend equipment life. Integration with IoT-enabled sensors, cloud platforms, and AI-based analytics enhances measurement accuracy, supports remote monitoring, and optimizes maintenance schedules. Continuous advancements in predictive software, growing focus on condition-based maintenance, and increasing digitalization are fueling adoption. As industries prioritize reliability, efficiency, and cost optimization, the software segment is emerging as a key growth driver within the oil condition monitoring market ecosystem.

" Rising Focus on Reliability and Efficiency to Propel Energy & Power Industry Segment Growth."

The energy & power industry segment is expected to grow at a significant CAGR during the forecast period, driven by the increasing focus on operational reliability and efficiency. Oil condition monitoring solutions in this segment enable operators to anticipate equipment issues, optimize maintenance schedules, and improve overall system performance, ensuring uninterrupted power generation. Integration with digital monitoring platforms and IoT-enabled sensors provides real-time insights, supports proactive decision-making, and reduces unplanned downtime. Growing investments in power infrastructure modernization, smart grid deployment, and renewable energy integration are further accelerating adoption. As industries continue to prioritize resilience, efficiency, and cost management, the energy & power segment is emerging as a key growth driver within the broader oil condition monitoring market.

" North America Leads the Oil Condition Monitoring Market with Strong Technological Adoption"

North America is expected to dominate the oil condition monitoring (OCM) market during the forecast period, supported by the region's advanced industrial infrastructure, high adoption of predictive maintenance practices, and strong presence of key market players. Industries such as oil and gas, automotive, aerospace, and manufacturing are increasingly leveraging OCM solutions to optimize asset performance, reduce downtime, and enhance operational safety. The region's strong focus on integrating advanced technologies such as IoT, AI, and cloud-based analytics into maintenance operations further drives market growth. Additionally, stringent regulations on equipment safety and environmental compliance encourage industries to adopt proactive monitoring systems. Continuous investments in R&D, coupled with the rapid digital transformation of industrial processes, position North America as a leading market for OCM solutions.

Breakdown of primaries

A variety of executives from key organizations operating in the oil condition monitoring market, including CEOs, marketing directors, and innovation and technology directors, were interviewed in depth.

- By Company Type: Tier 1 - 45%, Tier 2 - 35%, and Tier 3 - 20%

- By Designation: Directors - 45%, C-level - 30%, and Others - 25%

- By Region: Asia Pacific - 45%, North America - 25%, Europe - 20%, and RoW - 10%

Note: Other designations include sales and product managers. The three tiers of the companies are defined based on their total revenue in 2024: Tier 1 - revenue greater than or equal to USD 1 billion; Tier 2 - revenue between USD 500 million and USD 1 billion; and Tier 3 revenue less than or equal to USD 500 million.

Major players profiled in this report are as follows: Parker Hannifin Corp (US), Eaton (Ireland), GE Vernova (US), ifm electronic gmbh (Germany), TE Connectivity (Ireland), Schaeffler AG (Germany), Shell (UK), TotalEnergies (France), Chevron Corporation (US), Intertek Group plc (UK), Bureau Veritas (France), Everllence (Germany), Unimarine (Singapore), HYDAC International GmbH (Germany), Tan Delta Systems PLC (UK), SPECTRO Analytical Instruments GmbH (Germany), Avenisense (France), Micromen Technologies Inc. (Canada), Gill Sensors & Controls Limited (UK), Poseidon Systems, LLC (US), CM Technologies GmbH (Germany), Des-Case (US), Minimac Systems Pvt Ltd (India), eralytics GmbH (Austria), and Buhler Technologies GmbH (Germany). These leading companies possess a wide portfolio of products, establishing a prominent presence in established as well as emerging markets.

The study provides a detailed competitive analysis of these key players in the oil condition monitoring market, presenting their company profiles, most recent developments, and key market strategies.

Research Coverage

In this report, the oil condition monitoring market has been segmented based on offering, end use, industry, and region. The offering segment includes hardware, software, and services. The end use segment is categorized into turbines, compressors, engines, hydraulic systems, and other systems (gear systems, industrial tooling systems, transformers). Based on industry, the market is segmented into automotive & transportation, energy & power, oil & gas, metal & mining, food & beverages, pharmaceutical, chemical, and others (pulp, paper & cement). The regional analysis covers North America, Europe, Asia Pacific, and the Rest of the World (RoW).

Reasons to buy the report

The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market and the subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the oil condition monitoring market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

Key Benefits of Buying the Report

- Analysis of key drivers (surging demand for cost-effective solutions for maintaining health of machinery, Increasing awareness regarding importance of oil condition monitoring among industries, growing focus on reducing maintenance costs, increasing use of synthetic and specialized lubricants), restraints (expenses incurred in retrofitting existing systems, lack of skilled technical resources for data analysis, data security concerns in connected monitoring systems), opportunities (growing demand for energy, increasing adoption of big data analytics and IIoT, integration of AI-powered diagnostics for real-time insights), and challenges (adaptation to harsh operating environments, offline oil sampling limitations) influencing the growth of the oil condition monitoring market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the oil condition monitoring market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the oil condition monitoring market across varied regions.

- Market Diversification: Exhaustive information about new products/services, untapped geographies, recent developments, and investments in the oil condition monitoring market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Parker Hannifin Corp (US), Eaton (Ireland), ifm electronic gmbh (Germany), TE Connectivity (Ireland), Schaeffler AG (Germany), and others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 RESEARCH APPROACH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 Major secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Primary interviews with experts

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Steps for estimating market size by bottom-up approach (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Steps for estimating market size by top-down approach (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ASIA PACIFIC TO CREATE LUCRATIVE OPPORTUNITIES FOR PLAYERS IN OIL CONDITION MONITORING MARKET

- 4.2 OIL CONDITION MONITORING MARKET, BY OFFERING

- 4.3 OIL CONDITION MONITORING MARKET, BY END USE

- 4.4 OIL CONDITION MONITORING MARKET, BY INDUSTRY

- 4.5 OIL CONDITION MONITORING MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing requirement for cost-efficient strategies to maintain equipment health

- 5.2.1.2 Growing awareness regarding value of oil condition monitoring

- 5.2.1.3 Increasing attention toward lowering maintenance costs

- 5.2.1.4 Increasing use of synthetic and specialized lubricants

- 5.2.2 RESTRAINTS

- 5.2.2.1 Rising expenses for modernizing current systems

- 5.2.2.2 Deficit of expertise in managing data analysis and software systems

- 5.2.2.3 Data security concerns in connected monitoring systems

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising demand for energy with predictive maintenance solutions

- 5.2.3.2 Adoption of big data analytics and IIoT

- 5.2.3.3 Integration of AI-powered diagnostics for real-time insights

- 5.2.4 CHALLENGES

- 5.2.4.1 Adaptation to harsh operating environments

- 5.2.4.2 Offline oil sampling limitations

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 PRICING ANALYSIS

- 5.4.1 INDICATIVE PRICING OF OIL QUALITY SENSORS AND TESTING KITS, BY KEY PLAYER

- 5.4.2 AVERAGE SELLING PRICE OF OIL QUALITY SENSORS

- 5.4.3 AVERAGE SELLING PRICE OF OIL QUALITY SENSORS, BY REGION

- 5.5 PORTER'S FIVE FORCES ANALYSIS

- 5.6 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 AUSTRIAN PAPER MILL ADOPTED ERALYTICS' OIL CONDITION MONITORING SYSTEM TO REDUCE DOWNTIME AND IMPROVE LUBRICATION

- 5.8.2 EUROPEAN FARM OPERATOR ADOPTED INTERTEK'S SEM/EDS TO IDENTIFY FAILURE INDICATORS AND PREVENT FUTURE BREAKDOWNS

- 5.8.3 INTERTEK CALEB BRETT ENHANCED PARTICLE CHARACTERISATION WITH SEM/EDS FOR VARIOUS INDUSTRIAL CLIENTS

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Wear debris analysis

- 5.9.1.2 Spectroscopic oil analysis

- 5.9.1.3 Moisture and particle counters

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 IoT-enabled sensors

- 5.9.2.2 Cloud computing

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Vibration monitoring systems

- 5.9.3.2 Infrared thermography

- 5.9.1 KEY TECHNOLOGIES

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO (HS CODE 903190)

- 5.10.2 EXPORT SCENARIO (HS CODE 903190)

- 5.11 PATENT ANALYSIS

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS RELATED TO OIL CONDITION MONITORING MARKET

- 5.12.2 MAJOR STANDARDS RELATED TO OIL CONDITION MONITORING MARKET

- 5.13 IMPACT OF AI ON OIL CONDITION MONITORING MARKET

- 5.13.1 INTRODUCTION

- 5.13.2 IMPACT OF AI ON KEY INDUSTRIES IN OIL CONDITION MONITORING MARKET

- 5.13.2.1 Automotive & transportation

- 5.13.2.2 Energy & power

- 5.13.3 FUTURE OF AI IN OIL CONDITION MONITORING ECOSYSTEM

- 5.14 US 2025 TARIFF

- 5.14.1 INTRODUCTION

- 5.14.2 KEY TARIFF RATES

- 5.14.3 PRICE IMPACT ANALYSIS

- 5.14.4 IMPACT ON COUNTRY

- 5.14.4.1 US

- 5.14.4.2 Europe

- 5.14.4.3 Asia Pacific

- 5.14.5 IMPACT ON KEY END-USE INDUSTRIES

6 PARAMETERS FOR MEASURING OIL CONDITION

- 6.1 INTRODUCTION

- 6.2 TEMPERATURE

- 6.3 PRESSURE

- 6.4 DENSITY

- 6.5 VISCOSITY

- 6.6 DIELECTRIC

- 6.7 TAN/TBN

- 6.8 FUEL DILUTION

- 6.9 WATER DILUTION

- 6.10 SOOT

- 6.11 WEAR PARTICLES

7 KEY SENSORS USED FOR OIL CONDITION MONITORING

- 7.1 INTRODUCTION

- 7.2 OIL QUALITY SENSORS

- 7.3 WEAR DEBRIS SENSORS/METALLIC PARTICLE SENSORS

- 7.4 VISCOSITY/DENSITY SENSORS

- 7.5 WATER-IN-OIL SENSORS

8 MAJOR TECHNIQUES USED FOR OIL CONDITION MONITORING

- 8.1 INTRODUCTION

- 8.2 FERROGRAPHY

- 8.3 ON-LINE ACOUSTIC VISCOMETRY IN OIL CONDITION MONITORING

- 8.4 INDUCTIVELY COUPLED PLASMA - OPTICAL EMISSION SPECTROSCOPY (ICP-OES)

- 8.5 FOURIER TRANSFORM INFRARED (FTIR) SPECTROSCOPY

- 8.6 DIELECTRIC STRENGTH TEST

- 8.7 POTENTIOMETRIC TITRATION

9 SAMPLING TYPES IMPLEMENTED FOR OIL CONDITION MONITORING

- 9.1 INTRODUCTION

- 9.2 ON-SITE

- 9.2.1 PORTABLE KITS

- 9.2.1.1 Expanding use of portable test kits to enable flexibility and rapid troubleshooting in critical operations

- 9.2.2 FIXED CONTINUOUS MONITORING

- 9.2.2.1 Rising adoption of fixed continuous monitoring to support digital transformation and proactive asset management

- 9.2.1 PORTABLE KITS

- 9.3 OFF-SITE

- 9.3.1 RELIANCE ON LABORATORY ACCURACY AND COMPREHENSIVE ANALYSIS TO SUSTAIN DEMAND FOR OFF-SITE SAMPLING

10 OIL CONDITION MONITORING MARKET, BY OFFERING

- 10.1 INTRODUCTION

- 10.2 HARDWARE

- 10.2.1 ACCELERATED DEPLOYMENT OF SMART SENSORS AND PORTABLE ANALYZERS TO DRIVE MARKET

- 10.3 SOFTWARE

- 10.3.1 RISING INTEGRATION OF AI AND CLOUD-BASED ANALYTICS TO REDEFINE OIL CONDITION MONITORING SOFTWARE LANDSCAPE

- 10.4 SERVICES

- 10.4.1 DEMAND FOR COMPREHENSIVE TESTING AND MAINTENANCE SERVICES TO STRENGTHEN GROWTH

11 OIL CONDITION MONITORING MARKET, BY END USE

- 11.1 INTRODUCTION

- 11.2 TURBINES

- 11.2.1 NEED FOR PREDICTIVE MAINTENANCE AND ASSET RELIABILITY TO DRIVE ADOPTION OF OIL CONDITION MONITORING IN TURBINES

- 11.3 COMPRESSORS

- 11.3.1 FOCUS ON OPERATIONAL EFFICIENCY AND ENERGY OPTIMIZATION TO ACCELERATE ADOPTION OF COMPRESSOR OIL CONDITION MONITORING SOLUTIONS

- 11.4 ENGINES

- 11.4.1 EMPHASIS ON ENHANCED PERFORMANCE AND REDUCED MAINTENANCE COSTS TO DRIVE NEED FOR OIL CONDITION MONITORING FOR ENGINES

- 11.5 HYDRAULIC SYSTEMS

- 11.5.1 FOCUS ON SYSTEM RELIABILITY AND MAINTENANCE EFFICIENCY TO DRIVE NEED FOR OIL CONDITION MONITORING IN HYDRAULIC SYSTEMS

- 11.6 OTHER SYSTEMS

12 OIL CONDITION MONITORING MARKET, BY INDUSTRY

- 12.1 INTRODUCTION

- 12.2 AUTOMOTIVE & TRANSPORTATION

- 12.2.1 RISING DEMAND FOR PREDICTIVE MAINTENANCE IN VEHICLES AND FLEETS TO BOOST DEMAND

- 12.3 OIL & GAS

- 12.3.1 OIL CONDITION MONITORING TO ENHANCE EQUIPMENT RELIABILITY IN EXPLORATION AND REFINING

- 12.4 ENERGY & POWER

- 12.4.1 RISING DEMAND FOR PREDICTIVE MAINTENANCE IN POWER INFRASTRUCTURE TO DRIVE ADOPTION OF OIL CONDITION MONITORING SOLUTIONS

- 12.5 METAL & MINING

- 12.5.1 INCREASING ADOPTION OF OIL CONDITION MONITORING SYSTEMS TO ENHANCE HEAVY MACHINERY RELIABILITY

- 12.6 FOOD & BEVERAGES

- 12.6.1 GROWING ADOPTION OF OIL CONDITION MONITORING SOLUTIONS TO SAFEGUARD HYGIENE AND EQUIPMENT RELIABILITY

- 12.7 PHARMACEUTICALS

- 12.7.1 FOCUS ON MAINTAINING PRODUCTION CONSISTENCY AND STERILITY WITH OIL CONDITION MONITORING TO DRIVE MARKET

- 12.8 CHEMICALS

- 12.8.1 NEED FOR IMPROVING SAFETY AND PROCESS RELIABILITY TO BOOST GROWTH

- 12.9 OTHER INDUSTRIES

13 OIL CONDITION MONITORING MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 US

- 13.2.1.1 Industrial digitalization and government support to propel growth

- 13.2.2 CANADA

- 13.2.2.1 Need for modernization of energy sector to boost market

- 13.2.3 MEXICO

- 13.2.3.1 Rapid industrial growth and infrastructure development to drive market

- 13.2.1 US

- 13.3 EUROPE

- 13.3.1 GERMANY

- 13.3.1.1 Advancements in manufacturing and automotive sectors to drive market

- 13.3.2 UK

- 13.3.2.1 Focus on energy transition and offshore industries to spur demand

- 13.3.3 FRANCE

- 13.3.3.1 Strong growth in aerospace and automotive sectors to boost growth

- 13.3.4 ITALY

- 13.3.4.1 Expanding industrial manufacturing and marine sectors to spur market growth

- 13.3.5 SPAIN

- 13.3.5.1 Wind energy expansion and industrial diversification to propel market

- 13.3.6 REST OF EUROPE

- 13.3.1 GERMANY

- 13.4 ASIA PACIFIC

- 13.4.1 CHINA

- 13.4.1.1 Expanding industrial base and manufacturing leadership to strengthen adoption of oil condition monitoring solutions

- 13.4.2 JAPAN

- 13.4.2.1 Focus on maintaining robust automotive base to drive market growth

- 13.4.3 INDIA

- 13.4.3.1 Industrial expansion, energy transformation, and growth of oil & gas to accelerate market

- 13.4.4 SOUTH KOREA

- 13.4.4.1 Growth in automotive fleets, heavy industries, and marine operations to boost demand

- 13.4.5 REST OF ASIA PACIFIC

- 13.4.1 CHINA

- 13.5 ROW

- 13.5.1 SOUTH AMERICA

- 13.5.1.1 Rapid industrial expansion and energy sector modernization to propel market

- 13.5.2 MIDDLE EAST

- 13.5.2.1 Emphasis on predictive maintenance to accelerate need for oil condition monitoring

- 13.5.2.2 GCC countries

- 13.5.2.2.1 Dominance of oil & gas sector and rapid industrial modernization to fuel market

- 13.5.2.3 Rest of Middle East

- 13.5.3 AFRICA

- 13.5.3.1 Increase in mining, energy, and infrastructure projects to propel growth

- 13.5.1 SOUTH AMERICA

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 14.3 MARKET SHARE ANALYSIS, 2024

- 14.4 REVENUE ANALYSIS OF KEY COMPANIES, 2020-2024

- 14.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.5.1 STARS

- 14.5.2 EMERGING LEADERS

- 14.5.3 PERVASIVE PLAYERS

- 14.5.4 PARTICIPANTS

- 14.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.5.5.1 Company footprint

- 14.5.5.2 Offering footprint

- 14.5.5.3 Industry footprint

- 14.5.5.4 Region footprint

- 14.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.6.1 PROGRESSIVE COMPANIES

- 14.6.2 RESPONSIVE COMPANIES

- 14.6.3 DYNAMIC COMPANIES

- 14.6.4 STARTING BLOCKS

- 14.7 COMPETITIVE SCENARIO

- 14.7.1 PRODUCT LAUNCHES

- 14.7.2 DEALS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 PARKER HANNIFIN CORP

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions/Services offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Product launches

- 15.1.1.3.2 Deals

- 15.1.1.4 MnM view

- 15.1.1.4.1 Key strengths/Right to win

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses and competitive threats

- 15.1.2 SCHAEFFLER AG

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions/Services offered

- 15.1.2.3 MnM view

- 15.1.2.3.1 Key strengths/Right to win

- 15.1.2.3.2 Strategic choices

- 15.1.2.3.3 Weaknesses and competitive threats

- 15.1.3 IFM ELECTRONIC GMBH

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions/Services offered

- 15.1.3.3 MnM view

- 15.1.3.3.1 Key strengths/Right to win

- 15.1.3.3.2 Strategic choices

- 15.1.3.3.3 Weaknesses and competitive threats

- 15.1.4 TE CONNECTIVITY

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions/Services offered

- 15.1.4.3 MnM view

- 15.1.4.3.1 Key strengths/Right to win

- 15.1.4.3.2 Strategic choices

- 15.1.4.3.3 Weaknesses and competitive threats

- 15.1.5 EATON

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions/Services offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Product launches

- 15.1.5.4 MnM view

- 15.1.5.4.1 Key strengths/Right to win

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses and competitive threats

- 15.1.6 SHELL

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Deals

- 15.1.7 GE VERNOVA

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.8 CHEVRON CORPORATION

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.9 INTERTEK GROUP PLC

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Deals

- 15.1.10 BUREAU VERITAS

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.11 TOTALENERGIES

- 15.1.11.1 Business overview

- 15.1.11.2 Products/Solutions/Services offered

- 15.1.11.3 Recent developments

- 15.1.11.3.1 Deals

- 15.1.1 PARKER HANNIFIN CORP

- 15.2 OTHER KEY PLAYERS

- 15.2.1 EVERLLENCE

- 15.2.2 UNIMARINE

- 15.2.3 HYDAC INTERNATIONAL GMBH

- 15.2.4 TAN DELTA SYSTEMS PLC

- 15.2.5 VERITAS PETROLEUM SERVICES

- 15.2.6 SPECTRO ANALYTICAL INSTRUMENTS GMBH

- 15.2.7 AVENISENSE

- 15.2.8 MICROMEN TECHNOLOGIES INC.

- 15.2.9 GILL SENSORS & CONTROLS LIMITED

- 15.2.10 POSEIDON SYSTEMS, LLC

- 15.2.11 CM TECHNOLOGIES GMBH

- 15.2.12 ERALYTICS

- 15.2.13 DES-CASE

- 15.2.14 BUHLER TECHNOLOGIES GMBH

- 15.2.15 MINIMAC SYSTEMS PVT LTD

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

List of Tables

- TABLE 1 RESEARCH ASSUMPTIONS

- TABLE 2 INDICATIVE PRICING OF OIL QUALITY SENSORS, BY KEY PLAYER, 2021-2024 (USD)

- TABLE 3 AVERAGE PRICE OF INTERTEK'S OIL TESTING KITS, 2025 (USD)

- TABLE 4 AVERAGE SELLING PRICE OF OIL QUALITY SENSORS, 2021-2024 (USD)

- TABLE 5 AVERAGE SELLING PRICE OF OIL QUALITY SENSORS, BY REGION, 2021-2024 (USD)

- TABLE 6 IMPACT OF PORTER'S FORCES ON OIL CONDITION MONITORING MARKET

- TABLE 7 ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 8 IMPORT DATA FOR HS CODE 903190-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 9 EXPORT DATA FOR HS CODE 903190-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 10 OIL CONDITION MONITORING MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2021-2024

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 OIL CONDITION MONITORING STANDARDS

- TABLE 16 RECIPROCAL TARIFF RATES ADJUSTED BY US

- TABLE 17 OIL CONDITION MONITORING MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 18 OIL CONDITION MONITORING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 19 HARDWARE: OIL CONDITION MONITORING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 20 HARDWARE: OIL CONDITION MONITORING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 21 SOFTWARE: OIL CONDITION MONITORING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 22 SOFTWARE: OIL CONDITION MONITORING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 23 SERVICES: OIL CONDITION MONITORING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 24 SERVICES: OIL CONDITION MONITORING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 25 OIL CONDITION MONITORING MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 26 OIL CONDITION MONITORING MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 27 OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 28 OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 29 OIL CONDITION MONITORING MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 30 OIL CONDITION MONITORING MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 NORTH AMERICA: OIL CONDITION MONITORING MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 32 NORTH AMERICA: OIL CONDITION MONITORING MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 33 EUROPE: OIL CONDITION MONITORING MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 34 EUROPE: OIL CONDITION MONITORING MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 35 ASIA PACIFIC: OIL CONDITION MONITORING MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 36 ASIA PACIFIC: OIL CONDITION MONITORING MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 37 ROW: OIL CONDITION MONITORING MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 38 ROW: OIL CONDITION MONITORING MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 OIL CONDITION MONITORING MARKET FOR OIL & GAS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 40 OIL CONDITION MONITORING MARKET FOR OIL & GAS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 NORTH AMERICA: OIL CONDITION MONITORING MARKET FOR OIL & GAS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 42 NORTH AMERICA: OIL CONDITION MONITORING MARKET FOR OIL & GAS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 43 EUROPE: OIL CONDITION MONITORING MARKET FOR OIL & GAS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 44 EUROPE: OIL CONDITION MONITORING MARKET FOR OIL & GAS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 45 ASIA PACIFIC: OIL CONDITION MONITORING MARKET FOR OIL & GAS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 46 ASIA PACIFIC: OIL CONDITION MONITORING MARKET FOR OIL & GAS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 47 ROW: OIL CONDITION MONITORING MARKET FOR OIL & GAS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 48 ROW: OIL CONDITION MONITORING MARKET FOR OIL & GAS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 OIL CONDITION MONITORING MARKET FOR ENERGY & POWER, BY REGION, 2021-2024 (USD MILLION)

- TABLE 50 OIL CONDITION MONITORING MARKET FOR ENERGY & POWER, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 NORTH AMERICA: OIL CONDITION MONITORING MARKET FOR ENERGY & POWER, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 52 NORTH AMERICA: OIL CONDITION MONITORING MARKET FOR ENERGY & POWER, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 53 EUROPE: OIL CONDITION MONITORING MARKET FOR ENERGY & POWER, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 54 EUROPE: OIL CONDITION MONITORING MARKET FOR ENERGY & POWER, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 55 ASIA PACIFIC: OIL CONDITION MONITORING MARKET FOR ENERGY & POWER, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 56 ASIA PACIFIC: OIL CONDITION MONITORING MARKET FOR ENERGY & POWER, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 57 ROW: OIL CONDITION MONITORING MARKET FOR ENERGY & POWER, BY REGION, 2021-2024 (USD MILLION)

- TABLE 58 ROW: OIL CONDITION MONITORING MARKET FOR ENERGY & POWER, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 OIL CONDITION MONITORING MARKET FOR METAL & MINING, BY REGION, 2021-2024 (USD MILLION)

- TABLE 60 OIL CONDITION MONITORING MARKET FOR METAL & MINING, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 NORTH AMERICA: OIL CONDITION MONITORING MARKET FOR METAL & MINING, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 62 NORTH AMERICA: OIL CONDITION MONITORING MARKET FOR METAL & MINING, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 63 EUROPE: OIL CONDITION MONITORING MARKET FOR METAL & MINING, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 64 EUROPE: OIL CONDITION MONITORING MARKET FOR METAL & MINING, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 65 ASIA PACIFIC: OIL CONDITION MONITORING MARKET FOR METAL & MINING, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 66 ASIA PACIFIC: OIL CONDITION MONITORING MARKET FOR METAL & MINING, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 67 ROW: OIL CONDITION MONITORING MARKET FOR METAL & MINING, BY REGION, 2021-2024 (USD MILLION)

- TABLE 68 ROW: OIL CONDITION MONITORING MARKET FOR METAL & MINING, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 OIL CONDITION MONITORING MARKET FOR FOOD & BEVERAGES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 70 OIL CONDITION MONITORING MARKET FOR FOOD & BEVERAGES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 NORTH AMERICA: OIL CONDITION MONITORING MARKET FOR FOOD & BEVERAGES, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 72 NORTH AMERICA: OIL CONDITION MONITORING MARKET FOR FOOD & BEVERAGES, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 73 EUROPE: OIL CONDITION MONITORING MARKET FOR FOOD & BEVERAGES, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 74 EUROPE: OIL CONDITION MONITORING MARKET FOR FOOD & BEVERAGES, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 75 ASIA PACIFIC: OIL CONDITION MONITORING MARKET FOR FOOD & BEVERAGES, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 76 ASIA PACIFIC: OIL CONDITION MONITORING MARKET FOR FOOD & BEVERAGES, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 77 ROW: OIL CONDITION MONITORING MARKET FOR FOOD & BEVERAGES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 78 ROW: OIL CONDITION MONITORING MARKET FOR FOOD & BEVERAGES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79 OIL CONDITION MONITORING MARKET FOR PHARMACEUTICALS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 80 OIL CONDITION MONITORING MARKET FOR PHARMACEUTICALS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 NORTH AMERICA: OIL CONDITION MONITORING MARKET FOR PHARMACEUTICALS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 82 NORTH AMERICA: OIL CONDITION MONITORING MARKET FOR PHARMACEUTICALS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 83 EUROPE: OIL CONDITION MONITORING MARKET FOR PHARMACEUTICALS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 84 EUROPE: OIL CONDITION MONITORING MARKET FOR PHARMACEUTICALS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 85 ASIA PACIFIC: OIL CONDITION MONITORING MARKET FOR PHARMACEUTICALS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 86 ASIA PACIFIC: OIL CONDITION MONITORING MARKET FOR PHARMACEUTICALS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 87 ROW: OIL CONDITION MONITORING MARKET FOR PHARMACEUTICALS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 88 ROW: OIL CONDITION MONITORING MARKET FOR PHARMACEUTICALS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 OIL CONDITION MONITORING MARKET FOR CHEMICALS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 90 OIL CONDITION MONITORING MARKET FOR CHEMICALS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91 NORTH AMERICA: OIL CONDITION MONITORING MARKET FOR CHEMICALS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 92 NORTH AMERICA: OIL CONDITION MONITORING MARKET FOR CHEMICALS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 93 EUROPE: OIL CONDITION MONITORING MARKET FOR CHEMICALS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 94 EUROPE: OIL CONDITION MONITORING MARKET FOR CHEMICALS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 95 ASIA PACIFIC: OIL CONDITION MONITORING MARKET FOR CHEMICALS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 96 ASIA PACIFIC: OIL CONDITION MONITORING MARKET FOR CHEMICALS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 97 ROW: OIL CONDITION MONITORING MARKET FOR CHEMICALS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 98 ROW: OIL CONDITION MONITORING MARKET FOR CHEMICALS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 99 OIL CONDITION MONITORING MARKET FOR OTHER INDUSTRIES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 100 OIL CONDITION MONITORING MARKET FOR OTHER INDUSTRIES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 101 NORTH AMERICA: OIL CONDITION MONITORING MARKET FOR OTHER INDUSTRIES, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 102 NORTH AMERICA: OIL CONDITION MONITORING MARKET FOR OTHER INDUSTRIES, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 103 EUROPE: OIL CONDITION MONITORING MARKET FOR OTHER INDUSTRIES, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 104 EUROPE: OIL CONDITION MONITORING MARKET FOR OTHER INDUSTRIES, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 105 ASIA PACIFIC: OIL CONDITION MONITORING MARKET FOR OTHER INDUSTRIES, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 106 ASIA PACIFIC: OIL CONDITION MONITORING MARKET FOR OTHER INDUSTRIES, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 107 ROW: OIL CONDITION MONITORING MARKET FOR OTHER INDUSTRIES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 108 ROW: OIL CONDITION MONITORING MARKET FOR OTHER INDUSTRIES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 109 OIL CONDITION MONITORING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 110 OIL CONDITION MONITORING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 111 NORTH AMERICA: OIL CONDITION MONITORING MARKET, BY OFFERING 2021-2024 (USD MILLION)

- TABLE 112 NORTH AMERICA: OIL CONDITION MONITORING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 113 NORTH AMERICA: OIL CONDITION MONITORING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 114 NORTH AMERICA: OIL CONDITION MONITORING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 115 NORTH AMERICA: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 116 NORTH AMERICA: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 117 US: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 118 US: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 119 CANADA: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 120 CANADA: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 121 MEXICO: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 122 MEXICO: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 123 EUROPE: OIL CONDITION MONITORING MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 124 EUROPE: OIL CONDITION MONITORING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 125 EUROPE: OIL CONDITION MONITORING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 126 EUROPE: OIL CONDITION MONITORING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 127 EUROPE: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 128 EUROPE: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 129 GERMANY: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 130 GERMANY: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 131 UK: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 132 UK: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 133 FRANCE: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 134 FRANCE: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 135 ITALY: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 136 ITALY: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 137 SPAIN: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 138 SPAIN: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 139 REST OF EUROPE: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 140 REST OF EUROPE: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 141 ASIA PACIFIC: OIL CONDITION MONITORING MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 142 ASIA PACIFIC: OIL CONDITION MONITORING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 143 ASIA PACIFIC: OIL CONDITION MONITORING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 144 ASIA PACIFIC: OIL CONDITION MONITORING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 145 ASIA PACIFIC: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 146 ASIA PACIFIC: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 147 CHINA: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 148 CHINA: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 149 JAPAN: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 150 JAPAN: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 151 INDIA: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 152 INDIA: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 153 SOUTH KOREA: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 154 SOUTH KOREA: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 155 REST OF ASIA PACIFIC: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 156 REST OF ASIA PACIFIC: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 157 ROW: OIL CONDITION MONITORING MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 158 ROW: OIL CONDITION MONITORING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 159 ROW: OIL CONDITION MONITORING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 160 ROW: OIL CONDITION MONITORING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 161 ROW: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 162 ROW: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 163 SOUTH AMERICA: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 164 SOUTH AMERICA: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 165 MIDDLE EAST: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 166 MIDDLE EAST: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 167 MIDDLE EAST: OIL CONDITION MONITORING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 168 MIDDLE EAST: OIL CONDITION MONITORING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 169 AFRICA: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 170 AFRICA: OIL CONDITION MONITORING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 171 OVERVIEW OF STRATEGIES ADOPTED BY KEY OIL CONDITION MONITORING PRODUCT MANUFACTURERS

- TABLE 172 MARKET SHARE OF KEY FIVE PLAYERS, 2024

- TABLE 173 OIL CONDITION MONITORING MARKET: OFFERING FOOTPRINT

- TABLE 174 OIL CONDITION MONITORING MARKET: INDUSTRY FOOTPRINT

- TABLE 175 OIL CONDITION MONITORING MARKET: REGION FOOTPRINT

- TABLE 176 OIL CONDITION MONITORING MARKET: PRODUCT LAUNCHES, JUNE 2021-JUNE 2024

- TABLE 177 OIL CONDITION MONITORING MARKET: DEALS, JUNE 2021-JUNE 2024

- TABLE 178 PARKER HANNIFIN CORP: COMPANY OVERVIEW

- TABLE 179 PARKER HANNIFIN CORP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 180 PARKER HANNIFIN CORP: PRODUCT LAUNCHES

- TABLE 181 PARKER HANNIFIN CORP: DEALS

- TABLE 182 SCHAEFFLER AG: COMPANY OVERVIEW

- TABLE 183 SCHAEFFLER AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 IFM ELECTRONIC GMBH: COMPANY OVERVIEW

- TABLE 185 IFM ELECTRONIC GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 TE CONNECTIVITY: COMPANY OVERVIEW

- TABLE 187 TE CONNECTIVITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 EATON: COMPANY OVERVIEW

- TABLE 189 EATON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 EATON: PRODUCT LAUNCHES

- TABLE 191 SHELL: COMPANY OVERVIEW

- TABLE 192 SHELL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 SHELL: DEALS

- TABLE 194 GE VERNOVA: COMPANY OVERVIEW

- TABLE 195 GE VERNOVA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 CHEVRON CORPORATION: COMPANY OVERVIEW

- TABLE 197 CHEVRON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 INTERTEK GROUP PLC: COMPANY OVERVIEW

- TABLE 199 INTERTEK GROUP PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 INTERTEK GROUP PLC: DEALS

- TABLE 201 BUREAU VERITAS: COMPANY OVERVIEW

- TABLE 202 BUREAU VERITAS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 TOTALENERGIES: COMPANY OVERVIEW

- TABLE 204 TOTALENERGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 OIL CONDITION MONITORING MARKET: RESEARCH DESIGN

- FIGURE 2 RESEARCH FLOW

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION THROUGH SUPPLY-SIDE ANALYSIS

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 SOFTWARE SEGMENT TO ACHIEVE HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 8 ENGINES SEGMENT TO LEAD MARKET BY 2030

- FIGURE 9 AUTOMOTIVE & TRANSPORTATION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 10 ASIA PACIFIC TO EXHIBIT HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 11 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN OIL CONDITION MONITORING MARKET

- FIGURE 12 HARDWARE SEGMENT TO CAPTURE LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 13 ENGINES SEGMENT TO ACCOUNT FOR LARGEST MARKET BY 2030

- FIGURE 14 ENERGY & POWER SEGMENT TO REGISTER HIGHEST GROWTH BY 2030

- FIGURE 15 INDIA TO EXHIBIT HIGHEST GROWTH FROM 2025 TO 2030

- FIGURE 16 OIL CONDITION MONITORING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 MARKET DRIVERS: IMPACT ANALYSIS

- FIGURE 18 MARKET RESTRAINTS: IMPACT ANALYSIS

- FIGURE 19 MARKET OPPORTUNITIES: IMPACT ANALYSIS

- FIGURE 20 MARKET CHALLENGES: IMPACT ANALYSIS

- FIGURE 21 OIL CONDITION MONITORING MARKET: VALUE CHAIN ANALYSIS

- FIGURE 22 AVERAGE SELLING PRICE OF OIL QUALITY SENSORS, 2021-2024 (USD)

- FIGURE 23 AVERAGE SELLING PRICE OF OIL QUALITY SENSORS, BY REGION, 2021-2024 (USD)

- FIGURE 24 OIL CONDITION MONITORING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 25 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS OPERATING IN OIL CONDITION MONITORING MARKET

- FIGURE 26 ECOSYSTEM MAP

- FIGURE 27 IMPORT DATA FOR HS CODE 903190-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 28 EXPORT DATA FOR HS CODE 903190-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 29 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 30 INTEGRATION OF AI WITH OIL CONDITION MONITORING MARKET: USE CASES

- FIGURE 31 PARAMETERS FOR MEASURING OIL CONDITION

- FIGURE 32 OIL CONDITION MONITORING MARKET, BY OFFERING

- FIGURE 33 SOFTWARE SEGMENT TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 34 OIL CONDITION MONITORING MARKET, BY END USE

- FIGURE 35 TURBINES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 OIL CONDITION MONITORING MARKET, BY INDUSTRY

- FIGURE 37 AUTOMOTIVE & TRANSPORTATION SEGMENT TO LEAD MARKET BY 2030

- FIGURE 38 INDIA TO GROW AT HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 39 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 40 NORTH AMERICA: OIL CONDITION MONITORING MARKET SNAPSHOT

- FIGURE 41 EUROPE: OIL CONDITION MONITORING MARKET SNAPSHOT

- FIGURE 42 ASIA PACIFIC: OIL CONDITION MONITORING MARKET SNAPSHOT

- FIGURE 43 MARKET SHARE ANALYSIS, 2024

- FIGURE 44 OIL CONDITION MONITORING MARKET: REVENUE ANALYSIS OF FOUR KEY PLAYERS, 2020-2024 (USD BILLION)

- FIGURE 45 OIL CONDITION MONITORING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 46 OIL CONDITION MONITORING MARKET: COMPANY FOOTPRINT

- FIGURE 47 OIL CONDITION MONITORING MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 48 PARKER HANNIFIN CORP: COMPANY SNAPSHOT

- FIGURE 49 SCHAEFFLER AG: COMPANY SNAPSHOT

- FIGURE 50 TE CONNECTIVITY: COMPANY SNAPSHOT

- FIGURE 51 EATON: COMPANY SNAPSHOT

- FIGURE 52 SHELL: COMPANY SNAPSHOT

- FIGURE 53 GE VERNOVA: COMPANY SNAPSHOT

- FIGURE 54 CHEVRON CORPORATION: COMPANY SNAPSHOT

- FIGURE 55 INTERTEK GROUP PLC: COMPANY SNAPSHOT

- FIGURE 56 BUREAU VERITAS: COMPANY SNAPSHOT

- FIGURE 57 TOTALENERGIES: COMPANY SNAPSHOT