|

市場調查報告書

商品編碼

1808964

全球照護現場診斷市場(按產品/服務、技術、樣本類型、應用和最終用戶分類)- 預測至 2030 年Point-of-Care Molecular Diagnostics Market by Product & Service, Technology, Sample Type, Application, and End User - Global Forecast to 2030 |

||||||

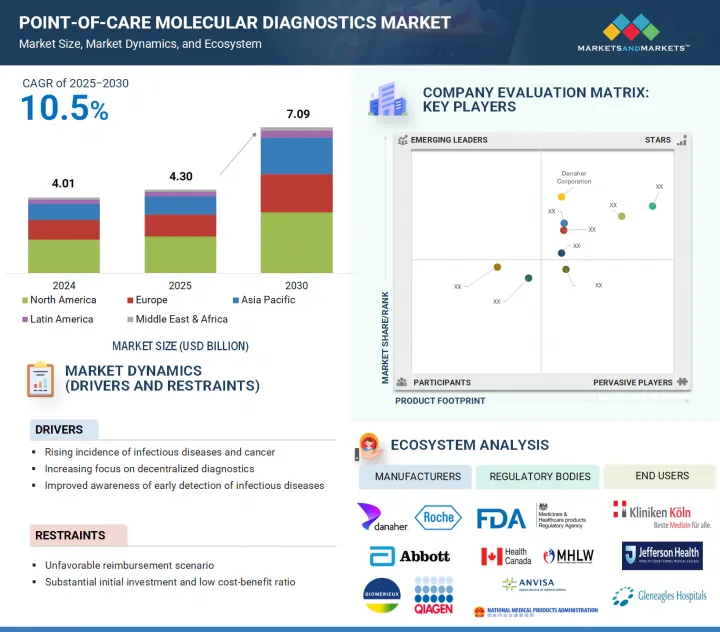

全球照護現場診斷市場預計將從 2025 年的 43 億美元成長到 2030 年的 70.9 億美元,複合年成長率為 10.5%。

市場的主要驅動力是越來越關注分散式檢查,以便在各種醫療保健環境中實現快速的臨床決策,這在資源有限和偏遠地區尤其重要,因為及時決策至關重要。

| 調查範圍 | |

|---|---|

| 調查年份 | 2024-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 單元 | 10億美元 |

| 部分 | 產品/服務、技術、樣品類型、應用、最終用戶 |

| 目標區域 | 北美、歐洲、亞太地區、拉丁美洲、中東和非洲 |

研發投入的增加進一步推動了先進行動科技的發展,這些技術不僅能夠促進分子偵測,還能保持可靠性。這些創新正在幫助醫療保健機構在傳統實驗室環境之外採用照護現場解決方案。

按產品/服務分類,檢測試劑套件預計將佔據照護現場診斷市場中最高的成長率。

預計檢測套件將成為預測期內成長最快的細分市場。這一成長源於對快速、準確且可直接在照護現場使用的檢測解決方案日益成長的需求。各種臨床環境中對檢測試劑套件的頻繁使用和持續需求,以及套件在診斷各種疾病狀況中日益增強的作用,是支撐這一趨勢的主要因素。隨著醫療保健系統持續優先考慮早期檢測和分散檢測,對可靠且易於使用的分子檢測套件的需求預計將穩定成長。

以樣本類型來看,血液是照護現場分子診斷市場中成長最快的部分。

照護現場診斷市場涵蓋血液和尿液等多種樣本類型。由於血液樣本廣泛應用於各種疾病,且採集方法微創,預計在預測期內將達到最高的複合年成長率。血液分子檢測具有較高的敏感度和特異性,適用於檢測多種感染疾病,例如愛滋病毒、肝炎和敗血症。重症加護點對快速診斷的需求不斷成長,血液通常是首選檢體,這進一步推動了這一成長。此外,技術進步正在提高血液就地檢驗的效率和可靠性,從而促進其廣泛應用。

亞太地區的照護現場分子診斷市場成長最快。

這一成長得益於醫療支出的不斷成長、診斷服務的普及以及政府為改善疾病早期檢測而採取的舉措。此外,醫療基礎設施的持續投入以及人們對就地檢驗益處的日益認知,也為市場成長創造了有利條件。中國和印度等新興經濟體注重提升診斷能力,進一步增強了市場的成長前景。

本報告研究了全球照護現場診斷市場,提供了關鍵促進因素和限制因素、競爭格局和未來趨勢的資訊。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章 主要發現

- 照護現場分子診斷市場概況

- 按產品和服務照護現場分子診斷市場

- 照護現場分子診斷市場(按技術)

- 照護現場分子診斷市場(依樣本類型)

- 照護現場分子診斷市場(按應用)

- 照護現場)

- 照護現場分子診斷市場:地理成長機會

第5章市場概述

- 介紹

- 市場動態

- 驅動程式

- 抑制因素

- 機會

- 任務

- 定價分析

- 照護現場分子診斷產品平均價格趨勢(2023-2025)

- 主要企業照護現場診斷分子診斷試劑套件平均價格趨勢(2023-2025)

- 各地區照護現場分子診斷產品平均售價趨勢(2023-2025)

- 專利分析

- 價值鏈分析

- 供應鏈分析

- 貿易分析

- 診斷與檢測試劑貿易分析

- 進口資料(HS編碼3822)

- 出口資料(HS編碼3822)

- 生態系分析

- 波特五力分析

- 監管格局

- 法規結構

- 監管機構、政府機構和其他組織

- 技術分析

- 主要技術

- 互補技術

- 鄰近技術

- 大型會議和活動(2025-2026年)

- 影響客戶業務的趨勢/中斷

- 主要相關利益者和採購標準

- 投資金籌措場景

- 案例研究分析

- 案例研究1:快速照護現場PCR 檢測簡化了德國醫院的急診護理

- 案例研究2:引進快速PCR檢測,改善諾羅病毒診斷與病床管理

- 案例研究3:利用分子診斷技術辨識非典型呼吸道感染疾病

- 人工智慧/生成式人工智慧對照護現場分子診斷市場的影響

- 介紹

- 人工智慧市場潛力

- 人工智慧用例

- 主要企業的人工智慧實施及用例

- 人工智慧在照護現場分子診斷的未來

- 川普關稅對照護現場分子診斷市場的影響

- 介紹

- 主要關稅稅率

- 價格影響分析

- 對國家的影響

- 對終端產業的影響

第6章照護現場診斷分子診斷市場(依產品與服務)

- 介紹

- 檢測試劑套件

- 儀器/分析儀

- 軟體和服務

第7章照護現場分子診斷市場(按技術)

- 介紹

- RT-PCR

- INAAT

- 其他技術

第 8照護現場診斷分子診斷市場(按樣本類型)

- 介紹

- 血液樣本

- 尿液樣本

- 其他樣本類型

第9章照護現場分子診斷市場(按應用)

- 介紹

- 呼吸系統疾病

- 性行為感染傳染病

- 醫院感染疾病

- 癌症

- 肝炎

- 胃腸道疾病

- 其他用途

第 10 章。照護現場分子診斷市場(按最終用戶)

- 介紹

- 醫院

- 診所

- 研究所

- 其他最終用戶

第 11 章。按地區照護現場診斷分子診斷市場

- 介紹

- 北美洲

- 北美宏觀經濟展望

- 美國

- 加拿大

- 歐洲

- 歐洲宏觀經濟展望

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 亞太宏觀經濟展望

- 中國

- 日本

- 印度

- 其他亞太地區

- 拉丁美洲

- 拉丁美洲宏觀經濟展望

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中東和非洲

- 中東和非洲的宏觀經濟展望

- 沙烏地阿拉伯王國(KSA)

- 阿拉伯聯合大公國

- 其他中東和非洲地區

第12章競爭格局

- 介紹

- 主要參與企業的策略/優勢

- 收益佔有率分析(2022-2024)

- 市場佔有率分析(2024年)

- 企業評估矩陣:主要企業(2024年)

- 公司評估矩陣:Start-Ups/中小企業(2024 年)

- 公司估值及財務指標

- 品牌/產品比較

- 競爭場景

第13章:公司簡介

- 主要企業

- DANAHER CORPORATION

- BIOMERIEUX

- F. HOFFMANN-LA ROCHE LTD.

- ABBOTT

- QIAGEN NV

- QUIDELORTHO CORPORATION

- CO-DIAGNOSTICS, INC.

- BIOCARTIS

- SD BIOSENSOR, INC.

- GENEDRIVE PLC

- 其他公司

- BINX HEALTH, INC.

- MOLBIO DIAGNOSTICS LIMITED

- OPGEN, INC.

- GENOMADIX

- VISBY MEDICAL, INC.

- QUANTUMDX GROUP LTD.

- DETECTACHEM

- LABSYSTEMS DIAGNOSTICS OY

- AKONNI BIOSYSTEMS, INC.

- UBIQUITOME LIMITED

- CREDO DIAGNOSTICS BIOMEDICAL PTE. LTD.

- NUCLEIN, LLC

- GENES2ME

- AXXIN

- HUWEL LIFESCIENCES

第14章 附錄

The global point-of-care molecular diagnostics market is projected to reach USD 7.09 billion by 2030, from USD 4.30 billion in 2025, with a CAGR of 10.5%. The market is primarily driven by the increasing focus on decentralized testing, which facilitates faster clinical decisions across various care settings. This is especially crucial in resource-limited or remote areas where timely decision-making is vital.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product & Service, Technology, Sample Type, Application, and End User |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

Rising R&D investments are further supporting the development of advanced, portable technologies that make molecular testing easier while maintaining reliability. These innovations are helping healthcare providers adopt point-of-care solutions outside traditional laboratory settings.

Assays & kits accounted for the highest growth rate in the point-of-care molecular diagnostics market by product & service.

The point-of-care molecular diagnostics market is classified into assays & kits, instruments & analyzers, and software & services. Assays & kits are expected to be the fastest-growing segment during the forecast period. This growth is fueled by the rising need for quick and precise testing solutions that can be used directly at the point of care. The frequent use and ongoing demand for assay kits across various clinical settings, as well as their growing role in diagnosing diverse conditions, are key factors supporting this trend. As healthcare systems continue to prioritize early detection and decentralized testing, the demand for reliable and easy-to-use molecular assay kits is likely to increase steadily.

Blood is the fastest-growing segment in the point-of-care molecular diagnostics market by sample type.

The point-of-care molecular diagnostics market includes various sample types, such as blood, urine, and others. The blood sample is expected to experience the highest CAGR during the forecast period, driven by its broad use across different diseases and the availability of minimally invasive collection methods. Blood-based molecular tests provide high sensitivity and specificity, making them suitable for detecting a wide range of infectious diseases, including HIV, hepatitis, and sepsis. The increasing demand for rapid diagnostics in critical care settings, where blood is often the preferred sample, further supports this growth. Additionally, technological advancements have improved the efficiency and reliability of blood-based point-of-care testing, promoting its wider adoption.

Asia Pacific exhibits the fastest growth in the point-of-care molecular diagnostics market.

The global market for point-of-care molecular diagnostics is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The Asia Pacific region is expected to experience the fastest growth in this market. This expansion is fueled by increasing healthcare spending, broader access to diagnostic services, and more government efforts to improve early disease detection. Additionally, ongoing investments in healthcare infrastructure and rising awareness of the benefits of point-of-care testing create positive conditions for market growth. The presence of emerging economies like China and India further boosts growth prospects due to their growing focus on enhancing diagnostic capabilities.

The break-up of the profile of primary participants in the point-of-care molecular diagnostics market:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C-level - 27%, D-level - 18%, and Others - 55%

- By Region: North America - 51%, Europe - 21%, Asia Pacific - 18%, Latin America - 6%, and Middle East & Africa - 4%

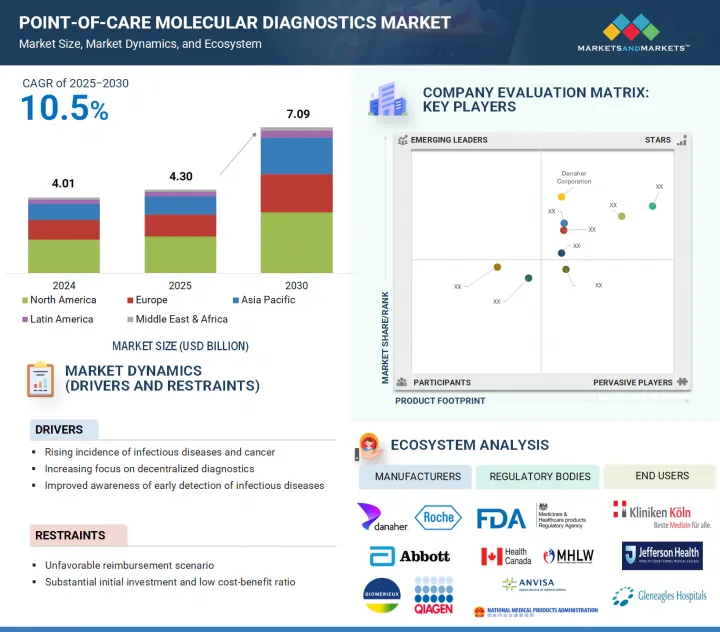

The key players in this market are Danaher Corporation (US), bioMerieux (France), F. Hoffmann-La Roche Ltd. (Switzerland), Abbott Laboratories (US), QIAGEN N.V. (Netherlands), QuidelOrtho Corporation (US), Co-Diagnostics, Inc. (US), Biocartis Group NV (Belgium), SD Biosensor, INC. (South Korea), genedrive plc (UK), Binx Health, Inc. (US), Molbio Diagnostics Pvt. Ltd. (India), Genomadix (Canada), Visby Medical, Inc. (US), QuantuMDx Group Ltd. (UK), DetectaChem (US), Labsystems Diagnostics Oy (Finland), Akonni Biosystems, Inc. (US), Ubiquitome Limited (New Zealand), Credo Diagnostics Biomedical Pte. Ltd. (Singapore), OpGen, Inc. (US), Nuclein, LLC (US), Genes2Me (India), Axxin (Australia), and Huwel Lifesciences (India).

Research Coverage:

This report categorizes the point-of-care molecular diagnostics market by product & service (assay & kits, instruments & analyzers, and software & services), technology (RT-PCR, INAAT, other technologies), sample type (blood samples, urine, and other sample types), application (respiratory diseases, sexually transmitted diseases, hospital-acquired infections, cancer, hepatitis, gastrointestinal disorders, and other applications), end user (physicians' offices/clinics, hospitals, research institutes, and other end users), and region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa). The scope of the report includes detailed information about the major factors affecting the growth of the point-of-care molecular diagnostics market, such as drivers, restraints, opportunities, and challenges. A thorough analysis of key industry players has been conducted to provide insights into their business overview, solutions, key strategies, acquisitions, and agreements. The report also covers new product launches and recent developments related to the point-of-care molecular diagnostics market. Additionally, it includes a competitive analysis of upcoming startups within the point-of-care molecular diagnostics market ecosystem.

Reasons to buy this report:

The report will assist market leaders and new entrants by providing near-accurate estimates of the revenue for the overall point-of-care molecular diagnostics market and its subsegments. It will help stakeholders understand the competitive landscape and gain insights to better position their businesses and develop effective go-to-market strategies. Additionally, the report offers stakeholders an understanding of market dynamics, including key drivers, restraints, opportunities, and challenges.

The report provides insights into the following pointers:

- Analysis of key drivers (rising incidence of infectious diseases and cancer, increasing focus on decentralized diagnostics, improved awareness of early detection of infectious diseases), opportunities (untapped growth potential across emerging economies), restraints (unfavorable reimbursement scenario, substantial initial investment and low cost-benefit ratio), and challenges (stringent and time-consuming regulatory policies, emergence of alternative technologies) influencing the growth of the point-of-care molecular diagnostics market

- Product Development/Innovation: Detailed insights on upcoming technologies, R&D activities, and new product launches in the point-of-care molecular diagnostics market

- Market Development: Comprehensive information about lucrative markets - the report analyses the point-of-care molecular diagnostics market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the point-of-care molecular diagnostics market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings of leading players like Danaher Corporation (US), bioMerieux (France), F. Hoffmann-La Roche Ltd. (Switzerland), Abbott Laboratories (US), and QIAGEN N.V. (Netherlands)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 KEY STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.2 RESEARCH APPROACH

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key secondary sources

- 2.2.1.2 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Primary sources

- 2.2.2.2 Key data from primary sources

- 2.2.2.3 Key industry insights

- 2.2.2.4 Breakdown of primary interviews

- 2.2.1 SECONDARY DATA

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Approach 1: Company revenue estimation approach

- 2.3.1.2 Approach 2: Presentations of companies and primary interviews

- 2.3.1.3 Growth forecast

- 2.3.1.4 CAGR projections

- 2.3.2 TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.5 MARKET SHARE ASSESSMENT

- 2.6 RESEARCH ASSUMPTIONS

- 2.6.1 PARAMETRIC ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

- 2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET OVERVIEW

- 4.2 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2025 VS. 2030 (USD MILLION)

- 4.3 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2025 VS. 2030 (USD MILLION)

- 4.4 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY SAMPLE TYPE, 2025 VS. 2030 (USD MILLION)

- 4.5 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- 4.6 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- 4.7 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing prevalence of infectious diseases and cancer

- 5.2.1.2 Increasing focus on decentralized diagnostics and subsequent rise in R&D funding

- 5.2.1.3 Growing awareness associated with early disease diagnosis

- 5.2.1.4 Increasing use of POC diagnostic tests

- 5.2.2 RESTRAINTS

- 5.2.2.1 Unfavorable reimbursements

- 5.2.2.2 High capital investments and low cost-benefit ratio

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth opportunities in emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Stringent regulatory guidelines that impact product commercialization

- 5.2.4.2 Introduction of alternative technologies

- 5.2.1 DRIVERS

- 5.3 PRICING ANALYSIS

- 5.3.1 AVERAGE PRICE TREND OF POINT OF CARE MOLECULAR DIAGNOSTIC PRODUCTS, 2023-2025

- 5.3.2 AVERAGE PRICE TREND OF POINT OF CARE MOLECULAR DIAGNOSTIC ASSAYS & KITS, BY KEY PLAYER, 2023-2025

- 5.3.3 AVERAGE SELLING PRICE TREND OF POINT OF CARE MOLECULAR DIAGNOSTIC PRODUCTS, BY REGION, 2023-2025

- 5.4 PATENT ANALYSIS

- 5.4.1 LIST OF KEY PATENTS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 TRADE ANALYSIS

- 5.7.1 TRADE ANALYSIS FOR DIAGNOSTIC & LABORATORY REAGENTS

- 5.7.2 IMPORT DATA (HS CODE 3822)

- 5.7.3 EXPORT DATA (HS CODE 3822)

- 5.8 ECOSYSTEM ANALYSIS

- 5.8.1 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET: ROLE IN ECOSYSTEM

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 BARGAINING POWER OF SUPPLIERS

- 5.9.3 THREAT OF SUBSTITUTES

- 5.9.4 BARGAINING POWER OF BUYERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATORY FRAMEWORK

- 5.10.1.1 North America

- 5.10.1.1.1 US

- 5.10.1.1.2 Canada

- 5.10.1.2 EUROPE

- 5.10.1.2.1 Germany

- 5.10.1.2.2 UK

- 5.10.1.2.3 France

- 5.10.1.2.4 Italy

- 5.10.1.3 Asia Pacific

- 5.10.1.3.1 China

- 5.10.1.3.2 Japan

- 5.10.1.3.3 India

- 5.10.1.4 Latin America

- 5.10.1.4.1 Brazil

- 5.10.1.4.2 Mexico

- 5.10.1.5 Middle East

- 5.10.1.5.1 Africa

- 5.10.1.1 North America

- 5.10.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.1 REGULATORY FRAMEWORK

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 KEY TECHNOLOGIES

- 5.11.1.1 RT-PCR

- 5.11.2 COMPLEMENTARY TECHNOLOGIES

- 5.11.2.1 INAAT (Isolated Nucleic Acid Amplification Technology)

- 5.11.3 ADJACENT TECHNOLOGIES

- 5.11.3.1 CRISPR (Clustered Regularly Interspaced Short Palindromic Repeats)

- 5.11.1 KEY TECHNOLOGIES

- 5.12 KEY CONFERENCES & EVENTS, 2025-2026

- 5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.14 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 INVESTMENT & FUNDING SCENARIO

- 5.16 CASE STUDY ANALYSIS

- 5.16.1 CASE STUDY 1: RAPID POINT OF CARE PCR TESTING STREAMLINES EMERGENCY CARE FOR HOSPITAL IN GERMANY

- 5.16.2 CASE STUDY 2: IMPLEMENTATION OF RAPID PCR TESTING TO IMPROVE NOROVIRUS DIAGNOSIS & BED MANAGEMENT

- 5.16.3 CASE STUDY 3: USING MOLECULAR DIAGNOSTICS TO IDENTIFY ATYPICAL RESPIRATORY INFECTION

- 5.17 IMPACT OF AI/GENERATIVE AI IN POINT OF CARE MOLECULAR DIAGNOSTICS MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 MARKET POTENTIAL OF AI

- 5.17.3 AI-USE CASES

- 5.17.4 IMPLEMENTATION OF AI, BY KEY COMPANY & USE CASE

- 5.17.5 FUTURE OF AI IN POINT OF CARE MOLECULAR DIAGNOSTICS MARKET

- 5.18 TRUMP TARIFF IMPACT ON POINT OF CARE MOLECULAR DIAGNOSTICS MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON COUNTRY/REGION

- 5.18.4.1 North America

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON END-USE INDUSTRIES

- 5.18.5.1 Physicians' Offices/Clinics

- 5.18.5.2 Hospitals

- 5.18.5.3 Research Institutes

6 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE

- 6.1 INTRODUCTION

- 6.2 ASSAYS & KITS

- 6.2.1 RECURRENT PURCHASE TO PROPEL MARKET

- 6.3 INSTRUMENTS & ANALYZERS

- 6.3.1 INCREASING ADOPTION OF ADVANCED POC TECHNOLOGIES TO DRIVE MARKET

- 6.4 SOFTWARE & SERVICES

- 6.4.1 UTILIZATION OF SOLUTIONS FOR ENHANCED USER EXPERIENCE TO SUPPORT MARKET GROWTH

7 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- 7.2 RT-PCR

- 7.2.1 HIGH SENSITIVITY AND SPECIFICITY TO BOOST DEMAND

- 7.3 INAAT

- 7.3.1 COST-BENEFITS AND RAPID AMPLIFICATION ABILITIES TO PROPEL MARKET

- 7.4 OTHER TECHNOLOGIES

8 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY SAMPLE TYPE

- 8.1 INTRODUCTION

- 8.2 BLOOD SAMPLES

- 8.2.1 ABILITY TO SUPPORT RAPID DETECTION FOR SEVERAL DISEASES TO PROPEL MARKET

- 8.3 URINE SAMPLES

- 8.3.1 NON-INVASIVE NATURE AND DETECTION OF LOW BIOMARKER CONCENTRATION TO BOOST DEMAND

- 8.4 OTHER SAMPLE TYPES

9 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 RESPIRATORY DISEASES

- 9.2.1 RISING INCIDENCE OF INFLUENZA AND RSV TO DRIVE MARKET

- 9.3 SEXUALLY TRANSMITTED DISEASES

- 9.3.1 RISING PREVALENCE OF HPV AND HIV TO DRIVE MARKET

- 9.4 HOSPITAL-ACQUIRED INFECTIONS

- 9.4.1 GROWING FOCUS ON TARGETED CLINICAL THERAPY FOR REDUCTION IN HAIS TO FUEL MARKET

- 9.5 CANCER

- 9.5.1 INCREASING PREFERENCE FOR ONCOLOGY THERAPEUTICS TO DRIVE MARKET

- 9.6 HEPATITIS

- 9.6.1 INCREASING PREVALENCE AMONG HIGH-RISK SUBGROUP POPULATIONS TO PROPEL MARKET

- 9.7 GASTROINTESTINAL DISORDERS

- 9.7.1 RISING INCIDENCE OF IBS TO SUPPORT MARKET GROWTH

- 9.8 OTHER APPLICATIONS

10 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 HOSPITALS

- 10.2.1 CAPABILITY TO PURCHASE ADVANCED DIAGNOSTIC EQUIPMENT AND ABILITY TO SUPPORT HIGH PATIENT FOOTFALL TO PROPEL MARKET

- 10.2.1.1 Sepsis

- 10.2.1.1.1 Rising requirement for rapid diagnosis & treatment to fuel uptake

- 10.2.1.2 Gastroenteritis

- 10.2.1.2.1 Increasing admissions to critical care units and rising focus on molecular tools for diagnosis to fuel uptake

- 10.2.1.3 Meningoencephalitis

- 10.2.1.3.1 Initialization of targeted treatment due to high mortality risk to fuel market

- 10.2.1.4 Other diseases

- 10.2.1.1 Sepsis

- 10.2.1 CAPABILITY TO PURCHASE ADVANCED DIAGNOSTIC EQUIPMENT AND ABILITY TO SUPPORT HIGH PATIENT FOOTFALL TO PROPEL MARKET

- 10.3 PHYSICIANS' OFFICES/CLINICS

- 10.3.1 RAPID RESULTS AND INDIVIDUALIZED CARE TO FUEL MARKET

- 10.4 RESEARCH INSTITUTES

- 10.4.1 INCREASING FOCUS ON GENOMICS & PROTEOMICS RESEARCH TO BOOST DEMAND

- 10.5 OTHER END USERS

11 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 11.2.2 US

- 11.2.2.1 High healthcare expenditure for advanced molecular diagnostic technologies to drive market

- 11.2.3 CANADA

- 11.2.3.1 Favorable government initiatives for early disease diagnosis awareness to fuel market

- 11.3 EUROPE

- 11.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 11.3.2 GERMANY

- 11.3.2.1 Universal healthcare coverage and favorable growth for decentralized care settings to fuel market

- 11.3.3 UK

- 11.3.3.1 Rising prevalence of STIs to boost demand

- 11.3.4 FRANCE

- 11.3.4.1 High disease burden of infectious diseases and cancer to drive market

- 11.3.5 ITALY

- 11.3.5.1 Rising demand for high-precision diagnostic tools to support market growth

- 11.3.6 SPAIN

- 11.3.6.1 Rising incidence of respiratory illnesses and HIV to boost demand

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 11.4.2 CHINA

- 11.4.2.1 Increasing incidence of influenza and epidemics to propel market

- 11.4.3 JAPAN

- 11.4.3.1 Growing access to advanced & affordable healthcare services to fuel market

- 11.4.4 INDIA

- 11.4.4.1 Expanding healthcare access and increasing prevalence of HIV to propel market

- 11.4.5 REST OF ASIA PACIFIC

- 11.5 LATIN AMERICA

- 11.5.1 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 11.5.2 BRAZIL

- 11.5.2.1 High incidence of hepatitis to support market uptake

- 11.5.3 MEXICO

- 11.5.3.1 Rising cases of TB and HAIs to fuel market

- 11.5.4 REST OF LATIN AMERICA

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 11.6.2 KINGDOM OF SAUDI ARABIA (KSA)

- 11.6.2.1 Improvements in healthcare infrastructure to drive market

- 11.6.3 UNITED ARAB EMIRATES (UAE)

- 11.6.3.1 Rising technological advancements in molecular diagnostics to fuel market

- 11.6.4 REST OF MIDDLE EAST & AFRICA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.2.1 OVERVIEW OF STRATEGIES DEPLOYED BY PLAYERS IN POINT OF CARE MOLECULAR DIAGNOSTICS MARKET

- 12.3 REVENUE SHARE ANALYSIS, 2022-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.5.5.1 Company footprint

- 12.5.5.2 Region footprint

- 12.5.5.3 Product & service footprint

- 12.5.5.4 Technology footprint

- 12.5.5.5 Application footprint

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.6.5.1 Detailed list of key startups/SMEs

- 12.6.5.2 Competitive benchmarking of key emerging players/startups (1/2)

- 12.6.5.3 Competitive benchmarking of key startups/SMEs (2/2)

- 12.7 COMPANY VALUATION & FINANCIAL METRICS

- 12.7.1 FINANCIAL METRICS

- 12.7.2 COMPANY VALUATION

- 12.8 BRAND/PRODUCT COMPARISON

- 12.8.1 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT/SERVICE LAUNCHES & APPROVALS

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 DANAHER CORPORATION

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product/Service launches & approvals

- 13.1.1.3.2 Deals

- 13.1.1.3.3 Expansions

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses & competitive threats

- 13.1.2 BIOMERIEUX

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product/Service launches & approvals

- 13.1.2.3.2 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses & competitive threats

- 13.1.3 F. HOFFMANN-LA ROCHE LTD.

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Products/Services launches & approvals

- 13.1.3.3.2 Deals

- 13.1.3.3.3 Expansions

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses & competitive threats

- 13.1.4 ABBOTT

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses & competitive threats

- 13.1.5 QIAGEN N.V.

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches & approvals

- 13.1.5.3.2 Deals

- 13.1.5.3.3 Expansions

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses & competitive threats

- 13.1.6 QUIDELORTHO CORPORATION

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product/Service launches & approvals

- 13.1.6.3.2 Deals

- 13.1.6.3.3 Expansions

- 13.1.7 CO-DIAGNOSTICS, INC.

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.7.3.2 Expansions

- 13.1.8 BIOCARTIS

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product/Service launches & approvals

- 13.1.8.3.2 Deals

- 13.1.9 SD BIOSENSOR, INC.

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Product/Service launches

- 13.1.9.3.2 Deals

- 13.1.9.3.3 Other developments

- 13.1.10 GENEDRIVE PLC

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Services offered

- 13.1.1 DANAHER CORPORATION

- 13.2 OTHER PLAYERS

- 13.2.1 BINX HEALTH, INC.

- 13.2.2 MOLBIO DIAGNOSTICS LIMITED

- 13.2.3 OPGEN, INC.

- 13.2.4 GENOMADIX

- 13.2.5 VISBY MEDICAL, INC.

- 13.2.6 QUANTUMDX GROUP LTD.

- 13.2.7 DETECTACHEM

- 13.2.8 LABSYSTEMS DIAGNOSTICS OY

- 13.2.9 AKONNI BIOSYSTEMS, INC.

- 13.2.10 UBIQUITOME LIMITED

- 13.2.11 CREDO DIAGNOSTICS BIOMEDICAL PTE. LTD.

- 13.2.12 NUCLEIN, LLC

- 13.2.13 GENES2ME

- 13.2.14 AXXIN

- 13.2.15 HUWEL LIFESCIENCES

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

List of Tables

- TABLE 1 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET: KEY DATA FROM PRIMARY SOURCES

- TABLE 3 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET: RISK ASSESSMENT ANALYSIS

- TABLE 4 REGIONAL HIV DATA, 2024

- TABLE 5 AVERAGE SELLING PRICING TREND OF POINT OF CARE MOLECULAR DIAGNOSTIC PRODUCTS, 2023-2025

- TABLE 6 AVERAGE SELLING PRICE TREND OF POINT OF CARE MOLECULAR DIAGNOSTIC ASSAYS & KITS, BY KEY PLAYER, 2023-2025

- TABLE 7 AVERAGE SELLING PRICE TREND OF POINT OF CARE MOLECULAR DIAGNOSTIC PRODUCTS, BY REGION, 2023-2025

- TABLE 8 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET: LIST OF MAJOR PATENTS

- TABLE 9 IMPORT DATA FOR DIAGNOSTIC AND LABORATORY REAGENTS (HS CODE 3822), BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 10 EXPORT DATA FOR DIAGNOSTIC AND LABORATORY REAGENTS (HS CODE 3822), BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 11 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET: ROLE IN ECOSYSTEM

- TABLE 12 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 13 CLASSIFICATION OF IVD DEVICES IN EUROPE

- TABLE 14 TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS IN JAPAN

- TABLE 17 ASIA PACIFIC: KEY REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET: DETAILED LIST OF KEY CONFERENCES & EVENTS, JANUARY 2025-DECEMBER 2026

- TABLE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF POINT OF CARE MOLECULAR DIAGNOSTIC PRODUCTS (%)

- TABLE 22 KEY BUYING CRITERIA FOR POINT OF CARE MOLECULAR DIAGNOSTIC PRODUCTS

- TABLE 23 IMPLEMENTATION OF AI, BY KEY COMPANY & USE CASE

- TABLE 24 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 25 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 26 KEY ASSAYS & KITS CURRENTLY AVAILABLE

- TABLE 27 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR ASSAYS & KITS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 28 NORTH AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR ASSAYS & KITS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 29 EUROPE: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR ASSAYS & KITS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 30 ASIA PACIFIC: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR ASSAYS & KITS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 31 LATIN AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR ASSAYS & KITS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 32 MIDDLE EAST & AFRICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR ASSAYS & KITS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 33 KEY INSTRUMENTS & ANALYZERS CURRENTLY AVAILABLE

- TABLE 34 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR INSTRUMENTS & ANALYZERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 35 NORTH AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR INSTRUMENTS & ANALYZERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 36 EUROPE: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR INSTRUMENTS & ANALYZERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 37 ASIA PACIFIC: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR INSTRUMENTS & ANALYZERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 38 LATIN AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR INSTRUMENTS & ANALYZERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 39 MIDDLE EAST & AFRICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR INSTRUMENTS & ANALYZERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 40 KEY SOFTWARE & SERVICES CURRENTLY AVAILABLE

- TABLE 41 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR SOFTWARE & SERVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 42 NORTH AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR SOFTWARE & SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 43 EUROPE: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR SOFTWARE & SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 44 ASIA PACIFIC: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR SOFTWARE & SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 45 LATIN AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR SOFTWARE & SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 46 MIDDLE EAST & AFRICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR SOFTWARE & SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 47 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 48 KEY RT-PCR-BASED PRODUCTS CURRENTLY AVAILABLE

- TABLE 49 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR RT-PCR, BY REGION, 2023-2030 (USD MILLION)

- TABLE 50 NORTH AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR RT-PCR, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 51 EUROPE: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR RT-PCR, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 52 ASIA PACIFIC: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR RT-PCR, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 53 LATIN AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR RT-PCR, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 54 MIDDLE EAST & AFRICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR RT-PCR, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 55 KEY INAAT-BASED PRODUCTS CURRENTLY AVAILABLE

- TABLE 56 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR INAAT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 57 NORTH AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR INAAT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 58 EUROPE: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR INAAT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 59 ASIA PACIFIC: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR INAAT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 60 LATIN AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR INAAT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 61 MIDDLE EAST & AFRICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR INAAT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 62 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR OTHER TECHNOLOGIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 63 NORTH AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR OTHER TECHNOLOGIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 64 EUROPE: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR OTHER TECHNOLOGIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 65 ASIA PACIFIC: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR OTHER TECHNOLOGIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 66 LATIN AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR OTHER TECHNOLOGIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 67 MIDDLE EAST & AFRICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR OTHER TECHNOLOGIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 68 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 69 KEY BLOOD SAMPLE TYPE-BASED PRODUCTS CURRENTLY AVAILABLE

- TABLE 70 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR BLOOD SAMPLES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 71 NORTH AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR BLOOD SAMPLES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 72 EUROPE: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR BLOOD SAMPLES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 73 ASIA PACIFIC: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR BLOOD SAMPLES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 74 LATIN AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR BLOOD SAMPLES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 75 MIDDLE EAST & AFRICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR BLOOD SAMPLES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 76 KEY URINE SAMPLE-BASED PRODUCTS CURRENTLY AVAILABLE

- TABLE 77 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR URINE SAMPLES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 78 NORTH AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR URINE SAMPLES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 79 EUROPE: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR URINE SAMPLES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 80 ASIA PACIFIC: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR URINE SAMPLES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 81 LATIN AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR URINE SAMPLES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 82 MIDDLE EAST & AFRICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR URINE SAMPLES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 83 KEY OTHER SAMPLE TYPE-BASED PRODUCTS CURRENTLY AVAILABLE

- TABLE 84 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR OTHER SAMPLE TYPES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 85 NORTH AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR OTHER SAMPLE TYPES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 86 EUROPE: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR OTHER SAMPLE TYPES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 87 ASIA PACIFIC: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR OTHER SAMPLE TYPES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 88 LATIN AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR OTHER SAMPLE TYPES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 89 MIDDLE EAST & AFRICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR OTHER SAMPLE TYPES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 90 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 91 KEY POC MOLECULAR DIAGNOSTIC PRODUCTS FOR RESPIRATORY DISEASES CURRENTLY AVAILABLE

- TABLE 92 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR RESPIRATORY DISEASES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 93 NORTH AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR RESPIRATORY DISEASES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 94 EUROPE: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR RESPIRATORY DISEASES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 95 ASIA PACIFIC: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR RESPIRATORY DISEASES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 96 LATIN AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR RESPIRATORY DISEASES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 97 MIDDLE EAST & AFRICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR RESPIRATORY DISEASES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 98 NUMBER OF NEWLY DIAGNOSED TUBERCULOSIS (TB) CASES, 2023-2030 (IN MILLIONS)

- TABLE 99 KEY POC MOLECULAR DIAGNOSTIC PRODUCTS FOR SEXUALLY TRANSMITTED DISEASES CURRENTLY AVAILABLE

- TABLE 100 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR SEXUALLY TRANSMITTED DISEASES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 101 NORTH AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR SEXUALLY TRANSMITTED DISEASES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 102 EUROPE: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR SEXUALLY TRANSMITTED DISEASES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 103 ASIA PACIFIC: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR SEXUALLY TRANSMITTED DISEASES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 104 LATIN AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR SEXUALLY TRANSMITTED DISEASES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 105 MIDDLE EAST & AFRICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR SEXUALLY TRANSMITTED DISEASES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 106 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR HOSPITAL-ACQUIRED INFECTIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 107 NORTH AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR HOSPITAL-ACQUIRED INFECTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 108 EUROPE: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR HOSPITAL-ACQUIRED INFECTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 109 ASIA PACIFIC: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR HOSPITAL-ACQUIRED INFECTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 110 LATIN AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR HOSPITAL-ACQUIRED INFECTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 111 MIDDLE EAST & AFRICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR HOSPITAL-ACQUIRED INFECTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 112 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR CANCER, BY REGION, 2023-2030 (USD MILLION)

- TABLE 113 NORTH AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR CANCER, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 114 EUROPE: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR CANCER, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 115 ASIA PACIFIC: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR CANCER, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 116 LATIN AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR CANCER, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 117 MIDDLE EAST & AFRICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR CANCER, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 118 KEY POC MOLECULAR DIAGNOSTIC PRODUCTS FOR HEPATITIS CURRENTLY AVAILABLE

- TABLE 119 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR HEPATITIS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 120 NORTH AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR HEPATITIS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 121 EUROPE: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR HEPATITIS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 122 ASIA PACIFIC: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR HEPATITIS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 123 LATIN AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR HEPATITIS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 124 MIDDLE EAST & AFRICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR HEPATITIS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 125 KEY POC MOLECULAR DIAGNOSTIC PRODUCTS FOR GASTROINTESTINAL DISORDERS CURRENTLY AVAILABLE

- TABLE 126 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR GASTROINTESTINAL DISORDERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 127 NORTH AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR GASTROINTESTINAL DISORDERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 128 EUROPE: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR GASTROINTESTINAL DISORDERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 129 ASIA PACIFIC: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR GASTROINTESTINAL DISORDERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 130 LATIN AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR GASTROINTESTINAL DISORDERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR GASTROINTESTINAL DISORDERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 132 KEY POC MOLECULAR DIAGNOSTIC PRODUCTS FOR OTHER APPLICATIONS CURRENTLY AVAILABLE

- TABLE 133 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR OTHER APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 134 NORTH AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 135 EUROPE: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 136 ASIA PACIFIC: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 137 LATIN AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 138 MIDDLE EAST & AFRICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 139 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 140 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR HOSPITALS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 141 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR HOSPITALS, BY DISEASE TYPE, 2023-2030 (USD MILLION)

- TABLE 142 NORTH AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR HOSPITALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 143 EUROPE: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR HOSPITALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 144 ASIA PACIFIC: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR HOSPITALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 145 LATIN AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR HOSPITALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR HOSPITALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 147 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR PHYSICIANS' OFFICES/CLINICS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 148 NORTH AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR PHYSICIANS' OFFICES/CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 149 EUROPE: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR PHYSICIANS' OFFICES/CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 150 ASIA PACIFIC: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR PHYSICIANS' OFFICES/CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 151 LATIN AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR PHYSICIANS' OFFICES/CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR PHYSICIANS' OFFICES/CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 153 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR RESEARCH INSTITUTES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 154 NORTH AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR RESEARCH INSTITUTES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 155 EUROPE: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR RESEARCH INSTITUTES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 156 ASIA PACIFIC: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR RESEARCH INSTITUTES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 157 LATIN AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR RESEARCH INSTITUTES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR RESEARCH INSTITUTES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 159 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR OTHER END USERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 160 NORTH AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 161 EUROPE: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 162 ASIA PACIFIC: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 163 LATIN AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 165 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 166 NORTH AMERICA: MACROECONOMIC INDICATORS

- TABLE 167 NORTH AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 168 NORTH AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 169 NORTH AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 170 NORTH AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 171 NORTH AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 172 NORTH AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 173 US: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 174 US: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 175 US: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 176 US: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 177 US: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 178 CANADA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 179 CANADA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 180 CANADA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 181 CANADA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 182 CANADA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 183 EUROPE: MACROECONOMIC INDICATORS

- TABLE 184 EUROPE: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 185 EUROPE: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 186 EUROPE: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 187 EUROPE: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 188 EUROPE: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 189 EUROPE: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 190 GERMANY: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 191 GERMANY: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 192 GERMANY: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 193 GERMANY: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 194 GERMANY: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 195 UK: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 196 UK: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 197 UK: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 198 UK: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 199 UK: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 200 FRANCE: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 201 FRANCE: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 202 FRANCE: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 203 FRANCE: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 204 FRANCE: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 205 ITALY: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 206 ITALY: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 207 ITALY: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 208 ITALY: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 209 ITALY: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 210 SPAIN: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 211 SPAIN: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 212 SPAIN: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 213 SPAIN: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 214 SPAIN: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 215 REST OF EUROPE: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 216 REST OF EUROPE: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 217 REST OF EUROPE: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 218 REST OF EUROPE: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 219 REST OF EUROPE: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 220 ASIA PACIFIC: MACROECONOMIC INDICATORS

- TABLE 221 ASIA PACIFIC: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 222 ASIA PACIFIC: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 223 ASIA PACIFIC: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 224 ASIA PACIFIC: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 225 ASIA PACIFIC: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 226 ASIA PACIFIC: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 227 CHINA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 228 CHINA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 229 CHINA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 230 CHINA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 231 CHINA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 232 JAPAN: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 233 JAPAN: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 234 JAPAN: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 235 JAPAN: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 236 JAPAN: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 237 INDIA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 238 INDIA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 239 INDIA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 240 INDIA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 241 INDIA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 242 REST OF ASIA PACIFIC: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 243 REST OF ASIA PACIFIC: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 244 REST OF ASIA PACIFIC: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 245 REST OF ASIA PACIFIC: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 246 REST OF ASIA PACIFIC: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 247 LATIN AMERICA: MACROECONOMIC INDICATORS

- TABLE 248 LATIN AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 249 LATIN AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 250 LATIN AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 251 LATIN AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 252 LATIN AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 253 LATIN AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 254 BRAZIL: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 255 BRAZIL: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 256 BRAZIL: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 257 BRAZIL: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 258 BRAZIL: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 259 MEXICO: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 260 MEXICO: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 261 MEXICO: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 262 MEXICO: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 263 MEXICO: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 264 REST OF LATIN AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 265 REST OF LATIN AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 266 REST OF LATIN AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 267 REST OF LATIN AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 268 REST OF LATIN AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 269 MIDDLE EAST & AFRICA: MACROECONOMIC INDICATORS

- TABLE 270 MIDDLE EAST & AFRICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 271 MIDDLE EAST & AFRICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 272 MIDDLE EAST & AFRICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 273 MIDDLE EAST & AFRICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 274 MIDDLE EAST & AFRICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 275 MIDDLE EAST & AFRICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 276 KINGDOM OF SAUDI ARABIA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 277 KINGDOM OF SAUDI ARABIA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 278 KINGDOM OF SAUDI ARABIA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 279 KINGDOM OF SAUDI ARABIA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 280 KINGDOM OF SAUDI ARABIA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 281 UNITED ARAB EMIRATES: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 282 UNITED ARAB EMIRATES: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 283 UNITED ARAB EMIRATES: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 284 UNITED ARAB EMIRATES: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 285 UNITED ARAB EMIRATES: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 286 REST OF MIDDLE EAST & AFRICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 287 REST OF MIDDLE EAST & AFRICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 288 REST OF MIDDLE EAST & AFRICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 289 REST OF MIDDLE EAST & AFRICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 290 REST OF MIDDLE EAST & AFRICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 291 OVERVIEW OF STRATEGIES DEPLOYED BY KEY COMPANIES IN POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, JANUARY 2021-JULY 2025

- TABLE 292 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET: DEGREE OF COMPETITION

- TABLE 293 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET: REGION FOOTPRINT

- TABLE 294 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET: PRODUCT & SERVICE FOOTPRINT

- TABLE 295 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET: TECHNOLOGY FOOTPRINT

- TABLE 296 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET: APPLICATION FOOTPRINT

- TABLE 297 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 298 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET: COMPETITIVE BENCHMARKING OF KEY EMERGING PLAYERS/STARTUPS (1/2)

- TABLE 299 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES (2/2)

- TABLE 300 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET: PRODUCT/SERVICE LAUNCHES & APPROVALS, JANUARY 2021-JULY 2025

- TABLE 301 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET: DEALS, JANUARY 2021-JULY 2025

- TABLE 302 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET: EXPANSIONS, JANUARY 2021-JULY 2025

- TABLE 303 DANAHER CORPORATION: COMPANY OVERVIEW

- TABLE 304 DANAHER CORPORATION: PRODUCTS/SERVICES OFFERED

- TABLE 305 DANAHER CORPORATION: PRODUCT/SERVICE LAUNCHES & APPROVALS, JANUARY 2021-JULY 2025

- TABLE 306 DANAHER CORPORATION: DEALS, JANUARY 2021-JULY 2025

- TABLE 307 DANAHER CORPORATION: EXPANSIONS, JANUARY 2021-JULY 2025

- TABLE 308 BIOMERIEUX: COMPANY OVERVIEW

- TABLE 309 BIOMERIEUX: PRODUCTS/SERVICES OFFERED

- TABLE 310 BIOMERIEUX: PRODUCT/SERVICE APPROVALS, JANUARY 2021-JULY 2025

- TABLE 311 BIOMERIEUX: DEALS, JANUARY 2021-JULY 2025

- TABLE 312 F. HOFFMANN-LA ROCHE LTD: COMPANY OVERVIEW

- TABLE 313 F. HOFFMANN-LA ROCHE LTD.: PRODUCTS/SERVICES OFFERED

- TABLE 314 F. HOFFMANN-LA ROCHE LTD.: PRODUCTS/SERVICES LAUNCHES & APPROVALS, JANUARY 2021-JULY 2025

- TABLE 315 F. HOFFMANN-LA ROCHE LTD.: DEALS, JANUARY 2021-JULY 2025

- TABLE 316 F. HOFFMANN-LA ROCHE LTD.: EXPANSIONS, JANUARY 2021-JULY 2025

- TABLE 317 ABBOTT: COMPANY OVERVIEW

- TABLE 318 ABBOTT PRODUCTS/SERVICES OFFERED

- TABLE 319 ABBOTT: DEALS, JANUARY 2021-JULY 2025

- TABLE 320 QIAGEN N.V.: COMPANY OVERVIEW

- TABLE 321 QIAGEN N.V.: PRODUCTS/SERVICES OFFERED

- TABLE 322 QIAGEN N.V.: PRODUCT LAUNCHES & APPROVALS, JANUARY 2021-JULY 2025

- TABLE 323 QIAGEN N.V.: DEALS, JANUARY 2021-JULY 2025

- TABLE 324 QIAGEN N.V.: EXPANSIONS, JANUARY 2021-JULY 2025

- TABLE 325 QUIDELORTHO CORPORATION: COMPANY OVERVIEW

- TABLE 326 QUIDELORTHO CORPORATION: PRODUCTS/SERVICES OFFERED

- TABLE 327 QUIDELORTHO CORPORATION: PRODUCT/SERVICE LAUNCHES & APPROVALS, JANUARY 2021-JULY 2025

- TABLE 328 QUIDELORTHO CORPORATION: DEALS, JANUARY 2021-JULY 2025

- TABLE 329 QUIDELORTHO CORPORATION: EXPANSIONS, JANUARY 2021-JULY 2025

- TABLE 330 CO-DIAGNOSTICS, INC.: COMPANY OVERVIEW

- TABLE 331 CO-DIAGNOSTICS, INC.: PRODUCTS/SERVICES OFFERED

- TABLE 332 CO-DIAGNOSTICS, INC.: DEALS, JANUARY 2021-JULY 2025

- TABLE 333 CO-DIAGNOSTICS, INC.: EXPANSIONS, JANUARY 2021-JULY 2025

- TABLE 334 BIOCARTIS: COMPANY OVERVIEW

- TABLE 335 BIOCARTIS: PRODUCTS/SERVICES OFFERED

- TABLE 336 BIOCARTIS: PRODUCT/SERVICE LAUNCHES & APPROVALS, JANUARY 2021-JULY 2025

- TABLE 337 BIOCARTIS: DEALS, JANUARY 2021-JULY 2025

- TABLE 338 SD BIOSENSOR, INC.: BUSINESS OVERVIEW

- TABLE 339 SD BIOSENSOR, INC.: PRODUCTS/SERVICES OFFERED

- TABLE 340 SD BIOSENSOR, INC.: PRODUCT/SERVICE LAUNCHES, JANUARY 2021-JULY 2025

- TABLE 341 SD BIOSENSOR, INC.: DEALS, JANUARY 2021-JULY 2025

- TABLE 342 SD BIOSENSOR, INC.: OTHER DEVELOPMENTS, JANUARY 2021-JULY 2025

- TABLE 343 GENEDRIVE PLC: COMPANY OVERVIEW

- TABLE 344 GENEDRIVE PLC: PRODUCTS/SERVICES OFFERED

- TABLE 345 BINX HEALTH, INC.: COMPANY OVERVIEW

- TABLE 346 MOLBIO DIAGNOSTICS LIMITED: COMPANY OVERVIEW

- TABLE 347 OPGEN, INC.: COMPANY OVERVIEW

- TABLE 348 GENOMADIX: COMPANY OVERVIEW

- TABLE 349 VISBY MEDICAL, INC.: COMPANY OVERVIEW

- TABLE 350 QUANTUMDX GROUP LTD.: COMPANY OVERVIEW

- TABLE 351 DETECTACHEM: COMPANY OVERVIEW

- TABLE 352 LABSYSTEMS DIAGNOSTICS OY: COMPANY OVERVIEW

- TABLE 353 AKONNI BIOSYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 354 UBIQUITOME LIMITED: COMPANY OVERVIEW

- TABLE 355 CREDO DIAGNOSTICS BIOMEDICAL PTE. LTD.: COMPANY OVERVIEW

- TABLE 356 NUCLEIN, LLC: COMPANY OVERVIEW

- TABLE 357 GENES2ME: COMPANY OVERVIEW

- TABLE 358 AXXIN: COMPANY OVERVIEW

- TABLE 359 HUWEL LIFESCIENCES: COMPANY OVERVIEW

List of Figures

- FIGURE 1 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET SEGMENTATION & REGIONAL SCOPE

- FIGURE 2 YEARS CONSIDERED

- FIGURE 3 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET: RESEARCH DESIGN METHODOLOGY

- FIGURE 4 PRIMARY SOURCES

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY SIDE AND DEMAND SIDE PARTICIPANTS

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 7 BOTTOM-UP APPROACH: COMPANY REVENUE ESTIMATION APPROACH

- FIGURE 8 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 9 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET: TOP-DOWN APPROACH

- FIGURE 10 DATA TRIANGULATION METHODOLOGY

- FIGURE 11 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET: RESEARCH ASSUMPTIONS

- FIGURE 12 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2025 VS. 2030 (USD MILLION)

- FIGURE 13 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY SAMPLE TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 15 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 16 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 17 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, BY REGION, 2025 VS. 2030 (USD MILLION)

- FIGURE 18 INCREASING ADVANCEMENTS IN MOLECULAR DIAGNOSTICS TECHNOLOGIES TO PROPEL MARKET

- FIGURE 19 ASSAYS & KITS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 20 RT-PCR SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 21 OTHER SAMPLE TYPES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 22 RESPIRATORY DISEASES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 23 HOSPITALS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 24 ASIA PACIFIC REGION TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 25 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 26 PATENT ANALYSIS FOR POINT OF CARE MOLECULAR DIAGNOSTICS (JANUARY 2014-DECEMBER 2024)

- FIGURE 27 VALUE CHAIN ANALYSIS OF POINT OF CARE MOLECULAR DIAGNOSTICS MARKET: MAJOR VALUE ADDED DURING MANUFACTURING & ASSEMBLY PHASES

- FIGURE 28 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 29 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 30 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 31 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET: TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF POINT OF CARE MOLECULAR DIAGNOSTIC PRODUCTS

- FIGURE 33 KEY BUYING CRITERIA FOR POINT OF CARE MOLECULAR DIAGNOSTIC PRODUCTS

- FIGURE 34 NUMBER OF DEALS & FUNDING ACTIVITIES IN POINT OF CARE MOLECULAR DIAGNOSTICS MARKET

- FIGURE 35 MARKET POTENTIAL OF AI IN POINT OF CARE MOLECULAR DIAGNOSTICS MARKET

- FIGURE 36 NORTH AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET SNAPSHOT

- FIGURE 37 ASIA PACIFIC: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET SNAPSHOT

- FIGURE 38 REVENUE ANALYSIS OF KEY PLAYERS IN POINT OF CARE MOLECULAR DIAGNOSTICS MARKET, 2022-2024

- FIGURE 39 MARKET SHARE ANALYSIS OF KEY PLAYERS IN POINT OF CARE MOLECULAR DIAGNOSTICS MARKET (2024)

- FIGURE 40 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 41 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET: COMPANY FOOTPRINT

- FIGURE 42 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 43 EV/EBITDA OF KEY VENDORS

- FIGURE 44 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 45 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET: BRAND COMPARISON FOR INSTRUMENTS

- FIGURE 46 DANAHER CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 47 BIOMERIEUX: COMPANY SNAPSHOT (2024)

- FIGURE 48 F. HOFFMANN-LA ROCHE LTD.: COMPANY SNAPSHOT (2024)

- FIGURE 49 ABBOTT: COMPANY SNAPSHOT (2024)

- FIGURE 50 QIAGEN N.V.: COMPANY SNAPSHOT (2024)

- FIGURE 51 QUIDELORTHO CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 52 CO-DIAGNOSTICS, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 53 BIOCARTIS: COMPANY SNAPSHOT (2022)

- FIGURE 54 SD BIOSENSOR, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 55 GENEDRIVE PLC: COMPANY SNAPSHOT (2024)