|

市場調查報告書

商品編碼

1808962

全球工業氮氣產生器市場規模、設計、技術類型、最終用途產業和地區預測(2030 年)Industrial Nitrogen Generator Market by Size, Design, Technology Type, End-use Industry, and Region - Global Forecast to 2030 |

||||||

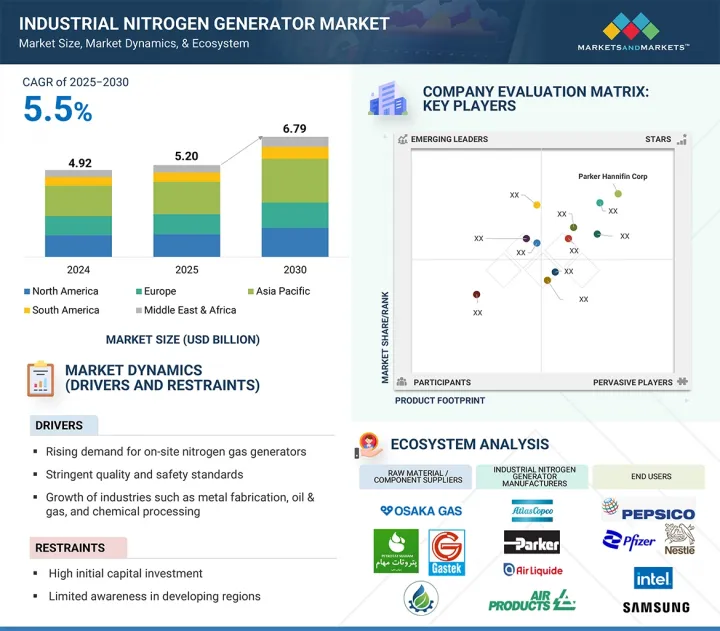

預計全球工業氮氣產生器市場將從 2025 年的 52 億美元成長到 2030 年的 67.9 億美元,預測期內的複合年成長率為 5.5%。

市場驅動力主要源自於食品飲料、製藥、化學、電子以及石油天然氣產業對高純度氮氣日益成長的需求。對經濟高效、持續的現場氮氣供應的需求日益成長,推動人們從傳統的氣體供應方式轉向氮氣產生器。使用這些系統,產業可以擺脫對外部供應商的依賴,同時降低運輸成本,提高安全性,並增強對營運的控制。

| 調查範圍 | |

|---|---|

| 調查年份 | 2022-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 單元 | 百萬美元,噸 |

| 部分 | 規模、設計、技術類型、最終用途產業、地區 |

| 目標區域 | 北美、歐洲、亞太地區、南美、中東和非洲 |

環境因素和嚴格的碳排放法規正在推動各行各業向節能永續的氣體生產技術邁進。此外,技術創新和近期的系統自動化使氮氣產生器更加緊湊、可靠,並且更易於整合到現有系統中。市場按應用細分為變壓式吸附(PSA)、膜分離和深冷分離。 PSA 系統目前佔據行業主導地位,因為它們能夠提供高純度氮氣和操作靈活性的最佳組合。薄膜技術適用於較低純度、較高流速的應用,而深冷系統則適用於更大規模、超高純度的應用。總體而言,多種促進因素正在推動市場在全球廣泛採用工業氮氣產生器產品。

“在預測期內,固定式工業氮氣發生器是工業氮氣發生器市場中成長速度第二快的類型。”

固定式工業氮氣產生器憑藉其穩定的需求和支援大規模、持續工業運作的能力,成為市場中成長速度第二快的細分市場。這些系統能夠生產大量高純度氮氣,是化學、製藥和電子等需要持續氣體供應的行業的理想選擇。由於固定式產生器和生產基礎設施專為工業用途而設計,因此其靈活性通常不如移動設備,但它們也具有顯著的優勢:長期擁有成本更低、對未簽約的氣體產品供應商的依賴更少、製程控制更佳。固定式氮氣產生器的一個關鍵優勢在於其能夠無縫整合到集中式生產線中,從而持續供應氮氣以滿足穩定的需求。

“在預測期內,低溫技術是工業氮氣發生器市場中成長速度第二快的技術類型。”

低溫技術是工業氮氣產生器市場中成長速度第二快的技術類型。它能夠生產大量超高純度氮氣,使其成為化學、石化和冶金等行業重型應用的理想選擇。在低溫氮氣產生器中,空氣經過低溫分離和處理,可穩定地供應需要最高純度製程所需的氮氣。雖然與其他氮氣生成技術相比,低溫系統通常具有更高的資本和營業成本,但其能夠輸送大量氮氣的能力,在大規模耗氮環境中可以證明這些成本的合理性。能源密集產業支撐的廣泛工業基礎設施高度依賴可靠的高容量氮氣系統。因此,商用低溫系統的採用和工業氮氣基礎設施的不斷發展,可能會透過增強氮氣系統的性能,為低溫氮氣生成系統帶來巨大的需求。

預計在預測期內,中東和非洲市場將成為工業氮氣發生器市場成長第二快的地區。

這一成長主要得益於化工、化肥和石化等能源密集產業的擴張,尤其是在埃及、沙烏地阿拉伯和奈及利亞。這些國家正在擴大出口並提高國內產量。中東和非洲也優先發展製造業和基礎設施,包括化肥廠、石化設施和食品加工設施。這一重點推動了對現場氮氣生產的需求,以支持這些業務。

本報告分析了全球工業氮氣產生器市場,提供了關鍵促進因素和限制因素、競爭格局和未來趨勢的資訊。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章 主要發現

- 工業氮氣發生器市場的企業機會

- 工業氮氣產生器市場規模

- 工業氮氣產生器市場設計

- 工業氮氣產生器市場(依技術)

- 工業氮氣發生器市場(按最終用途行業分類)

- 各國工業氮氣發生器市場

第5章市場概述

- 介紹

- 市場動態

- 驅動程式

- 抑制因素

- 機會

- 任務

- 波特五力分析

- 主要相關利益者和採購標準

- 總體經濟指標

- 價值鏈分析

- 監管格局

- 北美洲

- 亞太地區

- 歐洲

- 中東和非洲

- 南美洲

- 監管機構、政府機構和其他組織

- 貿易分析

- 進口情形(HS 編碼 840510)

- 出口情形(HS 編碼 840510)

- 生態系分析

- 影響客戶業務的趨勢/中斷

- 案例研究分析

- 派克漢尼汾為醫療和製藥應用提供氮氣產生器

- 阿特拉斯·科普柯為食品飲料產業提供PSA氮氣產生器

- 林德為電子製造業提供先進的氮氣產生器

- 技術分析

- 主要技術

- 互補技術

- 定價分析

- 各地區平均售價趨勢(2022-2024)

- 各終端用途產業主要企業平均銷售價格趨勢(2024年)

- 大型會議和活動(2025-2026年)

- 專利分析

- 調查方法

- 文件類型

- 公告趨勢

- 考慮

- 專利的法律地位

- 司法管轄權分析

- 主申請人

- 人工智慧/發電機人工智慧對工業氮氣產生器市場的影響

- 投資金籌措場景

- 2025年美國關稅對工業氮氣發生器市場的影響

- 介紹

- 主要關稅稅率

- 價格影響分析

- 對主要國家的影響

- 對終端產業的影響

6. 工業氮氣產生器市場(依設計)

- 介紹

- 即插即用

- 汽缸座

7. 工業氮氣產生器市場規模

- 介紹

- 固定式工業氮氣產生器

- 移動式工業氮氣產生器

8. 工業氮氣產生器市場(依技術)

- 介紹

- 變壓式吸附(PSA)

- 基於膜

- 低溫基地

9. 工業氮氣產生器市場(依最終用途產業)

- 介紹

- 食品/飲料

- 醫療/製藥

- 運輸

- 電機與電子工程

- 化工/石化

- 製造業

- 包裝

- 其他最終用途產業

第 10 章:工業氮氣產生器市場(按地區)

- 介紹

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 中東和非洲

- 海灣合作理事會國家

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

第11章競爭格局

- 概述

- 主要參與企業的策略(2023-2025)

- 收益分析(2022-2024)

- 市場佔有率分析(2024年)

- 公司估值與財務指標(2024年)

- 品牌/產品比較分析

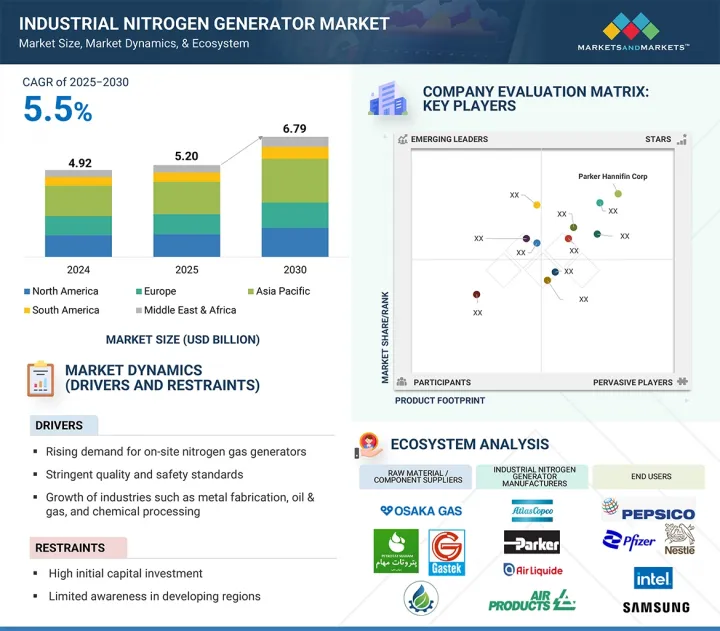

- 企業評估矩陣:主要企業(2024年)

- 公司評估矩陣:Start-Ups/中小企業(2024 年)

- 競爭場景

第12章:公司簡介

- 主要企業

- PARKER HANNIFIN CORP

- AIR PRODUCTS AND CHEMICALS, INC.

- ATLAS COPCO GROUP

- INGERSOLL RAND

- AIR LIQUIDE

- LINDE PLC

- HITACHI INDUSTRIAL EQUIPMENT SYSTEMS CO., LTD.

- INMATEC

- NOVAIR

- OXYMAT

- 其他公司

- AIRPACK

- CLAIND

- COMPRESSED GAS TECHNOLOGIES, INC.

- ERRE DUE SPA

- FOXOLUTION

- GENERON

- GAZTRON

- ISOLCELL SPA.

- NOBLEGEN

- OXYWISE SRO

- OMEGA AIR

- OXAIR

- ON SITE GAS

- PEAKGAS

- WERTHER INTERNATIONAL

第13章 附錄

The industrial nitrogen generator market is projected to reach USD 6.79 billion by 2030 from USD 5.20 billion in 2025, at a CAGR of 5.5% during the forecast period. The industrial nitrogen generator market is mainly driven by an increasing need for high-purity nitrogen in the food and beverage, pharmaceuticals, chemicals, electronics, and oil & gas industries. Growing demand for cost-efficient, continuous, on-site supply of nitrogen is encouraging industries to transition away from conventional methods of gas delivery to nitrogen generators. Using these systems allows industries to eliminate the dependency on external suppliers while providing lower transport costs, added safety, and much better control of the operations.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million)/ Volume (Tons) |

| Segments | Size, Design, Technology Type, End-use Industry, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and the Middle East & Africa |

Environmental factors and stringent regulations pertaining to carbon emissions are driving industries toward energy-efficient and sustainable gas generation technologies. Lastly, due to innovations and the recent automation of systems, nitrogen generators are much more compact, reliable, and easy to incorporate into any existing system. The market is segmented by application into pressure swing adsorption (PSA), membrane separation, and cryogenic separation. PSA systems currently dominate the industry as the most suitable system for both high-purity nitrogen and operational flexibility. Membrane technology is useful in applications with lower purity and higher flow, while cryogenic systems are suited for ultra-high purity applications on a larger scale. Overall, there are several drivers that are pushing the market toward more industrial nitrogen generator products geared toward global adoption.

"Stationary industrial nitrogen generator is the second-fastest-growing type in the industrial nitrogen generators market during the forecast period."

Stationary industrial nitrogen generators are the second-fastest-growing segment in the market due to their consistent demand and ability to support large-scale, continuous industrial operations. These systems produce high-capacity nitrogen with high-purity gas output, making them ideal for industries such as chemicals, pharmaceuticals, and electronics, where a continuous gas supply is essential. While stationary generators and production infrastructures are generally less flexible than portable units since they are specifically designed for industrial use, they offer significant advantages. These include lower long-term ownership costs, reduced reliance on uncontracted suppliers for gas products, and improved process control. A key benefit of stationary nitrogen generators is their seamless integration into centralized production lines, where they can supply nitrogen gas continuously to meet stable demand.

"Cryogenic-based is the second-fastest growing technology type in the industrial nitrogen generator market during the forecast period."

Cryogenic technology is the second-fastest-growing type in the industrial nitrogen generator market. It can produce ultra-high-purity nitrogen at high volumes, making it highly relevant for heavy-duty applications in industries such as chemicals, petrochemicals, and metallurgy. In cryogenic nitrogen generators, air is separated at cryogenic temperatures and processed to provide a consistent supply of nitrogen required for processes demanding the highest levels of purity. Although cryogenic systems typically involve higher capital and operational costs compared to other nitrogen generation technologies, their ability to deliver high volumes justifies these costs in environments with large-scale nitrogen consumption. The extensive industrial infrastructure supported by energy-intensive sectors relies heavily on reliable, high-capacity nitrogen systems. Therefore, the introduction of commercial cryogenic systems, along with the growing trends in industrial nitrogen infrastructure, is likely to create significant demand for cryogenic nitrogen generation systems by enhancing nitrogen system capacity.

"The Middle East & African market is the second-fastest growing region in the industrial nitrogen generator market during the forecast period."

The Middle East and Africa (MEA) is the second fastest-growing region in the industrial nitrogen generator market. This growth is driven by the expansion of energy-intensive industries, such as chemicals, fertilizers, and petrochemicals, particularly in Egypt, Saudi Arabia, and Nigeria. These countries are boosting their exports and increasing domestic production. MEA has also prioritized the development of manufacturing and infrastructure, including fertilizer plants, petrochemical facilities, and food processing units. This focus enhances the demand for on-site production of nitrogen gas to support operations. Additionally, global instability and rising price volatility for ammonia and urea supplies have led to a greater reliance on on-site solutions to provide nitrogen, helping to mitigate the risks associated with supply chain disruptions. Governments in many larger MEA markets are reinvesting in modernizing their industries and providing incentives for the development of sustainable or decarbonized gas infrastructures. The combination of increased industrialization, diversification away from oil and gas-dependent economies, and a push for environmentally sustainable initiatives positions the Middle East and Africa as the second-fastest-growing region for industrial nitrogen generator assets.

Extensive primary interviews were conducted to determine and verify the market size for several segments and sub-segments, and the information gathered through secondary research.

The breakdown of primary interviews is given below:

- By Department: Tier 1: 40%, Tier 2: 25%, and Tier 3: 35%

- By Designation: C-level: 35%, Director Level: 30%, and Executives: 35%

- By Region: North America: 25%, Europe: 45%, Asia Pacific: 20%, South America: 5%, and the Middle East & Africa: 5%

Parker Hannifin Corp (US), Air Products and Chemicals, Inc. (US), Atlas Copco Group (Sweden), Ingersoll Rand (US), Air Liquide (France), Linde PLC (UK), Hitachi Industrial Equipment Systems Co., Ltd. (Japan), Inmatec (Germany), Novair SAS (France), and OXYMAT A/S (Germany) are some of the key players in the industrial nitrogen generator market.

The study includes an in-depth competitive analysis of these key players in the market, with their company profiles, recent developments, and key market strategies.

Research Coverage

The market study covers the industrial nitrogen generator market across various segments. It aims to estimate the market size and the growth potential of this market across different segments based on design, size, technology type, end-use industry, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their position in the industrial nitrogen generator market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall industrial nitrogen generator market and its segments and subsegments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses, and plan suitable go-to-market strategies. The report also aims to help stakeholders understand the pulse of the market and provide them with information on the key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (rising demand for on-site nitrogen gas generators, stringent quality and safety standards, and growth of industries such as metal fabrication, oil & gas, and chemical processing), restraints (high initial capital investment and limited awareness in developing regions), opportunities (expansion of emerging markets and customization and scalability of industrial nitrogen generator), challenges (technological complexity and lack of a skilled workforce).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the industrial nitrogen generator market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the industrial nitrogen generator market across varied regions.

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the industrial nitrogen generator market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Parker Hannifin Corp (US), Air Products and Chemicals, Inc. (US), Atlas Copco Group (Sweden), Ingersoll Rand (US), Air Liquide (France), Linde PLC (UK), Hitachi Industrial Equipment Systems Co., Ltd. (Japan), Inmatec (Germany), Novair SAS (France), and OXYMAT A/S (Germany), among others, are the top manufacturers covered in the industrial nitrogen generators market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of primary interview participants-demand and supply side

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 FORECAST NUMBER CALCULATION

- 2.4 DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.6 ASSUMPTIONS

- 2.7 LIMITATIONS AND RISKS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 OPPORTUNITIES FOR PLAYERS IN INDUSTRIAL NITROGEN GENERATOR MARKET

- 4.2 INDUSTRIAL NITROGEN GENERATOR MARKET, BY SIZE

- 4.3 INDUSTRIAL NITROGEN GENERATOR MARKET, BY DESIGN

- 4.4 INDUSTRIAL NITROGEN GENERATOR MARKET, BY TECHNOLOGY TYPE

- 4.5 INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY

- 4.6 INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for on-site nitrogen gas generators

- 5.2.1.2 Stringent quality and safety standards

- 5.2.1.3 Growth of metal fabrication, oil & gas, and chemical processing industries

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial capital investments

- 5.2.2.2 Limited awareness in emerging regions

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion of emerging markets

- 5.2.3.2 Customization and scalability of industrial nitrogen generators

- 5.2.4 CHALLENGES

- 5.2.4.1 Technological complexities

- 5.2.4.2 Lack of skilled workforce

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GLOBAL GDP TRENDS

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 REGULATORY LANDSCAPE

- 5.7.1 NORTH AMERICA

- 5.7.1.1 US

- 5.7.1.2 Canada

- 5.7.2 ASIA PACIFIC

- 5.7.3 EUROPE

- 5.7.4 MIDDLE EAST & AFRICA

- 5.7.5 SOUTH AMERICA

- 5.7.6 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.7.1 NORTH AMERICA

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT SCENARIO (HS CODE 840510)

- 5.8.2 EXPORT SCENARIO (HS CODE 840510)

- 5.9 ECOSYSTEM ANALYSIS

- 5.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 PARKER HANNIFIN OFFERS NITROGEN GENERATORS FOR MEDICAL AND PHARMACEUTICAL APPLICATIONS

- 5.11.2 ATLAS COPCO PROVIDES PSA NITROGEN GENERATOR FOR FOOD & BEVERAGE INDUSTRY

- 5.11.3 LINDE OFFERS ADVANCED NITROGEN GENERATORS FOR ELECTRONIC MANUFACTURING

- 5.12 TECHNOLOGY ANALYSIS

- 5.12.1 KEY TECHNOLOGIES

- 5.12.1.1 Pressure Swing Adsorption (PSA)

- 5.12.1.2 Membrane Separation

- 5.12.1.3 Cryogenic Nitrogen Generation

- 5.12.2 COMPLEMENTARY TECHNOLOGIES

- 5.12.2.1 IoT and Smart Monitoring Systems

- 5.12.2.2 Energy Recovery Systems

- 5.12.1 KEY TECHNOLOGIES

- 5.13 PRICING ANALYSIS

- 5.13.1 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024

- 5.13.2 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY, 2024

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 PATENT ANALYSIS

- 5.15.1 METHODOLOGY

- 5.15.2 DOCUMENT TYPES

- 5.15.3 PUBLICATION TRENDS

- 5.15.4 INSIGHTS

- 5.15.5 LEGAL STATUS OF PATENTS

- 5.15.6 JURISDICTION ANALYSIS

- 5.15.7 TOP APPLICANTS

- 5.16 IMPACT OF AI/GEN AI ON INDUSTRIAL NITROGEN GENERATOR MARKET

- 5.17 INVESTMENT AND FUNDING SCENARIO

- 5.18 IMPACT OF 2025 US TARIFF ON INDUSTRIAL NITROGEN GENERATOR MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON KEY COUNTRIES/REGIONS

- 5.18.4.1 North America

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON END-USE INDUSTRIES

6 INDUSTRIAL NITROGEN GENERATOR MARKET, BY DESIGN

- 6.1 INTRODUCTION

- 6.2 PLUG & PLAY

- 6.2.1 COMPACT DESIGN, EASY ACCESSIBILITY, AND AUTONOMOUS FUNCTION TO BOOST GROWTH

- 6.3 CYLINDER-BASED

- 6.3.1 SPECIALIZED SYSTEM ARCHITECTURE PROVIDING SUPPLY CHAIN AUTONOMY TO DRIVE MARKET

7 INDUSTRIAL NITROGEN GENERATOR MARKET, BY SIZE

- 7.1 INTRODUCTION

- 7.2 STATIONARY INDUSTRIAL NITROGEN GENERATOR

- 7.2.1 DEMAND FOR COST-EFFECTIVE SOLUTION FOR PRODUCTION OF LARGE NITROGEN VOLUMES TO BOOST GROWTH

- 7.3 PORTABLE INDUSTRIAL NITROGEN GENERATOR

- 7.3.1 NEED FOR NITROGEN IN TEMPORARY, REMOTE, OR EMERGENCY SITUATIONS TO DRIVE GROWTH

- 7.3.2 CONTAINERIZED SYSTEMS

- 7.3.3 TRAILER-MOUNTED SYSTEMS

- 7.3.4 MOBILE PUMPING SERVICES

8 INDUSTRIAL NITROGEN GENERATOR MARKET, BY TECHNOLOGY TYPE

- 8.1 INTRODUCTION

- 8.2 PRESSURE SWING ADSORPTION (PSA)

- 8.2.1 DEMAND FOR HIGH TO ULTRA HIGH PURITY TO DRIVE MARKET

- 8.3 MEMBRANE-BASED

- 8.3.1 SIMPLE DESIGN AND COST-EFFECTIVENESS TO FUEL MARKET

- 8.4 CRYOGENIC-BASED

- 8.4.1 RISING DEMAND FOR ADVANCED SEMICONDUCTOR MANUFACTURING PROCESSES TO BOOST MARKET

9 INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- 9.2 FOOD & BEVERAGE

- 9.2.1 DEMAND FOR PRODUCTION, HANDLING, AND PACKING PRODUCTS TO DRIVE MARKET

- 9.3 MEDICAL & PHARMACEUTICAL

- 9.3.1 PROTECTION OF SENSITIVE, EXPENSIVE ACTIVE PHARMACEUTICAL INGREDIENTS, AND FINISHED DRUGS FROM DEGRADATION TO BOOST GROWTH

- 9.4 TRANSPORTATION

- 9.4.1 IMPROVED SAFETY, FUEL EFFICIENCY, AND TIRE LIFE TO FUEL MARKET

- 9.5 ELECTRICAL & ELECTRONICS

- 9.5.1 RISING DEMAND FOR CLEAN, STRONG, AND RELIABLE SOLDER JOINTS TO PROPEL GROWTH

- 9.6 CHEMICAL & PETROCHEMICAL

- 9.6.1 CREATION OF INERT ATMOSPHERES IN STORAGE TANKS, REACTORS, AND PIPELINES TO SUPPORT GROWTH

- 9.7 MANUFACTURING

- 9.7.1 DEMAND FOR PURGING, CARBONIZING, SHIELDING, AND COOLING APPLICATIONS TO BOOST MARKET

- 9.8 PACKAGING

- 9.8.1 RISING DEMAND FOR BOTTLING & CANNING, INERTING, AND BLANKETING APPLICATIONS TO FUEL GROWTH

- 9.9 OTHER END-USE INDUSTRIES

10 INDUSTRIAL NITROGEN GENERATOR MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 US

- 10.2.1.1 Changing lifestyles, growing demand for convenience foods, and recovering industrial activities to boost market

- 10.2.2 CANADA

- 10.2.2.1 Massive investments in battery manufacturing and clean hydrogen production to drive market

- 10.2.3 MEXICO

- 10.2.3.1 Surge in foreign direct investments and industrial real estate to drive market

- 10.2.1 US

- 10.3 EUROPE

- 10.3.1 GERMANY

- 10.3.1.1 Robust industrial base and leadership in high-precision manufacturing to fuel market

- 10.3.2 FRANCE

- 10.3.2.1 Growing food & beverage, electric vehicle, and pharmaceutical industries to propel market

- 10.3.3 UK

- 10.3.3.1 Industrial strategy focused on life sciences sector to drive market

- 10.3.4 ITALY

- 10.3.4.1 Pharmaceutical industry to drive demand

- 10.3.5 SPAIN

- 10.3.5.1 Electrification and renewable energy sector to boost market

- 10.3.6 REST OF EUROPE

- 10.3.1 GERMANY

- 10.4 ASIA PACIFIC

- 10.4.1 CHINA

- 10.4.1.1 Government policies and development of EV industry to drive market

- 10.4.2 JAPAN

- 10.4.2.1 Revitalization of semiconductor industry to boost market

- 10.4.3 INDIA

- 10.4.3.1 Growing food & beverage, pharmaceutical, and electronics industries to propel market

- 10.4.4 SOUTH KOREA

- 10.4.4.1 Massive investments in semiconductor industry to fuel market

- 10.4.5 REST OF ASIA PACIFIC

- 10.4.1 CHINA

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.5.1.1 Saudi Arabia

- 10.5.1.1.1 Vision 2030 and NEOM megaproject to support market growth

- 10.5.1.2 UAE

- 10.5.1.2.1 Government initiatives to drive market

- 10.5.1.3 Rest of GCC countries

- 10.5.1.1 Saudi Arabia

- 10.5.2 REST OF MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.6 SOUTH AMERICA

- 10.6.1 BRAZIL

- 10.6.1.1 Policy supporting healthcare segment to propel market

- 10.6.2 ARGENTINA

- 10.6.2.1 Demand for downstream shale production to fuel market

- 10.6.3 REST OF SOUTH AMERICA

- 10.6.1 BRAZIL

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES, 2023-2025

- 11.3 REVENUE ANALYSIS, 2022-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 11.6 BRAND/PRODUCT COMPARISON ANALYSIS

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Size footprint

- 11.7.5.4 Design footprint

- 11.7.5.5 Technology type footprint

- 11.7.5.6 End-use industry footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: KEY STARTUPS/SMES, 2024

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 PARKER HANNIFIN CORP

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 MnM view

- 12.1.1.3.1 Right to win

- 12.1.1.3.2 Strategic choices

- 12.1.1.3.3 Weaknesses and competitive threats

- 12.1.2 AIR PRODUCTS AND CHEMICALS, INC.

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.3.2 Expansions

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 ATLAS COPCO GROUP

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 INGERSOLL RAND

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 AIR LIQUIDE

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Expansions

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 LINDE PLC

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Expansions

- 12.1.6.4 MnM view

- 12.1.7 HITACHI INDUSTRIAL EQUIPMENT SYSTEMS CO., LTD.

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 MnM view

- 12.1.8 INMATEC

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 MnM view

- 12.1.9 NOVAIR

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 MnM view

- 12.1.10 OXYMAT

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 MnM view

- 12.1.1 PARKER HANNIFIN CORP

- 12.2 OTHER PLAYERS

- 12.2.1 AIRPACK

- 12.2.2 CLAIND

- 12.2.3 COMPRESSED GAS TECHNOLOGIES, INC.

- 12.2.4 ERRE DUE S.P.A.

- 12.2.5 FOXOLUTION

- 12.2.6 GENERON

- 12.2.7 GAZTRON

- 12.2.8 ISOLCELL SPA.

- 12.2.9 NOBLEGEN

- 12.2.10 OXYWISE S.R.O.

- 12.2.11 OMEGA AIR

- 12.2.12 OXAIR

- 12.2.13 ON SITE GAS

- 12.2.14 PEAKGAS

- 12.2.15 WERTHER INTERNATIONAL

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

List of Tables

- TABLE 1 LIST OF KEY SECONDARY SOURCES

- TABLE 2 INDUSTRIAL NITROGEN GENERATOR MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES (%)

- TABLE 4 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 5 PROJECTED REAL GDP GROWTH (ANNUAL PERCENT CHANGE) OF KEY COUNTRIES, 2021-2030

- TABLE 6 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 IMPORT SCENARIO FOR HS CODE 840510-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 10 EXPORT SCENARIO FOR HS CODE 840510-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 11 ROLE OF COMPANIES IN INDUSTRIAL NITROGEN GENERATOR ECOSYSTEM

- TABLE 12 AVERAGE SELLING PRICE OF INDUSTRIAL NITROGEN GENERATOR, BY REGION, 2022-2024 (USD/UNIT)

- TABLE 13 AVERAGE SELLING PRICE OF INDUSTRIAL NITROGEN GENERATOR, BY END-USE INDUSTRY, 2024 (USD/UNIT)

- TABLE 14 INDUSTRIAL NITROGEN GENERATOR MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 15 TOP 10 PATENT OWNERS, 2015-2024

- TABLE 16 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 17 INDUSTRIAL NITROGEN GENERATOR MARKET, BY DESIGN, 2022-2024 (USD MILLION)

- TABLE 18 INDUSTRIAL NITROGEN GENERATOR MARKET, BY DESIGN, 2025-2030 (USD MILLION)

- TABLE 19 INDUSTRIAL NITROGEN GENERATOR MARKET, BY DESIGN, 2022-2024 (UNIT)

- TABLE 20 INDUSTRIAL NITROGEN GENERATOR MARKET, BY DESIGN, 2025-2030 (UNIT)

- TABLE 21 INDUSTRIAL NITROGEN GENERATOR MARKET, BY SIZE, 2022-2024 (USD MILLION)

- TABLE 22 INDUSTRIAL NITROGEN GENERATORS MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 23 INDUSTRIAL NITROGEN GENERATORS MARKET, BY SIZE, 2022-2024 (UNIT)

- TABLE 24 INDUSTRIAL NITROGEN GENERATORS MARKET, BY SIZE, 2025-2030 (UNIT)

- TABLE 25 INDUSTRIAL NITROGEN GENERATOR MARKET, BY TECHNOLOGY TYPE, 2022-2024 (USD MILLION)

- TABLE 26 INDUSTRIAL NITROGEN GENERATOR MARKET, BY TECHNOLOGY TYPE, 2025-2030 (USD MILLION)

- TABLE 27 INDUSTRIAL NITROGEN GENERATOR MARKET, BY TECHNOLOGY TYPE, 2022-2024 (UNIT)

- TABLE 28 INDUSTRIAL NITROGEN GENERATOR MARKET, BY TECHNOLOGY TYPE, 2025-2030 (UNIT)

- TABLE 29 INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 30 INDUSTRIAL NITROGEN GENERATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 31 INDUSTRIAL NITROGEN GENERATORS MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 32 INDUSTRIAL NITROGEN GENERATORS MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 33 INDUSTRIAL NITROGEN GENERATOR MARKET, BY REGION, 2022-2024 (UNIT)

- TABLE 34 INDUSTRIAL NITROGEN GENERATOR MARKET, BY REGION, 2025-2030 (UNIT)

- TABLE 35 INDUSTRIAL NITROGEN GENERATOR MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 36 INDUSTRIAL NITROGEN GENERATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 NORTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY, 2022-2024 (UNIT)

- TABLE 38 NORTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY, 2025-2030 (UNIT)

- TABLE 39 NORTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 40 NORTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 41 NORTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 42 NORTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 43 NORTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 44 NORTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 45 US: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 46 US: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 47 US: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 48 US: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 49 CANADA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 50 CANADA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 51 CANADA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 52 CANADA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 53 MEXICO: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 54 MEXICO: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 55 MEXICO: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 56 MEXICO: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 57 EUROPE: INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY, 2022-2024 (UNIT)

- TABLE 58 EUROPE: INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY, 2025-2030 (UNIT)

- TABLE 59 EUROPE: INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 60 EUROPE: INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 61 EUROPE: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 62 EUROPE: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 63 EUROPE: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 64 EUROPE: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 65 GERMANY: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 66 GERMANY: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 67 GERMANY: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 68 GERMANY: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 69 FRANCE: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 70 FRANCE: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 71 FRANCE: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 72 FRANCE: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 73 UK: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 74 UK: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 75 UK: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 76 UK: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 77 ITALY: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 78 ITALY: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 79 ITALY: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 80 ITALY: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 81 SPAIN: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 82 SPAIN: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 83 SPAIN: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 84 SPAIN: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 85 REST OF EUROPE: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 86 REST OF EUROPE: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 87 REST OF EUROPE: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 88 REST OF EUROPE: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 89 ASIA PACIFIC: INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY, 2022-2024 (UNIT)

- TABLE 90 ASIA PACIFIC: INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY, 2025-2030 (UNIT)

- TABLE 91 ASIA PACIFIC: INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 92 ASIA PACIFIC: INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 93 ASIA PACIFIC: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 94 ASIA PACIFIC: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 95 ASIA PACIFIC: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 96 ASIA PACIFIC: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 97 CHINA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 98 CHINA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 99 CHINA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 100 CHINA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 101 JAPAN: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 102 JAPAN: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 103 JAPAN: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 104 JAPAN: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 105 INDIA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 106 INDIA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 107 INDIA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 108 INDIA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 109 SOUTH KOREA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 110 SOUTH KOREA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 111 SOUTH KOREA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 112 SOUTH KOREA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 113 REST OF ASIA PACIFIC: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 114 REST OF ASIA PACIFIC: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 115 REST OF ASIA PACIFIC: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 116 REST OF ASIA PACIFIC: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 117 MIDDLE EAST & AFRICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY, 2022-2024 (UNIT)

- TABLE 118 MIDDLE EAST & AFRICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY, 2025-2030 (UNIT)

- TABLE 119 MIDDLE EAST & AFRICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 120 MIDDLE EAST & AFRICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 122 MIDDLE EAST & AFRICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 123 MIDDLE EAST & AFRICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 124 MIDDLE EAST & AFRICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 125 SAUDI ARABIA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 126 SAUDI ARABIA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 127 SAUDI ARABIA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 128 SAUDI ARABIA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 129 UAE: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 130 UAE: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 131 UAE: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 132 UAE: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 133 REST OF GCC COUNTRIES: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 134 REST OF GCC COUNTRIES: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 135 REST OF GCC COUNTRIES: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 136 REST OF GCC COUNTRIES: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 137 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 138 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 139 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 140 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 141 SOUTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY, 2022-2024 (UNIT)

- TABLE 142 SOUTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY, 2025-2030 (UNIT)

- TABLE 143 SOUTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 144 SOUTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 145 SOUTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 146 SOUTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 147 SOUTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 148 SOUTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 149 BRAZIL: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 150 BRAZIL: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 151 BRAZIL: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 152 BRAZIL: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 153 ARGENTINA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 154 ARGENTINA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 155 ARGENTINA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 156 ARGENTINA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 157 REST OF SOUTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 158 REST OF SOUTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 159 REST OF SOUTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 160 REST OF SOUTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 161 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN INDUSTRIAL NITROGEN GENERATOR MARKET BETWEEN 2023 AND 2025

- TABLE 162 INDUSTRIAL NITROGEN GENERATOR MARKET: DEGREE OF COMPETITION

- TABLE 163 INDUSTRIAL NITROGEN GENERATOR MARKET: REGION FOOTPRINT

- TABLE 164 INDUSTRIAL NITROGEN GENERATOR MARKET: SIZE FOOTPRINT

- TABLE 165 INDUSTRIAL NITROGEN GENERATOR MARKET: DESIGN FOOTPRINT

- TABLE 166 INDUSTRIAL NITROGEN GENERATOR MARKET: TECHNOLOGY TYPE FOOTPRINT

- TABLE 167 INDUSTRIAL NITROGEN GENERATOR MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 168 INDUSTRIAL NITROGEN GENERATOR MARKET: KEY STARTUPS/SMES

- TABLE 169 INDUSTRIAL NITROGEN GENERATOR MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES (1/2)

- TABLE 170 INDUSTRIAL NITROGEN GENERATOR MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES (2/2)

- TABLE 171 INDUSTRIAL NITROGEN GENERATOR MARKET: PRODUCT LAUNCHES, JANUARY 2023-JULY 2025

- TABLE 172 INDUSTRIAL NITROGEN GENERATOR MARKET: DEALS, JANUARY 2023-JULY 2025

- TABLE 173 INDUSTRIAL NITROGEN GENERATOR MARKET: EXPANSIONS, JANUARY 2023-JULY 2025

- TABLE 174 PARKER HANNIFIN CORP: COMPANY OVERVIEW

- TABLE 175 PARKER HANNIFIN CORP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 176 AIR PRODUCTS AND CHEMICALS, INC.: COMPANY OVERVIEW

- TABLE 177 AIR PRODUCTS AND CHEMICALS, INC.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 178 AIR PRODUCTS AND CHEMICALS, INC.: PRODUCT LAUNCHES, JANUARY 2023-JULY 2025

- TABLE 179 AIR PRODUCTS AND CHEMICALS, INC.: EXPANSIONS, JANUARY 2023-JULY 2025

- TABLE 180 ATLAS COPCO GROUP: COMPANY OVERVIEW

- TABLE 181 ATLAS COPCO GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 182 ATLAS COPCO GROUP: DEALS, JANUARY 2023-JULY 2025

- TABLE 183 INGERSOLL RAND: COMPANY OVERVIEW

- TABLE 184 INGERSOLL RAND: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 185 INGERSOLL RAND: DEALS, JANUARY 2023-JULY 2025

- TABLE 186 AIR LIQUIDE: COMPANY OVERVIEW

- TABLE 187 AIR LIQUIDE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 AIR LIQUIDE: EXPANSIONS, JANUARY 2023-JULY 2025

- TABLE 189 LINDE PLC: COMPANY OVERVIEW

- TABLE 190 LINDE PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 LINDE PLC: EXPANSIONS, JANUARY 2023-JULY 2025

- TABLE 192 HITACHI INDUSTRIAL EQUIPMENT SYSTEMS CO., LTD.: COMPANY OVERVIEW

- TABLE 193 HITACHI INDUSTRIAL EQUIPMENT SYSTEMS CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 INMATEC: COMPANY OVERVIEW

- TABLE 195 INMATEC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 NOVAIR: COMPANY OVERVIEW

- TABLE 197 NOVAIR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 OXYMAT: COMPANY OVERVIEW

- TABLE 199 OXYMAT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 AIRPACK: COMPANY OVERVIEW

- TABLE 201 CLAIND: COMPANY OVERVIEW

- TABLE 202 COMPRESSED GAS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 203 ERRE DUE S.P.A.: COMPANY OVERVIEW

- TABLE 204 FOXOLUTION: COMPANY OVERVIEW

- TABLE 205 GENERON: COMPANY OVERVIEW

- TABLE 206 GAZTRON: COMPANY OVERVIEW

- TABLE 207 ISOLCELL S.P.A.: COMPANY OVERVIEW

- TABLE 208 NOBLEGEN: COMPANY OVERVIEW

- TABLE 209 OXYWISE S.R.O.: COMPANY OVERVIEW

- TABLE 210 OMEGA AIR: COMPANY OVERVIEW

- TABLE 211 OXAIR: COMPANY OVERVIEW

- TABLE 212 ON SITE GAS: COMPANY OVERVIEW

- TABLE 213 PEAKGAS: COMPANY OVERVIEW

- TABLE 214 WERTHER INTERNATIONAL: COMPANY OVERVIEW

List of Figures

- FIGURE 1 INDUSTRIAL NITROGEN GENERATOR MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 INDUSTRIAL NITROGEN GENERATOR MARKET: RESEARCH DESIGN

- FIGURE 3 INDUSTRIAL NITROGEN GENERATOR MARKET: BOTTOM-UP APPROACH

- FIGURE 4 INDUSTRIAL NITROGEN GENERATOR MARKET: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: INDUSTRIAL NITROGEN GENERATOR MARKET TOP-DOWN APPROACH

- FIGURE 6 DEMAND-SIDE FORECAST PROJECTIONS

- FIGURE 7 INDUSTRIAL NITROGEN GENERATOR MARKET: DATA TRIANGULATION

- FIGURE 8 PLUG & PLAY TO BE LARGER DESIGN TYPE BETWEEN 2025 AND 2030

- FIGURE 9 STATIONARY INDUSTRIAL NITROGEN GENERATOR SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 10 PSA INDUSTRIAL NITROGEN GENERATOR SEGMENT TO LEAD INDUSTRIAL NITROGEN GENERATOR MARKET DURING FORECAST PERIOD

- FIGURE 11 FOOD & BEVERAGE SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 12 ASIA PACIFIC TO BE FASTEST-GROWING MARKET BETWEEN 2025 AND 2030

- FIGURE 13 EMERGING ECONOMIES TO OFFER ATTRACTIVE OPPORTUNITIES DURING FORECAST PERIOD

- FIGURE 14 STATIONARY INDUSTRIAL NITROGEN GENERATOR SEGMENT TO CAPTURE LARGER MARKET SHARE BY 2030

- FIGURE 15 PLUG & PLAY DESIGN TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 16 PSA TECHNOLOGY TYPE TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 17 FOOD & BEVERAGE INDUSTRY TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 18 MARKET IN INDIA TO REGISTER HIGHEST CAGR BETWEEN 2025 AND 2030

- FIGURE 19 INDUSTRIAL NITROGEN GENERATOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 INDUSTRIAL NITROGEN GENERATOR MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 22 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- FIGURE 23 INDUSTRIAL NITROGEN GENERATOR MARKET: VALUE CHAIN ANALYSIS

- FIGURE 24 IMPORT DATA FOR HS CODE 840510-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 25 EXPORT DATA FOR HS CODE 840510-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 26 INDUSTRIAL NITROGEN GENERATOR MARKET: ECOSYSTEM ANALYSIS

- FIGURE 27 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 28 AVERAGE SELLING PRICE TREND OF INDUSTRIAL NITROGEN GENERATOR, BY REGION, 2022-2024 (USD/UNIT)

- FIGURE 29 AVERAGE SELLING PRICE TREND OF INDUSTRIAL NITROGEN GENERATOR, BY KEY PLAYERS, BY END-USE INDUSTRY, 2024 (USD/UNIT)

- FIGURE 30 INDUSTRIAL NITROGEN GENERATOR MARKET: GRANTED PATENTS, 2015-2024

- FIGURE 31 NUMBER OF PATENTS PER YEAR, 2015-2024

- FIGURE 32 LEGAL STATUS OF PATENTS, 2015-2024

- FIGURE 33 TOP JURISDICTION, BY DOCUMENT, 2015-2024

- FIGURE 34 TOP 10 PATENT APPLICANTS, 2015-2024

- FIGURE 35 INVESTMENT AND FUNDING SCENARIO, 2021-2024 (USD MILLION)

- FIGURE 36 PLUG & PLAY INDUSTRIAL NITROGEN GENERATORS TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 37 STATIONARY INDUSTRIAL NITROGEN GENERATOR SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 38 PRESSURE SWING ADSORPTION (PSA) INDUSTRIAL NITROGEN GENERATOR SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 39 FOOD & BEVERAGE INDUSTRIAL NITROGEN GENERATOR SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 40 INDIA TO BE FASTEST-GROWING INDUSTRIAL NITROGEN GENERATOR MARKET DURING FORECAST PERIOD

- FIGURE 41 NORTH AMERICA: INDUSTRIAL NITROGEN GENERATOR MARKET SNAPSHOT

- FIGURE 42 EUROPE: INDUSTRIAL NITROGEN GENERATOR MARKET SNAPSHOT

- FIGURE 43 ASIA PACIFIC: INDUSTRIAL NITROGEN GENERATOR MARKET SNAPSHOT

- FIGURE 44 REVENUE ANALYSIS OF KEY COMPANIES IN INDUSTRIAL NITROGEN GENERATOR MARKET, 2022-2024

- FIGURE 45 SHARE OF TOP FIVE COMPANIES IN INDUSTRIAL NITROGEN GENERATOR MARKET, 2024

- FIGURE 46 VALUATION OF KEY COMPANIES IN INDUSTRIAL NITROGEN GENERATOR MARKET, 2024

- FIGURE 47 FINANCIAL METRICS OF KEY COMPANIES IN INDUSTRIAL NITROGEN GENERATOR MARKET, 2024

- FIGURE 48 INDUSTRIAL NITROGEN GENERATOR MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 49 INDUSTRIAL NITROGEN GENERATOR MARKET: COMPANY EVALUATION MATRIX, KEY PLAYERS, 2024

- FIGURE 50 INDUSTRIAL NITROGEN GENERATOR MARKET: COMPANY FOOTPRINT

- FIGURE 51 INDUSTRIAL NITROGEN GENERATOR MARKET: COMPANY EVALUATION MATRIX, STARTUPS/SMES, 2024

- FIGURE 52 PARKER HANNIFIN CORP: COMPANY SNAPSHOT

- FIGURE 53 AIR PRODUCTS AND CHEMICALS, INC.: COMPANY SNAPSHOT

- FIGURE 54 ATLAS COPCO GROUP: COMPANY SNAPSHOT

- FIGURE 55 INGERSOLL RAND: COMPANY SNAPSHOT

- FIGURE 56 AIR LIQUIDE: COMPANY SNAPSHOT

- FIGURE 57 LINDE PLC: COMPANY SNAPSHOT