|

市場調查報告書

商品編碼

1807081

全球電池材料市場:2030 年電池類型、材料、應用和地區預測Battery Materials Market by Battery Type (Lead-Acid, Lithium-Ion), Material [Cathode (LFP, LCO, NMC, NCA, LMO), Anode, Electrolyte], Application (Automotive, Electric Vehicles, Portable Devices, Industrial), and Region - Global Forecast to 2030 |

||||||

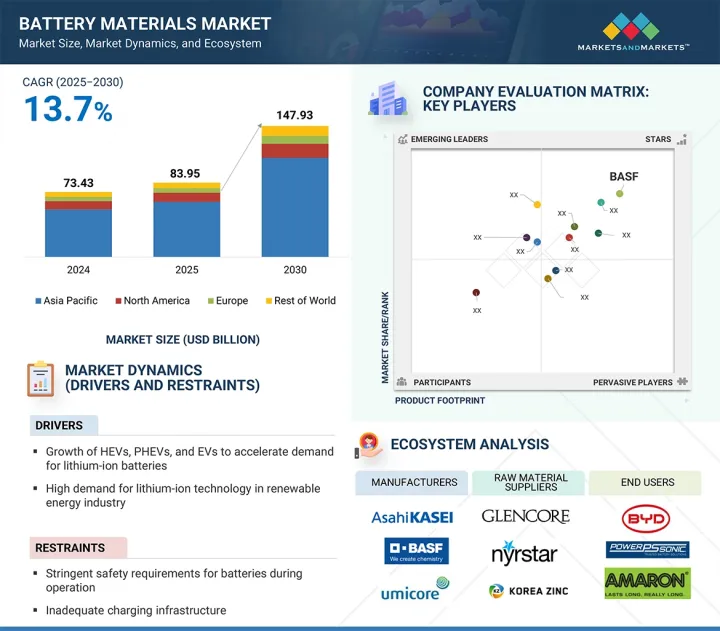

全球電池材料市場預計將從 2025 年的 839.5 億美元成長到 2030 年的 1,479.3 億美元,預測期內的複合年成長率為 13.7%。

由於全球向電氣化、清潔能源和數位技術的轉變,市場呈現強勁成長。電動車、可攜式電子產品和能源儲存系統的需求不斷成長,推動了對高性能材料的需求。

| 調查範圍 | |

|---|---|

| 調查年份 | 2021-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 單元 | 百萬美元每千噸 |

| 部分 | 材料、電池類型和應用 |

| 目標區域 | 北美、亞太、歐洲及其他地區 |

政府和工業界正在大力投資電池生產能力、原料採購和回收基礎設施。

“根據電池類型,預計預測期內鉛酸電池領域將佔據第二大市場以金額為準。”

預計在預測期內,鉛酸電池領域將佔據電池材料市場的第二大佔有率(以金額為準),這得益於其在汽車、工業備用電源和離網能源儲存應用中的廣泛應用。鉛酸電池可靠性高、成本低廉且回收基礎設施完善,使其成為發展中地區和需要高突波電流的應用的首選。鉛酸電池設計的持續進步,例如改進的FLA和AGM技術,也正在推動市場成長。

“根據應用,行動裝置領域預計將在預測期內佔據第二大以金額為準。”

受消費者對智慧型手機、筆記型電腦、平板電腦、穿戴式裝置和無線配件需求不斷成長的推動,行動裝置領域預計將在預測期內佔據電池材料市場的第二大佔有率(按以金額為準)。該領域的電池利用率保持穩定。小型化、電池壽命和快速充電功能的進步也推動了對高性能、緊湊型電池材料的需求。隨著數位連接和行動生活方式在全球範圍內的擴展,行動裝置的應用預計將對電池材料市場做出重大貢獻。

“預計在預測期內,北美將佔據第二大市場佔有率。”

預計在預測期內,北美將在電池材料市場中佔據第二大佔有率(按數量計算),這得益於電動車的普及、對可再生能源的需求以及政府的支持。美國憑藉強力的政策和發達的國內供應鏈處於領先地位,加拿大正在投資鋰生產,而墨西哥則憑藉其成本優勢吸引了許多電池製造商。這些因素共同推動了該地區對電池材料的需求,使北美成為全球電池生態系統的關鍵參與者。

本報告對全球電池材料市場進行了分析,提供了關鍵促進因素和限制因素、競爭格局和未來趨勢的資訊。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章 主要發現

- 電池材料市場為企業帶來誘人機會

- 電池材料市場(按區域)

- 按電池類型分類的電池材料市場

- 電池材料市場:按鋰離子電池應用

- 電池材料市場:鉛酸電池應用

- 電池材料市場:依主要國家分類

第5章市場概述

- 市場動態

- 驅動程式

- 抑制因素

- 機會

- 任務

第6章 產業趨勢

- 全球宏觀經濟展望

- 供應鏈分析

- 原料

- 電池材料

- 電池製造

- 分銷網路

- 最終用途產業

- 生態系分析

- 波特五力分析

- 主要相關利益者和採購標準

- 定價分析

- 各地區天然石墨平均售價(2022-2024年)

- 以負極材料分類的電池材料平均售價(2024年)

- 主要企業平均銷售價格

- 各地區鈷平均銷售價格

- 各地區鎳平均售價

- 關稅和監管格局

- 海關分析

- 電池材料相關關稅

- 監管機構、政府機構和其他組織

- 大型會議和活動(2025-2026年)

- 專利分析

- 技術分析

- 主要技術

- 互補技術

- 案例研究分析

- FPORTERA 的豐田鋰離子電池案例研究

- REDWOOD MATERIALS 的電池金屬回收技術可減少礦場污染

- 個人電動Scooter製化鋰電池解決方案

- 貿易數據

- 進口情形(HS 編碼 850650)

- 出口情形(HS 編碼 850650)

- 影響客戶業務的趨勢/中斷

- 投資金籌措場景

- 生成式人工智慧對電池材料市場的影響

- 介紹

- 資料收集和結構化

- 材料特性的預測模型

- 新材料的衍生設計

- 實驗優先排序和檢驗

- 材料製造中的製程最佳化

- 整合到電池系統中

- 電池生命週期和回收利用

- 持續學習與回饋循環

- 川普關稅對電池材料市場的影響

- 影響市場的主要關稅

- 價格影響分析

- 對各地區產生重大影響

- 電池材料市場對終端使用產業的影響

第7章 電池材料市場(依材料)

- 介紹

- 鋰離子電池材料

- 正極材料

- 負極材料

- 電解質材料

- 其他成分

- 鉛酸電池材料

- 正極材料

- 負極材料

- 電解質材料

- 其他成分

- 其他電池材料

第8章電池材料市場(按應用)

- 介紹

- 鋰離子電池

- 行動裝置

- 電動車

- 產業

- 其他用途

- 鉛酸電池

- 車

- 產業

- 其他用途

第9章 電池材料市場(以電池類型)

- 介紹

- 鋰離子

- 鉛酸電池

- 其他電池類型

第10章 電池材料市場(按區域)

- 介紹

- 亞太地區

- 中國

- 韓國

- 日本

- 印度

- 其他亞太地區

- 北美洲

- 美國

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 其他歐洲國家

- 其他地區

- 巴西

- 其他國家

第11章競爭格局

- 介紹

- 主要參與企業的策略/優勢

- 收益分析

- 市場佔有率分析

- 品牌/產品比較

- 企業評估矩陣:主要企業(2024年)

- 公司評估矩陣:Start-Ups/中小企業(2024 年)

- 公司估值及財務指標

- 競爭場景

第12章:公司簡介

- 主要企業

- UMICORE

- ASAHI KASEI CORPORATION

- MITSUBISHI CHEMICAL GROUP CORPORATION

- POSCO FUTURE M

- EV METALS GROUP

- RESONAC HOLDINGS CORPORATION

- KUREHA CORPORATION

- SUMITOMO METAL MINING CO., LTD.

- TORAY INDUSTRIES, INC.

- MITSUI MINING & SMELTING CO., LTD.

- UBE CORPORATION

- BASF

- L&F CO., LTD.

- TODA KOGYO CORP.

- NEI CORPORATION

- TANAKA CHEMICAL CORPORATION

- NINGBO SHANSHAN CO., LTD.

- HAMMOND GROUP, INC.

- SINOMA SCIENCE & TECHNOLOGY CO., LTD.

- SHANGHAI ENERGY NEW MATERIALS TECHNOLOGY CO., LTD.

- PENOX GROUP

- GRAVITA INDIA LTD.

- 其他公司

- NICHIA CORPORATION

- PULEAD TECHNOLOGY INDUSTRY

- ENTEK

- NEXEON LTD.

- ZHANGJIAGANG GUOTAI HUARONG CHEMICAL NEW MATERIAL

- ECOPRO BM

- ASCEND ELEMENTS, INC.

第13章:相鄰市場與相關市場

- 介紹

- 限制

- 互聯市場

- 鋰離子電池市場

- 市場定義

- 市場概覽

- 鋰離子電池市場類型

- 鋰鎳錳鈷 (NMC)

- 磷酸鋰鐵(LFP)

- 鈷酸鋰(LCO)

- 鈦酸鋰(LTO)

- 鋰錳氧化物(LMO)

- 鋰鎳氧化物(NCA)

第14章 附錄

The global battery materials market is projected to grow from USD 83.95 billion in 2025 to USD 147.93 billion by 2030, at a CAGR of 13.7% during the forecast period. The battery materials market is experiencing strong growth, driven by the worldwide shift toward electrification, clean energy, and digital technology. Increasing demand for electric vehicles, portable electronics, and energy storage systems is boosting the need for high-performance materials.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Kiloton) |

| Segments | Material, Battery Type, and Application |

| Regions covered | North America, Asia Pacific, Europe, and the Rest of World |

Governments and industries are making significant investments in battery production capacity, raw material sourcing, and recycling infrastructure.

"Lead-acid segment, by battery type, is estimated to account for the second-largest share during the forecast period in terms of value."

The lead-acid segment is expected to hold the second-largest share in the battery materials market by value during the forecast period, due to its widespread use in automotive, industrial backup power, and off-grid energy storage applications. Its reliability, low cost, and well-established recycling infrastructure make it a preferred choice in developing regions and for applications that require high surge currents. Ongoing advancements in lead-acid battery design, including improved flooded and AGM technologies, are also driving market growth.

"By application, the portable device segment will account for the second-largest share during the forecast period in terms of value."

The portable device segment is expected to hold the second-largest share in the battery materials market by value during the forecast period, driven by rising consumer demand for smartphones, laptops, tablets, wearables, and wireless accessories. This segment sustains steady battery usage. Advances in miniaturization, battery life, and fast-charging features are also increasing the need for high-performance, compact battery materials. As digital connectivity and mobile lifestyles expand worldwide, applications for portable devices are likely to contribute significantly to the battery material market.

"The North America region is estimated to account for the second-largest share during the forecast period in terms of volume."

The North America region is expected to hold the second-largest share in the battery materials market by volume during the forecast period, driven by increasing EV adoption, renewable energy demand, and government support. The US leads with strong policies and a developed domestic supply chain, while Canada invests in lithium production, and Mexico draws major battery manufacturing due to its cost advantages. These factors collectively boost regional demand for battery materials, establishing North America as a key player in the global battery ecosystem.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 65%, Tier 2 - 20%, and Tier 3 - 15%

- By Designation: Directors- 25%, Managers- 30%, and Others - 45%

- By Region: North America - 30%, Asia Pacific - 40%, Europe - 20%, and Rest of the World - 10%

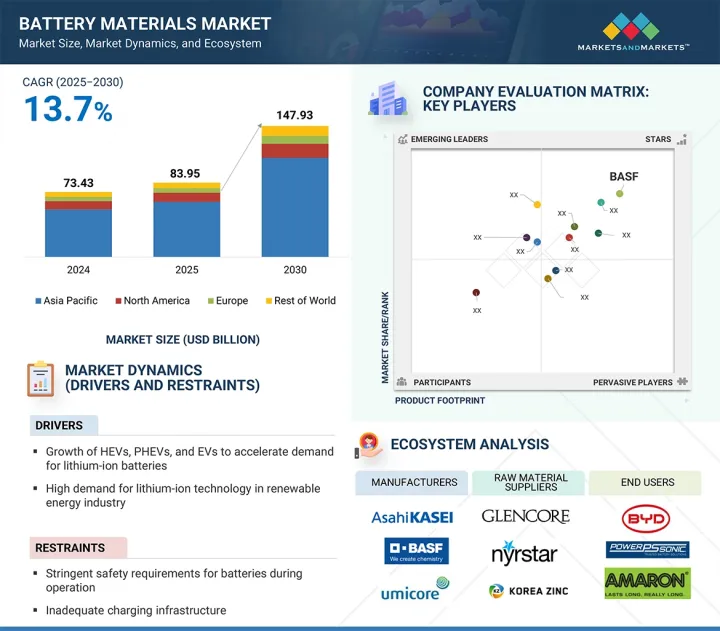

BASF (Germany), POSCO Future M (South Korea), Asahi Kasei Corporation (Japan), Umicore (Belgium), and Sumitomo Metal Mining Co., Ltd. (Japan) are some of the major players in the battery materials market. These players have adopted agreements, joint ventures, expansions, and other strategies to increase their market share and business revenue.

Research Coverage:

The report defines, segments, and projects the size of the battery materials market based on material, battery type, application, and region. It offers detailed information on key factors affecting the market's growth, such as drivers, restraints, opportunities, and challenges. It strategically profiles battery materials manufacturers, thoroughly analyzing their market shares and core competencies, and monitors and assesses competitive developments, including agreements, joint ventures, partnerships, expansion, and others.

Reasons to Buy the Report:

The report aims to assist market leaders and new entrants by providing the most accurate estimates of revenue figures for the battery materials market and its segments. It is also designed to help stakeholders gain a better understanding of the market's competitive landscape, acquire insights to enhance their business positioning, and develop effective go-to-market strategies. Additionally, it enables stakeholders to gauge market trends and offers information on key drivers, restraints, challenges, and opportunities.

The report offers insights on the following points:

- Analysis of critical drivers (growth of HEVs, PHEVs, and EVs to accelerate demand for lithium-ion batteries, high demand for lithium-ion technology in renewable energy industry, growth in consumer electronic devices), restraints (stringent safety requirements for batteries during operation, inadequate charging infrastructure), opportunities (use of batteries in energy storage devices, innovation and advances in lithium-ion battery technology, declining lithium-ion battery prices), and challenges (overheating issues of lithium-ion batteries) influencing the growth of the battery materials market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities in the battery materials market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the battery materials market across varied regions

- Market Diversification: Exhaustive information about new products, various types, untapped geographies, recent developments, and investments in the battery materials market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and product offerings of leading players in the battery materials market, such as BASF (Germany), POSCO Future M (South Korea), Asahi Kasei Corporation (Japan), Umicore (Belgium), and Sumitomo Metal Mining Co., Ltd. (Japan)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of primary interview participants-demand and supply sides

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 DEMAND-SIDE ANALYSIS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.4 SUPPLY-SIDE ANALYSIS

- 2.4.1 CALCULATIONS FOR SUPPLY-SIDE ANALYSIS

- 2.5 GROWTH FORECAST

- 2.6 DATA TRIANGULATION

- 2.7 FACTOR ANALYSIS

- 2.8 RESEARCH ASSUMPTIONS

- 2.9 RESEARCH LIMITATIONS

- 2.10 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN BATTERY MATERIALS MARKET

- 4.2 BATTERY MATERIALS MARKET, BY REGION

- 4.3 BATTERY MATERIALS MARKET, BY BATTERY TYPE

- 4.4 BATTERY MATERIALS MARKET, BY APPLICATION OF LITHIUM-ION BATTERIES

- 4.5 BATTERY MATERIALS MARKET, BY APPLICATION OF LEAD-ACID BATTERIES

- 4.6 BATTERY MATERIALS MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 MARKET DYNAMICS

- 5.1.1 DRIVERS

- 5.1.1.1 Growth of HEVs, PHEVs, and EVs to accelerate demand for lithium- ion batteries

- 5.1.1.2 High demand for lithium-ion technology in renewable energy industry

- 5.1.1.3 Growth in consumer electronic devices

- 5.1.2 RESTRAINTS

- 5.1.2.1 Stringent safety requirements for batteries during operations

- 5.1.2.2 Inadequate charging infrastructure

- 5.1.3 OPPORTUNITIES

- 5.1.3.1 Use of batteries in energy storage devices

- 5.1.3.2 Innovation and advances in lithium-ion battery technology

- 5.1.3.3 Declining lithium-ion battery prices

- 5.1.4 CHALLENGES

- 5.1.4.1 Overheating issues of lithium-ion batteries

- 5.1.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 GLOBAL MACROECONOMIC OUTLOOK

- 6.2 SUPPLY CHAIN ANALYSIS

- 6.2.1 RAW MATERIALS

- 6.2.2 BATTERY MATERIALS

- 6.2.3 BATTERY MANUFACTURING

- 6.2.4 DISTRIBUTION NETWORK

- 6.2.5 END-USE INDUSTRIES

- 6.3 ECOSYSTEM ANALYSIS

- 6.4 PORTER'S FIVE FORCES ANALYSIS

- 6.4.1 BARGAINING POWER OF SUPPLIERS

- 6.4.2 BARGAINING POWER OF BUYERS

- 6.4.3 THREAT OF NEW ENTRANTS

- 6.4.4 THREAT OF SUBSTITUTES

- 6.4.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.5 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.5.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.5.2 BUYING CRITERIA

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE OF NATURAL GRAPHITE, BY REGION, 2022-2024

- 6.6.2 AVERAGE SELLING PRICE OF BATTERY MATERIALS, BY ANODE MATERIAL, 2024

- 6.6.3 AVERAGE SELLING PRICE OF LITHIUM CARBONATE, BY KEY PLAYERS

- 6.6.4 AVERAGE SELLING PRICE OF COBALT, BY REGION

- 6.6.5 AVERAGE SELLING PRICE OF NICKEL, BY REGION

- 6.7 TARIFF AND REGULATORY LANDSCAPE

- 6.7.1 TARIFF ANALYSIS

- 6.7.2 TARIFF RELATED TO BATTERY MATERIALS

- 6.7.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.8 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.9 PATENT ANALYSIS

- 6.9.1 METHODOLOGY

- 6.10 TECHNOLOGY ANALYSIS

- 6.10.1 KEY TECHNOLOGIES

- 6.10.1.1 High-nickel cathodes

- 6.10.2 COMPLEMENTARY TECHNOLOGIES

- 6.10.2.1 Lithium metal batteries

- 6.10.1 KEY TECHNOLOGIES

- 6.11 CASE STUDY ANALYSIS

- 6.11.1 FPORTERA CASE STUDY WITH TOYOTA LITHIUM-ION BATTERIES

- 6.11.2 REDWOOD MATERIALS' BATTERY METALS RECOVERY CUTS MINE MESS

- 6.11.3 CUSTOM LITHIUM BATTERY SOLUTION FOR PERSONAL ELECTRIC SCOOTER

- 6.12 TRADE DATA

- 6.12.1 IMPORT SCENARIO (HS CODE 850650)

- 6.12.2 EXPORT SCENARIO (HS CODE 850650)

- 6.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.14 INVESTMENT AND FUNDING SCENARIO

- 6.15 IMPACT OF GENERATIVE AI ON BATTERY MATERIALS MARKET

- 6.15.1 INTRODUCTION

- 6.15.2 DATA COLLECTION AND STRUCTURING

- 6.15.3 PREDICTIVE MODELING OF MATERIAL PROPERTIES

- 6.15.4 GENERATIVE DESIGN OF NEW MATERIALS

- 6.15.5 EXPERIMENTAL PRIORITIZATION AND VALIDATION

- 6.15.6 PROCESS OPTIMIZATION IN MATERIAL MANUFACTURING

- 6.15.7 INTEGRATION INTO BATTERY SYSTEMS

- 6.15.8 BATTERY LIFECYCLE AND RECYCLING

- 6.15.9 CONTINUOUS LEARNING AND FEEDBACK LOOP

- 6.16 TRUMP TARIFF IMPACT ON BATTERY MATERIALS MARKET

- 6.16.1 KEY TARIFF RATES IMPACTING MARKET

- 6.16.2 PRICE IMPACT ANALYSIS

- 6.16.3 KEY IMPACT ON VARIOUS REGIONS

- 6.16.3.1 US

- 6.16.3.2 Europe

- 6.16.3.3 Asia Pacific

- 6.16.4 IMPACT ON END-USE INDUSTRIES OF BATTERY MATERIALS MARKET

- 6.16.4.1 Lithium-ion batteries

- 6.16.4.1.1 Portable devices

- 6.16.4.1.2 Electric vehicles (EVs)

- 6.16.4.1.3 Industrial applications

- 6.16.4.1.4 Others

- 6.16.4.2 Lead-acid batteries

- 6.16.4.2.1 Automotive sector

- 6.16.4.2.2 Industrial applications

- 6.16.4.3 Others

- 6.16.4.1 Lithium-ion batteries

7 BATTERY MATERIALS MARKET, BY MATERIAL

- 7.1 INTRODUCTION

- 7.2 LITHIUM-ION BATTERY MATERIALS

- 7.2.1 CATHODE MATERIAL

- 7.2.1.1 Cathode materials for lithium-ion batteries

- 7.2.1.1.1 Lithium iron phosphate (LFP)

- 7.2.1.1.2 Lithium cobalt oxide (LCO)

- 7.2.1.1.3 Lithium nickel manganese cobalt (NMC)

- 7.2.1.1.4 Lithium nickel cobalt aluminum (NCA)

- 7.2.1.1.5 Lithium manganese oxide (LMO)

- 7.2.1.1 Cathode materials for lithium-ion batteries

- 7.2.2 ANODE MATERIAL

- 7.2.2.1 Anode materials for lithium-ion batteries

- 7.2.2.2 Natural graphite

- 7.2.2.3 Artificial graphite

- 7.2.2.4 Other anode materials

- 7.2.3 ELECTROLYTE MATERIAL

- 7.2.4 OTHER MATERIALS

- 7.2.1 CATHODE MATERIAL

- 7.3 LEAD ACID BATTERY MATERIALS

- 7.3.1 CATHODE MATERIAL

- 7.3.2 ANODE MATERIAL

- 7.3.3 ELECTROLYTE MATERIAL

- 7.3.4 OTHER MATERIALS

- 7.4 OTHER BATTERY MATERIALS

8 BATTERY MATERIALS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 LITHIUM-ION BATTERY

- 8.2.1 PORTABLE DEVICES

- 8.2.2 ELECTRIC VEHICLES

- 8.2.3 INDUSTRIAL

- 8.2.4 OTHER APPLICATIONS

- 8.3 LEAD-ACID BATTERY

- 8.3.1 AUTOMOTIVE

- 8.3.2 INDUSTRIAL

- 8.4 OTHER APPLICATIONS

9 BATTERY MATERIALS MARKET, BY BATTERY TYPE

- 9.1 INTRODUCTION

- 9.2 LITHIUM-ION

- 9.2.1 GROWING DEMAND FOR HIGH-PERFORMANCE BATTERIES TO PROPEL MARKET

- 9.3 LEAD-ACID

- 9.3.1 SURGE IN LOW-COST ENERGY STORAGE AND VEHICLE DEMAND TO BOOST MARKET

- 9.4 OTHER BATTERY TYPES

10 BATTERY MATERIALS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

- 10.2.1 CHINA

- 10.2.1.1 Surge in electric vehicle production to boost market

- 10.2.2 SOUTH KOREA

- 10.2.2.1 Government efforts to increase adoption of electric vehicles to fuel market

- 10.2.3 JAPAN

- 10.2.3.1 Boost in domestic production capacity of batteries and growing industries to propel market

- 10.2.4 INDIA

- 10.2.4.1 Expanding EV and clean energy growth to boost market

- 10.2.5 REST OF ASIA PACIFIC

- 10.2.1 CHINA

- 10.3 NORTH AMERICA

- 10.3.1 US

- 10.3.1.1 Surging EV and renewable energy sectors to fuel market

- 10.3.2 REST OF NORTH AMERICA

- 10.3.1 US

- 10.4 EUROPE

- 10.4.1 GERMANY

- 10.4.1.1 Rise in the automotive sector to fuel market growth

- 10.4.2 FRANCE

- 10.4.2.1 Increasing demand in the automotive and marine industries to drive the market

- 10.4.3 UK

- 10.4.3.1 Government initiatives for the adoption of EVs to boost market

- 10.4.4 REST OF EUROPE

- 10.4.1 GERMANY

- 10.5 REST OF THE WORLD

- 10.5.1 BRAZIL

- 10.5.1.1 Growing automotive sector to drive market

- 10.5.2 OTHER COUNTRIES

- 10.5.1 BRAZIL

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 REVENUE ANALYSIS

- 11.4 MARKET SHARE ANALYSIS

- 11.5 BRAND/PRODUCT COMPARISON

- 11.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.6.1 STARS

- 11.6.2 CEMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- 11.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.6.5.1 Company footprint

- 11.6.5.2 Region footprint

- 11.6.5.3 Application footprint

- 11.6.5.4 Material footprint

- 11.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- 11.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.7.5.1 Detailed list of key startups/SMEs

- 11.7.5.2 Competitive benchmarking of key startups/SMEs

- 11.8 COMPANY VALUATION AND FINANCIAL METRICS

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY COMPANIES

- 12.1.1 UMICORE

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.3.2 Expansions

- 12.1.1.4 MnM View

- 12.1.1.4.1 Key Strengths/Right to Win:

- 12.1.1.4.2 Strategic Choices

- 12.1.1.4.3 Weaknesses/Competitive threats

- 12.1.2 ASAHI KASEI CORPORATION

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.3.2 Expansions

- 12.1.2.4 MnM View

- 12.1.2.4.1 Key Strengths/Right to Win

- 12.1.2.5 Strategic Choices

- 12.1.2.6 Weaknesses/Competitive threats:

- 12.1.3 MITSUBISHI CHEMICAL GROUP CORPORATION

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.3.2 Expansions

- 12.1.4 POSCO FUTURE M

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches

- 12.1.4.3.2 Deals

- 12.1.4.3.3 Expansions

- 12.1.4.4 MnM View

- 12.1.4.4.1 Key Strengths/Right to Win:

- 12.1.4.4.2 Strategic Choices:

- 12.1.4.4.3 Weaknesses/Competitive threats:

- 12.1.5 EV METALS GROUP

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Deals

- 12.1.6 RESONAC HOLDINGS CORPORATION

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.7 KUREHA CORPORATION

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.8 SUMITOMO METAL MINING CO., LTD.

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.8.3.2 Expansions

- 12.1.8.4 MnM View

- 12.1.8.4.1 Key Strengths/Right to Win

- 12.1.8.4.2 Strategic choices

- 12.1.8.4.3 Weaknesses/Competitive threats

- 12.1.9 TORAY INDUSTRIES, INC.

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Deals

- 12.1.10 MITSUI MINING & SMELTING CO., LTD.

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.11 UBE CORPORATION

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Deals

- 12.1.11.3.2 Expansions

- 12.1.12 BASF

- 12.1.12.1 Business Overview

- 12.1.12.2 Products Offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Deals

- 12.1.12.3.2 Expansions

- 12.1.12.4 MnM View

- 12.1.12.4.1 Key Strengths/Right to Win:

- 12.1.12.4.2 Strategic Choices:

- 12.1.12.4.3 Weaknesses/Competitive threats:

- 12.1.13 L&F CO., LTD.

- 12.1.13.1 Business overview

- 12.1.13.2 Products offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Expansions

- 12.1.14 TODA KOGYO CORP.

- 12.1.14.1 Business overview

- 12.1.14.2 Products offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Expansions

- 12.1.15 NEI CORPORATION

- 12.1.15.1 Business overview

- 12.1.15.2 Products offered

- 12.1.15.3 Recent developments

- 12.1.15.4 Product launches

- 12.1.15.4.1 Contracts

- 12.1.15.4.2 Expansions

- 12.1.16 TANAKA CHEMICAL CORPORATION

- 12.1.16.1 Business overview

- 12.1.16.2 Products Offered

- 12.1.17 NINGBO SHANSHAN CO., LTD.

- 12.1.17.1 Business overview

- 12.1.17.2 Products offered

- 12.1.17.3 Recent developments

- 12.1.17.3.1 Deals

- 12.1.17.3.2 Expansions

- 12.1.18 HAMMOND GROUP, INC.

- 12.1.18.1 Business overview

- 12.1.18.2 Products offered

- 12.1.19 SINOMA SCIENCE & TECHNOLOGY CO., LTD.

- 12.1.19.1 Business overview

- 12.1.19.2 Products/Solutions/Services offered

- 12.1.20 SHANGHAI ENERGY NEW MATERIALS TECHNOLOGY CO., LTD.

- 12.1.20.1 Business overview

- 12.1.20.2 Products/Solutions/Services offered

- 12.1.20.3 Recent developments

- 12.1.20.3.1 Product launches

- 12.1.20.4 Deals

- 12.1.20.5 Others

- 12.1.21 PENOX GROUP

- 12.1.21.1 Business overview

- 12.1.21.2 Products/Solutions/Services offered

- 12.1.22 GRAVITA INDIA LTD.

- 12.1.22.1 Business overview

- 12.1.22.2 Products offered

- 12.1.22.3 Recent developments

- 12.1.22.3.1 Expansions

- 12.1.1 UMICORE

- 12.2 OTHER PLAYERS

- 12.2.1 NICHIA CORPORATION

- 12.2.2 PULEAD TECHNOLOGY INDUSTRY

- 12.2.3 ENTEK

- 12.2.3.1 Recent developments

- 12.2.3.1.1 Deals

- 12.2.3.1.2 Expansions

- 12.2.3.1 Recent developments

- 12.2.4 NEXEON LTD.

- 12.2.4.1 Recent developments

- 12.2.4.1.1 Deals

- 12.2.4.1.2 Expansions

- 12.2.4.1 Recent developments

- 12.2.5 ZHANGJIAGANG GUOTAI HUARONG CHEMICAL NEW MATERIAL

- 12.2.6 ECOPRO BM

- 12.2.7 ASCEND ELEMENTS, INC.

- 12.2.7.1 Recent developments

- 12.2.7.1.1 Deals

- 12.2.7.1.2 Expansions

- 12.2.7.1 Recent developments

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 INTERCONNECTED MARKETS

- 13.4 LITHIUM-ION BATTERY MARKET

- 13.4.1 MARKET DEFINITION

- 13.4.2 MARKET OVERVIEW

- 13.4.3 LITHIUM-ION BATTERY MARKET, BY TYPE

- 13.4.4 LITHIUM NICKEL MANGANESE COBALT (NMC)

- 13.4.4.1 Low self-heating rate to drive adoption

- 13.4.5 LITHIUM IRON PHOSPHATE (LFP)

- 13.4.5.1 Growing deployment in HEVs and PHEVs to boost demand

- 13.4.6 LITHIUM COBALT OXIDE (LCO)

- 13.4.6.1 Increasing deployment as power source in consumer electronics to drive market

- 13.4.7 LITHIUM TITANATE OXIDE (LTO)

- 13.4.7.1 High security and stability due to low operating voltage to boost demand

- 13.4.8 LITHIUM MANGANESE OXIDE (LMO)

- 13.4.8.1 Low internal resistance and high thermal stability to drive segmental growth

- 13.4.9 LITHIUM NICKEL COBALT ALUMINIUM OXIDE (NCA)

- 13.4.9.1 Power and automotive industries to offer lucrative growth opportunities

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

List of Tables

- TABLE 1 BATTERY MATERIALS MARKET SNAPSHOT: 2025 VS. 2030

- TABLE 2 LIST OF OEM ANNOUNCEMENTS ON ELECTRIC CARS AS OF JULY 2021

- TABLE 3 ELECTRIC CAR SALES, BY KEY COUNTRY, 2020-2023, (MILLION UNITS)

- TABLE 4 REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE), BY KEY COUNTRY, 2022-2024 (%)

- TABLE 5 UNEMPLOYMENT RATE, BY KEY COUNTRY, 2022-2024 (%)

- TABLE 6 INFLATION RATE AVERAGE CONSUMER PRICES, BY KEY COUNTRY, 2022-2024 (%)

- TABLE 7 FOREIGN DIRECT INVESTMENT, BY REGION, 2022 & 2023 (USD BILLION)

- TABLE 8 ROLES OF COMPANIES IN BATTERY MATERIALS ECOSYSTEM

- TABLE 9 BATTERY MATERIALS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION (%)

- TABLE 11 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 12 AVERAGE SELLING PRICE OF BATTERY MATERIALS, BY REGION, 2022-2024 (USD/KG)

- TABLE 13 AVERAGE SELLING PRICE OF BATTERY MATERIALS, BY ANODE MATERIAL, 2024 (USD/KG)

- TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 BATTERY MATERIALS MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 18 BATTERY MATERIALS MARKET: LIST OF MAJOR PATENTS, 2014-2024

- TABLE 19 IMPORT DATA FOR HS CODE 850650, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 20 EXPORT DATA FOR HS CODE 850650, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 21 LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2021-2024 (KILOTON)

- TABLE 22 LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2025-2030 (KILOTON)

- TABLE 23 LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 24 LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 25 LITHIUM-ION BATTERY CATHODE MATERIALS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 26 LITHIUM-ION BATTERY CATHODE MATERIALS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 27 LITHIUM-ION BATTERY CATHODE MATERIALS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 28 LITHIUM-ION BATTERY CATHODE MATERIALS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 CATHODE MATERIALS MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 30 CATHODE MATERIALS MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 31 CATHODE MATERIALS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 32 CATHODE MATERIALS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 33 LFP CATHODE MATERIALS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 34 LFP CATHODE MATERIALS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 35 LFP CATHODE MATERIALS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 36 LFP CATHODE MATERIALS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 LCO CATHODE MATERIALS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 38 LCO CATHODE MATERIALS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 39 LCO CATHODE MATERIALS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 40 LCO CATHODE MATERIALS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 NMC CATHODE MATERIALS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 42 NMC CATHODE MATERIALS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 43 NMC CATHODE MATERIALS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 44 NMC CATHODE MATERIALS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 NCA CATHODE MATERIALS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 46 NCA CATHODE MATERIALS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 47 NCA CATHODE MATERIALS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 48 NCA CATHODE MATERIALS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 LMO CATHODE MATERIALS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 50 LMO CATHODE MATERIALS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 51 LMO CATHODE MATERIALS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 52 LMO CATHODE MATERIALS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 LITHIUM-ION BATTERY ANODE MATERIALS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 54 LITHIUM-ION BATTERY ANODE MATERIALS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 55 LITHIUM-ION BATTERY ANODE MATERIALS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 LITHIUM-ION BATTERY ANODE MATERIALS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 ANODE MATERIALS MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 58 ANODE MATERIALS MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 59 ANODE MATERIALS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 60 ANODE MATERIALS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 61 NATURAL GRAPHITE ANODE MATERIALS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 62 NATURAL GRAPHITE ANODE MATERIALS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 63 NATURAL GRAPHITE ANODE MATERIALS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 64 NATURAL GRAPHITE ANODE MATERIALS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 ARTIFICIAL GRAPHITE ANODE MATERIALS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 66 ARTIFICIAL GRAPHITE ANODE MATERIALS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 67 ARTIFICIAL GRAPHITE ANODE MATERIALS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 68 ARTIFICIAL GRAPHITE ANODE MATERIALS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 OTHER ANODE MATERIALS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 70 OTHER ANODE MATERIALS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 71 OTHER ANODE MATERIALS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 72 OTHER ANODE MATERIALS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 LITHIUM-ION BATTERY ELECTROLYTE MATERIALS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 74 LITHIUM-ION BATTERY ELECTROLYTE MATERIALS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 75 LITHIUM-ION BATTERY ELECTROLYTE MATERIALS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 76 LITHIUM-ION BATTERY ELECTROLYTE MATERIALS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 LITHIUM-ION BATTERY OTHER MATERIALS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 78 LITHIUM-ION BATTERY OTHER MATERIALS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 79 LITHIUM-ION BATTERY OTHER MATERIALS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 80 LITHIUM-ION BATTERY OTHER MATERIALS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 LEAD-ACID BATTERY MATERIALS MARKET, BY MATERIAL, 2021-2024 (KILOTON)

- TABLE 82 LEAD-ACID BATTERY MATERIALS MARKET, BY MATERIAL, 2025-2030 (KILOTON)

- TABLE 83 LEAD-ACID BATTERY MATERIALS MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 84 LEAD-ACID BATTERY MATERIALS MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 85 LEAD-ACID BATTERY CATHODE MATERIALS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 86 LEAD-ACID BATTERY CATHODE MATERIALS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 87 LEAD-ACID BATTERY CATHODE MATERIALS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 88 LEAD-ACID BATTERY CATHODE MATERIALS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 LEAD-ACID BATTERY ANODE MATERIALS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 90 LEAD-ACID BATTERY ANODE MATERIALS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 91 LEAD-ACID BATTERY ANODE MATERIALS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 92 LEAD-ACID BATTERY ANODE MATERIALS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 93 LEAD-ACID BATTERY ELECTROLYTE MATERIALS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 94 LEAD-ACID BATTERY ELECTROLYTE MATERIALS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 95 LEAD-ACID BATTERY ELECTROLYTE MATERIALS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 96 LEAD-ACID BATTERY ELECTROLYTE MATERIALS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 97 LEAD-ACID BATTERY OTHER MATERIALS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 98 LEAD-ACID BATTERY OTHER MATERIALS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 99 LEAD-ACID BATTERY OTHER MATERIALS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 100 LEAD-ACID BATTERY OTHER MATERIALS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 101 LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 102 LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 103 LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 104 LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 105 LITHIUM-ION BATTERY MATERIALS MARKET IN PORTABLE DEVICES, BY REGION, 2021-2024 (KILOTON)

- TABLE 106 LITHIUM-ION BATTERY MATERIALS MARKET IN PORTABLE DEVICES, BY REGION, 2025-2030 (KILOTON)

- TABLE 107 LITHIUM-ION BATTERY MATERIALS MARKET IN PORTABLE DEVICES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 108 LITHIUM-ION BATTERY MATERIALS MARKET IN PORTABLE DEVICES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 109 LITHIUM-ION BATTERY MATERIALS MARKET IN ELECTRIC VEHICLES, BY REGION, 2021-2024 (KILOTON)

- TABLE 110 LITHIUM-ION BATTERY MATERIALS MARKET IN ELECTRIC VEHICLES, BY REGION, 2025-2030 (KILOTON)

- TABLE 111 LITHIUM-ION BATTERY MATERIALS MARKET IN ELECTRIC VEHICLES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 112 LITHIUM-ION BATTERY MATERIALS MARKET IN ELECTRIC VEHICLES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 113 LITHIUM-ION BATTERY MATERIALS MARKET IN INDUSTRIAL, BY REGION, 2021-2024 (KILOTON)

- TABLE 114 LITHIUM-ION BATTERY MATERIALS MARKET IN INDUSTRIAL, BY REGION, 2025-2030 (KILOTON)

- TABLE 115 LITHIUM-ION BATTERY MATERIALS MARKET IN INDUSTRIAL, BY REGION, 2021-2024 (USD MILLION)

- TABLE 116 LITHIUM-ION BATTERY MATERIALS MARKET IN INDUSTRIAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 117 LITHIUM-ION BATTERY MATERIALS MARKET IN OTHER APPLICATIONS, BY REGION, 2021-2024 (KILOTON)

- TABLE 118 LITHIUM-ION BATTERY MATERIALS MARKET IN OTHER APPLICATIONS, BY REGION, 2025-2030 (KILOTON)

- TABLE 119 LITHIUM-ION BATTERY MATERIALS MARKET IN OTHER APPLICATIONS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 120 LITHIUM-ION BATTERY MATERIALS MARKET IN OTHER APPLICATIONS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 121 LEAD-ACID BATTERY MATERIALS MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 122 LEAD-ACID BATTERY MATERIALS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 123 LEAD-ACID BATTERY MATERIALS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 124 LEAD-ACID BATTERY MATERIALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 125 LEAD-ACID BATTERY MATERIALS MARKET IN AUTOMOTIVE, BY REGION, 2021-2024 (KILOTON)

- TABLE 126 LEAD-ACID BATTERY MATERIALS MARKET IN AUTOMOTIVE, BY REGION, 2025-2030 (KILOTON)

- TABLE 127 LEAD-ACID BATTERY MATERIALS MARKET IN AUTOMOTIVE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 128 LEAD-ACID BATTERY MATERIALS MARKET IN AUTOMOTIVE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 129 LEAD-ACID BATTERY MATERIALS MARKET IN INDUSTRIAL, BY REGION, 2021-2024 (KILOTON)

- TABLE 130 LEAD-ACID BATTERY MATERIALS MARKET IN INDUSTRIAL, BY REGION, 2025-2030 (KILOTON)

- TABLE 131 LEAD-ACID BATTERY MATERIALS MARKET IN INDUSTRIAL, BY REGION, 2021-2024 (USD MILLION)

- TABLE 132 LEAD-ACID BATTERY MATERIALS MARKET IN INDUSTRIAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 133 BATTERY MATERIALS MARKET, BY BATTERY TYPE, 2021-2024 (KILOTON)

- TABLE 134 BATTERY MATERIALS MARKET, BY BATTERY TYPE, 2025-2030 (KILOTON)

- TABLE 135 BATTERY MATERIALS MARKET, BY BATTERY TYPE, 2021-2024 (USD MILLION)

- TABLE 136 BATTERY MATERIALS MARKET, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 137 LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 138 LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 139 LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 140 LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 141 LEAD-ACID BATTERY MATERIALS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 142 LEAD-ACID BATTERY MATERIALS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 143 LEAD-ACID BATTERY MATERIALS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 144 LEAD-ACID BATTERY MATERIALS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 145 OTHER BATTERY MATERIALS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 146 OTHER BATTERY MATERIALS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 147 OTHER BATTERY MATERIALS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 148 OTHER BATTERY MATERIALS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 149 BATTERY MATERIALS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 150 BATTERY MATERIALS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 151 BATTERY MATERIALS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 152 BATTERY MATERIALS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 153 ASIA PACIFIC: BATTERY MATERIALS MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 154 ASIA PACIFIC: BATTERY MATERIALS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 155 ASIA PACIFIC: BATTERY MATERIALS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 156 ASIA PACIFIC: BATTERY MATERIALS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 157 ASIA PACIFIC: BATTERY MATERIALS MARKET, BY BATTERY TYPE, 2021-2024 (KILOTON)

- TABLE 158 ASIA PACIFIC: BATTERY MATERIALS MARKET, BY BATTERY TYPE, 2025-2030 (KILOTON)

- TABLE 159 ASIA PACIFIC: BATTERY MATERIALS MARKET, BY BATTERY TYPE, 2021-2024 (USD MILLION)

- TABLE 160 ASIA PACIFIC: BATTERY MATERIALS MARKET, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 161 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY MATERIAL, 2021-2024 (KILOTON)

- TABLE 162 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY MATERIAL, 2025-2030 (KILOTON)

- TABLE 163 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 164 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 165 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY CATHODE MATERIAL, 2021-2024 (KILOTON)

- TABLE 166 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY CATHODE MATERIAL, 2025-2030 (KILOTON)

- TABLE 167 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY CATHODE MATERIAL, 2021-2024 (USD MILLION)

- TABLE 168 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY CATHODE MATERIAL, 2025-2030 (USD MILLION)

- TABLE 169 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY ANODE MATERIAL, 2021-2024 (KILOTON)

- TABLE 170 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY ANODE MATERIAL, 2025-2030 (KILOTON)

- TABLE 171 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY ANODE MATERIAL, 2021-2024 (USD MILLION)

- TABLE 172 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY ANODE MATERIAL, 2025-2030 (USD MILLION)

- TABLE 173 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 174 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 175 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 176 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 177 ASIA PACIFIC: LEAD-ACID BATTERY MATERIALS MARKET, BY BATTERY MATERIALS, 2021-2024 (KILOTON)

- TABLE 178 ASIA PACIFIC: LEAD-ACID BATTERY MATERIALS MARKET, BY BATTERY MATERIAL, 2025-2030 (KILOTON)

- TABLE 179 ASIA PACIFIC: LEAD-ACID BATTERY MATERIALS MARKET, BY BATTERY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 180 ASIA PACIFIC: LEAD-ACID BATTERY MATERIALS MARKET, BY BATTERY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 181 ASIA PACIFIC: LEAD-ACID BATTERY MATERIALS MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 182 ASIA PACIFIC: LEAD-ACID BATTERY MATERIALS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 183 ASIA PACIFIC: LEAD-ACID BATTERY MATERIALS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 184 ASIA PACIFIC: LEAD-ACID BATTERY MATERIALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 185 NORTH AMERICA: BATTERY MATERIALS MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 186 NORTH AMERICA: BATTERY MATERIALS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 187 NORTH AMERICA: BATTERY MATERIALS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 188 NORTH AMERICA: BATTERY MATERIALS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 189 NORTH AMERICA: BATTERY MATERIALS MARKET, BY BATTERY TYPE, 2021-2024 (KILOTON)

- TABLE 190 NORTH AMERICA: BATTERY MATERIALS MARKET, BY BATTERY TYPE, 2025-2030 (KILOTON)

- TABLE 191 NORTH AMERICA: BATTERY MATERIALS MARKET, BY BATTERY TYPE, 2021-2024 (USD MILLION)

- TABLE 192 NORTH AMERICA: BATTERY MATERIALS MARKET, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 193 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY MATERIAL, 2021-2024 (KILOTON)

- TABLE 194 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY MATERIAL, 2025-2030 (KILOTON)

- TABLE 195 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 196 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 197 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY CATHODE MATERIAL, 2021-2024 (KILOTON)

- TABLE 198 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY CATHODE MATERIAL, 2025-2030 (KILOTON)

- TABLE 199 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY CATHODE MATERIAL, 2021-2024 (USD MILLION)

- TABLE 200 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY CATHODE MATERIAL, 2025-2030 (USD MILLION)

- TABLE 201 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY ANODE MATERIAL, 2021-2024 (KILOTON)

- TABLE 202 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY ANODE MATERIAL, 2025-2030 (KILOTON)

- TABLE 203 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY ANODE MATERIAL, 2021-2024 (USD MILLION)

- TABLE 204 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY ANODE MATERIAL, 2025-2030 (USD MILLION)

- TABLE 205 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 206 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 207 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 208 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 209 NORTH AMERICA: LEAD-ACID BATTERY MATERIALS MARKET, BY BATTERY MATERIALS, 2021-2024 (KILOTON)

- TABLE 210 NORTH AMERICA: LEAD-ACID BATTERY MATERIALS MARKET, BY BATTERY MATERIALS, 2025-2030 (KILOTON)

- TABLE 211 NORTH AMERICA: LEAD-ACID BATTERY MATERIALS MARKET, BY BATTERY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 212 NORTH AMERICA: LEAD-ACID BATTERY MATERIALS MARKET, BY BATTERY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 213 NORTH AMERICA: LEAD-ACID BATTERY MATERIALS MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 214 NORTH AMERICA: LEAD-ACID BATTERY MATERIALS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 215 NORTH AMERICA: LEAD-ACID BATTERY MATERIALS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 216 NORTH AMERICA: LEAD-ACID BATTERY MATERIALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 217 EUROPE: BATTERY MATERIALS MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 218 EUROPE: BATTERY MATERIALS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 219 EUROPE: BATTERY MATERIALS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 220 EUROPE: BATTERY MATERIALS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 221 EUROPE: BATTERY MATERIALS MARKET, BY BATTERY TYPE, 2021-2024 (KILOTON)

- TABLE 222 EUROPE: BATTERY MATERIALS MARKET, BY BATTERY TYPE, 2025-2030 (KILOTON)

- TABLE 223 EUROPE: BATTERY MATERIALS MARKET, BY BATTERY TYPE, 2021-2024 (USD MILLION)

- TABLE 224 EUROPE: BATTERY MATERIALS MARKET, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 225 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY MATERIAL, 2021-2024 (KILOTON)

- TABLE 226 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY MATERIAL, 2025-2030 (KILOTON)

- TABLE 227 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 228 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 229 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY CATHODE MATERIAL, 2021-2024 (KILOTON)

- TABLE 230 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY CATHODE MATERIAL, 2025-2030 (KILOTON)

- TABLE 231 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY CATHODE MATERIAL, 2021-2024 (USD MILLION)

- TABLE 232 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY CATHODE MATERIAL, 2025-2030 (USD MILLION)

- TABLE 233 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY ANODE MATERIAL, 2021-2024 (KILOTON)

- TABLE 234 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY ANODE MATERIAL, 2025-2030 (KILOTON)

- TABLE 235 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY ANODE MATERIAL, 2021-2024 (USD MILLION)

- TABLE 236 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY ANODE MATERIAL, 2025-2030 (USD MILLION)

- TABLE 237 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 238 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 239 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 240 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 241 EUROPE: LEAD-ACID BATTERY MATERIALS MARKET, BY BATTERY MATERIALS, 2021-2024 (KILOTON)

- TABLE 242 EUROPE: LEAD-ACID BATTERY MATERIALS MARKET, BY BATTERY MATERIALS, 2025-2030 (KILOTON)

- TABLE 243 EUROPE: LEAD-ACID BATTERY MATERIALS MARKET, BY BATTERY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 244 EUROPE: LEAD-ACID BATTERY MATERIALS MARKET, BY BATTERY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 245 EUROPE: LEAD-ACID BATTERY MATERIALS MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 246 EUROPE: LEAD-ACID BATTERY MATERIALS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 247 EUROPE: LEAD-ACID BATTERY MATERIALS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 248 EUROPE: LEAD-ACID BATTERY MATERIALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 249 REST OF THE WORLD: BATTERY MATERIALS MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 250 REST OF THE WORLD: BATTERY MATERIALS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 251 REST OF THE WORLD: BATTERY MATERIALS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 252 REST OF THE WORLD: BATTERY MATERIALS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 253 REST OF THE WORLD: BATTERY MATERIALS MARKET, BY BATTERY TYPE, 2021-2024 (KILOTON)

- TABLE 254 REST OF THE WORLD: BATTERY MATERIALS MARKET, BY BATTERY TYPE, 2025-2030 (KILOTON)

- TABLE 255 REST OF THE WORLD: BATTERY MATERIALS MARKET, BY BATTERY TYPE, 2021-2024 (USD MILLION)

- TABLE 256 REST OF THE WORLD: BATTERY MATERIALS MARKET, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 257 REST OF THE WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY MATERIAL, 2021-2024 (KILOTON)

- TABLE 258 REST OF THE WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY MATERIAL, 2025-2030 (KILOTON)

- TABLE 259 REST OF THE WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 260 REST OF THE WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 261 REST OF THE WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY CATHODE MATERIAL, 2021-2024 (KILOTON)

- TABLE 262 REST OF THE WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY CATHODE MATERIAL, 2025-2030 (KILOTON)

- TABLE 263 REST OF THE WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY CATHODE MATERIAL, 2021-2024 (USD MILLION)

- TABLE 264 REST OF THE WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY CATHODE MATERIAL, 2025-2030 (USD MILLION)

- TABLE 265 REST OF THE WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY ANODE MATERIAL, 2021-2024 (KILOTON)

- TABLE 266 REST OF THE WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY ANODE MATERIAL, 2025-2030 (KILOTON)

- TABLE 267 REST OF THE WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY ANODE MATERIAL, 2021-2024 (USD MILLION)

- TABLE 268 REST OF THE WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY ANODE MATERIAL, 2025-2030 (USD MILLION)

- TABLE 269 REST OF THE WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 270 REST OF THE WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 271 REST OF THE WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 272 REST OF THE WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 273 REST OF THE WORLD: LEAD-ACID BATTERY MATERIALS MARKET, BY BATTERY MATERIAL, 2021-2024 (KILOTON)

- TABLE 274 REST OF THE WORLD: LEAD-ACID BATTERY MATERIALS MARKET, BY BATTERY MATERIAL, 2025-2030 (KILOTON)

- TABLE 275 REST OF THE WORLD: LEAD-ACID BATTERY MATERIALS MARKET, BY BATTERY MATERIALS, 2021-2024 (USD MILLION)

- TABLE 276 REST OF THE WORLD: LEAD-ACID BATTERY MATERIALS MARKET, BY BATTERY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 277 REST OF THE WORLD: LEAD-ACID BATTERY MATERIALS MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 278 REST OF THE WORLD: LEAD-ACID BATTERY MATERIALS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 279 REST OF THE WORLD: LEAD-ACID BATTERY MATERIALS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 280 REST OF THE WORLD: LEAD-ACID BATTERY MATERIALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 281 BATTERY MATERIALS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2025)

- TABLE 282 BATTERY MATERIALS MARKET: DEGREE OF COMPETITION, 2024

- TABLE 283 BATTERY MATERIALS MARKET: REGION FOOTPRINT

- TABLE 284 BATTERY MATERIALS MARKET: APPLICATION FOOTPRINT

- TABLE 285 BATTERY MATERIALS MARKET: MATERIAL FOOTPRINT

- TABLE 286 BATERY MATERIALS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 287 BATTERY MATERIALS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 288 BATTERY MATERIALS MARKET: PRODUCT LAUNCHES, JANUARY 2020- JULY 2025

- TABLE 289 BATTERY MATERIALS MARKET: DEALS, JANUARY 2020- JULY 2025

- TABLE 290 BATTERY MATERIALS MARKET: EXPANSIONS, JANUARY 2020 - JULY 2025

- TABLE 291 UMICORE: COMPANY OVERVIEW

- TABLE 292 UMICORE: PRODUCTS OFFERED

- TABLE 293 UMICORE: DEALS, JANUARY 2020- JULY 2025

- TABLE 294 UMICORE: EXPANSIONS, JANUARY 2020- JULY 2025

- TABLE 295 ASAHI KASEI CORPORATION: COMPANY OVERVIEW

- TABLE 296 ASAHI KASEI CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 297 ASAHI KASEI CORPORATION: DEALS, JANUARY 2020- JULY 2025

- TABLE 298 ASAHI KASEI CORPORATION: EXPANSIONS, JANUARY 2020- JULY 2025

- TABLE 299 MITSUBISHI CHEMICAL GROUP CORPORATION: COMPANY OVERVIEW

- TABLE 300 MITSUBISHI CHEMICAL GROUP CORPORATION: PRODUCTS OFFERED

- TABLE 301 MITSUBISHI CHEMICAL GROUP CORPORATION: DEALS, JANUARY 2020- JULY 2025

- TABLE 302 MITSUBISHI CHEMICAL GROUP CORPORATION: EXPANSIONS, JANUARY 2020- JULY 2025

- TABLE 303 POSCO FUTURE M: COMPANY OVERVIEW

- TABLE 304 POSCO FUTURE M: PRODUCTS OFFERED

- TABLE 305 POSCO FUTURE M: PRODUCT LAUNCHES, JANUARY 2020- JULY 2025

- TABLE 306 POSCO FUTURE M: DEALS, JANUARY 2020- JULY 2025

- TABLE 307 POSCO FUTURE M: EXPANSIONS, JANUARY 2020- JULY 2025

- TABLE 308 EV METALS GROUP: COMPANY OVERVIEW

- TABLE 309 EV METALS GROUP: PRODUCTS OFFERED

- TABLE 310 EV METALS GROUP: DEALS, JANUARY 2020- JULY 2025

- TABLE 311 RESONAC HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 312 RESONAC HOLDINGS CORPORATION: PRODUCTS OFFERED

- TABLE 313 RESONAC HOLDINGS CORPORATION: DEALS, JANUARY 2020- JULY 2025

- TABLE 314 KUREHA CORPORATION: COMPANY OVERVIEW

- TABLE 315 KUREHA CORPORATION: PRODUCTS OFFERED

- TABLE 316 SUMITOMO METAL MINING CO., LTD.: COMPANY OVERVIEW

- TABLE 317 SUMITOMO METAL MINING CO., LTD.: PRODUCTS OFFERED

- TABLE 318 SUMITOMO METAL MINING CO., LTD.: DEALS, JANUARY 2020- JULY 2025

- TABLE 319 SUMITOMO METAL MINING CO., LTD.: EXPANSIONS, JANUARY 2020- JULY 2025

- TABLE 320 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 321 TORAY INDUSTRIES, INC.: PRODUCTS OFFERED

- TABLE 322 TORAY INDUSTRIES, INC.: DEALS, JANUARY 2020- JULY 2025

- TABLE 323 MITSUI MINING & SMELTING CO., LTD.: COMPANY OVERVIEW

- TABLE 324 MITSUI MINING & SMELTING CO., LTD.: PRODUCTS OFFERED

- TABLE 325 UBE CORPORATION: COMPANY OVERVIEW

- TABLE 326 UBE CORPORATION: PRODUCTS OFFERED

- TABLE 327 UBE CORPORATION: DEALS, JANUARY 2020- JULY 2025

- TABLE 328 UBE CORPORATION: EXPANSIONS, JANUARY 2020- JULY 2025

- TABLE 329 BASF: COMPANY OVERVIEW

- TABLE 330 BASF: PRODUCTS OFFERED

- TABLE 331 BASF: DEALS, JANUARY 2020- JULY 2025

- TABLE 332 BASF: EXPANSIONS

- TABLE 333 L&F CO., LTD.: COMPANY OVERVIEW

- TABLE 334 L&F CO., LTD.: PRODUCTS OFFERED

- TABLE 335 L&F CO., LTD.: EXPANSIONS, JANUARY 2020- JULY 2025

- TABLE 336 TODA KOGYO CORP.: COMPANY OVERVIEW

- TABLE 337 TODA KOGYO CORP.: PRODUCTS OFFERED

- TABLE 338 TODA KOGYO CORP.: EXPANSIONS, JANUARY 2020- JULY 2025

- TABLE 339 NEI CORPORATION: COMPANY OVERVIEW

- TABLE 340 NEI CORPORATION: PRODUCTS OFFERED

- TABLE 341 NEI CORPORATION: PRODUCT LAUNCHES, JANUARY 2020- JULY 2025

- TABLE 342 NEI CORPORATION: CONTRACTS, JANUARY 2020- JULY 2025

- TABLE 343 NEI CORPORATION: EXPANSIONS, JANUARY 2020- JULY 2025

- TABLE 344 TANAKA CHEMICAL CORPORATION: COMPANY OVERVIEW

- TABLE 345 TANAKA CHEMICAL CORPORATION: PRODUCTS OFFERED

- TABLE 346 NINGBO SHANSHAN CO., LTD.: COMPANY OVERVIEW

- TABLE 347 NINGBO SHANSHAN CO., LTD.: PRODUCTS OFFERED

- TABLE 348 NINGBO SHANSHAN CO., LTD.: DEALS, JANUARY 2020- JULY 2025

- TABLE 349 NINGBO SHANSHAN CO., LTD.: EXPANSIONS, JANUARY 2020- JULY 2025

- TABLE 350 HAMMOND GROUP, INC.: COMPANY OVERVIEW

- TABLE 351 HAMMOND GROUP, INC.: PRODUCTS OFFERED

- TABLE 352 SINOMA SCIENCE & TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 353 SINOMA SCIENCE & TECHNOLOGY CO., LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 354 SHANGHAI ENERGY NEW MATERIALS TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 355 SHANGHAI ENERGY NEW MATERIALS TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- TABLE 356 SHANGHAI ENERGY NEW MATERIALS TECHNOLOGY CO., LTD.: PRODUCT LAUNCHES, JANUARY 2020- JULY 2025

- TABLE 357 SHANGHAI ENERGY NEW MATERIALS TECHNOLOGY CO., LTD.: DEALS, JANUARY 2020- JULY 2025

- TABLE 358 SHANGHAI ENERGY NEW MATERIALS TECHNOLOGY CO., LTD.: OTHERS, JANUARY 2020- JULY 2025

- TABLE 359 PENOX GROUP: COMPANY OVERVIEW

- TABLE 360 PENOX GROUP: PRODUCTS OFFERED

- TABLE 361 GRAVITA INDIA LTD.: COMPANY OVERVIEW

- TABLE 362 GRAVITA INDIA LTD.: PRODUCTS OFFERED

- TABLE 363 GRAVITA INDIA LTD.: EXPANSIONS, JANUARY 2020- JULY 2025

- TABLE 364 NICHIA CORPORATION: COMPANY OVERVIEW

- TABLE 365 PULEAD TECHNOLOGY INDUSTRY: COMPANY OVERVIEW

- TABLE 366 ENTEK: COMPANY OVERVIEW

- TABLE 367 ENTEK: DEALS, JANUARY 2020- JULY 2025

- TABLE 368 ENTEK: EXPANSIONS, JANUARY 2020- JULY 2025

- TABLE 369 NEXEON LTD.: COMPANY OVERVIEW

- TABLE 370 NEXEON LTD.: DEALS, JANUARY 2020- JULY 2025

- TABLE 371 NEXEON LTD.: EXPANSIONS, JANUARY 2020- JULY 2025

- TABLE 372 ZHANGJIAGANG GUOTAI HUARONG CHEMICAL NEW MATERIAL: COMPANY OVERVIEW

- TABLE 373 ECOPRO BM: COMPANY OVERVIEW

- TABLE 374 ASCEND ELEMENTS, INC.: COMPANY OVERVIEW

- TABLE 375 ASCEND ELEMENTS, INC.: DEALS, JANUARY 2020- JULY 2025

- TABLE 376 ASCEND ELEMENTS, INC.: EXPANSIONS, JANUARY 2020- JULY 2025

- TABLE 377 LITHIUM-ION BATTERY MARKET, BY TYPE, 2019-2022 (USD BILLION)

- TABLE 378 LITHIUM-ION BATTERY MARKET, BY TYPE, 2023-2032 (USD BILLION)

List of Figures

IGURE 1 BATTERY MATERIALS MARKET: SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 BATTERY MATERIALS MARKET: RESEARCH DESIGN

- FIGURE 3 MAIN MATRIX CONSIDERED TO ASSESS DEMAND FOR BATTERY MATERIALS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 METHODOLOGY USED FOR SUPPLY-SIDE SIZING OF BATTERY MATERIALS

- FIGURE 7 BATTERY MATERIALS MARKET: DATA TRIANGULATION

- FIGURE 8 LITHIUM-ION SEGMENT TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 9 ELECTRIC VEHICLE SEGMENT TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 10 INDUSTRIAL SEGMENT TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 12 DECLINING LITHIUM-ION PRICES TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 13 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 14 LITHIUM-ION SEGMENT TO WITNESS HIGH GROWTH FROM 2025 TO 2030

- FIGURE 15 ELECTRIC VEHICLE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 INDUSTRIAL SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 BATTERY MATERIALS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 GLOBAL COMBINED SALES OF BATTERY ELECTRIC VEHICLES AND PLUG-IN HYBRIDS

- FIGURE 20 VOLUME-WEIGHTED AVERAGE LITHIUM-ION BATTERY PACK AND CELL PRICE, 2013-2024 (USD/KWH)

- FIGURE 21 BATTERY MATERIALS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 22 BATTERY MATERIALS MARKET: ECOSYSTEM MAPPING

- FIGURE 23 BATTERY MATERIALS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- FIGURE 25 KEY BUYING CRITERIA, BY APPLICATION

- FIGURE 26 AVERAGE SELLING PRICE OF NATURAL GRAPHITE, BY REGION, 2022-2024 (USD/KG)

- FIGURE 27 AVERAGE SELLING PRICE OF BATTERY MATERIALS, BY ANODE MATERIAL, 2024 (USD/KG)

- FIGURE 28 AVERAGE SELLING PRICE TREND OF LITHIUM CARBONATE, BY KEY PLAYERS, 2024

- FIGURE 29 AVERAGE SELLING PRICE OF COBALT, BY REGION, 2021-2024

- FIGURE 30 AVERAGE SELLING PRICE OF NICKEL, BY REGION, 2021-2024

- FIGURE 31 LIST OF MAJOR PATENTS RELATED TO BATTERY MATERIALS, 2014-2024

- FIGURE 32 IMPORT DATA RELATED TO HS CODE 850650, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 33 EXPORT DATA RELATED TO HS CODE 850650, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 34 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 35 BATTERY MATERIALS MARKET: INVESTMENT AND FUNDING SCENARIO, 2019-2025

- FIGURE 36 CATHODE MATERIAL CONTINUES TO BE LARGEST SEGMENT IN MARKET

- FIGURE 37 CATHODE MATERIAL TO BE THE LARGEST GROWING SEGMENT IN THE MARKET

- FIGURE 38 ELECTRIC VEHICLES SEGMENT TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 39 ELECTRIC VEHICLES SEGMENT TO BE FASTEST-GROWING SEGMENT IN MARKET DURING FORECAST PERIOD

- FIGURE 40 LITHIUM-ION TO BE FASTEST-GROWING SEGMENT IN MARKET

- FIGURE 41 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE OF BATTERY MATERIALS MARKET IN 2025

- FIGURE 42 ASIA PACIFIC: BATTERY MATERIALS MARKET SNAPSHOT

- FIGURE 43 NORTH AMERICA: BATTERY MATERIALS MARKET SNAPSHOT

- FIGURE 44 EUROPE: BATTERY MATERIALS MARKET SNAPSHOT

- FIGURE 45 REST OF THE WORLD: BATTERY MATERIALS MARKET SNAPSHOT

- FIGURE 46 BATTERY MATERIALS MARKET: REVENUE ANALYSIS OF KEY COMPANIES, 2019-2024 (USD BILLION)

- FIGURE 47 BATTERY MATERIALS MARKET SHARE ANALYSIS, 2024

- FIGURE 48 BATTERY MATERIALS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 49 BATTERY MATERIALS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 50 BATTERY MATERIALS MARKET: COMPANY FOOTPRINT

- FIGURE 51 BATTERY MATERIALS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 52 BATTERY MATERIALS MARKET: EV/EBITDA

- FIGURE 53 BATTERY MATERIALS MARKET: ENTERPRISE VALUE (USD BILLION)

- FIGURE 54 BATTERY MATERIALS MARKET: YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND FIVE-YEAR STOCK BETA OF KEY MANUFACTURERS

- FIGURE 55 UMICORE: COMPANY SNAPSHOT

- FIGURE 56 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT

- FIGURE 57 MITSUBISHI CHEMICAL GROUP CORPORATION: COMPANY SNAPSHOT

- FIGURE 58 POSCO FUTURE M: COMPANY SNAPSHOT

- FIGURE 59 RESONAC HOLDINGS CORPORATION: COMPANY SNAPSHOT

- FIGURE 60 KUREHA CORPORATION: COMPANY SNAPSHOT

- FIGURE 61 SUMITOMO METAL MINING CO., LTD.: COMPANY SNAPSHOT

- FIGURE 62 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 63 MITSUI MINING & SMELTING CO., LTD.: COMPANY SNAPSHOT

- FIGURE 64 UBE CORPORATION: COMPANY SNAPSHOT

- FIGURE 65 BASF: COMPANY SNAPSHOT

- FIGURE 66 L&F CO., LTD.: COMPANY SNAPSHOT

- FIGURE 67 TODA KOGYO CORP.: COMPANY SNAPSHOT

- FIGURE 68 TANAKA CHEMICAL CORPORATION: COMPANY SNAPSHOT

- FIGURE 69 NINGBO SHANSHAN CO., LTD.: COMPANY SNAPSHOT

- FIGURE 70 GRAVITA INDIA LTD.: COMPANY SNAPSHOT