|

市場調查報告書

商品編碼

1804852

全球特種油田化學品市場(按類型、儲存類型、應用和地區分類)- 預測至 2030 年Specialty Oilfield Chemicals Market by Type, Reservoir Type, Application (Production, Well Stimulation, Drilling Fluids, Enhanced Oil Recovery, Cementing, and Workover & Completion), and Region - Global Forecast to 2030 |

||||||

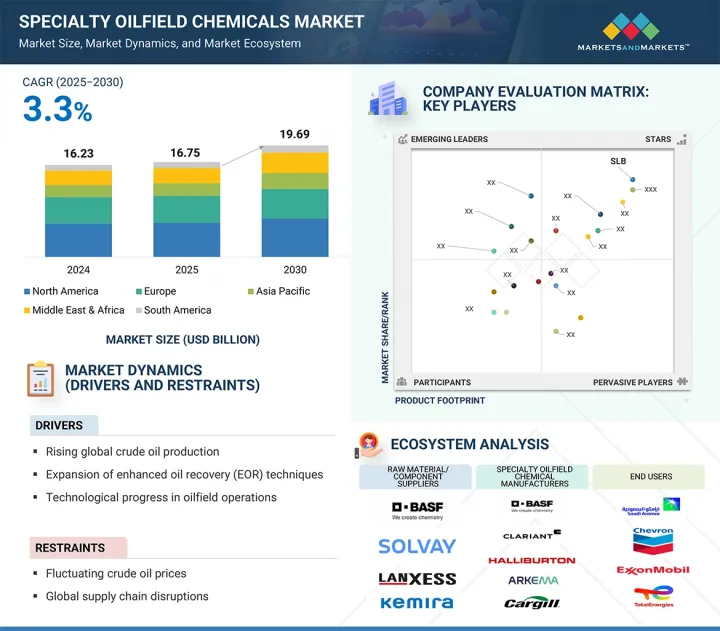

預計特種油田化學品市場將從 2025 年的 167.5 億美元成長到 2030 年的 196.9 億美元,預測期內的複合年成長率為 3.3%。

| 調查範圍 | |

|---|---|

| 調查年份 | 2021-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 對價單位 | 金額(百萬美元)和數量(千噸) |

| 部分 | 按類型、儲存類型、應用程式和地區 |

| 目標區域 | 北美、亞太地區、歐洲、中東和非洲、南美 |

由於上游油氣作業對永續高效儲存化學品的需求不斷成長,特種油田化學品市場正在持續成長。在深水和傳統型油藏等惡劣條件下,這些化學物質能夠提高儲存的採收率,同時保持油井完整性並最佳化鑽井作業。

美國環保署 (EPA) 和歐洲化學品管理局 (ECHA) 等機構在化學品使用、毒性和環境影響方面不斷加大的監管壓力,推動了該業務的發展。製造商正在透過開發更具永續、生物分解性且低揮發性有機化合物 (VOC) 的產品來應對。這些監管壓力正在加速精準化學和綠色產品開發的進步。這些產品方案的一個日益普遍的特徵是即時監控和智慧化學品輸送系統,以提高快速反應和合規性。特種油田化學品對於進入具有挑戰性的探勘領域以及確保上游能源營運的安全、高效和環境永續至關重要。

2024年,降凝劑因其在低溫條件下促進原油流動的關鍵作用,佔據特種油田化學品市場的最大佔有率。這些化學物質可以降低蠟晶體形成的溫度,防止管道堵塞,並有效地促進石油運輸,尤其是在寒冷地區和海上。在原油含蠟量高、黏度大的地區,例如俄羅斯、加拿大和中東部分地區,降凝劑的使用尤其重要。深水油田和北極油田產量的不斷成長,以及對可靠流動保障解決方案日益成長的需求,繼續支撐降凝劑在特種油田化學品市場的主導地位。

油田作業日益複雜,加上高效開採方法的需求不斷成長,預計到2024年,生產部門將主導特種油田化學品市場。去乳化劑與阻垢劑和腐蝕抑制劑的結合使用,對於提高油氣產量、提升產量以及保護基礎設施至關重要。由於能源需求(尤其是工業和電力行業的需求)不斷成長,傳統和現代儲存的生產活動都在增加。該部門透過在嚴苛條件下改進化學配方,同時遵守環保法規,在全球市場上實現安全、經濟的石油生產,從而維持了市場領先地位。

2024年,得益於二疊紀頁岩、巴肯頁岩和鷹福特頁岩等地層上游油氣活動的強勁發展,北美地區在特種油田化學品市場佔據主導地位。該地區正在廣泛採用提高採收率(EOR)、先進鑽井技術以及鼓勵環保化學處理的監管措施。傳統型蘊藏量產量的不斷成長,推動了對腐蝕抑制劑、阻垢劑和去乳化劑等高性能化學品的需求不斷成長。此外,對深水和緻密油計劃的持續投資,加上對提高營運效率和環保合規性的重視,鞏固了北美在全球特種油田化學品市場的領導地位。

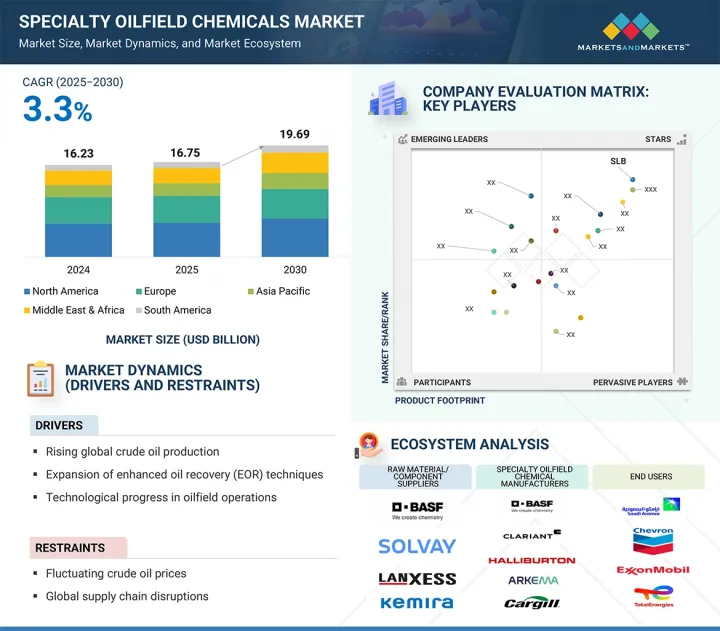

參與公司包括:BASF(德國)、科萊恩(瑞士)、陶氏(美國)、Syensqo(比利時)、SLB(美國)、哈里伯頓(美國)、貝克休斯公司(美國)、阿科瑪(法國)、嘉吉公司(美國)、雪佛龍菲利普斯化學公司(美國)。

本研究對特種油田化學品市場的主要企業進行了詳細的競爭分析,包括公司簡介、最新發展和主要市場策略。

調查對象

本研究報告按類型、儲存類型、應用和地區細分特種油田化學品市場。報告涵蓋影響特種油田化學品市場成長的促進因素、限制因素、挑戰和機會的詳細資訊。該報告對主要行業參與企業進行了詳細分析,深入了解其業務概況、產品供應以及與特種油田化學品市場相關的關鍵策略,例如合作夥伴關係、協作、合併、收購、產品發布和業務擴張。報告中還涵蓋了特種油田化學品市場生態系統中新興企業的競爭分析。

購買報告的原因

本報告為市場領導/新進業者提供整個特種油田化學品市場及其細分市場最接近的收益數據資訊。本報告幫助相關人員了解競爭格局,獲得洞察力,從而更好地定位業務,並規劃合適的打入市場策略。本報告幫助相關人員掌握市場脈搏,並提供關鍵市場促進因素、限制、挑戰和機會的資訊。

本報告研究了全球特種油田化學品市場,按類型、儲存類型、應用和地區進行細分,並提供了參與市場的公司概況。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章重要考察

第5章市場概述

- 介紹

- 市場動態

- 影響客戶業務的趨勢和中斷

- 生態系分析

- 價值鏈分析

- 關稅和監管狀況

- 貿易分析

- 技術分析

- 專利分析

- 2025-2026年主要會議和活動

- 案例研究分析

- 投資金籌措場景

- 生成式人工智慧/人工智慧對特種油田化學品市場的影響

- 波特五力分析

- 主要相關人員和採購標準

- 宏觀經濟分析

- 2025年美國關稅對特種油田化學品市場的影響

第6章特種油田化學品市場(按類型)

- 介紹

- 去乳化劑

- 抑制劑和清除劑

- 流變改質劑

- 減摩裝置

- 特殊除生物劑

- 特殊界面活性劑

- 流動點降低劑

- 其他

7. 特種油田化學品市場(依儲存類型)

- 介紹

- 海上

- 陸上

第 8 章 專用油田化學品市場(依應用)

- 介紹

- 生產

- 井刺激

- 鑽井液

- 提高石油採收率

- 水泥

- 維修及竣工

第9章 特種油田化學品市場(按地區)

- 介紹

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 挪威

- 英國

- 俄羅斯

- 哈薩克

- 荷蘭

- 其他

- 中東和非洲

- 海灣合作理事會國家

- 伊朗

- 伊拉克

- 奈及利亞

- 其他

- 亞太地區

- 中國

- 印尼

- 印度

- 馬來西亞

- 泰國

- 其他

- 南美洲

- 巴西

- 委內瑞拉

- 其他

第10章 競爭格局

- 概述

- 主要參與企業的策略

- 市場佔有率分析

- 收益分析

- 估值和財務指標

- 產品/品牌比較

- 公司估值矩陣:2024 年關鍵參與企業

- 公司估值矩陣:Start-Ups/中小企業,2024 年

- 競爭場景

第11章 公司簡介

- 主要參與企業

- SLB

- BASF

- DOW

- CLARIANT

- SYENSQO

- HALLIBURTON

- BAKER HUGHES COMPANY

- ARKEMA

- CARGILL, INCORPORATED

- CHEVRON PHILLIPS CHEMICAL COMPANY LLC

- 其他公司

- ALBEMARLE CORPORATION

- STEPAN COMPANY

- INNOSPEC

- LUBRIZOL

- NOURYON

- ASHLAND

- THERMAX LIMITED

- ELEMENTIS PLC

- FLOTEK INDUSTRIES, INC.

- GEO

- SMC GLOBAL

- OLEON NV

- PURECHEM SERVICES

- STERLING SPECIALTY CHEMICALS

- ENROIL

第12章:相鄰市場與相關市場

第13章 附錄

The specialty oilfield chemicals market is expected to reach USD 19.69 billion by 2030 from USD 16.75 billion in 2025, at a CAGR of 3.3% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Kiloton) |

| Segments | Type, Reservoir Type, Application, and Region |

| Regions covered | North America, Asia Pacific, Europe, Middle East & Africa, and South America |

The specialty oilfield chemicals market is experiencing consistent growth, due to the upstream oil and gas operations' demand for sustainable and efficient oilfield chemicals. In extreme circumstances such as deepwater and unconventional reservoirs, these chemicals enhance the extraction of oil from the reservoirs while maintaining the integrity of the wellbore and optimizing drilling operations.

The business has been supported by regulatory bodies like the US Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA), which are enforcing tougher rules on chemical use, toxicity, and environmental impact. Manufacturers are responding by developing more sustainable, biodegradable, and low-VOC products. This regulatory initiative has accelerated advances in accurate chemistry and green product development. An increasingly common feature in these product approaches is real-time monitoring and smart chemical delivery systems to improve faster action and compliance. Specialty oilfield chemicals are crucial as exploration advances into challenging areas, ensuring that upstream energy operations are safe, efficient, and environmentally sustainable.

"Pour point depressants accounted for the largest share in the specialty oilfield chemicals market in 2024."

In 2024, pour point depressants accounted for the largest share of the specialty oilfield chemicals market, due to their vital role in promoting the flow of crude oil in low-temperature conditions. These chemicals lower the temperature at which wax crystals form, preventing pipeline blockages and promoting effective oil transportation, especially in cold climates and offshore operations. Their use is particularly critical in high-wax, high-viscosity crude regions such as Russia, Canada, and parts of the Middle East. The growing production from deepwater and arctic fields, along with rising demand for reliable flow assurance solutions, continues to support the dominance of pour point depressants in the specialty oilfield chemicals market.

"Production segment accounted for the largest share of the specialty oilfield chemicals market in 2024."

The increasing complexity of oilfield operations with the requirement for efficient extraction methods led to the production sector dominating the specialty oilfield chemicals market in 2024. The protection of infrastructure alongside enhanced oil and gas production and increased yield requires the essential use of demulsifiers in combination with scale inhibitors and corrosion inhibitors. Both traditional and modern reservoirs witness rising production activities because energy demand continues to increase, particularly from industrial and power sectors. The segment maintains its market leadership position through chemical formula advancements for challenging conditions alongside environmental regulation adherence, which delivers safe, economical oil production across worldwide markets.

"North America dominated the regional market for specialty oilfield chemicals in 2024."

In 2024, North America dominated the specialty oilfield chemicals market due to vigorous upstream activities in the Permian, Bakken, and Eagle Ford shale formations. The region utilizes advanced drilling techniques alongside widespread enhanced oil recovery (EOR) practices and robust rules that encourage environmentally acceptable chemical treatments. Increased demand for high-performance chemicals-such as corrosion inhibitors, scale inhibitors, and demulsifiers-has been fueled by growing production from unconventional reserves. Additionally, ongoing investments in deepwater and tight oil projects, combined with a focus on improving operational efficiency and environmental compliance, have solidified North America's leadership in the global specialty oilfield chemicals market.

By Company Type: Tier 1: 25%, Tier 2: 42%, and Tier 3: 33%

By Designation: C-level Executives: 20%, Directors: 30%, and Other Designations: 50%

By Region: North America: 20%, Europe: 10%, Asia Pacific: 40%, South America: 10%, and the Middle East & Africa: 20%

Companies Covered: BASF (Germany), Clariant (Switzerland), Dow (US), Syensqo (Belgium), SLB (US), Halliburton (US), Baker Hughes Company (US), Arkema (France), Cargill, Incorporated (US), and Chevron Phillips Chemical Company LLC (US) are covered in the report.

The study includes an in-depth competitive analysis of these key players in the specialty oilfield chemicals market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the specialty oilfield chemicals market based on type (demulsifiers, inhibitors & scavengers, rheology modifiers, friction reducers, specialty biocides, specialty surfactants, pour point depressants, and other types), reservoir type (onshore reservoirs and offshore reservoirs), application (production, well stimulation, drilling fluids, enhanced oil recovery, cementing, and workover & completion), and region (Asia Pacific, North America, Europe, South America, and Middle East & Africa). The report's scope covers detailed information regarding drivers, restraints, challenges, and opportunities influencing the growth of the specialty oilfield chemicals market. A detailed analysis of the key industry players has been done to provide insights into their business overview, products offered, and key strategies, such as partnerships, collaborations, mergers, acquisitions, product launches, and expansions, associated with the specialty oilfield chemicals market. This report covers a competitive analysis of upcoming startups in the specialty oilfield chemicals market ecosystem.

Reasons to Buy the Report

The report will offer the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall specialty oilfield chemicals market and the subsegments. This report will help stakeholders understand the competitive landscape, gain more insights into positioning their businesses better, and plan suitable go-to-market strategies. The report will help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (rising global crude oil production, expansion of enhanced oil recovery (EOR) techniques, and technological progress in oilfield operations), restraints (fluctuating crude oil prices and global supply chain disruptions), opportunities (rising oilfield explorations in emerging regions and growing aging oil reservoirs), and challenges (stringent environmental regulations and sustainability pressures and operational complexity in extreme environments limits chemical performance).

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the specialty oilfield chemicals market.

- Market Development: Comprehensive information about profitable markets - the report analyzes the specialty oilfield chemicals market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the specialty oilfield chemicals market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as BASF (Germany), Clariant (Switzerland), Dow (US), Syensqo (Belgium), SLB (US), Halliburton (US), Baker Hughes Company (US), Arkema (France), Cargill, Incorporated (US), and Chevron Phillips Chemical Company LLC (US), among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 BASE NUMBER CALCULATION

- 2.3.1 DEMAND-SIDE APPROACH

- 2.3.2 SUPPLY-SIDE APPROACH

- 2.4 MARKET FORECAST APPROACH

- 2.4.1 SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- 2.5 DATA TRIANGULATION

- 2.6 FACTOR ANALYSIS

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SPECIALTY OILFIELD CHEMICALS MARKET

- 4.2 NORTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION AND COUNTRY

- 4.3 SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE

- 4.4 SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION

- 4.5 SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising global crude oil production

- 5.2.1.2 Expansion of Enhanced Oil Recovery (EOR) techniques

- 5.2.1.3 Increasing sophistication of exploration and production technologies

- 5.2.2 RESTRAINTS

- 5.2.2.1 Fluctuating crude oil prices

- 5.2.2.2 Global supply chain disruptions

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising oilfield exploration in emerging regions

- 5.2.3.2 Growing aging oil reservoirs

- 5.2.4 CHALLENGES

- 5.2.4.1 Stringent environmental regulations and sustainability pressures

- 5.2.4.2 Operational complexities in extreme environments limit chemical performance

- 5.2.1 DRIVERS

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.3.1 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 TARIFF AND REGULATORY LANDSCAPE

- 5.6.1 TARIFF ANALYSIS (HS CODE: 381190)

- 5.6.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.6.3 KEY REGULATIONS

- 5.6.3.1 ISO 10414-1 / API RP 13B-1

- 5.6.3.2 OSPAR Decision 2000/2 & HOCNF

- 5.6.3.3 API RP 55 - Recommended Practices for Oilfield H2S Safety

- 5.6.3.4 ISO 10416 / API RP 13K

- 5.6.3.5 REACH Regulation (EC) No 1907/2006

- 5.6.4 PRICING ANALYSIS

- 5.6.4.1 Pricing analysis based on type

- 5.6.4.2 Pricing analysis based on region

- 5.7 TRADE ANALYSIS

- 5.7.1 EXPORT SCENARIO (HS CODE 381190)

- 5.7.2 IMPORT SCENARIO (HS CODE 381190)

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Nanoemulsions

- 5.8.1.2 Biodegradable chemicals

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Controlled-release additives (Encapsulation)

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Enzyme-based formulations

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- 5.9.1 INTRODUCTION

- 5.9.2 METHODOLOGY

- 5.9.3 SPECIALTY OILFIELD CHEMICALS MARKET, PATENT ANALYSIS, 2015-2024

- 5.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 SCALE DEPOSITION PREVENTION WITH ANTI-SCALING AND HIGH-TEMPERATURE BIOCIDE SOLUTION - ARKEMA'S NORUST 9 M 50 FR

- 5.11.2 REDUCING THERMAL REMEDIATION FREQUENCY WITH HIGH-PERFORMANCE WINTERIZED PARAFFIN INHIBITOR

- 5.11.3 PREVENTING SCALE DEPOSITION WITH MULTI-FUNCTION TRIAZINE-BASED H2S SCAVENGER - LX-1358

- 5.12 INVESTMENT AND FUNDING SCENARIO

- 5.13 IMPACT OF GEN AI/AI ON SPECIALTY OILFIELD CHEMICALS MARKET

- 5.13.1 INTRODUCTION

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 MACROECONOMIC ANALYSIS

- 5.16.1 INTRODUCTION

- 5.16.2 GDP TRENDS AND FORECASTS

- 5.17 IMPACT OF 2025 US TARIFF ON SPECIALTY OILFIELD CHEMICALS MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 China

- 5.17.4.3 Middle East

- 5.17.4.4 India

- 5.17.5 IMPACT ON END-USE INDUSTRIES

6 SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 DEMULSIFIERS

- 6.2.1 DEMAND FOR ENHANCING CRUDE OIL PURITY TO DRIVE MARKET

- 6.3 INHIBITORS & SCAVENGERS

- 6.3.1 RISING CORROSION CHALLENGES IN AGING WELLS TO FUEL MARKET

- 6.4 RHEOLOGY MODIFIERS

- 6.4.1 RISING DEMAND FOR ENSURING OPERATIONAL PRECISION AND SAFETY IN DRILLING OPERATIONS TO BOOST MARKET

- 6.5 FRICTION REDUCERS

- 6.5.1 EXPANDING WELL-STIMULATION PROGRAMS TO ACCELERATE DEMAND

- 6.6 SPECIALTY BIOCIDES

- 6.6.1 RISING NEED TO COMBAT MICROBIAL-INDUCED CORROSION TO DRIVE DEMAND

- 6.7 SPECIALTY SURFACTANTS

- 6.7.1 SURGE IN ENHANCED OIL RECOVERY EFFORTS TO PROPEL DEMAND

- 6.8 POUR POINT DEPRESSANTS

- 6.8.1 HIGH WAX CONTENT IN ASIAN CRUDE OILS TO SUPPORT DEMAND

- 6.9 OTHER TYPES

7 SPECIALTY OILFIELD CHEMICALS MARKET, BY RESERVOIR TYPE

- 7.1 INTRODUCTION

- 7.2 OFFSHORE RESERVOIRS

- 7.2.1 INCREASING DEEPWATER EXPLORATION AND HARSH OFFSHORE CONDITIONS TO FUEL MARKET

- 7.3 ONSHORE RESERVOIRS

- 7.3.1 EXPANDING UNCONVENTIONAL DRILLING AND AGING FIELDS TO DRIVE DEMAND

8 SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 PRODUCTION

- 8.2.1 EXPANDING GLOBAL CRUDE OIL OUTPUT TO DRIVE DEMAND

- 8.3 WELL STIMULATION

- 8.3.1 RAPID GROWTH IN HYDRAULIC FRACTURING TO FUEL MARKET

- 8.4 DRILLING FLUIDS

- 8.4.1 ENSURING WELLBORE STABILITY AND EFFICIENT DRILLING TO BOOST MARKET

- 8.5 ENHANCED OIL RECOVERY

- 8.5.1 MATURING RESERVES TO SPUR ADOPTION

- 8.6 CEMENTING

- 8.6.1 COMPLEX SUBSURFACE CONDITIONS TO ACCELERATE DEMAND

- 8.7 WORKOVER & COMPLETION

- 8.7.1 CRITICAL FORMATION PRESSURE MANAGEMENT TO PROPEL MARKET

9 SPECIALTY OILFIELD CHEMICALS MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 US

- 9.2.1.1 High upstream activities and stringent regulations to drive demand

- 9.2.2 CANADA

- 9.2.2.1 Rising oil sands output and heavy crude exports to boost demand

- 9.2.3 MEXICO

- 9.2.3.1 Rising offshore production, mature fields, and stricter regulations to propel demand

- 9.2.1 US

- 9.3 EUROPE

- 9.3.1 NORWAY

- 9.3.1.1 Advancing offshore projects and operations in harsh environments to stimulate demand

- 9.3.2 UK

- 9.3.2.1 North Sea revival and sustainability goals to propel demand

- 9.3.3 RUSSIA

- 9.3.3.1 Diversified energy output and production shifts to boost market

- 9.3.4 KAZAKHSTAN

- 9.3.4.1 Upstream expansion and complex hydrocarbon operations to propel market

- 9.3.5 NETHERLANDS

- 9.3.5.1 Focus on offshore gas and regulatory shifts to accelerate demand

- 9.3.6 REST OF EUROPE

- 9.3.1 NORWAY

- 9.4 MIDDLE EAST & AFRICA

- 9.4.1 GCC COUNTRIES

- 9.4.1.1 Saudi Arabia

- 9.4.1.1.1 Rising production volumes and reservoir complexity to fuel demand

- 9.4.1.2 UAE

- 9.4.1.2.1 Upstream expansion and digitalization drive market

- 9.4.1.3 Rest of GCC countries

- 9.4.1.1 Saudi Arabia

- 9.4.2 IRAN

- 9.4.2.1 Rising exploration and production activities to boost market

- 9.4.3 IRAQ

- 9.4.3.1 Surging licensing and well development to accelerate specialty chemical needs

- 9.4.4 NIGERIA

- 9.4.4.1 Evolving production dynamics and regulatory initiatives to boost demand

- 9.4.5 REST OF MIDDLE EAST & AFRICA

- 9.4.1 GCC COUNTRIES

- 9.5 ASIA PACIFIC

- 9.5.1 CHINA

- 9.5.1.1 Production push and EOR investments to fuel demand

- 9.5.2 INDONESIA

- 9.5.2.1 Revitalization of oil and gas reserves to support demand

- 9.5.3 INDIA

- 9.5.3.1 Expanding domestic exploration and offshore enhancements to propel demand

- 9.5.4 MALAYSIA

- 9.5.4.1 New discoveries and offshore expansion to elevate demand

- 9.5.5 THAILAND

- 9.5.5.1 Offshore gas expansion and rising licensing to lead to market growth

- 9.5.6 REST OF ASIA PACIFIC

- 9.5.1 CHINA

- 9.6 SOUTH AMERICA

- 9.6.1 BRAZIL

- 9.6.1.1 Rapidly evolving deepwater and ultra-deepwater exploration and production to propel market growth

- 9.6.2 VENEZUELA

- 9.6.2.1 Resurgence of oil and gas sector to boost market

- 9.6.3 REST OF SOUTH AMERICA

- 9.6.1 BRAZIL

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES

- 10.3 MARKET SHARE ANALYSIS

- 10.4 REVENUE ANALYSIS

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 PRODUCT/BRAND COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Regional footprint

- 10.7.5.3 Type footprint

- 10.7.5.4 Reservoir type footprint

- 10.7.5.5 Application footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 SLB

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Deals

- 11.1.1.3.2 Expansions

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 BASF

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Deals

- 11.1.2.3.2 Expansions

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 DOW

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 CLARIANT

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches

- 11.1.4.3.2 Deals

- 11.1.4.3.3 Expansions

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 SYENSQO

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 MnM view

- 11.1.5.3.1 Right to win

- 11.1.5.3.2 Strategic choices

- 11.1.5.3.3 Weaknesses and competitive threats

- 11.1.6 HALLIBURTON

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches

- 11.1.6.3.2 Deals

- 11.1.6.3.3 Expansions

- 11.1.6.4 MnM view

- 11.1.7 BAKER HUGHES COMPANY

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Deals

- 11.1.7.3.2 Expansions

- 11.1.7.4 MnM view

- 11.1.8 ARKEMA

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Product launches

- 11.1.8.4 MnM view

- 11.1.9 CARGILL, INCORPORATED

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Deals

- 11.1.9.4 MnM view

- 11.1.10 CHEVRON PHILLIPS CHEMICAL COMPANY LLC

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Expansions

- 11.1.10.4 MnM view

- 11.1.1 SLB

- 11.2 OTHER PLAYERS

- 11.2.1 ALBEMARLE CORPORATION

- 11.2.2 STEPAN COMPANY

- 11.2.3 INNOSPEC

- 11.2.4 LUBRIZOL

- 11.2.5 NOURYON

- 11.2.6 ASHLAND

- 11.2.7 THERMAX LIMITED

- 11.2.8 ELEMENTIS PLC

- 11.2.9 FLOTEK INDUSTRIES, INC.

- 11.2.10 GEO

- 11.2.11 SMC GLOBAL

- 11.2.12 OLEON NV

- 11.2.13 PURECHEM SERVICES

- 11.2.14 STERLING SPECIALTY CHEMICALS

- 11.2.15 ENROIL

12 ADJACENT AND RELATED MARKET

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

- 12.2.1 OILFIELD STIMULATION CHEMICALS MARKET

- 12.2.1.1 Market definition

- 12.2.1.2 Oilfield stimulation chemicals market, by raw material

- 12.2.1.3 Oilfield stimulation chemicals market, by application

- 12.2.1.4 Oilfield stimulation chemicals market, by region

- 12.2.1 OILFIELD STIMULATION CHEMICALS MARKET

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

List of Tables

- TABLE 1 GLOBAL CRUDE OIL PRODUCTION (THOUSAND BARRELS PER DAY) BY REGION/ COUNTRY, 2020-2024

- TABLE 2 GLOBAL PROVEN CRUDE OIL RESERVES (MILLION BARRELS), BY COUNTRY/REGION, 2020-2024

- TABLE 3 ROLES OF COMPANIES IN SPECIALTY OILFIELD CHEMICALS ECOSYSTEM

- TABLE 4 TARIFF SCENARIO FOR HS CODE 381190-COMPLIANT PRODUCTS, BY COUNTRY, 2024 (%)

- TABLE 5 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, INDUSTRY ASSOCIATIONS, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, INDUSTRY ASSOCIATIONS, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, INDUSTRY ASSOCIATIONS, AND OTHER ORGANIZATIONS

- TABLE 8 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, INDUSTRY ASSOCIATIONS, AND OTHER ORGANIZATIONS

- TABLE 9 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, INDUSTRY ASSOCIATIONS, AND OTHER ORGANIZATIONS

- TABLE 10 AVERAGE SELLING PRICE OF TYPE, BY KEY PLAYERS, 2024 (USD/KG)

- TABLE 11 AVERAGE SELLING PRICE OF KEY PLAYERS, BY REGION, 2021-2024 (USD/KG)

- TABLE 12 EXPORT DATA RELATED TO HS CODE 381190-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 13 IMPORT DATA RELATED TO HS CODE 381190-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 14 SPECIALTY OILFIELD CHEMICALS MARKET: LIST OF KEY PATENTS, 2022-2024

- TABLE 15 SPECIALTY OILFIELD CHEMICALS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 16 PORTER'S FIVE FORCES ANALYSIS

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY APPLICATIONS

- TABLE 18 KEY BUYING CRITERIA FOR KEY APPLICATIONS

- TABLE 19 GLOBAL GDP GROWTH PROJECTION, BY REGION, 2021-2028 (USD TRILLION)

- TABLE 20 SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 21 SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 22 SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 23 SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 24 SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 25 SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 26 SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 27 SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 28 SPECIALTY OILFIELD CHEMICALS MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 29 SPECIALTY OILFIELD CHEMICALS MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 30 SPECIALTY OILFIELD CHEMICALS MARKET, BY REGION, 2021-2023 (KILOTON)

- TABLE 31 SPECIALTY OILFIELD CHEMICALS MARKET, BY REGION, 2024-2030 (KILOTON)

- TABLE 32 NORTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 33 NORTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 34 NORTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 35 NORTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- TABLE 36 NORTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 37 NORTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 38 NORTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 39 NORTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 40 NORTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 41 NORTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 42 NORTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 43 NORTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 44 US: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 45 US: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 46 US: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 47 US: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 48 US: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 49 US: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 50 US: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 51 US: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 52 CANADA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 53 CANADA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 54 CANADA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 55 CANADA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 56 CANADA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 57 CANADA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 58 CANADA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 59 CANADA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 60 MEXICO: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 61 MEXICO: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 62 MEXICO: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 63 MEXICO: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 64 MEXICO: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 65 MEXICO: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 66 MEXICO: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 67 MEXICO: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 68 EUROPE: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 69 EUROPE: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 70 EUROPE: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 71 EUROPE: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- TABLE 72 EUROPE: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 73 EUROPE: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 74 EUROPE: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 75 EUROPE: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 76 EUROPE: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 77 EUROPE: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 78 EUROPE: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 79 EUROPE: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 80 NORWAY: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 81 NORWAY: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 82 NORWAY: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 83 NORWAY: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 84 NORWAY: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 85 NORWAY: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 86 NORWAY: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 87 NORWAY: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 88 UK: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 89 UK: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 90 UK: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 91 UK: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 92 UK: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 93 UK: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 94 UK: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 95 UK: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 96 RUSSIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 97 RUSSIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 98 RUSSIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 99 RUSSIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 100 RUSSIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 101 RUSSIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 102 RUSSIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 103 RUSSIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 104 KAZAKHSTAN: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 105 KAZAKHSTAN: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 106 KAZAKHSTAN: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 107 KAZAKHSTAN: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 108 KAZAKHSTAN: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 109 KAZAKHSTAN: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 110 KAZAKHSTAN: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 111 KAZAKHSTAN: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 112 NETHERLANDS: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 113 NETHERLANDS: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 114 NETHERLANDS: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 115 NETHERLANDS: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 116 NETHERLANDS: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 117 NETHERLANDS: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 118 NETHERLANDS: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 119 NETHERLANDS: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 120 REST OF EUROPE: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 121 REST OF EUROPE: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 122 REST OF EUROPE: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 123 REST OF EUROPE: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 124 REST OF EUROPE: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 125 REST OF EUROPE: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 126 REST OF EUROPE: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 127 REST OF EUROPE: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 128 MIDDLE EAST & AFRICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 131 MIDDLE EAST & AFRICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- TABLE 132 MIDDLE EAST & AFRICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 133 MIDDLE EAST & AFRICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 134 MIDDLE EAST & AFRICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 135 MIDDLE EAST & AFRICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 136 MIDDLE EAST & AFRICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 138 MIDDLE EAST & AFRICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 139 MIDDLE EAST & AFRICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 140 GCC COUNTRIES: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 141 GCC COUNTRIES: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 142 GCC COUNTRIES: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 143 GCC COUNTRIES: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 144 GCC COUNTRIES: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 145 GCC COUNTRIES: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 146 GCC COUNTRIES: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 147 GCC COUNTRIES: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 148 SAUDI ARABIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 149 SAUDI ARABIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 150 SAUDI ARABIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 151 SAUDI ARABIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 152 SAUDI ARABIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 153 SAUDI ARABIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 154 SAUDI ARABIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 155 SAUDI ARABIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 156 UAE: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 157 UAE: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 158 UAE: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 159 UAE: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 160 UAE: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 161 UAE: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 162 UAE: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 163 UAE: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 164 REST OF GCC COUNTRIES: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 165 REST OF GCC COUNTRIES: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 166 REST OF GCC COUNTRIES: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 167 REST OF GCC COUNTRIES: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 168 REST OF GCC COUNTRIES: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 169 REST OF GCC COUNTRIES: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 170 REST OF GCC COUNTRIES: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 171 REST OF GCC COUNTRIES: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 172 IRAN: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 173 IRAN: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 174 IRAN: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 175 IRAN: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 176 IRAN: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 177 IRAN: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 178 IRAN: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 179 IRAN: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 180 IRAQ: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 181 IRAQ: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 182 IRAQ: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 183 IRAQ: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 184 IRAQ: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 185 IRAQ: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 186 IRAQ: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 187 IRAQ: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 188 NIGERIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 189 NIGERIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 190 NIGERIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 191 NIGERIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 192 NIGERIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 193 NIGERIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 194 NIGERIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 195 NIGERIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 196 REST OF MIDDLE EAST & AFRICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 197 REST OF MIDDLE EAST & AFRICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 198 REST OF MIDDLE EAST & AFRICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 199 REST OF MIDDLE EAST & AFRICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 200 REST OF MIDDLE EAST & AFRICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 201 REST OF MIDDLE EAST & AFRICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 202 REST OF MIDDLE EAST & AFRICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 203 REST OF MIDDLE EAST & AFRICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 204 ASIA PACIFIC: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 205 ASIA PACIFIC: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 206 ASIA PACIFIC: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 207 ASIA PACIFIC: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- TABLE 208 ASIA PACIFIC: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 209 ASIA PACIFIC: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 210 ASIA PACIFIC: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 211 ASIA PACIFIC: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 212 ASIA PACIFIC: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 213 ASIA PACIFIC: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 214 ASIA PACIFIC: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 215 ASIA PACIFIC: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 216 CHINA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 217 CHINA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 218 CHINA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 219 CHINA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 220 CHINA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 221 CHINA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 222 CHINA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 223 CHINA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 224 INDONESIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 225 INDONESIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 226 INDONESIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 227 INDONESIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 228 INDONESIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 229 INDONESIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 230 INDONESIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 231 INDONESIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 232 INDIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 233 INDIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 234 INDIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 235 INDIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 236 INDIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 237 INDIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 238 INDIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 239 INDIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 240 MALAYSIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 241 MALAYSIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 242 MALAYSIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 243 MALAYSIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 244 MALAYSIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 245 MALAYSIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 246 MALAYSIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 247 MALAYSIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 248 THAILAND: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 249 THAILAND: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 250 THAILAND: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 251 THAILAND: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 252 THAILAND: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 253 THAILAND: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 254 THAILAND: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 255 THAILAND: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 256 REST OF ASIA PACIFIC: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 257 REST OF ASIA PACIFIC: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 258 REST OF ASIA PACIFIC: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 259 REST OF ASIA PACIFIC: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 260 REST OF ASIA PACIFIC: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 261 REST OF ASIA PACIFIC: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 262 REST OF ASIA PACIFIC: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 263 REST OF ASIA PACIFIC: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 264 SOUTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 265 SOUTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 266 SOUTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 267 SOUTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- TABLE 268 SOUTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 269 SOUTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 270 SOUTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 271 SOUTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 272 SOUTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 273 SOUTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 274 SOUTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 275 SOUTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 276 BRAZIL: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 277 BRAZIL: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 278 BRAZIL: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 279 BRAZIL: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 280 BRAZIL: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 281 BRAZIL: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 282 BRAZIL: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 283 BRAZIL: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 284 VENEZUELA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 285 VENEZUELA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 286 VENEZUELA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 287 VENEZUELA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 288 VENEZUELA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 289 VENEZUELA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 290 VENEZUELA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 291 VENEZUELA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 292 REST OF SOUTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 293 REST OF SOUTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 294 REST OF SOUTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 295 REST OF SOUTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 296 REST OF SOUTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 297 REST OF SOUTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 298 REST OF SOUTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 299 REST OF SOUTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 300 SPECIALTY OILFIELD CHEMICALS MARKET: OVERVIEW OF MAJOR STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2020-JULY 2025

- TABLE 301 SPECIALTY OILFIELD CHEMICALS MARKET: DEGREE OF COMPETITION, 2024

- TABLE 302 SPECIALTY OILFIELD CHEMICALS MARKET: REGIONAL FOOTPRINT, 2024

- TABLE 303 SPECIALTY OILFIELD CHEMICALS MARKET: TYPE FOOTPRINT, 2024

- TABLE 304 SPECIALTY OILFIELD CHEMICALS MARKET: RESERVOIR TYPE FOOTPRINT, 2024

- TABLE 305 SPECIALTY OILFIELD CHEMICALS MARKET: APPLICATION FOOTPRINT, 2024

- TABLE 306 SPECIALTY OILFIELD CHEMICALS MARKET: DETAILED LIST OF KEY STARTUPS/ SMES, 2024

- TABLE 307 SPECIALTY OILFIELD CHEMICALS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024

- TABLE 308 SPECIALTY OILFIELD CHEMICALS MARKET: PRODUCT LAUNCHES, JANUARY 2020-JULY 2025

- TABLE 309 SPECIALTY OILFIELD CHEMICALS MARKET: DEALS, JANUARY 2020-JULY 2025

- TABLE 310 SPECIALTY OILFIELD CHEMICALS MARKET: EXPANSIONS, JANUARY 2020-JULY 2025

- TABLE 311 SLB: COMPANY OVERVIEW

- TABLE 312 SLB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 313 SLB: DEALS, JANUARY 2020-JULY 2025

- TABLE 314 SLB: EXPANSIONS, JANUARY 2020-JULY 2025

- TABLE 315 BASF: COMPANY OVERVIEW

- TABLE 316 BASF: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 317 BASF: DEALS, JANUARY 2020-JULY 2025

- TABLE 318 BASF: EXPANSIONS, JANUARY 2020-JULY 2025

- TABLE 319 DOW: COMPANY OVERVIEW

- TABLE 320 DOW: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 321 DOW: DEALS, JANUARY 2020-JULY 2025

- TABLE 322 CLARIANT: COMPANY OVERVIEW

- TABLE 323 CLARIANT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 324 CLARIANT: PRODUCT LAUNCHES, JANUARY 2020-JULY 2025

- TABLE 325 CLARIANT: DEALS, JANUARY 2020-JULY 2025

- TABLE 326 CLARIANT: EXPANSIONS, JANUARY 2020-JULY 2025

- TABLE 327 SYENSQO: COMPANY OVERVIEW

- TABLE 328 SYENSQO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 329 HALLIBURTON: COMPANY OVERVIEW

- TABLE 330 HALLIBURTON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 331 HALLIBURTON: PRODUCT LAUNCHES, JANUARY 2020-JULY 2025

- TABLE 332 HALLIBURTON: DEALS, JANUARY 2020-JULY 2025

- TABLE 333 HALLIBURTON: EXPANSIONS, JANUARY 2020-JULY 2025

- TABLE 334 BAKER HUGHES COMPANY: COMPANY OVERVIEW

- TABLE 335 BAKER HUGHES COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 336 BAKER HUGHES COMPANY: DEALS, JANUARY 2020-JULY 2025

- TABLE 337 BAKER HUGHES COMPANY: EXPANSIONS, JANUARY 2020-JULY 2025

- TABLE 338 ARKEMA: COMPANY OVERVIEW

- TABLE 339 ARKEMA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 340 ARKEMA: PRODUCT LAUNCHES, JANUARY 2020-JULY 2025

- TABLE 341 CARGILL, INCORPORATED: COMPANY OVERVIEW

- TABLE 342 CARGILL, INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 343 CARGILL, INCORPORATED: DEALS, JANUARY 2020-JULY 2025

- TABLE 344 CHEVRON PHILLIPS CHEMICAL COMPANY LLC: COMPANY OVERVIEW

- TABLE 345 CHEVRON PHILLIPS CHEMICAL COMPANY LLC: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 346 CHEVRON PHILLIPS CHEMICAL COMPANY LLC: EXPANSIONS, JANUARY 2020-JULY 2025

- TABLE 347 ALBEMARLE CORPORATION: COMPANY OVERVIEW

- TABLE 348 STEPAN COMPANY: COMPANY OVERVIEW

- TABLE 349 INNOSPEC: COMPANY OVERVIEW

- TABLE 350 LUBRIZOL: COMPANY OVERVIEW

- TABLE 351 NOURYON: COMPANY OVERVIEW

- TABLE 352 ASHLAND: COMPANY OVERVIEW

- TABLE 353 THERMAX LIMITED: COMPANY OVERVIEW

- TABLE 354 ELEMENTIS PLC: COMPANY OVERVIEW

- TABLE 355 FLOTEK INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 356 GEO: COMPANY OVERVIEW

- TABLE 357 SMC GLOBAL: COMPANY OVERVIEW

- TABLE 358 OLEON NV: COMPANY OVERVIEW

- TABLE 359 PURECHEM SERVICES: COMPANY OVERVIEW

- TABLE 360 STERLING SPECIALTY CHEMICALS: COMPANY OVERVIEW

- TABLE 361 ENROIL: COMPANY OVERVIEW

- TABLE 362 OILFIELD STIMULATION CHEMICALS MARKET, BY TYPE, 2013-2020 (USD MILLION)

- TABLE 363 OILFIELD STIMULATION CHEMICALS MARKET, BY APPLICATION, 2013-2020 (USD MILLION)

- TABLE 364 OILFIELD STIMULATION CHEMICALS MARKET, BY REGION, 2013-2020 (USD MILLION)

List of Figures

- FIGURE 1 SPECIALTY OILFIELD CHEMICALS MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 SPECIALTY OILFIELD CHEMICALS MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF INTERVIEWS WITH EXPERTS

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 SPECIALTY OILFIELD CHEMICALS MARKET: APPROACH 1

- FIGURE 7 SPECIALTY OILFIELD CHEMICALS MARKET

- FIGURE 8 SPECIALTY OILFIELD CHEMICALS MARKET: DATA TRIANGULATION

- FIGURE 9 SPECIALTY SURFACTANTS TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 10 WELL STIMULATION TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 11 MIDDLE EAST & AFRICA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 12 EMERGING ECONOMIES OFFER ATTRACTIVE OPPORTUNITIES IN SPECIALTY OILFIELD CHEMICALS MARKET

- FIGURE 13 PRODUCTION SEGMENT AND US ACCOUNTED FOR LARGEST SHARES IN 2024

- FIGURE 14 FRICTION REDUCERS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 15 PRODUCTION PROJECTED TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 16 MARKET IN IRAQ TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN SPECIALTY OILFIELD CHEMICALS MARKET

- FIGURE 18 CRUDE OIL PRICE, 2019-2024 (USD/BBL)

- FIGURE 19 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 20 SPECIALTY OILFIELD CHEMICALS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 21 SPECIALTY OILFIELD CHEMICALS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 22 AVERAGE SELLING PRICE TREND OF TYPE, BY KEY PLAYERS, 2024 (USD/KG)

- FIGURE 23 SPECIALTY OILFIELD CHEMICALS MARKET: AVERAGE SELLING PRICE, BY REGION, 2021-2024 (USD/KG)

- FIGURE 24 EXPORT DATA FOR HS CODE 381190-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 25 IMPORT DATA FOR HS CODE 381190-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 26 LIST OF MAJOR PATENTS FOR SPECIALTY OILFIELD CHEMICALS, 2015-2024

- FIGURE 27 MAJOR PATENTS APPLIED AND GRANTED RELATED FOR SPECIALTY OILFIELD CHEMICALS, BY COUNTRY/REGION, 2015-2024

- FIGURE 28 INVESTMENT AND FUNDING SCENARIO, 2018-2024

- FIGURE 29 IMPACT OF GEN AI/AI ON SPECIALTY OILFIELD CHEMICALS MARKET

- FIGURE 30 SPECIALTY OILFIELD CHEMICALS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY APPLICATIONS

- FIGURE 32 KEY BUYING CRITERIA FOR KEY APPLICATIONS

- FIGURE 33 POUR POINT DEPRESSANTS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 34 WELL STIMULATION SEGMENT TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 35 IRAQ TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 36 NORTH AMERICA TO LEAD SPECIALTY OILFIELD CHEMICALS MARKET DURING FORECAST PERIOD

- FIGURE 37 NORTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET SNAPSHOT

- FIGURE 38 EUROPE: SPECIALTY OILFIELD CHEMICALS MARKET SNAPSHOT

- FIGURE 39 SPECIALTY OILFIELD CHEMICALS MARKET SHARE ANALYSIS, 2024

- FIGURE 40 SPECIALTY OILFIELD CHEMICALS MARKET: REVENUE ANALYSIS OF KEY COMPANIES FOR LAST FIVE YEARS, 2020-2024 (USD BILLION)

- FIGURE 41 SPECIALTY OILFIELD CHEMICALS MARKET: COMPANY VALUATION, 2024 (USD BILLION)

- FIGURE 42 SPECIALTY OILFIELD CHEMICALS MARKET: FINANCIAL MATRIX: EV/EBITDA RATIO, 2024

- FIGURE 43 SPECIALTY OILFIELD CHEMICALS MARKET: YEAR-TO-DATE PRICE AND FIVE-YEAR STOCK BETA, 2024

- FIGURE 44 SPECIALTY OILFIELD CHEMICALS MARKET: PRODUCT/BRAND COMPARISON

- FIGURE 45 SPECIALTY OILFIELD CHEMICALS MARKET: COMPANY EVALUATION MATRIX, KEY PLAYERS, 2024

- FIGURE 46 SPECIALTY OILFIELD CHEMICALS MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 47 SPECIALTY OILFIELD CHEMICALS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 48 SLB: COMPANY SNAPSHOT

- FIGURE 49 BASF: COMPANY SNAPSHOT

- FIGURE 50 DOW: COMPANY SNAPSHOT

- FIGURE 51 CLARIANT: COMPANY SNAPSHOT

- FIGURE 52 SYENSQO: COMPANY SNAPSHOT

- FIGURE 53 HALLIBURTON: COMPANY SNAPSHOT

- FIGURE 54 BAKER HUGHES COMPANY: COMPANY SNAPSHOT

- FIGURE 55 ARKEMA: COMPANY SNAPSHOT