|

市場調查報告書

商品編碼

1804841

全球手術顯微鏡市場(至 2030 年)按產品類型、應用、最終用戶和地區分類Surgical Microscopes Market by Product Type, Application, End User, and Region - Global Forecast to 2030 |

||||||

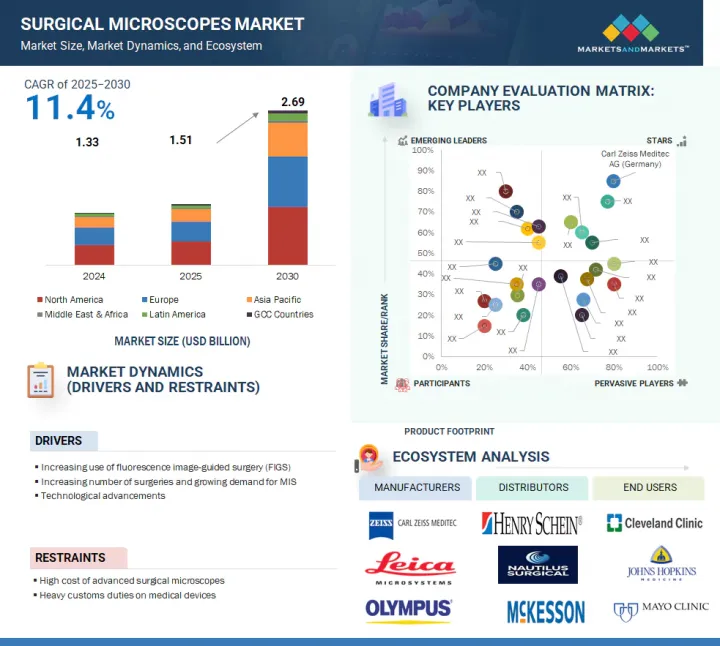

預計全球手術顯微鏡市場規模將從 2025 年的 15.1 億美元成長到 2030 年的 26.9 億美元,預測期內的複合年成長率為 11.4%。

| 調查範圍 | |

|---|---|

| 調查年份 | 2024-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 單元 | 金額(美元) |

| 部分 | 產品類型、應用程式、最終用戶、地區 |

| 目標區域 | 亞太地區、北美、歐洲、拉丁美洲、中東和非洲、海灣合作理事會國家 |

先進外科技術的普及以及全球人口的成長預計將推動市場成長。手術顯微鏡技術(例如光學、數位成像和整合功能)的持續創新,正在提高手術的精確度、易用性和工作流程。因此,這些系統在各個外科領域越來越普及,也越來越受歡迎。此外,人口老化導致的外科手術需求不斷成長,也推動了對高精度視覺化設備的需求成長。

然而,手術顯微鏡的高成本以及有效使用它們所需的專門培訓可能會限制市場成長。

按產品類型分類,設備領域將在 2024 年佔據最大佔有率。

設備領域佔據市場主導地位,手術顯微鏡和特殊顯微鏡已成為手術室的關鍵投資。新建醫院和手術室整修都始於這些先進顯微鏡的引入,這些顯微鏡具有可變放大倍率和強光照明等功能。定期的技術更新和翻新需求確保了設備銷售的穩定收益。此外,市場領導持續研發,開發出符合人體工學和數位增強功能的顯微鏡,其對影像品質和精度的高臨床標準進一步鞏固了其在該領域的主導地位。

根據應用,神經脊椎手術領域在 2024 年佔據最大佔有率。

神經脊椎手術領域由於其複雜的手術操作需要手術顯微鏡提供的精確度和視覺化功能而處於領先地位。這些系統增強了照明、放大和深度感知,有助於微創手術並減少併發症。神經系統疾病、脊椎疾病和創傷性損傷的增多,以及對專業手術設施的投資不斷增加,正在推動該領域的需求。

預計亞太地區將在預測期內佔據最大佔有率。

人口快速成長、對先進外科護理的需求不斷成長以及中階的崛起,極大地推動了亞太地區對手術顯微鏡的需求。此外,視覺化技術領域的全球領導企業正在透過推出手術顯微鏡、整合數位解決方案以及特定應用的創新產品來擴大其在該地區的業務。

本報告調查了全球手術顯微鏡市場,並提供了市場概況、影響市場成長的各種因素分析、技術和專利趨勢、法律制度、案例研究、市場規模趨勢和預測、各個細分市場、地區/主要國家的詳細分析、競爭格局和主要企業的概況。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章重要考察

第5章市場概述

- 市場動態

- 驅動程式

- 抑制因素

- 機會

- 任務

- 產業趨勢

- 技術分析

- 定價分析

- 生態系分析

- 還款情境分析

- 價值鏈分析

- 波特五力分析

- 主要相關人員和採購標準

- 供應鏈分析

- 貿易分析

- 監管分析

- 專利分析

- 2025-2026年重要會議和活動

- 鄰近市場分析

- 影響客戶業務的趨勢/中斷

- 未滿足的需求/最終用戶期望

- 人工智慧/生成式人工智慧對手術顯微鏡市場的影響

- 案例研究分析

- 投資金籌措場景

- 2025年美國關稅對手術顯微鏡市場的影響

第6章 手術顯微鏡市場(依類型)

- 裝置

- 配件

- 軟體

第7章手術顯微鏡市場(依應用)

- 神經外科和脊椎外科

- 整形外科/重組外科

- 眼科

- 婦科和泌尿系統

- 瘤

- 耳鼻喉手術

- 牙科

- 其他

第8章 手術顯微鏡市場(依最終使用者)

- 醫院

- 門診設施

- 其他

第9章手術顯微鏡市場(按地區)

- 北美洲

- 宏觀經濟展望

- 美國

- 加拿大

- 歐洲

- 宏觀經濟展望

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 其他

- 亞太地區

- 宏觀經濟展望

- 中國

- 印度

- 韓國

- 日本

- 澳洲

- 其他

- 拉丁美洲

- 宏觀經濟展望

- 巴西

- 墨西哥

- 其他

- 中東和非洲

- 宏觀經濟展望

- 海灣合作理事會國家

- 宏觀經濟展望

第10章 競爭格局

- 主要參與企業的策略/優勢

- 收益分析

- 市場佔有率分析

- 公司評估矩陣:主要企業

- 公司估值矩陣:Start-Ups/中小型企業

- 估值和財務指標

- 品牌/產品比較

- 主要企業研發支出

- 競爭場景

第11章 公司簡介

- 主要企業

- CARL ZEISS MEDITEC AG

- DANAHER (LEICA MICROSYSTEMS)

- ALCON

- HAAG-STREIT GROUP

- OLYMPUS CORPORATION

- ALLTION (GUANGXI) INSTRUMENT CO., LTD.

- TOPCON CORPORATION

- GLOBAL SURGICAL CORPORATION

- TAKAGI SEIKO CO., LTD.

- KARL KAPS GMBH & CO. KG

- 其他公司

- MITAKA KOHKI CO., LTD.

- SEILER INSTRUMENT INC.

- ATMOS MEDIZINTECHNIK GMBH & CO. KG

- AVANTE HEALTH SOLUTIONS

- ARI MEDICAL TECHNOLOGY CO., LTD.

- MUNICH SURGICAL IMAGING GMBH

- OPTOFINE INSTRUMENTS PVT. LTD.

- DONG-A CHAMMED

- LABOMED WORLD

- ZUMAX MEDICAL CO., LTD.

- SYNAPTIVE MEDICAL

- BHS TECHNOLOGIES GMBH

- MATRONIX OPTOTECHNIK PRIVATE LIMITED

- MEDICARE SURGICAL

- QUASMO

第12章 附錄

The global surgical microscopes market is projected to reach USD 2.69 billion by 2030 from USD 1.51 billion in 2025, at a CAGR of 11.4% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product Type, Application, End User, and Region |

| Regions covered | Asia Pacific, North America, Europe, Latin America, the Middle East & Africa, and GCC Countries |

The growing knowledge of advanced surgical technology, along with an expanding global population, is expected to drive market growth. Ongoing innovations in surgical microscope technology, including improvements in optics, digital imaging, and integration capabilities, are enhancing accuracy, usability, and workflow. As a result, these systems are becoming more accessible and desirable across various surgical specialties. Additionally, aging populations with increasing surgical needs are contributing to the rising demand for high-precision visualization equipment.

However, the significant cost of surgical microscopes and the specialized training required to use them effectively may limit market growth.

Based on product type, the devices segment accounted for the largest share of the global surgical microscopes market in 2024.

The surgical microscopes market comprises three product segments: devices, accessories, and software. The devices segment dominates the market, as operative and specialty microscopes are critical investments for surgical suites. New hospital constructions and operating room renovations begin with these advanced microscopes, which offer features like variable magnification and intense illumination. Regular technology refreshment and capital replacement needs ensure steady revenue from device sales. Ongoing R&D by market leaders to develop ergonomically optimized and digitally enhanced microscopes further solidifies this segment's dominance, driven by the high clinical standards for image quality and accuracy.

Based on applications, the neuro & spine surgery segment accounted for the largest share of the global surgical microscopes market in 2024.

The global surgical microscopes market is divided into several applications, including dentistry, ENT surgery, gynecology, neuro and spine surgery, oncology, ophthalmology, and plastic surgery. The neuro and spine surgery segment is expected to dominate the market due to the complexity of procedures that require precision and visualization provided by surgical microscopes. These systems enhance illumination, magnification, and depth perception, supporting minimally invasive techniques and reducing complications. The rise in neurological disorders, spinal diseases, and trauma injuries, along with increased investment in specialized surgical facilities, is driving demand in this segment.

The Asia Pacific accounted for the largest share of the surgical microscopes market during the forecast period.

The rapid population growth, increasing demand for advanced surgical care, and the emergence of a flourishing middle class are significantly driving the demand for surgical microscopes in the Asia Pacific region. Furthermore, global leaders in visualization technologies are expanding their presence in this area by introducing surgical microscopes, integrated digital solutions, and innovations tailored to specific applications.

A breakdown of the primary participants (supply side) for the surgical microscopes market referred to in this report is provided below:

- By Company Type: Tier 1 (30%), Tier 2 (35%), and Tier 3 (35%)

- By Designation: C-level Executives (20%), Directors (35%), and Others (45%)

- By Region: North America (30%), Europe (25%), Asia Pacific (20%), Latin America (20%), the Middle East & Africa (2%), and GCC Countries (3%)

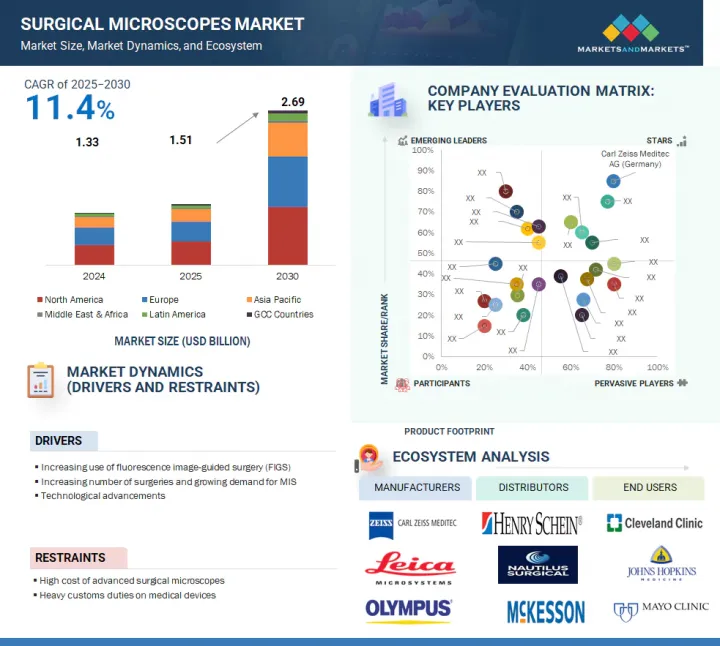

Prominent players in the surgical microscopes market include Carl Zeiss Meditec AG (Germany), Leica Microsystems (US), Alcon Inc. (Switzerland), Haag-Streit Group (Switzerland), Olympus Corporation (Japan), Alltion (Guangxi) Instrument Co., Ltd. (China), Topcon Corporation (Japan), Global Surgical Corporation (US), Takagi Seiko Co., Ltd. (Japan), Karl Kaps GmbH & Co. KG (Germany), MITAKA KOHKI Co., Ltd. (Japan), Seiler Instrument Inc. (US), ATMOS Medizintechnik GmbH & Co. KG (Germany), Avante Health Solutions (US), ARI Medical Technology Co., Ltd. (China), Munich Surgical Imaging GmbH (Germany), Optofine Instruments Pvt. Ltd. (India), DONG-A CHAMMED (South Korea), Labomed World (India), and Zumax Medical Co., Ltd. (China).

Research Coverage

The report analyzes the surgical microscopes market, aiming to estimate its size and potential for future growth across various segments, such as end users, regions, applications, and product types. Additionally, it includes a competitive analysis of the key players in the market, providing details about their company profiles, product and service offerings, recent developments, and key strategies.

Reasons to Buy the Report

The report offers valuable insights for both established market leaders and new entrants in the surgical microscopes industry. It includes approximate revenue figures for the overall market and its subsegments, helping stakeholders understand the competitive landscape. This understanding enables them to effectively position their businesses and develop successful go-to-market strategies. Additionally, the report highlights key market drivers, restraints, challenges, and opportunities, allowing stakeholders to assess the current state of the market.

This report provides insights into the following pointers:

- Analysis of key drivers (increasing use of fluorescence image-guided surgery (FIGS), increase in number of surgeries, and growing demand for MIS), restraints (high cost of advanced surgical microscopes and heavy customs duties on medical devices), opportunities (potential for growth in emerging countries and broadened applications of surgical microscopes), and challenges (high degree of technical expertise).

- Market Penetration: This report provides detailed information on the product portfolios offered by major players in the global surgical microscopes market. It covers various segments, including product types, applications, end users, and regions.

- Product Enhancement/Innovation: Comprehensive details about new product launches and anticipated trends in the global surgical microscopes market.

- Market Development: Thorough knowledge and analysis of the profitable rising markets by product types, applications, end users, and regions.

- Market Diversification: Comprehensive information about newly launched products and services, expanding markets, current advancements, and investments in the global surgical microscopes market.

- Competitive Assessment: Thorough evaluation of the market shares, growth plans, offerings of products and services, and capacities of the major competitors in the global surgical microscopes market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary data

- 2.1.1.2 Key secondary data sources

- 2.1.1.3 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary sources

- 2.1.2.2 Key objectives of primary research

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 REVENUE SHARE ANALYSIS

- 2.2.2 BOTTOM-UP APPROACH (SUPPLY-SIDE ANALYSIS)

- 2.2.3 COMPANY PRESENTATIONS & PRIMARY INTERVIEWS

- 2.2.4 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 MARKET SHARE ESTIMATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.6.1 SCOPE-RELATED LIMITATIONS

- 2.6.2 METHODOLOGY-RELATED LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 SURGICAL MICROSCOPES MARKET OVERVIEW

- 4.2 ASIA PACIFIC: SURGICAL MICROSCOPES MARKET, BY TYPE AND COUNTRY

- 4.3 SURGICAL MICROSOCPES MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.4 SURGICAL MICROSCOPES MARKET: REGIONAL MIX, 2023-2030

- 4.5 SURGICAL MICROSCOPES MARKET: EMERGING VS. DEVELOPED MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Global rise in geriatric population

- 5.2.1.2 Increase in general and specialty surgical procedures

- 5.2.1.3 Technological advancements in surgical/operating microscopes

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial capital and maintenance cost of surgical microscopes

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 High growth potential in emerging economies

- 5.2.3.2 Global expansion of hospital infrastructure

- 5.2.4 CHALLENGES

- 5.2.4.1 Dearth of skilled personnel

- 5.2.4.2 Stringent regulatory requirements for surgical microscopes

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 4K 3D VISUALIZATION TECHNOLOGY

- 5.3.2 AUGMENTED REALITY

- 5.3.3 ERGONOMIC DESIGN

- 5.4 TECHNOLOGY ANALYSIS

- 5.4.1 KEY TECHNOLOGIES

- 5.4.1.1 Optical lens systems

- 5.4.2 COMPLEMENTARY TECHNOLOGIES

- 5.4.2.1 HD monitors

- 5.4.2.2 Fluorescence imaging modules

- 5.4.3 ADJACENT TECHNOLOGIES

- 5.4.3.1 Surgical lighting systems

- 5.4.1 KEY TECHNOLOGIES

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND OF SURGICAL MICROSCOPES, BY KEY PLAYER, 2022-2024

- 5.5.2 AVERAGE SELLING PRICE TREND OF SURGICAL MICROSCOPES, BY REGION, 2022-2024

- 5.6 ECOSYSTEM ANALYSIS

- 5.6.1 ROLE IN ECOSYSTEM

- 5.7 REIMBURSEMENT SCENARIO ANALYSIS

- 5.8 VALUE CHAIN ANALYSIS

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.9.2 BARGAINING POWER OF SUPPLIERS

- 5.9.3 BARGAINING POWER OF BUYERS

- 5.9.4 THREAT OF SUBSTITUTES

- 5.9.5 THREAT OF NEW ENTRANTS

- 5.10 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 KEY BUYING CRITERIA

- 5.11 SUPPLY CHAIN ANALYSIS

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT DATA FOR HS CODE 901180, 2020-2024

- 5.12.2 EXPORT DATA FOR HS CODE 901180, 2020-2024

- 5.13 REGULATORY ANALYSIS

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 REGULATORY FRAMEWORK

- 5.13.2.1 North America

- 5.13.2.1.1 US

- 5.13.2.1.2 Canada

- 5.13.2.2 Europe

- 5.13.2.3 Asia Pacific

- 5.13.2.3.1 Japan

- 5.13.2.3.2 China

- 5.13.2.3.3 India

- 5.13.2.1 North America

- 5.14 PATENT ANALYSIS

- 5.14.1 PATENT PUBLICATION TRENDS FOR SURGICAL MICROSCOPES MARKET

- 5.14.2 JURISDICTION ANALYSIS: TOP APPLICANTS FOR PATENTS IN SURGICAL MICROSCOPES MARKET

- 5.14.3 LIST OF MAJOR PATENTS

- 5.15 KEY CONFERENCES & EVENTS, 2025-2026

- 5.16 ADJACENT MARKET ANALYSIS

- 5.17 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.18 UNMET NEEDS/END-USER EXPECTATIONS

- 5.18.1 UNMET NEEDS

- 5.18.2 END-USER EXPECTATIONS

- 5.19 IMPACT OF AI/GEN AI ON SURGICAL MICROSCOPES MARKET

- 5.20 CASE STUDY ANALYSIS

- 5.20.1 XIJING HOSPITAL TO INTEGRATE ALLTION AOMS 1600 SURGICAL MICROSCOPE FOR BETTER PRECISION SURGERY

- 5.20.2 KING FAISAL HOSPITAL RWANDA TO ACQUIRE EAST AFRICA'S FIRST ZEISS KINEVO 900S

- 5.20.3 UNIVERSITY OF CHICAGO TO ENHANCE SURGICAL VERSATILITY WITH LEICA PROVEO 8 UPGRADEABLE OPHTHALMIC MICROSCOPE PLATFORM

- 5.21 INVESTMENT & FUNDING SCENARIO

- 5.22 IMPACT OF 2025 US TARIFF ON SURGICAL MICROSCOPES MARKET

- 5.22.1 INTRODUCTION

- 5.22.2 KEY TARIFF RATES

- 5.22.3 PRICE IMPACT ANALYSIS

- 5.22.4 IMPACT ON COUNTRY/REGION

- 5.22.4.1 North America

- 5.22.4.1.1 US

- 5.22.4.2 Europe

- 5.22.4.3 Asia Pacific

- 5.22.4.1 North America

- 5.22.5 IMPACT ON END-USE INDUSTRIES

6 SURGICAL MICROSCOPES MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 DEVICES

- 6.2.1 DEVICES COMMANDED LARGEST SHARE IN SURGICAL MICROSCOPES TYPE MARKET IN 2024

- 6.3 ACCESSORIES

- 6.3.1 ACCESSORIES TO ENHANCE FUNCTIONALITY, VERSATILITY, AND EASE OF USE IN COMPLEX PROCEDURES

- 6.4 SOFTWARE

- 6.4.1 ADVANCED SURGICAL MICROSCOPE SOFTWARE TO PROVIDE BETTER PRECISION, VISUALIZATION, AND WORKFLOW EFFICIENCY

7 SURGICAL MICROSCOPES MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 NEURO & SPINE SURGERY

- 7.2.1 INCREASING R&D ACTIVITIES ON TISSUE CLEARING AND TARGETED CELL LABELING FOR BRAIN FUNCTIONS TO AID MARKET GROWTH

- 7.3 PLASTIC & RECONSTRUCTIVE SURGERY

- 7.3.1 POPULARITY OF COSMETIC PROCEDURES TO AUGMENT MARKET GROWTH

- 7.4 OPHTHALMOLOGY

- 7.4.1 RISING PREVALENCE OF GLAUCOMA TO SUPPORT MARKET GROWTH

- 7.5 GYNECOLOGY & UROLOGY

- 7.5.1 RISING DEMAND FOR MINIMALLY INVASIVE GYNECOLOGY SURGERIES TO FAVOR MARKET GROWTH

- 7.6 ONCOLOGY

- 7.6.1 HIGH CANCER BURDEN TO INCREASE ADOPTION OF SURGICAL MICROSCOPES FOR DIAGNOSIS AND TREATMENT

- 7.7 ENT SURGERY

- 7.7.1 INCREASED PREVALENCE OF CHRONIC SINUSITIS AND FAVORABLE REIMBURSEMENT POLICIES TO DRIVE MARKET

- 7.8 DENTISTRY

- 7.8.1 LESS PATIENT DISCOMFORT AND HIGH PRECISION OF MICROSURGICAL INCISIONS & SUTURING TO AID MARKET GROWTH

- 7.9 OTHER APPLICATIONS

8 SURGICAL MICROSCOPES MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 HOSPITALS

- 8.2.1 HOSPITALS COMMANDED LARGEST SHARE IN SURGICAL MICROSCOPES END USER MARKET IN 2024

- 8.3 OUTPATIENT FACILITIES

- 8.3.1 COST-EFFECTIVENESS AND PREFERENCE FOR MINIMAL HOSPITALIZATION TO FAVOR MARKET GROWTH

- 8.4 OTHER END USERS

9 SURGICAL MICROSCOPES MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 US to dominate North American surgical microscopes market during forecast period

- 9.2.3 CANADA

- 9.2.3.1 Rising demand for surgical procedures to support market growth

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Favorable healthcare initiatives and increased adoption of surgical robots to propel market growth

- 9.3.3 UK

- 9.3.3.1 Demand for precision medicines and favorable public health policies to drive market

- 9.3.4 FRANCE

- 9.3.4.1 Advancements in minimally invasive surgeries and increased adoption of precision technologies to fuel market growth

- 9.3.5 SPAIN

- 9.3.5.1 Advancements in microsurgical techniques and strong public healthcare infrastructure to augment market growth

- 9.3.6 ITALY

- 9.3.6.1 Emphasis on modernizing surgical infrastructure to boost market growth

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 CHINA

- 9.4.2.1 Advanced healthcare infrastructure and favorable government policies to drive market

- 9.4.3 INDIA

- 9.4.3.1 Modernization of public & private healthcare infrastructure and high surgical volumes to propel market growth

- 9.4.4 SOUTH KOREA

- 9.4.4.1 Advanced healthcare system and high volume of complex surgeries to spur market growth

- 9.4.5 JAPAN

- 9.4.5.1 High geriatric population and popularity of minimally invasive surgeries to propel market growth

- 9.4.6 AUSTRALIA

- 9.4.6.1 Adoption of advanced medical technologies for high-precision surgical outcomes to favor market growth

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 9.5.2 BRAZIL

- 9.5.2.1 Growing prevalence of colorectal cancer and inflammatory bowel disease to support market growth

- 9.5.3 MEXICO

- 9.5.3.1 Increasing popularity of medical tourism to favor market growth

- 9.5.4 REST OF LATIN AMERICA

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 NEED FOR ADVANCED MEDICAL TECHNOLOGIES TO DRIVE DEMAND FOR SURGICAL MICROSCOPES

- 9.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 9.7 GCC COUNTRIES

- 9.7.1 STRONG HEALTHCARE SECTOR AND FAVORABLE GOVERNMENT STRATEGIC INITIATIVES TO PROPEL MARKET GROWTH

- 9.7.2 MACROECONOMIC OUTLOOK FOR GCC COUNTRIES

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN SURGICAL MICROSCOPES MARKET

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Region footprint

- 10.5.5.3 Type footprint

- 10.5.5.4 Application footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/SMEs

- 10.6.5.2 Competitive benchmarking of key startups/SMEs

- 10.7 COMPANY VALUATION & FINANCIAL METRICS

- 10.7.1 FINANCIAL METRICS

- 10.7.2 COMPANY VALUATION

- 10.8 BRAND/PRODUCT COMPARISON

- 10.9 R&D EXPENDITURE OF KEY PLAYERS

- 10.10 COMPETITIVE SCENARIO

- 10.10.1 PRODUCT LAUNCHES & APPROVALS

- 10.10.2 DEALS

- 10.10.3 EXPANSIONS

- 10.10.4 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 CARL ZEISS MEDITEC AG

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.3.2 Deals

- 11.1.1.3.3 Expansions

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses & competitive threats

- 11.1.2 DANAHER (LEICA MICROSYSTEMS)

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches

- 11.1.2.3.2 Deals

- 11.1.2.3.3 Expansions

- 11.1.2.3.4 Other developments

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses & competitive threats

- 11.1.3 ALCON

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Expansions

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses & competitive threats

- 11.1.4 HAAG-STREIT GROUP

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches

- 11.1.4.3.2 Expansions

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses & competitive threats

- 11.1.5 OLYMPUS CORPORATION

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Expansions

- 11.1.5.4 MnM view

- 11.1.5.4.1 Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses & competitive threats

- 11.1.6 ALLTION (GUANGXI) INSTRUMENT CO., LTD.

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches & approvals

- 11.1.6.3.2 Expansions

- 11.1.7 TOPCON CORPORATION

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Deals

- 11.1.7.3.2 Expansions

- 11.1.8 GLOBAL SURGICAL CORPORATION

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.9 TAKAGI SEIKO CO., LTD.

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Expansions

- 11.1.10 KARL KAPS GMBH & CO. KG

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.1 CARL ZEISS MEDITEC AG

- 11.2 OTHER PLAYERS

- 11.2.1 MITAKA KOHKI CO., LTD.

- 11.2.2 SEILER INSTRUMENT INC.

- 11.2.3 ATMOS MEDIZINTECHNIK GMBH & CO. KG

- 11.2.4 AVANTE HEALTH SOLUTIONS

- 11.2.5 ARI MEDICAL TECHNOLOGY CO., LTD.

- 11.2.6 MUNICH SURGICAL IMAGING GMBH

- 11.2.7 OPTOFINE INSTRUMENTS PVT. LTD.

- 11.2.8 DONG-A CHAMMED

- 11.2.9 LABOMED WORLD

- 11.2.10 ZUMAX MEDICAL CO., LTD.

- 11.2.11 SYNAPTIVE MEDICAL

- 11.2.12 BHS TECHNOLOGIES GMBH

- 11.2.13 MATRONIX OPTOTECHNIK PRIVATE LIMITED

- 11.2.14 MEDICARE SURGICAL

- 11.2.15 QUASMO

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

List of Tables

- TABLE 1 SURGICAL MICROSCOPES MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 STANDARD CURRENCY CONVERSION RATES

- TABLE 3 SURGICAL MICROSCOPES MARKET: STUDY ASSUMPTIONS

- TABLE 4 SURGICAL MICROSCOPES MARKET: RISK ANALYSIS

- TABLE 5 PERCENTAGE OF GERIATRIC POPULATION (AGED 65 AND ABOVE), BY REGION, 2016 VS. 2023

- TABLE 6 TECHNOLOGICAL ADVANCEMENTS IN SURGICAL/OPERATING MICROSCOPES

- TABLE 7 AVERAGE SELLING PRICE TREND OF SURGICAL MICROSCOPES, BY KEY PLAYER, 2022-2024 (USD)

- TABLE 8 AVERAGE SELLING PRICE TREND OF SURGICAL MICROSCOPES, BY REGION, 2022-2024 (USD)

- TABLE 9 SURGICAL MICROSCOPES MARKET: ROLE IN ECOSYSTEM

- TABLE 10 SURGICAL MICROSCOPES MARKET: PORTER'S FIVE FORCES

- TABLE 11 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS, BY END USER

- TABLE 12 KEY BUYING CRITERIA, BY END USER

- TABLE 13 IMPORT DATA FOR HS CODE 901180, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 14 EXPORT DATA FOR HS CODE 901180, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 CLASSIFICATION OF MEDICAL DEVICES BY US FDA

- TABLE 21 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 22 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 23 JAPAN: CLASSIFICATION OF MEDICAL DEVICES AND REVIEWING BODIES

- TABLE 24 MEDICAL DEVICES CLASSIFICATION BY NATIONAL MEDICAL PRODUCTS ADMINISTRATION (NMPA)

- TABLE 25 SURGICAL MICROSCOPES MARKET: LIST OF MAJOR PATENTS, 2024

- TABLE 26 DETAILED LIST OF KEY CONFERENCES & EVENTS IN SURGICAL MICROSCOPES MARKET, JANUARY 2025-DECEMBER 2026

- TABLE 27 SURGICAL MICROSCOPES MARKET: UNMET NEEDS

- TABLE 28 SURGICAL MICROSCOPES MARKET: END-USER EXPECTATIONS

- TABLE 29 CASE STUDY 1: XIJING HOSPITAL TO INTEGRATE ALLTION AOMS 1600 SURGICAL MICROSCOPE FOR BETTER PRECISION SURGERY

- TABLE 30 CASE STUDY 2: KING FAISAL HOSPITAL, RWANDA TO ACQUIRE EAST AFRICA'S FIRST ZEISS KINEVO 900S

- TABLE 31 CASE STUDY 3: UNIVERSITY OF CHICAGO TO ENHANCE SURGICAL VERSATILITY WITH LEICA PROVEO 8 UPGRADEABLE OPHTHALMIC MICROSCOPE PLATFORM

- TABLE 32 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 33 KEY PRODUCT-RELATED TARIFFS EFFECTIVE FOR SURGICAL MICROSCOPES

- TABLE 34 SURGICAL MICROSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 35 SURGICAL MICROSCOPES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 36 SURGICAL MICROSCOPES MARKET, BY TYPE, 2023-2030 (THOUSAND UNITS)

- TABLE 37 SURGICAL MICROSCOPE DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 38 SURGICAL MICROSCOPE ACCESSORIES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 39 SURGICAL MICROSCOPE SOFTWARE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 40 SURGICAL MICROSCOPES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 41 SURGICAL MICROSCOPES MARKET FOR NEURO & SPINE SURGERY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 42 SURGICAL MICROSCOPES MARKET FOR PLASTIC & RECONSTRUCTIVE SURGERY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 43 SURGICAL MICROSCOPES MARKET FOR OPHTHALMOLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 44 SURGICAL MICROSCOPES MARKET FOR GYNECOLOGY & UROLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 45 SURGICAL MICROSCOPES MARKET FOR ONCOLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 46 SURGICAL MICROSCOPES MARKET FOR ENT SURGERY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 47 SURGICAL MICROSCOPES MARKET FOR DENTISTRY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 48 SURGICAL MICROSCOPES MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 49 SURGICAL MICROSCOPES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 50 SURGICAL MICROSCOPES END USER MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 51 SURGICAL MICROSCOPES MARKET FOR HOSPITALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 52 SURGICAL MICROSCOPES MARKET FOR OUTPATIENT FACILITIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 53 SURGICAL MICROSCOPES MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 54 NORTH AMERICA: SURGICAL MICROSCOPES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 55 NORTH AMERICA: SURGICAL MICROSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 56 NORTH AMERICA: SURGICAL MICROSCOPES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 57 NORTH AMERICA: SURGICAL MICROSCOPES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 58 US: SURGICAL MICROSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 59 US: SURGICAL MICROSCOPES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 60 US: SURGICAL MICROSCOPES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 61 CANADA: SURGICAL MICROSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 62 CANADA: SURGICAL MICROSCOPES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 63 CANADA: SURGICAL MICROSCOPES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 64 EUROPE: SURGICAL MICROSCOPES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 65 EUROPE: SURGICAL MICROSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 66 EUROPE: SURGICAL MICROSCOPES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 67 EUROPE: SURGICAL MICROSCOPES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 68 GERMANY: SURGICAL MICROSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 69 GERMANY: SURGICAL MICROSCOPES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 70 GERMANY: SURGICAL MICROSCOPES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 71 UK: SURGICAL MICROSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 72 UK: SURGICAL MICROSCOPES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 73 UK: SURGICAL MICROSCOPES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 74 FRANCE: SURGICAL MICROSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 75 FRANCE: SURGICAL MICROSCOPES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 76 FRANCE: SURGICAL MICROSCOPES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 77 SPAIN: SURGICAL MICROSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 78 SPAIN: SURGICAL MICROSCOPES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 79 SPAIN: SURGICAL MICROSCOPES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 80 ITALY: SURGICAL MICROSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 81 ITALY: SURGICAL MICROSCOPES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 82 ITALY: SURGICAL MICROSCOPES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 83 REST OF EUROPE: SURGICAL MICROSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 84 REST OF EUROPE: SURGICAL MICROSCOPES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 85 REST OF EUROPE: SURGICAL MICROSCOPES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 86 ASIA PACIFIC: SURGICAL MICROSCOPES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 87 ASIA PACIFIC: SURGICAL MICROSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 88 ASIA PACIFIC: SURGICAL MICROSCOPES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 89 ASIA PACIFIC: SURGICAL MICROSCOPES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 90 CHINA: SURGICAL MICROSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 91 CHINA: SURGICAL MICROSCOPES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 92 CHINA: SURGICAL MICROSCOPES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 93 INDIA: SURGICAL MICROSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 94 INDIA: SURGICAL MICROSCOPES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 95 INDIA: SURGICAL MICROSCOPES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 96 SOUTH KOREA: SURGICAL MICROSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 97 SOUTH KOREA: SURGICAL MICROSCOPES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 98 SOUTH KOREA: SURGICAL MICROSCOPES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 99 JAPAN: SURGICAL MICROSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 100 JAPAN: SURGICAL MICROSCOPES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 101 JAPAN: SURGICAL MICROSCOPES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 102 AUSTRALIA: SURGICAL MICROSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 103 AUSTRALIA: SURGICAL MICROSCOPES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 104 AUSTRALIA: SURGICAL MICROSCOPES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 105 REST OF ASIA PACIFIC: SURGICAL MICROSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 106 REST OF ASIA PACIFIC: SURGICAL MICROSCOPES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 107 REST OF ASIA PACIFIC: SURGICAL MICROSCOPES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 108 LATIN AMERICA: SURGICAL MICROSCOPES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 109 LATIN AMERICA: SURGICAL MICROSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 110 LATIN AMERICA: SURGICAL MICROSCOPES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 111 LATIN AMERICA: SURGICAL MICROSCOPES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 112 BRAZIL: SURGICAL MICROSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 113 BRAZIL: SURGICAL MICROSCOPES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 114 BRAZIL: SURGICAL MICROSCOPES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 115 MEXICO: SURGICAL MICROSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 116 MEXICO: SURGICAL MICROSCOPES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 117 MEXICO: SURGICAL MICROSCOPES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 118 REST OF LATIN AMERICA: SURGICAL MICROSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 119 REST OF LATIN AMERICA: SURGICAL MICROSCOPES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 120 REST OF LATIN AMERICA: SURGICAL MICROSCOPES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: SURGICAL MICROSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 122 MIDDLE EAST & AFRICA: SURGICAL MICROSCOPES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 123 MIDDLE EAST & AFRICA: SURGICAL MICROSCOPES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 124 GCC COUNTRIES: SURGICAL MICROSCOPES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 125 GCC COUNTRIES: SURGICAL MICROSCOPES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 126 GCC COUNTRIES: SURGICAL MICROSCOPES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 127 STRATEGIES DEPLOYED BY KEY PLAYERS IN SURGICAL MICROSCOPES MARKET, JANUARY 2022-JUNE 2025

- TABLE 128 SURGICAL MICROSCOPES MARKET: DEGREE OF COMPETITION

- TABLE 129 SURGICAL MICROSCOPES MARKET: REGION FOOTPRINT

- TABLE 130 SURGICAL MICROSCOPES MARKET: TYPE FOOTPRINT

- TABLE 131 SURGICAL MICROSCOPES MARKET: APPLICATION FOOTPRINT

- TABLE 132 SURGICAL MICROSCOPES MARKET: DETAILED LIST OF KEY STARTUPS/SME PLAYERS

- TABLE 133 SURGICAL MICROSCOPES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SME PLAYERS, BY TYPE AND REGION

- TABLE 134 SURGICAL MICROSCOPES MARKET: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-JUNE 2025

- TABLE 135 SURGICAL MICROSCOPES MARKET: DEALS, JANUARY 2022-JUNE 2025

- TABLE 136 SURGICAL MICROSCOPES MARKET: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 137 SURGICAL MICROSCOPES MARKET: OTHER DEVELOPMENTS, JANUARY 2022-JUNE 2025

- TABLE 138 CARL ZEISS MEDITEC AG: COMPANY OVERVIEW

- TABLE 139 CARL ZEISS MEDITEC AG: PRODUCTS OFFERED

- TABLE 140 CARL ZEISS MEDITEC AG: PRODUCTS LAUNCHES, JANUARY 2022-JUNE 2025

- TABLE 141 CARL ZEISS MEDITEC AG: DEALS, JANUARY 2022-JUNE 2025

- TABLE 142 CARL ZEISS MEDITEC AG: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 143 DANAHER (LEICA MICROSYSTEMS): COMPANY OVERVIEW

- TABLE 144 DANAHER (LEICA MICROSYSTEMS): PRODUCTS OFFERED

- TABLE 145 DANAHER (LEICA MICROSYSTEMS): PRODUCTS LAUNCHES, JANUARY 2022-JUNE 2025

- TABLE 146 DANAHER (LEICA MICROSYSTEMS): DEALS, JANUARY 2022-JUNE 2025

- TABLE 147 DANAHER (LEICA MICROSYSTEMS): EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 148 DANAHER (LEICA MICROSYSTEMS): OTHER DEVELOPMENTS, JANUARY 2022-JUNE 2025

- TABLE 149 ALCON: COMPANY OVERVIEW

- TABLE 150 ALCON: PRODUCTS OFFERED

- TABLE 151 ALCON: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 152 HAAG-STREIT GROUP: COMPANY OVERVIEW

- TABLE 153 HAAG-STREIT GROUP: PRODUCTS OFFERED

- TABLE 154 HAAG-STREIT GROUP: PRODUCTS LAUNCHES, JANUARY 2022-JUNE 2025

- TABLE 155 HAAG-STREIT GROUP: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 156 OLYMPUS CORPORATION: COMPANY OVERVIEW

- TABLE 157 OLYMPUS CORPORATION: PRODUCTS OFFERED

- TABLE 158 OLYMPUS CORPORATION: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 159 ALLTION (GUANGXI) INSTRUMENT CO., LTD.: COMPANY OVERVIEW

- TABLE 160 ALLTION (GUANGXI) INSTRUMENT CO., LTD.: PRODUCTS OFFERED

- TABLE 161 ALLTION (GUANGXI) INSTRUMENT CO., LTD.: PRODUCTS LAUNCHES & APPROVALS, JANUARY 2022-JUNE 2025

- TABLE 162 ALLTION (GUANGXI) INSTRUMENT CO., LTD.: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 163 TOPCON CORPORATION: COMPANY OVERVIEW

- TABLE 164 TOPCON CORPORATION: PRODUCTS OFFERED

- TABLE 165 TOPCON CORPORATION: DEALS, JANUARY 2022-JUNE 2025

- TABLE 166 TOPCON CORPORATION: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 167 GLOBAL SURGICAL CORPORATION: COMPANY OVERVIEW

- TABLE 168 GLOBAL SURGICAL CORPORATION: PRODUCTS OFFERED

- TABLE 169 TAKAGI SEIKO CO., LTD.: COMPANY OVERVIEW

- TABLE 170 TAKAGI SEIKO CO., LTD.: PRODUCTS OFFERED

- TABLE 171 TAKAGI SEIKO CO., LTD.: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 172 KARL KAPS GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 173 KARL KAPS GMBH & CO. KG: PRODUCTS OFFERED

- TABLE 174 MITAKA KOHKI CO., LTD.: COMPANY OVERVIEW

- TABLE 175 SEILER INSTRUMENT INC.: COMPANY OVERVIEW

- TABLE 176 ATMOS MEDIZINTECHNIK GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 177 AVANTE HEALTH SOLUTIONS: COMPANY OVERVIEW

- TABLE 178 ARI MEDICAL TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 179 MUNICH SURGICAL IMAGING GMBH: COMPANY OVERVIEW

- TABLE 180 OPTOFINE INSTRUMENTS PVT. LTD.: COMPANY OVERVIEW

- TABLE 181 DONG-A CHAMMED: COMPANY OVERVIEW

- TABLE 182 LABOMED WORLD: COMPANY OVERVIEW

- TABLE 183 ZUMAX MEDICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 184 SYNAPTIVE MEDICAL: COMPANY OVERVIEW

- TABLE 185 BHS TECHNOLOGIES GMBH: COMPANY OVERVIEW

- TABLE 186 MATRONIX OPTOTECHNIK PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 187 MEDICARE SURGICAL: COMPANY OVERVIEW

- TABLE 188 QUASMO: COMPANY OVERVIEW

List of Figures

- FIGURE 1 SURGICAL MICROSCOPES MARKET SEGMENTATION & REGIONAL SCOPE

- FIGURE 2 SURGICAL MICROSCOPES MARKET: YEARS CONSIDERED

- FIGURE 3 SURGICAL MICROSCOPES MARKET: RESEARCH DESIGN

- FIGURE 4 SURGICAL MICROSCOPES MARKET: KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 SURGICAL MICROSCOPES MARKET: KEY PRIMARY SOURCES

- FIGURE 6 SURGICAL MICROSCOPES MARKET: KEY DATA FROM PRIMARY SOURCES

- FIGURE 7 SURGICAL MICROSCOPES MARKET: KEY INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 8 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY- AND DEMAND-SIDE PARTICIPANTS

- FIGURE 9 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 10 SURGICAL MICROSCOPES MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS (2024)

- FIGURE 11 REVENUE SHARE ANALYSIS FOR CARL ZEISS MEDITEC AG (2024)

- FIGURE 12 SURGICAL MICROSCOPES MARKET: SUPPLY-SIDE ANALYSIS (2024)

- FIGURE 13 SURGICAL MICROSCOPES MARKET: CAGR PROJECTIONS (SUPPLY-SIDE ANALYSIS)

- FIGURE 14 SURGICAL MICROSCOPES MARKET: BOTTOM-UP APPROACH

- FIGURE 15 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2025-2030)

- FIGURE 16 SURGICAL MICROSCOPES MARKET: TOP-DOWN APPROACH

- FIGURE 17 SURGICAL MICROSCOPES MARKET: DATA TRIANGULATION METHODOLOGY

- FIGURE 18 SURGICAL MICROSCOPES MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 19 SURGICAL MICROSCOPES MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 20 SURGICAL MICROSCOPES MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 21 REGIONAL SNAPSHOT OF SURGICAL MICROSOCPES MARKET

- FIGURE 22 INCREASING NUMBER OF SURGERIES AND GROWING DEMAND FOR ADVANCED TECHNOLOGIES TO DRIVE MARKET

- FIGURE 23 JAPAN AND DEVICES SEGMENT COMMANDED LARGEST ASIA PACIFIC MARKET SHARE IN 2024

- FIGURE 24 CHINA TO REGISTER HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 25 ASIA PACIFIC TO WITNESS HIGHEST GROWTH RATE DURING STUDY PERIOD

- FIGURE 26 EMERGING MARKETS TO REGISTER HIGHER GROWTH RATES DURING FORECAST PERIOD

- FIGURE 27 SURGICAL MICROSCOPES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 28 SURGICAL MICROSCOPES MARKET: ECOSYSTEM ANALYSIS

- FIGURE 29 SURGICAL MICROSCOPES MARKET: VALUE CHAIN ANALYSIS

- FIGURE 30 SURGICAL MICROSCOPES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 31 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS, BY END USER

- FIGURE 32 KEY BUYING CRITERIA, BY END USER

- FIGURE 33 SURGICAL MICROSCOPES MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 34 PREMARKET NOTIFICATION: 510(K) APPROVALS FOR MEDICAL DEVICES

- FIGURE 35 EUROPE: CE APPROVAL PROCESS FOR MEDICAL DEVICES

- FIGURE 36 TOP PATENT APPLICANTS/OWNERS (COMPANIES/INSTITUTES) FOR SURGICAL MICROSCOPES (JANUARY 2014-DECEMBER 2024)

- FIGURE 37 TOP PATENT APPLICANT COUNTRIES FOR SURGICAL MICROSCOPES (JANUARY 2014-DECEMBER 2024)

- FIGURE 38 ADJACENT MARKETS TO SURGICAL MICROSCOPES MARKET

- FIGURE 39 SURGICAL MICROSCOPES MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 40 SURGICAL MICROSCOPES MARKET: FUNDING AND NUMBER OF DEALS (2018-2022)

- FIGURE 41 SURGICAL MICROSCOPES MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 42 NORTH AMERICA: SURGICAL MICROSCOPES MARKET SNAPSHOT

- FIGURE 43 EUROPE: SURGICAL MICROSCOPES MARKET SNAPSHOT

- FIGURE 44 ASIA PACIFIC: SURGICAL MICROSCOPES MARKET SNAPSHOT

- FIGURE 45 REVENUE ANALYSIS OF KEY PLAYERS IN SURGICAL MICROSCOPES MARKET, 2020-2024 (USD MILLION)

- FIGURE 46 MARKET SHARE ANALYSIS OF KEY PLAYERS IN SURGICAL MICROSCOPES MARKET (2024)

- FIGURE 47 SURGICAL MICROSCOPES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 48 SURGICAL MICROSCOPES MARKET: COMPANY FOOTPRINT

- FIGURE 49 SURGICAL MICROSCOPES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 50 EV/EBITDA OF KEY VENDORS

- FIGURE 51 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 52 SURGICAL MICROSCOPES MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 53 R&D EXPENDITURE OF KEY PLAYERS IN SURGICAL MICROSCOPES MARKET, 2022-2024

- FIGURE 54 CARL ZEISS MEDITEC AG: COMPANY SNAPSHOT

- FIGURE 55 DANAHER (LEICA MICROSYSTEMS): COMPANY SNAPSHOT

- FIGURE 56 ALCON: COMPANY SNAPSHOT

- FIGURE 57 OLYMPUS CORPORATION: COMPANY SNAPSHOT

- FIGURE 58 TOPCON CORPORATION: COMPANY SNAPSHOT