|

市場調查報告書

商品編碼

1802923

全球製造業人工智慧市場:處理器、軟體、技術與應用—2030 年預測Artificial Intelligence in Manufacturing Market by Processor (MPUS, GPUs, FPGA, ASICs), Software (On-premises, Cloud), Technology (Machine Learning, NLP, Context-aware Computing, Computer Vision, Generative Al), Application - Global Forecast to 2030 |

||||||

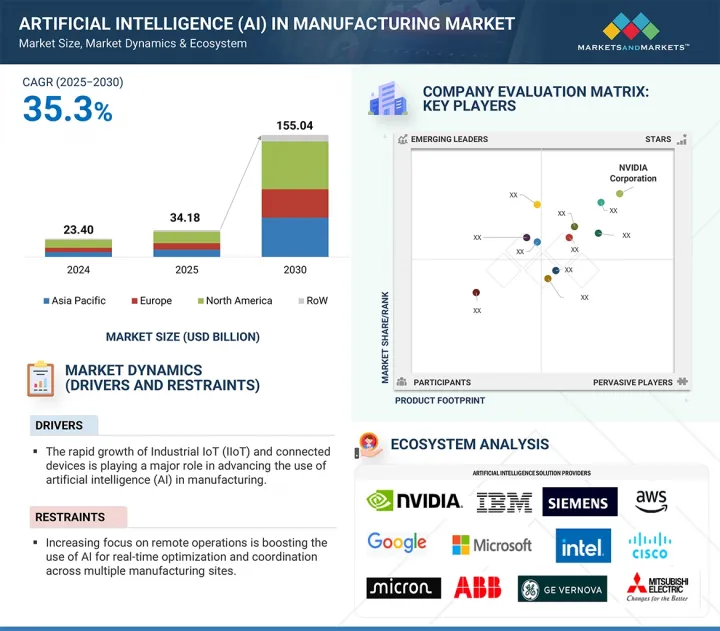

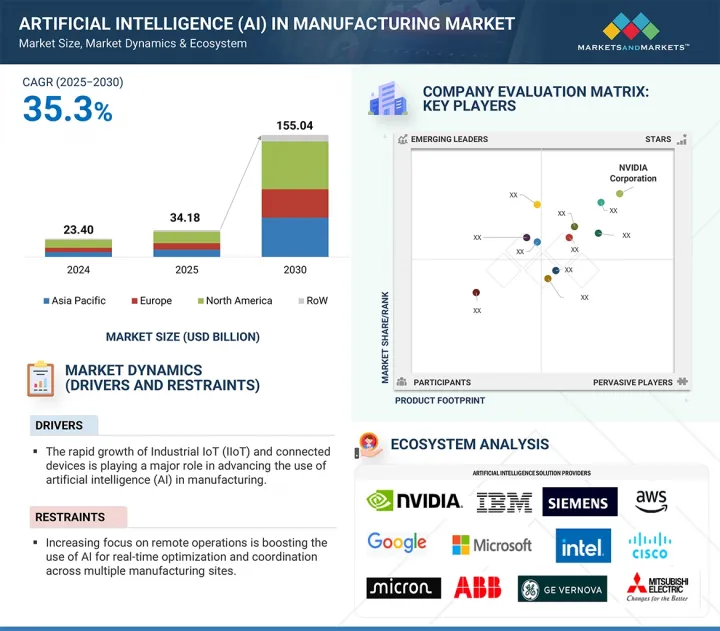

預計全球製造業人工智慧市場規模將從 2025 年的 341.8 億美元成長至 2030 年的 1,550.4 億美元,複合年成長率為 35.3%。

這一強勁成長得益於人工智慧技術的快速應用,這些技術用於簡化生產流程、增強即時決策能力,並支援跨製造業務的預測性維護。隨著製造業力求提高敏捷性、成本效益並改善品質保證,人工智慧解決方案在提升業務智慧化和生產力方面發揮關鍵作用。汽車、電子、航太和消費品等行業正在利用機器學習、電腦視覺和自然語言處理來最佳化生產調度、減少停機時間,並在早期發現異常。

| 調查範圍 | |

|---|---|

| 調查年份 | 2021-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 單元 | 10億美元 |

| 部分 | 產品、用途、技術、產業、地區 |

| 目標區域 | 北美、歐洲、亞太地區及其他地區 |

人工智慧機器人、數位雙胞胎和智慧品管系統的使用,使製造商能夠精準且靈活地擴大生產規模。此外,將人工智慧融入工業IoT平台和雲端基礎資料分析,將建構一個互聯互通的資料驅動生態系統,並加速智慧工廠的轉型。隨著對永續性、競爭準備和全球競爭力的日益重視,人工智慧將在塑造下一代製造模式方面發揮變革性作用。在智慧自動化和持續流程創新需求不斷成長的推動下,製造業人工智慧市場預計將在所有地區和產業持續擴張。

“根據應用,預測性維護領域將在 2024 年佔據最大的市場佔有率。”

2024年,預測性維護領域成為人工智慧在製造業市場的領先應用,這得益於對最大程度減少設備故障、減少營運停機時間和最佳化資產性能的日益重視。各行各業的製造商擴大採用基於人工智慧的預測維修系統來分析感測器資料、偵測異常並預測設備故障的發生。這種方法能夠及時且有針對性地進行干預,幫助企業避免代價高昂的中斷並提高整體生產效率。汽車、重型設備、能源電力以及半導體和電子製造等關鍵行業已將預測性維護列為優先事項,尤其是在大批量、資本密集的業務中,因為計劃外停機可能會造成重大損失。

與物聯網和雲端平台整合的人工智慧演算法可實現即時狀態監控和智慧診斷,相較於傳統的被動式和基於時間的維護模式,具有顯著優勢。人工智慧洞察在預測故障、最佳化維護計劃和減少備件浪費方面的廣泛應用,極大地促進了該領域的主導地位。此外,透過提高設備運作、延長資產壽命和降低人事費用來實現預測性維護的投資回報已成為製造商的策略重點。隨著工廠持續朝向更智慧、以數據為中心的營運模式發展,預測性維護在2024年仍將維持其作為製造業最具影響力的人工智慧應用的地位。

“從技術角度來看,機器學習領域佔據了最大的市場佔有率。”

2024年,機器學習佔據了製造業人工智慧市場的最大佔有率,這反映了其在實現數據主導決策、流程最佳化和跨產業自適應自動化方面的核心作用。製造商越來越依賴機器學習演算法來分析感測器、機器和企業系統產生的大量業務數據,以發現傳統方法無法檢測到的模式和趨勢。這使企業能夠提高生產效率、改善品管,並更快地回應不斷變化的市場需求。汽車、電子、金屬和重型設備製造等行業正在採用機器學習來驅動各種應用,從需求預測和預測性維護到異常檢測和流程最佳化。該技術能夠基於即時數據持續學習和改進模型,這在複雜的操作和動態多變的環境中尤其重要。機器學習與工業IoT平台、雲端運算和邊緣設備的整合,顯著擴展了其在離散製造和流程製造中的應用。其自動化決策、減少人為錯誤和發現隱藏的低效環節的能力,鞏固了機器學習作為基礎人工智慧技術的主導地位。隨著製造業追求更高的靈活性、擴充性和競爭優勢,機器學習已成為製造業人工智慧領域採用最廣泛、影響力最大的技術。

本報告研究了全球製造業人工智慧市場,提供了關鍵促進因素和限制因素、競爭格局和未來趨勢的資訊。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章 主要發現

- 製造業人工智慧公司面臨的誘人機會

- 為製造業提供人工智慧市場

- 製造業人工智慧市場(按技術)

- 製造業人工智慧市場(按行業分類)

- 製造業人工智慧市場:按應用

- 各國製造業人工智慧市場

第5章市場概述

- 介紹

- 市場動態

- 驅動程式

- 抑制因素

- 機會

- 任務

- 價值鏈分析

- 生態系分析

- 影響客戶業務的趨勢/中斷

- 波特五力分析

- 主要相關利益者和採購標準

- 案例研究分析

- 伊士曼化學公司利用 GE Vernova 的 AI 驅動可靠性計畫實現設備監控轉型

- 浩亭科技集團利用微軟和西門子的人工智慧工程加速連接器設計

- Renishaw PLC 利用西門子 NX CAM 軟體提高精度並減少廢品

- 三菱汽車公司與 IBM 合作,轉型業務,打造更有效率、更敏捷的未來

- 殼牌利用微軟和 C3.AI 的 AI 解決方案實現預測性維護的營運績效和可擴展性

- 技術分析

- 主要技術

- 互補技術

- 鄰近技術

- 定價分析

- 主要企業處理器平均售價(按類型)(2024年)

- 主要企業提供的處理器價格分佈(按類型)(2024 年)

- 各地區 GPU 平均售價趨勢(2021-2024 年)

- 各地區 FPGA 平均售價趨勢(2021-2024)

- 投資金籌措場景

- 貿易分析

- 進口情形(HS 編碼 8471)

- 出口情形(HS 編碼 8471)

- 專利分析

- 大型會議和活動(2025-2026年)

- 監管格局

- 2025年美國關稅的影響—概述

- 介紹

- 主要關稅稅率

- 價格影響分析

- 對國家的影響

- 對產業的影響

- 製造業人工智慧應用策略藍圖(2024-2030)

- 新興區域熱點

- 製造業人工智慧的未來

- 生成式人工智慧與模擬驅動設計

- 自主與協作機器人

- 數位雙胞胎和人工智慧驅動的工廠規劃

- 人工智慧驅動的永續性和能源效率

- 在整個製造生態系統中擴展人工智慧

第6章:製造業人工智慧市場(按應用)

- 介紹

- 硬體

- 處理器

- 儲存裝置

- 網路裝置

- 軟體

- 人工智慧解決方案

- 人工智慧平台

- 服務

- 部署和整合

- 支援和維護

第7章:製造業人工智慧市場(按技術)

- 介紹

- 機器學習

- 深度學習

- 監督學習

- 強化學習

- 無監督學習

- 其他

- 自然語言處理

- 情境感知計算

- 電腦視覺

- 人工智慧世代

第 8 章:製造業人工智慧市場(按應用)

- 介紹

- 庫存最佳化

- 預測性維護和機器檢查

- 生產計畫

- 現場服務

- 開墾

- 品管

- 網路安全

- 工業機器人

第9章:製造業人工智慧市場(按行業)

- 介紹

- 車

- 能源與電力

- 製藥

- 金屬/重型機械

- 半導體和電子

- 食品/飲料

- 其他行業

第 10 章:按地區分類的製造業人工智慧市場

- 介紹

- 北美洲

- 北美微觀經濟展望

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 歐洲微觀經濟展望

- 德國

- 英國

- 法國

- 義大利

- 波蘭

- 西班牙

- 北歐的

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 其他地區

- 中東

- 非洲

- 南美洲

第11章競爭格局

- 概述

- 主要參與企業的策略/優勢(2023-2025)

- 收益分析(2020-2024)

- 市場佔有率分析(2024年)

- 公司估值及財務指標

- 比較品牌

- 企業評估矩陣:主要企業(2024年)

- 公司評估矩陣:Start-Ups/中小企業(2024 年)

- 競爭場景

第12章:公司簡介

- 主要企業

- NVIDIA CORPORATION

- IBM

- SIEMENS

- ABB

- HONEYWELL INTERNATIONAL INC.

- GE VERNOVA

- GOOGLE LLC

- MICROSOFT

- MICRON TECHNOLOGY, INC.

- INTEL CORPORATION

- AMAZON WEB SERVICES, INC.

- ROCKWELL AUTOMATION

- SAP SE

- ORACLE

- MITSUBISHI ELECTRIC CORPORATION

- PTC

- SCHNEIDER ELECTRIC

- 其他公司

- CISCO SYSTEMS, INC.

- HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

- DASSAULT SYSTEMES

- PROGRESS SOFTWARE CORPORATION

- ZEBRA TECHNOLOGIES CORP.

- UBTECH ROBOTICS CORP LTD

- AQUANT

- BRIGHT MACHINES, INC.

- AVATHON

- SIGHT MACHINE

第13章 附錄

With a CAGR of 35.3%, the global AI in manufacturing market is anticipated to rise from USD 34.18 billion in 2025 to USD 155.04 billion by 2030. This robust growth is being driven by the rapid adoption of AI technologies to streamline production workflows, enhance real-time decision making, and support predictive maintenance across diverse manufacturing operations. As manufacturers strive for greater agility, cost efficiency, and quality assurance, AI solutions are becoming instrumental in unlocking new levels of operational intelligence and productivity. Industries such as automotive, electronics, aerospace, and consumer goods are leveraging machine learning, computer vision, and natural language processing to optimize production scheduling, reduce downtime, and detect anomalies early in the process.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Offering, Application, Technology, Industry, and Region |

| Regions covered | North America, Europe, APAC, RoW |

The use of AI-enabled robots, digital twins, and intelligent quality control systems allows manufacturers to scale output with precision and adaptability. Additionally, AI integration with industrial IoT platforms and cloud-based data analytics accelerates the transition to smart factories by enabling connected, data-driven ecosystems. With growing emphasis on sustainability, customization, and global competitiveness, AI is set to play a transformative role in shaping next-generation manufacturing paradigms. As the demand for intelligent automation and continuous process innovation intensifies, the AI in manufacturing market is poised for sustained expansion across all regions and industry verticals.

"By Application, Predictive Maintenance Segment Held the Largest Market Share in 2024."

In 2024, the predictive maintenance segment emerged as the leading application in the AI in manufacturing market, driven by the growing emphasis on minimizing equipment failures, reducing operational downtime, and optimizing asset performance. Manufacturers across industries increasingly adopted AI-powered predictive maintenance systems to analyze sensor data, detect anomalies, and forecast equipment failures before they occurred. This approach enabled timely and targeted interventions, helping companies avoid costly disruptions and improve overall production efficiency. Key sectors such as automotive, heavy machinery, energy & power, and semiconductor & electronics manufacturing prioritized predictive maintenance, particularly in high-volume and capital-intensive operations where unplanned outages could result in significant losses.

AI algorithms, integrated with IoT and cloud platforms, enabled real-time condition monitoring and intelligent diagnostics, offering a clear advantage over traditional reactive or time-based maintenance models. The widespread use of AI-driven insights to anticipate failures, optimize maintenance schedules, and reduce spare part wastage contributed significantly to the segment's dominance. Additionally, the return on investment from predictive maintenance through improved equipment uptime, extended asset life, and reduced labor costs made it a strategic priority for manufacturers. As factories continued to evolve toward smarter, data-centric operations, predictive maintenance firmly held its position as the most impactful AI application in the manufacturing sector in 2024.

"By Technology, the Machine Learning Segment Held the Largest Market Share."

In 2024, the machine learning segment accounted for the largest share of the AI in manufacturing market, reflecting its central role in enabling data-driven decision making, process optimization, and adaptive automation across the industry. Manufacturers increasingly relied on machine learning algorithms to analyze large volumes of operational data generated by sensors, machines, and enterprise systems, uncovering patterns and trends that traditional methods could not detect. This allowed companies to enhance production efficiency, improve quality control, and respond swiftly to changing market demands. Industries such as automotive, electronics, and metals & heavy machinery manufacturing have adopted machine learning to drive a range of applications, from demand forecasting and predictive maintenance to anomaly detection and process optimization. The technology's ability to continuously learn and refine models based on real-time data made it especially valuable in dynamic environments with complex operations and high variability. The integration of machine learning with industrial IoT platforms, cloud computing, and edge devices significantly expanded its use across both discrete and process manufacturing. The ability to automate decision-making, reduce human error, and uncover hidden inefficiencies reinforced machine learning's dominance as a foundational AI technology. As manufacturers pursued greater agility, scalability, and competitiveness, machine learning emerged as the most widely implemented and impactful technology within the AI in manufacturing landscape.

"By Region, Europe Recorded Significant Growth in the AI in Manufacturing Market During the Forecast Period."

Europe is expected to witness significant growth in the AI in manufacturing market, supported by a strong focus on industrial modernization, digital innovation, and automation-led competitiveness. Manufacturers will continue to embrace AI technologies to improve productivity, reduce operational inefficiencies, and meet evolving regulatory and sustainability standards. Government-led initiatives across various European nations have played a significant role in accelerating AI integration within the manufacturing sector. Investments in research and development, along with supportive policies for smart factory development, have created a favorable environment for AI adoption.

Additionally, the presence of a highly skilled workforce, advanced industrial infrastructure, and well-established digital ecosystems has enabled faster deployment of AI solutions across the region. European manufacturers are increasingly leveraging AI to enhance production intelligence, implement real-time monitoring, and support autonomous decision-making. The emphasis on quality, precision, and traceability has further driven the demand for AI technologies that enable continuous improvement and adaptive control. As the region balances the goals of industrial innovation and environmental responsibility, AI adoption is expected to remain a key enabler of its manufacturing transformation, reinforcing Europe's position as a major contributor to the global AI in manufacturing market.

Breakdown of primaries

A variety of executives from key organizations operating in the AI in manufacturing market, including CEOs, marketing directors, and innovation and technology directors, were interviewed in depth.

- By Company Type: Tier 1 - 45%, Tier 2 - 35%, and Tier 3 - 20%

- By Designation: Directors - 45%, C-level - 30%, and Others - 25%

- By Region: North America - 45%, Europe - 25%, Asia Pacific - 20%, and RoW - 10%

Note: Other designations include sales and product managers and project engineers. The three tiers of the companies are defined based on their total revenue in 2024: Tier 1 - revenue >= USD 1 billion; Tier 2 - revenue USD 100 million-USD 1 billion; and Tier 3 revenue < USD 100 million.

Major players profiled in this report are as follows:

Siemens (Germany), NVIDIA Corporation (US), IBM (US), Intel Corporation (US), GE Vernova (US), Google (US), Micron Technology, Inc (US), Microsoft (US), Amazon Web Services, Inc (US), Rockwell Automation (US), ABB (Switzerland), Honeywell International Inc. (US), Cisco Systems, Inc. (US), Hewlett Packard Enterprise Development LP (US), SAP SE (Germany), Mitsubishi Electric Corporation (Japan), Oracle (US), Dassault Systemes (France), Sight Machine ( US), Progress Software Corporation (US), Aquant (US), Bright Machines, Inc. (US), Avathon, Inc. (US), and Zebra Technologies Corp. (US).

The study provides a detailed competitive analysis of these key players in the AI in manufacturing market, presenting their company profiles, most recent developments, and key market strategies.

Study Coverage

In this report, the AI in manufacturing market has been segmented based on offering, technology, application, industry, and region. The offering segment includes hardware, software, & services. The technology segment comprises machine learning, natural language processing, context-aware computing, computer vision, and generative AI. The application segment comprises inventory optimization, predictive maintenance & machinery inspection, production planning, field services, reclamation, quality control, cybersecurity, and industrial robots. The industry segment comprises semiconductor & electronics, energy & power, pharmaceuticals, automotive, metals & heavy machinery, food & beverages, and other industries. The market has been segmented into four regions - North America, Asia Pacific, Europe, and Rest of the World (RoW).

Reasons to buy the report

The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market and the sub-segments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the AI in manufacturing market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

Key Benefits of Buying the Report

- Analysis of key drivers (The proliferation of industrial IoT and connected devices is enabling seamless integration of AI across factory ecosystems. Data-driven decision making and process intelligence are becoming central to modern manufacturing strategies, allowing companies to uncover inefficiencies, optimize production schedules, and reduce variability through AI-powered insights. Enhanced human-machine collaboration, or augmented intelligence, is improving shop floor productivity by empowering workers with AI-assisted tools and systems), restraints (Data quality and availability challenges continue to limit the full potential of AI in manufacturing. The complexity in scaling AI from pilot projects to full-scale production environments presents a significant hurdle), opportunities (Increasing focus on remote operations is boosting the use of AI for real-time optimization and coordination across multiple manufacturing sites. Growing demand for personalized products is driving AI adoption to enable flexible, small-batch production tailored to individual customer needs), and challenges (Difficulty in managing real-time AI decision feedback loops limits responsiveness and disrupts tightly synchronized production workflows. Frequent changes in materials, processes, or demand patterns challenge the ability to keep AI models updated, reducing their accuracy and long-term effectiveness in dynamic manufacturing environments) influencing the growth of the AI in manufacturing market is available in the report.

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, new product launches in the AI in manufacturing market are available.

- Market Development: Comprehensive information about lucrative markets - the report analyses the AI in manufacturing market across regions.

- Market Diversification: Exhaustive information about new products/services, untapped geographies, recent developments, and investments in the AI in manufacturing market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as NVIDIA Corporation (US), IBM (US), Siemens (Germany), Intel Corporation (US), Amazon Web Services, Inc. (US), and others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 List of participants in primary interviews

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET

- 4.2 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY OFFERING

- 4.3 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY TECHNOLOGY

- 4.4 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY

- 4.5 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY APPLICATION

- 4.6 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing adoption of IIoT and connected devices across manufacturing plants

- 5.2.1.2 Growing inclination toward AI-enabled decision-making in manufacturing

- 5.2.1.3 Growing role of augmented intelligence in enhancing workforce productivity

- 5.2.2 RESTRAINTS

- 5.2.2.1 Poor data integrity and data availability gaps in legacy systems

- 5.2.2.2 Barriers to enterprise-wide AI deployment in manufacturing

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emerging trend of managing global plants remotely with AI

- 5.2.3.2 Shifting focus from mass production to smart customization

- 5.2.4 CHALLENGES

- 5.2.4.1 Complexities in aligning AI output with dynamic manufacturing environments

- 5.2.4.2 Sustaining AI accuracy in dynamic production environments

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 BARGAINING POWER OF SUPPLIERS

- 5.6.2 BARGAINING POWER OF BUYERS

- 5.6.3 THREAT OF NEW ENTRANTS

- 5.6.4 THREAT OF SUBSTITUTES

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.7.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.7.2 BUYING CRITERIA

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 EASTMAN CHEMICAL COMPANY TRANSFORMS EQUIPMENT MONITORING WITH AI-DRIVEN RELIABILITY PROGRAM OFFERED BY GE VERNOVA

- 5.8.2 HARTING TECHNOLOGY GROUP ACCELERATES CONNECTOR DESIGN WITH AI-POWERED ENGINEERING FROM MICROSOFT AND SIEMENS

- 5.8.3 RENISHAW PLC IMPROVES PRECISION AND REDUCES SCRAP USING NX CAM SOFTWARE OF SIEMENS

- 5.8.4 MITSUBISHI MOTORS CORPORATION TRANSFORMS OPERATIONS WITH IBM FOR MORE EFFICIENT AND AGILE FUTURE

- 5.8.5 SHELL ACHIEVES OPERATIONAL EXCELLENCE AND SCALABILITY IN PREDICTIVE MAINTENANCE WITH AI SOLUTIONS OFFERED BY MICROSOFT AND C3.AI

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Reinforcement learning

- 5.9.1.2 Augmented reality, virtual reality, and mixed reality

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Internet of Things (IoT)

- 5.9.2.2 Edge computing

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Additive manufacturing

- 5.9.3.2 Digital twin

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PRICING ANALYSIS

- 5.10.1 AVERAGE SELLING PRICE OF PROCESSORS OFFERED BY KEY PLAYERS, BY TYPE, 2024

- 5.10.2 PRICING RANGE OF PROCESSORS OFFERED BY KEY PLAYERS, BY TYPE, 2024

- 5.10.3 AVERAGE SELLING PRICE TREND OF GPU, BY REGION, 2021-2024

- 5.10.4 AVERAGE SELLING PRICE TREND OF FPGA, BY REGION, 2021-2024

- 5.11 INVESTMENT AND FUNDING SCENARIO

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT SCENARIO (HS CODE 8471)

- 5.12.2 EXPORT SCENARIO (HS CODE 8471)

- 5.13 PATENT ANALYSIS

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 REGULATORY LANDSCAPE

- 5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.16 IMPACT OF 2025 US TARIFF - OVERVIEW

- 5.16.1 INTRODUCTION

- 5.16.2 KEY TARIFF RATES

- 5.16.3 PRICE IMPACT ANALYSIS

- 5.16.4 IMPACT ON COUNTRIES/REGIONS

- 5.16.4.1 US

- 5.16.4.2 Europe

- 5.16.4.3 Asia Pacific

- 5.16.5 IMPACT ON INDUSTRIES

- 5.16.5.1 Semiconductor & electronics

- 5.16.5.2 Automotive

- 5.17 STRATEGIC ROADMAP FOR AI ADOPTION IN MANUFACTURING (2024-2030)

- 5.18 EMERGING REGIONAL HOTSPOTS

- 5.19 FUTURE OF AI IN MANUFACTURING

- 5.19.1 GENERATIVE AI AND SIMULATION-DRIVEN DESIGN

- 5.19.2 AUTONOMOUS AND COLLABORATIVE ROBOTICS

- 5.19.3 DIGITAL TWINS AND AI-DRIVEN FACTORY PLANNING

- 5.19.4 AI-DRIVEN SUSTAINABILITY AND ENERGY EFFICIENCY

- 5.19.5 SCALING AI ACROSS MANUFACTURING ECOSYSTEM

6 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.2 HARDWARE

- 6.2.1 PROCESSORS

- 6.2.1.1 Rising need for faster and more energy-efficient computation to boost demand

- 6.2.1.2 Microprocessor units (MPUs)

- 6.2.1.3 Graphics processing units (GPUs)

- 6.2.1.4 Field programmable gate arrays (FPGAs)

- 6.2.1.5 Application-specific integrated circuits (ASICs)

- 6.2.2 MEMORY DEVICES

- 6.2.2.1 Increasing significance of real-time decision-making in automated manufacturing processes to accelerate demand

- 6.2.3 NETWORK DEVICES

- 6.2.3.1 Elevating demand for Ethernet adaptors and interconnects to create opportunities

- 6.2.1 PROCESSORS

- 6.3 SOFTWARE

- 6.3.1 AI SOLUTIONS

- 6.3.1.1 Rising focus on enhancing efficiency, quality, and flexibility on factory floor to drive segmental growth

- 6.3.1.2 On-premises

- 6.3.1.2.1 Greater flexibility and control to fuel segmental growth

- 6.3.1.3 Cloud-based

- 6.3.1.3.1 Lower operational costs, hassle-free deployment, and high scalability to foster segmental growth

- 6.3.2 AI PLATFORMS

- 6.3.2.1 Machine learning framework

- 6.3.2.1.1 Emphasis on enhancing distributed training for large-scale manufacturing applications to spike demand

- 6.3.2.2 Application programming interface

- 6.3.2.2.1 Ability to enable seamless communication between AI-driven analytics tools and factory floor machinery to spur demand

- 6.3.2.1 Machine learning framework

- 6.3.1 AI SOLUTIONS

- 6.4 SERVICES

- 6.4.1 DEPLOYMENT & INTEGRATION

- 6.4.1.1 Escalating adoption of AI technology by manufacturing firms to drive market

- 6.4.2 SUPPORT & MAINTENANCE

- 6.4.2.1 Rising focus on maximizing uptime and ensuring peak performance to fuel market growth

- 6.4.1 DEPLOYMENT & INTEGRATION

7 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- 7.2 MACHINE LEARNING

- 7.2.1 DEEP LEARNING

- 7.2.1.1 Rising adoption of IIoT, machine vision, and robotics across industries to create opportunities

- 7.2.2 SUPERVISED LEARNING

- 7.2.2.1 Growing importance of quality assurance, inventory planning, and predictive maintenance to spike demand

- 7.2.3 REINFORCEMENT LEARNING

- 7.2.3.1 Potential to automatically determine context-specific ideal behavior to maximize performance to drive segmental growth

- 7.2.4 UNSUPERVISED LEARNING

- 7.2.4.1 Ability to detect real-time anomalies in complex, multi-step manufacturing environments to boost demand

- 7.2.5 OTHERS

- 7.2.1 DEEP LEARNING

- 7.3 NATURAL LANGUAGE PROCESSING

- 7.3.1 POTENTIAL TO TRANSFORM DOMAIN-SPECIFIC TEXT INTO ACTIONABLE KNOWLEDGE TO SPUR DEMAND

- 7.4 CONTEXT-AWARE COMPUTING

- 7.4.1 COMPETENCE TO EMPOWER NEXT-GENERATION SMART DEVICES TO ACCELERATE ADOPTION

- 7.5 COMPUTER VISION

- 7.5.1 ABILITY TO ENHANCE INDUSTRIAL EFFICIENCY TO FUEL SEGMENTAL GROWTH

- 7.6 GENERATIVE AI

- 7.6.1 SCALING DEPLOYMENT TO ENHANCE PRODUCTION EFFICIENCY TO FUEL MARKET GROWTH

8 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 INVENTORY OPTIMIZATION

- 8.2.1 GROWING FOCUS ON ACHIEVING COST EFFICIENCY AND SUPPLY CHAIN RESILIENCE TO STIMULATE DEMAND

- 8.3 PREDICTIVE MAINTENANCE & MACHINERY INSPECTION

- 8.3.1 POTENTIAL TO MAXIMIZE EQUIPMENT UPTIME AND REDUCE OPERATIONAL COSTS TO DRIVE ADOPTION

- 8.4 PRODUCTION PLANNING

- 8.4.1 PRESSING NEED TO STAY COMPETITIVE IN DYNAMIC GLOBAL MARKET TO FUEL IMPLEMENTATION

- 8.5 FIELD SERVICES

- 8.5.1 NECESSITY TO OPTIMIZE WORKFORCE DEPLOYMENT AND TRACK ASSET HEALTH TO FUEL SEGMENTAL GROWTH

- 8.6 RECLAMATION

- 8.6.1 STRINGENT QUALITY STANDARDS AND SIGNIFICANT FOCUS ON WASTE REDUCTION TO DRIVE MARKET

- 8.7 QUALITY CONTROL

- 8.7.1 INCREASING USE OF AI-POWERED QUALITY CONTROL SYSTEMS BY PHARMACEUTICAL AND FOOD & BEVERAGE COMPANIES TO ACCELERATE MARKET GROWTH

- 8.8 CYBERSECURITY

- 8.8.1 CAPABILITY TO SECURE DIGITAL ASSETS AND ENSURE UNINTERRUPTED OPERATIONS TO FOSTER SEGMENTAL GROWTH

- 8.9 INDUSTRIAL ROBOTS

- 8.9.1 SEAMLESS INTEGRATION OF AI INTO INDUSTRIAL ROBOTS TO DRIVE MARKET

9 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY

- 9.1 INTRODUCTION

- 9.2 AUTOMOTIVE

- 9.2.1 ELEVATING DEPLOYMENT OF AI-POWERED CAMERA-BASED AUTONOMOUS DRIVING SOLUTIONS TO PROPEL MARKET

- 9.3 ENERGY & POWER

- 9.3.1 NEED TO SYNCHRONIZE PRODUCTION SCHEDULES AND QUALITY CONTROL ACROSS ENERGY ASSETS TO BOOST ADOPTION

- 9.4 PHARMACEUTICALS

- 9.4.1 NECESSITY TO MAINTAIN CONSISTENT PRODUCT QUALITY TO STIMULATE DEMAND

- 9.5 METALS & HEAVY MACHINERY

- 9.5.1 ESCALATING NEED TO MONITOR HEAT, SOUND, LIGHT, ODOR, AND VIBRATIONS IN METALS AND HEAVY MACHINERY TO PUSH DEMAND

- 9.6 SEMICONDUCTOR & ELECTRONICS

- 9.6.1 PRESSING NEED TO SCALE UP PRODUCTION WHILE MAINTAINING QUALITY TO ACCELERATE DEMAND

- 9.7 FOOD & BEVERAGES

- 9.7.1 GROWING ADOPTION OF AUTOMATION TO MAINTAIN HYGIENIC FOOD PROCESSING SOLUTIONS TO FUEL MARKET GROWTH

- 9.8 OTHER INDUSTRIES

10 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MICROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Private investments in AI manufacturing infrastructure development to accelerate market growth

- 10.2.3 CANADA

- 10.2.3.1 Strategic alignment of public-private investments to integrate AI into manufacturing to fuel market growth

- 10.2.4 MEXICO

- 10.2.4.1 Rapid expansion of AI startup ecosystem to foster market growth

- 10.3 EUROPE

- 10.3.1 MICROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 Integration of big data technologies within factories and rise in AI startups to support market growth

- 10.3.3 UK

- 10.3.3.1 Launch of AI Opportunities Action Plan to contribute to market growth

- 10.3.4 FRANCE

- 10.3.4.1 Substantial investment in AI and cloud technologies, along with data center expansion, to expedite market growth

- 10.3.5 ITALY

- 10.3.5.1 Emphasis on cultivating skilled professionals in AI technologies to facilitate market growth

- 10.3.6 POLAND

- 10.3.6.1 Influx of capital to foster AI innovation and research to promote market growth

- 10.3.7 SPAIN

- 10.3.7.1 Rapid digital transformation to optimize production and improve quality control to create growth opportunities

- 10.3.8 NORDIC

- 10.3.8.1 Significant investments in digital infrastructure and talent development to fuel market growth

- 10.3.9 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 CHINA

- 10.4.1.1 Rapid expansion of smart factories to accelerate market growth

- 10.4.2 JAPAN

- 10.4.2.1 Development of advanced large language models, industrial AI platforms, and robotics solutions for meeting factory needs to drive demand

- 10.4.3 SOUTH KOREA

- 10.4.3.1 Significant focus on development of humanoid robots to spike demand

- 10.4.4 INDIA

- 10.4.4.1 Shift from AI pilot projects to full-scale integration in industrial plants to create opportunities

- 10.4.5 AUSTRALIA

- 10.4.5.1 Public-private partnerships, infrastructure upgrades, and government initiatives in the AI space to expedite market expansion

- 10.4.6 MALAYSIA

- 10.4.6.1 High focus on building AI startups and expanding AI chip production to create opportunities

- 10.4.7 THAILAND

- 10.4.7.1 Smart factory pilot programs to boost demand

- 10.4.8 INDONESIA

- 10.4.8.1 Surging adoption of Industry 4.0 across manufacturing firms to promote market growth

- 10.4.9 VIETNAM

- 10.4.9.1 Smart factor programs and large-scale infrastructure products to create growth opportunities

- 10.4.10 REST OF ASIA PACIFIC

- 10.4.1 CHINA

- 10.5 ROW

- 10.5.1 MIDDLE EAST

- 10.5.1.1 Saudi Arabia

- 10.5.1.1.1 Heavy investments in AI and talent development to support market growth

- 10.5.1.2 UAE

- 10.5.1.2.1 Strategic partnership with academia to create AI talent pipeline to contribute to market growth

- 10.5.1.3 Qatar

- 10.5.1.3.1 Adoption of eco-friendly manufacturing practices and energy-efficient technologies to boost demand

- 10.5.1.4 Kuwait

- 10.5.1.4.1 Rise of AI-driven manufacturing for predictive maintenance and real-time monitoring in oil field production to fuel market growth

- 10.5.1.5 Oman

- 10.5.1.5.1 Involvement of startups in developing AI solutions addressing local manufacturing challenges to spur demand

- 10.5.1.6 Bahrain

- 10.5.1.6.1 Foreign direct investment in AI technologies to support market growth

- 10.5.1.7 Rest of Middle East

- 10.5.1.1 Saudi Arabia

- 10.5.2 AFRICA

- 10.5.2.1 South Africa

- 10.5.2.1.1 Significant AI investment focused on innovation, startup support, and workforce development to drive market

- 10.5.2.2 Other African countries

- 10.5.2.1 South Africa

- 10.5.3 SOUTH AMERICA

- 10.5.3.1 Brazil

- 10.5.3.1.1 Funding toward high-performance computing, national data centers, and startup support to favor market expansion

- 10.5.3.2 Argentina

- 10.5.3.2.1 Collaborative technology transfer programs to support market growth

- 10.5.3.3 Rest of South America

- 10.5.3.1 Brazil

- 10.5.1 MIDDLE EAST

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2023-2025

- 11.3 REVENUE ANALYSIS, 2020-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.6 BRAND COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Industry footprint

- 11.7.5.4 Offering footprint

- 11.7.5.5 Technology footprint

- 11.7.5.6 Application footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.8.5.1 Detailed list of key startup/SMEs

- 11.8.5.2 Competitive benchmarking of key startup/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 NVIDIA CORPORATION

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches

- 12.1.1.3.2 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths/Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses/Competitive threats

- 12.1.2 IBM

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.3.2 Deals

- 12.1.2.4 MNM view

- 12.1.2.4.1 Key strengths/Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses/Competitive threats

- 12.1.3 SIEMENS

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches

- 12.1.3.3.2 Deals

- 12.1.3.4 MNM view

- 12.1.3.4.1 Key strengths/Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses/Competitive threats

- 12.1.4 ABB

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths/Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses/Competitive threats

- 12.1.5 HONEYWELL INTERNATIONAL INC.

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths/Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses/Competitive threats

- 12.1.6 GE VERNOVA

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches

- 12.1.7 GOOGLE LLC

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.8 MICROSOFT

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches

- 12.1.8.3.2 Deals

- 12.1.8.3.3 Expansions

- 12.1.9 MICRON TECHNOLOGY, INC.

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product launches

- 12.1.9.3.2 Expansions

- 12.1.10 INTEL CORPORATION

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches

- 12.1.10.3.2 Deals

- 12.1.11 AMAZON WEB SERVICES, INC.

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Product launches

- 12.1.11.3.2 Deals

- 12.1.12 ROCKWELL AUTOMATION

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions/Services offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Deals

- 12.1.13 SAP SE

- 12.1.13.1 Business overview

- 12.1.13.2 Products/Solutions/Services offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Deals

- 12.1.14 ORACLE

- 12.1.14.1 Business overview

- 12.1.14.2 Products/Solutions/Services offered

- 12.1.15 MITSUBISHI ELECTRIC CORPORATION

- 12.1.15.1 Business overview

- 12.1.15.2 Products/Solutions/Services offered

- 12.1.16 PTC

- 12.1.16.1 Business overview

- 12.1.16.2 Products/Solutions/Services offered

- 12.1.16.3 Recent developments

- 12.1.16.3.1 Product launches

- 12.1.16.3.2 Deals

- 12.1.17 SCHNEIDER ELECTRIC

- 12.1.17.1 Business overview

- 12.1.17.2 Products/Solutions/Services offered

- 12.1.17.3 Recent developments

- 12.1.17.3.1 Deals

- 12.1.1 NVIDIA CORPORATION

- 12.2 OTHER PLAYERS

- 12.2.1 CISCO SYSTEMS, INC.

- 12.2.2 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

- 12.2.3 DASSAULT SYSTEMES

- 12.2.4 PROGRESS SOFTWARE CORPORATION

- 12.2.5 ZEBRA TECHNOLOGIES CORP.

- 12.2.6 UBTECH ROBOTICS CORP LTD

- 12.2.7 AQUANT

- 12.2.8 BRIGHT MACHINES, INC.

- 12.2.9 AVATHON

- 12.2.10 SIGHT MACHINE

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

List of Tables

- TABLE 1 INCLUSIONS AND EXCLUSIONS IN ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET REPORT

- TABLE 2 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 3 IMPACT OF EACH FORCE ON ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

- TABLE 5 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 6 PRICING RANGE OF PROCESSOR TYPES OFFERED BY KEY PLAYERS, 2024 (USD)

- TABLE 7 AVERAGE SELLING PRICE TREND OF GPU, BY REGION, 2021-2024 (USD)

- TABLE 8 AVERAGE SELLING PRICE TREND OF FPGA, BY REGION, 2021-2024 (USD)

- TABLE 9 IMPORT DATA FOR HS CODE 8471-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD BILLION)

- TABLE 10 EXPORT DATA FOR HS CODE 8471-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD BILLION)

- TABLE 11 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2023-2024

- TABLE 12 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET: CONFERENCES AND EVENTS

- TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 18 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 19 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 20 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY HARDWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 21 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY HARDWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 22 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY SOFTWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 23 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY SOFTWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 24 AI SOLUTIONS: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY DEPLOYMENT TYPE, 2021-2024 (USD MILLION)

- TABLE 25 AI SOLUTIONS: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 26 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY AI PLATFORM TYPE, 2021-2024 (USD MILLION)

- TABLE 27 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY AI PLATFORM TYPE, 2025-2030 (USD MILLION)

- TABLE 28 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY SERVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 29 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 30 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 31 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 32 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY MACHINE LEARNING TYPE, 2021-2024 (USD MILLION)

- TABLE 33 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY MACHINE LEARNING TYPE, 2025-2030 (USD MILLION)

- TABLE 34 MACHINE LEARNING: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 35 MACHINE LEARNING: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 36 NATURAL LANGUAGE PROCESSING: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 37 NATURAL LANGUAGE PROCESSING: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 38 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY CONTEXT-AWARE COMPUTING TYPE, 2021-2024 (USD MILLION)

- TABLE 39 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY CONTEXT-AWARE COMPUTING TYPE, 2025-2030 (USD MILLION)

- TABLE 40 CONTEXT-AWARE COMPUTING: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 41 CONTEXT-AWARE COMPUTING: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 42 COMPUTER VISION: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 43 COMPUTER VISION: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 44 GENERATIVE AI: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 45 GENERATIVE AI: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 46 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 47 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 48 INVENTORY OPTIMIZATION: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 49 INVENTORY OPTIMIZATION: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 50 PREDICTIVE MAINTENANCE & MACHINERY INSPECTION: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 51 PREDICTIVE MAINTENANCE & MACHINERY INSPECTION: ARTIFICIAL INTELLIGENCE IN MANUFACTURING, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 52 PRODUCTION PLANNING: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 53 PRODUCTION PLANNING: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 54 FIELD SERVICES: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 55 FIELD SERVICES: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 56 RECLAMATION: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 57 RECLAMATION: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 58 QUALITY CONTROL: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 59 QUALITY CONTROL: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 60 CYBERSECURITY: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 61 CYBERSECURITY: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 62 INDUSTRIAL ROBOTS: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 63 INDUSTRIAL ROBOTS: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 64 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 65 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 66 AUTOMOTIVE: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 67 AUTOMOTIVE: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 AUTOMOTIVE: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 69 AUTOMOTIVE: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 70 AUTOMOTIVE: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 71 AUTOMOTIVE: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 72 AUTOMOTIVE: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 73 AUTOMOTIVE: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 74 AUTOMOTIVE: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 75 AUTOMOTIVE: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 76 ENERGY & POWER: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 77 ENERGY & POWER: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 ENERGY & POWER: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 79 ENERGY & POWER: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 80 ENERGY & POWER: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 81 ENERGY & POWER: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 82 ENERGY & POWER: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 83 ENERGY & POWER: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 84 ENERGY & POWER: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 85 ENERGY & POWER: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 86 PHARMACEUTICALS: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 87 PHARMACEUTICALS: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 88 PHARMACEUTICALS: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 89 PHARMACEUTICALS: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 90 PHARMACEUTICALS: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 91 PHARMACEUTICALS: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 92 PHARMACEUTICALS: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 93 PHARMACEUTICALS: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 94 PHARMACEUTICALS: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 95 PHARMACEUTICALS: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 96 METALS & HEAVY MACHINERY: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 97 METALS & HEAVY MACHINERY: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 98 METALS & HEAVY MACHINERY: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 99 METALS & HEAVY MACHINERY: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 100 METALS & HEAVY MACHINERY: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 101 METALS & HEAVY MACHINERY: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 102 METALS & HEAVY MACHINERY: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 103 METALS & HEAVY MACHINERY: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 104 METALS & HEAVY MACHINERY: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 105 METALS & HEAVY MACHINERY: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 106 SEMICONDUCTOR & ELECTRONICS: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 107 SEMICONDUCTOR & ELECTRONICS: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 108 SEMICONDUCTOR & ELECTRONICS: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 109 SEMICONDUCTOR & ELECTRONICS: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 110 SEMICONDUCTOR & ELECTRONICS: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 111 SEMICONDUCTOR & ELECTRONICS: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 112 SEMICONDUCTOR & ELECTRONICS: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 113 SEMICONDUCTOR & ELECTRONICS: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 114 SEMICONDUCTOR & ELECTRONICS: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 115 SEMICONDUCTOR & ELECTRONICS: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 116 FOOD & BEVERAGES: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 117 FOOD & BEVERAGES: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 118 FOOD & BEVERAGES: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 119 FOOD & BEVERAGES: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 120 FOOD & BEVERAGES: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 121 FOOD & BEVERAGES: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 122 FOOD & BEVERAGES: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 123 FOOD & BEVERAGES: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 124 FOOD & BEVERAGES: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 125 FOOD & BEVERAGES: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 126 OTHER INDUSTRIES: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 127 OTHER INDUSTRIES: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 128 OTHER INDUSTRIES: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 129 OTHER INDUSTRIES: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 130 OTHER INDUSTRIES: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 131 OTHER INDUSTRIES: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 132 OTHER INDUSTRIES: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 133 OTHER INDUSTRIES: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 134 OTHER INDUSTRIES: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 135 OTHER INDUSTRIES: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 136 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 137 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 138 NORTH AMERICA: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 139 NORTH AMERICA: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 140 NORTH AMERICA: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 141 NORTH AMERICA: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 142 US: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 143 US: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 144 CANADA: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 145 CANADA: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 146 MEXICO: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 147 MEXICO: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 148 EUROPE: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 149 EUROPE: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 150 EUROPE: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 151 EUROPE: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 152 GERMANY: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 153 GERMANY: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 154 UK: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 155 UK: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 156 FRANCE: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 157 FRANCE: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 158 ITALY: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 159 ITALY: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 160 POLAND: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 161 POLAND: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 162 SPAIN: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 163 SPAIN: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 164 NORDIC: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 165 NORDIC: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 166 REST OF EUROPE: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 167 REST OF EUROPE: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 168 ASIA PACIFIC: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 169 ASIA PACIFIC: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 170 ASIA PACIFIC: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 171 ASIA PACIFIC: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 172 CHINA: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 173 CHINA: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 174 JAPAN: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 175 JAPAN: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 176 SOUTH KOREA: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 177 SOUTH KOREA: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 178 INDIA: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 179 INDIA: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 180 AUSTRALIA: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 181 AUSTRALIA: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 182 MALAYSIA: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 183 MALAYSIA: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 184 THAILAND: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 185 THAILAND: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 186 INDONESIA: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 187 INDONESIA: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 188 VIETNAM: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 189 VIETNEM: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 190 REST OF ASIA PACIFIC: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 191 REST OF ASIA PACIFIC: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 192 ROW: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 193 ROW: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 194 ROW: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 195 ROW: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 196 MIDDLE EAST: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 197 MIDDLE EAST: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 198 MIDDLE EAST: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 199 MIDDLE EAST: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 200 AFRICA: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 201 AFRICA: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 202 AFRICA: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 203 AFRICA: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 204 SOUTH AMERICA: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 205 SOUTH AMERICA: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 206 SOUTH AMERICA: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 207 SOUTH AMERICA: ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 208 OVERVIEW OF STRATEGIES ADOPTED BY AI SOLUTION/SERVICE PROVIDERS, JANUARY 2023-JULY 2025

- TABLE 209 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET SHARE ANALYSIS, 2024

- TABLE 210 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET: REGION FOOTPRINT

- TABLE 211 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET: INDUSTRY FOOTPRINT

- TABLE 212 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET: OFFERING FOOTPRINT

- TABLE 213 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET: TECHNOLOGY FOOTPRINT

- TABLE 214 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET: APPLICATION FOOTPRINT

- TABLE 215 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 216 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 217 ARTIFICIAL INTELLIGENCE IN INTELLIGENCE MARKET: PRODUCT LAUNCHES, JANUARY 2023-JULY 2025

- TABLE 218 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET: DEALS, JANUARY 2023-JULY 2025

- TABLE 219 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET: EXPANSIONS, JANUARY 2023-JULY 2025

- TABLE 220 NVIDIA CORPORATION: COMPANY OVERVIEW

- TABLE 221 NVIDIA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 NVIDIA CORPORATION: PRODUCT LAUNCHES

- TABLE 223 NVIDIA CORPORATION: DEALS

- TABLE 224 IBM: COMPANY OVERVIEW

- TABLE 225 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 IBM: PRODUCT LAUNCHES

- TABLE 227 IBM: DEALS

- TABLE 228 SIEMENS: COMPANY OVERVIEW

- TABLE 229 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 SIEMENS: PRODUCT LAUNCHES

- TABLE 231 SIEMENS: DEALS

- TABLE 232 ABB: BUSINESS OVERVIEW

- TABLE 233 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 ABB: DEALS

- TABLE 235 HONEYWELL INTERNATIONAL INC.: BUSINESS OVERVIEW

- TABLE 236 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 237 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 238 GE VERNOVA: COMPANY OVERVIEW

- TABLE 239 GE VERNOVA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 GE VERNOVA: PRODUCT LAUNCHES

- TABLE 241 GOOGLE LLC: COMPANY OVERVIEW

- TABLE 242 GOOGLE LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 243 MICROSOFT: COMPANY OVERVIEW

- TABLE 244 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 MICROSOFT: PRODUCT LAUNCHES

- TABLE 246 MICROSOFT: DEALS

- TABLE 247 MICROSOFT: EXPANSIONS

- TABLE 248 MICRON TECHNOLOGY, INC.: COMPANY OVERVIEW

- TABLE 249 MICRON TECHNOLOGY, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 250 MICRON TECHNOLOGY, INC.: PRODUCT LAUNCHES

- TABLE 251 MICRON TECHNOLOGY, INC.: EXPANSIONS

- TABLE 252 INTEL CORPORATION: COMPANY OVERVIEW

- TABLE 253 INTEL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 254 INTEL CORPORATION: PRODUCT LAUNCHES

- TABLE 255 INTEL CORPORATION: DEALS

- TABLE 256 AMAZON WEB SERVICES, INC.: COMPANY OVERVIEW

- TABLE 257 AMAZON WEB SERVICES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 258 AMAZON WEB SERVICES, INC.: PRODUCT LAUNCHES

- TABLE 259 AMAZON WEB SERVICES, INC.: DEALS

- TABLE 260 ROCKWELL AUTOMATION: BUSINESS OVERVIEW

- TABLE 261 ROCKWELL AUTOMATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 262 ROCKWELL AUTOMATION: DEALS

- TABLE 263 SAP SE: BUSINESS OVERVIEW

- TABLE 264 SAP SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 265 SAP SE: DEALS

- TABLE 266 ORACLE: BUSINESS OVERVIEW

- TABLE 267 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 268 MITSUBISHI ELECTRIC CORPORATION: BUSINESS OVERVIEW

- TABLE 269 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 270 PTC: BUSINESS OVERVIEW

- TABLE 271 PTC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 272 PTC: PRODUCT LAUNCHES

- TABLE 273 PTC: DEALS

- TABLE 274 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

- TABLE 275 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 276 SCHNEIDER ELECTRIC: DEALS

- TABLE 277 CISCO SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 278 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP: COMPANY OVERVIEW

- TABLE 279 DASSAULT SYSTEMES: COMPANY OVERVIEW

- TABLE 280 PROGRESS SOFTWARE CORPORATION: COMPANY OVERVIEW

- TABLE 281 ZEBRA TECHNOLOGIES CORP.: COMPANY OVERVIEW

- TABLE 282 UBTECH ROBOTICS CORP LTD: COMPANY OVERVIEW

- TABLE 283 AQUANT: COMPANY OVERVIEW

- TABLE 284 BRIGHT MACHINES, INC.: COMPANY OVERVIEW

- TABLE 285 AVATHON: COMPANY OVERVIEW

- TABLE 286 SIGHT MACHINE: COMPANY OVERVIEW

List of Figures

- FIGURE 1 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 DURATION COVERED

- FIGURE 3 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET: RESEARCH DESIGN

- FIGURE 4 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET: RESEARCH APPROACH

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: (DEMAND SIDE) REVENUE GENERATED BY COMPANIES IN ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET

- FIGURE 8 DATA TRIANGULATION METHODOLOGY

- FIGURE 9 SOFTWARE OFFERINGS TO CAPTURE PROMINENT MARKET SHARE IN 2030

- FIGURE 10 GENERATIVE AI TECHNOLOGY TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 AUTOMOTIVE INDUSTRY TO CAPTURE MAJORITY OF MARKET SHARE IN 20230

- FIGURE 12 PREDICTIVE MAINTENANCE & MACHINERY INSPECTION APPLICATIONS TO SECURE LARGEST MARKET SHARE IN 2030

- FIGURE 13 NORTH AMERICA ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 14 RISING ADOPTION OF AI SOLUTIONS BY MANUFACTURING FIRMS TO FUEL MARKET GROWTH

- FIGURE 15 SOFTWARE SEGMENT TO LEAD ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN 2025

- FIGURE 16 MACHINE LEARNING SEGMENT TO SECURE LARGEST MARKET SHARE IN 2025

- FIGURE 17 AUTOMOTIVE SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2025

- FIGURE 18 PREDICTIVE MAINTENANCE & MACHINERY INSPECTION SEGMENT TO COMMAND MARKET IN 2025

- FIGURE 19 CHINA TO RECORD HIGHEST CAGR IN GLOBAL ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET FROM 2025 TO 2030

- FIGURE 20 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET DYNAMICS

- FIGURE 21 IMPACT ANALYSIS OF DRIVERS

- FIGURE 22 IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 23 IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 24 IMPACT ANALYSIS OF CHALLENGES

- FIGURE 25 ARTIFICIAL INTELLIGENCE IN MANUFACTURING VALUE CHAIN ANALYSIS

- FIGURE 26 ECOSYSTEM OF AI IN MANUFACTURING

- FIGURE 27 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 28 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- FIGURE 30 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- FIGURE 31 AVERAGE SELLING PRICE OF PROCESSORS PROVIDED BY KEY PLAYERS, BY TYPE, 2024

- FIGURE 32 AVERAGE SELLING PRICE TREND OF GPU, BY REGION, 2021-2024

- FIGURE 33 AVERAGE SELLING PRICE TREND OF FPGA, BY REGION, 2021-2024

- FIGURE 34 INVESTMENT AND FUNDING SCENARIO, 2020-2024

- FIGURE 35 IMPORT SCENARIO FOR HS CODE 8471-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020-2024

- FIGURE 36 EXPORT SCENARIO FOR HS CODE 8471-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020-2024

- FIGURE 37 KEY PATENT APPLICANTS AND OWNERS, 2015-2024

- FIGURE 38 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY OFFERING

- FIGURE 39 SOFTWARE SEGMENT TO HOLD LARGEST SHARE OF ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN 2030

- FIGURE 40 MACHINE LEARNING TECHNOLOGY TO HOLD LARGEST SHARE OF ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN 2030

- FIGURE 41 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY APPLICATION

- FIGURE 42 PREDICTIVE MAINTENANCE & MACHINERY INSPECTION SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 43 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET, BY INDUSTRY

- FIGURE 44 AUTOMOTIVE INDUSTRY TO HOLD LARGEST SHARE OF ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN 2025

- FIGURE 45 CHINA TO BE FASTEST-GROWING ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET GLOBALLY DURING FORECAST PERIOD

- FIGURE 46 NORTH AMERICA TO CAPTURE PROMINENT SHARE OF ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN 2030

- FIGURE 47 SNAPSHOT OF ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN NORTH AMERICA

- FIGURE 48 SNAPSHOT OF ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN EUROPE

- FIGURE 49 SNAPSHOT OF ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET IN ASIA PACIFIC

- FIGURE 50 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET: REVENUE ANALYSIS, 2020-2024

- FIGURE 51 MARKET SHARE ANALYSIS, 2024

- FIGURE 52 COMPANY VALUATION

- FIGURE 53 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 54 BRAND COMPARISON

- FIGURE 55 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 56 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET: COMPANY FOOTPRINT

- FIGURE 57 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 58 NVIDIA CORPORATION: COMPANY SNAPSHOT

- FIGURE 59 IBM: COMPANY SNAPSHOT

- FIGURE 60 SIEMENS: COMPANY SNAPSHOT

- FIGURE 61 ABB: COMPANY SNAPSHOT

- FIGURE 62 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 63 GE VERNOVA: COMPANY SNAPSHOT

- FIGURE 64 GOOGLE LLC: COMPANY SNAPSHOT

- FIGURE 65 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 66 MICRON TECHNOLOGY, INC.: COMPANY SNAPSHOT

- FIGURE 67 INTEL CORPORATION: COMPANY SNAPSHOT

- FIGURE 68 AMAZON WEB SERVICES, INC.: COMPANY SNAPSHOT

- FIGURE 69 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

- FIGURE 70 SAP SE: COMPANY SNAPSHOT

- FIGURE 71 ORACLE: COMPANY SNAPSHOT

- FIGURE 72 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 73 PTC: COMPANY SNAPSHOT

- FIGURE 74 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT