|

市場調查報告書

商品編碼

1801775

全球汽車訂閱服務市場:區域分析、未來趨勢、定價分析、產品格局、消費者分析和競爭格局-預測至 2035 年Vehicle Subscription Services Market by Region (Europe, Asia Pacific (excl. China), North America, and China), Future Trends, Pricing Analysis, Product Landscape, Consumer Analysis, and Competitive Landscape - Global Forecast to 2035 |

|||||||

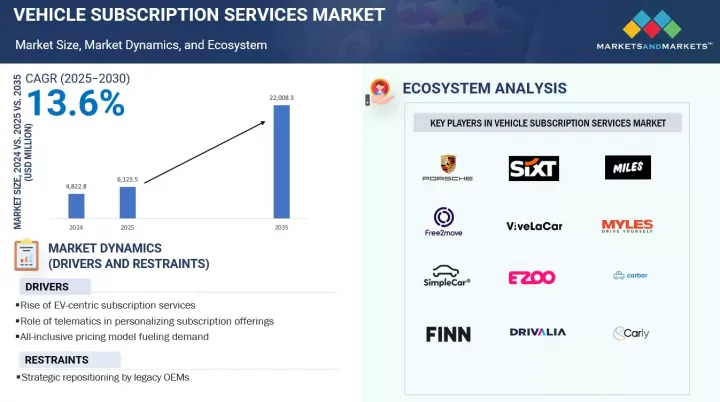

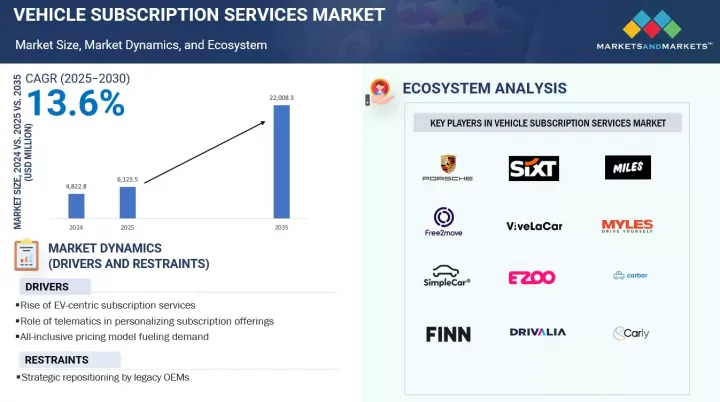

汽車訂閱服務市場預計將從 2024 年的 48.228 億美元成長到 2035 年的 220.083 億美元,複合年成長率為 13.6%。

| 調查範圍 | |

|---|---|

| 調查年份 | 2024-2035 |

| 基準年 | 2024 |

| 預測期 | 2025-2035 |

| 對價單位 | 金額(百萬美元) |

| 部分 | 汽車訂閱服務市場(按地區、北美、中國分類)、未來趨勢、定價分析、產品格局、消費者分析、競爭格局 - 預測至 2035 年 |

| 目標區域 | 北美、歐洲、亞太地區、中國 |

都市化和汽車保有量的監管壓力正在顯著推動這一市場的發展。在世界各地的城市,燃油汽車的保險、維護、維修成本以及高昂的稅費使得擁有和營運私家車變得難以負擔。因此,城市居民,尤其是特大城市的居民,正在轉向靈活的旅遊解決方案。

此外,全球商務旅行的增加、混合辦公文化以及靈活的調動方式也刺激了汽車訂閱服務的興起。由於專業人士經常在城市之間奔波或在多個地點辦公,因此對靈活、短期且高品質的旅行選擇的需求日益成長。在歐洲、北美和東南亞部分地區,許多辦公室職員和顧問現在更傾向於選擇固定費率的汽車,而不是租車或計程車,用於長期停留和城際通勤。與缺乏個人化和車隊靈活性的租車模式不同,訂閱服務提供了一種擁有感,而且沒有經濟負擔,尤其是提供按月換車選項。一些公司將汽車訂閱服務(包括個人和商用車)作為員工社會福利計畫的一部分,進一步支持了這種需求。

汽車訂閱服務供應商正大力投資個人化服務,力求為每位使用者打造獨一無二、符合其偏好的體驗。遠端資訊處理技術在此過程中發揮關鍵作用。透過分析駕駛習慣、頻率、里程和位置數據,平台可以提供客製化套餐、升級選項或基於使用情況的定價,從而維持消費者的參與度和滿意度。例如,低里程的都市區駕駛者可以選擇緊湊型電動車套餐,並偶爾獲得升級積分;而週末出行者則可以以折扣價換購SUV。這種方法有助於建立情感忠誠度,讓使用者感受到被理解和重視,而不是向他們推銷千篇一律的服務。

亞太地區的快速都市化和特大城市的成長使得靈活的出行解決方案比擁有汽車更具吸引力。訂閱服務通常包括送貨上門、全包價格和短期契約,非常適合城市居民忙碌的生活方式。此外,不斷發展的新興企業生態系統和創業投資活動正在推動該地區的出行創新。投資者正在資助快速可擴展的輕資產模式,這些模式結合了數位支付、人工智慧定價和基於應用程式的車隊管理。作為綠色舉措的一部分,各國政府也開始支持訂閱模式,特別是電動車的訂閱模式。隨著越來越多的電動車進入市場,用戶尋求先試後買的選擇,訂閱服務成為了理想的解決方案。技術準備、城市壓力和財務現實性的結合,使亞太地區成為採用汽車訂閱服務的高成長地區。

本報告研究了全球汽車訂閱服務市場,總結了區域趨勢和進入市場的公司概況。

目錄

第1章執行摘要

第2章:調查目標、範圍和調查方法

第3章市場概述

- 所有權模式

- 市場演變

- 價值鏈分析

- 訂閱、租賃和購買

- 策略品牌

- 客戶分析

- 客戶維繫策略

- 轉向軟體即服務

第4章 主要趨勢

- 電動車訂閱服務的興起

- 遠端資訊處理應用

- 透過夥伴關係擴大業務範圍

第5章區域分析

- 歐洲:汽車訂閱服務現狀

- 歐洲:競爭性地圖繪製

- 北美:汽車訂閱服務格局

- 北美:競爭性地圖繪製

- 亞太地區(不包括中國):汽車訂閱服務格局

- 中國:汽車訂閱服務現狀

- 亞太地區(不包括中國)和中國:競爭地圖

第6章定價分析

- 地區

- 訂閱、租賃和購買

- ICE 車型與 EV 車型

第7章 公司簡介

- FINN

- AUTONOMY

- BIPI

- MYLES

- FREE2MOVE

第 8 章作業

第9章 結論

第10章 附錄

The vehicle subscription services market is expected to grow from USD 4,822.8 million in 2024 to USD 22,008.3 million by 2035, with a CAGR of 13.6%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2035 |

| Base Year | 2024 |

| Forecast Period | 2025-2035 |

| Units Considered | Value (USD Million) |

| Segments | Vehicle Subscription Services Market by Region, North America, and China), Future Trends, Pricing Analysis, Product Landscape, Consumer Analysis, and Competitive Landscape - Global Forecast to 2035 |

| Regions covered | North America, Europe, Asia Pacific, and China |

Urbanization and regulatory pressures on vehicle ownership significantly drive this market. Cities worldwide are making it difficult to own and operate private vehicles through costs like insurance, maintenance, and repairs, along with high taxes on fuel-based vehicles. As a result, urban residents, especially in megacities, are shifting toward flexible mobility solutions.

Additionally, the rise in vehicle subscription services is fueled by a global increase in business travel, hybrid work culture, and relocation flexibility. With professionals often moving between cities or working from multiple locations, the demand for adaptable, short-term, high-quality mobility options has risen. In regions like Europe, North America, and parts of Southeast Asia, many corporate employees and consultants now prefer subscription vehicles over rentals or taxis for long-term stays or intercity commutes. Unlike car rental models that lack personalization or fleet flexibility, subscription services provide a sense of ownership without the financial burden, especially with monthly swap options. This demand is further supported by companies offering vehicle subscriptions as part of employee benefits packages, including cars for personal and professional use.

Key consumer retention strategies of vehicle subscription service providers

Vehicle subscription providers are heavily investing in personalization, making each user's experience unique and tailored to their preferences. Telematics plays a key role in this process. By analyzing driving habits, frequency, mileage, and location data, platforms can offer customized packages, upgrade options, or usage-based pricing that keeps consumers engaged and satisfied. For instance, a low-mileage urban driver could be offered a compact EV plan with occasional upgrade credits, while a weekend traveler might receive discounted SUV swaps. This approach helps build emotional loyalty by making users feel understood and cared for, rather than selling a generic service.

Asia Pacific witnesses significant growth in vehicle subscription services

Asia Pacific's rapid urbanization and the growth of megacities make flexible mobility solutions more attractive than car ownership. Subscription services, which often include door-to-door delivery, all-inclusive pricing, and short-term contracts, fit with the lifestyles of busy urban professionals. Additionally, the expanding startup ecosystem and venture capital activity in the region have spurred mobility innovation. Investors are funding asset-light models that scale quickly and incorporate digital payments, AI-driven pricing, and app-based fleet management. Governments are also beginning to support subscription models, especially for EVs, as part of their green mobility initiatives. As more EVs enter the market and users look for trial options before buying, subscriptions provide an ideal solution. This combination of technological readiness, urban pressure, and financial pragmatism positions Asia Pacific as a high-growth region for vehicle subscription adoption.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and strategy directors, and executives from various key organizations operating in this market.

- By Company Type: OEMs - 30%, Third-party Providers - 60%, and Vehicle Subscription Platform Providers - 10%

- By Designation: C-level - 40%, Directors - 40%, and Others - 20%

- By Region: North America - 21%, Europe - 50%, Asia Pacific - 10%, and China - 16%

Established players such as Miles Mobility (Germany), FINN (Germany), Autonomy (US), Free2Move (Germany), Myle (India), Drivalia (UK), REVV (India), LeasePlan (Germany), Mocean Subscription (Germany), and Ezoo (UK) lead the vehicle subscription services market.

Key Benefits of Buying this Report:

The report will assist market leaders and new entrants by providing information on the closest estimates. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and develop effective go-to-market strategies. Additionally, the report helps stakeholders grasp the market's pulse and offers information on key market drivers, restraints, and opportunities.

The report provides insights on the following pointers:

Analysis of key drivers (rapid urbanization and shift in lifestyle preferences), restraints (high operational complexity and margins dilution), and opportunities (shift from ownership to usership), influencing market growth

Product Development/Innovation: Detailed insights on upcoming technologies and new vehicle range & services of the vehicle subscription services market

Market Development: Comprehensive information about the lucrative market - the report analyzes the vehicle subscription services market across varied regions

Market Diversification: Exhaustive information about untapped geographies, recent developments, and investments in the vehicle subscription services market

Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Miles Mobility, FINN, Autonomy, Free2Move, Myle, Drivalia, REVV, LeasePlan, Mocean Subscription, and Ezoo

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY

2 RESEARCH OBJECTIVES, SCOPE, AND METHODOLOGY

- 2.1 RESEARCH OBJECTIVES AND METHODOLOGY

- 2.2 RESEARCH SCOPE

3 MARKET OVERVIEW

- 3.1 OWNERSHIP MODEL

- 3.2 MARKET EVOLUTION

- 3.3 VALUE CHAIN ANALYSIS

- 3.4 SUBSCRIPTION VS. LEASE VS. PURCHASE

- 3.5 STRATEGIC BRANDING

- 3.6 CUSTOMER ANALYSIS

- 3.7 CUSTOMER RETENTION STRATEGIES

- 3.8 SHIFT TOWARD SOFTWARE-AS-A-SERVICE

4 KEY TRENDS

- 4.1 RISE OF EV SUBSCRIPTION SERVICES

- 4.2 ADOPTION OF TELEMATICS

- 4.3 EXPANDING BUSINESS REACH THROUGH PARTNERSHIPS

5 REGIONAL ANALYSIS

- 5.1 EUROPE: VEHICLE SUBSCRIPTION SERVICES LANDSCAPE

- 5.2 EUROPE: COMPETITIVE MAPPING

- 5.3 NORTH AMERICA: VEHICLE SUBSCRIPTION SERVICES LANDSCAPE

- 5.4 NORTH AMERICA: COMPETITIVE MAPPING

- 5.5 ASIA PACIFIC (EXCL. CHINA): VEHICLE SUBSCRIPTION SERVICES LANDSCAPE

- 5.6 CHINA: VEHICLE SUBSCRIPTION SERVICES LANDSCAPE

- 5.7 ASIA PACIFIC (EXCL. CHINA) AND CHINA: COMPETITIVE MAPPING

6 PRICING ANALYSIS

- 6.1 REGIONAL

- 6.2 SUBSCRIPTION VS. LEASE. VS. PURCHASE

- 6.3 ICE VS. EV MODEL

7 COMPANY PROFILES

- 7.1 FINN

- 7.2 AUTONOMY

- 7.3 BIPI

- 7.4 MYLES

- 7.5 FREE2MOVE