|

市場調查報告書

商品編碼

1801771

全球海鮮副產品市場(按類型、技術、產地、最終用途產業、回收部分、技術和地區分類)—預測至 2030 年Fishery By-products Market by Type (Protein & Protein Derivative, Fish Oil, Bioactives & Specialty Compound), Source (Marine, Aquaculture), End-user Industry (Food & Beverage, Animal Feed, Agriculture), Technology, & Region - Global Forecast to 2030 |

||||||

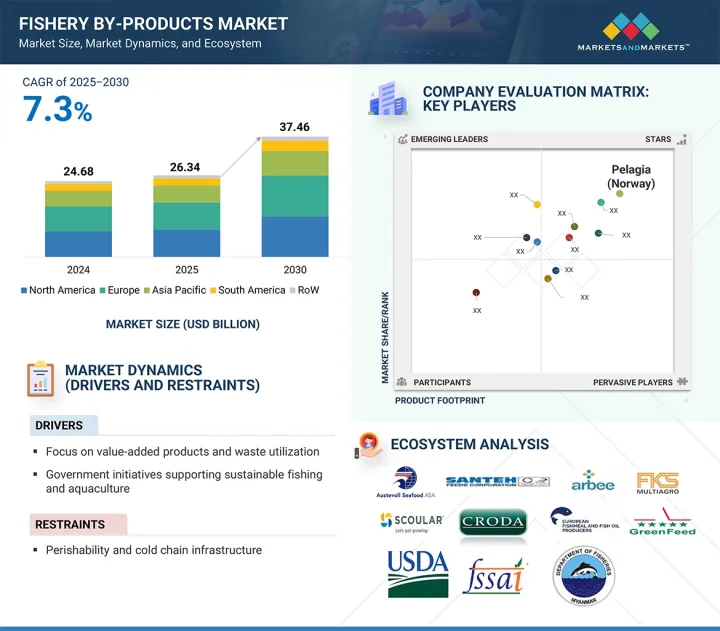

預計到 2025 年全球海鮮副產品市場價值將達到 263.4 億美元,預測期內複合年成長率為 7.3%,預計到 2030 年將達到 374.6 億美元。

據估計,在全球整體,30%至70%的魚類生質能在廢棄物對已開發國家和開發中國家的廢棄物廢棄物都構成了重大挑戰。

| 調查範圍 | |

|---|---|

| 調查年份 | 2025-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 目標單位 | 金額(美元)及數量(單位) |

| 按細分市場 | 按類型、技術、產地、最終用途行業、回收零件、技術和地區 |

| 目標區域 | 北美、歐洲、亞太、南美和其他地區 |

然而,這些副產品富含有價值的營養成分和化合物,如Omega-3脂肪酸、膠原蛋白、明膠、酵素、幾丁質、幾丁聚醣、羥磷石灰等。利用這些成分不僅可以創造經濟價值,還有助於減少廢棄物處理對環境的影響,特別是海洋傾倒、焚燒和垃圾掩埋。

食品和飲料產業是海產品副產品不斷成長且越來越重要的市場。主要應用包括使用從魚類和其他海洋動物的皮膚、骨骼和軟骨中提取的海洋膠原蛋白、明膠和軟骨素。海洋膠原蛋白已成為機能性食品和營養補充劑,尤其受到注重健康的老年人的歡迎。膠原蛋白肽因其對皮膚健康、關節支持和骨骼強度的公認益處而擴大被添加到即飲飲料、蛋白棒和膳食補充劑中。由於與牛和豬膠原蛋白相關的宗教和飲食限制,海洋膠原膠原蛋白在亞洲和北美特別受歡迎。從魚皮和魚骨中提取的明膠也用於軟糖、甜點和糖果甜點。與哺乳動物明膠相比,它的熔點較低,這使其適用於某些應用,例如益生菌和調味劑的封裝。以海鮮副產品為基礎的鈣,如羥磷石灰和磷酸鈣,擴大被添加到強化食品中,針對缺乏鈣人群,特別是女性和老年人。

魚粉提供所有必需胺基酸、礦物質、磷脂質和脂肪酸(例如二十二碳六烯酸 (DHA) 和二十碳五烯酸 (EPA))的均衡供應,以促進魚類(尤其是魚種和種苗)的最佳發育、生長和繁殖。魚粉中的營養成分還能透過增強和維持健康、功能性的免疫系統來增強抗病能力。在水產飼料中添加魚粉和魚油可確保供人類食用的魚類獲得 EPA 和 DHA 等必需脂肪酸,這些脂肪酸對人體健康和功能至關重要。在水產飼料中添加魚粉可以提高營養物質的消化率,進而減少污染。在飼料中使用優質魚粉可以使最終產品具有與野生捕撈魚類相同的“天然或健康”品質。由於大多數水產養殖動物不能很好地利用碳水化合物,因此水產飼料需要高蛋白質。

亞太地區魚粉和魚油市場為製造商提供了眾多商機。亞太地區是全球最大的魚油消費地區,其中中國、日本和印度的消費量特別高。在日本,魚油產品因其豐富的Omega-3脂肪酸以及對心臟、皮膚和認知健康的益處而被廣泛用於藥品和膳食補充劑。隨著人們對牲畜和寵物健康意識的日益增強,魚粉也為亞太地區畜牧業帶來了巨大的機會。

亞太地區憑藉其廣闊的海岸線、豐富的海洋資源和豐富的海鮮加工,在全球海鮮副產品市場中佔據主導地位。該地區的國家,包括中國、印度、印尼、越南、泰國、日本、韓國和菲律賓,都是世界上最大的魚貝類生產國和出口國。這產生了大量的副產品,例如魚頭、魚骨、魚皮、魚內臟、魚鱗和魚殼廢料,這些副產品正被開發利用,成為商業性機會。由於對永續原料的需求不斷成長、水產養殖業的發展、政府舉措以及循環經濟舉措的推動,該市場目前正在快速發展。

該地區海鮮副產品的主要終端用途是動物飼料,尤其是水產飼料,這主要得益於水產養殖業的快速成長。魚粉和魚油(可由整魚和副產品生產)是吳郭魚、巴沙魚、鯉魚和蝦等養殖魚類飼料的主要成分。此外,水解魚蛋白由於易於消化且含有特定的氨基酸,在寵物食品和專用牲畜飼料中越來越受歡迎。在食品和營養補充劑領域,日本、韓國和中國是海洋膠原蛋白、胜肽和魚油補充劑的成熟市場。這些市場的成長受到人口老化、對機能性食品的文化親和力以及消費者對天然和海洋保健產品的認知的推動。

本報告研究了全球海鮮副產品市場,並提供了按類型、技術、產地、最終用途行業、回收部件、技術、區域趨勢和公司簡介分類的市場資訊。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章重要考察

第5章市場概述

- 介紹

- 總體經濟指標

- 市場動態

- 生成式人工智慧/人工智慧對海鮮副產品市場的影響

第6章 產業趨勢

- 介紹

- 影響客戶業務的趨勢/中斷

- 定價分析

- 價值鏈分析

- 生態系分析

- 技術分析

- 專利分析

- 貿易分析

- 2025-2026年主要會議和活動

- 監管狀況

- 波特五力分析

- 主要相關人員和採購標準

- 投資金籌措場景

- 案例研究分析

- 關稅對海鮮副產品市場的影響

第7章海鮮副產品市場(按類型)

- 介紹

- 蛋白質和蛋白質衍生物

- 魚油

- 礦物

- 生物活性和特種化合物

第 8 章:漁業副產品市場(按技術)

- 介紹

- 酵素水解

- 化學萃取

- 發酵

- 冷凍乾燥

第9章 水產副產品市場(按產地)

- 介紹

- 捕獲捕魚

- 水產養殖

第10章 海產品副產品市場(依最終用途產業)

- 介紹

- 食品/飲料

- 動物飼料

- 農業

- 化妝品和個人護理

- 藥品和營養補充劑

- 產業

第11章 水產副產品市場(依回收部位(品質))

- 介紹

- 頭部、骨骼、器官

- 皮膚、鱗片

- 貝殼:生物聚合物的來源

- 切片:風味與餵食基礎知識

- 肝臟、卵巢、魚血等:各種副產品

第 12 章海鮮副產品市場(按地區)

- 介紹

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 亞太地區

- 中國

- 印度

- 日本

- 越南

- 泰國

- 澳洲和紐西蘭

- 韓國

- 其他

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 挪威

- 丹麥

- 其他

- 南美洲

- 智利

- 巴西

- 秘魯

- 其他

- 其他地區

- 非洲

- 中東

第13章競爭格局

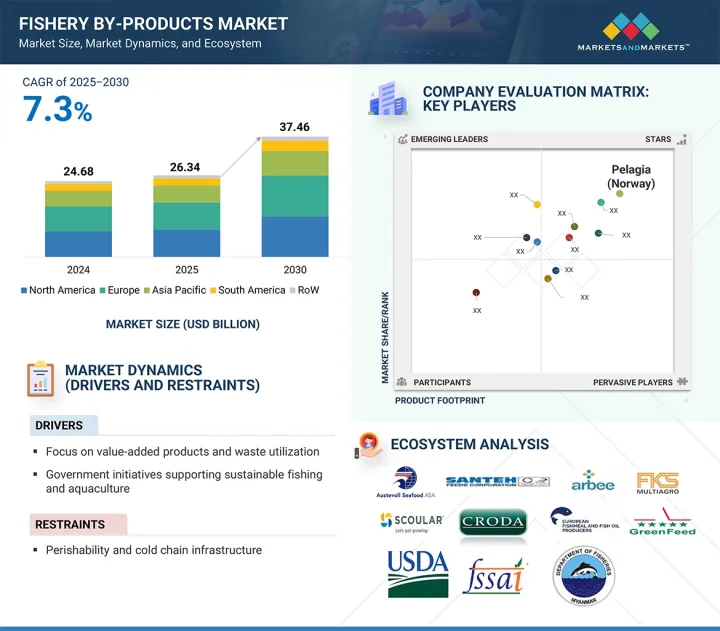

- 概述

- 主要參與企業的策略/優勢

- 2020-2024年收益分析

- 2024年市場佔有率分析

- 公司估值與財務矩陣

- 品牌/產品比較

- 公司估值矩陣:2024 年關鍵參與企業

- 公司估值矩陣:Start-Ups/中小企業,2024 年

- 競爭情境和趨勢

第14章:公司簡介

- 主要參與企業

- SCOULAR COMPANY

- MARUHA NICHIRO CORPORATION

- NISSUI CORPORATION

- AUSTEVOLL SEAFOOD ASA

- THAI UNION GROUP PUBLIC COMPANY LIMITED

- PESQUERA DIAMANTE SA

- OCEANA GROUP LIMITED

- TRIPLENINE

- FF SKAGEN A/S

- SEAGARDEN GROUP

- LYSI HF

- SOPROPECHE

- HOFSETH BIOCARE ASA

- ZHEJIANG GOLDEN-SHELL PHARMACEUTICAL CO., LTD.

- ATLANTIS SEA-AGRI GROUP

- 其他公司

- PATTANI FISH MEAL(1988)CO., LTD.

- WUDI DEDA AGRICULTURE CO., LTD.

- RAJ FISHMEAL AND OIL COMPANY

- TITAN BIOTECH

- DAI DAI THANH SEAFOODS

- ASIA FISH OIL CORPORATION

- AASHA BIOCHEM

- ATHOS COLLAGEN

- AQUAFOOD

- SALMON PROTEINS

第15章:鄰近市場與相關市場

第16章 附錄

The global market for fishery by-products is estimated to be USD 26.34 billion in 2025 and is projected to reach USD 37.46 billion by 2030, at a CAGR of 7.3% during the forecast period. Globally, it is estimated that 30-70% of fish biomass is discarded as waste during processing, depending on the species and method used. For example, fish heads, skins, scales, bones, viscera, and shells from crustaceans like shrimp and crabs often go unused. This presents a significant waste management challenge in both developed and developing countries.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2025-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) and Volume (Units) |

| Segments | By Type, End-User Industry, Source, Technology, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and Rest of the World (RoW) |

However, these by-products are rich in valuable nutrients and compounds such as omega-3 fatty acids, collagen, gelatin, enzymes, chitin, chitosan, and hydroxyapatite. Utilizing these components not only creates economic value but also helps reduce the environmental impact of waste disposal-particularly marine dumping, incineration, or landfilling.

"The food & beverage segment is projected to register a significant CAGR during the forecast period."

The food and beverage industry is a growing and increasingly vital market for fishery by-products. Main applications include the use of marine collagen, gelatin, and chondroitin, which are extracted from the skin, bones, and cartilage of fish and other marine animals. Marine collagen has become popular in functional foods and nutraceutical drinks, especially among health-conscious and aging populations. Collagen peptides are increasingly added to ready-to-drink beverages, protein bars, and health supplements because of their perceived benefits for skin health, joint support, and bone strength. Marine-sourced collagen is particularly preferred in Asia and North America due to religious and dietary restrictions related to bovine or porcine sources. Gelatin made from fish skin and bones is also used in gummies, desserts, and confections. Its lower melting point compared to mammalian gelatin makes it suitable for specific uses such as encapsulating probiotics and flavors. Fishery by-product-based calcium, like hydroxyapatite or calcium phosphate, is being added more frequently to fortified food products, targeting calcium-deficient groups, especially women and the elderly.

"Fishmeal is projected to hold a significant market share in the type segment during the forecast period."

Fishmeal provides a balanced supply of all essential amino acids, minerals, phospholipids, and fatty acids (such as docosahexaenoic acid or DHA and eicosapentaenoic acid or EPA) for optimal development, growth, and reproduction, especially in larvae and broodstock. The nutrients in fishmeal also support disease resistance by enhancing and maintaining a healthy, functional immune system. Adding fishmeal and fish oil to aquaculture diets ensures that the fish intended for human consumption are a source of essential fatty acids, like EPA and DHA, vital for human health functions. Including fishmeal in the diets of aquatic animals helps reduce pollution by improving nutrient digestibility. Using high-quality fishmeal in feed gives the final product a 'natural or wholesome' quality, similar to that of wild fish. Protein needs are higher in aquaculture diets because most aquatic animals poorly utilize carbohydrates.

The fishmeal and fish oil market in the Asia Pacific region offers numerous business opportunities for manufacturers. Asia Pacific is the largest consumer of fish oil worldwide. Consumption is especially high in China, Japan, and India. In Japan, fish oil products are widely used in pharmaceuticals and nutraceuticals due to their rich omega-3 content and their beneficial effects on the heart, skin, and cognitive health. Fishmeal also represents a significant business opportunity for the Asia Pacific livestock industry, thanks to the increasing awareness of livestock and pet health.

Asia Pacific is expected to account for a significant market share.

The Asia Pacific (APAC) region holds a leading position in the global fishery by-products market due to its extensive coastline, marine resources, and seafood processing. Countries in the region, such as China, India, Indonesia, Vietnam, Thailand, Japan, South Korea, and the Philippines, are among the largest global producers and exporters of fish and seafood. As a result, they generate large quantities of by-products-such as fish heads, bones, skins, viscera, scales, and shell waste-and are seeking to valorize these by-products for commercial opportunities. The market is now rapidly evolving, driven by a combination of increasing demand for sustainable ingredients, growth in aquaculture, government initiatives, and a commitment to the circular economy.

The main end-use sector for fishery by-products in the region is animal feed, especially aquafeed, which has developed primarily due to the rapid growth of the aquaculture industry. Fishmeal and fish oils (which can be produced from both whole fish and by-products) are the main ingredients used to feed farmed species like tilapia, pangasius, carp, and shrimp. Additionally, hydrolyzed forms of fish proteins are becoming more popular in pet food and specialty livestock feed because these proteins are easily digestible and contain specific amino acids. In the food and nutraceutical sectors, Japan, South Korea, and China are well-established markets for marine collagen, peptides, and fish oil supplements. Growth in these markets has been driven by aging populations, a cultural familiarity with functional foods, and consumer awareness of natural and marine-based health products.

In-depth interviews have been conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the fishery by-products market:

- By Company Type: Tier 1 - 25%, Tier 2 - 45%, and Tier 3 - 30%

- By Designation: CXOs - 20%, Managers - 50%, Executives- 30%

- By Region: North America - 25%, Europe - 30%, Asia Pacific - 20%, South America - 15%, and Rest of the World -10%

Prominent companies in the market include FKS Multi Agro (Indonesia), Pesquera Diamante Peru (Peru), Oceana Group Limited (South Africa), Scoular Company (US), Austevoll Seafood ASA (Norway), Maruha Nichiro Corporation (Japan), Nippon Suisan Kais (Japan), Sopropeche (France), Thai Union Ingredients (Thailand), Seagarden Group (Norway), Lysi hf. (Iceland), Hofseth Biocare AS (Norway), Ashland (US), Atlantis Sea-Agri Group (Africa), and Dai Dai Thanh Seafoods (Vietnam).

Other players include Pattani Fish Meal Co., Ltd. (Thailand), GC Reiber Oil (Norway), Croda International PLC (UK), Omega Protein Corporation (US), Sursan A.S. (Turkey), Fritz Koster Handelsgesellschaft AG (Germany), Maxland Group (Czech Republic), and Gold Fin International (Oman).

Research Coverage:

This research report categorizes the fishery by-products market by Type (Proteins & Protein Derivatives, Fish Oil, Minerals, Bioactives & Specialty Compounds) End-user Industry (Food & Beverage, Animal Feed, Agriculture, Cosmetics & Personal Care, Pharmaceutical & Nutraceuticals, Industrial Applications), Source (Marine, Aquaculture), Technology (Enzymatic Hydrolysis, Chemical Extraction (Acid/Base), Fermentation, Freeze Drying, Supercritical Fluid Extraction), and Region (North America, Europe, Asia Pacific, South America, and Rest of the World). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the market. A detailed analysis of the key industry players has been done to provide insights into their business overview, services, key strategies, contracts, partnerships, agreements, new service launches, mergers and acquisitions, and recent developments associated with the fishery by-products market. This report covers a competitive analysis of upcoming startups in the fishery by-products market ecosystem. Furthermore, industry-specific trends such as technology analysis, ecosystem and market mapping, patent analysis, and regulatory landscape, among others, are also covered in the study.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall fishery by-products and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (advancements in waste utilization and biorefinery technologies), restraints (lack of standardized collection and processing infrastructure), opportunities (government incentives and blue economy initiatives), and challenges (seasonal and regional variability in raw material supply) influencing the growth of the fishery by-products market.

- New Product Launch/Innovation: Detailed insights on research & development activities and new product launches in the fishery by-products market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the fishery by-products across varied regions.

- Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the fishery by-products market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, brand/product comparison, and product food prints of leading players such as FKS Multi Agro (Indonesia), Pesquera Diamante Peru (Peru), Oceana Group Limited (South Africa), Scoular Company (US), Austevoll Seafood A (Norway), Maruha Nichiro Cor (Japan), Nippon Suisan Kais (Japan), Sopropeche (France), Thai Union Ingredient (Thailand), and other players in the fishery by-products market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.5.1 CURRENCY/VALUE UNIT

- 1.5.2 VOLUME UNIT

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key insights from industry experts

- 2.1.2.3 Breakdown of primary profiles

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 APPROACH ONE - BOTTOM-UP (BASED ON TYPE, BY REGION)

- 2.2.2 APPROACH TWO - TOP-DOWN (BASED ON GLOBAL MARKET)

- 2.2.3 SUPPLY-SIDE ANALYSIS

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR KEY PLAYERS IN FISHERY BY-PRODUCTS MARKET

- 4.2 ASIA PACIFIC FISHERY BY- PRODUCTS MARKET, BY SOURCE AND COUNTRY

- 4.3 FISHERY BY-PRODUCTS MARKET, TYPE (VOLUME)

- 4.4 FISHERY BY-PRODUCTS MARKET, BY SOURCE AND REGION

- 4.5 FISHERY BY-PRODUCTS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 GLOBAL AQUATIC ANIMAL PRODUCTION AND INNOVATION

- 5.2.2 CIRCULAR ECONOMY INITIATIVES AND ZERO-WASTE POLICIES

- 5.3 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Rising awareness about livestock and pet health and nutrition

- 5.3.1.2 Increasing incorporation of fishmeal and fish oil in swine and poultry diets

- 5.3.1.3 Need for improving productivity and environmental performance of aquaculture

- 5.3.2 RESTRAINTS

- 5.3.2.1 Unsustainable fishing practices by fishmeal and fish oil manufacturers

- 5.3.2.2 Surge in allergic and toxic reactions from consuming herring and anchovies

- 5.3.2.3 Availability of alternative products

- 5.3.2.4 Consumer skepticism about minimal-sourced products and limitations on shark fishing

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Rising demand for organic fertilizers

- 5.3.3.2 Sustainable intensification of aquaculture

- 5.3.3.3 Growing demand for functional and convenience food products

- 5.3.4 CHALLENGES

- 5.3.4.1 Raw material, contamination, & traceability challenges

- 5.3.4.2 Rising incidence of animal-borne diseases

- 5.3.1 DRIVERS

- 5.4 IMPACT OF GENERATIVE AI/AI ON FISHERY BY-PRODUCTS MARKET

- 5.4.1 USE OF GEN AI IN FISHERY BY-PRODUCTS MARKET

- 5.4.2 CASE STUDY ANALYSIS

- 5.4.2.1 Norway's Fish Silage Innovation to Address Aquaculture Waste

- 5.4.2.2 Thai Union - Circular Economy through Fish Waste Bioconversion

- 5.4.2.3 TripleNine Group - Enhancing Quality of Fish Meal from By-products

- 5.4.3 IMPACT OF AI ON FISHERY BY-PRODUCTS MARKET

- 5.4.4 IMPACT OF GEN AI ON ADJACENT ECOSYSTEM

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.3 PRICING ANALYSIS

- 6.3.1 AVERAGE SELLING PRICE OF TYPES, BY KEY PLAYERS, 2024

- 6.3.2 AVERAGE SELLING PRICE TREND, BY REGION, 2023-2030

- 6.4 VALUE CHAIN ANALYSIS

- 6.4.1 RAW MATERIAL SOURCING

- 6.4.2 COLLECTION, HANDLING, AND PRE-TREATMENT

- 6.4.3 PROCESSING AND VALORIZATION

- 6.4.4 QUALITY CONTROL AND REGULATORY COMPLIANCE

- 6.4.5 DISTRIBUTION AND MARKETING

- 6.4.6 END-USE AND PRODUCT INTEGRATION

- 6.5 ECOSYSTEM ANALYSIS

- 6.5.1 DEMAND SIDE

- 6.5.2 SUPPLY SIDE

- 6.6 TECHNOLOGY ANALYSIS

- 6.6.1 KEY TECHNOLOGIES

- 6.6.1.1 Supercritical fluid extraction

- 6.6.1.2 Advanced rendering techniques

- 6.6.2 COMPLEMENTARY TECHNOLOGIES

- 6.6.2.1 Microencapsulation

- 6.6.2.2 Enzymatic hydrolysis

- 6.6.3 ADJACENT TECHNOLOGIES

- 6.6.3.1 Aquaculture automation & AI

- 6.6.3.2 Cold chain & preservation technologies

- 6.6.1 KEY TECHNOLOGIES

- 6.7 PATENT ANALYSIS

- 6.8 TRADE ANALYSIS

- 6.8.1 IMPORT SCENARIO OF HS CODE 150410

- 6.8.2 EXPORT SCENARIO OF HS CODE 150410

- 6.9 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.10 REGULATORY LANDSCAPE

- 6.10.1 NORTH AMERICA

- 6.10.1.1 US

- 6.10.1.2 United States Department of Agriculture (USDA)

- 6.10.1.3 National Oceanic and Atmospheric Administration (NOAA)

- 6.10.2 EUROPE

- 6.10.2.1 UK

- 6.10.2.2 European Fishmeal and Fish Oil Producers (EFFOP)

- 6.10.3 ASIA PACIFIC

- 6.10.3.1 China

- 6.10.3.2 India

- 6.10.3.3 Malaysia

- 6.10.1 NORTH AMERICA

- 6.11 PORTER'S FIVE FORCES ANALYSIS

- 6.11.1 THREAT OF NEW ENTRANTS

- 6.11.2 THREAT OF SUBSTITUTES

- 6.11.3 BARGAINING POWER OF SUPPLIERS

- 6.11.4 BARGAINING POWER OF BUYERS

- 6.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.12.2 BUYING CRITERIA

- 6.13 INVESTMENT AND FUNDING SCENARIO

- 6.14 CASE STUDY ANALYSIS

- 6.14.1 NITTA GELATIN DEVELOPED XACTSET TO MEET RISING DEMAND FOR STARCHLESS GUMMY PRODUCTS

- 6.14.2 PERFECT DAY'S ACQUISITION OF STERLING BIOTECH LIMITED BROADENED ITS MARKET OFFERINGS

- 6.14.3 AQUABIOTECH GROUP DEVELOPED MARINE PROTEIN HYDROLYSATE TO MEET GROWING DEMAND FOR SUSTAINABLE ANIMAL FEED INGREDIENTS

- 6.15 TARIFF IMPACT ON FISHERY BY-PRODUCTS MARKET

- 6.15.1 INTRODUCTION

- 6.15.2 KEY TARIFF RATES

- 6.15.3 DISRUPTION IN FISHERY BY-PRODUCTS

- 6.15.4 PRICE IMPACT ANALYSIS

- 6.15.5 KEY IMPACTS ON VARIOUS REGIONS

- 6.15.5.1 US

- 6.15.5.2 Europe

- 6.15.5.3 Asia Pacific

- 6.15.6 END-USE INDUSTRY-LEVEL IMPACT

7 FISHERY BY-PRODUCTS MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 PROTEIN & PROTEIN DERIVATIVES

- 7.2.1 HIGH NUTRITIONAL VALUE OF FISH-DERIVED PROTEINS AND THEIR VERSATILE APPLICATIONS

- 7.2.2 FISHMEAL

- 7.2.2.1 Global expansion of aquaculture and increasing demand for high-efficiency feed ingredients to drive market

- 7.2.3 FISH SILAGE

- 7.2.3.1 Low-cost and decentralized production to enable efficient use of fish waste in low-income or infrastructure-limited regions

- 7.2.4 FISH HYDROLYSATE

- 7.2.4.1 Rising demand for biofunctional protein ingredients across pet food, aquaculture, and agriculture to fuel growth

- 7.2.5 GELATIN

- 7.2.5.1 Need to replace porcine and bovine gelatin in sensitive markets to fuel demand

- 7.2.6 COLLAGEN

- 7.2.6.1 Rising demand for collagen peptides or hydrolysates derived from marine sources to drive market

- 7.3 FISH OIL

- 7.3.1 INCREASING NEED FOR OMEGA-3 FATTY ACIDS FOR HUMAN AND ANIMAL HEALTH IN END-USE APPLICATIONS TO BOOST DEMAND

- 7.4 MINERALS

- 7.4.1 RISING DEMAND IN AGRICULTURE AND BIOMEDICINE TO EMPHASIZE CIRCULAR ECONOMY PRACTICES

- 7.4.2 BONE POWDER

- 7.4.2.1 Growing demand for natural calcium supplements in animal feed and organic fertilizers to drive market

- 7.4.3 CHITIN

- 7.4.3.1 Increasing demand for biodegradable and biocompatible materials in agriculture and medicine to boost market

- 7.4.4 CHITOSAN

- 7.4.4.1 Superior bioactivity to boost utilization in pharmaceuticals and cosmetics

- 7.5 BIOACTIVES & SPECIALTY COMPOUNDS

- 7.5.1 DEMAND FOR NATURAL AND MULTIFUNCTIONAL INGREDIENTS IN HEALTH AND WELLNESS APPLICATIONS

- 7.5.2 ENZYMES

- 7.5.2.1 Growing demand for sustainable biocatalysts in industrial biotechnology to boost market

- 7.5.3 SQUALENE

- 7.5.3.1 Increased demand for sustainable, non-shark sources of squalene in cosmetics and vaccines

- 7.5.4 CAROTENOIDS

- 7.5.4.1 Rising use of natural antioxidants in health supplements and cosmetics to boost demand for bio-based ingredients

- 7.5.5 CARTILAGE

- 7.5.5.1 Rising prevalence of joint-related disorders and demand for natural alternatives to drive market

- 7.5.6 COLLAGEN PEPTIDES

- 7.5.6.1 Increasing consumer inclination toward marine collagen for beauty-from-within and joint-health formulations

8 FISHERY BY-PRODUCTS MARKET, BY TECHNOLOGY

- 8.1 INTRODUCTION

- 8.2 ENZYMATIC HYDROLYSIS

- 8.2.1 MILD PROCESSING CONDITIONS TO RETAIN NUTRITIONAL AND FUNCTIONAL INTEGRITY OF FINAL PRODUCT

- 8.3 CHEMICAL EXTRACTION

- 8.3.1 ABILITY TO HANDLE LARGE VOLUMES OF HETEROGENEOUS FISH WASTE TO DRIVE MARKET

- 8.4 FERMENTATION

- 8.4.1 USE OF LOW-ENERGY REQUIREMENT AND MINIMAL USE OF SYNTHETIC CHEMICALS TO DRIVE MARKET

- 8.5 FREEZE DRYING

- 8.5.1 HIGH-QUALITY, SHELF-STABLE INGREDIENTS WITH MINIMAL LOSS OF ACTIVITY, COLOR, FLAVOR, OR NUTRITIONAL CONTENT

- 8.5.2 SUPERCRITICAL FLUID EXTRACTION

- 8.5.2.1 Non-toxic, non-flammable, and leaves no harmful residues properties ideal for human consumption

9 FISHERY BY-PRODUCTS MARKET, BY SOURCE

- 9.1 INTRODUCTION

- 9.2 CAPTURE FISHERIES

- 9.2.1 AVAILABILITY OF LOW-VALUE OR NON-EDIBLE WILD SPECIES IN HIGH VOLUMES

- 9.2.2 MARINE

- 9.2.2.1 High biomass yield from small pelagic species found in marine waters to drive market

- 9.2.3 INLAND

- 9.2.3.1 Rural livelihoods and need for food security in emerging economies to boost demand

- 9.3 AQUACULTURE

- 9.3.1 CONTROLLED, SCALABLE, AND TRACEABLE PRODUCTION SYSTEMS ENABLING CONSISTENT BY-PRODUCT YIELD

10 FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY

- 10.1 INTRODUCTION

- 10.2 FOOD & BEVERAGE

- 10.2.1 CONSUMER DEMAND FOR CLEAN-LABEL AND HIGH-PROTEIN FOOD PRODUCTS TO DRIVE MARKET

- 10.2.2 FLAVOR ENHANCERS

- 10.2.2.1 Growing demand for clean-label, natural umami ingredients as alternatives to synthetic MSG and artificial flavor enhancers

- 10.2.3 NUTRITIONAL SUPPLEMENTS

- 10.2.3.1 Growing aging population to boost demand for marine collagen and omega-3 supplements

- 10.2.4 FORTIFIED FOOD & BEVERAGE

- 10.2.4.1 Rising need for biofunctional protein ingredients across pet food, aquaculture, functional nutrition, and agriculture

- 10.3 ANIMAL FEED

- 10.3.1 NEED TO REPLACE PORCINE AND BOVINE GELATIN IN SENSITIVE MARKETS TO FUEL DEMAND ACROSS SECTORS

- 10.3.2 AQUACULTURE FEED

- 10.3.2.1 Growing concerns about sustainability and feed efficiency to drive market

- 10.3.3 LIVESTOCK FEED

- 10.3.3.1 High-quality protein demand in early-stage poultry and swine diets to support fishmeal inclusion

- 10.3.4 PET FOOD ADDITIVES

- 10.3.4.1 Rising premium pet food trends and demand for digestible, hypoallergenic marine proteins to drive fish-derived functional ingredients

- 10.4 AGRICULTURE

- 10.4.1 RISING DEMAND FOR ORGANIC FARMING AND SUSTAINABLE BIOFERTILIZERS TO BOOST USE OF FISHERY BY-PRODUCTS

- 10.5 COSMETICS & PERSONAL CARE

- 10.5.1 GROWING DEMAND FOR MARINE-SOURCED BIOACTIVES TO BOOST CLEAN-LABEL SKINCARE AND NUTRICOSMETICS

- 10.6 PHARMACEUTICALS & NUTRACEUTICALS

- 10.6.1 INCREASING NEED FOR SUSTAINABLE MARINE BIOACTIVES TO ENHANCE CLEAN-LABEL BEAUTY FORMULATIONS

- 10.7 INDUSTRIAL APPLICATIONS

- 10.7.1 RISING DEMAND FOR SUSTAINABLE, BIO-BASED INDUSTRIAL MATERIALS TO DRIVE MARKET

11 FISHERY BY-PRODUCTS MARKET, BY PARTS OF FISHERY TO BE RECYCLED (QUALITATIVE)

- 11.1 INTRODUCTION

- 11.2 HEADS, BONES, & VISCERA

- 11.3 SKINS & SCALES

- 11.4 SHELLS: SOURCE OF BIOPOLYMERS

- 11.5 FISH TRIMMINGS: FOUNDATION FOR FLAVOR & FEED

- 11.6 LIVER, ROE, FISH BLOOD, AND OTHERS: DIVERSE POOL OF BY-PRODUCTS

12 FISHERY BY-PRODUCTS MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 US

- 12.2.1.1 Rising rate of pet adoption to boost demand for fishery byproducts

- 12.2.2 CANADA

- 12.2.2.1 Growing concerns about arthritis and obesity to drive gelatin demand

- 12.2.3 MEXICO

- 12.2.3.1 Changing consumer preferences toward vegan products and dependency on US and Canadian manufacturers to boost market

- 12.2.1 US

- 12.3 ASIA PACIFIC

- 12.3.1 CHINA

- 12.3.1.1 Increasing meat consumption and rapidly growing livestock industry to drive market

- 12.3.2 INDIA

- 12.3.2.1 Rising focus on protein-rich ingredients and pet health to drive market

- 12.3.3 JAPAN

- 12.3.3.1 Rise in awareness surrounding meat processing and health concerns to propel market

- 12.3.4 VIETNAM

- 12.3.4.1 Consumer preferences, environmental concerns, and sustainability to accelerate market growth

- 12.3.5 THAILAND

- 12.3.5.1 Rapid growth in shrimp production to boost demand

- 12.3.6 AUSTRALIA & NEW ZEALAND

- 12.3.6.1 Pharmaceutical and food & beverage industries to drive demand for gelatin

- 12.3.7 SOUTH KOREA

- 12.3.7.1 Advanced seafood processing sector and strong governmental focus on environmental sustainability to drive market

- 12.3.8 REST OF ASIA PACIFIC

- 12.3.1 CHINA

- 12.4 EUROPE

- 12.4.1 GERMANY

- 12.4.1.1 Rise in aging population and increasing pet adoption rate to drive market

- 12.4.2 UK

- 12.4.2.1 Rise in health awareness to contribute to market growth

- 12.4.3 FRANCE

- 12.4.3.1 Growing pharmaceutical industry and trade opportunities to boost demand for gelatin

- 12.4.4 ITALY

- 12.4.4.1 Growth of food and pharmaceutical industries to fuel demand for gelatin

- 12.4.5 SPAIN

- 12.4.5.1 Rise in consumer demands for quality and convenience in food services to drive market

- 12.4.6 NORWAY

- 12.4.6.1 Vast marine resources and highly integrated seafood value chains to drive market

- 12.4.7 DENMARK

- 12.4.7.1 Well-established aquaculture industry and increasing exports to drive market

- 12.4.8 REST OF EUROPE

- 12.4.1 GERMANY

- 12.5 SOUTH AMERICA

- 12.5.1 CHILE

- 12.5.1.1 Growth of aquaculture industry and rising demand for high-quality fish meal to drive market

- 12.5.2 BRAZIL

- 12.5.2.1 Increased spending on health-focused pet food ingredients to drive market

- 12.5.3 PERU

- 12.5.3.1 Rising global demand for sustainable, high-protein ingredients to accelerate fishery by-product valorization

- 12.5.4 REST OF SOUTH AMERICA

- 12.5.1 CHILE

- 12.6 REST OF THE WORLD (ROW)

- 12.6.1 AFRICA

- 12.6.1.1 Rising demand of collagen peptides & gelatin in medicines to address chronic diseases

- 12.6.2 MIDDLE EAST

- 12.6.2.1 Rising investments in healthcare industry to drive market

- 12.6.1 AFRICA

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.3 REVENUE ANALYSIS, 2020-2024

- 13.4 MARKET SHARE ANALYSIS, 2024

- 13.5 COMPANY VALUATION AND FINANCIAL MATRIX

- 13.6 BRAND/PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 Type footprint

- 13.7.5.4 Source footprint

- 13.7.5.5 End-use industry footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.8.5.1 Detailed list of key start-ups/SMEs

- 13.9 COMPETITIVE SCENARIO AND TRENDS

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

- 13.9.4 OTHERS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 SCOULAR COMPANY

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Deals

- 14.1.1.4 MnM view

- 14.1.1.4.1 Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses & competitive threats

- 14.1.2 MARUHA NICHIRO CORPORATION

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Deals

- 14.1.2.3.2 Expansion

- 14.1.2.4 MnM view

- 14.1.2.4.1 Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses & competitive threats

- 14.1.3 NISSUI CORPORATION

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Deals

- 14.1.3.4 MnM View

- 14.1.3.4.1 Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses & competitive threats

- 14.1.4 AUSTEVOLL SEAFOOD ASA

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Deals

- 14.1.4.4 MnM view

- 14.1.4.4.1 Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses & competitive threats

- 14.1.5 THAI UNION GROUP PUBLIC COMPANY LIMITED

- 14.1.5.1 Business overview

- 14.1.5.2 Product/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches

- 14.1.5.3.2 Deals

- 14.1.5.3.3 Expansions

- 14.1.5.3.4 Others

- 14.1.5.4 MnM view

- 14.1.5.4.1 Right to win

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses & competitive threats

- 14.1.6 PESQUERA DIAMANTE S.A.

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 MnM view

- 14.1.7 OCEANA GROUP LIMITED

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 MnM view

- 14.1.8 TRIPLENINE

- 14.1.8.1 Business overview

- 14.1.8.2 Product/Solutions/Services offered

- 14.1.8.3 MnM view

- 14.1.9 FF SKAGEN A/S

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Expansion

- 14.1.9.4 MnM view

- 14.1.10 SEAGARDEN GROUP

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Product launches

- 14.1.10.3.2 Deals

- 14.1.10.4 MnM view

- 14.1.11 LYSI HF

- 14.1.11.1 Business overview

- 14.1.11.2 Product/Solutions/Services offered

- 14.1.11.3 MnM view

- 14.1.12 SOPROPECHE

- 14.1.12.1 Business overview

- 14.1.12.2 Product/Solutions/Services offered

- 14.1.12.3 MnM view

- 14.1.13 HOFSETH BIOCARE ASA

- 14.1.13.1 Business overview

- 14.1.13.2 Products/Solutions/Services offered

- 14.1.13.3 Recent developments

- 14.1.13.3.1 Deals

- 14.1.13.3.2 Expansions

- 14.1.13.4 MnM view

- 14.1.14 ZHEJIANG GOLDEN-SHELL PHARMACEUTICAL CO., LTD.

- 14.1.14.1 Business overview

- 14.1.14.2 Product/Solutions/Services offered

- 14.1.15 ATLANTIS SEA-AGRI GROUP

- 14.1.15.1 Business overview

- 14.1.15.2 Product/Solutions/Services offered

- 14.1.15.3 Recent developments

- 14.1.15.3.1 Product launches

- 14.1.15.4 MnM view

- 14.1.1 SCOULAR COMPANY

- 14.2 OTHER PLAYERS

- 14.2.1 PATTANI FISH MEAL (1988) CO., LTD.

- 14.2.1.1 Business overview

- 14.2.1.2 Product/Solutions/Services offered

- 14.2.1.3 MnM view

- 14.2.2 WUDI DEDA AGRICULTURE CO., LTD.

- 14.2.2.1 Business overview

- 14.2.2.2 Product/Solutions/Services offered

- 14.2.2.3 MnM view

- 14.2.3 RAJ FISHMEAL AND OIL COMPANY

- 14.2.3.1 Business overview

- 14.2.3.2 Product/Solutions/Services offered

- 14.2.3.3 MnM view

- 14.2.4 TITAN BIOTECH

- 14.2.4.1 Business overview

- 14.2.4.2 Product/Solutions/Services offered

- 14.2.4.3 MnM view

- 14.2.5 DAI DAI THANH SEAFOODS

- 14.2.5.1 Business overview

- 14.2.5.2 Products/Services/Solutions offered

- 14.2.5.3 MnM view

- 14.2.6 ASIA FISH OIL CORPORATION

- 14.2.7 AASHA BIOCHEM

- 14.2.8 ATHOS COLLAGEN

- 14.2.9 AQUAFOOD

- 14.2.10 SALMON PROTEINS

- 14.2.1 PATTANI FISH MEAL (1988) CO., LTD.

15 ADJACENT AND RELATED MARKETS

- 15.1 INTRODUCTION

- 15.2 LIMITATIONS

- 15.3 MARINE COLLAGEN MARKET

- 15.3.1 MARKET DEFINITION

- 15.3.2 MARKET OVERVIEW

- 15.4 FISH MEAL & FISH OIL MARKET

- 15.4.1 MARKET DEFINITION

- 15.4.2 MARKET OVERVIEW

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

List of Tables

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2020-2024

- TABLE 2 FISHERY BY-PRODUCTS MARKET SNAPSHOT, 2025 VS. 2030

- TABLE 3 WORLD FISHERIES AND AQUACULTURE TRENDS

- TABLE 4 AVERAGE SELLING PRICE OF TYPES, BY KEY PLAYERS, 2024 (USD/KG)

- TABLE 5 AVERAGE SELLING PRICE TREND OF FISHERY BY-PRODUCTS, BY REGION, 2023-2030 (USD/KG)

- TABLE 6 ROLE OF PLAYERS IN FISHERY BY-PRODUCTS ECOSYSTEM

- TABLE 7 LIST OF FEW PATENTS IN FISHERY BY-PRODUCTS MARKET, 2015-2025

- TABLE 8 IMPORT VALUE OF HS CODE 150410, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 9 IMPORT VALUE OF HS CODE 150410, BY KEY COUNTRY, 2020-2024 (TONS)

- TABLE 10 IMPORT VALUE OF HS CODE 150410, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 11 EXPORT VALUE OF HS CODE 150410, BY KEY COUNTRY, 2020-2024 (TONS)

- TABLE 12 FISHERY BY-PRODUCTS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 PORTER'S FIVE FORCES IMPACT ON FISHERY BY-PRODUCTS MARKET

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP FOUR TYPES

- TABLE 20 KEY BUYING CRITERIA FOR TOP FOUR TYPES

- TABLE 21 US: ADJUSTED RECIPROCAL TARIFF RATES, 2024

- TABLE 22 EXPECTED IMPACT LEVEL ON TARGET INGREDIENTS WITH RELEVANT HS CODES DUE TO TRUMP TARIFFS

- TABLE 23 EXPECTED TARIFF IMPACT ON END-USE INDUSTRIES: FISHERY BY-PRODUCTS MARKET

- TABLE 24 FISHERY BY-PRODUCTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 25 FISHERY BY-PRODUCTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 26 FISHERY BY-PRODUCTS MARKET, BY TYPE, 2020-2024 (KT)

- TABLE 27 FISHERY BY-PRODUCTS MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 28 PROTEIN & PROTEIN DERIVATIVES: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 29 PROTEIN & PROTEIN DERIVATIVES: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 PROTEIN & PROTEIN DERIVATIVES: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 31 PROTEIN & PROTEIN DERIVATIVES: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 32 PROTEIN & PROTEIN DERIVATIVES: FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 33 PROTEIN & PROTEIN DERIVATIVES: FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 34 PROTEIN & PROTEIN DERIVATIVES: FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (KILOTON)

- TABLE 35 PROTEIN & PROTEIN DERIVATIVES: FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (KILOTON)

- TABLE 36 FISHMEAL: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 37 FISHMEAL: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 FISHMEAL: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 39 FISHMEAL: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 40 FISH SILAGE: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 41 FISH SILAGE: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 FISH SILAGE: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 43 FISH SILAGE: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 44 FISH HYDROLYSATE: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 45 FISH HYDROLYSATE: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 FISH HYDROLYSATE: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 47 FISH HYDROLYSATE: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 48 GELATIN: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 49 GELATIN: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 GELATIN: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 51 GELATIN: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 52 COLLAGEN: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 53 COLLAGEN: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 COLLAGEN: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 55 COLLAGEN: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 56 FISHOIL: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 57 FISHOIL: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 FISHOIL: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 59 FISHOIL: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 60 MINERALS: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 61 MINERALS: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 MINERALS: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 63 MINERALS: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 64 MINERALS: FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 65 MINERALS: FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 66 MINERALS: FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (KILOTON)

- TABLE 67 MINERALS: FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (KILOTON)

- TABLE 68 BONE POWDER: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 69 BONE POWDER: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 BONE POWDER: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 71 BONE POWDER: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 72 CHITIN: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 73 CHITIN: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 74 CHITIN: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 75 CHITIN: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 76 CHITOSAN: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 77 CHITOSAN: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 CHITOSAN: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 79 CHITOSAN: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 80 BIOACTIVES & SPECIALTY COMPOUNDS: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 81 BIOACTIVES & SPECIALTY COMPOUNDS: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 82 BIOACTIVES & SPECIALTY COMPOUNDS: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 83 BIOACTIVES & SPECIALTY COMPOUNDS: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 84 BIOACTIVES & SPECIALTY COMPOUNDS: FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 85 BIOACTIVES & SPECIALTY COMPOUNDS: FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 86 BIOACTIVES & SPECIALTY COMPOUNDS: FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (KILOTON)

- TABLE 87 BIOACTIVES & SPECIALTY COMPOUNDS: FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (KILOTON)

- TABLE 88 ENZYMES: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 89 ENZYMES: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 90 ENZYMES: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 91 ENZYMES: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 92 SQUALENE: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 93 SQUALENE: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 94 SQUALENE: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 95 SQUALENE: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 96 CAROTENOIDS: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 97 CAROTENOIDS: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 98 CAROTENOIDS: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 99 CAROTENOIDS: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 100 CARTILAGE: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 101 CARTILAGE: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 102 CARTILAGE: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 103 CARTILAGE: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 104 COLLAGEN PEPTIDES: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 105 COLLAGEN PEPTIDES: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 106 COLLAGEN PEPTIDES: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 107 COLLAGEN PEPTIDES: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 108 FISHERY BY-PRODUCTS MARKET, BY SOURCE, 2020-2024 (USD MILLION)

- TABLE 109 FISHERY BY-PRODUCTS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 110 CAPTURE FISHERIES: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 111 CAPTURE FISHERIES: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 112 CAPTURE FISHERIES: FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 113 FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 114 MARINE: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 115 MARINE: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 116 INLAND: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 117 INLAND: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 118 AQUACULTURE: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 119 AQUACULTURE: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 120 FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 121 FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 122 FOOD & BEVERAGE: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 123 FOOD & BEVERAGE: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 124 FOOD & BEVERAGE: FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 125 FOOD & BEVERAGE: FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 126 FLAVOR ENHANCERS: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 127 FLAVOR ENHANCERS: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 128 NUTRITIONAL SUPPLEMENTS: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 129 NUTRITIONAL SUPPLEMENTS: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 130 FORTIFIED FOOD & BEVERAGE: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 131 FORTIFIED FOOD & BEVERAGE: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 132 ANIMAL FEED: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 133 ANIMAL FEED: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 134 ANIMAL FEED: FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 135 ANIMAL FEED: FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 136 AQUACULTURE FEED: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 137 AQUACULTURE FEED: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 138 LIVESTOCK FEED: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 139 LIVESTOCK FEED: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 140 PET FOOD ADDITIVES: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 141 PET FOOD ADDITIVES: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 142 AGRICULTURE: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 143 AGRICULTURE: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 144 COSMETICS & PERSONAL CARE: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 145 COSMETICS & PERSONAL CARE: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 146 PHARMACEUTICALS & NUTRACEUTICALS: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 147 PHARMACEUTICALS & NUTRACEUTICALS: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 148 INDUSTRIAL APPLICATIONS: FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 149 INDUSTRIAL APPLICATIONS: FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 150 FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 151 FISHERY BY-PRODUCTS PROTEIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 152 FISHERY BY-PRODUCTS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 153 FISHERY BY-PRODUCTS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 154 NORTH AMERICA: FISHERY BY-PRODUCTS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 155 NORTH AMERICA: FISHERY BY-PRODUCTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 156 NORTH AMERICA: FISHERY BY-PRODUCTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 157 NORTH AMERICA: FISHERY BY-PRODUCTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 158 NORTH AMERICA: FISHERY BY-PRODUCTS MARKET, BY TYPE, 2020-2024 (KILOTON)

- TABLE 159 NORTH AMERICA: FISHERY BY-PRODUCTS MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 160 PROTEIN & PROTEIN DERIVATIVES: NORTH AMERICA FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 161 PROTEIN & PROTEIN DERIVATIVES: NORTH AMERICA FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 162 PROTEIN & PROTEIN DERIVATIVES: NORTH AMERICA FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (KILOTON)

- TABLE 163 PROTEIN & PROTEIN DERIVATIVES: NORTH AMERICA FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (KILOTON)

- TABLE 164 BIOACTIVES & SPECIALTY COMPOUNDS: NORTH AMERICA FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 165 BIOACTIVES & SPECIALTY COMPOUNDS: NORTH AMERICA FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 166 BIOACTIVES & SPECIALTY COMPOUNDS: NORTH AMERICA FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (KILOTON)

- TABLE 167 BIOACTIVES & SPECIALTY COMPOUNDS: NORTH AMERICA FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (KILOTON)

- TABLE 168 MINERALS: NORTH AMERICA FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 169 MINERALS: NORTH AMERICA FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 170 MINERALS: NORTH AMERICA FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (KILOTON)

- TABLE 171 MINERALS: NORTH AMERICA FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (KILOTON)

- TABLE 172 NORTH AMERICA: FISHERY BY-PRODUCTS MARKET, BY SOURCE, 2020-2024 (USD MILLION)

- TABLE 173 NORTH AMERICA: FISHERY BY-PRODUCTS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 174 CAPTURE FISHERIES: NORTH AMERICA FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 175 CAPTURE FISHERIES: NORTH AMERICA FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 176 NORTH AMERICA: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 177 NORTH AMERICA: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 178 ANIMAL FEED: NORTH AMERICA FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 179 ANIMAL FEED: NORTH AMERICA FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 180 FOOD & BEVERAGE: NORTH AMERICA FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 181 FOOD & BEVERAGE: NORTH AMERICA FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 182 US: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 183 US: : FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 184 CANADA: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 185 CANADA: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 186 MEXICO: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 187 MEXICO: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 188 ASIA PACIFIC: FISHERY BY-PRODUCTS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 189 ASIA PACIFIC: FISHERY BY-PRODUCTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 190 ASIA PACIFIC: FISHERY BY-PRODUCTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 191 ASIA PACIFIC: FISHERY BY-PRODUCTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 192 ASIA PACIFIC: FISHERY BY-PRODUCTS MARKET, BY TYPE, 2020-2024 (KILOTON)

- TABLE 193 ASIA PACIFIC: FISHERY BY-PRODUCTS MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 194 PROTEIN & PROTEIN DERIVATIVES: ASIA PACIFIC FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 195 PROTEIN & PROTEIN DERIVATIVES: ASIA PACIFIC FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 196 PROTEIN & PROTEIN DERIVATIVES: ASIA PACIFIC FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (KILOTON)

- TABLE 197 PROTEIN & PROTEIN DERIVATIVES: ASIA PACIFIC FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (KILOTON)

- TABLE 198 BIOACTIVES & SPECIALTY COMPOUNDS: ASIA PACIFIC FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 199 BIOACTIVES & SPECIALTY COMPOUNDS: ASIA PACIFIC FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 200 BIOACTIVES & SPECIALTY COMPOUNDS: ASIA PACIFIC FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (KILOTON)

- TABLE 201 BIOACTIVES & SPECIALTY COMPOUNDS: ASIA PACIFIC FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (KILOTON)

- TABLE 202 MINERALS: ASIA PACIFIC FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 203 MINERALS: ASIA PACIFIC FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 204 MINERALS: ASIA PACIFIC FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (KILOTON)

- TABLE 205 MINERALS: ASIA PACIFIC FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (KILOTON)

- TABLE 206 ASIA PACIFIC: FISHERY BY-PRODUCTS MARKET, BY SOURCE, 2020-2024 (USD MILLION)

- TABLE 207 ASIA PACIFIC: FISHERY BY-PRODUCTS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 208 CAPTURE FISHERIES: ASIA PACIFIC FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 209 CAPTURE FISHERIES: ASIA PACIFIC FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 210 ASIA PACIFIC: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 211 ASIA PACIFIC: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 212 ANIMAL FEED: ASIA PACIFIC FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 213 ANIMAL FEED: ASIA PACIFIC FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 214 FOOD & BEVERAGE: ASIA PACIFIC FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 215 FOOD & BEVERAGE: ASIA PACIFIC FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 216 CHINA: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 217 CHINA: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 218 INDIA: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 219 INDIA: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 220 JAPAN: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 221 JAPAN: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 222 VIETNAM: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 223 VIETNAM: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 224 THAILAND: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 225 THAILAND: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 226 AUSTRALIA & NEW ZEALAND: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 227 AUSTRALIA & NEW ZEALAND: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 228 SOUTH KOREA: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 229 SOUTH KOREA: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 230 REST OF ASIA PACIFIC: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 231 REST OF ASIA PACIFIC: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 232 EUROPE: FISHERY BY-PRODUCTS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 233 EUROPE: FISHERY BY-PRODUCTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 234 EUROPE: FISHERY BY-PRODUCTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 235 EUROPE: FISHERY BY-PRODUCTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 236 EUROPE: FISHERY BY-PRODUCTS MARKET, BY TYPE, 2020-2024 (KILOTON)

- TABLE 237 EUROPE: FISHERY BY-PRODUCTS MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 238 PROTEIN & PROTEIN DERIVATIVES: EUROPE FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 239 PROTEIN & PROTEIN DERIVATIVES: EUROPE FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 240 PROTEIN & PROTEIN DERIVATIVES: EUROPE FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (KILOTON)

- TABLE 241 PROTEIN & PROTEIN DERIVATIVES: EUROPE FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (KILOTON)

- TABLE 242 BIOACTIVES & SPECIALTY COMPOUNDS: EUROPE FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 243 BIOACTIVES & SPECIALTY COMPOUNDS: EUROPE FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 244 BIOACTIVES & SPECIALTY COMPOUNDS: EUROPE FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (KILOTON)

- TABLE 245 BIOACTIVES & SPECIALTY COMPOUNDS: EUROPE FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (KILOTON)

- TABLE 246 MINERALS: EUROPE FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 247 MINERALS: EUROPE FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 248 MINERALS: EUROPE FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (KILOTON)

- TABLE 249 MINERALS: EUROPE FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (KILOTON)

- TABLE 250 EUROPE: FISHERY BY-PRODUCTS MARKET, BY SOURCE, 2020-2024 (USD MILLION)

- TABLE 251 EUROPE: FISHERY BY-PRODUCTS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 252 CAPTURE FISHERIES: EUROPE FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 253 CAPTURE FISHERIES: EUROPE FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 254 EUROPE: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 255 EUROPE: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 256 ANIMAL FEED: EUROPE FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 257 ANIMAL FEED: EUROPE FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 258 FOOD & BEVERAGE: EUROPE FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 259 FOOD & BEVERAGE: EUROPE FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 260 GERMANY: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 261 GERMANY: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 262 UK: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 263 UK: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 264 FRANCE: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 265 FRANCE: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 266 ITALY: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 267 ITALY: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 268 SPAIN: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 269 SPAIN: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 270 NORWAY: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 271 NORWAY: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 272 DENMARK: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 273 DENMARK: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 274 REST OF EUROPE: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 275 REST OF EUROPE: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 276 SOUTH AMERICA: FISHERY BY-PRODUCTS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 277 SOUTH AMERICA: FISHERY BY-PRODUCTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 278 SOUTH AMERICA: FISHERY BY-PRODUCTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 279 SOUTH AMERICA: FISHERY BY-PRODUCTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 280 SOUTH AMERICA: FISHERY BY-PRODUCTS MARKET, BY TYPE, 2020-2024 (KILOTON)

- TABLE 281 SOUTH AMERICA: FISHERY BY-PRODUCTS MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 282 PROTEIN & PROTEIN DERIVATIVES: SOUTH AMERICA FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 283 PROTEIN & PROTEIN DERIVATIVES: SOUTH AMERICA FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 284 PROTEIN & PROTEIN DERIVATIVES: SOUTH AMERICA FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (KILOTON)

- TABLE 285 PROTEIN & PROTEIN DERIVATIVES: SOUTH AMERICA FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (KILOTON)

- TABLE 286 BIOACTIVES & SPECIALTY COMPOUNDS: SOUTH AMERICA FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 287 BIOACTIVES & SPECIALTY COMPOUNDS: SOUTH AMERICA FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 288 BIOACTIVES & SPECIALTY COMPOUNDS: SOUTH AMERICA FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (KILOTON)

- TABLE 289 BIOACTIVES & SPECIALTY COMPOUNDS: SOUTH AMERICA FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (KILOTON)

- TABLE 290 MINERALS: SOUTH AMERICA FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 291 MINERALS: SOUTH AMERICA FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 292 MINERALS: SOUTH AMERICA FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (KILOTON)

- TABLE 293 MINERALS: SOUTH AMERICA FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (KILOTON)

- TABLE 294 SOUTH AMERICA: FISHERY BY-PRODUCTS MARKET, BY SOURCE, 2020-2024 (USD MILLION)

- TABLE 295 SOUTH AMERICA: FISHERY BY-PRODUCTS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 296 CAPTURE FISHERIES: SOUTH AMERICA FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 297 CAPTURE FISHERIES: SOUTH AMERICA FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 298 SOUTH AMERICA: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 299 SOUTH AMERICA: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 300 ANIMAL FEED: SOUTH AMERICA FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 301 ANIMAL FEED: SOUTH AMERICA FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 302 FOOD & BEVERAGE: SOUTH AMERICA FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 303 FOOD & BEVERAGE: SOUTH AMERICA FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 304 CHILE: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 305 CHILE: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 306 BRAZIL: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 307 BRAZIL: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 308 PERU: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 309 PERU: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 310 REST OF SOUTH AMERICA: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 311 REST OF SOUTH AMERICA: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 312 ROW: FISHERY BY-PRODUCTS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 313 ROW: FISHERY BY-PRODUCTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 314 ROW: FISHERY BY-PRODUCTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 315 ROW: FISHERY BY-PRODUCTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 316 ROW: FISHERY BY-PRODUCTS MARKET, BY TYPE, 2020-2024 (KILOTON)

- TABLE 317 ROW: FISHERY BY-PRODUCTS MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 318 PROTEIN & PROTEIN DERIVATIVES: ROW FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 319 PROTEIN & PROTEIN DERIVATIVES: ROW FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 320 PROTEIN & PROTEIN DERIVATIVES: ROW FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (KILOTON)

- TABLE 321 PROTEIN & PROTEIN DERIVATIVES: ROW FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (KILOTON)

- TABLE 322 BIOACTIVES & SPECIALTY COMPOUNDS: ROW FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 323 BIOACTIVES & SPECIALTY COMPOUNDS: ROW FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 324 BIOACTIVES & SPECIALTY COMPOUNDS: ROW FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (KILOTON)

- TABLE 325 BIOACTIVES & SPECIALTY COMPOUNDS: ROW FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (KILOTON)

- TABLE 326 MINERALS: ROW FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 327 MINERALS: ROW FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 328 MINERALS: ROW FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (KILOTON)

- TABLE 329 MINERALS: ROW FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (KILOTON)

- TABLE 330 ROW: FISHERY BY-PRODUCTS MARKET, BY SOURCE, 2020-2024 (USD MILLION)

- TABLE 331 ROW: FISHERY BY-PRODUCTS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 332 CAPTURE FISHERIES: ROW FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 333 CAPTURE FISHERIES: ROW FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 334 ROW: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 335 ROW: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 336 ANIMAL FEED: ROW FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 337 ANIMAL FEED: ROW FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 338 FOOD & BEVERAGE: ROW FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 339 FOOD & BEVERAGE: ROW FISHERY BY-PRODUCTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 340 AFRICA: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 341 AFRICA: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 342 MIDDLE EAST: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 343 MIDDLE EAST: FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 344 OVERVIEW OF STRATEGIES ADOPTED BY KEY FISHERY BY-PRODUCT MANUFACTURERS

- TABLE 345 FISHERY BY-PRODUCTS MARKET: INTENSITY OF COMPETITIVE RIVALRY

- TABLE 346 FISHERY BY-PRODUCTS MARKET: REGION FOOTPRINT

- TABLE 347 FISHERY BY-PRODUCTS MARKET: TYPE FOOTPRINT

- TABLE 348 FISHERY BY-PRODUCTS MARKET: SOURCE FOOTPRINT

- TABLE 349 FISHERY BY-PRODUCTS MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 350 FISHERY BY-PRODUCTS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 351 FISHERY BY-PRODUCTS MARKET: PRODUCT LAUNCHES, JANUARY 2020-JUNE 2025

- TABLE 352 FISHERY BY-PRODUCTS MARKET: DEALS, JANUARY 2020-JUNE 2025

- TABLE 353 FISHERY BY-PRODUCTS MARKET: EXPANSIONS, JANUARY 2020-JUNE 2025

- TABLE 354 FISHERY BY-PRODUCTS MARKET: OTHERS, JANUARY 2020-JUNE 2025

- TABLE 355 SCOULAR COMPANY: COMPANY OVERVIEW

- TABLE 356 SCOULAR COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 357 SCOULAR COMPANY: DEALS

- TABLE 358 MARUHA NICHIRO CORPORATION: COMPANY OVERVIEW

- TABLE 359 MARUHA NICHIRO CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 360 MARUHA NICHIRO CORPORATION: DEALS

- TABLE 361 MARUHA NICHIRO CORPORATION: EXPANSION

- TABLE 362 NISSUI CORPORATION: COMPANY OVERVIEW

- TABLE 363 NISSUI CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 364 NISSUI CORPORATION: DEALS

- TABLE 365 AUSTEVOLL SEAFOOD ASA: COMPANY OVERVIEW

- TABLE 366 AUSTEVOLL SEAFOOD ASA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 367 AUSTEVOLL SEAFOOD ASA: DEALS

- TABLE 368 THAI UNION GROUP: COMPANY OVERVIEW

- TABLE 369 THAI UNION GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 370 THAI UNION GROUP: PRODUCT LAUNCHES

- TABLE 371 THAI UNION GROUP: DEALS

- TABLE 372 THAI UNION GROUP: EXPANSIONS

- TABLE 373 THAI UNION GROUP: OTHERS

- TABLE 374 PESQUERA DIAMANTE S.A.: COMPANY OVERVIEW

- TABLE 375 PESQUERA DIAMANTE S.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 376 OCEANA GROUP LIMITED: COMPANY OVERVIEW

- TABLE 377 OCEANA GROUP LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 378 TRIPLENINE: COMPANY OVERVIEW

- TABLE 379 TRIPLENINE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 380 FF SKAGEN A/S: COMPANY OVERVIEW

- TABLE 381 FF SKAGEN A/S: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 382 FF SKAGEN A/S: EXPANSION

- TABLE 383 SEAGARDEN GROUP: COMPANY OVERVIEW

- TABLE 384 SEAGARDEN GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 385 SEAGARDEN GROUP: PRODUCT LAUNCHES

- TABLE 386 SEAGARDEN GROUP: DEALS

- TABLE 387 LYSI HF: COMPANY OVERVIEW

- TABLE 388 LYSI HF: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 389 SOPROPECHE: COMPANY OVERVIEW

- TABLE 390 SOPROPECHE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 391 HOFSETH BIOCARE ASA: COMPANY OVERVIEW

- TABLE 392 HOFSETH BIOCARE ASA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 393 HOFSETH BIOCARE ASA: DEALS

- TABLE 394 HOFSETH BIOCARE ASA: EXPANSIONS

- TABLE 395 ZHEJIANG GOLDEN-SHELL PHARMACEUTICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 396 ZHEJIANG GOLDEN-SHELL PHARMACEUTICAL CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 397 ATLANTIS SEA-AGRI GROUP: COMPANY OVERVIEW

- TABLE 398 ATLANTIS SEA-AGRI GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 399 ATLANTIS SEA-AGRI GROUP: PRODUCT LAUNCHES

- TABLE 400 PATTANI FISH MEAL (1988) CO., LTD.: COMPANY OVERVIEW

- TABLE 401 PATTANI FISH MEAL (1988) CO., LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 402 WUDI DEDA AGRICULTURE CO., LTD.: COMPANY OVERVIEW

- TABLE 403 WUDI DEDA AGRICULTURE CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 404 RAJ FISHMEAL AND OIL COMPANY: COMPANY OVERVIEW

- TABLE 405 RAJ FISHMEAL AND OIL COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 406 TITAN BIOTECH: COMPANY OVERVIEW

- TABLE 407 TITAN BIOTECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 408 DAI DAI THANH SEAFOODS: BUSINESS OVERVIEW

- TABLE 409 DAI DAI THANH SEAFOODS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 410 ADJACENT MARKETS TO FISHERY BY-PRODUCTS MARKET

- TABLE 411 MARINE COLLAGEN MARKET, BY TYPE, 2021-2026 (USD MILLION)

- TABLE 412 FISH MEAL & FISH OIL MARKET, BY INDUSTRIAL APPLICATION, 2019-2021 (USD MILLION)

- TABLE 413 FISH MEAL & FISH OIL MARKET, BY INDUSTRIAL APPLICATION, 2022-2027 (USD MILLION)

List of Figures

- FIGURE 1 MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 FISHERY BY-PRODUCTS MARKET: RESEARCH DESIGN

- FIGURE 3 FISHERY BY-PRODUCTS MARKET SIZE ESTIMATION STEPS AND RESPECTIVE SOURCES: SUPPLY SIDE

- FIGURE 4 FISHERY BY-PRODUCTS MARKET: DATA TRIANGULATION

- FIGURE 5 FISHERY BY-PRODUCTS MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 6 FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2025 VS. 2030 (USD MILLION)

- FIGURE 7 FISHERY BY-PRODUCTS MARKET, BY SOURCE, 2025 VS. 2030 (USD MILLION)

- FIGURE 8 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 9 DEVELOPMENT AND INNOVATION OF NEW PRODUCTS AND GROWING DEMAND FOR SUSTAINABLE MARINE-DERIVED INGREDIENTS TO DRIVE MARKET

- FIGURE 10 AQUACULTURE SEGMENT & CHINA TO ACCOUNT FOR LARGEST SHARES IN ASIA PACIFIC FISHERY BY-PRODUCTS MARKET IN 2024

- FIGURE 11 PROTEIN & PROTEIN DERIVATIVES TO ACCOUNT FOR LARGEST MARKET IN TERMS OF VOLUME DURING FORECAST PERIOD

- FIGURE 12 CAPTURE FISHERIES SEGMENT AND ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARES DURING FORECAST PERIOD

- FIGURE 13 CHINA TO ACCOUNT FOR LARGEST MARKET SHARE (BY VALUE) IN 2025

- FIGURE 14 FISHERY BY-PRODUCTS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 15 TOP TEN COUNTRIES IMPORTING CONFECTIONERY PRODUCTS FROM US IN 2022

- FIGURE 16 ADOPTION OF GEN AI IN FISHERY BY-PRODUCTS MARKET

- FIGURE 17 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 18 AVERAGE SELLING PRICE OF TYPES, BY KEY PLAYERS, 2024

- FIGURE 19 AVERAGE SELLING PRICE TREND OF FISHERY BY-PRODUCTS, BY REGION, 2023-2030

- FIGURE 20 FISHERY BY-PRODUCTS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 21 KEY STAKEHOLDERS IN FISHERY BY-PRODUCT ECOSYSTEM

- FIGURE 22 NUMBER OF MAJOR PATENTS GRANTED FOR FISHERY BY-PRODUCTS MARKET, 2015-2025

- FIGURE 23 REGIONAL ANALYSIS OF PATENTS GRANTED FOR FISHERY BY-PRODUCTS MARKET, 2015-2025

- FIGURE 24 IMPORT VALUE OF HS CODE 150410: KEY COUNTRIES, 2020-2024 (USD THOUSAND)

- FIGURE 25 IMPORT VALUE OF HS CODE 150410: KEY COUNTRIES, 2020-2024 (USD THOUSAND)

- FIGURE 26 FISHERY BY-PRODUCTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 28 KEY BUYING CRITERIA FOR TOP FOUR TYPES

- FIGURE 29 INVESTMENT AND FUNDING SCENARIO, 2020-2024 (USD BILLION)

- FIGURE 30 FISHERY BY-PRODUCTS MARKET, BY TYPE, 2025 VS. 2030

- FIGURE 31 FISHERY BY-PRODUCTS MARKET, BY TECHNOLOGY (MARKET SHARE, 2025)

- FIGURE 32 FISHERY BY-PRODUCTS MARKET, BY SOURCE, 2025 VS. 2030

- FIGURE 33 FISHERY BY-PRODUCTS MARKET, BY END-USE INDUSTRY, 2025 VS. 2030

- FIGURE 34 CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 36 EUROPE: REGIONAL SNAPSHOT

- FIGURE 37 REVENUE ANALYSIS FOR KEY PLAYERS IN FISHERY BY-PRODUCTS MARKET, 2020-2024 (USD BILLION)

- FIGURE 38 SHARE OF LEADING COMPANIES IN FISHERY BY-PRODUCTS MARKET, 2024

- FIGURE 39 COMPANY VALUATION OF KEY VENDORS (USD BILLION)

- FIGURE 40 FINANCIAL METRICS OF KEY VENDORS, 2024

- FIGURE 41 BRAND/PRODUCT COMPARISON ANALYSIS, BY PRODUCT BRAND

- FIGURE 42 FISHERY BY-PRODUCTS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 43 FISHERY BY-PRODUCTS MARKET: COMPANY FOOTPRINT

- FIGURE 44 FISHERY BY-PRODUCTS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 45 SCOULAR COMPANY: COMPANY SNAPSHOT

- FIGURE 46 MARUHA NICHIRO CORPORATION: COMPANY SNAPSHOT

- FIGURE 47 NISSUI CORPORATION: COMPANY SNAPSHOT

- FIGURE 48 AUSTEVOLL SEAFOOD ASA: COMPANY SNAPSHOT

- FIGURE 49 THAI UNION GROUP: COMPANY SNAPSHOT

- FIGURE 50 OCEANA GROUP LIMITED: COMPANY SNAPSHOT