|

市場調查報告書

商品編碼

1796197

全球 GPU 伺服器市場(按部署、外形規格、功能、冷卻技術、應用、最終用途產業和地區分類)- 預測至 2030 年GPU Server Market by Deployment (On-premises, Cloud-based), Form Factor (Rack-mounted Server, Blade Server, Tower Server), Function (Training, Inference), Cooling Technology, Application, End-user Industry and Region - Global Forecast to 2030 |

||||||

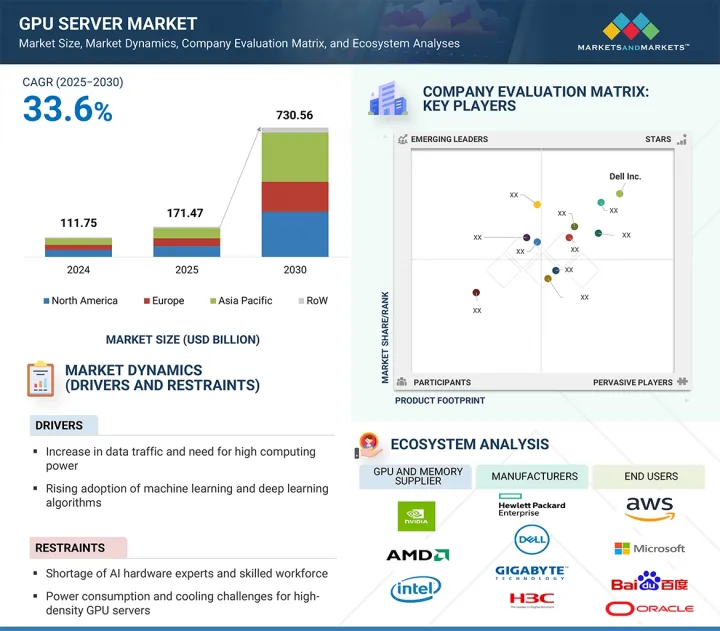

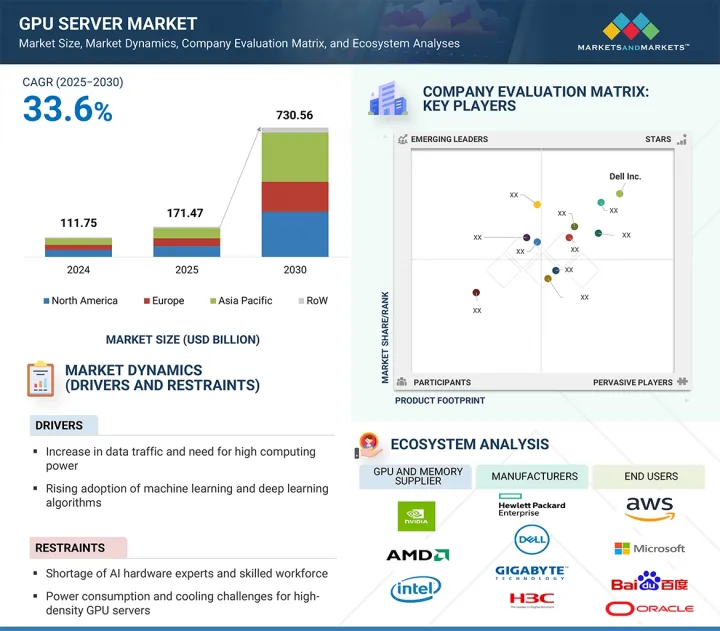

全球 GPU 伺服器市場預計將從 2025 年的 1,714.7 億美元成長到 2030 年的 7,305.6 億美元,2025 年至 2030 年的複合年成長率為 33.6%。

| 調查範圍 | |

|---|---|

| 調查年份 | 2021-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 單元 | 10億美元 |

| 部分 | 功能、部署、外形規格、冷卻技術、應用、最終用戶、區域 |

| 目標區域 | 北美、歐洲、亞太地區及其他地區 |

各行各業日益普及的雲端基礎人工智慧解決方案、機器學習和深度學習演算法的應用,以及人工智慧在醫療保健領域日益成長的潛力,都在推動市場成長。雲端服務供應商不斷增加對資料中心的投資,也推動了GDP的成長。因此,隨著虛擬環境的普及,配備GPU伺服器的資料中心將能夠承受更重的運算負載,並提供流暢、快速回應的虛擬體驗。元宇宙和VR應用的興起,為GPU伺服器市場創造了機會。

“基於外形規格,預計機架式伺服器將在 2030 年佔據最大的市場佔有率。”

機架式伺服器正經歷著高速成長,被廣泛應用於大型資料中心,其功能效用在於運行複雜的基於 AI 的工作負載。當以外形規格對 GPU 伺服器進行分類時,機架式伺服器佔據主導地位,它們將 GPU 伺服器轉變為具有可擴展性和高效空間利用率的高密度運算單元。這使得它們非常適合 AI 訓練、資料分析和 HPC 工作負載,多個 GPU 安裝在單一底盤中,可跨機架競爭。對大規模 AI 模型的日益成長的需求也在推動其採用,這需要在超大規模和企業資料中心安裝高效節省空間的基礎設施,以及更好的溫度控管管理和電源管理。隨著 AI 和雲端運算的擴展,機架式 GPU 伺服器的採用動力仍然強勁。

“基於終端使用行業,預計雲端服務供應商部門將在預測期內佔據 GPU 伺服器市場的最大佔有率。”

雲端服務供應商從處理由物聯網設備、社交媒體網站和企業應用程式產生的複雜資料集中受益匪淺。人工智慧技術在各行各業的廣泛部署刺激了雲端服務供應商(CSP) 提供的基於人工智慧的雲端服務的需求。 GPU 伺服器使這些供應商能夠以前所未有的速度分析和處理大量資料。雲端服務供應商(CSP) 透過向企業、開發人員和研究機構提供對 GPU 功能的彈性、按需訪問,推動了 GPU 伺服器市場的成長。領先的 CSP,如 AWS、Microsoft Azure 和 Google Cloud,正在大力投資支援 GPU 的基礎設施,以託管各種運算密集型應用程式,包括人工智慧/機器學習訓練、深度學習、資料分析和高階渲染。關鍵促進因素是對高效、敏捷和可擴展運算能力日益成長的需求;人工智慧和生成模型的快速採用;以及企業需要在不投資實體資產的情況下更快地將產品推向市場。

“按國家分類,預計到 2030 年美國將佔據北美 GPU 伺服器市場的最大佔有率。”

預計到 2030 年,美國將佔據北美 GPU 伺服器市場的最大佔有率。這是由於人工智慧技術的進步、人們對其優勢的認知不斷提高、支持性生態系統、政府舉措以及該地區特定的行業用例。由於人工智慧技術的進步、人們對其優勢的認知不斷提高、支持性生態系統、政府舉措以及特定的行業用例,美國對人工智慧技術的採用正在增加。人工智慧演算法和處理能力的不斷改進使更多企業能夠整合人工智慧解決方案。機器學習和深度學習應用的興起對能夠處理密集型運算任務的強大 GPU 伺服器產生了巨大的需求。 GPU 伺服器市場的主要企業,如戴爾公司(美國)和惠普企業發展有限公司(美國),總部都設在美國,進一步推動了市場成長。

本報告對全球 GPU 伺服器市場進行了分析,提供了關鍵促進因素和限制因素、競爭格局和未來趨勢的資訊。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章 主要發現

- GPU 伺服器市場為企業帶來誘人機會

- GPU 伺服器市場(按冷卻技術)

- GPU 伺服器市場(依外形規格)

- GPU 伺服器市場(依公司類型)

- GPU 伺服器市場(按國家/地區)

第5章市場概述

- 介紹

- 市場動態

- 驅動程式

- 抑制因素

- 機會

- 任務

- 價值鏈分析

- 生態系分析

- 定價分析

- 主要企業提供的 GPU 伺服器價格分佈(2024 年)

- 各地區 GPU 伺服器平均售價趨勢(2021-2024)

- 投資金籌措場景

- 影響客戶業務的趨勢/中斷

- 技術分析

- 主要技術

- 互補技術

- 鄰近技術

- 案例研究分析

- AIVRES GPU 伺服器加速 UPSTAGE OCR Pack 的 AI 開發

- SEEWEB 與聯想和 NVIDIA 合作,宣布推出 GPU 運算即服務模式,以擴展 AI 的可近性

- SHARONAI 利用聯想高 GPU 密度 Truscale 伺服器擴充 AI 功能

- ELEUTHERAI 使用 NVIDIA TRITON 伺服器提升 LLM 推理效能

- ELEUTHERAI 使用 NVIDIA TRITON 推理伺服器降低 LLM 延遲

- 專利分析

- 貿易分析

- 進口情形(HS 編碼 847150)

- 出口情形(HS 編碼 847150)

- 波特五力分析

- 主要相關利益者和採購標準

- 標準和監管環境

- 監管機構、政府機構和其他組織

- 標準

- 大型會議和活動(2025-2026年)

- 2025年美國關稅對GPU伺服器市場的影響

- 介紹

- 主要關稅稅率

- 價格影響分析

- 對國家的影響

- 對最終用戶的影響

第6章 GPU 伺服器的類型

- 介紹

- 入門級 GPU

- 中階GPU

- 高階GPU

7. GPU 伺服器市場(按冷卻技術)

- 介紹

- 風冷

- 液體冷卻

- 混合冷卻

8. GPU 伺服器市場(按部署)

- 介紹

- 本地

- 雲端基礎

9. GPU 伺服器市場(依功能)

- 介紹

- 訓練

- 推理

第 10 章:GPU 伺服器市場(以外形規格)

- 介紹

- 機架式伺服器

- 刀鋒伺服器

- 直立式伺服器

第 11 章 GPU 伺服器市場(按應用)

- 介紹

- 人工智慧世代

- 基於規則的模型

- 統計模型

- 深度學習

- GAN

- 自動編碼器

- CNN

- 變壓器模型

- 機器學習

- 自然語言處理

- 電腦視覺

第 12 章:GPU 伺服器市場(按最終用戶)

- 介紹

- 雲端服務供應商

- 公司

- 醫療保健

- BFSI

- 車

- 零售與電子商務

- 媒體與娛樂

- 其他公司

- 政府機構

第 13 章:GPU 伺服器市場(按地區)

- 介紹

- 北美洲

- 北美宏觀經濟展望

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 歐洲宏觀經濟展望

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 亞太宏觀經濟展望

- 中國

- 日本

- 韓國

- 印度

- 其他亞太地區

- 其他地區

- 其他地區的宏觀經濟展望

- 中東

- 非洲

- 南美洲

第14章競爭格局

- 概述

- 主要參與企業的策略/優勢(2021-2024)

- 市場佔有率分析(2024年)

- 收益分析(2022-2024)

- 公司估值及財務指標

- 比較品牌

- 企業評估矩陣(2024年)

- Start-Ups/中小企業評估矩陣(2024年)

- 競爭場景

第15章:公司簡介

- 主要企業

- DELL INC.

- HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

- LENOVO

- HUAWEI TECHNOLOGIES CO., LTD.

- IBM

- H3C TECHNOLOGIES CO., LTD.

- CISCO SYSTEMS, INC.

- SUPER MICRO COMPUTER, INC.

- FUJITSU

- INSPUR CO., LTD.

- ADLINK TECHNOLOGY INC.

- QUANTA COMPUTER INC.

- WISTRON CORPORATION

- ASUSTEK COMPUTER INC.

- ZTE CORPORATION

- 其他公司

- NVIDIA CORPORATION

- ADVANCED MICRO DEVICES, INC.

- GIGABIT TECHNOLOGIES PVT. LTD

- AIVRES

- AIME

- WIWYNN CORPORATION

- MITAC COMPUTING TECHNOLOGY CORPORATION

- NEC CORPORATION

- 2CRSI GROUP

- PENGUIN COMPUTING

- SYSTEM76

- SERVER SIMPLY

第16章 附錄

The global GPU server market is projected to grow from USD 171.47 billion in 2025 to USD 730.56 billion by 2030, at a CAGR of 33.6% from 2025 to 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Function, Deployment, Form Factor, Cooling Technology, Application, End user, and Region |

| Regions covered | North America, Europe, APAC, RoW |

The growth in the market is attributed to the rising adoption of cloud-based AI solutions across industries, increasing adoption of machine learning and deep learning algorithms, and the growing potential of AI in the healthcare sector. Increased investment in cloud service providers' data centers is bolstering the GDP growth. Therefore, as virtual environments become rampant, data centers with GPU servers will stand to bear heavier computation loads and provide smooth and responsive virtual experiences. With the rise of the Metaverse and VR apps, opportunities are posed for the GPU server market.

"By form factor, the rack-mounted server segment is expected to account for the largest market share in 2030."

The high-growth rack-mount servers are witnessing extensive adoption across large data centers, and their functional utility is in running complex AI-based workloads. In the form-factor-based distinction within the spectrum of GPU servers, rack-mounted servers are certainly the most dominant ones, converting GPU servers into a high-density computing unit with properties of scalability and efficient utilization of space. This fits exactly to AI training, data analytics, and HPC workloads, turning into a single chassis with more than one GPU and competition across racks. Some adoption drivers are the ramp-up demand for large-scale AI models, necessitating space-efficient infrastructure established in hyperscale and enterprise data centers, and better thermal and power management. The adoption preference for rack-mount GPU servers remains strong in the growing dimension and scale of AI and cloud computing capacities.

"By end user industry, the cloud service providers segment is expected to capture the largest share of the GPU server market during the forecast period."

Cloud service providers provide immense benefits in processing complex data sets produced by IoT devices, social media websites, and enterprise applications. The widespread deployment of AI technologies in different verticals is fueling the need for AI-based cloud services provided by cloud service providers (CSPs). GPU servers enable these providers to analyze and process immense volumes of data at unprecedented velocities. Cloud service providers (CSPs) are the key drivers of growth in the GPU server market as they offer businesses, developers, and research institutions elastic, on-demand use of GPU capabilities. Top CSPs such as AWS, Microsoft Azure, and Google Cloud are significantly investing in GPU-enabled infrastructure to host various compute-intensive applications such as AI/ML training, deep learning, data analytics, and high-end rendering. The primary driving forces are the increasing need for efficient, agile, and scalable compute power, rapid adoption of AI and generative models, and the business need to bring products to market faster without investing in physical assets.

"By country, the US is expected to hold the largest share of the GPU server market in North America in 2030."

The US is expected to hold the largest share of the GPU server market in North America in 2030. This is due to advancements in artificial intelligence technologies, increased recognition of its benefits, a supportive ecosystem, government initiatives, and industry-specific use cases in the region. The US is experiencing an increase in the adoption of AI technologies driven by advancements in artificial intelligence technologies, increased recognition of its benefits, a supportive ecosystem, government initiatives, and industry-specific use cases. Continuous improvements in AI algorithms and processing capabilities are enabling more businesses to integrate AI solutions. The rise of machine learning and deep learning applications has generated significant demand for powerful GPU servers capable of handling intensive computational tasks. Key players in the GPU server market, including Dell Inc. (US) and Hewlett Packard Enterprise Development LP (US), are headquartered in the US, further fueling the market growth.

Extensive primary interviews were conducted with key industry experts in the GPU server market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakup of primary participants for the report is shown below: The study contains insights from various industry experts, from component suppliers to Tier 1

Companies and OEMs. The breakup of the primaries is as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation: C-level Executives - 45%, Directors - 35%, and Others - 20%

- By Region: North America - 30%, Europe - 22%, Asia Pacific - 40%, and RoW - 8%

Note: Three tiers of companies are defined based on their total revenue as of 2024; tier 1: revenue more than or equal to USD 500 million, tier 2: revenue between USD 100 million and USD 500 million, and tier 3: revenue less than or equal to USD 100 million. Other designations include sales and marketing executives and researchers, as well as members of various GPU server organizations.

NVIDIA Corporation (US), Dell Inc. (US), Hewlett Packard Enterprise Development LP (US), Lenovo (Hong Kong), Huawei Technologies Co., Ltd. (China), IBM (US), H3C Technologies Co., Ltd. (China), Cisco Systems, Inc. (US), Fujitsu (Japan), and INSPUR Co., Ltd. (China), among others are some key players in the GPU server market.

The study includes an in-depth competitive analysis of these key players in the GPU server market, as well as their company profiles, recent developments, and key market strategies.

Research Coverage:

This research report categorizes the GPU server market based on cooling technology (air cooling, liquid cooling, hybrid cooling), form factor (rack-mounted servers, blade servers, tower servers), function (training, inference), deployment (on-premises, cloud-based), application (generative ai, machine learning, natural language processing, computer vision), end-user industry(cloud service providers (CSP), enterprises, government organizations), and region (North America, Europe, Asia Pacific and RoW). The report describes the major drivers, restraints, challenges, and opportunities pertaining to the GPU server market and forecasts the same till 2030. The report also consists of leadership mapping and analysis of all the companies included in the GPU server ecosystem.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants in this market by providing information on the closest approximations of the revenue numbers for the overall GPU server market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (increase in data traffic and need for high computing power, increasing adoption of machine learning and deep learning algorithms, rising adoption of cloud-based AI solutions across industries) restraints (shortage of AI hardware experts and skilled workforce, power consumption and cooling challenges for high-density GPU servers), opportunities (growing potential of AI in healthcare sector, increasing investments in data centers by cloud service providers, emergence of Metaverse and Virtual Reality (VR)) and challenges (data security and privacy concerns) influencing the growth of the GPU server market

- Product Development/Innovation: Detailed insights into upcoming technologies, research and development activities, and the latest product and service launches in the GPU server market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the GPU server market across varied regions.

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the GPU server market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as NVIDIA Corporation (US), Dell Inc. (US), Hewlett Packard Enterprise Development LP (US), Lenovo (Hong Kong), Huawei Technologies Co., Ltd. (China), IBM (US), H3C Technologies Co., Ltd. (China), Cisco Systems, Inc. (US), Fujitsu (Japan), and INSPUR Co., Ltd. (China) NVIDIA Corporation (US), Dell Inc. (US), Hewlett Packard Enterprise Development LP (US), Lenovo (Hong Kong), Huawei Technologies Co., Ltd. (China), IBM (US), H3C Technologies Co., Ltd. (China), Cisco Systems, Inc. (US), Fujitsu (Japan), and INSPUR Co., Ltd. (China) in the GPU server market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ANALYSIS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN GPU SERVER MARKET

- 4.2 GPU SERVER MARKET, BY COOLING TECHNOLOGY

- 4.3 GPU SERVER MARKET, BY FORM FACTOR

- 4.4 GPU SERVER MARKET, BY ENTERPRISE TYPE

- 4.5 GPU SERVER MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Proliferation of connected devices

- 5.2.1.2 Increasing adoption of machine learning and deep learning algorithms

- 5.2.1.3 Shift toward cloud-based AI solutions

- 5.2.2 RESTRAINTS

- 5.2.2.1 Shortage of hardware experts and skilled workforce

- 5.2.2.2 Power consumption and cooling challenges for high-density AI servers

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Deployment of AI across global healthcare systems

- 5.2.3.2 Increasing investments in data centers by cloud service providers

- 5.2.3.3 Emergence of metaverse and VR

- 5.2.4 CHALLENGES

- 5.2.4.1 Data security and privacy concerns

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 PRICE RANGE OF GPU SERVERS OFFERED BY KEY PLAYERS, 2024

- 5.5.2 AVERAGE SELLING PRICE TREND OF GPU SERVERS, BY REGION, 2021-2024

- 5.6 INVESTMENT AND FUNDING SCENARIO

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 High-performance computing (HPC)

- 5.8.1.2 GenAI

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 High-speed interconnects

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Quantum AI

- 5.8.1 KEY TECHNOLOGIES

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 AIVRES' GPU SERVER BOOSTS AI DEVELOPMENT FOR UPSTAGE'S OCR PACK

- 5.9.2 SEEWEB COLLABORATES WITH LENOVO AND NVIDIA TO LAUNCH GPU-COMPUTING-AS-A-SERVICE MODEL FOR EXPANDING AI ACCESSIBILITY

- 5.9.3 SHARONAI EXPANDS AI CAPABILITIES WITH LENOVO'S GPU-DENSE TRUSCALE SERVERS

- 5.9.4 ELEUTHERAI BOOSTS LLM INFERENCE PERFORMANCE USING NVIDIA TRITON SERVER

- 5.9.5 ELEUTHERAI REDUCES LLM LATENCY USING NVIDIA TRITON INFERENCE SERVER

- 5.10 PATENT ANALYSIS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO (HS CODE 847150)

- 5.11.2 EXPORT SCENARIO (HS CODE 847150)

- 5.12 PORTER'S FIVE FORCES ANALYSIS

- 5.12.1 THREAT OF NEW ENTRANTS

- 5.12.2 THREAT OF SUBSTITUTES

- 5.12.3 BARGAINING POWER OF SUPPLIERS

- 5.12.4 BARGAINING POWER OF BUYERS

- 5.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 STANDARDS AND REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 STANDARDS

- 5.15 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.16 IMPACT OF 2025 US TARIFF ON GPU SERVER MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 KEY TARIFF RATES

- 5.16.3 PRICE IMPACT ANALYSIS

- 5.16.4 IMPACT ON COUNTRY/REGION

- 5.16.4.1 US

- 5.16.4.2 Europe

- 5.16.4.3 Asia Pacific

- 5.16.5 IMPACT ON END USER

- 5.16.5.1 Cloud service providers (CSPs)

- 5.16.5.2 Enterprises

6 TYPE OF GPU SERVERS

- 6.1 INTRODUCTION

- 6.2 ENTRY LEVEL GPU

- 6.3 MID-RANGE GPU

- 6.4 HIGH-END GPU

7 GPU SERVER MARKET, BY COOLING TECHNOLOGY

- 7.1 INTRODUCTION

- 7.2 AIR COOLING

- 7.2.1 LOW OPERATIONAL AND CAPITAL EXPENDITURE TO DRIVE MARKET

- 7.3 LIQUID COOLING

- 7.3.1 ESCALATING THERMAL DEMANDS OF HIGH-PERFORMANCE COMPUTING AND AI WORKLOADS TO FUEL MARKET GROWTH

- 7.4 HYBRID COOLING

- 7.4.1 RISING AI-DRIVEN WORKLOADS TO FUEL SEGMENTAL GROWTH

8 GPU SERVER MARKET, BY DEPLOYMENT

- 8.1 INTRODUCTION

- 8.2 ON-PREMISES

- 8.2.1 INCREASING INVESTMENTS IN ORCHESTRATION TOOLS FOR RESOURCE ALLOCATION AND GPU MANAGEMENT TO FOSTER MARKET GROWTH

- 8.3 CLOUD-BASED

- 8.3.1 GROWING EMPHASIS ON INTEGRATING AI CAPABILITIES WITH SUSTAINABLE PRACTICES TO FUEL MARKET GROWTH

9 GPU SERVER MARKET, BY FUNCTION

- 9.1 INTRODUCTION

- 9.2 TRAINING

- 9.2.1 INCREASING ADOPTION OF DEEP LEARNING TECHNOLOGIES TO ENHANCE MODEL PRECISION TO SUPPORT MARKET GROWTH

- 9.3 INFERENCE

- 9.3.1 ONGOING ADVANCEMENTS IN GPU TO OFFER IMPROVED ENERGY EFFICIENCY AND LOW LATENCY TO BOOST DEMAND

10 GPU SERVER MARKET, BY FORM FACTOR

- 10.1 INTRODUCTION

- 10.2 RACK-MOUNTED SERVERS

- 10.2.1 SUITABILITY FOR AI TRAINING, DATA ANALYTICS, AND HPC WORKLOADS TO FOSTER MARKET GROWTH

- 10.3 BLADE SERVERS

- 10.3.1 INCREASING PRESSURE ON DATA CENTERS TO OPTIMIZE ENERGY AND SPACE UTILIZATION TO SUPPORT MARKET GROWTH

- 10.4 TOWER SERVERS

- 10.4.1 RISING APPLICATIONS IN SMES, RESEARCH LABS, AND EDGE COMPUTING ENVIRONMENTS TO FUEL MARKET GROWTH

11 GPU SERVER MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- 11.2 GENERATIVE AI

- 11.2.1 RULE-BASED MODELS

- 11.2.1.1 Ability to process data and make consistent, traceable, and reliable decisions to boost demand

- 11.2.2 STATISTICAL MODELS

- 11.2.2.1 Rising demand for improved predictions and enhanced accuracy to fuel market growth

- 11.2.3 DEEP LEARNING

- 11.2.3.1 Proliferation of AI in healthcare, automotive, and consumer electronics to drive market

- 11.2.4 GENERATIVE ADVERSARIAL NETWORKS (GANS)

- 11.2.4.1 Growing application for generating high-quality images and videos for entertainment and marketing to boost demand

- 11.2.5 AUTOENCODERS

- 11.2.5.1 Benefits offered for latency-sensitive tasks like video streaming or real-time decision-making to fuel market growth

- 11.2.6 CONVOLUTIONAL NEURAL NETWORKS (CNNS)

- 11.2.6.1 Increasing demand for advanced image and video analytics to foster market growth

- 11.2.7 TRANSFORMER MODELS

- 11.2.7.1 Ability to capture long-range dependencies within data to support market growth

- 11.2.1 RULE-BASED MODELS

- 11.3 MACHINE LEARNING

- 11.3.1 ABILITY TO PERFORM MASSIVE MATRIX MULTIPLICATIONS TO DRIVE MARKET

- 11.4 NATURAL LANGUAGE PROCESSING

- 11.4.1 DEPLOYMENT IN CHATBOTS, SENTIMENT ANALYSIS, MACHINE TRANSLATION, AND EXTENSIVE LANGUAGE MODELS TO FUEL MARKET GROWTH

- 11.5 COMPUTER VISION

- 11.5.1 ACCELERATED COMPUTATION OF INTRICATE VISUAL DATA AND REDUCED LATENCY TO BOOST DEMAND

12 GPU SERVER MARKET, BY END USER

- 12.1 INTRODUCTION

- 12.2 CLOUD SERVICE PROVIDERS

- 12.2.1 RISING DEMAND FOR COST-EFFECTIVE, FLEXIBLE, AND SCALABLE COMPUTING POWER TO FUEL MARKET GROWTH

- 12.3 ENTERPRISES

- 12.3.1 HEALTHCARE

- 12.3.1.1 Ability to process and analyze vast amounts of medical data quickly and efficiently to drive market

- 12.3.2 BFSI

- 12.3.2.1 Rising need to improve customer service and mitigate risks to fuel market growth

- 12.3.3 AUTOMOTIVE

- 12.3.3.1 Accelerated development of autonomous driving algorithms and ADAS to offer lucrative growth opportunities

- 12.3.4 RETAIL & E-COMMERCE

- 12.3.4.1 Growing need for real-time data processing for personalized product recommendations, and customer behavior analysis to drive market

- 12.3.5 MEDIA & ENTERTAINMENT

- 12.3.5.1 Rise of streaming platforms, gaming, and digital content consumption to augment market growth

- 12.3.6 OTHER ENTERPRISES

- 12.3.1 HEALTHCARE

- 12.4 GOVERNMENT ORGANIZATIONS

- 12.4.1 INCREASING RELIANCE ON AI FOR NATIONAL SECURITY AND DEFENSE SIMULATIONS TO FOSTER MARKET GROWTH

13 GPU SERVER MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 13.2.2 US

- 13.2.2.1 Continuous improvements in AI algorithms and processing capabilities to foster market growth

- 13.2.3 CANADA

- 13.2.3.1 Expanding data center infrastructure to support market growth

- 13.2.4 MEXICO

- 13.2.4.1 Accelerating digital transformation and increasing adoption of cloud computing to drive market

- 13.3 EUROPE

- 13.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 13.3.2 UK

- 13.3.2.1 Significant investments in data center infrastructure to support market growth

- 13.3.3 GERMANY

- 13.3.3.1 Surging adoption in automotive sector to drive market

- 13.3.4 FRANCE

- 13.3.4.1 Growing ecosystem of AI startups to boost demand

- 13.3.5 ITALY

- 13.3.5.1 Emphasis on modernizing industrial sector and developing smart cities to support market growth

- 13.3.6 SPAIN

- 13.3.6.1 Rising availability of data and advancements in AI technology to accelerate market growth

- 13.3.7 REST OF EUROPE

- 13.4 ASIA PACIFIC

- 13.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 13.4.2 CHINA

- 13.4.2.1 Rapid expansion of cloud computing and proliferation of IoT devices to fuel market growth

- 13.4.3 JAPAN

- 13.4.3.1 Increasing collaboration among academic institutions, government agencies, and private companies to advance AI research to boost demand

- 13.4.4 SOUTH KOREA

- 13.4.4.1 Development of advanced AI chips and server solutions to fuel market growth

- 13.4.5 INDIA

- 13.4.5.1 Government-led initiatives to enhance e-governance to boost demand

- 13.4.6 REST OF ASIA PACIFIC

- 13.5 ROW

- 13.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 13.5.2 MIDDLE EAST

- 13.5.2.1 Growing emphasis on digital transformation and technological innovation to foster market growth

- 13.5.2.2 GCC

- 13.5.2.2.1 UAE

- 13.5.2.2.1.1 Establishment of regulatory frameworks to support market growth

- 13.5.2.2.2 Rest of GCC

- 13.5.2.2.1 UAE

- 13.5.2.3 Rest of Middle East

- 13.5.3 AFRICA

- 13.5.3.1 Expansion of data center capacity to drive market

- 13.5.4 SOUTH AMERICA

- 13.5.4.1 Surging demand for cloud services to fuel market growth

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 14.3 MARKET SHARE ANALYSIS, 2024

- 14.4 REVENUE ANALYSIS, 2022-2024

- 14.5 COMPANY VALUATION AND FINANCIAL METRICS

- 14.6 BRAND COMPARISON

- 14.7 COMPANY EVALUATION MATRIX, 2024

- 14.7.1 STARS

- 14.7.2 EMERGING LEADERS

- 14.7.3 PERVASIVE PLAYERS

- 14.7.4 PARTICIPANTS

- 14.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.7.5.1 Company footprint

- 14.7.5.2 Region footprint

- 14.7.5.3 Function footprint

- 14.7.5.4 Deployment footprint

- 14.7.5.5 Application footprint

- 14.7.5.6 End user footprint

- 14.8 STARTUPS/SME EVALUATION MATRIX, 2024

- 14.8.1 PROGRESSIVE COMPANIES

- 14.8.2 RESPONSIVE COMPANIES

- 14.8.3 DYNAMIC COMPANIES

- 14.8.4 STARTING BLOCKS

- 14.8.5 COMPETITIVE BENCHMARKING

- 14.9 COMPETITIVE SCENARIOS

- 14.9.1 PRODUCT LAUNCHES

- 14.9.2 DEALS

- 14.9.3 OTHER DEVELOPMENTS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 DELL INC.

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions/Services offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Deals

- 15.1.1.4 MnM view

- 15.1.1.4.1 Key strengths/Right to win

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses/Competitive threats

- 15.1.2 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions/Services offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Product launches

- 15.1.2.3.2 Deals

- 15.1.2.4 MnM view

- 15.1.2.4.1 Key strengths/Right to win

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses/Competitive threats

- 15.1.3 LENOVO

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions/Services offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Product launches

- 15.1.3.3.2 Deals

- 15.1.3.3.3 Expansions

- 15.1.3.4 MnM view

- 15.1.3.4.1 Key strengths/Right to win

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses/Competitive threats

- 15.1.4 HUAWEI TECHNOLOGIES CO., LTD.

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions/Services offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Deals

- 15.1.4.4 MnM view

- 15.1.4.4.1 Key strengths/Right to win

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses/Competitive threats

- 15.1.5 IBM

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions/Services offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Products launches

- 15.1.5.3.2 Deals

- 15.1.5.4 MnM view

- 15.1.5.4.1 Key strengths/Right to win

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses/Competitive threats

- 15.1.6 H3C TECHNOLOGIES CO., LTD.

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Product launches

- 15.1.6.3.2 Deals

- 15.1.7 CISCO SYSTEMS, INC.

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Deals

- 15.1.8 SUPER MICRO COMPUTER, INC.

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Product launches

- 15.1.8.3.2 Deals

- 15.1.9 FUJITSU

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Deals

- 15.1.10 INSPUR CO., LTD.

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Product launches

- 15.1.10.3.2 Deals

- 15.1.11 ADLINK TECHNOLOGY INC.

- 15.1.11.1 Business overview

- 15.1.11.2 Products/Solutions/Services offered

- 15.1.11.3 Recent developments

- 15.1.11.3.1 Deals

- 15.1.12 QUANTA COMPUTER INC.

- 15.1.12.1 Business overview

- 15.1.12.2 Products/Solutions/Services offered

- 15.1.13 WISTRON CORPORATION

- 15.1.13.1 Business overview

- 15.1.13.2 Products/Solutions/Services offered

- 15.1.13.3 Recent developments

- 15.1.13.3.1 Deals

- 15.1.14 ASUSTEK COMPUTER INC.

- 15.1.14.1 Business overview

- 15.1.14.2 Products/Solutions/Services offered

- 15.1.15 ZTE CORPORATION

- 15.1.15.1 Business overview

- 15.1.15.2 Products/Solutions/Services offered

- 15.1.15.3 Recent developments

- 15.1.15.3.1 Product launches

- 15.1.1 DELL INC.

- 15.2 OTHER PLAYERS

- 15.2.1 NVIDIA CORPORATION

- 15.2.2 ADVANCED MICRO DEVICES, INC.

- 15.2.3 GIGABIT TECHNOLOGIES PVT. LTD

- 15.2.4 AIVRES

- 15.2.5 AIME

- 15.2.6 WIWYNN CORPORATION

- 15.2.7 MITAC COMPUTING TECHNOLOGY CORPORATION

- 15.2.8 NEC CORPORATION

- 15.2.9 2CRSI GROUP

- 15.2.10 PENGUIN COMPUTING

- 15.2.11 SYSTEM76

- 15.2.12 SERVER SIMPLY

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

List of Tables

- TABLE 1 GPU SERVER MARKET: RISK ANALYSIS

- TABLE 2 COMPARATIVE OVERVIEW OF NVIDIA'S HIGH-PERFORMANCE GPU PLATFORMS EXCEEDING TDP VALUES 1 KW

- TABLE 3 ROLE OF KEY PLAYERS IN GPU SERVER ECOSYSTEM

- TABLE 4 PRICING RANGE OF GPU SERVERS, BY KEY PLAYER, 2024 (USD)

- TABLE 5 AVERAGE SELLING PRICE TREND OF GPU SERVERS, BY REGION, 2021-2024 (USD)

- TABLE 6 LIST OF MAJOR PATENTS, 2023-2025

- TABLE 7 IMPORT SCENARIO FOR HS CODE 847150-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 8 EXPORT SCENARIO FOR HS CODE 847150-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 9 GPU SERVER MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS (%)

- TABLE 11 KEY BUYING CRITERIA FOR END USERS

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 STANDARDS

- TABLE 17 LIST OF KEY CONFERENCES AND EVENTS. 2025-2026

- TABLE 18 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 19 GPU SERVER MARKET, BY COOLING TECHNOLOGY, 2021-2024 (USD BILLION)

- TABLE 20 GPU SERVER MARKET, BY COOLING TECHNOLOGY, 2025-2030 (USD BILLION)

- TABLE 21 GPU SERVER MARKET, BY DEPLOYMENT, 2021-2024 (USD BILLION)

- TABLE 22 GPU SERVER MARKET, BY DEPLOYMENT, 2025-2030 (USD BILLION)

- TABLE 23 ON-PREMISES: GPU SERVER MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 24 ON-PREMISES: GPU SERVER MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 25 CLOUD-BASED: GPU SERVER MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 26 CLOUD-BASED: GPU SERVER MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 27 GPU SERVER MARKET, BY FUNCTION, 2021-2024 (THOUSAND UNITS)

- TABLE 28 GPU SERVER MARKET, BY FUNCTION, 2025-2030 (THOUSAND UNITS)

- TABLE 29 GPU SERVER MARKET, BY FUNCTION, 2021-2024 (USD BILLION)

- TABLE 30 GPU SERVER MARKET, BY FUNCTION, 2025-2030 (USD BILLION)

- TABLE 31 GPU SERVER MARKET, BY FORM FACTOR, 2021-2024 (USD BILLION)

- TABLE 32 GPU SERVER MARKET, BY FORM FACTOR, 2025-2030 (USD BILLION)

- TABLE 33 GPU SERVER MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 34 GPU SERVER MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 35 GENERATIVE AI: GPU SERVER MARKET, BY TYPE, 2021-2024 (USD BILLION)

- TABLE 36 GENERATIVE AI: GPU SERVER MARKET, BY TYPE, 2025-2030 (USD BILLION)

- TABLE 37 GPU SERVER MARKET, BY END USER, 2021-2024 (USD BILLION)

- TABLE 38 GPU SERVER MARKET, BY END USER, 2025-2030 (USD BILLION)

- TABLE 39 CLOUD SERVICE PROVIDERS: GPU SERVER MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 40 CLOUD SERVICE PROVIDERS: GPU SERVER MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 41 CLOUD SERVICE PROVIDERS: GPU SERVER MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 42 CLOUD SERVICE PROVIDERS: GPU SERVER MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 43 CLOUD SERVICE PROVIDERS: GPU SERVER MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 44 CLOUD SERVICE PROVIDERS: GPU SERVER MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 45 CLOUD SERVICE PROVIDERS: GPU SERVER MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 46 CLOUD SERVICE PROVIDERS: GPU SERVER MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 47 CLOUD SERVICE PROVIDERS: GPU SERVER MARKET IN ROW, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 48 CLOUD SERVICE PROVIDERS: GPU SERVER MARKET IN ROW, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 49 GPU SERVER MARKET, BY ENTERPRISE TYPE, 2021-2024 (USD BILLION)

- TABLE 50 GPU SERVER MARKET, BY ENTERPRISE TYPE, 2025-2030 (USD BILLION)

- TABLE 51 ENTERPRISES: GPU SERVER MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 52 ENTERPRISES: GPU SERVER MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 53 ENTERPRISES: GPU SERVER MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 54 ENTERPRISES: GPU SERVER MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 55 ENTERPRISES: GPU SERVER MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 56 ENTERPRISES: GPU SERVER MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 57 ENTERPRISES: GPU SERVER MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 58 ENTERPRISES: GPU SERVER MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 59 ENTERPRISES: GPU SERVER MARKET IN ROW, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 60 ENTERPRISES: GPU SERVER MARKET IN ROW, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 61 HEALTHCARE: GPU SERVER MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 62 HEALTHCARE: GPU SERVER MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 63 HEALTHCARE: GPU SERVER MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 64 HEALTHCARE: GPU SERVER MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 65 HEALTHCARE: GPU SERVER MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 66 HEALTHCARE: GPU SERVER MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 67 HEALTHCARE: GPU SERVER MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 68 HEALTHCARE: GPU SERVER MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 69 HEALTHCARE: GPU SERVER MARKET IN ROW, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 70 HEALTHCARE: GPU SERVER MARKET IN ROW, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 71 BFSI: GPU SERVER MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 72 BFSI: GPU SERVER MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 73 BFSI: GPU SERVER MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 74 BFSI: GPU SERVER MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 75 BFSI: GPU SERVER MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 76 BFSI: GPU SERVER MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 77 BFSI: GPU SERVER MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 78 BFSI: GPU SERVER MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 79 BFSI: GPU SERVER MARKET IN ROW, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 80 BFSI: GPU SERVER MARKET IN ROW, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 81 AUTOMOTIVE: GPU SERVER MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 82 AUTOMOTIVE: GPU SERVER MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 83 AUTOMOTIVE: GPU SERVER MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 84 AUTOMOTIVE: GPU SERVER MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 85 AUTOMOTIVE: GPU SERVER MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 86 AUTOMOTIVE: GPU SERVER MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 87 AUTOMOTIVE: GPU SERVER MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 88 AUTOMOTIVE: GPU SERVER MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 89 AUTOMOTIVE: GPU SERVER MARKET IN ROW, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 90 AUTOMOTIVE: GPU SERVER MARKET IN ROW, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 91 RETAIL & E-COMMERCE: GPU SERVER MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 92 RETAIL & E-COMMERCE: GPU SERVER MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 93 RETAIL & E-COMMERCE: GPU SERVER MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 94 RETAIL & E-COMMERCE: GPU SERVER MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 95 RETAIL & E-COMMERCE: GPU SERVER MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 96 RETAIL & E-COMMERCE: GPU SERVER MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 97 RETAIL & E-COMMERCE: GPU SERVER MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 98 RETAIL & E-COMMERCE: GPU SERVER MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 99 RETAIL & E-COMMERCE: GPU SERVER MARKET IN ROW, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 100 RETAIL & E-COMMERCE: GPU SERVER MARKET IN ROW, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 101 MEDIA & ENTERTAINMENT: GPU SERVER MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 102 MEDIA & ENTERTAINMENT: GPU SERVER MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 103 MEDIA & ENTERTAINMENT: GPU SERVER MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 104 MEDIA & ENTERTAINMENT: GPU SERVER MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 105 MEDIA & ENTERTAINMENT: GPU SERVER MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 106 MEDIA & ENTERTAINMENT: GPU SERVER MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 107 MEDIA & ENTERTAINMENT: GPU SERVER MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 108 MEDIA & ENTERTAINMENT: GPU SERVER MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 109 MEDIA & ENTERTAINMENT: ROW GPU SERVER MARKET, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 110 MEDIA & ENTERTAINMENT: GPU SERVER MARKET IN ROW, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 111 OTHER ENTERPRISES: GPU SERVER MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 112 OTHER ENTERPRISES: GPU SERVER MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 113 OTHER ENTERPRISES: GPU SERVER MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 114 OTHER ENTERPRISES: GPU SERVER MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 115 OTHER ENTERPRISES: GPU SERVER MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 116 OTHER ENTERPRISES: GPU SERVER MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 117 OTHER ENTERPRISES: GPU SERVER MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 118 OTHER ENTERPRISES: GPU SERVER MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 119 OTHER ENTERPRISES: ROW GPU SERVER MARKET, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 120 OTHER ENTERPRISES: GPU SERVER MARKET IN ROW, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 121 GOVERNMENT ORGANIZATIONS: GPU SERVER MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 122 GOVERNMENT ORGANIZATIONS: GPU SERVER MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 123 GOVERNMENT ORGANIZATIONS: GPU SERVER MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 124 GOVERNMENT ORGANIZATIONS: GPU SERVER MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 125 GOVERNMENT ORGANIZATIONS: GPU SERVER MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 126 GOVERNMENT ORGANIZATIONS: GPU SERVER MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 127 GOVERNMENT ORGANIZATIONS: GPU SERVER MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 128 GOVERNMENT ORGANIZATIONS: GPU SERVER MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 129 GOVERNMENT ORGANIZATIONS: GPU SERVER MARKET IN ROW, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 130 GOVERNMENT ORGANIZATIONS: GPU SERVER MARKET IN ROW, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 131 GPU SERVER MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 132 GPU SERVER MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 133 NORTH AMERICA: GPU SERVER MARKET, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 134 NORTH AMERICA: GPU SERVER MARKET, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 135 NORTH AMERICA: GPU SERVER MARKET, BY DEPLOYMENT, 2021-2024 (USD BILLION)

- TABLE 136 NORTH AMERICA: GPU SERVER MARKET, BY DEPLOYMENT, 2025-2030 (USD BILLION)

- TABLE 137 NORTH AMERICA: GPU SERVER MARKET, BY END USER, 2021-2024 (USD BILLION)

- TABLE 138 NORTH AMERICA: GPU SERVER MARKET, BY END USER, 2025-2030 (USD BILLION)

- TABLE 139 NORTH AMERICA: GPU SERVER MARKET, BY ENTERPRISE TYPE, 2021-2024 (USD BILLION)

- TABLE 140 NORTH AMERICA: GPU SERVER MARKET, BY ENTERPRISE TYPE, 2025-2030 (USD BILLION)

- TABLE 141 EUROPE: GPU SERVER MARKET, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 142 EUROPE: GPU SERVER MARKET, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 143 EUROPE: GPU SERVER MARKET, BY DEPLOYMENT, 2021-2024 (USD BILLION)

- TABLE 144 EUROPE: GPU SERVER MARKET, BY DEPLOYMENT, 2025-2030 (USD BILLION)

- TABLE 145 EUROPE: GPU SERVER MARKET, BY END USER, 2021-2024 (USD BILLION)

- TABLE 146 EUROPE: GPU SERVER MARKET, BY END USER, 2025-2030 (USD BILLION)

- TABLE 147 EUROPE: GPU SERVER MARKET, BY ENTERPRISE TYPE, 2021-2024 (USD BILLION)

- TABLE 148 EUROPE: GPU SERVER MARKET, BY ENTERPRISE TYPE, 2025-2030 (USD BILLION)

- TABLE 149 ASIA PACIFIC: GPU SERVER MARKET, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 150 ASIA PACIFIC: GPU SERVER MARKET, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 151 ASIA PACIFIC: GPU SERVER MARKET, BY DEPLOYMENT, 2021-2024 (USD BILLION)

- TABLE 152 ASIA PACIFIC: GPU SERVER MARKET, BY DEPLOYMENT, 2025-2030 (USD BILLION)

- TABLE 153 ASIA PACIFIC: GPU SERVER MARKET, BY END USER, 2021-2024 (USD BILLION)

- TABLE 154 ASIA PACIFIC: GPU SERVER MARKET, BY END USER, 2025-2030 (USD BILLION)

- TABLE 155 ASIA PACIFIC: GPU SERVER MARKET, BY ENTERPRISE TYPE, 2021-2024 (USD BILLION)

- TABLE 156 ASIA PACIFIC: GPU SERVER MARKET, BY ENTERPRISE TYPE, 2025-2030 (USD BILLION)

- TABLE 157 ROW: GPU SERVER MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 158 ROW: GPU SERVER MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 159 ROW: GPU SERVER MARKET, BY DEPLOYMENT, 2021-2024 (USD BILLION)

- TABLE 160 ROW: GPU SERVER MARKET, BY DEPLOYMENT, 2025-2030 (USD BILLION)

- TABLE 161 ROW: GPU SERVER MARKET, BY END USER, 2021-2024 (USD BILLION)

- TABLE 162 ROW: GPU SERVER MARKET, BY END USER, 2025-2030 (USD BILLION)

- TABLE 163 ROW: GPU SERVER MARKET, BY ENTERPRISE TYPE, 2021-2024 (USD BILLION)

- TABLE 164 ROW: GPU SERVER MARKET, BY ENTERPRISE TYPE, 2025-2030 (USD BILLION)

- TABLE 165 MIDDLE EAST: GPU SERVER MARKET, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 166 MIDDLE EAST: GPU SERVER MARKET, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 167 GCC: GPU SERVER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 168 GCC: GPU SERVER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 169 GPU SERVER MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2021-JUNE 2025

- TABLE 170 GPU SERVER MARKET SHARE ANALYSIS, 2024

- TABLE 171 GPU SERVER MARKET: REGION FOOTPRINT

- TABLE 172 GPU SERVER MARKET: FUNCTION FOOTPRINT

- TABLE 173 GPU SERVER MARKET: DEPLOYMENT FOOTPRINT

- TABLE 174 GPU SERVER MARKET: APPLICATION FOOTPRINT

- TABLE 175 GPU SERVER MARKET: END USER FOOTPRINT

- TABLE 176 GPU SERVER MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 177 GPU SERVER MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 178 GPU SERVER MARKET: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 179 GPU SERVER MARKET: DEALS, JANUARY 2021-JUNE 2025

- TABLE 180 GPU SERVER MARKET: OTHER DEVELOPMENTS, JANUARY 2021-JUNE 2025

- TABLE 181 DELL INC.: COMPANY OVERVIEW

- TABLE 182 DELL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 183 DELL INC.: DEALS

- TABLE 184 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP: COMPANY OVERVIEW

- TABLE 185 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP: PRODUCT LAUNCHES

- TABLE 187 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP: DEALS

- TABLE 188 LENOVO: COMPANY OVERVIEW

- TABLE 189 LENOVO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 LENOVO: PRODUCT LAUNCHES

- TABLE 191 LENOVO: DEALS

- TABLE 192 LENOVO: EXPANSIONS

- TABLE 193 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY OVERVIEW

- TABLE 194 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 HUAWEI TECHNOLOGIES CO., LTD.: DEALS

- TABLE 196 IBM: COMPANY OVERVIEW

- TABLE 197 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 IBM: PRODUCT LAUNCHES

- TABLE 199 IBM: DEALS

- TABLE 200 H3C TECHNOLOGIES CO., LTD.: COMPANY OVERVIEW

- TABLE 201 H3C TECHNOLOGIES CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 202 H3C TECHNOLOGIES CO., LTD.: PRODUCT LAUNCHES

- TABLE 203 H3C TECHNOLOGIES CO., LTD.: DEALS

- TABLE 204 CISCO SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 205 CISCO SYSTEMS, INC.: PRODUCT LAUNCHES

- TABLE 206 CISCO SYSTEMS, INC.: DEALS

- TABLE 207 SUPER MICRO COMPUTER, INC.: COMPANY OVERVIEW

- TABLE 208 SUPER MICRO COMPUTER, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 SUPER MICRO COMPUTER, INC.: PRODUCT LAUNCHES

- TABLE 210 SUPER MICRO COMPUTER, INC.: DEALS

- TABLE 211 FUJITSU: COMPANY OVERVIEW

- TABLE 212 FUJITSU: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 FUJITSU: DEALS

- TABLE 214 INSPUR CO., LTD.: COMPANY OVERVIEW

- TABLE 215 INSPUR CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 INSPUR CO., LTD.: PRODUCT LAUNCHES

- TABLE 217 INSPUR CO., LTD.: DEALS

- TABLE 218 ADLINK TECHNOLOGY INC.: COMPANY OVERVIEW

- TABLE 219 ADLINK TECHNOLOGY INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 ADLINK TECHNOLOGY INC.: DEALS

- TABLE 221 QUANTA COMPUTER INC.: COMPANY OVERVIEW

- TABLE 222 QUANTA COMPUTER INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 WISTRON CORPORATION: COMPANY OVERVIEW

- TABLE 224 WISTRON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 WISTRON CORPORATION: DEALS

- TABLE 226 ASUSTEK COMPUTER INC.: COMPANY OVERVIEW

- TABLE 227 ASUSTEK COMPUTER INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 ZTE CORPORATION: COMPANY OVERVIEW

- TABLE 229 ZTE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 ZTE CORPORATION: PRODUCT LAUNCHES

List of Figures

- FIGURE 1 GPU SERVER MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 GPU SERVER MARKET: RESEARCH DESIGN

- FIGURE 3 GPU SERVER MARKET: RESEARCH FLOW OF MARKET SIZE ESTIMATION

- FIGURE 4 GPU SERVER MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 5 GPU SERVER MARKET: BOTTOM-UP APPROACH

- FIGURE 6 GPU SERVER MARKET: TOP-DOWN APPROACH

- FIGURE 7 GPU SERVER MARKET: DATA TRIANGULATION

- FIGURE 8 INFERENCE SEGMENT TO GARNER HIGHER MARKET SHARE IN 2030

- FIGURE 9 LIQUID COOLING SEGMENT TO WITNESS HIGHEST MARKET SHARE IN 2025

- FIGURE 10 RACK-MOUNTED SERVER SEGMENT DOMINATED MARKET IN 2024

- FIGURE 11 CLOUD-BASED SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2030

- FIGURE 12 MACHINE LEARNING SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 13 CLOUD SERVICE PROVIDER SEGMENT TO LEAD MARKET IN 2025

- FIGURE 14 NORTH AMERICA HELD LARGEST MARKET SHARE IN 2024

- FIGURE 15 RISING DEMAND FOR GPU-BASED GPU SERVERS TO BOOST MARKET GROWTH

- FIGURE 16 LIQUID COOLING SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 17 RACK-MOUNTED SERVERS TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 18 HEALTHCARE SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 19 CHINA TO REGISTER HIGHEST CAGR IN GLOBAL GPU SERVER MARKET DURING FORECAST PERIOD

- FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 GPU SERVER MARKET: DRIVERS AND THEIR IMPACT

- FIGURE 22 POWER CONSUMPTION OF NVIDIA DATACENTER GPUS BY TDP CLASSIFICATION (2016-2024)

- FIGURE 23 POWER CONSUMPTION OF INTEL DATACENTER GPUS BY TDP CLASSIFICATION (2022-2024)

- FIGURE 24 GPU SERVER MARKET: RESTRAINTS AND THEIR IMPACT

- FIGURE 25 GPU SERVER MARKET: OPPORTUNITIES AND THEIR IMPACT

- FIGURE 26 GPU SERVER MARKET: CHALLENGES AND THEIR IMPACT

- FIGURE 27 GPU SERVER MARKET: VALUE CHAIN ANALYSIS

- FIGURE 28 GPU SERVER ECOSYSTEM ANALYSIS

- FIGURE 29 PRICING RANGE OF GPU SERVER TYPES, BY KEY PLAYER, 2024

- FIGURE 30 AVERAGE SELLING PRICE TREND OF GPU SERVERS, BY REGION, 2021-2024

- FIGURE 31 INVESTMENT AND FUNDING SCENARIO, 2023-2024

- FIGURE 32 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 33 PATENTS APPLIED AND GRANTED, 2015-2025

- FIGURE 34 IMPORT DATA FOR HS CODE 847150-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 35 EXPORT DATA FOR HS CODE 847150-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 36 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 37 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

- FIGURE 38 KEY BUYING CRITERIA FOR END USERS

- FIGURE 39 LIQUID COOLING SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 ON-PREMISES SEGMENT TO DISPLAY HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 41 TRAINING FUNCTION TO REGISTER HIGHER CAGR IN GPU SERVER MARKET DURING FORECAST PERIOD

- FIGURE 42 RACK-MOUNTED SERVERS TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 43 GENERATIVE AI TO EXPAND AT HIGHEST CAGR IN GPU SERVER MARKET DURING FORECAST PERIOD

- FIGURE 44 ENTERPRISES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 45 ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 46 NORTH AMERICA: GPU SERVER MARKET SNAPSHOT

- FIGURE 47 US TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 48 EUROPE: GPU SERVER MARKET SNAPSHOT

- FIGURE 49 GERMANY TO DISPLAY HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 50 ASIA PACIFIC: GPU SERVER MARKET SNAPSHOT

- FIGURE 51 CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 52 MIDDLE EAST TO RECORD HIGHEST CAGR IN ROW DURING FORECAST PERIOD

- FIGURE 53 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2024

- FIGURE 54 REVENUE ANALYSIS, 2022-2024

- FIGURE 55 COMPANY VALUATION

- FIGURE 56 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 57 BRAND COMPARISON

- FIGURE 58 GPU SERVER MARKET: COMPANY EVALUATION MATRIX, 2024

- FIGURE 59 GPU SERVER MARKET: COMPANY FOOTPRINT

- FIGURE 60 GPU SERVER MARKET: STARTUP/SME EVALUATION MATRIX, 2024

- FIGURE 61 DELL INC.: COMPANY SNAPSHOT

- FIGURE 62 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP: COMPANY SNAPSHOT

- FIGURE 63 LENOVO: COMPANY SNAPSHOT

- FIGURE 64 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY SNAPSHOT

- FIGURE 65 IBM: COMPANY SNAPSHOT

- FIGURE 66 CISCO SYSTEMS, INC.: COMPANY SNAPSHOT

- FIGURE 67 SUPER MICRO COMPUTER, INC.: COMPANY SNAPSHOT

- FIGURE 68 FUJITSU: COMPANY SNAPSHOT

- FIGURE 69 ADLINK TECHNOLOGY INC.: COMPANY SNAPSHOT

- FIGURE 70 QUANTA COMPUTER INC.: COMPANY SNAPSHOT

- FIGURE 71 WISTRON CORPORATION: COMPANY SNAPSHOT

- FIGURE 72 ASUSTEK COMPUTER INC.: COMPANY SNAPSHOT

- FIGURE 73 ZTE CORPORATION: COMPANY SNAPSHOT