|

市場調查報告書

商品編碼

1796192

全球加油站市場:按收益模式、地區/國家、經營模式、相關人員分析、競爭基準化分析和地理區域分類 - 預測至 2035 年Forecourts Market by Revenue Model, Region/Country, Business Models, Stakeholder Mapping, Competitive Benchmarking - Global Forecast to 2035 |

|||||||

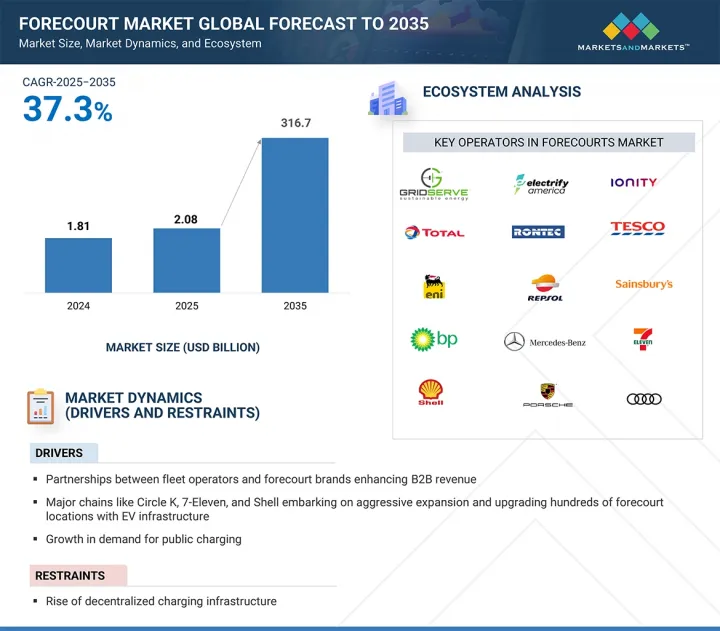

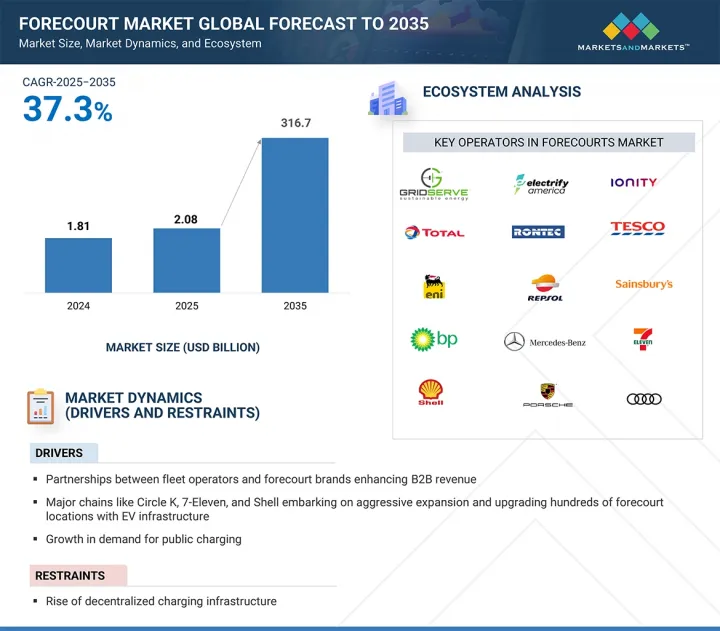

預計加油站市場規模將從 2024 年的 70 億美元成長到 2035 年的 3,166 億美元,複合年成長率為 37.3%。

| 調查範圍 | |

|---|---|

| 調查年份 | 2024-2035 |

| 基準年 | 2024 |

| 預測期 | 2025-2035 |

| 對價單位 | 金額(十億美元) |

| 部分 | 按動力、車輛類型、載重指數、應用、輪圈尺寸、銷售管道和地區 |

| 目標區域 | 北美、歐洲、亞太地區 |

全球各國政府正透過補貼電動車充電和建設加油站基礎設施來推動清潔出行。這些政策措施既支持資本投資,也支持加油站部署和營運的長期成長。

在加油站市場,充電樁收益佔最大佔有率,這主要得益於電動車(EV)的快速普及以及政府推出的鼓勵電氣化的支持性政策。隨著電動車用戶在充電站花費的時間越來越多,他們也擴大參與購物、餐飲和汽車保養等輔助活動。這種消費行為顯著提高了附加價值服務的收益。此外,整合電池儲能系統(BESS)使加油站能夠在高峰需求時段出售儲存的電力,並利用波動的能源市場。由於預計這些尖峰時段的能源價格將上漲,預計在預測期內,能源儲存部門的收益潛力將大幅成長。

能源儲存(BESS) 和車輛到電網 (V2G) 等儲能技術正在蓬勃發展。這些技術不再只是一種附加元件,而是正在成為核心收益來源。電動車的日益普及對電網基礎設施帶來越來越大的壓力,需要更智慧、分散式的能源管理解決方案。電池儲能系統 (BESS) 和車輛到電網 (V2G) 為加油站提供了一種盈利的收益模式,不僅能分配能源,還能儲存、管理和交易能源。因此,預計在 2025 年至 2035 年期間,加油站能源儲存服務的收益將呈指數級成長。

此外,作為電池儲能系統 (BESS) 和車輛到電網 (V2G) 核心的鋰離子電池組成本大幅下降,從而減少了加油站營運商的資本支出。隨著電池技術的不斷成熟和規模經濟的實現,部署將變得更加經濟實惠且更具可擴展性。因此,預計這一趨勢將在加速能源儲存服務的普及方面發揮關鍵作用。

在亞太地區,由於靠近高速公路和城市入口戰略定位,加油站客流量依然居高不下,因此成為安裝電動車充電樁的優先選擇。這些地點交通便利,且能夠容納大量車輛,是快速充電基礎設施的理想選擇。此外,電動車充電的典型停留時間接近30分鐘,這非常符合客戶尋求快速便捷和短暫休息的使用模式。

歐洲日益嚴格的排放法規和歐盟綠色新政正在推動全部區域邁向清潔。加油站正在透過安裝電動車充電基礎設施來適應這一趨勢,並將自己定位為轉型的支柱。此外,道達爾能源、英國石油和意昂集團等大型能源公司正在投資升級歐洲各地的加油站,並支持推出數千個新的充電樁和智慧零售站。

公共交通和電動車生態系統的不斷發展,以及能源巨頭的大量投資,預計將推動歐洲和亞太地區的加油站市場的發展。

目錄

第1章執行摘要

第2章 關鍵市場趨勢與動向

- 透過多樣化服務改善客戶體驗

- 客戶體驗(服務實施):雲端基礎和人工智慧的加油站

- 新用例:定位服務

- 定位服務:GRIDSEVE案例研究

- 新能源經營模式

- 定位服務:GridServe 透過能源創新實現 1.5 倍收益潛力的案例(第 1 部分,共 2 部分)

- 加油站積極發展太陽能發電業務而無需額外收入(2/2)

- 有利的法規環境

第3章案例研究

- GRIDSERVE

- ENI - ENILIVE

- CIRCLE K

- SHELL RECHARGE

- ELECTRIFY AMERICA

- PORSCHE CHARGING LOUNGE

- AUDI

第4章相關利益者分析與競爭基準測試

- 加油站營運商概述

- 競爭基準測試

- 電子加油站及獨立加油站零售商

- C 商店

- 能源參與企業

- 電子加油站相關利益者地圖:展望未來

第5章加油站基礎設施與營運成本

- 加油站基礎設施:GRIDSEVE

- 電動加油站:資本支出與營運支出

第6章 市場潛力與商業案例

- 電子加油站收益模式

- 預計 2025 年至 2035 年間,歐洲充電站收益的複合年成長率將達到 33% 左右

- 歐洲超過 6% 的加油站設有電動車充電樁

- 預計 2025 年至 2035 年期間北美充電站收益的複合年成長率約為 44%

- 在北美,大約 3% 的加油站設有電動車充電站。

- 在亞太地區,預計 2025 年至 2035 年期間,電動車充電站的收益將以約 33% 的複合年成長率成長

- 在亞太地區,約有 2% 的加油站設有電動車充電樁

- 電子停車領域 BESS 和 V2G 的全球年收益潛力

- 中國配備 BESS 和 V2G 的電動車加氣站的預測收益和單位經濟效益(2024-2035 年)

- 德國配備 BESS 和 V2G 的電動車加油站預計收益和單位經濟效益(2024-2035 年)

- 美國使用 BESS 和 V2G 的電子加油站收益和單位經濟效益(2024-2035 年)

- 對中國、德國和美國BESS 和 V2G 發展的關鍵見解

- 預計 2024 年至 2035 年間,電子停車普及率的複合年成長率約為 29%

- 預計 2024 年至 2035 年間充電樁滲透率將以約 28% 的複合年成長率成長

- 能源儲存經營模式的滲透

- 策略結論

第7章 附錄

- BESS 商業案例的關鍵假設和 E-Fuel Station S 的盈利

- 策略結論關鍵假設 V2G 商業案例和電子加油站盈利

- 策略結論

The forecourts market is projected to grow from USD 7.0 billion in 2024 to USD 316.6 billion by 2035 at a CAGR of 37.3%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2035 |

| Base Year | 2024 |

| Forecast Period | 2025-2035 |

| Units Considered | Value (USD Billion) |

| Segments | Propulsion, Vehicle Type, Load Index, Application, Rim Size, Sales Channel, and Region |

| Regions covered | North America, Europe, and Asia Pacific |

Globally, governments are promoting clean mobility through subsidies for EV charging and forecourt infrastructure development. These policy measures support both capital investment and long-term growth in forecourt deployment and operations.

The revenue from charging points segment holds the largest share in the forecourts market, primarily driven by the rapid rise in electric vehicle (EV) adoption and supportive government policies encouraging electrification. As EV users spend more time at charging stations, they are increasingly engaging in ancillary activities such as shopping, dining, or vehicle care. This consumer behavior is significantly boosting the revenue generated from value-added services. Furthermore, the integration of grid-connected battery energy storage systems (BESS) enables forecourts to capitalize on fluctuating energy markets by selling stored electricity during peak demand periods. With energy prices expected to rise during these peak intervals, the revenue potential from the energy storage segment is projected to grow substantially over the forecast period.

Revenue from Energy Storage Service (BESS and V2G) segment to register highest growth

There is a surge in energy storage technologies like BESS and Vehicle-to-Grid (V2G). These technologies are no longer complementary add-ons but are emerging as central revenue streams. With the expansion of EV adoption, the pressure on grid infrastructure is mounting, necessitating smarter, decentralized energy management solutions. BESS and V2G offer forecourts a profitable revenue model, where energy is not just dispensed but also stored, managed, and traded. Therefore, between 2025 and 2035, the revenue generated from energy storage services at forecourts is expected to grow exponentially.

Moreover, the cost of lithium-ion battery packs-central to both BESS and V2G-has declined significantly, reducing capital expenditure for forecourt operators. As battery technology continues to mature and economies of scale are achieved, implementation becomes more affordable and scalable. Therefore, this trend is expected to play a key role in accelerating the adoption of energy storage services.

Asia Pacific and Europe to hold significant shares in forecourts market

In Asia Pacific, footfall at forecourts remains high due to their strategic locations-near highways and urban entry points, they are being prioritized for EV charging point installation. These sites serve as ideal locations for fast-charging infrastructure due to their accessibility and ability to handle high volumes of vehicles. Additionally, the typical dwell time of nearly half an hour during EV charging aligns well with the usage patterns of customers seeking quick convenience or rest stops.

Europe's stringent emission norms and the EU green deal are pushing the entire region toward clean mobility. Forecourts are adapting by installing EV charging infrastructure, positioning themselves as pillars of the transition. Additionally, major energy players like TotalEnergies, BP, and E.ON are investing in forecourt upgrades across Europe, supporting the rollout of thousands of new charging points and smart retail stations.

The ongoing developments in public transit and EV ecosystem, coupled with the high investment from energy giants, are projected to drive the forecourts market in the European and Asia Pacific regions.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and strategy directors, and executives from various key organizations operating in this market.

- By Company Type: Energy Players-45%, Convenience stores-25%, OEMs-5%, Charging Point Operators-10%, E-forecourt Retailers -15%

- By Designation: C Level- 40%, Directors- 40%, and Others- 20%

- By Region: North America- 20%, Europe- 30%, and Asia Pacific- 30%,

The forecourts market is led by established players such as GRIDSERVE (UK), Motor Fuel Group (MFG) (UK), Rontec (UK), Circle K (US), and SHELL RECHARGE (US).

Key Benefits of Buying the Report:

The forecourts market report will help market leaders and new entrants with information on the revenue segments of forecourts, including revenue from charging, value-added services, and energy storage systems. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the market's pulse and provides information on key market drivers, restraints, and opportunities.

The report provides insights into the following points:

Analysis of key drivers (charging points as revenue-generating hubs, rise in EV adoption), restraints (rise of decentralized charging infrastructure, cost and convenience of home charging), opportunities (monetization through BESS, V2G as a two-way revenue stream) influencing the forecourts market

Product Development/Innovation: Detailed insights into development activities, upcoming BESS and V2G project plans in the forecourts market

Market Development: Comprehensive information about the lucrative market (the report analyzes the forecourts market across varied regions)

Market Diversification: Exhaustive information about business opportunities, revenue potential, untapped geographies, and investments in the forecourts market

Competitive Assessment: In-depth assessment of growth strategies, and service offerings of leading players like GRIDSERVE (UK), Motor Fuel Group (MFG) (UK), Rontec (UK), Circle K (US), and SHELL RECHARGE (US) in the forecourts market

TABLE OF CONTENTS

1. EXECUTIVE SUMMARY

2. KEY MARKET TRENDS AND DEVELOPMENTS

- 2.1 ENHANCING CUSTOMER EXPERIENCE THROUGH SERVICE DIVERSIFICATION

- 2.1.1 CUSTOMER EXPERIENCE (SERVICE IMPLEMENTATION): CLOUD-BASED AND AI-LED FORECOURTS

- 2.2 EMERGING USE CASES: LOCATION-BASED SERVICES

- 2.2.1 LOCATION-BASED SERVICES: GRIDSERVE CASE STUDY

- 2.3 NEW ENERGY BUSINESS MODELS

- 2.3.1 LOCATION-BASED SERVICES: GRIDSERVE CASE 1.5X REVENUE POTENTIAL THROUGH ENERGY INNOVATION (1/2)

- 2.3.2 FUEL FORECOURTS ARE ACTIVELY 'SOLARIZING' OPERATIONS WITHOUT EARNING ADDITIONAL REVENUES (2/2)

- 2.4 FAVORABLE REGULATORY ENVIRONMENT

3. CASE STUDIES

- 3.1 GRIDSERVE

- 3.2 ENI - ENILIVE

- 3.3 CIRCLE K

- 3.4 SHELL RECHARGE

- 3.5 ELECTRIFY AMERICA

- 3.6 PORSCHE CHARGING LOUNGE

- 3.7 AUDI

4. STAKEHOLDER MAPPING & COMPETITOR BENCHMARKING

- 4.1 OVERVIEW OF FORECOURT OPERATORS

- 4.2 COMPETITOR BENCHMARKING

- 4.2.1 E-FORECOURT & INDEPENDENT FORECOURT RETAILER

- 4.2.2 C-STORES

- 4.2.3 ENERGY PLAYERS

- 4.3 E-FORECOURT STAKEHOLDER MAPPING: FUTURE OUTLOOK

5. FORECOURT INFRASTRUCTURE AND COST TO OPERATOR

- 5.1 FORECOURT INFRASTRUCTURE: GRIDSERVE

- 5.2 E-FORECOURTS: CAPEX AND OPEX

6. MARKET POTENTIAL AND BUSINESS CASE

- 6.1 E-FORECOURTS REVENUE MODELS

- 6.1.1 REVENUE FROM CHARGING POINTS IN EUROPE TO GROW AT A CAGR OF ~33% BETWEEN 2025 AND 2035

- 6.1.2 IN EUROPE, MORE THAN 6% OF FORECOURTS HAVE EV CHARGING POINTS

- 6.1.3 REVENUE FROM CHARGING POINTS IN NORTH AMERICA TO GROW AT CAGR OF ~44% FROM 2025 TO 2035

- 6.1.4 IN NORTH AMERICA, NEARLY 3% OF FORECOURTS HAVE EV CHARGING POINTS.

- 6.1.5 REVENUE FROM EV CHARGING FROM FORECOURT IS EXPECTED TO GROW AT A CAGR OF ~33% FROM 2025 TO 2035 IN ASIA PACIFIC.

- 6.1.6 IN ASIA PACIFIC, NEARLY 2% OF FORECOURTS HAVE EV CHARGING POINTS

- 6.2 GLOBAL ANNUAL REVENUE POTENTIAL OF BESS AND V2G IN E-FORECOURTS

- 6.2.1 PROJECTED REVENUE AND UNIT ECONOMICS OF E-FORECOURTS WITH BESS AND V2G IN CHINA (2024-2035)

- 6.2.2 PROJECTED REVENUE & UNIT ECONOMICS OF E-FORECOURTS WITH BESS AND V2G IN GERMANY (2024-2035)

- 6.2.3 PROJECTED REVENUE & UNIT ECONOMICS OF E-FORECOURTS WITH BESS AND V2G IN US (2024-2035)

- 6.3 KEY INSIGHTS ON BESS AND V2G DEVELOPMENTS IN CHINA, GERMANY, AND US

- 6.4 PENETRATION OF E-FORECOURTS TO GROW AT A CAGR OF ~29% FROM 2024 TO 2035

- 6.5 PENETRATION OF CHARGING POINTS TO GROW AT A CAGR OF ~28% FROM 2024 TO 2035

- 6.6 PENETRATION OF ENERGY STORAGE BUSINESS MODELS

- 6.7 STRATEGIC CONCLUSIONS

7. APPENDIX

- 7.1 KEY ASSUMPTIONS FOR BESS BUSINESS CASE AND REVENUE POTENTIAL OF E-FORECOURTS

- 7.2 STRATEGIC CONCLUSIONS KEY ASSUMPTIONS V2G BUSINESS CASE AND REVENUE POTENTIAL OF E-FORECOURTS

- 7.3 STRATEGIC CONCLUSIONS