|

市場調查報告書

商品編碼

1788518

Polybutylene Adipate Terephthalate(PBAT) 市場(按等級、應用、最終用途產業和地區)- 預測至 2030 年Polybutylene Adipate Terephthalate Market by Grade, Application (Films, Sheets & Bin Liners, Coatings & Adhesives, Molded Products, Fibers), End-use Industry (Packaging, Consumer Goods, Agriculture, Bio-medical), and Region - Global Forecast to 2030 |

||||||

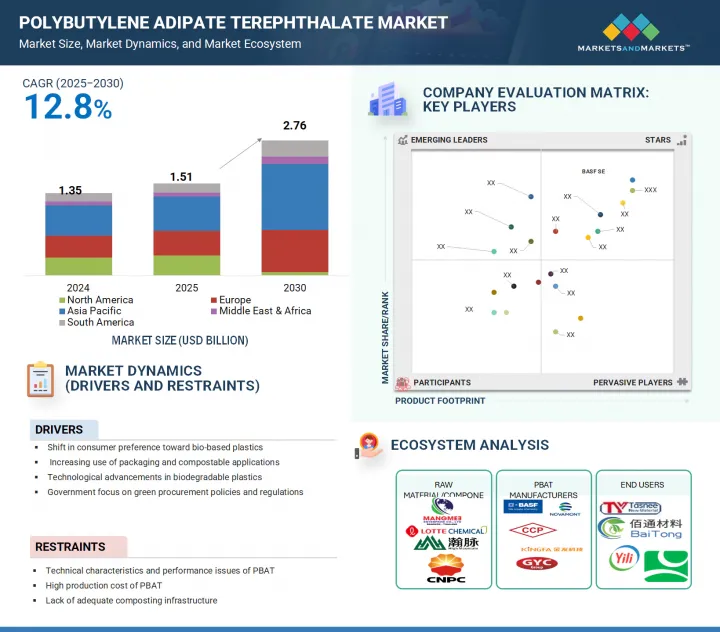

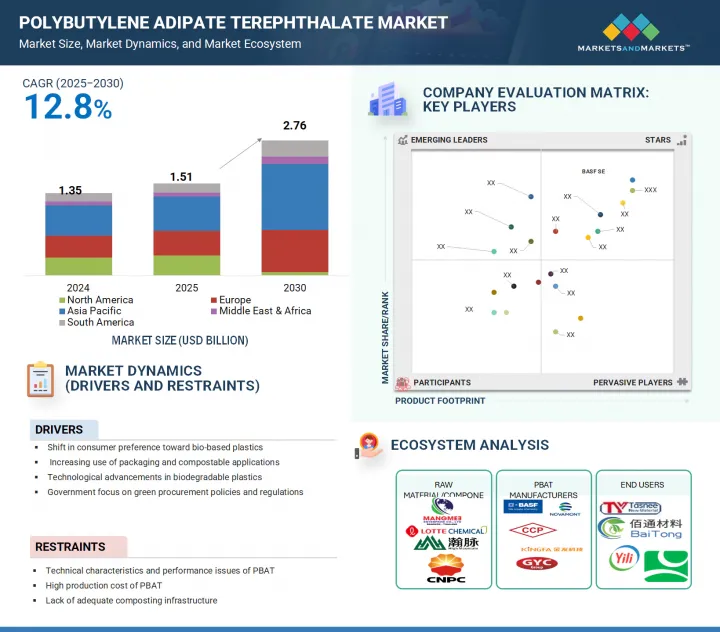

全球Polybutylene Adipate Terephthalate(PBAT) 市場預計將從 2025 年的 15.1 億美元成長到 2030 年的 27.6 億美元,2025 年至 2030 年的複合年成長率為 12.8%。

| 調查範圍 | |

|---|---|

| 調查年份 | 2022-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 單元 | 百萬美元,噸 |

| 部分 | 等級、最終用途、行業、地區 |

| 目標區域 | 歐洲、北美、亞太地區、中東和非洲、南美 |

由於熱成型等級在硬質和半硬質包裝應用中的使用日益增多,預計其將佔據PBAT市場的第二大佔有率。 PBAT兼具柔韌性、耐熱性和生物分解性,使其能夠用於熱成型工藝,並常用於製造一次性餐具、翻蓋式容器、可堆肥食品托盤和蓋子等產品。

隨著食品服務提供者(尤其是在北美和歐洲)響應歐盟一次性塑膠指令和美國多個州的禁令等法律要求,轉向永續替代品,生物分解性的熱成型產品正變得越來越受歡迎。在商用餐飲、外帶服務和已調理食品包裝等注重性能和可堆肥性的行業中,熱成型PBAT產品的使用也日益增多。

市場也受益於 PBAT 與 PLA 和澱粉混合物的日益普及,這種混合物提高了剛度和成型性,這對於成功的熱成型至關重要。由於工業堆肥能力的提高和消費者對環保包裝形式的偏好,熱成型級 PBAT 市場預計將持續強勁成長。

“就價值而言,預計在預測期內,模塑塑膠產品應用將佔據整體市場的第二大佔有率。”

市場對射出成型一次性產品的生物分解性替代品的需求日益成長,預計將推動模塑塑膠產品領域的顯著成長。 PBAT 的多功能性、生物分解性以及與射出成型的兼容性使其成為生產各種模塑產品的理想材料,包括食品容器、包裝組件、一次性餐具和農具。此外,國際上針對不可堆肥一次性塑膠的法規日益增多,尤其是在食品服務、飯店和醫療保健領域,也進一步推動了這一成長。歐洲、北美和亞太地區各國實施的嚴格法規,例如歐盟的《一次性塑膠指令》和美國的禁令,正在鼓勵製造商轉向生物基模塑產品。

此外,模塑PBAT產品在商用和外帶包裝領域越來越受歡迎,符合ASTM D6400和EN 13432標準的輕質、可堆肥替代品正在取代傳統的硬質塑膠零件。由於堆肥基礎設施的進步以及消費者對環保包裝需求的不斷成長,模塑塑膠產品領域預計將繼續保持其作為PBAT市場第二大貢獻者的地位。

“預測期內,消費品終端用途行業將佔據第二大市場佔有率。”

日常用品中對環保和生物分解性替代品的需求日益成長,預計將推動消費品的成長。 PBAT 優異的機械性能、可堆肥性以及與各種混合物的兼容性,使其成為各種消費品的理想選擇,包括購物袋、家用包裝、寵物垃圾袋、一次性餐具和衛生用品。在消費者對永續生活方式日益成長的偏好和日益增強的環保意識的推動下,各行各業的品牌都在積極採用 PBAT 基材。可堆肥家居和個人保養用品產品透過零售店和電商管道的擴張也促進了這一領域的成長。此外,北美和歐洲的大型超級市場正在透過在其自有品牌產品中使用 PBAT 來顯著提升市場滲透率。世界各國政府正在鼓勵製造商透過推廣永續產品設計和綠色採購政策的舉措,在消費品應用中取代傳統塑膠。預計消費品產業將繼續成為 PBAT 需求的重要驅動力,鞏固其作為僅次於包裝的第二大應用領域的地位,尤其是在工業堆肥基礎設施不斷擴張以及全球對一次性塑膠的監管壓力不斷加大的情況下。

本報告分析了全球Polybutylene Adipate Terephthalate(PBAT) 市場,提供了關鍵促進因素和限制因素、競爭格局和未來趨勢的資訊。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章 主要發現

- Polybutylene Adipate Terephthalate(PBAT)市場為企業帶來誘人機會

- 亞太地區Polybutylene Adipate Terephthalate(PBAT) 市場(依最終用途產業和國家分類)

- Polybutylene Adipate Terephthalate(PBAT) 市場(依等級)

- Polybutylene Adipate Terephthalate(PBAT) 市場應用

- Polybutylene Adipate Terephthalate(PBAT) 市場(依最終用途產業分類)

- 各國Polybutylene Adipate Terephthalate(PBAT) 市場

第5章市場概述

- 介紹

- 市場動態

- 驅動程式

- 抑制因素

- 機會

- 任務

- 價值鏈分析

- 波特五力分析

- 生態系分析

- 專利分析

- 介紹

- 調查方法

- 文件類型

- 考慮

- 司法管轄權分析

- 主要企業/申請人

- 定價分析

- 各地區平均銷售價格趨勢(2022-2030 年)

- 按應用分類的平均銷售價格趨勢(2022-2030 年)

- 各終端用途產業主要企業平均銷售價格趨勢(2024年)

- 關稅和監管格局

- 北美洲

- 亞太地區

- 歐洲

- 中東、非洲和南美洲

- 監管機構、政府機構和其他組織的列表

- 影響購買決策的關鍵因素

- 品質

- 服務

- 大型會議和活動(2025-2026年)

- 影響客戶業務的趨勢/中斷

- 總體經濟指標

- 技術分析

- Polybutylene Adipate Terephthalate(PBAT)的酵素回收

- Polybutylene Adipate Terephthalate(PBAT)的3D列印

- Polybutylene Adipate Terephthalate(PBAT) 的生物醫學應用

- 莊信萬豐的BDO技術

- 生質能平衡PBAT

- 雙螺桿擠壓技術

- 貿易分析

- 進口情形(HS 編碼 291712)

- 出口情形(HS 編碼 291712)

- 人工智慧/生成式人工智慧的影響

- 案例研究分析

第6章 PBAT 市場(依等級)

- 介紹

- 擠壓等級

- 熱成型級

- 其他等級

第7章 PBAT 市場:按應用

- 介紹

- 薄膜、片材、垃圾袋

- 塗料和黏合劑

- 成型品

- 纖維

- 其他用途

第 8 章:PBAT 市場(依最終用途產業分類)

- 介紹

- 包裝

- 消費品

- 農業

- 生物醫學

- 其他最終用途產業

第9章Polybutylene Adipate Terephthalate(PBAT) 市場(依區域)

- 介紹

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- GCC

- 南非

- 其他中東和非洲地區

第10章 競爭格局

- 概述

- 主要參與企業的策略

- 市場佔有率分析

- 收益分析

- 公司估值及財務指標

- 產品/品牌比較

- 企業評估矩陣:主要企業(2024年)

- 公司評估矩陣:Start-Ups/中小企業(2024 年)

- 競爭場景

第11章:公司簡介

- 主要企業

- BASF SE

- CHANG CHUN GROUP

- KINGFA SCI.&TECH. CO., LTD

- NOVAMONT SPA

- GO YEN CHEMICAL INDUSTRIAL CO LTD

- ANHUI JUMEI BIOLOGICAL TECHNOLOGY CO., LTD

- HANGZHOU PEIJIN CHEMICAL CO., LTD.

- JIN HUI ZHAO LONG HIGH TECH CO., LTD.

- T.EN ZIMMER GMBH

- MITSUI PLASTICS, INC.

- 其他公司

- ZHEJIANG BIODEGRADABLE ADVANCED MATERIAL CO. LTD

- HENGLI GROUP CO., LTD.

- JUNYUAN PETROLEUM GROUP

- QINGDAO ZHOUSHI PLASTIC PACKAGING CO., LTD.

- RED AVENUE

- SGA POLYCHEM PVT LTD

- XINJIANG BLUE RIDGE TUNHE SCI.&TECH. CO., LTD.

- TAPRATH ELASTOMERS LLP

- EASY FLUX

- ENTEC POLYMERS

- INDOCAL

- YUVIKA GREEN EARTH SOLUTIONS

- NINGBO CHANGHONG POLYMER SCIENTIFIC AND TECHNICAL INC

- POLYROCKS CHEMICAL CO., LTD

- SHANDONG DAWN INTERNATIONAL TRADING CO., LTD (DAWN GROUP)

第12章 附錄

The global PBAT market is expected to reach USD 2.76 billion by 2030 from USD 1.51 billion in 2025, at a CAGR of 12.8% from 2025 to 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Ton) |

| Segments | Grade, Application, End-use Industry, and Region |

| Regions covered | Europe, North America, Asia Pacific, Middle East & Africa, and South America |

Because of its increasing use in rigid and semi-rigid packaging applications, the thermoforming grade is projected to hold the second-largest share of the PBAT market. Because of its special blend of flexibility, heat resistance, and biodegradability, PBAT can be used in thermoforming processes, which are frequently used to create products like disposable cutlery, clamshell containers, compostable food trays, and lids.

Biodegradable thermoformed products are becoming increasingly popular as food service providers, particularly in North America and Europe, move toward sustainable alternatives in response to legal requirements such as the EU Single-use Plastics Directive and several state bans in the US. In industries where performance and compostability are crucial, such as institutional catering, takeout services, and ready-to-eat food packaging, thermoformed PBAT products are also being utilized more.

The increasing availability of PBAT blends with PLA or starch, which improve rigidity and moldability-two essentials for successful thermoforming-benefits the market. Second, only to the leading films & sheets segment in terms of volume and revenue, the thermoforming-grade PBAT market is expected to grow strongly and sustainably due to growing industrial composting capabilities and consumer preference for eco-friendly packaging formats.

''In terms of value, the molded plastic products application is expected to account for the second-largest share of the overall market during the forecast period''

The increasing demand for biodegradable alternatives to injection-molded single-use products is expected to drive significant growth in the molded plastic products segment. Because of its versatility, biodegradability, and compatibility with injection molding, PBAT is an ideal material for producing a wide range of molded goods, including food containers, packaging components, disposable cutlery, and agricultural tools. Additionally, the rise of international regulations on non-compostable single-use plastics, especially in the food service, hospitality, and healthcare sectors, is further supporting this growth. Manufacturers are being encouraged to shift toward bio-based molded products due to strict regulations implemented by countries in Europe, North America, and the Asia Pacific, such as the EU Single-use Plastics Directive and various state-level bans in the US.

Additionally, molded PBAT products are becoming more popular in institutional and takeout packaging, where lightweight, compostable alternatives that satisfy ASTM D6400 and EN 13432 standards are replacing conventional rigid plastic components. The molded plastic products segment is expected to maintain its position as the second-largest contributor to the PBAT market, as composting infrastructure advances and consumer demand for environmentally friendly packaging rises.

"Consumer goods end-use industry to account for the second-largest market share during the forecast period"

The increasing demand for eco-friendly and biodegradable alternatives in everyday products is anticipated to drive the growth of consumer goods. With excellent mechanical properties, compostability, and compatibility with various blends, PBAT is ideal for a wide range of consumer goods, including shopping bags, household packaging, pet waste bags, disposable cutlery, and hygiene products. Brands across various industries are incorporating PBAT-based materials in response to rising consumer preferences for sustainable lifestyles and heightened environmental awareness. The expansion of compostable household and personal care products through retail and e-commerce is also contributing to the segment's growth. Additionally, the use of PBAT in private-label products by major supermarket chains in North America and Europe is significantly increasing market penetration. Governments are encouraging manufacturers to replace traditional plastics in consumer applications through initiatives promoting sustainable product design and the implementation of green procurement policies. The consumer goods sector is well-positioned to remain a major driver of PBAT demand, reinforcing its status as the second-largest application segment after packaging, especially as industrial composting infrastructure expands and global regulatory pressure on single-use plastics grows.

"Europe to account for the second-largest share of the PBAT during the forecast period"

Due to robust regulatory frameworks, developed recycling and composting infrastructure, and rising consumer demand for environmentally friendly packaging, Europe is anticipated to hold the second-largest share of the global PBAT market. With stringent laws like the EU Single-use Plastics Directive, the Green Deal, and the Circular Economy Action Plan that encourage the use of biodegradable and compostable substitutes like PBAT, the European Union has been leading the global effort to reduce plastic pollution. Key markets in the region include Germany, Italy, France, and Spain, all of which actively enforce laws prohibiting traditional plastic bags and promote certified compostable packaging for use in waste management, food service, and retail settings. For European manufacturers looking to meet compostability standards like EN 13432, PBAT is a preferred material due to its compatibility with PLA and starch blends and suitability for rigid and flexible packaging, agricultural films, and consumer goods. Europe continues to play a significant role in the global PBAT market, ranking second only to the Asia Pacific in terms of market share and influence, due to sustained innovation, public support for sustainable materials, and a strong emphasis on reducing plastic waste through legislative action.

This study has been validated through primary interviews with industry experts globally. These primary sources have been divided into the following three categories:

- By Company Type: Tier 1 - 60%, Tier 2 - 20%, and Tier 3 - 20%

- By Designation: C Level - 33%, Director Level - 33%, and Managers - 34%

- By Region: North America - 20%, Europe - 25%, Asia Pacific - 25%, the Middle East & Africa - 15%, and Latin America - 15%

The report provides a comprehensive analysis of company profiles of prominent companies such as BASF SE (Germany), Chang Chun Group (China), Kingfa Sci. & Tech. Co., Ltd. (China), Novamont S.p.A. (Italy), GO YEN CHEMICAL INDUSTRIAL CO LTD (Taiwan), Anhui Jumei Biological Technology Co., Ltd. (China), Hangzhou Peijin Chemical Co., Ltd. (China), Jin Hui Zhao Long High Tech Co., Ltd. (China), T.EN Zimmer GmbH (Germany), Mitsui Plastics, Inc. (US), Zhejiang Baidigorei Biomaterials Co., Ltd. (China), Hengli Group Co., Ltd. (China), Junyuan Petroleum Group (China), Qingdao Zhoushi Plastic Packaging Co., Ltd. (China), Red Avenue New Materials Group Co., Ltd. (China), SGA POLYCHEM PVT LTD (India), Xinjiang Blue Ridge Tunhe Sci. & Tech. Co., Ltd. (China), Taprath Elastomers LLP (India), Easy Flux (India), Entec Polymers (US), Indocal (India), Yuvika Green Earth Solutions (India), Ningbo Changhong Polymer Scientific and Technical Inc. (China), Polyrocks Chemical Co., Ltd. (China), and Shandong Dawn Polymer Co., Ltd. (Dawn Group) (China).

Research Coverage

This research report categorizes the PBAT market by grade (extrusion and thermoforming), application (films, sheets & bin liners, coatings & adhesives, molded products, and fibers), end-use industry (packaging, consumer goods, agriculture, and bio-medical), and region (North America, Europe, Asia Pacific, the Middle East & Africa, and South America). The scope of the report includes detailed information about the major factors influencing the growth of the PBAT market, such as drivers, restraints, challenges, and opportunities. A thorough examination of the key industry players has been conducted to provide insights into their business overview, solutions & services, key strategies, contracts, partnerships, and agreements. Product launches, mergers and acquisitions, and recent developments in the PBAT market are all covered. This report includes a competitive analysis of upcoming startups in the PBAT market ecosystem.

Reasons to Buy this Report

The report will provide market leaders and new entrants with information on the closest approximations of the revenue numbers for the PBAT market and its subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report will also help stakeholders understand the market pulse and provide information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following points:

- Analysis of key drivers (shift in consumer preference toward bio-based plastics, increasing use of packaging and compostable applications, technological advancements in biodegradable plastics, and government focus on green procurement policies and regulations), restraints (technical characteristics and performance issues of PBAT, high production cost of PBAT, and lack of adequate composting infrastructure), opportunities (development of new applications, high potential of PBAT in emerging economies, and building a strong green branding strategy), and challenges (competition from alternative bioplastics and consumer misunderstanding regarding biodegradability) influencing the growth of the PBAT market.

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and service launches in the PBAT market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the PBAT market across varied regions.

- Market Diversification: Exhaustive information about services, untapped geographies, recent developments, and investments in the PBAT market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as BASF SE (Germany), Chang Chun Group (China), Kingfa Sci. & Tech. Co., Ltd. (China), Novamont S.p.A. (Italy), GO YEN CHEMICAL INDUSTRIAL CO LTD (Taiwan), Anhui Jumei Biological Technology Co., Ltd. (China), Hangzhou Peijin Chemical Co., Ltd. (China), Jin Hui Zhao Long High Tech Co., Ltd. (China), T.EN Zimmer GmbH (Germany), Mitsui Plastics, Inc. (US), Zhejiang Baidigorei Biomaterials Co., Ltd. (China), Hengli Group Co., Ltd. (China), Junyuan Petroleum Group (China), Qingdao Zhoushi Plastic Packaging Co., Ltd. (China), Red Avenue New Materials Group Co., Ltd. (China), SGA POLYCHEM PVT LTD (India), Xinjiang Blue Ridge Tunhe Sci. & Tech. Co., Ltd. (China), Taprath Elastomers LLP (India), Easy Flux (India), Entec Polymers (US), Indocal (India), Yuvika Green Earth Solutions (India), Ningbo Changhong Polymer Scientific and Technical Inc. (China), Polyrocks Chemical Co., Ltd. (China), and Shandong Dawn Polymer Co., Ltd. (Dawn Group) (China).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of primary interview participants-demand and supply sides

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 FORECAST NUMBER CALCULATION

- 2.4 DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET

- 4.2 ASIA PACIFIC POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY AND COUNTRY

- 4.3 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE

- 4.4 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION

- 4.5 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY

- 4.6 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Shift in consumer preference toward bio-based plastics

- 5.2.1.2 Increasing use of packaging and compostable applications

- 5.2.1.3 Technological advancements in biodegradable plastics

- 5.2.1.4 Government focuses on green procurement policies and regulations

- 5.2.2 RESTRAINTS

- 5.2.2.1 Technical characteristics and performance issues of PBAT

- 5.2.2.2 High production cost

- 5.2.2.3 Lack of adequate composting infrastructure

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Widening application scope

- 5.2.3.2 High potential of PBAT in emerging economies

- 5.2.3.3 Adoption of green branding strategies

- 5.2.4 CHALLENGES

- 5.2.4.1 Competition from alternative bioplastics

- 5.2.4.2 Misunderstanding regarding biodegradability among consumers

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 PORTER'S FIVE FORCES ANALYSIS

- 5.4.1 THREAT OF NEW ENTRANTS

- 5.4.2 THREATS OF SUBSTITUTES

- 5.4.3 BARGAINING POWER OF SUPPLIERS

- 5.4.4 BARGAINING POWER OF BUYERS

- 5.4.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 PATENT ANALYSIS

- 5.6.1 INTRODUCTION

- 5.6.2 METHODOLOGY

- 5.6.3 DOCUMENT TYPE

- 5.6.4 INSIGHTS

- 5.6.5 JURISDICTION ANALYSIS

- 5.6.6 TOP COMPANIES/APPLICANTS

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2030

- 5.7.2 AVERAGE SELLING PRICE TREND, BY APPLICATION, 2022-2030

- 5.7.3 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY, 2024

- 5.8 TARIFF AND REGULATORY LANDSCAPE

- 5.8.1 NORTH AMERICA

- 5.8.1.1 US

- 5.8.1.2 Canada & Mexico

- 5.8.2 ASIA PACIFIC

- 5.8.3 EUROPE

- 5.8.4 MIDDLE EAST & AFRICA AND SOUTH AMERICA

- 5.8.4.1 Middle East & Africa

- 5.8.4.2 South America

- 5.8.5 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8.1 NORTH AMERICA

- 5.9 KEY FACTORS AFFECTING BUYING DECISIONS

- 5.9.1 QUALITY

- 5.9.2 SERVICE

- 5.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.12 MACROECONOMIC INDICATORS

- 5.12.1 GROSS DOMESTIC PRODUCT TRENDS AND FORECASTS

- 5.13 TECHNOLOGY ANALYSIS

- 5.13.1 ENZYMATIC RECYCLING OF POLYBUTYLENE ADIPATE TEREPHTHALATE

- 5.13.2 3D PRINTING OF POLYBUTYLENE ADIPATE TEREPHTHALATE

- 5.13.3 BIO-MEDICAL APPLICATIONS OF POLYBUTYLENE ADIPATE TEREPHTHALATE

- 5.13.4 JOHNSON MATTHEY'S BDO TECHNOLOGY

- 5.13.5 BIOMASS BALANCED PBAT

- 5.13.6 TWIN-SCREW EXTRUSION TECHNOLOGY

- 5.14 TRADE ANALYSIS

- 5.14.1 IMPORT SCENARIO (HS CODE 291712)

- 5.14.2 EXPORT SCENARIO (HS CODE 291712)

- 5.15 IMPACT OF AI/GEN AI

- 5.16 CASE STUDY ANALYSIS

- 5.16.1 RELIANCE INDUSTRIES

6 PBAT MARKET, BY GRADE

- 6.1 INTRODUCTION

- 6.2 EXTRUSION GRADE

- 6.2.1 HIGH MELT STRENGTH AND VISCOSITY OF PBAT TO DRIVE DEMAND

- 6.3 THERMOFORMING GRADE

- 6.3.1 LOW SHRINKAGE AND EXCELLENT CLARITY OF PBAT TO FUEL DEMAND

- 6.4 OTHER GRADES

7 PBAT MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 FILMS, SHEETS & BIN LINERS

- 7.2.1 BIODEGRADABILITY AND COMPOSTABILITY OF PBAT TO DRIVE DEMAND

- 7.3 COATINGS & ADHESIVES

- 7.3.1 USE OF PBAT COATINGS FOR IMPROVING SHELF LIFE OF MATERIALS TO FUEL MARKET GROWTH

- 7.4 MOLDED PRODUCTS

- 7.4.1 THERMOPLASTIC NATURE OF PBAT TO DRIVE DEMAND

- 7.5 FIBERS

- 7.5.1 USE AS BIODEGRADABLE AND COMPOSTABLE MATERIAL IN FIBER PRODUCTION TO PROPEL MARKET

- 7.6 OTHER APPLICATIONS

8 PBAT MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- 8.2 PACKAGING

- 8.2.1 USE AS ALTERNATIVE TO CONVENTIONAL PLASTICS TO DRIVE MARKET

- 8.2.2 FOOD PACKAGING

- 8.2.3 NON-FOOD PACKAGING

- 8.3 CONSUMER GOODS

- 8.3.1 EXCELLENT PHYSICAL PROPERTIES COMPARED TO CONVENTIONAL PLASTICS TO DRIVE DEMAND

- 8.4 AGRICULTURE

- 8.4.1 INCREASED APPLICATIONS IN AGRICULTURE INDUSTRY TO DRIVE MARKET

- 8.4.2 MULCH FILMS

- 8.4.3 NETTING

- 8.5 BIO-MEDICAL

- 8.5.1 HIGH STRENGTH AND DURABILITY OF PBAT TO DRIVE DEMAND

- 8.5.2 MEDICAL DEVICES

- 8.5.3 MEDICAL CONSUMABLES

- 8.5.4 BONE IMPLANTS

- 8.6 OTHER END-USE INDUSTRIES

9 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 ASIA PACIFIC

- 9.2.1 CHINA

- 9.2.1.1 Ban on single-use plastics and rising awareness regarding negative impacts of plastic waste to drive market

- 9.2.2 JAPAN

- 9.2.2.1 Implementation of policies promoting biodegradable plastics and reducing plastic waste to drive market

- 9.2.3 INDIA

- 9.2.3.1 Increasing consumer awareness about negative impact of plastic waste on environment to drive market

- 9.2.4 SOUTH KOREA

- 9.2.4.1 Focus on environmental sustainability and reducing plastic waste to boost market

- 9.2.5 REST OF ASIA PACIFIC

- 9.2.1 CHINA

- 9.3 EUROPE

- 9.3.1 GERMANY

- 9.3.1.1 Consumer awareness about the importance of sustainable products and strict government regulations to drive market

- 9.3.2 UK

- 9.3.2.1 Implementation of policies and regulations to reduce plastic waste to drive market

- 9.3.3 FRANCE

- 9.3.3.1 Demand for sustainable biodegradable plastics from consumers to drive market

- 9.3.4 ITALY

- 9.3.4.1 Booming food processing industry to drive market

- 9.3.5 SPAIN

- 9.3.5.1 Rising demand for sustainable packaging solutions to drive market

- 9.3.6 REST OF EUROPE

- 9.3.1 GERMANY

- 9.4 NORTH AMERICA

- 9.4.1 US

- 9.4.1.1 Focus on manufacturing bioplastic packaging products by private sector companies to boost market

- 9.4.2 CANADA

- 9.4.2.1 Prime focus of plastic industry on manufacturing certified compostable bags to drive market

- 9.4.3 MEXICO

- 9.4.3.1 Growing developments in biodegradable plastics sector and focus on sustainability to drive market

- 9.4.1 US

- 9.5 SOUTH AMERICA

- 9.5.1 BRAZIL

- 9.5.1.1 Rising demand for sustainable packaging solutions from agriculture sector to drive market

- 9.5.2 ARGENTINA

- 9.5.2.1 Rising demand for environmentally friendly materials and growing adoption of biodegradable plastics to drive market

- 9.5.3 REST OF SOUTH AMERICA

- 9.5.1 BRAZIL

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 GCC

- 9.6.1.1 Saudi Arabia

- 9.6.1.1.1 Decision of SASO to limit application of technical regulations for biodegradable plastics to drive market

- 9.6.1.2 UAE

- 9.6.1.2.1 Growing push for sustainable plastics amid policy reforms to drive market

- 9.6.1.3 Rest of GCC

- 9.6.1.1 Saudi Arabia

- 9.6.2 SOUTH AFRICA

- 9.6.2.1 Advancements in bioplastics research to improve management of renewable biological resources and propel market

- 9.6.3 REST OF MIDDLE EAST & AFRICA

- 9.6.1 GCC

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES

- 10.3 MARKET SHARE ANALYSIS

- 10.4 REVENUE ANALYSIS

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 PRODUCT/BRAND COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 End-use industry footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 BASF SE

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.3.2 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 CHANG CHUN GROUP

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 MnM view

- 11.1.3 KINGFA SCI.&TECH. CO., LTD

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 NOVAMONT S.P.A.

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches

- 11.1.4.3.2 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 GO YEN CHEMICAL INDUSTRIAL CO LTD

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 MnM view

- 11.1.5.3.1 Key strengths

- 11.1.5.3.2 Strategic choices

- 11.1.5.3.3 Weaknesses and competitive threats

- 11.1.6 ANHUI JUMEI BIOLOGICAL TECHNOLOGY CO.,LTD

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 MnM view

- 11.1.6.3.1 Key strengths

- 11.1.6.3.2 Strategic choices

- 11.1.6.3.3 Weaknesses and competitive threats

- 11.1.7 HANGZHOU PEIJIN CHEMICAL CO.,LTD.

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 MnM view

- 11.1.8 JIN HUI ZHAO LONG HIGH TECH CO., LTD.

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 MnM view

- 11.1.9 T.EN ZIMMER GMBH

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 MnM view

- 11.1.10 MITSUI PLASTICS, INC.

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 MnM view

- 11.1.1 BASF SE

- 11.2 OTHER PLAYERS

- 11.2.1 ZHEJIANG BIODEGRADABLE ADVANCED MATERIAL CO. LTD

- 11.2.2 HENGLI GROUP CO., LTD.

- 11.2.3 JUNYUAN PETROLEUM GROUP

- 11.2.4 QINGDAO ZHOUSHI PLASTIC PACKAGING CO., LTD.

- 11.2.5 RED AVENUE

- 11.2.6 SGA POLYCHEM PVT LTD

- 11.2.7 XINJIANG BLUE RIDGE TUNHE SCI.&TECH. CO., LTD.

- 11.2.8 TAPRATH ELASTOMERS LLP

- 11.2.9 EASY FLUX

- 11.2.10 ENTEC POLYMERS

- 11.2.11 INDOCAL

- 11.2.12 YUVIKA GREEN EARTH SOLUTIONS

- 11.2.13 NINGBO CHANGHONG POLYMER SCIENTIFIC AND TECHNICAL INC

- 11.2.14 POLYROCKS CHEMICAL CO., LTD

- 11.2.15 SHANDONG DAWN INTERNATIONAL TRADING CO., LTD (DAWN GROUP)

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

List of Tables

- TABLE 1 LIST OF KEY SECONDARY SOURCES

- TABLE 2 ADVERSE HEALTH EFFECTS DUE TO CONVENTIONAL PLASTICS USAGE

- TABLE 3 REGULATIONS ON USE OF PLASTIC BAGS

- TABLE 4 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 ROLES OF COMPANIES IN POLYBUTYLENE ADIPATE TEREPHTHALATE ECOSYSTEM

- TABLE 6 TOP TEN PATENT OWNERS, 2015-2024

- TABLE 7 AVERAGE SELLING PRICE TREND OF PBAT, BY APPLICATION, 2022-2030 (USD/KG)

- TABLE 8 INDICATIVE PRICING ANALYSIS OF PBAT OFFERED BY KEY PLAYERS, BY END-USE INDUSTRY, 2024 (USD/KG)

- TABLE 9 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET: LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 11 PROJECTED REAL GROSS DOMESTIC PRODUCT GROWTH (ANNUAL PERCENT CHANGE) OF KEY COUNTRIES, 2018-2025

- TABLE 12 IMPORT DATA FOR HS CODE 291712-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024(USD THOUSAND)

- TABLE 13 EXPORT DATA RELATED TO HS CODE 291712-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 14 PBAT MARKET, BY GRADE, 2022-2024 (USD MILLION)

- TABLE 15 PBAT MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 16 PBAT MARKET, BY GRADE, 2022-2024 (KILOTON)

- TABLE 17 PBAT MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 18 PBAT MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 19 PBAT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 20 PBAT MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 21 PBAT MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 22 PBAT MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 23 PBAT MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 24 PBAT MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 25 PBAT MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 26 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 27 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 28 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 29 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 30 ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 31 ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 32 ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 33 ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 34 ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2022-2024 (USD MILLION)

- TABLE 35 ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 36 ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2022-2024 (KILOTON)

- TABLE 37 ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 38 ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 39 ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 40 ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 41 ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 42 ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 43 ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 44 ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 45 ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 46 CHINA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 47 CHINA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 48 CHINA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 49 CHINA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 50 JAPAN: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 51 JAPAN: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 52 JAPAN: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 53 JAPAN: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 54 INDIA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 55 INDIA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 56 INDIA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 57 INDIA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 58 SOUTH KOREA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 59 SOUTH KOREA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 60 SOUTH KOREA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 61 SOUTH KOREA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 62 REST OF ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 63 REST OF ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 64 REST OF ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 65 REST OF ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 66 EUROPE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 67 EUROPE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 68 EUROPE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 69 EUROPE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 70 EUROPE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2022-2024 (USD MILLION)

- TABLE 71 EUROPE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 72 EUROPE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2022-2024 (KILOTON)

- TABLE 73 EUROPE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 74 EUROPE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 75 EUROPE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 76 EUROPE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 77 EUROPE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 78 EUROPE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 79 EUROPE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 80 EUROPE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 81 EUROPE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 82 GERMANY: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 83 GERMANY: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 84 GERMANY: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 85 GERMANY: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 86 UK: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 87 UK: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 88 UK: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 89 UK: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 90 FRANCE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 91 FRANCE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 92 FRANCE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 93 FRANCE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 94 ITALY: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 95 ITALY: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 96 ITALY: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 97 ITALY: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 98 SPAIN: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 99 SPAIN: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 100 SPAIN: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 101 SPAIN: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 102 REST OF EUROPE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 103 REST OF EUROPE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 104 REST OF EUROPE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 105 REST OF EUROPE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 106 NORTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 107 NORTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 108 NORTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 109 NORTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 110 NORTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2022-2024 (USD MILLION)

- TABLE 111 NORTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 112 NORTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2022-2024 (KILOTON)

- TABLE 113 NORTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 114 NORTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 115 NORTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 116 NORTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 117 NORTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 118 NORTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 119 NORTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 120 NORTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 121 NORTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 122 US: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 123 US: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 124 US: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 125 US: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 126 CANADA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 127 CANADA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 128 CANADA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 129 CANADA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 130 MEXICO: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 131 MEXICO: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 132 MEXICO: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 133 MEXICO: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 134 SOUTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 135 SOUTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 136 SOUTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 137 SOUTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 138 SOUTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2022-2024 (USD MILLION)

- TABLE 139 SOUTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 140 SOUTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2022-2024 (KILOTON)

- TABLE 141 SOUTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 142 SOUTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 143 SOUTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 144 SOUTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 145 SOUTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 146 SOUTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 147 SOUTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 148 SOUTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 149 SOUTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 150 BRAZIL: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 151 BRAZIL: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 152 BRAZIL: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 153 BRAZIL: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 154 ARGENTINA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 155 ARGENTINA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 156 ARGENTINA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 157 ARGENTINA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 158 REST OF SOUTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 159 REST OF SOUTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 160 REST OF SOUTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 161 REST OF SOUTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 162 MIDDLE EAST & AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 165 MIDDLE EAST & AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 166 MIDDLE EAST & AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2022-2024 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2022-2024 (KILOTON)

- TABLE 169 MIDDLE EAST & AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 170 MIDDLE EAST & AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 173 MIDDLE EAST & AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 174 MIDDLE EAST & AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 177 MIDDLE EAST & AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 178 SAUDI ARABIA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 179 SAUDI ARABIA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 180 SAUDI ARABIA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 181 SAUDI ARABIA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 182 UAE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 183 UAE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 184 UAE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 185 UAE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 186 REST OF GCC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 187 REST OF GCC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 188 REST OF GCC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 189 REST OF GCC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 190 SOUTH AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 191 SOUTH AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 192 SOUTH AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 193 SOUTH AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 194 REST OF MIDDLE EAST & AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 195 REST OF MIDDLE EAST & AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 196 REST OF MIDDLE EAST & AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 197 REST OF MIDDLE EAST & AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 198 PBAT MARKET: OVERVIEW OF MAJOR STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2020-JUNE 2025

- TABLE 199 PBAT MARKET: DEGREE OF COMPETITION, 2024

- TABLE 200 PBAT MARKET: REGION FOOTPRINT

- TABLE 201 PBAT MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 202 PBAT MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 203 PBAT MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 204 PBAT MARKET: PRODUCT LAUNCHES, JANUARY 2020-JUNE 2025

- TABLE 205 PBAT MARKET: DEALS, JANUARY 2020-JUNE 2025

- TABLE 206 BASF SE: COMPANY OVERVIEW

- TABLE 207 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 BASF SE: PRODUCT LAUNCHES, JANUARY 2020-JUNE 2025

- TABLE 209 BASF SE: DEALS, JANUARY 2020-JUNE 2025

- TABLE 210 CHANG CHUN GROUP: COMPANY OVERVIEW

- TABLE 211 CHANG CHUN GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 KINGFA SCI.&TECH. CO., LTD: COMPANY OVERVIEW

- TABLE 213 KINGFA SCI.&TECH. CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 KINGFA SCI.&TECH. CO., LTD: DEALS, JANUARY 2020-JUNE 2025

- TABLE 215 NOVAMONT S.P.A.: COMPANY OVERVIEW

- TABLE 216 NOVAMONT S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 NOVAMONT S.P.A.: PRODUCT LAUNCHES, JANUARY 2020-JUNE 2025

- TABLE 218 NOVAMONT S.P.A.: DEALS, JANUARY 2020-JUNE 2025

- TABLE 219 GO YEN CHEMICAL INDUSTRIAL CO LTD: COMPANY OVERVIEW

- TABLE 220 GO YEN CHEMICAL INDUSTRIAL CO LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 ANHUI JUMEI BIOLOGICAL TECHNOLOGY CO.,LTD: COMPANY OVERVIEW

- TABLE 222 ANHUI JUMEI BIOLOGICAL TECHNOLOGY CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 HANGZHOU PEIJIN CHEMICAL CO.,LTD.: COMPANY OVERVIEW

- TABLE 224 HANGZHOU PEIJIN CHEMICAL CO.,LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 JIN HUI ZHAO LONG HIGH TECH CO., LTD.: COMPANY OVERVIEW

- TABLE 226 JIN HUI ZHAO LONG HIGH TECH CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 T.EN ZIMMER GMBH: COMPANY OVERVIEW

- TABLE 228 T.EN ZIMMER GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 MITSUI PLASTICS, INC.: COMPANY OVERVIEW

- TABLE 230 MITSUI PLASTICS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 ZHEJIANG BIODEGRADABLE ADVANCED MATERIAL CO. LTD: COMPANY OVERVIEW

- TABLE 232 HENGLI GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 233 JUNYUAN PETROLEUM GROUP: COMPANY OVERVIEW

- TABLE 234 QINGDAO ZHOUSHI PLASTIC PACKAGING CO., LTD.: COMPANY OVERVIEW

- TABLE 235 RED AVENUE: COMPANY OVERVIEW

- TABLE 236 SGA POLYCHEM PVT LTD: COMPANY OVERVIEW

- TABLE 237 XINJIANG BLUE RIDGE TUNHE SCI.&TECH. CO., LTD.: COMPANY OVERVIEW

- TABLE 238 TAPRATH ELASTOMERS LLP: COMPANY OVERVIEW

- TABLE 239 EASY FLUX: COMPANY OVERVIEW

- TABLE 240 ENTEC POLYMERS: COMPANY OVERVIEW

- TABLE 241 INDOCAL: COMPANY OVERVIEW

- TABLE 242 YUVIKA GREEN EARTH SOLUTIONS: COMPANY OVERVIEW

- TABLE 243 NINGBO CHANGHONG POLYMER SCIENTIFIC AND TECHNICAL INC: COMPANY OVERVIEW

- TABLE 244 POLYROCKS CHEMICAL CO., LTD: COMPANY OVERVIEW

- TABLE 245 SHANDONG DAWN INTERNATIONAL TRADING CO., LTD: COMPANY OVERVIEW

List of Figures

- FIGURE 1 PBAT MARKET: SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 PBAT MARKET: RESEARCH DESIGN

- FIGURE 3 PBAT MARKET: BOTTOM-UP APPROACH

- FIGURE 4 PBAT MARKET: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: PBAT MARKET TOP-DOWN APPROACH

- FIGURE 6 DEMAND-SIDE FORECAST PROJECTIONS

- FIGURE 7 PBAT MARKET: DATA TRIANGULATION

- FIGURE 8 EXTRUSION GRADE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 9 FILMS, SHEETS & BIN LINERS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 10 PACKAGING SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 12 EMERGING ECONOMIES TO EXHIBIT HIGH GROWTH POTENTIAL FOR MARKET PLAYERS

- FIGURE 13 PACKAGING SEGMENT AND CHINA LED ASIA PACIFIC POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET IN 2024

- FIGURE 14 EXTRUSION GRADE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 15 FILMS, SHEETS & BIN LINERS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 16 PACKAGING SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 17 CHINA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 18 PBAT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 20 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET: PORTER'S FIVE FORCES MODEL ANALYSIS

- FIGURE 21 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET: ECOSYSTEM ANALYSIS

- FIGURE 22 PATENT APPLICATIONS TO ACCOUNT FOR HIGHEST SHARE FROM 2015 TO 2024

- FIGURE 23 PUBLICATION TRENDS, 2015-2024

- FIGURE 24 TOP JURISDICTIONS, BY DOCUMENT, 2015-2024

- FIGURE 25 TOP COMPANIES/APPLICANTS, 2015-2024

- FIGURE 26 AVERAGE SELLING PRICE TREND OF PBAT, BY REGION, 2022-2030 (USD/KG)

- FIGURE 27 AVERAGE SELLING PRICE TREND OF PBAT OFFERED BY KEY PLAYERS, BY END-USE INDUSTRY, 2024 (USD/KG)

- FIGURE 28 SUPPLIER SELECTION CRITERION

- FIGURE 29 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS BUSINESS

- FIGURE 30 IMPORT DATA RELATED TO HS CODE 291712-COMPLIANT PRODUCTS, BY REGION, 2020-2024 (USD THOUSAND)

- FIGURE 31 EXPORT DATA RELATED TO HS CODE 291712-COMPLIANT PRODUCTS, BY REGION, 2020-2024 (USD THOUSAND)

- FIGURE 32 EXTRUSION GRADE SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 33 FILMS, SHEETS & BIN LINERS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 34 PACKAGING SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 35 CHINA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 36 ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET SNAPSHOT

- FIGURE 37 EUROPE: FILMS, SHEETS & BIN LINERS TO BE THE LARGEST MARKET IN 2025

- FIGURE 38 NORTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET SNAPSHOT

- FIGURE 39 PBAT MARKET SHARE ANALYSIS, 2024

- FIGURE 40 PBAT MARKET: REVENUE ANALYSIS OF KEY COMPANIES IN LAST FIVE YEARS, 2020-2024 (USD BILLION)

- FIGURE 41 PBAT MARKET: COMPANY VALUATION, 2024 (USD BILLION)

- FIGURE 42 PBAT MARKET: PRODUCT/BRAND COMPARISON

- FIGURE 43 PBAT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 44 PBAT MARKET: COMPANY FOOTPRINT

- FIGURE 45 PBAT MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 46 BASF SE: COMPANY SNAPSHOT