|

市場調查報告書

商品編碼

1786130

製藥金屬探測器市場:全球產品、技術、應用、最終用戶和地區 - 預測至 2030 年Pharmaceutical Metal Detector Market by Product, Technology, and Application - Global Forecast to 2030 |

||||||

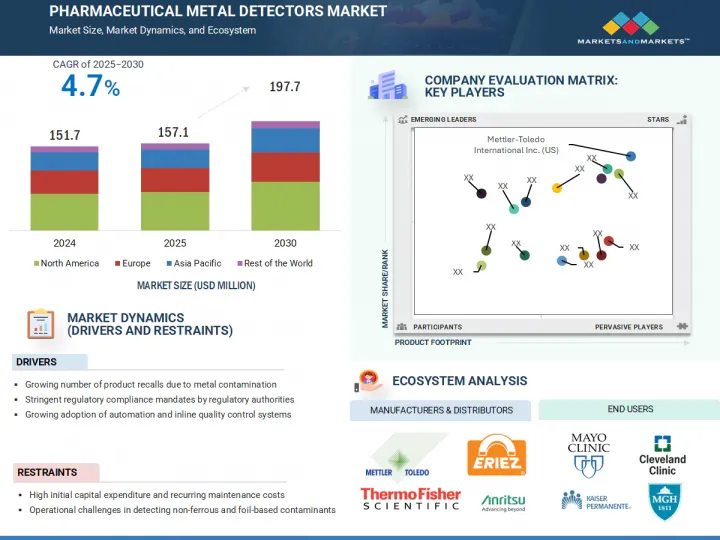

全球醫藥金屬探測器市場預計將從 2025 年的 1.571 億美元增至 2030 年的 1.977 億美元,預測期內的複合年成長率為 4.7%。

這一成長主要源於嚴格的產品安全監管要求以及對無污染藥品日益成長的需求。日益增多的產品案例和品質問題迫使製造商採用先進的檢測技術。

| 調查範圍 | |

|---|---|

| 調查年份 | 2024-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 對價單位 | 金額(百萬美元) |

| 部分 | 按產品、技術、應用、最終用戶和地區 |

| 目標區域 | 北美、歐洲、亞太地區及其他地區 |

自動化和智慧金屬檢測系統整合度的不斷提升,加上感測器靈敏度和即時監控技術的創新,預計將進一步擴大市場規模。製藥公司對遵守GMP和FDA標準的重視也推動了對高精度檢測設備的投資。此外,產業參與者擴大轉向產品創新和策略聯盟,以增強競爭力並確保製程可靠性。

2024年,錠劑金屬探測器佔據了製藥金屬探測器市場的主導地位,這主要得益於全球製藥業錠劑的廣泛生產。由於錠劑使用方便、保存期限長且患者依從性高,它仍然是最受歡迎且最常見的固態劑型。錠劑金屬探測器因其易於整合、經濟高效且可靠性高,已被主要製藥商和契約製造組織 (CMO) 廣泛採用。受全球藥品需求成長和品管日益嚴格的推動,錠劑金屬探測器的使用範圍不斷擴大,鞏固了其作為該市場領先產品類型的地位。

磁場檢測器憑藉其久經考驗的有效性、成本效益以及對各種製藥應用的適應性,在2024年佔據了製藥金屬探測器市場的最大佔有率。與X檢測器和多頻檢測器等更先進的系統相比,磁場檢測器所需的資金更少。這種經濟實惠且性能卓越的結合,使磁場技術成為眾多製藥製造商的首選,尤其是在成本敏感市場和新興市場營運的製造商。總體而言,其精準度、多功能性和經濟價值的結合鞏固了其在製藥金屬探測器市場的主導地位。

推動北美市場成長的關鍵因素包括製藥廠的高技術採用率和自動化程度。這樣的環境支援整合先進的金屬檢測系統,該系統具有即時數據追蹤、基於人工智慧的校準和自動剔除系統等功能。不斷成長的研發支出和工業4.0的早期應用,正在推動檢測器各工廠使用多頻和磁場檢測器。對技術創新和業務效率的重視進一步推動了該地區的需求。由於污染風險導致的藥品召回事件增多,以及美國和加拿大製造的藥品出口量的不斷成長,也使得嚴格的檢查通訊協定成為必要,這進一步鞏固了北美在製藥金屬探測器市場的主導地位。

本報告研究了全球製藥金屬探測市場,並總結了產品、技術、應用、最終用戶和地區的趨勢,以及參與市場的公司概況。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章重要考察

第5章市場概述

- 介紹

- 市場動態

- 技術分析

- 波特五力分析

- 監管分析

- 專利分析

- 貿易分析

- 2025-2026年主要會議和活動

- 主要相關人員和採購標準

- 定價分析

- 價值鏈分析

- 生態系分析

- AI/GEN AI 對醫藥金屬探測器市場的影響

- 影響客戶業務的趨勢/中斷

- 投資金籌措場景

- 2025年美國關稅對製藥金屬探測器市場的影響

第6章 醫藥金屬探測器市場(依產品)

- 介紹

- 錠劑金屬探測器

- 膠囊金屬探測器

- 粉末金屬探測器

- 液態金屬探測器

- 管道金屬探測器

7. 製藥金屬探測器市場(依技術)

- 介紹

- 磁場檢測器

- 多頻檢測器

- 使用金屬探測器進行 X 光檢查

- 其他

第 8 章 製藥金屬探測器市場(按應用)

- 介紹

- 品管

- 污染物檢測

- 包裝

- 遵守

9. 製藥金屬探測器市場(按最終用戶分類)

- 介紹

- 製藥公司

- 合約開發和受託製造廠商(CDMO)

- 生物製藥公司

- 其他

第 10 章 製藥金屬探測器市場(按地區)

- 介紹

- 北美洲

- 北美宏觀經濟展望

- 美國

- 加拿大

- 歐洲

- 歐洲宏觀經濟展望

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他

- 亞太地區

- 亞太宏觀經濟展望

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 其他

- 其他地區

- 世界其他地區宏觀經濟展望

第11章競爭格局

- 概述

- 主要參與企業的策略/優勢

- 2022-2024年收益分析

- 2024年市場佔有率分析

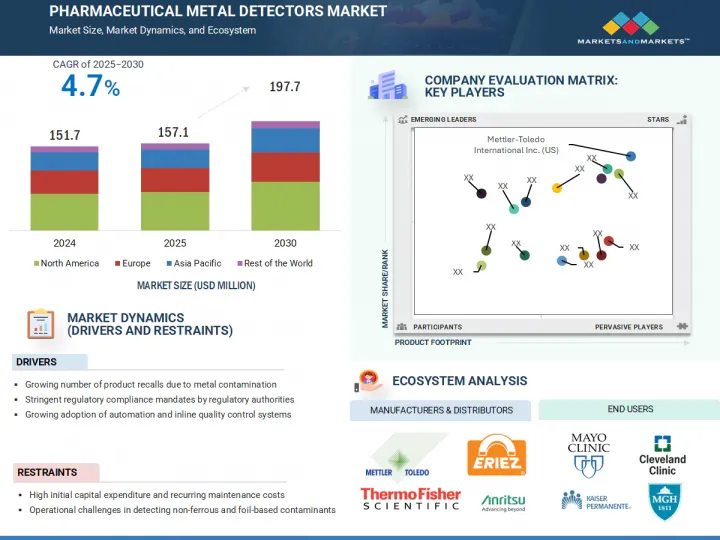

- 公司估值矩陣:2024 年關鍵參與企業

- 公司估值矩陣:Start-Ups/中小企業,2024 年

- 品牌/產品比較

- 主要企業研發支出

- 估值和財務指標

- 競爭場景

第12章:公司簡介

- 主要參與企業

- METTLER-TOLEDO INTERNATIONAL INC.

- THERMO FISHER SCIENTIFIC INC.

- ANRITSU CORPORATION

- MINEBEAMITSUMI INC.

- ILLINOIS TOOL WORKS INC.

- ERIEZ MANUFACTURING CO.

- CEIA SPA

- FORTRESS TECHNOLOGY INC.

- CASSEL MESSTECHNIK GMBH

- BUNTING

- NIKKA DENSOK LIMITED

- PRISMA INDUSTRIALE SRL

- WIPOTEC GMBH

- DONGGUAN COSO ELECTRONIC TECH CO., LTD.

- VINSYST TECHNOLOGIES

- 其他公司

- SED PHARMA

- NEMESIS SRL

- SOLLAU SRO

- TECHNOFOUR ELECTRONICS PVT. LTD.

- INOS

- ACG

- ULTRACON ENGIMECH PVT. LTD.

- DAS ELECTRONICS

- UNIQUE EQUIPMENT

- LODHA INTERNATIONAL LLP

第13章 附錄

The global pharmaceutical metal detectors market is projected to reach USD 197.7 million by 2030 from USD 157.1 million in 2025, registering a CAGR of 4.7% during the forecast period. The growth is primarily driven by stringent regulatory requirements for product safety and the rising demand for contamination-free pharmaceutical products. Increasing cases of product recalls and quality-related concerns have compelled manufacturers to adopt advanced detection technologies.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD million) |

| Segments | Product, Technology, Application, End User, Region |

| Regions covered | North America, Europe, APAC, RoW |

The growing integration of automated and intelligent metal detection systems, coupled with innovations in sensor sensitivity and real-time monitoring, is further expected to boost market expansion. Emphasis on compliance with GMP and FDA standards also encourages pharmaceutical companies to invest in high-precision inspection equipment. Moreover, industry players are increasingly engaging in product innovation and strategic collaborations to enhance their competitive edge and ensure process reliability.

By product type, the tablet metal detectors segment accounted for the largest market share in 2024.

Tablet metal detectors dominated the pharmaceutical metal detectors market in 2024, primarily due to the widespread production of tablets across the global pharmaceutical industry. Tablets remain the most preferred and commonly manufactured solid dosage form because of their convenience, long shelf life, and patient compliance. The ease of integration, cost-efficiency, and reliability of tablet metal detectors have led to their wide adoption by both large pharmaceutical manufacturers and contract manufacturing organizations (CMOs). With rising global drug demand and tighter quality controls, the use of tablet metal detectors continues to expand, solidifying their position as the leading product type in this market.

By technology, the magnetic field detectors segment accounted for the largest share of the market in 2024.

Magnetic field detectors held the largest share of the pharmaceutical metal detectors market in 2024 due to their proven effectiveness, cost-efficiency, and adaptability across various pharmaceutical applications. Magnetic field detectors require less capital than more advanced systems like X-ray or multi-frequency detectors. For many pharmaceutical manufacturers, especially those operating in cost-sensitive or emerging markets, this affordability, paired with performance, makes magnetic field technology the preferred choice. Altogether, their combination of precision, versatility, and economic value solidifies their dominance in the pharmaceutical metal detectors market.

By region, North America is expected to witness the highest growth rate during the forecast period.

The key factors driving market growth in North America include a high level of technological adoption and automation in pharmaceutical manufacturing facilities. This environment supports the integration of advanced metal detection systems that feature real-time data tracking, AI-based calibration, and automated rejection systems. Higher R&D spending and early adoption of Industry 4.0 practices have driven the use of multi-frequency and magnetic field detectors across North American facilities. This focus on innovation and operational efficiency further boosts the regional demand. The increasing number of drug recalls due to contamination risks and the growing export volume of US- and Canada-manufactured pharmaceutical products also necessitate robust inspection protocols, further reinforcing the dominance of North America in the pharmaceutical metal detectors market.

Breakdown of supply-side primary interviews:

- By Company Type: Tier 1 (45%), Tier 2 (20%), and Tier 3 (35%)

- By Designation: C-level Executives (35%), Directors (25%), and Others (40%)

- By Region: North America (40%), Europe (25%), Asia Pacific (20%), Latin America (10%), and the Middle East & Africa (5%)

Breakdown of demand-side primary interviews:

- By Company Type: Pharmaceutical Companies (50%), CDMOs (25%), Biopharmaceutical Companies (15%), and Other End Users (10%)

- By Designation: Heads of Manufacturing/Production (40%), Quality Assurance Managers (30%), Regulatory Compliance Officers (20%), and Other Designations (10%)

- By Region: North America (40%), Europe (25%), Asia Pacific (20%), Latin America (10%), and the Middle East & Africa (5%)

Research Coverage

This report studies the pharmaceutical metal detectors market by product, technology, application, end user, and region. The report also studies factors affecting market growth (drivers, restraints, opportunities, and challenges). It analyzes the opportunities and challenges in the market and provides details of the competitive landscape for market leaders. Additionally, the report examines micromarkets concerning their growth trends and predicts the revenue of the market segments across four key regions and their respective countries.

Reasons to Buy the Report

The report can assist both established and smaller firms in assessing the market, which would enable them to capture a larger share. Companies that purchase the report could utilize one or a combination of the five strategies outlined below.

This report provides insights into the following pointers:

- Analysis of key drivers (growing number of product recalls due to metal contamination, stringent regulatory compliance mandates by regulatory authorities, and growing adoption of automation and inline quality control systems), restraints (high initial capital expenditure and recurring maintenance costs and operational challenges in detecting non-ferrous and foil-based contaminants), opportunities (focus on production optimization and high R&D investments and expansion of pharmaceutical exports and contract manufacturing), and challenges (integration complexity with existing production lines) are expected to influence the growth of the pharmaceutical metal detectors market.

- Product Development/Innovation: Detailed insights into upcoming technologies, R&D activities, and product launches in the pharmaceutical metal detectors market.

- Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the markets for several types of pharmaceutical metal detection processes across regions.

- Market Diversification: Exhaustive information about products, untapped regions, recent developments, and investments in the pharmaceutical metal detectors market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, distribution networks, and manufacturing capabilities of the leading players in the pharmaceutical metal detectors market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.4 MARKET SHARE ESTIMATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 RISK ASSESSMENT

- 2.7 RESEARCH LIMITATIONS

- 2.7.1 METHODOLOGY-RELATED LIMITATIONS

- 2.7.2 SCOPE-RELATED LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 PHARMACEUTICAL METAL DETECTORS MARKET OVERVIEW

- 4.2 NORTH AMERICA: PHARMACEUTICAL METAL DETECTORS MARKET OVERVIEW

- 4.3 PHARMACEUTICAL METAL DETECTORS MARKET: REGIONAL MIX

- 4.4 PHARMACEUTICAL METAL DETECTORS MARKET: GEOGRAPHICAL GROWTH OPPORTUNITIES

- 4.5 PHARMACEUTICAL METAL DETECTORS MARKET: DEVELOPING VS. DEVELOPED ECONOMIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing number of product recalls due to metal contamination

- 5.2.1.2 Stringent regulatory compliance mandates

- 5.2.1.3 Growing adoption of automation and inline quality control systems

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial capital expenditure and recurring maintenance costs

- 5.2.2.2 Operational challenges in detecting non-ferrous and foil-based contaminants

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Focus on production optimization and high R&D investment

- 5.2.3.2 Expansion of pharmaceutical exports and contract manufacturing

- 5.2.4 CHALLENGES

- 5.2.4.1 Integration complexity with existing production lines

- 5.2.1 DRIVERS

- 5.3 TECHNOLOGY ANALYSIS

- 5.3.1 KEY TECHNOLOGIES

- 5.3.1.1 Electromagnetic induction technology

- 5.3.1.2 Multi frequency detection

- 5.3.2 COMPLEMENTARY TECHNOLOGIES

- 5.3.2.1 Conveyor and reject mechanism systems

- 5.3.2.2 Human-machine interface (HMI) and touchscreen controls

- 5.3.1 KEY TECHNOLOGIES

- 5.4 PORTER'S FIVE FORCES ANALYSIS

- 5.4.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.4.2 BARGAINING POWER OF BUYERS

- 5.4.3 BARGAINING POWER OF SUPPLIERS

- 5.4.4 THREAT OF SUBSTITUTES

- 5.4.5 THREAT OF NEW ENTRANTS

- 5.5 REGULATORY ANALYSIS

- 5.5.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.5.2 REGULATORY FRAMEWORK

- 5.5.2.1 North America

- 5.5.2.1.1 US

- 5.5.2.1.2 Canada

- 5.5.2.2 Europe

- 5.5.2.2.1 Germany

- 5.5.2.3 Asia Pacific

- 5.5.2.3.1 China

- 5.5.2.3.2 Japan

- 5.5.2.3.3 India

- 5.5.2.3.4 Australia

- 5.5.2.4 Rest of the World

- 5.5.2.1 North America

- 5.6 PATENT ANALYSIS

- 5.6.1 INSIGHTS ON PATENT PUBLICATION TRENDS, TOP APPLICANTS, AND JURISDICTION FOR PHARMACEUTICAL METAL DETECTORS MARKET, JANUARY 2015-MAY 2025

- 5.6.2 LIST OF MAJOR PATENTS, 2023-2024

- 5.7 TRADE ANALYSIS

- 5.7.1 IMPORT DATA FOR HS CODE 854370, 2020-2024

- 5.7.2 EXPORT DATA FOR HS CODE 854370, 2020-2024

- 5.8 KEY CONFERENCES & EVENTS, 2025-2026

- 5.9 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.9.2 KEY BUYING CRITERIA

- 5.10 PRICING ANALYSIS

- 5.10.1 INDICATIVE PRICING ANALYSIS OF KEY PLAYERS, BY PRODUCT TYPE, 2022-2024

- 5.10.2 INDICATIVE PRICING ANALYSIS OF PHARMACEUTICAL METAL DETECTORS, BY REGION, 2022-2024

- 5.11 VALUE CHAIN ANALYSIS

- 5.12 ECOSYSTEM ANALYSIS

- 5.13 IMPACT OF AI/GEN AI ON PHARMACEUTICAL METAL DETECTORS MARKET

- 5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.15 INVESTMENT & FUNDING SCENARIO

- 5.16 IMPACT OF 2025 US TARIFF ON PHARMACEUTICAL METAL DETECTORS MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 KEY TARIFF RATES

- 5.16.3 PRICE IMPACT ANALYSIS

- 5.16.4 IMPACT ON COUNTRY/REGION

- 5.16.4.1 US

- 5.16.4.2 Europe

- 5.16.4.3 APAC

- 5.16.5 IMPACT ON END-USE INDUSTRIES

- 5.16.5.1 Pharmaceutical companies

- 5.16.5.2 Contract Development and Manufacturing Organizations (CDMOs)

- 5.16.5.3 Other end users

6 PHARMACEUTICAL METAL DETECTORS MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 TABLET METAL DETECTORS

- 6.2.1 TABLET METAL DETECTORS TO DOMINATE MARKET DUE TO HIGH DEPLOYMENT IN LINE WITH TABLET PRESSES

- 6.3 CAPSULE METAL DETECTORS

- 6.3.1 INCREASING NEED FOR PRECISION DURING CAPSULE FILLING AND PACKAGING TO BOOST ADOPTION

- 6.4 POWDER METAL DETECTORS

- 6.4.1 HIGH RISK OF CONTAMINATION IN DRY BULK PROCESSING TO DRIVE ADOPTION OF POWDER METAL DETECTORS

- 6.5 LIQUID METAL DETECTORS

- 6.5.1 INCREASING USE IN SYRUPS AND SUSPENSIONS REQUIRING BATCH PURITY TO SUPPORT MARKET GROWTH

- 6.6 PIPELINE METAL DETECTORS

- 6.6.1 GROWING POPULARITY DUE TO EFFICIENCY IN CONTINUOUS FLOW SYSTEMS FOR SEMI-SOLIDS AND LIQUIDS TO FUEL MARKET GROWTH

7 PHARMACEUTICAL METAL DETECTORS MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- 7.2 MAGNETIC FIELD DETECTORS

- 7.2.1 VERSATILITY OF MAGNETIC FIELD DETECTORS ACROSS VARIOUS PRODUCT TYPES AND PACKAGING FORMATS TO BOOST ADOPTION

- 7.3 MULTI-FREQUENCY DETECTORS

- 7.3.1 NEED FOR HIGH SENSITIVITY IN MIXED PRODUCT LINES TO BOOST DEMAND FOR MULTI-FREQUENCY METAL DETECTORS

- 7.4 X-RAY INSPECTION WITH METAL DETECTORS

- 7.4.1 SUPERIOR PERFORMANCE IN DETECTING DENSE AND NON-METALLIC CONTAMINANTS TO SUPPORT MARKET GROWTH

- 7.5 OTHER TECHNOLOGIES

8 PHARMACEUTICAL METAL DETECTORS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 QUALITY CONTROL

- 8.2.1 STRINGENT GMP GUIDELINES EMPHASIZING END-TO-END PRODUCT INSPECTION TO CONTRIBUTE TO MARKET GROWTH

- 8.3 CONTAMINANT DETECTION

- 8.3.1 GROWING PRODUCT RECALLS AND HEALTH RISKS TO BOOST GROWTH

- 8.4 PACKAGING

- 8.4.1 RISING USE OF INLINE DETECTORS IN HIGH-SPEED PRODUCTION LINES TO SUPPORT MARKET GROWTH

- 8.5 COMPLIANCE

- 8.5.1 TIGHTER GLOBAL REGULATIONS AND INCREASED AUDIT PREPAREDNESS TO DRIVE GROWTH IN MARKET

9 PHARMACEUTICAL METAL DETECTORS MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 PHARMACEUTICAL COMPANIES

- 9.2.1 HIGH VOLUME OF DRUG MANUFACTURING ACTIVITIES AND STRINGENT QA PROTOCOLS TO DRIVE GROWTH

- 9.3 CONTRACT DEVELOPMENT AND MANUFACTURING ORGANIZATIONS (CDMOS)

- 9.3.1 STRONG OUTSOURCING DEMAND TO PROPEL CDMO SEGMENTAL GROWTH

- 9.4 BIOPHARMACEUTICAL COMPANIES

- 9.4.1 RAPID EXPANSION OF BIOLOGICS MANUFACTURING CAPACITY TO BOOST METAL DETECTOR USAGE IN BIOPHARMACEUTICAL FIRMS

- 9.5 OTHER END USERS

10 PHARMACEUTICAL METAL DETECTORS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Stringent FDA enforcement and contamination recalls to propel metal detector demand in US

- 10.2.3 CANADA

- 10.2.3.1 National biomanufacturing strategy to spur metal detector integration in Canada

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 Robust R&D and manufacturing excellence to drive market

- 10.3.3 UK

- 10.3.3.1 Rising quality-driven inspection spending to boost market

- 10.3.4 FRANCE

- 10.3.4.1 Government-backed reshoring efforts and sterile drug production to propel demand for metal detectors in France

- 10.3.5 ITALY

- 10.3.5.1 Country's biopharmaceutical growth to support market uptake

- 10.3.6 SPAIN

- 10.3.6.1 Public-sector manufacturing expansion and generics uptake to boost metal detector demand

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 Booming biologics hubs to fuel market growth in China

- 10.4.3 JAPAN

- 10.4.3.1 Aging population and universal health coverage to drive adoption

- 10.4.4 INDIA

- 10.4.4.1 Surging compliance upgrades and massive export ambitions to drive adoption

- 10.4.5 AUSTRALIA

- 10.4.5.1 Advanced pharmaceutical manufacturing to drive quality-centric investments

- 10.4.6 SOUTH KOREA

- 10.4.6.1 Innovation-driven pharma sector to promote advanced quality assurance

- 10.4.7 REST OF ASIA PACIFIC

- 10.5 REST OF THE WORLD

- 10.5.1 MACROECONOMIC OUTLOOK FOR REST OF THE WORLD

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGY/RIGHT TO WIN

- 11.3 REVENUE ANALYSIS, 2022-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Product footprint

- 11.5.5.4 Technology footprint

- 11.5.5.5 Application footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.6.5.1 Detailed list of key startup/SME players

- 11.6.5.2 Competitive benchmarking of key emerging players/startups

- 11.7 BRAND/PRODUCT COMPARISON

- 11.8 R&D EXPENDITURE OF KEY PLAYERS

- 11.9 COMPANY VALUATION & FINANCIAL METRICS

- 11.9.1 FINANCIAL METRICS

- 11.9.2 COMPANY VALUATION

- 11.10 COMPETITIVE SCENARIO

- 11.10.1 PRODUCT LAUNCHES

- 11.10.2 DEALS

- 11.10.3 EXPANSIONS

- 11.10.4 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 METTLER-TOLEDO INTERNATIONAL INC.

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 MnM view

- 12.1.1.3.1 Right to win

- 12.1.1.3.2 Strategic choices

- 12.1.1.3.3 Weaknesses & competitive threats

- 12.1.2 THERMO FISHER SCIENTIFIC INC.

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 MnM view

- 12.1.2.3.1 Right to win

- 12.1.2.3.2 Strategic choices

- 12.1.2.3.3 Weaknesses & competitive threats

- 12.1.3 ANRITSU CORPORATION

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses & competitive threats

- 12.1.4 MINEBEAMITSUMI INC.

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches

- 12.1.5 ILLINOIS TOOL WORKS INC.

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches

- 12.1.6 ERIEZ MANUFACTURING CO.

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.6.3.2 Other developments

- 12.1.6.4 MnM view

- 12.1.6.4.1 Right to win

- 12.1.6.4.2 Strategic choices

- 12.1.6.4.3 Weaknesses & competitive threats

- 12.1.7 CEIA S.P.A.

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches

- 12.1.7.3.2 Expansions

- 12.1.7.4 MnM view

- 12.1.7.4.1 Right to win

- 12.1.7.4.2 Strategic choices

- 12.1.7.4.3 Weaknesses & competitive threats

- 12.1.8 FORTRESS TECHNOLOGY INC.

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches

- 12.1.8.3.2 Deals

- 12.1.9 CASSEL MESSTECHNIK GMBH

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product launches

- 12.1.10 BUNTING

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.11 NIKKA DENSOK LIMITED

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.12 PRISMA INDUSTRIALE S.R.L.

- 12.1.12.1 Business overview

- 12.1.12.2 Products offered

- 12.1.13 WIPOTEC GMBH

- 12.1.13.1 Business overview

- 12.1.13.2 Products offered

- 12.1.14 DONGGUAN COSO ELECTRONIC TECH CO., LTD.

- 12.1.14.1 Business overview

- 12.1.14.2 Products offered

- 12.1.15 VINSYST TECHNOLOGIES

- 12.1.15.1 Business overview

- 12.1.15.2 Products offered

- 12.1.1 METTLER-TOLEDO INTERNATIONAL INC.

- 12.2 OTHER PLAYERS

- 12.2.1 SED PHARMA

- 12.2.2 NEMESIS SRL

- 12.2.3 SOLLAU S.R.O.

- 12.2.4 TECHNOFOUR ELECTRONICS PVT. LTD.

- 12.2.5 INOS

- 12.2.6 ACG

- 12.2.7 ULTRACON ENGIMECH PVT. LTD.

- 12.2.8 DAS ELECTRONICS

- 12.2.9 UNIQUE EQUIPMENT

- 12.2.10 LODHA INTERNATIONAL LLP

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

List of Tables

- TABLE 1 STANDARD CURRENCY CONVERSION RATES (USD)

- TABLE 2 PHARMACEUTICAL METAL DETECTORS MARKET: STUDY ASSUMPTION ANALYSIS

- TABLE 3 PHARMACEUTICAL METAL DETECTORS MARKET: RISK ASSESSMENT ANALYSIS

- TABLE 4 PHARMACEUTICAL METAL DETECTORS MARKET: PORTER'S FIVE FORCES

- TABLE 5 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 IMPORT DATA FOR HS CODE 854370, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 11 EXPORT DATA FOR HS CODE 854370, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 12 PHARMACEUTICAL METAL DETECTORS MARKET: DETAILED LIST OF KEY CONFERENCES & EVENTS, JULY 2025-JUNE 2026

- TABLE 13 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS, BY PRODUCT TYPE

- TABLE 14 KEY BUYING CRITERIA FOR PHARMACEUTICAL METAL DETECTORS, BY END USER

- TABLE 15 INDICATIVE PRICING ANALYSIS OF KEY PLAYERS, BY PRODUCT TYPE, 2022-2024 (USD)

- TABLE 16 INDICATIVE PRICING ANALYSIS OF PHARMACEUTICAL METAL DETECTORS, BY REGION, 2022-2024 (USD)

- TABLE 17 PHARMACEUTICAL METAL DETECTORS MARKET: IMPACT OF AI/GEN AI

- TABLE 18 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 19 PHARMACEUTICAL METAL DETECTORS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 20 TABLET METAL DETECTORS AVAILABLE IN MARKET

- TABLE 21 TABLET METAL DETECTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 22 CAPSULE METAL DETECTORS AVAILABLE IN MARKET

- TABLE 23 CAPSULE METAL DETECTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 24 POWDER METAL DETECTORS AVAILABLE IN MARKET

- TABLE 25 POWDER METAL DETECTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 26 LIQUID METAL DETECTORS AVAILABLE IN MARKET

- TABLE 27 LIQUID METAL DETECTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 28 PIPELINE METAL DETECTORS AVAILABLE IN MARKET

- TABLE 29 PIPELINE METAL DETECTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 30 PHARMACEUTICAL METAL DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 31 MAGNETIC FIELD DETECTORS AVAILABLE IN MARKET

- TABLE 32 MAGNETIC FIELD DETECTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 33 MULTI-FREQUENCY DETECTORS AVAILABLE IN MARKET

- TABLE 34 MULTI-FREQUENCY DETECTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 35 X-RAY INSPECTION WITH METAL DETECTORS AVAILABLE IN MARKET

- TABLE 36 X-RAY INSPECTION WITH METAL DETECTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 37 OTHER PHARMACEUTICAL METAL DETECTION TECHNOLOGIES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 38 PHARMACEUTICAL METAL DETECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 39 PHARMACEUTICAL METAL DETECTORS MARKET FOR QUALITY CONTROL APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 40 PHARMACEUTICAL METAL DETECTORS MARKET FOR CONTAMINANT DETECTION APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 41 PHARMACEUTICAL METAL DETECTORS MARKET FOR PACKAGING APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 42 PHARMACEUTICAL METAL DETECTORS MARKET FOR COMPLIANCE APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 43 PHARMACEUTICAL METAL DETECTORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 44 PHARMACEUTICAL METAL DETECTORS MARKET FOR PHARMACEUTICAL COMPANIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 45 PHARMACEUTICAL METAL DETECTORS MARKET FOR CONTRACT DEVELOPMENT AND MANUFACTURING ORGANIZATIONS (CDMOS), BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 46 PHARMACEUTICAL METAL DETECTORS MARKET FOR BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 47 PHARMACEUTICAL METAL DETECTORS MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 48 PHARMACEUTICAL METAL DETECTORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 49 NORTH AMERICA: PHARMACEUTICAL METAL DETECTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 50 NORTH AMERICA: PHARMACEUTICAL METAL DETECTORS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 51 NORTH AMERICA: PHARMACEUTICAL METAL DETECTORS MARKET, BY PRODUCT, 2023-2030 (HUNDRED UNITS)

- TABLE 52 NORTH AMERICA: PHARMACEUTICAL METAL DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 53 NORTH AMERICA: PHARMACEUTICAL METAL DETECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 54 NORTH AMERICA: PHARMACEUTICAL METAL DETECTORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 55 US: KEY MACROINDICATORS

- TABLE 56 US: PHARMACEUTICAL METAL DETECTORS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 57 US: PHARMACEUTICAL METAL DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 58 US: PHARMACEUTICAL METAL DETECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 59 US: PHARMACEUTICAL METAL DETECTORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 60 CANADA: KEY MACROINDICATORS

- TABLE 61 CANADA: PHARMACEUTICAL METAL DETECTORS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 62 CANADA: PHARMACEUTICAL METAL DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 63 CANADA: PHARMACEUTICAL METAL DETECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 64 CANADA: PHARMACEUTICAL METAL DETECTORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 65 EUROPE: PHARMACEUTICAL METAL DETECTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 66 EUROPE: PHARMACEUTICAL METAL DETECTORS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 67 EUROPE: PHARMACEUTICAL METAL DETECTORS MARKET, BY PRODUCT, 2023-2030 (HUNDRED UNITS)

- TABLE 68 EUROPE: PHARMACEUTICAL METAL DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 69 EUROPE: PHARMACEUTICAL METAL DETECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 70 EUROPE: PHARMACEUTICAL METAL DETECTORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 71 GERMANY: KEY MACROINDICATORS

- TABLE 72 GERMANY: PHARMACEUTICAL METAL DETECTORS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 73 GERMANY: PHARMACEUTICAL METAL DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 74 GERMANY: PHARMACEUTICAL METAL DETECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 75 GERMANY: PHARMACEUTICAL METAL DETECTORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 76 UK: KEY MACROINDICATORS

- TABLE 77 UK: PHARMACEUTICAL METAL DETECTORS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 78 UK: PHARMACEUTICAL METAL DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 79 UK: PHARMACEUTICAL METAL DETECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 80 UK: PHARMACEUTICAL METAL DETECTORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 81 FRANCE: KEY MACROINDICATORS

- TABLE 82 FRANCE: PHARMACEUTICAL METAL DETECTORS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 83 FRANCE: PHARMACEUTICAL METAL DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 84 FRANCE: PHARMACEUTICAL METAL DETECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 85 FRANCE: PHARMACEUTICAL METAL DETECTORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 86 ITALY: KEY MACROINDICATORS

- TABLE 87 ITALY: PHARMACEUTICAL METAL DETECTORS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 88 ITALY: PHARMACEUTICAL METAL DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 89 ITALY: PHARMACEUTICAL METAL DETECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 90 ITALY: PHARMACEUTICAL METAL DETECTORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 91 SPAIN: KEY MACROINDICATORS

- TABLE 92 SPAIN: PHARMACEUTICAL METAL DETECTORS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 93 SPAIN: PHARMACEUTICAL METAL DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 94 SPAIN: PHARMACEUTICAL METAL DETECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 95 SPAIN: PHARMACEUTICAL METAL DETECTORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 96 REST OF EUROPE: PHARMACEUTICAL METAL DETECTORS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 97 REST OF EUROPE: PHARMACEUTICAL METAL DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 98 REST OF EUROPE: PHARMACEUTICAL METAL DETECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 99 REST OF EUROPE: PHARMACEUTICAL METAL DETECTORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 100 ASIA PACIFIC: PHARMACEUTICAL METAL DETECTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 101 ASIA PACIFIC: PHARMACEUTICAL METAL DETECTORS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 102 ASIA PACIFIC: PHARMACEUTICAL METAL DETECTORS MARKET, BY PRODUCT, 2023-2030 (HUNDRED UNITS)

- TABLE 103 ASIA PACIFIC: PHARMACEUTICAL METAL DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 104 ASIA PACIFIC: PHARMACEUTICAL METAL DETECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 105 ASIA PACIFIC: PHARMACEUTICAL METAL DETECTORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 106 CHINA: KEY MACROINDICATORS

- TABLE 107 CHINA: PHARMACEUTICAL METAL DETECTORS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 108 CHINA: PHARMACEUTICAL METAL DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 109 CHINA: PHARMACEUTICAL METAL DETECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 110 CHINA: PHARMACEUTICAL METAL DETECTORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 111 JAPAN: KEY MACROINDICATORS

- TABLE 112 JAPAN: PHARMACEUTICAL METAL DETECTORS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 113 JAPAN: PHARMACEUTICAL METAL DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 114 JAPAN: PHARMACEUTICAL METAL DETECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 115 JAPAN: PHARMACEUTICAL METAL DETECTORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 116 INDIA: KEY MACROINDICATORS

- TABLE 117 INDIA: PHARMACEUTICAL METAL DETECTORS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 118 INDIA: PHARMACEUTICAL METAL DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 119 INDIA: PHARMACEUTICAL METAL DETECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 120 INDIA: PHARMACEUTICAL METAL DETECTORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 121 AUSTRALIA: KEY MACROINDICATORS

- TABLE 122 AUSTRALIA: PHARMACEUTICAL METAL DETECTORS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 123 AUSTRALIA: PHARMACEUTICAL METAL DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 124 AUSTRALIA: PHARMACEUTICAL METAL DETECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 125 AUSTRALIA: PHARMACEUTICAL METAL DETECTORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 126 SOUTH KOREA: KEY MACROINDICATORS

- TABLE 127 SOUTH KOREA: PHARMACEUTICAL METAL DETECTORS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 128 SOUTH KOREA: PHARMACEUTICAL METAL DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 129 SOUTH KOREA: PHARMACEUTICAL METAL DETECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 130 SOUTH KOREA: PHARMACEUTICAL METAL DETECTORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 131 REST OF ASIA PACIFIC: PHARMACEUTICAL METAL DETECTORS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 132 REST OF ASIA PACIFIC: PHARMACEUTICAL METAL DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 133 REST OF ASIA PACIFIC: PHARMACEUTICAL METAL DETECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 134 REST OF ASIA PACIFIC: PHARMACEUTICAL METAL DETECTORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 135 REST OF THE WORLD: PHARMACEUTICAL METAL DETECTORS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 136 REST OF THE WORLD: PHARMACEUTICAL METAL DETECTORS MARKET, BY PRODUCT, 2023-2030 (HUNDRED UNITS)

- TABLE 137 REST OF THE WORLD: PHARMACEUTICAL METAL DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 138 REST OF THE WORLD: PHARMACEUTICAL METAL DETECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 139 REST OF THE WORLD: PHARMACEUTICAL METAL DETECTORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 140 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN PHARMACEUTICAL METAL DETECTORS MARKET

- TABLE 141 PHARMACEUTICAL METAL DETECTORS MARKET: DEGREE OF COMPETITION

- TABLE 142 PHARMACEUTICAL METAL DETECTORS MARKET: REGION FOOTPRINT

- TABLE 143 PHARMACEUTICAL METAL DETECTORS MARKET: PRODUCT FOOTPRINT

- TABLE 144 PHARMACEUTICAL METAL DETECTORS MARKET: TECHNOLOGY FOOTPRINT

- TABLE 145 PHARMACEUTICAL METAL DETECTORS MARKET: APPLICATION FOOTPRINT

- TABLE 146 PHARMACEUTICAL METAL DETECTORS MARKET: DETAILED LIST OF KEY STARTUP/SME PLAYERS

- TABLE 147 PHARMACEUTICAL METAL DETECTORS MARKET: COMPETITIVE BENCHMARKING OF KEY EMERGING PLAYERS/STARTUPS

- TABLE 148 PHARMACEUTICAL METAL DETECTORS MARKET: PRODUCT LAUNCHES, JANUARY 2022 - MAY 2025

- TABLE 149 PHARMACEUTICAL METAL DETECTORS MARKET: DEALS, JANUARY 2022 - MAY 2025

- TABLE 150 PHARMACEUTICAL METAL DETECTORS MARKET: EXPANSIONS, JANUARY 2022-MAY 2025

- TABLE 151 PHARMACEUTICAL METAL DETECTORS MARKET: OTHER DEVELOPMENTS, JANUARY 2022-JUNE 2025

- TABLE 152 METTLER-TOLEDO INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 153 METTLER-TOLEDO INTERNATIONAL INC.: PRODUCTS OFFERED

- TABLE 154 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- TABLE 155 THERMO FISHER SCIENTIFIC INC.: PRODUCTS OFFERED

- TABLE 156 ANRITSU CORPORATION: COMPANY OVERVIEW

- TABLE 157 ANRITSU CORPORATION: PRODUCTS OFFERED

- TABLE 158 ANRITSU CORPORATION: PRODUCT LAUNCHES, JANUARY 2022-JUNE 2025

- TABLE 159 MINEBEAMITSUMI INC.: COMPANY OVERVIEW

- TABLE 160 MINEBEAMITSUMI INC.: PRODUCTS OFFERED

- TABLE 161 MINEBEAMITSUMI INC.: PRODUCT LAUNCHES, JANUARY 2022-JUNE 2025

- TABLE 162 ILLINOIS TOOL WORKS INC.: COMPANY OVERVIEW

- TABLE 163 ILLINOIS TOOL WORKS INC.: PRODUCTS OFFERED

- TABLE 164 ILLINOIS TOOL WORKS INC.: PRODUCT LAUNCHES, JANUARY 2022-JUNE 2025

- TABLE 165 ERIEZ MANUFACTURING CO.: COMPANY OVERVIEW

- TABLE 166 ERIEZ MANUFACTURING CO.: PRODUCTS OFFERED

- TABLE 167 ERIEZ MANUFACTURING CO.: DEALS, JANUARY 2022-JUNE 2025

- TABLE 168 ERIEZ MANUFACTURING CO.: OTHER DEVELOPMENTS, JANUARY 2022-JUNE 2025

- TABLE 169 CEIA S.P.A.: COMPANY OVERVIEW

- TABLE 170 CEIA S.P.A.: PRODUCTS OFFERED

- TABLE 171 CEIA S.P.A.: PRODUCT LAUNCHES, JANUARY 2022-JUNE 2025

- TABLE 172 CEIA S.P.A.: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 173 FORTRESS TECHNOLOGY INC.: COMPANY OVERVIEW

- TABLE 174 FORTRESS TECHNOLOGY INC.: PRODUCTS OFFERED

- TABLE 175 FORTRESS TECHNOLOGY INC.: PRODUCT LAUNCHES, JANUARY 2022-JUNE 2025

- TABLE 176 FORTRESS TECHNOLOGY INC.: DEALS, JANUARY 2022-JUNE 2025

- TABLE 177 CASSEL MESSTECHNIK GMBH: COMPANY OVERVIEW

- TABLE 178 CASSEL MESSTECHNIK GMBH: PRODUCTS OFFERED

- TABLE 179 CASSEL MESSTECHNIK GMBH: PRODUCT LAUNCHES, JANUARY 2022-JUNE 2025

- TABLE 180 BUNTING: COMPANY OVERVIEW

- TABLE 181 BUNTING: PRODUCTS OFFERED

- TABLE 182 NIKKA DENSOK LIMITED: COMPANY OVERVIEW

- TABLE 183 NIKKA DENSOK LIMITED: PRODUCTS OFFERED

- TABLE 184 PRISMA INDUSTRIALE S.R.L.: COMPANY OVERVIEW

- TABLE 185 PRISMA INDUSTRIALE S.R.L.: PRODUCTS OFFERED

- TABLE 186 WIPOTEC GMBH: COMPANY OVERVIEW

- TABLE 187 WIPOTEC GMBH: PRODUCTS OFFERED

- TABLE 188 DONGGUAN COSO ELECTRONIC TECH CO., LTD.: COMPANY OVERVIEW

- TABLE 189 DONGGUAN COSO ELECTRONIC TECH CO., LTD.: PRODUCTS OFFERED

- TABLE 190 VINSYST TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 191 VINSYST TECHNOLOGIES: PRODUCTS OFFERED

List of Figures

- FIGURE 1 PHARMACEUTICAL METAL DETECTORS MARKET SEGMENTATION & REGIONAL SCOPE

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 PRIMARY SOURCES

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY END USER, DESIGNATION, AND REGION

- FIGURE 7 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 8 REVENUE SHARE ANALYSIS ILLUSTRATION: METTLER-TOLEDO INTERNATIONAL INC.

- FIGURE 9 PHARMACEUTICAL METAL DETECTORS MARKET: SUPPLY-SIDE ANALYSIS (2024)

- FIGURE 10 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2025-2030)

- FIGURE 11 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 12 TOP-DOWN APPROACH

- FIGURE 13 DATA TRIANGULATION METHODOLOGY

- FIGURE 14 PHARMACEUTICAL METAL DETECTORS MARKET, BY PRODUCT, 2025 VS. 2030 (USD MILLION)

- FIGURE 15 PHARMACEUTICAL METAL DETECTORS MARKET, BY TECHNOLOGY, 2025 VS. 2030 (USD MILLION)

- FIGURE 16 PHARMACEUTICAL METAL DETECTORS MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 17 PHARMACEUTICAL METAL DETECTORS MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 18 PHARMACEUTICAL METAL DETECTORS MARKET: GEOGRAPHIC SNAPSHOT

- FIGURE 19 GROWING NUMBER OF PRODUCT RECALLS DUE TO METAL CONTAMINATION TO DRIVE GROWTH IN PHARMACEUTICAL METAL DETECTORS MARKET

- FIGURE 20 TABLET METAL DETECTORS SEGMENT ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICAN PHARMACEUTICAL METAL DETECTORS MARKET IN 2024

- FIGURE 21 NORTH AMERICA TO REGISTER HIGHEST CAGR IN MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 22 CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 23 DEVELOPING ECONOMIES TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 24 PHARMACEUTICAL METAL DETECTORS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 25 PHARMACEUTICAL METAL DETECTORS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 26 PATENT PUBLICATION TRENDS, JURISDICTION, AND TOP APPLICANT ANALYSIS (JANUARY 2015-MAY 2025)

- FIGURE 27 TOP APPLICANT COUNTRIES/REGIONS FOR PHARMACEUTICAL METAL DETECTOR PATENTS (JANUARY 2015-MAY 2025)

- FIGURE 28 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS, BY PRODUCT TYPE

- FIGURE 29 KEY BUYING CRITERIA FOR PHARMACEUTICAL METAL DETECTORS, BY END USER

- FIGURE 30 PHARMACEUTICAL METAL DETECTORS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 31 PHARMACEUTICAL METAL DETECTORS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 32 PHARMACEUTICAL METAL DETECTORS MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 33 PHARMACEUTICAL METAL DETECTORS MARKET: FUNDING AND NUMBER OF DEALS, 2020-2024

- FIGURE 34 PHARMACEUTICAL METAL DETECTORS MARKET: GEOGRAPHIC SNAPSHOT

- FIGURE 35 NORTH AMERICA: PHARMACEUTICAL METAL DETECTORS MARKET SNAPSHOT

- FIGURE 36 ASIA PACIFIC: PHARMACEUTICAL METAL DETECTORS MARKET SNAPSHOT

- FIGURE 37 REVENUE ANALYSIS OF KEY PLAYERS IN PHARMACEUTICAL METAL DETECTORS MARKET (2022-2024)

- FIGURE 38 MARKET SHARE ANALYSIS OF KEY PLAYERS IN PHARMACEUTICAL METAL DETECTORS MARKET (2024)

- FIGURE 39 PHARMACEUTICAL METAL DETECTORS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 40 PHARMACEUTICAL METAL DETECTORS MARKET: COMPANY FOOTPRINT

- FIGURE 41 PHARMACEUTICAL METAL DETECTORS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 42 PHARMACEUTICAL METAL DETECTORS MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 43 R&D EXPENDITURE OF KEY PLAYERS IN PHARMACEUTICAL METAL DETECTORS MARKET, 2022-2024

- FIGURE 44 EV/EBITDA OF KEY VENDORS

- FIGURE 45 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 46 METTLER-TOLEDO INTERNATIONAL INC.: COMPANY SNAPSHOT (2024)

- FIGURE 47 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2024)

- FIGURE 48 ANRITSU CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 49 MINEBEAMITSUMI INC.: COMPANY SNAPSHOT (2024)

- FIGURE 50 ILLINOIS TOOL WORKS INC.: COMPANY SNAPSHOT (2024)