|

市場調查報告書

商品編碼

1784318

全球細胞培養市場(按產品、應用和最終用戶分類)預測(至 2030 年)Cell Culture Market by Product (Consumables (Media, Sera, Reagent, Vessels ), Equipment ), Application, End User - Global Forecast to 2030 |

||||||

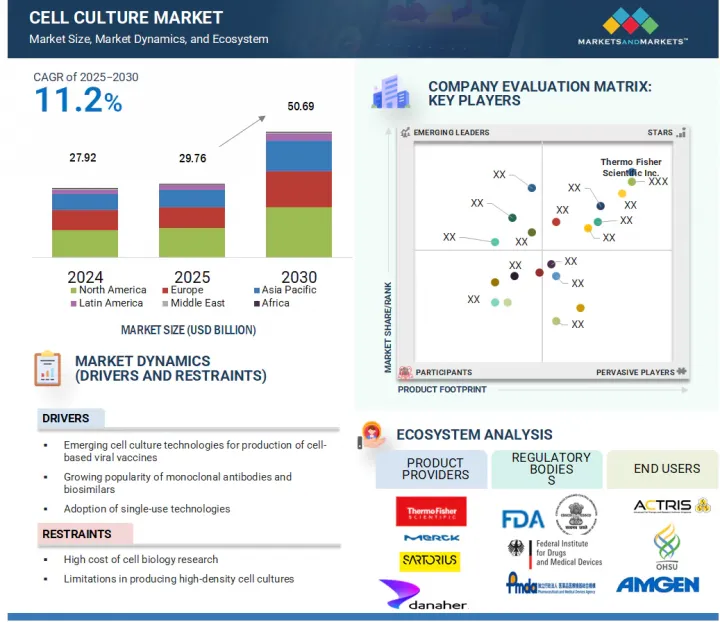

全球細胞培養市場預計將從 2025 年的 297.6 億美元成長到 2030 年的 506.9 億美元,2025-2030 年預測期間的複合年成長率為 11.2%。

| 調查範圍 | |

|---|---|

| 調查年份 | 2024-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 單元 | 10億美元 |

| 部分 | 產品、應用程式和最終用戶 |

| 目標區域 | 北美、歐洲、亞太地區、拉丁美洲、中東和非洲 |

這一市場成長可歸因於細胞生物學領域研究投入和資金的不斷增加。癌症等慢性疾病的日益流行,推動了對組織工程和再生醫學等先進治療方法的需求。預計這一趨勢將在未來幾年推動細胞培養市場的成長。

按應用分類,生物製藥生產領域在 2024 年佔據最大佔有率。

感染疾病的爆發推動了對疫苗、單株抗體和治療性蛋白質等生物製藥的需求,從而推動了細胞培養市場生物製藥產量的成長。

2024 年,血清、培養基和試劑部分佔據消耗品市場的大部分佔有率。

該細分市場的巨大佔有率源於生物技術和製藥行業對耗材的頻繁大宗購買和需求。實驗室和生產設施通常需要大量的血清、培養基、試劑、培養皿和配件來維持細胞培養的持續進行。這需要為實驗、測試和生產流程進行頻繁且大量的採購。

2024年美國將主導細胞培養市場。

2024年,美國主導北美細胞培養市場。作為全球最大的生物製藥市場,美國因其對生物製藥研究和投資的重視而佔據顯著地位。此外,美國擁有哈佛大學、史丹佛大學和麻省理工學院(MIT)等知名學術研究機構,這些機構以在藥物研發和生物技術等生命科學領域開展開創性研究而聞名,並透過廣泛應用細胞培養技術推動市場擴張。此外,美國在組織工程和再生醫學研發方面的投資不斷增加,也促進了細胞培養市場的成長。

本報告研究了全球細胞培養市場,提供了關鍵促進因素和限制因素、競爭格局和未來趨勢的資訊。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章 主要發現

- 細胞培養市場對企業來說極具吸引力的機會

- 北美細胞培養市場(按產品和國家分類)

- 細胞培養市場佔有率(按應用)

- 細胞培養市場佔有率(按最終用戶)

- 細胞培養市場:地理成長機會

第5章市場概述

- 介紹

- 市場動態

- 驅動程式

- 抑制因素

- 機會

- 任務

- 影響客戶業務的趨勢/中斷

- 定價分析

- 主要企業平均銷售價格趨勢:依產品分類

- 各地區產品平均售價

- 價值鏈分析

- 生態系分析

- 投資金籌措場景

- 技術分析

- 主要技術

- 互補技術

- 鄰近技術

- 專利分析

- 貿易分析

- 導入數據

- 匯出數據

- 大型會議和活動(2025-2026年)

- 關稅和監管格局

- 細胞培養產品關稅

- 法規結構

- 監管機構、政府機構和其他組織

- 波特五力分析

- 主要相關利益者和採購標準

- 人工智慧/生成式人工智慧對細胞培養產品市場的影響

- 介紹

- 人工智慧在細胞培養應用的市場潛力

- 人工智慧用例

- 採用人工智慧的主要企業

- 細胞培養生態系中生成式人工智慧的未來

- 2025年美國關稅對細胞培養市場的影響

- 介紹

- 主要關稅稅率

- 價格影響分析

- 對國家的影響

- 對終端產業的影響

第6章 細胞培養市場:依產品

- 介紹

- 耗材

- 血清、培養基和試劑

- 容器

- 配件

- 裝置

- 生物反應器

- 倉儲設備

- 其他設備

第7章 細胞培養市場:依應用

- 介紹

- 生物製藥生產

- 單株抗體生產

- 疫苗生產

- 其他治療性蛋白質的生產

- 診斷

- 組織工程與再生醫學

- 細胞和基因治療

- 其他組織工程及再生醫學應用

- 藥物篩檢與開發

- 其他用途

第 8 章 細胞培養市場(依最終用戶分類)

- 介紹

- 製藥和生物技術公司

- 醫院和診斷實驗室

- 研究和學術機構

- 其他最終用戶

第9章細胞培養市場:按地區

- 介紹

- 北美洲

- 北美宏觀經濟展望

- 美國

- 加拿大

- 歐洲

- 歐洲宏觀經濟展望

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 亞太宏觀經濟展望

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 其他亞太地區

- 拉丁美洲

- 拉丁美洲宏觀經濟展望

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中東

- 中東宏觀經濟展望

- 海灣合作理事會國家

- 其他中東地區

- 非洲

第10章 競爭格局

- 概述

- 主要參與企業的策略/優勢

- 收益分析(2020-2024)

- 市場佔有率分析(2024年)

- 公司估值及財務指標

- 品牌/產品比較

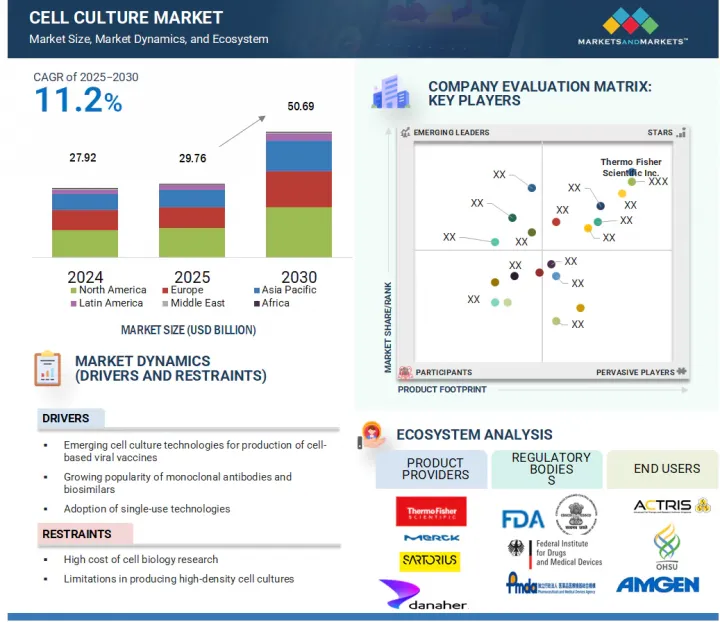

- 企業評估矩陣:主要企業(2024年)

- 公司評估矩陣:Start-Ups/中小企業(2024 年)

- 競爭場景

第11章:公司簡介

- 介紹

- 主要企業

- THERMO FISHER SCIENTIFIC INC.

- DANAHER

- MERCK KGAA

- SARTORIUS AG

- CORNING INCORPORATED

- FUJIFILM HOLDINGS CORPORATION

- BD

- EPPENDORF SE

- LONZA

- GETINGE

- AGILENT TECHNOLOGIES, INC.

- HIMEDIA LABORATORIES

- BIO-TECHNE

- 其他公司

- MILTENYI BIOTEC

- STEMCELL TECHNOLOGIES

- SOLIDA BIOTECH GMBH

- CAISSON LABS

- PROMOCELL GMBH

- INVIVOGEN

- PAN-BIOTECH

- CELLEXUS

- MEISSNER FILTRATION PRODUCTS, INC.

- ADOLF KUHNER AG

- ADVANCION CORPORATION

- BIOSPHERIX LLC

第12章 附錄

The cell culture market is projected to reach USD 50.69 billion by 2030 from an estimated USD 29.76 billion in 2025, at a CAGR of 11.2% during the forecast period of 2025 to 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Application, and End User |

| Regions covered | North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

The growth of this market can be attributed to growing investments and funding for research in the field of cell biology. The rising incidence of chronic diseases such as cancer is boosting the demand for advanced therapies such as tissue engineering and regenerative medicine. This trend is expected to drive the growth of the cell culture market in the coming years.

The biopharmaceutical production segment accounted for the largest share of the application segment in 2024.

In 2024, the biopharmaceutical production segment accounted for the largest share of the application segment in the global cell culture market. The biopharmaceutical production segment is further categorized into vaccine production, monoclonal antibody production, and other therapeutic protein production. The growing prevalence of infectious diseases is boosting the demand for biopharmaceuticals such as vaccines, monoclonal antibodies, and therapeutic proteins, which is promoting the growth of biopharmaceutical production in the cell culture market.

The sera, media, and reagents segment accounted for a major share of the consumables market in 2024.

The cell culture consumables market is categorized by type into sera, media, and reagents; vessels; and accessories. The sera, media, and reagents segment accounted for the largest share of the cell culture consumables market in 2024. The large share of this segment is attributed to the repeated bulk purchase and requirement for consumables in the biotechnology and pharmaceutical industries. Research labs and production facilities often require large quantities of sera, media, reagents, vessels, and accessories to sustain continuous cell culture activities. This leads to frequent and substantial procurement for experimentation, testing, and manufacturing processes.

The US dominated the cell culture market in 2024.

In 2024, the cell culture market in North America was led by the US. As the world's largest biopharmaceutical market with a strong emphasis on research and investment in biopharmaceuticals, the US holds a prominent position. Moreover, the country hosts renowned academic research institutions such as Harvard University, Stanford University, and the Massachusetts Institute of Technology (MIT), renowned for their groundbreaking work in life sciences, including drug discovery and biotechnology, which extensively employ cell culture techniques, thereby fueling market expansion. Furthermore, increasing investments in tissue engineering and regenerative medicine R&D are contributing to the growth of the cell culture market.

The primary interviews conducted for this report can be categorized as follows:

- By Respondent: Supply Side- 70% and Demand Side 30%

- By Designation: Managers - 45%, CXOs & Directors - 30%, and Executives - 25%

- By Region: North America - 40%, Europe -25%, Asia-Pacific -25%, Latin America -5% and Middle East & Africa- 5%

List of Companies Profiled in the Report:

- Thermo Fisher Scientific Inc. (US)

- Danaher Corporation (US)

- Sartorius AG (Germany)

- Merck KGaA (Germany)

- Corning Incorporated (US)

- FUJIFILM Holdings Corporation (Japan)

- BD (US)

- Eppendorf SE (Germany)

- Lonza (Switzerland)

- Getinge AB (Sweden)

- Agilent Technologies, Inc. (US)

- HiMedia Laboratories (India)

- Miltenyi Biotec (Germany)

- STEMCELL Technologies (Canada)

- Solida Biotech GmbH (Germany)

- Caisson Labs (US)

- PromoCell GmbH (Germany)

- InvivoGen (France)

- PAN-Biotech (Germany)

- Cellexus (Scotland)

- Meissner Filtration Products Inc. (US)

- Adolf Kuhner AG (Switzerland)

- Bio-Techne (US)

- Advancion Corporation (US)

- BioSpherix, Ltd. (US)

Research Coverage

This research report categorizes the cell culture market by product ((equipment (bioreactors, storage equipment, and other equipment), consumables (sera, media, reagents; vessels, and accessories)), by application (biopharmaceutical production (vaccine production, monoclonal antibody production, and other therapeutic protein production), diagnostics, tissue engineering & regenerative medicine (cell & gene therapy and other tissue engineering & regenerative medicine applications), drug screening & development, and other applications), by end user (pharmaceutical & biotechnology companies, hospitals & diagnostic laboratories, research & academic institutes, and other end users), and by region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the cell culture market. A detailed analysis of the key industry players has been done to provide insights into their business overview, products, solutions, key strategies, collaborations, partnerships, and agreements. New launches, collaborations, and acquisitions are the recent developments associated with the cell culture market.

Key Benefits of Buying the Report

The report will help market leaders/new entrants by providing them with the closest approximations of the revenue numbers for the overall cell culture market and its subsegments. It will also help stakeholders better understand the competitive landscape and gain more insights to better position their business and make suitable go-to-market strategies. This report will enable stakeholders to understand the market's pulse and provide them with information on the key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (increasing prevalence of infectious diseases, rising adoption of single-use technologies, and growing strategic alliances for the development of advanced therapy medicine products), restraints (high cost of cell biology research and limitations regarding production of high density cell culture), opportunities (growing opportunities in emerging economies, rising demand for 3D cell culture), and challenges (ethical concern regarding cell usage) influencing the growth of the market.

- Product Development/Innovation: Detailed insights on newly launched products of the cell culture market

- Market Development: Comprehensive information about lucrative markets - the report analyses the market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the cell culture market

- Competitive Assessment: Thermo Fisher Scientific Inc. (US), Danaher Corporation (US), Sartorius AG (Germany), Merck KGaA (Germany), Corning Incorporated (US), FUJIFILM Holdings Corporation (Japan), BD (US), Eppendorf SE (Germany), Lonza (Switzerland), Getinge AB (Sweden), Agilent Technologies, Inc. (US), HiMedia Laboratories (India), Miltenyi Biotec (Germany), STEMCELL Technologies (Canada), Solida Biotech GmbH (Germany), Caisson Labs (US), PromoCell GmbH (Germany), InvivoGen (France), PAN-Biotech (Germany), Cellexus (Scotland), Meissner Filtration Products Inc. (US), Adolf Kuhner AG (Switzerland), Bio-Techne (US), Advancion Corporation (US), and BioSpherix, Ltd. (US)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.2 MARKET ESTIMATION METHODOLOGY

- 2.2.1 GLOBAL MARKET SIZE ESTIMATION, 2024

- 2.2.1.1 Insights from primary sources

- 2.2.2 SEGMENTAL MARKET ESTIMATION

- 2.2.1 GLOBAL MARKET SIZE ESTIMATION, 2024

- 2.3 GROWTH RATE PROJECTIONS

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CELL CULTURE MARKET

- 4.2 NORTH AMERICA: CELL CULTURE MARKET, BY PRODUCT AND COUNTRY

- 4.3 CELL CULTURE MARKET SHARE, BY APPLICATION

- 4.4 CELL CULTURE MARKET SHARE, BY END USER

- 4.5 CELL CULTURE MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing support and funding for cell-based research

- 5.2.1.2 Emerging cell culture technologies

- 5.2.1.3 Growing popularity of monoclonal antibodies and biosimilars

- 5.2.1.4 Increasing adoption of single-use technologies

- 5.2.1.5 Rise in product launches

- 5.2.1.6 Growth in advanced therapy medicinal products

- 5.2.1.7 Increasing incidence of infectious diseases

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of cell biology research

- 5.2.2.2 Limitations in producing high-density cell cultures

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising demand for 3D cell culture

- 5.2.3.2 Growth opportunities in emerging economies

- 5.2.3.3 Increasing focus on next-generation therapeutics

- 5.2.4 CHALLENGES

- 5.2.4.1 Disposal of plastic consumables

- 5.2.4.2 Ethical concerns related to cell usage

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY PRODUCT

- 5.4.2 AVERAGE SELLING PRICE OF PRODUCTS, BY REGION

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Single-use technology

- 5.8.1.2 Flow cytometry

- 5.8.1.3 Microscopy

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 High-throughput screening

- 5.8.2.2 Mass spectrometry

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Microfluidics and organ-on-a-chip

- 5.8.3.2 3D bioprinting

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT DATA

- 5.10.2 EXPORT DATA

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 TARIFF AND REGULATORY LANDSCAPE

- 5.12.1 TARIFF RELATED TO CELL CULTURE PRODUCTS

- 5.12.2 REGULATORY FRAMEWORK

- 5.12.2.1 North America

- 5.12.2.2 Europe

- 5.12.2.3 Asia Pacific

- 5.12.2.4 Latin America

- 5.12.2.5 Middle East & Africa

- 5.12.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 BARGAINING POWER OF SUPPLIERS

- 5.13.2 BARGAINING POWER OF BUYERS

- 5.13.3 THREAT OF NEW ENTRANTS

- 5.13.4 THREAT OF SUBSTITUTES

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 KEY BUYING CRITERIA

- 5.15 IMPACT OF AI/GENERATIVE AI ON CELL CULTURE PRODUCTS MARKET

- 5.15.1 INTRODUCTION

- 5.15.2 MARKET POTENTIAL OF AI IN CELL CULTURE APPLICATIONS

- 5.15.3 AI USE CASES

- 5.15.4 KEY COMPANIES IMPLEMENTING AI

- 5.15.5 FUTURE OF GENERATIVE AI IN CELL CULTURE ECOSYSTEM

- 5.16 IMPACT OF 2025 US TARIFF ON CELL CULTURE MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 KEY TARIFF RATES

- 5.16.3 PRICE IMPACT ANALYSIS

- 5.16.4 IMPACT ON COUNTRY/REGION

- 5.16.4.1 US

- 5.16.4.2 Europe

- 5.16.4.3 Asia Pacific

- 5.16.5 IMPACT ON END-USE INDUSTRIES

- 5.16.5.1 Pharmaceutical & biotech companies

- 5.16.5.2 Hospitals & diagnostic laboratories

- 5.16.5.3 Academic & research institutes

- 5.16.5.4 Contract research organizations & contract development and manufacturing organizations

6 CELL CULTURE MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 CONSUMABLES

- 6.2.1 SERA, MEDIA, AND REAGENTS

- 6.2.1.1 Media

- 6.2.1.1.1 Serum-free media

- 6.2.1.1.1.1 Enhanced control, reproducibility, and decreased batch-to-batch variability to aid growth

- 6.2.1.1.2 Classical media & salts

- 6.2.1.1.2.1 Need for efficient and scalable vaccine production to bolster growth

- 6.2.1.1.3 Stem cell culture media

- 6.2.1.1.3.1 Rising funding and support for stem cell-based research and therapy to augment growth

- 6.2.1.1.4 Chemically-defined media

- 6.2.1.1.4.1 Rising need for reproducibility, regulatory compliance, and precise control in cell culture systems to aid growth

- 6.2.1.1.5 Specialty media

- 6.2.1.1.5.1 Suitability for use in selective cell types in bioprocessing and biomanufacturing industries to boost market

- 6.2.1.1.6 Other media

- 6.2.1.1.1 Serum-free media

- 6.2.1.2 Reagents

- 6.2.1.2.1 Growth factors

- 6.2.1.2.1.1 Need to regulate cell proliferation, differentiation, and migration to sustain growth

- 6.2.1.2.2 Supplements

- 6.2.1.2.2.1 Growing acquisitions and expansions by cell culture vendors to propel market

- 6.2.1.2.3 Buffers & chemicals

- 6.2.1.2.3.1 Ability to maintain stable pH levels to facilitate growth

- 6.2.1.2.4 Cell dissociation reagents

- 6.2.1.2.4.1 Ability to minimize cell stress and reduce cell damage to foster growth

- 6.2.1.2.5 Balanced salt solutions

- 6.2.1.2.5.1 Ability to maintain optimal physiological conditions for cell growth and experimentation to assist growth

- 6.2.1.2.6 Attachment & matrix factors

- 6.2.1.2.6.1 Rising adoption of 3D cell culture models to support growth

- 6.2.1.2.7 Antibiotics/Antimycotics

- 6.2.1.2.7.1 Ability to mitigate growth of contaminating bacteria, fungi, and mycoplasma to drive market

- 6.2.1.2.8 Cryoprotective reagents

- 6.2.1.2.8.1 Ability to preserve cell viability during freezing and thawing to aid growth

- 6.2.1.2.9 Contamination detection kits

- 6.2.1.2.9.1 Need for rapid identification of microbial contaminants to promote growth

- 6.2.1.2.10 Other reagents

- 6.2.1.2.1 Growth factors

- 6.2.1.3 Sera

- 6.2.1.3.1 Fetal bovine sera

- 6.2.1.3.1.1 Increasing role of fetal bovine sera in cell proliferation to favor growth

- 6.2.1.3.2 Adult bovine sera

- 6.2.1.3.2.1 Cost-effectiveness to contribute to growth

- 6.2.1.3.3 Other animal sera

- 6.2.1.3.1 Fetal bovine sera

- 6.2.1.1 Media

- 6.2.2 VESSELS

- 6.2.2.1 Cell factory systems/cell stacks

- 6.2.2.1.1 Efficient and scalable solutions for large-scale expansion to drive adoption

- 6.2.2.2 Roller/roux bottles

- 6.2.2.2.1 Scalability, cost-effectiveness, and ease of handling to support growth

- 6.2.2.3 Flasks

- 6.2.2.3.1 Growing advancements in cell culture flasks to boost market

- 6.2.2.4 Multiwell plates

- 6.2.2.4.1 Increasing adoption of multiwell plates in high-throughput or high-content screening to aid growth

- 6.2.2.5 Petri dishes

- 6.2.2.5.1 Rising use of petri dishes as sterile containers to sustain growth

- 6.2.2.1 Cell factory systems/cell stacks

- 6.2.3 ACCESSORIES

- 6.2.3.1 Reduced preparation time and equipment performance improvements to augment growth

- 6.2.1 SERA, MEDIA, AND REAGENTS

- 6.3 EQUIPMENT

- 6.3.1 BIOREACTORS

- 6.3.1.1 Conventional bioreactors

- 6.3.1.1.1 Utilization in large-scale manufacturing of drugs to drive market

- 6.3.1.2 Single-use bioreactors

- 6.3.1.2.1 Lower operational costs and increased flexibility to boost market

- 6.3.1.1 Conventional bioreactors

- 6.3.2 STORAGE EQUIPMENT

- 6.3.2.1 Refrigerators & freezers

- 6.3.2.1.1 Increasing need for storage solutions to propel market

- 6.3.2.2 Cryostorage systems

- 6.3.2.2.1 Benefits of long-term preservation of cell cultures to support growth

- 6.3.2.1 Refrigerators & freezers

- 6.3.3 OTHER EQUIPMENT

- 6.3.3.1 Filtration systems

- 6.3.3.1.1 Growing use in bioprocessing industry to boost market

- 6.3.3.2 Cell counters

- 6.3.3.2.1 Growing adoption of automated cell counters to propel market

- 6.3.3.3 Carbon dioxide incubators

- 6.3.3.3.1 Increasing focus of research institutes on developing lab-scale incubators to drive market

- 6.3.3.4 Centrifuges

- 6.3.3.4.1 Increasing demand for bioproduction applications to drive adoption of centrifuges

- 6.3.3.5 Autoclaves

- 6.3.3.5.1 Reliance on single-use labware and equipment to affect demand for autoclaves

- 6.3.3.6 Microscopes

- 6.3.3.6.1 Enhanced imaging capabilities to augment growth

- 6.3.3.7 Biosafety cabinets

- 6.3.3.7.1 Increasing launches of biosafety cabinets to promote growth

- 6.3.3.8 Other supporting equipment

- 6.3.3.1 Filtration systems

- 6.3.1 BIOREACTORS

7 CELL CULTURE MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 BIOPHARMACEUTICAL PRODUCTION

- 7.2.1 MONOCLONAL ANTIBODY PRODUCTION

- 7.2.1.1 Increasing approval and launch of mAb candidates to amplify growth

- 7.2.2 VACCINE PRODUCTION

- 7.2.2.1 Rising incidence of infectious diseases to support growth

- 7.2.3 OTHER THERAPEUTIC PROTEIN PRODUCTION

- 7.2.1 MONOCLONAL ANTIBODY PRODUCTION

- 7.3 DIAGNOSTICS

- 7.3.1 GROWING ADVANCEMENTS AND ADOPTION OF NEW TECHNIQUES TO FUEL MARKET

- 7.4 TISSUE ENGINEERING & REGENERATIVE MEDICINE

- 7.4.1 CELL & GENE THERAPY

- 7.4.1.1 Rising investments in developing cell-based immunotherapies to foster growth

- 7.4.2 OTHER TISSUE ENGINEERING & REGENERATIVE MEDICINE APPLICATIONS

- 7.4.1 CELL & GENE THERAPY

- 7.5 DRUG SCREENING & DEVELOPMENT

- 7.5.1 INCREASING FOCUS ON BIOLOGIC DRUGS TO FAVOR GROWTH

- 7.6 OTHER APPLICATIONS

8 CELL CULTURE MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- 8.2.1 INCREASING DEMAND FOR CULTURE CELL LINES FOR DRUG SCREENING AND R&D TO AID GROWTH

- 8.3 HOSPITALS & DIAGNOSTIC LABORATORIES

- 8.3.1 GROWING USE OF CELL CULTURE FOR CELLULAR PHYSIOLOGY, DISEASE MECHANISMS, AND DRUG RESPONSES TO BOOST MARKET

- 8.4 RESEARCH & ACADEMIC INSTITUTES

- 8.4.1 RISING FUNDING ACTIVITIES TO CONTRIBUTE TO GROWTH

- 8.5 OTHER END USERS

9 CELL CULTURE MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 Advanced healthcare infrastructure and government support to bolster growth

- 9.2.3 CANADA

- 9.2.3.1 Increasing funding and investments for cell-based therapies to boost market

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Rising R&D investments and strategic alliances to promote growth

- 9.3.3 UK

- 9.3.3.1 Growth in life science industry and favorable government investments to drive market

- 9.3.4 FRANCE

- 9.3.4.1 Rising number of cell-based research projects to enhance growth

- 9.3.5 ITALY

- 9.3.5.1 Strong government support for R&D activities to spur growth

- 9.3.6 SPAIN

- 9.3.6.1 Booming biotechnology industry to bolster growth

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 CHINA

- 9.4.2.1 Rising focus on stem cell & regenerative medicine research to expedite growth

- 9.4.3 JAPAN

- 9.4.3.1 Rising government initiatives and increasing investments in biotech to intensify growth

- 9.4.4 INDIA

- 9.4.4.1 Favorable government support and expansion by key cell culture players to augment growth

- 9.4.5 SOUTH KOREA

- 9.4.5.1 Growing pharmaceutical sector to drive market

- 9.4.6 AUSTRALIA

- 9.4.6.1 Increasing prevalence of chronic diseases to accelerate growth

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 9.5.2 BRAZIL

- 9.5.2.1 Rising prevalence of cancer and related research activities to support growth

- 9.5.3 MEXICO

- 9.5.3.1 Increasing advancements in biotechnology industry to spur growth

- 9.5.4 REST OF LATIN AMERICA

- 9.6 MIDDLE EAST

- 9.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST

- 9.6.2 GCC COUNTRIES

- 9.6.2.1 Saudi Arabia

- 9.6.2.1.1 Increasing focus of key players on expansion to drive market

- 9.6.2.2 UAE

- 9.6.2.2.1 Increasing shift from importing to manufacturing pharmaceuticals to boost market

- 9.6.2.3 Rest of GCC Countries

- 9.6.2.1 Saudi Arabia

- 9.6.3 REST OF MIDDLE EAST

- 9.7 AFRICA

- 9.7.1 RISING GRANTS AND FUNDING FOR CELL AND GENE THERAPY PRODUCTS TO FOSTER GROWTH

- 9.7.2 MACROECONOMIC OUTLOOK FOR AFRICA

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN CELL CULTURE MARKET

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 BRAND/PRODUCT COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 Product footprint

- 10.7.5.4 Application footprint

- 10.7.5.5 End-user footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

11 COMPANY PROFILES

- 11.1 INTRODUCTION

- 11.2 KEY PLAYERS

- 11.2.1 THERMO FISHER SCIENTIFIC INC.

- 11.2.1.1 Business overview

- 11.2.1.2 Products offered

- 11.2.1.3 Recent developments

- 11.2.1.3.1 Product launches

- 11.2.1.3.2 Deals

- 11.2.1.3.3 Expansions

- 11.2.1.4 MnM view

- 11.2.1.4.1 Key strengths

- 11.2.1.4.2 Strategic choices

- 11.2.1.4.3 Weaknesses and competitive threats

- 11.2.2 DANAHER

- 11.2.2.1 Business overview

- 11.2.2.2 Products offered

- 11.2.2.3 Recent developments

- 11.2.2.3.1 Product launches

- 11.2.2.3.2 Deals

- 11.2.2.3.3 Expansions

- 11.2.2.3.4 Other developments

- 11.2.2.4 MnM view

- 11.2.2.4.1 Key strengths

- 11.2.2.4.2 Strategic choices

- 11.2.2.4.3 Weaknesses and competitive threats

- 11.2.3 MERCK KGAA

- 11.2.3.1 Business overview

- 11.2.3.2 Products offered

- 11.2.3.3 Recent developments

- 11.2.3.3.1 Product launches

- 11.2.3.3.2 Deals

- 11.2.3.3.3 Expansions

- 11.2.3.4 MnM view

- 11.2.3.4.1 Key strengths

- 11.2.3.4.2 Strategic choices

- 11.2.3.4.3 Weaknesses and competitive threats

- 11.2.4 SARTORIUS AG

- 11.2.4.1 Business overview

- 11.2.4.2 Products offered

- 11.2.4.3 Recent developments

- 11.2.4.3.1 Product launches

- 11.2.4.3.2 Deals

- 11.2.4.3.3 Expansions

- 11.2.5 CORNING INCORPORATED

- 11.2.5.1 Business overview

- 11.2.5.2 Products offered

- 11.2.5.3 Recent developments

- 11.2.5.3.1 Product launches

- 11.2.5.3.2 Deals

- 11.2.6 FUJIFILM HOLDINGS CORPORATION

- 11.2.6.1 Business overview

- 11.2.6.2 Products offered

- 11.2.6.3 Recent developments

- 11.2.6.3.1 Product launches

- 11.2.6.3.2 Deals

- 11.2.6.3.3 Expansions

- 11.2.6.3.4 Other developments

- 11.2.7 BD

- 11.2.7.1 Business overview

- 11.2.7.2 Product offered

- 11.2.7.3 Recent developments

- 11.2.7.3.1 Product Launches

- 11.2.7.3.2 Deals

- 11.2.8 EPPENDORF SE

- 11.2.8.1 Business overview

- 11.2.8.2 Products offered

- 11.2.8.3 Recent developments

- 11.2.8.3.1 Product launches

- 11.2.8.3.2 Deals

- 11.2.8.3.3 Expansions

- 11.2.9 LONZA

- 11.2.9.1 Business overview

- 11.2.9.2 Products offered

- 11.2.9.3 Recent developments

- 11.2.9.3.1 Product launches

- 11.2.9.3.2 Deals

- 11.2.10 GETINGE

- 11.2.10.1 Business overview

- 11.2.10.2 Products offered

- 11.2.10.3 Recent developments

- 11.2.10.3.1 Product launches

- 11.2.10.3.2 Deals

- 11.2.10.3.3 Expansions

- 11.2.11 AGILENT TECHNOLOGIES, INC.

- 11.2.11.1 Business overview

- 11.2.11.2 Products offered

- 11.2.11.3 Recent developments

- 11.2.11.3.1 Product launches

- 11.2.11.3.2 Deals

- 11.2.11.3.3 Expansions

- 11.2.12 HIMEDIA LABORATORIES

- 11.2.12.1 Business overview

- 11.2.12.2 Products offered

- 11.2.13 BIO-TECHNE

- 11.2.13.1 Business overview

- 11.2.13.2 Products offered

- 11.2.13.3 Recent developments

- 11.2.13.3.1 Product launches

- 11.2.13.3.2 Deals

- 11.2.13.3.3 Expansions

- 11.2.1 THERMO FISHER SCIENTIFIC INC.

- 11.3 OTHER PLAYERS

- 11.3.1 MILTENYI BIOTEC

- 11.3.2 STEMCELL TECHNOLOGIES

- 11.3.3 SOLIDA BIOTECH GMBH

- 11.3.4 CAISSON LABS

- 11.3.5 PROMOCELL GMBH

- 11.3.6 INVIVOGEN

- 11.3.7 PAN-BIOTECH

- 11.3.8 CELLEXUS

- 11.3.9 MEISSNER FILTRATION PRODUCTS, INC.

- 11.3.10 ADOLF KUHNER AG

- 11.3.11 ADVANCION CORPORATION

- 11.3.12 BIOSPHERIX LLC

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

List of Tables

- TABLE 1 CELL CULTURE MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 IMPACT ANALYSIS OF SUPPLY-SIDE AND DEMAND-SIDE FACTORS

- TABLE 3 CELL CULTURE MARKET: RISK ANALYSIS

- TABLE 4 CELL CULTURE MARKET: IMPACT ANALYSIS OF MARKET DYNAMICS

- TABLE 5 NATIONAL INSTITUTES OF HEALTH FUNDING FOR STEM CELL-BASED RESEARCH, 2020-2024 (USD MILLION)

- TABLE 6 FUNDING INVESTMENTS IN CELL & GENE THERAPY, 2023 - 2025

- TABLE 7 COMMERCIALLY SPONSORED MONOCLONAL ANTIBODY THERAPEUTICS GRANTED FIRST APPROVAL IN 2024

- TABLE 8 ASIA PACIFIC: PRIVATE ROUNDS IN BIOTECH COMPANIES FOCUSED ON HEALTHCARE, 2023-2025

- TABLE 9 COMPARISON OF SINGLE-USE BIOPROCESSING SYSTEM DISPOSAL OPTIONS

- TABLE 10 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY PRODUCT, 2022-2024

- TABLE 11 AVERAGE SELLING PRICE OF SINGLE-USE ASSEMBLIES, BY REGION, 2024

- TABLE 12 AVERAGE SELLING PRICE OF MEDIA, BY DEVELOPING VS. DEVELOPED COUNTRIES, 2024

- TABLE 13 CELL CULTURE MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 14 ADVANTAGES OF SINGLE-USE AND STAINLESS-STEEL BIOREACTORS

- TABLE 15 ADVANTAGES AND DISADVANTAGES OF MICROFLUIDIC CELL CULTURE

- TABLE 16 CELL CULTURE MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2025

- TABLE 17 IMPORT DATA FOR HS CODE 382100, 2020-2024 (USD THOUSAND)

- TABLE 18 IMPORT DATA FOR HS CODE 382100, 2020-2024 (TONS)

- TABLE 19 EXPORT DATA FOR HS CODE 382100, 2020-2024 (USD THOUSAND)

- TABLE 20 EXPORT DATA FOR HS CODE 382100, 2020-2024 (TONS)

- TABLE 21 CELL CULTURE MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 22 AVERAGE TARIFF RELATED TO CELL CULTURE PRODUCTS FOR HS CODE 382100, 2024

- TABLE 23 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 25 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 26 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 27 CELL CULTURE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 28 BUYING CRITERIA FOR CELL CULTURE PRODUCTS, BY END USER

- TABLE 29 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 30 CELL CULTURE PRODUCTS-RELATED TARIFF REVISION

- TABLE 31 IMPACT ON END-USE APPLICATIONS OF CELL-BASED ASSAY PRODUCTS

- TABLE 32 CELL CULTURE MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 33 CELL CULTURE CONSUMABLES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 34 CELL CULTURE CONSUMABLES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 35 NORTH AMERICA: CELL CULTURE CONSUMABLES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 36 EUROPE: CELL CULTURE CONSUMABLES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 37 ASIA PACIFIC: CELL CULTURE CONSUMABLES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 38 LATIN AMERICA: CELL CULTURE CONSUMABLES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 39 MIDDLE EAST: CELL CULTURE CONSUMABLES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 40 GCC COUNTRIES: CELL CULTURE CONSUMABLES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 41 CELL CULTURE SERA, MEDIA, AND REAGENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 42 CELL CULTURE SERA, MEDIA, AND REAGENTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 43 NORTH AMERICA: CELL CULTURE SERA, MEDIA, AND REAGENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 44 EUROPE: CELL CULTURE SERA, MEDIA, AND REAGENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 45 ASIA PACIFIC: CELL CULTURE SERA, MEDIA, AND REAGENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 46 LATIN AMERICA: CELL CULTURE SERA, MEDIA, AND REAGENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 47 MIDDLE EAST: CELL CULTURE SERA, MEDIA, AND REAGENTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 48 GCC COUNTRIES: CELL CULTURE SERA, MEDIA, AND REAGENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 49 CELL CULTURE MEDIA MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 50 CELL CULTURE MEDIA MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 51 CELL CULTURE MEDIA MARKET, BY REGION, 2023-2030 (MILLION LITERS)

- TABLE 52 NORTH AMERICA: CELL CULTURE MEDIA MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 53 EUROPE: CELL CULTURE MEDIA MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 54 ASIA PACIFIC: CELL CULTURE MEDIA MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 55 LATIN AMERICA: CELL CULTURE MEDIA MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 56 MIDDLE EAST: CELL CULTURE MEDIA MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 57 GCC COUNTRIES: CELL CULTURE MEDIA MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 58 SERUM-FREE MEDIA OFFERED BY KEY MARKET PLAYERS

- TABLE 59 CELL CULTURE MARKET FOR SERUM-FREE MEDIA, BY REGION, 2023-2030 (USD MILLION)

- TABLE 60 NORTH AMERICA: CELL CULTURE MARKET FOR SERUM-FREE MEDIA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 61 EUROPE: CELL CULTURE MARKET FOR SERUM-FREE MEDIA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 62 ASIA PACIFIC: CELL CULTURE MARKET FOR SERUM-FREE MEDIA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 63 LATIN AMERICA: CELL CULTURE MARKET FOR SERUM-FREE MEDIA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 64 MIDDLE EAST: CELL CULTURE MARKET FOR SERUM-FREE MEDIA, BY REGION, 2023-2030 (USD MILLION)

- TABLE 65 GCC COUNTRIES: CELL CULTURE MARKET FOR SERUM-FREE MEDIA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 66 CLASSICAL MEDIA & SALTS OFFERED BY KEY MARKET PLAYERS

- TABLE 67 CELL CULTURE MARKET FOR CLASSICAL MEDIA & SALTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 68 NORTH AMERICA: CELL CULTURE MARKET FOR CLASSICAL MEDIA & SALTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 69 EUROPE: CELL CULTURE MARKET FOR CLASSICAL MEDIA & SALTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 70 ASIA PACIFIC: CELL CULTURE MARKET FOR CLASSICAL MEDIA & SALTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 71 LATIN AMERICA: CELL CULTURE MARKET FOR CLASSICAL MEDIA & SALTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 72 MIDDLE EAST: CELL CULTURE MARKET FOR CLASSICAL MEDIA & SALTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 73 GCC COUNTRIES: CELL CULTURE MARKET FOR CLASSICAL MEDIA & SALTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 74 STEM CELL CULTURE MEDIA OFFERED BY KEY MARKET PLAYERS

- TABLE 75 CELL CULTURE MARKET FOR STEM CELL CULTURE MEDIA, BY REGION, 2023-2030 (USD MILLION)

- TABLE 76 NORTH AMERICA: CELL CULTURE MARKET FOR STEM CELL CULTURE MEDIA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 77 EUROPE: CELL CULTURE MARKET FOR STEM CELL CULTURE MEDIA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 78 ASIA PACIFIC: CELL CULTURE MARKET FOR STEM CELL CULTURE MEDIA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 79 LATIN AMERICA: CELL CULTURE MARKET FOR STEM CELL CULTURE MEDIA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 80 MIDDLE EAST: CELL CULTURE MARKET FOR STEM CELL CULTURE MEDIA, BY REGION, 2023-2030 (USD MILLION)

- TABLE 81 GCC COUNTRIES: CELL CULTURE MARKET FOR STEM CELL CULTURE MEDIA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 82 CHEMICALLY-DEFINED MEDIA OFFERED BY KEY MARKET PLAYERS

- TABLE 83 CELL CULTURE MARKET FOR CHEMICALLY-DEFINED MEDIA, BY REGION, 2023-2030 (USD MILLION)

- TABLE 84 NORTH AMERICA: CELL CULTURE MARKET FOR CHEMICALLY-DEFINED MEDIA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 85 EUROPE: CELL CULTURE MARKET FOR CHEMICALLY-DEFINED MEDIA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 86 ASIA PACIFIC: CELL CULTURE MARKET FOR CHEMICALLY-DEFINED MEDIA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 87 LATIN AMERICA: CELL CULTURE MARKET FOR CHEMICALLY-DEFINED MEDIA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 88 MIDDLE EAST: CELL CULTURE MARKET FOR CHEMICALLY-DEFINED MEDIA, BY REGION, 2023-2030 (USD MILLION)

- TABLE 89 GCC COUNTRIES: CELL CULTURE MARKET FOR CHEMICALLY-DEFINED MEDIA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 90 SPECIALTY MEDIA OFFERED BY KEY MARKET PLAYERS

- TABLE 91 CELL CULTURE MARKET FOR SPECIALTY MEDIA, BY REGION, 2023-2030 (USD MILLION)

- TABLE 92 NORTH AMERICA: CELL CULTURE MARKET FOR SPECIALTY MEDIA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 93 EUROPE: CELL CULTURE MARKET FOR SPECIALTY MEDIA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 94 ASIA PACIFIC: CELL CULTURE MARKET FOR SPECIALTY MEDIA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 95 LATIN AMERICA: CELL CULTURE MARKET FOR SPECIALTY MEDIA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 96 MIDDLE EAST: CELL CULTURE MARKET FOR SPECIALTY MEDIA, BY REGION, 2023-2030 (USD MILLION)

- TABLE 97 GCC COUNTRIES: CELL CULTURE MARKET FOR SPECIALTY MEDIA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 98 OTHER MEDIA OFFERED BY KEY MARKET PLAYERS

- TABLE 99 CELL CULTURE MARKET FOR OTHER MEDIA, BY REGION, 2023-2030 (USD MILLION)

- TABLE 100 NORTH AMERICA: CELL CULTURE MARKET FOR OTHER MEDIA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 101 EUROPE: CELL CULTURE MARKET FOR OTHER MEDIA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 102 ASIA PACIFIC: CELL CULTURE MARKET FOR OTHER MEDIA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 103 LATIN AMERICA: CELL CULTURE MARKET FOR OTHER MEDIA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 104 MIDDLE EAST: CELL CULTURE MARKET FOR OTHER MEDIA, BY REGION, 2023-2030 (USD MILLION)

- TABLE 105 GCC COUNTRIES: CELL CULTURE MARKET FOR OTHER MEDIA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 106 CELL CULTURE REAGENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 107 CELL CULTURE REAGENTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 108 NORTH AMERICA: CELL CULTURE REAGENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 109 EUROPE: CELL CULTURE REAGENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 110 ASIA PACIFIC: CELL CULTURE REAGENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 111 LATIN AMERICA: CELL CULTURE REAGENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 112 MIDDLE EAST: CELL CULTURE REAGENTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 113 GCC COUNTRIES: CELL CULTURE REAGENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 114 CELL CULTURE MARKET FOR GROWTH FACTORS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 115 NORTH AMERICA: CELL CULTURE MARKET FOR GROWTH FACTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 116 EUROPE: CELL CULTURE MARKET FOR GROWTH FACTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 117 ASIA PACIFIC: CELL CULTURE MARKET FOR GROWTH FACTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 118 LATIN AMERICA: CELL CULTURE MARKET FOR GROWTH FACTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 119 MIDDLE EAST: CELL CULTURE MARKET FOR GROWTH FACTORS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 120 GCC COUNTRIES: CELL CULTURE MARKET FOR GROWTH FACTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 121 CELL CULTURE MARKET FOR SUPPLEMENTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 122 NORTH AMERICA: CELL CULTURE MARKET FOR SUPPLEMENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 123 EUROPE: CELL CULTURE MARKET FOR SUPPLEMENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 124 ASIA PACIFIC: CELL CULTURE MARKET FOR SUPPLEMENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 125 LATIN AMERICA: CELL CULTURE MARKET FOR SUPPLEMENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 126 MIDDLE EAST: CELL CULTURE MARKET FOR SUPPLEMENTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 127 GCC COUNTRIES: CELL CULTURE MARKET FOR SUPPLEMENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 128 CELL CULTURE MARKET FOR BUFFERS & CHEMICALS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 129 NORTH AMERICA: CELL CULTURE MARKET FOR BUFFERS & CHEMICALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 130 EUROPE: CELL CULTURE MARKET FOR BUFFERS & CHEMICALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 131 ASIA PACIFIC: CELL CULTURE MARKET FOR BUFFERS & CHEMICALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 132 LATIN AMERICA: CELL CULTURE MARKET FOR BUFFERS & CHEMICALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 133 MIDDLE EAST: CELL CULTURE MARKET FOR BUFFERS & CHEMICALS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 134 GCC COUNTRIES: CELL CULTURE MARKET FOR BUFFERS & CHEMICALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 135 CELL CULTURE MARKET FOR CELL DISSOCIATION REAGENTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 136 NORTH AMERICA: CELL CULTURE MARKET FOR CELL DISSOCIATION REAGENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 137 EUROPE: CELL CULTURE MARKET FOR CELL DISSOCIATION REAGENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 138 ASIA PACIFIC: CELL CULTURE MARKET FOR CELL DISSOCIATION REAGENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 139 LATIN AMERICA: CELL CULTURE MARKET FOR CELL DISSOCIATION REAGENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 140 MIDDLE EAST: CELL CULTURE MARKET FOR CELL DISSOCIATION REAGENTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 141 GCC COUNTRIES: CELL CULTURE MARKET FOR CELL DISSOCIATION REAGENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 142 CELL CULTURE MARKET FOR BALANCED SALT SOLUTIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 143 NORTH AMERICA: CELL CULTURE MARKET FOR BALANCED SALT SOLUTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 144 EUROPE: CELL CULTURE MARKET FOR BALANCED SALT SOLUTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 145 ASIA PACIFIC: CELL CULTURE MARKET FOR BALANCED SALT SOLUTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 146 LATIN AMERICA: CELL CULTURE MARKET FOR BALANCED SALT SOLUTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 147 MIDDLE EAST: CELL CULTURE MARKET FOR BALANCED SALT SOLUTIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 148 GCC COUNTRIES: CELL CULTURE MARKET FOR BALANCED SALT SOLUTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 149 CELL CULTURE MARKET FOR ATTACHMENT & MATRIX FACTORS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 150 NORTH AMERICA: CELL CULTURE MARKET FOR ATTACHMENT & MATRIX FACTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 151 EUROPE: CELL CULTURE MARKET FOR ATTACHMENT & MATRIX FACTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 152 ASIA PACIFIC: CELL CULTURE MARKET FOR ATTACHMENT & MATRIX FACTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 153 LATIN AMERICA: CELL CULTURE MARKET FOR ATTACHMENT & MATRIX FACTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 154 MIDDLE EAST: CELL CULTURE MARKET FOR ATTACHMENT & MATRIX FACTORS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 155 GCC COUNTRIES: CELL CULTURE MARKET FOR ATTACHMENT & MATRIX FACTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 156 CELL CULTURE MEDIA FOR ANTIBIOTICS/ANTIMYCOTICS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 157 NORTH AMERICA: CELL CULTURE MEDIA FOR ANTIBIOTICS/ANTIMYCOTICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 158 EUROPE: CELL CULTURE MEDIA FOR ANTIBIOTICS/ANTIMYCOTICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 159 ASIA PACIFIC: CELL CULTURE MEDIA FOR ANTIBIOTICS/ANTIMYCOTICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 160 LATIN AMERICA: CELL CULTURE MEDIA FOR ANTIBIOTICS/ANTIMYCOTICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 161 MIDDLE EAST: CELL CULTURE MEDIA FOR ANTIBIOTICS/ANTIMYCOTICS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 162 GCC COUNTRIES: CELL CULTURE MEDIA FOR ANTIBIOTICS/ANTIMYCOTICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 163 CELL CULTURE MARKET FOR CRYOPROTECTIVE REAGENTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 164 NORTH AMERICA: CELL CULTURE MARKET FOR CRYOPROTECTIVE REAGENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 165 EUROPE: CELL CULTURE MARKET FOR CRYOPROTECTIVE REAGENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 166 ASIA PACIFIC: CELL CULTURE MARKET FOR CRYOPROTECTIVE REAGENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 167 LATIN AMERICA: CELL CULTURE MARKET FOR CRYOPROTECTIVE REAGENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 168 MIDDLE EAST: CELL CULTURE MARKET FOR CRYOPROTECTIVE REAGENTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 169 GCC COUNTRIES: CELL CULTURE MARKET FOR CRYOPROTECTIVE REAGENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 170 CELL CULTURE MARKET FOR CONTAMINATION DETECTION KITS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 171 NORTH AMERICA: CELL CULTURE MARKET FOR CONTAMINATION DETECTION KITS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 172 EUROPE: CELL CULTURE MARKET FOR CONTAMINATION DETECTION KITS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 173 ASIA PACIFIC: CELL CULTURE MARKET FOR CONTAMINATION DETECTION KITS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 174 LATIN AMERICA: CELL CULTURE MARKET FOR CONTAMINATION DETECTION KITS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 175 MIDDLE EAST: CELL CULTURE MARKET FOR CONTAMINATION DETECTION KITS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 176 GCC COUNTRIES: CELL CULTURE MARKET FOR CONTAMINATION DETECTION KITS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 177 CELL CULTURE MARKET FOR OTHER REAGENTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 178 NORTH AMERICA: CELL CULTURE MARKET FOR OTHER REAGENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 179 EUROPE: CELL CULTURE MARKET FOR OTHER REAGENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 180 ASIA PACIFIC: CELL CULTURE MARKET FOR OTHER REAGENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 181 LATIN AMERICA: CELL CULTURE MARKET FOR OTHER REAGENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 182 MIDDLE EAST: CELL CULTURE MARKET FOR OTHER REAGENTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 183 GCC COUNTRIES: CELL CULTURE MARKET FOR OTHER REAGENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 184 CELL CULTURE SERA MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 185 CELL CULTURE SERA MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 186 NORTH AMERICA: CELL CULTURE SERA MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 187 EUROPE: CELL CULTURE SERA MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 188 ASIA PACIFIC: CELL CULTURE SERA MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 189 LATIN AMERICA: CELL CULTURE SERA MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 190 MIDDLE EAST: CELL CULTURE SERA MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 191 GCC COUNTRIES: CELL CULTURE SERA MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 192 CELL CULTURE MEDIA FOR FETAL BOVINE SERA, BY REGION, 2023-2030 (USD MILLION)

- TABLE 193 NORTH AMERICA: CELL CULTURE MEDIA FOR FETAL BOVINE SERA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 194 EUROPE: CELL CULTURE MEDIA FOR FETAL BOVINE SERA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 195 ASIA PACIFIC: CELL CULTURE MEDIA FOR FETAL BOVINE SERA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 196 LATIN AMERICA: CELL CULTURE MEDIA FOR FETAL BOVINE SERA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 197 MIDDLE EAST: CELL CULTURE MEDIA FOR FETAL BOVINE SERA, BY REGION, 2023-2030 (USD MILLION)

- TABLE 198 GCC COUNTRIES: CELL CULTURE MEDIA FOR FETAL BOVINE SERA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 199 CELL CULTURE MEDIA FOR ADULT BOVINE SERA, BY REGION, 2023-2030 (USD MILLION)

- TABLE 200 NORTH AMERICA: CELL CULTURE MEDIA FOR ADULT BOVINE SERA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 201 EUROPE: CELL CULTURE MEDIA FOR ADULT BOVINE SERA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 202 ASIA PACIFIC: CELL CULTURE MEDIA FOR ADULT BOVINE SERA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 203 LATIN AMERICA: CELL CULTURE MEDIA FOR ADULT BOVINE SERA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 204 MIDDLE EAST: CELL CULTURE MEDIA FOR ADULT BOVINE SERA, BY REGION, 2023-2030 (USD MILLION)

- TABLE 205 GCC COUNTRIES: CELL CULTURE MEDIA FOR ADULT BOVINE SERA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 206 CELL CULTURE MARKET FOR OTHER ANIMAL SERA, BY REGION, 2023-2030 (USD MILLION)

- TABLE 207 NORTH AMERICA: CELL CULTURE MARKET FOR OTHER ANIMAL SERA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 208 EUROPE: CELL CULTURE MARKET FOR OTHER ANIMAL SERA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 209 ASIA PACIFIC: CELL CULTURE MARKET FOR OTHER ANIMAL SERA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 210 LATIN AMERICA: CELL CULTURE MARKET FOR OTHER ANIMAL SERA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 211 MIDDLE EAST: CELL CULTURE MARKET FOR OTHER ANIMAL SERA, BY REGION, 2023-2030 (USD MILLION)

- TABLE 212 GCC COUNTRIES: CELL CULTURE MARKET FOR OTHER ANIMAL SERA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 213 CELL CULTURE VESSELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 214 CELL CULTURE VESSELS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 215 NORTH AMERICA: CELL CULTURE VESSELS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 216 EUROPE: CELL CULTURE VESSELS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 217 ASIA PACIFIC: CELL CULTURE VESSELS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 218 LATIN AMERICA: CELL CULTURE VESSELS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 219 MIDDLE EAST: CELL CULTURE VESSELS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 220 GCC COUNTRIES: CELL CULTURE VESSELS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 221 CELL CULTURE MARKET FOR CELL FACTORY SYSTEMS/CELL STACKS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 222 NORTH AMERICA: CELL CULTURE MARKET FOR CELL FACTORY SYSTEMS/ CELL STACKS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 223 EUROPE: CELL CULTURE MARKET FOR CELL FACTORY SYSTEMS/CELL STACKS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 224 ASIA PACIFIC: CELL CULTURE MARKET FOR CELL FACTORY SYSTEMS/CELL STACKS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 225 LATIN AMERICA: CELL CULTURE MARKET FOR CELL FACTORY SYSTEMS/ CELL STACKS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 226 MIDDLE EAST: CELL CULTURE MARKET FOR CELL FACTORY SYSTEMS/ CELL STACKS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 227 GCC COUNTRIES: CELL CULTURE MARKET FOR CELL FACTORY SYSTEMS/ CELL STACKS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 228 CELL CULTURE MARKET FOR ROLLER/ROUX BOTTLES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 229 NORTH AMERICA: CELL CULTURE MARKET FOR ROLLER/ROUX BOTTLES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 230 EUROPE: CELL CULTURE MARKET FOR ROLLER/ROUX BOTTLES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 231 ASIA PACIFIC: CELL CULTURE MARKET FOR ROLLER/ROUX BOTTLES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 232 LATIN AMERICA: CELL CULTURE MARKET FOR ROLLER/ROUX BOTTLES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 233 MIDDLE EAST: CELL CULTURE MARKET FOR ROLLER/ROUX BOTTLES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 234 GCC COUNTRIES: CELL CULTURE MARKET FOR ROLLER/ROUX BOTTLES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 235 CELL CULTURE MARKET FOR FLASKS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 236 NORTH AMERICA: CELL CULTURE MARKET FOR FLASKS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 237 EUROPE: CELL CULTURE MARKET FOR FLASKS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 238 ASIA PACIFIC: CELL CULTURE MARKET FOR FLASKS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 239 LATIN AMERICA: CELL CULTURE MARKET FOR FLASKS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 240 MIDDLE EAST: CELL CULTURE MARKET FOR FLASKS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 241 GCC COUNTRIES: CELL CULTURE MARKET FOR FLASKS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 242 CELL CULTURE MARKET FOR MULTIWELL PLATES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 243 NORTH AMERICA: CELL CULTURE MARKET FOR MULTIWELL PLATES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 244 EUROPE: CELL CULTURE MARKET FOR MULTIWELL PLATES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 245 ASIA PACIFIC: CELL CULTURE MARKET FOR MULTIWELL PLATES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 246 LATIN AMERICA: CELL CULTURE MARKET FOR MULTIWELL PLATES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 247 MIDDLE EAST: CELL CULTURE MARKET FOR MULTIWELL PLATES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 248 GCC COUNTRIES: CELL CULTURE MARKET FOR MULTIWELL PLATES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 249 CELL CULTURE MARKET FOR PETRI DISHES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 250 NORTH AMERICA: CELL CULTURE MARKET FOR PETRI DISHES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 251 EUROPE: CELL CULTURE MARKET FOR PETRI DISHES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 252 ASIA PACIFIC: CELL CULTURE MARKET FOR PETRI DISHES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 253 LATIN AMERICA: CELL CULTURE MARKET FOR PETRI DISHES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 254 MIDDLE EAST: CELL CULTURE MARKET FOR PETRI DISHES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 255 GCC COUNTRIES: CELL CULTURE MARKET FOR PETRI DISHES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 256 CELL CULTURE ACCESSORIES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 257 NORTH AMERICA: CELL CULTURE ACCESSORIES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 258 EUROPE: CELL CULTURE ACCESSORIES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 259 ASIA PACIFIC: CELL CULTURE ACCESSORIES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 260 LATIN AMERICA: CELL CULTURE ACCESSORIES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 261 MIDDLE EAST: CELL CULTURE ACCESSORIES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 262 GCC COUNTRIES: CELL CULTURE ACCESSORIES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 263 CELL CULTURE EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 264 CELL CULTURE EQUIPMENT MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 265 NORTH AMERICA: CELL CULTURE EQUIPMENT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 266 EUROPE: CELL CULTURE EQUIPMENT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 267 ASIA PACIFIC: CELL CULTURE EQUIPMENT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 268 LATIN AMERICA: CELL CULTURE EQUIPMENT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 269 MIDDLE EAST: CELL CULTURE EQUIPMENT MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 270 GCC COUNTRIES: CELL CULTURE EQUIPMENT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 271 CELL CULTURE MARKET FOR BIOREACTORS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 272 CELL CULTURE MARKET FOR BIOREACTORS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 273 NORTH AMERICA: CELL CULTURE MARKET FOR BIOREACTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 274 EUROPE: CELL CULTURE MARKET FOR BIOREACTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 275 ASIA PACIFIC: CELL CULTURE MARKET FOR BIOREACTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 276 LATIN AMERICA: CELL CULTURE MARKET FOR BIOREACTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 277 MIDDLE EAST: CELL CULTURE MARKET FOR BIOREACTORS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 278 GCC COUNTRIES: CELL CULTURE MARKET FOR BIOREACTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 279 CELL CULTURE MARKET FOR CONVENTIONAL BIOREACTORS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 280 NORTH AMERICA: CELL CULTURE MARKET FOR CONVENTIONAL BIOREACTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 281 EUROPE: CELL CULTURE MARKET FOR CONVENTIONAL BIOREACTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 282 ASIA PACIFIC: CELL CULTURE MARKET FOR CONVENTIONAL BIOREACTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 283 LATIN AMERICA: CELL CULTURE MARKET FOR CONVENTIONAL BIOREACTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 284 MIDDLE EAST: CELL CULTURE MARKET FOR CONVENTIONAL BIOREACTORS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 285 GCC COUNTRIES: CELL CULTURE MARKET FOR CONVENTIONAL BIOREACTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 286 COMMERCIALLY AVAILABLE SINGLE-USE BIOREACTORS BY KEY PLAYERS

- TABLE 287 CELL CULTURE MARKET FOR SINGLE-USE BIOREACTORS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 288 NORTH AMERICA: CELL CULTURE MARKET FOR SINGLE-USE BIOREACTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 289 EUROPE: CELL CULTURE MARKET FOR SINGLE-USE BIOREACTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 290 ASIA PACIFIC: CELL CULTURE MARKET FOR SINGLE-USE BIOREACTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 291 LATIN AMERICA: CELL CULTURE MARKET FOR SINGLE-USE BIOREACTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 292 MIDDLE EAST: CELL CULTURE MARKET FOR SINGLE-USE BIOREACTORS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 293 GCC COUNTRIES: CELL CULTURE MARKET FOR SINGLE-USE BIOREACTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 294 CELL CULTURE MARKET FOR STORAGE EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 295 CELL CULTURE MARKET FOR STORAGE EQUIPMENT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 296 NORTH AMERICA: CELL CULTURE MARKET FOR STORAGE EQUIPMENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 297 EUROPE: CELL CULTURE MARKET FOR STORAGE EQUIPMENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 298 ASIA PACIFIC: CELL CULTURE MARKET FOR STORAGE EQUIPMENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 299 LATIN AMERICA: CELL CULTURE MARKET FOR STORAGE EQUIPMENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 300 MIDDLE EAST: CELL CULTURE MARKET FOR STORAGE EQUIPMENT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 301 GCC COUNTRIES: CELL CULTURE MARKET FOR STORAGE EQUIPMENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 302 CELL CULTURE MARKET FOR REFRIGERATORS & FREEZERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 303 NORTH AMERICA: CELL CULTURE MARKET FOR REFRIGERATORS & FREEZERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 304 EUROPE: CELL CULTURE MARKET FOR REFRIGERATORS & FREEZERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 305 ASIA PACIFIC: CELL CULTURE MARKET FOR REFRIGERATORS & FREEZERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 306 LATIN AMERICA: CELL CULTURE MARKET FOR REFRIGERATORS & FREEZERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 307 MIDDLE EAST: CELL CULTURE MARKET FOR REFRIGERATORS & FREEZERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 308 GCC COUNTRIES: CELL CULTURE MARKET FOR REFRIGERATORS & FREEZERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 309 CELL CULTURE MARKET FOR CRYOSTORAGE SYSTEMS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 310 NORTH AMERICA: CELL CULTURE MARKET FOR CRYOSTORAGE SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 311 EUROPE: CELL CULTURE MARKET FOR CRYOSTORAGE SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 312 ASIA PACIFIC: CELL CULTURE MARKET FOR CRYOSTORAGE SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 313 LATIN AMERICA: CELL CULTURE MARKET FOR CRYOSTORAGE SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 314 MIDDLE EAST: CELL CULTURE MARKET FOR CRYOSTORAGE SYSTEMS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 315 GCC COUNTRIES: CELL CULTURE MARKET FOR CRYOSTORAGE SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 316 CELL CULTURE MARKET FOR OTHER EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 317 CELL CULTURE MARKET FOR OTHER EQUIPMENT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 318 NORTH AMERICA: CELL CULTURE MARKET FOR OTHER EQUIPMENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 319 EUROPE: CELL CULTURE MARKET FOR OTHER EQUIPMENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 320 ASIA PACIFIC: CELL CULTURE MARKET FOR OTHER EQUIPMENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 321 LATIN AMERICA: CELL CULTURE MARKET FOR OTHER EQUIPMENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 322 MIDDLE EAST: CELL CULTURE MARKET FOR OTHER EQUIPMENT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 323 GCC COUNTRIES: CELL CULTURE MARKET FOR OTHER EQUIPMENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 324 FILTRATION SYSTEMS OFFERED BY KEY PLAYERS

- TABLE 325 CELL CULTURE MARKET FOR FILTRATION SYSTEMS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 326 NORTH AMERICA: CELL CULTURE MARKET FOR FILTRATION SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 327 EUROPE: CELL CULTURE MARKET FOR FILTRATION SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 328 ASIA PACIFIC: CELL CULTURE MARKET FOR FILTRATION SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 329 LATIN AMERICA: CELL CULTURE MARKET FOR FILTRATION SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 330 MIDDLE EAST: CELL CULTURE MARKET FOR FILTRATION SYSTEMS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 331 GCC COUNTRIES: CELL CULTURE MARKET FOR FILTRATION SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 332 CELL COUNTERS OFFERED BY KEY MARKET PLAYERS

- TABLE 333 CELL CULTURE MARKET FOR CELL COUNTERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 334 NORTH AMERICA: CELL CULTURE MARKET FOR CELL COUNTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 335 EUROPE: CELL CULTURE MARKET FOR CELL COUNTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 336 ASIA PACIFIC: CELL CULTURE MARKET FOR CELL COUNTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 337 LATIN AMERICA: CELL CULTURE MARKET FOR CELL COUNTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 338 MIDDLE EAST: CELL CULTURE MARKET FOR CELL COUNTERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 339 GCC COUNTRIES: CELL CULTURE MARKET FOR CELL COUNTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 340 CARBON DIOXIDE INCUBATORS OFFERED BY KEY MARKET PLAYERS

- TABLE 341 CELL CULTURE MARKET FOR CARBON DIOXIDE INCUBATORS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 342 NORTH AMERICA: CELL CULTURE MARKET FOR CARBON DIOXIDE INCUBATORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 343 EUROPE: CELL CULTURE MARKET FOR CARBON DIOXIDE INCUBATORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 344 ASIA PACIFIC: CELL CULTURE MARKET FOR CARBON DIOXIDE INCUBATORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 345 LATIN AMERICA: CELL CULTURE MARKET FOR CARBON DIOXIDE INCUBATORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 346 MIDDLE EAST: CELL CULTURE MARKET FOR CARBON DIOXIDE INCUBATORS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 347 GCC COUNTRIES: CELL CULTURE MARKET FOR CARBON DIOXIDE INCUBATORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 348 CENTRIFUGES OFFERED BY KEY MARKET PLAYERS

- TABLE 349 CELL CULTURE MARKET FOR CENTRIFUGES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 350 NORTH AMERICA: CELL CULTURE MARKET FOR CENTRIFUGES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 351 EUROPE: CELL CULTURE MARKET FOR CENTRIFUGES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 352 ASIA PACIFIC: CELL CULTURE MARKET FOR CENTRIFUGES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 353 LATIN AMERICA: CELL CULTURE MARKET FOR CENTRIFUGES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 354 MIDDLE EAST: CELL CULTURE MARKET FOR CENTRIFUGES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 355 GCC COUNTRIES: CELL CULTURE MARKET FOR CENTRIFUGES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 356 CELL CULTURE MARKET FOR AUTOCLAVES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 357 NORTH AMERICA: CELL CULTURE MARKET FOR AUTOCLAVES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 358 EUROPE: CELL CULTURE MARKET FOR AUTOCLAVES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 359 ASIA PACIFIC: CELL CULTURE MARKET FOR AUTOCLAVES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 360 LATIN AMERICA: CELL CULTURE MARKET FOR AUTOCLAVES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 361 MIDDLE EAST: CELL CULTURE MARKET FOR AUTOCLAVES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 362 GCC COUNTRIES: CELL CULTURE MARKET FOR AUTOCLAVES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 363 CELL CULTURE MARKET FOR MICROSCOPES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 364 NORTH AMERICA: CELL CULTURE MARKET FOR MICROSCOPES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 365 EUROPE: CELL CULTURE MARKET FOR MICROSCOPES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 366 ASIA PACIFIC: CELL CULTURE MARKET FOR MICROSCOPES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 367 LATIN AMERICA: CELL CULTURE MARKET FOR MICROSCOPES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 368 MIDDLE EAST: CELL CULTURE MARKET FOR MICROSCOPES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 369 GCC COUNTRIES: CELL CULTURE MARKET FOR MICROSCOPES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 370 BIOSAFETY CABINETS OFFERED BY KEY MARKET PLAYERS

- TABLE 371 CELL CULTURE MARKET FOR BIOSAFETY CABINETS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 372 NORTH AMERICA: CELL CULTURE MARKET FOR BIOSAFETY CABINETS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 373 EUROPE: CELL CULTURE MARKET FOR BIOSAFETY CABINETS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 374 ASIA PACIFIC: CELL CULTURE MARKET FOR BIOSAFETY CABINETS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 375 LATIN AMERICA: CELL CULTURE MARKET FOR BIOSAFETY CABINETS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 376 MIDDLE EAST: CELL CULTURE MARKET FOR BIOSAFETY CABINETS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 377 GCC COUNTRIES: CELL CULTURE MARKET FOR BIOSAFETY CABINETS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 378 OTHER SUPPORTING EQUIPMENT OFFERED BY KEY MARKET PLAYERS

- TABLE 379 CELL CULTURE MARKET FOR OTHER SUPPORTING EQUIPMENT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 380 NORTH AMERICA: CELL CULTURE MARKET FOR OTHER SUPPORTING EQUIPMENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 381 EUROPE: CELL CULTURE MARKET FOR OTHER SUPPORTING EQUIPMENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 382 ASIA PACIFIC: CELL CULTURE MARKET FOR OTHER SUPPORTING EQUIPMENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 383 LATIN AMERICA: CELL CULTURE MARKET FOR OTHER SUPPORTING EQUIPMENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 384 MIDDLE EAST: CELL CULTURE MARKET FOR OTHER SUPPORTING EQUIPMENT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 385 GCC COUNTRIES: CELL CULTURE MARKET FOR OTHER SUPPORTING EQUIPMENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 386 CELL CULTURE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 387 CELL CULTURE MARKET FOR BIOPHARMACEUTICAL PRODUCTION, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 388 CELL CULTURE MARKET FOR BIOPHARMACEUTICAL PRODUCTION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 389 NORTH AMERICA: CELL CULTURE MARKET FOR BIOPHARMACEUTICAL PRODUCTION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 390 EUROPE: CELL CULTURE MARKET FOR BIOPHARMACEUTICAL PRODUCTION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 391 ASIA PACIFIC: CELL CULTURE MARKET FOR BIOPHARMACEUTICAL PRODUCTION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 392 LATIN AMERICA: CELL CULTURE MARKET FOR BIOPHARMACEUTICAL PRODUCTION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 393 MIDDLE EAST: CELL CULTURE MARKET FOR BIOPHARMACEUTICAL PRODUCTION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 394 GCC COUNTRIES: CELL CULTURE MARKET FOR BIOPHARMACEUTICAL PRODUCTION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 395 CELL CULTURE MARKET FOR MONOCLONAL ANTIBODY PRODUCTION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 396 NORTH AMERICA: CELL CULTURE MARKET FOR MONOCLONAL ANTIBODY PRODUCTION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 397 EUROPE: CELL CULTURE MARKET FOR MONOCLONAL ANTIBODY PRODUCTION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 398 ASIA PACIFIC: CELL CULTURE MARKET FOR MONOCLONAL ANTIBODY PRODUCTION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 399 LATIN AMERICA: CELL CULTURE MARKET FOR MONOCLONAL ANTIBODY PRODUCTION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 400 MIDDLE EAST: CELL CULTURE MARKET FOR MONOCLONAL ANTIBODY PRODUCTION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 401 GCC COUNTRIES: CELL CULTURE MARKET FOR MONOCLONAL ANTIBODY PRODUCTION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 402 CELL CULTURE MARKET FOR VACCINE PRODUCTION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 403 NORTH AMERICA: CELL CULTURE MARKET FOR VACCINE PRODUCTION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 404 EUROPE: CELL CULTURE MARKET FOR VACCINE PRODUCTION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 405 ASIA PACIFIC: CELL CULTURE MARKET FOR VACCINE PRODUCTION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 406 LATIN AMERICA: CELL CULTURE MARKET FOR VACCINE PRODUCTION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 407 MIDDLE EAST: CELL CULTURE MARKET FOR VACCINE PRODUCTION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 408 GCC COUNTRIES: CELL CULTURE MARKET FOR VACCINE PRODUCTION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 409 CELL CULTURE MARKET FOR OTHER THERAPEUTIC PROTEIN PRODUCTION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 410 NORTH AMERICA: CELL CULTURE MARKET FOR OTHER THERAPEUTIC PROTEIN PRODUCTION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 411 EUROPE: CELL CULTURE MARKET FOR OTHER THERAPEUTIC PROTEIN PRODUCTION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 412 ASIA PACIFIC: CELL CULTURE MARKET FOR OTHER THERAPEUTIC PROTEIN PRODUCTION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 413 LATIN AMERICA: CELL CULTURE MARKET FOR OTHER THERAPEUTIC PROTEIN PRODUCTION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 414 MIDDLE EAST: CELL CULTURE MARKET FOR OTHER THERAPEUTIC PROTEIN PRODUCTION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 415 GCC COUNTRIES: CELL CULTURE MARKET FOR OTHER THERAPEUTIC PROTEIN PRODUCTION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 416 CELL CULTURE MARKET FOR DIAGNOSTICS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 417 NORTH AMERICA: CELL CULTURE MARKET FOR DIAGNOSTICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 418 EUROPE: CELL CULTURE MARKET FOR DIAGNOSTICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 419 ASIA PACIFIC: CELL CULTURE MARKET FOR DIAGNOSTICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 420 LATIN AMERICA: CELL CULTURE MARKET FOR DIAGNOSTI CS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 421 MIDDLE EAST: CELL CULTURE MARKET FOR DIAGNOSTICS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 422 GCC COUNTRIES: CELL CULTURE MARKET FOR DIAGNOSTICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 423 CELL CULTURE MARKET FOR TISSUE ENGINEERING & REGENERATIVE MEDICINE, BY REGION, 2023-2030 (USD MILLION)

- TABLE 424 NORTH AMERICA: CELL CULTURE MARKET FOR TISSUE ENGINEERING & REGENERATIVE MEDICINE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 425 EUROPE: CELL CULTURE MARKET FOR TISSUE ENGINEERING & REGENERATIVE MEDICINE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 426 ASIA PACIFIC: CELL CULTURE MARKET FOR TISSUE ENGINEERING & REGENERATIVE MEDICINE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 427 LATIN AMERICA: CELL CULTURE MARKET FOR TISSUE ENGINEERING & REGENERATIVE MEDICINE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 428 MIDDLE EAST: CELL CULTURE MARKET FOR TISSUE ENGINEERING & REGENERATIVE MEDICINE, BY REGION, 2023-2030 (USD MILLION)

- TABLE 429 GCC COUNTRIES: CELL CULTURE MARKET FOR TISSUE ENGINEERING & REGENERATIVE MEDICINE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 430 CELL CULTURE MARKET FOR TISSUE ENGINEERING & REGENERATIVE MEDICINE, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 431 CELL CULTURE MARKET FOR CELL & GENE THERAPY, BY REGION, 2023-2030 (USD MILLION)

- TABLE 432 NORTH AMERICA: CELL CULTURE MARKET FOR CELL & GENE THERAPY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 433 EUROPE: CELL CULTURE MARKET FOR CELL & GENE THERAPY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 434 ASIA PACIFIC: CELL CULTURE MARKET FOR CELL & GENE THERAPY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 435 LATIN AMERICA: CELL CULTURE MARKET FOR CELL & GENE THERAPY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 436 MIDDLE EAST: CELL CULTURE MARKET FOR CELL & GENE THERAPY, BY REGION, 2023-2030 (USD MILLION)

- TABLE 437 GCC COUNTRIES: CELL CULTURE MARKET FOR CELL & GENE THERAPY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 438 CELL CULTURE MARKET FOR OTHER TISSUE ENGINEERING & REGENERATIVE MEDICINE APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 439 NORTH AMERICA: CELL CULTURE MARKET FOR OTHER TISSUE ENGINEERING & REGENERATIVE MEDICINE APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 440 EUROPE: CELL CULTURE MARKET FOR OTHER TISSUE ENGINEERING & REGENERATIVE MEDICINE APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 441 ASIA PACIFIC: CELL CULTURE MARKET FOR OTHER TISSUE ENGINEERING & REGENERATIVE MEDICINE APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 442 LATIN AMERICA: CELL CULTURE MARKET FOR OTHER TISSUE ENGINEERING & REGENERATIVE MEDICINE APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 443 MIDDLE EAST: CELL CULTURE MARKET FOR OTHER TISSUE ENGINEERING & REGENERATIVE MEDICINE APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 444 GCC COUNTRIES: CELL CULTURE MARKET FOR OTHER TISSUE ENGINEERING & REGENERATIVE MEDICINE APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 445 CELL CULTURE MARKET FOR DRUG SCREENING & DEVELOPMENT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 446 NORTH AMERICA: CELL CULTURE MARKET FOR DRUG SCREENING & DEVELOPMENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 447 EUROPE: CELL CULTURE MARKET FOR DRUG SCREENING & DEVELOPMENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 448 ASIA PACIFIC: CELL CULTURE MARKET FOR DRUG SCREENING & DEVELOPMENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 449 LATIN AMERICA: CELL CULTURE MARKET FOR DRUG SCREENING & DEVELOPMENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 450 MIDDLE EAST: CELL CULTURE MARKET FOR DRUG SCREENING & DEVELOPMENT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 451 GCC COUNTRIES: CELL CULTURE MARKET FOR DRUG SCREENING & DEVELOPMENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 452 CELL CULTURE MARKET FOR OTHER APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 453 NORTH AMERICA: CELL CULTURE MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 454 EUROPE: CELL CULTURE MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 455 ASIA PACIFIC: CELL CULTURE MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 456 LATIN AMERICA: CELL CULTURE MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 457 MIDDLE EAST: CELL CULTURE MARKET FOR OTHER APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 458 GCC COUNTRIES: CELL CULTURE MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 459 CELL CULTURE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 460 RECENT DEVELOPMENTS IN PHARMA & BIOTECH SECTOR, 2021-2024

- TABLE 461 CELL CULTURE MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 462 NORTH AMERICA: CELL CULTURE MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 463 EUROPE: CELL CULTURE MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2023-2030 (USD MILLION)