|

市場調查報告書

商品編碼

1784316

全球超導線材市場(按類型、銷售管道、應用、最終用戶和地區分類)- 2030 年預測Superconducting Wire Market by Type, Application, End User, Sales Channel, and Region - Global Forecast to 2030 |

||||||

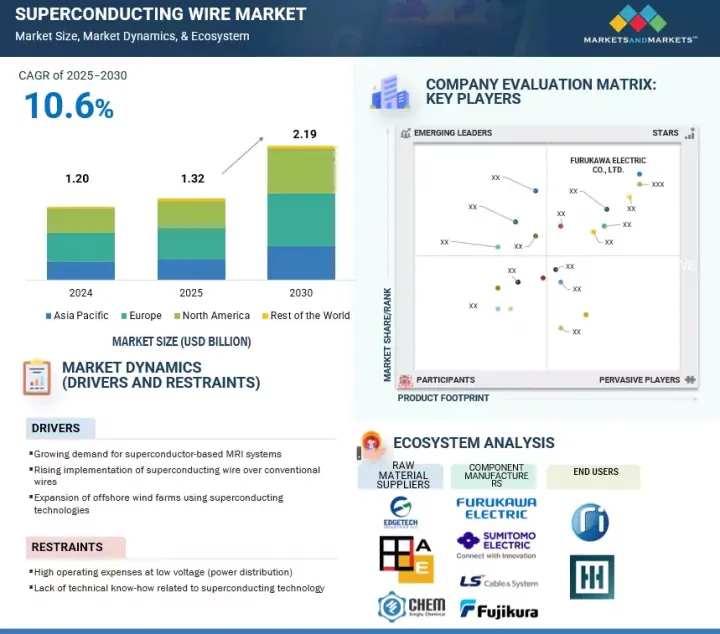

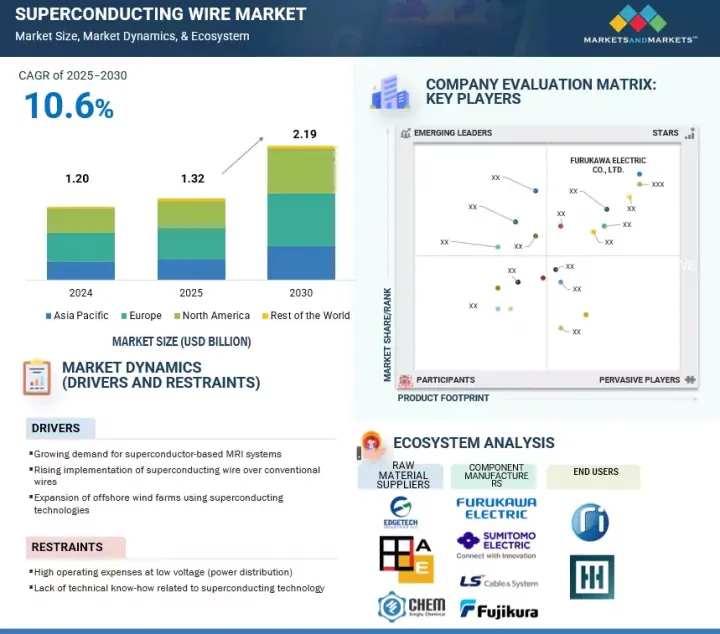

全球超導線材市場預計將從 2025 年的 13.2 億美元成長至 2030 年的 21.9 億美元,複合年成長率為 10.6%。

| 調查範圍 | |

|---|---|

| 調查年份 | 2021-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 目標單位 | 金額(百萬美元/十億美元)和數量(公里) |

| 按細分市場 | 超導線材市場:按類型、銷售管道、應用、最終用戶和地區分類 |

| 目標區域 | 北美、歐洲、亞太地區及其他地區 |

基於超導的磁振造影(MRI)系統的需求不斷成長,以及超導線作為傳統導體的優質替代品的日益普及,是推動超導線市場成長的關鍵因素。

超導導線市場按類型細分為低溫超導體、中溫超導體和高溫超導體。預計到2025年,高溫超導體將佔據第二大市場佔有率。隨著超導導線的應用日益普及,高溫超導體已成為磁振磁浮( 磁浮 ) 等應用的理想選擇。

超導導線市場按終端用戶細分為能源、醫療保健、運輸、科學研究等領域。預計醫療保健領域將在整個預測期內佔據市場主導地位。在全球範圍內,MRI 和 NMR 系統向超導磁體應用的強勁轉變預計將推動醫療領域對超導線的需求。

在北美國家,尤其是美國,離岸風力發電領域的投資不斷增加、磁浮列車的發展以及政府對發展醫療設施的興趣日益濃厚,預計將推動使用超導導線的磁振造影(MRI)掃描儀的普及,從而推動北美超導導線市場的成長。

超導導線市場由幾家業務遍佈全球的大型公司主導。主要參與企業包括工業株式會社(日本)、藤倉株式會社(日本)、工業株式會社(日本)、布魯克(美國)和美國超導公司(美國)。

本報告按類型、垂直行業、應用程式、銷售管道和地區對全球超導導線市場進行了定義、說明和預測。該報告還對市場進行了深入的定性和定量分析,並全面回顧了關鍵的市場促進因素、限制因素、機會和挑戰。報告還涵蓋了市場的各個重要方面,包括競爭格局分析、市場動態、以金額為準的市場估值以及超導導線市場的未來趨勢。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章重要考察

第5章市場概述

- 介紹

- 市場動態

- 影響客戶業務的趨勢/中斷

- 價值鏈分析

- 生態系分析

- 案例研究分析

- 世界宏觀經濟展望

- 投資金籌措場景

- 技術分析

- 定價分析

- 貿易分析

- 生成式人工智慧/人工智慧對超導性導線市場的影響

- 專利分析

- 2025年主要會議和活動

- 關稅和監管狀況

- 波特五力分析

- 主要相關人員和採購標準

- 2025年美國關稅對超導性導線市場的影響

第6章超導性線材市場(依類型)

- 介紹

- LTS 電線

- MTS 線材

- 高溫超導線材

第7章超導性線材市場(依銷售管道)

- 介紹

- 銷售管道

- 間接銷售管道

第 8 章超導性線材市場(按應用)

- 介紹

- 磁振造影

- 電網基礎設施

- 超導性故障電流限流器

- 磁浮列車

- 其他

第9章超導性線材市場(依最終用戶)

- 介紹

- 能源

- 衛生保健

- 運輸

- 研究

- 其他

第 10 章超導性線材市場(按地區)

- 介紹

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 紐西蘭

- 其他

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 瑞士

- 瑞典

- 其他

- 其他地區

第11章競爭格局

- 介紹

- 主要參與企業的策略/優勢,2021-2024

- 2024年市場佔有率分析

- 公司估值矩陣:2024 年關鍵參與企業

- 公司估值矩陣:Start-Ups/中小企業,2024 年

- 估值和財務指標

- 品牌/產品比較

- 競爭場景

第12章:公司簡介

- 主要參與企業

- SUMITOMO ELECTRIC INDUSTRIES, LTD.

- FUJIKURA LTD.

- FURUKAWA ELECTRIC CO., LTD.

- BRUKER

- AMERICAN SUPERCONDUCTOR

- NEXANS

- LS CABLE & SYSTEM LTD.

- KISWIRE ADVANCED TECHNOLOGY CO., LTD.

- METOX TECHNOLOGIES, INC.

- SAM DONG

- THEVA DUNNSCHICHTTECHNIK GMBH

- FIRMETAL GROUP

- SUPEROX

- ASG SUPERCONDUCTORS SPA

- SUPERCON, INC.

- 其他公司

- LUVATA

- JAPAN SUPERCONDUCTOR TECHNOLOGY, INC.(JASTEC)

- HYPER TECH RESEARCH, INC.

- AMPEERS LLC

- WESTERN SUPERCONDUCTING TECHNOLOGIES CO., LTD.

- SUNAM CO., LTD

- SUPERNODE

- CUTTING EDGE SUPERCONDUCTORS, INC.

- SOLID MATERIAL SOLUTIONS LLC

- CRYOMAGNETICS

第13章 附錄

The global superconducting wire market is anticipated to grow from USD 1.32 billion in 2025 to USD 2.19 billion by 2030, at a CAGR of 10.6%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) and Volume (KM) |

| Segments | Superconducting wire market, by type, end user, sales channel, application, and region |

| Regions covered | North America, Europe, Asia Pacific, and Rest of the World |

The increasing demand for superconductor-based magnetic resonance imaging (MRI) systems, coupled with the growing adoption of superconducting wires as a superior alternative to conventional conductors, are key factors driving the growth of the superconducting wire market.

"High-temperature superconductor to be second-largest segment of superconducting wire market, by type"

The superconducting wire market is split by type into low-temperature, medium-temperature, and high-temperature superconductors. In 2025, high-temperature superconductor wires are likely to account for the second-largest market share. The rising implementation of superconducting wires over conventional wires makes high-temperature superconductors ideal for applications such as magnetic resonance imaging (MRI) and magnetic levitation (maglev).

"Medical segment to capture prominent share of superconducting wire market based on end user"

The superconducting wire market has been segmented by end user into energy, medical, transportation, research, and others. The medical segment is expected to command the market throughout the forecast period. A strong global shift toward using superconductor-wound magnets in MRI and NMR systems is expected to drive the demand for superconducting wires in the medical segment.

"North America to be second-largest market during forecast period"

North America is expected to be the second-largest market due to the Increasing investments in the offshore wind energy sector, development of maglev trains, and increasing focus of the governments on developing medical facilities in North American countris, specifically the US, is anticipated to boost the adoption of superconducting wire-based magnetic resonance imaging (MRI) scanners are expected to drive the growth of the superconducting wire market in North America.

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and assess future market prospects.

The distribution of primary interviews is as follows:

By Company Type: Tier 1 - 65%, Tier 2 - 24%, and Tier 3 - 11%

By Designation: C-level Executives - 30%, Directors - 25%, and Others - 45%

By Region: North America - 27%, Europe - 20%, and Asia Pacific - 53%

Note: Others include product engineers, product specialists, and engineering leads.

The tiers of the companies are defined based on their total revenues as of 2024. Tier 1: >USD 1 billion, Tier 2: from USD 500 million to USD 1 billion, and Tier 3: <USD 500 million

A few major players with a wide regional presence dominate the superconducting wire market. The leading players are Sumitomo Electric Industries, Ltd. (Japan), Fujikura Ltd. (Japan), Furukawa Electric Co., Ltd. (Japan), Bruker (US), and American Superconductor (US).

Research Coverage:

The report defines, describes, and forecasts the global superconducting wire market based on type, vertical, application, sales channel, and region. It also offers a detailed qualitative and quantitative analysis of the market. The report comprehensively reviews the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates, in terms of value, and future trends in the superconducting wire market.

Key Benefits of Buying the Report.

- Product Development/Innovation: Key drivers (growing demand for zero-loss power transmission, compact high-field magnet systems, and advanced grid technologies), restraints (high material and cryogenic costs), opportunities (advancements in HTS wire fabrication and fusion energy projects), and challenges (technical complexity in manufacturing and limited commercial-scale deployment outside niche applications) influence the market.

- Market Development: In March 2025, Furukawa Electric's SuperPower Inc. division delivered next-generation 2G HTS wire for a grid-scale superconducting cable project in South Korea. The development marked a significant milestone in long-distance, high-capacity energy transmission, aligning with global goals for grid decarbonization and improved efficiency.

- Market Diversification: The superconducting wire market has witnessed increasing product diversification, including LTS, MTS, and HTS types, catering to varied end uses from MRI and NMR imaging in healthcare to maglev trains, particle accelerators, and SFCLs in the energy and transportation sectors. Enhanced performance at higher operating temperatures and innovation in flexible, durable HTS tapes have broadened adoption across developed and emerging markets.

- Competitive Assessment: An evaluation of the competitive positioning of key players in the superconducting wire market includes leading companies such as Sumitomo Electric Industries, Ltd. (Japan), Fujikura Ltd. (Japan), Furukawa Electric Co., Ltd. (Japan), Bruker Corporation (United States), and American Superconductor Corporation (United States).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.3.2 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 UNIT CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Intended participants and key opinion leaders

- 2.1.2.2 Key industry insights

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Regional analysis

- 2.2.1.2 Country-level analysis

- 2.2.1.3 Demand-side assumptions

- 2.2.1.4 Demand-side calculations

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Supply-side assumptions

- 2.2.2.2 Supply-side calculations

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 FORECAST

- 2.5 RESEARCH ASSUMPTION

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SUPERCONDUCTING WIRE MARKET

- 4.2 SUPERCONDUCTING WIRE MARKET, BY SALES CHANNEL AND TYPE

- 4.3 SUPERCONDUCTING WIRE MARKET, BY SALES CHANNEL

- 4.4 SUPERCONDUCTING WIRE MARKET, BY TYPE

- 4.5 SUPERCONDUCTING WIRE MARKET, BY END USER

- 4.6 SUPERCONDUCTING WIRE MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing need for advanced MRI systems globally

- 5.2.1.2 Cost and performance advantages of superconducting wires over conventional wires

- 5.2.1.3 Expansion of offshore wind farms using superconducting technologies

- 5.2.2 RESTRAINTS

- 5.2.2.1 Cost constraints hampering superconducting adoption in low-voltage and medium-voltage applications

- 5.2.2.2 Slow rate of commercialization due to lack of skilled workforce

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing R&D activities in medical and transportation fields

- 5.2.4 CHALLENGES

- 5.2.4.1 High manufacturing costs of superconductors

- 5.2.4.2 Limited testing infrastructure

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 CASE STUDY ANALYSIS

- 5.6.1 BRUKER SUPPLIES CHROMIUM-PLATED NIOBIUM-TIN SUPERCONDUCTING WIRES FOR ITER PROJECT

- 5.6.2 SUPERPOWER INC. PROVIDES 2G HTS WIRES TO ENDESA TO PROTECT GRID AGAINST SHORT CIRCUITS

- 5.6.3 ENHANCING MGB2 SUPERCONDUCTING WIRE PERFORMANCE THROUGH INITIAL FILLING DENSITY OPTIMIZATION AND THERMOMECHANICAL TREATMENT

- 5.7 GLOBAL MACROECONOMIC OUTLOOK

- 5.7.1 INTRODUCTION

- 5.7.2 GDP TRENDS AND FORECAST

- 5.7.3 IMPACT OF INFLATION ON SUPERCONDUCTING WIRE MARKET

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Powder-in-tube (PIT)

- 5.9.2 ADJACENT TECHNOLOGIES

- 5.9.2.1 Cryogenic cooling technologies

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PRICING ANALYSIS

- 5.10.1 PRICING RANGE OF SUPERCONDUCTING WIRES, BY TYPE, 2024

- 5.10.2 AVERAGE SELLING PRICE TREND OF SUPERCONDUCTING WIRES, BY REGION, 2021-2024

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO (HS CODE 854419)

- 5.11.2 EXPORT SCENARIO (HS CODE 854419)

- 5.12 IMPACT OF GENERATIVE AI/AI ON SUPERCONDUCTING WIRE MARKET

- 5.12.1 USE CASES OF GENERATIVE AI/AI IN SUPERCONDUCTING WIRE MARKET

- 5.12.2 IMPACT OF GENERATIVE AI/AI ON KEY END USERS, BY REGION

- 5.13 PATENT ANALYSIS

- 5.14 KEY CONFERENCES AND EVENTS, 2025

- 5.15 TARIFF AND REGULATORY LANDSCAPE

- 5.15.1 TARIFF ANALYSIS

- 5.15.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.16 PORTER'S FIVE FORCES ANALYSIS

- 5.16.1 THREAT OF SUBSTITUTES

- 5.16.2 BARGAINING POWER OF SUPPLIERS

- 5.16.3 BARGAINING POWER OF BUYERS

- 5.16.4 THREAT OF NEW ENTRANTS

- 5.16.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.17 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.17.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.17.2 BUYING CRITERIA

- 5.18 IMPACT OF 2025 US TARIFF ON SUPERCONDUCTING WIRE MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 IMPACT ON COUNTRIES/REGIONS

- 5.18.3.1 North America

- 5.18.3.2 Europe

- 5.18.3.3 Asia Pacific

- 5.18.3.4 RoW

- 5.18.4 IMPACT ON END USERS

6 SUPERCONDUCTING WIRE MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 LTS WIRES

- 6.2.1 ENHANCED CRITICAL CURRENT DENSITY AND DURABILITY TO DRIVE ADOPTION IN SCIENTIFIC INFRASTRUCTURE

- 6.3 MTS WIRES

- 6.3.1 RISING USE IN MEDICAL IMAGING TO FOSTER MARKET GROWTH

- 6.4 HTS WIRES

- 6.4.1 ABILITY TO OPERATE AT HIGHER MAGNETIC FIELDS AND CURRENT DENSITIES TO STIMULATE ADOPTION IN ENERGY SECTOR

- 6.4.2 FIRST-GENERATION

- 6.4.2.1 Cost-sensitive and cryogen-free applications to accelerate demand

- 6.4.3 SECOND-GENERATION

- 6.4.3.1 Enhanced performance and scalability to increase implementation in future power systems

7 SUPERCONDUCTING WIRE MARKET, BY SALES CHANNEL

- 7.1 INTRODUCTION

- 7.2 DIRECT SALES CHANNEL

- 7.2.1 NEED FOR CUSTOMIZED WIRES TO MEET SPECIFIC APPLICATION REQUIREMENTS TO FUEL SEGMENTAL GROWTH

- 7.3 INDIRECT SALES CHANNEL

- 7.3.1 WIDE GEOGRAPHIC REACH OF LARGE CONGLOMERATES TO PROPEL SEGMENTAL GROWTH

8 SUPERCONDUCTING WIRE MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 MAGNETIC RESONANCE IMAGING

- 8.2.1 PERFORMANCE AND COST ADVANTAGES OF SUPERCONDUCTING WIRES TO DRIVE ADOPTION

- 8.3 POWER GRID INFRASTRUCTURE

- 8.3.1 GREATER EFFICIENCY AND MINIMUM ENERGY LOSSES UNDER HIGH CURRENT LOADS TO SPIKE DEMAND

- 8.4 SUPERCONDUCTING FAULT CURRENT LIMITER

- 8.4.1 NEED FOR SAFETY, EFFICIENCY, AND RESILIENCE ACROSS DIVERSE AND EVOLVING POWER APPLICATIONS TO SUPPORT MARKET GROWTH

- 8.5 MAGLEV

- 8.5.1 SURGING DEMAND FOR SUSTAINABLE AND HIGH-SPEED TRANSPORTATION SOLUTIONS TO CONTRIBUTE TO MARKET GROWTH

- 8.6 OTHER APPLICATIONS

9 SUPERCONDUCTING WIRE MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 ENERGY

- 9.2.1 ELEVATING DEMAND FOR SUSTAINABLE ENERGY SOLUTIONS TO DRIVE MARKET

- 9.3 HEALTHCARE

- 9.3.1 REQUIREMENT FOR MRI MACHINES WITH SUSTAINED MAGNETIC FIELD STRENGTH TO CREATE GROWTH OPPORTUNITIES

- 9.4 TRANSPORTATION

- 9.4.1 INCREASING FOCUS ON ENHANCING RAIL LINE CAPACITY AND OPERATIONAL EFFICIENCY TO STIMULATE DEMAND

- 9.5 RESEARCH

- 9.5.1 ONGOING RESEARCH FUELING SUPERCONDUCTING WIRE INNOVATION ACROSS KEY SECTORS TO BOOST DEMAND

- 9.6 OTHER END USERS

10 SUPERCONDUCTING WIRE MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 US

- 10.2.1.1 Substantial investments in quantum computing, fusion energy, and power grid modernization to drive market

- 10.2.2 CANADA

- 10.2.2.1 Exploration of superconducting technologies for grid reliability and clean energy applications to propel market

- 10.2.3 MEXICO

- 10.2.3.1 Elevating use of MRI and diagnostic imaging systems across public and private healthcare facilities to fuel market growth

- 10.2.1 US

- 10.3 ASIA PACIFIC

- 10.3.1 CHINA

- 10.3.1.1 Government investment in high-speed rail and next-generation computing to contribute to market growth

- 10.3.2 JAPAN

- 10.3.2.1 Strategic role of country in fusion, transportation, and medical applications to boost demand

- 10.3.3 INDIA

- 10.3.3.1 Rising MRI installations in Tier 2 and Tier 3 cities to accelerate demand

- 10.3.4 SOUTH KOREA

- 10.3.4.1 Installation of power grid pilot projects to fuel market growth

- 10.3.5 AUSTRALIA

- 10.3.5.1 Active participation and investment in superconductivity-related R&D to support market development

- 10.3.6 NEW ZEALAND

- 10.3.6.1 Involvement of research institutes in cryogenics and magnetic field studies to facilitate market growth

- 10.3.7 REST OF ASIA PACIFIC

- 10.3.1 CHINA

- 10.4 EUROPE

- 10.4.1 GERMANY

- 10.4.1.1 Energy transition policies, medical innovation, and advanced scientific research to promote adoption

- 10.4.2 UK

- 10.4.2.1 NHS-backed investment in AI-powered diagnostics and infrastructure modernization to support upward market trajectory

- 10.4.3 ITALY

- 10.4.3.1 National energy transition goals to trigger opportunities for market players

- 10.4.4 FRANCE

- 10.4.4.1 Surging demand for advanced power transmission technologies to boost market uptake

- 10.4.5 SWITZERLAND

- 10.4.5.1 Excellence in applied superconductivity research to strengthen market momentum

- 10.4.6 SWEDEN

- 10.4.6.1 Electrification of transportation sector to drive market

- 10.4.7 REST OF EUROPE

- 10.4.1 GERMANY

- 10.5 REST OF THE WORLD (ROW)

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 11.3 MARKET SHARE ANALYSIS, 2024

- 11.4 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.4.1 STARS

- 11.4.2 EMERGING LEADERS

- 11.4.3 PERVASIVE PLAYERS

- 11.4.4 PARTICIPANTS

- 11.4.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.4.5.1 Company footprint

- 11.4.5.2 Region footprint

- 11.4.5.3 Type footprint

- 11.4.5.4 End user footprint

- 11.4.5.5 Sales channel footprint

- 11.5 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.5.1 PROGRESSIVE COMPANIES

- 11.5.2 RESPONSIVE COMPANIES

- 11.5.3 DYNAMIC COMPANIES

- 11.5.4 STARTING BLOCKS

- 11.5.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.5.5.1 List of key startups/SMEs

- 11.5.5.2 Competitive benchmarking of key startups/SMEs

- 11.6 COMPANY VALUATION AND FINANCIAL METRICS

- 11.7 BRAND/PRODUCT COMPARISON

- 11.8 COMPETITIVE SCENARIO

- 11.8.1 PRODUCT LAUNCHES

- 11.8.2 DEALS

- 11.8.3 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 SUMITOMO ELECTRIC INDUSTRIES, LTD.

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 MnM view

- 12.1.1.3.1 Key strengths/Right to win

- 12.1.1.3.2 Strategic choices

- 12.1.1.3.3 Weaknesses/Competitive threats

- 12.1.2 FUJIKURA LTD.

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 MnM view

- 12.1.2.3.1 Key strengths/Right to win

- 12.1.2.3.2 Strategic choices

- 12.1.2.3.3 Weaknesses/Competitive threats

- 12.1.3 FURUKAWA ELECTRIC CO., LTD.

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 MnM view

- 12.1.3.3.1 Key strengths/Right to win

- 12.1.3.3.2 Strategic choices

- 12.1.3.3.3 Weaknesses/Competitive threats

- 12.1.4 BRUKER

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Developments

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths/Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses/Competitive threats

- 12.1.5 AMERICAN SUPERCONDUCTOR

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Developments

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths/Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses/Competitive threats

- 12.1.6 NEXANS

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Developments

- 12.1.7 LS CABLE & SYSTEM LTD.

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Deals

- 12.1.8 KISWIRE ADVANCED TECHNOLOGY CO., LTD.

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.9 METOX TECHNOLOGIES, INC.

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.10 SAM DONG

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.11 THEVA DUNNSCHICHTTECHNIK GMBH

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Product launches

- 12.1.11.3.2 Deals

- 12.1.11.3.3 Other developments

- 12.1.12 FIRMETAL GROUP

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions/Services offered

- 12.1.13 SUPEROX

- 12.1.13.1 Business overview

- 12.1.13.2 Products/Solutions/Services offered

- 12.1.14 ASG SUPERCONDUCTORS S.P.A.

- 12.1.14.1 Business overview

- 12.1.14.2 Products/Solutions/Services offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Deals

- 12.1.14.3.2 Other developments

- 12.1.15 SUPERCON, INC.

- 12.1.15.1 Business overview

- 12.1.15.2 Products/Solutions/Services offered

- 12.1.1 SUMITOMO ELECTRIC INDUSTRIES, LTD.

- 12.2 OTHER PLAYERS

- 12.2.1 LUVATA

- 12.2.2 JAPAN SUPERCONDUCTOR TECHNOLOGY, INC. (JASTEC)

- 12.2.3 HYPER TECH RESEARCH, INC.

- 12.2.4 AMPEERS LLC

- 12.2.5 WESTERN SUPERCONDUCTING TECHNOLOGIES CO., LTD.

- 12.2.6 SUNAM CO., LTD

- 12.2.7 SUPERNODE

- 12.2.8 CUTTING EDGE SUPERCONDUCTORS, INC.

- 12.2.9 SOLID MATERIAL SOLUTIONS LLC

- 12.2.10 CRYOMAGNETICS

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS

List of Tables

- TABLE 1 SUPERCONDUCTING WIRE MARKET: BY TYPE

- TABLE 2 SUPERCONDUCTING WIRE MARKET: BY SALES CHANNEL

- TABLE 3 SUPERCONDUCTING WIRE MARKET: BY APPLICATION

- TABLE 4 SUPERCONDUCTING WIRE MARKET: BY END USER

- TABLE 5 SUPERCONDUCTING WIRE MARKET SIZE ESTIMATION METHODOLOGY (DEMAND SIDE)

- TABLE 6 SUPERCONDUCTING WIRE MARKET: RISK ANALYSIS

- TABLE 7 SUPERCONDUCTING WIRE MARKET SNAPSHOT

- TABLE 8 NUMBER OF MRI SCANNERS IN SELECTED COUNTRIES, 2023 (PER MILLION INHABITANTS)

- TABLE 9 MAJOR RESEARCH CENTERS WORKING ON SUPERCONDUCTING WIRES

- TABLE 10 ROLE OF COMPANIES IN SUPERCONDUCTING WIRE ECOSYSTEM

- TABLE 11 GLOBAL GDP GROWTH, 2021-2028 (USD TRILLION)

- TABLE 12 AVERAGE INFLATION RATES, BY GEOGRAPHY, 2025

- TABLE 13 PRICING RANGE OF DIFFERENT TYPES OF SUPERCONDUCTING WIRES, 2024 (USD/METER)

- TABLE 14 AVERAGE SELLING PRICE TREND OF SUPERCONDUCTING WIRES, BY REGION, 2021-2024 (USD PER METER)

- TABLE 15 IMPORT DATA FOR HS CODE 854419-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 16 EXPORT DATA FOR HS CODE 854419-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 17 LIST OF KEU PATENTS, 2021-2024

- TABLE 18 SUPERCONDUCTING WIRE MARKET: LIST OF CONFERENCES AND EVENTS, 2025

- TABLE 19 AVERAGE TARIFF ANALYSIS FOR SUPERCONDUCTING WIRES, BY COUNTRY, 2024

- TABLE 20 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 SUPERCONDUCTING WIRE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 25 INFLUENCE OF MAJOR END USERS ON BUYING PROCESS OF SUPERCONDUCTING WIRES

- TABLE 26 KEY BUYING CRITERIA FOR MAJOR END USERS

- TABLE 27 US-ADJUSTED RECIPROCAL TARIFF RATES, 2024 (USD BILLION)

- TABLE 28 ANTICIPATED CHANGES IN PRICES AND POTENTIAL IMPACT OF TARIFFS ON END USERS

- TABLE 29 SUPERCONDUCTING WIRE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 30 SUPERCONDUCTING WIRE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 31 LTS WIRES: SUPERCONDUCTING WIRE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 32 LTS WIRES: SUPERCONDUCTING WIRE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 MTS WIRES: SUPERCONDUCTING WIRE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 34 MTS WIRES: SUPERCONDUCTING WIRE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 HTS WIRES: SUPERCONDUCTING WIRE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 36 HTS WIRES: SUPERCONDUCTING WIRE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 37 HTS WIRES: SUPERCONDUCTING WIRE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 38 HTS WIRES: SUPERCONDUCTING WIRE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 FIRST-GENERATION HTS WIRES: SUPERCONDUCTING WIRE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 40 FIRST-GENERATION HTS WIRES: SUPERCONDUCTING WIRE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 SECOND-GENERATION HTS WIRES: SUPERCONDUCTING WIRE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 SECOND-GENERATION HTS WIRES: SUPERCONDUCTING WIRE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 SUPERCONDUCTING WIRE MARKET, BY SALES CHANNEL, 2021-2024 (USD MILLION)

- TABLE 44 SUPERCONDUCTING WIRE MARKET, BY SALES CHANNEL, 2025-2030 (USD MILLION)

- TABLE 45 DIRECT SALES CHANNEL: SUPERCONDUCTING WIRE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 46 DIRECT SALES CHANNEL: SUPERCONDUCTING WIRE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 INDIRECT SALES CHANNEL: SUPERCONDUCTING WIRE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 48 INDIRECT SALES CHANNEL: SUPERCONDUCTING WIRE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 SUPERCONDUCTING WIRE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 50 SUPERCONDUCTING WIRE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 51 MAGNETIC RESONANCE IMAGING: SUPERCONDUCTING WIRE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 52 MAGNETIC RESONANCE IMAGING: SUPERCONDUCTING WIRE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 POWER GRID INFRASTRUCTURE: SUPERCONDUCTING WIRE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 54 POWER GRID INFRASTRUCTURE: SUPERCONDUCTING WIRE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 SUPERCONDUCTING FAULT CURRENT LIMITER: SUPERCONDUCTING WIRE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 SUPERCONDUCTING FAULT CURRENT LIMITER: SUPERCONDUCTING WIRE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 MAGLEV: SUPERCONDUCTING WIRE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 58 MAGLEV: SUPERCONDUCTING WIRE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 OTHER APPLICATIONS: SUPERCONDUCTING WIRE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 60 OTHER APPLICATIONS: SUPERCONDUCTING WIRE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 SUPERCONDUCTING WIRE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 62 SUPERCONDUCTING WIRE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 63 ENERGY: SUPERCONDUCTING WIRE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 64 ENERGY: SUPERCONDUCTING WIRE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 HEALTHCARE: SUPERCONDUCTING WIRE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 66 HEALTHCARE: SUPERCONDUCTING WIRE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 TRANSPORTATION: SUPERCONDUCTING WIRE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 68 TRANSPORTATION: SUPERCONDUCTING WIRE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 RESEARCH: SUPERCONDUCTING WIRE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 70 RESEARCH: SUPERCONDUCTING WIRE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 OTHER END USERS: SUPERCONDUCTING WIRE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 72 OTHER END USERS: SUPERCONDUCTING WIRE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 SUPERCONDUCTING WIRE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 SUPERCONDUCTING WIRE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 SUPERCONDUCTING WIRE MARKET, BY REGION, 2021-2024 (KM)

- TABLE 76 SUPERCONDUCTING WIRE MARKET, BY REGION, 2025-2030 (KM)

- TABLE 77 NORTH AMERICA: SUPERCONDUCTING WIRE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 78 NORTH AMERICA: SUPERCONDUCTING WIRE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 79 NORTH AMERICA: SUPERCONDUCTING WIRE MARKET FOR HTS WIRES, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 80 NORTH AMERICA: SUPERCONDUCTING WIRE MARKET FOR HTS WIRES, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 81 NORTH AMERICA: SUPERCONDUCTING WIRE MARKET, BY SALES CHANNEL, 2021-2024

- TABLE 82 NORTH AMERICA: SUPERCONDUCTING WIRE MARKET, BY SALES CHANNEL, 2025-2030

- TABLE 83 NORTH AMERICA: SUPERCONDUCTING WIRE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 84 NORTH AMERICA: SUPERCONDUCTING WIRE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 85 NORTH AMERICA: SUPERCONDUCTING WIRE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 86 NORTH AMERICA: SUPERCONDUCTING WIRE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 87 NORTH AMERICA: SUPERCONDUCTING WIRE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 88 NORTH AMERICA: SUPERCONDUCTING WIRE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 89 US: SUPERCONDUCTING WIRE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 90 US: SUPERCONDUCTING WIRE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 91 CANADA: SUPERCONDUCTING WIRE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 92 CANADA: SUPERCONDUCTING WIRE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 93 MEXICO: SUPERCONDUCTING WIRE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 94 MEXICO: SUPERCONDUCTING WIRE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 95 ASIA PACIFIC: SUPERCONDUCTING WIRE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 96 ASIA PACIFIC: SUPERCONDUCTING WIRE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 97 ASIA PACIFIC: SUPERCONDUCTING WIRE MARKET FOR HTS WIRES, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 98 ASIA PACIFIC: SUPERCONDUCTING WIRE MARKET FOR HTS WIRES, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 99 ASIA PACIFIC: SUPERCONDUCTING WIRE MARKET, BY SALES CHANNEL, 2021-2024 (USD MILLION)

- TABLE 100 ASIA PACIFIC: SUPERCONDUCTING WIRE MARKET, BY SALES CHANNEL, 2025-2030 (USD MILLION)

- TABLE 101 ASIA PACIFIC: SUPERCONDUCTING WIRE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 102 ASIA PACIFIC: SUPERCONDUCTING WIRE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 103 ASIA PACIFIC: SUPERCONDUCTING WIRE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 104 ASIA PACIFIC: SUPERCONDUCTING WIRE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 105 Asia Pacific: SUPERCONDUCTING WIRE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 106 ASIA PACIFIC: SUPERCONDUCTING WIRE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 107 CHINA: SUPERCONDUCTING WIRE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 108 CHINA: SUPERCONDUCTING WIRE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 109 JAPAN: SUPERCONDUCTING WIRE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 110 JAPAN: SUPERCONDUCTING WIRE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 111 INDIA: SUPERCONDUCTING WIRE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 112 INDIA: SUPERCONDUCTING WIRE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 113 SOUTH KOREA: SUPERCONDUCTING WIRE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 114 SOUTH KOREA: SUPERCONDUCTING WIRE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 115 AUSTRALIA: SUPERCONDUCTING WIRE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 116 AUSTRALIA: SUPERCONDUCTING WIRE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 117 NEW ZEALAND: SUPERCONDUCTING WIRE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 118 NEW ZEALAND: SUPERCONDUCTING WIRE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 119 REST OF ASIA PACIFIC: SUPERCONDUCTING WIRE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 120 REST OF ASIA PACIFIC: SUPERCONDUCTING WIRE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 121 EUROPE: SUPERCONDUCTING WIRE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 122 EUROPE: SUPERCONDUCTING WIRE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 123 EUROPE: SUPERCONDUCTING WIRE MARKET FOR HTS WIRES, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 124 EUROPE: SUPERCONDUCTING WIRE MARKET FOR HTS WIRES, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 125 EUROPE: SUPERCONDUCTING WIRE MARKET, BY SALES CHANNEL, 2021-2024

- TABLE 126 EUROPE: SUPERCONDUCTING WIRE MARKET, BY SALES CHANNEL, 2025-2030

- TABLE 127 EUROPE: SUPERCONDUCTING WIRE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 128 EUROPE: SUPERCONDUCTING WIRE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 129 EUROPE: SUPERCONDUCTING WIRE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 130 EUROPE: SUPERCONDUCTING WIRE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 131 EUROPE: SUPERCONDUCTING WIRE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 132 EUROPE: SUPERCONDUCTING WIRE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 133 GERMANY: SUPERCONDUCTING WIRE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 134 GERMANY: SUPERCONDUCTING WIRE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 135 UK: SUPERCONDUCTING WIRE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 136 UK: SUPERCONDUCTING WIRE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 137 ITALY: SUPERCONDUCTING WIRE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 138 ITALY: SUPERCONDUCTING WIRE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 139 FRANCE: SUPERCONDUCTING WIRE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 140 FRANCE: SUPERCONDUCTING WIRE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 141 SWITZERLAND: SUPERCONDUCTING WIRE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 142 SWITZERLAND: SUPERCONDUCTING WIRE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 143 SWEDEN: SUPERCONDUCTING WIRE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 144 SWEDEN: SUPERCONDUCTING WIRE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 145 REST OF EUROPE: SUPERCONDUCTING WIRE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 146 REST OF EUROPE: SUPERCONDUCTING WIRE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 147 ROW: SUPERCONDUCTING WIRE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 148 ROW: SUPERCONDUCTING WIRE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 149 ROW: SUPERCONDUCTING WIRE MARKET FOR HTS WIRES, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 150 ROW: SUPERCONDUCTING WIRE MARKET FOR HTS WIRES, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 151 ROW: SUPERCONDUCTING WIRE MARKET, BY SALES CHANNEL, 2021-2024

- TABLE 152 ROW: SUPERCONDUCTING WIRE MARKET, BY SALES CHANNEL, 2025-2030

- TABLE 153 ROW: SUPERCONDUCTING WIRE MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 154 ROW: SUPERCONDUCTING WIRE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 155 ROW: SUPERCONDUCTING WIRE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 156 ROW: SUPERCONDUCTING WIRE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 157 SUPERCONDUCTING WIRE MARKET: STRATEGIES ADOPTED BY KEY PLAYERS, 2021-2024

- TABLE 158 SUPERCONDUCTING WIRE MARKET: DEGREE OF COMPETITION

- TABLE 159 SUPERCONDUCTING WIRE MARKET: REGION FOOTPRINT

- TABLE 160 SUPERCONDUCTING WIRE MARKET: TYPE FOOTPRINT

- TABLE 161 SUPERCONDUCTING WIRE MARKET: END USER FOOTPRINT

- TABLE 162 SUPERCONDUCTING WIRE MARKET: SALES CHANNEL FOOTPRINT

- TABLE 163 SUPERCONDUCTING WIRE MARKET: LIST OF KEY STARTUPS/SMES, 2024

- TABLE 164 SUPERCONDUCTING WIRE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024

- TABLE 165 SUPERCONDUCTING WIRE MARKET: PRODUCT LAUNCHES, JANUARY 2021- JANUARY 2024

- TABLE 166 SUPERCONDUCTING WIRE MARKET: DEALS, JANUARY 2021-JANUARY 2024

- TABLE 167 SUPERCONDUCTING WIRE MARKET: OTHER DEVELOPMENTS, JANUARY 2021-JANUARY 2024

- TABLE 168 SUMITOMO ELECTRIC INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 169 SUMITOMO ELECTRIC INDUSTRIES, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 170 FUJIKURA LTD.: COMPANY OVERVIEW

- TABLE 171 FUJIKURA LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 172 FURUKAWA ELECTRIC CO., LTD.: COMPANY OVERVIEW

- TABLE 173 FURUKAWA ELECTRIC CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 174 BRUKER GROUP: BUSINESS OVERVIEW

- TABLE 175 BRUKER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 176 BRUKER: DEVELOPMENTS

- TABLE 177 AMERICAN SUPERCONDUCTOR: COMPANY OVERVIEW

- TABLE 178 AMERICAN SUPERCONDUCTOR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 179 AMERICAN SUPERCONDUCTOR: DEVELOPMENTS

- TABLE 180 NEXANS: COMPANY OVERVIEW

- TABLE 181 NEXANS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 182 NEXANS: DEVELOPMENTS

- TABLE 183 LS CABLE & SYSTEM LTD.: COMPANY OVERVIEW

- TABLE 184 LS CABLE & SYSTEM LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 185 LS CABLE & SYSTEM LTD.: DEALS

- TABLE 186 KISWIRE ADVANCED TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 187 KISWIRE ADVANCED TECHNOLOGY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 METOX TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 189 METOX TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 SAM DONG: COMPANY OVERVIEW

- TABLE 191 SAM DONG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 THEVA DUNNSCHICHTTECHNIK GMBH: COMPANY OVERVIEW

- TABLE 193 THEVA DUNNSCHICHTTECHNIK GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 THEVA DUNNSCHICHTTECHNIK GMBH: PRODUCT LAUNCHES

- TABLE 195 THEVA DUNNSCHICHTTECHNIK GMBH: DEALS

- TABLE 196 THEVA DUNNSCHICHTTECHNIK GMBH: OTHER DEVELOPMENTS

- TABLE 197 FIRMETAL GROUP: COMPANY OVERVIEW

- TABLE 198 FIRMETAL GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 SUPEROX: COMPANY OVERVIEW

- TABLE 200 SUPEROX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 ASG SUPERCONDUCTORS S.P.A.: COMPANY OVERVIEW

- TABLE 202 ASG SUPERCONDUCTORS S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 ASG SUPERCONDUCTORS S.P.A.: DEALS

- TABLE 204 ASG SUPERCONDUCTORS S.P.A.: OTHER DEVELOPMENTS

- TABLE 205 SUPERCON, INC.: COMPANY OVERVIEW

- TABLE 206 SUPERCON, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 SUPERCONDUCTING WIRE MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 SUPERCONDUCTING WIRE MARKET: RESEARCH DESIGN

- FIGURE 3 KEY METRICS CONSIDERED TO ANALYZE DEMAND FOR SUPERCONDUCTING WIRES

- FIGURE 4 SUPERCONDUCTING WIRE MARKET: BOTTOM-UP APPROACH

- FIGURE 5 SUPERCONDUCTING WIRE MARKET: TOP-DOWN APPROACH

- FIGURE 6 KEY STEPS CONSIDERED TO ASSESS SUPPLY OF SUPERCONDUCTING WIRES

- FIGURE 7 SUPERCONDUCTING WIRE MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE)

- FIGURE 8 SUPERCONDUCTING WIRE MARKET: DATA TRIANGULATION

- FIGURE 9 DIRECT SALES CHANNELS TO CAPTURE PROMINENT MARKET SHARE IN 2030

- FIGURE 10 LTS WIRES ACCOUNTED FOR LARGER MARKET SHARE IN 2024

- FIGURE 11 ENERGY SEGMENT TO WITNESS HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 12 EUROPE DOMINATED SUPERCONDUCTING WIRE MARKET IN 2024

- FIGURE 13 GROWING INVESTMENTS IN DEVELOPMENT OF SUPERCONDUCTOR-BASED GENERATORS FOR ENERGY SECTOR TO DRIVE MARKET

- FIGURE 14 DIRECT SALES CHANNELS AND LTS WIRES HELD LARGEST MARKET SHARE IN 2024

- FIGURE 15 DIRECT SALES CHANNELS TO ACCOUNT FOR MAJORITY OF MARKET SHARE IN 2030

- FIGURE 16 LTS WIRES TO DOMINATE MARKET IN 2030

- FIGURE 17 HEALTHCARE SEGMENT TO COMMAND MARKET IN 2030

- FIGURE 18 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN SUPERCONDUCTING WIRE MARKET DURING FORECAST PERIOD

- FIGURE 19 SUPERCONDUCTING WIRE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 PRESENT VALUE (PV) OF COST OVER ENTIRE LIFETIME FOR CONVENTIONAL AND HIGH-TEMPERATURE SUPERCONDUCTING SOLUTIONS

- FIGURE 21 GLOBAL NEW INSTALLATIONS OF OFFSHORE WIND ENERGY, 2010-2023

- FIGURE 22 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 23 VALUE CHAIN ANALYSIS

- FIGURE 24 SUPERCONDUCTING WIRE ECOSYSTEM ANALYSIS

- FIGURE 25 INVESTMENT AND FUNDING SCENARIO, 2024

- FIGURE 26 AVERAGE SELLING PRICE TREND OF SUPERCONDUCTING WIRES, BY REGION, 2021-2024

- FIGURE 27 IMPORT SCENARIO FOR HS CODE 854419-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 28 EXPORT SCENARIO FOR HS CODE 854419-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 29 IMPACT OF AI ON SUPERCONDUCTING WIRE MARKET ON MAJOR END USERS, BY REGION

- FIGURE 30 PATENTS APPLIED AND GRANTED, 2014-2024

- FIGURE 31 PORTER'S FIVE FORCES ANALYSIS FOR SUPERCONDUCTING WIRE MARKET

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END USERS

- FIGURE 33 KEY BUYING CRITERIA FOR TOP 3 END USERS

- FIGURE 34 SUPERCONDUCTING WIRE MARKET SHARE, IN TERMS OF VALUE, BY TYPE, 2024

- FIGURE 35 SUPERCONDUCTING WIRE MARKET SHARE, IN TERMS OF VALUE, BY SALES CHANNEL, 2024

- FIGURE 36 SUPERCONDUCTING WIRE MARKET SHARE, IN TERMS OF VALUE, BY APPLICATION, 2024

- FIGURE 37 SUPERCONDUCTING WIRE MARKET SHARE, IN TERMS OF VALUE, BY END USER, 2024

- FIGURE 38 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN SUPERCONDUCTING WIRE MARKET DURING FORECAST PERIOD

- FIGURE 39 NORTH AMERICA: SUPERCONDUCTOR WIRE MARKET SNAPSHOT

- FIGURE 40 ASIA PACIFIC: SUPERCONDUCTING WIRE MARKET SNAPSHOT

- FIGURE 41 MARKET SHARE ANALYSIS, 2024

- FIGURE 42 REVENUE ANALYSIS OF TOP PLAYERS, 2020-2024

- FIGURE 43 SUPERCONDUCTING WIRE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 44 SUPERCONDUCTING WIRE MARKET: COMPANY FOOTPRINT

- FIGURE 45 SUPERCONDUCTING WIRE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 46 COMPANY VALUATION, 2025 (USD BILLION)

- FIGURE 47 FINANCIAL METRICS

- FIGURE 48 SUPERCONDUCTING WIRE MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 49 SUMITOMO ELECTRIC INDUSTRIES, LTD.: COMPANY SNAPSHOT

- FIGURE 50 FUJIKURA LTD.: COMPANY SNAPSHOT

- FIGURE 51 FURUKAWA ELECTRIC CO., LTD.: COMPANY SNAPSHOT

- FIGURE 52 BRUKER: COMPANY SNAPSHOT

- FIGURE 53 AMERICAN SUPERCONDUCTOR: COMPANY SNAPSHOT

- FIGURE 54 NEXANS: COMPANY SNAPSHOT

- FIGURE 55 LS CABLE & SYSTEM LTD.: COMPANY SNAPSHOT