|

市場調查報告書

商品編碼

1783248

全球牙科影像市場(按產品、應用和最終用戶分類)- 預測至 2030 年Dental Imaging Market by Product (Extraoral Imaging (CBCT, Panoramic), Intraoral Imaging (X-ray, Intraoral Camera, IOL Scanner)), Application (Endodontics, Implantology), & End User (Dental Hospitals, Dental Diagnostic Centers) - Global Forecast to 2030 |

||||||

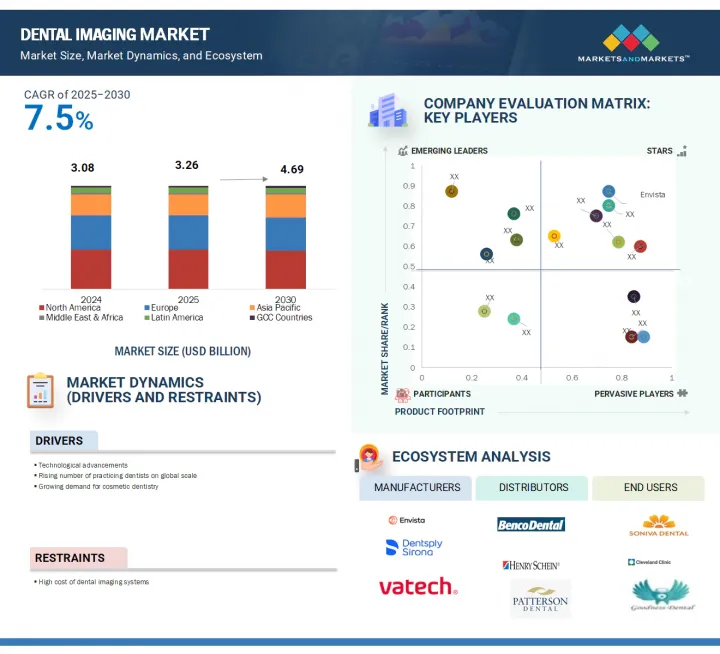

全球牙科影像市場預計將從 2025 年的 32.6 億美元成長到 2030 年的 46.9 億美元,2025 年至 2030 年的複合年成長率為 7.5%。

由於多種因素,包括技術進步和人們對美容牙科日益成長的興趣(這需要對解剖結構進行詳細成像),對牙科成像產品的需求正在增加。

| 調查範圍 | |

|---|---|

| 調查年份 | 2024-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 單元 | 10億美元 |

| 部分 | 產品、應用、最終用戶、地區 |

| 目標區域 | 北美、歐洲、亞太地區、中東和非洲、拉丁美洲 |

此外,齲齒和牙周病的增加以及牙科旅遊業的蓬勃發展是推動牙科成像市場成長的主要因素。

該市場受到多種因素的影響,例如牙科疾病盛行率的上升、3D成像技術的進步以及對精準診斷和治療計劃日益成長的需求。此外,可攜式牙科影像設備的日益普及也改善了牙科護理的可及性,尤其是對於偏遠地區和出行不便的患者而言,這進一步擴大了市場。

“按產品分類,口外成像系統佔據牙科成像市場的最大佔有率。”

預計口外成像系統領域將在2024年佔據牙科成像市場的最大佔有率。在口外成像領域,3D CBCT預計在預測期內實現最高複合年成長率。口外影像系統在診斷、治療計劃和治療後評估中的廣泛應用,尤其是在植入、牙髓科、顎顏面外科和正畸科,正在推動該領域的成長。

“根據應用,植入領域將在 2024 年佔據牙科成像市場的最大佔有率。”

這主要是由於成像的優勢,它可以在植入過程中進行精確測量,確保治療的準確性,並有助於治療後評估。

“按最終用戶分類,牙科診斷中心領域在 2024 年佔據最大的市場佔有率。”

這種成長是由先進成像系統的日益普及、意識提升以及對快速診斷和有效治療計劃的需求不斷成長所推動的。

“2024年,北美佔據牙科成像市場的最大佔有率。”

這種龐大的市場影響可以歸因於多種因素,例如主要製造商加強研發力度、對美容牙科的興趣日益濃厚、對先進技術系統的需求不斷成長以及診斷中心廣泛採用錐狀射束CT (CBCT) 系統。

相反,預計亞太地區將在預測期內見證最高的複合年成長率,這得益於新興和成熟的市場參與者、相對寬鬆的監管準則以及亞洲開發中國家醫療保健基礎設施的改善。

本報告研究了全球牙科影像市場,提供了關鍵促進因素和限制因素、競爭格局和未來趨勢的資訊。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章 主要發現

- 牙科影像市場概況

- 亞太地區牙科影像市場(按產品類型和國家分類)

- 牙科成像市場:地理成長機會

- 牙科影像市場:區域細分

- 牙科影像市場:新興國家和已開發國家

第5章市場概述

- 介紹

- 市場動態

- 驅動程式

- 抑制因素

- 機會

- 任務

- 波特五力分析

- 監管格局

- 美國

- 歐洲聯盟

- 中國

- 監管機構、政府機構和其他組織

- 產業趨勢

- 利用人工智慧

- 行動裝置和手持設備

- 贖回情景

- 投資金籌措場景

- 技術分析

- 主要技術

- 互補技術

- 鄰近技術

- 大型會議及活動

- 定價分析

- 主要企業各產品平均銷售價格

- 各地區牙科影像產品平均銷售價格

- 貿易分析

- 導入場景

- 匯出場景

- 專利分析

- 牙科成像相關專利出版物的趨勢

- 司法管轄區分析:牙科影像市場的主要專利申請人

- 價值鏈分析

- 生態系統

- 供應鏈分析

- 案例研究分析

- 診斷隱藏的根管問題

- 3D成像提高診斷準確性

- 具有特殊解剖結構的磨牙的治療

- 影響客戶業務的趨勢/中斷

- 主要相關利益者和採購標準

- 鄰近市場分析

- 牙科影像市場中未滿足的需求/最終用戶的期望

- 人工智慧/生成式人工智慧對牙科影像市場的影響

- 2025年美國關稅的影響—概述

- 介紹

- 主要關稅稅率

- 價格影響分析

- 對終端產業的影響

6. 牙科影像市場(按產品)

- 介紹

- 口外成像系統

- 全景系統

- 全景頭顱測量系統

- 3D CBCT系統

- 口內成像系統

- 口內掃描儀

- 口內X光系統

- 口內感測器

- 口內光激磷光體系統

- 口內攝影機

- 牙科影像軟體

第7章 牙科影像市場(按應用)

- 介紹

- 植入

- 根管治療

- 口腔顎顏面外科

- 正畸

- 其他用途

第 8 章牙科影像市場(按最終用戶)

- 介紹

- 牙醫診所和診所

- 牙科診斷中心

- 牙科學術研究所

9. 牙科影像市場(按地區)

- 介紹

- 北美洲

- 北美宏觀經濟展望

- 美國

- 加拿大

- 歐洲

- 歐洲宏觀經濟展望

- 德國

- 義大利

- 法國

- 西班牙

- 英國

- 其他歐洲國家

- 亞太地區

- 亞太宏觀經濟展望

- 中國

- 韓國

- 日本

- 印度

- 澳洲

- 其他亞太地區

- 拉丁美洲

- 拉丁美洲宏觀經濟展望

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中東和非洲

- 海灣合作理事會國家

第10章 競爭格局

- 概述

- 主要參與企業的策略/優勢

- 收益佔有率分析

- 市場佔有率分析

- 企業評估矩陣:主要企業(2024年)

- 中小企業和Start-Ups的競爭領導地圖(2024)

- 公司估值及財務指標

- 品牌/產品比較

- 競爭場景

第11章:公司簡介

- 主要企業

- ENVISTA

- DENTSPLY SIRONA, INC.

- PLANMECA OY

- CARESTREAM DENTAL, LLC

- VATECH CO., LTD.

- GENORAY CO., LTD.

- ALIGN TECHNOLOGY, INC.

- INSTITUT STRAUMANN AG

- RAY CO. LTD

- ACTEON

- OWANDY RADIOLOGY

- J. MORITA CORP

- MIDMARK CORPORATION

- DURR DENTAL SE

- 其他公司

- XLINE SRL

- 3SHAPE A/S

- RUNYES MEDICAL INSTRUMENT CO., LTD.

- ASAHI ROENTGEN IND. CO., LTD.

- CEFLA SC

- YOSHIDA DENTAL MFG. CO. LTD.

- PREXION, INC.

- YOFO MEDICAL TECHNOLOGY CO., LTD.

- MEDIT CORP

- SHINING 3D

- SHANGHAI HANDY MEDICAL EQUIPMENT

- SHANGHAI CAREJOY MEDICAL CO., LTD

第12章 附錄

The dental imaging market is projected to reach USD 4.69 billion by 2030 from USD 3.26 billion in 2025, at a CAGR of 7.5% from 2025 to 2030. The demand for dental imaging products is increasing due to several factors, including technological advancements and a growing interest in cosmetic dentistry, which requires detailed imaging of anatomical structures.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

Additionally, the rise in caries and periodontal diseases, along with a boost in dental tourism, are key drivers contributing to the growth of the dental imaging market.

The market is influenced by several factors, including the rising prevalence of dental disorders, advancements in 3D imaging technologies, and the increasing demand for accurate diagnosis and treatment planning. Additionally, the growing availability of portable dental imaging devices is enhancing access to dental care, particularly in remote areas and for patients with mobility challenges, thereby further expanding the market.

"By product, the extraoral imaging systems segment holds the largest share of the dental imaging market."

Within the product category, the dental imaging market has been segmented into extraoral imaging and intraoral imaging systems. The extraoral imaging systems segment accounted for the largest share of the dental imaging market in 2024. Within the extraoral imaging segment, 3D CBCT is expected to grow at the highest CAGR during the forecast period. The extensive use of extraoral imaging systems for diagnosis, treatment planning, and post-treatment assessment, particularly in implantology, endodontics, oral and maxillofacial surgery, and orthodontics, is driving the growth of this segment.

"By application, the implantology segment held the largest share of the dental imaging market in 2024."

The dental imaging market is divided into several segments based on application, including implantology, endodontics, oral & maxillofacial surgery, orthodontics, and other applications. Among these, the implantology segment holds the largest market share. This is primarily due to the advantages of imaging, which enables precise measurements during implant placement, ensures treatment accuracy, and aids in post-treatment evaluation.

"By end user, the dental diagnostic centers segment held the largest market share in 2024."

The dental imaging market has been segmented based on end users into three categories: dental clinics & hospitals, dental diagnostic centers, and dental research & academic institutes. The dental diagnostic centers segment holds the largest market share in the dental imaging market. This growth is driven by the increasing adoption of advanced imaging systems, heightened awareness among patients, and a growing demand for quick diagnosis and effective treatment planning.

"North America held the largest share of the dental imaging market in 2024."

North America held the largest share of the global dental imaging market in 2024. This significant market presence can be attributed to several factors, including increased research and development efforts by key manufacturers, a growing interest in cosmetic dentistry, rising demand for advanced technological systems, and the widespread adoption of cone beam computed tomography (CBCT) systems in diagnostic centers.

Conversely, the Asia Pacific (APAC) region is expected to experience the highest CAGR during the forecast period. This growth is driven by emerging and established market players in developing Asian countries, relatively lenient regulatory guidelines, and improvements in healthcare infrastructure.

The breakdown of primary participants was as mentioned below:

- By Company Type: Tier 1 (40%), Tier 2 (30%), and Tier 3 (30%)

- By Designation: C-level Executives (50%), Directors (30%), and Others (20%)

- By Region: North America (30%), Europe (25%), Asia Pacific (20%), Latin America (15%), and the Middle East & Africa (10%)

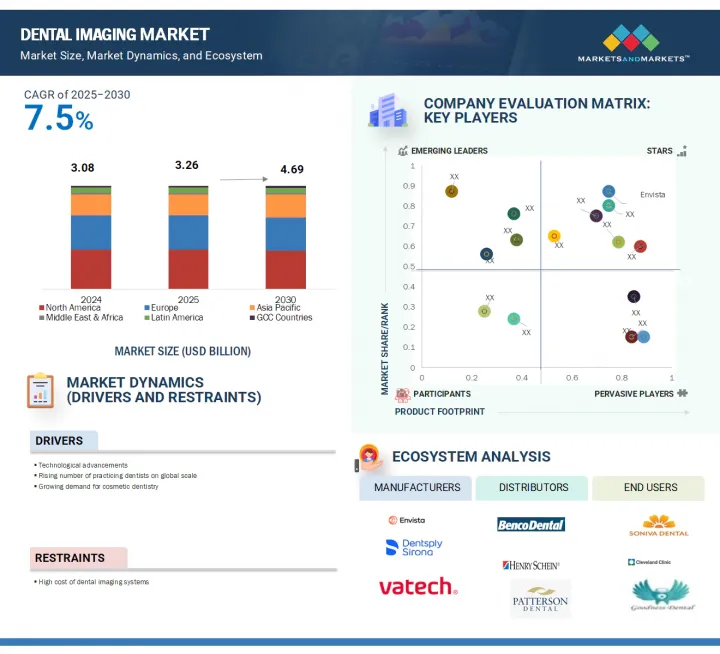

The major players in the global dental imaging industry are Envista Holdings Corporation (US), Planmeca Oy (Finland), ACTEON (UK), DENTSPLY SIRONA, Inc. (US), Carestream Dental LLC (US), VATECH (South Korea), Owandy Radiology, Inc. (France), DURR DENTAL AG (Germany), Midmark Corporation (US), Genoray Co., Ltd. (South Korea), Asahi Roentgen Co., Ltd. (Japan), 3Shape A/S (Denmark), PreXion, Inc. (US), Runyes Medical Instrument Co., Ltd. (China), Cefla s.c. (Italy), RAY Co. (South Korea), The Yoshida Dental Mfg. Co., Ltd. (Japan), Align Technology Inc. (US), J. MORITA CORP (Japan), and Xline S.r.l (Italy).

Research Coverage

The report examines various dental imaging products and their adoption patterns across different fields, including implantology, endodontics, oral and maxillofacial surgery, orthodontics, and more. Its purpose is to estimate the market size and future growth potential of the global dental imaging market, focusing on various segments such as products, applications, end users, and regions. Additionally, the report features a comprehensive competitive analysis of key players in the market, including their company profiles, product offerings, and recent developments.

Reasons to Buy the Report

The report will benefit both established companies and new or smaller firms by providing insights into market trends. This information will help them capture a larger market share. Companies that purchase the report can use one or more of the five strategies outlined below to strengthen their market position.

This report provides insights on the following pointers:

- Analysis of key drivers (technological advancements, increasing number of dental practices, growing demand for cosmetic dentistry, rising incidence of dental caries and periodontal diseases, and rising dental tourism in emerging market), restraints (high cost of dental imaging system), opportunities (high growth potential in emerging countries and AI in dental imaging), and challenges (managing vast amounts of imaging data).

- Market Penetration: The report includes extensive information on products offered by the major players in the global dental imaging market. It also includes various segments by product type, application, distribution, and region.

- Product Development/Innovation: Detailed insights on the upcoming trends, R&D activities, and product launches in the global dental imaging market.

- Market Development: Comprehensive information on the lucrative emerging regions by product, application, and end user.

- Market Diversification: Exhaustive information about new products, growing geographies, and recent developments in the global dental imaging market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and products of leading players in the global dental imaging market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY UNIT CONSIDERED

- 1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 DATA TRIANGULATION

- 2.4 MARKET SHARE ESTIMATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.6.1 SCOPE-RELATED LIMITATIONS

- 2.6.2 METHODOLOGY-RELATED LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 DENTAL IMAGING MARKET OVERVIEW

- 4.2 ASIA PACIFIC: DENTAL IMAGING MARKET, BY PRODUCT TYPE AND COUNTRY

- 4.3 DENTAL IMAGING MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.4 DENTAL IMAGING MARKET: REGIONAL MIX

- 4.5 DENTAL IMAGING MARKET: EMERGING VS. DEVELOPED COUNTRIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Technological advancements

- 5.2.1.2 Increase in number of dental practices and rise in dental expenditure

- 5.2.1.3 Growth in demand for cosmetic dentistry

- 5.2.1.4 Rise in incidence of dental caries and other periodontal diseases

- 5.2.1.5 Growing dental tourism in emerging markets

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of dental imaging systems

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 High growth potential in emerging countries

- 5.2.3.2 Artificial intelligence in dental imaging

- 5.2.3.3 Expansion of DSOs

- 5.2.4 CHALLENGES

- 5.2.4.1 Managing high volumes of imaging data

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.3.2 BARGAINING POWER OF SUPPLIERS

- 5.3.3 BARGAINING POWER OF BUYERS

- 5.3.4 THREAT OF SUBSTITUTES

- 5.3.5 THREAT OF NEW ENTRANTS

- 5.4 REGULATORY LANDSCAPE

- 5.4.1 US

- 5.4.2 EUROPEAN UNION

- 5.4.3 CHINA

- 5.4.4 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.5 INDUSTRY TRENDS

- 5.5.1 USE OF AI

- 5.5.2 PORTABLE AND HANDHELD DEVICES

- 5.6 REIMBURSEMENT SCENARIO

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 CAD/CAM technology

- 5.8.1.2 AI in intraoral scanners

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Fluorescence-based caries detection

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 3D printing

- 5.8.1 KEY TECHNOLOGIES

- 5.9 KEY CONFERENCES & EVENTS

- 5.10 PRICING ANALYSIS

- 5.10.1 AVERAGE SELLING PRICE OF DENTAL IMAGING AMONG KEY PLAYERS, BY PRODUCT

- 5.10.2 AVERAGE SELLING PRICE OF DENTAL IMAGING, BY REGION

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO

- 5.11.2 EXPORT SCENARIO

- 5.12 PATENT ANALYSIS

- 5.12.1 PATENT PUBLICATION TRENDS FOR DENTAL IMAGING

- 5.12.2 JURISDICTION ANALYSIS: TOP APPLICANTS FOR PATENTS IN DENTAL IMAGING MARKET

- 5.13 VALUE CHAIN ANALYSIS

- 5.14 ECOSYSTEM

- 5.15 SUPPLY CHAIN ANALYSIS

- 5.16 CASE STUDY ANALYSIS

- 5.16.1 DIAGNOSING HIDDEN ROOT CANAL ISSUES

- 5.16.2 ENHANCING DIAGNOSTIC ACCURACY WITH 3D IMAGING

- 5.16.3 TREATING MOLARS WITH UNUSUAL ANATOMY

- 5.17 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.18 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.18.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.18.2 BUYING CRITERIA

- 5.19 ADJACENT MARKET ANALYSIS

- 5.20 UNMET NEEDS/END USER EXPECTATIONS IN DENTAL IMAGING MARKET

- 5.21 IMPACT OF AI/GENERATIVE AI ON DENTAL IMAGING MARKET

- 5.22 IMPACT OF 2025 US TARIFF - OVERVIEW

- 5.22.1 INTRODUCTION

- 5.22.2 KEY TARIFF RATES

- 5.22.3 PRICE IMPACT ANALYSIS

- 5.22.4 IMPACT ON END-USER INDUSTRIES

6 DENTAL IMAGING MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 EXTRAORAL IMAGING SYSTEMS

- 6.2.1 PANORAMIC SYSTEMS

- 6.2.1.1 Increase in prevalence of dental disorders to support growth of this market segment

- 6.2.2 PANORAMIC & CEPHALOMETRIC SYSTEMS

- 6.2.2.1 Benefits of offering single digital platform for dental treatments to drive subsegment

- 6.2.3 3D CBCT SYSTEMS

- 6.2.3.1 Increase in dental implants to drive demand for 3D CBCT systems

- 6.2.1 PANORAMIC SYSTEMS

- 6.3 INTRAORAL IMAGING SYSTEMS

- 6.3.1 INTRAORAL SCANNERS

- 6.3.1.1 Intraoral scanners to provide fast and accurate scanning

- 6.3.2 INTRAORAL X-RAY SYSTEMS

- 6.3.2.1 Efficient and faster intraoral diagnostics to offer major advantages

- 6.3.3 INTRAORAL SENSORS

- 6.3.3.1 Intraoral sensors to enable significant reduction in operating time

- 6.3.4 INTRAORAL PHOTOSTIMULABLE PHOSPHOR SYSTEMS

- 6.3.4.1 Phosphor imaging plates to offer economical option for intraoral imaging

- 6.3.5 INTRAORAL CAMERAS

- 6.3.5.1 Intraoral cameras help in early detection and accurate representation of dental conditions

- 6.3.6 DENTAL IMAGING SOFTWARE

- 6.3.6.1 Continuous development of AI-powered diagnostic aids and seamless integration with practice management systems to strengthen importance of dental imaging software

- 6.3.1 INTRAORAL SCANNERS

7 DENTAL IMAGING MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 IMPLANTOLOGY

- 7.2.1 IMPLANTOLOGY SEGMENT TO LEAD DENTAL IMAGING MARKET

- 7.3 ENDODONTICS

- 7.3.1 CBCT SYSTEMS: IMPORTANT DIAGNOSTIC TOOLS IN ENDODONTICS

- 7.4 ORAL & MAXILLOFACIAL SURGERY

- 7.4.1 CLINICAL AND RADIOLOGICAL DATA TO PLAY MAJOR ROLE IN ORAL & MAXILLOFACIAL SURGERY

- 7.5 ORTHODONTICS

- 7.5.1 GROWING PENETRATION OF 3D IMAGING TECHNIQUES TO SUPPORT MARKET GROWTH

- 7.6 OTHER APPLICATIONS

8 DENTAL IMAGING MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 DENTAL HOSPITALS & CLINICS

- 8.2.1 RISE IN ADOPTION OF ADVANCED TECHNOLOGIES TO SUPPORT GROWTH OF THIS END-USER SEGMENT

- 8.3 DENTAL DIAGNOSTIC CENTERS

- 8.3.1 INCREASE IN NUMBER OF DENTAL PROCEDURES AND DEMAND FOR COSMETIC DENTISTRY TO SUPPORT GROWTH OF THIS SEGMENT

- 8.4 DENTAL ACADEMIC & RESEARCH INSTITUTES

- 8.4.1 LOW PURCHASING POWER AND SLOW ADOPTION OF ADVANCED DENTAL TECHNOLOGIES TO HINDER GROWTH OF THIS SEGMENT

9 DENTAL IMAGING MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 US to dominate North American dental imaging market

- 9.2.3 CANADA

- 9.2.3.1 Increase in awareness of dental care to support growth of dental imaging industry in Canada

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Germany to be largest market for dental imaging in Europe

- 9.3.3 ITALY

- 9.3.3.1 Increase in spending on oral health to drive dental imaging market in Italy

- 9.3.4 FRANCE

- 9.3.4.1 Well-organized distribution network to support market growth in France

- 9.3.5 SPAIN

- 9.3.5.1 Increase in number of dentists, growing dental tourism, and rise in geriatric population to aid market growth

- 9.3.6 UK

- 9.3.6.1 Subsidies for treatment costs by NHS to provide broader access to essential dental care in UK

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 CHINA

- 9.4.2.1 Significant increase in demand for dental care services to drive market growth in China

- 9.4.3 SOUTH KOREA

- 9.4.3.1 Rise in disposable incomes to drive overall market growth in South Korea

- 9.4.4 JAPAN

- 9.4.4.1 Increase in geriatric population and dental awareness among patients to support market growth in Japan

- 9.4.5 INDIA

- 9.4.5.1 India to offer lucrative growth opportunities for market players

- 9.4.6 AUSTRALIA

- 9.4.6.1 Growth in number of registered dental practitioners to support market growth

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 9.5.2 BRAZIL

- 9.5.2.1 Large number of dentists and dental tourism to drive market

- 9.5.3 MEXICO

- 9.5.3.1 Lower dental care costs compared to other countries to support market growth

- 9.5.4 REST OF LATIN AMERICA

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 MACROECONOMIC OUTLOOK FOR THE MIDDLE EAST & AFRICA

- 9.7 GCC COUNTRIES

- 9.7.1 MACROECONOMIC OUTLOOK FOR GCC COUNTRIES

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN DENTAL IMAGING MARKET

- 10.3 REVENUE SHARE ANALYSIS

- 10.4 MARKET SHARE ANALYSIS

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 PERVASIVE PLAYERS

- 10.5.3 EMERGING LEADERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Product type footprint

- 10.5.5.3 Application footprint

- 10.5.5.4 End user footprint

- 10.5.5.5 Region footprint

- 10.6 COMPETITIVE LEADERSHIP MAPPING FOR SMES & STARTUPS, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 DYNAMIC COMPANIES

- 10.6.3 STARTING BLOCKS

- 10.6.4 RESPONSIVE COMPANIES

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/SMEs

- 10.6.5.2 Competitive benchmarking of key startups/SMEs

- 10.7 COMPANY VALUATION & FINANCIAL METRICS

- 10.7.1 FINANCIAL METRICS

- 10.7.2 COMPANY VALUATION

- 10.8 BRAND/PRODUCT COMPARISON

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT & SERVICE LAUNCHES AND APPROVALS

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

- 10.9.4 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 ENVISTA

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches & approvals

- 11.1.1.3.2 Deals

- 11.1.1.3.3 Other developments

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 DENTSPLY SIRONA, INC.

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches & approvals

- 11.1.2.3.2 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 PLANMECA OY

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches & approvals

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM View

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 CARESTREAM DENTAL, LLC

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches & approvals

- 11.1.4.3.2 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 VATECH CO., LTD.

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 GENORAY CO., LTD.

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches & approvals

- 11.1.6.3.2 Expansions

- 11.1.7 ALIGN TECHNOLOGY, INC.

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product launches & approvals

- 11.1.7.3.2 Deals

- 11.1.8 INSTITUT STRAUMANN AG

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Deals

- 11.1.9 RAY CO. LTD

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.10 ACTEON

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product launches & approvals

- 11.1.11 OWANDY RADIOLOGY

- 11.1.11.1 Business overview

- 11.1.11.2 Products offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Product launches & approvals

- 11.1.12 J. MORITA CORP

- 11.1.12.1 Business overview

- 11.1.12.2 Products offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 Expansions

- 11.1.13 MIDMARK CORPORATION

- 11.1.13.1 Business overview

- 11.1.13.2 Products offered

- 11.1.14 DURR DENTAL SE

- 11.1.14.1 Business overview

- 11.1.14.2 Products offered

- 11.1.14.3 Recent developments

- 11.1.14.3.1 Product launches & approvals

- 11.1.14.3.2 Deals

- 11.1.14.3.3 Expansions

- 11.1.1 ENVISTA

- 11.2 OTHER PLAYERS

- 11.2.1 XLINE S.R.L

- 11.2.2 3SHAPE A/S

- 11.2.3 RUNYES MEDICAL INSTRUMENT CO., LTD.

- 11.2.4 ASAHI ROENTGEN IND. CO., LTD.

- 11.2.5 CEFLA S.C.

- 11.2.6 YOSHIDA DENTAL MFG. CO. LTD.

- 11.2.7 PREXION, INC.

- 11.2.8 YOFO MEDICAL TECHNOLOGY CO., LTD.

- 11.2.9 MEDIT CORP

- 11.2.10 SHINING 3D

- 11.2.11 SHANGHAI HANDY MEDICAL EQUIPMENT

- 11.2.12 SHANGHAI CAREJOY MEDICAL CO., LTD

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

List of Tables

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 STANDARD CURRENCY CONVERSION RATES

- TABLE 3 STUDY ASSUMPTIONS

- TABLE 4 RISK ASSESSMENT: DENTAL IMAGING MARKET

- TABLE 5 DENTAL IMAGING MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 DENTAL IMAGING MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2025-2026

- TABLE 12 AVERAGE SELLING PRICE OF DENTAL IMAGING AMONG KEY PLAYERS, BY PRODUCT, 2022-2024 (USD)

- TABLE 13 AVERAGE SELLING PRICE OF DENTAL IMAGING, BY REGION, 2024 (USD)

- TABLE 14 IMPORT DATA FOR DENTAL IMAGING (HS CODE: 9022), BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 15 EXPORT DATA FOR DENTAL IMAGING (HS CODE: 9022), BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 16 LIST OF PATENTS IN DENTAL IMAGING MARKET, 2022-2024

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF TOP THREE APPLICATIONS

- TABLE 18 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 19 UNMET NEEDS: DENTAL IMAGING MARKET

- TABLE 20 END-USER EXPECTATIONS: DENTAL IMAGING MARKET

- TABLE 21 US: ADJUSTED RECIPROCAL TARIFF RATES, 2024

- TABLE 22 KEY PRODUCT-RELATED TARIFF EFFECTIVE FOR DENTAL IMAGING

- TABLE 23 DENTAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 24 DENTAL IMAGING MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 25 INTRAORAL AND EXTRAORAL DENTAL IMAGING SYSTEMS MARKET, 2023-2030 (BILLION UNITS)

- TABLE 26 EXTRAORAL DENTAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 27 EXTRAORAL DENTAL IMAGING SYSTEMS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 28 LIST OF KEY PANORAMIC SYSTEMS AVAILABLE

- TABLE 29 PANORAMIC SYSTEMS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 30 LIST OF KEY PANORAMIC & CEPHALOMETRIC SYSTEMS AVAILABLE

- TABLE 31 PANORAMIC & CEPHALOMETRIC SYSTEMS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 32 LIST OF KEY 3D CBCT SYSTEMS AVAILABLE

- TABLE 33 3D CBCT SYSTEMS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 34 INTRAORAL DENTAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 35 INTRAORAL DENTAL IMAGING SYSTEMS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 36 LIST OF INTRAORAL SCANNERS AVAILABLE

- TABLE 37 INTRAORAL SCANNERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 38 LIST OF KEY INTRAORAL X-RAY UNITS AVAILABLE

- TABLE 39 INTRAORAL X-RAY SYSTEMS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 40 LIST OF KEY INTRAORAL SENSORS AVAILABLE

- TABLE 41 INTRAORAL SENSORS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 42 LIST OF KEY PSP SYSTEMS AVAILABLE

- TABLE 43 INTRAORAL PSP SYSTEMS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 44 LIST OF KEY INTRAORAL CAMERAS AVAILABLE

- TABLE 45 INTRAORAL CAMERAS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 46 DENTAL IMAGING SOFTWARE MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 47 DENTAL IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 48 DENTAL IMAGING MARKET FOR IMPLANTOLOGY APPLICATIONS, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 49 DENTAL IMAGING MARKET FOR ENDODONTIC APPLICATIONS, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 50 DENTAL IMAGING MARKET FOR ORAL & MAXILLOFACIAL SURGERY APPLICATIONS, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 51 DENTAL IMAGING MARKET FOR ORTHODONTIC APPLICATIONS, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 52 DENTAL IMAGING MARKET FOR OTHER APPLICATIONS, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 53 DENTAL IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 54 DENTAL HOSPITALS & CLINICS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 55 DENTAL DIAGNOSTIC CENTERS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 56 DENTAL ACADEMIC & RESEARCH INSTITUTES MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 57 DENTAL IMAGING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 58 US: DENTAL EXPENDITURE, 2014-2023 (USD BILLION)

- TABLE 59 NORTH AMERICA: DENTAL IMAGING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 60 NORTH AMERICA: DENTAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 61 NORTH AMERICA: EXTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 62 NORTH AMERICA: INTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 63 NORTH AMERICA: DENTAL IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 64 NORTH AMERICA: DENTAL IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 65 US: DENTAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 66 US: EXTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 67 US: INTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 68 US: DENTAL IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 69 US: DENTAL IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 70 CANADA: DENTAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 71 CANADA: EXTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 72 CANADA: INTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 73 CANADA: DENTAL IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 74 CANADA: DENTAL IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 75 EUROPE: DENTAL IMAGING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 76 EUROPE: DENTAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 77 EUROPE: EXTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 78 EUROPE: INTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 79 EUROPE: DENTAL IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 80 EUROPE: DENTAL IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 81 GERMANY: DENTAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 82 GERMANY: EXTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 83 GERMANY: INTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 84 GERMANY: DENTAL IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 85 GERMANY: DENTAL IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 86 ITALY: DENTAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 87 ITALY: EXTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 88 ITALY: INTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 89 ITALY: DENTAL IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 90 ITALY: DENTAL IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 91 FRANCE: DENTAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 92 FRANCE: EXTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 93 FRANCE: INTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 94 FRANCE: DENTAL IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 95 FRANCE: DENTAL IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 96 SPAIN: DENTAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 97 SPAIN: EXTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 98 SPAIN: INTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 99 SPAIN: DENTAL IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 100 SPAIN: DENTAL IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 101 UK: DENTAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 102 UK: EXTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 103 UK: INTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 104 UK: DENTAL IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 105 UK: DENTAL IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 106 REST OF EUROPE: DENTAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 107 REST OF EUROPE: EXTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 108 REST OF EUROPE: INTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 109 REST OF EUROPE: DENTAL IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 110 REST OF EUROPE: DENTAL IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 111 ASIA PACIFIC: DENTAL IMAGING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 112 ASIA PACIFIC: DENTAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 113 ASIA PACIFIC: EXTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 114 ASIA PACIFIC: INTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 115 ASIA PACIFIC: DENTAL IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 116 ASIA PACIFIC: DENTAL IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 117 CHINA: DENTAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 118 CHINA: EXTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 119 CHINA: INTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 120 CHINA: DENTAL IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 121 CHINA: DENTAL IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 122 SOUTH KOREA: DENTAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 123 SOUTH KOREA: EXTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 124 SOUTH KOREA: INTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 125 SOUTH KOREA: DENTAL IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 126 SOUTH KOREA: DENTAL IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 127 JAPAN: DENTAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 128 JAPAN: EXTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 129 JAPAN: INTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 130 JAPAN: DENTAL IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 131 JAPAN: DENTAL IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 132 INDIA: DENTAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 133 INDIA: EXTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 134 INDIA: INTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 135 INDIA: DENTAL IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 136 INDIA: DENTAL IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 137 AUSTRALIA: DENTAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 138 AUSTRALIA: EXTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 139 AUSTRALIA: INTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 140 AUSTRALIA: DENTAL IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 141 AUSTRALIA: DENTAL IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 142 REST OF ASIA PACIFIC: DENTAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 143 REST OF ASIA PACIFIC: EXTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 144 REST OF ASIA PACIFIC: INTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 145 REST OF ASIA PACIFIC: DENTAL IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 146 REST OF ASIA PACIFIC: DENTAL IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 147 LATIN AMERICA: DENTAL IMAGING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 148 LATIN AMERICA: DENTAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 149 LATIN AMERICA: EXTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 150 LATIN AMERICA: INTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 151 LATIN AMERICA: DENTAL IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 152 LATIN AMERICA: DENTAL IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 153 BRAZIL: DENTAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 154 BRAZIL: EXTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 155 BRAZIL: INTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 156 BRAZIL: DENTAL IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 157 BRAZIL: DENTAL IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 158 MEXICO: DENTAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 159 MEXICO: EXTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 160 MEXICO: INTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 161 MEXICO: DENTAL IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 162 MEXICO: DENTAL IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 163 REST OF LATIN AMERICA: DENTAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 164 REST OF LATIN AMERICA: EXTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 165 REST OF LATIN AMERICA: INTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 166 REST OF LATIN AMERICA: DENTAL IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 167 REST OF LATIN AMERICA: DENTAL IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: DENTAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: EXTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: INTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: DENTAL IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: DENTAL IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 173 GCC COUNTRIES: DENTAL IMAGING MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 174 GCC COUNTRIES: EXTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 175 GCC COUNTRIES: INTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 176 GCC COUNTRIES: DENTAL IMAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 177 GCC COUNTRIES: DENTAL IMAGING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 178 STRATEGIES ADOPTED BY KEY PLAYERS IN DENTAL IMAGING MARKET, JANUARY 2021-MAY 2025

- TABLE 181 DENTAL IMAGING MARKET: APPLICATION FOOTPRINT, 2024

- TABLE 183 DENTAL IMAGING MARKET: REGIONAL FOOTPRINT, 2024

- TABLE 184 DENTAL IMAGING MARKET: DETAILED LIST OF KEY STARTUPS/SMES, 2024

- TABLE 185 DENTAL IMAGING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 186 DENTAL IMAGING MARKET: PRODUCT & SERVICE LAUNCHES AND APPROVALS, JANUARY 2021-MAY 2025

- TABLE 187 DENTAL IMAGING MARKET: DEALS, JANUARY 2021-MAY 2025

- TABLE 188 DENTAL IMAGING MARKET: EXPANSIONS, JANUARY 2021-MAY 2025

- TABLE 189 TABLE 8 DENTAL IMAGING MARKET: OTHER DEVELOPMENTS, JANUARY 2021-MAY 2025

- TABLE 190 ENVISTA: COMPANY OVERVIEW

- TABLE 191 ENVISTA: PRODUCTS OFFERED

- TABLE 192 ENVISTA: PRODUCT LAUNCHES & APPROVALS

- TABLE 193 ENVISTA: DEALS

- TABLE 194 ENVISTA: OTHER DEVELOPMENTS

- TABLE 195 DENTSPLY SIRONA INC.: COMPANY OVERVIEW

- TABLE 196 DENTSPLY SIRONA, INC.: PRODUCTS OFFERED

- TABLE 197 DENTSPLY SIRONA, INC.: PRODUCT LAUNCHES & APPROVALS

- TABLE 198 DENTSPLY SIRONA, INC.: DEALS

- TABLE 199 PLANMECA OY: COMPANY OVERVIEW

- TABLE 200 PLANMECA OY: PRODUCTS OFFERED

- TABLE 201 PLANMECA OY: PRODUCT LAUNCHES & APPROVALS

- TABLE 202 PLANMECA OY: DEALS

- TABLE 203 CARESTREAM DENTAL LLC: COMPANY OVERVIEW

- TABLE 204 CARESTREAM DENTAL LLC: PRODUCTS OFFERED

- TABLE 205 CARESTREAM DENTAL LLC: PRODUCT LAUNCHES & APPROVALS

- TABLE 206 CARESTREAM DENTAL LLC: DEALS

- TABLE 207 VATECH CO., LTD.: COMPANY OVERVIEW

- TABLE 208 VATECH CO., LTD.: PRODUCTS OFFERED

- TABLE 209 VATECH CO., LTD: DEALS

- TABLE 210 GENORAY CO., LTD.: COMPANY OVERVIEW

- TABLE 211 GENORAY CO., LTD.: PRODUCTS OFFERED

- TABLE 212 GENORAY CO., LTD.: PRODUCT LAUNCHES & APPROVALS

- TABLE 213 GENORAY CO LTD: EXPANSIONS

- TABLE 214 ALIGN TECHNOLOGY, INC.: COMPANY OVERVIEW

- TABLE 215 ALIGN TECHNOLOGY, INC.: PRODUCTS OFFERED

- TABLE 216 ALIGN TECHNOLOGY, INC.: PRODUCT LAUNCHES & APPROVALS

- TABLE 217 ALIGN TECHNOLOGY, INC.: DEALS

- TABLE 218 INSTITUT STRAUMANN AG: COMPANY OVERVIEW

- TABLE 219 INSTITUT STRAUMANN AG: PRODUCTS OFFERED

- TABLE 220 INSTITUT STRAUMANN AG: DEALS

- TABLE 221 RAY CO., LTD.: COMPANY OVERVIEW

- TABLE 222 RAY CO., LTD.: PRODUCTS OFFERED

- TABLE 223 ACTEON: COMPANY OVERVIEW

- TABLE 224 ACTEON: PRODUCTS OFFERED

- TABLE 225 ACTEON: PRODUCT LAUNCHES & APPROVALS

- TABLE 226 OWANDY RADIOLOGY: COMPANY OVERVIEW

- TABLE 227 OWANDY RADIOLOGY: PRODUCTS OFFERED

- TABLE 228 OWANDY RADIOLOGY: PRODUCT LAUNCHES & APPROVALS

- TABLE 229 J. MORITA CORP: COMPANY OVERVIEW

- TABLE 230 J. MORITA CORP: PRODUCTS OFFERED

- TABLE 231 J. MORITA CORP: EXPANSIONS

- TABLE 232 MIDMARK CORPORATION: COMPANY OVERVIEW

- TABLE 233 MIDMARK CORPORATION: PRODUCTS OFFERED

- TABLE 234 DURR DENTAL SE: BUSINESS OVERVIEW

- TABLE 235 DURR DENTAL SE: BUSINESS OVERVIEW

- TABLE 236 DURR DENTAL SE: PRODUCT LAUNCHES & APPROVALS

- TABLE 237 DURR DENTAL SE: DEALS

- TABLE 238 DURR DENTAL SE: EXPANSIONS

List of Figures

- FIGURE 1 DENTAL IMAGING MARKET SEGMENTATION

- FIGURE 2 STUDY YEARS CONSIDERED

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 PRIMARY SOURCES

- FIGURE 6 KEY DATA FROM PRIMARY SOURCES

- FIGURE 7 KEY INDUSTRY INSIGHTS

- FIGURE 8 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY SIDE AND DEMAND SIDE PARTICIPANTS

- FIGURE 9 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE), BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 10 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE), BY END USER, DESIGNATION, AND REGION

- FIGURE 11 SUPPLY SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 12 REVENUE SHARE ANALYSIS ILLUSTRATION

- FIGURE 13 SUPPLY SIDE MARKET SIZE ESTIMATION: DENTAL IMAGING MARKET, 2024

- FIGURE 14 BOTTOM-UP APPROACH

- FIGURE 15 TOP-DOWN APPROACH

- FIGURE 16 CAGR PROJECTIONS FROM DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES ANALYSIS, 2025-2030

- FIGURE 17 CAGR PROJECTIONS: SUPPLY SIDE ANALYSIS

- FIGURE 18 DATA TRIANGULATION METHODOLOGY

- FIGURE 19 DENTAL IMAGING SYSTEMS MARKET, BY PRODUCT TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 20 EXTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 21 INTRAORAL IMAGING SYSTEMS MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 22 DENTAL IMAGING MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 23 DENTAL IMAGING MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 24 GEOGRAPHICAL SNAPSHOT OF DENTAL IMAGING MARKET

- FIGURE 25 RISING INCIDENCE OF DENTAL CARIES AND OTHER PERIODONTAL DISEASES TO DRIVE MARKET GROWTH DURING THE FORECAST PERIOD

- FIGURE 26 EXTRAORAL IMAGING AND CHINA ACCOUNTED FOR LARGEST SEGMENTAL SHARES OF ASIA PACIFIC MARKET IN 2024

- FIGURE 27 JAPAN TO REGISTER HIGHEST GROWTH IN DENTAL IMAGING MARKET DURING FORECAST PERIOD

- FIGURE 28 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 29 EMERGING COUNTRIES TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 30 DENTAL IMAGING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 31 DENTAL IMAGING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 32 INVESTMENT AND FUNDING SCENARIO FOR DENTAL IMAGING, 2019-2023 (USD MILLION)

- FIGURE 33 TOP PATENT APPLICANTS AND OWNERS (COMPANIES/INSTITUTES) FOR DENTAL IMAGING MARKET, JANUARY 2014-DECEMBER 2024

- FIGURE 34 TOP PATENT APPLICANT COUNTRIES FOR DENTAL IMAGING, JANUARY 2014-JANUARY 2025

- FIGURE 35 DENTAL IMAGING MARKET: VALUE CHAIN ANALYSIS

- FIGURE 36 DENTAL IMAGING MARKET: ECOSYSTEM MAPPING

- FIGURE 37 DENTAL IMAGING MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 38 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES IN DENTAL IMAGING MARKET

- FIGURE 39 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF TOP THREE APPLICATIONS

- FIGURE 41 DENTAL IMAGING MARKET: ADJACENT MARKET ANALYSIS

- FIGURE 42 DENTAL IMAGING MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 43 NORTH AMERICA: DENTAL IMAGING MARKET SNAPSHOT

- FIGURE 44 EUROPE: DENTAL IMAGING MARKET SNAPSHOT

- FIGURE 45 ASIA PACIFIC: DENTAL IMAGING MARKET SNAPSHOT

- FIGURE 48 DENTAL IMAGING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 49 DENTAL IMAGING MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 50 DENTAL IMAGING MARKET: SME/STARTUP COMPANY EVALUATION MATRIX, 2024

- FIGURE 51 EV/EBITDA OF KEY VENDORS, 2024

- FIGURE 52 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 53 DENTAL IMAGING MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 54 ENVISTA: COMPANY SNAPSHOT, 2024

- FIGURE 55 DENTSPLY SIRONA, INC.: COMPANY SNAPSHOT, 2024

- FIGURE 56 VATECH CO., LTD.: COMPANY SNAPSHOT, 2024

- FIGURE 57 GENORAY CO., LTD.: COMPANY SNAPSHOT, 2024

- FIGURE 58 ALIGN TECHNOLOGY, INC.: COMPANY SNAPSHOT, 2024

- FIGURE 59 INSTITUT STRAUMANN AG: COMPANY SNAPSHOT, 2024