|

市場調查報告書

商品編碼

1777938

全球現場娛樂市場(按應用程式、串流媒體類型和地區分類)—預測至 2030 年Live Entertainment Market by music concerts, sports events, e-sports, theaters & musicals, Al & automation, motion tracking, real-time streaming, pre-recorded/recorded streaming, distribution & streaming - Global Forecast to 2030 |

||||||

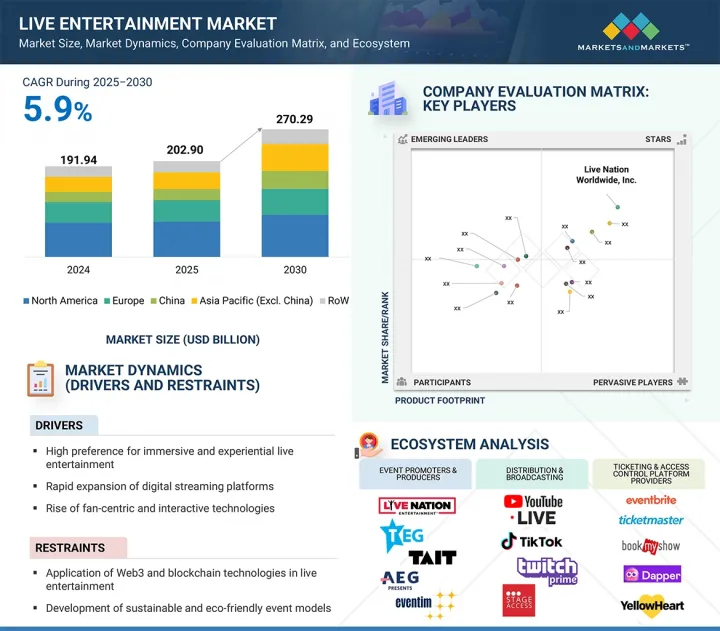

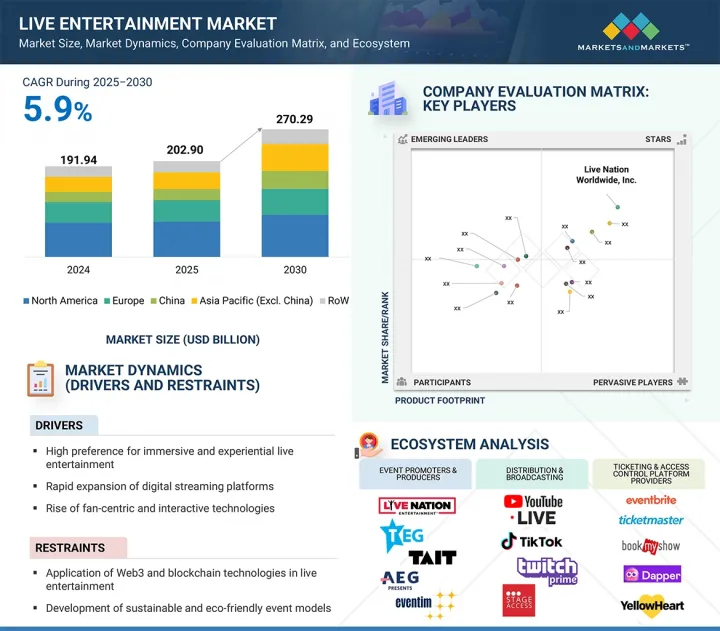

現場娛樂市場預計將從 2025 年的 2,029 億美元成長到 2030 年的 2,702.9 億美元,複合年成長率為 5.9%。

人們對身臨其境型和體驗式現場娛樂的強烈偏好正在推動對超越傳統活動形式的即時情感體驗的需求,從而加速現場娛樂市場的成長。

| 調查範圍 | |

|---|---|

| 調查年份 | 2021-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 對價單位 | 金額(十億美元) |

| 按細分市場 | 按用途、串流媒體類型和地區 |

| 目標區域 | 北美、歐洲、亞太地區及其他地區 |

數位串流媒體平台的快速擴張進一步推動了這一勢頭,使其能夠實現更廣泛的訪問和全球觀眾的參與。此外,以粉絲為中心的互動技術(如 AR/VR 和個人化內容傳送)的興起,正在提高用戶的參與度和忠誠度。音樂、體育和電子競技的粉絲群不斷成長,加上人們越來越注重透過混合活動模式實現收益最大化和涵蓋範圍,正在推動巨大的市場機會。然而,市場面臨巨大的限制因素。未經授權的串流收益流失對內容收益構成了嚴峻挑戰,而受眾碎片化和平台飽和使得提供者越來越難以在各個管道獲取和留住穩定的觀眾。

預計到2025年,音樂會將佔據第二大市場佔有率,這得益於全球巡迴活動、音樂節參與人數以及跨流派粉絲忠誠度的穩步成長。藝術家和推廣方正在利用高階製作、身臨其境型技術和獨家周邊商品來提升現場體驗並增加收益。此外,這一領域也受益於串流媒體帶來的全球曝光,這推動了人們對線下演出的期望。

受體育賽事直播、音樂會和電子競技等互動式身臨其境型內容需求成長的推動,預計預測期內即時串流媒體的複合年成長率最高。北美憑藉其先進的數位基礎設施、高額的直播內容消費支出以及主流串流媒體平台和內容創作者的主導地位,已成為最大的即時串流媒體市場。亞太地區預計將出現強勁成長,這得益於新興經濟體網路普及率和智慧型手機使用率的提升。

預計在整個預測期內,美國將在規模和成長方面引領北美現場娛樂市場。作為最大的市場,美國擁有許多優勢,例如完善的大型活動基礎設施、高人均娛樂支出以及成熟的推廣商、藝術家和串流平台生態系統。此外,美國還擁有大量售票活動,包括音樂會、體育賽事和戲劇表演。數位整合和混合活動形式的快速普及進一步支持了市場擴張,使美國成為成長最快的地區。此外,疫情後對體驗式娛樂的強勁需求以及大型企業的策略投資將繼續鞏固美國市場的領導地位。

本報告研究了全球現場娛樂市場,深入了解了應用程式、串流媒體類型和地區的趨勢,以及進入市場的公司概況。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章重要考察

第5章市場概述

- 介紹

- 市場動態

- 影響客戶業務的趨勢/中斷

- 供應鏈分析

- 生態系分析

- 案例研究分析

- 監管狀況

- 人工智慧/生成式人工智慧對現場娛樂市場的影響

第6章:科技改變現場娛樂產業

- 介紹

- 人工智慧和自動化

- 5G和邊緣運算

- 區塊鏈

- 擴增實境、虛擬實境、混合實境

- 運動追蹤

- 觸覺技術

- 其他

第7章:現場娛樂產業價值鏈分析

- 介紹

- 內容創作

- 現場製作

- 廣播和串流媒體

- 觀看體驗

第 8 章:現場娛樂價值鏈的觀賞體驗階段

- 介紹

- 面對面/真實觀看

- 虛擬/數位現場觀看

- 衛星直播/混合觀看

第9章 現場娛樂市場(按應用)

- 介紹

- 音樂會

- 體育賽事

- 電競

- 戲劇和音樂劇

第10章 現場娛樂市場(依串流媒體類型)

- 介紹

- 即時串流媒體

- 預錄/錄製串流媒體

第11章 現場娛樂市集(按地區)

- 介紹

- 北美洲

- 北美宏觀經濟展望

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 歐洲宏觀經濟展望

- 德國

- 英國

- 義大利

- 其他

- 中國

- 中國宏觀經濟展望

- 城市財富、平台主導的參與以及政府文化推廣將推動市場成長

- 亞太地區

- 亞太宏觀經濟展望

- 日本

- 韓國

- 印度

- 其他

- 其他地區

- 其他地區宏觀經濟展望

- 拉丁美洲

- 中東和非洲

第12章競爭格局

- 概述

- 主要參與企業所採取的策略(2023-2025)

- 2020-2024年收益分析

- 2024年市場佔有率分析

- 估值和財務指標

- 競爭場景

第13章:公司簡介

- 主要參與企業

- LIVE NATION WORLDWIDE, INC.

- AEG

- CTS EVENTIM AG & CO. KGAA

- LIBERTY MEDIA CORPORATION

- ENDEAVOR OPERATING COMPANY, LLC

- SAVVY GAMES GROUP

- TWITCH INTERACTIVE, INC.

- CIRQUE DU SOLEIL

- DISNEY

- MSG ENTERTAINMENT HOLDINGS, LLC

- HYBE

- SPOTIFY TECHNOLOGY SA

第14章 附錄

The live entertainment market is expected to grow from USD 202.90 billion in 2025 to USD 270.29 billion by 2030, at a CAGR of 5.9%. High preference for immersive and experiential live entertainment is accelerating the live entertainment market's growth by fueling demand for real-time, emotionally engaging experiences that go beyond traditional event formats.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By streaming type, application and region |

| Regions covered | North America, Europe, APAC, RoW |

This momentum is further supported by the rapid expansion of digital streaming platforms, enabling broader access and global audience participation. Additionally, the rise of fan-centric and interactive technologies, such as AR/VR and personalized content delivery, is enhancing user engagement and loyalty. A growing fan base for music, sports, and e-sports, along with the increasing focus on maximizing revenue and reach through hybrid event models, is driving significant market opportunities. However, the market faces notable restraints. Revenue leakage due to unauthorized streaming poses a serious challenge to content monetization, while audience fragmentation and platform saturation are making it increasingly difficult for providers to capture and retain consistent viewership across channels.

"Music Concerts are set to hold the second-largest share in the live entertainment market by 2025"

Music concerts are estimated to have the second-largest market share in 2025, driven by a steady increase in global tour activity, festival attendance, and fan loyalty across genres. Artists and promoters are leveraging high production values, immersive technologies, and exclusive merchandise to enhance the live experience and boost revenue. The segment also benefits from global streaming exposure, which builds anticipation for in-person performances.

"Real-time streaming to witness fastest growth due to surge in on-demand content and low latency requirements"

Real-time streaming is projected to grow at the highest CAGR during the forecast period, driven by rising demand for interactive and immersive content such as live sports, concerts, and e-sports. North America emerged as the largest market for real-time streaming, owing to its advanced digital infrastructure, high consumer spending on live content, and dominance of key streaming platforms and content creators. Additionally, Asia Pacific is expected to register strong growth due to increasing internet penetration and smartphone usage in emerging economies.

"US leads North America's live entertainment market, driven by high consumer spending and digital integration"

The US is poised to lead the North American live entertainment market both in terms of size and growth through the forecast period. As the largest market, the US benefits from a well-established infrastructure for large-scale events, high per capita entertainment spending, and a mature ecosystem of promoters, artists, and streaming platforms. It also accounts for a high number of ticketed events across music concerts, sports, and theater. The country's fast-paced digital integration and adoption of hybrid event formats are further driving market expansion, positioning it as the fastest-growing geography within the region. Additionally, strong demand for experiential entertainment post-pandemic and strategic investments by major players continue to reinforce the US's market leadership.

Breakdown of primaries

A variety of executives from key organizations operating in the live entertainment market were interviewed in-depth, including CEOs, marketing directors, and innovation and technology directors.

- By Company Type: Tier 1 -47%, Tier 2 - 36%, and Tier 3 - 17%

- By Designation: C-level Executives - 58%, Directors - 28%, and Others - 14%

- By Region: North America - 43%, Europe - 27%, China-12%, Asia Pacific (Excl. China)- 10%, and RoW - 8%

The live entertainment market is dominated by globally established players such as Live Nation Worldwide, Inc. (US), Disney (US), AEG (US), CTS EVENTIM AG & Co. KGaA (Germany), Liberty Media Corporation (US), MSG Entertainment Holdings, LLC (US), Endeavor Operating Company, LLC (US), Savvy Games Group (Saudi Arabia), Twitch Interactive, Inc (US), Cirque du Soleil (Canada), and Spotify Technology S.A (Sweden). The study includes an in-depth competitive analysis of these key players in the live entertainment market, with their company profiles, recent developments, and key market strategies.

Study Coverage

The report segments the live entertainment market and forecasts its size by streaming type, application, and region. The report also defines and describes segments by technology, value chain, and viewing experience. The report also discusses the drivers, restraints, opportunities, and challenges pertaining to the market. It gives a detailed view of the market across five main geographies-North America, Europe, China, Asia Pacific (Excl. China), and RoW. A supply chain analysis has been included in the report, along with the key players and their competitive analysis of the live entertainment ecosystem.

Key Benefits of Buying the Report

- Analysis of key drivers (High preference for immersive and experiential live entertainment; Rapid expansion of digital streaming platforms; Rise of fan-centric and interactive technologies; Growing fan base for music, sports, and e-sports; Rising focus on maximizing revenue and reach through hybrid event models), restraints (Revenue leakage due to unauthorized streaming; Audience fragmentation and platform saturation), opportunities (Application of Web3 and blockchain technologies in live entertainment; Development of sustainable and eco-friendly event models; Expansion of live entertainment industry into untapped regional markets), and challenge (High complexity and expenses associated with hybrid models; Technology gaps and infrastructure limitations in emerging markets) influencing the growth of the live entertainment market.

- Solution/Service Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new solution/service launches in the live entertainment market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the live entertainment market across varied regions.

- Market Diversification: Exhaustive information about new solutions/services, untapped geographies, recent developments, and investments in the live entertainment market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Live Nation Worldwide, Inc., Disney, CTS EVENTIM AG & Co. KGaA, Liberty Media Corporation, and MSG Entertainment Holdings, LLC, among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primary interviews

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up approach

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down approach

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN LIVE ENTERTAINMENT MARKET

- 4.2 LIVE ENTERTAINMENT MARKET, BY GEOGRAPHY

- 4.3 LIVE ENTERTAINMENT MARKET FOR MUSIC CONCERTS, BY GEOGRAPHY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 High preference for immersive and experiential live entertainment

- 5.2.1.2 Rapid expansion of digital streaming platforms

- 5.2.1.3 Rise of fan-centric and interactive technologies

- 5.2.1.4 Growing fan base for music, sports, and e-sports

- 5.2.1.5 Rising focus on maximizing revenue and reach through hybrid event models

- 5.2.2 RESTRAINTS

- 5.2.2.1 Revenue leakage due to unauthorized streaming

- 5.2.2.2 Audience fragmentation and platform saturation

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Application of Web3 and blockchain technologies in live entertainment

- 5.2.3.2 Development of sustainable and eco-friendly event models

- 5.2.3.3 Expansion of live entertainment industry into untapped regional markets

- 5.2.4 CHALLENGES

- 5.2.4.1 High complexity and expenses associated with hybrid models

- 5.2.4.2 Technology gaps and infrastructure limitations in emerging markets

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 CASE STUDY ANALYSIS

- 5.7 REGULATORY LANDSCAPE

- 5.7.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8 IMPACT OF AI/GEN AI ON LIVE ENTERTAINMENT MARKET

- 5.8.1 INTRODUCTION

- 5.8.2 USE OF GEN AI IN LIVE ENTERTAINMENT

- 5.8.3 IMPACT ON LIVE ENTERTAINMENT MARKET

6 TECHNOLOGIES TRANSFORMING LIVE ENTERTAINMENT INDUSTRY

- 6.1 INTRODUCTION

- 6.2 AI & AUTOMATION

- 6.2.1 ENHANCING PERSONALIZATION AND OPERATIONAL EFFICIENCY

- 6.3 5G AND EDGE COMPUTING

- 6.3.1 REVOLUTIONIZING REAL-TIME STREAMING AND INTERACTIVITY

- 6.4 BLOCKCHAIN

- 6.4.1 ENHANCING SECURITY AND TRANSPARENCY IN LIVE ENTERTAINMENT

- 6.5 AUGMENTED REALITY, VIRTUAL REALITY, AND MIXED REALITY

- 6.5.1 IMMERSING AUDIENCES IN FUTURE OF LIVE ENTERTAINMENT

- 6.6 MOTION TRACKING

- 6.6.1 ENABLING REAL-TIME INTERACTION AND ENHANCED IMMERSION

- 6.7 HAPTIC TECHNOLOGY

- 6.7.1 ADDING SENSORY DIMENSION TO LIVE ENTERTAINMENT

- 6.8 OTHER TECHNOLOGIES

7 VALUE CHAIN ANALYSIS FOR LIVE ENTERTAINMENT INDUSTRY

- 7.1 INTRODUCTION

- 7.2 CONTENT CREATION

- 7.2.1 RISE OF IMMERSIVE AND PERSONALIZED EXPERIENCES

- 7.3 LIVE PRODUCTION

- 7.3.1 INTRODUCTION OF AUTOMATION AND SMART PRODUCTION SYSTEMS

- 7.4 DISTRIBUTION AND STREAMING

- 7.4.1 ACCELERATION OF HYBRID AND DIRECT-TO-CONSUMER MODELS

- 7.5 VIEWING EXPERIENCE

- 7.5.1 DEMAND FOR INTERACTIVITY AND IMMERSION

8 VIEWING EXPERIENCE PHASE IN LIVE ENTERTAINMENT VALUE CHAIN

- 8.1 INTRODUCTION

- 8.2 IN-PERSON/REAL LIVE VIEWING

- 8.2.1 EXPERIENTIAL DEMAND SURGE IN POST-DIGITAL FATIGUE ERA

- 8.3 VIRTUAL/DIGITAL LIVE VIEWING

- 8.3.1 IMMERSIVE DIGITAL WORLDS AND BORDERLESS PARTICIPATION

- 8.4 SATELLITE LIVE/HYBRID VIEWING

- 8.4.1 HIGH-FIDELITY REACH AND GLOBAL SYNCHRONIZATION

9 LIVE ENTERTAINMENT MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 MUSIC CONCERTS

- 9.2.1 ENHANCING CONCERT ACCESSIBILITY THROUGH STREAMING AND SOCIAL PLATFORMS TO BOOST SEGMENTAL GROWTH

- 9.3 SPORTS EVENTS

- 9.3.1 GROWING FAN ENGAGEMENT THROUGH IMMERSIVE IN-STADIUM EXPERIENCES TO DRIVE MARKET

- 9.4 E-SPORTS

- 9.4.1 RISING DIGITAL CONSUMPTION AND COMPETITIVE GAMING CULTURE AMONG YOUTHS TO SUPPORT MARKET GROWTH

- 9.5 THEATERS & MUSICALS

- 9.5.1 DEMAND FOR CULTURALLY RICH, STORYTELLING-BASED LIVE EXPERIENCES TO FUEL SEGMENTAL GROWTH

10 LIVE ENTERTAINMENT MARKET, BY STREAMING TYPE

- 10.1 INTRODUCTION

- 10.2 REAL-TIME STREAMING

- 10.2.1 COMMERCIAL EVOLUTION OF DIGITAL ENTERTAINMENT TO BOOST SEGMENTAL GROWTH

- 10.3 PRE-RECORDED/RECORDED STREAMING

- 10.3.1 MULTI-PLATFORM DISTRIBUTION VALUE TO MAXIMIZE PRE-RECORDED CONTENT ACCESSIBILITY

11 LIVE ENTERTAINMENT MARKET, BY GEOGRAPHY

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Robust consumer spending and diversified event ecosystem to drive market

- 11.2.3 CANADA

- 11.2.3.1 Private-sector investments in venue expansion and touring infrastructure projects to fuel market growth

- 11.2.4 MEXICO

- 11.2.4.1 Cultural tradition of community-centered celebrations to foster market growth

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Strong infrastructure and deep-rooted music & festival culture to support market growth

- 11.3.3 UK

- 11.3.3.1 High per capita event spending and developments in ticketing and digital monetization to contribute to market growth

- 11.3.4 ITALY

- 11.3.4.1 Heritage venues and tourism-fueled demand to create opportunities

- 11.3.5 REST OF EUROPE

- 11.4 CHINA

- 11.4.1 MACROECONOMIC OUTLOOK FOR CHINA

- 11.4.2 URBAN AFFLUENCE, PLATFORM-LED ENGAGEMENT, AND GOVERNMENT CULTURAL PROMOTION TO ACCELERATE MARKET GROWTH

- 11.5 ASIA PACIFIC

- 11.5.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.5.2 JAPAN

- 11.5.2.1 Strong base of consumers willing to pay for immersive, premium experiences to drive market

- 11.5.3 SOUTH KOREA

- 11.5.3.1 Digitally native audience and high-tech integration in entertainment experiences to spur demand

- 11.5.4 INDIA

- 11.5.4.1 Expanding youth demographic and mobile-first digital consumption to stimulate market growth

- 11.5.5 REST OF ASIA PACIFIC

- 11.6 ROW

- 11.6.1 MACROECONOMIC OUTLOOK FOR ROW

- 11.6.2 LATIN AMERICA

- 11.6.2.1 Rising adoption of digital platforms for ticketing and growing international tours to spur demand

- 11.6.3 MIDDLE EAST & AFRICA

- 11.6.3.1 Government-led investments and liberalization of entertainment sector to drive market

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS, 2023-2025

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 COMPETITIVE SCENARIO

- 12.6.1 SOLUTION/SERVICE LAUNCHES

- 12.6.1.1 Deals

- 12.6.1.2 Expansions

- 12.6.1.3 Other developments

- 12.6.1 SOLUTION/SERVICE LAUNCHES

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 LIVE NATION WORLDWIDE, INC.

- 13.1.1.1 Business overview

- 13.1.1.2 Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.3.2 Other developments

- 13.1.2 AEG

- 13.1.2.1 Business overview

- 13.1.2.2 Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.3.2 Expansions

- 13.1.2.3.3 Other developments

- 13.1.3 CTS EVENTIM AG & CO. KGAA

- 13.1.3.1 Business overview

- 13.1.3.2 Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.3.2 Other developments

- 13.1.4 LIBERTY MEDIA CORPORATION

- 13.1.4.1 Business overview

- 13.1.4.2 Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.5 ENDEAVOR OPERATING COMPANY, LLC

- 13.1.5.1 Business overview

- 13.1.5.2 Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.6 SAVVY GAMES GROUP

- 13.1.6.1 Business overview

- 13.1.6.2 Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.7 TWITCH INTERACTIVE, INC.

- 13.1.7.1 Business overview

- 13.1.7.2 Solutions/Services offered

- 13.1.8 CIRQUE DU SOLEIL

- 13.1.8.1 Business overview

- 13.1.8.2 Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Solution/Service launches

- 13.1.8.3.2 Deals

- 13.1.9 DISNEY

- 13.1.9.1 Business overview

- 13.1.9.2 Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.9.3.2 Other developments

- 13.1.10 MSG ENTERTAINMENT HOLDINGS, LLC

- 13.1.10.1 Business overview

- 13.1.10.2 Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Deals

- 13.1.11 HYBE

- 13.1.11.1 Business overview

- 13.1.11.2 Solutions/Services offered

- 13.1.12 SPOTIFY TECHNOLOGY S.A.

- 13.1.12.1 Business overview

- 13.1.12.2 Solutions/Services offered

- 13.1.1 LIVE NATION WORLDWIDE, INC.

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS

List of Tables

- TABLE 1 INCLUDED AND EXCLUDED SEGMENTS

- TABLE 2 KEY SECONDARY SOURCES

- TABLE 3 KEY PARTICIPANTS IN PRIMARY INTERVIEWS

- TABLE 4 RISK FACTOR ANALYSIS

- TABLE 5 ROLE OF COMPANIES IN LIVE ENTERTAINMENT ECOSYSTEM

- TABLE 6 CASE STUDY 1: LEVERAGING XR AND VIRTUAL AVATARS IN ABBA VOYAGE TO DELIVER FUTURISTIC AND EMOTIONALLY IMMERSIVE CONCERT EXPERIENCE

- TABLE 7 CASE STUDY 2: REPLACING FIREWORKS WITH DRONE LIGHT SHOWS IN OLYMPICS TO REDUCE ENVIRONMENTAL FOOTPRINT

- TABLE 8 CASE STUDY 3: IMPLEMENTING WRAP-AROUND LED SCREEN AT SPHERE TO ENHANCE AUDIENCE INTERACTION AND OFFER IMMERSIVE EXPERIENCE

- TABLE 9 CASE STUDY 4: DEPLOYING AI-POWERED REAL-TIME CROWD ANALYTICS AT O2 ARENA TO ENSURE VENUE SAFETY AND IMPROVE PLACEMENT OF SERVICES

- TABLE 10 CASE STUDY 5: EMPLOYING NFTS AND BLOCKCHAIN TICKETING MODEL AT COACHELLA TO AVOID COUNTERFEITING, DUPLICATION, AND SCALPING ISSUES

- TABLE 11 CASE STUDY 6: MERGING PHYSICAL SHOWS WITH IMMERSIVE VIRTUAL EXPERIENCES THROUGH BLACKPINK'S HYBRID CONCERT MODEL

- TABLE 12 CASE STUDY 7: TRANSFORMING GAMING PLATFORM INTO LIVE MUSIC VENUE AT FORTNITE CONCERT TO STRENGTHEN BOND BETWEEN GAMING AND MUSIC CULTURE

- TABLE 13 LIVE ENTERTAINMENT MARKET: REGULATIONS

- TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 LIVE ENTERTAINMENT MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 19 LIVE ENTERTAINMENT MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 20 MUSIC CONCERTS: LIVE ENTERTAINMENT MARKET, BY GEOGRAPHY, 2021-2024 (USD BILLION)

- TABLE 21 MUSIC CONCERTS: LIVE ENTERTAINMENT MARKET, BY GEOGRAPHY, 2025-2030 (USD BILLION)

- TABLE 22 SPORTS EVENTS: LIVE ENTERTAINMENT MARKET, BY GEOGRAPHY, 2021-2024 (USD BILLION)

- TABLE 23 SPORTS EVENTS: LIVE ENTERTAINMENT MARKET, BY GEOGRAPHY, 2025-2030 (USD BILLION)

- TABLE 24 E-SPORTS: LIVE ENTERTAINMENT MARKET, BY GEOGRAPHY, 2021-2024 (USD BILLION)

- TABLE 25 E-SPORTS: LIVE ENTERTAINMENT MARKET, BY GEOGRAPHY, 2025-2030 (USD BILLION)

- TABLE 26 THEATERS & MUSICALS: LIVE ENTERTAINMENT MARKET, BY GEOGRAPHY, 2021-2024 (USD BILLION)

- TABLE 27 THEATERS & MUSICALS: LIVE ENTERTAINMENT MARKET, BY GEOGRAPHY, 2025-2030 (USD BILLION)

- TABLE 28 LIVE ENTERTAINMENT MARKET, BY STREAMING TYPE, 2021-2024 (USD BILLION)

- TABLE 29 LIVE ENTERTAINMENT MARKET, BY STREAMING TYPE, 2025-2030 (USD BILLION)

- TABLE 30 LIVE ENTERTAINMENT MARKET, BY GEOGRAPHY, 2021-2024 (USD BILLION)

- TABLE 31 LIVE ENTERTAINMENT MARKET, BY GEOGRAPHY, 2025-2030 (USD BILLION)

- TABLE 32 NORTH AMERICA: LIVE ENTERTAINMENT MARKET, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 33 NORTH AMERICA: LIVE ENTERTAINMENT MARKET, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 34 NORTH AMERICA: LIVE ENTERTAINMENT MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 35 NORTH AMERICA: LIVE ENTERTAINMENT MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 36 US: LIVE ENTERTAINMENT MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 37 US: LIVE ENTERTAINMENT MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 38 CANADA: LIVE ENTERTAINMENT MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 39 CANADA: LIVE ENTERTAINMENT MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 40 MEXICO: LIVE ENTERTAINMENT MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 41 MEXICO: LIVE ENTERTAINMENT MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 42 EUROPE: LIVE ENTERTAINMENT MARKET, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 43 EUROPE: LIVE ENTERTAINMENT MARKET, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 44 EUROPE: LIVE ENTERTAINMENT MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 45 EUROPE: LIVE ENTERTAINMENT MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 46 GERMANY: LIVE ENTERTAINMENT MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 47 GERMANY: LIVE ENTERTAINMENT MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 48 UK: LIVE ENTERTAINMENT MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 49 UK: LIVE ENTERTAINMENT MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 50 ITALY: LIVE ENTERTAINMENT MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 51 ITALY: LIVE ENTERTAINMENT MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 52 REST OF EUROPE: LIVE ENTERTAINMENT MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 53 REST OF EUROPE: LIVE ENTERTAINMENT MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 54 CHINA: LIVE ENTERTAINMENT MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 55 CHINA: LIVE ENTERTAINMENT MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 56 ASIA PACIFIC: LIVE ENTERTAINMENT MARKET, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 57 ASIA PACIFIC: LIVE ENTERTAINMENT MARKET, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 58 ASIA PACIFIC: LIVE ENTERTAINMENT MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 59 ASIA PACIFIC: LIVE ENTERTAINMENT MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 60 JAPAN: LIVE ENTERTAINMENT MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 61 JAPAN: LIVE ENTERTAINMENT MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 62 SOUTH KOREA: LIVE ENTERTAINMENT MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 63 SOUTH KOREA: LIVE ENTERTAINMENT MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 64 INDIA: LIVE ENTERTAINMENT MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 65 INDIA: LIVE ENTERTAINMENT MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 66 REST OF ASIA PACIFIC: LIVE ENTERTAINMENT MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 67 REST OF ASIA PACIFIC: LIVE ENTERTAINMENT MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 68 ROW: LIVE ENTERTAINMENT MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 69 ROW: LIVE ENTERTAINMENT MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 70 ROW: LIVE ENTERTAINMENT MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 71 ROW: LIVE ENTERTAINMENT MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 72 LATIN AMERICA: LIVE ENTERTAINMENT MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 73 LATIN AMERICA: LIVE ENTERTAINMENT MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 74 MIDDLE EAST & AFRICA: LIVE ENTERTAINMENT MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 75 MIDDLE EAST & AFRICA: LIVE ENTERTAINMENT MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 76 LIVE ENTERTAINMENT MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2023-2025

- TABLE 77 LIVE ENTERTAINMENT MARKET: DEGREE OF COMPETITION, 2024

- TABLE 78 LIVE ENTERTAINMENT MARKET: SOLUTION/SERVICE LAUNCHES, DECEMBER 2023-JUNE 2025

- TABLE 79 LIVE ENTERTAINMENT MARKET: DEALS, DECEMBER 2023-JUNE 2025

- TABLE 80 LIVE ENTERTAINMENT MARKET: EXPANSIONS, DECEMBER 2023-JUNE 2025

- TABLE 81 LIVE ENTERTAINMENT MARKET: OTHER DEVELOPMENTS, DECEMBER 2023-JUNE 2025

- TABLE 82 LIVE NATION WORLDWIDE, INC.: COMPANY OVERVIEW

- TABLE 83 LIVE NATION WORLDWIDE, INC.: SOLUTIONS/SERVICES OFFERED

- TABLE 84 LIVE NATION WORLDWIDE, INC.: DEALS

- TABLE 85 LIVE NATION WORLDWIDE, INC.: OTHER DEVELOPMENTS

- TABLE 86 AEG: COMPANY OVERVIEW

- TABLE 87 AEG: SOLUTIONS/SERVICES OFFERED

- TABLE 88 AEG: DEALS

- TABLE 89 AEG: EXPANSIONS

- TABLE 90 AEG: OTHER DEVELOPMENTS

- TABLE 91 CTS EVENTIM AG & CO. KGAA: COMPANY OVERVIEW

- TABLE 92 CTS EVENTIM AG & CO. KGAA: SOLUTIONS/SERVICES OFFERED

- TABLE 93 CTS EVENTIM AG & CO. KGAA: DEALS

- TABLE 94 CTS EVENTIM AG & CO. KGAA: OTHER DEVELOPMENTS

- TABLE 95 LIBERTY MEDIA CORPORATION: COMPANY OVERVIEW

- TABLE 96 LIBERTY MEDIA CORPORATION: SOLUTIONS/SERVICES OFFERED

- TABLE 97 LIBERTY MEDIA CORPORATION: DEALS

- TABLE 98 ENDEAVOR OPERATING COMPANY, LLC: COMPANY OVERVIEW

- TABLE 99 ENDEAVOR OPERATING COMPANY, LLC: SOLUTIONS/SERVICES OFFERED

- TABLE 100 ENDEAVOR OPERATING COMPANY, LLC: DEALS

- TABLE 101 SAVVY GAMES GROUP: COMPANY OVERVIEW

- TABLE 102 SAVVY GAMES GROUP: SOLUTIONS/SERVICES OFFERED

- TABLE 103 SAVVY GAMES GROUP: DEALS

- TABLE 104 TWITCH INTERACTIVE, INC.: COMPANY OVERVIEW

- TABLE 105 TWITCH INTERACTIVE, INC.: SOLUTIONS/SERVICES OFFERED

- TABLE 106 CIRQUE DU SOLEIL: COMPANY OVERVIEW

- TABLE 107 CIRQUE DU SOLEIL: SOLUTIONS/SERVICES OFFERED

- TABLE 108 CIRQUE DU SOLEIL: SOLUTION/SERVICE LAUNCHES

- TABLE 109 CIRQUE DU SOLEIL: DEALS

- TABLE 110 DISNEY: COMPANY OVERVIEW

- TABLE 111 DISNEY: SOLUTIONS/SERVICES OFFERED

- TABLE 112 DISNEY: DEALS

- TABLE 113 DISNEY: OTHER DEVELOPMENTS

- TABLE 114 MSG ENTERTAINMENT HOLDINGS, LLC: COMPANY OVERVIEW

- TABLE 115 MSG ENTERTAINMENT HOLDINGS, LLC: SOLUTIONS/SERVICES OFFERED

- TABLE 116 MSG ENTERTAINMENT HOLDINGS, LLC: DEALS

- TABLE 117 HYBE: COMPANY OVERVIEW

- TABLE 118 HYBE: SOLUTIONS/SERVICES OFFERED

- TABLE 119 SPOTIFY TECHNOLOGY S.A.: COMPANY OVERVIEW

- TABLE 120 SPOTIFY TECHNOLOGY S.A.: SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 LIVE ENTERTAINMENT MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 YEARS CONSIDERED FOR STUDY

- FIGURE 3 LIVE ENTERTAINMENT MARKET: RESEARCH DESIGN

- FIGURE 4 DATA GATHERED THROUGH PRIMARY SOURCES

- FIGURE 5 INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 6 PRIMARY INTERVIEW BREAKDOWN: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 7 APPROACH 1 (SUPPLY SIDE): REVENUE GENERATED BY KEY SOLUTION/SERVICE PROVIDERS IN LIVE ENTERTAINMENT ECOSYSTEM

- FIGURE 8 APPROACH 2 (DEMAND SIDE): MARKET ESTIMATION BASED ON REGION

- FIGURE 9 BOTTOM-UP APPROACH

- FIGURE 10 TOP-DOWN APPROACH

- FIGURE 11 DATA TRIANGULATION

- FIGURE 12 ASSUMPTIONS CONSIDERED

- FIGURE 13 STUDY LIMITATIONS

- FIGURE 14 LIVE ENTERTAINMENT MARKET, 2021-2030 (USD BILLION)

- FIGURE 15 MUSIC CONCERTS SEGMENT TO RECORD HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 16 REAL-TIME STREAMING SEGMENT TO REGISTER HIGHER CAGR BETWEEN 2025 AND 2030

- FIGURE 17 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF GLOBAL LIVE ENTERTAINMENT MARKET IN 2025

- FIGURE 18 RISING DEMAND FOR HYBRID AND VIRTUAL CONCERTS WORLDWIDE TO DRIVE MARKET

- FIGURE 19 US TO ACCOUNT FOR LARGEST SHARE OF GLOBAL LIVE ENTERTAINMENT MARKET IN 2025

- FIGURE 20 NORTH AMERICA TO CAPTURE LARGEST SHARE OF LIVE ENTERTAINMENT MARKET FOR MUSIC CONCERTS IN 2025

- FIGURE 21 LIVE ENTERTAINMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 IMPACT OF DRIVERS ON LIVE ENTERTAINMENT MARKET

- FIGURE 23 IMPACT OF RESTRAINTS ON LIVE ENTERTAINMENT MARKET

- FIGURE 24 IMPACT OF OPPORTUNITIES ON LIVE ENTERTAINMENT MARKET

- FIGURE 25 IMPACT OF CHALLENGES ON LIVE ENTERTAINMENT MARKET

- FIGURE 26 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 27 LIVE ENTERTAINMENT MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 28 LIVE ENTERTAINMENT ECOSYSTEM ANALYSIS

- FIGURE 29 ADOPTION OF GEN AI IN LIVE ENTERTAINMENT

- FIGURE 30 VALUE CHAIN ANALYSIS: LIVE ENTERTAINMENT INDUSTRY

- FIGURE 31 MUSIC CONCERTS TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 32 CHINA TO EXHIBIT HIGHEST CAGR IN LIVE ENTERTAINMENT MARKET FOR MUSIC CONCERTS DURING FORECAST PERIOD

- FIGURE 33 LIVE ENTERTAINMENT MARKET IN ASIA PACIFIC FOR SPORTS EVENTS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 34 REAL-TIME STREAMING SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 35 SOUTH KOREA TO RECORD HIGHEST CAGR IN GLOBAL LIVE ENTERTAINMENT MARKET DURING FORECAST PERIOD

- FIGURE 36 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 37 SNAPSHOT OF LIVE ENTERTAINMENT MARKET IN NORTH AMERICA

- FIGURE 38 SNAPSHOT OF LIVE ENTERTAINMENT MARKET IN EUROPE

- FIGURE 39 SNAPSHOT OF LIVE ENTERTAINMENT MARKET IN ASIA PACIFIC

- FIGURE 40 REVENUE ANALYSIS OF TOP 5 PLAYERS IN LIVE ENTERTAINMENT MARKET, 2020-2024

- FIGURE 41 MARKET SHARE ANALYSIS OF KEY COMPANIES, 2024

- FIGURE 42 COMPANY VALUATION

- FIGURE 43 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 44 LIVE NATION WORLDWIDE, INC.: COMPANY SNAPSHOT

- FIGURE 45 CTS EVENTIM AG & CO. KGAA: COMPANY SNAPSHOT

- FIGURE 46 LIBERTY MEDIA CORPORATION: COMPANY SNAPSHOT

- FIGURE 47 DISNEY: COMPANY SNAPSHOT

- FIGURE 48 MSG ENTERTAINMENT HOLDINGS, LLC: COMPANY SNAPSHOT

- FIGURE 49 HYBE: COMPANY SNAPSHOT

- FIGURE 50 SPOTIFY TECHNOLOGY S.A.: COMPANY SNAPSHOT