|

市場調查報告書

商品編碼

1775084

全球器官保存市場(按保存解決方案類型、技術、器官和最終用戶分類)- 預測至 2030 年Organ Preservation Market by Solution Type (UW, Custodial HTK, Perfadex), Technique (Static Cold Storage, Hypothermic, Normothermic), Organ (Kidneys, Liver, Heart), End User (Transplant Centers, Hospitals, Specialty Clinics) - Global Forecast to 2030 |

||||||

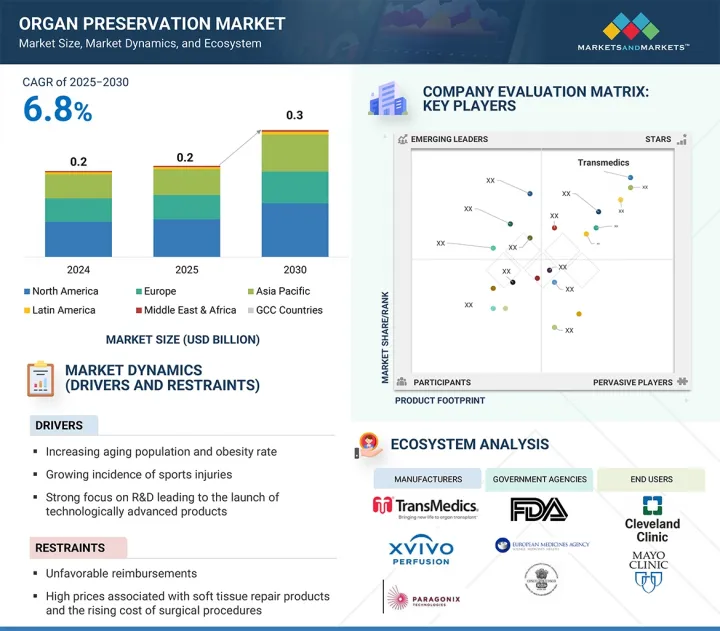

全球器官保存市場規模預計將從 2025 年的 20 萬美元成長到 2030 年的 3 億美元,預測期內的複合年成長率為 6.8%。

| 研究範圍 | |

|---|---|

| 調查年份 | 2024-2030 |

| 基準年 | 2024 |

| 預測期 | 2024-2030 |

| 單元 | 10億美元 |

| 部分 | 保存解決方案、技術、器官類型、最終用戶 |

| 目標區域 | 北美、歐洲、亞太地區、拉丁美洲、中東和非洲、海灣合作理事會國家 |

器官保存解決方案和設備的主要目標是從獲取器官到移植,維持器官的活力和功能。全球器官移植數量的增加、保存技術的進步以及低溫和常溫機械灌注系統等專用保存解決方案的引入等多種因素,正在推動該市場的持續成長。末期腎功能衰竭和肝功能衰竭等慢性疾病的盛行率不斷上升,推動了器官移植的需求,從而導致對有效保存技術的需求日益成長。

按防腐劑類型分類,威斯康辛大學 (UW) 部門在 2024 年佔據了最大的市場佔有率。

根據保存液類型,市場細分為UW、Custodiol HTK、Perfadex和其他保存液。 2024年,威斯康辛大學(UW)保存液憑藉其高採用率和特性(例如在保存肝臟、腎臟和胰臟等器官方面已證實有效)佔據最大市場佔有率。 UW保存液是首個推出的細胞內器官保存液,廣受認可為器官保存的全球標準。其成熟的臨床表現和可靠性使其成為移植外科醫生和醫療機構的首選。

基於技術,常溫機器灌注部分預計在預測期內實現最高的複合年成長率。

預計常溫灌注技術在預測期內將以最高的複合年成長率成長。該技術透過維持正常體溫並為器官提供必需的營養和氧氣來模擬自然生理條件。它在整個保存期間支持細胞功能和新陳代謝。常溫灌注有助於維持器官活力,並最大限度地減少發炎反應和缺血性損傷,尤其是在肝臟移植中。常溫灌注對於改善移植物再生至關重要,並且在涉及擴大標準捐贈者(例如老年捐贈者和併發症)的移植病例中與更好的結果相關。因此,它在尋求最佳化移植物長期存活率和功能的移植專業人士中越來越重要。

根據器官類型,預計肺部器官在預測期內的複合年成長率最高。

預計肺部疾病領域在預測期內將以最高的複合年成長率成長。肺移植是末期肺病患者的首選治療方法,例如慢性阻塞性肺病(COPD)、特發性肺纖維化和囊腫纖維化,所有這些疾病都促進了該領域的成長。成年患者末期肺病的其他常見原因包括α-1抗胰蛋白酶缺乏症和肺動脈高壓。隨著呼吸系統疾病的增多,需要肺移植的患者數量預計將增加,從而推動肺移植的需求。此外,移植物存活率和長期移植物功能的提高已使肺移植成為重要且通常可以挽救生命的治療選擇。

根據最終用戶,專科診所部門預計在預測期內將以最高的複合年成長率成長。

根據最終用戶,器官保存市場可細分為器官移植中心、醫院和專科診所。由於專科診所在移植手術和術後護理中的作用日益增強,專科診所細分市場預計將以最高的複合年成長率成長。這些診所提供專業的專業知識、快速的周轉時間和先進的器官保存技術。此外,患者對專科護理的偏好日益成長以及私人醫療保健投資的增加,進一步推動了該細分市場的成長。

根據地區來看,預計亞太地區在預測期內的複合年成長率最高。

預計亞太地區在預測期內的複合年成長率最高。該領域的高成長率主要得益於政府的優惠政策、社會意識的提升以及器官捐贈數量的增加。例如,由於公眾教育的加強、動員力度的增加以及器官移植技術的進步,中國的器官捐贈率正在上升。另一方面,印度的醫療基礎設施正在快速發展,這為市場成長提供了支撐,並促進了醫療旅遊的發展。儘管有宗教方面的擔憂,但日本的器官捐贈率仍在上升,這得益於民眾捐贈意願的增強。

本報告對全球器官保存市場進行了深入分析,包括關鍵促進因素和限制因素、競爭格局和未來趨勢。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章 主要發現

- 器官保存市場為企業帶來誘人機會

- 亞太地區器官保存市場(按保存解決方案和國家/地區分類)

- 器官保存市場:地理成長機會

- 器官保存市場(按地區)(2023-2030)

- 器官保存市場:已開發市場與新興市場

第5章市場概述

- 介紹

- 市場動態

- 驅動程式

- 限制因素

- 機會

- 任務

- 生態系分析

- 價值鏈分析

- 定價分析

- 供應鏈分析

- 專利分析

- 器官保存市場的專利趨勢

- 器官保存專利的主要申請人

- 司法管轄區分析:器官保存市場專利申請的主要國家

- 技術分析

- 主要技術

- 相關技術

- 互補技術

- 貿易分析

- 導入數據

- 匯出數據

- 大型會議和活動(2025-2026年)

- 監管格局

- 監管分析

- 監管機構、政府機構和其他組織

- 波特五力分析

- 主要相關利益者和採購標準

- 影響客戶業務的趨勢/中斷

- 案例研究分析

- 投資金籌措場景

- 贖回方案

- 人工智慧對器官保存市場的影響

- 器官保存市場的最終用戶期望

- 2025年美國關稅的影響

- 介紹

- 主要關稅稅率

- 價格影響分析

- 對最終用戶的影響

第6章 器官保存市場(依保存解決方案)

- 介紹

- UW

- Custodiol HTK

- Perfadex

- 其他防腐溶液

第7章 器官保存市場(依技術)

- 介紹

- 靜態冷藏

- 低溫機灌注

- 常溫機械灌注

第8章 器官保存市場(按器官)

- 介紹

- 腎

- 肝

- 肺

- 心

- 其他器官

第9章 器官保存市場(依最終使用者)

- 介紹

- 器官移植中心

- 醫院

- 專科診所

第10章 器官保存市場(按地區)

- 介紹

- 北美洲

- 宏觀經濟展望

- 美國

- 加拿大

- 歐洲

- 宏觀經濟展望

- 德國

- 法國

- 英國

- 西班牙

- 義大利

- 其他歐洲國家

- 亞太地區

- 宏觀經濟展望

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 其他亞太地區

- 拉丁美洲

- 宏觀經濟展望

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中東和非洲

- 海灣合作理事會國家

第11章競爭格局

- 概述

- 主要參與企業的策略/優勢

- 收益分析(2022-2024)

- 市場佔有率分析

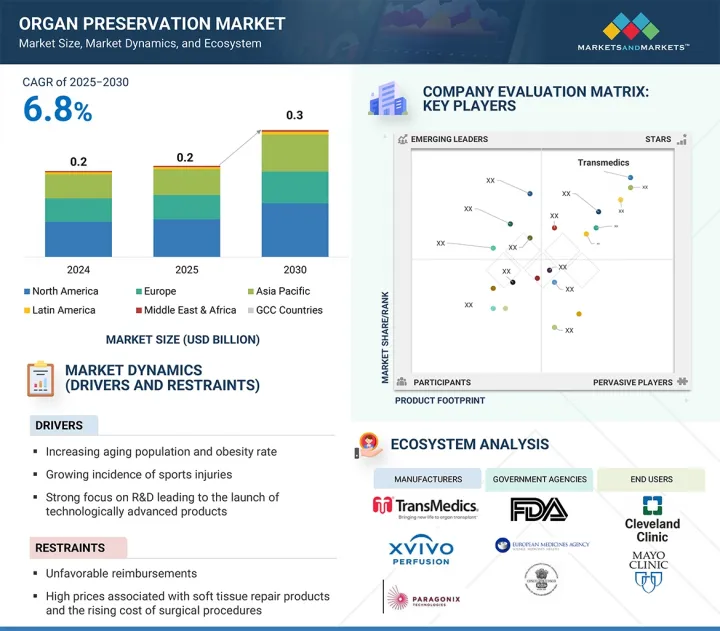

- 企業評估矩陣:主要企業(2024年)

- 公司評估矩陣:Start-Ups/中小企業(2024 年)

- 公司估值和財務指標

- 品牌/產品比較

- 競爭場景

第12章 公司簡介

- 主要企業

- PARAGONIX TECHNOLOGIES, INC.

- XVIVO PERFUSION AB

- DR. FRANZ KOHLER CHEMIE GMBH

- ESSENTIAL PHARMACEUTICALS, LLC (SUBSIDIARY OF ACCORD HEALTHCARE)

- TRANSMEDICS, INC.

- ORGANOX LIMITED

- 21ST CENTURY MEDICINE

- BIOLIFE SOLUTIONS, INC.

- BRIDGE TO LIFE LIMITED

- WATERS MEDICAL SYSTEMS LLC

- 其他公司

- SHANGHAI GENEXT MEDICAL TECHNOLOGY CO., LTD.

- PRESERVATION SOLUTIONS, INC.

- CARNAMEDICA

- TRANSPLANT BIOMEDICALS

- INSTITUT GEORGES LOPEZ

- GLOBAL TRANSPLANT SOLUTIONS

- AVIONORD

- ORGAN PRESERVATION SOLUTIONS LTD.

- EBERS

- SALF

- BIOCHEFA

- VASCULAR PERFUSION SOLUTIONS, INC.

- TX INNOVATIONS

- TAIYO NIPPON SANSO CORPORATION

- X-THERMA, INC.

第13章 附錄

The global organ preservation market is projected to reach USD 0.3 billion by 2030 from USD 0.2 million in 2025, at a CAGR of 6.8% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD billion) |

| Segments | Solution, Technique, Organ Type, and End-user |

| Regions covered | North America, Europe, Asia Pacific, Latin America, the Middle East & Africa, and GCC Countries |

The primary objective of organ preservation solutions and devices is to maintain the viability and functionality of organs between procurement and transplantation. Several factors fuel consistent growth in this market, including the increasing volume of organ transplants globally, technological advancements in preservation techniques, and the introduction of specialized solutions such as hypothermic and normothermic machine perfusion systems. The growing incidence of chronic diseases such as end-stage renal and liver failure is driving the demand for organ transplants, which in turn boosts the need for effective preservation technologies.

By solution type, the University of Wisconsin (UW) segment accounted for the largest market share in 2024.

The market is categorized into UW, Custodiol HTK, Perfadex, and other solutions by solution type. In 2024, the University of Wisconsin (UW) solution accounted for the largest market share owing to high adoption and features such as proven efficacy in preserving organs like the liver, kidneys, and pancreas. It was the first introduced intracellular preservation solution and is widely regarded as the global benchmark for organ preservation. Its established clinical outcomes and reliability have solidified its position as the preferred choice among transplant surgeons and healthcare facilities.

By technique, the normothermic machine perfusion segment is expected to register the highest CAGR during the forecast period.

The normothermic machine perfusion segment is expected to grow at the highest CAGR during the forecast period. This technique simulates natural physiological conditions by maintaining normal body temperature and supplying essential nutrients and oxygen to the organ. It supports cellular function and metabolism throughout the preservation period. Normothermic perfusion helps maintain organ viability and minimizes inflammatory responses and ischemic injury, particularly in liver transplants. It is vital in improving graft regeneration and has been associated with better outcomes in transplant cases involving extended criteria donors, such as older individuals or those with comorbidities. As a result, its relevance is growing among transplant professionals seeking to optimize long-term graft survival and function.

By organ type, the lungs segment is expected to grow at the highest CAGR during the forecast period.

The lungs segment is expected to grow at the highest CAGR during the forecast period. Lung transplantation is regarded as the preferred treatment for patients with end-stage lung diseases such as chronic obstructive pulmonary disease (COPD), idiopathic pulmonary fibrosis, or cystic fibrosis, all of which contribute to the growth of this segment. Other common causes of end-stage lung disease in adult patients include alpha-1 antitrypsin deficiency and pulmonary hypertension. With the increasing prevalence of respiratory illnesses, the number of patients requiring lung transplants is anticipated to rise, thereby driving demand for lung transplants. Additionally, advancements in graft survival and long-term graft function have established lung transplantation as a vital and often life-saving therapeutic option.

By end user, the specialty clinics segment is expected to grow at the highest CAGR during the forecast period.

The organ preservation market is segmented by end-users into organ transplant centers, hospitals, and specialty clinics. The specialty clinics segment is projected to grow at the highest CAGR in the organ preservation market due to their increasing role in transplant procedures and post-operative care. These clinics offer focused expertise, faster turnaround times, and advanced technologies tailored to organ preservation needs. Additionally, growing patient preference for specialized care and the rise in private healthcare investments further accelerate their growth in this segment.

By region, the Asia Pacific is expected to grow at the highest CAGR during the forecast period.

The Asia Pacific region is projected to grow at the highest CAGR during the forecast period. The high growth rate of this segment is primarily attributed to the combination of favorable government policies, increased public awareness, and a higher number of organ donations. For instance, China has seen its donation rates improve thanks to intensified public education, mobilization efforts, and technological advancements in organ transplants. Meanwhile, India's rapid development in healthcare infrastructure has supported market growth and fostered medical tourism. Even with religious considerations, Japan has observed an improvement in organ donation due to a higher willingness to donate organs.

The breakdown of primary participants was as mentioned below:

- By Company Type - Tier 1-35%, Tier 2-45%, and Tier 3-20%

- By Designation - C-level-35%, Director-level-25%, Others-40%

- By Region - North America-45%, Europe-30%, Asia Pacific-20%, Latin America- 3%, the Middle East & Africa-1%, and GCC countries-1%

Key Players in the Organ Preservation Market

The key players operating in the organ preservation market include Paragonix Technologies (US), XVIVO Perfusion AB (Sweden), Dr. Franz Kohler Chemie GmbH (Germany), Essential Pharmaceuticals, LLC (US), TransMedics (US), OrganOx Limited (UK), 21st Century Medicine (US), Shanghai Genext Medical Technology (China), Bridge to Life Limited (US), Waters Medical Systems (US), Preservation Solutions (US), Carnamedica (Poland), Transplant Biomedicals (Spain), Institut Georges Lopez (France), Global Transplant Solutions (US), Avionord (Italy), Organ Preservation Solutions (England), EBERS (Spain), S.A.L.F. (Italy), Biochefa (Poland), Vascular Perfusion Solutions (US), and TX Innovations (Netherlands).

Research Coverage:

The report analyzes the organ preservation market and aims to estimate the market size and future growth potential based on various segments such as solution, technique, organ type, end user, and region. The report also includes a product portfolio matrix of various organ preservation products available in the market. The report also provides a competitive analysis of the key players in this market, along with their company profiles, product offerings, and key market strategies.

Reasons to Buy the Report

The report will enrich established firms and new entrants/smaller firms to gauge the market's pulse, which in turn would help them garner a more significant share of the market. Firms purchasing the report could use one or any combination of the below-mentioned strategies to strengthen their position in the market.

This report provides insights into the following pointers:

Analysis of key drivers (Ascending cases of multiple organ failure and growth in the geriatric population, the increasing initiatives to promote public awareness and encourage organ donation, the rising number of organ donors boost adoption of solid organ transplantation procedures); restraints (High cost of organ transplantation and religious concerns and misconceptions associated to organ donation); opportunities (the increasing focus on healthcare investments); and challenges (Significant gap between the number of organs donated and organs required annually coupled with the development of artificial organs)

- Market Penetration: Comprehensive information on product portfolios offered by the top players in the global organ preservation market. The report analyzes this market by solution, technique, organ type, and end user.

- Product Enhancement/Innovation: Detailed insights on upcoming trends and product launches in the global organ preservation market

- Market Development: Comprehensive information on the lucrative emerging markets by solution type, technique, organ type, and end user

- Market Diversification: Exhaustive information about new products or product enhancements, growing geographies, recent developments, and investments in the global organ preservation market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, competitive leadership mapping, and capabilities of leading players in the global organ preservation market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.2 RESEARCH DESIGN

- 2.2.1 SECONDARY RESEARCH

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Key data from primary sources

- 2.2.2.2 Key industry insights

- 2.2.1 SECONDARY RESEARCH

- 2.3 MARKET SIZE ESTIMATION

- 2.4 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.5 MARKET RANKING ANALYSIS

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

- 2.7.1 METHODOLOGY-RELATED LIMITATIONS

- 2.7.2 SCOPE-RELATED LIMITATIONS

- 2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ORGAN PRESERVATION MARKET

- 4.2 ASIA PACIFIC: ORGAN PRESERVATION MARKET, BY SOLUTION AND COUNTRY

- 4.3 ORGAN PRESERVATION MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.4 ORGAN PRESERVATION MARKET, BY REGION, 2023-2030

- 4.5 ORGAN PRESERVATION MARKET: DEVELOPED VS. EMERGING MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing geriatric population and subsequent growth in cases of multiple organ failure

- 5.2.1.2 Increasing initiatives to promote public awareness and encourage organ donation

- 5.2.1.3 Rising number of organ donors and growing adoption of solid organ transplantation procedures

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of organ transplantation

- 5.2.2.2 Religious concerns and misconceptions associated with organ donation

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing healthcare investments

- 5.2.4 CHALLENGES

- 5.2.4.1 Significant gap between number of organs donated and organs required annually

- 5.2.4.2 Development of artificial organs

- 5.2.1 DRIVERS

- 5.3 ECOSYSTEM ANALYSIS

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 PATENT ANALYSIS

- 5.7.1 PATENT PUBLICATION TRENDS FOR ORGAN PRESERVATION MARKET

- 5.7.2 TOP APPLICANTS (COMPANIES) OF ORGAN PRESERVATION PATENTS

- 5.7.3 JURISDICTION ANALYSIS: TOP APPLICANTS (COUNTRIES) FOR PATENTS IN ORGAN PRESERVATION MARKET

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Machine perfusion

- 5.8.1.2 Organ perfusion

- 5.8.2 ADJACENT TECHNOLOGIES

- 5.8.2.1 Cryopreservation & vitrification

- 5.8.3 COMPLEMENTARY TECHNOLOGIES

- 5.8.3.1 Temperature monitoring devices

- 5.8.1 KEY TECHNOLOGIES

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT DATA

- 5.9.2 EXPORT DATA

- 5.10 KEY CONFERENCES AND EVENTS IN 2025-2026

- 5.11 REGULATORY LANDSCAPE

- 5.11.1 REGULATORY ANALYSIS

- 5.11.1.1 North America

- 5.11.1.1.1 US

- 5.11.1.1.2 Canada

- 5.11.1.2 Europe

- 5.11.1.3 Asia Pacific

- 5.11.1.3.1 China

- 5.11.1.3.2 Japan

- 5.11.1.3.3 India

- 5.11.1.4 Latin America

- 5.11.1.4.1 Brazil

- 5.11.1.4.2 Mexico

- 5.11.1.5 Middle East

- 5.11.1.6 Africa

- 5.11.1.1 North America

- 5.11.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.1 REGULATORY ANALYSIS

- 5.12 PORTER'S FIVE FORCES ANALYSIS

- 5.12.1 THREAT FROM NEW ENTRANTS

- 5.12.2 THREAT FROM SUBSTITUTES

- 5.12.3 BARGAINING POWER OF SUPPLIERS

- 5.12.4 BARGAINING POWER OF BUYERS

- 5.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.15 CASE STUDY ANALYSIS

- 5.16 INVESTMENT AND FUNDING SCENARIO

- 5.17 REIMBURSEMENT SCENARIO

- 5.18 IMPACT OF AI ON ORGAN PRESERVATION MARKET

- 5.19 END USER EXPECTATIONS IN ORGAN PRESERVATION MARKET

- 5.20 IMPACT OF 2025 US TARIFFS

- 5.20.1 INTRODUCTION

- 5.20.2 KEY TARIFF RATES

- 5.20.3 PRICE IMPACT ANALYSIS

- 5.20.4 IMPACT ON END USERS

6 ORGAN PRESERVATION MARKET, BY SOLUTION

- 6.1 INTRODUCTION

- 6.2 UNIVERSITY OF WISCONSIN

- 6.2.1 METABOLICALLY INERT SUBSTRATES ENABLE BETTER TRANSPLANTATION OUTCOMES

- 6.3 CUSTODIOL HTK

- 6.3.1 INDICATED FOR PERFUSION AND FLUSHING OF KIDNEYS, LIVER, PANCREAS, AND HEART

- 6.4 PERFADEX

- 6.4.1 LAUNCH OF PERFADEX PLUS TO DRIVE MARKET

- 6.5 OTHER SOLUTIONS

7 ORGAN PRESERVATION MARKET, BY TECHNIQUE

- 7.1 INTRODUCTION

- 7.2 STATIC COLD STORAGE

- 7.2.1 MOST WIDELY ADOPTED ORGAN PRESERVATION TECHNIQUE

- 7.3 HYPOTHERMIC MACHINE PERFUSION

- 7.3.1 ADVANTAGES ASSOCIATED WITH HYPOTHERMIC MACHINE PERFUSION TO DRIVE DEMAND

- 7.4 NORMOTHERMIC MACHINE PERFUSION

- 7.4.1 PROVIDES VIABLE ENVIRONMENT FOR ORGAN PRESERVATION, VIABILITY, AND REPAIR PRIOR TO TRANSPLANTATION

8 ORGAN PRESERVATION MARKET, BY ORGAN TYPE

- 8.1 INTRODUCTION

- 8.2 KIDNEYS

- 8.2.1 MOST TRANSPLANTED ORGANS GLOBALLY

- 8.3 LIVER

- 8.3.1 RISING PREVALENCE OF LIVER DISEASE AND GROWING CASES OF LIVER FAILURE TO DRIVE DEMAND FOR LIVER TRANSPLANTATION PROCEDURES

- 8.4 LUNGS

- 8.4.1 GROWTH IN COPD INCIDENCE TO BOOST DEMAND FOR PRESERVATION TECHNIQUES AND PRODUCTS

- 8.5 HEART

- 8.5.1 ADVANCEMENTS IN HEART PRESERVATION TECHNIQUES TO DRIVE MARKET

- 8.6 OTHER ORGANS

9 ORGAN PRESERVATION MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 ORGAN TRANSPLANT CENTERS

- 9.2.1 MAJOR END USERS OF ORGAN PRESERVATION SOLUTIONS

- 9.3 HOSPITALS

- 9.3.1 INCREASING CASES OF ACCIDENTAL INJURIES AND CHRONIC DISEASES TO DRIVE MARKET

- 9.4 SPECIALTY CLINICS

- 9.4.1 INCREASING PREVALENCE OF END-STAGE DISEASES AND ORGAN FAILURE TO DRIVE MARKET

10 ORGAN PRESERVATION MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK

- 10.2.2 US

- 10.2.2.1 Growing cases of organ failure and underlying diseases to drive demand

- 10.2.3 CANADA

- 10.2.3.1 Improved organ donation rates to drive growth

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK

- 10.3.2 GERMANY

- 10.3.2.1 Growing patient population to drive demand

- 10.3.3 FRANCE

- 10.3.3.1 Increasing number of organ transplants and organ donor registrations to drive growth

- 10.3.4 UK

- 10.3.4.1 Increasing disease/disorder prevalence and favorable regulations to drive demand

- 10.3.5 SPAIN

- 10.3.5.1 High donation rates to drive growth

- 10.3.6 ITALY

- 10.3.6.1 Surge in donor numbers and technological innovation to drive growth

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK

- 10.4.2 CHINA

- 10.4.2.1 Growing awareness and adoption of laws favoring organ donation to drive market

- 10.4.3 JAPAN

- 10.4.3.1 Nationwide awareness campaigns and promoted opt-in registration to drive growth

- 10.4.4 INDIA

- 10.4.4.1 Growing number of initiatives to increase public awareness to drive market

- 10.4.5 AUSTRALIA

- 10.4.5.1 Enhanced hospital-based donation programs to drive growth

- 10.4.6 SOUTH KOREA

- 10.4.6.1 Improved donor registration systems to drive growth

- 10.4.7 REST OF ASIA PACIFIC

- 10.5 LATIN AMERICA

- 10.5.1 MACROECONOMIC OUTLOOK

- 10.5.2 BRAZIL

- 10.5.2.1 Digitalization of donor registries to drive growth

- 10.5.3 MEXICO

- 10.5.3.1 Organ donation efforts supported by centralized transplant registry and national coordination to drive growth

- 10.5.4 REST OF LATIN AMERICA

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 IMPLEMENTATION OF GOVERNMENT INITIATIVES AND POLICIES TO DRIVE MARKET

- 10.6.2 MACROECONOMIC OUTLOOK

- 10.7 GCC COUNTRIES

- 10.7.1 STRONG ORGAN PRESERVATION THROUGH INCENTIVES, INFRASTRUCTURE, AND PUBLIC AWARENESS TO DRIVE GROWTH

- 10.7.2 MACROECONOMIC OUTLOOK

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 REVENUE ANALYSIS, 2022-2024

- 11.4 MARKET SHARE ANALYSIS

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company footprint

- 11.5.5.2 Solution footprint

- 11.5.5.3 Technique footprint

- 11.5.5.4 End user footprint

- 11.5.5.5 Region footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.6.5.1 List of key startups/SMEs

- 11.6.5.2 Competitive benchmarking of key startups/SMEs

- 11.7 COMPANY VALUATION AND FINANCIAL METRICS

- 11.7.1 COMPANY VALUATION

- 11.7.2 FINANCIAL METRICS

- 11.8 BRAND/PRODUCT COMPARISON

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES & APPROVALS

- 11.9.2 DEALS

- 11.9.3 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 PARAGONIX TECHNOLOGIES, INC.

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches

- 12.1.1.3.2 Deals

- 12.1.1.3.3 Other developments

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 XVIVO PERFUSION AB

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches & approvals

- 12.1.2.3.2 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 DR. FRANZ KOHLER CHEMIE GMBH

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 MnM view

- 12.1.3.3.1 Right to win

- 12.1.3.3.2 Strategic choices

- 12.1.3.3.3 Weaknesses and competitive threats

- 12.1.4 ESSENTIAL PHARMACEUTICALS, LLC (SUBSIDIARY OF ACCORD HEALTHCARE)

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 MnM view

- 12.1.4.3.1 Right to win

- 12.1.4.3.2 Strategic choices

- 12.1.4.3.3 Weaknesses and competitive threats

- 12.1.5 TRANSMEDICS, INC.

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches & approvals

- 12.1.5.3.2 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 ORGANOX LIMITED

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches & approvals

- 12.1.6.3.2 Deals

- 12.1.7 21ST CENTURY MEDICINE

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.8 BIOLIFE SOLUTIONS, INC.

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches

- 12.1.8.3.2 Deals

- 12.1.9 BRIDGE TO LIFE LIMITED

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product launches & approvals

- 12.1.9.3.2 Deals

- 12.1.10 WATERS MEDICAL SYSTEMS LLC

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.1 PARAGONIX TECHNOLOGIES, INC.

- 12.2 OTHER PLAYERS

- 12.2.1 SHANGHAI GENEXT MEDICAL TECHNOLOGY CO., LTD.

- 12.2.2 PRESERVATION SOLUTIONS, INC.

- 12.2.3 CARNAMEDICA

- 12.2.4 TRANSPLANT BIOMEDICALS

- 12.2.5 INSTITUT GEORGES LOPEZ

- 12.2.6 GLOBAL TRANSPLANT SOLUTIONS

- 12.2.7 AVIONORD

- 12.2.8 ORGAN PRESERVATION SOLUTIONS LTD.

- 12.2.9 EBERS

- 12.2.10 S.A.L.F.

- 12.2.11 BIOCHEFA

- 12.2.12 VASCULAR PERFUSION SOLUTIONS, INC.

- 12.2.13 TX INNOVATIONS

- 12.2.14 TAIYO NIPPON SANSO CORPORATION

- 12.2.15 X-THERMA, INC.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 AVAILABLE CUSTOMIZATIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

List of Tables

- TABLE 1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD, 2021-2024

- TABLE 2 GROWTH IN GERIATRIC POPULATION (ABOVE 65 AGE GROUP), BY REGION, 2019 VS. 2050 (MILLION)

- TABLE 3 NUMBER OF ORGAN DONATIONS, 2020

- TABLE 4 COST OF SURGICAL PROCEDURES: US VS. INDIA (USD)

- TABLE 5 AVERAGE SELLING PRICE RANGE OF ORGAN PRESERVATION SOLUTIONS, BY KEY PLAYERS, 2023-2024

- TABLE 6 AVERAGE SELLING PRICE RANGE OF CUSTODIOL SOLUTIONS FOR ORGAN PRESERVATION SOLUTIONS IN KEY REGIONS, 2022-2024

- TABLE 7 ORGAN PRESERVATION MARKET: LIST OF MAJOR PATENTS, 2020-2021

- TABLE 8 IMPORT DATA OF ORGAN PRESERVATION FOR HS CODE 300640, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 9 EXPORT DATA OF ORGAN PRESERVATION FOR HS CODE 300640, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 SOLUTIONS (%)

- TABLE 15 KEY BUYING CRITERIA FOR TOP 3 SOLUTIONS

- TABLE 16 CASE STUDY 1: PRESERVATION OF MARGINAL LIVER USING NORMOTHERMIC MACHINE PERFUSION (NMP)

- TABLE 17 CASE STUDY 2: HYPOTHERMIC MACHINE PERFUSION FOR EXTENDED CRITERIA KIDNEY TRANSPLANT

- TABLE 18 CASE STUDY 3: USE OF PORTABLE NORMOTHERMIC PERFUSION FOR HEART TRANSPLANTATION

- TABLE 19 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 20 ORGAN PRESERVATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- TABLE 21 ORGAN PRESERVATION SOLUTIONS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 22 ORGAN PRESERVATION MARKET FOR UW SOLUTIONS, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 23 ORGAN PRESERVATION MARKET FOR CUSTODIOL HTK SOLUTIONS, BY COUNTRY/ REGION, 2023-2030 (USD MILLION)

- TABLE 24 ORGAN PRESERVATION MARKET FOR PERFADEX SOLUTIONS, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 25 OTHER ORGAN PRESERVATION SOLUTIONS MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 26 COMPARISON OF METHODS USED FOR ORGAN PRESERVATION

- TABLE 27 ORGAN PRESERVATION MARKET, BY TECHNIQUE, 2023-2030 (USD MILLION)

- TABLE 28 ORGAN PRESERVATION TECHNIQUE MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 29 STATIC COLD STORAGE: ADVANTAGES AND DISADVANTAGES

- TABLE 30 ORGAN PRESERVATION MARKET FOR STATIC COLD STORAGE, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 31 HYPOTHERMIC MACHINE PERFUSION: ADVANTAGES AND DISADVANTAGES

- TABLE 32 ORGAN PRESERVATION MARKET FOR HYPOTHERMIC MACHINE PERFUSION, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 33 NORMOTHERMIC MACHINE PERFUSION: ADVANTAGES AND DISADVANTAGES

- TABLE 34 ORGAN PRESERVATION MARKET FOR NORMOTHERMIC MACHINE PERFUSION, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 35 ORGAN PRESERVATION MARKET, BY ORGAN TYPE, 2023-2030 (USD MILLION)

- TABLE 36 KIDNEY PRESERVATION MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 37 LIVER PRESERVATION MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 38 LUNG PRESERVATION MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 39 HEART PRESERVATION MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 40 OTHER ORGAN PRESERVATION MARKET, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 41 ORGAN PRESERVATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 42 ORGAN PRESERVATION MARKET FOR ORGAN TRANSPLANT CENTERS, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 43 ORGAN PRESERVATION MARKET FOR HOSPITALS, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 44 ORGAN PRESERVATION MARKET FOR SPECIALTY CLINICS, BY COUNTRY/REGION, 2023-2030 (USD MILLION)

- TABLE 45 ORGAN PRESERVATION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 46 NORTH AMERICA: ORGAN PRESERVATION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 47 NORTH AMERICA: ORGAN PRESERVATION MARKET, BY TECHNIQUE, 2023-2030 (USD MILLION)

- TABLE 48 NORTH AMERICA: ORGAN PRESERVATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- TABLE 49 NORTH AMERICA: ORGAN PRESERVATION MARKET, BY ORGAN TYPE, 2023-2030 (USD MILLION)

- TABLE 50 NORTH AMERICA: ORGAN PRESERVATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 51 US: KEY MACROINDICATORS

- TABLE 52 WAITING LIST FOR ORGAN TRANSPLANTS AS OF JANUARY 2022

- TABLE 53 US: ORGAN PRESERVATION MARKET, BY TECHNIQUE, 2023-2030 (USD MILLION)

- TABLE 54 US: ORGAN PRESERVATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- TABLE 55 US: ORGAN PRESERVATION MARKET, BY ORGAN TYPE, 2023-2030 (USD MILLION)

- TABLE 56 US: ORGAN PRESERVATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 57 CANADA: KEY MACROINDICATORS

- TABLE 58 CANADA: ORGAN PRESERVATION MARKET, BY TECHNIQUE, 2023-2030 (USD MILLION)

- TABLE 59 CANADA: ORGAN PRESERVATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- TABLE 60 CANADA: ORGAN PRESERVATION MARKET, BY ORGAN TYPE, 2023-2030 (USD MILLION)

- TABLE 61 CANADA: ORGAN PRESERVATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 62 EUROPE: ORGAN PRESERVATION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 63 EUROPE: ORGAN PRESERVATION MARKET, BY TECHNIQUE, 2023-2030 (USD MILLION)

- TABLE 64 EUROPE: ORGAN PRESERVATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- TABLE 65 EUROPE: ORGAN PRESERVATION MARKET, BY ORGAN TYPE, 2023-2030 (USD MILLION)

- TABLE 66 EUROPE: ORGAN PRESERVATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 67 GERMANY: KEY MACROINDICATORS

- TABLE 68 GERMANY: ORGAN PRESERVATION MARKET, BY TECHNIQUE, 2023-2030 (USD MILLION)

- TABLE 69 GERMANY: ORGAN PRESERVATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- TABLE 70 GERMANY: ORGAN PRESERVATION MARKET, BY ORGAN TYPE, 2023-2030 (USD MILLION)

- TABLE 71 GERMANY: ORGAN PRESERVATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 72 FRANCE: KEY MACROINDICATORS

- TABLE 73 FRANCE: ORGAN PRESERVATION MARKET, BY TECHNIQUE, 2023-2030 (USD MILLION)

- TABLE 74 FRANCE: ORGAN PRESERVATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- TABLE 75 FRANCE: ORGAN PRESERVATION MARKET, BY ORGAN TYPE, 2023-2030 (USD MILLION)

- TABLE 76 FRANCE: ORGAN PRESERVATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 77 UK: KEY MACROINDICATORS

- TABLE 78 TOTAL NUMBER OF PATIENTS ON ACTIVE ORGAN TRANSPLANT WAITING LIST IN UK (AS OF APRIL 8, 2021)

- TABLE 79 UK: ORGAN PRESERVATION MARKET, BY TECHNIQUE, 2023-2030 (USD MILLION)

- TABLE 80 UK: ORGAN PRESERVATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- TABLE 81 UK: ORGAN PRESERVATION MARKET, BY ORGAN TYPE, 2023-2030 (USD MILLION)

- TABLE 82 UK: ORGAN PRESERVATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 83 SPAIN: KEY MACROINDICATORS

- TABLE 84 SPAIN: ORGAN PRESERVATION MARKET, BY TECHNIQUE, 2023-2030 (USD MILLION)

- TABLE 85 SPAIN: ORGAN PRESERVATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- TABLE 86 SPAIN: ORGAN PRESERVATION MARKET, BY ORGAN TYPE, 2023-2030 (USD MILLION)

- TABLE 87 SPAIN: ORGAN PRESERVATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 88 ITALY: KEY MACROINDICATORS

- TABLE 89 ITALY: ORGAN PRESERVATION MARKET, BY TECHNIQUE, 2023-2030 (USD MILLION)

- TABLE 90 ITALY: ORGAN PRESERVATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- TABLE 91 ITALY: ORGAN PRESERVATION MARKET, BY ORGAN TYPE, 2023-2030 (USD MILLION)

- TABLE 92 ITALY: ORGAN PRESERVATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 93 REST OF EUROPE: ORGAN PRESERVATION MARKET, BY TECHNIQUE, 2023-2030 (USD MILLION)

- TABLE 94 REST OF EUROPE: ORGAN PRESERVATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- TABLE 95 REST OF EUROPE: ORGAN PRESERVATION MARKET, BY ORGAN TYPE, 2023-2030 (USD MILLION)

- TABLE 96 REST OF EUROPE: ORGAN PRESERVATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 97 ASIA PACIFIC: ORGAN PRESERVATION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 98 ASIA PACIFIC: ORGAN PRESERVATION MARKET, BY TECHNIQUE, 2023-2030 (USD MILLION)

- TABLE 99 ASIA PACIFIC: ORGAN PRESERVATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- TABLE 100 ASIA PACIFIC: ORGAN PRESERVATION MARKET, BY ORGAN TYPE, 2023-2030 (USD MILLION)

- TABLE 101 ASIA PACIFIC: ORGAN PRESERVATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 102 CHINA: ORGAN PRESERVATION MARKET, BY TECHNIQUE, 2023-2030 (USD MILLION)

- TABLE 103 CHINA: ORGAN PRESERVATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- TABLE 104 CHINA: ORGAN PRESERVATION MARKET, BY ORGAN TYPE, 2023-2030 (USD MILLION)

- TABLE 105 CHINA: ORGAN PRESERVATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 106 TOTAL NUMBER OF PATIENTS ON ORGAN TRANSPLANT WAITING LIST IN JAPAN (AS OF MARCH 31, 2021)

- TABLE 107 JAPAN: ORGAN PRESERVATION MARKET, BY TECHNIQUE, 2023-2030 (USD MILLION)

- TABLE 108 JAPAN: ORGAN PRESERVATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- TABLE 109 JAPAN: ORGAN PRESERVATION MARKET, BY ORGAN TYPE, 2023-2030 (USD MILLION)

- TABLE 110 JAPAN: ORGAN PRESERVATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 111 INDIA: ORGAN PRESERVATION MARKET, BY TECHNIQUE, 2023-2030 (USD MILLION)

- TABLE 112 INDIA: ORGAN PRESERVATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- TABLE 113 INDIA: ORGAN PRESERVATION MARKET, BY ORGAN TYPE, 2023-2030 (USD MILLION)

- TABLE 114 INDIA: ORGAN PRESERVATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 115 AUSTRALIA: ORGAN PRESERVATION MARKET, BY TECHNIQUE, 2023-2030 (USD MILLION)

- TABLE 116 AUSTRALIA: ORGAN PRESERVATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- TABLE 117 AUSTRALIA: ORGAN PRESERVATION MARKET, BY ORGAN TYPE, 2023-2030 (USD MILLION)

- TABLE 118 AUSTRALIA: ORGAN PRESERVATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 119 SOUTH KOREA: ORGAN PRESERVATION MARKET, BY TECHNIQUE, 2023-2030 (USD MILLION)

- TABLE 120 SOUTH KOREA: ORGAN PRESERVATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- TABLE 121 SOUTH KOREA: ORGAN PRESERVATION MARKET, BY ORGAN TYPE, 2023-2030 (USD MILLION)

- TABLE 122 SOUTH KOREA: ORGAN PRESERVATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 123 REST OF ASIA PACIFIC: ORGAN PRESERVATION MARKET, BY TECHNIQUE, 2023-2030 (USD MILLION)

- TABLE 124 REST OF ASIA PACIFIC: ORGAN PRESERVATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- TABLE 125 REST OF ASIA PACIFIC: ORGAN PRESERVATION MARKET, BY ORGAN TYPE, 2023-2030 (USD MILLION)

- TABLE 126 REST OF ASIA PACIFIC: ORGAN PRESERVATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 127 LATIN AMERICA: ORGAN PRESERVATION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 128 LATIN AMERICA: ORGAN PRESERVATION MARKET, BY TECHNIQUE, 2023-2030 (USD MILLION)

- TABLE 129 LATIN AMERICA: ORGAN PRESERVATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- TABLE 130 LATIN AMERICA: ORGAN PRESERVATION MARKET, BY ORGAN TYPE, 2023-2030 (USD MILLION)

- TABLE 131 LATIN AMERICA: ORGAN PRESERVATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 132 BRAZIL: ORGAN PRESERVATION MARKET, BY TECHNIQUE, 2023-2030 (USD MILLION)

- TABLE 133 BRAZIL: ORGAN PRESERVATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- TABLE 134 BRAZIL: ORGAN PRESERVATION MARKET, BY ORGAN TYPE, 2023-2030 (USD MILLION)

- TABLE 135 BRAZIL: ORGAN PRESERVATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 136 MEXICO: ORGAN PRESERVATION MARKET, BY TECHNIQUE, 2023-2030 (USD MILLION)

- TABLE 137 MEXICO: ORGAN PRESERVATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- TABLE 138 MEXICO: ORGAN PRESERVATION MARKET, BY ORGAN TYPE, 2023-2030 (USD MILLION)

- TABLE 139 MEXICO: ORGAN PRESERVATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 140 REST OF LATIN AMERICA: ORGAN PRESERVATION MARKET, BY TECHNIQUE, 2023-2030 (USD MILLION)

- TABLE 141 REST OF LATIN AMERICA: ORGAN PRESERVATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- TABLE 142 REST OF LATIN AMERICA: ORGAN PRESERVATION MARKET, BY ORGAN TYPE, 2023-2030 (USD MILLION)

- TABLE 143 REST OF LATIN AMERICA: ORGAN PRESERVATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: ORGAN PRESERVATION MARKET, BY TECHNIQUE, 2023-2030 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: ORGAN PRESERVATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: ORGAN PRESERVATION MARKET, BY ORGAN TYPE, 2023-2030 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: ORGAN PRESERVATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 148 GCC COUNTRIES: ORGAN PRESERVATION MARKET, BY TECHNIQUE, 2023-2030 (USD MILLION)

- TABLE 149 GCC COUNTRIES: ORGAN PRESERVATION MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- TABLE 150 GCC COUNTRIES: ORGAN PRESERVATION MARKET, BY ORGAN TYPE, 2023-2030 (USD MILLION)

- TABLE 151 GCC COUNTRIES: ORGAN PRESERVATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 152 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN ORGAN PRESERVATION MARKET

- TABLE 153 ORGAN PRESERVATION MARKET: DEGREE OF COMPETITION

- TABLE 154 ORGAN PRESERVATION MARKET: SOLUTION FOOTPRINT

- TABLE 155 ORGAN PRESERVATION MARKET: TECHNIQUE FOOTPRINT

- TABLE 156 ORGAN PRESERVATION MARKET: END USER FOOTPRINT

- TABLE 157 ORGAN PRESERVATION MARKET: REGION FOOTPRINT

- TABLE 158 ORGAN PRESERVATION MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 159 ORGAN PRESERVATION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 160 ORGAN PRESERVATION MARKET: PRODUCT LAUNCHES & APPROVALS, JANUARY 2021-JUNE 2025

- TABLE 161 ORGAN PRESERVATION MARKET: DEALS, JANUARY 2021-JUNE 2025

- TABLE 162 ORGAN PRESERVATION MARKET: OTHER DEVELOPMENTS, JANUARY 2021-JUNE 2025

- TABLE 163 PARAGONIX TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 164 PARAGONIX TECHNOLOGIES, INC.: PRODUCTS OFFERED

- TABLE 165 PARAGONIX TECHNOLOGIES, INC.: PRODUCT LAUNCHES, JANUARY 2021-MAY 2025

- TABLE 166 PARAGONIX TECHNOLOGIES, INC.: DEALS, JANUARY 2021-MAY 2025

- TABLE 167 PARAGONIX TECHNOLOGIES, INC.: OTHER DEVELOPMENTS, JANUARY 2021-MAY 2025

- TABLE 168 XVIVO PERFUSION AB: COMPANY OVERVIEW

- TABLE 169 XVIVO PERFUSION AB: PRODUCTS OFFERED

- TABLE 170 XVIVO PERFUSION AB: PRODUCT LAUNCHES & APPROVALS, JANUARY 2021-MAY 2025

- TABLE 171 XVIVO PERFUSION AB: DEALS, JANUARY 2021-MAY 2025

- TABLE 172 DR. FRANZ KOHLER CHEMIE GMBH: COMPANY OVERVIEW

- TABLE 173 DR. FRANZ KOHLER CHEMIE GMBH: PRODUCTS OFFERED

- TABLE 174 ESSENTIAL PHARMACEUTICALS, LLC: COMPANY OVERVIEW

- TABLE 175 ESSENTIAL PHARMACEUTICALS, LLC: PRODUCTS OFFERED

- TABLE 176 TRANSMEDICS, INC.: COMPANY OVERVIEW

- TABLE 177 TRANSMEDICS, INC.: PRODUCTS OFFERED

- TABLE 178 TRANSMEDICS, INC.: PRODUCT LAUNCHES & APPROVALS

- TABLE 179 TRANSMEDICS, INC.: DEALS

- TABLE 180 ORGANOX LIMITED: COMPANY OVERVIEW

- TABLE 181 ORGANOX LIMITED: PRODUCTS OFFERED

- TABLE 182 ORGANOX LIMITED: PRODUCT LAUNCHES & APPROVALS

- TABLE 183 ORGANOX LIMITED: DEALS

- TABLE 184 21ST CENTURY MEDICINE: COMPANY OVERVIEW

- TABLE 185 21ST CENTURY MEDICINE: PRODUCTS OFFERED

- TABLE 186 BIOLIFE SOLUTIONS, INC.: COMPANY OVERVIEW

- TABLE 187 BIOLIFE SOLUTIONS, INC.: PRODUCTS OFFERED

- TABLE 188 BIOLIFE SOLUTIONS, INC.: PRODUCT LAUNCHES, JANUARY 2021-MAY 2025

- TABLE 189 BIOLIFE SOLUTIONS, INC.: DEALS, JANUARY 2021-MAY 2025

- TABLE 190 BRIDGE TO LIFE LIMITED: COMPANY OVERVIEW

- TABLE 191 BRIDGE TO LIFE LIMITED: PRODUCTS OFFERED

- TABLE 192 BRIDGE TO LIFE LIMITED: PRODUCT LAUNCHES & APPROVALS, JANUARY 2021-MAY 2025

- TABLE 193 BRIDGE TO LIFE LIMITED: DEALS, JANUARY 2021-MAY 2025

- TABLE 194 WATERS MEDICAL SYSTEMS LLC: COMPANY OVERVIEW

- TABLE 195 WATERS MEDICAL SYSTEMS LLC: PRODUCTS OFFERED

List of Figures

- FIGURE 1 ORGAN PRESERVATION MARKET: RESEARCH DESIGN

- FIGURE 2 LIST OF PRIMARY SOURCES

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 7 REVENUE SHARE ANALYSIS ILLUSTRATION: XVIVO PERFUSION AB (2024)

- FIGURE 8 ILLUSTRATIVE EXAMPLE OF PROCEDURE-BASED MARKET ESTIMATION

- FIGURE 9 SUPPLY-SIDE MARKET SIZE ESTIMATION: ORGAN PRESERVATION MARKET (2024)

- FIGURE 10 TOP-DOWN APPROACH

- FIGURE 11 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN ORGAN PRESERVATION MARKET (2025-2030)

- FIGURE 12 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 13 DATA TRIANGULATION METHODOLOGY

- FIGURE 14 ORGAN PRESERVATION MARKET, BY SOLUTION, 2025 VS. 2030 (USD MILLION)

- FIGURE 15 ORGAN PRESERVATION MARKET, BY TECHNIQUE, 2025 VS. 2030 (USD MILLION)

- FIGURE 16 ORGAN PRESERVATION MARKET, BY ORGAN TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 17 ORGAN PRESERVATION MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 18 GEOGRAPHIC ANALYSIS OF ORGAN PRESERVATION MARKET

- FIGURE 19 RISING NUMBER OF SOLID ORGAN TRANSPLANTS TO DRIVE ORGAN PRESERVATION MARKET

- FIGURE 20 UNIVERSITY OF WISCONSIN SOLUTION AND CHINA SEGMENTS ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC ORGAN PRESERVATION MARKET IN 2024

- FIGURE 21 CHINA TO REGISTER FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 22 NORTH AMERICA TO DOMINATE ORGAN PRESERVATION MARKET TILL 2030

- FIGURE 23 EMERGING MARKETS TO REGISTER HIGHER GROWTH RATES DURING FORECAST PERIOD

- FIGURE 24 ORGAN PRESERVATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 25 ORGAN PRESERVATION MARKET: ECOSYSTEM ANALYSIS

- FIGURE 26 ORGAN PRESERVATION MARKET: VALUE CHAIN ANALYSIS

- FIGURE 27 SUPPLY CHAIN ANALYSIS: ORGAN PRESERVATION MARKET (2024)

- FIGURE 28 TOP PATENT APPLICANTS AND OWNERS (COMPANIES/INSTITUTES) FOR ORGAN PRESERVATION SOLUTIONS (JANUARY 2014-APRIL 2025)

- FIGURE 29 JURISDICTION ANALYSIS: TOP APPLICANT COUNTRIES FOR ORGAN PRESERVATION PATENTS, 2014-2025

- FIGURE 30 ORGAN PRESERVATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 SOLUTIONS

- FIGURE 32 KEY BUYING CRITERIA FOR TOP 3 SOLUTIONS

- FIGURE 33 TRENDS AND DISRUPTIONS DISRUPTING CUSTOMER BUSINESS IN ORGAN PRESERVATION MARKET

- FIGURE 34 ORGAN PRESERVATION MARKET: INVESTMENT AND FUNDING SCENARIO, 2021-2024

- FIGURE 35 ORGAN PRESERVATION MARKET: AI INTEGRATION

- FIGURE 38 ASIA PACIFIC: ORGAN PRESERVATION MARKET SNAPSHOT

- FIGURE 39 REVENUE ANALYSIS OF KEY PLAYERS IN ORGAN PRESERVATION MARKET (2021-2024)

- FIGURE 40 MARKET SHARE ANALYSIS OF KEY PLAYERS (2024)

- FIGURE 41 ORGAN PRESERVATION MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 42 ORGAN PRESERVATION MARKET: COMPANY FOOTPRINT

- FIGURE 43 ORGAN PRESERVATION MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 44 YEAR-TO-DATE (YTD) PRICE, TOTAL RETURN, AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 45 EV/EBITDA OF KEY VENDORS

- FIGURE 46 ORGAN PRESERVATION MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 47 XVIVO PERFUSION AB: COMPANY SNAPSHOT (2024)

- FIGURE 48 TRANSMEDICS, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 49 BIOLIFE SOLUTIONS, INC.: COMPANY SNAPSHOT (2024)