|

市場調查報告書

商品編碼

1827023

產業用推動器的數位化:引進報告 (2025年)Digitalization of Industrial Drives - Adoption Report 2025 |

|||||||

樣品預覽

現代工業推動正在從獨立組件發展成為互聯互通的軟體定義資產。這種數位化使用戶能夠即時監控設備狀態、遠端調整性能並同時控制多個推動。這項變更為原始設備製造商 (OEM)、系統整合商 (SI) 和最終用戶帶來了新的機會和課題。

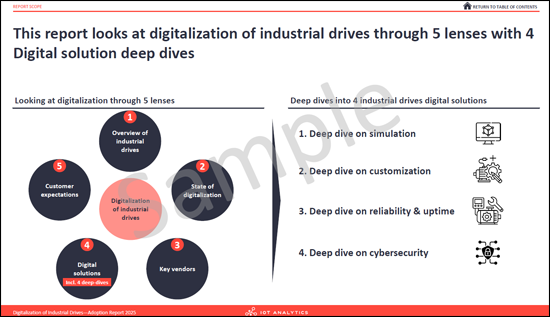

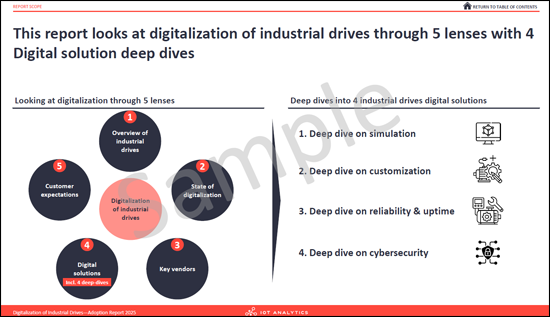

本報告系統性地分析了關鍵數位化解決方案在整個工業推動生命週期中的應用。報告從五個不同的角度審視市場:工業推動概述、數位化現狀、主要技術供應商的趨勢、四個數位化解決方案領域的詳細分析以及客戶期望分析。

本研究包含問卷調查和針對工業推動原始設備製造商和系統整合商的深入訪談。受訪者來自歐洲、北美、中東和非洲等多個產業。

樣品預覽

報告概要

- 157頁報告:全面涵蓋工業推動數位化解決方案的實施。

- 四大數位化解決方案分析:深入研究四個領域:模擬、客製化、可靠性與可用性、網路安全。

- 涵蓋 30 多個產業的資料:涵蓋製造業、能源業、採礦業和金屬業等眾多產業。

- 供應商格局細分:主要供應商依解決方案類型、地區、公司特徵和產業進行分類。

- 客戶期望模型:詳細分析客戶對製造商支援和定價的需求。

重點分析領域

- 工業推動概述:提供機械、電動和液壓/氣動推動的定義和分類,特別關注電動推動。本報告介紹了推動系統的關鍵組件和典型的軟體堆疊。

- 數位化現況:我們按地區、公司規模和產業分析客戶的數位化成熟度, 識別數位化應用的推動因素和障礙,並描述原始設備製造商 (OEM) 和系統整合商 (SI) 的客戶旅程。

- 工業推動供應商格局:我們按地區、公司特徵、產業垂直領域和解決方案類別全面介紹推動相關的數位解決方案供應商。

- 模擬解決方案深度分析:我們分析了整個生命週期中的 11 個模擬用例,考察了所使用的工具類型、採用推動因素、實施課題和可靠性因素。

- 客製化解決方案深度分析:我們考察了 11 個客製化用例和場景,詳細說明了客製化方法、採用動機和實施課題。

- 可靠性和可用性解決方案深度分析:我們分析了八種數位可靠性和可用性解決方案,考察如何從推動系統收集數據以及整合外部監控解決方案的課題。

- 網路安全解決方案深度分析:我們評估了 26 個安全框架的採用情況,並分析了這些框架的重要性、採用的推動因素和障礙。

- 客戶期望:我們分析製造商在模擬、客製化、可靠性和正常運行時間以及網路安全方面的支援需求,並研究先進數位解決方案的定價預期。

刊載企業

本報告所涵蓋的部分公司:

|

|

|

目錄

第1章 摘要整理

第2章 簡介

第3章 產業用推動器的數位化的現狀

第4章 產業用推動器供應商

第5章 數位解決方案詳細內容

- 1.模擬

- 2.客制化

- 3.與可靠性運作時間

- 4.網路安全

第6章 客戶的期待

第7章 調查手法

第8章 關於IoT Analytics

A 157-page report on the adoption of key digital solutions across the life cycle of industrial drives, based on a survey of industrial drives OEM and system integrators as well as in-depth interviews.

Sample preview

Modern industrial drives have evolved from stand-alone components into connected, software-defined assets. This digitalization allows users to monitor conditions in real time, tune performance remotely, and orchestrate entire fleets of drives. This shift creates a new landscape of opportunities and challenges for original equipment manufacturers (OEMs), system integrators (SIs), and their end customers.

The "Digitalization of Industrial Drives - Adoption Report 2025" provides a structured analysis of the adoption of key digital solutions across the life cycle of industrial drives. It examines the market through five distinct lenses: an overview of industrial drives, the current state of digitalization, the landscape of key technology vendors, deep dives into four digital solution categories, and an analysis of customer expectations.

The research is based on a survey of industrial drive OEMs and system integrators, supplemented by in-depth interviews. The participants were selected across various industries in Europe, North America, and the Middle East & Africa.

Sample preview

Report at a glance:

- 157-page report: Detailing the adoption of digital solutions for industrial drives.

- 4 in-depth digital solution analyses: A deep-dive into 4 industrial drives digital solutions: Simulation, Customization, Reliability & Uptime, and Cybersecurity.

- Data from 30+ industrial verticals: Insights drawn from a wide range of sectors, including various types of manufacturing, energy, mining, and basic metals.

- Vendor landscape breakdown: An analysis of the primary industrial drive technology vendor market by solution type, region, company profile, and industry.

- Customer expectation models: A dedicated analysis of customer requirements for manufacturer support and pricing for digital solutions.

Key areas of analysis:

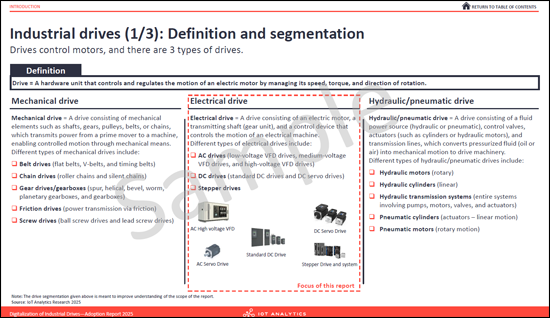

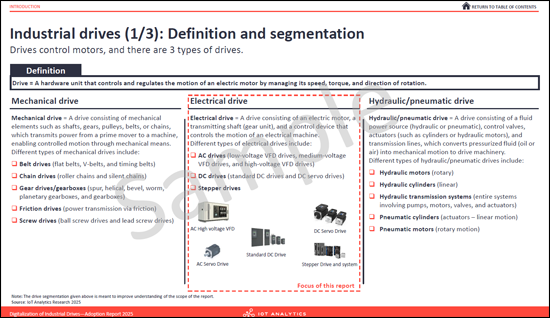

- Introduction to industrial drives: Details the definition and segmentation of mechanical, electrical, and hydraulic/pneumatic drives, with a focus on electrical drives. It also outlines the key components of a drive system and a typical electrical drive software stack.

- State of digitalization: Analyzes the digital maturity of end customers by region, company profile, and industry. It examines the primary drivers and challenges influencing the adoption of digital solutions and describes the customer journey for both OEMs and SIs.

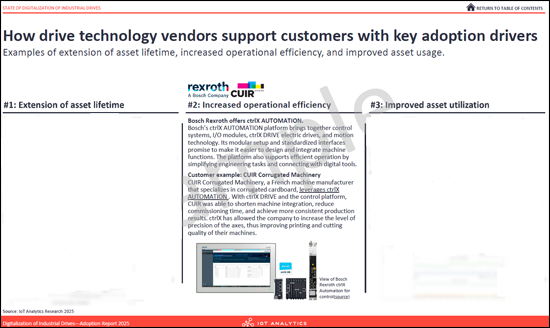

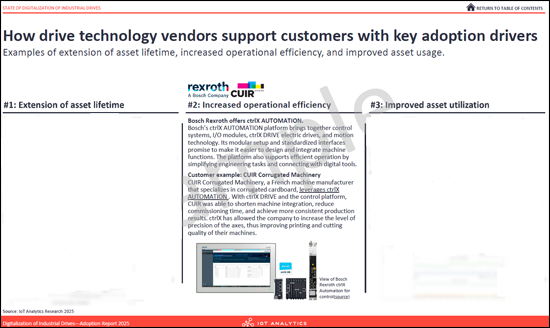

- Industrial drive vendor landscape: Presents an overview of vendors for drive digital solutions. The analysis breaks down the landscape by region, company profile, served industry, and specific digital solution category.

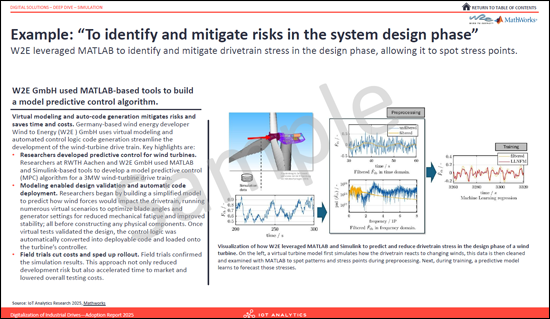

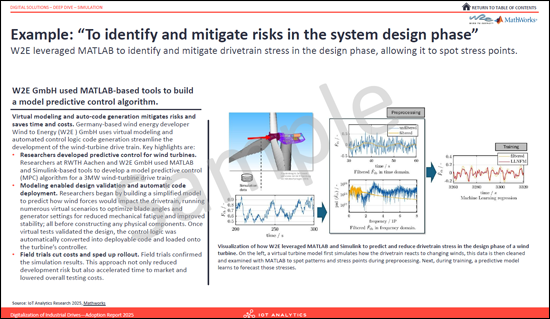

- Simulation solutions deep dive: Examines 11 simulation use cases across the drive life cycle, including the types of simulation tools used. The analysis details the drivers and challenges for adoption and discusses factors that build trust in simulation results.

- Customization solutions deep dive: Investigates 11 customization use cases and scenarios. It details the various methods used for drive customization, key adoption drivers, and implementation challenges.

- Reliability & uptime solutions deep dive: Analyzes 8 digital reliability and uptime solutions. The section outlines common data collection methods from drive systems and examines the issues faced when integrating third-party condition monitoring solutions.

- Cybersecurity solutions deep dive: Details the state of cybersecurity adoption, including an analysis of 26 different frameworks. It examines the importance placed on various security frameworks and outlines the key drivers and challenges for adoption.

- Customer expectations: Analyzes customer requirements for manufacturer support across simulation, customization, reliability & uptime, and cybersecurity. It also examines customer pricing expectations for premium digital solutions.

A data-driven foundation for key business functions:

- Strategy & corporate development: Inform strategic planning and market positioning with analysis of digital maturity levels, adoption drivers, and implementation challenges across different industries and regions.

- Product management & marketing: Guide product roadmaps and messaging with detailed examinations of digital solution use cases, the vendor landscape, and specific customer expectations for features and support.

- R&D & engineering leadership: Direct technical development priorities with insights into customer journeys, technical challenges, and expectations for simulation models, customization tools, and embedded cybersecurity.

- Market intelligence & competitive analysis: Benchmark offerings and identify market opportunities using the structured breakdown of the technology vendor landscape by region, industry, and digital solution.

Key concepts defined:

- Industrial drives: The report focuses on electrical drives, which are hardware units that control and regulate the motion of an electric motor by managing its speed, torque, and direction. They function as the "brain" of a larger drive system that converts electrical energy into mechanical energy.

- Simulation: The use of software tools to create a virtual model of a drive system. This model allows for testing the drive's behavior under various operating conditions without needing to test on a physical system.

- Customization: The use of specialized software tools to adapt and optimize drive operations according to the unique requirements of each customer, including performance profiles and control interfaces.

- Reliability & uptime: The set of integration-, operation-, and maintenance-related activities that are critical to ensuring the highest level of drive availability and utilization.

- Cybersecurity: The deployment of security measures such as secure boot, encrypted telemetry, access controls, and intrusion detection to defend industrial drives against cyber threats.

Questions answered:

- What are the life cycle stages of an industrial drive and key digital solutions?

- What is the digital maturity of end customers and the drivers and challenges in adoption of digital solutions?

- What are some of the key vendor of drive digital solutions?

- What are some of the "Simulation" solution use cases and the drivers and challenges to its adoption?

- What are some of the "Customization" solution use cases and the drivers and challenges to its adoption?

- What are some of the "Reliability & uptime" solutions and the drivers and challenges to its adoption?

- What are some of the "Cybersecurity" frameworks and the drivers and challenges to its adoption?

- What are the customer expectations from a drive manufacturer?

Companies mentioned:

A selection of companies mentioned in the report.

|

|

|

Table of Contents

1. Executive Summary

2. Introduction

3. State of digitalization of industrial drives

4. Industrial drive vendors

5. Digital solutions deep dive

- 1. Simulation

- 2. Customization

- 3. Reliability and uptime

- 4. Cybersecurity