|

市場調查報告書

商品編碼

1827022

季度趨勢報告:CEO們在2025年第三季談了什麼Quarterly Trend Report: What CEOs Talked About in Q3 2025 |

|||||||

本報告分析了2025年第三季美國上市公司財報電話會議中所出現的趨勢。 數據基於2019年第一季至2025年第三季超過11萬場財報電話會議。

樣品預覽

樣品預覽

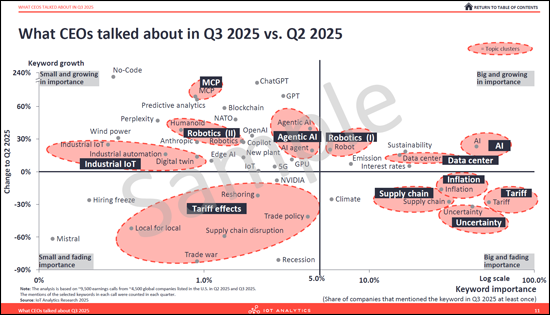

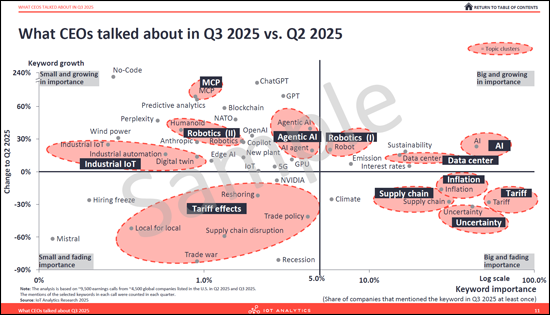

2025年第3季新興的主要主題

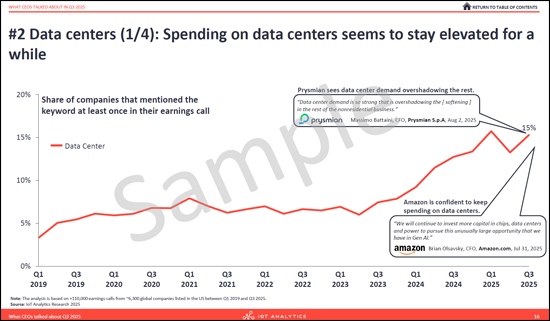

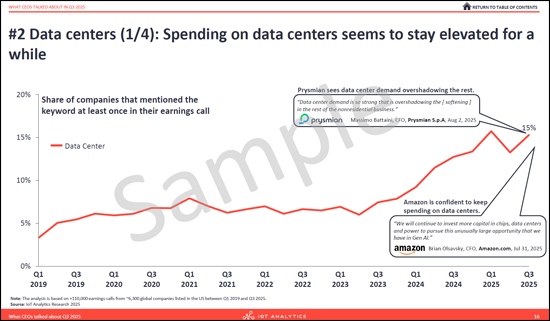

- 資料中心

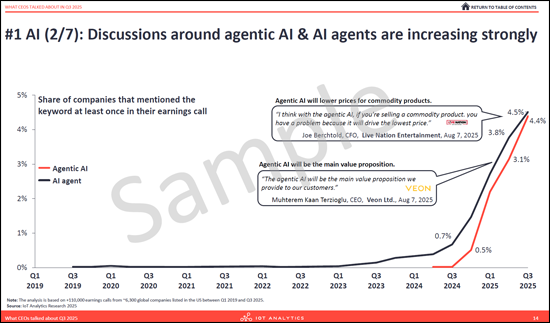

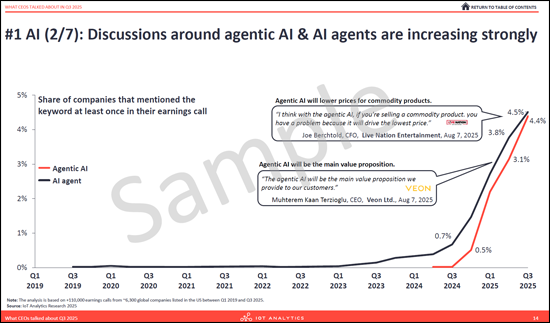

- 代理商型AI和AI代理商

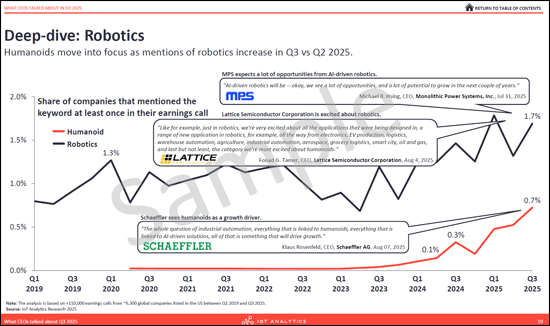

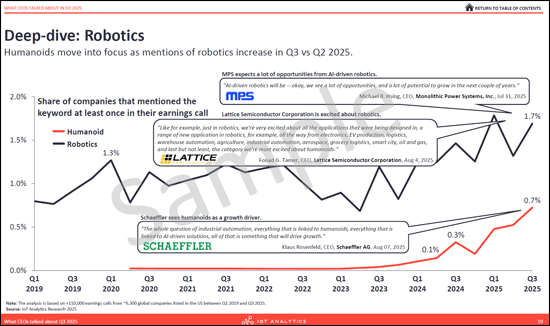

- 機器人工學

2025年第3季衰退的主要主題

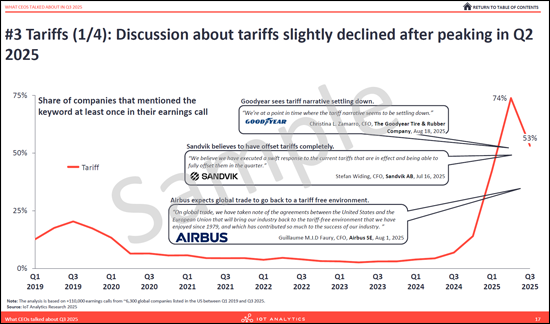

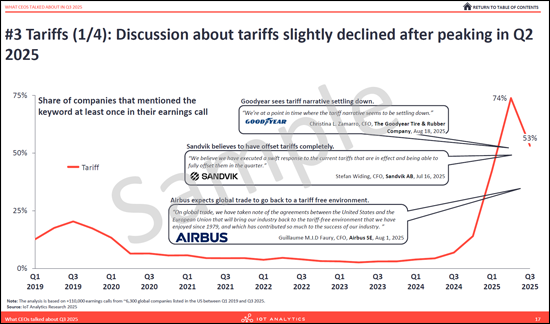

- 關稅

- 不確定性

- 景氣衰退

CEO 的五個關鍵問題

- 您的關稅應對措施是否與第三季一致? 關稅仍然是最常被提及的話題。定價、供應商組合和緩解策略(雙重採購、近岸選項等)請重新評估您的策略。

- 您在 AI 人才爭奪戰中是否勝出? 需求正在快速成長。重新審視您招募、提陞技能和留住 AI 工程師、資料科學家和產品負責人的計畫。確定哪些職位需要立即填補。確定可以填補當前潛在空缺的合作夥伴關係。

- 您是否從人工智慧和代理商中獲得了可衡量的投資回報率 (ROI)? 人工智慧的提及率達到了歷史最高水平,代理人工智慧也正在迅速崛起。請優先考慮成功的用例,加強治理,並規劃所需的技能和招募。

- 您未來 12 個月的自動化和機器人策略路線圖是什麼? 人們對機器人(包括人形機器人)的興趣日益濃厚。請確定試點生產線,定義安全和變更管理步驟,並確定簡單的投資報酬率 (ROI) 指標以進行擴展。

- 您是否應該重新評估需求計畫和生產能力,以應對波動風險? 每週領先指標(訂單、取消訂單、庫存)我們將引入靈活的生產系統,並預先批准加班規則。我們將精簡長尾 SKU,並建立一個快速反應價格波動的系統。

樣品預覽

目錄

第1章 摘要整理

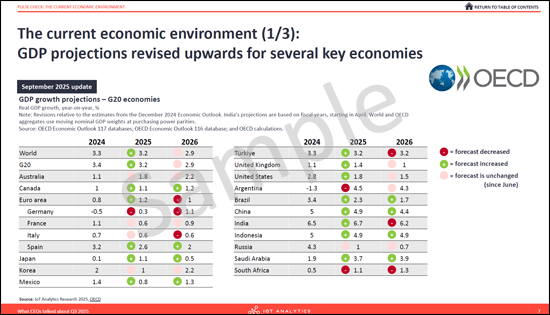

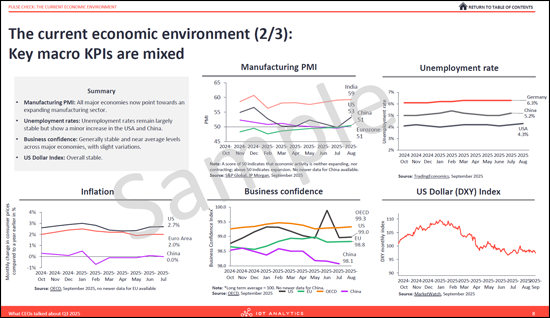

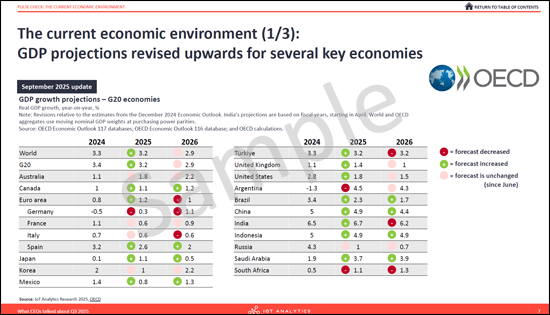

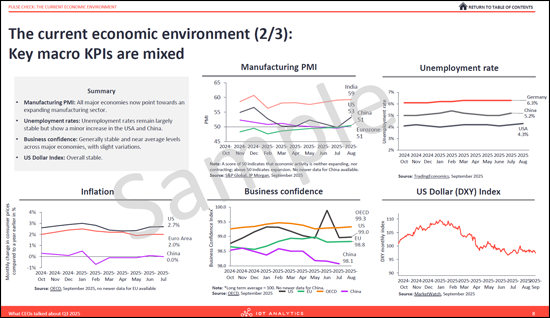

第2章 脈衝檢查:目前經濟環境

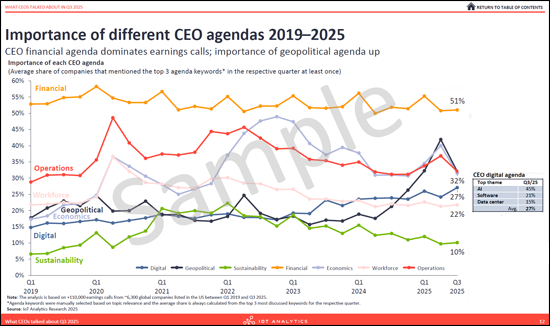

第3章 2025年第3季的CEO的話題

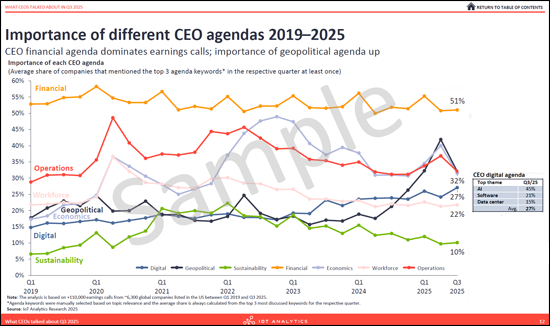

- 自 2019 年第一季以來財報電話會議中討論的關鍵議題重要性的變化

- AI

- 資料中心

- 關稅

- 詳細內容:部門概要

- 詳細內容:主要專題

製造業的詳細分析

- 製造業 CEO 語錄

- 當前課題

第5章 產業·各地區感情與展望

第6章 附錄

A 60-page report on the trends that emerged in Q3 2025 earnings calls. The report is based on data of 110,000+ earnings calls of US-listed companies from Q1 2019 through Q3 2025.

Sample preview

The "Quarterly trend report: What CEOs talked about in Q3 2025" is part of IoT Analytics' ongoing coverage of the IoT and related technology markets. The information presented in this report is based on a database of 110,000+ earnings calls of US-listed companies from Q1 2019 through Q3 2025. Every quarter, IoT Analytics analyzes some trends that emerge in the earnings calls and presents some findings for the most recent quarter. The purpose is to inform other market participants about the current focus of CEOs and companies. To ensure objectivity, IoT Analytics did not alter or supplement any results and did not exclude any earnings calls deliberately.

Sample preview

Key rising themes in Q3 2025

- Data centers

- Agentic AI and AI agents

- Robotics

Key declining themes in Q3 2025

- Tariffs

- Uncertainty

- Recession

5 critical questions for CEOs

- Are our tariff responses still fit for Q3 conditions? Tariffs remain the most cited topic. Recheck pricing, supplier mix, and mitigation strategies (e.g., dual sourcing, nearshore options).

- Are we set to win the AI talent race? Demand is rising fast. Check on the plan to hire, upskill, and retain AI engineers, data scientists, and product owners. Identify which roles need to be filled immediately. Do we have partnerships that can fill a potential gap at this time?

- Do we have measurable ROI from AI and agents today? AI mentions hit a new high, with agentic AI rising fast. Prioritize use cases with tracked outcomes, tighten governance, and plan skills and hiring where needed.

- What is our automation and robotics roadmap for 12 months? Interest in robotics (including humanoids) is growing. Identify pilot lines, define safety and change management steps, and establish simple ROI gates for scale-up.

- Should we stress-test demand planning and capacity to handle sudden demand fluctuations now? Add weekly leading indicators (orders, cancellations, and channel inventory). Pre-approve flex capacity and overtime rules. Trim long-tail SKUs. Tighten pricing guardrails for rapid moves up or down.

Sample preview

Questions answered:

- How is the overall economic environment in Q3 2025?

- What are some of the upcoming trends that CEOs talk about?

- What keywords were most prevalent in the earnings calls in the last quarter?

- What are the key themes that CEOs discuss related to the main keywords?

- Which themes have lost importance in the last few years?

- What are upcoming trends in different sectors?

- How did the sentiment change in earnings calls in Q3 2025?

Table of Contents

1. Executive summary

2. Pulse check: The current economic environment

3. What CEOs talked about in Q3 2025

- 3.1. Importance of selected topics in earnings calls since Q1 2019

- 3.2. AI

- 3.3. Data Centers

- 3.4. Tariffs

- 3.5. Deep-dive: Sector overview

- 3.6. Deep-dive: Selected topics

Manufacturing deep-dive

- 4.1. What manufacturing CEOs talked about

- 4.2. Current challenges