|

市場調查報告書

商品編碼

1759928

季度趨勢報告:2025 年第二季 CEO 熱門話題Quarterly Trend Report: What CEOs Talked About in Q2 2025 |

|||||||

這份 61 頁的報告總結了 2025 年第二季財報電話會議中所出現的趨勢。該報告是根據 2019 年第一季至 2025 年第二季美國上市公司超過 11 萬場財報電話會議的數據。

樣品預覽

本報告是 IoT Analytics 對物聯網及相關技術市場持續通報的一部分。報告提供的資訊是根據一個包含 2019 年第一季至 2025 年第二季超過 110,000 份美國上市公司財報電話會議的資料庫。 IoT Analytics 每季都會分析財報電話會議中出現的一些趨勢,並顯示最近一個季度的調查結果。其目的是讓其他市場參與者了解 CEO 和公司目前關注的重點。為了確保客觀性,IoT Analytics 不會更改或補充其任何結果,也不會故意排除任何財報電話會議。

樣品預覽

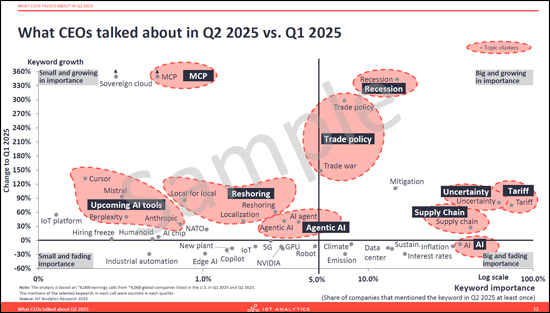

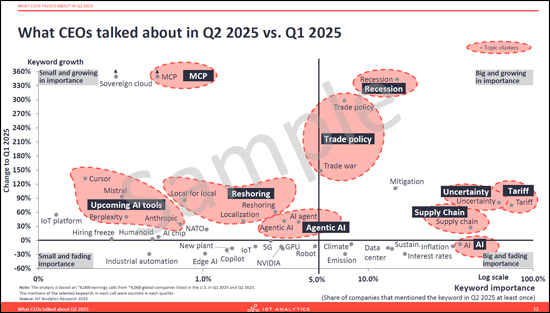

2025年第2季受到關注高漲了的主要的題目:

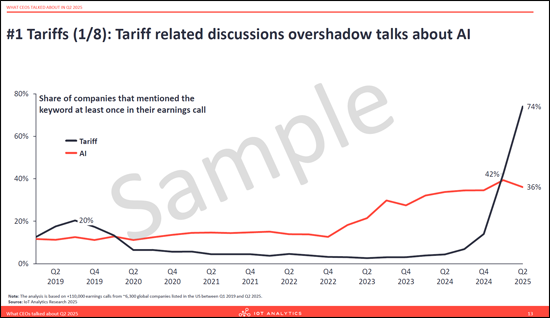

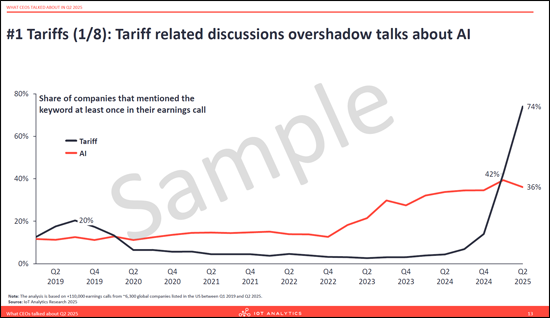

- 關稅

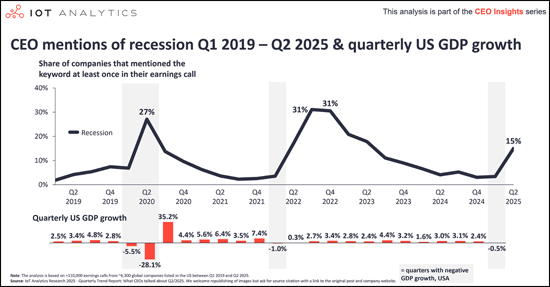

- 景氣衰退的可能性

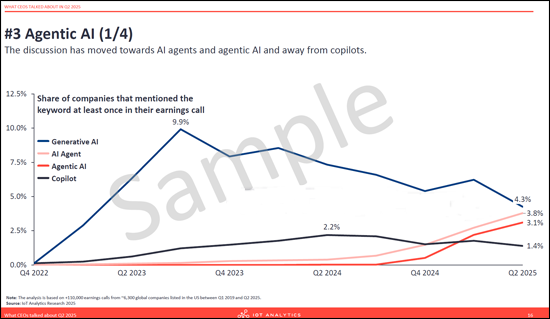

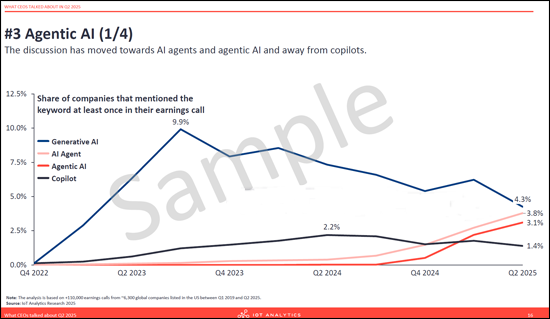

- 代理商型AI

2025年第2季受到關注降低了的主要的題目:

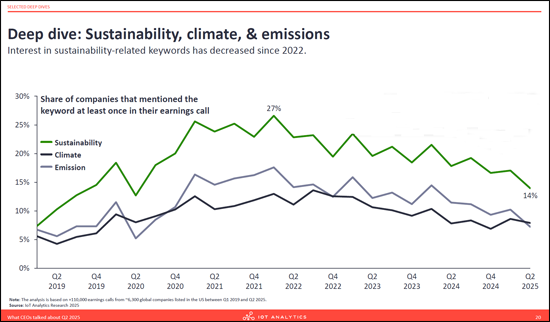

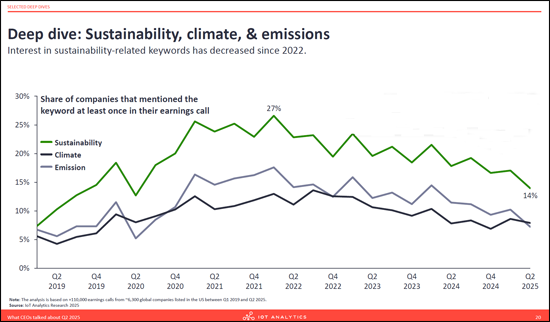

- 永續性

- 有關AI的一般的專題

樣品預覽

CEO 的五個關鍵問題:

- 關稅的影響:關稅是 CEO 們討論最多的議題-我們如何重新思考我們的定價策略、供應鏈配置和採購決策最大限度地降低風險?

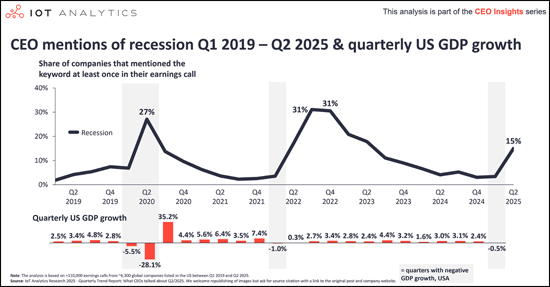

- 經濟衰退準備:隨著宏觀經濟不確定性持續存在,以及經濟衰退討論的增多,我們是否已為潛在的經濟衰退做好準備?

- 貿易政策:隨著各國政府繼續就貿易協定和關稅進行談判,我們是否已掌握決策流程,並為各種情況做好準備?

- 代理AI準備:隨著基於代理的AI技術日益普及,我們的組織是否已準備好將這些技術整合到我們的業務流程中?在採用AI方面,我們如何與競爭對手脫穎而出?

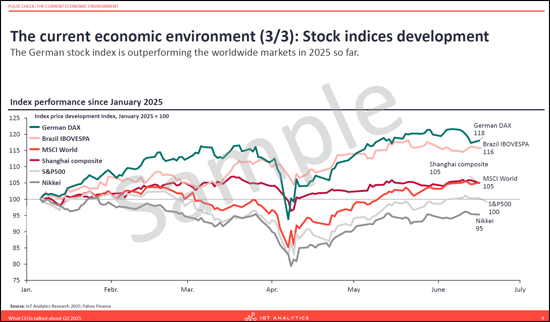

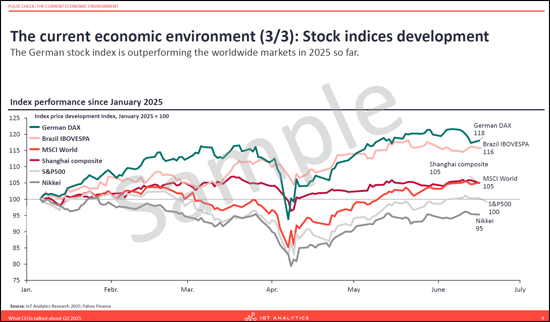

- 市場情緒下滑:隨著全球市場情緒下滑,我們是否已準備好幫助我們的客戶和業務夥伴應對他們面臨的具體課題?

問題解答:

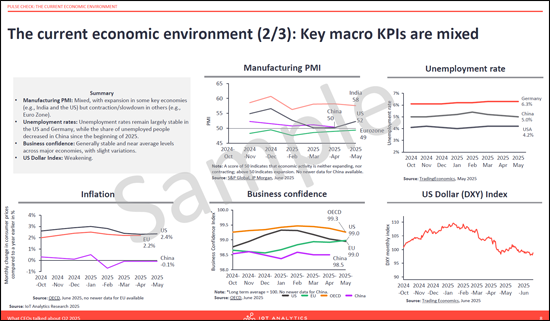

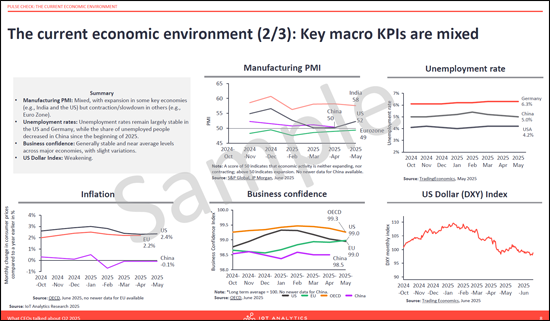

- 2025年第二季的整體經濟環境如何?

- 執行長們正在討論哪些未來趨勢?

- 上季財報電話會議上最熱門的關鍵字是什麼?

- CEO們討論的與關鍵字相關的關鍵主題是什麼?

- 近年來哪些主題變得不再重要?

- 各行業的未來趨勢是什麼?

- 2025 年第二季財報電話會議的市場情緒有何變化?

目錄

第1章 摘要整理

第2章 脈衝檢查:目前經濟環境

第3章 2025年第2季的CEO的話題

- 2019年第一季以後的決算說明會被選擇了的專題的重要性

- 關稅

- 不景氣

- 代理商AI

第4章 關鍵深度分析

- 行業概覽

- 工業部門

- 人工智慧

- 回流

- 其他

第5章 各業界的感情與展望

第6章 附錄

A 61-page report on the trends that emerged in Q2 2025 earnings calls. The report is based on data of 110,000+ earnings calls of US-listed companies from Q1 2019 through Q2 2025.

Sample preview

The "Quarterly trend report: What CEOs talked about in Q2 2025" is part of IoT Analytics' ongoing coverage of the IoT and related technology markets. The information presented in this report is based on a database of 110,000+ earnings calls of US-listed companies from Q1 2019 through Q2 2025. Every quarter, IoT Analytics analyzes some trends that emerge in the earnings calls and presents some findings for the most recent quarter. The purpose is to inform other market participants about the current focus of CEOs and companies. To ensure objectivity, IoT Analytics did not alter or supplement any results and did not exclude any earnings calls deliberately.

Sample preview

Key rising themes in Q2 2025:

- Tariffs

- Possibility of recession

- Agentic AI

Key declining themes in Q2 2025:

- Sustainability

- General topics around AI

Sample preview

5 critical questions for CEOs:

- Tariff impact: With tariffs being the most discussed topic among CEOs, how should we adjust our pricing strategies, supply chain setup, and sourcing decisions to minimize risks?

- Recession preparation: Given ongoing macroeconomic uncertainty and increasing discussions about recessions, are we prepared for a potential recession?

- Trade policy: Governments worldwide are involved in ongoing negotiations on trade deals and tariff agreements. Are we monitoring the decision-making process and preparing for various eventualities?

- Agentic AI readiness: As agentic AI gains traction, is our organization equipped to integrate these capabilities into our business processes, and how do we differentiate from competitors in AI adoption?

- Decreasing sentiment: With global sentiment declining, are we ready to help our customers and business partners in addressing their specific pain points?

Questions answered:

- How is the overall economic environment in Q2 2025?

- What are some of the upcoming trends that CEOs talk about?

- What keywords were most prevalent in the earnings calls in the last quarter?

- What are the key themes that CEOs discuss related to the main keywords?

- Which themes have lost importance in the last few years?

- What are upcoming trends in different sectors?

- How did the sentiment change in earnings calls in Q2 2025?

Table of Contents

1. Executive summary

2. Pulse check: The current economic environment

3. What CEOs talked about in Q2 2025

- Importance of selected topics in earnings calls since Q1 2019

- 3.1. Tariffs

- 3.2. Recession

- 3.3. Agentic AI

4. Selected deep-dives

- 4.1. Sector overview

- 4.2. Industrial sector

- 4.3. AI

- 4.4. Reshoring

- 4.5. Other