|

市場調查報告書

商品編碼

1928864

生質柴油及生質燃料加工設備市場機會、成長要素、產業趨勢分析及預測(2026-2035)Biodiesel and Biofuels Processing Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

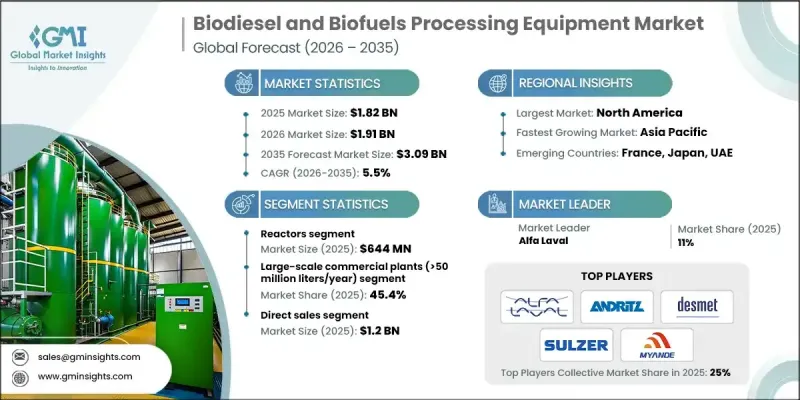

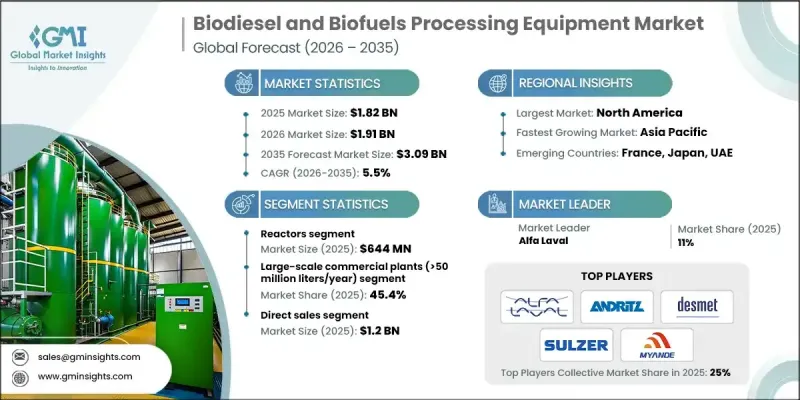

全球生質柴油和生質燃料加工設備市場預計到 2025 年將達到 18.2 億美元,預計到 2035 年將達到 30.9 億美元,年複合成長率為 5.5%。

在全球各地,人們正積極反思如何開發和部署能源系統,以應對日益成長的淨零排放目標壓力。各國政府、企業和投資者正將目光從石化燃料轉向可再生和低碳能源來源。推動這項轉變的因素包括:氣候變遷相關風險日益加劇、各產業對環境、社會和管治(ESG)課責的日益重視,以及持續的技術進步使可再生燃料在成本和性能方面更具競爭力。生質燃料被視為國家和產業脫碳策略的關鍵組成部分,尤其是在缺乏即時替代方案的地區。對高能量、相容燃料的需求正在加速成長,促使企業加大對新建生產設施和先進加工設備的投資。製造商優先考慮擴充性、高效且可靠的系統,以確保長期燃料供應安全,同時滿足監管規定的混合比例和永續性目標。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 18.2億美元 |

| 預測金額 | 30.9億美元 |

| 複合年成長率 | 5.5% |

市場持續受益於對先進生產設備的投資增加,這些設備能夠實現高產量和穩定的運作性能。生產商越來越傾向於尋求能夠提高效率、增加產量並實現連續運作的系統。這項變更反映了更廣泛的趨勢,即向現代化設備配置轉型,以提高運作柔軟性和成本控制,從而使製造商能夠有效地滿足日益成長的全球燃料需求。

預計到2025年,反應器市場規模將達到6.44億美元。這些系統仍然是生物柴油和生質燃料生產的核心,因為它們是生產設施中的核心處理單位。市場需求傾向於能夠提供穩定條件、高轉換效率和更高產量的解決方案。設備供應商不斷開發先進的設計,這些設計超越了傳統系統,能夠實現連續運作、更好的製程控制和擴充性,從而滿足工業級生產需求。

年產量超過5000萬公升的大型商業設施在2025年佔了45.4%的市場。這些工廠在滿足政府的摻混規定以及向工業用戶供應可再生燃料方面發揮關鍵作用。實現全年不間斷運作需要先進的工程技術、可靠的設備以及強大的原料採購物流支援。大規模生產降低了單位成本,使生質燃料與傳統燃料相比更具競爭力。

預計到2025年,北美生質柴油和生質燃料加工設備市場將佔據77.2%的市場佔有率,市場規模達4.751億美元。聯邦和州政府的激勵措施持續支持無污染燃料的推廣應用,鼓勵生產者擴大產能。隨著商業營運商建設規模更大的生產設施,為滿足可再生燃料標準和日益成長的替代燃料應用需求,相關設備的需求也不斷上升。

目錄

第1章調查方法和範圍

第2章執行摘要

第3章業界考察

- 生態系分析

- 供應商情況

- 利潤率

- 每個階段的附加價值

- 影響價值鏈的因素

- 產業影響因素

- 促進要素

- 全球脫碳和能源轉型

- 政府混合義務和政策獎勵

- 擴大先進生質燃料(HVO、SAF)的引進

- 產業潛在風險與挑戰

- 高昂的資本成本

- 基礎設施和供應鏈中的脆弱性

- 機會

- 先進生質燃料工廠擴建

- 航空和航運業可再生燃料的成長

- 促進要素

- 成長潛力分析

- 未來市場趨勢

- 科技與創新趨勢

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 透過裝置

- 監管環境

- 標準和合規要求

- 區域法規結構

- 認證標準

- 波特分析

- PESTEL 分析

第4章 競爭情勢

- 介紹

- 公司市佔率分析

- 按地區

- 企業矩陣分析

- 主要市場公司的競爭分析

- 競爭定位矩陣

- 重大進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章 依設備類型分類的市場估算與預測(2022-2035 年)

- 熱交換器

- 製程冷卻和加熱熱交換器

- 甲醇回收熱交換器

- 甘油加工熱交換器

- 每套熱交換器單元的管體積

- 蒸餾塔

- 甲醇精煉塔

- 甘油精煉塔

- 原料預處理塔

- 每塔管數

- 蒸發濃縮系統

- 甲醇閃蒸器

- 降膜蒸發器

- 反應爐

第6章 市場估算與預測:依材質(2022-2035 年)

- 304/304L不銹鋼管

- 316/316L不銹鋼管

- 雙相和超雙相不銹鋼管

- 鈦管

- 鎳合金及其他材質

第7章 市場估計與預測:依應用領域分類(2022-2035 年)

- 甲醇回收提純系統

- 甘油回收純化系統

- 原料預處理和製備

- 酯交換反應的溫度控管

- 生質柴油/FAMA冷卻和表面處理工程

- 可再生柴油(HVO/HEFA)高壓系統

第8章 依最終用途規模分類的市場估算與預測(2022-2035 年)

- 大型商業工廠(年產量超過5000萬公升)

- 中型區域性工廠(年產1000萬至5000萬公升)

- 小規模分散式生產(年產量低於1000萬公升)

- 農場和合作生物柴油系統

第9章 按分銷管道分類的市場估計和預測(2022-2035 年)

- 直銷

- 間接銷售

第10章 各地區市場估計與預測(2022-2035 年)

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第11章 公司簡介

- Advance Biofuel

- Alfa Laval

- American Crane &Equipment

- ANDRITZ

- CPM Crown

- Desmet

- Ecolab

- Florida Biodiesel

- JBT

- Myande

- N&T Engitech

- S. Howes

- Springboard Biodiesel

- SRS International

- Sulzer

The Global Biodiesel and Biofuels Processing Equipment Market was valued at USD 1.82 billion in 2025 and is estimated to grow at a CAGR of 5.5% to reach USD 3.09 billion by 2035.

Communities worldwide are actively reassessing how energy systems are developed and deployed as pressure increases to achieve net-zero targets. Governments, corporations, and investors are shifting their focus away from fossil fuel dependency and toward renewable and low-carbon energy sources. This transition is driven by increasing climate-related risks, stronger ESG accountability across industries, and continuous technological improvements that allow renewable fuels to compete on cost and performance. Biofuels are positioned as essential components in national and sector-specific decarbonization strategies, especially where immediate alternatives remain limited. Demand is accelerating in industries that require high-energy, compatible fuels, which is leading to greater investment in new production facilities and advanced processing equipment. Manufacturers are prioritizing scalable, efficient, and reliable systems that can support long-term fuel supply stability while meeting regulatory blending mandates and sustainability objectives.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.82 Billion |

| Forecast Value | $3.09 Billion |

| CAGR | 5.5% |

The market continues to benefit from rising investment in advanced production equipment designed to support higher throughput and consistent operational performance. Producers increasingly demand systems that improve efficiency, enhance output, and support continuous operation. This shift reflects a broader move toward modernized equipment configurations that deliver operational flexibility and improved cost control, allowing manufacturers to respond more effectively to growing global fuel demand.

The reactors segment generated USD 644 million in 2025. These systems remain central to biodiesel and biofuel manufacturing, as they serve as the core processing units within production facilities. Market demand favors solutions that deliver stable conditions, higher conversion efficiency, and increased output volumes. Equipment suppliers continue to develop advanced designs that outperform traditional systems by enabling continuous operation, better process control, and greater scalability to meet industrial-level production requirements.

The large-scale commercial facilities with annual output exceeding 50 million liters accounted for 45.4% share in 2025. These plants play a vital role in meeting government blending mandates while supplying renewable fuels to industrial consumers. Their ability to operate continuously throughout the year requires sophisticated engineering, dependable equipment, and strong logistics support for feedstock sourcing. High-volume production allows these facilities to achieve lower per-unit costs, making biofuels increasingly competitive with conventional fuels.

North America Biodiesel and Biofuels Processing Equipment Market held 77.2% share and generated USD 475.1 million in 2025. Federal and state-level incentives continue to support the adoption of cleaner fuels, encouraging producers to expand capacity. Equipment demand is rising as commercial operators develop large production facilities to comply with renewable fuel standards and respond to increasing interest in alternative fuel applications.

Key companies operating in the Global Biodiesel and Biofuels Processing Equipment Market include Alfa Laval, ANDRITZ, Desmet, Sulzer, Myande, CPM Crown, JBT, SRS International, N&T Engitech, Advance Biofuel, Florida Biodiesel, Springboard Biodiesel, American Crane & Equipment, S. Howes, and Ecolab. Companies in the Global Biodiesel and Biofuels Processing Equipment Market focus on capacity expansion, technology upgrades, and strategic partnerships to strengthen their market position. Many manufacturers invest heavily in research and development to improve the efficiency, durability, and scalability of equipment. Firms also emphasize customization to meet regional regulatory requirements and diverse feedstock conditions. Strategic collaborations with fuel producers help suppliers secure long-term contracts and improve product validation. Expansion into emerging markets allows companies to capture new demand driven by sustainability mandates.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment Type

- 2.2.3 Material Type

- 2.2.4 Application

- 2.2.5 End use scale

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Global decarbonization & energy transition

- 3.2.1.2 Government blend mandates & policy incentives

- 3.2.1.3 Rising adoption of advanced biofuels (HVO, SAF)

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High capital costs

- 3.2.2.2 Infrastructure & supply chain weaknesses

- 3.2.3 Opportunities

- 3.2.3.1 Expansion of advanced biofuel plants

- 3.2.3.2 Growth in aviation & marine renewable fuels

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By equipment type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter';s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Equipment Type, 2022 - 2035 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Heat exchangers

- 5.2.1 Process cooling/heating heat exchangers

- 5.2.2 Methanol recovery heat exchangers

- 5.2.3 Glycerin processing heat exchangers

- 5.2.4 Tube content per heat exchanger unit

- 5.3 Distillation columns

- 5.3.1 Methanol rectification columns

- 5.3.2 Glycerin purification columns

- 5.3.3 Feedstock pre-treatment columns

- 5.3.4 Tube content per column

- 5.4 Evaporation & concentration systems

- 5.4.1 Methanol flash evaporators

- 5.4.2 Falling film evaporators

- 5.5 Reactors

Chapter 6 Market Estimates and Forecast, By Material Type, 2022 - 2035 (USD Million)

- 6.1 Key trends

- 6.2 Stainless steel 304/304l tubes

- 6.3 Stainless steel 316/316L tubes

- 6.4 Duplex and super duplex stainless-steel tubes

- 6.5 Titanium tubes

- 6.6 Nickel alloys and other materials

Chapter 7 Market Estimates and Forecast, By Application, 2022 - 2035 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Methanol recovery and purification systems

- 7.3 Glycerin recovery and purification systems

- 7.4 Feedstock pre-treatment and preparation

- 7.5 Transesterification reaction thermal management

- 7.6 Biodiesel/FAMA cooling and finishing

- 7.7 Renewable diesel (HVO/HEFA) high-pressure systems

Chapter 8 Market Estimates and Forecast, By End Use Scale, 2022 - 2035 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Large-scale commercial plants (>50 million liters/year)

- 8.3 Mid-scale regional plants (10-50 million liters/year)

- 8.4 Small-scale and distributed production (<10 million liters/year)

- 8.5 On-farm and cooperative biodiesel systems

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Advance Biofuel

- 11.2 Alfa Laval

- 11.3 American Crane & Equipment

- 11.4 ANDRITZ

- 11.5 CPM Crown

- 11.6 Desmet

- 11.7 Ecolab

- 11.8 Florida Biodiesel

- 11.9 JBT

- 11.10 Myande

- 11.11 N&T Engitech

- 11.12 S. Howes

- 11.13 Springboard Biodiesel

- 11.14 SRS International

- 11.15 Sulzer