|

市場調查報告書

商品編碼

1913463

毫米波技術市場機會、成長要素、產業趨勢分析及2026年至2035年預測Millimeter Wave Technology Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

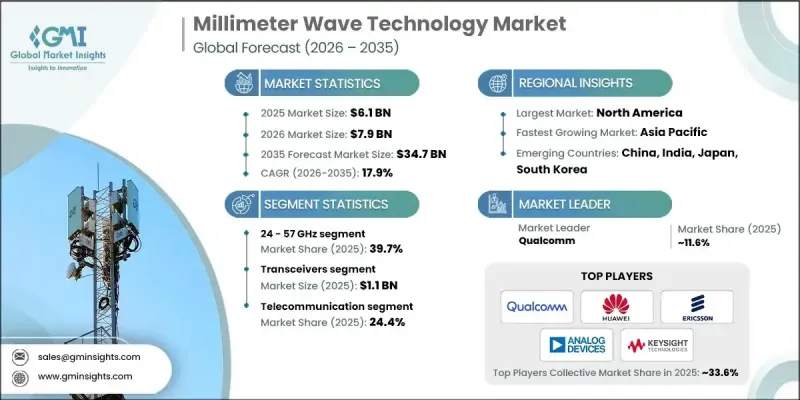

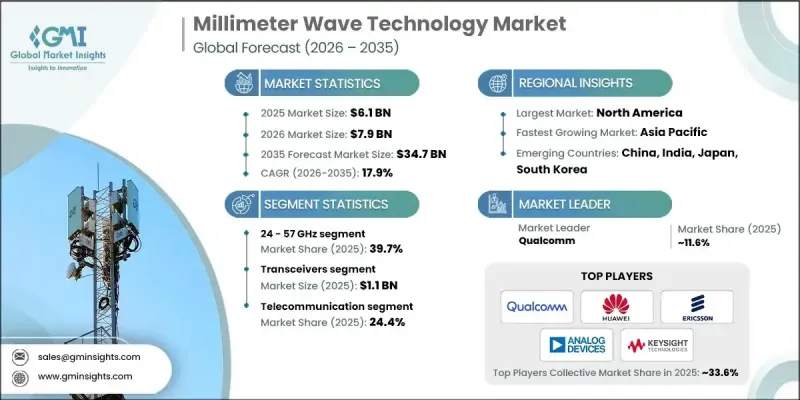

全球毫米波技術市場預計到 2025 年將達到 61 億美元,到 2035 年將達到 347 億美元,年複合成長率為 17.9%。

對超高速資料傳輸日益成長的需求、下一代無線網路的不斷擴展部署以及對先進通訊基礎設施投入的不斷增加,共同推動了毫米波技術的發展。隨著網路營運商和技術供應商優先考慮更高的容量、更低的延遲和更高的頻譜效率,毫米波技術正獲得廣泛應用。頻寬頻寬數位服務的日益普及以及各行各業對先進成像和感測能力的需求,也進一步推動了這一需求。公共和私營部門為加強連接基礎設施而進行的投資,正在加速毫米波解決方案的採用,尤其是在網路密集的環境中。正在進行的基礎設施建設舉措也擴大將這些技術融入其中,以實現高容量的網路架構。此外,人們對身臨其境型數位平台的興趣日益濃厚,也推動了對更快、更可靠的無線效能的需求。這些因素共同推動了毫米波技術在全球範圍內,在各種應用和地區中持續普及。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 61億美元 |

| 預測金額 | 347億美元 |

| 複合年成長率 | 17.9% |

預計到2025年,24-57 GHz頻寬將佔據39.7%的市佔率。此頻寬廣泛用於支援低延遲、高吞吐量的無線通訊和先進的感測系統。人們對頻譜最佳化和高效訊號傳輸的日益關注,正推動著在該頻寬內運行的高效能解決方案的開發,以提高整體網路可靠性和容量。

預計到2025年,收發器業務的營收將達到11億美元。這些組件在實現高速資料交換、高效訊號處理和無縫系統整合方面發揮關鍵作用。不斷提高的效能要求正在推動收發器設計的創新,以支援更高的資料速率、更低的功耗以及與下一代無線標準的兼容性。

預計到2025年,北美毫米波技術市佔率將達到35%。該地區市場擴張的動力源於持續的網路升級、對數位基礎設施的大力投資以及連接技術的加速普及。此外,不斷推進的城市發展舉措和雲端服務的廣泛應用也進一步促進了區域市場的成長。

目錄

第1章調查方法和範圍

第2章執行摘要

第3章業界考察

- 生態系分析

- 供應商情況

- 利潤率

- 成本結構

- 每個階段的附加價值

- 影響價值鏈的因素

- 中斷

- 生態系分析

- 產業影響因素

- 促進要素

- 對5G網路的需求不斷成長

- 對高頻寬應用的需求不斷成長

- 加大對通訊基礎設施的投資

- 在醫學影像領域不斷擴展的應用

- 安全系統應用範圍不斷擴大

- 挑戰與困難

- 範圍和普遍性有限

- 傳播方面的挑戰

- 市場機遇

- 智慧城市的發展

- 擴增實境(AR)和虛擬實境(VR)應用的發展

- 促進要素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特五力分析

- PESTEL 分析

- 科技與創新趨勢

- 當前技術趨勢

- 新興技術

- 新興經營模式

- 合規要求

- 永續性措施

- 消費者心理分析

- 專利和智慧財產權分析

- 地緣政治和貿易趨勢

第4章 競爭情勢

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 市場集中度分析

- 按地區

- 主要企業的競爭標竿分析

- 財務績效比較

- 收入

- 利潤率

- 研究與開發

- 產品系列比較

- 產品線的廣度

- 科技

- 創新

- 地理分佈比較

- 全球擴張分析

- 服務網路覆蓋

- 按地區分類的市場滲透率

- 競爭定位矩陣

- 領導企業

- 受讓人

- 追蹤者

- 小眾玩家

- 戰略展望矩陣

- 財務績效比較

- 2021-2024 年主要發展動態

- 併購

- 夥伴關係與合作

- 技術進步

- 擴張與投資策略

- 永續發展計劃

- 數位轉型計劃

- 新興/Start-Ups競賽的趨勢

第5章 按組件分類的市場估算與預測,2022-2035年

- 轉變

- PIN二極體開關

- 場效電晶體開關

- MEMS開關

- 同軸開關

- 波導開關

- 天線

- 相位陣列天線

- 線性陣列

- 平面陣列

- 共形陣列

- 非相位陣列天線

- 貼片天線

- 喇叭天線

- 反射器天線

- 相位陣列天線

- 收發器

- 通訊與網路

- 介面

- 射頻/無線

- 影像

- 感測器和控制裝置

- 電源/電池

- 其他

第6章 依頻段分類的市場估計與預測,2022-2035年

- 24-57 GHz

- 57-86 GHz

- 86~300 GHz

7. 依最終用途分類的市場估計與預測,2022-2035 年

- 溝通

- 衛生保健

- 工業的

- 車

- 運輸

- 其他

第8章 2022-2035年各地區市場估算與預測

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- 主要企業

- Qualcomm

- Huawei

- Ericsson

- Keysight Technologies Inc.

- Broadcom

- 按地區分類的主要企業

- 北美洲

- Analog Devices, Inc.

- Bridgewave Communications Inc.

- L3Harris Technologies Inc.

- Millimeter Wave Products Inc.

- 亞太地區

- Siklu Communication Ltd.

- NEC Corporation

- Eravant(SAGE Millimeter Inc.)

- 歐洲

- Farran Technology Ltd.

- Infineon

- Kyocera Corporation

- Smiths Interconnect Group Limited

- 北美洲

- 小眾玩家/顛覆者

- Cambium Networks

- Ducommun Incorporated

- E-band Communications LLC

- Aviat Networks

The Global Millimeter Wave Technology Market was valued at USD 6.1 billion in 2025 and is estimated to grow at a CAGR of 17.9% to reach USD 34.7 billion by 2035.

Growth is supported by rising requirements for ultra-fast data transmission, expanding deployment of next-generation wireless networks, and increasing capital allocation toward advanced communication infrastructure. Millimeter wave technology is gaining traction as network operators and technology providers prioritize higher capacity, reduced latency, and improved spectral efficiency. Demand is further strengthened by the wider adoption of bandwidth-intensive digital services and the need for enhanced imaging and sensing capabilities across multiple industries. Public and private sector investments aimed at strengthening connectivity frameworks are accelerating the deployment of millimeter wave solutions, particularly in dense network environments. Ongoing infrastructure development initiatives are increasingly incorporating these technologies to enable high-capacity network architectures. Additionally, growing interest in immersive digital platforms is supporting demand for faster and more reliable wireless performance. These combined factors are driving sustained global adoption of millimeter wave technology across diverse applications and regions.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $6.1 Billion |

| Forecast Value | $34.7 Billion |

| CAGR | 17.9% |

The 24-57 GHz frequency range accounted for 39.7% share in 2025. This band is widely used to support low-latency, high-throughput wireless communication and advanced sensing systems. Increasing focus on spectrum optimization and efficient signal transmission is encouraging the development of high-performance solutions operating within this frequency range to improve overall network reliability and capacity.

The transceivers segment generated USD 1.1 billion in 2025. These components play a critical role in enabling fast data exchange, efficient signal processing, and seamless system integration. Growing performance expectations are driving innovation in transceiver design to support higher data rates, reduced power consumption, and compatibility with next-generation wireless standards.

North America Millimeter Wave Technology Market represented 35% share in 2025. Market expansion in the region is supported by continuous network upgrades, strong investment in digital infrastructure, and accelerating deployment of connected technologies. Increasing urban development initiatives and widespread adoption of cloud-based services are further contributing to regional market growth.

Major companies operating in the Global Millimeter Wave Technology Market include Qualcomm, Ericsson, Huawei, Broadcom, Analog Devices, Inc., NEC Corporation, Infineon, Keysight Technologies Inc., Kyocera Corporation, Siklu Communication Ltd., Aviat Networks, Cambium Networks, Farran Technology Ltd., Bridgewave Communications Inc., L3Harris Technologies Inc., Smiths Interconnect Group Limited, Eravant (SAGE Millimeter Inc.), Millimeter Wave Products Inc., Ducommun Incorporated, and E-band Communications LLC. Companies in the Global Millimeter Wave Technology Market are focusing on strengthening their competitive position through continuous research and development aimed at improving signal efficiency, component integration, and system reliability. Many players are investing in advanced semiconductor technologies and compact designs to enhance performance while reducing power consumption. Strategic collaborations with network operators and infrastructure providers are helping accelerate commercialization and large-scale deployment.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Component trends

- 2.2.2 Frequency band trends

- 2.2.3 End use trends

- 2.2.4 Regional trends

- 2.3 TAM Analysis, 2026-2035 (USD Million)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry ecosystem analysis

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Growing demand for 5G Networks

- 3.3.1.2 Increasing demand for high-bandwidth applications

- 3.3.1.3 Rising investments in telecommunication infrastructure

- 3.3.1.4 Increasing applications in healthcare imaging

- 3.3.1.5 Increasing deployment in security systems

- 3.3.2 Pitfalls and challenges

- 3.3.2.1 Limited range and penetration

- 3.3.2.2 Propagation challenges

- 3.3.3 Market opportunities

- 3.3.3.1 Advancements in smart cities

- 3.3.3.2 Expansion of AR/VR applications

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.5.4 Latin America

- 3.5.5 Middle East & Africa

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Technology and Innovation landscape

- 3.8.1 Current technological trends

- 3.8.2 Emerging technologies

- 3.9 Emerging Business Models

- 3.10 Compliance Requirements

- 3.11 Sustainability Measures

- 3.12 Consumer Sentiment Analysis

- 3.13 Patent and IP analysis

- 3.14 Geopolitical and trade dynamics

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Component, 2022 - 2035 (USD Million)

- 5.1 Key trends

- 5.2 Switches

- 5.2.1 PIN diode switches

- 5.2.2 FET switches

- 5.2.3 MEMS switches

- 5.2.4 Coaxial switches

- 5.2.5 Waveguide switches

- 5.3 Antennas

- 5.3.1 Phased array antennas

- 5.3.1.1 Linear arrays

- 5.3.1.2 Planar arrays

- 5.3.1.3 Conformal arrays

- 5.3.2 Non-Phased array antennas

- 5.3.2.1 Patch antennas

- 5.3.2.2 Horn antennas

- 5.3.2.3 Reflector Antennas

- 5.3.1 Phased array antennas

- 5.4 Transceiver

- 5.5 Communications and networking

- 5.6 Interface

- 5.7 RF & radio

- 5.8 Imaging

- 5.9 Sensor & controls

- 5.10 Power & battery

- 5.11 Others

Chapter 6 Market Estimates and Forecast, By Frequency Band, 2022 - 2035 (USD Million)

- 6.1 Key trends

- 6.2 24 - 57 GHz

- 6.3 57 - 86 GHz

- 6.4 86 - 300 GHz

Chapter 7 Market Estimates and Forecast, By End Use, 2022 - 2035 (USD Million)

- 7.1 Key trends

- 7.2 Telecommunication

- 7.3 Healthcare

- 7.4 Industrial

- 7.5 Automotive

- 7.6 Transportation

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Global Key Players

- 9.1.1 Qualcomm

- 9.1.2 Huawei

- 9.1.3 Ericsson

- 9.1.4 Keysight Technologies Inc.

- 9.1.5 Broadcom

- 9.2 Regional key players

- 9.2.1 North America

- 9.2.1.1 Analog Devices, Inc.

- 9.2.1.2 Bridgewave Communications Inc.

- 9.2.1.3 L3Harris Technologies Inc.

- 9.2.1.4 Millimeter Wave Products Inc.

- 9.2.2 Asia Pacific

- 9.2.2.1 Siklu Communication Ltd.

- 9.2.2.2 NEC Corporation

- 9.2.2.3 Eravant (SAGE Millimeter Inc.)

- 9.2.3 Europe

- 9.2.3.1 Farran Technology Ltd.

- 9.2.3.2 Infineon

- 9.2.3.3 Kyocera Corporation

- 9.2.3.4 Smiths Interconnect Group Limited

- 9.2.1 North America

- 9.3 Niche Players/Disruptors

- 9.3.1 Cambium Networks

- 9.3.2 Ducommun Incorporated

- 9.3.3 E-band Communications LLC

- 9.3.4 Aviat Networks