|

市場調查報告書

商品編碼

1913460

智慧醫療設備市場機會、成長要素、產業趨勢分析及2026年至2035年預測Smart Medical Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

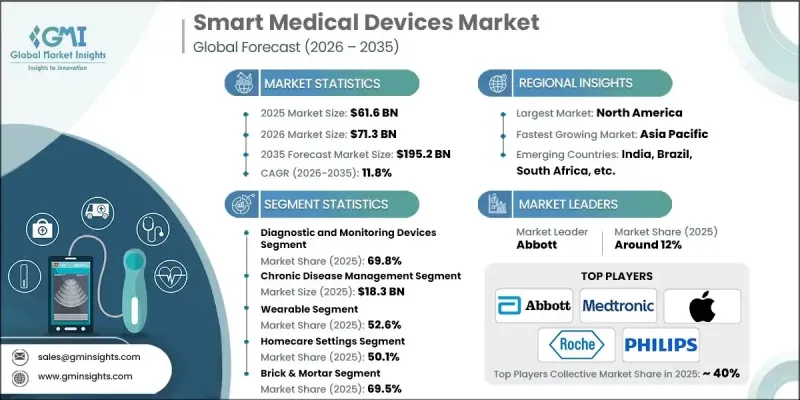

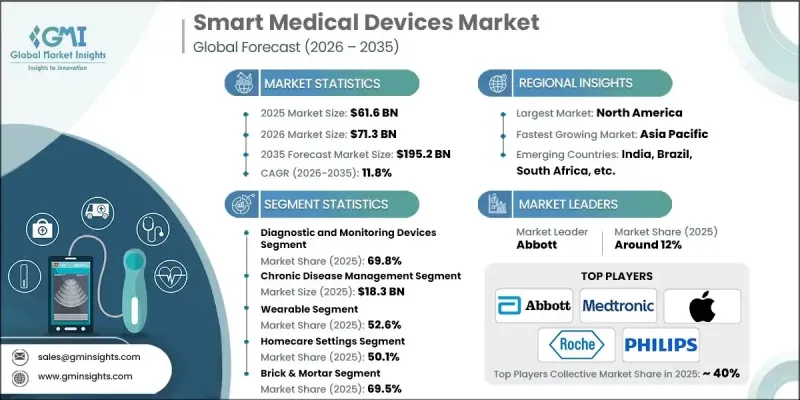

全球智慧醫療設備市場預計到 2025 年將達到 616 億美元,到 2035 年將達到 1952 億美元,年複合成長率為 11.8%。

這一成長主要受糖尿病、氣喘等慢性病患病率上升以及對居家醫療解決方案和遠端患者監護(RPM) 設備需求不斷成長的推動。遠端醫療和數位健康平台的擴展,以及物聯網、人工智慧和雲端整合等技術的進步,正在推動智慧醫療設備的普及。穿戴式和微型化設備、預防性照護和居家醫療模式等趨勢也進一步推動了市場需求。雅培、蘋果、Medtronic、羅氏和飛利浦等領導企業正致力於地域擴張、產品創新、提高產品可負擔性以及與醫療服務提供者建立合作關係,以鞏固其市場地位。健康意識的提高以及向個人化、即時病患監測的轉變,也顯著促進了該行業的成長。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 616億美元 |

| 預測金額 | 1952億美元 |

| 複合年成長率 | 11.8% |

預計到2025年,診斷和監測設備領域將佔據69.8%的市場。此領域包括連續血糖監測儀(CGM)、穿戴式心電圖貼片、智慧血壓計和脈動式血氧監測儀系統。這些設備能夠即時持續擷取生理數據,並將其傳輸至連網平台進行分析。技術提供者與醫療機構之間的合作,使得病患監測更加便捷高效,進一步推動了該領域的成長。

預計到2025年,慢性病管理市場規模將達183億美元。用於慢性病管理的智慧型裝置整合了穿戴式感測器、家庭監測裝置和藥物依從性系統,用於追蹤生命徵象、症狀和治療方法使用情況。即時數據收集使臨床醫生和患者能夠評估風險評分,有效管理多種疾病,從而支持長期照護並改善患者預後。

預計到2025年,北美智慧醫療設備市佔率將達到34.8%。該地區的成長主要得益於完善的醫療保健體系、慢性病高發、數位醫療技術的廣泛應用以及有利的報銷政策。遠端醫療基礎設施也進一步推動了該地區智慧設備的普及,使北美成為智慧醫療解決方案創新和成長的關鍵市場。

目錄

第1章調查方法和範圍

第2章執行摘要

第3章業界考察

- 生態系分析

- 產業影響因素

- 促進要素

- 糖尿病、氣喘和其他疾病的發生率呈上升趨勢

- 快速發展的醫療設備產業

- 網路普及率的提高和巨量資料應用的增加

- 即時數據驅動的診斷和治療方法正變得越來越重要

- 產業潛在風險與挑戰

- 隱私問題

- 低收入和中等收入國家基礎設施不足

- 促進要素

- 成長潛力分析

- 監管環境

- 救贖方案

- 技術格局

- 定價分析

- 未來市場趨勢

- 供應商情況

- 併購活動

- 波特五力分析

- PESTEL 分析

- 差距分析

第4章 競爭情勢

- 介紹

- 企業矩陣分析

- 公司市佔率分析

- 競爭定位矩陣

- 戰略儀錶板

第5章 依產品類型分類的市場估算與預測,2021-2032年

- 診斷和監測設備

- 血糖值監測儀

- 心率監測器

- 脈動式血氧監測儀系統

- 血壓監測儀

- 酒精測試儀

- 其他診斷和監測設備

- 治療設備

- 攜帶式氧氣濃縮機和人工呼吸器

- 胰島素幫浦

- 助聽器

- 其他醫療器材

- 其他產品類型

第6章 依最終用途分類的市場估計與預測,2021-2032年

- 醫院

- 居家醫療環境

- 其他用途

7. 2021-2032年按分銷管道分類的市場估算與預測

- 實體店面

- 電子商務

第8章 2021-2032年各地區市場估算與預測

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Abbott

- Apple

- Biobeat

- Boston Scientific Corporation

- Dexcom

- F Hoffmann-La Roche

- Fitbit

- Medtronic

- NeuroMetrix

- Novo Nordisk

- Omron Corporation

- SAMSUNG

- VitalConnect

- West Pharmaceutical Services

The Global Smart Medical Devices Market was valued at USD 61.6 billion in 2025 and is estimated to grow at a CAGR of 11.8% to reach USD 195.2 billion by 2035.

The growth is fueled by the rising prevalence of chronic conditions such as diabetes and asthma, coupled with the increasing demand for home healthcare solutions and remote patient monitoring (RPM) devices. Expansion of telemedicine and digital health platforms, alongside technological advancements in IoT, AI, and cloud-based integrations, are driving the adoption of smart medical devices. Trends such as wearable and miniaturized devices, preventive care, and hospital-at-home models are further boosting market demand. Leading players such as Abbott, Apple, Medtronic, Roche, and Philips are focusing on geographic expansion, product innovation, affordability, and collaboration with healthcare providers to strengthen market presence. Rising health awareness and the shift toward personalized, real-time patient monitoring are significantly contributing to industry growth.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $61.6 Billion |

| Forecast Value | $195.2 Billion |

| CAGR | 11.8% |

The diagnostic and monitoring devices segment held 69.8% share in 2025. This segment includes continuous glucose monitors (CGMs), wearable ECG patches, smart blood pressure monitors, and pulse oximeters. These devices continuously collect physiological data in real time and transmit it to connected platforms for analysis. Partnerships between technology providers and healthcare organizations are expected to drive further growth in this category by enhancing the accessibility and efficiency of patient monitoring.

The chronic disease management segment reached USD 18.3 billion in 2025. Smart devices for chronic disease management integrate wearable sensors, home monitoring equipment, and medication adherence systems to track vital signs, symptoms, and therapy usage. Real-time data collection allows clinicians and patients to assess risk scores and manage multiple conditions effectively, supporting long-term treatment and improving patient outcomes.

North America Smart Medical Devices Market held a 34.8% share in 2025. Regional growth is driven by a well-established healthcare system, high incidence of chronic diseases, widespread use of digital health technologies, and favorable reimbursement policies. The availability of health insurance and advanced telehealth infrastructure further supports the adoption of smart devices in the region, positioning North America as a leading market for innovation and growth in smart healthcare solutions.

Key players operating in the Global Smart Medical Devices Market include Abbott, Apple, Biobeat Medical, Boston Scientific, Dexcom, Fitbit, Masimo, Medtronic, NeuroMetrix, Novo Nordisk, OMRON Healthcare, Philips, Roche, SAMSUNG, Shenzhen Ztsense Hi Tech, SmartCardia, VitalConnect, Vital Health Ring, West Pharmaceutical Services, and WS Audiology. Companies in the Global Smart Medical Devices Market are focusing on multiple strategies to strengthen their market position. They invest heavily in research and development to launch innovative, miniaturized, and wearable solutions that integrate AI, IoT, and cloud platforms. Geographic expansion allows access to emerging markets with rising healthcare demands. Strategic collaborations with hospitals, clinics, and telemedicine providers enhance device adoption and distribution. Companies are also prioritizing affordability, regulatory compliance, and real-time data capabilities to improve patient engagement.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates & calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of diabetes, asthma and other diseases

- 3.2.1.2 Booming medical device industry

- 3.2.1.3 Increasing internet penetration rate and adoption of big data

- 3.2.1.4 Rising importance of real time data driven approach for diagnostics and treatment

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Privacy concerns

- 3.2.2.2 Lack of suitable infrastructure in low- and middle-income countries

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Reimbursement scenario

- 3.6 Technological landscape

- 3.7 Pricing analysis

- 3.8 Future market trends

- 3.9 Supplier landscape

- 3.10 M&A activities

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

- 3.13 Gap analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2032 ($ Mn)

- 5.1 Key trends

- 5.2 Diagnostic and monitoring devices

- 5.2.1 Blood glucose monitors

- 5.2.2 Heart rate monitors

- 5.2.3 Pulse oximeters

- 5.2.4 Blood pressure monitors

- 5.2.5 Breathalyzers

- 5.2.6 Other diagnostic and monitoring devices

- 5.3 Therapeutic devices

- 5.3.1 Portable oxygen concentrators and ventilators

- 5.3.2 Insulin pumps

- 5.3.3 Hearing aid

- 5.3.4 Other therapeutic devices

- 5.4 Other product types

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2032 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals

- 6.3 Homecare settings

- 6.4 Other End Use

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2032 ($ Mn)

- 7.1 Key trends

- 7.2 Brick & mortar

- 7.3 E-commerce

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2032 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott

- 9.2 Apple

- 9.3 Biobeat

- 9.4 Boston Scientific Corporation

- 9.5 Dexcom

- 9.6 F Hoffmann-La Roche

- 9.7 Fitbit

- 9.8 Medtronic

- 9.9 NeuroMetrix

- 9.10 Novo Nordisk

- 9.11 Omron Corporation

- 9.12 SAMSUNG

- 9.13 VitalConnect

- 9.14 West Pharmaceutical Services