|

市場調查報告書

商品編碼

1913453

自行車滾筒煞車市場機會、成長要素、產業趨勢分析及預測(2026年至2035年)Bicycle Roller Brake Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

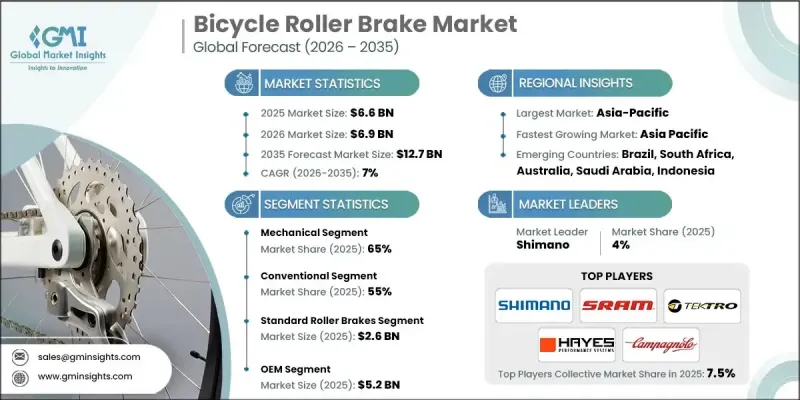

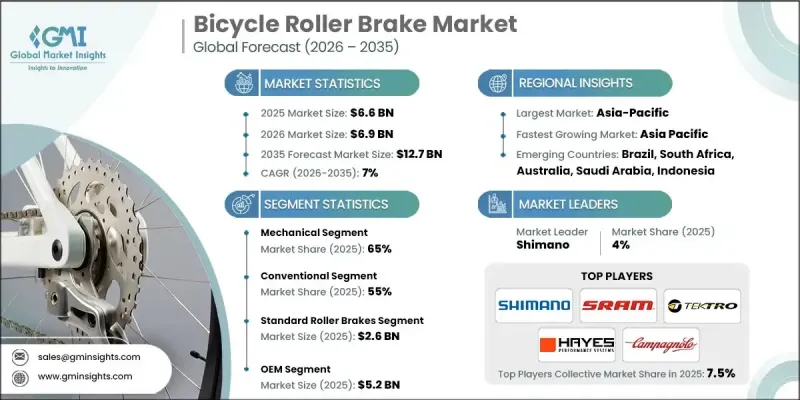

2025 年全球自行車滾筒煞車市場價值 66 億美元,預計到 2035 年將達到 127 億美元,年複合成長率為 7%。

報告指出,由於騎乘者期望的改變、煞車技術的穩定發展以及城市交通行為的長期變化,市場正在經歷重大變革時期。這些因素正在重塑競爭格局,並為那些能夠快速回應不斷變化的客戶需求的品牌開闢新的收入來源。滾筒煞車被定位為一種密封煞車解決方案,旨在實現穩定的性能和長久的使用壽命,因此在都市區和實際騎乘環境中尤其受歡迎,因為在這些環境中,可靠性在各種天氣條件下都至關重要。報告強調,對低維護自行車的需求不斷成長是推動市場需求的主要因素,尤其是在尋求無需技術維護的可靠交通途徑的城市通勤者中。市場趨勢表明,整合式、低維護自行車平台的日益普及正在促進其普及。此外,報告指出,大規模共享旅遊營運商越來越傾向於使用耐用的煞車系統來減少停機時間,這進一步加速了滾筒煞車的普及。總體而言,用戶群優先考慮便利性、耐用性和易於擁有,這使得滾筒煞車成為成熟、高使用率自行車市場中的實用解決方案。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 66億美元 |

| 預測金額 | 127億美元 |

| 複合年成長率 | 7% |

預計到2025年,機械式煞車將佔據65%的市場佔有率,並在2026年至2035年間以6%的複合年成長率成長。機械式滾筒煞車是一種鋼索驅動系統,可在提供可靠煞車力道的同時保持成本效益。這些解決方案基於成熟的機械槓桿原理,確保長期穩定的性能。該細分市場受益於廣泛的標準部件相容性、成熟的分銷網路和簡化的維護流程。此外,無需專用設備即可進行診斷和維修的特性也有助於其在全球市場中保持較高的滲透率。

預計到2025年,傳統自行車市佔率將達到55%,並在2035年之前以6.3%的複合年成長率成長。這一主導地位主要歸功於自行車作為日常交通工具的高銷量。這些產品定位為經濟實惠的交通選擇,而穩定的煞車性能至關重要。鑑於傳統自行車設計創新空間有限,製造商正日益依賴滾筒煞車系統來提升現有產品的耐用性和吸引力。

預計到2025年,亞太地區自行車滾筒煞車市場規模將達21億美元。該地區的主導地位歸功於其完善的製造業基礎設施和大規模的自行車用戶層。中國、日本和印度是產能和消費需求的主要貢獻者。中國是公認的主要製造地,約佔全球自行車產量的68%。中國年產量達4,600萬套,相當於每月約130萬套,已成為滾筒煞車系統最大的消費國和供應國。

目錄

第1章調查方法和範圍

第2章執行摘要

第3章業界考察

- 生態系分析

- 供應商情況

- 零件製造商

- 煞車製造商和整合商

- 自行車製造商

- 售後市場通路

- 最終用戶和服務網路

- 成本結構

- 利潤率

- 每個階段的附加價值

- 垂直整合趨勢

- 顛覆者

- 供應商情況

- 影響因素

- 促進要素

- 都市化與通勤自行車的成長

- 電動式自行車和實用自行車的擴張

- 安全性和可靠性是輪圈煞車的首要考慮因素。

- 城市/舒適型自行車領域的OEM整合

- 產業潛在風險與挑戰

- 採用碟煞的比賽

- 在陡坡上或高速行駛時出現過熱問題

- 市場機遇

- 低維護成本自行車平台的成長

- 與內部移位輪轂整合

- 共享單車的新需求趨勢

- 產品改進(散熱和調製性能)

- 促進要素

- 技術趨勢與創新生態系統

- 目前技術

- 新興技術

- 成長潛力分析

- 監管環境

- 北美洲

- 美國消費品安全委員會(CPSC)標準

- ASTM國際標準(F2043、F1898)

- 加拿大自行車安全法規

- 歐洲

- EN 15194(電動自行車標準)

- 歐洲的腳踏式自行車法規

- 低排放氣體/城市交通政策

- 亞太地區

- 中國自行車和電動式自行車國家標準(GB)

- 印度汽車工業標準(AIS 052 電動自行車標準)

- 日本JIS標準

- 東協自行車標準

- 拉丁美洲

- 巴西ABNT NBR標準

- 阿根廷INTA/IRAM標準

- 墨西哥NOM標準

- 中東和非洲

- 阿拉伯聯合大公國GSO/ESMA自行車法規

- 沙烏地阿拉伯 SASO 自行車標準

- 南非SABS自行車安全法規

- 北美洲

- 波特五力分析

- PESTEL 分析

- 成本細分分析

- 價格趨勢

- 按地區

- 依產品

- 專利分析

- 生產統計

- 生產基地

- 消費中心

- 出口和進口

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 製造業的能源效率

- 環保舉措

- 碳足跡考量

- 技術比較:滾筒煞車及其他技術

- 滾筒煞車與輪圈煞車

- 滾筒煞車與機械式碟式煞車的比較

- 滾筒煞車與液壓碟式煞車的比較

- 效能、成本、可維護性和安全性之間的權衡

- OEM規格和採用策略

- 自行車類中滾筒煞車的採用情況

- 入門級和中階車型的OEM定位

- 按地區分類的OEM偏好模式

- 兼顧成本和耐用性的設計之間的權衡

- 系統相容性和整合性考慮因素

- 售後市場需求趨勢

第4章 競爭情勢

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 競爭定位矩陣

- 戰略展望矩陣

- 重大進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 企業擴張計畫和資金籌措

第5章 2022-2035年按產品分類的市場估算與預測

- 標準滾筒煞車

- 高性能滾筒煞車

- 整合式輪轂齒輪滾輪煞車器

- 腳煞車

第6章 2022-2035年各細分市場的估計與預測

- 機械的

- 油壓

第7章 自行車市場估算與預測,2022-2035年

- 傳統的

- 電動自行車

第8章 按應用領域分類的市場估算與預測,2022-2035年

- 城市/都市自行車

- 山地自行車

- 賽車自行車

- 油電混合自行車

第9章 依銷售管道分類的市場估計與預測,2022-2035年

- OEM

- 售後市場

第10章 2022-2035年各地區市場估計與預測

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 比利時

- 荷蘭

- 瑞典

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 新加坡

- 韓國

- 越南

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第11章:公司簡介

- 世界公司

- Campagnolo

- Hayes Performance Systems

- Magura

- Promax Components

- Shimano

- SRAM

- SunRace Sturmey-Archer

- Tektro Technology

- Region players

- Alhonga

- Avid

- Cane Creek

- Clarks Cycle Systems

- Dia-Compe

- Hope Technology

- Jagwire

- KCNC

- Paul Component Engineering

- 新興製造商

- TRP Cycling Components

- Weinmann

- XLC Components

The Global Bicycle Roller Brake Market was valued at USD 6.6 billion in 2025 and is estimated to grow at a CAGR of 7% to reach USD 12.7 billion by 2035.

The market is described as undergoing notable transformation due to shifting rider expectations, steady advancements in braking technologies, and long-term changes in urban transportation behavior. It is explained that these forces are redefining competition and opening new revenue pathways for brands that respond quickly to evolving customer needs. Roller brakes are identified as enclosed braking solutions designed for consistent performance and long service life, particularly valued in urban and utility cycling environments where reliability in varied weather conditions is essential. It is emphasized that the rising preference for bicycles requiring minimal servicing has significantly supported demand, especially among city commuters seeking dependable transportation without technical upkeep. The market narrative highlights that the growing presence of integrated, low-maintenance bicycle platforms has contributed to increased adoption. It is further stated that large-scale shared mobility operators increasingly favor durable braking systems to limit downtime, which has accelerated acceptance. Overall, demand is said to be shaped by users prioritizing convenience, longevity, and ease of ownership, positioning roller brakes as a practical solution in mature and high-usage cycling markets.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $6.6 Billion |

| Forecast Value | $12.7 Billion |

| CAGR | 7% |

The mechanical segment accounted for 65% share in 2025 and is forecast to grow at a CAGR of 6% from 2026 to 2035. Mechanical roller brakes are described as cable-actuated systems that deliver dependable stopping power while remaining cost-efficient. These solutions are said to rely on established mechanical leverage principles that ensure stable performance over long periods. The segment benefits from widespread compatibility with standard components, mature distribution networks, and straightforward maintenance processes. It is further noted that the ability to diagnose and service these systems without specialized equipment continues to support their strong adoption across global markets.

The conventional bicycle segment held a 55% share in 2025 and is projected to grow at a CAGR of 6.3% through 2035. This dominance is attributed to high sales volumes associated with everyday transportation bicycles. It is explained that these products are positioned as affordable mobility options where consistent braking performance is essential. Manufacturers are said to increasingly rely on roller brake systems to enhance durability and product appeal within established categories, particularly as innovation opportunities remain limited in traditional bicycle designs.

Asia-Pacific Bicycle Roller Brake Market generated USD 2.1 billion in 2025. The region's leadership is linked to its extensive manufacturing infrastructure and large cycling population. China, Japan, and India are referenced as major contributors to production capacity and consumer demand. China is identified as the primary manufacturing hub, accounting for nearly 68% of worldwide bicycle output. Annual production in the country is stated at 46 million units, equal to approximately 1,300,000 bicycles per month, positioning China as both the largest consumer and supplier of roller brake systems.

Key companies operating in the Bicycle Roller Brake Market include Shimano, SRAM, Tektro Technology, Campagnolo, Magura, Hayes Performance Systems, Promax Components, Clarks Cycle Systems, Alhonga, and Hope Technology (IPCO). Companies in the Bicycle Roller Brake Market are said to be strengthening their positions through a combination of product innovation, manufacturing optimization, and strategic partnerships. Leading players are focusing on improving durability, heat management, and system efficiency to meet evolving performance expectations. Many manufacturers are investing in automation and localized production to reduce costs and ensure consistent quality. Strategic collaborations with bicycle manufacturers and fleet operators are also emphasized as a key approach to securing long-term supply agreements. In addition, companies are expanding their presence in high-growth regions by strengthening distribution networks and offering tailored solutions aligned with regional riding.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Break

- 2.2.4 Bicycle

- 2.2.5 Application

- 2.2.6 Sales Channel

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Component manufacturers

- 3.1.1.2 Break manufacturers & integrators

- 3.1.1.3 Bicycle manufacturers

- 3.1.1.4 Aftermarket distribution channels

- 3.1.1.5 End-user & service networks

- 3.1.2 Cost structure

- 3.1.3 Profit margin

- 3.1.4 Value addition at each stage

- 3.1.5 Vertical integration trends

- 3.1.6 Disruptors

- 3.1.1 Supplier landscape

- 3.2 Impact on forces

- 3.2.1 Growth drivers

- 3.2.1.1 Urbanization & growth of commuter cycling

- 3.2.1.2 Expansion of e-bikes & utility bikes

- 3.2.1.3 Safety & reliability preference over rim brakes

- 3.2.1.4 OEM integration in city/comfort bicycle segments

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Competition from disc brakes

- 3.2.2.2 Heat buildup under steep/high-speed use

- 3.2.3 Market opportunities

- 3.2.3.1 Growth of low-maintenance bicycle platforms

- 3.2.3.2 Integration with internal gear hubs

- 3.2.3.3 Emerging demand in bike-sharing fleets

- 3.2.3.4 Product improvements (heat dissipation & modulation)

- 3.2.1 Growth drivers

- 3.3 Technology trends & innovation ecosystem

- 3.3.1 Current technologies

- 3.3.2 Emerging technologies

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.1.1 U.S. Consumer Product Safety Commission (CPSC) standards

- 3.5.1.2 ASTM international standards (F2043, F1898)

- 3.5.1.3 Canada bicycle safety regulations

- 3.5.2 Europe

- 3.5.2.1 EN 15194 (E-Bike Standard)

- 3.5.2.2 European pedal-powered bicycle regulations

- 3.5.2.3 Low-Emission / Urban mobility policies

- 3.5.3 Asia-Pacific

- 3.5.3.1 China GB standards for bicycles and e-bikes

- 3.5.3.2 India Automotive Industry Standards (AIS 052 for E-Bikes)

- 3.5.3.3 Japan JIS standards

- 3.5.3.4 ASEAN bicycle standards

- 3.5.4 Latin America

- 3.5.4.1 Brazil ABNT NBR standards

- 3.5.4.2 Argentina INTA / IRAM standards

- 3.5.4.3 Mexico NOM standards

- 3.5.5 Middle East & Africa

- 3.5.5.1 UAE GSO / ESMA bicycle regulations

- 3.5.5.2 Saudi Arabia SASO bicycle standards

- 3.5.5.3 South Africa SABS bicycle safety regulations

- 3.5.1 North America

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Cost breakdown analysis

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By product

- 3.10 Patent analysis

- 3.11 Production statistics

- 3.11.1 Production hubs

- 3.11.2 Consumption hubs

- 3.11.3 Export and import

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Technology benchmarking: roller brakes vs alternatives

- 3.13.1 Roller brakes vs rim brakes

- 3.13.2 Roller brakes vs mechanical disc brakes

- 3.13.3 Roller brakes vs hydraulic disc brakes

- 3.13.4 Performance, cost, maintenance & safety trade-offs

- 3.14 OEM specification & adoption strategy

- 3.14.1 Roller brake fitment by bicycle category

- 3.14.2 Entry-level vs mid-range OEM positioning

- 3.14.3 Regional OEM preference patterns

- 3.14.4 Design-for-cost vs design-for-durability trade-offs

- 3.15 System compatibility & integration considerations

- 3.16 Aftermarket demand dynamics

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia-Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Key developments

- 4.5.1 Mergers & acquisitions

- 4.5.2 Partnerships & collaborations

- 4.5.3 New product launches

- 4.5.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2022 - 2035 ($Bn, Units)

- 5.1 Key trends

- 5.2 Standard roller brakes

- 5.3 High-performance roller brakes

- 5.4 Integrated hub-gear roller brakes

- 5.5 Coaster brakes

Chapter 6 Market Estimates & Forecast, By Break, 2022 - 2035 ($Bn, Units)

- 6.1 Key trends

- 6.2 Mechanical

- 6.3 Hydraulic

Chapter 7 Market Estimates & Forecast, By Bicycle, 2022 - 2035 ($Bn, Units)

- 7.1 Key trends

- 7.2 Conventional

- 7.3 E-bike

Chapter 8 Market Estimates & Forecast, By Application, 2022 - 2035 ($Bn, Units)

- 8.1 Key trends

- 8.2 City/Urban bicycles

- 8.3 Mountain bicycles

- 8.4 Racing bicycles

- 8.5 Hybrid bicycles

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2022 - 2035 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn, Units)

- 10.1 North America

- 10.1.1 US

- 10.1.2 Canada

- 10.2 Europe

- 10.2.1 UK

- 10.2.2 Germany

- 10.2.3 France

- 10.2.4 Italy

- 10.2.5 Spain

- 10.2.6 Belgium

- 10.2.7 Netherlands

- 10.2.8 Sweden

- 10.2.9 Russia

- 10.3 Asia Pacific

- 10.3.1 China

- 10.3.2 India

- 10.3.3 Japan

- 10.3.4 Australia

- 10.3.5 Singapore

- 10.3.6 South Korea

- 10.3.7 Vietnam

- 10.3.8 Indonesia

- 10.4 Latin America

- 10.4.1 Brazil

- 10.4.2 Mexico

- 10.4.3 Argentina

- 10.5 MEA

- 10.5.1 South Africa

- 10.5.2 Saudi Arabia

- 10.5.3 UAE

Chapter 11 Company Profiles

- 11.1 Global players

- 11.1.1 Campagnolo

- 11.1.2 Hayes Performance Systems

- 11.1.3 Magura

- 11.1.4 Promax Components

- 11.1.5 Shimano

- 11.1.6 SRAM

- 11.1.7 SunRace Sturmey-Archer

- 11.1.8 Tektro Technology

- 11.2 Region players

- 11.2.1 Alhonga

- 11.2.2 Avid

- 11.2.3 Cane Creek

- 11.2.4 Clarks Cycle Systems

- 11.2.5 Dia-Compe

- 11.2.6 Hope Technology

- 11.2.7 Jagwire

- 11.2.8 KCNC

- 11.2.9 Paul Component Engineering

- 11.3 Emerging players

- 11.3.1 TRP Cycling Components

- 11.3.2 Weinmann

- 11.3.3 XLC Components