|

市場調查報告書

商品編碼

1913448

壓力式咖啡機市場機會、成長要素、產業趨勢分析及預測(2026-2035年)Pressure Coffee Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

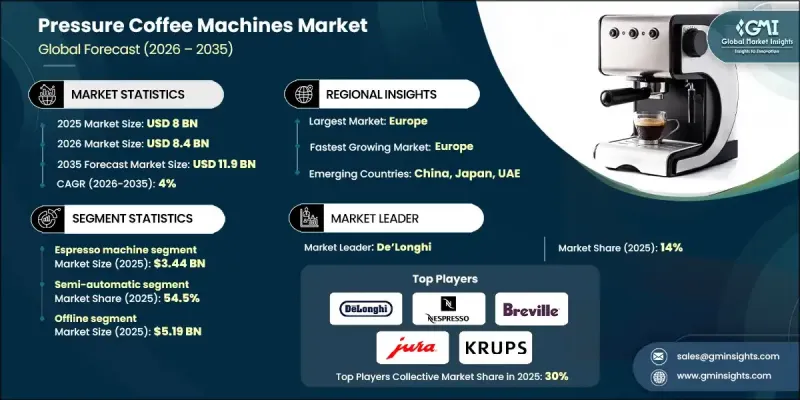

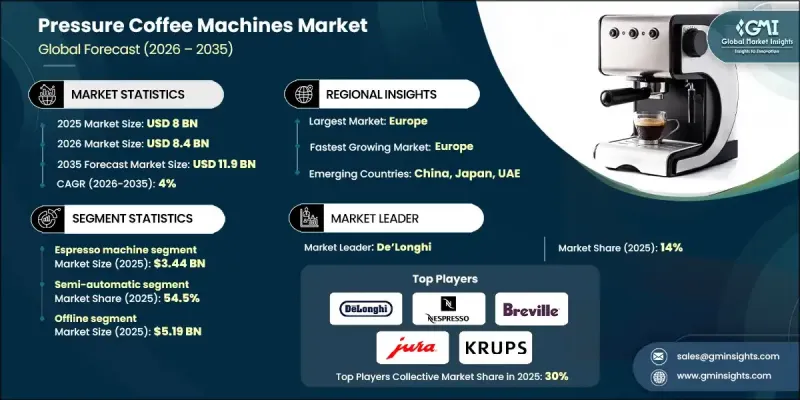

全球壓力式咖啡機市場預計到 2025 年將達到 80 億美元,到 2035 年將達到 119 億美元,年複合成長率為 4%。

全球咖啡消費量持續成長,推動市場發展,其驅動力包括生活方式的改變、城市人口的成長以及消費者對高品質咖啡日益成長的需求。消費者對咖啡的風味、沖泡方法和咖啡豆產地越來越挑剔,推動了對高階沖泡解決方案的需求。咖啡已成為日常生活不可或缺的一部分,尤其在年輕一代中,咖啡越來越被視為一種社交和自我表達的方式。這種轉變促使消費者增加對能夠提供穩定品質的高階沖泡設備的投入。咖啡文化的興起和國際咖啡品牌的流行進一步提升了消費者對便利性和飲品品質的期望。因此,為了在家庭和商業環境中重現專業級的咖啡體驗,消費者對壓力式咖啡機的投資正在不斷成長,從而增強了市場的長期穩定性。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 80億美元 |

| 預測金額 | 119億美元 |

| 複合年成長率 | 4% |

預計到2025年,濃縮咖啡咖啡機市場規模將達到34.4億美元,反映了其在整體市場中的強勁地位。由於能夠透過加壓萃取製作濃縮咖啡,這些機器被廣泛應用於住宅和商業場所。消費者對特產飲料的持續需求將繼續推動其普及,而科技的進步也提高了義式咖啡機的易用性和可靠性,使其對經驗豐富的用戶和新買家都更具吸引力。

截至2025年,半自動咖啡機佔了54.5%的市場。這類咖啡機之所以經久不衰,是因為它們兼顧了使用者控制和操作輔助功能。使用者可以調節關鍵的沖煮參數,而壓力和溫度的穩定性則由機器自動控制。這種柔軟性使得用戶無需像全手動系統那樣進行複雜的操作即可實現個性化客製化,從而使半自動咖啡機更易於使用且用途廣泛。

預計到2025年,美國壓力式咖啡機市場將佔據68%的市場佔有率,並創造15.2億美元的收入。美國濃厚的咖啡文化以及消費者對高品質家用咖啡機的日益成長的需求,持續推動市場需求。消費者越來越傾向於選擇兼具便利性、個人化和先進技術的咖啡機,這使得壓力式咖啡機成為住宅和商用領域的核心產品類別。

目錄

第1章調查方法和範圍

第2章執行摘要

第3章業界考察

- 生態系分析

- 供應商情況

- 利潤率

- 每個階段的附加價值

- 影響價值鏈的因素

- 產業影響因素

- 促進要素

- 咖啡消費量增加

- 家庭咖啡沖泡文化

- 技術進步

- 產業潛在風險與挑戰

- 安裝和維修成本高昂

- 仿冒品的風險

- 機會

- 智慧互聯系統

- 能源效率和永續性認證

- 促進要素

- 成長潛力分析

- 未來市場趨勢

- 科技與創新趨勢

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監管環境

- 標準和合規要求

- 區域法規結構

- 認證標準

- 波特五力分析

- PESTEL 分析

第4章 競爭情勢

- 介紹

- 公司市佔率分析

- 按地區

- 企業矩陣分析

- 主要市場公司的競爭分析

- 競爭定位矩陣

- 重大進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章 按類型分類的市場估算與預測,2022-2035年

- 濃縮咖啡機

- 泵式咖啡機

- 滴濾咖啡機

- 手滴式咖啡機

- 其他(法國媒體)

6. 2022-2035年按營運方式分類的市場估計與預測

- 半自動

- 全自動

第7章 依壓力範圍分類的市場估計與預測,2022-2035年

- 5巴或更低

- 5至10巴

- 10 至 15 巴

- 15巴或以上

第8章 按設備類型分類的市場估算與預測,2022-2035年

- 固定式

- 內建

9. 依最終用途分類的市場估計與預測,2022-2035 年

- 住宅

- 商業的

- 適用於辦公室/企業

- 咖啡館/餐廳

- 飯店

- 醫院

- 其他(教育機構、會議廳等)

第10章 按分銷管道分類的市場估算與預測,2022-2035年

- 直銷

- 間接銷售

第11章 2022-2035年各地區市場估計與預測

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第12章:公司簡介

- AGARO

- BLACK+DECKER

- Bosch

- Breville

- Continental

- De'Longhi

- ECM

- Gaggia

- Jura

- Krups

- Lavazza

- Miele

- Nespresso

- Russell Hobbs

- SMEG SpA

The Global Pressure Coffee Machines Market was valued at USD 8 billion in 2025 and is estimated to grow at a CAGR of 4% to reach USD 11.9 billion by 2035.

Rising global coffee consumption continues to support market development, driven by evolving lifestyles, increasing urban populations, and a growing appreciation for high-quality coffee. Consumers are becoming more selective about taste, preparation methods, and bean sourcing, which is elevating demand for premium brewing solutions. Coffee has become an integral part of daily routines, particularly among younger demographics, who associate it with social interaction and personal expression. This shift has increased spending on advanced brewing equipment that delivers consistent quality. The expanding cafe culture and wider presence of international coffee brands have further shaped expectations around convenience and beverage quality. As a result, consumers are increasingly investing in pressure-based coffee machines to recreate professional-grade coffee experiences at home and in commercial environments, reinforcing long-term market stability.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $8 Billion |

| Forecast Value | $11.9 Billion |

| CAGR | 4% |

The espresso machines segment generated USD 3.44 billion in 2025, reflecting its strong position within the overall market. These machines are widely used across residential and commercial settings due to their ability to produce concentrated coffee using pressurized extraction. Ongoing demand for specialty beverages continues to support adoption, while technological advancements have improved usability and consistency, broadening their appeal among both experienced users and new buyers.

The semi-automatic category accounted for 54.5% share in 2025. These machines remain popular because they balance user control with operational support. Users can influence key brewing variables while relying on the machine to manage pressure and temperature stability. This flexibility allows for customization without the complexity associated with fully manual systems, making semi-automatic models accessible and versatile.

U.S. Pressure Coffee Machines Market held 68% share and generated USD 1.52 billion in 2025. Strong domestic coffee culture and rising interest in premium home brewing solutions continue to drive demand. Consumers increasingly favor machines that offer convenience, personalization, and technological refinement, positioning pressure coffee machines as a core category across residential and professional settings.

Key companies operating in the Global Pressure Coffee Machines Market include De'Longhi, Breville, Bosch, Nespresso, Jura, Miele, Gaggia, Krups, Lavazza, SMEG S.p.A., BLACK+DECKER, Russell Hobbs, AGARO, ECM, and Continental. These brands remain competitive through product innovation, design differentiation, and global distribution strength. Companies in the Global Pressure Coffee Machines Market are strengthening their market position by focusing on innovation, product differentiation, and brand positioning. Manufacturers are investing in advanced engineering to improve consistency, durability, and ease of use while catering to both entry-level and premium segments. Design aesthetics and compact form factors are being emphasized to align with modern living spaces. Firms are also expanding their global retail and online presence to improve accessibility and brand visibility. Strategic collaborations with coffee brands and service providers help enhance product credibility.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Operation

- 2.2.4 Pressure range

- 2.2.5 Installation

- 2.2.6 End use

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising coffee consumption

- 3.2.1.2 Home-brewing culture

- 3.2.1.3 Technological advancements

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High acquisition & maintenance costs

- 3.2.2.2 Counterfeit product risks

- 3.2.3 Opportunities

- 3.2.3.1 Smart & connected systems

- 3.2.3.2 Energy efficiency & sustainability credentials

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By Region

- 3.6.2 By Type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2022 - 2035 (USD Billion)

- 5.1 Key trends

- 5.2 Espresso machine

- 5.3 Pump coffee machine

- 5.4 Drip coffee machine

- 5.5 Pour-over coffee machine

- 5.6 Others (French press)

Chapter 6 Market Estimates and Forecast, By Operation, 2022 - 2035 (USD Billion)

- 6.1 Key trends

- 6.2 Semi-automatic

- 6.3 Fully automatic

Chapter 7 Market Estimates and Forecast, By Pressure Range, 2022 - 2035 (USD Billion)

- 7.1 Key trends

- 7.2 Up to 5 bars

- 7.3 5 to 10 bars

- 7.4 10 to 15 bars

- 7.5 Above 15 bars

Chapter 8 Market Estimates and Forecast, By Installation, 2022 - 2035 (USD Billion)

- 8.1 Key trends

- 8.2 Freestanding

- 8.3 Built-in

Chapter 9 Market Estimates and Forecast, By End Use, 2022 - 2035 (USD Billion)

- 9.1 Key trends

- 9.2 Residential

- 9.3 Commercial

- 9.3.1 Office/Corporate

- 9.3.2 Cafes/Restaurants

- 9.3.3 Hotels

- 9.3.4 Hospitals

- 9.3.5 Others (institutions, conference venues)

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 (USD Billion)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 AGARO

- 12.2 BLACK+DECKER

- 12.3 Bosch

- 12.4 Breville

- 12.5 Continental

- 12.6 De’Longhi

- 12.7 ECM

- 12.8 Gaggia

- 12.9 Jura

- 12.10 Krups

- 12.11 Lavazza

- 12.12 Miele

- 12.13 Nespresso

- 12.14 Russell Hobbs

- 12.15 SMEG S.p.A.