|

市場調查報告書

商品編碼

1913431

診斷超音波市場機會、成長要素、產業趨勢分析及預測(2026-2035年)Diagnostic Ultrasound Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

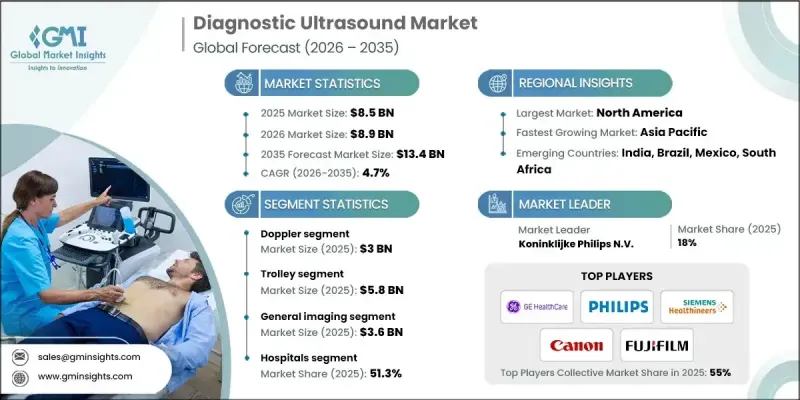

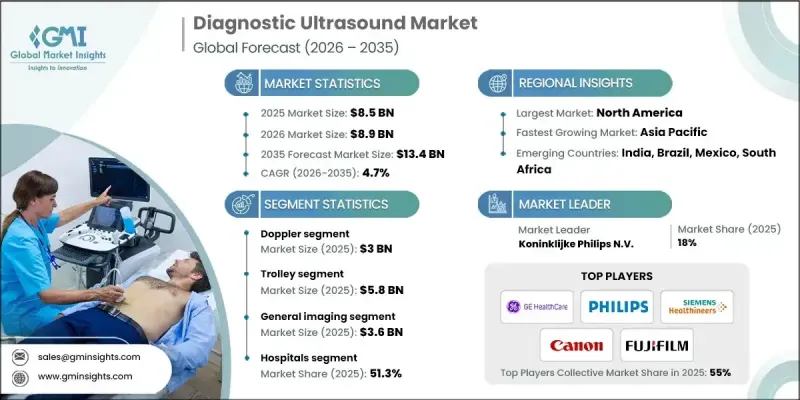

全球診斷超音波市場預計到 2025 年將達到 85 億美元,到 2035 年將達到 134 億美元,年複合成長率為 4.7%。

市場成長受多種因素驅動,包括已開發經濟體和新興經濟體人口老化加劇、慢性病盛行率上升、部分國家出生率提高以及超音波設備的不斷創新。診斷性超音波是一種非侵入性成像技術,利用超高頻聲波產生內部器官的高解析度影像。它廣泛用於檢查腹部、心臟、肌肉骨骼系統和其他身體部位。尤其在引導微創手術方面,例如懷孕期間胎兒監護和切片檢查,超音波技術備受重視。心血管疾病、癌症和其他慢性疾病的增加推動了對安全且經濟高效的診斷影像解決方案的需求。攜帶式和照護現場超音波系統的發展提高了醫院和門診的普及率,實現了快速、即時的診斷,從而提高了效率並改善了患者的治療效果。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 85億美元 |

| 預測金額 | 134億美元 |

| 複合年成長率 | 4.7% |

預計到2025年,多普勒超音波市場規模將達30億美元。多普勒超音波是一種透過檢測聲波頻率變化來測量血管內血流的專業技術。它有多種形式,例如彩色多普勒、能量多普勒和頻譜多普勒,廣泛應用於心血管、血管和產科領域,提供重要的即時血流動力學資訊。其在診斷心血管疾病、監測胎兒健康和評估血管狀況方面的作用,鞏固了其在診斷超音波市場的主導地位。

預計到2025年,推車式超音波設備市場規模將達58億美元。推車式超音波系統是傳統的推車式設備,旨在為醫院和診斷中心提供全面的超音波診斷服務。它們配備多個換能器和先進的成像功能,例如多普勒、3D/4D和造影超音波,是需要深度成像和無縫工作流程整合的高強度環境的理想選擇。

預計到2025年,北美診斷超音波市場佔有率將達到33.8%。該地區的市場佔有率得益於先進的醫療基礎設施、對創新成像技術的早期應用以及主要製造商的存在。完善的報銷政策、對診斷成像設施的持續投資以及超音波在心臟病學、產科和急診醫學領域日益成長的應用,都為該地區強大的市場地位做出了貢獻。

目錄

第1章調查方法和範圍

第2章執行摘要

第3章業界考察

- 生態系分析

- 產業影響因素

- 促進要素

- 已開發國家和發展中國家老齡人口不斷成長的趨勢

- 慢性病發生率增加

- 開發中國家出生率不斷上升

- 診斷超音波設備的創新與進展

- 產業潛在風險與挑戰

- 熟練專業人員短缺,尤其是在發展中和低度開發地區。

- 發展中經濟體普及診斷性超音波的障礙

- 市場機遇

- 人工智慧(AI)與先進成像技術的融合

- 在預防和初級保健領域拓展應用

- 促進要素

- 成長潛力分析

- 監管環境

- 技術進步

- 當前技術趨勢

- 新興技術

- 供應鏈分析

- 救贖方案

- 2025年定價分析

- 未來市場趨勢

- 差距分析

- 波特五力分析

- PESTEL 分析

第4章 競爭情勢

- 介紹

- 公司市佔率分析

- 企業矩陣分析

- 主要市場公司的競爭分析

- 競爭定位矩陣

- 重大進展

- 併購

- 合作夥伴關係和合資企業

- 新產品發布

- 擴張計劃

第5章 按技術分類的市場估算與預測,2022-2035年

- 2D

- 3D和4D

- 多普勒

第6章 市場估算與預測:2022-2035年手機性別分佈

- 手推車

- 緊湊型/手持式

第7章 按應用領域分類的市場估算與預測,2022-2035年

- 普通診斷影像

- 心臟病學

- 婦產科

- 其他應用

第8章 依最終用途分類的市場估算與預測,2022-2035年

- 醫院

- 婦產科中心

- 其他用途

第9章 2022-2035年各地區市場估算與預測

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- Alpinion Medical Systems

- Butterfly Network

- Canon Medical Systems Corporation

- CHISON Medical Technologies

- Clarius Mobile Health

- Esaote SpA

- FujiFilm Holdings Corporation

- General Electric Company(GE Healthcare)

- Hologic, Inc.

- Konica Minolta Inc.

- Koninklijke Philips NV(BioTelemetry, Inc.)

- Samsung Electronics Co. Ltd.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Siemens Healthineers AG

- SonoScape

The Global Diagnostic Ultrasound Market was valued at USD 8.5 billion in 2025 and is estimated to grow at a CAGR of 4.7% to reach USD 13.4 billion by 2035.

Market growth is driven by multiple factors, including a rising geriatric population in both developed and emerging regions, the growing prevalence of chronic illnesses, increasing birth rates in certain countries, and continuous technological innovations in ultrasound devices. Diagnostic ultrasound is a non-invasive imaging technology that generates high-resolution images of internal organs using ultra-high-frequency sound waves. It is widely used to examine the abdomen, heart, musculoskeletal system, and other body parts. Technology is particularly valued for fetal monitoring during pregnancy and for guiding minimally invasive procedures such as biopsies. Increasing rates of cardiovascular diseases, cancer, and other chronic conditions are driving demand for safe, cost-effective imaging solutions. The development of portable and point-of-care ultrasound systems is improving accessibility and enabling faster real-time diagnostics in hospitals and outpatient settings, enhancing both efficiency and patient outcomes.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $8.5 Billion |

| Forecast Value | $13.4 Billion |

| CAGR | 4.7% |

The Doppler segment reached USD 3 billion in 2025. Doppler ultrasound is a specialized modality that measures blood flow within vessels by detecting changes in sound wave frequency. Available in formats such as color, power, and spectral Doppler, it is widely used for cardiovascular, vascular, and obstetric applications, providing critical real-time hemodynamic information. Its role in diagnosing cardiovascular disorders, monitoring fetal health, and assessing vascular conditions drives its dominance in the diagnostic ultrasound market.

The trolley segment reached USD 5.8 billion in 2025. Trolley-based ultrasound systems are traditional cart-mounted devices designed for comprehensive hospital and diagnostic center use. Equipped with multiple transducers and advanced imaging features, including Doppler, 3D/4D, and contrast-enhanced ultrasound, these systems are ideal for high-volume settings that require detailed imaging and seamless workflow integration.

North America Diagnostic Ultrasound Market accounted for 33.8% share in 2025. The region's share is supported by advanced healthcare infrastructure, early adoption of innovative imaging technologies, and the presence of leading manufacturers. Established reimbursement policies, consistent investment in imaging facilities, and the growing use of ultrasound in cardiology, obstetrics, and emergency care contribute to its strong market position.

Key players operating in the Global Diagnostic Ultrasound Market include Siemens Healthineers AG, Canon Medical Systems Corporation, Alpinion Medical Systems, Butterfly Network, Konica Minolta Inc., General Electric Company (GE Healthcare), Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Samsung Electronics Co., Ltd., Clarius Mobile Health, Hologic, Inc., CHISON Medical Technologies, Koninklijke Philips N.V., SonoScape, Esaote SpA, and FujiFilm Holdings Corporation. Companies in the Global Diagnostic Ultrasound Market strengthen their position through continuous product innovation, expanding their portfolio of advanced imaging modalities such as Doppler, 3D/4D, and point-of-care devices. Strategic partnerships with hospitals, clinics, and research institutions help expand adoption and enhance brand visibility. R&D investment drives miniaturization, portability, and software-enabled diagnostic capabilities. Firms also focus on improving workflow integration, user-friendly interfaces, and AI-based imaging analytics to deliver more accurate and faster diagnostics.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Technology trends

- 2.2.3 Portability trends

- 2.2.4 Application trends

- 2.2.5 End Use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing geriatric population base in developed as well as developing regions

- 3.2.1.2 Increasing incidence of chronic diseases

- 3.2.1.3 Increasing birth rates in developing countries

- 3.2.1.4 Technological innovations and advancements in diagnostic ultrasound devices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Dearth of skilled professionals especially in developing and underdeveloped regions

- 3.2.2.2 Barriers impeding use of diagnostic ultrasound in developing economies

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of AI and advanced imaging technologies

- 3.2.3.2 Increasing applications in preventive and primary care

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Reimbursement scenario

- 3.8 Pricing analysis, 2025

- 3.9 Future market trends

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Technology, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 2D

- 5.3 3D and 4D

- 5.4 Doppler

Chapter 6 Market Estimates and Forecast, By Portability, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Trolley

- 6.3 Compact/handheld

Chapter 7 Market Estimates and Forecast, By Application, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 General imaging

- 7.3 Cardiology

- 7.4 OB/GYN

- 7.5 Other application

Chapter 8 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Maternity centers

- 8.4 Other End Use

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Alpinion Medical Systems

- 10.2 Butterfly Network

- 10.3 Canon Medical Systems Corporation

- 10.4 CHISON Medical Technologies

- 10.5 Clarius Mobile Health

- 10.6 Esaote SpA

- 10.7 FujiFilm Holdings Corporation

- 10.8 General Electric Company (GE Healthcare)

- 10.9 Hologic, Inc.

- 10.10 Konica Minolta Inc.

- 10.11 Koninklijke Philips N.V. (BioTelemetry, Inc.)

- 10.12 Samsung Electronics Co. Ltd.

- 10.13 Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- 10.14 Siemens Healthineers AG

- 10.15 SonoScape