|

市場調查報告書

商品編碼

1913419

汽車隔熱罩市場機會、成長要素、產業趨勢分析及2026年至2035年預測Automotive Heat Shield Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

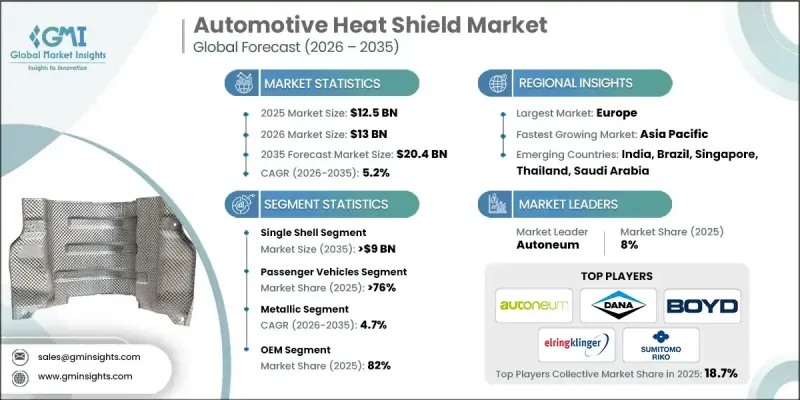

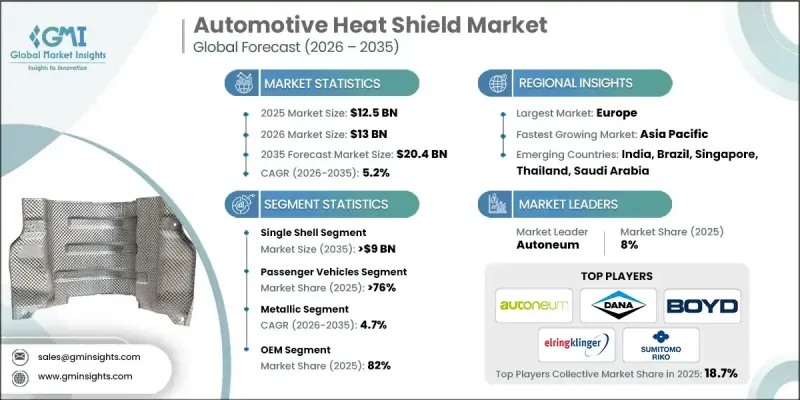

全球汽車隔熱罩市場預計到 2025 年將達到 125 億美元,到 2035 年將達到 204 億美元,年複合成長率為 5.2%。

現代車輛架構對溫度控管的需求日益成長,推動了市場成長。汽油和柴油車輛中增壓引擎的日益普及,促使人們需要耐用的隔熱解決方案來保護周圍部件、維持結構完整性並支持引擎的長期性能。同時,向電動化出行的轉型也對電池、電力電子設備和充電系統提出了新的熱控制要求。汽車隔熱罩正被擴大用於調節散熱、延長零件壽命,並支援電動和混合動力汽車平台的安全駕駛。消費者對駕駛舒適性和車輛安全性的日益關注也進一步推動了市場需求。有效的隔熱材料可以限制熱量傳遞到車廂,並保護敏感系統免受高溫影響。監管壓力也發揮關鍵作用,汽車製造商依靠隔熱罩來滿足全球市場日益嚴格的排放氣體、防火安全和熱合規標準。隨著車輛變得越來越複雜和高功率,先進的隔熱解決方案對於車輛的性能、安全性和合規性仍然至關重要。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 125億美元 |

| 預測金額 | 204億美元 |

| 複合年成長率 | 5.2% |

2025 年,單殼類別佔 47% 的市場佔有率,預計到 2035 年將達到 90 億美元。由於其成本效益高、易於製造,以及在熱負荷適中的應用中的有效性,尤其是在大規模生產的汽車平臺上,該細分市場繼續保持較高的普及率。

預計到 2025 年,乘用車將佔市場佔有率的 76%,市場規模將達到 95 億美元。大規模生產、更嚴格的排放氣體法規、渦輪增壓引擎的普及以及電氣化的加速發展,使得主流車型和豪華車型的溫度控管變得更加複雜。

美國汽車隔熱罩市場預計到2025年將達到19.1億美元,並預計在2035年之前保持強勁成長。渦輪增壓引擎和混合動力系統的持續普及推動了對先進排氣系統和動力傳動系統隔熱罩解決方案的需求。輕量化需求促使複合材料和多層設計得到應用,以幫助實現效率目標、延長電動車續航里程並滿足聯邦安全和排放氣體標準。

目錄

第1章調查方法

第2章執行摘要

第3章業界考察

- 生態系分析

- 供應商情況

- 利潤率分析

- 成本結構

- 每個過程都增加了價值

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 促進要素

- 更嚴格的排放氣體和熱安全法規

- 汽車產量和車輛擁有量不斷成長

- 渦輪增壓器和高性能引擎的日益普及

- 電動和混合動力汽車對溫度控管的需求日益成長

- 售後市場替換需求成長

- 產業潛在風險與挑戰

- 原物料價格波動

- 純電動車中隔熱罩使用量減少的趨勢

- 市場機遇

- 電動汽車電池和電力電子設備的隔熱罩

- 輕量化和先進絕緣材料的現狀

- 擴充底盤和模組化隔熱罩解決方案

- 新興市場售後市場及改造需求成長

- 成長潛力分析

- 監管環境

- 北美洲

- 美國- ISO 9001品質管理體系

- 加拿大 - ISO 45001 職業健康與安全

- 歐洲

- 英國- ISO/IEC 27001資訊安全管理

- 德國 - ISO 50001 能源管理體系

- 法國 - ISO 45001 職業健康與安全

- 義大利 - ISO 14001 環境管理體系

- 西班牙 - ISO 22000 食品安全管理體系

- 亞太地區

- 中國-ISO/IEC 27001資訊安全管理體系

- 日本 - ISO 14001 環境管理體系

- 印度 - ISO 45001 職業健康與安全

- 拉丁美洲

- 巴西 - ISO 14001 環境管理體系

- 墨西哥 - ISO 45001 職業健康與安全

- 阿根廷 - ISO 14001 環境管理體系

- 中東和非洲

- 阿拉伯聯合大公國-ISO 14001環境管理體系

- 南非 - ISO 45001 職業健康與安全

- 沙烏地阿拉伯 - ISO 14001 環境管理體系

- 北美洲

- 波特五力分析

- PESTEL 分析

- 科技與創新趨勢

- 當前技術趨勢

- 新興技術

- 生產統計

- 生產基地

- 消費基礎

- 出口和進口

- 成本細分分析

- 開發成本結構

- 研發成本分析

- 行銷和銷售成本

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 未來市場展望與機遇

- OEM設計所有權與採購決策框架

- OEM指定和供應商設計的隔熱罩

- 成本、重量和熱性能之間的權衡

- 平台級籌資策略

- 輕量化和材料替代趨勢

- 從金屬到複合材料的趨勢

- 平衡減重和成本敏感性

- 對汽車製造商二氧化碳排放監管策略的影響

- 尖端材料應用障礙

- 電動車對隔熱罩結構和設計演變的影響

- 內燃機汽車、混合動力汽車和電動車對隔熱罩的需求變化

- 電池、逆變器和電力電子設備需要屏蔽。

- 每輛車的淨含量變化

第4章 競爭情勢

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 主要市場公司的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 重大進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 企業擴張計畫和資金籌措

第5章 2022-2035年按產品分類的市場估算與預測

- 單殼

- 雙層殼

- 三明治

第6章 依車輛類型分類的市場估計與預測,2022-2035年

- 搭乘用車

- 掀背車

- 轎車

- SUV

- 商用車輛

- 輕型商用車(LCV)

- MCV

- 重型商用車(HCV)

第7章 按材料分類的市場估算與預測,2022-2035年

- 金屬

- 陶瓷製品

- 複合材料

第8章 2022-2035年按推進方式分類的市場估算與預測

- 內燃機(ICE)

- 混合

- 電的

- 電池式電動車(BEV)

- 燃料電池汽車(FCEV)

- PHEV

第9章 依銷售管道分類的市場估計與預測,2022-2035年

- OEM

- 售後市場

第10章 依應用領域分類的市場估計與預測,2022-2035年

- 底盤隔熱罩

- 引擎

- 排氣

- 渦輪增壓器

- 傳播

- 其他

第11章 2022-2035年各地區市場估計與預測

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐國家

- 葡萄牙

- 克羅埃西亞

- 比荷盧經濟聯盟

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 新加坡

- 泰國

- 印尼

- 越南

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 哥倫比亞

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

第12章:公司簡介

- 世界玩家

- Autoneum

- Dana

- ElringKlinger

- Freudenberg Sealing Technologies

- Morgan Advanced Materials

- Sumitomo Riko

- Carcoustics

- UGN

- Adler Pelzer

- Toyoda Gosei

- Nihon Tokushu Toryo

- 區域玩家

- Boyd

- Frenzelit

- Happich

- Talbros

- Design Engineering

- Thermo-Tec Automotive

- Sekisui Chemical

- Sika Automotive

- Trelleborg Automotive

- Emerging/Disruptor Players

- Alpha Engineered Components

- Anhui Parker New Material

- Heatshield Products

- Zircotec

- Pyrotek Automotive Thermal Solutions

- Unifrax

The Global Automotive Heat Shield Market was valued at USD 12.5 billion in 2025 and is estimated to grow at a CAGR of 5.2% to reach USD 20.4 billion by 2035.

Market growth is supported by rising thermal management requirements across modern vehicle architectures. Increasing adoption of forced-induction engines in both gasoline and diesel vehicles is intensifying the need for durable heat protection solutions that safeguard surrounding components, preserve structural integrity, and support long-term engine performance. At the same time, the shift toward electrified mobility is introducing new thermal control demands linked to batteries, power electronics, and charging systems. Automotive heat shields are increasingly used to regulate heat dispersion, improve component lifespan, and support safe operation across electric and hybrid platforms. Growing consumer focus on driving comfort and vehicle safety is further strengthening demand, as effective thermal insulation limits heat transfer into the cabin and protects sensitive systems from elevated temperatures. Regulatory pressure also plays a key role, with automakers relying on heat shields to meet tightening emission, fire safety, and thermal compliance standards across global markets. As vehicles become more complex and power-dense, advanced heat shielding solutions remain essential to performance, safety, and regulatory alignment.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $12.5 Billion |

| Forecast Value | $20.4 Billion |

| CAGR | 5.2% |

In 2025, the single-shell category represented 47% share and is forecast to reach USD 9 billion by 2035. This segment continues to see strong adoption due to its cost efficiency, straightforward production, and effectiveness in applications with moderate thermal exposure, particularly across high-volume vehicle platforms.

The passenger vehicles accounted for 76% share in 2025, generating USD 9.5 billion. High production volumes, stricter emission requirements, widespread turbocharged engine use, and accelerating electrification are increasing thermal management complexity across both mainstream and premium vehicle segments.

U.S. Automotive Heat Shield Market was valued at USD 1.91 billion in 2025 and is expected to post solid growth through 2035. Continued uptake of turbocharged engines and hybrid drivetrains is sustaining demand for advanced exhaust and powertrain heat shielding solutions. Lightweighting priorities encourage greater use of composite and multilayer designs to support efficiency targets, extended electric driving range, and compliance with federal safety and emission standards.

Key companies operating in the Global Automotive Heat Shield Market include Dana, Autoneum, ElringKlinger, Morgan Advanced Materials, Boyd, Freudenberg Sealing Technologies, Sumitomo Riko, Zircotec, Carcoustics, and Thermo-Tec Automotive. Companies in the Global Automotive Heat Shield Market are strengthening their competitive position through material innovation, lightweight design development, and close collaboration with vehicle manufacturers. Investments in advanced composites and multilayer insulation technologies are helping suppliers address rising thermal loads while supporting fuel efficiency and electric vehicle range targets. Manufacturers are expanding localized production and engineering capabilities to align with OEM platform strategies and shorten development cycles. Long-term supply agreements, platform-specific customization, and early-stage design integration are being used to secure recurring business.

Table of Contents

Chapter 1 Methodology

- 1.1 Research approach

- 1.2 Quality commitments

- 1.2.1 GMI AI policy & data integrity commitment

- 1.3 Research trail & confidence scoring

- 1.3.1 Research trail components

- 1.3.2 Scoring components

- 1.4 Data collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.6 Base estimates and calculations

- 1.6.1 Base year calculation

- 1.7 Forecast

- 1.8 Research transparency addendum

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Vehicle

- 2.2.4 Material

- 2.2.5 Sales channel

- 2.2.6 Propulsion

- 2.2.7 Application

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook & strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Stringent emission and thermal safety regulations

- 3.2.1.3 Rising vehicle production and vehicle parc growth

- 3.2.1.4 Increasing adoption of turbocharged and high-performance engines

- 3.2.1.5 Expanding thermal management needs in electric and hybrid vehicles

- 3.2.1.6 Growth in aftermarket replacement demand

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Volatility in raw material prices

- 3.2.2.2 Declining heat shield intensity in fully electric vehicles

- 3.2.3 Market opportunities

- 3.2.3.1 EV battery and power electronics heat shielding

- 3.2.3.2 Adoption of lightweight and advanced insulation materials

- 3.2.3.3 Expansion of underbody and modular heat shield solutions

- 3.2.3.4 Aftermarket and retrofit growth in emerging markets

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S. - ISO 9001 Quality Management Systems

- 3.4.1.2 Canada - ISO 45001 Occupational Health and Safety

- 3.4.2 Europe

- 3.4.2.1 UK - ISO/IEC 27001 Information Security Management

- 3.4.2.2 Germany - ISO 50001 Energy Management Systems

- 3.4.2.3 France - ISO 45001 Occupational Health and Safety

- 3.4.2.4 Italy - ISO 14001 Environmental Management Systems

- 3.4.2.5 Spain - ISO 22000 Food Safety Management Systems

- 3.4.3 Asia Pacific

- 3.4.3.1 China - ISO/IEC 27001 Information Security Management

- 3.4.3.2 Japan - ISO 14001 Environmental Management Systems

- 3.4.3.3 India - ISO 45001 Occupational Health and Safety

- 3.4.4 Latin America

- 3.4.4.1 Brazil - ISO 14001 Environmental Management Systems

- 3.4.4.2 Mexico - ISO 45001 Occupational Health and Safety

- 3.4.4.3 Argentina - ISO 14001 Environmental Management Systems

- 3.4.5 Middle East & Africa

- 3.4.5.1 UAE - ISO 14001 Environmental Management Systems

- 3.4.5.2 South Africa - ISO 45001 Occupational Health and Safety

- 3.4.5.3 Saudi Arabia - ISO 14001 Environmental Management Systems

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Production statistics

- 3.8.1 Production hubs

- 3.8.2 Consumption hubs

- 3.8.3 Export and import

- 3.9 Cost breakdown analysis

- 3.9.1 Development cost structure

- 3.9.2 R&D cost analysis

- 3.9.3 Marketing & sales costs

- 3.10 Patent analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly Initiatives

- 3.12 Future market outlook & opportunities

- 3.13 OEM design ownership & sourcing decision framework

- 3.13.1 OEM-specified vs supplier-designed heat shields

- 3.13.2 Cost, weight & thermal performance trade-offs

- 3.13.3 Platform-level sourcing strategies

- 3.14 Lightweighting & material substitution dynamics

- 3.14.1 Metal-to-composite transition trends

- 3.14.2 Weight reduction vs cost sensitivity

- 3.14.3 Impact on OEM CO2 compliance strategies

- 3.14.4 Adoption barriers for advanced materials

- 3.15 EV impact on heat shield content & design evolution

- 3.15.1 Heat shield demand shifts in ICE vs hybrid vs EVs

- 3.15.2 Battery, inverter & power electronics shielding needs

- 3.15.3 Net content change per vehicle

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast By Product, 2022 - 2035 ($Bn, Units)

- 5.1 Key trends

- 5.2 Single shell

- 5.3 Double shell

- 5.4 Sandwich

Chapter 6 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger vehicles

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 LCV

- 6.3.2 MCV

- 6.3.3 HCV

Chapter 7 Market Estimates & Forecast, By Material, 2022 - 2035 ($Bn, Units)

- 7.1 Key trends

- 7.2 Metallic

- 7.3 Ceramic

- 7.4 Composite

Chapter 8 Market Estimates & Forecast, By Propulsion, 2022 - 2035 ($Bn, Units)

- 8.1 Key trends

- 8.2 ICE

- 8.3 Hybrid

- 8.4 Electric

- 8.4.1 BEV

- 8.4.2 FCEV

- 8.4.3 PHEV

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2022 - 2035 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Application, 2022 - 2035 ($Bn, Units)

- 10.1 Key trends

- 10.2 Underbody heatshield

- 10.3 Engine

- 10.4 Exhaust

- 10.5 Turbocharger

- 10.6 Transmission

- 10.7 Others

Chapter 11 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.3.8 Portugal

- 11.3.9 Croatia

- 11.3.10 Benelux

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Singapore

- 11.4.7 Thailand

- 11.4.8 Indonesia

- 11.4.9 Vietnam

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Colombia

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

- 11.6.4 Turkey

Chapter 12 Company Profiles

- 12.1 Global Players

- 12.1.1 Autoneum

- 12.1.2 Dana

- 12.1.3 ElringKlinger

- 12.1.4 Freudenberg Sealing Technologies

- 12.1.5 Morgan Advanced Materials

- 12.1.6 Sumitomo Riko

- 12.1.7 Carcoustics

- 12.1.8 UGN

- 12.1.9 Adler Pelzer

- 12.1.10 Toyoda Gosei

- 12.1.11 Nihon Tokushu Toryo

- 12.2 Regional Players

- 12.2.1 Boyd

- 12.2.2 Frenzelit

- 12.2.3 Happich

- 12.2.4 Talbros

- 12.2.5 Design Engineering

- 12.2.6 Thermo-Tec Automotive

- 12.2.7 Sekisui Chemical

- 12.2.8 Sika Automotive

- 12.2.9 Trelleborg Automotive

- 12.3 Emerging / Disruptor Players

- 12.3.1 Alpha Engineered Components

- 12.3.2 Anhui Parker New Material

- 12.3.3 Heatshield Products

- 12.3.4 Zircotec

- 12.3.5 Pyrotek Automotive Thermal Solutions

- 12.3.6 Unifrax