|

市場調查報告書

商品編碼

1913414

電動嬰兒車市場機會、成長要素、產業趨勢分析及預測(2026年至2035年)Electric Baby Car Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

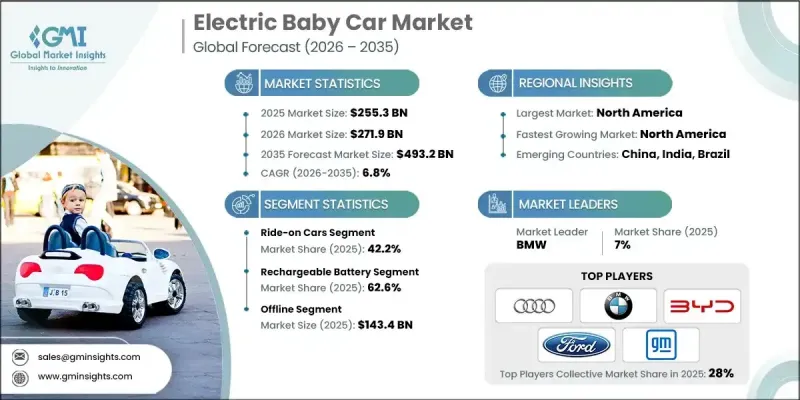

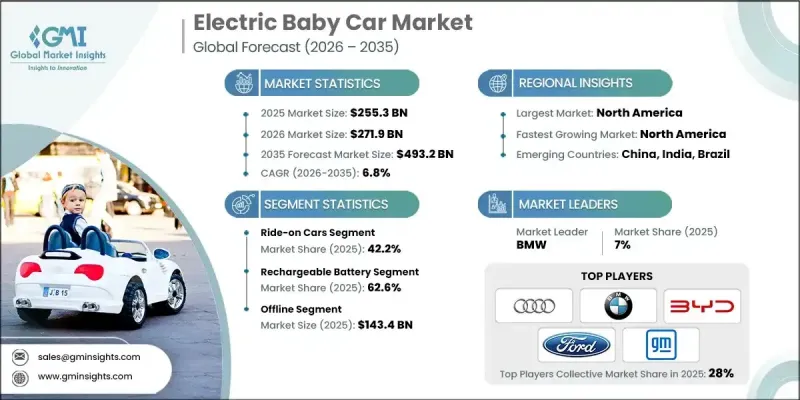

全球電動嬰兒車市場預計到 2025 年將達到 2,553 億美元,預計到 2035 年將達到 4,932 億美元,年複合成長率為 6.8%。

智慧技術的快速發展正將電動玩具搭乘用轉變為高度精密、互聯互通的產品。製造商不斷融入創新功能,提升兒童和家長的參與、安全性和整體使用者體驗。行動應用程式的整合是關鍵所在,它為家長提供遠端控制、即時速度管理、緊急煞車和地理圍欄功能,使車輛在指定安全區域外無法行駛。 GPS追蹤、RFID啟動鑰匙和智慧型儀錶板等附加功能進一步增強了安全性和監控能力,而音樂應用程式和語音引導指令則提供了早期教育的機會。隨著物聯網整合的日益普及,智慧電動車正將自身定位為高級產品,目標客戶是那些追求高品質、功能豐富的科技達人家長。市場擴張的驅動力在於消費者對互聯、安全、互動式兒童出行解決方案日益成長的需求。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 2553億美元 |

| 預測金額 | 4932億美元 |

| 複合年成長率 | 6.8% |

截至2025年,搭乘用市佔率將達到42.2%,這主要得益於其適應性強、後座可轉換為前座以及長期價值。安全合規性、側面碰撞保護和便利的安裝系統是其受歡迎程度的主要促進因素。這些車輛配備了可正常工作的頭燈和安全帶,提供逼真的駕駛體驗。藍牙連接和先進的家長控制功能的引入預計將繼續推動市場成長。

線下銷售領域將佔據市場的大部分佔有率,到 2025 年將創造 1,434 億美元的收入。消費者更喜歡線下管道,以獲得親身體驗、個人化的產品選擇和配置指導以及售後支持,這對電動嬰兒車來說至關重要。

預計到 2025 年,美國電動嬰兒車市場將佔據 84.5% 的市場佔有率,市場規模將達到 788 億美元。強大的物流網路、不斷提高的技術普及率以及政府安全法規正在推動市場成長,而北美將成為全球需求的主要貢獻者。

目錄

第1章調查方法和範圍

第2章執行摘要

第3章業界考察

- 生態系分析

- 供應商情況

- 利潤率

- 每個階段的附加價值

- 影響價值鏈的因素

- 產業影響因素

- 促進要素

- 嚴格執行兒童安全法規

- 提高家長安全意識,並關注兒童安全

- 智慧座椅技術整合

- 產業潛在風險與挑戰

- 高昂的初始成本和認證座椅系統

- 消費者困惑與安裝難題

- 機會

- 新興經濟體的成長

- 開發輕量化和電商最佳化座椅

- 促進要素

- 成長潛力分析

- 未來市場趨勢

- 科技與創新趨勢

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監管環境

- 標準和合規要求

- 區域法規結構

- 認證標準

- 波特五力分析

- PESTEL 分析

第4章 競爭情勢

- 介紹

- 公司市佔率分析

- 按地區

- 企業矩陣分析

- 主要市場公司的競爭分析

- 競爭定位矩陣

- 重大進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章 2022-2035年按產品分類的市場估算與預測

- 搭乘用玩具車

- 遙控車

- 電池驅動車輛

第6章 依年齡層別分類的市場估計與預測,2022-2035年

- 0-1歲

- 1至3歲

- 3至5歲

第7章 2022-2035年按價格分類的市場估計與預測

- 低價位

- 中價位

- 高的

第8章 2022-2035年按能源類型分類的市場估算與預測

- 可充電電池

- 插電式電動車

9. 2022-2035年按分銷管道分類的市場估算與預測

- 線上

- 電子商務網站

- 公司經營的網站

- 離線

- 零售店

- 其他

第10章 2022-2035年各地區市場估計與預測

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第11章 公司簡介

- Audi

- BMW

- Peg Perego

- Ford

- General Motors(Chevrolet)

- Volkswagen

- Honda

- Hyundai

- Kia

- Lucid Motors

- Mercedes-Benz

- Nissan

- Polestar

- Rivian

- Tesla

The Global Electric Baby Car Market was valued at USD 255.3 billion in 2025 and is estimated to grow at a CAGR of 6.8% to reach USD 493.2 billion by 2035.

Rapid advancements in smart technology are transforming electric ride-on cars into highly sophisticated, connected products. Manufacturers are incorporating innovative features that enhance engagement, safety, and overall user experience for children and parents. Mobile app connectivity is a key driver, providing parents with remote control, real-time speed management, emergency braking, and geo-fencing that disables the vehicle outside designated safe zones. Additional features such as GPS tracking, RFID start keys, and smart dashboards further improve safety and monitoring, while music apps and voice-guided instructions introduce early educational opportunities. As IoT integration becomes commonplace, smart electric cars are increasingly positioned as premium products, appealing to tech-savvy parents seeking high-quality, feature-rich models. Market expansion is fueled by the rising demand for connected, safe, and interactive mobility solutions for children.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $255.3 Billion |

| Forecast Value | $493.2 Billion |

| CAGR | 6.8% |

The ride-on cars segment held a 42.2% share in 2025, owing to their adaptability, rear-to-forward seating transitions, and long-term value. Popularity stems from safety compliance, side-impact protection, and easy installation systems. These vehicles offer realistic driving experiences, complete with working headlights and safety belts, and their growth is expected to continue with the introduction of Bluetooth connectivity and advanced parental controls.

The offline sales segment generated USD 143.4 billion in 2025, capturing a major portion of the market. Consumers prefer offline channels for the hands-on experience, personalized guidance on product selection, configuration, and after-sales support, which is critical for electric baby cars.

U.S. Electric Baby Car Market held 84.5% share, generating USD 78.8 billion in 2025. Market growth is driven by strong logistics networks, widespread technology adoption, and government safety regulations, positioning North America as a major contributor to global demand.

Prominent players in the Global Electric Baby Car Market include Tesla, Ford, Lucid Motors, BMW, Audi, Mercedes-Benz, Rivian, Volkswagen, Honda, Hyundai, Kia, Nissan, Polestar, Peg Perego, and General Motors (Chevrolet). To strengthen their presence, companies are focusing on continuous product innovation by integrating advanced smart features, safety enhancements, and connectivity options into their vehicles. Collaborations with technology providers and app developers improve real-time monitoring and parental control functionalities. Firms are expanding offline and online distribution networks to enhance accessibility and consumer reach. They invest in targeted marketing campaigns to highlight premium, safe, and interactive product offerings.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Power source

- 2.2.4 Age group

- 2.2.5 Pricing

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Enforcement of stringent child safety regulation

- 3.2.1.2 Increased parental awareness and focus on child safety

- 3.2.1.3 Technological integration of smart seats

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial cost and certified seat systems

- 3.2.2.2 Consumer confusion and installation gaps

- 3.2.3 Opportunities

- 3.2.3.1 Growth in emerging economies.

- 3.2.3.2 Development of lightweight and e-commerce optimized seats

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2022 - 2035 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Ride-on cars

- 5.3 Remote-controlled cars

- 5.4 Battery-powered vehicles

Chapter 6 Market Estimates and Forecast, By Age Group, 2022 - 2035 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 0-1 years

- 6.3 1-3 years

- 6.4 3-5 years

Chapter 7 Market Estimates and Forecast, By Price, 2022 - 2035 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates and Forecast, By Power Source, 2022 - 2035 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Rechargeable battery

- 8.3 Plug-in electric

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 E-commerce site

- 9.2.2 Company owned site

- 9.3 Offline

- 9.3.1 Retail stores

- 9.3.2 Others

Chapter 10 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Audi

- 11.2 BMW

- 11.3 Peg Perego

- 11.4 Ford

- 11.5 General Motors (Chevrolet)

- 11.6 Volkswagen

- 11.7 Honda

- 11.8 Hyundai

- 11.9 Kia

- 11.10 Lucid Motors

- 11.11 Mercedes-Benz

- 11.12 Nissan

- 11.13 Polestar

- 11.14 Rivian

- 11.15 Tesla