|

市場調查報告書

商品編碼

1913386

BETA-聚葡萄糖市場:市場機會、成長促進因素、產業趨勢分析及預測(2026-2035)Beta Glucan Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

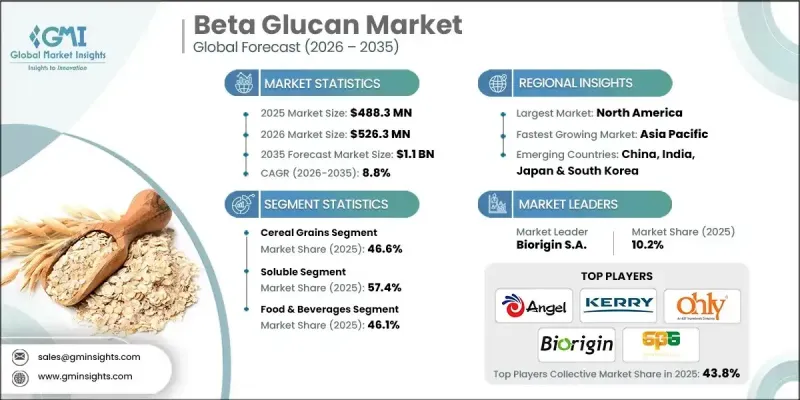

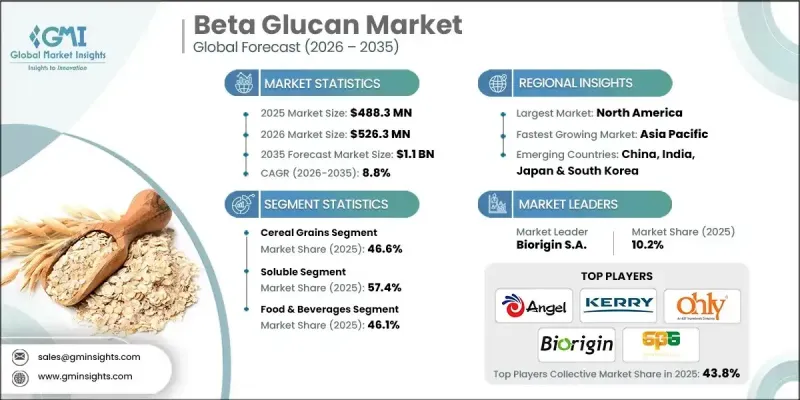

全球BETA-聚葡萄糖市場預計到2025年將達到4.883億美元,到2035年將達到11億美元,年複合成長率為8.8%。

市場擴張的驅動力在於人們對BETA-聚葡萄糖生理益處的認知不斷提高,以及其在食品、營養和製藥領域應用範圍的不斷擴大。 BETA-聚葡萄糖是一種天然膳食纖維,因其支持免疫反應、調節膽固醇水平和促進碳水化合物代謝平衡而備受認可。其在促進心臟健康和增強免疫力方面的作用,正促使其在注重健康的食品配方中得到更廣泛的應用。消費者對天然健康成分的日益青睞也進一步推動了市場需求。此外,BETA-葡聚醣在血糖值管理和抗氧化活性方面的其他益處,也使其在長期健康管理中發揮重要作用。從商業性角度來看,製造商正在拓展其應用領域,並將BETA-聚葡萄糖擴大添加到面向注重健康的消費者的食品和飲料配方中。這種多元化發展,加上科學檢驗和產品創新,正使全球市場保持強勁的成長動能。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測期 | 2026-2035 |

| 初始市場規模 | 4.883億美元 |

| 市場規模預測 | 11億美元 |

| 複合年成長率 | 8.8% |

預計到2025年,穀物來源的BETA-聚葡萄糖市場佔有率將達到46.6%,並在2035年之前以8.9%的複合年成長率成長。此細分市場受益於消費者對植物來源功能性成分的長期接受度以及萃取效率的穩定提升。加工技術的進步提高了產品的純度和均勻性,而日益成長的潔淨標示趨勢則推動了負責任採購原料的使用。已開發市場完善的法規結構也持續推動該細分市場的應用和商業性規模化。

預計到2025年,可溶性BETA-聚葡萄糖將佔據57.4%的市場佔有率,並在2026年至2035年間以8.9%的複合年成長率成長。該類產品因其功能性強、吸收率高,且適用於心血管健康、免疫支持和血糖值調節等膳食補充劑,而被廣泛應用。其生物利用度的提高也增強了其功效,並使其在多個應用領域中保持了持續的需求。

北美是BETA-聚葡萄糖市場最大的區域貢獻者,預計到2025年將佔38.8%的市佔率。該地區市場成長的主要驅動力是消費者對健康產品的濃厚興趣,以及食品、膳食補充劑和藥品領域對功能性成分的日益成長的需求。消費者持續關注免疫健康、心臟健康和體重管理,這仍然是產品研發的重點,同時,對潔淨標示和植物來源配方的需求也十分旺盛。

目錄

第1章:分析方法和範圍

第2章執行摘要

第3章業界考察

- 產業生態系分析

- 供應商情況

- 利潤率

- 每個階段的附加價值

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 促進要素

- 產業潛在風險與挑戰

- 市場機遇

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特五力分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 依產品類型

- 未來市場趨勢

- 科技與創新趨勢

- 當前技術趨勢

- 新興技術

- 專利狀態

- 貿易統計(HS編碼)(註:僅提供主要國家的貿易統計)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續努力

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 考慮到碳足跡

第4章 競爭情勢

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 企業矩陣分析

- 主要市場公司的競爭分析

- 競爭定位矩陣

- 重大進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 業務拓展計劃

5. 按萃取物分類的市場估算和預測(2022-2035 年)

- 穀類

- 酵母菌

- 菇

- 海藻

第6章 按類型分類的市場估算與預測(2022-2035 年)

- 可溶性

- 不溶物

第7章 按應用領域分類的市場估算與預測(2022-2035 年)

- 食品/飲料

- 烘焙產品

- 早餐用麥片穀類和能量棒

- 機能飲料

- 乳製品和乳製品替代品

- 湯、醬汁和加工食品

- 零嘴零食

- 製藥

- 臨床營養

- 創傷護理和組織修復

- 藥物輸送系統

- 化妝品

- 護膚品

- 頭髮和頭皮護理

- 身體保養

- 動物飼料

- 家禽飼料(肉雞、蛋雞、火雞和野禽)

- 豬飼料(適用於小豬、生長豬、育肥豬、母豬)

- 水產飼料(魚、蝦)

- 反芻動物飼料(牛/牛)

- 寵物營養(伴侶動物)

- 其他

第8章 各地區市場估算與預測(2022-2035 年)

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 其他歐洲

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 其他中東和非洲地區

第9章:公司簡介

- Angel Yeast

- Biorigin SA

- DSM

- Givaudan

- Kemin Industries

- Kerry

- Lallemand

- Lantmannen Biorefineries

- Leiber GmbH

- Ohly

- Super Beta Glucan

- Tate &Lyle PLC

- VW-Ingredients

The Global Beta Glucan Market was valued at USD 488.3 million in 2025 and is estimated to grow at a CAGR of 8.8% to reach USD 1.1 billion by 2035.

Market expansion is linked to growing awareness of the physiological benefits associated with beta glucan and its widening use across food, nutrition, and pharmaceutical applications. Beta glucan is positioned as a naturally derived dietary fiber recognized for supporting immune response, managing cholesterol levels, and assisting in balanced carbohydrate metabolism. Its role in promoting heart health and immune defense has strengthened its adoption in wellness-focused product formulations. Consumers are increasingly inclined toward naturally sourced health ingredients, further reinforcing demand. Additional benefits related to blood sugar management and antioxidant activity continue to support its relevance in long-term health management. From a commercial perspective, manufacturers are broadening application areas, with beta glucan increasingly incorporated into food and beverage formulations aimed at health-conscious buyers. This diversification, combined with scientific validation and product innovation, is sustaining strong global market momentum.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $488.3 Million |

| Forecast Value | $1.1 Billion |

| CAGR | 8.8% |

The cereal grain-based beta glucan segment accounted for 46.6% share in 2025 and is forecast to grow at a CAGR of 8.9% through 2035. This segment benefits from long-term consumer acceptance of plant-derived functional ingredients and steady improvements in extraction efficiency. Advances in processing technologies are enhancing product purity and consistency, while clean-label preferences are encouraging the use of responsibly sourced raw materials. Supportive regulatory frameworks across developed markets continue to strengthen adoption and commercial scalability.

The soluble form of beta glucan held a 57.4% share in 2025 and is expected to grow at a CAGR of 8.9% from 2026 to 2035. This category is widely used due to its high functional performance, improved absorption, and suitability for nutritional formulations targeting cardiovascular wellness, immune support, and glucose regulation. Enhanced bioavailability contributes to its effectiveness and sustained demand across multiple application segments.

North America Beta Glucan Market held 38.8% share in 2025, making it the leading regional contributor. Market growth in the region is driven by strong consumer engagement with wellness-focused products and increasing incorporation of functional ingredients across food, supplement, and pharmaceutical categories. Emphasis on immune health, heart health, and weight management continues to support product development, while demand for clean-label and plant-based formulations remains high.

Key companies operating in the Global Beta Glucan Market include DSM, Kerry, Tate & Lyle PLC, Givaudan, Angel Yeast, Lallemand, Kemin Industries, Lantmannen Biorefineries, Leiber GmbH, Biorigin S.A., Ohly, Super Beta Glucan, and VW-Ingredients. Companies in the Global Beta Glucan Market are strengthening their competitive position through innovation-driven product development and strategic capacity expansion. Leading players are investing in advanced processing technologies to improve yield, consistency, and functional performance. Strategic collaborations with food, nutrition, and pharmaceutical manufacturers are helping companies expand application reach and secure long-term supply agreements. Firms are also focusing on clean-label positioning, sustainability commitments, and transparent sourcing to align with evolving consumer expectations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Extract

- 2.2.3 Form

- 2.2.4 Application

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By Product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: The trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Extract, 2022-2035 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Cereal grains

- 5.3 Yeast

- 5.4 Mushroom

- 5.5 Seaweed

Chapter 6 Market Estimates and Forecast, By Form, 2022-2035 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Soluble

- 6.3 Insoluble

Chapter 7 Market Estimates and Forecast, By Application, 2022-2035 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food & beverage

- 7.2.1 Bakery products

- 7.2.2 Breakfast cereals & bars

- 7.2.3 Functional beverages

- 7.2.4 Dairy & dairy alternatives

- 7.2.5 Soups, sauces & prepared foods

- 7.2.6 Snack foods

- 7.3 Pharmaceuticals

- 7.3.1 Clinical nutrition

- 7.3.2 Wound care & tissue repair

- 7.3.3 Drug delivery systems

- 7.4 Cosmetics

- 7.4.1 Skin care products

- 7.4.2 Hair & scalp care

- 7.4.3 Body care

- 7.5 Animal feed

- 7.5.1 Poultry feed (broiler, layer, turkey & game birds)

- 7.5.2 Swine feed (piglet, grower, finisher, sow)

- 7.5.3 Aquaculture feed (fish, shrimp)

- 7.5.4 Ruminant feed (dairy & beef cattle)

- 7.5.5 Pet nutrition (companion animals)

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2022-2035 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Angel Yeast

- 9.2 Biorigin S.A.

- 9.3 DSM

- 9.4 Givaudan

- 9.5 Kemin Industries

- 9.6 Kerry

- 9.7 Lallemand

- 9.8 Lantmannen Biorefineries

- 9.9 Leiber GmbH

- 9.10 Ohly

- 9.11 Super Beta Glucan

- 9.12 Tate & Lyle PLC

- 9.13 VW-Ingredients