|

市場調查報告書

商品編碼

1913384

低速切碎機市場:市場機會、成長促進因素、產業趨勢分析及預測(2026-2035)Slow Speed Shredding Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

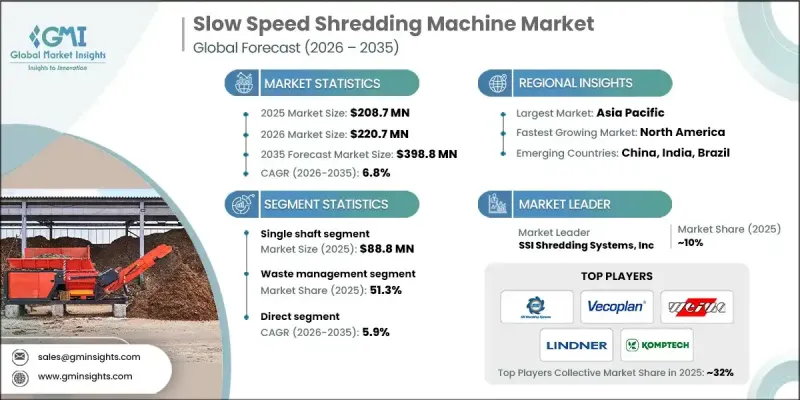

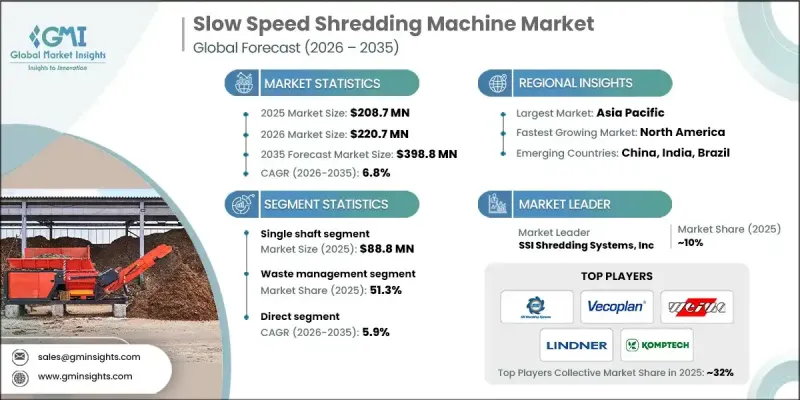

2025 年全球低速切碎機市場價值為 2.087 億美元,預計到 2035 年將達到 3.988 億美元,年複合成長率為 6.8%。

全球廢棄物產生量的快速成長以及旨在減少對掩埋依賴的更嚴格法規的實施,推動了市場成長。市政、工業和商業領域的組織正在加速低速破碎解決方案,以最大限度地減少垃圾量並改善下游物料輸送。這些設備可以減少廢棄物體積,支援高效的分類、收集和回收流程,同時在降低運輸和處置成本方面也發揮關鍵作用。人們對永續廢棄物管理方法和長期環境責任的日益關注,進一步刺激了對切碎機設備的投資。企業和公共組織對環境、社會和管治(ESG) 計劃的日益重視,推動了對耐用且節能的切碎機解決方案的需求。此外,綜合廢棄物管理系統和資源回收設施的日益普及也持續推動著低速破碎設備的穩定應用。隨著各國政府和私人企業致力於實現循環經濟目標,低速切碎機正成為全球現代廢棄物處理基礎設施的重要組成部分。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測期 | 2026-2035 |

| 初始市場規模 | 2.087億美元 |

| 市場規模預測 | 3.988億美元 |

| 複合年成長率 | 6.8% |

單軸工具機市場預計到2025年將創造8,880萬美元的收入,並在2026年至2035年間以5.4%的複合年成長率成長。該市場憑藉其高效的營運、穩定的產品品質和低維護需求而蓬勃發展。簡單的配置不僅支援可靠的材料加工,還有助於減少操作員停機時間和整體營運成本。

預計從 2026 年到 2035 年,直銷業務將以 5.9% 的複合年成長率成長。製造商與最終用戶之間的直接互動能夠實現客製化的設備解決方案、具有競爭力的價格和更完善的技術支持,使其成為那些優先考慮性能最佳化和長期服務可靠性的市場中首選的銷售管道。

美國低速切碎機市場預計到 2025 年將達到 3,370 萬美元,到 2035 年將以 6.8% 的複合年成長率成長。強大的法規結構、先進的回收系統以及工業和市政部門的穩定需求,正在支撐美國市場的持續強勁成長。

目錄

第1章:分析方法和範圍

第2章執行摘要

第3章業界考察

- 產業生態系分析

- 供應商情況

- 利潤率

- 每個階段的附加價值

- 影響價值鏈的因素

- 產業影響因素

- 促進要素

- 對廢棄物管理和回收效率的需求不斷成長

- 擴大永續和循環經濟實踐

- 切碎機自動化和能源效率的技術進步

- 潛在風險和挑戰

- 較高的初始投資和維護成本

- 嚴格的環境和安全法規

- 市場機遇

- 透過物聯網和智慧監控的整合實現預測性維護

- 新興市場需求成長與可再生能源復甦

- 促進要素

- 成長潛力分析

- 未來市場趨勢

- 科技與創新趨勢

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品

- 監管環境

- 北美洲

- 美國:消費品安全委員會(CPSC)聯邦法規(CFR)第16篇第1512部分

- 加拿大:國際標準化組織(ISO)4210

- 歐洲

- 德國:德國標準化協會 (DIN) 歐洲標準 (EN) ISO 4210

- 英國:歐洲標準 (EN) ISO 4210/英國合格評定 (UKCA)

- 法國:歐洲標準 (EN) ISO 4210

- 亞太地區

- 中國:國家標準(GB)3565

- 印度:印度標準 (IS) 10613

- 日本:日本工業標準(JIS)D 9110

- 拉丁美洲

- 巴西:巴西技術標準協會 (ABNT) 巴西標準 (NBR) ISO 4210

- 墨西哥:國際標準化組織(ISO)4210

- 中東和非洲

- 南非:南非國家標準 (SANS) 311

- 沙烏地阿拉伯:沙烏地阿拉伯標準、計量和品質組織 (SASO) 海灣標準組織 (GSO) ISO 4210

- 北美洲

- 監管環境

- 貿易統計(HS編碼-84798200)

- 主要進口國

- 主要出口國

- 波特五力分析

- PESTEL 分析

第4章 競爭情勢

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 企業矩陣分析

- 主要企業的競爭分析

- 競爭定位矩陣

- 主要趨勢

- 企業合併(M&A)

- 商業夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章 按類型分類的市場估算與預測(2022-2035 年)

- 單軸

- 雙軸

- 其他

第6章 依產能分類的市場估計與預測(2022-2035 年)

- 不足1噸

- 超過1噸

第7章 移動出行市場估算與預測(2022-2035 年)

- 固定式

- 可攜式的

第8章 按應用領域分類的市場估算與預測(2022-2035 年)

- 廢棄物管理

- 塑膠和橡膠

- 金屬回收

- 木材加工

- 紙和紙板

- 其他(輪胎回收等)

第9章 按分銷管道分類的市場估計和預測(2022-2035 年)

- 直銷

- 間接銷售

第10章 各地區市場估計與預測(2022-2035 年)

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第11章 公司簡介

- Amstar Machinery Co., Ltd

- Arjes GmbH

- EDGE Innovate(NI)Ltd

- FORNNAX Technology Pvt Ltd

- GENOX Recycling Tech Co., Ltd

- Granutech-Saturn Systems

- Komptech Group

- LINDNER-RECYCLINGTECH GMBH

- SSI Shredding Systems, Inc

- Terex Corporation

- UNTHA shredding technology

- Vecoplan AG

- Vermeer Corporation

- WEIMA Maschinenbau GmbH

- ZERMA Machinery &Recycling Technology

The Global Slow Speed Shredding Machine Market was valued at USD 208.7 million in 2025 and is estimated to grow at a CAGR of 6.8% to reach USD 398.8 million by 2035.

Market growth is driven by the rapid increase in global waste generation and the introduction of stricter regulations aimed at reducing landfill dependency. Organizations across municipal, industrial, and commercial sectors are increasingly adopting slow speed shredding solutions to minimize waste volume and improve downstream material handling. These machines play a critical role in reducing waste size to support efficient sorting, recovery, and reuse processes while lowering transportation and disposal costs. Growing emphasis on sustainable waste management practices and long-term environmental responsibility is further accelerating investment in shredding equipment. Rising awareness of environmental, social, and governance commitments among corporations and public entities is strengthening demand for durable and energy-efficient shredding solutions. Additionally, the expanding role of integrated waste management systems and material recovery facilities continues to support steady adoption. As governments and private operators focus on circular economy objectives, slow speed shredding machines are becoming an essential component of modern waste processing infrastructure worldwide.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $208.7 Million |

| Forecast Value | $398.8 Million |

| CAGR | 6.8% |

The single shaft segment generated USD 88.8 million in 2025 and is expected to grow at a CAGR of 5.4% from 2026 to 2035. This segment is gaining momentum due to its operational efficiency, consistent output quality, and lower maintenance requirements. The simple configuration supports reliable material processing while helping operators reduce downtime and overall operating costs.

The direct sales segment is forecast to grow at a CAGR of 5.9% from 2026 to 2035. Direct engagement between manufacturers and end users allows for customized equipment solutions, competitive pricing structures, and improved technical support, making it the preferred route in a market that values performance optimization and long-term service reliability.

United States Slow Speed Shredding Machine Market reached USD 33.7 million in 2025 and is anticipated to grow at a CAGR of 6.8% through 2035. Strong regulatory frameworks, advanced recycling systems, and consistent demand from industrial and municipal sectors are supporting continued market strength across the country.

Key companies operating in the Global Slow Speed Shredding Machine Market include SSI Shredding Systems, Inc., UNTHA shredding technology, Vecoplan AG, Terex Corporation, Komptech Group, Vermeer Corporation, LINDNER-RECYCLINGTECH GMBH, WEIMA Maschinenbau GmbH, Arjes GmbH, EDGE Innovate (NI) Ltd, ZERMA Machinery & Recycling Technology, Granutech-Saturn Systems, GENOX Recycling Tech Co., Ltd, FORNNAX Technology Pvt Ltd, and Amstar Machinery Co., Ltd. Companies in the Slow Speed Shredding Machine Market are strengthening their market position through continuous product innovation and performance enhancement. Manufacturers are focusing on developing machines with higher torque efficiency, improved durability, and lower energy consumption to meet evolving customer requirements. Expansion of direct sales networks and localized service support is helping companies build closer relationships with end users. Strategic investments in research and development are enabling customization and application-specific solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Capacity

- 2.2.4 Mobility

- 2.2.5 Application

- 2.2.6 Distribution channels

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for waste management and recycling efficiency

- 3.2.1.2 Increasing adoption of sustainable and circular economy practices

- 3.2.1.3 Technological advancements in shredding automation and energy efficiency

- 3.2.2 Pitfalls & Challenges:

- 3.2.2.1 High initial investment and maintenance costs

- 3.2.2.2 Stringent environmental and safety regulations

- 3.2.3 Opportunities:

- 3.2.3.1 Integration of IoT and smart monitoring for predictive maintenance

- 3.2.3.2 Growing demand in emerging markets and renewable material recovery

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory landscape

- 3.7.1 North America

- 3.7.1.1 US: Consumer Product Safety Commission (CPSC) 16 Code of Federal Regulations (CFR) part 1512

- 3.7.1.2 Canada: International Organization for Standardization (ISO) 4210

- 3.7.2 Europe

- 3.7.2.1 Germany: Deutsches Institut fur Normung (DIN) European Norm (EN) ISO 4210

- 3.7.2.2 UK: European Norm (EN) ISO 4210 / United Kingdom Conformity Assessed (UKCA)

- 3.7.2.3 France: European Norm (EN) ISO 4210

- 3.7.3 Asia Pacific

- 3.7.3.1 China: Guobiao (GB) 3565

- 3.7.3.2 India: Indian Standard (IS) 10613

- 3.7.3.3 Japan: Japanese Industrial Standard (JIS) D 9110

- 3.7.4 Latin America

- 3.7.4.1 Brazil: Associacao Brasileira de Normas Tecnicas (ABNT) Norma Brasileira (NBR) ISO 4210

- 3.7.4.2 Mexico: International Organization for Standardization (ISO) 4210

- 3.7.5 Middle East & Africa

- 3.7.5.1 South Africa: South African National Standard (SANS) 311

- 3.7.5.2 Saudi Arabia: Saudi Standards, Metrology and Quality Organization (SASO) Gulf Standardization Organization (GSO) ISO 4210

- 3.7.1 North America

- 3.8 Trade statistics (HS Code - 84798200)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2022 - 2035, (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Single shaft

- 5.3 Double/twin shaft

- 5.4 Others

Chapter 6 Market Estimates & Forecast, By Capacity, 2022 - 2035, (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Below 1 ton

- 6.3 Above 1 ton

Chapter 7 Market Estimates & Forecast, By Mobility, 2022 - 2035, (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Stationary

- 7.3 Mobile

Chapter 8 Market Estimates & Forecast, By Application, 2022 - 2035, (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Waste management

- 8.3 Plastics & rubber

- 8.4 Metal recycling

- 8.5 Wood processing

- 8.6 Paper & cardboard

- 8.7 Others (tire recycling, etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Amstar Machinery Co., Ltd

- 11.2 Arjes GmbH

- 11.3 EDGE Innovate (NI) Ltd

- 11.4 FORNNAX Technology Pvt Ltd

- 11.5 GENOX Recycling Tech Co., Ltd

- 11.6 Granutech-Saturn Systems

- 11.7 Komptech Group

- 11.8 LINDNER-RECYCLINGTECH GMBH

- 11.9 SSI Shredding Systems, Inc

- 11.10 Terex Corporation

- 11.11 UNTHA shredding technology

- 11.12 Vecoplan AG

- 11.13 Vermeer Corporation

- 11.14 WEIMA Maschinenbau GmbH

- 11.15 ZERMA Machinery & Recycling Technology