|

市場調查報告書

商品編碼

1913381

工業3D列印市場:市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Industrial 3D Printer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

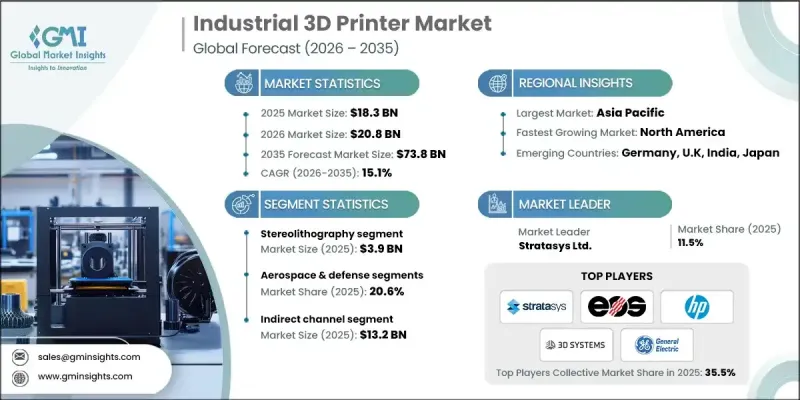

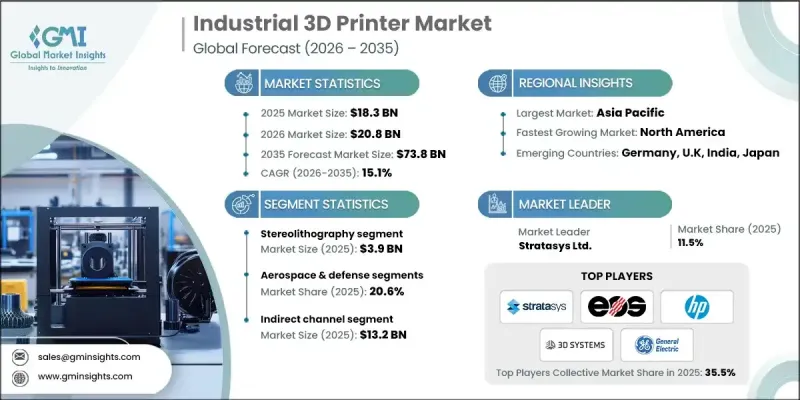

全球工業 3D 列印市場預計到 2025 年將達到 183 億美元,到 2035 年將達到 738 億美元,年複合成長率為 15.1%。

成本效益是市場成長的關鍵驅動力,它使製造商能夠將模具成本降低高達 80-90%,這意味著在某些應用領域的小批量生產中,每個零件可節省超過 10 萬美元。 3D 列印技術能夠生產高度客製化、幾何形狀複雜的零件,從而為市場帶來許多好處。在醫療領域,該技術可提供患者特異性的植入,並有助於改善修復效果。材料效率和永續性也發揮關鍵作用,3D 列印技術可根據應用的不同,減少 30-95% 的廢棄物。金屬積層製造和多材料列印等技術創新正透過催生新的工業應用案例,進一步拓展市場。政府的舉措和資助計畫正在支持相關研究和應用,尤其是在需要高精度和先進材料性能的應用領域。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測期 | 2026-2035 |

| 初始市場規模 | 183億美元 |

| 市場規模預測 | 738億美元 |

| 複合年成長率 | 15.1% |

立體光刻技術(SLA)技術預計到2025年將創造39億美元的市場規模。 SLA能夠以極高的精度生產複雜的原型和功能部件,使其成為複雜設計行業的理想選擇。政府的資金支持和政策措施正在推動工業界對SLA技術的應用,並促進專用SLA樹脂和特定應用領域的創新。

到2025年,航太和國防領域將佔據20.6%的市場佔有率,這主要得益於對輕量化、節能型和幾何形狀先進的零件的需求。積層製造技術能夠生產傳統技術無法實現的晶格結構和隨形冷卻通道,這使得航太和國防領域穩居工業3D列印技術的主要應用領域。

預計到2025年,美國工業3D列印機市佔率將達到78.1%。這一成長得益於強大的製造業基礎和先進技術的快速普及。 Stratasys和3D Systems等主要企業正透過拓展產品線以滿足航太和醫療等高精度產業的需求,並與主要製造商合作,推動3D生產線規模化發展,從而促進美國市場的成長。

目錄

第1章:分析方法和範圍

第2章執行摘要

第3章業界考察

- 產業生態系分析

- 供應商情況

- 利潤率

- 每個階段的附加價值

- 影響價值鏈的因素

- 產業影響因素

- 促進要素

- 快速原型製作的廣泛應用

- 產品開發與供應鏈改進

- 政府對3D列印計劃的投資

- 產業潛在風險與挑戰

- 材料限制和品管

- 利用3D列印技術輕鬆複製設計

- 市場機遇

- 醫療和生物列印應用

- 永續性和合規性解決方案

- 促進要素

- 成長潛力分析

- 未來市場趨勢

- 科技與創新趨勢

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 透過技術

- 按地區

- 監管環境

- 標準和合規要求

- 區域法規結構

- 認證標準

- 差距分析

- 風險評估與緩解

- 波特五力分析

- PESTEL 分析

第4章 競爭情勢

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 企業矩陣分析

- 主要企業的競爭分析

- 競爭定位矩陣

- 主要趨勢

- 企業合併(M&A)

- 商業夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章 依技術分類的市場估計與預測(2022-2035 年)

- 選擇性雷射燒結

- 立體光刻技術

- 熔融沈積成型

- 直接金屬雷射燒結

- 噴墨列印

- 噴膠成形列印

- 電子束熔化

- 層壓物製造

- 數位光處理技術

- 雷射金屬沉積法

- 其他

第6章 依最終使用者分類的市場估算與預測(2022-2035 年)

- 車

- 航太/國防

- 醫療保健

- 家用電子電器

- 食物與烹飪

- 電力和能源

- 其他

第7章 按分銷管道分類的市場估計和預測(2022-2035 年)

- 直接地

- 間接

第8章 各地區市場估算與預測(2022-2035 年)

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- 3D Systems

- Desktop Metal

- EOS

- Formlabs

- General Electric

- HP

- Markforged

- Materialise

- Nano Dimension

- Prodways

- Renishaw

- SLM Solutions

- Stratasys

- Ultimaker

- Velo3D

The Global Industrial 3D Printer Market was valued at USD 18.3 billion in 2025 and is estimated to grow at a CAGR of 15.1% to reach USD 73.8 billion by 2035.

Cost efficiency remains a key factor driving market growth, with manufacturers able to reduce tooling costs by up to 80-90%, translating into savings of over USD 100,000 per part in certain applications, even for limited production runs. The market benefits from 3D printing's ability to produce highly customized and geometrically complex components. In the healthcare sector, companies are delivering patient-specific implants, enhancing recovery outcomes. Material efficiency and sustainability also play a crucial role, as 3D printing reduces waste by 30-95% depending on the application. Technological innovations, including metal additive manufacturing and multi-material printing, are further broadening the market by enabling new industrial use cases. Government initiatives and funding programs are supporting research and adoption, particularly for applications requiring precision and advanced material capabilities.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $18.3 Billion |

| Forecast Value | $73.8 Billion |

| CAGR | 15.1% |

The stereolithography (SLA) generated USD 3.9 billion in 2025. SLA enables the production of highly intricate prototypes and functional parts with exceptional precision, making it ideal for industries that demand complex designs. Its industrial adoption is bolstered by government funding and initiatives, fostering innovation in specialized SLA resins and targeted applications.

The aerospace and defense sector held 20.6% share in 2025, driven by the need for lightweight, fuel-efficient, and geometrically sophisticated components. Additive manufacturing allows production of lattice structures and conformal cooling channels that are impossible to achieve with conventional techniques, cementing aerospace and defense as a leading adopter of industrial 3D printing.

United States Industrial 3D Printer Market held 78.1% share in 2025. The growth is supported by a strong manufacturing base and rapid adoption of advanced technologies. Leading companies such as Stratasys and 3D Systems have propelled the U.S. market by expanding their portfolios to meet the demands of high-precision sectors, including aerospace and healthcare, and collaborating with major manufacturers to scale 3D production lines.

Key players in the Global Industrial 3D Printer Market include HP, Markforged, Nano Dimension, Prodways, SLM Solutions, 3D Systems, Stratasys, EOS, General Electric, Formlabs, Ultimaker, Velo3D, and Materialise. Companies in the Global Industrial 3D Printer Market are strengthening their position through several strategic initiatives. They are heavily investing in R&D to enhance precision, material versatility, and production speed. Partnerships with OEMs and industry leaders enable large-scale adoption of 3D printing technologies. Firms focus on expanding regional distribution networks and service infrastructure to improve accessibility and customer support. They are also introducing software solutions for process optimization and workflow integration. Emphasis on sustainability, including reducing material waste and energy consumption, helps companies meet regulatory requirements and attract environmentally conscious clients.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 End use

- 2.2.4 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Wide use of rapid prototyping

- 3.2.1.2 Improvements in product development and supply chains

- 3.2.1.3 Government investments in 3D printing projects

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Material limitations and quality control

- 3.2.2.2 Ease of replicating designs with 3D printing technology

- 3.2.3 Opportunities

- 3.2.3.1 Expansion into healthcare and bioprinting

- 3.2.3.2 Sustainability and regulatory compliance solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By technology

- 3.6.2 By region

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Gap analysis

- 3.9 Risk assessment and mitigation

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Technology, 2022-2035 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Selective laser sintering

- 5.3 Stereolithography

- 5.4 Fuse deposition modeling

- 5.5 Direct metal laser sintering

- 5.6 Inkjet printing

- 5.7 Polyjet printing

- 5.8 Electron beam melting

- 5.9 Laminated object manufacturing

- 5.10 Digital light processing

- 5.11 Laser metal deposition

- 5.12 Others

Chapter 6 Market Estimates & Forecast, By End-User, 2022-2035 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Automotive

- 6.3 Aerospace & defense

- 6.4 Healthcare

- 6.5 Consumer electronics

- 6.6 Food & culinary

- 6.7 Power & energy

- 6.8 Others

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2022-2035 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Direct

- 7.3 Indirect

Chapter 8 Market Estimates & Forecast, By Region, 2022-2035 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 France

- 8.3.3 UK

- 8.3.4 Italy

- 8.3.5 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 3D Systems

- 9.2 Desktop Metal

- 9.3 EOS

- 9.4 Formlabs

- 9.5 General Electric

- 9.6 HP

- 9.7 Markforged

- 9.8 Materialise

- 9.9 Nano Dimension

- 9.10 Prodways

- 9.11 Renishaw

- 9.12 SLM Solutions

- 9.13 Stratasys

- 9.14 Ultimaker

- 9.15 Velo3D