|

市場調查報告書

商品編碼

1913375

羧甲基纖維素市場:市場機會、成長促進因素、產業趨勢分析及預測(2026-2035)Carboxymethyl Cellulose Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

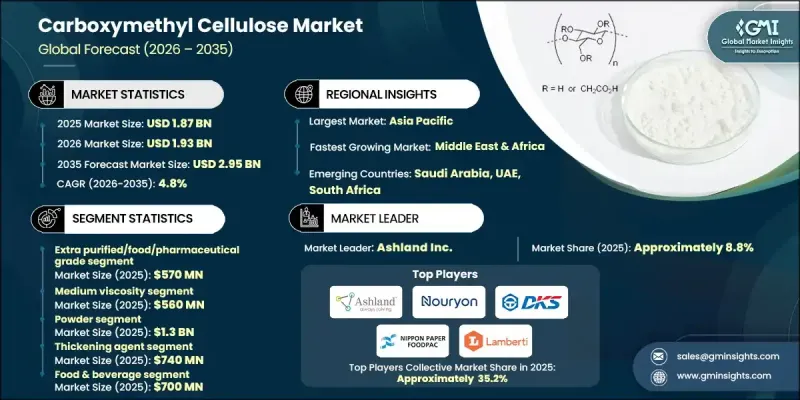

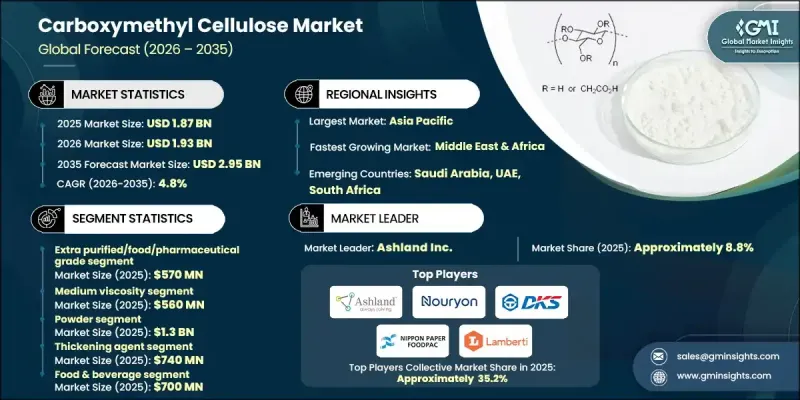

2025 年全球羧甲基纖維素市場價值為 18.7 億美元,預計到 2035 年將達到 29.5 億美元,年複合成長率為 4.8%。

市場成長反映了羧甲基纖維素(CMC)因其多功能性能而在多個終端應用行業中日益普及。便利的消費模式正在加速CMC的推廣應用,尤其是在食品加工領域,隨著製造商越來越依賴CMC來控制黏度、穩定產品和發揮黏合作用,市場需求持續成長。人們對衛生、健康和產品品質的日益重視,尤其是在發展中地區,也進一步推動了市場成長。在製藥領域,CMC因其配方柔軟性以及改善產品均勻性、穩定性和延長保存期限的能力,已成為不可或缺的成分。隨著全球對高品質藥品的需求持續成長,CMC在提高藥物性能和可靠性方面的作用日益重要。此外,特種級CMC的創新和不斷擴展的工業應用也推動了市場發展,使CMC成為尋求性能效率、符合法規要求和長期產品穩定性的製造商的關鍵成分。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測期 | 2026-2035 |

| 初始市場規模 | 18.7億美元 |

| 市場規模預測 | 29.5億美元 |

| 複合年成長率 | 4.8% |

預計到2025年,超高純度食品級和醫藥級陶瓷基複合材料(CMC)市場規模將達到5.7億美元,並在2026年至2035年間以5.1%的複合年成長率成長。這些高純度產品因其嚴格的品管和性能精度要求,成為應用領域的首選。電池級CMC也日益受到關注,預計其市場發展將與儲能和電動車的發展趨勢保持一致。

預計到 2025 年,粉狀產品市場規模將達到 13 億美元,到 2035 年將以 4.5% 的複合年成長率成長。易於操作、儲存效率高以及廣泛的工業應用等因素推動了這一成長,從而帶動了市場需求的成長。

預計到2025年,北美羧甲基纖維素市場規模將達到4.9億美元,並有望維持穩定成長。食品製造、製藥、個人護理、造紙和能源相關應用領域需求的成長將推動市場擴張。

目錄

第1章:分析方法和範圍

第2章執行摘要

第3章業界考察

- 生態系分析

- 供應商情況

- 利潤率

- 每個階段的附加價值

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 促進要素

- 產業潛在風險與挑戰

- 市場機遇

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特五力分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 依產品

- 未來市場趨勢

- 科技與創新趨勢

- 當前技術趨勢

- 新興技術

- 專利狀態

- 貿易統計(註:僅提供主要國家的貿易統計)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章 競爭情勢

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 企業矩陣分析

- 主要企業的競爭分析

- 競爭定位矩陣

- 主要趨勢

- 併購

- 夥伴關係與合作

- 新產品發布

- 業務拓展計劃

第5章 依等級分類的市場估算與預測(2022-2035 年)

- 工業級

- 半精煉級

- 精製級

- 超精製/食品/醫藥級

- 電池級

第6章 依黏度等級分類的市場估算與預測(2022-2035 年)

- 超低黏度

- 低黏度

- 中等黏度

- 高黏度

- 超高黏度

- 超高黏度

第7章 按類型分類的市場估計和預測(2022-2035 年)

- 粉末

- 顆粒狀

- 液體/溶液

- 薄片

第8章 按功能分類的市場估計和預測(2022-2035 年)

- 增稠劑

- 穩定器

- 粘合劑

- 成膜劑

- 保水劑

- 暫停

第9章 依最終用途分類的市場估算與預測(2022-2035 年)

- 食品/飲料

- 製藥

- 個人護理及化妝品

- 石油和天然氣

- 紙漿和造紙

- 清潔劑和洗衣用品

- 電池和儲能

- 纖維

- 3D列印生物醫學

- 採礦和礦產

- 其他(建築、油漆、黏合劑、陶瓷)

第10章 按分銷管道分類的市場估計和預測(2022-2035 年)

- 直銷(B2B/工業)

- 間接銷售(批發商/零售商)

第11章 各地區市場估計與預測(2022-2035 年)

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 其他中東和非洲地區

第12章:公司簡介

- Zibo Hailan Chemical Co. Ltd

- Ashland Global Holdings

- Chongqing Lihong Fine Chemicals

- Daicel Corporation

- DKS Co. Ltd

- PAC &CMC Manufacturing Co.,Ltd.

- Nouryon

- Lamberti SpA

- Nippon Paper Industries

- Patel Industries

- Pioma Chemicals

- Qingdao Tianya Chemical

- Mare Austria GmbH

- AKKIM

The Global Carboxymethyl Cellulose Market was valued at USD 1.87 billion in 2025 and is estimated to grow at a CAGR of 4.8% to reach USD 2.95 billion by 2035.

Market growth reflects the expanding adoption of carboxymethyl cellulose across multiple end-use industries due to its multifunctional performance characteristics. Demand continues to rise as manufacturers increasingly rely on CMC for viscosity control, stabilization, and binding functions, particularly in food processing, where convenience-oriented consumption patterns are accelerating adoption. Growth is further supported by rising awareness of hygiene, wellness, and product quality, especially across developing regions. In pharmaceutical manufacturing, CMC has become an essential material due to its formulation flexibility and ability to enhance product consistency, stability, and shelf life. As global demand for high-quality medicines continues to rise, the role of CMC in improving drug performance and reliability is becoming more prominent. The market is also benefiting from innovation in specialty grades and expanding industrial applications, positioning CMC as a critical ingredient for manufacturers seeking performance efficiency, regulatory compliance, and long-term product stability.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.87 Billion |

| Forecast Value | $2.95 Billion |

| CAGR | 4.8% |

The extra-purified, food, and pharmaceutical grade segment generated USD 570 million in 2025 and is projected to grow at a CAGR of 5.1% from 2026 to 2035. These high-purity grades are preferred for applications requiring strict quality control and performance precision. Battery-grade CMC is also gaining traction, aligning the market with energy storage and electric mobility trends.

The powder form segment reached USD 1.3 billion in 2025 and is forecast to grow at a CAGR of 4.5% through 2035. Strong demand is driven by ease of handling, storage efficiency, and broad industrial usability.

North America Carboxymethyl Cellulose Market accounted for USD 490 million in 2025 and is expected to witness steady growth. Expansion is supported by rising demand across food manufacturing, pharmaceuticals, personal care, paper processing, and energy-related applications.

Key companies operating in the Global Carboxymethyl Cellulose Market include Nouryon, Ashland Global Holdings, Nippon Paper Industries, Lamberti S.p.A., DKS Co. Ltd, and other established producers. Companies in the Global Carboxymethyl Cellulose Market are strengthening their competitive position through capacity expansion, grade innovation, and targeted application development. Manufacturers are investing in research to enhance purity levels, performance consistency, and functional efficiency. Strategic partnerships with end-use industries support customized product development and long-term supply agreements. Geographic expansion into high-growth regions is improving market penetration and revenue stability. Companies are also focusing on sustainable sourcing, efficient production processes, and regulatory compliance to meet evolving industry standards. Strengthening distribution networks and technical support capabilities further enhances customer engagement and brand reliability.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Grade

- 2.2.3 Viscosity Grade

- 2.2.4 Form

- 2.2.5 Function

- 2.2.6 End Use

- 2.2.7 Distribution Channel

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Grade, 2022- 2035 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Technical/industrial grade

- 5.3 Semi-purified grade

- 5.4 Purified grade

- 5.5 Extra purified/food/pharmaceutical grade

- 5.6 Battery grade

Chapter 6 Market Estimates and Forecast, By Viscosity Grade, 2022- 2035 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Extra low viscosity

- 6.3 Low viscosity

- 6.4 Medium viscosity

- 6.5 High viscosity

- 6.6 Extra high viscosity

- 6.7 Super high viscosity

Chapter 7 Market Estimates and Forecast, By Form, 2022 - 2035 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Powder

- 7.3 Granular

- 7.4 Liquid/solution

- 7.5 Flake

Chapter 8 Market Estimates and Forecast, By Function, 2022 - 2035 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 Thickening agent

- 8.3 Stabilizer

- 8.4 Binder

- 8.5 Film-former

- 8.6 Water retention agent

- 8.7 Suspending agent

Chapter 9 Market Estimates and Forecast, By End Use, 2022 - 2035 (USD Billion, Kilo Tons)

- 9.1 Key trends

- 9.2 Food & beverage

- 9.3 Pharmaceuticals

- 9.4 Personal care & cosmetics

- 9.5 Oil & gas

- 9.6 Pulp & paper

- 9.7 Detergents & laundry

- 9.8 Battery/energy storage

- 9.9 Textile

- 9.10 3d printing & biomedical

- 9.11 Mining & minerals

- 9.12 Others (construction, paints, adhesives, ceramics)

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 (USD Billion, Kilo Tons)

- 10.1 Key trends

- 10.2 Direct sales (B2B industrial)

- 10.3 Indirect sales (distributor/retail)

Chapter 11 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion, Kilo Tons)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Rest of Europe

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Rest of Asia Pacific

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Rest of Latin America

- 11.6 Middle East & Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

- 11.6.4 Rest of Middle East & Africa

Chapter 12 Company Profiles

- 12.1 Zibo Hailan Chemical Co. Ltd

- 12.2 Ashland Global Holdings

- 12.3 Chongqing Lihong Fine Chemicals

- 12.4 Daicel Corporation

- 12.5 DKS Co. Ltd

- 12.6 PAC & CMC Manufacturing Co.,Ltd.

- 12.7 Nouryon

- 12.8 Lamberti S.p.A.

- 12.9 Nippon Paper Industries

- 12.10 Patel Industries

- 12.11 Pioma Chemicals

- 12.12 Qingdao Tianya Chemical

- 12.13 Mare Austria GmbH

- 12.14 AKKIM