|

市場調查報告書

商品編碼

1913369

中風管理市場:市場機會、成長促進因素、產業趨勢分析及預測(2026-2035 年)Stroke Management Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

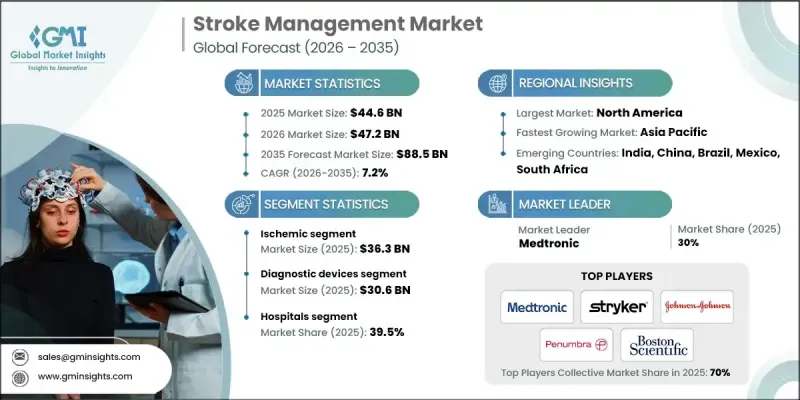

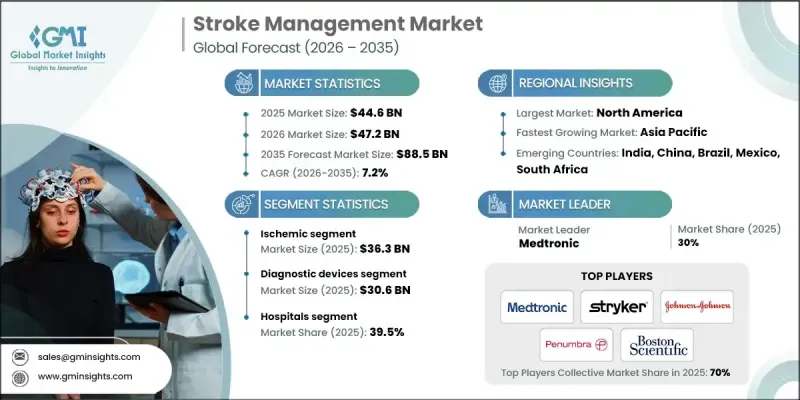

全球中風管理市場預計到 2025 年將達到 446 億美元,到 2035 年將達到 885 億美元,年複合成長率為 7.2%。

微創治療方法的日益普及、全球卒中相關疾病發病率的上升以及卒中診斷、治療和卒中後護理技術的不斷進步,共同推動了市場成長。世界各地的醫療衛生系統越來越重視早期發現、快速反應和協調的照護路徑,以降低長期殘疾和死亡率。遠端醫療平台和行動醫療服務模式的投資不斷增加,有助於改善服務不足地區和農村地區獲得卒中照護的機會。隨著預防策略和及時臨床干預日益成為公共衛生部門的優先事項,對先進解決方案和綜合中風護理系統的需求持續成長,為整個市場創造了持續成長的機會。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測期 | 2026-2035 |

| 初始市場規模 | 446億美元 |

| 市場規模預測 | 885億美元 |

| 複合年成長率 | 7.2% |

全球心血管疾病盛行率的不斷上升持續推動著市場擴張。心臟相關疾病與中風風險的密切關聯,促使人們需要能夠支持快速診斷和及時介入的先進中風診療方案。為了應對這些相互交織的疾病,醫療系統日益重視協調的疾病管理方法,旨在透過早期療育和最佳化治療流程來提高存活率和改善患者的長期預後。

預計到2025年,缺血性中風市場規模將達到363億美元,佔總市場的81.4%。由於需要即時診斷、快速治療和製定結構化的復健方案,缺血性中風仍然是卒中管理的核心。這種卒中類型的高度時效性持續推動著對專業護理解決方案和先進臨床基礎設施的投資。

預計到2025年,診斷設備市場規模將達到306億美元,這反映出其在早期識別中風類型和嚴重程度方面發揮著至關重要的作用。準確快速的診斷能夠指導臨床決策,並直接影響治療效果,因此,該領域是整個中風管理系統的關鍵組成部分。

2025年,美國中風治療市值將達374億美元。市場成長與心臟相關疾病發生率的上升以及對先進醫療技術的持續投資密切相關,這些技術能夠實現更快的干涉、改善治療效果和減少併發症。

目錄

第1章:分析方法和範圍

第2章執行摘要

第3章業界考察

- 生態系分析

- 產業影響因素

- 促進要素

- 人們越來越傾向微創手術

- 全球中風和心血管疾病的發生率不斷上升。

- 中風管理的技術進步

- 人口老化加劇

- 產業潛在風險與挑戰

- 嚴格的法規結構

- 醫療成本不斷上漲

- 市場機遇

- 遠端醫療和遠距中風服務

- 促進要素

- 成長潛力分析

- 監管環境

- 技術進步

- 當前技術趨勢

- 新興技術

- 價格分析(2024)

- 未來市場趨勢

- 波特五力分析

- PESTEL 分析

第4章 競爭情勢

- 介紹

- 企業矩陣分析

- 公司市佔率分析

- 主要企業的競爭分析

- 競爭定位矩陣

- 主要趨勢

- 企業合併(M&A)

- 合夥/合資企業

- 新產品發布

- 擴張計劃

第5章 按類型分類的市場估算與預測(2022-2035 年)

- 缺血性

- 出血性

- 短暫性腦缺血發作(TIA)

- 其他類型

第6章 按產品分類的市場估算與預測(2022-2035 年)

- 診斷設備

- 磁振造影(MRI)

- 電腦斷層掃描(電腦斷層掃描)

- 心電圖

- 頸動脈超音波

- 腦血管造影術

- 其他

- 治療設備

- 磁振造影(MRI)

- 電腦斷層掃描(電腦斷層掃描)

- 心電圖

- 頸動脈超音波

- 腦血管造影術

- 其他

7. 依最終用途分類的市場估計與預測(2022-2035 年)

- 醫院

- 門診手術中心

- 診斷中心

- 其他最終用途

第8章 各地區市場估算與預測(2021-2034 年)

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Medtronic

- Abbott laboratories

- GE HealthCare

- Siemens Healthineers

- Philips Healthcare

- Stryker Corporation

- Johnson &Johnson

- Penumbra

- Boston Scientific

- Imperative Care

- NeuroVasc Technologies

- Kaneka Medix Corp

The Global Stroke Management Market was valued at USD 44.6 billion in 2025 and is estimated to grow at a CAGR of 7.2% to reach USD 88.5 billion by 2035.

Market growth is supported by a rising shift toward less invasive treatment approaches, the increasing global incidence of stroke-related conditions, and continuous technological progress across diagnosis, treatment, and post-stroke care. Health systems worldwide are placing stronger emphasis on early detection, faster response times, and coordinated care pathways to reduce long-term disability and mortality. Growing investments in remote care platforms and mobile healthcare delivery models are helping improve access to stroke services in underserved and rural regions. As prevention strategies and timely clinical intervention become higher priorities for public health authorities, demand for advanced solutions and integrated stroke care frameworks continues to increase, creating sustained growth opportunities across the market.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $44.6 Billion |

| Forecast Value | $88.5 Billion |

| CAGR | 7.2% |

The rising global prevalence of cardiovascular conditions remains a major contributor to market expansion. The close relationship between heart-related disorders and stroke risk has intensified the need for advanced stroke care solutions that support rapid diagnosis and timely intervention. Health systems are increasingly prioritizing coordinated disease management approaches to address these overlapping conditions, aiming to improve survival rates and long-term patient outcomes through early intervention and optimized treatment workflows.

The ischemic stroke segment accounted for USD 36.3 billion in 2025 and represented 81.4% share. This segment remains central to stroke management due to the urgent need for immediate diagnosis, fast therapeutic response, and structured rehabilitation pathways. The high time sensitivity associated with this stroke type continues to drive investment in specialized care solutions and advanced clinical infrastructure.

The diagnostic devices segment generated USD 30.6 billion in 2025, reflecting their essential role in identifying stroke type and severity at early stages. Accurate and rapid diagnostics guide clinical decision-making and directly influence treatment effectiveness, making this segment a critical component of the overall stroke management ecosystem.

U.S. Stroke Management Market was valued at USD 37.4 billion in 2025. Market growth is strongly linked to increasing rates of cardiac-related conditions and continued investment in advanced care technologies that enable faster intervention, improved outcomes, and reduced complications.

Key companies active in the Global Stroke Management Market include Medtronic, Siemens Healthineers, Abbott Laboratories, GE HealthCare, Philips Healthcare, Stryker Corporation, Boston Scientific, Penumbra, Johnson & Johnson, Imperative Care, Kaneka Medix Corp, and NeuroVasc Technologies. Companies in the Global Stroke Management Market are strengthening their market position through continuous innovation, strategic collaborations, and expansion of comprehensive care portfolios. Many players are investing heavily in research and development to enhance diagnostic accuracy, treatment efficiency, and post-stroke recovery solutions. Partnerships with healthcare providers and academic institutions are helping accelerate technology adoption and clinical validation. Firms are also expanding geographically to tap into underserved markets while aligning products with evolving regulatory requirements. Integration of digital health platforms and data-driven decision support tools is being prioritized to improve care coordination.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Type trends

- 2.2.3 Product trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing preference for minimally invasive procedures

- 3.2.1.2 Increasing prevalence of stroke and cardiovascular diseases worldwide

- 3.2.1.3 Technological advancement in stroke management

- 3.2.1.4 Rising geriatric population

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory framework

- 3.2.2.2 High cost of procedures

- 3.2.3 Market opportunities

- 3.2.3.1 Telemedicine and telestroke services

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Pricing analysis, 2024

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Ischemic

- 5.3 Hemorrhagic

- 5.4 Transient Ischemic Attack (TIA)

- 5.5 Other types

Chapter 6 Market Estimates and Forecast, By Product, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Diagnostic devices

- 6.2.1 Magnetic Resonance Imaging (MRI)

- 6.2.2 Computed Tomography Scan (CT scan)

- 6.2.3 Electrocardiography

- 6.2.4 Carotid Ultrasound

- 6.2.5 Cerebral Angiography

- 6.2.6 Other

- 6.3 Therapeutic devices

- 6.3.1 Magnetic Resonance Imaging (MRI)

- 6.3.2 Computed Tomography Scan (CT scan)

- 6.3.3 Electrocardiography

- 6.3.4 Carotid Ultrasound

- 6.3.5 Cerebral Angiography

- 6.3.6 Other

Chapter 7 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory Surgery Centers

- 7.4 Diagnostic Centers

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Medtronic

- 9.2 Abbott laboratories

- 9.3 GE HealthCare

- 9.4 Siemens Healthineers

- 9.5 Philips Healthcare

- 9.6 Stryker Corporation

- 9.7 Johnson & Johnson

- 9.8 Penumbra

- 9.9 Boston Scientific

- 9.10 Imperative Care

- 9.11 NeuroVasc Technologies

- 9.12 Kaneka Medix Corp