|

市場調查報告書

商品編碼

1913360

壓迫療法市場機會、成長要素、產業趨勢分析及2026年至2035年預測Compression Therapy Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

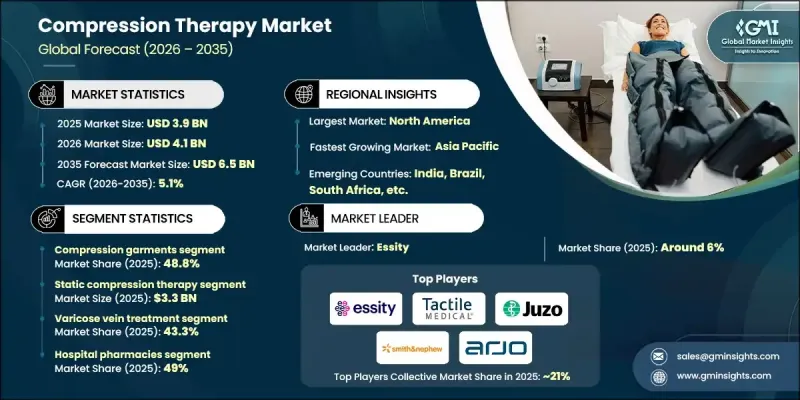

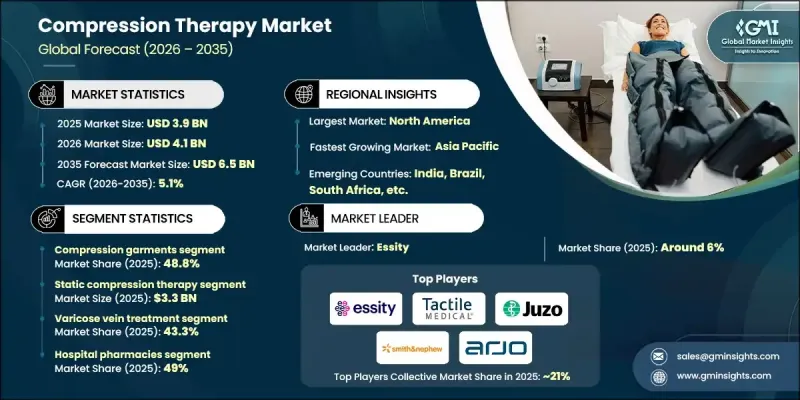

全球壓迫療法市場預計到 2025 年將達到 39 億美元,到 2035 年將達到 65 億美元,年複合成長率為 5.1%。

推動該市場成長的因素包括靜脈疾病盛行率上升、人們對現有治療方案的認知度提高以及運動相關損傷和事故的增加。居家醫療解決方案的擴展、對非侵入性治療方法需求的成長以及整形外科手術和術後護理的激增也進一步推動了市場成長。設備方面的技術創新、材料的改進以及以患者為中心的設計正在改善治療效果。壓迫療法正日益成為運動員和復健專業人員促進復原和改善活動能力的首選。隨著專業和休閒運動參與度的提高,預計壓力解決方案在復健、提升運動表現和預防傷害方面的應用將推動全球醫療保健和運動醫學領域的持續成長。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 39億美元 |

| 預測金額 | 65億美元 |

| 複合年成長率 | 5.1% |

截至2025年,壓力服市佔率達48.8%。壓力服,包括長筒襪、袖套和緊身褲,提供從腳踝處壓力最大並向上逐漸減弱的梯度壓力,有助於促進血液循環、減輕腫脹並預防血栓形成。人們對淋巴水腫、深層靜脈栓塞症栓塞(DVT)和術後恢復的日益關注推動了該領域的需求。現代設計著重於舒適性、透氣性和美觀性,進而提高患者的依從性和延長穿著時間。

2025年,靜態壓迫療法市場規模預計將達33億美元。這種療法透過服裝、繃帶和固定裝置對患處施加持續壓力,以改善淋巴排放和血液循環。它廣泛應用於慢性靜脈疾病、術後康復和損傷康復,有助於促進癒合和恢復活動能力。

預計到2025年,北美壓迫療法市佔率將達到32.1%。該地區受益於先進的醫療基礎設施、完善的報銷政策以及非侵入性治療方法的廣泛接受度。靜脈疾病、淋巴水腫和深層靜脈栓塞症(DVT)的高發生率,加上人口老化和肥胖率上升,持續推動臨床和居家照護環境中對壓力服和氣動裝置的需求。

目錄

第1章調查方法和範圍

第2章執行摘要

第3章業界考察

- 生態系分析

- 產業影響因素

- 促進要素

- 運動傷害和事故增多

- 整形外科和術後手術數量激增

- 靜脈疾病呈上升趨勢

- 提高患者對治療方案的認知

- 近期技術進步

- 產業潛在風險與挑戰

- 替代治療方法的可近性

- 配戴不適導致依從性降低

- 使用壓迫療法可能產生的副作用

- 機會

- 智慧紡織品與物聯網賦能型壓縮服裝的開發

- 促進要素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- LAMEA

- 科技與創新趨勢

- 當前技術趨勢

- 新興技術

- 價值鏈分析

- 救贖方案

- 對消費行為的洞察

- 定價分析

- 環境與永續性考量

- 政策環境

- 波特五力分析

- PESTEL 分析

- 差距分析

- 未來市場趨勢

第4章 競爭情勢

- 介紹

- 企業矩陣分析

- 公司市佔率分析

- 世界

- 北美洲

- 歐洲

- 亞太地區

- LAMEA

- 主要市場公司的競爭分析

- 競爭定位矩陣

- 重大進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章 2022-2035年按產品分類的市場估算與預測

- 壓力衣

- 加壓繃帶

- 壓力襪

- 一級壓縮

- 二級壓縮等級

- 三級壓縮

- 其他壓縮服

- 壓縮矯正器具

- 壓縮膠帶

- 壓縮幫浦

第6章 按技術分類的市場估計與預測,2022-2035年

- 靜態壓迫療法

- 動態壓迫療法

第7章 按應用領域分類的市場估算與預測,2022-2035年

- 靜脈曲張治療

- 深層靜脈栓塞症治療

- 淋巴水腫治療

- 腿部潰瘍治療

- 其他用途

第8章 按分銷管道分類的市場估算與預測,2022-2035年

- 醫院藥房

- 零售藥房

- 網路藥房

第9章 2022-2035年各地區市場估算與預測

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- ALCARE

- Arjo

- Bio Compression Systems

- Cardinal Health

- ConvaTec

- Enovis

- essity

- HARTMANN

- Juzo

- medi

- SANYLEG

- SIGVARIS GROUP

- Smith+Nephew

- Solventum

- Tactile Medical

The Global Compression Therapy Market was valued at USD 3.9 billion in 2025 and is estimated to grow at a CAGR of 5.1% to reach USD 6.5 billion by 2035.

The market is fueled by the rising prevalence of venous disorders, increased awareness of available treatment options, and a growing number of sports-related injuries and accidents. Expansion in home healthcare solutions, rising demand for non-invasive therapies, and a surge in orthopedic and post-surgical procedures are further driving growth. Technological innovations in devices, improved materials, and patient-centric designs are enhancing treatment efficacy. Athletes and rehabilitation professionals increasingly prefer compression therapy for faster recovery and improved mobility. As professional and recreational sports participation grows, the adoption of compression solutions for healing, performance, and injury prevention is expected to provide sustained momentum across medical and sports medicine applications globally.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $3.9 Billion |

| Forecast Value | $6.5 Billion |

| CAGR | 5.1% |

The compression garments segment held 48.8% share in 2025. These garments, including stockings, sleeves, and tights, provide graduated pressure, highest at the ankle and gradually reducing upward, to enhance blood circulation, reduce swelling, and prevent clot formation. Rising cases of lymphedema, deep vein thrombosis (DVT), and postoperative recovery needs are driving segmental demand. Modern designs emphasize comfort, breathability, and aesthetics, ensuring higher patient compliance and prolonged use.

The static compression therapy segment reached USD 3.3 billion in 2025. This therapy delivers continuous pressure through garments, wraps, or bandages over affected areas, improving lymphatic drainage and blood flow. It is widely applied in chronic venous disorders, post-surgical recovery, and injury rehabilitation to accelerate healing and restore mobility.

North America Compression Therapy Market held 32.1% share in 2025. The region benefits from advanced healthcare infrastructure, strong insurance reimbursement policies, and widespread acceptance of non-invasive treatment options. High prevalence of venous disorders, lymphedema, and DVT, along with an aging population and rising obesity rates, continues to drive demand for compression garments and pneumatic devices in both clinical and home care settings.

Key companies operating in the Global Compression Therapy Market include Tactile Medical, Smith+Nephew, ALCARE, Arjo, Bio Compression Systems, Cardinal Health, ConvaTec, Enovis, Essity, HARTMANN, Juzo, Medi, SANYLEG, SIGVARIS GROUP, and Solventum. Companies in the Global Compression Therapy Market are strengthening their position through several strategic initiatives. They focus on continuous product innovation, integrating smart technologies and advanced materials to improve comfort, durability, and therapeutic effectiveness. Geographic expansion enables access to emerging markets, while collaborations with healthcare providers and rehabilitation centers enhance product adoption. Firms are also emphasizing affordability and customizable solutions to cater to diverse patient needs.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Technology trends

- 2.2.4 Application trends

- 2.2.5 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increase in the number of sports injuries and accidents

- 3.2.1.2 Surge in orthopedic and post-surgical procedures

- 3.2.1.3 Rising prevalence of venous disorders

- 3.2.1.4 Growing awareness among patients regarding treatment options

- 3.2.1.5 Recent technological advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Availability of alternative treatments

- 3.2.2.2 Reduced compliance due to wearer discomfort

- 3.2.2.3 Side effects associated with the use of compression therapy

- 3.2.3 Opportunities

- 3.2.3.1 Development of smart textiles and IoT-enabled compression wear

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 LAMEA

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Value chain analysis

- 3.7 Reimbursement scenario

- 3.8 Consumer behavioral insights

- 3.9 Pricing analysis

- 3.10 Environmental and sustainability considerations

- 3.11 Policy landscape

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

- 3.14 Gap analysis

- 3.15 Future market trends

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Compression garments

- 5.2.1 Compression bandages

- 5.2.2 Compression stockings

- 5.2.2.1 Compression class I

- 5.2.2.2 Compression class II

- 5.2.2.3 Compression class III

- 5.2.3 Other compression garments

- 5.3 Compression braces

- 5.4 Compression tapes

- 5.5 Compression pumps

Chapter 6 Market Estimates and Forecast, By Technology, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Static compression therapy

- 6.3 Dynamic compression therapy

Chapter 7 Market Estimates and Forecast, By Application, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Varicose veins treatment

- 7.3 Deep vein thrombosis treatment

- 7.4 Lymphedema treatment

- 7.5 Leg ulcer treatment

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ALCARE

- 10.2 Arjo

- 10.3 Bio Compression Systems

- 10.4 Cardinal Health

- 10.5 ConvaTec

- 10.6 Enovis

- 10.7 essity

- 10.8 HARTMANN

- 10.9 Juzo

- 10.10 medi

- 10.11 SANYLEG

- 10.12 SIGVARIS GROUP

- 10.13 Smith+Nephew

- 10.14 Solventum

- 10.15 Tactile Medical