|

市場調查報告書

商品編碼

1913353

鉛酸蓄電池回收市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Lead Acid Battery Recycling Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

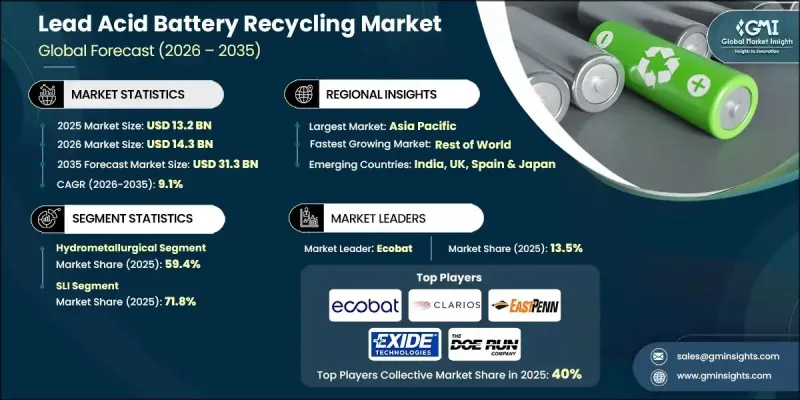

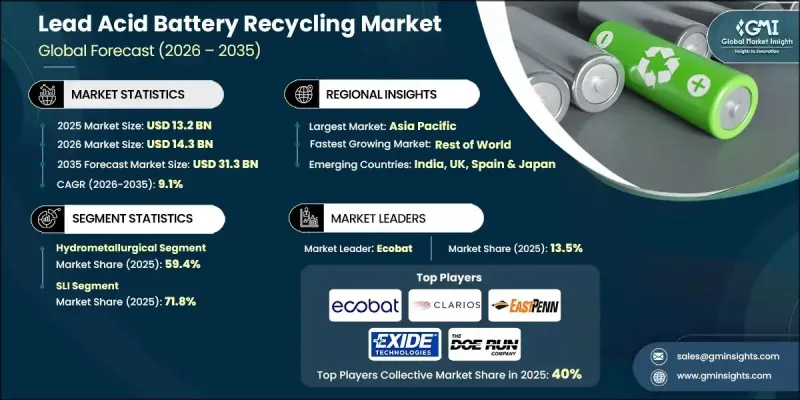

全球鉛酸電池回收市場預計到 2025 年將達到 132 億美元,到 2035 年將達到 313 億美元,年複合成長率為 9.1%。

加速推進電氣化以及鉛酸電池在交通運輸、儲能和工業系統中日益廣泛的應用,正在推動這一成長。鉛酸電池回收是指系統性地收集和處理廢棄電池,以回收鉛、塑膠零件和電解等可再利用材料的過程。這種做法有助於提高資源利用效率,降低環境風險,並符合全球永續性目標。回收過程在減少污染、確保安全處置廢棄物以及滿足不斷變化的合規要求方面發揮關鍵作用。電池消費量的成長以及日益嚴格的環境監管,正在加速全球回收工作的發展。各國政府和監管機構正在加強系統化的電池廢棄物管理,建立支持市場長期成長的框架,並促進多個終端用戶產業採用循環經濟模式。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 132億美元 |

| 預測金額 | 313億美元 |

| 複合年成長率 | 9.1% |

鉛酸電池在車輛、備用電源系統和工業基礎設施的應用日益廣泛,導致其回收量顯著成長。隨著儲能需求的不斷擴大,回收已成為材料供應鏈的關鍵環節,有助於減少對原生資源的依賴。以環境保護和材料回收為重點的法規結構持續鼓勵製造商和回收商推廣負責任的電池報廢管理實踐。

預計到2025年,濕式冶金回收將佔據59.4%的市場佔有率,並在2035年之前以9.2%的複合年成長率成長。與其他回收製程相比,此方法排放更低、廢棄物產生量更少、能耗更低,因此正日益受到青睞。它能夠在實現高純度金屬回收的同時,幫助企業滿足環境法規的要求,使其成為注重永續營運的回收企業的重要技術選擇。

預計到2025年,SLI細分市場將佔據71.8%的市場佔有率,並在2026年至2035年間以9%的複合年成長率成長。汽車產業的持續需求和穩定的換代週期支撐著穩定的回收量。日益嚴格的電池處置環境法規進一步推動了該應用領域負責任的回收方法和材料再利用。

北美鉛酸電池回收市場佔全球市場的 92.3%,預計到 2035 年將成長至 43 億美元。更嚴格的環境法規、不斷成長的儲能需求以及對降低鉛暴露相關健康風險的日益重視,都推動了先進回收方法的發展和運營效率的提高。

目錄

第1章調查方法和範圍

第2章執行摘要

第3章業界考察

- 產業生態系統

- 原物料供應及採購分析

- 製造能力評估

- 供應鏈韌性與風險因素

- 配電網路分析

- 監管環境

- 產業影響因素

- 促進要素

- 產業潛在風險與挑戰

- 成長潛力分析

- 成本結構分析

- 波特五力分析

- PESTEL 分析

- 新的機會與趨勢

- 數位化和物聯網整合

- 拓展新興市場

- 投資分析及未來展望

第4章 競爭情勢

- 介紹

- 按地區分類的公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

- 戰略儀錶板

- 策略舉措

- 企業標竿管理

- 創新與科技趨勢

第5章 依製程分類的市場規模及預測(2022-2035年)

- 火法冶金

- 濕式冶金

- 物理/機械

第6章 依應用領域分類的市場規模及預測(2022-2035年)

- SLI

- 固定式

- 其他

第7章 2022-2035年各地區市場規模及預測

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 西班牙

- 德國

- 法國

- 亞太地區

- 中國

- 韓國

- 日本

- 印度

- 世界其他地區

第8章 公司簡介

- Amara Raja

- Aqua Metals

- Battery Recyclers of America

- BPL Nigeria Limited

- Cirba Solutions

- Clarios

- Doe Run Company

- East Penn Manufacturing Company

- Ecobat

- EnerSys

- Engitec Technologies

- Exide Technologies

- Glencore

- GME Recycling

- Gopher Resource LLC

- Gravita India

- Interstate Batteries

The Global Lead Acid Battery Recycling Market was valued at USD 13.2 billion in 2025 and is estimated to grow at a CAGR of 9.1% to reach USD 31.3 billion by 2035.

Rising electrification trends and the increasing use of lead acid batteries across transportation, energy storage, and industrial systems drive this growth. Lead acid battery recycling involves the systematic collection and processing of spent batteries to recover reusable materials such as lead, plastic components, and electrolyte solutions. This approach supports resource efficiency, reduces environmental risks, and aligns with global sustainability objectives. The recycling process plays a critical role in reducing pollution, ensuring safe waste handling, and meeting evolving compliance requirements. Growing battery consumption, combined with stronger environmental oversight, is accelerating recycling activity worldwide. Governments and regulatory bodies are reinforcing structured battery waste management practices, creating a supportive framework for long-term market growth and encouraging circular economy adoption across multiple end-use industries.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $13.2 Billion |

| Forecast Value | $31.3 Billion |

| CAGR | 9.1% |

Rising deployment of lead-acid batteries in vehicles, power backup systems, and industrial infrastructure is significantly increasing recycling volumes. As energy storage demand grows, recycling is becoming an essential component of material supply chains, helping reduce dependency on newly mined resources. Regulatory frameworks focused on environmental protection and material recovery continue to push manufacturers and recyclers toward responsible end-of-life battery management practices.

The hydrometallurgical recycling segment held 59.4% share in 2025 and is projected to grow at a CAGR of 9.2% through 2035. This method is gaining preference due to its lower emissions, reduced waste generation, and lower energy requirements when compared to alternative recycling processes. Its ability to deliver high-purity metal recovery while supporting environmental compliance has made it a key technology choice for recyclers focused on sustainable operations.

The SLI segment held a 71.8% share in 2025 and is expected to grow at a CAGR of 9% from 2026 to 2035. Continued demand from the automotive sector and steady replacement cycles are supporting consistent recycling volumes. Strengthening environmental rules surrounding battery disposal is further reinforcing responsible recovery practices and material reuse for this application segment.

North America Lead Acid Battery Recycling Market held 92.3% share and is projected to generate USD 4.3 billion by 2035. Strict environmental enforcement, rising energy storage needs, and increased focus on reducing health risks associated with lead exposure are supporting advanced recycling practices and operational efficiency.

Prominent companies active in the Global Lead Acid Battery Recycling Market include Ecobat, Exide Technologies, Glencore, EnerSys, Clarios, Aqua Metals, Gravita India, Gopher Resource LLC, Cirba Solutions, East Penn Manufacturing Company, Interstate Batteries, Engitec Technologies, Doe Run Company, Amara Raja, Battery Recyclers of America, GME Recycling, and BPL Nigeria Limited. These participants continue to shape market dynamics through capacity expansion, technology upgrades, and strategic partnerships. Companies in the Global Lead Acid Battery Recycling Market are strengthening their competitive position through investments in cleaner recycling technologies and process optimization. Many players are focusing on expanding recycling capacity to meet rising battery disposal volumes while improving recovery efficiency. Vertical integration across collection, processing, and material reuse is being adopted to secure supply chains and control costs. Firms are also prioritizing compliance-driven innovation to meet tightening environmental standards.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Market estimates & forecast parameters

- 1.3 Forecast

- 1.3.1 Key trends for market estimates

- 1.3.1.1 Quantified market impact analysis

- 1.3.2 Scenario analysis framework

- 1.3.1 Key trends for market estimates

- 1.4 Primary research and validation

- 1.4.1 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Paid Sources

- 1.5.2 Sources, by region

- 1.6 Research trail & scoring components

- 1.6.1 Research trail components

- 1.6.2 Scoring components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

- 1.8 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022 - 2035

- 2.2 Business trends

- 2.3 Process trends

- 2.4 Application trends

- 2.5 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Cost structure analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

- 3.7.1 Political factors

- 3.7.2 Economic factors

- 3.7.3 Social factors

- 3.7.4 Technological factors

- 3.7.5 Legal factors

- 3.7.6 Environmental factors

- 3.8 Emerging opportunities & trends

- 3.8.1 Digitalization & IoT integration

- 3.8.2 Emerging market penetration

- 3.9 Investment analysis and future outlook

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2025

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Rest of World

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Process, 2022 - 2035 (USD Billion)

- 5.1 Key trends

- 5.2 Pyrometallurgical

- 5.3 Hydrometallurgical

- 5.4 Physical/mechanical

Chapter 6 Market Size and Forecast, By Application, 2022 - 2035 (USD Billion)

- 6.1 Key trends

- 6.2 SLI

- 6.3 Stationary

- 6.4 Others

Chapter 7 Market Size and Forecast, By Region, 2022 - 2035 (USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Spain

- 7.3.3 Germany

- 7.3.4 France

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 South Korea

- 7.4.3 Japan

- 7.4.4 India

- 7.5 Rest of World

Chapter 8 Company Profiles

- 8.1 Amara Raja

- 8.2 Aqua Metals

- 8.3 Battery Recyclers of America

- 8.4 BPL Nigeria Limited

- 8.5 Cirba Solutions

- 8.6 Clarios

- 8.7 Doe Run Company

- 8.8 East Penn Manufacturing Company

- 8.9 Ecobat

- 8.10 EnerSys

- 8.11 Engitec Technologies

- 8.12 Exide Technologies

- 8.13 Glencore

- 8.14 GME Recycling

- 8.15 Gopher Resource LLC

- 8.16 Gravita India

- 8.17 Interstate Batteries