|

市場調查報告書

商品編碼

1913344

鎢市場機會、成長要素、產業趨勢分析及預測(2026年至2035年)Tungsten Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

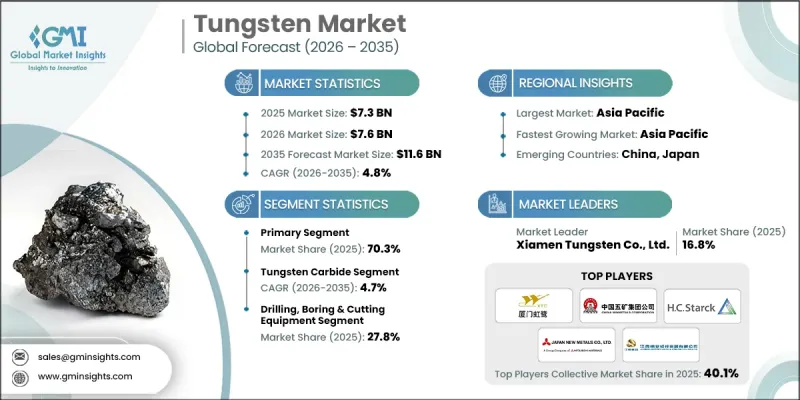

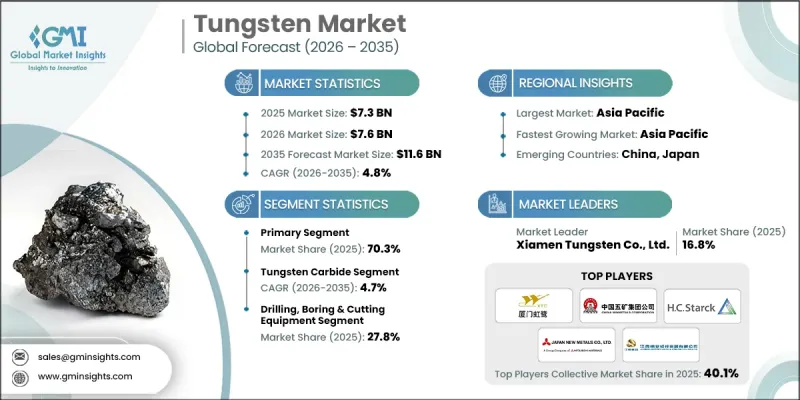

預計到 2025 年,全球鎢市場價值將達到 73 億美元,到 2035 年將達到 116 億美元,年複合成長率為 4.8%。

在成本效益、監管壓力和長期材料安全需求的驅動下,隨著循環經濟實踐在整個供應鏈中的實施,市場正在經歷結構性變革。回收技術的進步使再生鎢能夠達到與原生鎢相同的化學純度、晶體結構和性能穩定性,從而使回收變得越來越重要。與傳統的採礦和提煉製程相比,現代熱回收和化學回收製程在實現高回收率的同時,顯著降低了能源消耗和排放。這些改進增強了再生鎢的經濟合理性,尤其是在能源價格和碳排放成本較高的地區。同時,原生資源的地緣政治集中度持續影響市場趨勢,推動多元化和對替代採購途徑的投資。先進製造業、工業工具和高性能材料應用領域不斷成長的需求持續支撐著市場的穩步擴張,而以永續性發展為導向的採購政策進一步增強了全球終端用戶產業的長期成長潛力。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 73億美元 |

| 預測金額 | 116億美元 |

| 複合年成長率 | 4.8% |

到2025年,原生鎢產業市佔率將達到70.3%,主要得益於黑鎢礦和白鎢礦的開採和精礦生產。目前,鎢的生產仍高度集中於特定地區,造成了供應風險。因此,各國推出了旨在透過貿易措施和供應鏈多元化舉措來降低對單一供應區域依賴的政策。

預計到 2025 年,碳化鎢市場佔有率將達到 60%,到 2035 年將以 4.7% 的複合年成長率成長。其優勢體現在其無與倫比的硬度、結構穩定性和對惡劣工作條件的耐受性,使其成為需要高耐磨性和高精度的工業應用的重要材料。

預計到2025年,美國鎢市場規模將達到12億美元,到2035年將達30億美元。北美地區到2025年將佔18.9%的市場佔有率,該地區下游加工能力強,但對進口原料的依賴程度較高。旨在增強國內能力和降低外部依賴性的政策措施將繼續影響區域市場動態。

目錄

第1章調查方法和範圍

第2章執行摘要

第3章業界考察

- 生態系分析

- 供應商情況

- 利潤率

- 每個階段的附加價值

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 促進要素

- 產業潛在風險與挑戰

- 市場機遇

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特五力分析

- PESTEL 分析

- 價格趨勢

- 未來市場趨勢

- 科技與創新趨勢

- 當前技術趨勢

- 新興技術

- 專利狀態

- 貿易統計(HS編碼)(註:僅提供主要國家的貿易統計)

- 主要進口國

- 主要出口國

第4章 競爭情勢

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 企業矩陣分析

- 主要市場公司的競爭分析

- 競爭定位矩陣

- 重大進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 業務拓展計劃

第5章 依原產國分類的市場估計與預測,2022-2035年

- 基本的

- 次要

第6章 2022-2035年按產品分類的市場估算與預測

- 六氟化鎢

- 碳化鎢

- 金屬合金

- 軋延產品

- 其他

- 電氣和電子設備

- 其他(催化劑、化學品、國防設備等)

7. 依最終用途分類的市場估計與預測,2022-2035 年

- 汽車零件

- 航太零件

- 鑽孔、鑽孔設備

- 伐木設備

- 電氣和電子設備

- 半導體

- 其他(催化劑、化學品、國防設備等)

第8章 2022-2035年各地區市場估算與預測

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 其他中東和非洲地區

第9章:公司簡介

- Chongyi ZhangYuan Tungsten Co., Ltd

- Kennametal Inc.

- Sumitomo Electric Industries, Ltd

- China Minmetals Corporation

- Global Tungsten &Powders

- HC Starck Tungsten GmbH

- Japan New Metals Co., Ltd

- Soloro SLU

- WOLFRAM Company JSC

- Buffalo Tungsten Inc.

- Elmet Technologies

- Betek GmbH &Co. KG

- Accumet Materials Co.

- Xiamen Tungsten Co., Ltd

- Cleveland Tungsten, Inc.

The Global Tungsten Market was valued at USD 7.3 billion in 2025 and is estimated to grow at a CAGR of 4.8% to reach USD 11.6 billion by 2035.

The market is undergoing a structural shift as circular economy practices become increasingly embedded across supply chains, driven by cost efficiency, regulatory pressure, and the need for long-term material security. Recycling is gaining strategic importance as recovery technologies now allow secondary tungsten to achieve the same chemical purity, crystalline structure, and performance consistency as primary material. Modern thermal and chemical recycling processes enable high recovery yields while significantly lowering energy use and emissions compared to conventional mining and refining. These improvements strengthen the economic rationale for recycled tungsten, particularly in regions facing high energy prices or carbon-related costs. At the same time, geopolitical concentration of primary resources continues to influence market behavior, encouraging diversification and investment in alternative sourcing routes. Growing demand from advanced manufacturing, industrial tooling, and high-performance materials applications continues to underpin steady market expansion, while sustainability-driven procurement policies further reinforce long-term growth potential across global end-use industries.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $7.3 Billion |

| Forecast Value | $11.6 Billion |

| CAGR | 4.8% |

The primary tungsten segment accounted for 70.3% share in 2025, supported by mining and concentrate production derived mainly from wolframite and scheelite ores. Production remains highly concentrated geographically, creating supply risk and driving policy actions aimed at reducing dependence on a single source region through trade measures and supply chain diversification initiatives.

The tungsten carbide segment held 60% share in 2025 and is projected to grow at a CAGR of 4.7% through 2035. Its dominance reflects unmatched hardness, structural stability, and resistance to extreme operating conditions, making it indispensable for high-wear and precision-critical industrial applications.

U.S. Tungsten Market was valued at USD 1.2 billion in 2025 and is forecast to reach USD 3 billion by 2035. North America held 18.9% share in 2025, with the region characterized by strong downstream processing capacity and heavy reliance on imported raw materials. Policy measures aimed at strengthening domestic capabilities and reducing external dependence continue to influence regional market dynamics.

Key participants in the Global Tungsten Market include Kennametal Inc., Xiamen Tungsten Co., Ltd., H.C. Starck Tungsten GmbH, China Minmetals Corporation, Global Tungsten & Powders, Sumitomo Electric Industries, Ltd., Buffalo Tungsten Inc., Elmet Technologies, Japan New Metals Co., Ltd., Chongyi ZhangYuan Tungsten Co., Ltd., Betek GmbH & Co. KG, Soloro S.L.U, Accumet Materials Co., WOLFRAM Company JSC, and Cleveland Tungsten, Inc. Companies operating in the Global Tungsten Market are strengthening their competitive position through a combination of vertical integration, recycling investments, and technology-driven process optimization. Many players are expanding secondary material recovery capabilities to improve supply security and reduce exposure to raw material volatility. Strategic partnerships with industrial end users support customized product development and long-term contracts. Firms are also prioritizing geographic diversification of sourcing and processing assets to mitigate geopolitical risks. Continuous investment in high-purity powders and advanced carbide solutions enables differentiation in premium applications.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Origin

- 2.2.3 Product

- 2.2.4 End-use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Origin, 2022-2035 (USD Billion & Tons)

- 5.1 Key trends

- 5.2 Primary

- 5.3 Secondary

Chapter 6 Market Estimates and Forecast, By Product, 2022-2035 (USD Billion & Tons)

- 6.1 Key trends

- 6.2 Tungsten Hexafluoride

- 6.3 Tungsten carbide

- 6.4 Metal alloys

- 6.5 Mill Products

- 6.6 Others

- 6.6.1 Electrical & electronics appliances

- 6.6.2 Others (catalyst, chemical, defense equipment, etc.)

Chapter 7 Market Estimates and Forecast, By End Use, 2022-2035 (USD Billion & Tons)

- 7.1 Key trends

- 7.2 Automotive parts

- 7.3 Aerospace components

- 7.4 Drilling, boring & cutting equipment

- 7.5 Logging equipment

- 7.6 Electrical & electronic appliances

- 7.7 Semiconductor

- 7.8 Others (catalyst, chemical, defense equipment, etc.)

Chapter 8 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion & Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Chongyi ZhangYuan Tungsten Co., Ltd

- 9.2 Kennametal Inc.

- 9.3 Sumitomo Electric Industries, Ltd

- 9.4 China Minmetals Corporation

- 9.5 Global Tungsten & Powders

- 9.6 H.C. Starck Tungsten GmbH

- 9.7 Japan New Metals Co., Ltd

- 9.8 Soloro S.L.U

- 9.9 WOLFRAM Company JSC

- 9.10 Buffalo Tungsten Inc.

- 9.11 Elmet Technologies

- 9.12 Betek GmbH & Co. KG

- 9.13 Accumet Materials Co.

- 9.14 Xiamen Tungsten Co., Ltd

- 9.15 Cleveland Tungsten, Inc.